Get IRS 4972 Form

Filing taxes can often feel overwhelming due to the myriad of forms and regulations. Among these, the IRS 4972 form stands out for individuals who have received lump-sum distributions from qualified retirement plans. This form allows taxpayers to potentially lower their tax liability by calculating the tax on these distributions under special methods. Its use is specific to those who are taking large, one-time withdrawals from their retirement savings, which can include 401(k)s, 403(b)s, and governmental 457 plans. The purpose behind this provision is to recognize and mitigate the potential financial impact of having a significant amount of taxable income recognized in one year. It's important for taxpayers who are considering taking a lump-sum distribution to understand the eligibility criteria, how to elect this special tax treatment, and the implications it may have on their overall tax situation. By familiarizing oneself with the IRS 4972 form, retirees and beneficiaries can make informed decisions that might lead to substantial tax savings under the right circumstances.

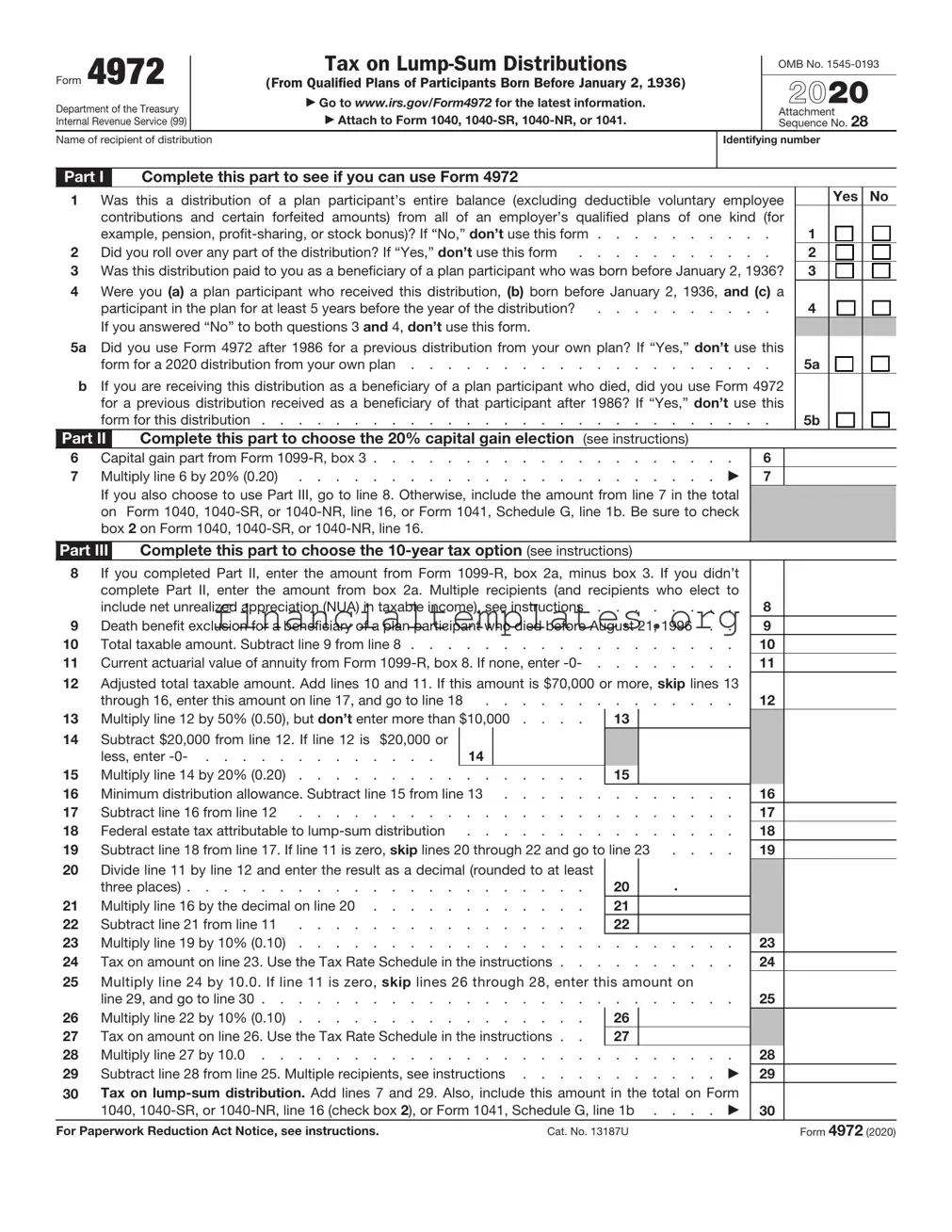

IRS 4972 Example

|

Form 4972 |

|

Tax on |

|

OMB No. |

|||||

|

|

|

||||||||

|

|

(From Qualified Plans of Participants Born Before January 2, 1936) |

|

|

2021 |

|||||

|

Department of the Treasury |

|

▶ Go to www.irs.gov/Form4972 for the latest information. |

|

|

|||||

|

|

▶ Attach to Form 1040, |

|

Attachment |

28 |

|||||

|

Internal Revenue Service (99) |

|

|

Sequence No. |

||||||

|

Name of recipient of distribution |

|

Identifying number |

|

||||||

|

|

|

|

|

|

|

|

|||

|

Part I |

Complete this part to see if you can use Form 4972 |

|

|

|

|

|

|||

1 |

Was this a distribution of a plan participant’s entire balance (excluding deductible voluntary |

employee |

|

Yes No |

||||||

|

|

contributions and certain forfeited amounts) from all of an employer’s qualified plans of one kind (for |

|

|

|

|||||

|

|

example, pension, |

. . . |

|

1 |

|

||||

2 |

Did you roll over any part of the distribution? If “Yes,” don’t use this form |

. . . |

|

2 |

|

|||||

3 |

Was this distribution paid to you as a beneficiary of a plan participant who was born before January 2, 1936? |

3 |

|

|||||||

4Were you (a) a plan participant who received this distribution, (b) born before January 2, 1936, and (c) a

