Get Irs 5129 Form

Navigating tax forms can often feel like trying to understand a foreign language, but taking the time to get familiar with forms like the IRS 5129 can make a significant difference in how efficiently and accurately one files taxes. The IRS 5129 form, revised in December 2007, serves as a comprehensive questionnaire designed to guide individuals through the intricacies of filing status, exemptions, and deductions. Its first section collects basic taxpayer data, including names, addresses, and Social Security numbers, ensuring that all information aligns with what is on the income tax return. Moving forward, the form delves into the specifics of filing status—whether single, married (filing jointly or separately), head of household, or qualifying widow(er) with dependent child—requiring taxpayers to answer detailed questions about their living situation, their spouse’s tax filings, and whether they lived with their spouse during the last six months of the tax year. It not only asks about the taxpayer's dependent children but also extends to other relatives who might qualify as dependents, underscoring the importance of understanding who in your family unit can affect your tax status and potential deductions. Moreover, the form addresses age and disability-related considerations, asking about blindness and age over 65, which can influence the standard deduction amount. Completing the IRS 5129 form with meticulous attention to detail is crucial for taxpayers aiming to maximize their deductions and accurately report their filing status, leading to a smoother tax filing experience.

Irs 5129 Example

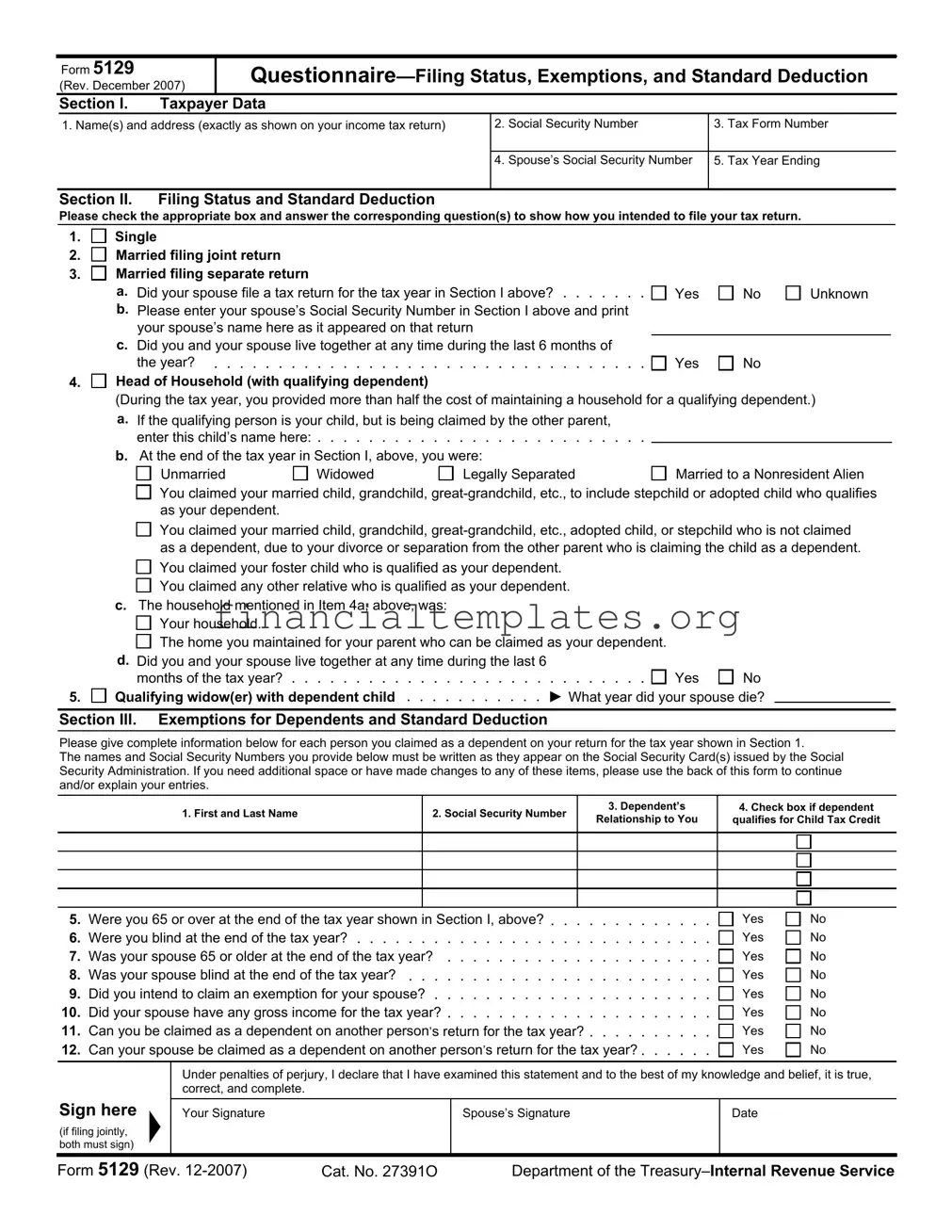

Form 5129

(Rev. December 2007)

Section I. Taxpayer Data

1. Name(s) and address (exactly as shown on your income tax return)

2. Social Security Number

3. Tax Form Number

4. Spouse’s Social Security Number

5. Tax Year Ending

Section II. Filing Status and Standard Deduction

Please check the appropriate box and answer the corresponding question(s) to show how you intended to file your tax return.

1.

2.

3.

4.

Single

Single

Married filing joint return

Married filing separate return

a.Did your spouse file a tax return for the tax year in Section I above? . . . . . . .

b.Please enter your spouse’s Social Security Number in Section I above and print your spouse’s name here as it appeared on that return

c.Did you and your spouse live together at any time during the last 6 months of

the year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Head of Household (with qualifying dependent)

Yes

Yes

No

No

Unknown

Unknown

Yes

Yes

No

No

5.

(During the tax year, you provided more than half the cost of maintaining a household for a qualifying dependent.)

