Get IRS 5472 Form

In navigating the complexities of tax obligations within the United States, foreign companies and individuals engaged in business activities find themselves confronted with a myriad of reporting requirements designed to ensure compliance and transparency. Among these, the IRS Form 5472 stands out as a critical tool employed by the Internal Revenue Service to capture detailed information on the transactions between a U.S. corporation or a foreign corporation engaged in a U.S. trade or business and a related party with foreign ties. This form, integral to the enforcement of tax regulations and prevention of tax evasion, serves not just as a means of reporting but also plays a pivotal role in the broader framework of international tax compliance. Its importance is further highlighted by the severe penalties imposed for failure to file or inaccurate filings, underlining the necessity for those affected to approach this requirement with diligence and precision. Through collecting data on monetary transactions and the relationships between involved entities, the IRS scrutinizes the flow of money across borders, thereby ensuring that taxable events are accurately captured and taxed accordingly.

IRS 5472 Example

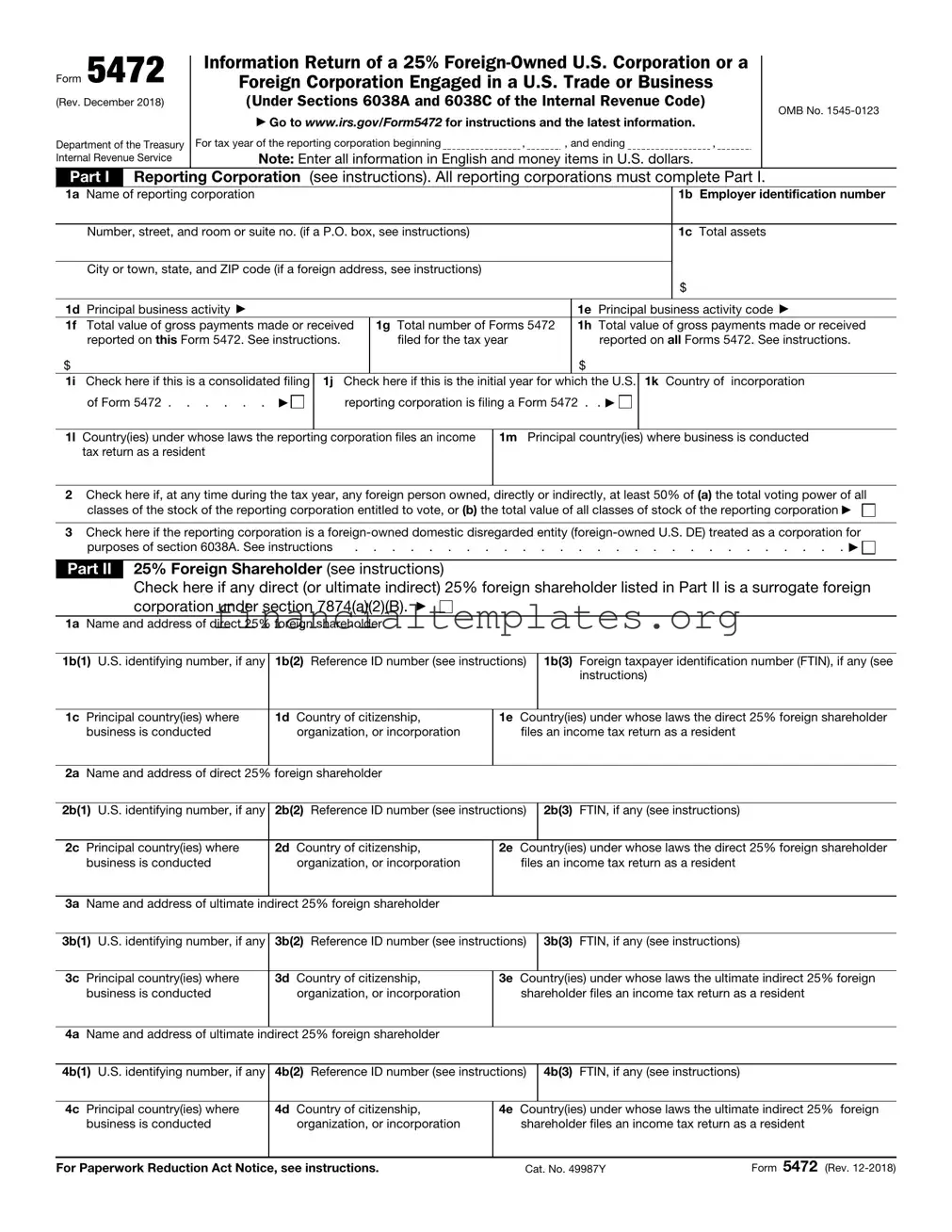

Form 5472 |

Information Return of a 25% |

|

Foreign Corporation Engaged in a U.S. Trade or Business |

|

|

(Rev. December 2021) |

(Under Sections 6038A and 6038C of the Internal Revenue Code) |

OMB No. |

|

|

▶Go to www.irs.gov/Form5472 for instructions and the latest information.

Department of the Treasury |

For tax year of the reporting corporation beginning |

, |

, and ending |

, |

Internal Revenue Service |

Note: Enter all information in English and money items in U.S. dollars. |

|

||

Part I Reporting Corporation (see instructions). All reporting corporations must complete Part I.

1a Name of reporting corporation |

|

|

|

|

|

1b Employer identification number |

||

|

|

|

|

|

|

|

