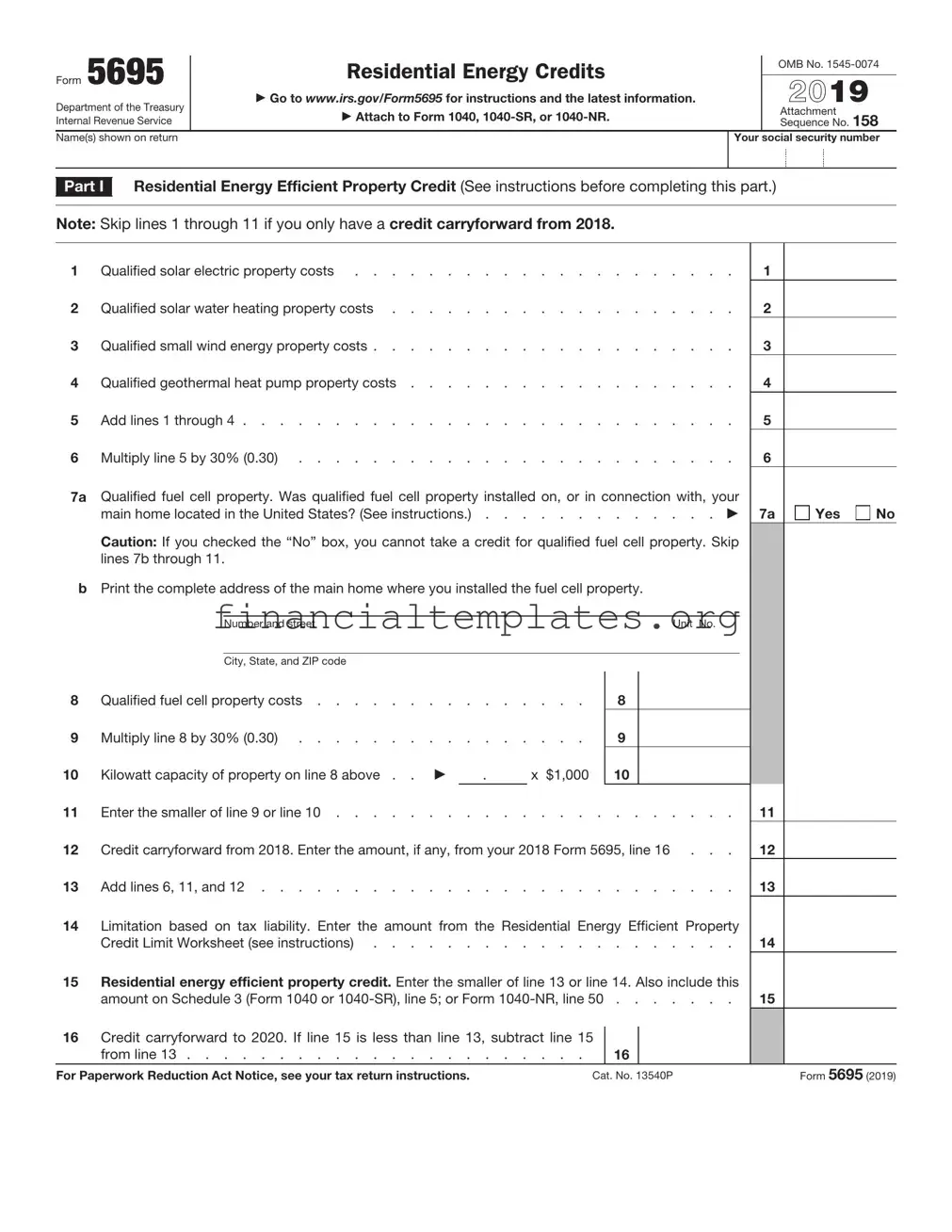

Get IRS 5695 Form

For taxpayers looking to leverage energy efficiency in their homes, the IRS Form 5695 serves as a critical pathway. This form, integral to filing federal income taxes, allows individuals to claim credits for residential energy-efficient improvements and renewable energy installations—a move that can not only reduce one’s tax liability but also promote environmental sustainability. Key elements that can qualify for these tax benefits include solar panels, solar water heaters, geothermal heat pumps, small wind turbines, and fuel cell property. The form breaks down into two main parts: one focused on residential energy-efficient improvements and the other on residential energy property costs. Understanding the nuanced eligibility requirements, the specific types of improvements that qualify, and how to accurately calculate and claim the credit are all essential aspects for taxpayers. Through careful completion of IRS Form 5695, individuals have the opportunity to not only lower their tax bills but also contribute to a larger goal of energy efficiency and environmental stewardship.

