Get IRS 5305-SEP Form

Small businesses and self-employed individuals looking to set up Simplified Employee Pension (SEP) plans will find the IRS 5305-SEP form to be of significant importance. Designed to facilitate the process, this form helps in establishing the guidelines under which contributions are made to an employee's SEP-IRA. With retirement planning being crucial for financial security, the 5305-SEP plays a pivotal role by offering a straightforward method for employers to contribute towards their employees' future, without the complexities often associated with pension plans. The form outlines eligibility criteria, contribution limits, and the operational framework, ensuring that all parties have a clear understanding of the plan's parameters. Moreover, by using this form, businesses can reap tax benefits, thus providing an incentive for securing employee retirement benefits early on. Understanding and filling out the 5305-SEP correctly is essential for maintaining compliance with IRS regulations, making it a priority for those considering or currently offering SEP plans.

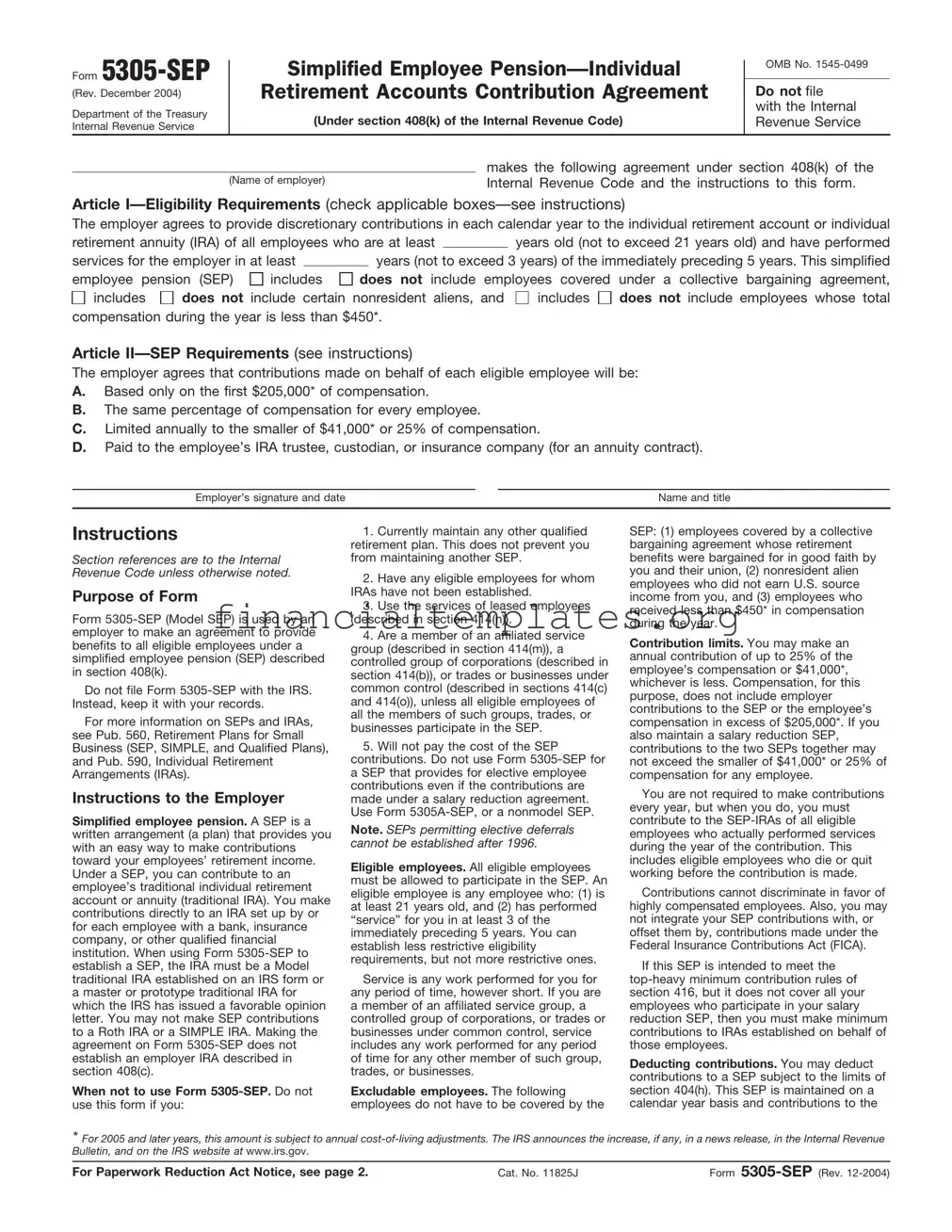

IRS 5305-SEP Example

Form

(Rev. December 2004)

Department of the Treasury Internal Revenue Service

Simplified Employee

Retirement Accounts Contribution Agreement

(Under section 408(k) of the Internal Revenue Code)

OMB No.

