Get IRS 5405 Form

Navigating the complex landscape of tax forms can be a daunting task, but understanding particular forms like the IRS 5405 is crucial for certain taxpayers. This form serves an important role for individuals who are navigating the financial aspects of home ownership, specifically those who have taken advantage of first-time homebuyer credit or who need to repay this credit. The form includes sections for calculating the credit, as well as guidelines for repayment conditions, making it an essential document for eligible taxpayers. It may also come into play under specific circumstances that require the recapture of the credit, adding another layer of complexity to its completion. Given its significance, taxpayers benefit from a thorough comprehension of the form’s purposes, the situations in which it is required, and the detailed instructions it provides for accurately reporting and potentially repaying the first-time homebuyer credit.

IRS 5405 Example

Form 5405 |

|

Repayment of the |

|

OMB No. |

|

|

|||

(Rev. November 2021) |

|

Homebuyer Credit |

|

|

|

|

|

||

Department of the Treasury |

|

▶ Attach to Form 1040, |

|

Attachment |

Internal Revenue Service |

|

▶ Go to www.irs.gov/Form5405 for instructions and the latest information. |

|

Sequence No. 58 |

Name shown on return |

|

|

Your social security number |

|

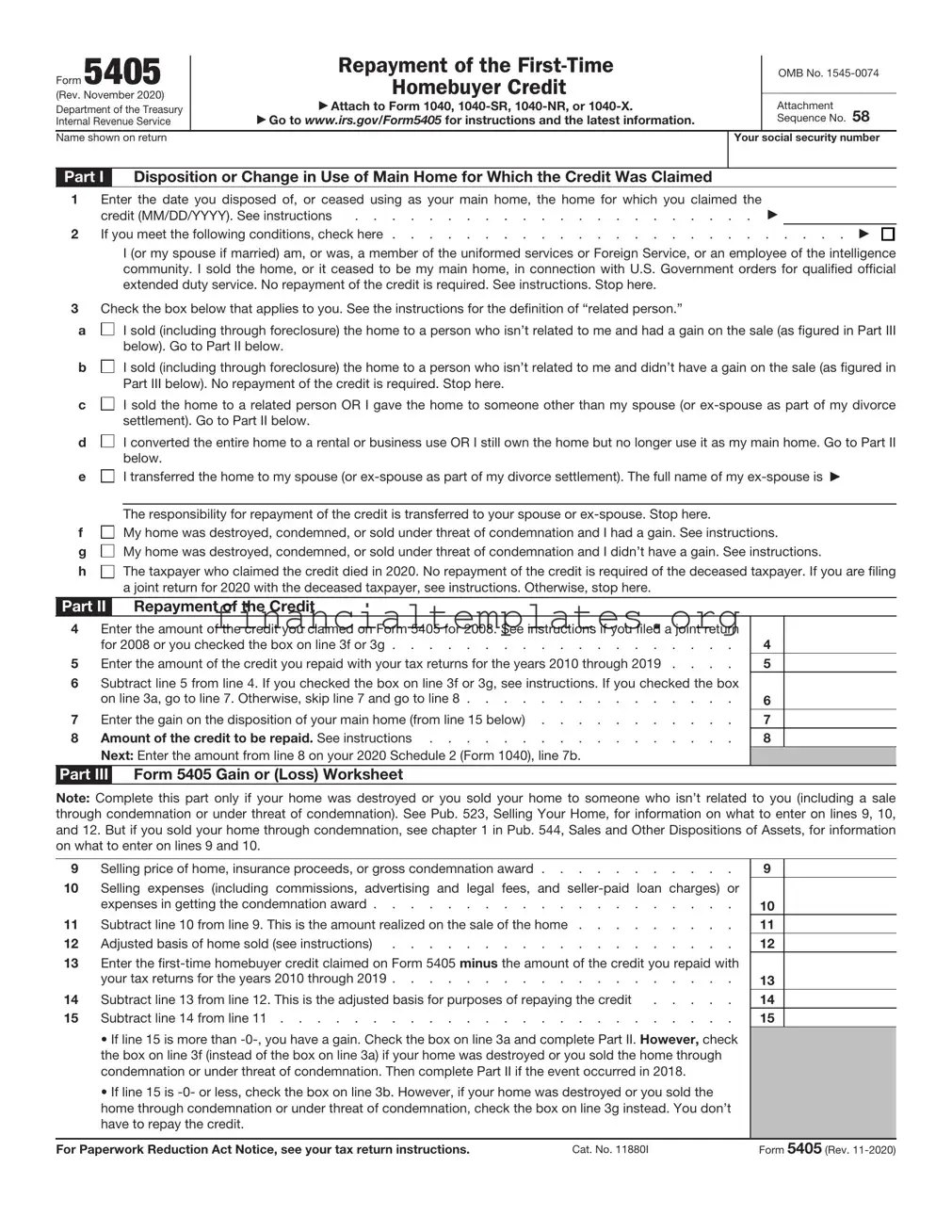

Part I Disposition or Change in Use of Main Home for Which the Credit Was Claimed

1Enter the date you disposed of, or ceased using as your main home, the home for which you claimed the

credit (MM/DD/YYYY). See instructions |

▶ |

|

2 If you meet the following conditions, check here |

. . . . . ▶ |

|

I (or my spouse if married) am, or was, a member of the uniformed services or Foreign Service, or an employee of the intelligence community. I sold the home, or it ceased to be my main home, in connection with U.S. Government orders for qualified official extended duty service. No repayment of the credit is required. See instructions. Stop here.

3Check the box below that applies to you. See the instructions for the definition of “related person.”

a

I sold (including through foreclosure) the home to a person who isn’t related to me and had a gain on the sale (as figured in Part III below). Go to Part II below.

