Get IRS 5498 Form

For many individuals, planning for retirement or managing an individual retirement arrangement (IRA) involves interacting with various tax forms issued by the IRS. Of these, the IRS 5498 form plays a crucial role, though it might not be as familiar to most taxpayers as the W-2 or 1040 forms. This form is sent by the financial institution that manages your IRA and provides detailed information about the contributions made to the account throughout the tax year. It covers different types of IRAs such as Traditional, Roth, SIMPLE, and SEP IRAs. Beyond contributions, the form also reports rollovers, conversions from one type of IRA to another, recharacterizations of contributions, and the fair market value of the account at the end of the year. Both the account holder and the IRS receive this form, making it an essential document for ensuring that one's retirement savings are accurately reported and benefit from the associated tax advantages. Understanding the 5498 form is vital for anyone who has an IRA, as it impacts how you plan for your future and comply with the tax laws.

IRS 5498 Example

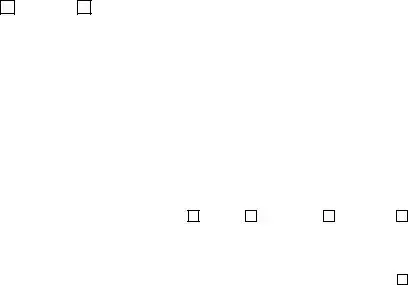

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file copy A downloaded from this website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. See part O in the current General Instructions for Certain Information Returns, available at www.irs.gov/form1099, for more information about penalties.

Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient.

To order official IRS information returns, which include a scannable Copy A for filing with the IRS and all other applicable copies of the form, visit www.IRS.gov/orderforms. Click on Employer and Information Returns, and we’ll mail you the forms you request and their instructions, as well as any publications you may order.

Information returns may also be filed electronically using the IRS Filing Information Returns Electronically (FIRE) system (visit www.IRS.gov/FIRE) or the IRS Affordable Care Act Information Returns (AIR) program (visit www.IRS.gov/AIR).

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax forms.

2828 |

|

|

VOID |

CORRECTED |

|

|

|

|

|

|

||

TRUSTEE’S or ISSUER’S name, street address, city or town, state or |

1 |

IRA contributions (other |

OMB No. |

|

|

|||||||

province, country, and ZIP or foreign postal code |

|

|

than amounts in boxes |

|

|

|

|

IRA |

||||

|

|

|

|

|

|

2022 |

|

|||||

|

|

|

|

|

$ |

|

|

|

Contribution |

|||

|

|

|

|

|

|

|

|

|

|

|

|

Information |

|

|

|

|

|

2 |

Rollover contributions |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

$ |

|

|

Form 5498 |

|

|

||

|

|

|

|

|

3 |

Roth IRA conversion |

4 Recharacterized |

Copy A |

||||

|

|

|

|

|

|

amount |

|

contributions |

||||

|

|

|

|

$ |

|

|

$ |

|

|

|

For |

|

TRUSTEE’S or ISSUER’S TIN |

|

|

PARTICIPANT’S TIN |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Internal Revenue |

||

|

|

|

|

|

5 |

FMV of account |

6 Life insurance cost included in |

|||||

|

|

|

|

|

|

|

|

box 1 |

|

|

|

Service Center |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

File with Form 1096. |

|

PARTICIPANT’S name |

|

|

7 |

IRA |

SEP |

SIMPLE |

|

Roth IRA |

|

|||

|

|

|

|

|

8 |

SEP contributions |

9 SIMPLE contributions |

For Privacy Act |

||||

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and Paperwork |

||

Street address (including apt. no.) |

|

|

10 |

Roth IRA contributions |

11 Check if RMD for 2023 |

|||||||

|

|

Reduction Act |

||||||||||

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notice, see the |

|

|

|

|

|

|

12a RMD date |

|

12b RMD amount |

|||||

|

|

|

|

|

|

2022 General |

||||||

|

|

|

|

|

|

|

|

$ |

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

Instructions for |

||||||

|

|

|

|

|

13a Postponed/late contrib. |

13b Year |

13c Code |

Certain |

||||

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Information |

|

|

|

|

|

|

14a Repayments |

|

14b Code |

|

|

|

Returns. |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

Account number (see instructions) |

|

|

|

15a FMV of certain specified |

15b Code(s) |

|

||||||

|

|

|

|

|

$ |

assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 5498 |

Cat. No. 50010C |

|

www.irs.gov/Form5498 |

Department of the Treasury - Internal Revenue Service |

||||||||

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

CORRECTED (if checked)