IRS 5695 Example

Form 5695 |

Residential Energy Credits |

|

OMB No. |

|

|

||

|

2021 |

||

Department of the Treasury |

▶ Go to www.irs.gov/Form5695 for instructions and the latest information. |

|

|

|

▶ Attach to Form 1040, |

|

Attachment |

Internal Revenue Service |

|

Sequence No. 158 |

|

Name(s) shown on return |

|

Your |

social security number |

|

|

|

|

Part I Residential Energy Efficient Property Credit (See instructions before completing this part.)

Note: Skip lines 1 through 11 if you only have a credit carryforward from 2020.

1 |

Qualified solar electric property costs |

1 |

|

|

2 |

Qualified solar water heating property costs |

2 |

|

|

3 |

Qualified small wind energy property costs |

3 |

|

|

4 |

Qualified geothermal heat pump property costs |

4 |

|

|

5 |

Qualified biomass fuel property costs |

5 |

|

|

6a |

Add lines 1 through 5 |

6a |

|

|

b |

Multiply line 6a by 26% (0.26) |

6b |

|

|

7a |

Qualified fuel cell property. Was qualified fuel cell property installed on, or in connection with, your |

|

|

|

|

main home located in the United States? (See instructions.) . . . . . . . . . . . . . ▶ |

7a |

Yes |

No |

|

Caution: If you checked the “No” box, you cannot take a credit for qualified fuel cell property. Skip |

|

|

|

|

lines 7b through 11. |

|

|

|

bPrint the complete address of the main home where you installed the fuel cell property.

|

|

Number and street |

|

|

|

|

Unit No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State, and ZIP code |

|

|

|

|

|

|

|

|

8 |

Qualified fuel cell property costs |

|

8 |

|

|

|

|

|||

|

|

|

|

|

||||||

9 |

Multiply line 8 by 26% (0.26) |

|

9 |

|

|

|

|

|||

10 |

Kilowatt capacity of property on line 8 above . . ▶ |

. |

x $1,000 |

|

10 |

|

|

|

|

|

11 |

Enter the smaller of line 9 or line 10 |

. . . . . . . |

|

11 |

||||||

12 |

Credit carryforward from 2020. Enter the amount, if any, from your 2020 Form 5695, line 16 . . . |

|

12 |

|||||||

13 |

Add lines 6b, 11, and 12 |

. . . . . . . |

13 |

|||||||

14Limitation based on tax liability. Enter the amount from the Residential Energy Efficient Property

Credit Limit Worksheet (see instructions) |

14 |

15Residential energy efficient property credit. Enter the smaller of line 13 or line 14. Also include this

