Get IRS 5498-SA Form

Navigating the labyrinth of tax forms can be a daunting task, but understanding each one's purpose is crucial for managing your finances effectively. Among these, the IRS 5498-SA form plays a pivotal role for individuals with Health Savings Accounts (HSAs), Archer Medical Savings Accounts (Archer MSAs), or Medicare Advantage MSAs. This important document serves as an annual statement, providing detailed information about contributions, including those made by an employer or others on your behalf, to your account over the tax year. More than just a piece of paper, it helps taxpayers and the IRS keep track of contributions to ensure they do not exceed the legal limits, potentially avoiding hefty penalties. It's also an essential record for determining your eligibility for certain tax deductions related to contributions to these accounts. The form, sent by the trustee or custodian of your health benefits account, plays a critical role in your tax filings, underscoring the significance of keeping accurate and up-to-date records of your health savings contributions throughout the year.

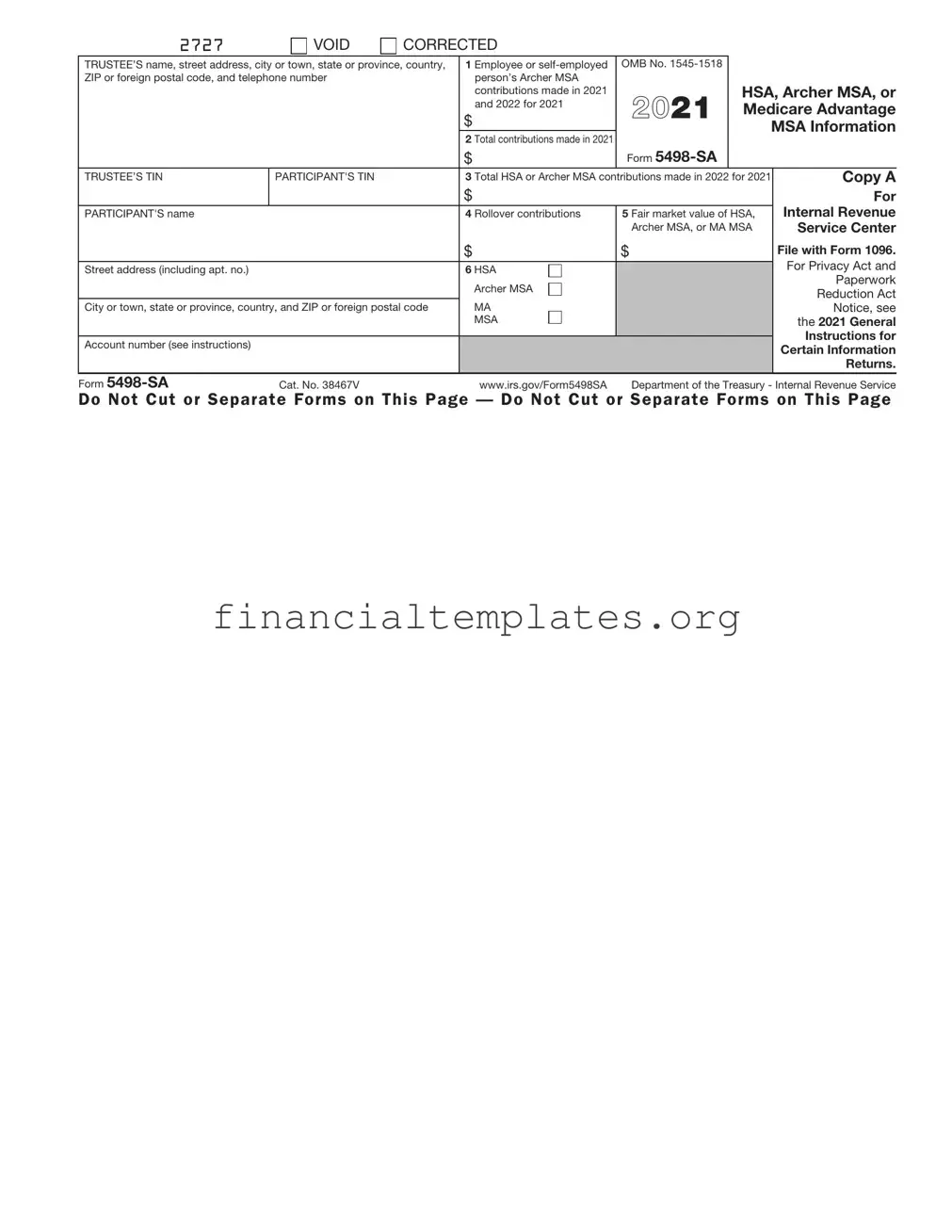

IRS 5498-SA Example

2727 |

VOID |

CORRECTED |

|

|

|

|

TRUSTEE’S name, street address, city or town, state or province, country, |

1 Employee or |

OMB No. |

|

|

||

ZIP or foreign postal code, and telephone number |

|

person’s Archer MSA |

|

HSA, Archer MSA, or |

||

|

|

|

contributions made in 2023 |

2023 |

||

|

|

|

and 2024 for 2023 |

Medicare Advantage |

||

|

|

|

$ |

|||

|

|

|

|

|

MSA Information |

|

|

|

|

2 Total contributions made in 2023 |

|

||

|

|

|

|

|

|

|

|

|

|

$ |

Form |

|

|

TRUSTEE’S TIN |

PARTICIPANT’S TIN |

|

3 Total HSA or Archer MSA contributions made in 2024 for 2023 |

Copy A |

||

|

|

|

$ |

|

|

For |

PARTICIPANT’S name |

|

|

4 Rollover contributions |

5 Fair market value of HSA, |

Internal Revenue |

|

|

|

|

|

Archer MSA, or MA MSA |

Service Center |

|

|

|

|

$ |

$ |

|

File with Form 1096. |

Street address (including apt. no.) |

|

|

6 HSA |

|

|

For Privacy Act and |

|

|

|

|

Paperwork |

||

|

|

|

Archer MSA |

|

|

|

|

|

|

|

|

Reduction Act |

|

City or town, state or province, country, and ZIP or foreign postal code |

MA MSA |

|

|

Notice, see |

||

|

|

|

|

|

the 2023 General |

|

|

|

|

|

|

|

Instructions for |

Account number (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

Certain Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Returns. |