CORRECTED (if checked)

TRUSTEE’S or ISSUER’S name, street address, city or town, state or |

|

1 |

IRA contributions (other |

OMB No. |

|

|

||||

province, country, and ZIP or foreign postal code |

|

|

than amounts in boxes |

|

|

|

IRA |

|||

|

|

|

|

|

2022 |

|

||||

|

|

|

|

$ |

|

|

|

Contribution |

||

|

|

|

|

|

|

|

|

|

|

Information |

|

|

|

|

2 |

Rollover contributions |

|

|

|

||

|

|

|

|

|

|

|

|

|||

|

|

|

|

$ |

|

|

Form 5498 |

|

|

|

|

|

|

|

3 |

Roth IRA conversion |

4 Recharacterized |

Copy B |

|||

|

|

|

|

|

amount |

|

contributions |

|||

|

|

|

|

$ |

|

|

$ |

|

|

|

TRUSTEE’S or ISSUER’S TIN |

|

PARTICIPANT’S TIN |

|

|

|

|

|

|

||

|

|

|

|

5 |

FMV of account |

6 Life insurance cost included in |

For |

|||

|

|

|

|

|

|

|

box 1 |

|

|

Participant |

|

|

|

|

$ |

|

|

$ |

|

|

|

PARTICIPANT’S name |

|

|

|

7 |

IRA |

SEP |

SIMPLE |

Roth IRA |

This information |

|

|

|

|

|

8 |

SEP contributions |

9 SIMPLE contributions |

is being |

|||

|

|

|

|

$ |

|

|

$ |

|

|

furnished to |

Street address (including apt. no.) |

|

|

|

10 |

Roth IRA contributions |

11 If checked, required minimum |

the IRS. |

|||

|

|

|

|

$ |

|

|

distribution for 2023 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12a RMD date |

|

12b RMD amount |

|

|||

|

|

|

|

|

$ |

|

|

|

||

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

|||

|

|

|

|

13a Postponed/late contrib. |

13b Year |

13c Code |

|

|||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

14a Repayments |

|

14b Code |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Account number (see instructions) |

|

|

|

15a FMV of certain specified |

15b Code(s) |

|

||||

|

|

|

|

|

assets |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Form 5498 |

(keep for your records) |

www.irs.gov/Form5498 |

Department of the Treasury - Internal Revenue Service |

|||||||

Instructions for Participant

The information on Form 5498 is submitted to the IRS by the trustee or issuer of your individual retirement arrangement (IRA) to report contributions, including any

Participant’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). However, the trustee or issuer has reported your complete TIN to the IRS.

Account number. May show an account or other unique number the trustee or issuer assigned to distinguish your account.

Box 1. Shows traditional IRA contributions for 2022 you made in 2022 and through April 18, 2023. These contributions may be deductible on your Form 1040 or

Box 2. Shows any rollover, including a direct rollover to a traditional IRA or Roth IRA, or a qualified rollover contribution (including a military death gratuity or SGLI payment) to a Roth IRA you made in 2022. It does not show any amounts you converted from your traditional IRA, SEP IRA, or SIMPLE IRA to a Roth IRA. They are shown in box 3. It does not show any late rollover contributions. They are shown in box 13a. See the Form 1040 or

Box 3. Shows the amount converted from a traditional IRA, SEP IRA, or SIMPLE IRA to a Roth IRA in 2022. Use Form 8606 to figure the taxable amount.

Box 4. Shows amounts recharacterized from transferring any part of the contribution (plus earnings) from one type of IRA to another. See Pub.

Box 5. Shows the FMV of all investments in your account at year end. However, if a decedent’s name is shown, the amount reported may be the FMV on the date of death. If the FMV shown is zero for a decedent, the executor or administrator of the estate may request a

Box 6. Shows for endowment contracts only the amount allocable to the cost of life insurance. Subtract this amount from your allowable IRA contribution included in box 1 to compute your IRA deduction.

