Get IRS 6251 Form

Understanding the complexities of the tax system is crucial for individuals navigating their financial responsibilities. One key element in this landscape is the IRS 6251 form, which plays a pivotal role for taxpayers who may be subject to the Alternative Minimum Tax (AMT). The AMT is a parallel tax system designed to ensure that individuals who benefit from certain deductions, credits, and exclusions pay at least a minimum amount of tax. The IRS 6251 form thus serves as a critical tool for calculating the AMT, requiring a detailed accounting of income, adjustments, and allowable exemptions. Given its significance, this form not only demands a thorough comprehension of its components but also an understanding of its implications on one’s tax obligations. This form navigates through various nuances, encompassing distinct income levels and tax situations, making it a vital part of the tax filing process for those it affects.

IRS 6251 Example

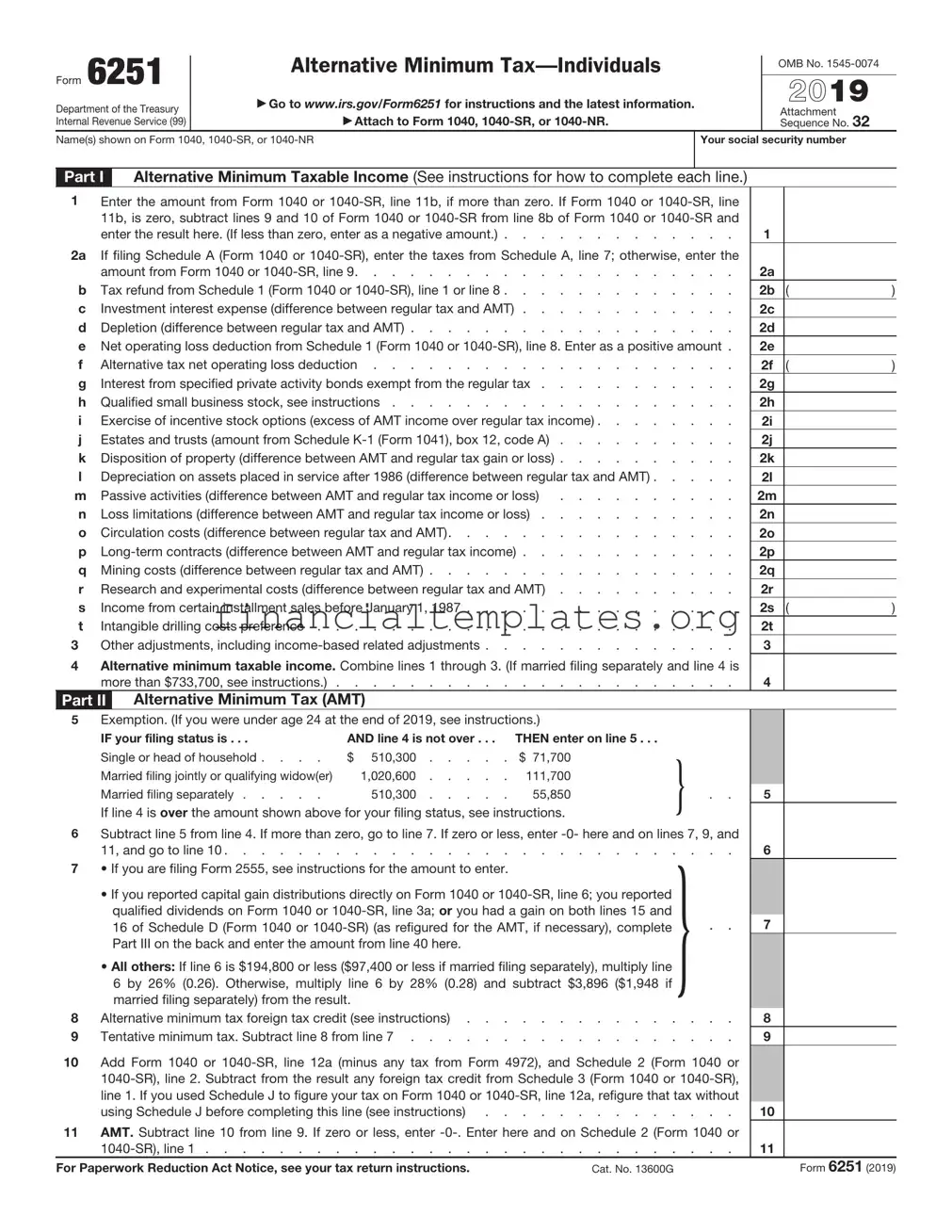

Form 6251

Department of the Treasury Internal Revenue Service (99)

Alternative Minimum

▶Go to www.irs.gov/Form6251 for instructions and the latest information.

▶Attach to Form 1040,

OMB No.

2021

Attachment Sequence No. 32

Name(s) shown on Form 1040, |

Your social security number |

Part I |

Alternative Minimum Taxable Income (See instructions for how to complete each line.) |

|

|

|

|

1 |

Enter the amount from Form 1040 or |

|

|

|

|

|

is zero, subtract line 14 of Form 1040 or |

|

|

|

|

|

here. (If less than zero, enter as a negative amount.) |

1 |

|

|

|

2a |

If filing Schedule A (Form 1040), enter the taxes from Schedule A, line 7; otherwise, enter the amount from |

|

|

|

|

|

Form 1040 or |

2a |

|

|

|

b |

Tax refund from Schedule 1 (Form 1040), line 1 or line 8z |

2b |

( |