Do not file

with the Internal Revenue Service

|

makes the following agreement under section 408(k) of the |

(Name of employer) |

Internal Revenue Code and the instructions to this form. |

Article

The employer agrees to provide discretionary contributions in each calendar year to the individual retirement account or individual

retirement annuity (IRA) of all employees who are at least |

|

years old (not to exceed 21 years old) and have performed |

||||||

services for the employer in at least |

|

|

years (not to exceed 3 years) of the immediately preceding 5 years. This simplified |

|||||

employee pension (SEP) |

includes |

does not include employees covered under a collective bargaining agreement, |

||||||

includes |

does not include certain |

nonresident aliens, and |

includes |

does not include employees whose total |

||||

compensation during the year is less than $450*.

Article

The employer agrees that contributions made on behalf of each eligible employee will be:

A.Based only on the first $205,000* of compensation.

B.The same percentage of compensation for every employee.

C.Limited annually to the smaller of $41,000* or 25% of compensation.

D.Paid to the employee’s IRA trustee, custodian, or insurance company (for an annuity contract).

Employer’s signature and date |

Name and title |

Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Purpose of Form

Form

Do not file Form

For more information on SEPs and IRAs, see Pub. 560, Retirement Plans for Small Business (SEP, SIMPLE, and Qualified Plans), and Pub. 590, Individual Retirement Arrangements (IRAs).

Instructions to the Employer

Simplified employee pension. A SEP is a written arrangement (a plan) that provides you with an easy way to make contributions toward your employees’ retirement income. Under a SEP, you can contribute to an employee’s traditional individual retirement account or annuity (traditional IRA). You make contributions directly to an IRA set up by or for each employee with a bank, insurance company, or other qualified financial institution. When using Form

When not to use Form

1.Currently maintain any other qualified retirement plan. This does not prevent you from maintaining another SEP.

2.Have any eligible employees for whom IRAs have not been established.

3.Use the services of leased employees (described in section 414(n)).

4.Are a member of an affiliated service group (described in section 414(m)), a controlled group of corporations (described in section 414(b)), or trades or businesses under common control (described in sections 414(c) and 414(o)), unless all eligible employees of all the members of such groups, trades, or businesses participate in the SEP.

5.Will not pay the cost of the SEP contributions. Do not use Form

Note. SEPs permitting elective deferrals cannot be established after 1996.

Eligible employees. All eligible employees must be allowed to participate in the SEP. An eligible employee is any employee who: (1) is at least 21 years old, and (2) has performed “service” for you in at least 3 of the immediately preceding 5 years. You can establish less restrictive eligibility requirements, but not more restrictive ones.

Service is any work performed for you for any period of time, however short. If you are a member of an affiliated service group, a controlled group of corporations, or trades or businesses under common control, service includes any work performed for any period of time for any other member of such group, trades, or businesses.

Excludable employees. The following employees do not have to be covered by the

SEP: (1) employees covered by a collective bargaining agreement whose retirement benefits were bargained for in good faith by you and their union, (2) nonresident alien employees who did not earn U.S. source income from you, and (3) employees who received less than $450* in compensation during the year.

Contribution limits. You may make an annual contribution of up to 25% of the employee’s compensation or $41,000*, whichever is less. Compensation, for this purpose, does not include employer contributions to the SEP or the employee’s compensation in excess of $205,000*. If you also maintain a salary reduction SEP, contributions to the two SEPs together may not exceed the smaller of $41,000* or 25% of compensation for any employee.

You are not required to make contributions every year, but when you do, you must contribute to the

Contributions cannot discriminate in favor of highly compensated employees. Also, you may not integrate your SEP contributions with, or offset them by, contributions made under the Federal Insurance Contributions Act (FICA).

