Get IRS 5304-SIMPLE Form

Setting up a retirement plan for a small business can often seem like navigating through a maze, with every turn presenting a new set of rules and choices. Among the options available, one standout choice for employers seeking a straightforward, cost-effective solution is the Savings Incentive Match Plan for Employees, or SIMPLE IRA. Specifically, the IRS 5304-SIMPLE form plays a crucial role in this process. This form allows a business to establish this type of plan, enabling employees to make contributions to their retirement savings directly from their paychecks, while also requiring employer contributions. The 5304-SIMPLE form is distinctive because it does not restrict employees to a particular financial institution for their SIMPLE IRA accounts, giving them the freedom to choose where they would like to keep their savings. This flexibility can be particularly appealing to businesses with employees who have a strong preference for managing their retirement accounts. Understanding the major features and requirements of the IRS 5304-SIMPLE form can significantly smooth the path for small businesses in setting up an employee retirement plan that is both beneficial and compliant with tax laws.

IRS 5304-SIMPLE Example

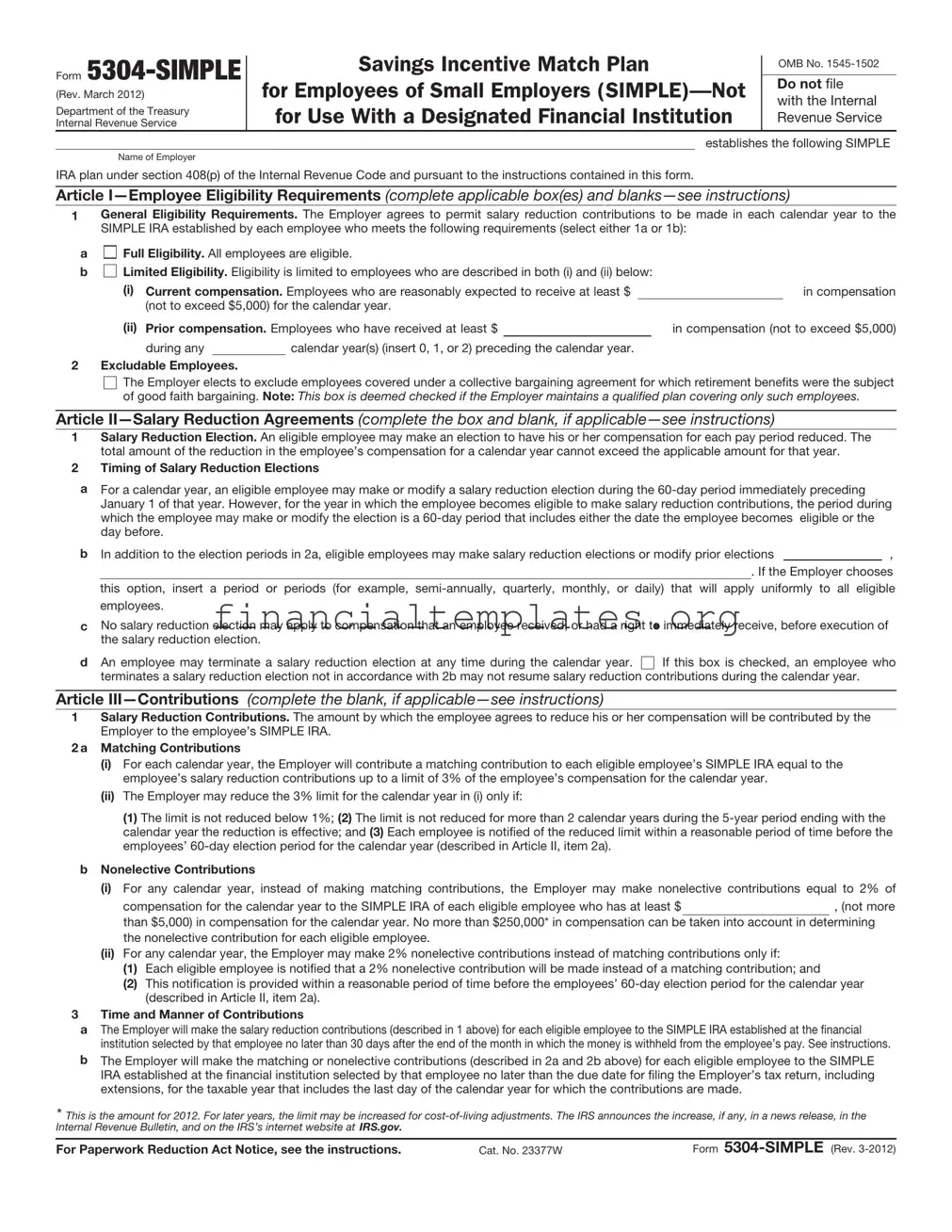

Form

(Rev. March 2012)

Department of the Treasury

Internal Revenue Service

Savings Incentive Match Plan

for Employees of Small Employers

OMB No.

Do not file

with the Internal Revenue Service

establishes the following SIMPLE

Name of Employer

IRA plan under section 408(p) of the Internal Revenue Code and pursuant to the instructions contained in this form.