Form |

Cat. No. 38467V |

|

www.irs.gov/Form5498SA |

Department of the Treasury - Internal Revenue Service |

||

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

CORRECTED (if checked)

CORRECTED (if checked)

TRUSTEE’S name, street address, city or town, state or province, country, |

1 Employee or |

OMB No. |

|

|

||

ZIP or foreign postal code, and telephone number |

person’s Archer MSA |

|

HSA, Archer MSA, or |

|||

|

|

|

contributions made in 2023 |

2023 |

||

|

|

|

and 2024 for 2023 |

Medicare Advantage |

||

|

|

|

$ |

|||

|

|

|

|

|

|

MSA Information |

|

|

|

2 Total contributions made in 2023 |

|

|

|

|

|

|

$ |

Form |

|

|

TRUSTEE’S TIN |

|

PARTICIPANT’S TIN |

3 Total HSA or Archer MSA contributions made in 2024 for 2023 |

Copy B |

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

PARTICIPANT’S name |

|

|

4 Rollover contributions |

5 Fair market value of HSA, |

For |

|

|

|

|

|

Archer MSA, or MA MSA |

||

|

|

|

$ |

$ |

|

Participant |

|

|

|

|

|

||

Street address (including apt. no.) |

|

|

6 HSA |

|

|

|

|

|

|

Archer MSA |

|

|

This information |

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|||

MA MSA |

|

|

is being furnished |

|||

|

|

|

|

|

||

|

|

|

|

|

|

to the IRS. |

Account number (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

||

Form |

(keep for your records) |

www.irs.gov/Form5498SA |

Department of the Treasury - Internal Revenue Service |

|||

Instructions for Participant

This information is submitted to the IRS by the trustee of your health savings account (HSA), Archer medical savings account (MSA), or Medicare Advantage MSA (MA MSA).

Generally, contributions you make to your Archer MSA are deductible. Employer contributions are excluded from your income and aren’t deductible by you. If your employer makes a contribution to one of your Archer MSAs, you can’t contribute to any Archer MSA for that year. If you made a contribution to your Archer MSA when your employer has contributed, you can’t deduct your contribution, and you will have an excess contribution. If your spouse’s employer makes a contribution to your spouse’s Archer MSA, you can’t make a contribution to your Archer MSA if your spouse is covered under a high deductible health plan that also covers you.

Contributions that the Social Security Administration makes to your MA MSA aren’t includible in your gross income nor are they deductible. Neither you nor your employer can make contributions to your MA MSA.