If this SEP is intended to meet the

Deducting contributions. You may deduct contributions to a SEP subject to the limits of section 404(h). This SEP is maintained on a calendar year basis and contributions to the

*For 2005 and later years, this amount is subject to annual

For Paperwork Reduction Act Notice, see page 2. |

Cat. No. 11825J |

Form |

Form |

Page 2 |

SEP are deductible for your tax year with or within which the calendar year ends. Contributions made for a particular tax year must be made by the due date of your income tax return (including extensions) for that tax year.

Completing the agreement. This agreement is considered adopted when:

●IRAs have been established for all your eligible employees;

●You have completed all blanks on the agreement form without modification; and

●You have given all your eligible employees the following information:

1.A copy of Form

2.A statement that traditional IRAs other than the traditional IRAs into which employer SEP contributions will be made may provide different rates of return and different terms concerning, among other things, transfers and withdrawals of funds from the IRAs.

3.A statement that, in addition to the information provided to an employee at the time the employee becomes eligible to participate, the administrator of the SEP must furnish each participant within 30 days of the effective date of any amendment to the SEP, a copy of the amendment and a written explanation of its effects.

4.A statement that the administrator will give written notification to each participant of any employer contributions made under the SEP to that participant’s IRA by the later of January 31 of the year following the year for which a contribution is made or 30 days after the contribution is made.

Employers who have established a SEP using Form

Information for the Employee

The information below explains what a SEP is, how contributions are made, and how to treat your employer’s contributions for tax purposes. For more information, see Pub. 590.

Simplified employee pension. A SEP is a written arrangement (a plan) that allows an employer to make contributions toward your retirement. Contributions are made to a traditional individual retirement account/annuity (traditional IRA). Contributions must be made to either a Model traditional IRA executed on an IRS form or a master or prototype traditional IRA for which the IRS has issued a favorable opinion letter.

An employer is not required to make SEP contributions. If a contribution is made, however, it must be allocated to all eligible employees according to the SEP agreement. The Model SEP (Form

Your employer will provide you with a copy of the agreement containing participation rules and a description of how employer contributions may be made to your IRA. Your employer must also provide you with a copy of the completed Form

All amounts contributed to your IRA by your employer belong to you even after you stop working for that employer.

Contribution limits. Your employer will determine the amount to be contributed to your IRA each year. However, the amount for any year is limited to the smaller of $41,000* or 25% of your compensation for that year. Compensation does not include any amount that is contributed by your employer to your IRA under the SEP. Your employer is not required to make contributions every year or to maintain a particular level of contributions.

Tax treatment of contributions. Employer contributions to your

Employee contributions. You may make regular IRA contributions to an IRA. However, the amount you can deduct may be reduced or eliminated because, as a participant in a SEP, you are covered by an employer retirement plan.

SEP participation. If your employer does not require you to participate in a SEP as a condition of employment, and you elect not to participate, all other employees of your employer may be prohibited from participating. If one or more eligible employees do not participate and the employer tries to establish a SEP for the remaining employees, it could cause adverse tax consequences for the participating employees.

An employer may not adopt this IRS Model SEP if the employer maintains another qualified retirement plan. This does not prevent your employer from adopting this IRS Model SEP and also maintaining an IRS Model Salary Reduction SEP or other SEP. However, if you work for several employers, you may be covered by a SEP of one employer and a different SEP or pension or

Withdrawals. You may withdraw your employer’s contribution at any time, but any amount withdrawn is includible in your income unless rolled over. Also, if withdrawals

occur before you reach age 591⁄2, you may be subject to a tax on early withdrawal.

Excess SEP contributions. Contributions exceeding the yearly limitations may be withdrawn without penalty by the due date (plus extensions) for filing your tax return (normally April 15), but are includible in your gross income. Excess contributions left in your

Financial institution requirements. The financial institution where your IRA is maintained must provide you with a disclosure statement that contains the following information in plain, nontechnical language:

1.The law that relates to your IRA.

2.The tax consequences of various options concerning your IRA.

3.Participation eligibility rules, and rules on the deductibility of retirement savings.

4.Situations and procedures for revoking your IRA, including the name, address, and telephone number of the person designated to receive notice of revocation. This information must be clearly displayed at the beginning of the disclosure statement.

5.A discussion of the penalties that may be assessed because of prohibited activities concerning your IRA.