Article

1General Eligibility Requirements. The Employer agrees to permit salary reduction contributions to be made in each calendar year to the SIMPLE IRA established by each employee who meets the following requirements (select either 1a or 1b):

a |

Full Eligibility. All employees are eligible. |

|

|

||||||

b |

Limited Eligibility. Eligibility is limited to employees who are described in both (i) and (ii) below: |

|

|

||||||

|

(i) |

Current compensation. Employees who are reasonably expected to receive at least $ |

|

in compensation |

|||||

|

(ii) |

(not to exceed $5,000) for the calendar year. |

|

|

|

||||

|

Prior compensation. Employees who have received at least $ |

|

|

in compensation (not to exceed $5,000) |

|||||

|

|

during any |

|

calendar year(s) (insert 0, 1, or 2) preceding the calendar year. |

|

|

|||

2Excludable Employees.

The Employer elects to exclude employees covered under a collective bargaining agreement for which retirement benefits were the subject of good faith bargaining. Note: This box is deemed checked if the Employer maintains a qualified plan covering only such employees.

Article

1Salary Reduction Election. An eligible employee may make an election to have his or her compensation for each pay period reduced. The total amount of the reduction in the employee’s compensation for a calendar year cannot exceed the applicable amount for that year.

2Timing of Salary Reduction Elections

aFor a calendar year, an eligible employee may make or modify a salary reduction election during the

b In addition to the election periods in 2a, eligible employees may make salary reduction elections or modify prior elections,

. If the Employer chooses this option, insert a period or periods (for example,

cNo salary reduction election may apply to compensation that an employee received, or had a right to immediately receive, before execution of the salary reduction election.

dAn employee may terminate a salary reduction election at any time during the calendar year.

If this box is checked, an employee who terminates a salary reduction election not in accordance with 2b may not resume salary reduction contributions during the calendar year.

If this box is checked, an employee who terminates a salary reduction election not in accordance with 2b may not resume salary reduction contributions during the calendar year.

Article

1Salary Reduction Contributions. The amount by which the employee agrees to reduce his or her compensation will be contributed by the Employer to the employee’s SIMPLE IRA.

2 a Matching Contributions

(i)For each calendar year, the Employer will contribute a matching contribution to each eligible employee’s SIMPLE IRA equal to the employee’s salary reduction contributions up to a limit of 3% of the employee’s compensation for the calendar year.

(ii)The Employer may reduce the 3% limit for the calendar year in (i) only if:

(1) The limit is not reduced below 1%; (2) The limit is not reduced for more than 2 calendar years during the

bNonelective Contributions

(i)For any calendar year, instead of making matching contributions, the Employer may make nonelective contributions equal to 2% of

compensation for the calendar year to the SIMPLE IRA of each eligible employee who has at least $, (not more

than $5,000) in compensation for the calendar year. No more than $250,000* in compensation can be taken into account in determining the nonelective contribution for each eligible employee.

(ii)For any calendar year, the Employer may make 2% nonelective contributions instead of matching contributions only if:

(1)Each eligible employee is notified that a 2% nonelective contribution will be made instead of a matching contribution; and

(2)This notification is provided within a reasonable period of time before the employees’

3Time and Manner of Contributions

aThe Employer will make the salary reduction contributions (described in 1 above) for each eligible employee to the SIMPLE IRA established at the financial institution selected by that employee no later than 30 days after the end of the month in which the money is withheld from the employee’s pay. See instructions.

bThe Employer will make the matching or nonelective contributions (described in 2a and 2b above) for each eligible employee to the SIMPLE IRA established at the financial institution selected by that employee no later than the due date for filing the Employer’s tax return, including extensions, for the taxable year that includes the last day of the calendar year for which the contributions are made.

* This is the amount for 2012. For later years, the limit may be increased for

For Paperwork Reduction Act Notice, see the instructions. |

Cat. No. 23377W |

Form |

Form |

Page 2 |

Article |

|

1Contributions in General. The Employer will make no contributions to the SIMPLE IRAs other than salary reduction contributions (described in Article III, item 1) and matching or nonelective contributions (described in Article III, items 2a and 2b).

2Vesting Requirements. All contributions made under this SIMPLE IRA plan are fully vested and nonforfeitable.

3No Withdrawal Restrictions. The Employer may not require the employee to retain any portion of the contributions in his or her SIMPLE IRA or otherwise impose any withdrawal restrictions.

4Selection of IRA Trustee. The Employer must permit each eligible employee to select the financial institution that will serve as the trustee, custodian, or issuer of the SIMPLE IRA to which the Employer will make all contributions on behalf of that employee.

5Amendments To This SIMPLE IRA Plan. This SIMPLE IRA plan may not be amended except to modify the entries inserted in the blanks or boxes provided in Articles I, II, III, VI, and VII.

6Effects Of Withdrawals and Rollovers

aAn amount withdrawn from the SIMPLE IRA is generally includible in gross income. However, a SIMPLE IRA balance may be rolled over or transferred on a

bIf an individual withdraws an amount from a SIMPLE IRA during the

Article

1Compensation

aGeneral Definition of Compensation. Compensation means the sum of the wages, tips, and other compensation from the Employer subject to federal income tax withholding (as described in section 6051(a)(3)), the amounts paid for domestic service in a private home, local college club, or local chapter of a college fraternity or sorority, and the employee’s salary reduction contributions made under this plan, and, if applicable, elective deferrals under a section 401(k) plan, a SARSEP, or a section 403(b) annuity contract and compensation deferred under a section 457 plan required to be reported by the Employer on Form

bCompensation for

2Employee. Employee means a

3Eligible Employee. An eligible employee means an employee who satisfies the conditions in Article I, item 1 and is not excluded under Article I, item 2.