Generally, contributions you or someone other than your employer make to your HSA are deductible on your tax return. Employer contributions to your HSA may be excluded from your income and aren’t deductible by you. You and your employer can make contributions to your HSA in the same year.

See Form 8853 and its instructions or Form 8889 and its instructions. Any employer contributions made to an Archer MSA are shown on your Form

Participant’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN). However, the issuer has reported your complete TIN to the IRS.

Account number. May show an account or other unique number the trustee assigned to distinguish your account.

Box 1. Shows contributions you made to your Archer MSA in 2023 and through April 15, 2024, for 2023. You may be able to deduct this amount on your 2023 Form 1040 or

Note: The information in boxes 2 and 3 is provided for IRS use only.

Box 2. Shows the total contributions made in 2023 to your HSA or Archer MSA. See Pub. 969 for who can make contributions. This includes qualified HSA funding distributions

Box 3. Shows the total HSA or Archer MSA contributions made in 2024 for 2023.

Box 4. Shows any rollover contribution from an Archer MSA to this Archer MSA in 2023 or any rollover from an HSA or Archer MSA to this HSA. See Form 8853 or Form 8889 and their instructions for information about how to report distributions. This amount isn’t included in box 1, 2, or 3.

Box 5. Shows the fair market value of your HSA, Archer MSA, or MA MSA at the end of 2023.

Box 6. Shows the type of account that is reported on this Form

Other information. The trustee of your HSA, Archer MSA, or MA MSA may provide other information about your account on this form.

Note: Don’t attach Form

Future developments. For the latest information about developments related to Form

Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for

|

VOID |

CORRECTED |

|

|

|

|

|

|

TRUSTEE’S name, street address, city or town, state or province, country, |

1 Employee or |

|

OMB No. |

|

|

|||

ZIP or foreign postal code, and telephone number |

|

person’s Archer MSA |

|

|

|

HSA, Archer MSA, or |

||

|

|

|

contributions made in 2023 |

|

|

2023 |

||

|

|

|

and 2024 for 2023 |

|

|

Medicare Advantage |

||

|

|

|

$ |

|

|

|||

|

|

|

|

|

|

|

MSA Information |

|

|

|

|

2 Total contributions made in 2023 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

Form |

|

|

|

TRUSTEE’S TIN |

PARTICIPANT’S TIN |

|

3 Total HSA or Archer MSA contributions made in 2024 for 2023 |

Copy C |

||||

|

|

|

$ |

|

|

|

|

For Trustee |

PARTICIPANT’S name |

|

|

4 Rollover contributions |

5 |

Fair market value of HSA, |

|

||

|

|

|

|

|

|

Archer MSA, or MA MSA |

For Privacy Act |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

and Paperwork |

|

|

|

|

|

|

|

|

|

Reduction Act |

Street address (including apt. no.) |

|

|

6 HSA |

|

|

|

|

|

|

|

|

|

|

|

Notice, see the |

||

|

|

|

Archer MSA |

|

|

|

|

|

|

|

|

|

|

|

|

2023 General |

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|||

MA MSA |

|

|

|

|

Instructions for |

|||

|

|

|

|

|

|

|

Certain |

|

|

|

|

|

|

|

|

|

|

Account number (see instructions) |

|

|

|

|

|

|

|

Information |

|

|

|

|

|

|

|

|

Returns. |

|

|

|

|

|

|

|

||

Form |

www.irs.gov/Form5498SA |

|

|

|

Department of the Treasury - Internal Revenue Service |

|||

Instructions for Trustee

To complete Form

•The 2023 General Instructions for Certain Information Returns, and

•The 2023 Instructions for Forms

To get and to order these instructions, go to www.irs.gov/EmployerForms.

Caution: Because paper forms are scanned during processing, you cannot file certain Forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the IRS website.

Filing and furnishing. For filing and furnishing instructions, including due dates, and to request filing or furnishing extensions, see the 2023 General Instructions for Certain Information Returns.