a.If the qualifying person is your child, but is being claimed by the other parent, enter this child’s name here: . . . . . . . . . . . . . . . . . . . . . . . . . .

b.At the end of the tax year in Section I, above, you were:

Unmarried |

Widowed |

Legally Separated |

Married to a Nonresident Alien |

You claimed your married child, grandchild,

You claimed your married child, grandchild,

You claimed your married child, grandchild,

You claimed your married child, grandchild,

You claimed your foster child who is qualified as your dependent.

You claimed your foster child who is qualified as your dependent.

You claimed any other relative who is qualified as your dependent.

You claimed any other relative who is qualified as your dependent.

c.The household mentioned in Item 4a, above, was:

Your household.

Your household.

The home you maintained for your parent who can be claimed as your dependent.

The home you maintained for your parent who can be claimed as your dependent.

d.Did you and your spouse live together at any time during the last 6

months of the tax year? |

. . . . . . . |

Yes |

No |

Qualifying widow(er) with dependent child |

What year did your spouse die? |

||

Section Ill. Exemptions for Dependents and Standard Deduction

Please give complete information below for each person you claimed as a dependent on your return for the tax year shown in Section 1.

The names and Social Security Numbers you provide below must be written as they appear on the Social Security Card(s) issued by the Social Security Administration. If you need additional space or have made changes to any of these items, please use the back of this form to continue and/or explain your entries.

1. First and Last Name

2. Social Security Number

3.Dependent’s Relationship to You

4.Check box if dependent qualifies for Child Tax Credit

5.Were you 65 or over at the end of the tax year shown in Section I, above? . . . . . . . . . . . . .

6.Were you blind at the end of the tax year? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.Was your spouse 65 or older at the end of the tax year? . . . . . . . . . . . . . . . . . . . . .

8.Was your spouse blind at the end of the tax year? . . . . . . . . . . . . . . . . . . . . . . . .

9.Did you intend to claim an exemption for your spouse? . . . . . . . . . . . . . . . . . . . . . .

10.Did your spouse have any gross income for the tax year? . . . . . . . . . . . . . . . . . . . . .

11.Can you be claimed as a dependent on another person’s return for the tax year? . . . . . . . . . .

12.Can your spouse be claimed as a dependent on another person’s return for the tax year? . . . . . .