4SIMPLE IRA. A SIMPLE IRA is an individual retirement account described in section 408(a), or an individual retirement annuity described in section 408(b), to which the only contributions that can be made are contributions under a SIMPLE IRA plan and rollovers or transfers from another SIMPLE IRA.

Article

are unavailable, or (2) that financial institution provides the procedures directly to the employee. See Employee Notification in the instructions.)

Article

This SIMPLE IRA plan is effective |

|

|

|

|

. See |

|

instructions. |

|

|

|

|

|

|

* |

* |

* |

* |

* |

|

|

|

|

|

|

|

|

|

Name of Employer |

|

By: |

Signature |

Date |

||

|

|

|

|

|

|

|

Address of Employer |

|

Name and title |

|

|

||

Form

Form |

Page 3 |

Model Notification to Eligible Employees

I.Opportunity to Participate in the SIMPLE IRA Plan

You are eligible to make salary reduction contributions to theSIMPLE IRA

plan. This notice and the attached summary description provide you with information that you should consider before you decide whether to start, continue, or change your salary reduction agreement.

II.Employer Contribution Election

For the |

|

calendar year, the Employer elects to contribute to your SIMPLE IRA (employer must select either (1), (2), or (3)): |

|||||

(1) |

A matching contribution equal to your salary reduction contributions up to a limit of 3% of your compensation for the year; |

||||||

(2) |

A matching contribution equal to your salary reduction contributions up to a limit of |

% (employer must insert a |

|||||

number from 1 to 3 and is subject to certain restrictions) of your compensation for the |

year; or |

|

|||||

(3) |

A nonelective contribution equal to 2% of your compensation for the year (limited to compensation of $250,000*) if you are an |

||||||

employee who makes at least $ |

|

(employer must insert an amount that is $5,000 or less) in compensation for |

|||||

the year. |

|

|

|

|

|

||

|

|

|

|

|

|||

III.Administrative Procedures

To start or change your salary reduction contributions, you must complete the salary reduction agreement and return it to

|

|

|

(employer should designate a place or |

individual by |

|

(employer should insert a date that is not less than 60 |

days after notice is given). |

|

|

|

|

IV. Employee Selection of Financial Institution

You must select the financial institution that will serve as the trustee, custodian, or issuer of your SIMPLE IRA and notify your Employer of your selection.

Model Salary Reduction Agreement

I.Salary Reduction Election

Subject to the requirements of the SIMPLE IRA plan of |

|

|

|

|

(name of |

|||

employer) I authorize |

|

% or $ |

|

|

(which equals |

|

% of my current rate of pay) to be withheld from |

|

my pay for each pay period and contributed to my SIMPLE IRA as a salary reduction contribution.

II.Maximum Salary Reduction

I understand that the total amount of my salary reduction contributions in any calendar year cannot exceed the applicable amount for that year. See instructions.

III.Date Salary Reduction Begins

I understand that my salary reduction contributions will start as soon as permitted under the SIMPLE IRA plan and as soon as

administratively feasible or, if later,. (Fill in the date you want the salary reduction contributions to begin. The date must be after you sign this agreement.)

IV. Employee Selection of Financial Institution

I select the following financial institution to serve as the trustee, custodian, or issuer of my SIMPLE IRA.

Name of financial institution

Address of financial institution

SIMPLE IRA account name and number

I understand that I must establish a SIMPLE IRA to receive any contributions made on my behalf under this SIMPLE IRA plan. If the information regarding my SIMPLE IRA is incomplete when I first submit my salary reduction agreement, I realize that it must be completed by the date contributions must be made under the SIMPLE IRA plan. If I fail to update my agreement to provide this information by that date, I understand that my Employer may select a financial institution for my SIMPLE IRA.

V.Duration of Election

This salary reduction agreement replaces any earlier agreement and will remain in effect as long as I remain an eligible employee under the SIMPLE IRA plan or until I provide my Employer with a request to end my salary reduction contributions or provide a new salary reduction agreement as permitted under this SIMPLE IRA plan.

Signature of employee |

|

Date |

*This is the amount for 2012. For later years, the limit may be increased for

Form

Form |

Page 4 |

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Purpose of Form

Form

SIMPLE IRA.

These instructions are designed to assist in the establishment and administration of the SIMPLE IRA plan. They are not intended to supersede any provision in the SIMPLE IRA plan.

Do not file Form

For more information, see Pub. 560, Retirement Plans for Small Business (SEP, SIMPLE, and Qualified Plans), and Pub. 590, Individual Retirement Arrangements (IRAs).

Note. If you used the March 2002, August 2005, or September 2008 version of Form

Which Employers May

Establish and Maintain a

SIMPLE IRA Plan?

To establish and maintain a SIMPLE IRA plan, you must meet both of the following requirements:

1.Last calendar year, you had no more than 100 employees (including

2.You do not maintain during any part of the calendar year another qualified plan with respect to which contributions are made, or benefits are accrued, for service in the calendar year. For this purpose, a qualified plan (defined in section 219(g)(5)) includes a qualified pension plan, a

participating in the SIMPLE IRA plan. If the failure to continue to satisfy the

Certain related employers (trades or businesses under common control) must be treated as a single employer for purposes of the SIMPLE IRA requirements. These are: (1) a controlled group of corporations under section 414(b); (2) a partnership or sole proprietorship under common control under section 414(c); or (3) an affiliated service group under section 414(m). In addition, if you have leased employees required to be treated as your own employees under the rules of section 414(n), then you must count all such leased employees for the requirements listed above.

