Get IRS 5558 Form

Deadlines are critical when it comes to managing taxes and retirement plans, but sometimes circumstances arise that make meeting those deadlines challenging. This is where the importance of the IRS 5558 form comes into play. Generally, this form acts as a lifeline for plan administrators and individuals who need extra time to file certain retirement plan returns or pay health insurance premiums. By correctly filling out and submitting this form, one can obtain an extension, ensuring that they avoid penalties associated with late submissions. Though it might seem straightforward, understanding when and how to utilize Form 5558, the specific documents it applies to, and the deadlines for submission are crucial aspects to consider. This form is not a one-size-fits-all solution but a targeted tool designed to provide relief in specific situations, making knowledge of its use and limitations vital for those it may benefit.

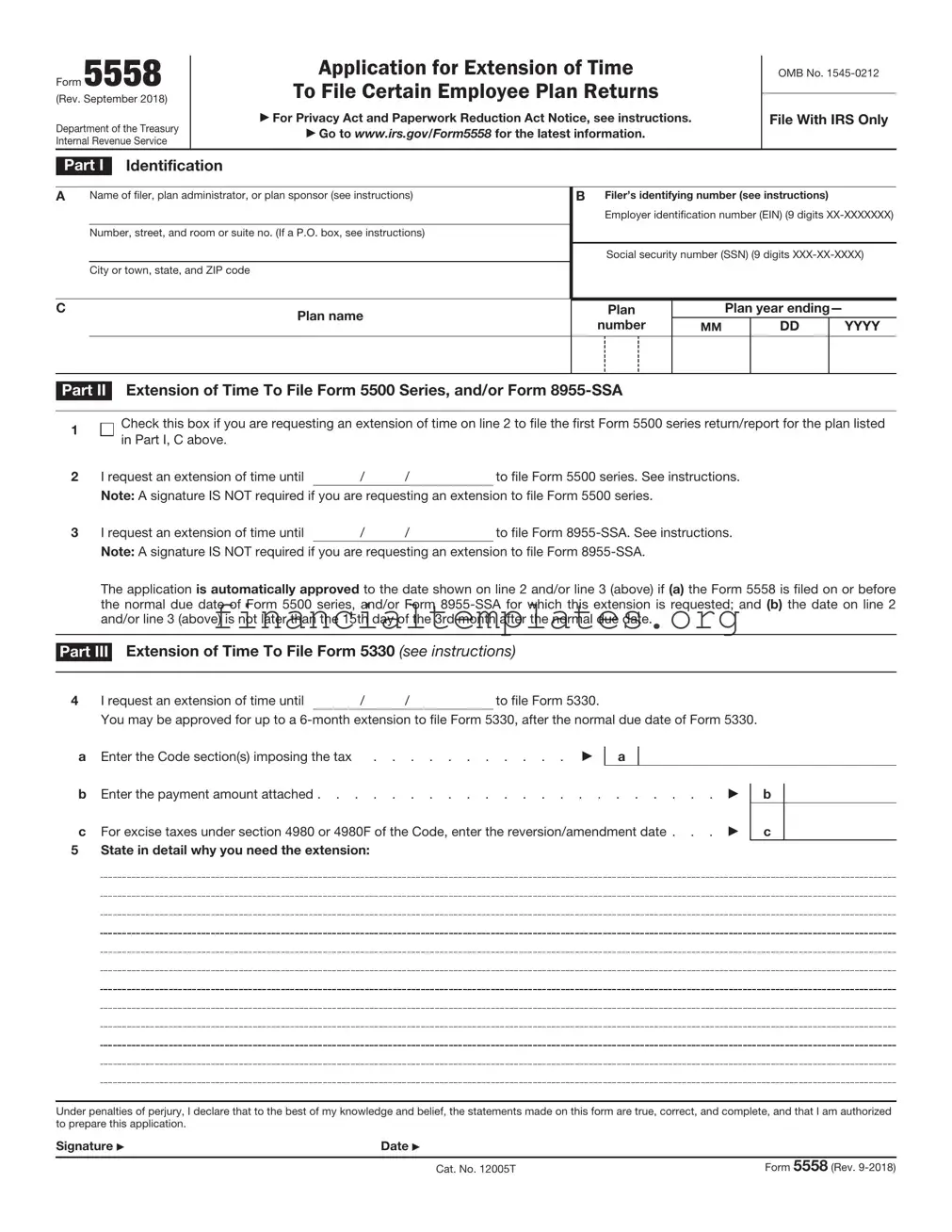

IRS 5558 Example

Form 5558

(Rev. September 2018)

Department of the Treasury Internal Revenue Service

Application for Extension of Time

To File Certain Employee Plan Returns

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Go to www.irs.gov/Form5558 for the latest information.