Box 7. May show the kind of IRA reported on this Form 5498.

Boxes 8 and 9. Show SEP (box 8) and SIMPLE (box 9) contributions made in 2022, including contributions made in 2022 for 2021, but not including contributions made in 2023 for 2022. If made by your employer, do not deduct on your income tax return. If you made the contributions as a

Box 10. Shows Roth IRA contributions you made in 2022 and through April 18, 2023. Do not deduct on your income tax return.

Box 11. If the box is checked, you must take an RMD for 2023. An RMD may be required even if the box is not checked. If you do not take the RMD for 2023, you are subject to a 50% excise tax on the amount not distributed. See Pub.

Box 12a. Shows the date by which the RMD amount in box 12b must be distributed to avoid the 50% excise tax on the undistributed amount for 2023.

Box 12b. Shows the amount of the RMD for 2023. If box 11 is checked and there is no amount in this box, the trustee or issuer must provide you the amount or offer to calculate the amount in a separate statement by January 31, 2023.

Box 13a. Shows the amount of a late rollover contribution (more than 60 days after distribution) made in 2022 and certified by the participant, or a postponed contribution made in 2022 for a prior year. This amount is not reported in box 1 or 2.

Box 13b. Shows the year to which the postponed contribution in box 13a was credited. If a late rollover contribution is shown in box 13a, this box will be blank.

Box 13c. For participants who made a postponed contribution due to an extension of the contribution due date because of a federally designated disaster, shows the code FD.

For participants who served in designated combat zones, qualified hazardous duty areas, or direct support areas, shows the appropriate code. The codes are: EO13239 for Afghanistan and associated direct support areas, EO12744 for the Arabian Peninsula areas,

For a participant who makes a rollover of a qualified plan loan offset, shows the code PO.

For a participant who has used the

Box 14a. Shows the amount of any repayment of a qualified reservist distribution, a qualified disaster distribution, or a qualified birth or adoption distribution. See Pub.

Box 14b. Shows the code QR for the repayment of a qualified reservist distribution, code DD for repayment of a qualified disaster distribution, or code BA for repayment of a qualified birth or adoption distribution.

Box 15a. Shows the FMV of the investments in the IRA that are specified in the categories identified in box 15b.

Box 15b. The following codes show the type(s) of investments held in your account for which the FMV is required to be reported in box 15a.