|

|

Number, street, and room or suite no. (If a P.O. box, see instructions.) |

|

|

|

|

1c Total assets |

|||

|

|

|

|

|

|

|

|

|

City or town, state, and ZIP code (If a foreign address, see instructions.) |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

1d Principal business activity ▶ |

|

|

|

|

1e Principal business activity code ▶ |

|||

|

|

|

|

|

|

|

||

1f Total value of gross payments made or received |

|

1g Total number of Forms 5472 |

|

1h Total value of gross payments made or received |

||||

reported on this Form 5472. See instructions. |

|

filed for the tax year |

|

|

reported on all Forms 5472. See instructions. |

|||

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

1i Check here if this is a |

1j Check here if this is the initial year for |

1k |

Total number of Parts VIII |

1l Country of incorporation |

||||

consolidated filing of |

which the U.S. reporting corporation |

|

attached to Form 5472 |

|

||||

Form 5472 . . ▶ |

is filing a Form 5472 |

. . . . ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|||

1m Date of incorporation |

1n Country(ies) under whose laws the reporting |

|

1o Principal country(ies) where business is conducted |

|||||

|

corporation files an income tax return as a resident |

|

|

|

||||

|

|

|

|

|

|

|

|

|

2Check here if, at any time during the tax year, any foreign person owned, directly or indirectly, at least 50% of (a) the total voting power of all

classes of the stock of the reporting corporation entitled to vote, or (b) the total value of all classes of stock of the reporting corporation ▶

3Check here if the reporting corporation is a

purposes of section 6038A. See instructions |

. . . . . . . . . . . . . . . . . . . . . . . . . . . ▶ |

Part II 25% Foreign Shareholder (see instructions)

Check here if any direct (or ultimate indirect) 25% foreign shareholder listed in Part II is a surrogate foreign corporation under section 7874(a)(2)(B). ▶