OMB No.

File With IRS Only

Part I Identification

AName of filer, plan administrator, or plan sponsor (see instructions)

Number, street, and room or suite no. (If a P.O. box, see instructions)

City or town, state, and ZIP code

BFiler’s identifying number (see instructions)

Employer identification number (EIN) (9 digits

Social security number (SSN) (9 digits

C

Plan name

Plan

number

Plan year ending—

MM |

DD |

YYYY |

|

|

|

Part II Extension of Time To File Form 5500 Series, and/or Form

1

2

3

Check this box if you are requesting an extension of time on line 2 to file the first Form 5500 series return/report for the plan listed in Part I, C above.

I request an extension of time until |

/ |

/ |

to file Form 5500 series. See instructions. |

Note: A signature IS NOT required if you are requesting an extension to file Form 5500 series.

I request an extension of time until |

/ |

/ |

to file Form |

Note: A signature IS NOT required if you are requesting an extension to file Form

The application is automatically approved to the date shown on line 2 and/or line 3 (above) if (a) the Form 5558 is filed on or before the normal due date of Form 5500 series, and/or Form

Part III Extension of Time To File Form 5330 (see instructions)

4 |

I request an extension of time until |

/ |

/ |

to file Form 5330. |

You may be approved for up to a

a Enter the Code section(s) imposing the tax . . . . . . . . . . .

a

b Enter the payment amount attached . . . . . . . . . . . . . . . . . . . . . .

cFor excise taxes under section 4980 or 4980F of the Code, enter the reversion/amendment date . . .

5 State in detail why you need the extension:

b

c

Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made on this form are true, correct, and complete, and that I am authorized to prepare this application.

Signature |

Date |

Cat. No. 12005T |

Form 5558 (Rev. |

Form 5558 (Rev. |

Page 2 |

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

What's New

An extension of time to file Form 5500 Series (Form 5500, Annual Return/Report of Employee Benefit Plan; Form

Future Developments

For the latest information about developments related to Form 5558 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form5558.

Purpose of Form

Use Form 5558 to apply for a

To avoid processing delays, the F! most recent version of this Form 5558 should always be used. For

CAUTION example, this Form 5558 (Rev. September 2018) should be used instead of the August 2012 version or any other prior version. To determine the most recent version of this form, go to www.irs.gov/Retirement.

Where To File

File Form 5558 with the Department of Treasury, Internal Revenue Service Center, Ogden, UT

Private delivery services. You can use certain private delivery services (PDS) designated by the IRS to meet the “timely mailing as timely filing” rule for tax returns. Go to www.irs.gov/PDS for the current list of designated services.

The PDS can tell you how to get written proof of the mailing date.

For the IRS mailing address to use if you're using PDS, go to www.irs.gov/PDSstreetAddresses.

PDS can’t deliver items to P.O. F! boxes. You must use the U.S.

Postal Service to mail any item to CAUTION an IRS P.O. box address.

Specific Instructions

Part I. Identification

A. Name and Address

Enter your name and address in the heading if you are requesting an extension of time to file the Form 5500, Form

The plan sponsor (generally, the employer for a

Include the suite, room, or other unit number after the street address. If the Post Office does not deliver mail to the street address and you have a P.O. box, show the box number instead of the street address.

If the entity’s address is outside the United States or its possessions, or territories, enter in the space for city or town, state, and ZIP code, the information in the following order: city, province or state, and country. Follow the country’s practice for entering the postal code. Do not abbreviate the country name.

