Get Irs 56 Form

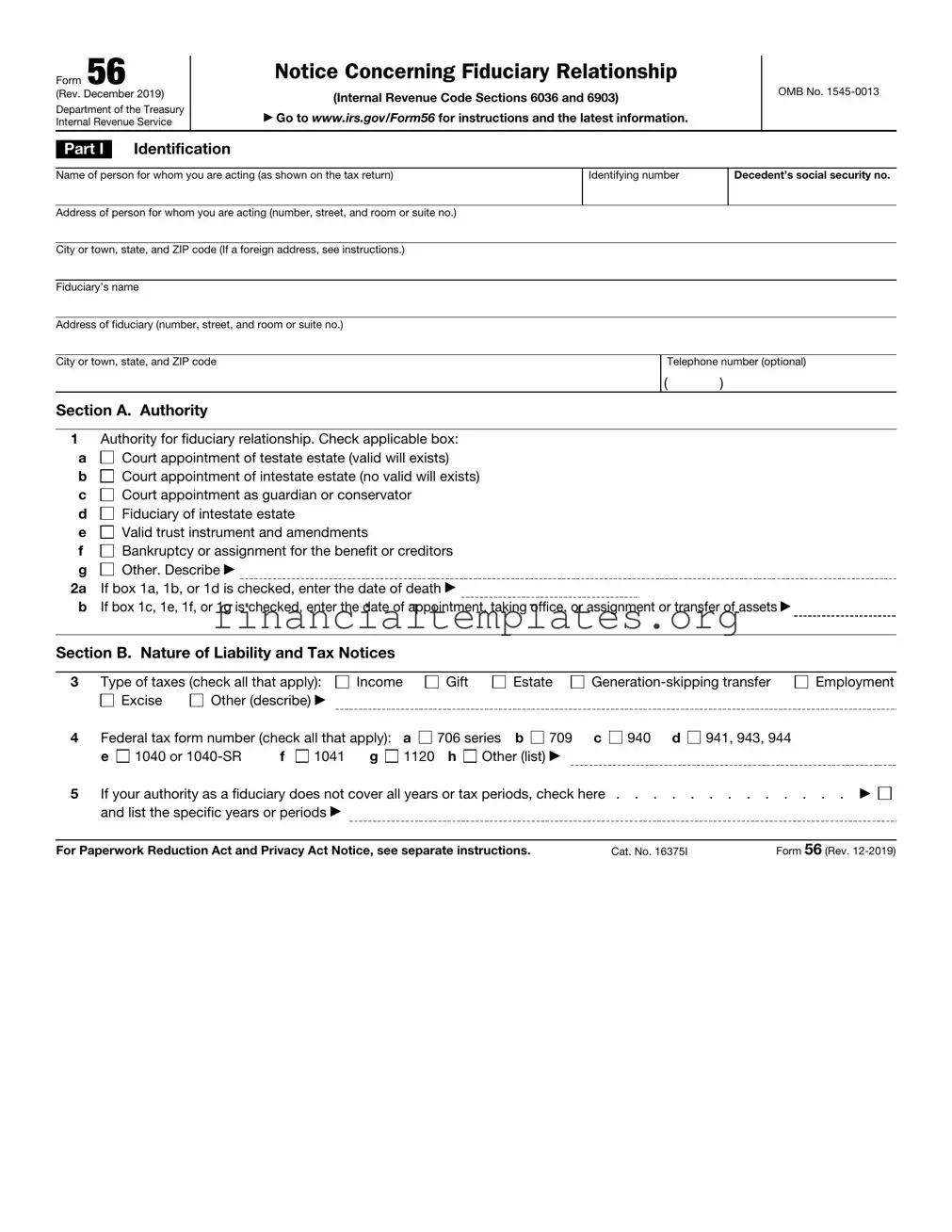

Filing taxes and managing tax-related responsibilities can be complex, especially when it involves acting on behalf of another person or an entity. Form 56, titled "Notice Concerning Fiduciary Relationship," serves as a critical tool in this process, providing a formal way to notify the Internal Revenue Service (IRS) of a fiduciary relationship. This form outlines the responsibilities of individuals or entities that have been appointed to act in fiduciary capacities, such as executors of estates, trustees, or guardians. Its main components include identifying information about the person for whom you are acting, the fiduciary's details, and the nature of the fiduciary authority. Additionally, it covers the types of taxes and tax forms involved, specifics about the authority's scope, and instructions for revoking or terminating the fiduciary relationship. Form 56 plays a foundational role in ensuring proper communication with the IRS about fiduciary matters, helping to manage tax obligations efficiently and correctly for those unable to do so themselves. Its importance cannot be understated, as it assists fiduciaries in navigating their duties within the framework of federal tax law requirements.

Irs 56 Example

Form 56 |

|

|

Notice Concerning Fiduciary Relationship |

|

|

|

|||

|

|

|

|

|

|||||

(Rev. December 2019) |

|

(Internal Revenue Code Sections 6036 and 6903) |

|

|

OMB No. |

||||

|

|

|

|

||||||

Department of the Treasury |

|

▶ Go to www.irs.gov/Form56 for instructions and the latest information. |

|

|

|

||||

Internal Revenue Service |

|

|

|

|

|||||

|

|

Identification |

|

|

|

|

|

|

|

Part I |

|

|

|

|

|

|

|||

|

|

|

|

|

|||||

Name of person for whom you are acting (as shown on the tax return) |

Identifying number |

|

Decedent’s social security no. |

||||||

|

|

|

|

|

|

||||