) |

|

c |

Investment interest expense (difference between regular tax and AMT) |

2c |

|

|

|

d |

Depletion (difference between regular tax and AMT) |

2d |

|

|

|

e |

Net operating loss deduction from Schedule 1 (Form 1040), line 8a. Enter as a positive amount . . . . |

2e |

|

|

|

f |

Alternative tax net operating loss deduction |

2f |

( |

) |

|

g |

Interest from specified private activity bonds exempt from the regular tax |

2g |

|

|

|

h |

Qualified small business stock, see instructions |

2h |

|

|

|

i |

Exercise of incentive stock options (excess of AMT income over regular tax income) |

2i |

|

|

|

j |

Estates and trusts (amount from Schedule |

2j |

|

|

|

k |

Disposition of property (difference between AMT and regular tax gain or loss) |

2k |

|

|

|

l |

Depreciation on assets placed in service after 1986 (difference between regular tax and AMT) |

2l |

|

|

|

m |

Passive activities (difference between AMT and regular tax income or loss) |

2m |

|

|

|

n |

Loss limitations (difference between AMT and regular tax income or loss) |

2n |

|

|

|

o |

Circulation costs (difference between regular tax and AMT) |

2o |

|

|

|

p |

2p |

|

|

||

q |

Mining costs (difference between regular tax and AMT) |

2q |

|

|

|

r |

Research and experimental costs (difference between regular tax and AMT) |

2r |

|

|

|

s |

Income from certain installment sales before January 1, 1987 |

2s |

( |

) |

|

t |

Intangible drilling costs preference |

2t |

|

|

|

3 |

Other adjustments, including |

3 |

|

|

|

4 |

Alternative minimum taxable income. Combine lines 1 through 3. (If married filing separately and line 4 is |

|

|

|

|

|

more than $752,800, see instructions.) |

4 |

|

|

|

Part II |

Alternative Minimum Tax (AMT) |

|

|

|

|

5Exemption.