|

VOID |

CORRECTED |

|

|

|

|

|

|||

TRUSTEE’S or ISSUER’S name, street address, city or town, state or |

|

1 |

IRA contributions (other |

OMB No. |

|

|

||||

province, country, and ZIP or foreign postal code |

|

|

|

than amounts in boxes |

|

|

|

IRA |

||

|

|

|

|

|

2022 |

|

||||

|

|

|

|

$ |

|

|

|

Contribution |

||

|

|

|

|

|

|

|

|

|

|

Information |

|

|

|

|

2 |

Rollover contributions |

|

|

|

||

|

|

|

|

|

|

|

|

|||

|

|

|

|

$ |

|

|

Form 5498 |

|

|

|

|

|

|

|

3 |

Roth IRA conversion |

4 Recharacterized |

Copy C |

|||

|

|

|

|

|

amount |

|

contributions |

|||

|

|

|

|

$ |

|

|

$ |

|

|

|

TRUSTEE’S or ISSUER’S TIN |

PARTICIPANT’S TIN |

|

|

|

|

|

|

|

||

|

|

|

|

5 |

FMV of account |

6 Life insurance cost included in |

For |

|||

|

|

|

|

|

|

|

box 1 |

|

|

Trustee or Issuer |

|

|

|

|

$ |

|

|

$ |

|

|

|

PARTICIPANT’S name |

|

|

|

7 |

IRA |

SEP |

SIMPLE |

Roth IRA |

|

|

|

|

|

|

8 |

SEP contributions |

9 SIMPLE contributions |

For Privacy Act |

|||

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

and Paperwork |

||

Street address (including apt. no.) |

|

|

|

10 |

Roth IRA contributions |

11 Check if RMD for 2023 |

||||

|

|

|

Reduction Act |

|||||||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notice, see the |

|

|

|

|

|

12a RMD date |

|

12b RMD amount |

||||

|

|

|

|

|

2022 General |

|||||

|

|

|

|

|

|

|

$ |

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

||||

|

|

|

|

|

|

Instructions for |

||||

|

|

|

|

13a Postponed/late contrib. |

13b Year |

13c Code |

Certain |

|||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Information |

|

|

|

|

|

14a Repayments |

|

14b Code |

|

|

Returns. |

|

|

|

|

|

$ |

|

|

|

|

|

|

Account number (see instructions) |

|

|

|

15a FMV of certain specified |

15b Code(s) |

|

||||

|

|

|

|

|

assets |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Form 5498 |

|

|

www.irs.gov/Form5498 |

Department of the Treasury - Internal Revenue Service |

||||||

Instructions for Trustee or Issuer

To complete Form 5498, use:

•The 2022 General Instructions for Certain Information Returns, and

•The 2022 Instructions for Forms

To order these instructions and additional forms, go to www.irs.gov/EmployerForms.

Caution: Because paper forms are scanned during processing, you cannot file certain Forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the IRS website.

Filing and furnishing. For filing and furnishing instructions, including due dates, and requesting filing or furnishing extensions, see the 2022 General Instructions for Certain Information Returns.

Need help? If you have questions about reporting on Form 5498, call the information reporting customer service site toll free at

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The IRS Form 5498 is an informational form that reports contributions to an Individual Retirement Account (IRA). |

| 2 | Financial institutions that manage IRAs are responsible for sending out Form 5498 to both the IRS and the IRA account holder. |

| 3 | Form 5498 includes information on the types of contributions made to the IRA, including rollovers, recharacterizations, and conversions. |

| 4 | The form is used to report contributions for the previous tax year. It's typically issued by May 31. |

| 5 | Account holders use the information on Form 5498 for tax filing purposes, particularly to verify that they have not exceeded contribution limits. |

| 6 | Form 5498 also reports the fair market value of IRA accounts as of December 31 of the tax year. |

| 7 | There are no direct tax consequences for the account holder from the information on Form 5498 itself; it's primarily for informational purposes. |

| 8 | Sections of Form 5498 are also used to report contributions to Coverdell ESAs (Education Savings Accounts) and HSAs (Health Savings Accounts). |

| 9 | There are no state-specific versions of IRS Form 5498; it's a federal form, and its rules and usage are the same across all states. |

| 10 | The IRS may impose penalties on trustees or issuers for failing to provide accurate and timely Form 5498. |

Guide to Writing IRS 5498

Once you've decided to contribute to your retirement account, keeping track of your contributions is a must. This is where the IRS Form 5498 comes into play. It's essentially a form used to report the amount you've contributed to your retirement accounts, such as an IRA, during the tax year. Getting this form filled out correctly is crucial, as it helps ensure your contributions are properly recorded by the IRS. Below are the steps you'll need to follow to accurately complete the Form 5498. Keep in mind that while the form itself might seem daunting at first glance, breaking down the process into smaller steps can make it manageable.

- Begin by gathering your necessary financial documents. These include your IRA contribution records, rollover information, and any recharacterizations of contributions made within the tax year.

- Access the latest version of the IRS Form 5498. You can find this on the Internal Revenue Service's official website.

- Fill in your personal information. This section requires your name, address, and Social Security number. Ensure this information is accurate to avoid any processing delays.

- Report the total amount of contributions made to your IRA during the tax year. This includes any regular contributions, rollovers, and recharacterizations.

- If applicable, indicate any contributions made for the previous tax year but were done so in the current calendar year. There’s a specific section on the form for this purpose.

- For those with a Roth IRA, report any conversion amounts from traditional, SEP, or SIMPLE IRAs to your Roth IRA.

- If you have made any recharacterizations during the tax year, ensure to report them appropriately on the form. This involves the reclassification of contributions from one type of IRA to another.

- Verify all the information entered on the form for accuracy. Mistakes can lead to unnecessary delays or issues with the IRS.

- Submit the form to the IRS by the deadline, typically May 31st following the tax year in which the contributions were made.