What Is a SIMPLE IRA Plan?

A SIMPLE IRA plan is a written arrangement that provides you and your employees with an easy way to make contributions to provide retirement income for your employees. Under a SIMPLE IRA plan, employees may choose whether to make salary reduction contributions to the SIMPLE IRA plan rather than receiving these amounts as part of their regular compensation. In addition, you will contribute matching or nonelective contributions on behalf of eligible employees (see Employee Eligibility Requirements below and Contributions later). All contributions under this plan will be deposited into a SIMPLE individual retirement account or annuity established for each eligible employee with the financial institution selected by him or her.

When To Use Form

A SIMPLE IRA plan may be established by using this Model Form or any other document that satisfies the statutory requirements.

Do not use Form

1.You want to require that all SIMPLE IRA plan contributions initially go to a financial institution designated by you. That is, you do not want to permit each of your eligible employees to choose a financial institution that will initially receive contributions. Instead, use Form

2.You want employees who are nonresident aliens receiving no earned income from you that is income from sources within the United States to be eligible under this plan; or

3.You want to establish a SIMPLE 401(k) plan.

Completing Form

Pages 1 and 2 of Form

The SIMPLE IRA plan is a legal document with important tax consequences for you and your employees. You may want to consult with your attorney or tax advisor before adopting this plan.

Employee Eligibility Requirements (Article I)

Each year for which this SIMPLE IRA plan is effective, you must permit salary reduction contributions to be made by all of your employees who are reasonably expected to receive at least $5,000 in compensation from you during the year, and who received at least $5,000 in compensation from you in any 2 preceding years. However, you can expand the group of employees who are eligible to participate in the SIMPLE IRA plan by completing the options provided in Article I, items 1a and 1b. To choose full eligibility, check the box in Article I, item 1a. Alternatively, to choose limited eligibility, check the box in Article I, item 1b, and then insert “$5,000” or a lower compensation amount (including zero) and “2” or a lower number of years of service in the blanks in (i) and (ii) of Article I, item 1b.

In addition, you can exclude from participation those employees covered under a collective bargaining agreement for which retirement benefits were the subject of good faith bargaining. You may do this by checking the box in Article I, item 2. Under certain circumstances, these employees must be excluded. See Which Employers May Establish and Maintain a SIMPLE IRA Plan? above.

Salary Reduction Agreements (Article II)

As indicated in Article II, item 1, a salary reduction agreement permits an eligible employee to make a salary reduction election to have his or her compensation for each pay period reduced by a percentage (expressed as a percentage or dollar amount). The total amount of

Form |

Page 5 |

the reduction in the employee’s compensation cannot exceed the applicable amount for any calendar year. The applicable amount is $11,500 for 2012. After 2012, the $11,500 amount may be increased for

Timing of Salary Reduction Elections

For any calendar year, an eligible employee may make or modify a salary reduction election during the

You can extend the

You may use the Model Salary Reduction Agreement on page 3 to enable eligible employees to make or modify salary reduction elections.

Employees must be permitted to terminate their salary reduction elections at any time. They may resume salary reduction contributions for the year if permitted under Article II, item 2b. However, by checking the box in Article II, item 2d, you may prohibit an employee who terminates a salary reduction election outside the normal election cycle from resuming salary reduction contributions during the remainder of the calendar year.

Contributions (Article III)

Only contributions described below may be made to this SIMPLE IRA plan. No additional contributions may be made.

Salary Reduction Contributions

As indicated in Article III, item 1, salary reduction contributions consist of the amount by which the employee agrees to reduce his or her compensation. You must contribute the salary reduction contributions to the financial institution selected by each eligible employee.

Matching Contributions

In general, you must contribute a matching contribution to each eligible employee’s SIMPLE IRA equal to the employee’s salary reduction contributions. This matching contribution cannot exceed 3% of the employee’s compensation. See Definition of Compensation, below.

You may reduce this 3% limit to a lower percentage, but not lower than 1%. You cannot lower the 3% limit for more than 2 calendar years out of the

Note. If any year in the

To elect this option, you must notify the employees of the reduced limit within a reasonable period of time before the applicable

Nonelective Contributions

Instead of making a matching contribution, you may, for any year, make a nonelective contribution equal to 2% of compensation for each eligible employee who has at least $5,000 in compensation for the year.

Nonelective contributions may not be based on more than $250,000* of compensation.

To elect to make nonelective contributions, you must notify employees within a reasonable period of time before the applicable

Note. Insert “$5,000” in Article III, item 2b(i) to impose the $5,000 compensation requirement. You may expand the group of employees who are eligible for nonelective contributions by inserting a compensation amount lower than $5,000.

Effective Date (Article VII)

Insert in Article VII the date you want the provisions of the SIMPLE IRA plan to become effective. You must insert January 1 of the applicable year unless this is the first year for which you are adopting any SIMPLE IRA plan. If this is the first year for which you are adopting a SIMPLE IRA plan, you may insert any date between January 1 and October 1, inclusive of the applicable year.

Additional Information

Timing of Salary Reduction Contributions

The employer must make the salary reduction contributions to the financial institution selected by each eligible employee for his or her SIMPLE IRA no later than the 30th day of the month following the month in which the amounts would otherwise have been payable to the employee in cash.