4a Name and address of direct 25% foreign shareholder

4b(1) U.S. identifying number, if any |

4b(2) Reference ID number (see instructions) |

4b(3) Foreign taxpayer identification number (FTIN), if any |

||||

|

|

|

|

|

(see instructions) |

|

|

|

|

|

|

|

|

4c |

Principal country(ies) where |

4d Country of citizenship, |

4e |

Country(ies) under whose laws the direct 25% foreign |

||

|

business is conducted |

organization, or incorporation |

|

shareholder files an income tax return as a resident |

||

|

|

|

|

|

|

|

5a |

Name and address of direct 25% foreign shareholder |

|

|

|

|

|

|

|

|

|

|

||

5b(1) U.S. identifying number, if any |

5b(2) Reference ID number (see instructions) |

|

5b(3) FTIN, if any (see instructions) |

|

||

|

|

|

|

|

|

|

5c |

Principal country(ies) where |

5d Country of citizenship, |

5e |

Country(ies) under whose laws the direct 25% foreign |

||

|

business is conducted |

organization, or incorporation |

|

shareholder files an income tax return as a resident |

||

|

|

|

|

|

|

|

6a |

Name and address of ultimate indirect 25% foreign shareholder |

|

|

|

|

|

|

|

|

|

|

||

6b(1) U.S. identifying number, if any |

6b(2) Reference ID number (see instructions) |

|

6b(3) FTIN, if any (see instructions) |

|

||

|

|

|

|

|

|

|

6c |

Principal country(ies) where |

6d Country of citizenship, |

6e |

Country(ies) under whose laws the ultimate indirect 25% foreign |

||

|

business is conducted |

organization, or incorporation |

|

shareholder files an income tax return as a resident |

||

|

|

|

|

|

|

|

7a |

Name and address of ultimate indirect 25% foreign shareholder |

|

|

|

|

|

|

|

|

|

|

||

7b(1) U.S. identifying number, if any |

7b(2) Reference ID number (see instructions) |

|

7b(3) FTIN, if any (see instructions) |

|

||

|

|

|

|

|

|

|

7c |

Principal country(ies) where |

7d Country of citizenship, |

7e |

Country(ies) under whose laws the ultimate indirect 25% foreign |

||

|

business is conducted |

organization, or incorporation |

|

shareholder files an income tax return as a resident |

||

|

|

|

|

|||

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 49987Y |

Form 5472 (Rev. |

||||

Form 5472 (Rev. |

Page 2 |

Part III Related Party (see instructions). All reporting corporations must complete this question and the rest of Part III. Check applicable box: Is the related party a

foreign person or

foreign person or

U.S. person?

U.S. person?

8a Name and address of related party

8b(1) U.S. identifying number, if any |

8b(2) |

Reference ID number (see instructions) |

|

8b(3) FTIN, if any (see instructions) |

|

|||

|

|

|

|

|

|

|

|

|

8c |

Principal business activity ▶ |

|

|

|

|

|

8d Principal business activity code ▶ |

|

|

|

|

|

|

|

|||

8e |

Related to reporting corporation |

Related to 25% foreign shareholder |

25% foreign shareholder |

|||||

|

|

|

||||||

8f |

Principal country(ies) where business is conducted |

8g Country(ies) under whose laws the related party files an income tax return as a |

||||||

|

|

|

|

resident |

|

|

|

|

Part IV |

Monetary Transactions Between Reporting Corporations and Foreign Related Party (see instructions) |

|||||

|

|

Caution: Part IV must be completed if the “foreign person” box is checked in the heading for Part III. |

||||

|

|

If estimates are used, check here. ▶ |

|

|

|

|

|

|

|

|

|

||

9 |

Sales of stock in trade (inventory) |

9 |

|

|||

10 |

Sales of tangible property other than stock in trade |

10 |

|

|||

11 |

Platform contribution transaction payments received |

11 |

|

|||

12 |

Cost sharing transaction payments received |

12 |

|

|||

13a |

Rents received (for other than intangible property rights) |

13a |

|

|||

b |

Royalties received (for other than intangible property rights) |

13b |

|

|||

14 |

Sales, leases, licenses, etc., of intangible property rights (for example, patents, trademarks, secret formulas) . . |

14 |

|

|||

15 |

Consideration received for technical, managerial, engineering, construction, scientific, or like services . . . . |

15 |

|

|||

16 |

Commissions received |

16 |

|

|||

17 |

Amounts borrowed (see instructions) a Beginning balance |

|

b Ending balance or monthly average ▶ |

17b |

|

|

18 |

Interest received |

18 |

|

|||

19 |

Premiums received for insurance or reinsurance |

19 |

|

|||

20 |

Loan guarantee fees received |

20 |

|

|||

21 |

Other amounts received (see instructions) |

21 |

|

|||

22 |

Total. Combine amounts on lines 9 through 21 |

22 |

|

|||

23 |

Purchases of stock in trade (inventory) |

23 |

|

|||

24 |

Purchases of tangible property other than stock in trade |

24 |

|

|||

25 |

Platform contribution transaction payments paid |

25 |

|

|||

26 |

Cost sharing transaction payments paid |

26 |

|

|||

27a |

Rents paid (for other than intangible property rights) |

27a |

|

|||

b |

Royalties paid (for other than intangible property rights) |

27b |

|

|||

28 |

Purchases, leases, licenses, etc., of intangible property rights (for example, patents, trademarks, secret formulas) |