The completion of the IRS Form 5498 is a critical step in ensuring your retirement contributions are properly accounted for. Once this form is filled out and submitted, you've successfully documented your retirement contributions for the year, taking a big step in managing your retirement savings. While it might seem like a lot of details to handle, following these steps will guide you through the process smoothly.

Understanding IRS 5498

-

What is an IRS Form 5498?

The IRS Form 5498 is an important document for individual taxpayers. It reports the amount of contributions made to an Individual Retirement Arrangement (IRA) during the year. This form is used by the IRS to verify that the contributions made to an IRA, including traditional, Roth, SEP, and SIMPLE IRAs, meet the legal tax requirements. It also includes information on rollovers, recharacterizations, and the fair market value of the IRA.

-

Who needs to file the IRS Form 5498?

This form is not actually filed by individual taxpayers. Instead, it's sent by the trustee or issuer of the IRA directly to the IRS. A copy of Form 5498 is also sent to the IRA owner for their records. It helps the taxpayer understand the contributions, rollovers, and conversions during the tax year, which is beneficial when preparing their tax return.

-

When is Form 5498 issued?

IRS Form 5498 is issued by May 31st following the tax year to which the contributions relate. This deadline allows for contributions to an IRA that are made up until the tax filing deadline in April to be reported. Therefore, the form reflects the total contributions for the previous tax year, including those made in the first four months of the current year.

-

What types of IRAs are reported on Form 5498?

Various types of IRAs are reported on Form 5498. These include:

- Traditional IRAs

- Roth IRAs

- Simplified Employee Pension (SEP) IRAs

- Savings Incentive Match Plan for Employees (SIMPLE) IRAs

Each type of IRA has its own tax benefits and contribution limits, which are tracked with Form 5498.

-

How does the Form 5498 affect my taxes?

While the form itself is not filed with your tax return, it contains important information that can affect your taxes. For example, contributions to a traditional IRA may be deductible, depending on your income, which can reduce your taxable income. Form 5498 helps you, and the IRS, verify the total contributions made during the year, ensuring you claim the correct deduction amount. Additionally, the form reports any rollovers or conversions, which could have tax implications.

-

What should I do if I don't receive Form 5498?

If you expect to receive Form 5498 but haven't by early June, first check with your IRA custodian or trustee to make sure they have your correct mailing address on file. Since it's sent directly to the IRS as well, your main need for the form is for your personal records and tax preparation. If discrepancies arise between your records and the form, or if you need the form for your records, request a copy from your IRA trustee or custodian.

-

Is there a penalty for not using Form 5498?

Because Form 5498 is filed by the trustee or custodian of your IRA, the individual taxpayer is not responsible for filing it and therefore cannot be penalized for not using it. However, trustees or custodians may face penalties from the IRS for failing to file or for submitting incorrect or incomplete forms. For individuals, the critical part is ensuring that their IRA contributions are correctly reported for their personal income tax filings.

-

Can I file my tax return without Form 5498?

Yes, you can file your tax return without having received Form 5498. Your IRA contributions can be reported on your tax return using your own records. It's recommended to keep track of your IRA contributions throughout the year. If you're claiming a deduction for traditional IRA contributions, or just need to note the contribution for a Roth IRA, your personal records will suffice.

-

What do I do if the information on Form 5498 is incorrect?

If the information reported on Form 5498 does not match your records, contact your IRA custodian or trustee as soon as possible to correct the discrepancy. Timely addressing inaccuracies will help avoid potential issues with the IRS concerning retirement contribution limits and tax deductions.

-

How do I interpret the different boxes on Form 5498?

Form 5498 includes several boxes, each reporting different types of information:

- Box 1 - IRA Contributions: The total amount you contributed to your IRA for the tax year.

- Box 2 - Rollover Contributions: Any funds rolled over from another retirement plan into your IRA.

- Box 4 - Recharacterizations: Amounts recharacterized from one type of IRA to another.

- Box 5 - Fair Market Value: The fair market value of your IRA as of December 31st of the tax year.

The form may include other boxes for specific situations, such as SEP and SIMPLE contributions. Each box provides vital information for different aspects of your IRA contributions and the account's value.

