Get IRS 6252 Form

When individuals or businesses decide to finance the sale of property over time, allowing the buyer to make payments in installments, understanding the intricacies of the IRS 6252 form becomes essential. This form, pivotal for reporting income received from such sales, offers a structured way to declare installment sale income under the Internal Revenue Code. The process, while seeming straightforward at a glance, demands meticulous attention to detail, as taxpayers must accurately document the selling price, the cost or other basis of the property sold, the payments received in the year of sale, and any interest charged. Ensuring these elements are correctly reported is crucial to comply with tax regulations and avoid potential penalties. Moreover, the form serves not only as a reporting mechanism but also as a planning tool for taxpayers, helping them to spread the tax burden of a significant sale over several years, aligning with the inflow of payment installments. This nuanced approach to taxation underscores the importance of understanding every facet of the IRS 6252 form for anyone engaged in an installment sale transaction.

IRS 6252 Example

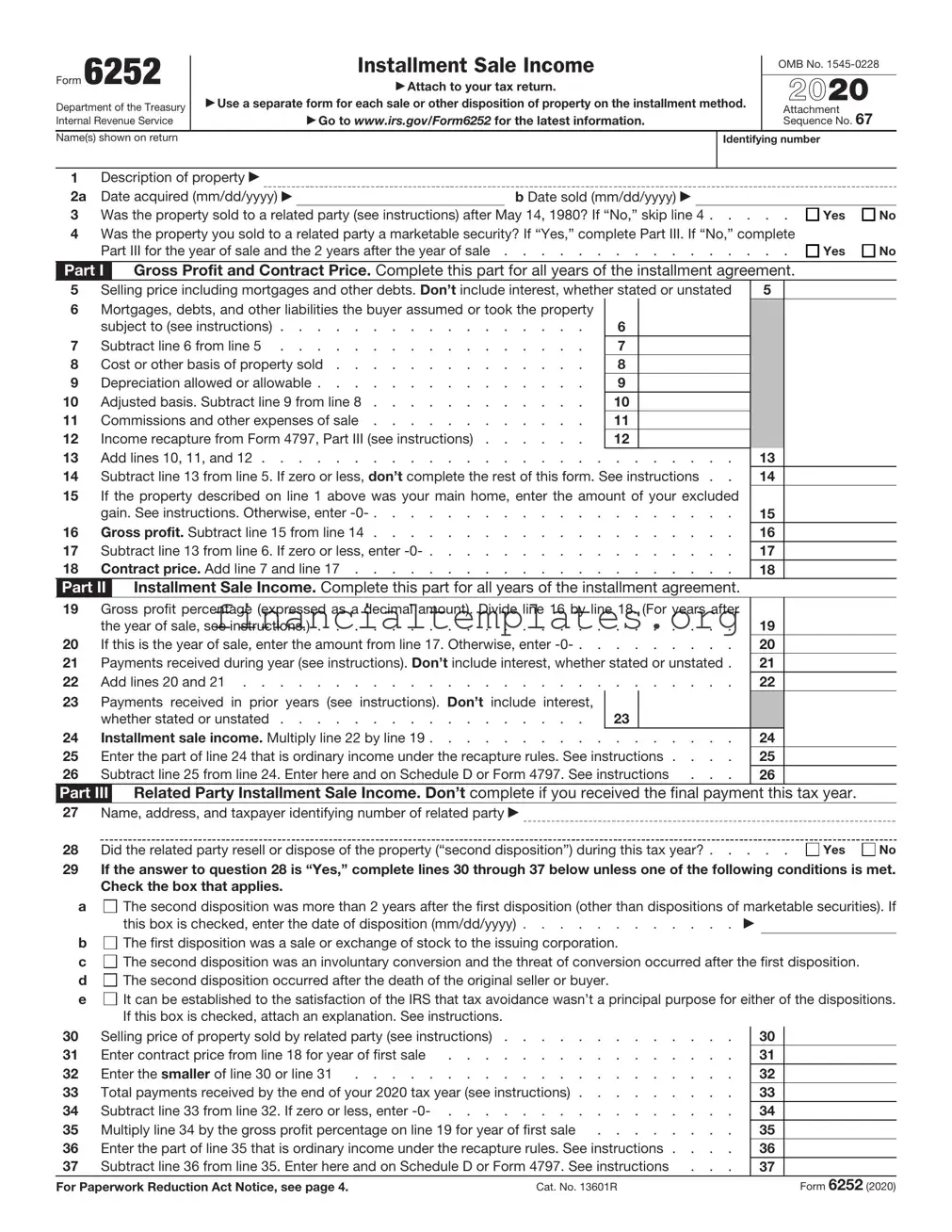

Form 6252 |

|

Installment Sale Income |

|

OMB No. |

|

|

|

||||

|

|

|

|

||

|

|

|

|

|

|

|

▶ Attach to your tax return. |

|

2021 |

||

Department of the Treasury |

|

▶ Use a separate form for each sale or other disposition of property on the installment method. |

|

||

|

▶ Go to www.irs.gov/Form6252 for the latest information. |

|

Attachment |

||

Internal Revenue Service |

|

|

Sequence No. 67 |

||

Name(s) shown on return |

|

|

Identifying number |

||

|

|

|

|

|

|

1Description of property ▶

2a |

Date acquired (mm/dd/yyyy) ▶ |

|

b Date sold (mm/dd/yyyy) ▶ |

|

|

|

3 |

Was the property sold to a related party (see instructions) after May 14, 1980? If “No,” skip line 4 |

Yes |

No |

|||

4Was the property you sold to a related party a marketable security? If “Yes,” complete Part III. If “No,” complete

Part III for the year of sale and the 2 years after the year of sale |

Yes |

No |

Part I Gross Profit and Contract Price. Complete this part for all years of the installment agreement.