|

IF your filing status is . . . |

AND line 4 is not over . . . |

THEN enter on line 5 . . . |

} |

|

|

|

|

Single or head of household . . . . |

$ 523,600 |

$ 73,600 |

|

|

|

|

|

|

|

|

|

|||

|

Married filing jointly or qualifying widow(er) |

1,047,200 |

114,600 |

|

|

|

|

|

Married filing separately |

523,600 |

57,300 |

|

. . |

5 |

|

|

If line 4 is over the amount shown above for your filing status, see instructions. |

|

|

|

|

||

6 |

Subtract line 5 from line 4. If more than zero, go to line 7. If zero or less, enter |

|

|

||||

|

11, and go to line 10 |

. . . . . . . . . . . . |

6 |

|

|||

7 |

• If you are filing Form 2555, see instructions for the amount to enter. |

|

|

|

|

|

|

|

• If you reported capital gain distributions directly on Form 1040 or |

|

|

|

|

||

|

qualified dividends on Form 1040 or |

|

. . |

|

|

||

|

|

7 |

|

||||

|

16 of Schedule D (Form 1040) (as refigured for the AMT, if necessary), complete Part III on the |

|

|

||||

|

back and enter the amount from line 40 here. |

|

|

|

|

|

|

|

All others: If line 6 is $199,900 or less ($99,950 or less if married filing separately), multiply line |

|

|

|

|

||

|

• 6 by 26% (0.26). Otherwise, multiply line 6 by 28% (0.28) and subtract $3,998 ($1,999 if} |

|

|

|

|||

|

married filing separately) from the result. |

|

|

|

|

|

|

8 |

Alternative minimum tax foreign tax credit (see instructions) . . . |

. . . . . . . . . . . . |

8 |

|

|||

9 |

Tentative minimum tax. Subtract line 8 from line 7 |

. . . . . . . . . . . . |

9 |

|

|||

10Add Form 1040 or

|

instructions |

10 |

|

11 |

AMT. Subtract line 10 from line 9. If zero or less, enter |

11 |

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 13600G |

Form 6251 (2021) |

|

Form 6251 (2021) |

Page 2 |

Part III Tax Computation Using Maximum Capital Gains Rates

Complete Part III only if you are required to do so by line 7 or by the Foreign Earned Income Tax Worksheet in the instructions.

12Enter the amount from Form 6251, line 6. If you are filing Form 2555, enter the amount from line 3 of the

worksheet in the instructions for line 7 |

12 |

13Enter the amount from line 4 of the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Form 1040 or the amount from line 13 of the Schedule D Tax Worksheet in the Instructions for Schedule D (Form 1040), whichever applies (as refigured for the AMT, if necessary). See instructions. If you are filing

Form 2555, see instructions for the amount to enter |

13 |

14Enter the amount from Schedule D (Form 1040), line 19 (as refigured for the AMT, if necessary). See

instructions. If you are filing Form 2555, see instructions for the amount to enter |

14 |

15If you did not complete a Schedule D Tax Worksheet for the regular tax or the AMT, enter the amount from line 13. Otherwise, add lines 13 and 14, and enter the smaller of that result or the amount from line 10 of the Schedule D Tax Worksheet (as refigured for the AMT, if necessary). If you are filing Form 2555, see

|

instructions for the amount to enter |

15 |

16 |

Enter the smaller of line 12 or line 15 |

16 |

17 |

Subtract line 16 from line 12 |

17 |

18If line 17 is $199,900 or less ($99,950 or less if married filing separately), multiply line 17 by 26% (0.26). Otherwise,

|

multiply line 17 by 28% (0.28) and subtract $3,998 ($1,999 if married filing separately) from the result . . |

. ▶ |

18 |

|

19 |

Enter: |

} |

|

|

|

• $80,800 if married filing jointly or qualifying widow(er), |

|

|

|

|

|

|

|

|

|

• $40,400 if single or married filing separately, or |

|

. . |

19 |

|

• $54,100 if head of household. |

|

|

|

20Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 14 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or

|

or less, enter |

. . . . . . . |

20 |

|

21 |

Subtract line 20 from line 19. If zero or less, enter |

. . . . . . . |

21 |

|

22 |

Enter the smaller of line 12 or line 13 |

. . . . . . . |

22 |

|

23 |

Enter the smaller of line 21 or line 22. This amount is taxed at 0% |

. . . . . . . |

23 |

|

24 |

Subtract line 23 from line 22 |

. . . . . . . |

24 |

|

25 |

Enter: |

} |

|

|

|

• $445,850 if single, |

|

|

|

|

• $250,800 if married filing separately, |

. . |

25 |

|

|

• $501,600 if married filing jointly or qualifying widow(er), or |

|

|

|

|

• $473,750 if head of household. |

|

|

|

26 |

Enter the amount from line 21 |

. . . . . . . |

26 |

|

27Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 21 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or