Common mistakes

Filling out the IRS 5498 form is an important task that can be easy to get wrong if one isn't careful. This form provides the IRS with information about Individual Retirement Arrangements (IRAs) including contributions, rollovers, and the fair market value of the account. Avoiding mistakes is key to ensuring that everything is reported accurately and can prevent potential headaches down the line. Here are nine common mistakes people make:

Not Reporting All Contributions: Sometimes, people forget to report all the contributions made throughout the year. This includes regular contributions, rollovers, and recharacterizations.

Incorrectly Reporting Rollovers: Rollovers from other retirement accounts into an IRA must be reported accurately. Confusion often arises between direct and indirect rollovers, leading to mistakes.

Misclassifying the Type of IRA: Traditional, Roth, SEP, and SIMPLE IRAs have different reporting requirements. Misclassifying the type of IRA can lead to incorrect reporting.

Overlooking Recharacterizations: If you've decided to recharacterize your contributions from one type of IRA to another, it's crucial to report this correctly. Missing this step can cause discrepancies.

Not Reporting the Fair Market Value: The form requires the fair market value of the IRA at the end of the calendar year. Failing to report this, or reporting an incorrect amount, is a common mistake.

Failing to Report a Deceased IRA Owner: If the IRA owner passed away during the tax year, specific reporting requirements need to be met, which people often miss.

Mismatched Social Security Numbers: An easily overlooked detail is ensuring the Social Security Number (SSN) on the form matches the SSN of the IRA owner. Mismatches can lead to processing delays or errors.

Incorrect Year of Contributions: Contributions for a specific tax year can be made up until the tax filing deadline of the following year. Sometimes, people mistakenly report the contribution for the wrong year.

Ignoring the Instructions: Not following the form instructions carefully is a fundamental mistake. Each part of the form has specific guidance that should be adhered to for accurate completion.

Avoiding these mistakes can save you from unnecessary stress and potential penalties. When in doubt, consulting a tax professional or carefully reviewing the IRS instructions can help ensure the form is filled out correctly.

Documents used along the form

The IRS Form 5498 is crucial for individuals with an Individual Retirement Account (IRA). It provides the IRS with information about contributions to IRAs, including Traditional, Roth, SEP, and SIMPLE IRAs, as well as accounts for Coverdell ESAs. When dealing with the complexities of retirement planning and tax preparation, several other forms and documents often accompany the IRS Form 5498 to ensure compliance and maximize benefits. Understanding these documents can aid in accurate reporting and efficient tax strategy development.

- IRS Form 1040: The primary individual income tax return form where taxpayers report their annual income, including distributions from IRAs that are reflected on the 5498.

- IRS Form 8606: Used to report non-deductible contributions to Traditional IRAs and distributions from Roth accounts, helping to track the taxable portion of distributions.

- IRS Form 1099-R: Issued by the financial institution managing the IRA, it reports the distribution of retirement benefits, including pensions, annuities, retirement or profit-sharing plans.

- IRS Form 5329: This form is for additional taxes on qualified plans (including IRAs) and other tax-favored accounts, crucial for reporting excess contributions or insufficient distributions.

- IRS Form 8880: Relevant for lower and middle-income filers, this form is used to claim the Retirement Savings Contributions Credit, also known as the Saver’s Credit.

- Bank statements and investment records: Essential for verifying the contributions and distributions reported on tax forms, these records should align with the figures reported on the IRS Form 5498.

- Beneficiary designations: Documents that outline who will inherit the IRA. These are crucial for estate planning and must be kept updated to reflect current wishes.

- Summary Plan Description (SPD): For those with employer-sponsored retirement plans like SEP or SIMPLE IRAs, this document provides comprehensive details about the plan's features and funding.

In navigating the complexities of retirement savings and tax reporting, these documents play pivotal roles alongside the IRS Form 5498. Individuals are encouraged to maintain organized records and consult with a tax professional to ensure accurate reporting and compliance. By understanding how these forms and documents interact with one another, taxpayers can make informed decisions about their retirement planning and tax obligations, potentially securing financial wellbeing in their retirement years.