Address of person for whom you are acting (number, street, and room or suite no.) |

|

|

|

|

|

||||

|

|

|

|

|

|

||||

City or town, state, and ZIP code (If a foreign address, see instructions.) |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||

Fiduciary’s name |

|

|

|

|

|

|

|||

|

|

|

|

|

|

||||

Address of fiduciary (number, street, and room or suite no.) |

|

|

|

|

|

||||

|

|

|

|

||||||

City or town, state, and ZIP code |

|

|

Telephone number (optional) |

||||||

|

|

|

|

|

|

( |

) |

|

|

Section A. Authority

1Authority for fiduciary relationship. Check applicable box:

a Court appointment of testate estate (valid will exists)

Court appointment of testate estate (valid will exists)

b Court appointment of intestate estate (no valid will exists)

Court appointment of intestate estate (no valid will exists)

c Court appointment as guardian or conservator

Court appointment as guardian or conservator

d Fiduciary of intestate estate

Fiduciary of intestate estate

e Valid trust instrument and amendments

Valid trust instrument and amendments

f Bankruptcy or assignment for the benefit or creditors

Bankruptcy or assignment for the benefit or creditors

g Other. Describe ▶

Other. Describe ▶

2a If box 1a, 1b, or 1d is checked, enter the date of death ▶

bIf box 1c, 1e, 1f, or 1g is checked, enter the date of appointment, taking office, or assignment or transfer of assets ▶

Section B. Nature of Liability and Tax Notices

3 |

Type of taxes (check all that apply): |

Income |

|

Gift |

|

Estate |

||||||||

|

|

Excise |

Other (describe) ▶ |

|

|

|

|

|

|

|

|

|

||

4 |

Federal tax form number (check all that apply): |

a |

706 series |

b |

709 |

c |

940 d |

941, 943, 944 |

||||||

|

e |

1040 or |

f |

1041 |

g |

1120 |

h |

Other (list) ▶ |

|

|

|

|||

Employment

5If your authority as a fiduciary does not cover all years or tax periods, check here . . . . . . . . . . . . . ▶

