Get Irs 593 V Form

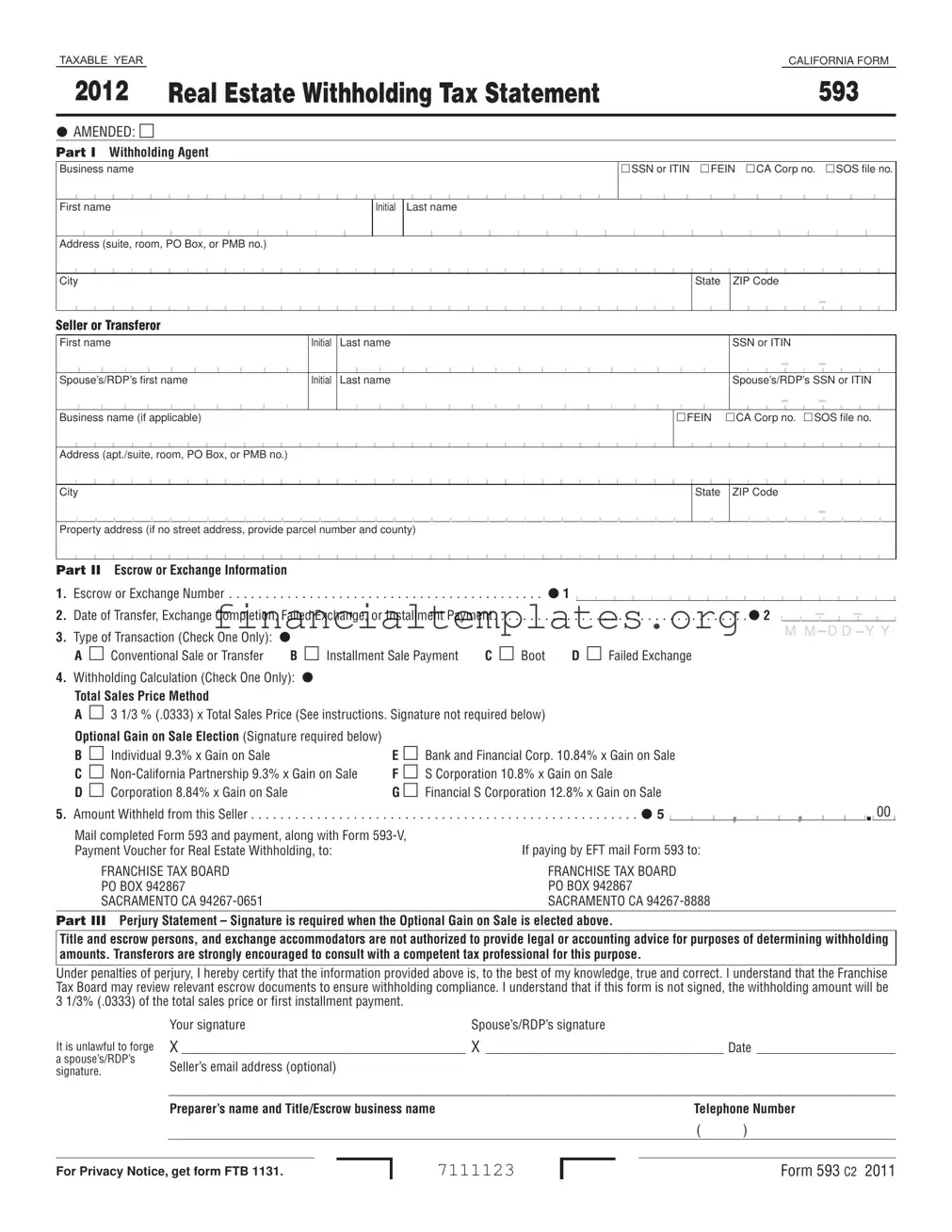

For individuals and businesses involved in the sale or transfer of real estate in California, navigating the complexities of tax withholding forms is a crucial step. Among the various forms, the IRS 593 V form, or the Payment Voucher for Real Estate Withholding, plays a vital role. This form is used alongside Form 593, the Real Estate Withholding Tax Statement, to report real estate withholding to the Franchise Tax Board. The requirement to submit Form 593 arises when there's a sale, transfer, or even certain types of exchanges of real property within California. It covers different transaction types—ranging from conventional sales and exchanges that either completed or failed, to installment sale payments. Additionally, it's imperative for the form to reflect accurate property and transaction details, including identification numbers and transaction types, to calculate the correct withholding amount. The process also includes options for how the withholding is calculated, either based on the total sales price or the optional gain on sale election. Besides ensuring compliance, prompt submission of Form 593 along with the 593 V payment voucher, directly impacts the timeliness of withholding payments. This not only helps in avoiding penalties but also in streamlining the filing process for both the withholding agents and the seller or transferor involved. Moreover, the form's introduction and subsequent updates aim to accommodate various transaction scenarios, including provisions for registered domestic partners and changes in personal income tax rates. With the intricacies involved, especially the potential financial implications for not adhering to the specified guidelines, the importance of correctly completing and submitting these forms cannot be overstated.

