Get IRS 5330 Form

Navigating the complexities of tax forms can often feel like wading through a maze, especially when dealing with the specifics of certain tax situations that go beyond the basics of filing annual returns. Among these specialized forms is the IRS 5330 form, a document essential for reporting taxes related to specific retirement plans and other tax-favored accounts. This form covers a range of tax situations, including excise taxes on excess contributions to retirement accounts, certain transactions in regard to 401(k) plans, and funding deficiencies in pension plans, among other scenarios. Designed to ensure compliance with the tax regulations governing these accounts, the form serves as a critical tool for both plan administrators and individual taxpayers in managing their responsibilities. While the form might seem daunting at first glance, understanding its major aspects is key to accurately reporting and potentially avoiding unnecessary penalties or fees associated with the mishandling of specialized tax situations. By delving into the purpose and requirements of the IRS 5330 form, individuals can gain a better understanding of how to navigate these complex tax waters, ensuring they stay on the right side of tax obligations while maximizing the benefits of their retirement plans and tax-favored accounts.

IRS 5330 Example

Note: The form, instructions, or publication you are looking

for begins after this coversheet.

Please review the updated information below.

Clarification for Form 5330, Schedule F, line 2b

Schedule F, line 2, is used to report section 4971(g)(4) tax on failure to adopt a rehabilitation plan. We are clarifying the text on line 2b with regard to the

Enter the number of days during the tax year which are included in the period beginning on the first day following the close of the

Form 5330

(Rev. December 2013)

Department of the Treasury

Internal Revenue Service

Return of Excise Taxes Related to Employee Benefit Plans

(Under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979A, 4980, and 4980F of the Internal Revenue Code)

Information about Form 5330 and its instructions is at www.irs.gov/form5330.

OMB No.

Filer tax year beginning |

, |

and ending |

, |

|

A Name of filer (see instructions) |

|

|

B Filer’s identifying number (Enter either the |

|

|

|

|

|

EIN or SSN, but not both. See instructions.) |

|

|

Employer identification number (EIN) |

||

|

Number, street, and room or suite no. (If a P.O. box or foreign address, see instructions.) |

|||

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

Social security number (SSN) |

|

|

|

|

|

|

C Name of plan |

|

|

E Plan sponsor’s EIN |

|

|

|

|

|

|

D Name and address of plan sponsor |

|

|

F Plan year ending (MM/DD/YYYY) |

|

|

|

|

|

|

H If this is an amended return, check here |

. . . . . . . . . . . . . . . |

G Plan number |

||

|

|

|

|

|

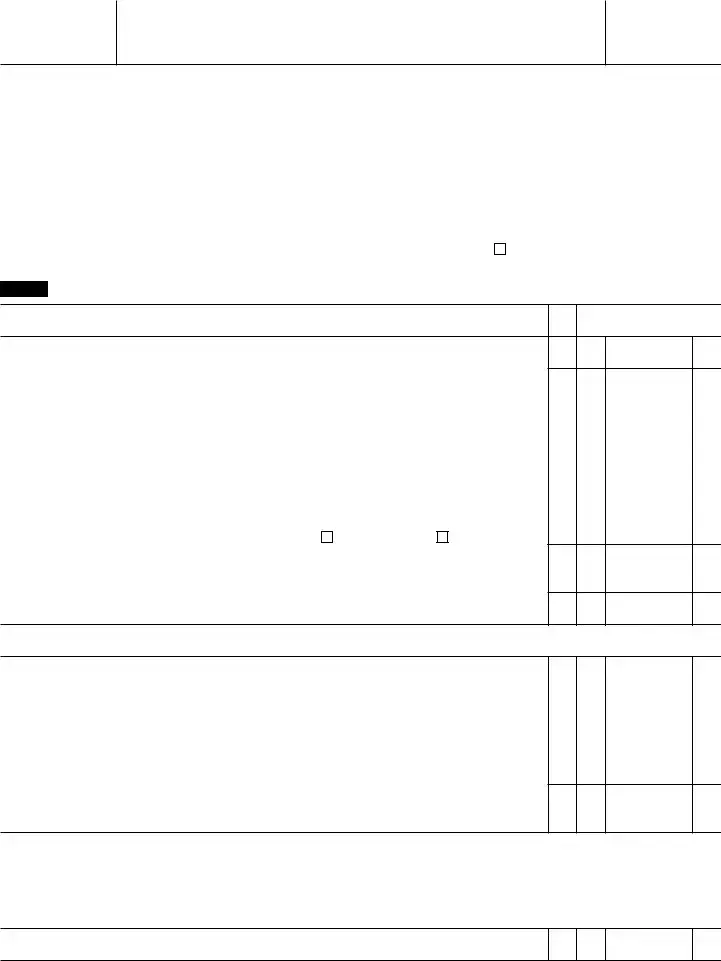

Part I Taxes. You can only complete one section of Part I for each Form 5330 filed (see instructions).