I sold (including through foreclosure) the home to a person who isn’t related to me and had a gain on the sale (as figured in Part III below). Go to Part II below.

b

I sold (including through foreclosure) the home to a person who isn’t related to me and didn’t have a gain on the sale (as figured in Part III below). No repayment of the credit is required. Stop here.

c

I sold the home to a related person OR I gave the home to someone other than my spouse (or

d

e

f g h

I converted the entire home to a rental or business use OR I still own the home but no longer use it as my main home. Go to Part II below.

I transferred the home to my spouse (or

The responsibility for repayment of the credit is transferred to your spouse or

My home was destroyed, condemned, or sold under threat of condemnation and I had a gain. See instructions.

My home was destroyed, condemned, or sold under threat of condemnation and I didn’t have a gain. See instructions.

The taxpayer who claimed the credit died in 2021. No repayment of the credit is required of the deceased taxpayer. If you are filing a joint return for 2021 with the deceased taxpayer, see instructions. Otherwise, stop here.

Part II Repayment of the Credit

4Enter the amount of the credit you claimed on Form 5405 for 2008. See instructions if you filed a joint return

|

for 2008 or you checked the box on line 3f or 3g |

4 |

|

5 |

Enter the amount of the credit you repaid with your tax returns for the years 2010 through 2020 . . . . |

5 |

|

6 |

Subtract line 5 from line 4. If you checked the box on line 3f or 3g, see instructions. If you checked the box |

|

|

|

on line 3a, go to line 7. Otherwise, skip line 7 and go to line 8 |

6 |

|

7 |

Enter the gain on the disposition of your main home (from line 15 below) |

7 |

|

8 |

Amount of the credit to be repaid. See instructions |

8 |

|

|

Next: Enter the amount from line 8 on your 2021 Schedule 2 (Form 1040), line 10. |

|

|

Part III |

Form 5405 Gain or (Loss) Worksheet |

|

|

Note: Complete this part only if your home was destroyed or you sold your home to someone who isn’t related to you (including a sale through condemnation or under threat of condemnation). See Pub. 523, Selling Your Home, for information on what to enter on lines 9, 10, and 12. But if you sold your home through condemnation, see chapter 1 in Pub. 544, Sales and Other Dispositions of Assets, for information on what to enter on lines 9 and 10.