5Selling price including mortgages and other debts. Don’t include interest, whether stated or unstated

6Mortgages, debts, and other liabilities the buyer assumed or took the property

|

subject to (see instructions) |

6 |

7 |

Subtract line 6 from line 5 |

7 |

8 |

Cost or other basis of property sold |

8 |

9 |

Depreciation allowed or allowable |

9 |

10 |

Adjusted basis. Subtract line 9 from line 8 |

10 |

11 |

Commissions and other expenses of sale |

11 |

12 |

Income recapture from Form 4797, Part III (see instructions) |

12 |

13 |

Add lines 10, 11, and 12 |

|

14Subtract line 13 from line 5. If zero or less, don’t complete the rest of this form. See instructions . .

15If the property described on line 1 above was your main home, enter the amount of your excluded

|

gain. See instructions. Otherwise, enter |

16 |

Gross profit. Subtract line 15 from line 14 |

17 |

Subtract line 13 from line 6. If zero or less, enter |

18Contract price. Add line 7 and line 17 . . . . . . . . . . . . . . . . . . . . .

Part II Installment Sale Income. Complete this part for all years of the installment agreement.

5

13

14

15

16

17

18

19Gross profit percentage (expressed as a decimal amount). Divide line 16 by line 18. (For years after

|

the year of sale, see instructions.) |

19 |

20 |

If this is the year of sale, enter the amount from line 17. Otherwise, enter |

20 |

21 |

Payments received during year (see instructions). Don’t include interest, whether stated or unstated . |

21 |

22 |

Add lines 20 and 21 |

22 |

23Payments received in prior years (see instructions). Don’t include interest,

|

whether stated or unstated |

23 |

|

|

24 |

Installment sale income. Multiply line 22 by line 19 |

24 |

|

|

25 |

Enter the part of line 24 that is ordinary income under the recapture rules. See instructions . . . . |

25 |

|

|

26 |

Subtract line 25 from line 24. Enter here and on Schedule D or Form 4797. See instructions . . . |

26 |

|

|

Part III Related Party Installment Sale Income. Don’t complete if you received the final payment this tax year.

27Name, address, and taxpayer identifying number of related party ▶

28 |

Did the related party resell or dispose of the property (“second disposition”) during this tax year? . . . . |

Yes |

No |

29If the answer to question 28 is “Yes,” complete lines 30 through 37 below unless one of the following conditions is met. Check the box that applies.

a The second disposition was more than 2 years after the first disposition (other than dispositions of marketable securities). If

The second disposition was more than 2 years after the first disposition (other than dispositions of marketable securities). If

this box is checked, enter the date of disposition (mm/dd/yyyy) . . . . . . . . . . . . ▶

b The first disposition was a sale or exchange of stock to the issuing corporation.

The first disposition was a sale or exchange of stock to the issuing corporation.

c The second disposition was an involuntary conversion and the threat of conversion occurred after the first disposition.

The second disposition was an involuntary conversion and the threat of conversion occurred after the first disposition.

d The second disposition occurred after the death of the original seller or buyer.

The second disposition occurred after the death of the original seller or buyer.

e It can be established to the satisfaction of the IRS that tax avoidance wasn’t a principal purpose for either of the dispositions. If this box is checked, attach an explanation. See instructions.

It can be established to the satisfaction of the IRS that tax avoidance wasn’t a principal purpose for either of the dispositions. If this box is checked, attach an explanation. See instructions.

30 |

Selling price of property sold by related party (see instructions) |

30 |

|

|

31 |

Enter contract price from line 18 for year of first sale |

31 |

|

|

32 |

Enter the smaller of line 30 or line 31 |

32 |

|

|

33 |

Total payments received by the end of your 2021 tax year (see instructions) |

33 |

|

|

34 |

Subtract line 33 from line 32. If zero or less, enter |

34 |

|

|

35 |

Multiply line 34 by the gross profit percentage on line 19 for year of first sale |

35 |

|

|

36 |

Enter the part of line 35 that is ordinary income under the recapture rules. See instructions . . . . |

36 |

|

|

37 |

Subtract line 36 from line 35. Enter here and on Schedule D or Form 4797. See instructions . . . |

37 |

|

|

For Paperwork Reduction Act Notice, see page 4. |

Cat. No. 13601R |

|

Form 6252 (2021) |

|

Form 6252 (2021) |

Page 2 |

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about developments related to Form 6252 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form6252.

What’s New

Installment sale reporting. In 2021 and later, if you have an outstanding installment sale balance after the initial year, complete lines 1 through 4, Part I, and Part II for each year of the installment agreement. If you sold property to a related party during the year, also complete Part III.

Qualified Opportunity Investment. If you held a qualified investment in a qualified opportunity fund (QOF) at any time during the year, you must file your return with Form 8997, Initial and Annual Statement of Qualified Opportunity Fund (QOF) Investments, attached. See the Form 8997 instructions.