participant in the plan for at least 5 years before the year of the distribution? |

4 |

|

If you answered “No” to both questions 3 and 4, don’t use this form. |

|

|

5a Did you use Form 4972 after 1986 for a previous distribution from your own plan? If “Yes,” don’t use this |

|

|

form for a 2021 distribution from your own plan |

5a |

|

bIf you are receiving this distribution as a beneficiary of a plan participant who died, did you use Form 4972 for a previous distribution received as a beneficiary of that participant after 1986? If “Yes,” don’t use this

|

form for this distribution |

. |

5b |

||

Part II |

Complete this part to choose the 20% capital gain elections (see instructions) |

|

|

||

6 |

Capital gain part from Form |

|

6 |

|

|

7 |

Multiply line 6 by 20% (0.20) . . . . . . . . . . . . . . . . . . . . . . . ▶ |

|

7 |

|

|

|

If you also choose to use Part III, go to line 8. Otherwise, include the amount from line 7 in the total |

|

|

||

|

on Form 1040, |

|

|

||

|

box 2 on Form 1040, |

|

|

||

Part III Complete this part to choose the

8If you completed Part II, enter the amount from Form

|

complete Part II, enter the amount from box 2a. Multiple recipients (and recipients who elect to |

|

|

include net unrealized appreciation (NUA) in taxable income), see instructions |

8 |

9 |

Death benefit exclusion for a beneficiary of a plan participant who died before August 21, 1996 . . |

9 |

10 |

Total taxable amount. Subtract line 9 from line 8 |

10 |

11 |

Current actuarial value of annuity from Form |

11 |

12Adjusted total taxable amount. Add lines 10 and 11. If this amount is $70,000 or more, skip lines 13

through 16, enter this amount on line 17, and go to line 18 |

. . . . . . . |

12 |

13 Multiply line 12 by 50% (0.50), but don’t enter more than $10,000 . . . . |

13 |

|

14Subtract $20,000 from line 12. If line 12 is $20,000 or

|

less, enter |

14 |

|

|

|

|

|

15 |

Multiply line 14 by 20% (0.20) |

15 |

|

|

|

|

|

16 |

Minimum distribution allowance. Subtract line 15 from line 13 |

. . . |

. . . . |

16 |

|

||

17 |

Subtract line 16 from line 12 |

. . . |

. . . . |

17 |

|

||

18 |

Federal estate tax attributable to |

. . . |

. . . . |

18 |

|

||

19 |

Subtract line 18 from line 17. If line 11 is zero, skip lines 20 through 22 and go to line 23 |