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

No

No

No

No

No

No

No

No

Sign here

(if filing jointly, both must sign)

Under penalties of perjury, I declare that I have examined this statement and to the best of my knowledge and belief, it is true, correct, and complete.

Your Signature |

Spouse’s Signature |

Date |

|

|

|

Form 5129 (Rev. |

Cat. No. 27391O |

Department of the |

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Number | 5129 |

| Revision Date | December 2007 |

| Title | Questionnaire—Filing Status, Exemptions, and Standard Deduction |

| Main Sections | Taxpayer Data, Filing Status and Standard Deduction, Exemptions for Dependents and Standard Deduction |

| Primary Purpose | To gather detailed information on how the taxpayer intends to file their tax return, including exemptions and deductions. |

| Filing Options Covered | Single, Married filing jointly, Married filing separately, Head of Household, Qualifying widow(er) with dependent child |

| Topics Addressed | Personal and spouse information, dependent exemptions, standard deduction eligibility, and tax credits for dependents. |

| Certification | Requires taxpayer (and spouse, if filing jointly) signature under penalties of perjury, confirming the statement's accuracy. |

| Agency | Department of the Treasury–Internal Revenue Service |

Guide to Writing Irs 5129

When filling out IRS Form 5129, it's important to approach the task with care and attention to detail. This form is utilized to provide specific information regarding your filing status, exemptions, and standard deductions. Having accurate and complete responses is essential for ensuring the correct processing of your tax return.

- Start with Section I: Taxpayer Data. Enter your name(s) and address exactly as it appears on your income tax return.

- Input your Social Security Number.

- Indicate the Tax Form Number you used for filing.

- If applicable, enter your Spouse’s Social Security Number.

- Specify the Tax Year Ending.

- Move to Section II: Filing Status and Standard Deduction. Here, check the appropriate box that matches your intended filing status.

- For each filing status, answer the corresponding questions. This includes whether your spouse filed a return, if you lived together during the last six months of the year, and information about dependents if you're filing as Head of Household or Qualifying Widow(er).

- In case of selecting 'Head of Household', provide the name of the qualifying child, if relevant, and check the corresponding situation that applies to your household.

- If you chose 'Qualifying Widow(er)', enter the year your spouse passed away.

- Transition to Section III: Exemptions for Dependents and Standard Deduction. List each person you claimed as a dependent, including their first and last name, Social Security Number, and their relationship to you.

- Mark the checkbox if the dependent qualifies for the Child Tax Credit.

- Answer questions about your age and any conditions such as being over 65 or blind, and do the same for your spouse if applicable.

- Answer whether you intend to claim an exemption for your spouse, if they had any gross income, and whether either of you can be claimed as a dependent on someone else’s return.

- Both you and your spouse (if filing jointly) need to sign the form. Ensure that the signatures and the date are included to validate the form.

After completing these steps, review the form thoroughly to ensure all information is accurate and complete. This meticulous approach helps prevent any processing delays or issues with your tax return. For any changes or additional information, use the back of the form as instructed. Once everything is confirmed to be correct, submit the form to the IRS following the instructions provided for your specific situation.

Understanding Irs 5129

What is Form 5129 and who needs to fill it out?

Form 5129, also known as the "Questionnaire—Filing Status, Exemptions, and Standard Deduction," is a document requested by the Internal Revenue Service (IRS) to clarify specific information regarding a taxpayer's filing status, exemptions, and whether they are claiming the standard deduction or itemizing deductions on their tax return. It is primarily used when the IRS needs additional information to process an individual's tax return accurately. Individuals who receive this form from the IRS should fill it out to ensure their tax return is processed correctly and efficiently.

How does one determine the correct filing status on Form 5129?

To determine the correct filing status on Form 5129, taxpayers should refer to the specific criteria outlined in Section II of the form. These include options such as Single, Married filing jointly, Married filing separately, Head of Household, or Qualifying widow(er) with dependent child. Taxpayers need to select the status that best fits their circumstances, considering factors such as marital status at the end of the tax year, whether they live with a spouse, and if they are responsible for over half the cost of maintaining a home for a qualifying dependent.