The Department of Labor has indicated that most SIMPLE IRA plans are also subject to Title I of the Employee Retirement Income Security Act of 1974 (ERISA). Under Department of Labor regulations at 29 CFR

Definition of Compensation

“Compensation” means the amount described in section 6051(a)(3) (wages, tips, and other compensation from the employer subject to federal income tax withholding under section 3401(a)), and amounts paid for domestic service in a private home, local college club, or local chapter of a college fraternity or sorority. Usually, this is the amount shown in box 1 of Form

For

Employee Notification

You must notify each eligible employee prior to the employee’s

*This is the amount for 2012. For later years, the limit may be increased for

Form |

Page 6 |

issuer of the employee’s SIMPLE IRA. In this notification, you must indicate whether you will provide:

1.A matching contribution equal to your employees’ salary reduction contributions up to a limit of 3% of their compensation;

2.A matching contribution equal to your employees’ salary reduction contributions subject to a percentage limit that is between 1 and 3% of their compensation; or

3.A nonelective contribution equal to 2% of your employees’ compensation.

You can use the Model Notification to Eligible Employees earlier to satisfy these employee notification requirements for this SIMPLE IRA plan. A Summary Description must also be provided to eligible employees at this time. This summary description requirement may be satisfied by providing a completed copy of pages 1 and 2 of Form

Article

If you fail to provide the employee notification (including the summary description) described above, you will be liable for a penalty of $50 per day until the notification is provided. If you can show that the failure was due to reasonable cause, the penalty will not be imposed.

If the financial institution’s name, address, or withdrawal procedures are not available at the time the employee must be given the summary description, you must provide the summary description without this information. In that case, you will have reasonable cause for not including this information in the summary description, but only if you ensure that it is provided to the employee as soon as administratively feasible.

Reporting Requirements

You are not required to file any annual information returns for your SIMPLE IRA plan, such as Form 5500, Annual Return/Report of Employee Benefit Plan, or Form

Deducting Contributions

Contributions to this SIMPLE IRA plan are deductible in your tax year containing the end of the calendar year for which the contributions are made.

Contributions will be treated as made for a particular tax year if they are made for that year and are made by the due date (including extensions) of your income tax return for that year.

Summary Description

Each year the SIMPLE IRA plan is in effect, the financial institution for the SIMPLE IRA of each eligible employee must provide the employer the information described in section 408(l)(2)(B). This requirement may be satisfied by providing the employer a current copy of Form

There is a penalty of $50 per day imposed on the financial institution for each failure to provide the summary description described above. However, if the failure was due to reasonable cause, the penalty will not be imposed.

Paperwork Reduction Act Notice. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping . . |

. |

. |

3 hr., 38 min. |

Learning about the |

|

|

|

law or the form . . |

. |

. |

2 hr., 26 min. |

Preparing the form |

. |

. |

. . 47 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:M:S, 1111 Constitution Ave. NW,

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The IRS 5304-SIMPLE form is used by small businesses to set up a Savings Incentive Match Plan for Employees (SIMPLE) IRA. |

| 2 | This form allows employees to choose the financial institution for their SIMPLE IRA contributions. |

| 3 | Businesses eligible to use this form typically have 100 or fewer employees who earned $5,000 or more during the preceding calendar year. |

| 4 | There are no state-specific versions of the IRS 5304-SIMPLE form since it is governed by federal law, specifically the Internal Revenue Code. |

| 5 | The form is part of the requirements for employers to contribute to their employees' retirement savings. |

| 6 | Employers can match employee contributions up to 3% of compensation or contribute 2% of each eligible employee's salary without requiring the employee to contribute. |

| 7 | Filing deadlines for the IRS 5304-SIMPLE form correspond with the start date of the plan, which must be set up between January 1 and October 1 in any given year. |

| 8 | The simplicity of the IRS 5304-SIMPLE form makes it an attractive option for small employers to provide retirement benefits to their employees. |

Guide to Writing IRS 5304-SIMPLE

Once you have decided to establish a savings incentive match plan for employees (SIMPLE) using a 5304-SIMPLE form, it's crucial to fill it out correctly to comply with IRS regulations. This form allows small businesses to set up SIMPLE IRA plans without specifying a financial institution for the IRAs, giving employees the flexibility to choose where their contributions will be held. Here's a clear, step-by-step guide to help you accurately complete the 5304-SIMPLE form.

- Begin by entering the calendar year at the top of the form to specify for which tax year the SIMPLE IRA plan is being established or maintained.

- Fill in the employer's name and address in the designated section.

- Provide the employer's identification number (EIN) in the space provided.

- Complete the “Article I” section by writing the name of the employer establishing the plan.

- In the “Article II” section, select your choice for the start date when employees will be eligible to participate in the plan. You can choose to allow participation as soon as possible or set a specific requirement for hours worked.

- For “Article III,” decide on the contribution type. This involves selecting whether to make nonelective contributions or matching contributions, then marking the appropriate box to indicate your decision.

- In “Article IV,” specify the financial institution that each employee can choose to act as the trustee of their SIMPLE IRA account, if this information is available at the time of the form completion.

- “Article V” involves selecting a compensation amount for determining each employee’s compensation under the plan. Insert the selected amount in the space provided.

- Complete “Article VI” by choosing how contributions to the plan are made. This involves specifying the payroll period contributions will be made.

- Finally, in the “Article IX,” ensure the form is signed and dated by the employer.

After filling out the 5304-SIMPLE form, keep a copy for your records and distribute copies to all participating employees so they fully understand the SIMPLE IRA plan terms. Carefully review all sections for accuracy before finalizing the document to ensure compliance with IRS regulations. Remember that this form is part of a broader set of documents and steps required to successfully set up a SIMPLE IRA plan.