|

or less, enter |

27 |

|

28 |

Add line 26 and line 27 |

28 |

|

29 |

Subtract line 28 from line 25. If zero or less, enter |

29 |

|

30 |

Enter the smaller of line 24 or line 29 |

30 |

|

31 |

Multiply line 30 by 15% (0.15) |

. ▶ |

31 |

32 |

Add lines 23 and 30 |

32 |

|

|

If lines 32 and 12 are the same, skip lines 33 through 37 and go to line 38. Otherwise, go to line 33. |

|

|

33 |

Subtract line 32 from line 22 |

33 |

|

34 |

Multiply line 33 by 20% (0.20) |

. ▶ |

34 |

|

If line 14 is zero or blank, skip lines 35 through 37 and go to line 38. Otherwise, go to line 35. |

|

|

35 |

Add lines 17, 32, and 33 |

35 |

|

36 |

Subtract line 35 from line 12 |

36 |

|

37 |

Multiply line 36 by 25% (0.25) |

. ▶ |

37 |

38 |

Add lines 18, 31, 34, and 37 |

38 |

|

39If line 12 is $199,900 or less ($99,950 or less if married filing separately), multiply line 12 by 26% (0.26).

Otherwise, multiply line 12 by 28% (0.28) and subtract $3,998 ($1,999 if married filing separately) from the result |

39 |

40Enter the smaller of line 38 or line 39 here and on line 7. If you are filing Form 2555, do not enter this

amount on line 7. Instead, enter it on line 4 of the worksheet in the instructions for line 7 |

40 |

Form 6251 (2021)

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 6251 | This form is used to calculate the Alternative Minimum Tax (AMT) owed by individuals. AMT is designed to ensure that taxpayers with a higher income pay at least a minimum amount of tax. |

| Who Needs to File | It is necessary for individuals, estates, and trusts that have exclusions or deductions for regular tax purposes, but these are disallowed for AMT. |

| Relevant Sections | The form is divided into various sections including income adjustments, AMT foreign tax credit, and calculation of AMT exemption amounts. |

| Underlying Authority | The Internal Revenue Code (IRC) provides the legal basis for the requirement of the Form 6251. The exact sections vary, dependent on the tax year and the most recent tax code revisions. |

Guide to Writing IRS 6251

When it comes to tax forms, correctly filling out the IRS 6251 form is essential for individuals who need to calculate and report alternative minimum tax (AMT). The AMT is a tax system parallel to the regular federal income tax, designed to ensure that individuals who benefit from certain deductions, credits, and exclusions pay at least a minimum amount of tax. Here are the steps you'll need to follow to complete this form accurately.

- Gather all required documents, including your federal income tax return, W-2 forms, and documentation for deductions and credits.

- Start by entering your name and social security number at the top of the form.

- Proceed to line 1, where you'll input your adjusted gross income (AGI) from your federal tax return.

- Follow the instructions on the form to adjust your AGI by adding or subtracting certain items, such as interest on private activity bonds or foreign tax credits, on lines 2 through 29.

- Calculate your alternative minimum taxable income (AMTI) on line 30 by summing up the amounts from the previous lines.

- If applicable, deduct the exemption amount stated in the form instructions from your AMTI to determine your taxable excess.

- Use the AMT tax rates provided in the form instructions to calculate the tentative minimum tax on the taxable excess.

- Compare the tentative minimum tax to your regular tax amount. If the tentative minimum tax is higher, the difference will be your AMT.

- Enter the AMT amount on line 35.

- Finally, follow the directions on the form for reporting and paying any AMT due, and attach Form 6251 to your tax return before submitting it.