Need help? If you have questions about reporting on Form

Document Specifics

| Fact | Description |

|---|---|

| Purpose | The IRS Form 5498-SA is used to report contributions to a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA (MA MSA). |

| Filing Party | Trustees or custodians of the HSA, Archer MSA, or Medicare Advantage MSA are responsible for filing the form with the IRS and providing a copy to the account holder. |

| Deadline | The form must be filed with the IRS by May 31st of the year following the year in which contributions were made or the account was reported. |

| Reportable Contributions | Contributions made by individuals or their employers to the accounts are reported, including rollover contributions and direct transfers from one account to another. |

| Federal Focus | IRS Form 5498-SA is governed by federal tax laws and regulations; it does not vary by state, as its requirements are consistent across the United States. |

| Recipient Copy | A copy must be sent to the individual for whom the contributions are reported, serving as an important document for their personal tax records and preparation. |

Guide to Writing IRS 5498-SA

Filing IRS forms can seem like a daunting task, yet it's a necessary part of managing your finances, especially when it comes to reporting contributions to health savings accounts (HSAs), Archer MSAs, or Medicare Advantage MSAs. The IRS 5498-SA form is specifically designed for this purpose, and it's important for both trustees and participants of these accounts. Once it's filled out, it provides a comprehensive record of contributions, which can be crucial for tax reporting and ensuring contributions do not exceed legal limits. Here's a step-by-step guide to help simplify the process for you.

- Start by gathering all necessary documents, including account statements and any records of contributions made during the year. This will help ensure accuracy as you fill out the form.

- Enter the trustee's or issuer's name, address, and federal identification number in the designated boxes at the top of the form. This information identifies the entity reporting the contributions.

- In the next section, provide the participant's social security number and name. This ensures that the contributions are correctly attributed to the right account holder.

- Check the box that corresponds to the type of account for which contributions are being reported: HSA, Archer MSA, or Medicare Advantage MSA.

- Fill in the boxes related to contributions. This includes contributions made for the current tax year and those made in the following year for the current tax year. Also, include the fair market value of the account.

- If reporting a rollover contribution, indicate the amount in the box labeled for rollovers. This records any funds transferred from another account of the same type.

- For Archer MSAs or Medicare Advantage MSAs, report the total distribution, if any, in the designated area. This step is crucial for differentiating between contributions and distributions throughout the year.

- Review the form to ensure all information is accurate and complete. Accidental errors can lead to discrepancies and potential issues with the IRS.

- Once the form is filled out, the trustee or issuer typically files it with the IRS and sends a copy to the account holder. This step is done by the financial institution, so as a participant, make sure to confirm with them that it has been completed.

After the form is filed, keep a copy for your records. It’s always a good practice to have your own documentation, especially if questions or concerns arise later. Remember, the 5498-SA form is a crucial document for anyone with an HSA, Archer MSA, or Medicare Advantage MSA, as it helps track contributions and ensures compliance with IRS guidelines.

Understanding IRS 5498-SA

-

What is an IRS 5498-SA form?

The IRS 5498-SA form is a statement provided by the trustees of a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA. It reports contributions to your account, including those you made and any that were rolled over from another account. This form helps you and the IRS keep track of your contributions, ensuring they meet legal limits and tax requirements.

-

Why did I receive an IRS 5498-SA form?

If you have an HSA, Archer MSA, or Medicare Advantage MSA, you'll receive this form because your account trustee is required to report all contributions to the IRS. It's a way to inform you about the total amount contributed to your account in the previous year. This information is vital for your tax records and future reference.

-

What should I do with my IRS 5498-SA form?

Keep it for your records. While you won’t need to submit this form with your tax return, it’s important to review it to ensure all contributions, including any rollovers, were correctly reported. Compare it with your own records to spot any discrepancies. If you overcontributed, it can help you address the excess contributions.

-

What does it mean if I have excess contributions?

Excess contributions occur when the amount contributed to your HSA, Archer MSA, or Medicare Advantage MSA for the year exceeds the legal limit. If this happens, you may owe a tax on the excess funds. The IRS 5498-SA form will help you identify overages so you can take corrective action, such as withdrawing the excess amounts.

-

When should I receive my IRS 5498-SA form?

Typically, trustees must send out IRS 5498-SA forms by May 31st, covering contributions made for the previous tax year. This includes contributions made for the prior year up until the tax filing deadline (usually April 15th).

-

Can I file my taxes without my IRS 5498-SA form?

Yes, you can file your taxes without this form. Your HSA, Archer MSA, or Medicare Advantage MSA contributions should be reported in your year-end tax documents, and you don’t need to attach the IRS 5498-SA form to your tax return. However, keep it with your tax records as proof of your contributions and for any post-filing inquiries.