6.Financial disclosure that provides the following information:

a. Projects value growth rates of your IRA under various contribution and retirement schedules, or describes the method of determining annual earnings and charges that may be assessed.

b. Describes whether, and for when, the growth projections are guaranteed, or a statement of the earnings rate and the terms on which the projections are based.

c. States the sales commission for each year expressed as a percentage of $1,000.

In addition, the financial institution must provide you with a financial statement each year. You may want to keep these statements to evaluate your IRA’s investment performance.

Paperwork Reduction Act Notice. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

1 |

hr., 40 |

min. |

Learning about the |

|

|

|

law or the form |

1 |

hr., 35 |

min. |

Preparing the form |

1 |

hr., 41 |

min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224. Do not send this form to this address. Instead, keep it with your records.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 5305-SEP | Used by employers to establish a Simplified Employee Pension (SEP) plan, allowing them to make contributions to their employees' retirement savings. |

| Eligibility to Use Form 5305-SEP | Any employer, including self-employed individuals, can use this form if they do not currently maintain any other retirement plan. |

| Contributions | Contributions are made to an Individual Retirement Arrangement (IRA) set up by the employee. Employers make the contributions. |

| Contribution Limits | The amount an employer can contribute to each employee's SEP-IRA cannot exceed the lesser of 25% of the employee's compensation or a specified maximum amount that is subject to annual adjustments for inflation. |

| Deadline for Establishment | The form must be completed and implemented by the employer's tax filing deadline, including extensions, for the year in which the SEP contributions are made. |

| Tax Benefits | Employers can deduct contributions made to the SEP-IRA on their tax return. Employees are not taxed on contributions until they are distributed. |

| Required Information | The form requires basic employer information, including the name of the employer, address, and the employer's tax identification number. |

| Governing Law | This form and the SEP plans are governed by federal tax laws and regulations. Specific state laws do not directly govern them, but state laws on taxation of distributions may apply. |

Guide to Writing IRS 5305-SEP

Filling out the IRS 5305-SEP form is essential for employers who want to establish a Simplified Employee Pension (SEP) plan. This process doesn't have to be daunting. By breaking it down step by step, you can efficiently complete the form and ensure you're on the right track towards creating a beneficial retirement plan for your employees. Make sure to have all the necessary information about your business and your employees handy before you start. Here’s what you need to do:

- Begin with the basics: Fill in the name of your business in the space provided.

- Enter your Employer Identification Number (EIN) next. This is a unique number assigned to your business by the IRS.

- Next, specify the calendar year in which the SEP plan is effective. This is critical as it determines the tax year for the contributions.

- Article I requires you to write the name of your business again, affirming the establishment of the SEP plan.

- In Article IV, input the percentage of pay (not exceeding 25%) that you will contribute to each eligible employee's SEP-IRA.

- Article V is about the eligibility requirements for employees. Here, you must decide the specific criteria for an employee to participate in the SEP plan. Normally, this includes minimum age, service, and compensation limits.

- Sign and date the form at the bottom to officially validate the document. Your signature asserts that you agree to abide by all the terms as stated by the SEP agreement.

- Lastly, remember to distribute copies of the signed form to each eligible employee as they need this document for their records.

Once you have completed these steps, your business's SEP plan is established. Your employees can start enjoying the benefits of a retirement savings plan, and your business can take advantage of potential tax savings. Remember, proper maintenance and compliance with IRS requirements are key to a successful SEP plan.

Understanding IRS 5305-SEP

-

What is an IRS 5305-SEP form?

The IRS 5305-SEP form is a document used by employers to establish a Simplified Employee Pension (SEP) plan. This plan allows employers to make contributions to their employees' retirement savings. It's a straightforward way for small businesses and self-employed individuals to offer retirement benefits.

-

Who can use the IRS 5305-SEP form?

Any employer, including self-employed individuals, can use the IRS 5305-SEP form, provided they do not maintain any other qualified retirement plan. This form is specifically designed for those who wish to set up a SEP plan.

-

Do I need to file the IRS 5305-SEP with the IRS?

No, you do not need to file the IRS 5305-SEP form with the Internal Revenue Service (IRS). However, it is important to complete the form and keep it in your records. The form serves as your formal written agreement to provide benefits to all eligible employees under the SEP plan.

-

What are the contribution limits for a SEP plan established with the 5305-SEP form?