Irs 593 V Example

TAXABLE YEARCALIFORNIA FORM

2012 |

|

|

|

|

Real Estate Withholding Tax Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

593 |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

IAMENDED: m |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Part I Withholding Agent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

Business name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mSSN or ITIN mFEIN mCA Corp no. |

|

mSOS file no. |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

First name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (suite, room, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

Seller or Transferor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

First name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

- |

|

|

|

|

|

|

|

|

||||

Spouse’s/RDP’s first name |

|

Initial |

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s SSN or ITIN |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

- |

|

|

|

|

|

|

|

|

||||

Business name (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mFEIN |

mCA Corp no. mSOS file no. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Address (apt./suite, room, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

- |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property address (if no street address, provide parcel number and county)

Part II Escrow or Exchange Information |

I1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Escrow or Exchange Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

2. |

. . . . . . .Date of Transfer, Exchange Completion, Failed Exchange, or Installment Payment |

. . . . . |

. . |

. . . |

. . |

. . . |

. . |

. . . |

|

. . . |

. . |

|

. . . |

|

2 |

|||||||||

3.Type of Transaction (Check One Only): I

A m Conventional Sale or Transfer |

B m Installment Sale Payment |

C m Boot |

D m Failed Exchange |

4.Withholding Calculation (Check One Only): I

Total Sales Price Method

A m 3 1/3 % (.0333) x Total Sales Price (See instructions. Signature not required below)

|

Optional Gain on Sale Election (Signature required below) |

E m Bank and Financial Corp. 10.84% x Gain on Sale |

|

|

||||

|

B m Individual 9.3% x Gain on Sale |

|

|

|||||

|

C m |

F m S Corporation 10.8% x Gain on Sale |

|

|

||||

|

D m Corporation 8.84% x Gain on Sale |

G m Financial S Corporation 12.8% x Gain on Sale |

|

|

||||

5. |

Amount Withheld from this Seller |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . I5 |

|

|

|

|

|

|

|

|

|

, |

|||||

Mail completed Form 593 and payment, along with Form

Payment Voucher for Real Estate Withholding, to:

FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA

M M D D Y Y

00

,.

Part III Perjury Statement – Signature is required when the Optional Gain on Sale is elected above.

Title and escrow persons, and exchange accommodators are not authorized to provide legal or accounting advice for purposes of determining withholding amounts. Transferors are strongly encouraged to consult with a competent tax professional for this purpose.

Under penalties of perjury, I hereby certify that the information provided above is, to the best of my knowledge, true and correct. I understand that the Franchise Tax Board may review relevant escrow documents to ensure withholding compliance. I understand that if this form is not signed, the withholding amount will be 3 1/3% (.0333) of the total sales price or first installment payment.

Your signatureSpouse’s/RDP’s signature

It is unlawful to forge X ___________________________________________ X ____________________________________ Date _____________________ |

|||

a spouse’s/RDP’s |

Seller’s email address (optional) |

|

|

signature. |

|

|

|

|

|

|

|

|

______________________________________________________________________________________________________________ |

||

|

Preparer’s name and Title/Escrow business name |

Telephone Number |

|

|

|

( |

) |

For Privacy Notice, get form FTB 1131.

7111123

Form 593 C2 2011

Instructions for 593

Real Estate Withholding Tax Statement

What’s New

Withhold on Installment Sale

General Information

For taxable years beginning on or after January 1, 2011, the maximum personal income tax rate is 9.3%. In addition, non- California partnerships are subject to withholding requirements on a sale of California real property at a rate of 3 1/3% (.0333) of sales price or 9.3% of gain. The alternative withholding rate for the gain on sale of California real property by S corporations is 10.8% and 12.8% for Financial S corporations.

For taxable years beginning January 1, 2010, use Form 593, Real Estate Withholding Tax Statement, to report real estate withholding and use Form

is submitted electronically or by mail. See General Information, A Purpose, for more information.

Form 593 is now a single page form. Although Copies A, B, and C have been eliminated you must still complete, file, and distribute three copies of Form 593. See General Information, C When and Where to File, for more information.

Installment Sales – For installment sales occurring on or after January 1, 2009, buyers are required to withhold on the principal portion of each installment payment if the sale of California real property is structured as an installment sale.

Registered Domestic Partners (RDP) – Under California law, RDPs must file their California income tax returns using either the married/ RDP filing jointly or married/RDP filing separately filing status. RDPs have the same legal benefits, protections, and responsibilities as married couples unless otherwise specified.

If you entered into a same sex legal union in another state, other than a marriage, and that union has been determined to be substantially equivalent to a California registered domestic partnership, you are required to file a California income tax return using either the married/RDP filing jointly or married/RDP filing separately filing status.

For purposes of California income tax, references to a spouse, husband, or wife also refer to a California RDP, unless otherwise specified. When we use the initials RDP they refer to both a California registered domestic “partner” and a California registered domestic “partnership,” as applicable. For more information on RDPs, get FTB Pub. 737, Tax Information for Registered Domestic Partners.

Electronic Filing Requirements

Form 593 information may be filed with the FTB electronically, using FTB’s Secure Web Internet File Transfer (SWIFT), instead of paper. However, withholding agents must continue to provide the seller or transferor with paper Form 593.

For electronic filing, submit your file using the SWIFT process as outlined in FTB Pub. 923, Secure Web Internet File Transfer (SWIFT) Guide for Resident, Nonresident, and Real Estate Withholding.

For the required file format and record layout for electronic filing, get FTB Pub. 1023R, Real Estate Withholding Electronic Submission Requirements. If you are the preparer for more than one withholding agent, provide a separate electronic file for each withholding agent. For electronic filing submit your payment using Electronic Funds Transfer (EFT) or Form

When remitting payments by EFT, mail a copy of Form 593 to the following address:

FRANCHISE TAX BOARD PO BOX 942867 SACRAMENTO CA

A Purpose

Use Form 593 to report real estate withholding on sales closing in 2012, on installment payments made in 2012, or on exchanges that were completed or failed in 2012.