Common mistakes

Filling out the IRS 5498-SA form, which relates to Health Savings Accounts (HSAs), Archer Medical Savings Accounts (Archer MSAs), or Medicare Advantage MSAs, requires careful attention to detail. Mistakes can lead to issues with the IRS, potentially impacting tax filings. Here are five common mistakes people often make:

-

Incorrect Account Information: One key mistake is entering incorrect account information. This includes mistakes in the account number or incorrectly identifying the type of account (HSA, Archer MSA, or Medicare Advantage MSA). Accurate account details are essential for the IRS to properly credit contributions.

-

Failing to Report Rollovers: Individuals sometimes forget to report rollovers between accounts. All rollovers should be reported accurately to avoid discrepancies that could flag IRS audits or result in tax issues.

-

Mixing Contributions: People often mix up contributions for the current year with those meant for the previous year. Contributions for a specific tax year must be accurately reported to ensure they are attributed correctly for tax purposes.

-

Not Including Fair Market Value: Not including the fair market value of the account is a significant error. This value is crucial, especially for the IRS to assess the growth or earnings of the account accurately during the tax year.

-

Overlooking Employer Contributions: Finally, another common mistake is failing to include employer contributions. Any contributions made by an employer to an individual's account should be reported for accurate tax calculations.

Avoiding these mistakes will ensure smoother processing of your IRS 5498-SA form and help prevent unnecessary complications with your tax filings. Reviewing your form for accuracy and completeness before submission is always a good practice.

Documents used along the form

The IRS 5498-SA form is pivotal for individuals with health savings accounts (HSAs), Archer Medical Savings Accounts (Archer MSAs), or Medicare Advantage MSAs. This document is indispensable for reporting contributions made to these accounts over the year. Alongside the IRS 5498-SA, several other documents play a crucial role in ensuring comprehensive tax reporting and compliance. Whether preparing for tax season or managing financial records, being acquainted with these documents can streamline the process significantly.

- IRS Form 1040: The U.S. Individual Income Tax Return is the cornerstone of personal tax filing. It serves to report an individual's annual income, calculate taxes due, or determine refunds.

- IRS Form 8889: This form is used specifically with Health Savings Accounts (HSAs). It details contributions, distributions, and the tax treatment of HSAs, complementing the data provided by IRS 5498-SA.

- Schedule A (Form 1040): Itemized Deductions are documented here. For individuals who opt to itemize rather than take the standard deduction, this form outlines allowable deductions, including certain medical expenses.

- IRS Form 1099-SA: Distributions from HSAs, Archer MSAs, or Medicare Advantage MSAs are reported here, outlining the amounts withdrawn from these accounts over the year.

- IRS Form 5329: Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts form is used for reporting additional taxes related to excess contributions, premature distributions, or other discrepancies in retirement and MSA contributions.

- IRS Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return helps individuals who need more time to prepare their tax return, extending the filing deadline.

- IRS Form 8853: Archer MSAs and Long-Term Care Insurance Contracts form is used to report contributions and distributions related to Archer MSAs, complementing the information provided on the IRS 5498-SA for these account types.

- IRS Form 8962: Premium Tax Credit (PTC) form is essential for individuals who purchase health insurance through the Marketplace, allowing them to calculate their credit and reconcile it with any advanced payments.

- IRS Form 8965: Health Coverage Exemptions form is used to report any exemptions from the health coverage requirement, providing necessary details to avoid penalties for lack of coverage.

- W-2 Forms: These forms report an employee's annual wages and the amount of taxes withheld from their paycheck, crucial for accurately reporting income on the tax return.

In the intricate landscape of tax filing and management, the IRS 5498-SA form and its associated documents constitute a framework that supports rigorous financial diligence. Familiarity with these forms not only aids in meticulous record-keeping but also ensures compliance with evolving tax regulations. For individuals navigating through the complexities of HSAs, MSAs, and tax obligations, these documents provide a structured approach to maintaining fidelity in financial and tax affairs.

Similar forms

The IRS 5498-SA form, closely associated with reporting contributions to Health Savings Accounts (HSAs), Archer Medical Savings Accounts (Archer MSAs), and Medicare Advantage MSAs, shares similarities with a host of other IRS documents. These forms collectively play pivotal roles in how individuals and entities report various types of contributions, distributions, and other financial activities to the Internal Revenue Service (IRS).