9 |

Selling price of home, insurance proceeds, or gross condemnation award |

9 |

10Selling expenses (including commissions, advertising and legal fees, and

|

expenses in getting the condemnation award |

10 |

11 |

Subtract line 10 from line 9. This is the amount realized on the sale of the home |

11 |

12 |

Adjusted basis of home sold (see instructions) |

12 |

13Enter the

|

your tax returns for the years 2010 through 2020 |

13 |

|

14 |

Subtract line 13 from line 12. This is the adjusted basis for purposes of repaying the credit |

14 |

|

15 |

Subtract line 14 from line 11 |

15 |

|

|

• If line 15 is more than |

|

|

|

the box on line 3f (instead of the box on line 3a) if your home was destroyed or you sold the home through |

|

|

|

condemnation or under threat of condemnation. Then complete Part II if the event occurred in 2019. |

|

|

|

• If line 15 is |

|

|

|

home through condemnation or under threat of condemnation, check the box on line 3g instead. You don’t |

|

|

|

have to repay the credit. |

|

|

|

|

|

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 11880I |

Form 5405 (Rev. |

|

Document Specifics

| Fact Name | Fact Detail |

|---|---|

| Form Number | IRS Form 5405 |

| Purpose | Used for reporting the repayment or claiming of the First-Time Homebuyer Credit. |

| Applicable Credits | Targets the First-Time Homebuyer Credit, a tax credit available to qualifying first-time homebuyers. |

| Year Introduced | The form was introduced following the Housing and Economic Recovery Act of 2008 to stimulate the U.S. housing market. |

| Repayment Feature | Homebuyers who took advantage of the credit must repay it over 15 years, starting two years after the purchase year, if the home remains their primary residence. |

| Claiming Process | Taxpayers use it to claim the credit for homes purchased in specified tax years, as outlined by the IRS regulations. |

| Form Availability | Available on the official IRS website and can be filed electronically or on paper. |

| Deadline for Filing | The deadline typically aligns with the tax return filing deadline, April 15, unless granted an extension. |

| State-Specific Versions | There are no state-specific versions of IRS Form 5405 since it is a federal form, but state credits may have similar requirements. |

| Governing Laws | Governed by federal tax law, specifically the provisions related to the First-Time Homebuyer Credit under the Housing and Economic Recovery Act of 2008. |

Guide to Writing IRS 5405

Filling out the IRS Form 5405 is a necessary step for individuals who are claiming specific tax benefits related to the purchase of a home. This process can be straightforward if approached methodically. By ensuring accurate and complete information, individuals can navigate this task efficiently, thereby avoiding common errors that may delay potential benefits.

- Start by gathering all necessary documents related to the home purchase, including settlement statements and any relevant financial records.

- Access the latest version of IRS Form 5405 from the official IRS website to ensure you are using the most up-to-date form.

- Read through the form to familiarize yourself with the information required and the overall layout of the document.

- Fill in your personal information in the designated sections at the top of the form, including your name and Social Security number.

- Enter the details of your home purchase, including the date of acquisition and the address of the property.

- If applicable, provide information on any previous homes owned and periods of ownership to accurately determine eligibility for the tax credit.

- Calculate the amount of credit you are claiming based on the instructions provided within the form and enter this in the designated area.

- Review your entries carefully, ensuring that all information is accurate and complete. Mistakes or omissions could result in processing delays or an incorrect tax credit.

- Attach Form 5405 to your tax return. Ensure that it is secured with the rest of your tax documents.

- Submit your tax return, including Form 5405, by the filing deadline to avoid any late penalties or interest charges.

After submitting Form 5405 along with your tax return, the IRS will process your claim. This process may take several weeks. It is important to monitor the status of your return through the IRS website or by contacting them directly if you have concerns. Should discrepancies be found or additional information be needed, the IRS will contact you. Successfully navigating this process can lead to significant tax benefits, so it is worth the effort to ensure the form is filled out correctly and submitted on time.

Understanding IRS 5405

-

What is the IRS Form 5405?

IRS Form 5405, titled "First-Time Homebuyer Credit and Repayment of the Credit," is a document used by individuals who need to report the purchase or sale of a property that qualified them for the first-time homebuyer credit. This form also helps to calculate the amount of the credit to be claimed, or the repayment amount if the home stops being the taxpayer's primary residence within a certain timeframe after purchase.

-

Who needs to file IRS Form 5405?

Form 5405 must be filed by taxpayers who are claiming the first-time homebuyer credit, as well as those who are required to repay all or part of a previously claimed first-time homebuyer credit. This requirement typically comes into play if the taxpayer disposes of the home or ceases to use it as their main home within the 36 months after the purchase.