and list the specific years or periods ▶

and list the specific years or periods ▶

For Paperwork Reduction Act and Privacy Act Notice, see separate instructions. |

Cat. No. 16375I |

Form 56 (Rev. |

Form 56 (Rev. |

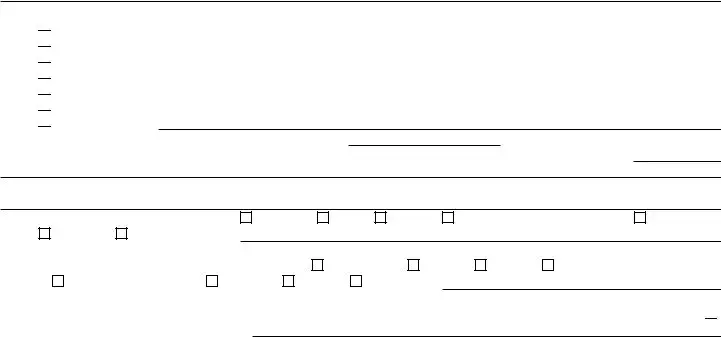

Page 2 |

|

|

|

|

|

Revocation or Termination of Notice |

|

Part II |

|

|

Section

6Check this box if you are revoking or terminating all prior notices concerning fiduciary relationships on file with the Internal

Revenue Service for the same tax matters and years or periods covered by this notice concerning fiduciary relationship ▶

a b c

Reason for termination of fiduciary relationship. Check applicable box:

Court order revoking fiduciary authority

Court order revoking fiduciary authority

Certificate of dissolution or termination of a business entity Other. Describe ▶

Section

7a Check this box if you are revoking earlier notices concerning fiduciary relationships on file with the Internal Revenue Service for the same tax matters and years or periods covered by this notice concerning fiduciary relationship . . . . . . ▶

bSpecify to whom granted, date, and address, including ZIP code.

▶

Section

8Check this box if a new fiduciary or fiduciaries have been or will be substituted for the revoking or terminating fiduciary and

specify the name(s) and address(es), including ZIP code(s), of the new fiduciary(ies) . . . . . . . . . . . . ▶

▶

Part III |

Court and Administrative Proceedings |

|

|

|

|

|

|

|

|

|

|

||

Name of court (if other than a court proceeding, identify the type of proceeding and name of agency) |

Date proceeding initiated |

|||||

|

|

|

|

|

||

Address of court |

|

Docket number of proceeding |

||||

|

|

|

|

|

|

|

City or town, state, and ZIP code |

Date |

|

Time |

a.m. |

Place of other proceedings |

|

|

|

|

|

|

p.m. |

|

|

|

|

|

|

|

|

Part IV

Please

Sign

Here

Signature

Under penalties of perjury, I declare that I have examined this document, including any accompanying statements, and to the best of my knowledge and belief, it is true, correct, and complete.

▲ |

|

|

|

|

|

Fiduciary’s signature |

|

Title, if applicable |

|

Date |

Form 56 (Rev.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title | Form 56 Notice Concerning Fiduciary Relationship |

| Revision Date | December 2019 |

| Governing Law(s) | Internal Revenue Code Sections 6036 and 6903 |

| Agency | Department of the Treasury, Internal Revenue Service |

| OMB Number | 1545-0013 |

| Official Website | www.irs.gov/Form56 |

Guide to Writing Irs 56

Filing Form 56 with the Internal Revenue Service (IRS) is essential for notifying the agency about the establishment or termination of a fiduciary relationship. This form is crucial for individuals appointed to act on behalf of another person, managing their tax affairs. The steps to complete this form are straightforward, but attention to detail is vital to ensure accurate submission.

- Enter the Name of the person for whom you're acting in Part I, as shown on their tax return, followed by their Identifying number, commonly the decedent's social security number.

- Provide the Address of the person for whom you are acting, including number, street, room or suite number, city or town, state, and ZIP code. If the address is foreign, refer to the instructions for the correct format.

- Fill in the Fiduciary’s name and Address, including city or town, state, and ZIP code. Adding a telephone number is optional but recommended for direct contact.

- In Section A, mark the Authority for fiduciary relationship box that applies to your situation (e.g., Court appointment, valid trust instrument). If "Other" is selected, describe the authority basis.

- Depending on the authority box checked, enter either the date of death or the date of appointment, taking office, or assignment or transfer of assets in the space provided.

- In Section B, select the Type of taxes and Federal tax form number(s) that apply. If the authority does not cover all tax years or periods, specify which ones are covered.