Section A. Taxes that are reported by the last day of the 7th month after the end of the tax |

FOR |

IRS |

|

year of the employer (or other person who must file the return) |

USE |

ONLY |

1Section 4972 tax on nondeductible contributions to qualified plans (from Schedule A,

line 12) |

161 |

1 |

2Section 4973(a)(3) tax on excess contributions to section 403(b)(7)(A) custodial accounts

|

(from Schedule B, line 12) |

164 |

2 |

|

||

3a |

Section 4975(a) tax on prohibited transactions (from Schedule C, line 3) |

159 |

3a |

|||

b |

Section 4975(b) tax on failure to correct prohibited transactions |

224 |

3b |

|||

4 |

Section 4976 tax on disqualified benefits for funded welfare plans |

200 |

4 |

|

||

5a |

Section 4978 tax on ESOP dispositions |

209 |

5a |

|||

b |

The tax on line 5a is a result of the application of: |

Sec. 664(g) |

Sec. 1042 |

|

5b |

|

6Section 4979A tax on certain prohibited allocations of qualified ESOP securities or ownership

of synthetic equity |

203 |

6 |

7 Total Section A taxes. Add lines 1 through 6. Enter here and on Part II, line 17 . . . .

7

Section B. Taxes that are reported by the last day of the 7th month after the end of the employer’s tax year or 81/2 months after the last day of the plan year that ends within the filer’s tax year

8a |

Section 4971(a) tax on failure to meet minimum funding standards (from Schedule D, line 2) |

. . |

163 |

8a |

b |

Section 4971(b) tax for failure to correct minimum funding standards |

. . |

225 |

8b |

9a |

Section 4971(f)(1) tax on failure to pay liquidity shortfall (from Schedule E, line 4) . . |

. . |

226 |

9a |

b |

Section 4971(f)(2) tax for failure to correct liquidity shortfall |

. . |

227 |

9b |

10a |

Section 4971(g)(2) tax on failure to comply with a funding improvement or rehabilitation |

plan |

|

|

|

(see instructions) |

. . |

450 |

10a |

bSection 4971(g)(3) tax on failure to meet requirements for plans in endangered or critical

status (from Schedule F, line 1c) |

451 |

10b |

c Section 4971(g)(4) tax on failure to adopt rehabilitation plan (from Schedule F, line 2d) . . |

452 |

10c |

Section B1. Tax that is reported by the last day of the 7th month after the end of the calendar year in which the excess fringe benefits were paid to the employer’s employees

11 |

Section 4977 tax on excess fringe benefits (from Schedule G, line 4) |

201 |

11 |

|

|

12 |

Total Section B taxes. Add lines 8a through 11. Enter here and on Part II, line 17 . . . |

|

12 |

|

|

Section C. Tax that is reported by the last day of the 15th month after the end of the plan year |

|

|

|

|

|

13Section 4979 tax on excess contributions to certain plans (from Schedule H, line 2). Enter

here and on Part II, line 17 |

205 13 |

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 11870M |

Form 5330 (Rev. |

Form 5330 (Rev. |

|

|

|

Page 2 |

||

Name of Filer: |

Filer’s identifying number: |

|||||

Section D. Tax that is reported by the last day of the month following the month in which the reversion occurred |

||||||

14 |

Section 4980 tax on reversion of qualified plan assets to an employer (from Schedule I, |

|

|

|

|

|

|

line 3). Enter here and on Part II, line 17 |

. . . . . . . . . |

204 |

14 |

|

|

Section E. Tax that is reported by the last day of the month following the month in which the |

failure |

occurred |

||||

15 |

Section 4980F tax on failure to provide notice of significant reduction in future accruals |

|

|

|

|

|

|

(from Schedule J, line 5). Enter here and on Part II, line 17 . . |

. . . . . . . . . |

228 |

15 |

|

|

Section F. Taxes reported on or before the 15th day of the 5th month following the close of the entity manager’s taxable year during which the plan became a party to a prohibited tax shelter transaction

16 Section 4965 tax on prohibited tax shelter transactions for entity managers (from Schedule |

|

|

|

|

|

|

|

|

|||||||||||

|

K, line 2). Enter here and on Part II, line 17 |

|

237 |

|

16 |

|

|

|

|

||||||||||

|

Tax Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Part II |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

Enter the amount from Part I, line 7, 12, 13, 14, 15, or 16 (whichever is applicable) . . . . |

. . |

|

17 |

|

|

|

|

|||||||||||

18 |

Enter amount of tax paid with Form 5558 or any other tax paid prior to filing this return . . |

. . |

|

18 |

|

|

|

|

|||||||||||

19 Tax due. Subtract line 18 from line 17. If the result is greater than zero, enter here, and attach |

|

|

|

|

|

|

|

||||||||||||

|

check or money order payable to “United States Treasury.” Write your name, identifying number, |

|

|

|

|

|

|

|

|||||||||||

|

plan number, and “Form 5330, Section(s) |

|

” on your payment . . . |

. |

|

|

19 |

|

|

|

|

||||||||

|

|

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge |

||||||||||||||||

Sign |

|

|

and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Here |

|

|

F |

|

|

|

F |

|

|

|

|

|

|

F |

|

|

|

||

|

|

|

Your Signature |

|

|

Telephone number |

|

|

|

|

|

Date |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Paid |

|

|

|

Print/Type preparer’s name |

Preparer's signature |

|

|

Date |

|

Check |

|

if |

|

PTIN |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Preparer |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Firm’s name |

|

|

|

|

|

Firm's EIN |

|

|

|

|

|

|

|||||||

Use Only |

|

|

|

|

|

|

|

|

|

|

|

||||||||

Firm's address |

|

|

|

|

|

Phone no. |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

5330 (Rev. |

|||

Form 5330 (Rev. |

Page 3 |

Name of Filer: |

Filer’s identifying number: |

Schedule A. Tax on Nondeductible Employer Contributions to Qualified Employer Plans (Section 4972)