amount on Schedule 3 (Form 1040), line 5 |

15 |

16Credit carryforward to 2022. If line 15 is less than line 13, subtract line 15

from line 13 |

16 |

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 13540P |

Form 5695 (2021) |

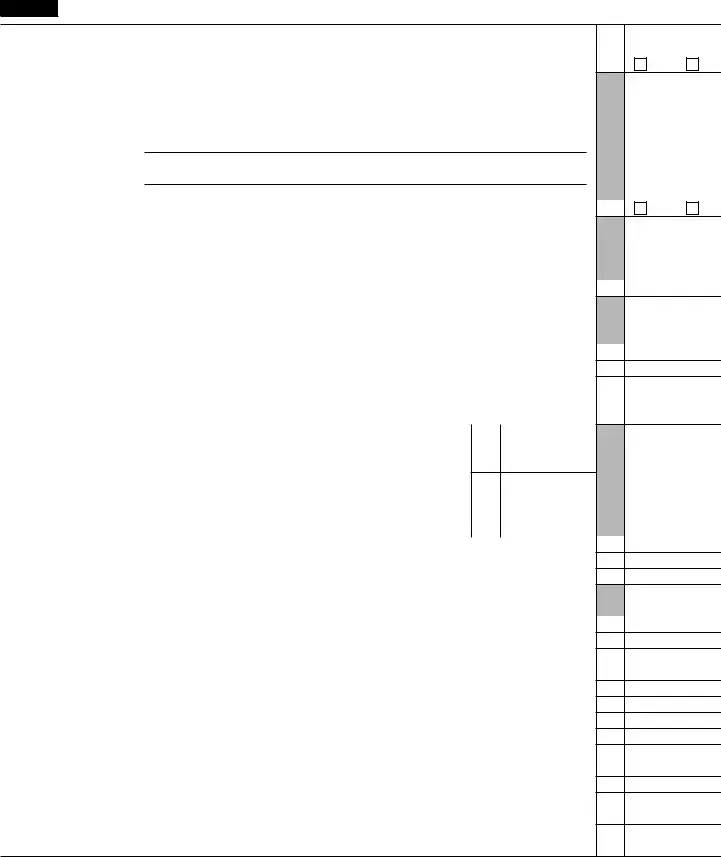

Form 5695 (2021) |

|

Page 2 |

||

|

Nonbusiness Energy Property Credit |

|

|

|

Part II |

|

|

||

|

|

|||

|

|

|

|

|

17a Were the qualified energy efficiency improvements or residential energy property costs for your main |

|

|

||

home located in the United States? (see instructions) . . . . . . . . . . . . . . . ▶ 17a |

Yes |

No |

||

Caution: If you checked the “No” box, you cannot claim the nonbusiness energy property credit. Do |

|

|

|

|

not complete Part II. |

|

|

||

bPrint the complete address of the main home where you made the qualifying improvements. Caution: You can only have one main home at a time.

|

|

Number and street |

Unit No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State, and ZIP code |

|

|

|

|

|

c |

Were any of these improvements related to the construction of this main home? |

. . . . . . ▶ |

|

17c |

Yes |

No |

|

|

Caution: If you checked the “Yes” box, you can only claim the nonbusiness energy property credit for |

|

|

|

|

||

|

qualifying improvements that were not related to the construction of the home. Do not include expenses |

|

|

|

|

||

|

related to the construction of your main home, even if the improvements were made after you moved |

|

|

|

|

||

|

into the home. |

|

|

|

|

|

|

18 |

Lifetime limitation. Enter the amount from the Lifetime Limitation Worksheet (see instructions) . . . |

18 |

|

|

|||

19Qualified energy efficiency improvements (original use must begin with you and the component must reasonably be expected to last for at least 5 years; do not include labor costs) (see instructions).

aInsulation material or system specifically and primarily designed to reduce heat loss or gain of your

home that meets the prescriptive criteria established by the 2009 IECC |

19a |

b Exterior doors that meet or exceed the version 6.0 Energy Star program requirements |

19b |

cMetal or asphalt roof that meets or exceeds the Energy Star program requirements and has appropriate pigmented coatings or cooling granules which are specifically and primarily designed to reduce the

heat gain of your home . . . . . . . . . . . . . . . . . . . . . . . . . . 19c

dExterior windows and skylights that meet or exceed the version 6.0 Energy

Star program requirements |

19d |

|

e Maximum amount of cost on which the credit can be figured |

19e |

$2,000 |

fIf you claimed window expenses on your Form 5695 prior to 2021, enter the amount from the Window Expense Worksheet (see instructions); otherwise

|

enter |

|

19f |

|

|

g |

Subtract line 19f from line 19e. If zero or less, enter |

|

19g |

|

|

h |

Enter the smaller of line 19d or line 19g |

. . . . . . . . |

|

19h |

|

20 |

Add lines 19a, 19b, 19c, and 19h |

. . . . . . . . |

|

20 |

|

21 |

Multiply line 20 by 10% (0.10) |

. . . . . . . . |

|

21 |

|

22Residential energy property costs (must be placed in service by you; include labor costs for onsite preparation, assembly, and original installation) (see instructions).

a |

22a |

|

b |

Qualified natural gas, propane, or oil furnace or hot water boiler. Do not enter more than $150 . . . |

22b |

cAdvanced main air circulating fan used in a natural gas, propane, or oil furnace. Do not enter more

|

than $50 |

22c |

|

23 |

Add lines 22a through 22c |

23 |

|

24 |

Add lines 21 and 23 |

24 |

|

25 |

Maximum credit amount. (If you jointly occupied the home, see instructions) |

25 |

$500 |

26 |

Enter the amount, if any, from line 18 |

26 |

|

27Subtract line 26 from line 25. If zero or less, stop; you cannot take the nonbusiness energy property

credit |

27 |

28 Enter the smaller of line 24 or line 27 |

28 |

29Limitation based on tax liability. Enter the amount from the Nonbusiness Energy Property Credit Limit