- For those looking to terminate a fiduciary relationship, move to Part II. Check the appropriate box in Section A for total revocation or termination, stating the reason. If partially revoking, complete Section B with required specifics. If a new fiduciary will substitute, fill in their details in Section C.

- Provide information about any relevant court or administrative proceedings in Part III, including the name of the court or agency, address, docket number, and dates.

- Finally, sign the form in Part IV, declaring under penalties of perjury that the information provided is correct. Include your title if applicable and date the form.

After completing Form 56 thoroughly, review all sections for accuracy before submitting it to the IRS. This step ensures your fiduciary relationship is properly recorded or terminated according to the current situation, maintaining compliance with tax laws and regulations.

Understanding Irs 56

What is Form 56, and why is it used?

Form 56 is a document issued by the Internal Revenue Service (IRS) recognized as "Notice Concerning Fiduciary Relationship" under Internal Revenue Code Sections 6036 and 6903. Its primary use is to notify the IRS when someone has been appointed as a fiduciary to act on behalf of another person (such as in cases of a decedent's estate, trusts, or for incapable persons). This form tells the IRS who is responsible for certain tax matters instead of the original taxpayer.

When should Form 56 be filed?

This form should be filed when a fiduciary appointment occurs, whether through a court appointment, by operation of law, or under the terms of a legal agreement or trust. It's crucial to file Form 56 promptly to ensure the IRS communicates with the right individual about tax liabilities and notices.

Who needs to fill out Form 56?

Any individual or entity appointed as a fiduciary (meaning they have been legally given the power to act on behalf of another person or entity) needs to fill out Form 56. This includes executors of estates, trustees, guardians, conservators, and anyone else assuming fiduciary duties under court orders or legal arrangements.

What information is required on Form 56?

Form 56 requires identification details of both the fiduciary and the person for whom the fiduciary is acting, including names, addresses, and Social Security numbers or other identifying numbers. It also asks for specific information about the authority for the fiduciary relationship, the nature of the liability and tax notices, and, if applicable, any revocation or termination of the fiduciary relationship.

How is Form 56 different from other tax forms?

Unlike most tax forms that deal with reporting financial transactions or tax liabilities, Form 56 primarily serves an administrative function. It is used to communicate changes in legal responsibility for tax matters to the IRS, ensuring that the agency corresponds with and holds the appropriate person accountable for these matters.

Can Form 56 be used to report changes in fiduciary relationships?

Yes, Form 56 includes sections for reporting both the establishment and the termination of fiduciary relationships. It allows for the notification of the IRS when a fiduciary responsibility is revoked or when a new fiduciary is appointed, ensuring that the IRS records are up-to-date.

What happens if Form 56 is not filed?

Failure to file Form 56 can lead to confusion and miscommunication with the IRS. This might result in the IRS continuing to contact the individual who previously had tax obligations or responsibilities, potentially leading to delays or mismanagement of tax matters, including notices, assessments, and collections.

Is there a deadline for filing Form 56?

The IRS does not specify a strict deadline for filing Form 56. However, it should be filed as soon as possible after the appointment of a fiduciary to ensure the correct management of tax matters and communications. Timeliness is key to avoiding potential issues with the IRS.

Where can one find instructions for completing Form 56?

Instructions for completing Form 56 can be found on the IRS website at www.irs.gov/Form56. These instructions provide detailed guidance on how to fill out the form correctly and explain the requirements for each section.

Can Form 56 be filed electronically?

As of the last update, Form 56 must be filed on paper; it cannot be filed electronically. The completed form should be mailed to the appropriate address listed in the instructions, which vary depending on the location and specific circumstances of the fiduciary relationship.

Common mistakes

Filling out IRS Form 56 can seem straightforward, but mistakes happen. These errors can cause delays and complications. Aware of the most common pitfalls can make the process smoother. Here's what to look out for:

- Not using the decedent's correct Social Security number. It's vital to enter this accurately to avoid processing issues.

- Failing to check the correct box under Section A, Authority. This clarifies your role and authority, so it's important it matches your situation.