Use a separate Form 593 to report the amount withheld from each seller. If the sellers are married or RDPs and they plan to file a joint return, include both spouses/RDPs on the same Form 593.

If the sellers are married or RDPs and they are entered as one seller, we treat them as having equal ownership interest. If the ownership interest is not equal, separate Forms 593 need to be filed for each individual to represent the correct interest percentage. If the information submitted is incorrect, an amended Form 593 must be submitted to the FTB by the withholding agent.

Use Form

Common Errors

Year of Form – The year (at the top) of Form 593 must be the same as the year on line 2. See instructions for line 2. If you do not have Form 593 with the correct year, go to ftb.ca.gov to get the correct form.

Identiication Numbers – Check to see that the withholding agent’s and seller’s identification numbers are correct and listed in the same order as the names. If both a husband/RDP and wife/RDP are listed, make sure both social security numbers (SSNs) or individual taxpayer identification numbers (ITINs) are listed in the same order as their names.

Trusts and Trustees – It is important to report the correct name and identification number when title is held in the name of a trust. If the seller is a trust, see the Specific Line Instructions on page 2 for Seller or Transferor.

Preparer’s Name and title/Escrow Business Name – Provide the preparer’s name and title/escrow’s business name and phone number.

B Who Must File

Any person who withheld on the sale or transfer of California real property during the calendar month must file Form 593 to report, and Form

C When and Where to File

You need three completed copies of Form 593 for filing and distribution. On the principal portion of the first installment payment, file a copy of Form 593, Form

FRANCHISE TAX BOARD PO BOX 942867 SACRAMENTO CA

Distribute the other two copies of Form 593 as follows:

•Send one copy to sellers within 20 days following the end of the month in which the transaction occurred.

•One copy will be retained by the withholding agent for a minimum of five years and must be provided to the FTB upon request.

Form 593 2011 Page 1

D Interest and Penalties

Interest will be assessed on late withholding payments and is computed from the due date to the date paid. If the real estate escrow person does not notify the buyer of the withholding requirements in writing, the penalty is the greater of $500 or 10% of the required withholding.

If the buyer (after notification) or other withholding agent does not withhold, the penalty is the greater of $500 or 10% of the required withholding.

If the withholding agent does not furnish complete and correct copies of Form 593 to the FTB by the due date, but does file them within 30 days of the due date, the penalty is $15 per Form 593. If Form 593 is filed more than 30 days but less than 180 days after the due date, the penalty is $30 per Form 593. If Form 593 is filed more than 180 days after the due date, the penalty is $50 per Form 593. If the failure is due to an intentional disregard of the requirement, the penalty is the greater of $100 or 10% of the required withholding.

If the withholding agent does not furnish complete and correct copies of Form 593 to the seller by the due date, the penalty is $50 per Form 593. If the failure is due to an intentional disregard of the requirement, the penalty is the greater of $100 or 10% of the required withholding.

E Amending Form 593

To amend Form 593:

•Complete a new Form 593 with the correct information.

•Check the “Amended” box at the top of the revised form.

•Include a letter explaining what changes were made and why.

•Mail the amended form and letter to:

FRANCHISE TAX BOARD PO BOX 942867 SACRAMENTO CA

Whenever an amended Form 593 is provided to the FTB, each affected seller should also be provided with a copy. Be sure to check the “Amended” box at the top of the revised form.

Amended forms can only be filed by the withholding agent. If a seller notices an error, the seller should contact the withholding agent.

Do not file an amended Form 593 to cancel the withholding amount for a Form

Instructions for Seller

This withholding of tax does not relieve you from the requirement to file a California income tax return and report the sale within three months and fifteen days (two months and

fifteen days for a corporation) after the close of your taxable year.

You may be assessed penalties if:

•You do not file a tax return.

•You file your tax return late.

•The amount of withholding does not satisfy your tax liability.

How to Claim the Withholding

To claim the withholding credit, report the sale or transfer as required and enter the amount from line 5 on the withholding line on your tax return, Withholding (Form

If withholding was done for a failed exchange or on boot in the year following the year the property was sold, the withholding is shown as a credit for the taxable year the withholding occurred since you qualify for installment sale reporting. If you elect to report the gain in the year the property was sold, instead of in the year you received the payment, contact the FTB at 888.792.4900 prior to filing your California tax return for instructions to have the credit transferred to the prior year.

Specific Instructions

Foreign Address - Enter the information in the following order: City, Country, Province/ Region, and Postal Code. Follow the country’s practice for entering the postal code. Do not abbreviate the country’s name.

Part I – Withholding Agent

Enter the business or individual withholding agent’s name, mailing address, and identification number of the withholding agent (payer/sender). Enter the SSN or ITIN only when the buyer, who is an individual, is sending the withholding payment. Include the Private Mail Box (PMB) in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123.

Seller or Transferor

Enter the individual or business name (if applicable), mailing address, and identification number of the seller or transferor. Include the PMB in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123. If the seller has applied for an identification number, but it has not been received, enter, “Applied For” in the space for the seller’s ID and attach a copy of the federal application behind Form 593.

If the seller is an individual, enter the SSN or ITIN. If the sellers are husband/RDP and wife/RDP and plan to file a joint return, enter the name and SSN or ITIN for each spouse/RDP. Otherwise, do not enter information for more than one seller. Instead, complete a separate Form 593 for each seller.

If the seller is a business, enter the business name in the business name field along with the federal employer identification number (FEIN), CA Corp number, Secretary of State (SOS) file number. If the seller is a grantor trust, enter the grantor’s individual name and SSN or ITIN. Do not enter the name of the grantor trust. The grantor trust is disregarded for tax purposes and the individual seller must report the sale and claim the withholding on the individual’s tax return.