If your mailing address has changed since you filed your last return, use Form

B. Filer’s Identifying Number

Employer identification number (EIN). Enter

the

An entity that does not have an EIN should apply online by visiting the IRS website at www.irs.gov/EIN. The organization may also apply for an EIN by faxing or mailing Form

Social security number (SSN). If you made excess contributions to a section 403(b)(7)(A) custodial account or you are a disqualified person other than an employer, and you are applying for an extension of time to file Form 5330, enter your

XXXXformat. Do not enter your SSN for Form 5500, Form

C. Plan Information

Complete the plan name, plan number, and plan year ending for the plan included on this Form 5558.

Part II. Extension of Time To File Form 5500 Series and/or Form

Use Form 5558 to apply for a

Do not include the Form 5500 F! series (Form 5500, Form

Exception: Form 5500, Form

An extension of time to file a Form 5500, Form

How to file. A separate Form 5558 must be used for each plan for which an extension is requested. For example, if an employer maintains a defined benefit plan and a profit- sharing plan, a separate Form 5558 must be filed for each plan. A single Form 5558 may, however, be used to extend the time to file a plan's Form 5500 series return/report and its Form

Lists of other plans should not be attached to a Form 5558. Only the plan listed on Form 5558 will be processed. Lists attached to the Form 5558 will not be processed.

When to file. To request an extension of time to file Form 5500, Form

Applications for extension of time to file Form 5500, Form

Form 5558 (Rev. |

Page 3 |

Note: If the filing date falls on a Saturday, Sunday, or a legal holiday, the return may be filed on the next day that is not a Saturday, Sunday, or a legal holiday.

Approved copies of Form 5558 requesting an extension of time to file Form 5500, Form

Line 1. Check this box if the extension of time being requested on line 2 is for the first Form 5500 series return/report filed for the plan.

This box should not be checked if the plan previously filed a Form 5500 series return/ report at any time for any year.

Line 2. Enter on line 2 the due date for which you are requesting to file Form 5500, Form

When using Form 5558 to request an extension of time to file Form 5500, Form

Line 3. Enter on line 3 the due date for which you are requesting to file Form

When using Form 5558 to request an extension of time to file Form

Part III. Extension of Time To File Form 5330

File one Form 5558 to request an extension of time to file Form 5330 for excise taxes with the same filing due date. For specific information on excise tax due dates, see the Instructions for Form 5330.

How to file. A separate Form 5558 must be used for an extension of time to file Form 5330. For example, if an employer maintains a

FAn extension of time to file does ! not extend the time to pay the

tax due. Any tax due must be

CAUTION paid with this application for an

extension of time to file Form 5330. Additionally, interest is charged on taxes not paid by the due date even if an extension of time to file is granted.

Note: The IRS will no longer return stamped copies of the Form 5558 to filers who request an extension of time to file a Form 5330. Instead, you will receive a computer- generated notice to inform you if your extension is approved or denied. Because of this change, we ask you to attach a photocopy of this notice to your Form 5330.

When to file. To request an extension of time to file Form 5330, file Form 5558 in sufficient time for the IRS to consider and act on it before the return’s normal due date.

The normal due date is the date the Form 5330 would otherwise be due, without extension.

Line 4. On line 4, enter the requested due date. If your application for extension of time to file Form 5330 is approved, you may be granted an extension of up to 6 months after the normal due date of Form 5330.

Line 4a. Indicate the section(s) for the excise tax for which you are requesting an extension.

Line 4b. Enter the amount of tax estimated to be due with Form 5330 and attach your payment to this form.

Make your check or money order payable to “United States Treasury.” Do not send cash. On all checks or money orders, write your name, filer’s identifying number (EIN or SSN), plan number, Form 5330 section number, and the tax year to which the payment applies.

Line 5. The IRS will grant a reasonable extension of time (not to exceed 6 months) for filing Form 5330 if you file a timely application showing that you are unable to file Form 5330 because of circumstances beyond your control. Clearly describe these circumstances. Generally, an application will be considered on the basis of your own efforts to fulfill this filing responsibility, rather than the convenience of anyone providing help in preparing the return. However, consideration will be given to any circumstances that prevent your practitioner, for reasons beyond his or her control, from filing the return by the normal due date, and to circumstances in which you are unable to get needed professional help in spite of timely efforts to do so.

FIf we grant you an extension of ! time to file Form 5330 and later

find that the statements made on

CAUTION this form are false or misleading, the extension will be null and void. A late filing penalty associated with the form for which you filed this extension will be charged.