- Omitting the date of death or the date of appointment. Depending on your fiduciary role, one of these dates is required to process the form.

- Skipping the type of taxes involved under Section B. You need to identify which taxes are relevant to the fiduciary relationship.

- Overlooking to list the federal tax form numbers. Identifying the specific forms involved helps the IRS understand the scope of your fiduciary duties.

- Forgetting to specify years or tax periods if your authority as a fiduciary does not cover all years or tax periods. This detail is crucial for accurate processing.

- Not identifying the reason for termination of the fiduciary relationship in Part II if you're filing to terminate or revoke a prior notice.

- Omitting the name and address of a substitute fiduciary, if applicable. This information is necessary for the IRS to know who will be responsible moving forward.

- Neglecting to provide detailed information about court and administrative proceedings in Part III, if relevant to your notice.

- Failing to sign the form. An unsigned form is not valid and will not be processed.

By diligently avoiding these mistakes, you can ensure the IRS processes your Form 56 without unnecessary delays. Remember, paying attention to details makes all the difference in legal and financial documents.

Documents used along the form

When dealing with the IRS Form 56, it's important to recognize that this form is just one piece of the puzzle in managing fiduciary responsibilities and ensuring compliance with tax obligations. In the realm of fiduciary relationships and tax filings, several other documents often accompany Form 56, playing critical roles in the administration of estates, trusts, and other fiduciary entities. These documents range from establishing the fiduciary's authority to dealing with specific tax-related filings. Understanding these documents ensures thorough and compliant management of fiduciary duties.

- IRS Form 1041: This is the U.S. Income Tax Return for Estates and Trusts. It's used by fiduciaries to report the income, deductions, gains, losses, etc., of estates and trusts.

- IRS Form 706: The United States Estate (and Generation-Skipping Transfer) Tax Return. It's filed for a decedent's estate to report the estate's value and calculate any estate tax owed.

- IRS Form 709: This is the United States Gift (and Generation-Skipping Transfer) Tax Return. It's used to report gifts that exceed the annual exclusion amount, calculating any gift tax liability.

- Certificate of Appointment of Executor or Administrator: This is a court-issued document that confirms the legal authority of an individual to act as the executor or administrator of an estate.

- Trust Agreement: This document outlines the terms of a trust, including the duties of the trustee and the rights of the beneficiaries. It is foundational for any fiduciary acting under a valid trust instrument.

- IRS Form 8821: Tax Information Authorization. It allows a fiduciary to designate a third party to receive and inspect confidential tax information.

- IRS Form 2848: Power of Attorney and Declaration of Representative. This grants an individual the authority to represent the fiduciary before the IRS, allowing them to make decisions and take actions regarding tax matters.

- Death Certificate: A government-issued document that certifies the death of an individual. It's necessary for many transactions involved in closing out an estate, including tax filings.

Together, these documents create a comprehensive framework for managing the tax responsibilities of estates, trusts, and other fiduciary entities. By ensuring all relevant forms and documents are properly handled, fiduciaries can fulfill their duties effectively while adhering to tax laws and regulations. It’s crucial, therefore, for fiduciaries to familiarize themselves with these forms and to maintain accurate and timely records as part of their role.

Similar forms

The IRS Form 2848, Power of Attorney and Declaration of Representative, is similar to the Form 56 in that both involve the authorization of individuals to act on behalf of others in matters related to the Internal Revenue Service. Form 2848 specifically allows an individual to appoint someone else to represent them before the IRS, handling their tax matters, much like Form 56 authorizes a fiduciary to act on behalf of another entity or person.

IRS Form 1041, U.S. Income Tax Return for Estates and Trusts, shares a connection with Form 56 through the focus on fiduciary activities, particularly concerning tax obligations. While Form 56 notifies the IRS of the creation or termination of a fiduciary relationship, Form 1041 is the actual tax return that a fiduciary might need to file to report income, deductions, and credits of an estate or trust.