After filling out and submitting your Form 6251, it's important to keep a copy for your records. This ensures that you have documentation of your AMT calculations, which may be useful for future reference or in case the IRS has questions about your return. The process of calculating and reporting AMT can be complex, but by taking it step by step, you can ensure that you comply with the tax laws and potentially avoid future tax issues.

Understanding IRS 6251

-

What is IRS Form 6251?

IRS Form 6251, also known as the Alternative Minimum Tax—Individuals form, is designed to ensure that individuals who benefit from certain tax benefits pay at least a minimum amount of tax. This form calculates the alternative minimum tax (AMT), which might apply if your taxable income, plus certain adjustments and preference items, exceeds the AMT exemption amount for your filing status.

-

Who needs to fill out the IRS Form 6251?

Individuals who have high income combined with certain types of deductions, credits, and exclusions, often referred to as "tax preference items," may need to fill out Form 6251. These items can include large deductions for state and local taxes, interest on certain home equity loans, and certain investment expenses. Completing a form 6251 can help determine whether AMT applies to your situation.

-

How does the Alternative Minimum Tax work?

The Alternative Minimum Tax (AMT) operates parallel to the regular tax system. It recalculates income tax after adding certain tax preference items back into your taxable income. If the AMT calculation results in a higher tax than your regular tax calculation, you are required to pay the difference as AMT. The AMT has its own rates and exemption amounts, which are adjusted annually for inflation.

-

What are the AMT exemption amounts?

The AMT exemption amount is a threshold under which the AMT does not apply. The exemption amount varies by filing status and is adjusted annually for inflation. For example, for the 2022 tax year, the exemption amounts were set at $73,600 for single filers and $114,600 for married couples filing jointly. However, these amounts phase out at higher incomes, reducing the exemption by $1 for every $4 over certain income thresholds.

-

What items are added back to calculate AMT income?

To calculate AMT income, you must add back to your taxable income various preferences and adjustments. These might include state and local tax deductions, the standard deduction (if claimed), foreign tax credits, and certain miscellaneous deductions that are not allowed for AMT purposes. Also, personal and dependency exemptions, which are disallowed under AMT rules, must be added back.

-

How can I avoid paying the AMT?

Avoiding the AMT requires careful planning and might involve limiting certain types of deductions and adjusting your income and tax planning strategies. Consider spreading out large deductions, avoiding short-term capital gains, and, if possible, minimizing AMT-triggering income. Consulting with a tax professional can help you navigate these strategies effectively.

-

What happens if I do not file Form 6251?

If you are required to pay the AMT but fail to file Form 6251, the IRS may calculate the tax for you and send a bill for the additional taxes owed, including interest and penalties. Not filing when required can lead to an understatement of your tax liability, potentially resulting in penalties and interest on the unpaid amount.

-

Where can I find IRS Form 6251 and its instructions?

IRS Form 6251 and its detailed instructions can be found on the official website of the Internal Revenue Service (IRS) at www.irs.gov. The website offers downloadable PDFs of the form and instructions for the current and past tax years. Additionally, tax software often includes the ability to calculate AMT and complete Form 6251 automatically based on the information you provide.

Common mistakes

Filling out IRS Form 6251, which is used to calculate the Alternative Minimum Tax (AMT), can be a complex process. Those who are required to file this form often face pitfalls. Understanding common mistakes can help taxpayers avoid them and ensure their forms are correctly completed. Here are nine frequently made errors:

Not Understanding When to File: Many taxpayers do not realize that they are required to file Form 6251 if their taxable income plus certain adjustments exceeds the AMT exemption amount for their filing status.

Incorrect Exemption Amount: Failing to apply the correct exemption amount based on filing status and income level is another common mistake. The exemption amounts are adjusted annually for inflation, so it's important to use the most current figures.

Miscalculating Income: Taxpayers often make errors in calculating their AMT income. It involves adding back to the regular taxable income certain deductions and exclusions claimed for the regular tax calculation.