. . . . |

19 |

|

|||

20 |

Divide line 11 by line 12 and enter the result as a decimal (rounded to at least |

|

|

. |

|

|

|

|

three places) |

20 |

|

|

|

||

21 |

Multiply line 16 by the decimal on line 20 |

21 |

|

|

|

|

|

22 |

Subtract line 21 from line 11 |

22 |

|

|

|

|

|

23 |

Multiply line 19 by 10% (0.10) |

. . . |

. . . . |

23 |

|

||

24 |

Tax on amount on line 23. Use the Tax Rate Schedule in the instructions . . . |

. . . |

. . . . |

24 |

|

||

25Multiply line 24 by 10.0. If line 11 is zero, skip lines 26 through 28, enter this amount on line 29, and

|

go to line 30 |

. . . . . . . |

25 |

|

|||

26 |

Multiply line |

22 by 10% (0.10) |

|

26 |

|

|

|

27 |

Tax on amount on line 26. Use the Tax Rate Schedule in the instructions . . |

|

27 |

|

|

|

|

28 |

Multiply line |

27 by 10.0 |

. . . . . . . . |

28 |

|

||

29 |

Subtract line 28 from line 25. Multiple recipients, see instructions . . . . |

. . . . . . . ▶ |

29 |

|

|||

30Tax on

1040, |

30 |

|

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 13187U |

Form 4972 (2021) |

Form 4972 (2021) |

Page 2 |

|

|

Section references are to the Internal Revenue Code.

Future developments. For the latest information about developments related to Form 4972 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form4972.

General Instructions

Purpose of Form

Use Form 4972 to figure the tax on a qualified

You pay the tax only once, for the year you receive the distribution, not over the next 10 years. The separate tax is added to the regular tax figured on your other income.

Related Publications

For more information related to this topic, see the following publications.

•Pub. 575, Pension and Annuity Income.

•Pub. 721, Tax Guide to U.S. Civil Service Retirement Benefits.

•Pub. 939, General Rule for Pensions and Annuities.

What Is a Qualified

It is the distribution or payment in 1 tax year of a plan participant’s entire balance from all of an employer’s qualified plans of one kind (for example, pension,

Distributions upon death of the plan participant. If you received a qualified distribution as a beneficiary after the participant’s death, the participant must have been born before January 2, 1936, for you to use this form for that distribution.

Distributions to alternate payees. If you are the spouse or former spouse of a plan participant who was born before January 2, 1936, and you received a qualified

Distributions That Don’t Qualify for the 20% Capital Gain Election or the 10- Year Tax Option

The following distributions aren’t qualified

•The part of a distribution not rolled over if the distribution is partially rolled over to another qualified plan or an IRA.

•Any distribution if an earlier election to use either the 5- or

•U.S. Retirement Plan Bonds distributed with the lump sum.

•A distribution made during the first 5 tax years that the participant was in the plan, unless it was made because the participant died.

•The current actuarial value of any annuity contract included in the lump sum (Form

•A distribution to a 5% owner that is subject to penalties under section 72(m)(5)(A).

•A distribution from an IRA.

•A distribution from a

•A distribution of the redemption proceeds of bonds rolled over tax free to a qualified pension plan, etc., from a qualified bond purchase plan.

•A distribution from a qualified plan if the participant or his or her surviving spouse previously received an eligible rollover distribution from the same plan (or another plan of the employer that must be combined with that plan for the

•A distribution from a qualified plan that received a rollover after 2001 from an IRA (other than a conduit IRA), a governmental section 457(b) plan, or a section 403(b) tax- sheltered annuity on behalf of the plan participant.

•A distribution from a qualified plan that received a rollover after 2001 from another qualified plan on behalf of that plan participant’s surviving spouse.

•A corrective distribution of excess deferrals, excess contributions, excess aggregate contributions, or excess annual additions.

•A

How To Report the Distribution

If you can use Form 4972, attach it to Form 1040 or

20% capital gain election. If there is an amount in Form

Taxable amount. If Form

575.

Where to report. Report amounts from your Form

1.If you don’t use Form 4972, and you file:

a. Form 1040,

2.If you don’t use Part III of Form 4972, but use Part II, report only the ordinary income portion of the distribution on Form 1040,

3.If you use Part III of Form 4972, don’t include any part of the distribution on Form 1040,

The entries in other boxes on Form

• Box 6 (Net unrealized appreciation in employer’s securities). See Net unrealized appreciation (NUA), later.

• Box 8 (Other). Current actuarial value of an annuity.

How Often You Can Use Form 4972

After 1986, you can use Form 4972 only once for each plan participant. If you receive more than one

If you make an election as a beneficiary of a deceased participant, it doesn’t affect any election you can make for qualified

Example. Your mother and father died and each was born before January 2, 1936. Each had a qualified plan of which you are the beneficiary. You also received a qualified

An earlier election on Form 4972 TIP or Form 5544 for a distribution

before 1987 doesn’t prevent you from making an election for a distribution after 1986 for the

same participant, provided the participant was under age 59½ at the time of the

Form 4972 (2021) |

Page 3 |

|

|

When To File Form 4972

You can file Form 4972 with either an original or amended return. For an amended return, you must generally file within 3 years after the date the original return was filed or within 2 years after the date the tax was paid, whichever is later, to use any part of Form 4972.