Similar forms

The IRS 5498 form is similar to the IRS 1099-R form in the way that both relate to retirement accounts. While the 5498 form reports contributions to various retirement plans, the 1099-R form details distributions made from those plans. This makes both documents crucial for accurately reporting retirement account activity to the IRS and for individuals to understand their retirement distributions and contributions for tax purposes.

Like the IRS 5498 form, the W-2 form is also tax-related but focuses on reporting an individual's income and taxes withheld by their employer. Both forms are essential for preparing accurate tax returns. The 5498 form helps account for contributions that might affect an individual’s tax liability, similar to how the W-2 impacts tax calculations based on income and withholdings.

The 1040 form, which is the standard IRS form for individual tax returns, shares a link with the 5498 form by being part of the process of reporting and calculating taxes owed or refunded by the government. Contributions reported on the 5498 can affect deductions and taxable income, aspects that are detailed on the 1040 form, making them interconnected in the tax reporting process.

The IRS 8606 form, used to report nondeductible contributions to IRAs, aligns with the 5498 form in the context of retirement savings reporting. Both forms work together to ensure that individuals properly report the tax treatment of their IRA contributions, whether they are deductible or not, providing a complete picture of an individual’s retirement contributions for accurate tax processing.

The Schedule D form, which is part of the wider tax return documentation and deals with capital gains and losses, is indirectly related to the 5498 form. Contributions to retirement accounts reported on the 5498 could eventually impact investment decisions that lead to capital gains or losses, thus making the information on the 5498 relevant for a comprehensive financial overview during tax season.

Similarly, the 5498-SA form, which specifically reports contributions to Health Savings Accounts (HSAs), Archer Medical Savings Accounts (Archer MSAs), and Medicare Advantage MSAs, mirrors the 5498 form's purpose for retirement accounts. Both forms assist in reporting contributions that might have tax implications, focusing on different types of accounts dedicated to savings, whether for healthcare or retirement.

The IRS 5329 form, used for reporting additional taxes on IRAs and other tax-favored accounts, complements the information on the 5498 form. When contributions exceed allowable limits, or withdrawals are made under certain conditions, the 5329 form comes into play, relying on contribution data that might be reported on the 5498, to calculate any additional taxes owed.

The Form 8889 is for Health Savings Account (HSA) transactions, and it connects with the 5498 form similarly to the 5498-SA form, but with a focus on HSAs. Contributions reported on the 5498-SA (or 5498 for IRAs) could impact deductions and tax liabilities reported on Form 8889, highlighting their interconnectivity in managing tax-advantaged accounts.

Last but not least, the IRS Form 5500 is related to the 5498 form in its focus on reporting information about pension plans and other retirement-related accounts. Although the 5500 is more detailed and geared towards plan administrators rather than individual taxpayers, both forms play crucial roles in the broader landscape of retirement planning and reporting, ensuring compliance and informing tax strategy.

Dos and Don'ts

When filling out the IRS 5498 form, which is crucial for reporting IRA contributions among other things, attention to detail is paramount. It's important to approach this task with a clear understanding of both what to do and what to avoid to ensure that the information provided is accurate and compliant with tax laws. Here are some key dos and don'ts to consider:

Do:

- Ensure that all information is accurate and complete. Double-check the account numbers, personal information, and contribution amounts for correctness.

- Consult with a tax advisor or professional if you have any questions or uncertainties regarding how to report your contributions or if specific contributions or rollovers qualify.

- Use the most current version of the form. Tax laws and form requirements can change, so it's critical to use the latest version of the IRS 5498 form available on the IRS website.

- Keep a copy of the completed form for your records. This will be helpful for future reference and in case of any discrepancies or audits.

Don't:

- Leave any required fields blank. If a specific field does not apply, use the appropriate designation such as "N/A" to indicate this. Incomplete forms can raise red flags with the IRS.

- Estimate or guess contribution amounts or other financial information. Always refer to actual financial statements or records to ensure accuracy.

- Forget to include rollovers or recharacterizations if they occurred during the tax year. These transactions are important and must be reported accurately on the form.

- Submit the form late. Be aware of the deadline (usually May 31st) for submitting the form to ensure that it is received on time. Late submissions can result in penalties.