Reported by the last day of the 7th month after the end of the tax year of the employer (or other person who must file the return)

1 |

Total contributions for your tax year to your qualified employer plan (under section 401(a), |

|

|

|

|||

|

403(a), 408(k), or 408(p)) |

. . . . . . |

1 |

|

|

||

2 |

Amount allowable as a deduction under section 404 |

. . . . . . |

2 |

|

|

||

3 |

Subtract line 2 from line 1 |

. . . . . . |

3 |

|

|

||

4 |

Enter amount of any prior year nondeductible contributions made for |

|

|

|

|

|

|

|

years beginning after 12/31/86 |

|

4 |

|

|

|

|

5 |

Amount of any prior year nondeductible contributions for years beginning |

|

|

|

|

|

|

|

after 12/31/86 returned to you in this tax year for any prior tax year . . |

|

5 |

|

|

|

|

6 |

Subtract line 5 from line 4 |

|

6 |

|

|

|

|

7 |

Amount of line 6 carried forward and deductible in this tax year . . . |

|

7 |

|

|

|

|

8 |

Subtract line 7 from line 6 |

. . . . . . |

8 |

|

|

||

9 |

Tentative taxable excess contributions. Add lines 3 and 8 |

. . . . . . |

9 |

|

|

||

10 |

Nondeductible section 4972(c)(6) or (7) contributions exempt from excise tax |

. . . . . . |

10 |

|

|

||

11 |

Taxable excess contributions. Subtract line 10 from line 9 |

. . . . . . |

11 |

|

|

||

12 |

Multiply line 11 by 10%. Enter here and on Part I, line 1 |

. . . . . |

12 |

|

|

||

Schedule B. Tax on Excess Contributions to Section 403(b)(7)(A) Custodial Accounts (Section 4973(a)(3))

Reported by the last day of the 7th month after the end of the tax year of the employer (or other person who must file the return)

1 |

Total amount contributed for current year less rollovers (see instructions) |

1 |

|

|

2 |

Amount excludable from gross income under section 403(b) (see instructions) |

2 |

|

|

3 |

Current year excess contributions. Subtract line 2 from line 1. If zero or less, enter |

3 |

|

|

4 |

Prior year excess contributions not previously eliminated. If zero, go to line 8 |

4 |

|

|

5 |

Contribution credit. If line 2 is more than line 1, enter the excess; otherwise, enter |

5 |

|

|

6 |

Total of all prior years’ distributions out of the account included in your gross income under |

|

|

|

|

section 72(e) and not previously used to reduce excess contributions |

6 |

|

|

7 |

Adjusted prior years’ excess contributions. Subtract the total of lines 5 and 6 from line 4 . . |

7 |

|

|

8 |

Taxable excess contributions. Add lines 3 and 7 |

8 |

|

|

9 |

Multiply line 8 by 6% |

9 |

|

|

10 |

Enter the value of your account as of the last day of the year |

10 |

|

|

11 |

Multiply line 10 by 6% |

11 |

|

|

12 |

Excess contributions tax. Enter the lesser of line 9 or line 11 here and on Part I, line 2 . . |

12 |

|

|

Form 5330 (Rev.

Form 5330 (Rev. |

Page 4 |

Name of Filer: |

Filer’s identifying number: |

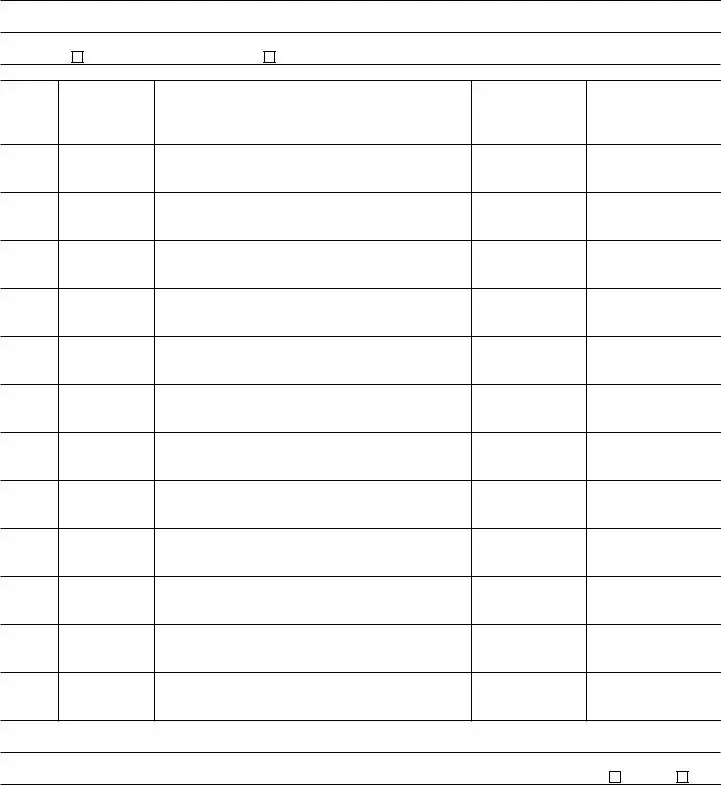

Schedule C. Tax on Prohibited Transactions (Section 4975) (see instructions) Reported by the last day of the 7th month after the end of the tax year of the employer (or other person who must file the return)