What information is required about dependents in Section III of Form 5129?

In Section III of Form 5129, taxpayers are asked to provide detailed information for each person they claimed as a dependent on their tax return. This includes the dependent’s first and last name, Social Security Number, relationship to the taxpayer, and whether the dependent qualifies for the Child Tax Credit. Additionally, taxpayers are asked about their own age and blindness status, as well as that of their spouse, to determine eligibility for specific exemptions and deductions related to age or disability.

How does living with a spouse affect the responses on Form 5129?

Living with a spouse can significantly influence the responses on Form 5129, especially in sections concerning filing status and eligibility for certain tax benefits. For example, if choosing Married filing separately, the taxpayer must indicate whether they lived with their spouse during the last six months of the tax year. This information is crucial as it affects eligibility for certain tax benefits like the Earned Income Credit or Head of Household filing status, which typically require taxpayers not to have lived with their spouse during the latter half of the year.

What should be done if additional space is needed to provide explanations or additional dependent information on Form 5129?

If additional space is needed on Form 5129 to provide explanations or information about dependents, taxpayers are instructed to use the back of the form. This section can be utilized to continue listing dependents if the provided space is insufficient or to clarify any responses that may not fit in the designated areas of the form. Taxpayers should ensure all information is clear and complete to avoid delays in the processing of their tax return.

Common mistakes

When dealing with IRS Form 5129, a document aimed at clarifying one's filing status, exemptions, and standard deductions, certain common mistakes often arise. These errors can complicate matters, leading to delays or discrepancies in tax assessments. Here's an insight into these missteps:

Incorrect Name and Address Information: One of the initial errors can be as basic as inaccurately filling out names and addresses. These should match exactly with those on the tax return to avoid processing delays.

Missing or Wrong Social Security Numbers: Individuals sometimes input incorrect Social Security Numbers (SSNs) or omit them altogether, especially concerning their spouse's SSN. Every SSN must be input accurately as it appears on the Social Security Card.

Failing to correctly identify the Filing Status and misunderstanding the qualifications for each status can lead to wrongly claimed exemptions or deductions.

Inaccurate Dependent Information: Not supplying complete and correct details for each dependent, including their names and SSNs as they appear on their Social Security Cards, complicates dependency claims.

Omitting information about whether the taxpayer or spouse is aged 65 or over, or blind, thereby potentially missing out on applicable deductions.

Errors in Exemption Claims for Spouse: Incorrectly indicating whether an exemption for a spouse is intended, especially regarding questions about gross income, spouse's age, or blindness.

Not properly addressing the dependency potentials such as overlooking to indicate if the taxpayer or their spouse can be considered dependents on someone else's return.

Failing to acknowledge and appropriately indicate the living situation in the case of Married Filing Separately, especially when it comes to whether the spouses lived together at any point during the latter half of the tax year.

To prevent these mistakes:

Double-check all personal information for accuracy, ensuring it matches existing records.

Review the instructions for each section meticulously to understand the filing status qualifications and implications.

Consult the guidelines regarding dependency to make sure every individual claimed meets the IRS criteria.

Be thorough with details related to age and blindness for both the taxpayer and the spouse to leverage available deductions correctly.

Finally, if uncertainties persist, consider seeking advice from a tax professional to navigate the complexities efficiently.

Documents used along the form

When dealing with IRS Form 5129, a detailed questionnaire regarding filing status, exemptions, and standard deduction, individuals often find themselves navigating through additional documents to accurately complete their tax return. These documents, each serving a distinct purpose, are critical in ensuring compliance with tax law and helping taxpayers accurately report their financial situation. Here’s a closer look at some of these essential forms and documents.

- Form 1040: The U.S. Individual Income Tax Return is the foundational document for personal income taxation, where taxpayers outline all sources of income, deductions, and credits.

- Form W-2: This Wage and Tax Statement is issued by employers to report an employee’s annual wages and the amount of taxes withheld from their paycheck.

- Form 1099: Various 1099 forms report income from sources other than wages, such as freelance earnings (1099-NEC), interest (1099-INT), and dividends (1099-DIV).