Misconceptions

The IRS Form 5498 is an important document for taxpayers, especially those who have an IRA (Individual Retirement Arrangement). However, several misconceptions about this form can lead to confusion. Here are seven common misunderstandings:

- All taxpayers receive a Form 5498. In reality, only individuals with an IRA, including traditional, Roth, SEP (Simplified Employee Pension), and SIMPLE (Savings Incentive Match Plan for Employees) IRAs, will receive a Form 5498 from their financial institution. It is not sent to all taxpayers.

- Form 5498 is needed to file your taxes. This is a misconception because the form is generally used for informational purposes and to report contributions, rollovers, conversions, and the fair market value of the account. Taxpayers usually don’t need Form 5498 to file their tax return since IRA contributions are reported by the taxpayer, not the custodian, on the tax return.

- Form 5498 reports the taxable amount of distributions. Actually, Form 5498 is intended to report contributions to an IRA, not the distributions. The taxable amount of any distributions from an IRA is reported on Form 1099-R.

- The deadline for IRA contributions is December 31. While many tax-related deadlines are at the end of the calendar year, taxpayers have until the tax filing deadline (usually April 15 of the following year) to make contributions to their IRA for the previous tax year. Form 5498 which reports these contributions, however, is sent by May 31, reflecting all contributions made before the filing deadline.

- You must act on the information in Form 5498 immediately. Since the form is primarily informational and reports on the previous year's contributions and the account's fair market value, immediate action is not usually necessary. However, it's a good practice to review the form for accuracy to ensure that all contributions and rollovers are correctly reported.

- Form 5498 is only for traditional and Roth IRAs. This form is also used for reporting contributions to SEP and SIMPLE IRAs, not just traditional and Roth IRAs. It's important for participants in these plans to be aware that their contributions will be reported on this form.

- If you don’t receive Form 5498, you can’t deduct your IRA contribution. The deduction eligibility for IRA contributions is determined by your income, filing status, and whether you or your spouse are covered by a retirement plan at work, among other factors. While Form 5498 provides documentation of contributions made, taxpayers can still claim the deduction if eligible, even if they have not yet received the form. Always keep personal records of contributions made throughout the year.

Key takeaways

The IRS Form 5498 is an important document for individual retirement account (IRA) holders, as it provides valuable information regarding the account's activities throughout the year. Understanding its purpose, how it's filled out, and its implications can help taxpayers ensure compliance and make informed decisions about their retirement savings. Here are key takeaways about this form:

- Form 5498 is issued by the IRA trustees or custodians, not the account holders. It reports contributions, including rollovers, recharacterizations, and conversions made to the IRA during the tax year.

- Reporting Deadline: Trustees are required to file this form with the IRS by May 31st of the year following the tax year in which the contributions were made. However, account holders typically receive their copy much earlier.

- Types of IRAs reported: This form covers Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. Each type has different tax implications and contribution limits.

- Form 5498 includes information such as the fair market value (FMV) of the IRA at the end of the tax year, which is crucial for determining the minimum required distributions once the account holder reaches the age threshold.

- The form also tracks rollovers, which are movements of funds from one retirement account to another that must be completed within 60 days to avoid taxes and penalties, and specifies the type of rollover.

- Roth conversions are reported on Form 5498, showing when traditional IRA funds are converted to Roth IRA funds, a move that has tax implications for the converting year.

- The form serves as a detailed record for IRS purposes and helps taxpayers verify that contributions to their IRAs do not exceed the legal limits, thus avoiding potential penalties.

- While taxpayers do not submit Form 5498 with their tax return, it’s critical for them to review it carefully for accuracy and keep it with their tax records. Errors should be addressed promptly by contacting the issuer.

Understanding the information reported on Form 5498 can aid individuals in planning for retirement, ensuring compliance with tax laws, and making strategic decisions about their retirement savings contributions and distributions. It’s an essential piece of the retirement planning puzzle and merits careful attention.

Popular PDF Documents

Irs Form 14242 - Discovered an abusive tax strategy? File a Form 14242 to inform the authorities.

Schedule a Deductions - Schedule A is used to itemize deductions, allowing taxpayers to lower their taxable income by reporting various eligible expenses.

¥7,200 - It is an essential tool for businesses aiming to maintain liquidity while supporting employees through paid leave during the pandemic.