Purpose of Form

Use Form 6252 to report income from an installment sale on the installment method. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. Ordinarily, an installment sale doesn’t include a disposition of personal property by a person who regularly sells or otherwise disposes of personal property of the same type, or a disposition of real property that is held by the taxpayer for sale to customers in the ordinary course of the taxpayer’s trade or business. However, gain on some dispositions by dealers in real property or farmers who dispose of any property used or produced in the trade or business of farming may be reported on the installment method.

Don’t file Form 6252 for sales that don’t result in a gain, even if you will receive a payment in a tax year after the year of sale. Instead, report the entire sale on Form 4797, Sales of Business Property; Form 8949, Sales and Other Dispositions of Capital Assets; or the Schedule D for your tax return, whichever applies.

Don’t file Form 6252 to report sales during the tax year of stock or securities traded on an established securities market. Instead, treat all payments as received during the year of sale.

Don’t file Form 6252 if you elect not to report the sale on the installment method. To elect out, report the full amount of the gain on a timely filed return (including extensions) on Form 4797, Form 8949, or the Schedule D for your tax return, whichever applies. If you filed your original return on time without making the election, you can make the election on an amended return filed no later than 6 months after the

due date of your tax return, excluding extensions. Enter “Filed pursuant to section

Which Parts To Complete

For All Years

Complete lines 1 through 4, Part I, and Part

II.If the property was sold to a related party, also complete Part III. Complete these requirements for Form 6252 for each year of the installment agreement, including the year of final payment, even if a payment wasn’t received during the year.

If you sold a marketable security to a related party after May 14, 1980, and before 1987, complete Form 6252 for each year of the installment agreement, even if you didn’t receive a payment. Complete lines 1 through 4. Complete Part III unless you received the final payment during the tax year.

After 1986, the installment method isn’t available for the sale of marketable securities.

Note: If you sold property other than a marketable security to a related party after May 14, 1980, complete Form 6252 for the year of sale and for 2 years after the year of sale, even if you didn’t receive a payment. Complete lines 1 through 4. Complete Part

IIfor any year during this

Special Rules

Interest

If any part of an installment payment you received is for interest or original issue discount, report that income on the appropriate form or schedule. Don’t report interest received, carrying charges received, or unstated interest on Form 6252. See Pub. 537, Installment Sales, for details on unstated interest.

Installment Sales to Related Party

A special rule applies to a first disposition (sale or exchange) of property under the installment method to a related party who then makes a second disposition (sale, exchange, gift, or cancellation of installment note) before making all payments on the first disposition. For this purpose, a related party includes your spouse, child, grandchild, parent, brother, sister; or a related corporation, S corporation, partnership, estate, or trust. See section 453(f)(1) for more details.

Under this rule, treat part or all of the amount the related party realized (or the fair market value (FMV) if the disposed property isn’t sold or exchanged) from the second disposition as if you received it from the first disposition at the time of the second disposition. Figure the gain, if any, on lines 30 through 37. This rule doesn’t apply if any of the conditions listed on line 29 are met.

Sale of Depreciable Property to Related Person

Generally, if you sell depreciable property to a related person (as defined in section 453(g)(3)), you can’t report the sale using the installment method. For this purpose, depreciable property is any property that (in the hands of the person or entity to whom you transfer it) is subject to the allowance for depreciation. However, you can use the installment method if you can show to the satisfaction of the IRS that avoidance of federal income taxes wasn’t one of the principal purposes of the sale (for example, no significant tax deferral benefits will result from the sale). If the installment method doesn’t apply, report the sale on Form 4797, Form 8949, or Schedule D, whichever applies. Treat all payments you will receive as if they were received in the year of sale. Use FMV for any payment that is contingent as to amount. If the FMV can’t be readily determined, basis is recovered ratably.

Pledge Rule

For certain dispositions under the installment method, if an installment obligation is pledged as security on a debt, the net proceeds of the secured debt are treated as payment on the installment obligation. However, the amount treated as payment can’t be more than the excess of the total installment contract price over any payments received under the contract before the secured debt was obtained.

An installment obligation is pledged as security on a debt to the extent that payment of principal and interest on the debt is directly secured by an interest in the installment obligation. For sales after December 16, 1999, payment on a debt is treated as directly secured by an interest in an installment obligation to the extent an arrangement allows you to satisfy all or part of the debt with the installment obligation.

The pledge rule applies to any installment sale after 1988 with a sales price of over $150,000 except:

•Personal use property disposed of by an individual,

•Farm property, and

•Timeshares and residential lots.

However, the pledge rule doesn’t apply to pledges made after December 17, 1987, if the debt is incurred to refinance the principal amount of a debt that was outstanding on December 17, 1987, and was secured by nondealer installment obligations on that date and at all times after that date until the refinancing. This exception doesn’t apply to the extent that the principal amount of the debt resulting from the refinancing exceeds the principal amount of the refinanced debt immediately before the refinancing. Also, the pledge rule doesn’t affect refinancing due to the calling of a debt by the creditor if the debt is then refinanced by a person other than this creditor or someone related to the creditor.

Form 6252 (2021) |

Page 3 |

Interest on Deferred Tax

Generally, you must pay interest on the deferred tax related to any obligation that arises during a tax year from the disposition of property under the installment method if:

•The property had a sales price over $150,000; and

•The aggregate balance of all nondealer installment obligations arising during, and outstanding at the close of, the tax year is more than $5 million.