Understanding IRS 5304-SIMPLE

-

What is the IRS 5304-SIMPLE form used for?

The IRS 5304-SIMPLE form is used by small businesses to establish a Savings Incentive Match Plan for Employees (SIMPLE) IRA. This allows employees and employers to contribute to traditional IRAs set up for employees. It is particularly designed for small businesses that do not have any other retirement plans.

-

Who is eligible to use the 5304-SIMPLE form?

Businesses that have 100 or fewer employees who received $5,000 or more in compensation from the employer in the preceding calendar year are eligible. Additionally, the employer must not currently maintain another qualified retirement plan.

-

Is there a deadline to set up a SIMPLE IRA using Form 5304-SIMPLE?

Yes, the deadline to set up a SIMPLE IRA plan using Form 5304-SIMPLE is October 1st of the year you plan to begin offering the plan. However, for businesses established after October 1st, the plan should be set up as soon as administratively feasible.

-

Can employees choose where to hold their SIMPLE IRA accounts?

Yes, when using Form 5304-SIMPLE, it allows employees to choose the financial institution where their SIMPLE IRA accounts will be held. This contrasts with Form 5305-SIMPLE, where the employer designates the financial institution for all SIMPLE IRAs.

-

What contributions are allowed in a SIMPLE IRA plan established with IRS 5304-SIMPLE?

Both employers and employees can contribute to a SIMPLE IRA. Employees can make salary reduction contributions up to the annual contribution limit, while employers are required to either match employee contributions up to 3% of their compensation or make a 2% nonelective contribution to each eligible employee.

-

Are there any reporting requirements for the IRS 5304-SIMPLE plan?

Employers must file an annual report regarding the plan using Form 5500. However, there is no requirement for the employer to file the 5304-SIMPLE form itself with the IRS.

-

What are the tax benefits of a SIMPLE IRA for employers and employees?

Employers can deduct their contributions to the SIMPLE IRA as a business expense. Employees benefit as contributions are made pre-tax, which can lower their total taxable income. Additionally, the investments grow tax-deferred until withdrawal.

-

How does the 5304-SIMPLE form differ from the 5305-SIMPLE form?

The main difference is that the 5304-SIMPLE form allows each employee to choose the financial institution for their IRA, giving them control over their investments. The 5305-SIMPLE requires all employee contributions to be deposited at a financial institution chosen by the employer.

-

Can the SIMPLE IRA plan be terminated?

Yes, an employer can terminate the plan at any time. To do so, they must notify their employees that the plan will not continue for the coming calendar year. This notification must be given within a reasonable time frame before the 60-day election period for salary reduction contributions.

-

What are the penalties for non-compliance with SIMPLE IRA rules?

Failure to follow the rules can lead to penalties. For example, if an employer does not make the required contributions, they may face a tax penalty. Employees also need to be aware of the early withdrawal penalties. Withdrawals made before age 59½ are subject to a 10% penalty, which increases to 25% if the withdrawal is made within the first two years of participation in the plan.

Common mistakes

Filling out the IRS 5304-SIMPLE form, a Savings Incentive Match Plan for Employees, often accompanies mistakes that can lead to delays and potential fines. Recognizing these common errors can guide individuals through a smoother filing process.

Not double-checking the employer and employee information: It's crucial to ensure all personal and business information is accurate. This includes the employer identification number (EIN), business name, and the employee's social security number. Mistakes in these areas can lead to processing delays and mismatches in tax filings.

Incorrectly calculating the match: Employers must correctly calculate their match to employee contributions. This requires a clear understanding of the percentage being matched and ensuring it does not exceed the limits set by the IRS. Miscalculations can result in compliance issues and affect the plan's tax advantages.

Omitting necessary signatures: Every section that requires a signature must be signed. Skipping signatures can render the form incomplete in the eyes of the IRS. This includes both the employer's and the trustee's signatures where applicable.

Failure to choose between contribution options: The 5304-SIMPLE form allows employees to choose their financial institution for receiving contributions. Failing to make a selection can lead to contributions not being deposited in a timely manner, impacting the employee's investment strategy.

Not updating the form for changes in the plan: If there are any changes to the plan, the form should be updated and re-filed. This includes changes in the business name, EIN, or contribution matches. Using outdated information can result in discrepancies and potential legal issues.

By avoiding these common mistakes, employers can ensure that they remain compliant with IRS regulations, thereby safeguarding the benefits of their SIMPLE IRA plan for themselves and their employees.

Documents used along the form

When setting up a SIMPLE IRA plan for employees, the IRS Form 5304-SIMPLE is a key document used to facilitate this process. This form is just the starting point. To successfully navigate the setup and maintenance of a SIMPLE IRA, several other forms and documents may also play critical roles. Each serves a specific function—from establishing the employer and employee contributions to ensuring compliance with federal regulations:

- Form 1040: Used by individuals to file their annual income tax return, which might include reporting contributions to a SIMPLE IRA.

- Form 940: Employers use this document to report their annual Federal Unemployment Tax Act (FUTA) tax, which is necessary for accurately managing payroll taxes in relation to employee benefits.

- Form 941: This quarterly tax form is for reporting income taxes, social security tax, or Medicare tax withheld from employees' paychecks and the employer's portion of social security or Medicare tax.

- Form W-2: Issued to employees annually, this wage and tax statement reports an employee's annual wages and the amount of taxes withheld from their paycheck.