1Is the excise tax a result of a prohibited transaction that was (box “a” or box “b” must be checked):

a |

discrete |

b |

other than discrete (a lease or a loan) |

2Complete the table below to disclose the prohibited transactions and figure the initial tax (see instructions)

|

|

|

(d) Amount involved |

(e) Initial tax on prohibited |

|

(a) |

(b) Date |

|

transaction (multiply each |

||

(c) Description of prohibited transaction |

in prohibited |

||||

Transaction |

of transaction |

transaction in column (d) by |

|||

transaction |

|||||

number |

(see instructions) |

|

the appropriate rate (see |

||

|

(see instructions) |

||||

|

|

|

instructions)) |

||

|

|

|

|

(i)

(ii)

(iii)

(iv)

(v)

(vi)

(vii)

(viii)

(ix)

(x)

(xi)

(xii)

3 Add amounts in column (e); enter here and on Part I, line 3a . . . . . . . . . . . .

4Have you corrected all of the prohibited transactions that you are reporting on this return? If “Yes,”

complete Schedule C, line 5, on the next page. If “No,” attach statement (see instructions) . . . |

Yes |

No

Form 5330 (Rev.

Form 5330 (Rev. |

Page 5 |

Name of Filer: |

Filer’s identifying number: |

Schedule C. Tax on Prohibited Transactions (Section 4975) Reported by the last day of the 7th month after the end of the tax year of the employer (or other person who must file the return) (continued)

5Complete the table below, if applicable, of other participating disqualified persons and description of correction (see instructions).

(a)

Item no.

from line 2

(b)

Name and address of

disqualified person

(c)

EIN or SSN

(d)

Date of

correction

(e)

Description of correction

Schedule D. Tax on Failure to Meet Minimum Funding Standards (Section 4971(a)) Reported by the last day of the 7th month after the end of the employer’s tax year or 81/2 months after the last day of the plan year that ends within the filer’s tax year

1 |

Aggregate unpaid required contributions (accumulated funding deficiency for multiemployer |

|

|

|

|

plans) (see instructions) |

1 |

|

|

2 |

Multiply line 1 by 10% (5% for multiemployer plans). Enter here and on Part I, line 8a . . . . |

2 |

|

|

Form 5330 (Rev.

Form 5330 (Rev. |

Page 6 |

Name of Filer: |

Filer’s identifying number: |

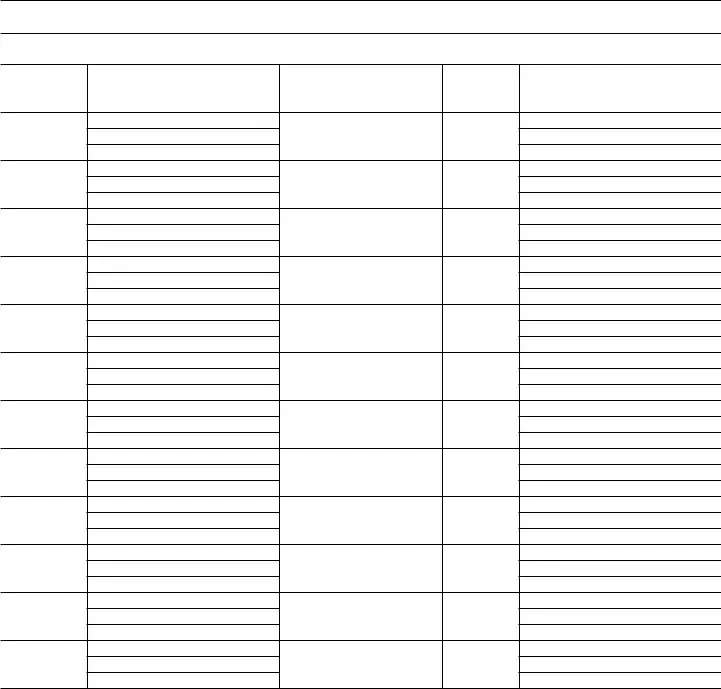

Schedule E. Tax on Failure to Pay Liquidity Shortfall (Section 4971(f)(1)) Reported by the last day of the 7th month after the end of the employer’s tax year or 81/2 months after the last day of the plan year that ends within the filer’s tax year

|

|

|

(a) 1st Quarter |

(b) 2nd Quarter |

(c) 3rd Quarter |

(d) 4th Quarter |

(e) Total |

||

|

|

|

Add cols. |

||||||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

1 |

Amount of shortfall . . . . |

1 |

|

|

|

|

|

|

|

2 |

Shortfall paid by the due date |

2 |

|

|

|

|

|

|

|

3 |

Net shortfall amount . . . |

3 |

|

|

|

|

|

|

|

4 |

Multiply line 3, column (e), by 10%. Enter here and on Part I, line 9a |

. . |

4 |

|

|

||||

Schedule F. Tax on Multiemployer Plans in Endangered or Critical Status (Section 4971(g)(3), 4971(g)(4)) Reported by the last day of the 7th month after the end of the employer’s tax year or 81/2 months after the last day of the plan year that ends within the filer’s tax year