28 |

|

|||

29 |

Consideration paid for technical, managerial, engineering, construction, scientific, or like services |

29 |

|

|||

30 |

Commissions paid |

30 |

|

|||

31 |

Amounts loaned (see instructions) a Beginning balance |

|

b Ending balance or monthly average ▶ |

31b |

|

|

32 |

Interest paid |

32 |

|

|||

33 |

Premiums paid for insurance or reinsurance |

33 |

|

|||

34 |

Loan guarantee fees paid |

34 |

|

|||

35 |

Other amounts paid (see instructions) |

35 |

|

|||

36 |

Total. Combine amounts on lines 23 through 35 |

36 |

|

|||

Part V |

Reportable Transactions of a Reporting Corporation That Is a |

DE |

(see instructions) |

|||

|

|

Describe on an attached separate sheet any other transaction as defined by Regulations section |

||||

|

|

such as amounts paid or received in connection with the formation, dissolution, acquisition, and disposition |

||||

|

|

of the entity, including contributions to and distributions from the entity, and check here. ▶ |

||||

|

|

|||||

Part VI |

Nonmonetary and |

|||||

and the Foreign Related Party (see instructions)

Describe these transactions on an attached separate sheet and check here. ▶

Form 5472 (Rev.

Form 5472 (Rev. |

Page 3 |

|

Part VII |

Additional Information. All reporting corporations must complete Part VII. |

|

37 |

Does the reporting corporation import goods from a foreign related party? |

38a |

If “Yes,” is the basis or inventory cost of the goods valued at greater than the customs value of the imported goods? . |

bIf “Yes,” attach a statement explaining the reason or reasons for such difference.

Yes Yes

No No

cIf the answers to questions 37 and 38a are “Yes,” were the documents used to support this treatment of the imported

goods in existence and available in the United States at the time of filing Form 5472? . . . . . . . . . . .

39During the tax year, was the foreign parent corporation a participant in any cost sharing arrangement (CSA)? . . . .

40a |

During the tax year, did the reporting corporation pay or accrue any interest or royalty for which the deduction is not |

|

allowed under section 267A? See instructions |

b |

If “Yes,” enter the total amount of the disallowed deductions . . . . . . . . . . . . . . . . . $ |

41a |

Does the reporting corporation claim a |

|

to amounts listed in Part IV? |

bIf “Yes,” enter the amount of gross income derived from sales, leases, exchanges, or other dispositions (but not licenses) of property to the foreign related party that the reporting corporation included in its computation of

deduction eligible income (FDDEI). See instructions . . . . . . . . . . . . . . . . . . . . $

cIf “Yes,” enter the amount of gross income derived from a license of property to the foreign related party that the reporting

corporation included in its computation of FDDEI. See instructions . . . . . . . . . . . . . . . . $

dIf “Yes,” enter the amount of gross income derived from services provided to the foreign related party that the reporting

corporation included in its computation of FDDEI. See instructions . . . . . . . . . . . . . . . $

42Did the reporting corporation have any loan to or from the related party, to which the

43a Did the reporting corporation make at least one distribution or acquisition (as defined by Regulations section

bIf the answer to question 43a is “Yes,” provide the following.

(1) |

The amount of such distribution(s) and acquisition(s) |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

$ |

(2) |

The amount of such related party indebtedness . . |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

$ |

Yes |

No |

Yes |

No |

Yes |

No |

|

|

Yes |

No |

|

|

|

|

|

|

Yes |

No |

Yes |

No |

Part VIII |

Cost Sharing Arrangement (CSA) |

Note: Complete a separate Part VIII for each CSA in which the reporting corporation was a participant during the tax year. Report all amounts in U.S. dollars. (See instructions.)

44Provide a brief description of the CSA with respect to which this Part VIII is being completed.

45During the course of the tax year, did the reporting corporation become a participant in the CSA? . . . . . . .