-

How does the repayment of the first-time homebuyer credit work?

If you received the first-time homebuyer credit for a home purchased in 2008, you generally must repay the credit over 15 years, starting with your 2010 tax return. However, if you sold the home or it ceased being your primary residence, you may have to repay the entire remaining amount of the credit in the year the home was no longer your primary residence.

-

Are there any exceptions to repaying the first-time homebuyer credit?

Yes, there are exceptions. For example, if you transferred your home to a spouse or ex-spouse as part of a divorce settlement, you may not be required to repay the credit. Similarly, if the home was destroyed or condemned, or if you sold your home to someone who is not related to you, special rules may apply. Each situation has specific requirements, so it's important to review the IRS guidelines or consult with a tax professional.

-

Can I claim the first-time homebuyer credit if I recently purchased a home?

The first-time homebuyer credit is no longer available for most taxpayers. It was designed as a temporary measure to stimulate the housing market and only applied to homes purchased before a specific date. If you're purchasing a home now, you won't be eligible for this credit.

-

What documentation do I need to file with Form 5405?

When filing Form 5405, you should attach documentation that supports the purchase or sale of the home. This may include a settlement statement, a final closing statement, or other documents that detail the transaction. Ensure that the documentation clearly shows the purchase price, date of acquisition, and other relevant details.

-

How do I determine the amount of the credit I need to repay?

The amount of the credit you need to repay depends on various factors, including the year the home was purchased and the circumstances under which it ceased being your principal residence. Form 5405 includes specific instructions and calculations to help determine the correct repayment amount.

-

What if I don't repay the credit as required?

Failing to repay the first-time homebuyer credit as required can lead to additional interest and penalties. The IRS may also take action to collect the amount owed, including offsetting your federal tax refund. It's crucial to address repayment requirements timely to avoid such consequences.

-

Where can I find IRS Form 5405?

You can find IRS Form 5405 on the Internal Revenue Service's official website. It's available for download in PDF format, which you can print and complete. Keep in mind that the IRS frequently updates its forms, so be sure to download the most current version for the tax year you're filing.

-

Can I file IRS Form 5405 electronically?

Yes, in many cases, you can file IRS Form 5405 electronically as part of your federal tax return through an IRS-approved e-file provider. However, depending on your specific tax situation, particularly if you need to attach supplemental documents, you might be required to file a paper return. Verify whether e-filing is an option for you by checking with the e-file software you plan to use or consulting a tax professional.

Common mistakes

Filling out IRS Form 5405, related to the first-time homebuyer credit, requires attention to detail. Misunderstandings or mistakes can lead to delays or errors in processing. Here are six common errors individuals should avoid:

Not verifying eligibility criteria. Before you fill out the form, ensure you meet all the eligibility criteria for the first-time homebuyer credit. Overlooking this step can lead to the rejection of your credit claim.

Incomplete information. Every field relevant to your situation on Form 5405 should be filled out. Missing information can cause processing delays or even incorrect determinations of your credit amount.

Incorrect figures. Entering wrong amounts, whether it’s the purchase price of your home or your adjusted gross income, can affect the credit you are entitled to. These inaccuracies can lead to audits or adjustments in your favor.

Mishandling the purchase date. The purchase date of your home determines eligibility and the credit year. Incorrectly reporting this date can disqualify you from receiving the credit or lead to its recapture.

Failing to attach required documents. If documentation supporting the home purchase, such as the settlement statement, is not attached, the IRS may delay processing or deny the credit.

Forgetting to sign and date the form. An unsigned or undated form is considered incomplete and will not be processed until rectified. This error, albeit small, can cause significant delays.

To ensure a smooth process with the IRS, double-check your form for these common mistakes. Accuracy and completeness are key to successfully claiming your first-time homebuyer credit.

Documents used along the form

Completing the IRS Form 5405, which is tied to the First-Time Homebuyer Credit and Repayment of the Credit, often requires additional documentation to ensure compliance and accuracy in one's tax filings. This list of documents not only supports the claims made on Form 5405 but also aids in a smoother processing of one's tax responsibilities. Here are several key forms and documents that are commonly used in conjunction with IRS Form 5405, each briefly described for better understanding.