Worksheet (see instructions) |

29 |

30Nonbusiness energy property credit. Enter the smaller of line 28 or line 29. Also include this amount

on Schedule 3 (Form 1040), line 5 |

30 |

Form 5695 (2021)

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 5695 is used for calculating and claiming tax credits for residential energy-efficient property and solar electric property costs. |

| Eligible Properties | This includes expenses related to solar electric systems, solar water heating, wind energy, geothermal heat pumps, and fuel cell properties installed on residential properties. |

| Energy Credits | The form allows homeowners to claim a percentage of the cost of eligible installations, which can reduce their tax liability. |

| Carryover Provision | If the credit exceeds the taxes owed, the excess amount may be carried over to the next tax year, subject to certain limitations. |

| Governing Laws | Specific credits and their requirements are governed by the Internal Revenue Code (IRC) and amendments made by various energy policies and acts. |

Guide to Writing IRS 5695

Filling out IRS Form 5695 is crucial for homeowners who've made specific improvements to their homes aimed at energy efficiency. This form allows you to calculate and claim your tax credit for solar electric property, solar water heating property, small wind energy property, geothermal heat pump property, and fuel cell property. The steps to complete this form are straightforward, yet it's essential to pay close attention to detail to ensure accuracy and maximize your potential tax benefits.

- Start by gathering all your receipts and records for qualifying energy-efficient improvements made during the tax year. This documentation will be necessary for calculating the tax credits.

- Download the latest version of Form 5695 from the IRS website. It's important to use the most recent form to comply with the current tax laws.

- Enter your name and social security number at the top of Form 5695. This information should match the details on your tax return.

- Proceed to Part I if you're claiming credits for solar electric property, solar water heating property, or other qualified equipment. Fill in the costs of each system installed on lines 1 through 3, following the instructions on the form.

- Calculate the total cost of all qualifying properties and enter this amount on line 5.

- Follow the form's instructions to calculate the total credit available for energy-efficient improvements. You'll multiply the total cost by the tax credit rate specified on the form.

- If you’re also eligible for credits related to fuel cell property, move to Part II. Complete the required sections based on the costs and limitations associated with installing fuel cell property.

- Carry the computed credit from Part I and Part II to the relevant line on your Form 1040. This will reduce your overall tax liability for the year.

- Review your entries carefully. Accuracy is key to avoiding errors that could impact your tax return or delay your refund.

- Attach Form 5695 to your tax return. Make sure you’ve also completed the other necessary forms and schedules that relate to your tax situation.

- File your tax return by the due date. Consider using electronic filing for a faster processing time.

Completing IRS Form 5695 accurately rewards you for contributing to a greener planet through your energy-efficient home improvements. By following these steps, you can smoothly navigate the process and enjoy the benefits of your eco-friendly investments.

Understanding IRS 5695

-

What is IRS Form 5695?

IRS Form 5695 is used by taxpayers to calculate and claim tax credits for residential energy-efficient improvements and renewable energy upgrades. This includes installations like solar electric property, solar water heaters, small wind turbines, and geothermal heat pumps. These credits can reduce the amount of tax you owe, providing financial incentives for making energy-efficient home improvements.

-

Who is eligible to file IRS Form 5695?

Any taxpayer who has installed qualifying energy-efficient improvements in their primary residence or a second home located in the United States can file IRS Form 5695. Rentals do not qualify. It's important to retain documentation of all expenses, as they need to be detailed on the form.

-

What types of improvements qualify for a tax credit?

Qualifying improvements include certain high-efficiency heating and cooling systems, water heaters, biomass stoves, insulation, windows, doors, and roofing materials. Additionally, costs related to solar electric property, solar water heaters, small wind energy property, geothermal heat pumps, and fuel cell property can qualify. Each category has specific requirements that must be met for the equipment to be eligible.

-

How much can you claim with IRS Form 5695?

The credit amount varies depending on the type of improvement. For example, taxpayers can claim a percentage of the cost of solar, wind, geothermal, and fuel cell technology installations. There's also a cap on the amount that can be claimed for certain improvements. The instructions for Form 5695 detail the specific percentages and caps applicable to each type of eligible equipment.

-

Can IRS Form 5695 credits be carried over?