46 Was the CSA in effect before January 5, 2009? . . . . . . . . . . . . . . . . . . . . . .

47What was the reporting corporation’s share of reasonably anticipated benefits for the CSA? . . . . . . . . .

48a Enter the total amount of

bEnter the total amount of deductions for the tax year for

and, at date of grant, is directly identified with, or reasonably allocable to, the intangible development activity under the CSA $

cWas there any

49a Enter the total amount of intangible development costs for the CSA . . . . . . . . . . . . . . . $

Yes |

No |

Yes |

No |

%

Yes |

No |

bEnter the amount of intangible development costs allocable to the reporting corporation based on the reporting corporation’s

|

reasonably anticipated benefits share |

$ |

|

|

|

|

|

|

|||

Part IX |

Base Erosion Payments and Base Erosion Tax Benefits Under Section 59A (see instructions) |

||||

50 |

Amounts defined as base erosion payments under section 59A(d) |

$ |

|

|

|

51 |

Amount of base erosion tax benefits under section 59A(c)(2) |

$ |

|

|

|

52 |

Amount of total qualified derivative payments as described in section 59A(h) made by the reporting corporation . . |

$ |

|

|

|

53 |

Reserved for future use |

|

|

|

|

|

|

|

|||

Form 5472 (Rev.

Document Specifics

| Fact Name | Description |

|---|---|

| Definition | The IRS Form 5472 is a requirement for certain U.S. corporations that engage in transactions with foreign related parties, including direct or indirect 25% foreign shareholders. This form helps the IRS keep track of transactions that might not be reported at fair market values. |

| Who Must File | Any U.S. corporation that is 25% foreign-owned and that has had any reportable transactions with a foreign or related party during the tax year must file Form 5472. |

| Requirements for Filing | Form 5472 must be attached to the reporting corporation's income tax return by the due date (including extensions). The form requests detailed information about the transactions with the foreign related party, such as amounts and nature of transactions. |

| Penalties for Non-compliance | Failing to file, incomplete filing, or late filing of Form 5472 can result in significant penalties, starting at $25,000 for each reporting period. These penalties can increase with time, underscoring the importance of compliance. |

| Governing Law | The rules and requirements for IRS Form 5472 are governed by the Internal Revenue Code (IRC), specifically under sections 6038A and 6038C. These sections stipulate the documentation, maintenance, and reporting requirements for transactions between a reporting corporation and its foreign related parties. |

Guide to Writing IRS 5472

When a U.S. business engages with foreign individuals or companies, understanding tax obligations becomes essential. One of the critical documents in this context is the IRS Form 5472. This form is used by certain U.S. entities that have a reportable transaction with a foreign or multinational party. Completing it correctly is crucial to comply with the IRS's reporting requirements and to avoid potential penalties. Here's a step-by-step guide to help you navigate the filling out process of the IRS 5472 form.

Steps for Filling Out the IRS 5472 Form:

- Gather Necessary Information: Before you start, collect all required information, including the reporting corporation's name, identification number, and the details of the reportable transactions.

- Identify the Reporting Corporation: Enter the name, tax identification number (TIN), and address of the reporting corporation at the top of the form.

- Detail the Reportable Transaction: For each reportable transaction, provide a detailed description, the monetary value, and the date of the transaction.

- Specify the Related Party: Identify the foreign or multinational party involved in the transaction. Include their name, country of residence, and any other relevant identifying information.

- Answer Additional Questions: The form includes a series of questions regarding the nature of the transactions and the relationships between parties. Answer each question thoroughly and accurately.

- Sign and Date the Form: After completing all the sections of the form, sign and date it. Ensure that an authorized individual within the corporation completes this step.

- Attach to Tax Return: Once filled out, attach Form 5472 to the reporting corporation’s tax return. If the corporation is filing electronically, follow the IRS’s guidelines for electronic submissions.

Filling out the IRS Form 5472 accurately is a vital step for businesses engaging in international transactions. Following the steps above can help you ensure that your filing is complete and compliant with IRS requirements. Always remember to review the form thoroughly before submission and consult with a tax professional if you have any doubts or questions regarding your specific situation.

Understanding IRS 5472

-

What is IRS Form 5472?