- Form 1040 - The U.S. Individual Income Tax Return is a mandatory form for all taxpayers filing an annual income tax return. It serves as the foundational document that details the taxpayer's income, deductions, and credits.

- Form 1098 - The Mortgage Interest Statement is critical for homeowners, as it reports the amount of mortgage interest paid during the tax year. This information is essential when calculating the homebuyer credit.

- Schedule D (Form 1040) - This form is used to report capital gains and losses from the sale or exchange of capital assets. It may be needed if a home previously purchased using the credit has been sold.

- Form 8822 - Change of Address form is important if the taxpayer has moved since the last filing. Keeping the address current ensures that any communication from the IRS reaches the taxpayer.

- Form 1099-S - The Proceeds from Real Estate Transactions form reports the sale or exchange of real estate. It's pertinent if the sale of the home affects the first-time homebuyer credit.

- Form 4506-T - Request for Transcript of Tax Return. This form allows taxpayers to request prior-year tax returns, which may be necessary to provide further evidence of eligibility for the credit.

- Property Settlement Statement - This document outlines the final settlement of the property transaction. It includes the selling price, loan amounts, and closing costs, vital for verifying the purchase that qualifies for the credit.

- HUD-1 Settlement Statement - Similar to the Property Settlement Statement, this document itemizes all charges and credits to the buyer and seller in a real estate transaction. It's required for purchases that qualify for the homebuyer credit.

- Certificate of Occupancy - For newly constructed homes, this legal document certifies that the property is in a condition suitable for occupancy. It may be necessary to establish the date of purchase for the credit.

- Loan Documents - Specifics of the home purchase financing, including the mortgage agreement, are crucial for substantiating the purchase details related to the homebuyer credit.

Collectively, these documents facilitate a comprehensive approach to filing Form 5405, ensuring that all related aspects of the home purchase and potential credit are accurately represented. It is recommended to consult with a tax professional or legal advisor to ensure the correct documentation is compiled and presented in accordance with IRS requirements, ultimately aiding in the accurate and timely processing of one's tax returns.

Similar forms

The IRS Form 1040, commonly known as the U.S. Individual Income Tax Return, shares similarities with the IRS 5405 form in that both are integral to reporting specific financial information to the IRS. The Form 1040 is broader, capturing an individual's total income, tax deductions, and tax credits for the year, whereas Form 5405 focuses on the specifics related to the first-time homebuyer credit. In essence, both forms contribute vital information for the calculation of one's tax liabilities or refunds due.

Form 8863, titled "Education Credits (American Opportunity and Lifetime Learning Credits)," is akin to Form 5405 as they both pertain to tax credits, albeit for different purposes. Form 8863 is used to claim educational credits, supporting taxpayers in reducing their tax bill based on qualified education expenses. This parallels how Form 5405 is utilized for claiming a credit, although this specifically aids first-time homebuyers. Each form, therefore, plays a significant role in the financial planning of individuals, offering opportunities to lessen their tax responsibilities through specific life activities.

The IRS Form 5695, "Residential Energy Credits," is similar to the 5405 form in its focus on tax credits related to personal situations. Form 5695 allows individuals to claim credits for specific investments in home energy efficiency, such as solar panels or other renewable energy installations. Like Form 5405, which provides a tax incentive for first-time homebuyers, Form 5695 incentivizes homeowners to invest in energy-saving improvements, highlighting the tax code's role in encouraging particular economic and personal choices.

Form 8859, the "District of Columbia First-Time Homebuyer Credit," closely resembles Form 5405. It's designed for a very specific audience - homebuyers in the District of Columbia - and facilitates a tax credit similar to what Form 5405 provides on a national level. Both forms serve to ease the financial burden of acquiring a new home by offering a tax credit, although the eligibility criteria and benefits detailed might vary to cater to their respective audiences.

IRS Form 8910, "Alternative Motor Vehicle Credit," is another form that, like 5405, deals with tax credits - this time for purchasers of alternative fuel vehicles. While the focus is different, the underlying principle of offering a financial incentive to influence personal purchasing decisions for societal benefit (environmental conservation in the case of Form 8910 and housing market stimulation for Form 5405) is a common thread that ties these forms together.