- Form W-3: Accompanies Form W-2 and is a summary of all wages, social security, and Medicare taxes withheld for all employees. Employers submit this form to the Social Security Administration.

- Form 5500: Needed for the annual reporting of a retirement plan’s financial condition, investments, and operations to the Department of Labor (DOL), Internal Revenue Service (IRS), and the Pension Benefit Guaranty Corporation (if applicable).

- Form 1099-R: Distributors use this form to report any distributions, such as pensions, annuities, retirement or profit-sharing plans, IRAs, or insurance contracts, made to an individual.

- Salary Reduction Agreement: A crucial document in the SIMPLE IRA setup, where employees agree to a salary reduction to contribute to their SIMPLE IRA.

- SIMPLE IRA Adoption Agreement: Used by employers to formally adopt the SIMPLE IRA plan, specifying the terms and conditions under which it operates.

- SIMPLE IRA Plan Notification to Eligible Employees: A necessary communication to inform eligible employees about the plan, how it operates, and how they can contribute.

In the realm of retirement planning, particularly for those going the route of setting up a SIMPLE IRA, these documents collectively enable employers to comply with legal requirements, manage their tax obligations, and ensure that both their interests and those of their employees are well protected. Understanding the purpose and requirements of each form can significantly simplify the process of maintaining a retirement plan compliant with federal laws.

Similar forms

The IRS 5304-SIMPLE form is similar to the IRS 5305-SIMPLE form in several ways. Both are utilized to establish a Savings Incentive Match Plan for Employees (SIMPLE) IRA for businesses that do not have a prior retirement plan. The main difference is that the 5304-SIMPLE allows employees to choose the financial institution for holding their SIMPLE IRA accounts, whereas the 5305-SIMPLE requires the employer to designate a specific financial institution for all employee accounts.

Another document related to the IRS 5304-SIMPLE form is the IRS Form 5498. Form 5498 is issued by financial institutions to report an individual's contributions to an IRA, which includes SIMPLE IRAs set up using the 5304-SIMPLE. This form is crucial for tax purposes, demonstrating the contributions to the IRA during the tax year, which can have implications for tax deductions and reporting requirements.

The IRS Form 1040, the U.S. individual income tax return, is indirectly related to the IRS 5304-SIMPLE form. Participants in a SIMPLE IRA plan may be eligible for a retirement savings contributions credit, which is reported on Form 1040. The contributions made to a SIMPLE IRA, through a plan established with the 5304-SIMPLE, can affect an individual's adjusted gross income and potentially qualify them for this credit.

The IRS Form 8880, "Credit for Qualified Retirement Savings Contributions," is also related to the IRS 5304-SIMPLE form. This form is used by taxpayers to claim the saver's credit for contributions made to retirement plans, including SIMPLE IRAs. The establishment of a SIMPLE IRA plan via the 5304-SIMPLE can make employees eligible for this tax credit, depending on their contributions and income level.

IRS Form 5329, "Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts," is pertinent as well. This form addresses the tax implications of certain distributions or excess contributions to retirement accounts, including SIMPLE IRAs established with a 5304-SIMPLE. It is used to calculate additional taxes owed due to early withdrawals or contributions that exceed legal limits.

The Plan Adoption Agreement and Basic Plan Document are essential for employers setting up a SIMPLE IRA plan. While not standard IRS forms like the 5304-SIMPLE, these documents are often provided by financial institutions and are customized to establish the specifics of the SIMPLE IRA plan, such as eligibility, contributions, and employer match specifics. They work in conjunction with the 5304-SIMPLE to define the plan's operation.

IRS Form W-4, the Employee's Withholding Certificate, is related because employees participating in a SIMPLE IRA plan established with IRS 5304-SIMPLE might adjust their withholding based on their contributions. Contributing to a SIMPLE IRA can lower taxable income, potentially prompting adjustments on Form W-4 to reflect these changes for accurate tax withholding.

The Summary Plan Description (SPD) is a required document that explains employees' rights, benefits, and responsibilities under the SIMPLE IRA plan set up by the 5304-SIMPLE form. It is not a government form but is mandated by the Employee Retirement Income Security Act (ERISA) for most retirement plans. The SPD complements the 5304-SIMPLE by providing participants detailed information about how the plan operates.

IRS Form 2848, "Power of Attorney and Declaration of Representative," though not directly related to the setup of a SIMPLE IRA plan with form 5304-SIMPLE, becomes relevant if an employer or employee needs to authorize another person to act on their behalf in matters related to the plan. This could include actions such as making contributions, changing investment choices, or handling distribution requests.

Finally, the IRS Form 8606, "Nondeductible IRAs," relates to the IRS 5304-SIMPLE form by involving IRA contributions but focuses on tracking nondeductible contributions and conversions to Roth IRAs, including transactions within SIMPLE IRAs established by a 5304-SIMPLE. Although SIMPLE IRA contributions are typically pre-tax, this form becomes important if nondeductible contributions or rollovers are made.

Dos and Don'ts

Filling out the IRS 5304-SIMPLE form, a document used to establish a Savings Incentive Match Plan for Employees (SIMPLE) IRA for small businesses, requires careful attention to detail. Below are guidelines highlighting what you should and shouldn't do when completing this form.

What You Should Do:

- Double-check your employer identification number (EIN) and the plan name for accuracy to ensure they match official records.

- Clearly specify the eligibility requirements for employees, such as the length of service, to avoid misunderstandings.