Capital Gain Election

If the distribution includes a capital gain amount, you can (a) make the 20% capital gain election in Part II of Form 4972, or (b) treat the capital gain as ordinary income.

Only the taxable amount of distributions resulting from

You can report the ordinary income portion of the distribution on Form 1040,

Net unrealized appreciation (NUA). Normally, NUA in employer securities received as part of a

The total amount to report as NUA should be shown in Form

Multiple recipients of a

If you shared in a

Step 1. Complete Form 4972, Parts I and II. If you make the 20% capital gain election in Part II and also elect to include NUA in taxable income, complete the NUA Worksheet below to determine the amount of NUA that qualifies for capital gain treatment. Then, skip Step 2 and go to Step 3.

Step 2. Use this step only if you don’t elect to include NUA in your taxable income or if you don’t have NUA.

•If you aren’t making the capital gain election, divide the amount from Form

•If you are making the capital gain election, subtract the amount from Form

•Complete Form 4972, lines 9 and 10. Divide the amount from Form

Step 3. Use this step only if you elect to include NUA in your taxable income.

•If you aren’t making the capital gain election, add the amount from Form

•If you are making the capital gain election, subtract the amount from Form

•Complete Form 4972, lines 9 and 10. Divide the amount from Form

Step 4. Complete Form 4972 through line 28.

Step 5. Complete the following worksheet to figure the entry for Form 4972, line 29.

A. Subtract line 28 from line 25 .

B. Enter your percentage of the distribution from box 9a . .

C. Multiply line A by line B. Enter here and on Form 4972, line 29. Also, write “MRD” on the dotted line next to line 29 . . . .

R, box 3. To figure the total amount subject to capital gain treatment including the NUA, complete the NUA Worksheet on this page.

Specific Instructions

Name of recipient of distribution and identifying number. At the top of Form 4972, fill in the name and identifying number of the recipient of the distribution.

If you received more than one qualified distribution in 2021 for the same plan participant, add them and figure the tax on the total amount. If you received qualified distributions in 2021 for more than one participant, file a separate Form 4972 for the distributions of each participant.

If you and your spouse are filing a joint return and each has received a

line 16.

NUA Worksheet (keep for your records)

A. |

Enter the amount from Form |

A. |

B. |

Enter the amount from Form |

B. |

C.Divide line A by line B and enter the result as a decimal (rounded to at

|

least three places) |

. . . . . . . . . . . . . . . |

C. |

. |

D. |

Enter the amount from Form |

D. |

|

|

E. |

Capital gain portion of NUA. Multiply line C by line D |

E. |

|

|

F. |

Ordinary income portion of NUA. Subtract line E from line D . . . |

F. |

|

|

G.Total capital gain portion of distribution. Add lines A and E. Enter here and on Form 4972, line 6. On the dotted line next to line 6, write “NUA” and the amount from line E above . . . . . . . . . G.

Death Benefit Worksheet (keep for your records)

A.Enter the amount from Form

NUA in taxable income, the amount from line G of the NUA Worksheet A.

B.Enter the amount from Form

NUA in taxable income, the amount from Form |

B. |

C.Divide line A by line B and enter the result as a decimal (rounded to at

|

least three places) |

. . . . . . . . . . . . . . . |

C. |

. |

D. |

Enter your share of the death benefit exclusion* |

D. |

|

|

E.Death benefit exclusion allocated to capital gain. Multiply line D by

line C . . . . . . . . . . . . . . . . . . . E.

F. |

Subtract line E from line A. Enter here and on Form 4972, line 6 . . |

F. |

*Applies only for participants who died before August 21, 1996. If there are multiple recipients of the distribution, the allowable death benefit exclusion must be allocated among the recipients in the same proportion that they share the distribution.

Form 4972 (2021) |

Page 4 |

|

|

Part II

See Capital Gain Election, earlier, before completing Part II.

Line 6. Leave this line blank if your distribution doesn’t include a capital gain amount or you aren’t making the 20% capital gain election, and go to Part III.

Generally, enter on line 6 the amount from Form

If any federal estate tax was paid on the

If you take the death benefit ▲! exclusion and federal estate tax

was paid on the capital gain CAUTION amount, the capital gain amount must be reduced by both the procedures discussed above to figure the correct entry for line 6.

Part III

Multiple recipients, see Multiple recipients of a

Line 8. If Form

If you made the 20% capital gain election, enter only the ordinary income portion of the distribution on this line. The ordinary income portion is the amount from Form

If you didn’t make the 20% capital gain election and didn’t elect to include NUA in taxable income, enter the amount from Form

Community property laws don’t ▲! apply in figuring tax on the amount

you report on line 8.