1 |

Section 4971(g)(3) tax on failure to meet requirements for plans in endangered or critical status . . |

1 |

|

|

||

a |

Enter the amount of contributions necessary to meet the applicable benchmarks or requirements . |

1a |

|

|

||

b |

Enter the amount of the accumulated funding deficiency |

1b |

|

|

||

c |

Enter the greater of line 1a or line 1b, here and on Part I, line 10b |

1c |

|

|

||

2 |

Section 4971(g)(4) tax on failure to adopt rehabilitation plan |

2 |

|

|

||

a Enter the amount of the excise tax on the accumulated funding deficiency under section 4971(a)(2) |

|

|

|

|||

|

from Schedule D, line 2 |

2a |

|

|

||

b Enter the number of days during the tax year which are included in the period beginning on the first day |

|

|

|

|||

|

of the 240 day period and ending on the day the rehabilitation plan is adopted |

|

|

2b |

|

|

c |

Multiply line 2b by $1,100 |

2c |

|

|

||

d |

Enter the greater of line 2a or line 2c, here and on Part I, line 10c |

2d |

|

|

||

Schedule G. Tax on Excess Fringe Benefits (Section 4977) Reported by the last day of the 7th month after the end of the calendar year in which the excess fringe benefits were paid to the employer’s employees

1 |

Did you make an election to be taxed under section 4977? |

Yes |

No |

|

|

|

|

2 |

If “Yes,” enter the calendar year (YYYY) in which the excess fringe benefits were paid |

|

|

|

|

|

|

3 |

|

|

|

|

3 |

|

|

If line 1 is “Yes,” enter the excess fringe benefits on this line (see instructions) |

. |

|

|

|

|||

4 |

Enter 30% of line 3 here and on Part I, line 11 |

|

|

4 |

|

|

|

Schedule H. Tax on Excess Contributions to Certain Plans (Section 4979) Reported by the last day of the 15th month after the end of the plan year

1 |

Enter the amount of an excess contribution under a cash or deferred arrangement that is part of a plan |

|

|

|

|

qualified under section 401(a), 403(a), 403(b), 408(k), or 501(c)(18) or excess aggregate contributions . |

1 |

|

|

2 |

Multiply line 1 by 10% and enter here and on Part I, line 13 |

2 |

|

|

Schedule I. Tax on Reversion of Qualified Plan Assets to an Employer (Section 4980) Reported by the last day of the month following the month in which the reversion occurred

1 |

Date reversion occurred |

MM |

|

DD |

|

YY |

|

|

|

|

|

||||

2a |

Employer reversion amount |

|

|

b Excise tax rate |

|

|

|

|

|

|

|

|

|||

3 |

Multiply line 2a by line 2b and enter the amount here and on Part I, line 14 . . . |

. . . |

|

|

3 |

|

|

||||||||

4Explain below why you qualify for a rate other than 50%:

Schedule J. Tax on Failure to Provide Notice of Significant Reduction in Future Accruals (Section 4980F) Reported by the last day of the month following the month in which the failure occurred

1 |

Enter the number of applicable individuals who were not provided ERISA section 204(h) notice |

|

|

|

|

|

1 |

|

|

|

|||||

2 |

Enter the effective date of the amendment |

MM |

DD |

YY |

|

2 |

|

|

|

||||||

3 |

Enter the number of days in the noncompliance period |

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

4 |

Enter the total number of failures to provide ERISA section 204(h) notice (see instructions) . . |

|

4 |

|

|

|

|||||||||

5 |

Multiply line 4 by $100. Enter here and on Part I, line 15 |

|

5 |

|

|

|

|||||||||

6 |

Provide a brief description of the failure, and of the correction, if any |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule K. Tax on Prohibited Tax Shelter Transactions (Section 4965) Reported on or before the 15th day of the 5th month following the close of the entity manager’s tax year during which the plan became a party to a prohibited tax shelter transaction

1 |

Enter the number of prohibited tax shelter transactions you caused the same plan to be a |

|

|

|

||

|

party to |

|

|

1 |

|

|

2 |

Multiply line 1 by $20,000. Enter the result here and on |

Part I, line 16 |

2 |

|

|

|

Form 5330 (Rev.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 5330 | Form 5330 is used to report and pay taxes related to specific retirement plans and tax-exempt organizations. |

| Applicable Taxes Reported | This form covers taxes including those on excess contributions, prohibited transactions, and other specific excises under chapters 41 and 43 of the Internal Revenue Code. |

| Filing Frequency | The filing requirement for Form 5330 can vary; it may be annual or occur only when specific transactions have taken place. |

| Due Date | The due date for filing the form depends on the type of tax being reported, typically within 7 months after the end of the plan year. |

| Penalties for Late Filing | Late filings may result in penalties, calculated based on the length of the delay and the amount of tax due. |

| Where to File | Where to file Form 5330 may change based on IRS instructions, commonly directed to specific IRS offices or filed electronically through approved channels. |

| Governing Laws | The requirements and stipulations for Form 5330 fall under chapters 41 and 43 of the Internal Revenue Code. |

| Electronic Filing | While the IRS encourages electronic filing for many forms, filers should verify current policies for Form 5330, as electronic options may vary. |

Guide to Writing IRS 5330

Filling out the IRS Form 5330 involves a series of steps crucial for accurate completion and submission. This form is used for reporting taxes related to certain employee pension and benefit plans. Once completed, this document serves as an essential component in remaining compliant with federal regulations, ensuring that the necessary taxes are accurately reported and paid. The following guidelines are designed to assist in navigating the process of filling out the form correctly.