Yes, if the tax credit you qualify for exceeds the amount of tax you owe in the year of installation, you can carry over the unused portion of the credit to the next tax year. The form's instructions offer guidance on how to calculate and carry over these credits.

-

How do you file IRS Form 5695?

IRS Form 5695 should be filled out and submitted with your annual tax return. You'll need to calculate your credit amount and include it on your Form 1040. Detailed instructions provided with Form 5695 will help guide you through the process of calculating your credit. Remember to keep receipts and records of your improvements as they may be needed for validation.

-

Where can you find IRS Form 5695?

You can download Form 5695 directly from the IRS website. Additionally, tax software programs that prepare your federal tax returns will include the form if your entries indicate you're eligible for energy credits. Tax professionals can also provide the form and offer assistance with completing it correctly.

Common mistakes

When completing the IRS Form 5695, which is used for calculating and claiming tax credits for residential energy-efficient property, taxpayers often encounter a variety of pitfalls. These credits can significantly lower a taxpayer's liability by providing a dollar-for-dollar reduction for certain energy-efficient home improvements or installations. However, accurately filling out this form is crucial to avoid delays or rejections of the tax credit claims. Here are six common mistakes:

Not checking for updates to the tax law or form instructions. Tax laws can change from year to year, impacting the eligibility and amount of the energy credit available. It's essential to review the most current form instructions and tax law changes before filing.

Failing to properly document the energy-efficient improvements or installations. Taxpayers should keep detailed records, including receipts, certifications from manufacturers, and any other relevant documentation that proves the eligibility of the improvements for the credit.

Inaccurately calculating the credit. The form requires taxpayers to calculate the cost of qualified energy efficiency improvements and the amount of credit they are eligible to claim. Errors in these calculations can lead to either an understated or overstated credit claim.

Not understanding the difference between refundable and nonrefundable tax credits. The Form 5695 credit is nonrefundable, meaning it can reduce the tax owed to zero, but it does not result in a refund if the credit exceeds the taxpayer's liability.

Overlooking carryover provisions. If the taxpayer's energy efficiency tax credit exceeds their tax liability for the year, the excess may be carried forward to the next tax year. Neglecting to carry forward or properly calculate the carryover can result in a loss of potential credits.

Mixing up the limits for different types of improvements. The IRS Form 5695 includes various limits for different categories of energy-efficient improvements. Applying a blanket limit across all types of improvements instead of applying the specific limits can result in incorrect credit amounts.

Commonly, these errors stem from a lack of understanding of the intricate details of tax laws relating to energy credits or simple oversight. To maximize the benefits of energy-efficient home improvements, taxpayers are encouraged to consult the form's instruction or a tax professional. This helps ensure the accuracy of the Form 5695 and secures the rightful energy credits, contributing to both fiscal savings and environmental conservation.

Documents used along the form

When dealing with tax incentives for residential energy credits, Form IRS 5695 plays a pivotal role. This form helps homeowners in the United States claim credits for eligible residential energy improvements, including costs related to solar electric property, solar water heating property, small wind energy property, and more. However, to complete this form correctly and maximize potential benefits, filers often need additional documents and forms. Below is a list of other forms and documents commonly used alongside Form IRS 5695, each serving a unique but supportive function in ensuring a seamless and beneficial filing process.

- Form 1040: The U.S. Individual Income Tax Return is the starting point for most taxpayers. It serves as the primary form for individuals to file their annual income tax returns, to which the results from IRS 5695 are transferred.

- Form 1040-SR: Similar to Form 1040, this version is designed for seniors, offering a larger print and a standard deduction chart. It's pertinent for older taxpayers claiming energy credits.

- Schedule 3 (Form 1040): This schedule is necessary for claiming nonrefundable tax credits, including the residential energy credit calculated on Form 5695, thus directly affecting the amount of tax owed or the refund received.

- Form 4868: To secure additional time for filing their tax return, taxpayers use Form 4868. This extension ensures they have ample time to gather necessary documents to accurately claim energy credits.

- Manufacturer’s Certification Statement: This document is a certification from the manufacturer that their product qualifies for a tax credit under the IRS guidelines. It's essential for proving eligibility for the credits sought with Form 5695.

- Receipts for Energy-Saving Improvements: Detailed receipts for the purchase and installation of energy-efficient improvements are critical for substantiating the expenses claimed on Form 5695.