- Choose a financial institution for the SIMPLE IRA plan with care, considering factors like investment options and fees.

- Sign and date the form once all the necessary information has been filled out to validate the document.

What You Shouldn't Do:

- Don't leave any required fields blank. Incomplete forms may be rejected or delay the establishment of your plan.

- Avoid using pencil or any erasable writing tools. All entries should be made in blue or black ink to ensure permanence and legibility.

- Refrain from making unauthorized changes to the form structure or wording, as this can invalidate the document.

- Do not forget to give copies of the form to eligible employees and the chosen financial institution, as they need this information for their records and actions.

Misconceptions

The IRS 5304-SIMPLE form is a Savings Incentive Match Plan for Employees that allows employees and employers to contribute to individual retirement accounts (IRAs) set up for employees. Despite its benefits, several misconceptions surround its application and suitability. Addressing these misconceptions is crucial for both employers and employees to make informed decisions regarding retirement savings plans.

Misconception 1: It's too complicated for small businesses. Many believe that the 5304-SIMPLE form and plan it represents are too complex for small businesses to administer. However, the SIMPLE IRA plan is specifically designed for small businesses, offering a straightforward approach to retirement benefits compared to other plans, like the 401(k).

Misconception 2: Only employees can contribute. There's a common misunderstanding that only employees can contribute to the SIMPLE IRA. In reality, employers are also required to make contributions, either matching employee contributions up to a certain percentage or contributing a fixed percentage for all eligible employees.

Misconception 3: It offers less tax savings than other retirement plans. Some assume that the SIMPLE IRA plan provides less tax savings compared to other retirement plans. While it's true that contribution limits are lower than some other plans, such as 401(k)s, the SIMPLE IRA still offers significant tax advantages for both employees and employers.

Misconception 4: It’s only for businesses with no retirement plans in place. There's a misconception that the SIMPLE IRA plan is exclusively for businesses that have never offered a retirement plan. Businesses that currently have another plan or have had one in the past can also establish a SIMPLE IRA, provided they meet certain conditions.

Misconception 5: All employees must be allowed to participate. While the SIMPLE IRA plan is designed to be inclusive, not all employees are required to be allowed to participate. The plan allows for exclusions based on criteria such as length of service or part-time status, within certain federal guidelines.

Misconception 6: It does not allow for loans or early withdrawals. Many believe that the SIMPLE IRA plan does not permit loans or early withdrawals. While it's true that the SIMPLE IRA has restrictions, participants can still access their funds before retirement under certain conditions, albeit with potential penalties and taxes.

Misconception 7: It’s only beneficial for older employees. The assumption that the SIMPLE IRA plan is only advantageous for older employees overlooks its benefits for employees of all ages. Starting retirement savings early is beneficial, and the SIMPLE IRA provides a structured way for younger employees to begin saving.

Misconception 8: Employers have no control over investments. Employers often think they have no say in the investment choices of a SIMPLE IRA plan. While it's employee-directed, employers can still choose the financial institution that manages the plan, which can influence the range of investment options available.

Misconception 9: It’s risky for small businesses to offer. Some small business owners believe that offering a retirement plan like the SIMPLE IRA is too risky or financially burdensome. In reality, the plan's design minimizes financial risk to employers while providing an attractive benefit to employees, potentially aiding in recruitment and retention.

Understanding these misconceptions can help employers and employees better appreciate the value and simplicity of the 5304-SIMPLE form and the SIMPLE IRA plan it supports. Making informed decisions about retirement planning is essential for long-term financial security.

Key takeaways

The IRS 5304-SIMPLE form is an essential document for small businesses looking to offer a SIMPLE (Savings Incentive Match Plan for Employees) IRA plan to their employees without designating a specific financial institution for the contributions. Here are five key takeaways to consider when filling out and using this form:

- Understanding the eligibility criteria is fundamental before beginning the process. The IRS 5304-SIMPLE form is intended for businesses with 100 or fewer employees earning $5,000 or more during the preceding calendar year. Ensuring your business meets these requirements is the first step toward setting up a SIMPLE IRA plan.

- The form allows employee choice in selecting a financial institution for their retirement contributions. Unlike the 5305-SIMPLE form, which requires the employer to select a single financial institution for all contributions, the 5304-SIMPLE form provides flexibility, allowing employees to choose where they want their retirement savings deposited.

- Accuracy in completing the form is crucial for its validity. Misinformation or incomplete sections can lead to processing delays or issues with the plan's implementation. Pay special attention to the dates, participant information, and the employer’s commitment to the contribution formulas described in the form.

- Timely notification to employees about the SIMPLE IRA plan is mandated. Once the 5304-SIMPLE form is correctly filled out, employers must promptly inform their employees. This notification should include information on eligibility, benefits, and how to participate, giving employees sufficient time to make informed decisions about their retirement savings.

- Saving and maintaining records of the completed 5304-SIMPLE form and related documents is advisable. Even though the form does not need to be submitted to the IRS, maintaining thorough records supports compliance with IRS requirements and aids in addressing any future discrepancies or audits.

By keeping these key takeaways in mind, employers can smoothly navigate the process of setting up a SIMPLE IRA plan that benefits both their business and their employees, contributing to a stronger, more secure financial future for all involved.

Popular PDF Documents

Formula for Marked Price - Emphasizes the critical aspects of financial health in a taxi business, including income diversification and stringent expense management.

1099b What Is It - Investors using a partnership or trust for trading might still be issued a 1099-B for transactions in these entities.