Overlooking AMT Adjustments and Preferences: Items like state and local taxes, home mortgage interest not used to buy, build, or substantially improve your home, and miscellaneous itemized deductions are treated differently for AMT purposes. Taxpayers sometimes miss including these adjustments, leading to an incorrect AMT calculation.

Failure to Claim AMT Credits: Those who pay AMT in one year may be eligible for a credit in future years but often fail to claim this credit, potentially paying more tax than necessary.

Improperly Calculating Depreciation: For AMT purposes, depreciation needs to be calculated using different rules than for regular tax purposes, which is frequently done incorrectly.

Forgetting to Include Tax-Exempt Interest from Private Activity Bonds: Tax-exempt interest from private activity bonds must be added back for AMT purposes, a step often overlooked by taxpayers.

Incorrectly Calculating the AMT Gain or Loss on Property Sales: The calculation of gain or loss for AMT purposes may differ from the regular tax calculation due to adjustments in basis and exclusion amounts, which can lead to errors.

Not Seeking Professional Help When Needed: Given the complexity of AMT calculations, taxpayers sometimes attempt to complete Form 6251 without the necessary guidance, leading to errors. Consulting a tax professional knowledgeable about AMT can provide invaluable assistance.

Avoiding these mistakes requires careful attention to the instructions for Form 6251 and, when in doubt, seeking advice from a tax professional. Being proactive and informed can help taxpayers navigate the complexities of the Alternative Minimum Tax efficiently and accurately.

Documents used along the form

When preparing your tax returns and dealing with the complexities surrounding the Alternative Minimum Tax (AMT), the IRS Form 6251 is not the only document you might need. Several other forms and documents often play a crucial role in ensuring your tax filings are complete and accurate. Understanding each of these forms will help streamline the process, making sure all aspects of your financial situation are properly addressed.

- Schedule A (Form 1040) - This form is used to itemize deductions that taxpayers can claim in lieu of the standard deduction. Common deductions include mortgage interest, property taxes, and charitable contributions. It's essential for determining allowable deductions under the AMT rules.

- Form 1116 - For taxpayers who have paid foreign taxes, Form 1116 is used to calculate the foreign tax credit. This can potentially reduce the AMT by avoiding double taxation on foreign income.

- Form 8824 - This form is necessary for reporting like-kind exchanges, which allow the deferral of capital gains taxes when a business or investment property is exchanged for a similar property. Given that certain deferral strategies might trigger AMT liabilities, understanding this document's implications is important.

- Form 8283 - Utilized for reporting non-cash charitable contributions over $500, Form 8283 is crucial for itemizing deductions under Schedule A. The form helps ensure that donations of valuable items are correctly reported and accounted for under the AMT.

- Form 6252 - Involved in reporting income from installment sales, Form 6252 can impact AMT calculations. This form is necessary when the sale of property results in receiving payments over time, influencing how income is reported and taxed.

- Form 8801 - Important for individuals who have previously paid AMT, Form 8801 is used to calculate the credit for AMT in subsequent years. This form helps taxpayers recover some of the AMT paid in past years by applying it against their regular tax liability.

- W-2 and 1099 Forms - These documents report wages, salaries, and other types of income. They're foundational in determining your taxable income, which in turn influences the potential AMT liability.

Navigating taxes involves dealing with multiple forms and understanding their interactions, especially when it comes to AMT considerations. Each of these forms plays a pivotal role in ensuring that your taxes are filed correctly, potentially saving you from costly errors. Armed with this knowledge, you're better positioned to manage your tax situation effectively, no matter how complex it may be.

Similar forms

The IRS Form 6251, known as the Alternative Minimum Tax—Individuals form, has similarities to several other tax documents, each designed for specific tax situations. One similar document is the IRS Form 1040, the U.S. Individual Income Tax Return. This form is the foundation of personal income tax filing, where taxpayers report their income, deductions, and credits to determine their tax liability. Similar to Form 6251, Form 1040 can lead to additional tax liability calculations, ensuring that all individuals pay a minimum level of tax. However, while Form 1040 calculates general income tax, Form 6251 focuses on ensuring that taxpayers with certain types of income and deductions pay at least a minimum amount of tax.