- Form 8857: Request for Innocent Spouse Relief provides a means for a spouse to seek relief if they believe they should not be held responsible for their spouse or former spouse's tax debt.

- Schedule A (Form 1040): Itemized Deductions allows taxpayers to itemize deductible expenses like medical and dental, taxes paid, and interest paid, potentially lowering their taxable income.

- Schedule C (Form 1040): Profit or Loss from Business (Sole Proprietorship) is used by self-employed individuals to report earnings and expenses from their business.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return helps taxpayers request a six-month extension to file their tax returns.

- Form 8332: Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent is crucial for determining which parent can claim a child as a dependent, in cases of divorced or separated parents.

- Form 8962: Premium Tax Credit (PTC) is filled by those who wish to claim the premium tax credit, a refundable credit that helps eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace.

- Form 2120: Multiple Support Declaration allows multiple persons who provide financial support to a single dependent to decide who will claim the dependent, especially when no one person provided more than half of the support.

In summary, navigating the complexities of tax filing necessitates understanding and utilizing a variety of documents, each designed to capture different elements of an individual's financial life. From income reports to deduction claims and requests for tax relief, these forms collectively ensure a comprehensive and compliant tax return. Careful consideration and accurate completion of these documents can not only help in avoiding potential legal pitfalls but also in optimizing one's financial obligations to the government.

Similar forms

The IRS Form 1040, "U.S. Individual Income Tax Return," shares substantial similarities with IRS Form 5129, as both are pivotal in determining the filing status and various exemptions applicable to taxpayers. Form 1040 serves as the standard federal income tax form used to report an individual's gross income, from which deductions and exemptions can be subtracted to ascertain taxable income. Like Form 5129, it requires detailed taxpayer data, including filing status (e.g., single, married filing jointly), which influences the standard deduction amount and eligibility for certain tax credits. Both forms necessitate careful attention to personal and financial details to ensure accurate taxation and the maximization of potential deductions.

IRS Form 8822, "Change of Address," while primarily focused on updating taxpayer address information with the IRS, indirectly mirrors aspects of Form 5129's emphasis on accurate taxpayer data. Ensuring current address details are on file is vital for receiving pertinent tax documents and notifications. This form, similar to Form 5129, contributes to maintaining accurate records with the IRS, which is crucial for proper tax filing and receiving any communications, including potential refunds. Address changes can affect where documents are mailed, highlighting the importance of up-to-date information for comprehensive tax reporting and compliance.

Form W-4, "Employee's Withholding Certificate," is another document paralleling the intent behind IRS Form 5129, albeit with a focus on controlling income tax withholding from wages. This form is essential for employees to indicate their withholding status and exemptions accurately, which can mirror the taxpayer data engaged in Form 5129. The similarities lie in their mutual goal of ensuring that individuals' tax situations are accurately reflected in the amount of tax paid throughout the year, either through payroll withholding or estimated tax payments, hence affecting their overall annual tax obligations.

The IRS Schedule EIC, "Earned Income Credit," also shares objectives akin to those of Form 5129, particularly in the determination and validation of eligibility criteria for specific tax benefits. This schedule is used by filers who qualify for the Earned Income Tax Credit (EITC), a benefit for working people with low to moderate income, and it requires detailed information about dependents, similar to the dependents' data section in Form 5129. Both forms serve the broader function of ensuring taxpayers receive the credits and deductions for which they are eligible, directly impacting their tax liability and potential refunds.

Dos and Don'ts

When filling out the IRS Form 5129, it's important to approach it with attention to detail and accuracy. This form is used for clarifying filing status, exemptions, and deductions, and ensuring it's filled out correctly can have a significant impact on your tax obligations and benefits. Below are essential do’s and don’ts to help guide you through the process:

- Do gather all necessary documents beforehand, such as Social Security cards and any relevant financial records, to ensure that all information provided matches official documents.

- Do carefully read each section and question to understand what is being asked before entering your information. Accuracy is key to preventing processing delays or errors in your tax return.

- Do use a black or blue pen if you are filling out the form by hand. This makes the form easier to read for processing and can prevent potential issues with legibility.