One such document is the IRS Form 1099-SA, which reports distributions from HSAs, Archer MSAs, or Medicare Advantage MSAs. Just like the 5498-SA form records contributions made to these accounts, the 1099-SA details withdrawals, highlighting their complementary roles in tax reporting for health savings and medical savings accounts.

Another related form is the IRS Form 5498, which serves a similar purpose to the 5498-SA but for Individual Retirement Accounts (IRAs). This form reports contributions to traditional and Roth IRAs, SEP IRAs, and SIMPLE IRAs, thus providing the IRS with information about retirement savings in a manner akin to how the 5498-SA reports on health-related savings.

The IRS Form 1099-R also bears similarity, reporting distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts. While it focuses on distributions rather than contributions, it complements the information provided by forms like the 5498 and 5498-SA, offering a full picture of an individual’s retirement and health savings transactions for the tax year.

IRS Form 8889 is closely related to the 5498-SA as it is used to report HSA contributions and distributions on the taxpayer's individual income tax return. This form directly utilizes the information reported on the 5498-SA and the 1099-SA to calculate deductions and taxable income related to HSAs.

The IRS Form 5329, which addresses additional taxes on IRAs and other tax-favored accounts, also links back to the 5498-SA. Since Form 5329 covers penalties for excess contributions and distributions across a wide array of accounts, including those reported on the 5498-SA, it's essential for ensuring taxpayers comply with contribution limits and withdrawal rules.

The IRS Form 8606 is used by individuals to report non-deductible contributions to traditional IRAs and distributions from IRAs, aiming to track the after-tax portion of their contributions. Although it focuses on IRAs rather than HSAs or MSAs, it shares the objective of the 5498-SA: to ensure proper tax treatment of contributions to tax-advantaged accounts.

Similarly, the IRS Form 1040, the standard federal income tax return for individuals, connects to the 5498-SA through various lines where individuals report deductions, taxable income, and tax credits associated with their HSAs, Archer MSAs, and Medicare Advantage MSAs, using information from forms like the 5498-SA and 1099-SA.

Last but not least, the IRS Form W-2, Wage and Tax Statement, has a connection to forms like the 5498-SA. Box 12 of Form W-2 can contain codes that report employer contributions to an employee's HSA, which complements the information reported on the 5498-SA by showing contributions made through payroll deduction.

Each of these documents plays a specific role in the broader tapestry of tax reporting and compliance, with the 5498-SA form being an essential piece for those with HSAs, Archer MSAs, or Medicare Advantage MSAs. Understanding how these forms interrelate helps taxpayers ensure accurate and complete reporting of their health savings and retirement contributions.

Dos and Don'ts

Filling out IRS Form 5498-SA, crucial for reporting contributions to your Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA, requires careful attention to detail. Below are essential guidelines to follow for an accurate submission.

What You Should Do

Double-check your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Ensuring this information is accurate is crucial for linking your contributions to the correct account.

Verify the type of account. It's important to correctly identify whether your contributions were made to an HSA, Archer MSA, or Medicare Advantage MSA, as this affects how your contributions are reported and taxed.

Report all contributions accurately. Include all contributions made for the tax year, including those made by your employer and any that you made yourself. Overlooking contributions can lead to discrepancies and potential audits.

Include rollover contributions. If you transferred funds from another HSA or MSA into the account being reported, these must be documented. Rollovers have different tax implications and must be accurately reported.

Check the fair market value. This is required if you are reporting a state's health savings account. The fair market value of your account at the end of the year should be accurately reflected to comply with tax requirements.

What You Shouldn't Do

Do not guess amounts. Estimating or guessing contribution amounts can lead to inaccuracies in your tax reporting, which might trigger audits or penalties. Always use exact numbers.

Avoid last-minute submissions. Filing your form at the last minute increases the risk of making errors or encountering processing delays, which could result in penalties for late reporting.

Don't ignore IRS instructions. The IRS provides specific instructions for Form 5498-SA, including how to report different types of contributions and withdrawals. Ignoring these guidelines can lead to errors in reporting.

Do not leave sections blank. If a section of the form applies to you, be sure to fill it out completely. Incomplete forms may be considered incorrectly filed and can lead to processing delays or inquiries from the IRS.

Avoid incorrect filing status. Make sure you are aware of the specific deadlines for contributions and report your contributions for the correct tax year. Contributions for a specific year made in the following year before the tax deadline should be properly reported to avoid confusion and potential penalties.