Another related document is the IRS Schedule A (Form 1040), which itemizes allowable deductions that taxpayers can claim against their income. Like Form 6251, which may require adjustments based on specific deductions or exclusions, Schedule A impacts the taxpayer's bottom line by reducing taxable income, albeit through a different mechanism. While Schedule A is focused on reducing taxable income through itemized deductions such as medical expenses, state taxes, and charitable donations, Form 6251 adjusts the taxpayer's income by adding back certain deductions and preference items, recalculating tax liability under the Alternative Minimum Tax rules.

The IRS Form 8801, Credit for Prior Year Minimum Tax—Individuals, Estates, and Trusts, is also closely related to Form 6251. After a taxpayer calculates and pays the Alternative Minimum Tax in one year, Form 8801 is used in subsequent years to determine if they are eligible for a credit. The credit recognizes that the taxpayer may have paid more tax than necessary under the regular tax system due to the Alternative Minimum Tax in the prior year. This form complements Form 6251 by potentially offering relief in the form of a tax credit for taxes previously paid under the AMT system, creating a bridge between the two tax years and their respective calculations.

Lastly, the IRS Form 1041, U.S. Income Tax Return for Estates and Trusts, shares the concept of ensuring that entities pay a fair share of taxes, similar to the objective of Form 6251 for individuals. While Form 1041 is used by estates and trusts to report income, deductions, gains, losses, and taxes due, it includes calculations to ensure these entities do not avoid their fair share of taxation. The idea of preventing tax avoidance through proper tax calculation mechanisms ties Form 1041 to Form 6251, despite the different taxpayer groups they are designed for. Both forms play essential roles in the broader tax reporting landscape, ensuring fairness and adherence to tax laws.

Dos and Don'ts

Filling out the IRS 6251 form, which is used to calculate alternative minimum tax (AMT) owed by a taxpayer, can be a daunting task. To make the process smoother and ensure accuracy, here is a list of do's and don'ts to keep in mind:

Do:Read the instructions carefully. The IRS provides comprehensive instructions for form 6251, which can clarify how to accurately report income, deductions, and calculate the AMT.

Gather all necessary documents beforehand. This includes your tax return, as well as any documents related to income, deductions, and credits that could affect your AMT calculation.

Use the correct tax year's form. Tax laws and forms can change from year to year, so ensure you are using the version of form 6251 that corresponds to the tax year you are filing for.

Check your calculations twice. Errors in arithmetic can lead to incorrectly calculated AMT and potentially trigger IRS notices or audits. Consider using tax software or consulting a tax professional to help with complex calculations.

Rush through the form. Take your time to understand each section and entry to avoid mistakes that could result in underpaying or overpaying your tax.

Skip parts of the form. Even if you think a section does not apply to you, review it to confirm. Some areas may impact your AMT calculation in ways you didn't anticipate.

Ignore the instructions for specific lines. Certain lines on form 6251 may require you to make adjustments based on your financial situation or carry over amounts from other forms and schedules.

Forget to sign and date the form. An unsigned form is considered invalid by the IRS, which could lead to delays in processing your tax return and calculating your AMT.

Misconceptions

Regarding the IRS 6251 form, which relates to the alternative minimum tax (AMT), there are several misconceptions. This form plays a critical role in the tax filing process for some, but misunderstandings can lead to confusion about who needs to file it and why. Here, we address some common misconceptions to clarify its purpose and requirements.

Only the wealthy need to file IRS 6251. While it's true that the AMT was initially designed to prevent high-income earners from avoiding federal income taxes through deductions and credits, over time, middle-income taxpayers can also be affected due to factors like inflation and tax law changes.

Filing Form 6251 is always required. Not everyone needs to file Form 6251. It's necessary only if your AMT is more than your regular tax amount. The IRS even provides a worksheet to help determine if you need to fill it out.

Form 6251 is too complicated for the average person to complete. While the form can seem daunting, the IRS provides instructions to guide taxpayers through the process. Furthermore, many tax software programs automatically calculate the need and fill out the form if required.