Similar to the 5405 form, IRS Form 8880, "Credit for Qualified Retirement Savings Contributions," offers taxpayers an avenue to claim a credit, emphasizing the government's interest in promoting specific fiscal behaviors - in this case, saving for retirement. While Form 5405 encourages the purchase of a first home, Form 8880 incentivizes taxpayers to contribute to retirement accounts, both critical aspects of personal financial stability.

Form 8396, "Mortgage Interest Credit," also shares a connection with Form 5405 since both are involved in homeownership and financial assistance. Form 8396 permits taxpayers to claim a credit for part of their mortgage interest if they were issued a mortgage credit certificate by a state or local governmental unit or agency. Similar to the goal of the first-time homebuyer credit, this form aims to alleviate the financial load of owning a home, enhancing affordability for targeted groups.

IRS Form 8829, "Expenses for Business Use of Your Home," relates to Form 5405 through its focus on the tax implications of homeownership, although it applies to those using a portion of their home for business purposes. It allows for the deduction of expenses such as mortgage interest, insurance, utilities, repairs, and depreciation. This form, much like the 5405, acknowledges the intersection between personal living spaces and broader economic activities (in this case, small business operations), providing tax benefits accordingly.

Last but not least, Form 1098, "Mortgage Interest Statement," is similar to Form 5405 because both deal with the financial aspects of owning a home. Form 1098 is typically issued by mortgage lenders to report the amount of interest and related expenses paid by a borrower during the year. It is instrumental in preparing one's tax return, often used in conjunction with other forms like the 5405 when claiming tax benefits related to homeownership, thereby linking the processes of obtaining a home and fulfilling tax obligations.

Dos and Don'ts

Filling out the IRS Form 5405, which is related to the repayment of the First-Time Homebuyer Credit, requires careful attention to ensure accuracy and compliance with tax laws. To guide you through this process, here are several do's and don'ts to consider:

Do:- Ensure you're eligible to claim the credit before filling out the form to prevent any issues with the IRS.

- Read the instructions provided by the IRS for Form 5405 carefully to understand each section and what is required.

- Gather all necessary documents, such as your Purchase Agreement and settlement statement, before starting the form to streamline the process.

- Double-check your Social Security Number (SSN) and other personal information to prevent processing delays due to errors.

- Calculate the credit correctly according to the instructions to avoid claims for incorrect amounts that could lead to audits or penalties.

- Attach Form 5405 to your tax return if required, ensuring that it is filed correctly and on time.

- Consult with a tax professional if you have any doubts or complex questions regarding your situation for expert advice.

- Assume eligibility without verifying it against the current tax year's requirements, as eligibility criteria may change.

- Ignore IRS instructions or guidance provided for Form 5405, as this can lead to mistakes and potential issues with your tax return.

- Rush through the form without verifying all information, as inaccuracies can cause significant delays or necessitate amended returns.

- Forget to sign and date the form, as this is a common oversight that can invalidatesubmission until corrected.

- Misplace your supporting documents, as these may be needed for your records or if the IRS requests additional information.

- Overlook the repayment obligation for the First-Time Homebuyer Credit if applicable, since failing to repay it when required can result in penalties.

- File late without requesting an extension, as failing to file or pay by the deadline can lead to penalties and interest charges.

Misconceptions

The IRS 5405 form, pivotal for those navigating the nuances of homebuyer tax credits, is often shrouded in misconceptions. This misinterpretation can lead to a myriad of confusion, which, thankfully, can be clarified to ensure individuals are both compliant and fully benefiting from potential tax advantages. Here are nine common misconceptions debunked:

IRS Form 5405 is only for first-time homebuyers: Contrary to what many believe, Form 5405 is not exclusively for first-time homebuyers. It was initially designed for this group, especially relevant when the first-time homebuyer credit was in effect. However, it has also been utilized for reporting the repayment of the credit, which can apply to individuals who have previously owned a home.

It must be filed every year: This form does not need to be filed annually by everyone who has ever claimed the homebuyer credit. Instead, it's specifically necessary when you first claim the credit or in situations where repayment of the credit is required, according to the particular rules governing the credit at the time it was claimed.