If the seller is a

trustee information.

If the seller is a single member disregarded LLC, enter the name and identification number of the single member.

For all other

Enter the address (or parcel number and county) of the California real property transferred.

Conventional Sale or Transfer and Installment Sales: Enter the address (parcel number and county) of the transferred property.

Exchanges: Enter the address of the relinquished property.

Part II – Escrow or Exchange Information

Line 1 – Escrow or Exchange Number

Enter the escrow or exchange number for the property transferred.

Line 2 – Date of Transfer, Exchange Completion, Failed Exchange, or Installment Payment

Conventional Sale or Transfer: Enter the date escrow closed.

Installment Sales: For withholding on the first installment payment, enter the date escrow closed. For withholding on the principal portion of each installment payment, enter the date of the installment payment.

Exchanges: For completed exchanges, enter the date that the boot (cash or cash equivalent) was distributed to the exchanger. For failed exchanges, enter the date when it was determined that the exchange would not meet the deferred exchange requirements and any cash was distributed to the seller.

When withholding on boot or a failed exchange, be sure to use the forms for the year that you entered on line 2 (rather than the year of the sale), since the seller will be able to use installment sale reporting for the gain.

Line 3 – Type of Transaction

Check one box that represents the type of real estate transaction for which the withholding is being calculated.

Page 2 Form 593 2011

Conventional Sale or Transfer: Check this box if the conventional sale or transfer represents the close of escrow for the real estate transaction. This sale or transfer does not contain any conditions such as an installment sale, boot, or failed exchange.

Installment Sale Payment: Check this box if you are withholding on either the principal portion of the first installment payment during escrow or on the principal portion of a subsequent installment payment including the final payoff in escrow. Attach a copy of the promissory note with the first installment payment.

Boot: Check this box if the seller intends to complete a deferred exchange, but receives boot (cash or cash equivalent) out of escrow.

Failed Exchange: Check this box for any failed exchange, including if a failed deferred exchange had boot withheld upon in the original relinquished property.

Line 4 – Withholding Calculation

Check one box that represents the method to be used to calculate the withholding amount on line 5. Either the Total Sales Price Method (31/3% (.0333) of the sale price) or the Optional Gain on Sale Election based on the applicable tax rate as applied to the gain on sale. Check only one box,

Line 5 – Amount Withheld

Enter the amount withheld from this transaction or installment payment based upon the appropriate calculation for either the Total Sales Price or the Optional Gain on Sale Election, below.

Withholding Amount Using Total Sales Price

Conventional Sale or Transfer:

a.Total Sales Price . . . . . . . . . .$__________

b.Enter the seller’s

ownership percentage . . . . . . _ _ _ ._ _%

c.Amount Subject to Withholding. Multiply line a by line b and

enter the result . . . . . . . . . .$__________

d.Withholding Amount. Multiply line c by 31/3% (.0333) and enter the result here and on

Form 593, line 5 . . . . . . . . . .$__________

Installment Sales:

a.Amount Subject to Withholding. If you are withholding on the first installment payment in escrow, enter the required amount of the first installment payment. If you are withholding on subsequent installment payments or the final payoff in escrow, enter

the principal portion of the

payment . . . . . . . . . . . . . . . .$__________

b.Withholding Amount. Multiply line a by 31/3% (.0333) and enter the result here and on

Form 593, line 5 . . . . . . . . . .$__________

Exchanges:

a.Amount Subject to Withholding. For completed deferred exchanges, enter the amount of boot (cash or cash equivalent) received by

the seller. . . . . . . . . . . . . . . .$__________

b.Withholding Amount. Multiply line a by 31/3% (.0333) and enter the result here and on

Form 593, line 5 . . . . . . . . . .$__________

Failed Exchanges:

a.Total Sales Price. If a deferred exchange is not completed or does not meet the deferred requirements, enter the total

sales price . . . . . . . . . . . . . .$__________

b.Ownership Percentage. If multiple transferors attempted to exchange this property, enter this seller’s ownership percentage. Otherwise,

enter 100.00% . . . . . . . . . . . . _ _ _ ._ _%

c.Amount Subject to Withholding. Multiply

line a by line b . . . . . . . . . . .$__________

d.Withholding Amount. Multiply line c by 31/3% (.0333) and enter the result here and

on Form 593, line 5 . . . . . . .$__________

Withholding Amount Using Optional Gain on Sale Election

Conventional Sale or Transfer: Enter the amount from Form

Installment Sales: The Installment Withholding Percent is applied to the principal portion of all installment payments, including the first installment payment received during escrow to determine the gain on sale. The gain on sale is then multiplied by the seller’s applicable tax rate to determine the withholding amount.

You must complete the calculation under Installment Withholding Percent first, in the next column, to determine the withholding percentage needed to complete the withholding amount in item c.

a.Installment Payment. . . . . . .$__________

b.Gain on Sale, multiply line a by the Installment Withholding Percent (calculated in the

next column) . . . . . . . . . . . .$__________

c.Withholding Amount. Multiply line b by the applicable tax rate* and enter the result here

and on Form 593, line 5 . . . .$__________

Installment Withholding Percent

Complete this calculation for the Installment Withholding Percent that will be applied to all installment payments, including the first installment payment received during escrow. If withholding on the principal portion of each

installment payment, the seller must provide the buyer with the Installment Withholding Percent to be included on Form

a.Gain on Sale from

Form

b.Selling Price from

Form

c.Installment Withholding Percent, divide line a by

line b . . . . . . . . . . . . . . . . . . . _ _ _ ._ _%

With the principal portion of the first installment payment, attach a copy of the promissory note to the original Form 593 that will be sent to the FTB.