IRS Form 5472 is a tax form used by certain U.S. corporations that engage in a reportable transaction with a foreign or related party. Its primary purpose is to provide information to the IRS about transactions between the reporting corporation and its foreign related parties. This form must be filed as part of the corporation's tax return.

-

Who is required to file Form 5472?

Two types of entities are required to file Form 5472: (1) Any U.S. corporation that is 25% foreign-owned and engages in any reportable transaction with a related party, and (2) Any foreign corporation that is engaged in a U.S. trade or business within the taxable year and engages in transactions with a related party. It is essential for businesses to assess their structure and activities to determine their filing obligations.

-

What constitutes a "reportable transaction"?

A reportable transaction includes any exchange of money or property between the reporting corporation and a foreign or related party. This broad definition encompasses a wide array of financial activities, such as sales, rents, royalties, commissions, loans, and more. Note that certain activities are explicitly excluded under the rules, and understanding these exceptions is crucial for compliance.

-

When is Form 5472 due?

Form 5472 must be filed by the due date (including extensions) of the corporation’s income tax return. The specific deadline depends on the corporation's tax year. Timely filing is critical, as failure to do so can result in significant penalties.

-

What are the penalties for not filing Form 5472?

The IRS imposes hefty penalties for failure to file Form 5472, failure to maintain records, or for filing an incomplete or inaccurate form. Currently, the penalty is $25,000 for each form not filed or incorrectly filed, with an additional $25,000 imposed if the failure continues more than 90 days after the IRS mails a notice of the failure. These penalties underscore the importance of compliance and accuracy in filing.

-

How should Form 5472 be filed?

Form 5472 must be filed electronically with the corporation’s federal income tax return. This is typically done using the IRS’s e-file system. The form itself is attached to the corporation’s tax return, and both must be submitted by the filing deadline.

-

Can Form 5472 be corrected if a mistake was made?

Yes, if an error is discovered on a previously filed Form 5472, it is possible to correct the mistake. The corporation should file an amended return, attach a corrected Form 5472, and explain the reason for the amendment. Addressing errors promptly can help mitigate potential penalties.

-

Where can more information about Form 5472 be found?

For more detailed information, including instructions for completing Form 5472, taxpayers can visit the IRS website. The site provides resources, guidance, and updates on any changes to filing requirements or penalties. Tax professionals and advisors can also offer invaluable assistance with compliance and planning related to Form 5472.

Common mistakes

Filing the IRS Form 5472 can be a complicated process, filled with potential pitfalls. This form, required for certain transactions between a U.S. corporation and its foreign shareholders, contains intricate details that need careful attention. Below are six common mistakes people make when completing this form:

-

Not Filing on Time: One of the most critical mistakes is missing the filing deadline. The IRS imposes strict deadlines for Form 5472, and failing to meet them can result in hefty penalties.

-

Incorrect Reporting of Transactions: Misreporting the nature or amount of transactions between the corporation and its foreign shareholders is a common error. Accuracy is paramount to avoid audits and penalties.

-

Failure to Properly Identify Reportable Transactions: Some filers struggle to differentiate between what constitutes a reportable transaction. Not all interactions with foreign shareholders need to be reported, and distinguishing these can be challenging.

-

Inadequate Record Keeping: The IRS requires detailed records to be kept for any transaction reported on Form 5472. Many filers fail to maintain these records properly, which can lead to complications if the IRS requests them.

-

Incorrect Taxpayer Identification Number (TIN): Providing the wrong TIN can lead to mismatches in the IRS system, causing unnecessary delays or inquiries.

-

Overlooking Attachments: Certain situations require additional documents to be attached with Form 5472. Overlooking this requirement can render the submission incomplete, leading to potential processing delays or even a failure to file.

Understanding and avoiding these common mistakes can significantly smooth the filing process for Form 5472, ensuring compliance with IRS regulations and avoiding potential fines.

Documents used along the form

When dealing with international transactions or foreign-owned U.S. corporations, Form 5472 is a crucial component. However, it's rarely filed in isolation. Understanding the auxiliary forms and documents that often accompany Form 5472 can significantly streamline the filing process and ensure compliance with the Internal Revenue Service (IRS). These additional forms serve various purposes, from declaring the company's tax status to reporting transactions with foreign affiliates. Here is a list of documents commonly associated with Form 5472 to provide clarity and guidance.