Misconceptions

Understanding the IRS 5498-SA form is crucial for anyone who has a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA. There are several misconceptions regarding this form that can lead to confusion. Let’s clear up some of the most common misunderstandings:

- Misconception 1: The IRS 5498-SA form is a bill. This form is not a bill. It's an informational form that reports contributions to your HSA, Archer MSA, or Medicare Advantage MSA to both you and the IRS.

- Misconception 2: All taxpayers must submit this form with their tax return. The financial institution that manages your account is responsible for sending Form 5498-SA to the IRS. You, the taxpayer, do not need to file it with your return, but you should keep it for your records.

- Misconception 3: Form 5498-SA reports only the contributions made by the account holder. This form reports all contributions made to the account, including those made by an employer or family member on behalf of the account holder.

- Misconception 4: Contributions reported on Form 5498-SA can be deducted on your tax return. While HSA contributions can be deducted, this form is used for reporting purposes and does not directly affect your tax deductions. Your contributions are deducted on Form 1040, not reported by Form 5498-SA.

- Misconception 5: Form 5498-SA must be received by the taxpayer by January 31. Unlike certain tax forms that are due by January 31, financial institutions have until May 31 to issue Form 5498-SA. This allows for contributions made for the previous year up until the tax filing deadline in April to be included.

- Misconception 6: The form only reports contributions made with cash. Form 5498-SA reports all contributions, regardless of whether they were made in cash or were a rollover or transfer from another account.

- Misconception 7: If you didn’t make any contributions, you won’t receive Form 5498-SA. Even if no contributions were made for the year, financial institutions may still send you this form if you have an account balance, as they also report the fair market value of the account.

- Misconception 8: The form is only for IRS use. While the form is primarily for IRS records to ensure compliance with contribution limits and tax laws, it also serves as a valuable record for taxpayers to track their contributions and account growth over time.

- Misconception 9: You need to request Form 5498-SA from your bank or financial institution. There is no need to request this form; your financial institution should automatically send it to both you and the IRS if applicable.

- Misconception 10: Errors on Form 5498-SA are the taxpayer’s responsibility to correct. If there are discrepancies or errors on Form 5498-SA, it is the responsibility of the financial institution that issued it to correct them. However, individuals should review their form for accuracy and contact the issuer if they believe there is an error.

Having a clear understanding of the IRS 5498-SA form and its role can help individuals manage their health savings and medical savings accounts more effectively, ensuring compliance with tax laws and making the most of their contributions.

Key takeaways

Understanding the IRS 5498-SA form is crucial for individuals contributing to, or receiving distributions from, health savings accounts (HSAs), Archer MSAs, or Medicare Advantage MSAs. This form serves as an important document for tax purposes, and here are six key takeaways that should be considered:

- The IRS 5498-SA form is used by trustees and custodians of HSAs, Archer Medical Savings Accounts (MSAs), and Medicare Advantage (MA) MSAs to report contributions to the IRS, including contributions for the current tax year and any contributions made for the current year that are designated for the previous tax year.

- This form helps in reporting the fair market value of the account as of December 31st of the reporting year, which is essential for the account holder's tax records.

- Account holders do not need to fill out this form themselves. Instead, it is the responsibility of the trustee or custodian of the health savings account to complete and send it to both the IRS and the account holder.

- Form 5498-SA must be sent to the account holder by May 31 of the year following the year to which the contributions relate. It is vital for account holders to ensure that they receive this form for their records and confirm that the information reported to the IRS accurately reflects their contributions and the fair market value.

- For taxpayers wishing to deduct contributions to an HSA, Archer MSA, or MA MSA on their tax return, the information on Form 5498-SA serves as proof of those contributions. However, it is the taxpayer's responsibility to report the correct amount of deductible contributions on their tax return.

- If discrepancies are found between the contributions reported by the trustee or custodian on Form 5498-SA and the taxpayer’s records, the account holder should immediately contact the trustee or custodian to correct any errors. Such discrepancies can lead to audits or penalties if not resolved.

By keeping these key points in mind, individuals can better understand the function and importance of the IRS 5498-SA form in managing their health savings accounts and ensuring compliance with tax requirements.

Popular PDF Documents

Partner's' Share of Income - The form is an essential document for tax planning, helping partners and their tax advisors make informed decisions about tax strategies.

2024 Ev Rebate - This form allows individuals and businesses to get a financial break for making eco-friendly transportation choices.