Exchanges:

a.Boot Amount. Not to

exceed recognized gain . . . .$__________

b.Withholding Amount. Multiply line a by the applicable tax rate* and enter the result here and on Form 593,

line 5 . . . . . . . . . . . . . . . . . .$__________

Failed Exchanges:

a.Gain on Sale from

Form

b.Ownership Percentage. If multiple transferors attempted to exchange this property, enter this seller’s ownership percentage. Otherwise,

enter 100.00% . . . . . . . . . . . . _ _ _ ._ _%

c.Amount Subject to Withholding. Multiply

line a by line b . . . . . . . . . . .$__________

d.Withholding Amount. Multiply line c by the applicable tax rate* and enter the result here

and on Form 593, line 5 . . . .$__________

If a failed deferred exchange had boot withheld upon in the original relinquished property, reduce the withholding amount by the amount previously remitted to the FTB.

*Tax Rates Individual 9.3%

Bank and Financial Corporation 10.84% S Corporation 10.8%

Financial S Corporation 12.8%

Part III – Perjury Statement

Complete the Seller’s and Preparer’s information. A signature is only required if the Optional Gain On Sale Election method is used.

Preparer’s Name and Title/Escrow Business Name

Provide the preparer’s name and title/escrow’s business name and phone number.

Form 593 2011 Page 3

Additional Information

For more information on real estate withholding, get FTB Pub. 1016, Real Estate Withholding Guidelines. To get withholding forms or publications, or to speak to a representative, contact our Withholding Services and Compliance’s automated telephone service at:

888.792.4900, or 916.845.4900 FAX 916.845.9512

Or write to:

WITHHOLDING SERVICES AND COMPLIANCE

FRANCHISE TAX BOARD PO BOX 942867 SACRAMENTO CA

You can download, view, and print California tax forms and publications at ftb.ca.gov.

Or to get forms by mail, write to:

TAX FORMS REQUEST UNIT FRANCHISE TAX BOARD PO BOX 307

RANCHO CORDOVA CA

For all other questions unrelated to withholding or to access the TTY/TDD number, see the information below.

Internet and Telephone Assistance

Website: |

ftb.ca.gov |

Phone: |

800.852.5711 from within the |

|

United States |

|

916.845.6500 from outside the |

|

United States |

TTY/TDD: 800.822.6268 for persons with hearing or speech impairments

Asistencia Por Internet y Teléfono

Sitio web: ftb.ca.gov

Teléfono: 800.852.5711 dentro de los Estados Unidos

916.845.6500 fuera de los Estados Unidos

TTY/TDD: 800.822.6268 personas con discapacidades auditivas y del habla

Page 4 Form 593 2011

Document Specifics

| Fact Name | Description |

|---|---|

| Form Usage | Form 593 is used to report real estate withholding on sales, installment payments, or exchanges completed or failed within the taxable year. |

| Payment Submission | When remitting withholding payments by check, money order, or EFT, use Form 593-V, and send it to the Franchise Tax Board at the specified address in Sacramento, CA. |

| Amendment Process | If corrections are needed, complete a new Form 593, check the “Amended” box, include an explanatory letter, and send to the Franchise Tax Board. |

| Governing Law | This form is subject to California state law, specifically regulated by the Franchise Tax Board for real estate transactions within California. |

Guide to Writing Irs 593 V

Filling out the IRS Form 593-V, Payment Voucher for Real Estate Withholding, accurately is a crucial task to ensure the proper handling of your real estate withholding. This form accompanies your payment when you're not paying electronically. Ensuring every detail is accurate helps in timely processing and avoids unnecessary delays or errors. Below are the steps to fill out Form 593-V correctly.

- Begin by entering the Taxable Year at the top of the form, indicating the year for which the real estate transaction occurred.

- In Part I, under Withholding Agent, fill out the business name or your name if you are the individual responsible for withholding the tax. Include your SSN, ITIN, FEIN, CA Corp no., or SOS file no. as applicable.

- Provide the complete address of the withholding agent, including suite, room, PO Box, or PMB no., followed by the city, state, and ZIP code.

- For the Seller or Transferor section, enter the first name, initial, and last name of the seller or transferor, along with their SSN or ITIN. If a spouse or RDP is involved, include their information as well. For a business seller, include the business name and appropriate identification numbers.

- Include the seller's or transferor's address, again with details such as apartment/suite number and city, state, and ZIP code.

- Enter the property address related to the real estate transaction. If no street address is available, provide the parcel number and county.

- Move to Part II, Escrow or Exchange Information. Fill in the escrow or exchange number and the date of transfer, exchange completion, failed exchange, or installment payment.

- Select the type of transaction by checking the appropriate box—conventional sale, installment sale payment, etc.

- For the Withholding Calculation section, select the method used to calculate the withholding (Total Sales Price or Optional Gain on Sale Election) and provide the calculated withholding amount.

- After completing the form, Mail it along with your payment to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0651. If you're paying by EFT, also mail Form 593 to this address.

- Finally, complete the Perjury Statement in Part III if you selected the Optional Gain on Sale Election, provide a signature from both you and your spouse or RDP (if applicable), and include the date. Seller’s email address and Preparer’s information are optional but recommended for future correspondence or clarification needs.