- Begin by obtaining the most recent version of Form 5330 from the Internal Revenue Service (IRS) website to ensure compliance with current tax laws and requirements.

- Review the instructions provided by the IRS for Form 5330 thoroughly to understand each section's requirements and how they specifically apply to your circumstances.

- Provide the identifying information required in the form's header, including the name of the plan, the plan's Employer Identification Number (EIN), and the plan year end date.

- Enter your personal or the plan administrator’s contact information, including name, address, and telephone number.

- Fill out the sections that apply to your specific tax situation, which may include taxes on forbidden transactions, amounts related to specific contributions limits, or other applicable taxes under the Employee Retirement Income Security Act (ERISA).

- Calculate the total tax liability carefully according to the instructions for each section that applies to your form. Use the provided tables and calculations methods in the instructions to ensure accuracy.

- If necessary, attach a detailed statement outlining the computation of each tax reported on the form. This may be required if the form does not provide enough space for a full explanation of the taxes owed.

- Review the form and attached documents thoroughly to ensure that all entered information is accurate and complete. Correct or amend any part as needed before submission.

- Sign and date the form. If you're preparing the form for someone else, ensure that the appropriate authorization is in place for you to do so.

- Follow the instructions for filing, which will indicate whether you need to mail the form or if there is an electronic submission option. Submit the form along with any payment required to the address specified in the filing instructions.

By following these steps, you can efficiently complete the IRS Form 5330, ensuring that all relevant taxes related to employee pension and benefit plans are reported accurately. Proper submission of this form is vital for compliance with federal requirements, helping to prevent potential fines or penalties associated with reporting errors or omissions.

Understanding IRS 5330

-

What is the purpose of the IRS Form 5330?

IRS Form 5330 is used to report and pay excise taxes related to specific pension plans and other tax-favored benefit accounts. Employers or plan administrators who may have engaged in certain transactions or failed to meet specific funding requirements need to file this form to report taxes due on those activities. These include taxes on excess contributions, prohibited transactions, and other items related to retirement plans.

-

Who needs to file IRS Form 5330?

This form must be filed by employers or plan administrators responsible for managing tax-favored accounts such as 401(k) plans, pension plans, and various other types of retirement plans. Specifically, if there have been excess contributions, prohibited transactions, or other reportable events as defined by the IRS, the responsible party needs to file Form 5330 to report and pay the associated excise taxes.

-

When is IRS Form 5330 due?

The due date for filing IRS Form 5330 can vary depending on the type of tax being reported. Generally, the form must be filed by the last day of the seventh month after the end of the plan year in which the taxable event occurred. However, extensions may be available, and specific deadlines can depend on the exact nature of the tax being reported. It's important to consult the IRS guidelines or a tax advisor to confirm the exact due date for your situation.

-

Can IRS Form 5330 be filed electronically?

As of the most current information available, IRS Form 5330 cannot be filed electronically. Filers must complete a paper form and mail it to the IRS at the address provided in the instructions for the form. It's essential to ensure that the form is filled out accurately and mailed well before the due date to avoid any potential late filing penalties.

-

What are the penalties for not filing IRS Form 5330 on time?

Failure to file IRS Form 5330 on time, or failing to pay the associated excise tax by the due date, can result in interest charges and penalties. The penalties can be substantial, including a percentage of the tax due, with additional charges accruing the longer the tax remains unpaid. Specific penalty amounts depend on the amount of tax owed and the length of the delay. Taking action as soon as possible to file and pay any owed taxes can help minimize these charges.

Common mistakes

Filling out the IRS 5330 form, which is used for reporting taxes and payments on certain employee benefit plans, can be a complex process. People often encounter pitfalls due to the form's detailed requirements. Understanding these common mistakes can guide individuals through a smoother filing process.

-

Incorrect Tax Year Reporting: A frequent mistake is misreporting the tax year. Filers sometimes use the current year instead of the year for which the taxes are due. This error can lead to processing delays and may require the submission of an amended return.

-

Failure to Include All Required Information: The form demands detailed information about the employee benefit plan. Omissions, such as not listing all participating employees or failing to break down the taxes owed by type, can lead to incomplete filings and potential audits.

-

Miscalculating Tax Amounts: Accurately calculating the taxes owed is crucial. Filers often make errors in this area by misunderstanding the rates or misapplying them to the plan's total figures. These mistakes can result in either underpayments, which may incur penalties, or overpayments, potentially costing the filer money.

-

Not Signing the Form: Though it seems straightforward, a surprising number of filers forget to sign and date the form. An unsigned form is considered incomplete and will not be processed, leading to unnecessary delays.

Avoiding these mistakes requires attention to detail and a thorough understanding of the form's instructions. Filers should double-check their work or consult a professional to ensure accuracy and compliance. This approach can save time, money, and the stress of dealing with errors after submission.