- Form 8903: For individuals involved in domestic production activities, this form may interact with IRS 5695 claims if energy-efficient improvements also qualify for domestic activities deductions.

- Form 8829: Utilized by those who claim a home office deduction, the expenses reported can sometimes overlap with energy-efficient improvements, affecting the reportable amount on IRS 5695.

- Energy Savings Performance Contracts (ESPC): Documentation from these contracts can provide detailed breakdowns of energy-saving investments and their expected lifespan, supporting claims on Form 5695.

Collectively, these forms and documents supplement the filing of IRS Form 5695, ensuring that taxpayers can accurately claim and substantiate their eligibility for residential energy credits. Having the correct paperwork assembled before starting the filing process minimizes errors and maximizes potential tax benefits. Along this journey, these forms not only serve as essential pieces of the tax filing puzzle but also as critical components of a taxpayer's financial record and planning strategy.

Similar forms

Form 1040, U.S. Individual Income Tax Return, bears similarity to IRS Form 5695 in that it serves as a foundational document for taxpayers to report annual income, claim deductions, and calculate the amount of tax owed or refund due from the federal government. While Form 5695 is specifically used for claiming residential energy credits, it directly affects calculations on Form 1040 since these credits can lower the total tax liability for the taxpayer. Both forms are integral to accurately reporting one’s financial circumstances and obtaining potential tax benefits.

Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), shares similarities with Form 5695 as both facilitate claiming tax credits, albeit for different purposes. While Form 5695 focuses on energy-efficient home improvements, Form 8863 is utilized to claim credits for educational expenses. Both provide a means for taxpayers to reduce their tax liability by detailing specific expenses that are eligible for federal tax credits, emphasizing the government’s role in encouraging certain expenditures by offering financial incentives through the tax code.

Form 2441, Child and Dependent Care Expenses, resembles Form 5695 in that they both address specific tax credits available to individuals, which can reduce the amount of tax they owe. Form 2441 is used by taxpayers to claim a credit for the costs of child or dependent care that enables them to work or actively seek employment. Similar to the energy credits on Form 5695, these claims impact the overall tax calculation by potentially lowering the taxpayer’s liability based on eligible expenditures.

Schedule A (Form 1040), Itemized Deductions, also parallels Form 5695 in its role within the tax filing process. Schedule A is utilized for itemizing deductions that taxpayers opt to claim instead of the standard deduction. Like the specific deductions for energy-efficient improvements and equipment detailed on Form 5695, Schedule A encompasses a broad range of deductible expenses including medical, tax, interest, and charitable contributions. Both forms serve to decrease the taxable income, thereby possibly reducing the taxpayer's overall tax payment obligation.

The Residential Energy Efficient Property Credit section of Form 5695 closely aligns with Form 8839, Qualified Adoption Expenses. Form 8839 allows individuals to claim a credit for certain expenses related to the adoption of a child. Though the nature of expenses differs significantly—adoption vs. energy efficiency—the underlying principle of using tax credits to incentivize personal investments that align with broader social goals is a common thread. Both forms adjust the taxpayer’s liability in reflection of personal choices that have broader societal implications, be it through the promotion of energy conservation or the support of child adoption.

Dos and Don'ts

When dealing with the IRS 5695 form, which is crucial for claiming residential energy credits, it is important to approach the task with attention to detail and accuracy. To ensure you complete the form correctly and maximize your benefits without running afoul of IRS regulations, consider the following do's and don'ts:

- Do gather all necessary documentation related to your energy-efficient improvements or installations before starting the form. This includes invoices, receipts, and Manufacturer’s Certification Statements.

- Do carefully review the instructions for IRS Form 5695 to understand which expenses qualify for the credit. Qualifying expenses can include costs related to solar electric property, solar water heating property, small wind energy property, and geothermal heat pump property.

- Do ensure that your energy-efficient improvements meet the standards set by the IRS. Only certain products and improvements are eligible for the credit.

- Do calculate the correct credit amounts. The form requires individuals to calculate the credit based on a percentage of the cost of the qualifying property or improvements.

- Do keep a copy of the filled-out form and all related documents for your records. If the IRS requires further information or decides to audit your tax return, having these records readily available will be invaluable.

- Don't forget to include the form with your tax return. Failing to attach the completed IRS Form 5695 to your tax return could result in the loss of your credit.

- Don't overlook local and state credits or rebates that you may be eligible for in addition to the federal credit. These can provide additional financial benefits.