- Form 1120: U.S. Corporation Income Tax Return. This form is essential for any U.S. corporation. It reports the company’s income, gains, losses, deductions, and credits and calculates the income tax liability of the corporation.

- Form 8832: Entity Classification Election. Companies use this form to elect how they wish to be classified for federal tax purposes: as a corporation, a partnership, or an entity disregarded as separate from its owner.

- Form SS-4: Application for Employer Identification Number (EIN). This form is used to apply for an EIN, a nine-digit number assigned by the IRS to identify a business entity.

- Form 1042: Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. This form is used to report taxes withheld on income, such as dividends and interests, paid to non-resident aliens, foreign partnerships, or foreign corporations.

- Form 926: Return by a U.S. Transferor of Property to a Foreign Corporation. This form is filed to report certain transfers of property to foreign corporations, to ensure compliance with tax regulations on international transactions.

- Form 3520-A: Annual Information Return of Foreign Trust With a U.S. Owner. Used by foreign trusts with a U.S. owner, this form provides information about the trust, its U.S. owner, and anyone else treated as an owner of any portion of the trust.

- Form 8938: Statement of Specified Foreign Financial Assets. This form is used to report specified foreign financial assets if the total value exceeds the applicable reporting threshold.

Navigating the tax obligations of international business activities can be complex. The forms listed above, when used alongside Form 5472, help ensure businesses meet their reporting requirements and maintain compliance with U.S. tax law. Understanding each document’s purpose and how it integrates with Form 5472 is a critical step in managing the tax aspects of operating a business with foreign connections.

Similar forms

The IRS 5472 form shares similarities with the IRS 1120 form, primarily because both are used by corporations for tax reporting purposes. While Form 5472 focuses on the transactions between a U.S. corporation and its foreign shareholders or related foreign entities, Form 1120 is a U.S. Corporation Income Tax Return, which deals with the corporation’s income, gains, losses, deductions, and credits. This means they both serve to maintain transparency with the IRS about different financial aspects of a corporation, but they target different areas of financial reporting.

Another document resembling IRS Form 5472 is the Schedule K-1 (Form 1065), which is used in partnership tax filings. Like Form 5472, which reports transactions of a corporation with foreign shareholders, Schedule K-1 reports the share of income, deductions, and credits of a partnership's earnings to its partners. Both forms are integral in clarifying the distribution of income and financial movements within entities for tax purposes, ensuring the correct allocation of income and taxes among stakeholders, whether foreign or domestic.

Similar to the IRS 5472, the FinCEN Form 114, also known as the Foreign Bank and Financial Accounts Report (FBAR), targets foreign financial disclosures. While the IRS 5472 form is concerned with reporting transactions between U.S. corporations and their foreign affiliates, the FBAR requires U.S. persons to report foreign financial accounts holding more than $10,000 at any point during the calendar year. Both forms are tools used by the U.S. government to prevent tax evasion and keep track of financial activities involving foreign entities.

The IRS Form 8832 also has connections to Form 5472 in terms of involving foreign entities in its declarations. Form 8832 is used by entities to choose their classification for federal tax purposes, such as a corporation, partnership, or disregarded entity. If a foreign entity elects to be treated as a U.S. corporation and has reportable transactions with its related foreign shareholders or entities, it would then also need to file Form 5472. Thus, both forms play crucial roles in the tax reporting and classification of entities with international ties.

Last but not least, the IRS Form 8865 parallels Form 5472 by focusing on foreign entities, although it addresses foreign partnerships. U.S. persons who have a certain level of control or interest in a foreign partnership use Form 8865 to report their share of the partnership’s income, deductions, and credits, much like how Form 5472 is used to report transactions with related foreign entities. Both forms ensure U.S. taxpayers disclose their foreign affiliations and financial activities to the IRS, promoting transparency and compliance with international tax obligations.

Dos and Don'ts

When tackling the IRS 5472 form, a significant document for reporting transactions between a U.S. corporation and foreign shareholders, attention to detail is paramount. Simplify this task with a clear pathway, marking what you should and shouldn't do, ensuring compliance and minimizing errors. Consider the following guidelines:

Things You Should Do:

Ensure accuracy in reporting all information, including the name and EIN of the reporting corporation, as well as the related party's details.