After you have completed all sections of the form and double-checked for accuracy, mail the form and your payment (unless paid by EFT) to the specified address. Ensure that you retain a copy of the form for your records. Completing Form 593-V carefully and correctly helps streamline the processing of your real estate withholding payment.

Understanding Irs 593 V

What is the purpose of Form 593?

Form 593 serves to report real estate withholding on sales, exchanges, or installment payments for California real estate transactions in the designated tax year. This form must be filed by anyone who has withheld taxes on the sale or transfer of California real property. It is used alongside Form 593-V, which is the payment voucher for the withholding tax submitted.Who should file Form 593?

Form 593 must be filed by the withholding agent, usually the title or escrow company, intermediary, or accommodator involved in the real estate transaction. In cases of installment sales, the buyer might also be responsible for reporting the withholding.When and where should Form 593 be filed?

Form 593, along with Form 593-V if applicable, should be filed within 20 days following the end of the month in which the real estate transaction occurred. These documents should be mailed to the FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0651.How do I amend a previously filed Form 593?

To amend a previously filed Form 593, complete a new form with the correct information, check the “Amended” box, and include a letter explaining the changes. Mail the amended form and letter to the Franchise Tax Board at the address provided for filing.What are the penalties for late or incorrect filings?

Penalties may be assessed for late payments, not notifying the buyer in writing of withholding requirements, not withholding, not furnishing Form 593 to the FTB or the seller by the due date, and other failures. Penalties vary from a minimum of $15 up to the greater of $100 or 10% of the required withholding for more severe violations.What counts as an installment sale for Form 593?

An installment sale for Form 593 involves a transaction where the buyer pays the seller the purchase price over a period exceeding one year, requiring withholding on the principal portion of each installment payment if the sale of California real property is structured in this manner.Can Form 593 be filed electronically?

Yes, information on Form 593 may be submitted to the FTB electronically using the Secure Web Internet File Transfer (SWIFT) system. However, withholding agents must still provide paper copies of Form 593 to the seller or transferor.How is the withholding amount on Form 593 calculated?

The withholding amount can be calculated using either the Total Sales Price Method (3 1/3% of the total sales price) or the Optional Gain on Sale Election, which varies based on the entity type and applicable tax rate. Details for calculating the withholding using both methods are provided in the instructions for Form 593.What should be done if the seller's or transferor's information on Form 593 is incorrect?

If the provided information is incorrect, an amended Form 593 must be submitted to the FTB by the withholding agent. If a seller finds an error, they should contact the withholding agent to correct it. Amended forms should include a letter explaining the changes and must be mailed to the FTB.How can a seller claim the withholding credit?

Sellers can claim the withholding credit by reporting the sale or transfer on their California income tax return and entering the withheld amount on the appropriate line. They must attach one copy of Form 593 to the front of their tax return to claim the credit.

Common mistakes

Filling out the IRS Form 593-V correctly is crucial for accurate tax reporting and compliance. However, people often make mistakes that can lead to potential issues or delays. Here are ten common mistakes to avoid:

- Incorrect Year on the Form: It's essential to use the Form 593 that corresponds with the taxable year you are reporting. Using a form for the wrong year is a common slip-up.

- Misidentifying Withholding Agent Information: People sometimes enter incorrect information for the withholding agent, such as mixing up the business name and the individual name fields or entering incorrect identification numbers.

- Incorrect Seller or Transferor Information: Failing to correctly identify the seller or transferor can lead to serious issues. This includes mixing up or leaving out SSNs, ITINs, FEINs, CA Corp numbers, or SOS file numbers.

- Not Reporting All Sellers: If the property is owned by more than one person, each seller must be listed separately, unless filing jointly as married or RDPs. This is commonly overlooked.

- Wrong Property Address: The address or parcel number and county of the California real property transferred must be accurately provided. Mistakes here can cause confusion and delays.

- Incorrect Date of Transfer: The date of the property transfer, exchange completion, failed exchange, or installment payment must accurately reflect the actual date of the transaction.

- Incorrect Type of Transaction: Checking the wrong transaction type box (e.g., conventional sale, installment sale, boot, failed exchange) can lead to incorrect withholding calculations.

- Calculating Withholding Incorrectly: Using the wrong method or making errors in the calculation of the withholding amount is a frequent mistake, whether using the Total Sales Price method or Optional Gain on Sale Election.

- Not Signing the Form When Required: The perjury statement requires a signature when the Optional Gain on Sale is elected. Failing to sign can invalidate the form.

- Ignoring Electronic Filing Requirements: When remitting payments by EFT, a copy of Form 593 must be mailed to the FTB. Not following the proper electronic filing procedures can lead to processing errors.

Avoiding these mistakes when completing Form 593-V ensures accurate and timely processing of real estate withholding tax information. Remember, when in doubt, consulting a tax professional can help navigate these requirements more easily.

Documents used along the form

When handling real estate transactions in California, particularly those that involve the challenging task of tax withholding on the sale or transfer of property, certain forms and documents become crucial to ensure compliance and accuracy in reporting. The Form 593-V, Payment Voucher for Real Estate Withholding, is just one piece of the puzzle, typically used in conjunction with the IRS Form 593. However, several other forms and documents often play a vital role in the process, ensuring that all aspects of a real estate transaction are correctly managed and reported.

- Form 593-E, Real Estate Withholding - Computation of Estimated Gain or Loss: This form helps sellers of California real property estimate the gain or loss on the sale. By determining this figure, sellers can accurately calculate the amount of tax that needs to be withheld in connection with the transaction.