Documents used along the form

The IRS 5330 form is typically associated with the reporting and payment of taxes related to specific retirement plans and tax-favored accounts. When dealing with this form, there are several other documents that individuals and businesses might also need to complete or consult to ensure full compliance with tax laws and regulations. These documents serve various purposes, from detailing the specifics of an individual's retirement plan contributions to offering guidance on correcting plan errors. Understanding these documents and their relevance to the IRS 5330 form can streamline the filing process and help avoid potential penalties.

- Form 5500 Series: This series of forms is essential for annual reporting on the financial condition, investments, and operations of pension and other employee benefit plans. The Form 5500 serves as a critical companion document to the IRS 5330, especially for identifying discrepancies that might lead to the necessity for filing the latter.

- Form 8955-SSA: An annual registration statement identifying separated participants with deferred vested benefits. The Form 8955-SSA works in tandem with the IRS 5330 form by providing details on participants who have left the employer but have benefits that are due in the future.

- Form 2848, Power of Attorney and Declaration of Representative: This form allows individuals to authorize a representative to act on their behalf in matters related to the IRS. When filing Form 5330, having a Form 2848 can be crucial if the filer needs someone else, such as a tax professional or lawyer, to communicate with the IRS regarding the form.

- Schedule MB (Form 5500): This schedule is specific to multiemployer defined benefit plans and provides detailed information regarding the plan’s actuarial values. It is often used alongside Form 5330 to ensure that the reported funding information aligns with the tax obligations reported.

- Schedule SB (Form 5500): Similar to Schedule MB but for single-employer defined benefit plans, this schedule outlines the funding and actuarial information necessary for proper reporting and tax calculation. It aids in cross-verifying the accuracy of the data reported on Form 5330, ensuring compliance.

When preparing the IRS 5330 form, gathering and accurately completing these associated documents is crucial for fulfilling legal obligations and minimizing errors. By understanding each document's purpose and how it relates to the IRS 5330 form, filers can navigate the complexities of retirement plan taxation with greater ease and confidence. Importantly, seeking the advice of a knowledgeable tax professional when dealing with these forms can provide additional assurance that all regulatory requirements are met.

Similar forms

The IRS 5330 form, used for reporting and paying excise taxes related to certain employee pension and benefit plans, shares similarities with the IRS Form 940. The IRS Form 940 is designed to report federal unemployment tax obligations. Both forms serve the purpose of reporting and paying taxes, but they cater to different types of taxes. Form 940 focuses on unemployment, whereas Form 5330 deals with excise taxes on specific pension and benefit plan activities.

Similarly, the IRS Form 941, which is used for reporting quarterly federal tax returns, can be compared to the IRS 5330 form. Form 941 is required by employers to report income taxes, Social Security tax, or Medicare tax withheld from their employees' paychecks. Like Form 5330, it involves the payment of taxes to the IRS, though Form 941 focuses on employment taxes, establishing a common ground in the tax reporting and payment processes between the two.

Another comparable document is the IRS Form 990-T, used by tax-exempt organizations to report and pay income tax on unrelated business income. Both the Form 990-T and the Form 5330 are concerned with tax payments, but they cater to different entities and types of taxes. Form 990-T specifically addresses unrelated business income of tax-exempt organizations, while Form 5330 covers excise taxes related to pensions and benefits.

The IRS Form 5500 is a document that requires annual reporting from pension and other employee benefit plans to the IRS and the Department of Labor. This form shares a connection with the IRS 5330 form through their focus on employee benefit plans. However, Form 5500 is more about compliance and informational reporting regarding the condition and operations of the plan, rather than the tax payments detailed in Form 5330.

Form 8955-SSA is yet another document related to the IRS 5330 form. It is used to report separated participants with deferred vested benefits under their retirement plan. Both forms are integral to the management and regulatory compliance of retirement plans, with Form 8955-SSA focusing on participant reporting and Form 5330 on excise tax implications of certain failures or actions within these plans.

Last but not least, the IRS Form 1120-POL, used by political organizations to report their income tax obligations, shares a resemblance with the IRS 5330 in terms of tax reporting and payments. While Form 1120-POL specifically targets political organizations, Form 5330 focuses on specific tax liabilities related to employee benefit plans. Both require the entity to report income and pay the necessary taxes owed to the federal government, highlighting their role in maintaining compliance with U.S. tax law.

Dos and Don'ts

When dealing with the IRS 5330 form, a document required for reporting taxes related to certain retirement plans, both diligence and precision are paramount. Below are essential dos and don'ts to aid in the successful completion and submission of this form.

Do:

- Ensure you have all the necessary information before you start. This includes the employer identification number (EIN), plan number, and tax period.

- Read the instructions for each part of the form carefully to understand what is required. The IRS provides detailed instructions that can help prevent common mistakes.

- Use black ink and write legibly if you are filling out the form by hand. Alternatively, consider using a fillable form via the IRS website for a cleaner, more accurate submission.

- Double-check your calculations. The IRS 5330 form requires precise calculations, so it's crucial to verify them to avoid errors.

- Sign and date the form. An unsigned form is considered incomplete and can lead to delays or penalties.

- Keep a copy of the completed form and any related documents for your records. This is important for reference in case of any queries from the IRS.