Utilize the correct tax period for your report, aligning it with the fiscal year of the reporting corporation to ensure consistency in your records.

Diligently report all transactions, including loans, sales, and purchases, to maintain transparency and compliance with tax laws.

Seek guidance from professionals if you're unsure about the form's requirements or if your situation involves complex international transactions.

Retain copies of the completed form and any supporting documentation for at least seven years, as they may be required for future reference or audits.

Things You Shouldn't Do:

Don't overlook the form's deadlines, as late submissions can result in significant penalties and interest charges.

Don't provide incomplete or inaccurate information, as this can lead to errors and potentially, audits or sanctions from the IRS.

Don't neglect the requirements for disclosing monetary transactions as well as non-monetary transactions, as both are critical for comprehensive reporting.

Don't forget to sign the form, as an unsigned form is considered incomplete and may not be processed.

Don't hesitate to update previously submitted forms if you discover errors or omissions. Amending your submissions can mitigate potential penalties.

Misconceptions

Many misconceptions exist surrounding the IRS 5472 form, which can lead to confusion and potential issues for those required to file it. Below, we clarify some of the most common misunderstandings about this form:

Only large corporations need to file Form 5472. This is not correct. Any U.S. corporation or foreign corporation engaging in a U.S. trade or business that has reportable transactions with a foreign or related party must file Form 5472. This requirement applies regardless of the size of the corporation.

Form 5472 is only for reporting financial transactions. While financial transactions are a significant component of what needs to be reported, Form 5472 also requires information on non-monetary transactions, such as certain agreements or leases with related parties not based in the United States.

If no transactions occurred, there's no need to file. This misconception can lead to compliance issues. Even if no transactions occurred during the reporting period, if the reporting corporation had reportable transactions in the past and continues to exist, it may still need to file Form 5472 to comply with reporting requirements.

Filing Form 5472 is the sole responsibility of the foreign party. Actually, the filing responsibility falls on the U.S. corporation or the foreign corporation that is engaged in a U.S. trade or business. It's crucial for entities to understand their obligations to avoid penalties for non-compliance.

Key takeaways

Filing IRS Form 5472 is a necessity for certain business entities in the United States, especially those with foreign ownership or transactions. Understanding the purpose and requirements of this form is crucial to comply with U.S. tax law and avoid potential penalties. Here are seven key takeaways to keep in mind:

- Who needs to file: Form 5472 must be filed by corporations in the United States that are 25% foreign-owned and engage in transactions with a foreign or related party, or by foreign corporations engaged in U.S. trade or business.

- Reporting requirements: The form is used to report certain transactions, such as sales, rents, leases, commissions, and loans, between the filing entity and related parties. Proper documentation and transparency are essential.

- Annual filing: This form needs to be filed annually, attached to the corporation's income tax return. Mark your calendar to ensure timely and consistent compliance.

- Recordkeeping: Entities must keep detailed records of all relevant transactions. These records should be readily available for IRS review if requested, often for a period of up to seven years after the filing date.

- Penalties: Failure to file, late filings, or incomplete filings of Form 5472 can lead to significant penalties, starting from $25,000 per required filing. This can increase with prolonged non-compliance.

- Use the correct version: Tax laws and form requirements can change. Always use the most current version of Form 5472 and its instructions, available on the IRS website, to ensure compliance.

- Consider professional help: Due to the complexity and potential impact of this filing, many corporations benefit from seeking advice from tax professionals who are experienced with international tax law and IRS Form 5472.

Being proactive and informed about your filing responsibilities will help your corporation avoid unnecessary penalties and maintain a healthy compliance status with the IRS.

Popular PDF Documents

Iowa Tax - The Iowa Individual Income Tax Return form IA 1040 is designed for residents to report their income for a specific fiscal year.

IRS 8959 - By completing IRS 8959, individuals can ensure compliance with tax laws regarding surplus income and contribute to Medicare funding.

Where to Find 1040 Form - A section for mailing address changes is included to ensure the City of Phoenix has current contact information.