The contribution limits for a SEP plan can change annually. Generally, contributions cannot exceed the lesser of 25% of an employee's compensation or a specific dollar amount that is adjusted for inflation each year. For the current year's limit, consult the IRS website or a tax professional.

-

Are there any deadlines for setting up a SEP plan using the 5305-SEP form?

Yes, to contribute for a tax year, a SEP plan must be set up by the employer's tax filing deadline, including extensions. This ensures that contributions made are applicable for the current tax year.

-

Can I amend the SEP plan established with the 5305-SEP form?

Yes, an employer can amend the plan. Amendments might be necessary to reflect changes in the law or modifications in the employer's requirements. To amend the plan, update the terms in your written agreement and notify all employees of the changes.

-

What happens if an employer no longer wants to contribute to the SEP plan?

An employer can choose not to make contributions in a particular year or to discontinue the SEP plan altogether. If contributions are stopped, or the plan is terminated, employees must be notified. Remember, any contributions made prior to discontinuing the plan remain in the employees' individual retirement accounts (IRAs).

-

Where can I find more information on setting up a SEP plan with the IRS 5305-SEP form?

For detailed guidelines and the most current information, visit the official IRS website. It offers comprehensive resources, including the latest contribution limits and rules regarding SEP plans. Consulting a tax advisor or financial planner can also provide personalized assistance tailored to specific situations.

Common mistakes

Filling out the IRS 5305-SEP form, which is essential for setting up a Simplified Employee Pension (SEP) plan, might seem straightforward. However, a few common mistakes can lead to bumps down the road. Being aware of these pitfalls can ensure the process is smooth and beneficial for both the employer and employees involved.

Not Checking Eligibility Criteria: Before even filling out the form, it's crucial to ensure that your business qualifies for a SEP plan. This encompasses understanding the specific requirements set by the IRS for employers, including size and types of contributions.

Incorrect Information: This might seem obvious, but accuracy is key. From the employer's identification number (EIN) to the business name, every detail must match your official documents. Misinformation can delay the implementation of your SEP plan or even lead to compliance issues.

Failing to Specify the Contribution Percentage: A common oversight is not clearly indicating the contribution percentage committed to each employee's SEP IRA. This percentage needs to be uniform for all eligible employees, reflecting the plan's fairness and compliance with IRS rules.

Overlooking the Employee Eligibility Requirements: The IRS has specific criteria for which employees can participate in a SEP plan. It includes factors such as age, length of service, and minimum earnings. Sometimes, employers mistakenly exclude eligible employees or include ineligible ones, leading to problems with the IRS.

Not Signing the Document: Believe it or not, something as simple as forgetting to sign the form can render it invalid. The IRS requires a physical signature to process and recognize the SEP plan officially.

Here are some additional, yet less common mistakes to be mindful of:

Not keeping the form on file: After completing the 5305-SEP, some might think it needs to be sent to the IRS. Instead, it should be retained with your records, available for IRS review upon request.

Delaying Contributions: After establishing a SEP plan, timely contributions are essential. Late contributions can lead to issues with the IRS and disappointments among employees.

Not informing employees: Each eligible employee should be informed about the SEP plan's terms and their rights under the plan. Failure to do so might not only cause confusion but could also result in legal repercussions.

By steering clear of these pitfalls, you can establish and maintain a SEP plan that is beneficial and compliant, securing a valuable retirement benefit for your employees and yourself.

Documents used along the form

Establishing a Simplified Employee Pension (SEP) plan with the IRS 5305-SEP form is a significant step for any business aiming to provide retirement benefits for its employees. This document is crucial, but it often works hand in hand with other forms and documents to ensure compliance, thorough understanding, and proper administration of the plan. Below is a selection of other forms and documents commonly used alongside IRS 5305-SEP, each playing its unique role in the broader context of managing a SEP plan.

- IRS Form 1040: This is the standard federal income tax form for individuals. Participants in a SEP plan might need to report contributions or distributions on their personal tax returns.

- IRS Form 5500: Required for some SEP plans, especially those with 100 or more participants. This form reports information about the plan's financial condition and operations to the IRS and the Department of Labor.

- IRS Form 8606: Used by individuals to report non-deductible contributions to their IRAs, including SEP IRAs. It helps taxpayers track the basis in their IRAs to correctly calculate the taxable portion of distributions.

- Payroll Records: Employers need to maintain accurate payroll records to determine eligible employees and calculate the correct contribution amounts for each employee under the SEP plan.