Signature

If you are filing Form 5558 for an extension of time to file Form 5330, the Form 5558 must be signed. The person who signs this form may be an employer, a plan sponsor, a plan administrator, a disqualified person required to file Form 5330, an attorney or certified public accountant qualified to practice before the IRS, a person enrolled to practice before the IRS, or a person holding a power of attorney.

If you are filing Form 5558 for an extension of time to file Form 5500 series return/report or Form

Privacy Act and Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States and the Employee Retirement Income Security Act of 1974 (ERISA). We need it to determine if you are entitled to an extension of time to file Form 5500, Form

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential as required by section 6103.

However, section 6103 allows or requires the IRS to disclose this information to others. We may disclose to the Department of Justice for civil or criminal litigation, to the Department of Labor and the Pension Benefit Guaranty Corporation for the administration of ERISA, and to cities, states, the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. We may also disclose the information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is 24 minutes.

If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can send us comments through www.irs.gov/ FormComments. Or you can write to:

Internal Revenue Service

Tax Forms and Publications

1111 Constitution Ave. NW,

Washington, DC 20224

Do not send the tax form to this address. Instead, see Where To File, earlier.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title | IRS Form 5558 |

| Purpose | Application for Extension of Time to File Certain Employee Plan Returns |

| Used by | Plan administrators or sponsors requesting an extension on filing Form 5500 series, and more. |

| Filing Method | Must be filed on paper; electronic filings are not accepted. |

| No Signature Requirement | No signature is required for Form 5558 to be valid. |

| Extension Period | Grants a one-time extension of up to 2½ months for Form 5500 series and up to 6 months for other forms. |

Guide to Writing IRS 5558

Filling out the IRS Form 5558 might sound daunting at first, but it's a straightforward process once you understand what each section requires. This form is typically used to request more time to file certain tax and retirement plan returns. Completing it correctly ensures that your request is processed smoothly and swiftly. Below, you'll find a step-by-step guide designed to help you fill out the form without unnecessary stress.

- Begin by gathering all necessary documentation related to the entity or plan for which you're requesting an extension. This information will support your filling out the form accurately.

- Enter the name of the plan or entity in the designated area at the top of the form. Make sure the name matches exactly with the name registered with the IRS.

- Provide the Employer Identification Number (EIN) or the plan number (PN) in the respective fields. This is crucial for the IRS to identify the exact entity or plan.

- Fill in the address connected to the plan or entity. Include the street address, city, state, and ZIP code to ensure the IRS can correspond correctly if needed.

- Choose the specific return or notice for which you're requesting an extension by checking the appropriate box. This step requires you to know precisely what extension you need.

- If applicable, include the end date of the plan year in the space provided. This information is necessary for retirement plan-related submissions.

- Sign and date the form. This must be done by an authorized individual who has the legal right to request an extension for the entity or plan.

- Review the completed form for accuracy. Incorrect or missing information can delay the processing of your request or lead to its denial.

- Mail the completed form to the address specified in the instructions. Make sure to use the correct address to avoid any delays.

By following these steps, you can confidently submit IRS Form 5558, knowing that you have accurately completed the necessary fields to request an extension. Remember, timely and correctly filing this form can prevent penalties and other complications related to late submissions. If you encounter difficulties or have questions about specific details, consulting with a tax professional is always a wise decision.

Understanding IRS 5558

-

What is the purpose of IRS Form 5558?

IRS Form 5558 is primarily used to request an extension of time to file certain employee plan returns. It can be used for requesting an extension on the filing of Form 5500 (Annual Return/Report of Employee Benefit Plan), Form 5500-SF (Short Form Annual Return/Report of Small Employee Benefit Plan), Form 5500-EZ (Annual Return of One-Participant (Owners and Their Spouses) Retirement Plan), or Form 8955-SSA (Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits). This form allows businesses and plan administrators extra time to gather necessary information and ensure their filings are accurate and complete.

-

How do I fill out and file IRS Form 5558?

To fill out IRS Form 5558, you'll need to provide your name, employer identification number (EIN), and the plan number. You must also specify the form number for which you are requesting an extension and indicate the tax year end. Form 5558 does not require a signature if you are only requesting an extension for Form 5500, 5500-SF, or 5500-EZ. However, a signature is required for an extension request for Form 8955-SSA. Once completed, mail it to the IRS address provided in the form's instructions.