Claiming the credit is automatic upon purchasing a home: Simply buying a home does not automatically entitle someone to the homebuyer tax credit. The IRS Form 5405 must be correctly filled out and submitted with the tax return for the year in which the home was purchased, and taxpayers must meet specific eligibility criteria.

The form is complicated and requires professional preparation: While it's always wise to consult with a tax professional if you're unsure, many taxpayers can accurately complete Form 5405 by carefully reading the instructions provided by the IRS. The form itself guides the filer through calculating the credit or repayment amounts, if any.

Filing Form 5405 will delay your refund: There's a common worry that including Form 5405 with your tax return will cause significant delays in receiving your refund. In reality, while the IRS might need extra time to review claims associated with homebuyer credits, filing this form does not inherently mean your refund will be delayed beyond the normal processing times.

You can claim the credit for a home purchased anytime: This is not true. The eligibility to claim the first-time homebuyer credit has a cutoff date determined by the legislation that introduced it. Purchases made after this date do not qualify for the credit.

Only U.S. citizens can file Form 5405: The credit is not restricted to U.S. citizens. Permanent residents and certain other non-citizens who have bought homes within the eligible periods and meet other criteria can also file this form to claim the credit or report repayment.

You need to repay the credit only if you sell your home: The requirement to repay the first-time homebuyer credit depends on the year the property was purchased and other conditions, such as how long the home was the principal residence. In some cases, repayment is required without selling the home.

Form 5405 can only be filed with a paper return: This form can be filed with both paper and electronic returns. Taxpayers should refer to the latest IRS guidelines and recommendations on filing methods to ensure compliance and efficiency in processing.

Understanding these nuances around IRS Form 5405 can save taxpayers from common pitfalls and help them to navigate their tax obligations with greater confidence and accuracy.

Key takeaways

The Internal Revenue Service (IRS) Form 5405 is essential for taxpayers who want to take advantage of first-time homebuyer credits or repayment obligations. Understanding how to properly fill out and use this form can lead to smoother processing of your tax return and ensure you receive any credits you're entitled to. Here are nine key takeaways about the IRS 5405 form:

- Eligibility Requirements: Before you proceed with the form, ensure you meet the eligibility criteria for the first-time homebuyer credit. The form details specific conditions, such as homeownership history and income limitations, that determine eligibility.

- Accurate Information: Providing accurate information is crucial. Errors or incomplete details can delay processing or result in the denial of the credit. Double-check figures related to purchase price, purchase date, and taxpayer identification numbers.

- Documentation: Have all necessary documentation on hand when filling out the form. This includes your closing statement, proof of residence, and any other required financial documents that support your claim for the credit.

- Repayment Features: Some taxpayers may be required to repay the first-time homebuyer credit. Understand the conditions of repayment, as they vary depending on when the home was purchased.

- Changes in Home Use: Notify the IRS of any changes in the use of your home that could affect your eligibility for the credit. This includes converting it to a rental or business property.

- Attaching to Tax Return: The completed Form 5405 must be attached to your tax return. Failing to attach the form correctly can lead to processing delays.

- Electronic Filing: If you’re filing your taxes electronically, ensure that the software you’re using supports Form 5405. Verify that the form is transmitted along with your tax return.

- Amended Returns: If you need to claim the credit after your original tax return has been filed, you may need to submit an amended return using Form 1040-X, along with Form 5405.

- IRS Guidance: The IRS provides guidance and updates regarding Form 5405 on their website. Stay informed about any changes to the form or the related tax credit that could affect you.

Properly understanding and utilizing Form 5405 can significantly impact individuals looking to benefit from the first-time homebuyer credit. While the process may seem daunting, taking it step by step and ensuring compliance with IRS rules will lead to a more favorable outcome. Should you have any doubts or require further explanation, consulting with a tax professional is highly recommended.

Popular PDF Documents

Whistleblower Irs Form - Award amounts for successful tips are determined by several factors, including the extent of the fraud and the amount of additional tax revenue collected by the IRS as a result.

Form 2848 Instructions 2023 - This form is necessary if you want a professional to discuss your Maine tax matters with the state tax authority.

Gi Bill Verification - By facilitating accurate and efficient processing of child care payments, this form supports both providers and families in Virginia.