- Plan Adoption Agreement: While the IRS 5305-SEP form establishes the SEP plan, the plan adoption agreement provides further customization regarding eligibility, contributions, and distributions, tailoring the plan to the specific needs of the business and its employees.

- SEP Plan Participant Notices: Employers must inform employees about any amendments to the plan, changes in the contribution formula, or any other significant modifications to the SEP plan.

- Investment Policy Statement: This document outlines how the SEP IRA funds will be managed. It includes information on investment choices, risk tolerance, and objectives, guiding the custodian's management of the accounts.

Understanding and properly managing these documents are fundamental tasks for employers offering a SEP plan. Each document serves a specific purpose, from reporting and compliance to managing contributions and informing participants about their benefits. Together, they ensure that the SEP plan runs smoothly, benefits the employees, and meets all legal and regulatory requirements.

Similar forms

The IRS 5305-SEP form shares similarities with the IRS Form 401(k) in its purpose to establish a retirement savings plan for employees. While the 5305-SEP form is specific to simplified employee pensions (SEP), the 401(k) form sets up a plan that allows employees to save and invest a portion of their paycheck before taxes are taken out. Both forms are integral to setting up employer-sponsored retirement plans, but they cater to different types of plans, with the 401(k) offering more flexibility and potentially more complexity in terms of administration and options for contributions.

Comparable to the IRS 5305-SEP is the IRS Form 403(b), which is used by tax-exempt organizations, religious groups, and public schools to provide employees with retirement benefits. Just like the 5305-SEP form allows for establishment of a SEP plan, the 403(b) form facilitates the setting up of a tax-sheltered annuity plan. While both are designed to promote retirement savings, the 403(b) plans are specific to employees of organizations that do not pay taxes, showcasing a targeted approach in fostering employee retirement savings across different sectors.

Also akin to the IRS 5305-SEP form, the Profit-Sharing Plan Agreement form is another document designed for employers to establish a framework for distributing a portion of the company's profits to eligible employees. Though the primary aim of both documents is to benefit the employees in their retirement years, the Profit-Sharing Plan Agreement introduces an element of performance-based benefits, directly linking the company's profitability with the employees' retirement contributions. This approach contrasts with the 5305-SEP's more straightforward method of employer contributions regardless of company profits.

SIMPLE IRA Plan Agreement forms bear a resemblance to the IRS 5305-SEP form in that they both establish tax-advantaged retirement savings plans for employees, but they serve different scales of businesses and employee numbers. The SIMPLE IRA is designed for smaller businesses with 100 or fewer employees and offers a simpler and less costly alternative to the 401(k) plan. Though both the SIMPLE IRA and 5305-SEP forms aim to provide retirement solutions, the SIMPLE IRA plan involves both employee and employer contributions, differentiating it from the SEP plan's reliance solely on employer contributions.

Dos and Don'ts

Filling out IRS Form 5305-SEP, involved in setting up a Simplified Employee Pension (SEP) plan, requires careful attention to detail. Below, find essential do's and don'ts to guide you through the process efficiently and accurately:

DO:- Read the instructions provided by the IRS for Form 5305-SEP thoroughly before starting. Understanding these guidelines will ensure you fill out the form correctly.

- Double-check the eligibility requirements for both the employer and employees to make sure that setting up a SEP plan is the right choice for your business.

- Ensure all entered information is accurate, especially when it comes to names, social security numbers, and the employer identification number (EIN). Mistakes in these areas can lead to significant delays or issues with the IRS.

- Consider consulting with a financial advisor or tax professional who has experience with SEP plans. Their expertise can provide valuable guidance and potentially help you avoid common pitfalls.

- Retain a copy of the completed Form 5305-SEP for your records and give a copy to each employee covered by the SEP plan. It's crucial to have this documentation readily available for future reference or in case of an audit.

- Do not overlook the specific deadlines for setting up and contributing to a SEP plan. Contributions must be made by the employer's tax filing deadline (including extensions).

- Do not attempt to use Form 5305-SEP if you have any plans to use contributions to purchase life insurance, as this form is not designed for those purposes.

- Do not ignore the need for all participating employees to receive information about the SEP plan. Communication is key to ensuring that everyone understands their benefits and rights under the plan.