You don't need Form 6251 if you take the standard deduction. The need to file Form 6251 is not solely based on whether you itemize deductions or take the standard deduction. Various adjustments and preferences can still result in AMT liability.

The AMT is permanent if you pay it once. Whether or not you need to pay the AMT and file Form 6251 can vary from year to year based on your income, deductions, and tax credits.

If you're subject to the AMT, you can't claim any deductions. While the AMT disallows or limits certain deductions and credits, taxpayers may still claim other deductions. For instance, medical expenses exceeding a certain percentage of your income remain deductible.

You must hire a professional to deal with Form 6251. Although seeking professional advice can be beneficial, especially in complex tax situations, many individuals successfully file Form 6251 on their own or with the aid of tax preparation software.

State tax refunds are always taxable under the AMT. The taxability of state income tax refunds under the AMT depends on whether the taxpayer opted for itemized deductions or the standard deduction in the previous year.

There's no way to avoid the AMT if you're close to the threshold. Tax planning strategies, such as timing income and deductions, can sometimes help manage AMT exposure. However, these strategies should be used with an understanding of the AMT rules to avoid unintended consequences.

Clearing up these misconceptions can help taxpayers better understand the IRS 6251 form, why it may be required, and how the alternative minimum tax may affect their tax situation. Tax laws and forms can change, so staying informed and, if necessary, seeking professional advice is always wise.

Key takeaways

Understanding and completing the IRS Form 6251 can seem complex, but it's an essential part of ensuring you're compliant with tax laws concerning Alternative Minimum Tax (AMT). Here are key takeaways to guide you through the purpose and process of using this form:

The IRS Form 6251 is used to calculate the Alternative Minimum Tax (AMT) that individuals may owe. The AMT is a separate tax system designed to ensure that taxpayers who benefit from certain deductions pay at least a minimum amount of tax.

Taxpayers need to fill out Form 6251 if their taxable income, plus certain adjustments, is more than the exemption amount for their filing status. This doesn't necessarily mean you will owe AMT, but it’s the first step in determining that.

Common adjustments that could trigger AMT include certain itemized deductions, such as state and local taxes, and home mortgage interest that doesn’t qualify as acquisition debt. Also, exercising incentive stock options without selling the stock in the same tax year.

Form 6251 requires you to calculate your AMT income (AMI), which involves adding or subtracting specified adjustments and preferences to your taxable income. This process can be complex and may require adjustments for things like depreciation and medical expenses.

After computing your AMI, you compare it with the AMT exemption amount. The exemption amount is designed to prevent people with incomes below a certain level from having to pay the AMT. The exemption amount changes yearly and varies according to filing status.

If your AMI exceeds the exemption amount, you must calculate the tentative minimum tax. This is essentially the amount of AMT you might owe. It's done by applying the AMT tax rates of 26% or 28% to the amount your AMI exceeds the exemption, then subtracting the AMT foreign tax credit if applicable.

Comparison between regular tax and AMT: After calculating your tentative minimum tax, you must compare this amount with your regular tax liability. If your tentative minimum tax is higher, you'll owe the difference as AMT on top of your regular tax.

Keep records and calculations for future reference, as some AMT adjustments can carry over to future tax years. For example, if you pay AMT because of incentive stock options, this could affect your tax calculations in the year you sell the stock.

Given the complexity of the AMT and the Form 6251, many taxpayers find it beneficial to consult with a tax professional. They can provide guidance tailored to your particular financial situation and help you minimize your AMT liability.

Properly addressing the AMT and completing the Form 6251 can be intricate, requiring a good understanding of various adjustments and preferences. Careful attention to detail and possibly professional advice can help you navigate this requirement effectively.

Popular PDF Documents

Teacher Student Loan Forgiveness - Guidance on how to process your application if you’ve taught at multiple eligible schools or educational service agencies.

Sba 1201 Loan Forgiveness - Emphasizes clear, block letter printing for entries to ensure legibility and accuracy in processing.