Don't:

- Forget to include any required schedules or attachments. Failure to provide all necessary information can result in the rejection of the form.

- Omit your employer identification number (EIN) or plan number. These are crucial for the IRS to properly process your form.

- Guess on figures or leave sections blank. If you’re unsure, seek clarification from a tax professional rather than risking inaccuracies.

- Use correction fluid or tape on the form. Mistakes should be neatly crossed out, and the correct information should be entered beside it or above it.

- Miss the deadline for submission. Late filing can result in penalties, so it’s important to submit the form on time.

- Ignore IRS notices regarding errors or requests for additional information. Promptly responding to these notices is crucial to avoid further complications.

Misconceptions

The Form 5330, often surrounded by a veil of complexity and misconceptions, serves a unique role within the Internal Revenue Service's array of documentation. This form primarily addresses taxes related to specific retirement plans and other tax-favored accounts. The common misunderstandings listed below not only shed light on its purpose but also help clarify the obligations and opportunities for those it impacts.

Misconception 1: The Form 5330 is only for large corporations. Contrary to this belief, the Form 5330 can be required from a range of entities including small businesses and non-profits, depending on their specific pension plan activities and the excise taxes applicable to them.

Misconception 2: It's an annual filing requirement for all retirement plans. In reality, Form 5330 is only needed when certain specific events trigger excise taxes under the Internal Revenue Code, not as an annual obligation for all retirement or tax-favored plans.

Misconception 3: Completing the Form 5330 is straightforward and requires no special knowledge. This form can be quite complex, often requiring detailed information about the plan and possibly consultation with a tax professional or attorney to ensure correct completion.

Misconception 4: Filing Form 5330 corrects errors in retirement plan operations. Filing this form and paying the associated excise tax does not rectify the operational issue; it merely satisfies the tax liability. The underlying problem must still be corrected through appropriate amendments or corrections to the plan's operations.

Misconception 5: The IRS rarely enforces penalties for issues related to Form 5330. The IRS does, in fact, actively enforce the collection of excise taxes due and can impose additional penalties and interest for late or inaccurate filings.

Misconception 6: Excise tax rates are standard across all issues. The rates of excise taxes applicable can vary widely based on the type of prohibited transaction or plan issue involved. Some rates are fixed, while others may depend on the duration or extent of the issue.

Misconception 7: The Form 5330 covers all types of excise taxes. While Form 5330 does cover a wide range of excise taxes related to retirement plans, it does not encompass all excise taxes that may be levied by the IRS. Other forms are sometimes required for different types of excise taxes.

Misconception 8: Filing Form 5330 is voluntary when discrepancies are discovered. Once a discrepancy that incurs an excise tax is identified, filing Form 5330 and paying the due tax become mandatory obligations, not voluntary actions.

Misconception 9: Only the plan sponsor or employer is responsible for filing Form 5330. While typically the plan sponsor or employer is responsible, in some instances, other parties involved in a pension plan, such as plan administrators or certain service providers, might also bear responsibility for filing Form 5330 and paying the appropriate taxes.

Misconception 10: Corrections made under the Employee Plans Compliance Resolution System (EPCRS) eliminate the need to file Form 5330. Although making corrections under EPCRS can help avoid some penalties, it does not necessarily exempt the filer from the requirement to file Form 5330 if excise taxes are owed due to prohibited transactions or other plan failures.

Key takeaways

The IRS Form 5330 serves a crucial role in the administration of tax liabilities related to specific retirement plans and tax-exempt organizations. Understanding its purpose, how to accurately complete it, and its implications, are fundamental for compliance and financial management within these entities. Here are four key takeaways about the IRS Form 5330 that stakeholders should be aware of.

- Understanding the Purpose: The IRS Form 5330 is used to report and pay excise taxes related to certain retirement plans and tax-exempt organizations. This form covers a range of tax liabilities, including those related to the misuse of funds, failing to meet minimum funding requirements, and specific prohibited transactions.

- Filling It Out Accurately: Accuracy is imperative when completing the IRS Form 5330. The form requires detailed information about the entity, the type of plan, the tax liability being reported, and the calculations for the tax owed. Entities are advised to carefully review the form’s instructions and, if necessary, seek expert advice to ensure accuracy and avoid penalties.

- Timeliness Matters: Timeliness in filing the IRS Form 5330 cannot be overstated. There are specific deadlines for filing this form, depending on the type of excise tax being reported. Late filings can result in penalties and interest charges, which can accumulate rapidly. It's important for entities to be aware of these deadlines and plan accordingly to avoid unnecessary financial burdens.

- Impact on Financial Management: The IRS Form 5330 has a significant impact on the financial management of retirement plans and tax-exempt organizations. Paying excise taxes can affect an entity’s cash flow and financial planning. Understanding the potential tax liabilities and planning for these expenses in advance is a critical aspect of financial management for these entities.

Popular PDF Documents

3rd Party Designee - This form is critical for those who need assistance in navigating tax issues and filing requirements.

Nj St-50 - It offers a comprehensive guide to prepare businesses for the online filing of the ST-50, ensuring accuracy and completeness.

Do I Have to Report Gambling Winnings - Properly filing this return helps ensure that charitable gaming activities contribute to the community in a regulated manner.