- Don't leave any fields blank. If a section does not apply to you, enter "N/A" (not applicable) to indicate that you have read and acknowledged the question but it doesn't pertain to your situation.

- Don't guess or estimate answers. If you're unsure about how to answer a question, it's better to seek clarification from a tax professional or the IRS to ensure the information you provide is accurate.

- Don't forget to sign and date the form. A missing signature can invalidate the form, requiring you to resubmit and potentially delaying your tax processing.

Remember, the goal is to provide clear, accurate and complete information to support your tax filing. When in doubt, consulting with a tax professional can help navigate complex questions or situations. By following these do’s and don’ts, you can make the process of completing IRS Form 5129 smoother and more efficient.

Misconceptions

Many believe the IRS 5129 form is only for disputing filing status, but it's primarily designed to clarify filing status, exemptions, and standard deductions on your tax return.

There's a misconception that you need to file Form 5129 annually. This form is only necessary when the IRS requests further information regarding your filing status or claims on your tax return.

Some think Form 5129 allows you to change your filing status after submitting your tax return. However, its purpose is to provide additional information requested by the IRS, not to amend previously filed returns.

There is a misconception that filing Form 5129 automatically corrects errors on your tax return. It is important to note that this form provides clarification or additional information needed by the IRS, but doesn't directly amend your tax return.

A common misunderstanding is that the 5129 form can be used to claim dependents not listed on your original tax return. This form asks for details about dependents already claimed, not for adding new dependents.

People often think that submitting Form 5129 extends the deadline for their tax return. This is not the case; it's a form requested by the IRS and does not impact filing deadlines.

It's wrongly assumed that Form 5129 is required if you're filing as Head of Household. The form is only needed if the IRS requests more information to verify your eligibility for this or any other filing status.

There's a mistaken belief that you can use Form 5129 for resolving any tax dispute or correction. In reality, this form is specific to questions about filing status, exemptions, and standard deductions, not for all types of tax issues.

Key takeaways

Filling out the IRS 5129 form correctly is paramount for accurately reporting your filing status, exemptions, and standard deduction claims to the Internal Revenue Service. Here are key takeaways to assist you in navigating this process.

- Ensure that the personal information, including names, addresses, and Social Security Numbers for you and your spouse, matches exactly with what is on your income tax return to avoid processing delays or errors.

- Be clear about your filing status. The form guides you through different scenarios, such as whether you're filing singly, jointly, separately, as head of household, or as a qualifying widow(er) with a dependent child. Your choice impacts your tax obligations and potential benefits.

- If you're married and filing separately, you'll need to know if your spouse has filed a tax return for the concerned tax year and include their Social Security Number and name as it appears on their return.

- Understand the qualifications for claiming someone as a dependent. This includes not only children but also other relatives or foster children who meet specific IRS criteria. Accurate reporting here is crucial for eligibility for certain tax credits.

- When claiming head of household status, verify whether the qualifying person is your child and being claimed by the other parent, and confirm your marital status at the end of the tax year. These details are vital for determining the right filing status.

- For every person you're claiming as a dependent, provide their complete information as required in Section III, ensuring that names and Social Security Numbers are correct and match those on their Social Security cards.

- Be aware of special considerations if you or your spouse are 65 or older or blind at the end of the tax year. These factors may affect your standard deduction and eligibility for certain tax benefits.

- Finally, carefully review the entire form for accuracy and completeness before signing. Both you and your spouse must sign if you're filing jointly, attesting under penalty of perjury that the information provided is true and correct.

Understanding these aspects of the IRS 5129 form can guide you through the intricate details of tax filing, ensuring that you comply with IRS requirements while maximizing any tax benefits for which you are eligible.

Popular PDF Documents

IRS 2210 - Use Form 2210 to determine if you’ve paid enough in taxes via withholdings or quarterly estimated payments.

South Carolina State Tax Form - Guidance for reporting disability retirement income that is taxed at the federal level but may have different treatment for state taxes.

IRS 1040-SR - With a larger font size and more readable layout, the 1040-SR form enhances accessibility for older taxpayers.