You must pay interest in subsequent years if installment obligations that originally required interest to be paid are still outstanding at the close of a tax year.

The interest rules don’t apply to dispositions of:

•Farm property,

•Personal use property by an individual,

•Real property before 1988, or

•Personal property before 1989.

See section 453(l) for more information on the sale of timeshares and residential lots under the installment method.

How to report the interest. The interest isn’t figured on Form 6252. See Pub. 537 for details and an example on how to report the interest under section 453A.

Capital Gains

If you have a capital gain, you can invest that gain into a QOF and elect to defer part or all of the gain that you would otherwise include in income. The gain is deferred until you sell or exchange the investment, you experience an inclusion event with respect to the investment, or December 31, 2026, whichever is earlier. You may also be able to permanently exclude gain from the sale or exchange of an investment in a QOF if the investment is held for at least 10 years. For information about what types of gains entitle you to elect these special rules, see the Instructions for Schedule D. Report the eligible gain on the form and in the manner otherwise instructed. See the Form 8949 instructions on how to report your election to defer eligible gains invested in a QOF. If you held a qualified investment in a QOF at any time during the year, you must file your return with Form 8997, Initial and Annual Statement of Qualified Opportunity Fund (QOF) Investments, attached. See the Form 8997 instructions.

Additional Information

See Pub. 537 for additional information, including details about reductions in selling price, the single sale of several assets, like- kind exchanges, dispositions of installment obligations, and repossessions.

Specific Instructions

Part

Line 1

Enter a code from the list below and describe the installment sale property.

Code:

1.Sale property is timeshare or residential lot.

2.Sale by an individual of personal use property (within the meaning of section 1275(b)(3)).

3.Sale of any property used or produced in the trade or business of farming (within the meaning of section 2032A(e)(4) or (5)).

4.All other installment sales not listed.

Line 5

Enter the total of any money, face amount of the installment obligation, and the FMV of other property or services that you received or will receive in exchange for the property sold. Include on line 5 any existing mortgage or other debt the buyer assumed or took the property subject to. Don’t include stated interest, unstated interest, any amount recomputed or recharacterized as interest, or original issue discount.

If there is no stated maximum selling price, such as in a contingent payment sale, attach a schedule showing the computation of gain. Enter the taxable part of the payment on line 24 and also on line 35 if Part III applies. See Temporary Regulations section

Line 6

Enter only mortgages, debts, or other liabilities the buyer assumed from the seller or took the property subject to. Don’t include new mortgages the buyer gets from a bank, the seller, or other sources.

Line 8

Enter the original cost and other expenses you incurred in buying the property. Add the cost of improvements, etc., and subtract any casualty losses and any of the following credits previously allowed with respect to the property.

•Nonbusiness energy property credit.

•Residential energy efficient property credit.

•Adoption credit.

•District of Columbia

•Disabled access credit.

•New markets credit.

•Credit for

•Energy efficient home credit.

•Alternative motor vehicle credit.

•Alternative fuel vehicle refueling property credit.

•Qualified railroad track maintenance credit.

•Enhanced oil recovery credit.

•Qualified

•Qualified

•Qualified electric vehicle credit.

For additional information, see Pub. 551, Basis of Assets.

Line 9

Enter all depreciation or amortization you deducted or were allowed to deduct from the date of purchase until the date of sale. Adjust the depreciation or amortization amount by adding any of the following deductions previously taken with respect to the property.

•Commercial revitalization deduction.

•Section 179 expense.

•Deduction for

•Deductions claimed under sections 190 and 193.

•Deductions claimed under section 1253(d)(2) and (3) (as in effect before enactment of P.L.

•Basis reduction to investment credit property.

Subtract the following recapture amounts and credits previously allowed with respect to the property.

•Section 179 or 280F.

•

•Investment credit amount.

•Credit for

•Alternative motor vehicle credit.

•Alternative fuel vehicle refueling property credit.

•Qualified

•Qualified

•Qualified electric vehicle credit.

Line 11

Enter sales commissions, advertising expenses, attorney and legal fees, and other selling expenses incurred to sell the property.

Line 12

Any ordinary income recapture under section 1245 or 1250 (including sections 179 and 291) is fully taxable in the year of sale even if no payments were received. To figure the recapture amount, complete Form 4797, Part III. The ordinary income recapture is the amount on line 31 of Form 4797. Enter it on line 12 of Form 6252 and also on line 13 of Form 4797. Don’t enter any gain for this property on line 32 of Form 4797. If you used Form 4797 only to figure the recapture amount on line 12 of Form 6252, enter “N/A” on line 32 of Form 4797. Partnerships and S corporations and their partners and shareholders, see the Instructions for Form 4797.

Form 6252 (2021) |

Page 4 |

Line 14

Don’t file Form 6252 if line 14 is zero or less. Instead, report the entire sale on Form 4797, Form 8949, or the Schedule D for your tax return.

Line 15

If the property described on line 1 was your main home, you may be able to exclude part or all of your gain. See Pub. 523, Selling Your Home, for details.

Part

Line 19

Enter the gross profit percentage determined for the year of sale even if you didn’t file Form 6252 for that year. Enter it as a decimal rounded to at least 4 digits, and include all zeros (for example,

25% = 0.2500, 35.25% = 0.3525, or

100% = 1.0000).