- Form 593-C, Real Estate Withholding Certificate: If a seller believes that their transaction should be exempt from withholding or subject to reduced withholding, this certificate can be filed. This might be the case if the seller is experiencing a loss on the sale or if the property qualifies for an exemption under California tax laws.

- Form 593-I, Real Estate Withholding Installment Sale Acknowledgment: For transactions structured as installment sales, this form serves as an acknowledgment of the buyer’s obligation to withhold a portion of each installment payment. It is a critical document for managing tax obligations on installment sales.

- Schedule D-1, Sale of Business Property: This schedule is required for sellers electing not to report a sale via the installment method and instead report the entire gain in the year of the sale. It helps in detailing the sale of business property on a California tax return.

- FTB Pub. 1016, Real Estate Withholding Guidelines: This publication provides comprehensive guidance on the real estate withholding process, including who needs to withhold, how much to withhold, and the exceptions to the withholding requirements.

- Copy of the Escrow or Exchange Agreement: While not an official form, including a copy of the escrow or exchange agreement when filing withholding documents can provide the necessary context and details about the transaction, further ensuring compliance with the Franchise Tax Board’s requirements.

These forms and documents, each with its specific purpose, collectively ensure the smooth execution of real estate transactions in compliance with California's tax withholding laws. By understanding and utilizing these forms appropriately, sellers, buyers, and their advisors can navigate the complexities of real estate transactions with greater ease and confidence, ensuring that all tax obligations are met accurately and efficiently.

Similar forms

The IRS 593-V form, while unique in its function, shares similarities with a variety of other tax documents and payment vouchers. This comparison isn't about their purpose in the tax world but about their structure, use, and the process they facilitate. These documents include, but are not limited to, the IRS 1040-ES, FTB 3567, IRS W-4, IRS 8283, FTB 3519, IRS 1099-S, FTB 3885A, and the IRS 4506-T. Each of these forms plays a crucial role in fulfilling one's tax obligations, with nuanced differences tailored to specific financial scenarios.

The IRS 1040-ES is akin to the 593-V, primarily because both serve the purpose of facilitating tax payments in anticipation of future obligations. Where Form 593-V deals with real estate withholding payments, Form 1040-ES is used for estimated tax payments by individuals. Both require filers to project forward, considering income, deductions, and credits, to ensure compliance and avoid underpayment penalties. This foresight in payment helps manage cash flow and tax obligations efficiently.

FTB 3567, the Payment Plan Request form, shares the procedural aspect of managing tax obligations with IRS 593-V, albeit for different stages of the tax process. While 593-V involves the upfront collection and remittance of withholding taxes from real estate transactions, FTB 3567 comes into play when taxpayers find themselves unable to fulfill tax liabilities upfront and need structured payment arrangements. Both highlight the importance of addressing tax obligations proactively, though from opposite ends of the tax timeline.

The IRS W-4 form, Employee's Withholding Certificate, like IRS 593-V, deals with the concept of withholding. However, W-4 focuses on payroll taxes for employment income, allowing employees to determine the amount of tax withheld from their paychecks. In contrast, 593-V is specific to real estate transactions. The similarity lies in their purpose to adjust the amount of tax withheld to meet anticipated tax liabilities closely.

IRS 8283, Noncash Charitable Contributions, shares the theme of reporting specific transactions to the IRS, similar to 593-V's focus on real estate withholding. Though 8283 is concerned with donations of property rather than real estate sales, both forms involve detailed reporting of transactions that significantly impact one's tax situation, emphasizing the need for thorough documentation and accuracy.

FTB 3519, Payment for Automatic Extension for Individuals, is linked to 593-V through the mechanism of paying taxes associated with specific circumstances. While 593-V addresses withholding tax payments for real estate, 3519 is used to remit payment alongside an extension request for filing individual income tax returns. Each form facilitates a specific payment related to tax filing requirements, aiding taxpayers in managing their fiscal responsibilities.

IRS 1099-S, Proceedings From Real Estate Transactions, is closely related to IRS 593-V by its direct involvement with real estate. 1099-S is used to report the sale or exchange of real estate, which is the income event that necessitates the withholding reported on 593-V. Both forms are pivotal in the documentation and reporting of real estate transactions, ensuring compliance with taxation obligations.

FTB 3885A, Depreciation and Amortization Adjustments, while focusing on the calculation of depreciation for state tax purposes, parallels the IRS 593-V in the broader scope of managing real estate assets' tax implications. Both contribute to the accurate reporting of financial events related to real estate, albeit from different angles—593-V from a transactional standpoint and 3885A from an asset management viewpoint.

Finally, the IRS 4506-T, Request for Transcript of Tax Return, albeit a request form, shares with 593-V the underlying necessity of accurate tax record maintenance and retrieval. While 4506-T is instrumental in obtaining past tax return information, possibly for audits, loans, or future tax filings, IRS 593-V plays a crucial role in the current reporting and payment of taxes due from real estate transactions. Both underscore the importance of diligent tax document management and compliance.

In summary, while each of these forms has its unique place within the tax filing and payment ecosystem, their comparison to IRS Form 593-V highlights the diverse mechanisms through which taxpayers fulfill their obligations, manage their financial responsibilities, and ensure compliance with tax laws.

Dos and Don'ts

Filling out IRS Form 593-V, which relates to real estate withholding on sales in California, is an important tax responsibility. The form is used to report and remit withheld taxes from the sale or transfer of real property. As a taxpayer or withholding agent, there are key practices to follow and avoid for compliant and accurate filing. Below are seven essential dos and don'ts:

- Do ensure all identification numbers are correct and match the names provided. This includes Social Security Numbers (SSNs), Individual Taxpayer Identification Numbers (ITINs), Federal Employer Identification Numbers (FEINs), California Corporation (CA Corp) numbers, and Secretary of State (SOS) file numbers.