-

Do I need a reason to file for an extension using Form 5558?

No, you do not need to provide a reason for requesting an extension with Form 5558. The IRS allows this extension as a matter of course, provided the form is properly completed and filed before the original due date of the return.

-

How long is the extension if my request on Form 5558 is approved?

For Form 5500, 5500-SF, and 5500-EZ, the extension is up to 2½ months from the original due date of the return. For Form 8955-SSA, the extension is until the due date of the federal income tax return of the employer, including extensions. It's important to note the extended due date on your calendar to ensure timely filing.

-

Can Form 5558 be filed electronically?

As of the latest guidance, IRS Form 5558 must be filed as a paper document. Despite the IRS moving towards more digital submissions for many forms, this particular form does not yet have an electronic filing option. The correct address for mailing the form can be found in the form's instructions.

-

What happens if I miss the deadline for filing Form 5558?

Missing the deadline to file Form 5558 means you may not receive the extension, thus failing to file the required returns (Form 5500, 5500-SF, 5500-EZ, or Form 8955-SSA) on time could result in penalties. It's crucial to file Form 5558 before the original due date of your return to avoid such complications.

-

Is there a penalty for filing Form 5558 late?

Since Form 5558 is an extension request, it must be filed by the original deadline of the return for which you're requesting the extension. There is no direct penalty for filing Form 5558 itself late because it simply won't be considered valid. The consequence is the loss of the opportunity to extend your filing deadline, which could lead to penalties associated with late filing of the forms you needed the extension for.

-

Can IRS Form 5558 extension request be denied?

Generally, if correctly filled out and filed on time, an extension request using IRS Form 5558 is automatically granted. However, there could be rare instances where an extension might not be granted, such as if the form is incomplete or not correctly executed. To avoid such issues, double-check all information on the form before submitting, ensure all required sections are completed, and file it before the due date.

Common mistakes

Filling out the IRS 5558 form, which is used to apply for an extension of time for certain tax returns and retirement plans, often appears straightforward. However, mistakes can easily occur. Awareness of common errors can save time and prevent the nuisance of dealing with red tape. Here are nine typical mistakes people make while completing this form:

Not double-checking the Social Security number or Employer Identification number. A single digit off can lead to processing delays or the form being rejected.

Forgetting to sign and date the form. An unsigned form is like not submitting one at all.

Misinterpreting the deadlines. People often miscalculate the extension period, potentially missing important deadlines.

Overlooking the need to file separate forms for different returns or plans. One form does not cover all filing needs.

Failing to include all required information. Incomplete forms can delay processing or result in denial of the requested extension.

Submitting the form to the wrong address. The IRS has various addresses depending on the nature of the form and where the filer is located.

Using outdated forms. Tax laws and form requirements change, so using the most current form is crucial.

Assuming approval is automatic. While often granted, extensions can be denied. It's important to follow up and confirm approval.

Ignoring the instructions. The IRS provides detailed instructions that are often overlooked. Reading them can prevent many common errors.

While some of these mistakes might seem minor, they can have significant consequences. They can delay the processing of your extension, potentially resulting in penalties and interest. To ensure a smooth process, it's important to approach this task with care and attention to detail. Avoiding these common pitfalls is the first step toward successfully obtaining an extension.

Documents used along the form

When dealing with tax-related matters, particularly those associated with retirement plans or health benefits, you'll often find yourself needing more than just the IRS 5558 form. This form is typically used to request an extension of time to file certain employee plan returns. However, managing or amending employee benefits often requires a collection of forms and documents. Below is a list of other common forms and documents you might use in conjunction with the IRS 5558 form, each briefly described to help you understand their purpose and application.

- IRS Form 5500 - This form is essential for reporting information about employee benefit plans. It's commonly used by plan administrators and is often the reason extensions are needed, hence the use of Form 5558.

- IRS Form 1099-R - Used for reporting distributions from pensions, annuities, retirement or profit-sharing plans, this form helps manage the tax implications for individuals receiving these distributions.

- IRS Form 990 - Required for tax-exempt organizations, Form 990 provides the IRS with information about the organization's activities, governance, and detailed financials.