Line 21

Enter all money and the FMV of any property or services you received in 2021. Include as payments any amount withheld to pay off a mortgage or other debt or to pay broker and legal fees. Generally, don’t include as a payment the buyer’s note, a mortgage, or other debt assumed by the buyer. However, a note or other debt that is payable on demand or readily tradable on an established securities market is considered a payment. For sales occurring before October 22, 2004, a note or other debt is considered a payment only if it was issued by a corporation or governmental entity. If you didn’t receive any payments in 2021, enter zero. If in prior years an amount was entered on the equivalent of line 34 of the 2021 form, don’t include it on this line. Instead, enter it on line 23. See Pledge Rule, earlier, for details about proceeds of debt secured by installment obligations that must be treated as payments on installment obligations.

Line 23

Enter all money and the FMV of property or services you received before 2021 from the sale. Include allocable installment income and any other deemed payments from prior years.

Deemed payments include amounts deemed received because of:

•A second disposition by a related party, or

•The pledge rule of section 453A(d).

Line 25

Enter here and on Form 4797, line 15, any ordinary income recapture on section 1252, 1254, or 1255 property for the year of sale or all remaining recapture from a prior year sale. Don’t enter ordinary income from a section 179 expense deduction. If this is the year of sale, complete Form 4797, Part

III.The amount from line 27c, 28b, or 29b of Form 4797 is

the ordinary income recapture. Don’t enter any gain for this property on line 31 or 32 of Form 4797. If you used Form 4797 only to figure the recapture on line 25 or 36 of Form 6252, enter “N/A” on lines 31 and 32 of Form 4797.

Also report on this line any ordinary income recapture remaining from prior years on section 1245 or 1250 property sold before June 7, 1984.

Don’t enter on line 25 more than the amount shown on line 24. Any excess must be reported in future years on Form 6252 up to the taxable part of the installment sale until all of the recapture has been reported.

Line 26

For trade or business property held more than 1 year, enter this amount on Form 4797, line 4. If the property was held 1 year or less or you have an ordinary gain from the sale of a noncapital asset (even if the holding period is more than 1 year), enter this amount on Form 4797, line 10, and enter “From Form 6252.” If the property was section 1250 property (generally, real property that you depreciated) held more than 1 year, figure the total amount of unrecaptured section 1250 gain included on line 26 using the Unrecaptured Section 1250 Gain Worksheet in the Instructions for Schedule D (Form 1040).

For capital assets, enter this amount on Schedule D as a short- or

Part

Line 29

If one of the conditions is met, check the appropriate box and skip lines 30 through

37.If you checked box 29e, attach an explanation. Generally, the nontax avoidance exception will apply to the second disposition if:

•The disposition was involuntary (for example, a creditor of the related party foreclosed on the property or the related party declared bankruptcy), or

•The disposition was an installment sale under which the terms of payment were substantially equal to or longer than those for the first sale. However, the resale terms must not permit significant deferral of recognition of gain from the first sale (for example, amounts from the resale are being collected sooner).

Line 30

If the related party sold all or part of the property from the original sale in 2021, enter the amount realized from the part resold. If part was sold in an earlier year and part was sold this year, enter the cumulative amount realized from the resale.

Amount realized. The amount realized from a sale or exchange is the total of all

money received plus the FMV of all property or services received. The amount realized also includes any liabilities that were assumed by the buyer and any liabilities to which the property transferred is subject, such as real estate taxes or a mortgage. For details, see Pub. 544, Sales and Other Dispositions of Assets.

Line 33

If you completed Part II, enter the sum of lines 22 and 23. Otherwise, enter all money and the FMV of property you received before 2021 from the sale. Include allocable installment income and any other deemed payments from prior years. Don’t include interest, whether stated or unstated.

Line 36

See the instructions for line 25. Don’t enter on line 36 more than the amount shown on line 35. Any excess must be reported in future years on Form 6252 up to the taxable part of the installment sale until all of the recapture has been reported.

Line 37

See the instructions for line 26.

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for individual taxpayers filing this form is approved under OMB control number

Recordkeeping . . . . |

1 hr., 18 min. |

||

Learning about the law |

|

|

|

or the form |

. |

. |

24 min. |

Preparing the form . . . |

. |

. |

. 1 hr. |

Copying, assembling, and |

|

|

|

sending the form to the IRS |

. |

. |

20 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. See the instructions for the tax return with which this form is filed.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 6252 | Form 6252 is used by taxpayers to report income from a sale of property under the installment method. This method allows income to be recognized over the period payments are received. |

| Who Must File | Any taxpayer who sells property and receives payments over one or more tax years beyond the year of sale must file Form 6252, unless the sale qualifies for an exception. |

| Tax Year Applicability | The form must be filed for each year in which a payment from an installment sale is received, including the year the property is sold. |

| Required Information | Taxpayers need to provide details on the sale, including date of sale, selling price, cost basis, and amounts received each year. |

| Governing Law | Form 6252 is governed by the Internal Revenue Code (IRC), specifically the provisions related to installment sales. This Federal law applies nationwide, not state-specific. |

Guide to Writing IRS 6252

Filling out IRS Form 6252 can seem daunting at first glance, but with careful attention to detail and a step-by-step approach, individuals can successfully complete the form. The form is designed for those who have sold property and are carrying a note, thereby receiving payment over time, rather than in a lump sum. This process ensures the appropriate income is reported and taxes are accurately calculated over the period of payments. After completing the form, it becomes a crucial part of one's tax records, reflecting income through installment sales. The steps outlined below will guide individuals through this process, ensuring clarity and compliance with IRS requirements.