Misconceptions

The IRS 5305-SEP form, related to Simplified Employee Pension (SEP) plans, is often surrounded by misconceptions. These misunderstandings can prevent both employers and employees from making the most of their retirement benefits. Here's a look at ten common misconceptions about the IRS 5305-SEP form:

- It's complicated to set up. Many believe that establishing a SEP plan with the IRS 5305-SEP form is complex. In reality, this form is designed for simplicity, allowing small businesses to offer retirement benefits without the administrative burden typical of traditional pension plans.

- It's only for large companies. There's a common misconception that the 5305-SEP form is intended only for large companies. In contrast, SEP plans are particularly advantageous for small businesses, freelancers, and self-employed individuals looking for a retirement savings option.

- Employees can contribute to the SEP. Unlike 401(k) plans, SEP plans are funded solely by employer contributions. Employees are not permitted to make salary deferral contributions into their SEP accounts.

- There are high annual fees. Some people shy away from SEP plans due to the mistaken belief that they are accompanied by high annual fees. Typically, SEP plans involve lower administrative costs than many other retirement plan options.

- Contributions are locked in until retirement. While SEP plans are designed for retirement savings, they offer flexibility. Contributions can be withdrawn at any time, subject to taxes and potential penalties, similar to other pre-tax retirement accounts.

- Only full-time employees qualify. SEP plans can be extended to part-time employees as well. The eligibility to participate can be set by the employer, as long as it meets the minimum requirements set by IRS guidelines, which include age and service criteria.

- All businesses qualify for a SEP. Most businesses can set up a SEP plan, but there are specific guidelines and eligibility criteria. It's a common misconception that any business can automatically qualify without meeting these guidelines.

- Tax filing for SEP plans is burdensome. Another misconception is the idea that SEP plans require complicated tax filing procedures. In reality, SEP plan contributions are straightforward to report, and the IRS provides clear guidance on how to do so.

- Only US-based employees can be included. While there are certain restrictions, international employees may also be eligible for SEP plans, provided they meet the specific criteria set by the employer and the IRS.

- Loans are permitted from SEP accounts. Some people mistakenly believe that they can take loans from their SEP accounts, similar to some 401(k) plans. However, loans are not permitted from SEP IRAs, which can impact your access to funds in certain situations.

Understanding these misconceptions about the IRS 5305-SEP form can help both employers and employees better navigate the benefits and limitations of SEP plans, ensuring they are utilized effectively for retirement savings.

Key takeaways

The IRS 5305-SEP form serves as an important document for small business owners who wish to establish a Simplified Employee Pension (SEP) plan, allowing them to contribute towards their employees' retirement. Understanding the key aspects of this form ensures that employers utilize it effectively to provide retirement benefits. Here are four essential takeaways about filling out and using the IRS 5305-SEP form:

- Eligibility Requirements: Before adopting a SEP plan using the 5305-SEP form, ensure that the business meets the specific eligibility criteria set by the IRS. This includes having one or more employees and agreeing to contribute equally to all eligible employees' SEP-IRAs.

- Contribution Limits: The form outlines the contributions limits, which are subject to annual adjustments by the IRS. Employers must familiarize themselves with the current limits to ensure that their contributions do not exceed the allowed amount, thus avoiding potential penalties.

- Deadlines for Contributions: The 5305-SEP form specifies the deadlines for when contributions must be made to the employees' SEP-IRAs. Typically, contributions should be made by the employer's tax filing deadline, including extensions. This is crucial for the contributions to be considered deductible for that tax year.

- Terms and Conditions: The IRS 5305-SEP form includes various terms and conditions that both the employer and employees should understand. This covers the operation of the SEP plan, including the allocation formula for contributions, the process for withdrawing funds, and the conditions under which the plan can be amended or terminated.

By paying close attention to these details, employers can ensure they are compliant with IRS regulations, maximizing the benefits for their employees while minimizing any potential legal or financial issues. Completing the IRS 5305-SEP form accurately is the first step in setting up a successful and compliant SEP plan.

Popular PDF Documents

Nevada Taxation Department - Get clarity on how to carry forward offsets from previous quarters and how they reduce the wage base for your current Nevada business tax calculation.

Tax POA 3520-PIT - Facilitates the appointment of a trusted individual to manage and resolve personal income tax affairs on one's behalf.

Mortgage Modification Agreement - Facilitates the inclusion of additional income from non-borrowers in the residence for a Home Affordable Modification Program application.