- Schedule MB (Form 5500) - This schedule is specific to multiemployer defined benefit plans and provides details on the plan's actuarial information.

- Schedule SB (Form 5500) - Similar to Schedule MB but for single-employer defined benefit plans, this schedule gives the IRS actuarial information specific to these types of plans.

- IRS Form 5300 - Application for determination for employee benefit plan, this form is used to request a review of the plan’s qualification status and its trust.

- IRS Form 8955-SSA - This form reports information about participants in an employer-sponsored retirement plan who have separated from service and have deferred vested benefits.

- IRS Form 8822-B - Used to notify the IRS of a change in address or the identity of a plan’s responsible party, ensuring all correspondence and documents are correctly directed.

- IRS Form 2848 - Power of Attorney and Declaration of Representative form allows a designated individual to represent the filer before the IRS, making it helpful for handling tax matters professionally.

- IRS Form 5330 - Filed to report and pay excise taxes related to employee benefit plans, this form is critical for maintaining compliance with tax obligations.

These forms and documents collectively ensure the comprehensive management and reporting of employee benefit plans and tax-exempt organizations. Whether you're extending a filing deadline using the IRS 5558 form or managing the complexities of benefit plans, understanding the role each of these forms plays can streamline processes and ensure compliance with IRS regulations. It's always best to consult with a tax professional or legal advisor to ensure the correct forms are used and accurately completed.

Similar forms

The IRS Form 5558 is akin to the IRS Form 7004 in that both serve as extension request forms, but they cater to different needs. While Form 5558 is specifically used to request an extension of time for certain employee plan and health coverage information returns, Form 7004 is designed for businesses to request an automatic extension of time to file certain business income tax, information, and other returns. Essentially, while both forms are crucial for gaining extra time to manage financial and tax responsibilities, they target different types of filings—one for employee benefit plans and the other for business-related tax returns.

Similar to IRS Form 5558, the IRS Form 4868 also plays a significant role in providing taxpayers with additional time to file. However, Form 4868 is utilized by individuals to request an automatic extension of time to file their personal income tax returns. This parallel showcases the flexibility the IRS offers for different entities—individuals, businesses, and employee benefit plans—to ensure compliance through extended deadlines. Both forms underscore the importance of meeting tax obligations by allowing extra time to organize and submit accurate information to the IRS.

Another document resembling IRS Form 5558 is the IRS Form 8868, which is used by non-profit organizations to request an extension of time to file their Form 990 series returns. This similarity delineates the IRS's approach to accommodating various organizational forms, from employee benefit plans to non-profit entities, in managing their filing requirements. Both forms 5558 and 8868 provide a mechanism for entities to seek additional time, ensuring they can complete their filings accurately and comprehensively without rushing due to the original deadline constraints.

The IRS Form 8809 also shares common ground with IRS Form 5558, as it allows filers to request an extension of time to file information returns. While Form 5558 specifically targets employee benefit plans and certain health coverage forms, Form 8809 can be used for a broader spectrum of information returns such as W-2s, 1099s, and other forms. This similarity shows the breadth of the IRS's extension options, catering to a wide range of reporting requirements and helping filers avoid penalties for late submissions by providing a structured way to request more time.

Dos and Don'ts

When it comes to navigating the complexities of IRS forms, understanding the do's and don'ts is crucial for a smooth process. The IRS 5558 form, utilized for requesting an extension of time to file certain employee plan returns, is no exception. Whether you're a seasoned tax professional or a newcomer trying to make sense of tax season, following these guidelines will help ensure your form is filled out correctly and efficiently.

Do's

- Do ensure all information is accurate: Before you submit, double-check every detail. Mistakes can cause delays or even denial of your extension request.

- Do provide a reason for the extension: Clearly state why you need more time. Although the IRS does not always require a detailed explanation, offering a reasonable cause can support your request.

- Do sign and date the form: An unsigned form is like sending a letter without a stamp – it won’t get very far. Ensure that the form is properly signed and dated.

- Do file before the original due date: To avoid penalties, submit the IRS 5558 form before the due date of the return for which you are requesting an extension.

- Do keep a copy for your records: After submitting the form, retain a copy for your records. It’s essential to have proof of your request.