- Locate the most current version of IRS Form 6252 on the Internal Revenue Service website. Ensure it's the version for the tax year you are reporting.

- Begin by entering your personal information at the top of the form, including your name, address, and Social Security number or Employer Identification Number if applicable.

- Proceed to Part I, titled "General Information." Here, enter details of the sale including the date of sale, type of property sold, and whether this sale was reported in prior years.

- In Part II, "Sales Price and Payments Received in 2023," input the total sales price of the property. This includes the cash payments received in the year of sale, the fair market value of any other property received, and any existing debts the buyer assumed.

- Calculate the cost or other basis of the property sold plus any expenses of sale and enter this information.

- Complete Part III, "Gain or Loss on Sale," by determining the gross profit percentage and reporting any depreciation recapture.

- For those continuing from a previous year, Part IV, "Installment Sale Income," requires information on payments received in the current tax year. This includes principal and interest portions.

- Double-check all entered information for accuracy. Calculation errors or incorrect information can lead to processing delays or potential audits.

- Sign and date the form. If prepared by someone other than the taxpayer, that individual also needs to sign and date the form.

- Attach Form 6252 to your Form 1040 and any other required schedules and forms. Ensure all necessary documentation is complete before submission.

- Submit the completed form to the IRS by the tax filing deadline for your 2023 return. This may be done electronically through IRS e-file or by mailing a paper copy to the appropriate address, depending on your filing preferences.

By meticulously following these steps, individuals can accurately complete IRS Form 6252, avoiding common pitfalls and ensuring correct reporting of installment sale income. This contributes to the overall integrity of their tax return and helps to maintain compliance with IRS regulations. It's always a good idea to consult with a tax professional or refer to IRS publications for guidance specific to your situation if any uncertainties arise during the process.

Understanding IRS 6252

-

What is the IRS 6252 form used for?

The IRS 6252 form is specifically designed for individuals or entities that sell something and choose to receive payment over time, a process often referred to as an installment sale. This form allows sellers to report income from the sale in the years in which they receive the payments, rather than reporting the entire sum in the year of the sale. This can be beneficial for tax purposes, as it might lower the tax liability in the year of the sale.

-

Who needs to file IRS Form 6252?

Anyone who sells property under an installment sale agreement should file Form 6252. This includes individuals, trusts, and estates that have sold property and are receiving payments in a year following the year of the sale. If you’re unsure whether your sale qualifies as an installment sale or if you need to file this form, it's advisable to consult with a tax professional.

-

What information do I need to complete Form 6252?

To fill out Form 6252, you will need detailed information about the sale, including the date of sale, total selling price, the cost or other basis of the property sold, expenses of sale, and the amounts received as payments in the year for which you are filing. Additionally, information on any property you received as part of the sale needs to be included to accurately calculate the installment sale income.

-

Can Form 6252 be filed electronically?

Yes, Form 6252 can be filed electronically along with your tax return using IRS e-file. Many tax software programs will include the form if it applies to your situation and will guide you through the process of filling it out and submitting it properly.

-

What happens if I receive all payments sooner than expected?

If you receive the entire payment for the property sold sooner than the terms originally agreed upon, you may need to amend previously filed tax returns to reflect the actual income received. This could result in a modification of the applicable tax for those years. For guidance on adjusting your returns in this situation, it may be helpful to seek advice from a tax advisor.

-

How does selling property on installment impact taxes?

Selling property on installment allows you to spread the reporting of income over the period you receive payments. This can potentially place you in a lower tax bracket for any given year, reducing your overall tax obligation related to the sale. Interest income from installment payments also needs to be reported, which is something to consider when planning for your tax liabilities.

-

Where can I get help with filling out Form 6252?

Help with filling out Form 6252 can be found through several sources. The IRS provides instructions for Form 6252 on its website, which can guide you through the process. Tax professionals, certified public accountants (CPAs), and authorized IRS e-file providers are also valuable resources for personalized assistance based on your specific circumstances.

Common mistakes

When it comes to dealing with the Internal Revenue Service (IRS), accuracy and diligence are paramount, especially when filling out forms related to your taxes. The IRS Form 6252, used for reporting income from an installment sale, is no exception. Missteps in completing this form can lead to unexpected tax liabilities or issues with the IRS. Below are some of the common mistakes individuals often make when filling out Form 6252:

- Not Reporting All Installment Sale Income:

Individuals sometimes neglect to report all income from the sale on Form 6252. All payments received in the tax year, including the down payment and any subsequent payments, must be accounted for.

- Failing to Accurately Calculate the Gross Profit Percentage:

This calculation is crucial as it determines the portion of each payment to be reported as income. Incorrectly calculating the gross profit percentage can lead to underreporting or overreporting income.

- Omitting Previously Reported Income:

If the installment sale spans multiple years, individuals may forget to include income reported in previous years. This can result in inaccuracies in income tracking and tax liabilities.

- Incorrectly Classifying Property Type:

Form 6252 requires taxpayers to classify the type of property sold (e.g., personal use, investment, business). Misclassification can lead to incorrect tax calculations and potential scrutiny from the IRS.