Form 8822, Change of Address, is implemented to inform the IRS about a change of address, similar to how Form 56 includes sections for detailing the addresses of both the fiduciary and the individual or entity for whom they're acting. This ensures that all correspondence and documentation from the IRS are sent to the correct address.

Form SS-4, Application for Employer Identification Number (EIN), is connected to Form 56 in situations where a fiduciary relationship impacts tax reporting and identification numbers. New estates or trusts might need an EIN, which is analogous to an individual's Social Security Number, to identify the entity for tax purposes. Form 56 also deals with identification numbers, including the decedent’s social security number and other identifying information.

IRS Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, is similar to Form 56 when dealing with estates since it involves tax filings required after someone's death. Form 56, in setting up a fiduciary relationship for an estate, often precedes the necessity of filing Form 706, which computes the estate tax due to the federal government.

IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, alongside Form 56, addresses the transfer of wealth, albeit in different contexts. Form 56 could be used in scenarios where a fiduciary manages gifts that are part of an estate or trust, while Form 709 is used to report gifts that exceed annual exclusions, potentially affecting the tax obligations of the estate or trust.

IRS Form 941, Employer's Quarterly Federal Tax Return, though primarily for employment taxes, relates to Form 56 in scenarios where a fiduciary manages an entity that has employees. The fiduciary, having been designated through Form 56, would be responsible for filing Form 941 to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks.

IRS Form 990, Return of Organization Exempt From Income Tax, and Form 56 cross paths when a fiduciary is managing a non-profit organization or a trust associated with charitable activities. In this case, Form 56 would indicate the fiduciary relationship, and Form 990 would be the required tax document to report the organization's exempt status and related financial activities.

IRS Form 4506, Request for Copy of Tax Return, complements Form 56 in contexts where a fiduciary needs to obtain prior tax returns of the person or entity they are representing. This might be necessary for a range of reasons, including resolving past tax issues or compiling financial histories.

Lastly, IRS Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, has similarities with Form 56 when a fiduciary manages or receives assets from foreign entities. In such cases, Form 56 declares the fiduciary relationship, while Form 3520 deals with the specific reporting requirements associated with foreign transactions.

Dos and Don'ts

When filling out the IRS Form 56, which notifies the IRS of the creation or termination of a fiduciary relationship, there are important steps to follow and pitfalls to avoid. This guidance ensures that the form is completed accurately, reflecting the fiduciary responsibilities as outlined by the law. Understanding what to do and what not to do can significantly streamline the process.

Do's:

Ensure you have the correct version of the form. Visit www.irs.gov/Form56 for the most current form and instructions.

Accurately fill out the Identification Part I, including the name, identifying number, and address of the person for whom you're acting, ensuring all information matches that person's tax records.

Select the correct authority for your fiduciary relationship in Section A. This selection dictates the necessary documentation and information required.

Complete Section B meticulously, listing the types of taxes and the federal tax form numbers that are relevant to the fiduciary relationship.

In cases where the fiduciary authority does not cover all years or tax periods, clearly list the specific years or periods in question.

Sign the form in Part IV under penalties of perjury, certifying the truth, correctness, and completeness of the information provided.

Don'ts:

Do not leave any required fields blank. Incomplete forms may result in processing delays or be considered invalid.

Do not guess or approximate any information. If unsure, verify all details accurately before submission to avoid potential legal issues.

Do not ignore the Revocation or Termination of Notice Part II if you are ending a fiduciary relationship. Proper completion is necessary to update the IRS records accurately.

Do not omit the signature and date in Part IV. An unsigned form is considered invalid and will not be processed.

Do not use pencil or erasable ink for filling out the form. All entries should be made in permanent ink to ensure legibility and permanence.

Do not neglect to keep a copy of the completed Form 56 for your records. It's crucial to have proof of submission and a record of the information provided to the IRS.

Misconceptions

When handling or learning about the IRS Form 56, "Notice Concerning Fiduciary Relationship," various misconceptions can arise due to its complex nature. Understanding these misconceptions is critical to accurately manage and represent fiduciary responsibilities to the Internal Revenue Service (IRS).