Don'ts

- Don’t forget any required supporting documentation: If your extension request needs additional documentation, make sure it’s complete and attached.

- Don’t ignore IRS notices: If the IRS reaches out with questions or requests for further information, responding promptly is crucial to maintain your extension status.

- Don’t assume the extension applies to payment: Understand that form IRS 5558 extends the time to file the return, not the time to pay any taxes owed. Ensure necessary payments are made to avoid penalties and interest.

- Don’t use outdated forms: The IRS periodically updates its forms. Always use the most current version to avoid processing delays.

Navigating IRS paperwork can be daunting, but attention to these dos and don'ts will help streamline the process of requesting an extension with form IRS 5558. Keep these pointers in mind, and you'll be better equipped to handle your IRS documentation with confidence.

Misconceptions

When it comes to IRS Form 5558, there are several misconceptions that can lead to confusion for individuals and businesses alike. Understanding the facts is crucial to properly using this form to request extensions for specific tax-related documents.

Myth 1: Form 5558 can be used for extending the deadline for federal income tax returns.

Fact: Form 5558 does not apply to individual or business income tax returns. Its use is specifically for requesting an extension on filing Form 5500 series (for employee benefit plans), Form 8955-SSA, and Form 5330.

Myth 2: You can file Form 5558 after the original deadline has passed.

Fact: The request for an extension must be submitted by the original due date of the return or report.

Myth 3: Filing Form 5558 automatically grants an extension.

Fact: Submission of Form 5558 does not guarantee an extension. The IRS may deny the request based on the validity of the reasons provided for the delay.

Myth 4: The IRS requires a detailed explanation for the need for an extension on Form 5558.

Fact: The IRS does not require a detailed reason for requesting an extension on this form; merely completing and submitting it correctly is generally sufficient.

Myth 5: Form 5558 applies to all types of retirement plans and tax forms.

Fact: Form 5558 is applicable only for certain tax forms (Form 5500 series, Form 8955-SSA, and Form 5330). It does not cover all types of retirement or tax forms.

Myth 6: Electronic filing is available for Form 5558.

Fact: As of the latest information, Form 5558 must be filed in paper format; electronic submission is not an option.

Myth 7: A single Form 5558 can be used to request extensions for multiple plans or filings.

Fact: A separate Form 5558 is required for each plan or filing for which an extension is sought. Each form must be filled out and submitted individually.

Myth 8: There is a fee associated with filing Form 5558.

Fact: There is no fee required to file Form 5558. The process of requesting an extension through this form is free of charge.

Key takeaways

The IRS 5558 form plays a critical role for those needing extra time to file certain tax-related documents. To make the most out of this form, it's important to grasp its key aspects. Below are four vital takeaways to keep in mind when dealing with the IRS 5558 form:

- Extension Purpose: The IRS 5558 form is specifically designed to request an extension for filing Form 5500 series (Annual Return/Report of Employee Benefit Plan), Form 8955-SSA (Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits), and, in some instances, Form 5330 (Return of Excise Taxes Related to Employee Benefit Plans). Knowing which forms qualify for an extension under IRS 5558 is crucial.

- No Extension for Payment: It's important to note that filing an extension using Form 5558 does not grant extra time for any payments due. The form solely extends the time to file the required documentation. Consequently, any payments due should be made on time to avoid potential penalties.

- Deadline: The timing for submitting the IRS 5558 form is also key. Typically, this form must be filed on or before the original due date of the form for which an extension is being requested. Timely submission is essential to ensure the extension is granted.

- Filing Method: Depending on the specific form, IRS 5558 can be submitted either electronically or through paper filing. Checking the latest IRS guidelines on the preferred or required submission method for this extension form can save time and prevent processing delays.

Understanding these takeaways can streamline the extension process, ensuring compliance with IRS requirements while avoiding unnecessary stress or penalties.

Popular PDF Documents

IRS 8396 - Though specific to mortgage interest, the broader implications of Form 8396 reflect the government's commitment to fiscal support for personal homeownership ventures.

Personal Loan Application Form - Loan repayment methods are discussed, emphasizing the importance of timely quarterly payments.

New Idr Plan - Spouses filing jointly must also provide financial information and signatures, indicating household income's role in determining payment amounts.