- Not Utilizing the Correct Tax Year Forms:

Tax laws and form requirements can change from year to year. Using an outdated version of Form 6252 can result in incorrect filings and potential penalties.

- Neglecting to Attach Required Schedules or Forms:

Depending on the specifics of the installment sale, additional IRS forms or schedules may need to be completed and attached. Failure to include these can result in incomplete filings.

Avoiding these mistakes can save an individual time, stress, and potentially money. Considering the complex nature of tax laws, seeking professional advice when completing IRS Form 6252 is often a prudent approach to ensure compliance and accuracy.

Documents used along the form

When dealing with the IRS 6252 form, it's used to report income from an installment sale, there are several other important documents and forms that often come into play. These documents help ensure that all aspects of the sale and its corresponding financial implications are fully accounted for. Let's take a brief look at some of these key documents.

- Form 1040: This is the U.S. Individual Income Tax Return form. It's where individuals report their annual income, including any income reported on Form 6252, along with deductions and credits. It's the primary form used by individuals to file their annual taxes.

- Schedule D (Form 1040): Capital Gains and Losses. This schedule is essential for reporting the sale or exchange of capital assets. If the installment sale results in a capital gain, this is where it would be reported, linking back to the information provided in Form 6252.

- Form 4797: Sales of Business Property. For sellers dealing with the sale of property used in a trade or business, this form is crucial. It reports the sale's details and calculates the recognizable gain or loss, which ties into the installment sale reported on Form 6252 if applicable.

- Form 4562: Depreciation and Amortization. If the installment sale involves property that has been depreciated, this form is used to report depreciation or amortization for the year, influencing the gain or loss calculation on the sale.

- Form 8594: Asset Acquisition Statement. When the installment sale includes an exchange of business assets, this form is used by both the seller and buyer to report the sale and purchase of business assets, affecting the overall tax consequences linked to the installment sale.

Handling these forms together requires a good understanding of the tax implications of installment sales and how they interact with different aspects of an individual's or business's financial landscape. By ensuring that all relevant forms are accurately completed and filed, taxpayers can better manage their tax responsibilities and avoid potential issues with the IRS.

Similar forms

The IRS Form 6252, used for reporting income from installment sales, bears resemblance to various other tax documents, each serving unique but related purposes in the realm of financial reporting and taxation. One such document is IRS Form 4797, "Sales of Business Property". This form is similar because it is used for reporting the sale of property used in a trade or business. Both forms require the taxpayer to detail sales transactions, but Form 4797 is specifically geared towards fixed assets or real estate used in business, whereas Form 6252 is focused on installment sale income.

Another document comparable to Form 6252 is IRS Form 8949, "Sales and Other Dispositions of Capital Assets". Form 8949 is used to list all capital asset transactions which may include stocks, bonds, and real estate property, and to calculate capital gains or losses. Like Form 6252, it deals with income or losses stemming from sales, but it encompasses a broader range of assets and is pivotal for reporting transactions that affect an individual’s capital gains tax obligations.

IRS Form Schedule D (Form 1040), "Capital Gains and Losses", also shares similarities with Form 6252. This form is integral for summarizing capital gains and losses from transactions detailed on Form 8949, including those that might be part of installment sales. While Schedule D compiles overall gains or losses affecting tax liabilities, Form 6252 provides a mechanism for spreading the tax impact of a sale over multiple years, thus affecting the figures reported on Schedule D.

IRS Schedule E (Form 1040), "Supplemental Income and Loss", is another document with aspects similar to Form 6252, specifically in context to reporting income or losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. Where it aligns with Form 6252 is in its focus on reporting periodic income, albeit primarily from passive activities and not directly from installment sales. However, certain installment sales reported on Form 6252 could also affect values reported on Schedule E, particularly if the sale involves property generating rental income.

Then there’s the IRS Form 4562, "Depreciation and Amortization", which, while primarily concerned with calculating depreciation or amortization deductions for business assets, relates tangentially to Form 6252 in the treatment of property sold on installment that has been subject to prior depreciation. The completion of Form 4562 can impact the basis of an asset reported on an installment sale, hence affecting the gain or loss calculation on Form 6252.

Lastly, IRS Form 8824, "Like-Kind Exchanges", offers similarities in the sense of deferring tax liabilities, but in the context of exchanging business or investment properties only, without the exchange of cash. Taxpayers use Form 8824 to report like-kind exchanges, which may defer recognition of gain or loss. Although Form 6252 and Form 8824 serve different types of transactions, they both provide mechanisms for taxpayers to spread recognition of income or gain over multiple years, thus offering a strategic tax planning tool.

Dos and Don'ts

The IRS Form 6252 plays a critical role for taxpayers who are reporting income from an installment sale. Given the complex nature of tax laws and the potential for costly errors, it's important to approach this form with a clear understanding of best practices. Let’s explore the essentials of what you should and shouldn't do when completing this form.

Things to Do:

- Review the instructions for Form 6252 carefully before you start filling it out. It contains critical information on eligibility, definitions, and other details that can influence how you report your installment sale.

- Gather all necessary documentation related to the sale, including the sales contract, payment records, and any other relevant financial documents. This information will help you accurately fill out the form.

- Report the sale in the year it occurs, and continue to file Form 6252 for each year you receive a payment. This step is crucial in maintaining compliance with IRS requirements.