- Do provide the complete and accurate address of the property, including suite, room, PO Box, or PMB number for both the withholding agent and the seller or transferor.

- Do clearly indicate the taxable year and ensure that the form you are using corresponds to the correct year of the transaction.

- Do check the appropriate box under Part II to accurately reflect the type of transaction, whether it's a conventional sale, installment sale payment, boot, or failed exchange.

- Do not leave the Perjury Statement section unsigned if you select the Optional Gain on Sale Election method. This is a certification that requires the seller's acknowledgment.

- Do not use the form to cancel withholding amounts for a Form 593-C filed after the close of escrow. Adjustments to withheld amounts must be addressed through proper tax filing and cannot be amended with Form 593-V directly.

- Do not forget to consult with a competent tax professional if you are unsure about any part of the withholding calculation or have questions regarding the transaction's tax implications. This action ensures compliance and helps avoid potential penalties.

Each of these points stems from the overarching goal of achieving accuracy and compliance in tax reporting. Paying close attention to the specifics of Form 593-V can significantly streamline the real estate withholding process for all parties involved.

Misconceptions

Many people have misconceptions about the IRS Form 593-V, Payment Voucher for Real Estate Withholding. Understanding these misconceptions can help ensure that real estate transactions involving withholding are processed correctly. Here are nine common misconceptions and the truths to dispel them:

- Electronic Filing Isn’t Allowed: Some believe that Form 593 and Form 593-V must always be filed on paper. In reality, information can be filed electronically using the Franchise Tax Board’s Secure Web Internet File Transfer (SWIFT), although withholding agents are still required to provide a paper copy to the seller or transferor.

- It Applies Only to Sales: It's often thought that Form 593-V is only for outright property sales. However, it also applies to installment sales payments, exchange completions, and even failed exchanges, not just conventional sales.

- Withholding Is Always a Flat Rate: Many assume a flat withholding rate applies to all transactions. In truth, different rates can apply based on the type of transaction and taxpayer, including specific percentages for corporations, S corporations, and individuals.

- It’s Only for California Residents: The misconception that only California residents need to deal with Form 593-V persists. Non-residents who sell or transfer real property in California are also subject to withholding requirements and need to file this form.

- Withholding Amount Is Non-negotiable: Sellers often believe the withholding amount is set in stone. However, the withholding can be based on either the total sales price or the optional gain on sale, which may lead to different withholding amounts.

- Amended Forms Are Prohibited: There’s a false belief that once Form 593 or Form 593-V is filed, it cannot be amended. In fact, if inaccuracies are found, an amended form and a letter of explanation can and should be submitted to the Franchise Tax Board.

- Sellers Don’t Need to File a Tax Return: Some sellers think that if tax was withheld at the time of sale, they're not required to file a California income tax return. Every seller must file a tax return to report the sale and apply the withholding as a credit against any tax due.

- Form 593-V Is Used for Payment Only: While Form 593-V is a payment voucher, the associated Form 593 must also be completed and filed to report the details of the real estate withholding.

- Only the Withholding Agent Can File: Some believe that the withholding agent is solely responsible for filing. However, buyers making installment payments may also need to complete and file these forms to report withholding.

Understanding these aspects of the IRS Form 593-V can help sellers, buyers, and withholding agents navigate real estate transactions more effectively, ensuring compliance with California's tax laws.

Key takeaways

Filling out and using the IRS Form 593-V involves several key steps and considerations important for ensuring compliance with California's tax withholding requirements on real estate transactions. Here are five essential takeaways to be aware of:

- Identify the transaction type: Form 593-V is used in conjunction with Form 593, Real Estate Withholding Tax Statement, to report and remit withholding from the sale or transfer of California real property. It's crucial to accurately check the transaction type on Form 593, as this determines the correct method of calculation and the applicable withholding rates.

- Correctly calculate the withholding amount: The withholding amount can be calculated using either the Total Sales Price method or the Optional Gain on Sale Election. The choice depends on factors such as the type of entity selling the property and the specifics of the transaction. Ensuring the correct calculation is vital for both compliance and the financial well-being of the seller.

- File and distribute copies appropriately: Three copies of Form 593 must be completed, filed, and distributed correctly. One copy is sent to the California Franchise Tax Board (FTB) along with Form 593-V, another is retained by the withholding agent, and the final copy is given to the seller or transferor for their records. This distribution is important for documentation and compliance purposes.

- Timing is crucial: The withholding tax and required forms must be submitted to the FTB within 20 days following the end of the month in which the transaction occurred. Late submissions can result in interest and penalties, emphasizing the importance of prompt and accurate filing.

- Amending Form 593: If any information submitted on Form 593 needs correction, an amended form must be filed. This requires completing a new Form 593 with the corrected information, marking the “Amended” box, and providing a letter explaining the changes. Both the amended form and the letter should then be mailed to the FTB. It's also necessary to provide each affected seller with a copy of the amended form.

Understanding these key aspects of Form 593 and Form 593-V can help ensure that real estate transactions involving California property are reported and taxed correctly, avoiding common errors and potential penalties.

Popular PDF Documents

1095 Form - Despite not needing to be filed with the IRS by the recipient, the information on the 1095-C form should be retained with other tax documents.

Reseller Permit Renewal - The address on the JT-1 form allows for direct communication and submission to the Arizona Department of Revenue’s Customer Care and Outreach division.