Here are eight common misconceptions about Form 56:

Form 56 is only for the deceased estates. While it's commonly associated with decedents' estates, Form 56 is also used for living individuals where a fiduciary relationship is established, such as guardianships, conservatorships, and trusts.

It’s a one-time submission. Actually, Form 56 may need to be filed more than once. A new form is required if there's a change in fiduciary, a revocation of a fiduciary, or a new fiduciary relationship is established.

Any form of authorization can be reported on Form 56. The form is specific about the types of fiduciary relationships and authorities it can document -- not all forms of power of attorney or authorization qualify.

Filing Form 56 transfers tax liability to the fiduciary. The purpose of Form 56 is to notify the IRS of who is authorized to act on behalf of another person or entity; it does not transfer the tax liability of the person or entity to the fiduciary.

It covers all tax matters and forms by default. Fiduciaries need to specify the types of taxes and the federal tax form numbers they are responsible for. Limitations to the authority can also be indicated.

There is no need to file Form 56 if you are a trustee. Trustees are often required to file Form 56 to notify the IRS of their fiduciary relationship, even though the relationship is established by a trust instrument.

Form 56 is only for reporting new fiduciary relationships. In addition to notifying the IRS about new relationships, Form 56 is also used to report the termination or revocation of fiduciary duties.

Submission of Form 56 is the fiduciary’s responsibility alone. While the fiduciary typically files Form 56, it's beneficial for the person or entity under the fiduciary’s care to ensure the form is filed. This cooperation helps maintain transparency and accuracy in tax matters.

Dispelling these misconceptions ensures that fiduciaries and those they represent can navigate their responsibilities more effectively, promoting a better understanding of the form’s function and importance in tax administration.

Key takeaways

Filing IRS Form 56, "Notice Concerning Fiduciary Relationship," is crucial for individuals who are acting in a fiduciary capacity. This form notifies the IRS of the creation or termination of a fiduciary relationship under Internal Revenue Code Sections 6036 and 6903. Understanding the key takeaways regarding this form can streamline the process and ensure compliance with the legal requirements. Here are five essential points to consider when filling out and using Form 56:

- Identify the Fiduciary Relationship: Clearly indicate the authority under which the fiduciary relationship has been established. This could be through a court appointment, a trust instrument, or other legal mechanisms. The type of authority affects the form's other sections and the IRS's expectations.

- Provide Detailed Information: Accurately fill out the personal information for both the fiduciary and the person or entity for whom they are acting. This includes names, social security or identifying numbers, and addresses. Correct information is vital for the IRS to process the form appropriately and communicate effectively.

- Specify the Type of Taxes and Forms: Form 56 requires fiduciaries to indicate the types of taxes and specific federal tax form numbers that the fiduciary relationship pertains to. Whether it involves income, estate, gift, or other types of tax, this section helps the IRS understand the scope of the fiduciary's responsibilities.

- Understand Revocation or Termination: If a fiduciary relationship is being terminated or replaced, Form 56 provides a process for notifying the IRS. This allows for a clear record of changes in fiduciary responsibility, which is essential for tax administration and legal purposes.

- Sign Under Penalties of Perjury: The fiduciary must sign Form 56, attesting to the truthfulness and completeness of the information provided under penalties of perjury. This emphasizes the seriousness of the information provided and the legal obligations of the fiduciary.

Filling out IRS Form 56 properly ensures that fiduciary duties are recognized by the IRS, facilitating tax administration and compliance. Whether establishing a new fiduciary relationship or terminating an existing one, taking the time to understand and correctly complete this form is essential. For individuals acting in a fiduciary capacity, being informed and vigilant about these responsibilities protects both the fiduciary and those they represent.

Popular PDF Documents

What Is a Pay Off Letter - Effortlessly provide authorization for others to request your mortgage payoff with our form.

Income Based Repayment Eligibility - Applying for IBR before the end of deferment or forbearance periods requires a specific form within the application packet.

Irs Pub 1141 - The document also provides contact information for queries regarding red-ink or black-and-white Forms W-2 and W-3.