By following these guidelines, you can more confidently navigate the process of claiming your residential energy credit, thus reducing your tax liability and contributing to a more sustainable environment.

Misconceptions

The IRS Form 5695 is integral for individuals looking to claim residential energy credits. However, several misconceptions surround its use and purpose. Understanding the facts can help taxpayers make informed decisions.

Form 5695 is only for solar energy systems: A common misconception is that IRS Form 5695 applies only to solar energy systems, such as solar panels. In reality, the form covers a broader range of residential energy-efficient improvements. This includes solar electric, solar water heating, small wind energy, geothermal heat pump, and fuel cell properties. Each of these improvements can qualify for credit, highlighting the form's broader applicability beyond solar products.

The credit amount is the same for all types of energy improvements: Some people mistakenly believe that the credit amount provided through IRS Form 5695 is the same, regardless of the type of energy-efficient improvement installed. However, the credit amount can vary based on the specific equipment and the installation date. The form outlines different credit rates and limits for various types of energy property, reflecting these variations in potential credits.

Form 5695 credits can reduce tax liability to less than zero: There's a general misunderstanding that the tax credits claimed via Form 5695 can reduce a taxpayer's liability to less than zero, potentially resulting in a refund. However, the residential energy credits are non-refundable, meaning they can only lower the tax bill to zero. If the credit amount exceeds the taxpayer’s liability, the excess cannot be refunded but may be carried forward to the next tax year, depending on specific conditions.

All energy-efficient products qualify for the credit: A widespread misconception is that all energy-efficient home improvements qualify for a credit when filing Form 5695. Yet, not all products meet the Internal Revenue Service (IRS) standards for energy efficiency. To qualify for the credit, products must have a Manufacturer’s Certification Statement, proving they meet specific energy efficiency requirements set by the IRS.

You can only claim the credit in the year the product is installed: Many believe that the energy credit must be claimed in the year the product is installed. While generally true, there are circumstances where a taxpayer can carry forward unused portions of the credit to future tax years. If the credit amount exceeds the taxpayer's liability in the year of installation, the unused amount may be eligible to reduce future tax liabilities. This flexibility helps maximize the benefit of residential energy credits over time.

Key takeaways

The IRS Form 5695, instrumental in the United States tax filing process, serves as a medium for taxpayers to claim credits for specific energy-efficient home improvements. Understanding the proper channels for filling out and leveraging this form is vital. Below are key takeaways designed to aid taxpayers in navigating this process efficiently.

- Eligible Improvements: Firstly, it's essential to identify what qualifies as eligible improvements under the form. This includes solar electric panels, solar water heaters, geothermal heat pumps, small wind turbines, and fuel cell property. Keeping receipts and manufacturer’s certifications for these improvements is crucial for verification purposes.

- Correct Sections: The form is divided into multiple sections, each corresponding to different types of energy credits. Taxpayers must ensure they accurately complete the relevant sections that apply to their specific improvements to avoid potential processing delays or denials.

- Carryover Benefits: If the credit amount exceeds the tax liability, the remainder can be carried over to the next tax year, offering a continued benefit. Understanding how to accurately calculate and apply this carryover is imperative for maximizing potential savings.

- Limitations and Caps: There are specific limitations and caps on the amount that can be claimed for each type of eligible property. Being aware of these caps ensures that taxpayers claim only the permissible amount, maintaining compliance and optimizing the financial benefit.

- Property Requirements: The form requires that the improvements be made to the taxpayer's primary or secondary residence located in the United States. Verifying that the property meets these requirements before claiming the credit is necessary to ensure eligibility.

- Filing Status and Impact: The taxpayer's filing status can impact the credit amount. For instance, different rules may apply if filing jointly or separately. Being conversant with how one’s filing status influences the credit helps in making informed decisions when claiming.

In summary, diligent attention to detail can significantly enhance the benefits derived from IRS Form 5695. It is recommended that taxpayers consult with a tax professional to ensure they fully leverage the available credits, adhere to the requirements, and comply with IRS regulations. This proactive approach can lead to considerable savings, making it a worthwhile endeavor for those investing in energy-efficient home improvements.

Popular PDF Documents

2024 Ev Rebate - It is specifically designed for those who have purchased vehicles that use alternative fuels.

Alternative Minimum Tax Credit - Enables taxpayers to reclaim credits from overpaid alternative minimum tax in past years.