- Double-check your figures for accuracy before submitting the form. Errors can lead to audits, penalties, or other complications with the IRS.

- Consider consulting with a tax professional if you're unsure about any aspects of your installment sale or how to report it. The complexity of tax law makes professional advice invaluable in many cases.

Things Not to Do:

- Do not underestimate the importance of accurately reporting your cost basis and selling price on the form. Misreporting these figures can lead to significant issues down the line.

- Avoid late filing of Form 6252. Ensure that you submit the form as part of your annual tax filing by the due date to avoid penalties.

- Do not ignore IRS correspondence regarding your installment sale. If you receive letters or notices from the IRS, respond promptly to avoid additional problems.

- Do not attempt to hide or manipulate income from the sale to save on taxes. The IRS has mechanisms in place to detect such behaviors, leading to severe consequences.

- Avoid guesswork if you're unclear about any information requested on the form. Making assumptions can lead to errors; it’s better to seek clarification or professional guidance.

Misconceptions

Understanding the IRS 6252 form is essential for individuals involved in installment sales. However, there are common misconceptions that can lead to confusion. Clarifying these can help ensure that taxpayers are better informed and can navigate their financial responsibilities with more confidence.

It's only for real estate transactions: The first misconception is that Form 6252 is solely used for reporting installment sales of real estate. While it's frequently used for that purpose, it's also applicable to other property types. Whenever a sale results in payments being received over more than one tax year, Form 6252 is necessary, regardless of whether the property is real estate, personal property, or something else.

All payments must be reported in the year received: Another misunderstanding is the belief that the entire sale must be reported in the year it occurs. Actually, Form 6252 allows for the income to be reported as payments are received across multiple years, helping to potentially ease the tax burden by spreading it out over time.

Use of the form results in lower taxes: Some people think that using Form 6252 will automatically reduce their taxes. Though spreading income over several years can lower the tax bracket in some cases, it does not inherently reduce the total amount of tax owed. The tax implications depend on various factors, including the individual's total income and the specifics of the sale.

Once filed, it cannot be amended: There's also a misconception that once you file Form 6252, it's set in stone. In reality, if errors are discovered or if certain details of the installment sale change, an amended return can be filed to correct the information. It's important to ensure the accuracy of your tax filings, and amendments are a valid way to address any mistakes or changes.

It's only for business sales: Finally, some believe that Form 6252 is only for sales made in the context of a business. However, this form is not limited to business transactions. It applies to any sale of property where the payments are received over time, regardless of whether the seller is an individual or a business.

Understanding these misconceptions can help taxpayers avoid potential pitfalls and manage their tax filings more effectively. When in doubt, consulting with a tax professional can provide personalized advice tailored to an individual's specific situation.

Key takeaways

The IRS Form 6252 is an essential document for individuals who sell property under an installment sale agreement. This form helps in reporting income from the sale over the years during which payments are received. Navigating through the intricacies of Form 6252 can ensure proper compliance with tax regulations and potentially optimize one's financial strategy. Here are ten key takeaways about filling out and using the IRS Form 6252:

- Understand the Installment Sale Method: An installment sale allows the seller of the property to receive payments over time. When you use Form 6252, you're electing to report income as it is received, which can spread out the tax liability over several years.

- Know When to File: If you enter into an installment sale during the tax year, you must file Form 6252 with your annual tax return for that year and for each subsequent year you receive a payment.

- Identify Eligible Sales: Most types of property sales can be reported using the installment method, but there are exceptions, such as stocks or securities traded on an established securities market.

- Calculate Gross Profit Percentage: Your gross profit percentage is a crucial figure that affects how much of each payment is taxable. It is calculated by dividing your gross profit from the sale by the total contract price.

- Report Initial and Subsequent Payments: The form is designed to track both the first year's income and the income received in following years. Accurately reporting both initial and subsequent payments is vital for precise tax calculation.

- Understand Interest Reporting: If the installment agreement specifies interest, or if there is imputed interest or unstated interest under the tax law, this interest must be reported separately from the sale income.

- Recognize the Importance of Record Keeping: Keeping detailed records of the sale, including the agreement, payments received, interest reported, and expenses, is critical. These records will support your tax filings each year you report income from the sale.

- Be Aware of Special Situations: Certain circumstances, such as selling depreciable property or dealing with related parties, have specific reporting requirements and may impact the calculation of your taxable income.

- Know the Impact of Dispositions: Disposing of an installment obligation, such as by selling it or paying it off early, has tax implications. These must be reported in the year the disposition occurs, which can affect your overall tax strategy.

- Seek Professional Advice: Given the complexities involved in reporting installment sales and the potential for significant tax consequences, consulting with a tax professional or legal advisor who is knowledgeable about IRS Form 6252 can provide valuable guidance and peace of mind.

By giving attention to these key aspects of IRS Form 6252, taxpayers can navigate the installment sale reporting process more effectively, potentially leading to beneficial outcomes in their tax responsibilities and financial planning.

Popular PDF Documents

How to Pay Form 4549 Online - A record of IRS adjustments to your filed tax return, indicating updated tax liabilities or refunds.

Irsc Rn Program - IRSC-68 is not just an administrative document; it symbolizes a gateway for ambitious students aiming to get a head start on their college education while in high school.

Types of Non Profits - The form calculates total support minus revenue from related activities to determine financial health.