CAUTION

Line 9. If you received the distribution because of the plan participant’s death and the participant died before August 21, 1996, you may be able to exclude up to $5,000 of the lump sum from your gross income. This exclusion applies to the beneficiaries or estates of

Enter the allowable death benefit exclusion on line 9. If you made the 20% capital gain election, enter the amount from line D of the Death Benefit Worksheet minus the amount from line E of that worksheet.

Multiple recipients. If there are multiple recipients of the distribution not all of whom are trusts, and you didn’t complete Part II, enter the full allowable death benefit exclusion on line 9. Don’t allocate the exclusion among the recipients; the computation under Multiple recipients of a

If you completed Part II, multiply the full allowable death benefit exclusion (don’t allocate among the recipients) by the percentage on line C of the Death Benefit Worksheet. Subtract the result from the full allowable death benefit exclusion. Enter the result on line 9.

Line 18. A beneficiary who receives a lump- sum distribution because of a plan participant’s death must reduce the taxable part of the distribution by any federal estate tax paid on the

Lines 24 and 27. Use the following Tax Rate Schedule to complete lines 24 and 27.

Line 29. Multiple recipients, see Multiple recipients of a

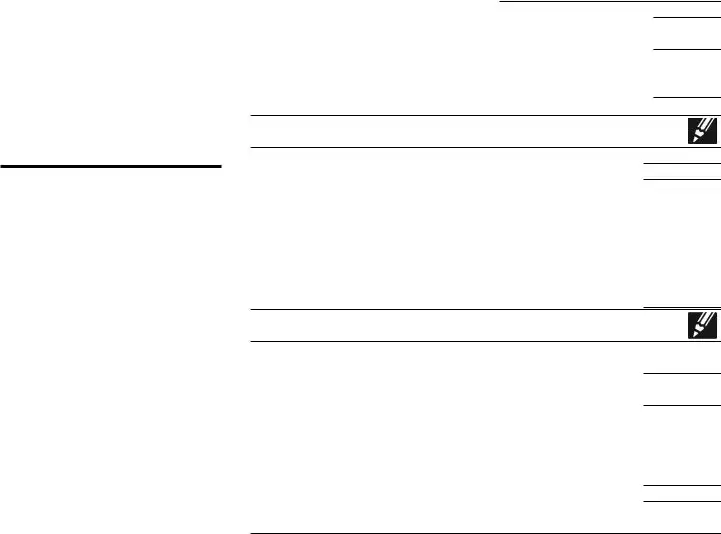

Tax Rate Schedule

If the amount on |

Enter on line |

|

||

line 23 or 26 is: |

24 or 27: |

|

||

|

|

|

|

Of the |

|

But not |

|

|

amount |

Over— |

over— |

|

|

over— |

$ 0 |

$ 1,190 |

- - - - - 11% |

$ 0 |

|

1,190 |

2,270 |

$130.90 + 12% |

1,190 |

|

2,270 |

4,530 |

260.50 |

+ 14% |

2,270 |

4,530 |

6,690 |

576.90 |

+ 15% |

4,530 |

6,690 |

9,170 |

900.90 |

+ 16% |

6,690 |

9,170 |

11,440 |

1,297.70 |

+ 18% |

9,170 |

11,440 |

13,710 |

1,706.30 |

+ 20% |

11,440 |

13,710 |

17,160 |

2,160.30 |

+ 23% |

13,710 |

17,160 |

22,880 |

2,953.80 |

+ 26% |

17,160 |

22,880 |

28,600 |

4,441.00 |

+ 30% |

22,880 |

28,600 |

34,320 |

6,157.00 |

+ 34% |

28,600 |

34,320 |

42,300 |

8,101.80 |

+ 38% |

34,320 |

42,300 |

57,190 |

11,134.20 |

+ 42% |

42,300 |

57,190 |

85,790 |

17,388.00 |

+ 48% |

57,190 |

85,790 |

- - - - - |

31,116.00 |

+ 50% |

85,790 |

|

|

|

|

|

|

|

|

|

|

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You aren’t required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete this form will vary depending on individual circumstances. The estimated burden for individual taxpayers filing this form is approved under OMB control number

Recordkeeping . . . . . . 19 min.

Learning about the law

or the form . . . . . . 1 hr., 36 min.

Preparing the form . . . . 2 hr., 7 min.

Copying, assembling, and

sending the form to the IRS . . . 20 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. See the instructions for the tax return with which this form is filed.

Document Specifics

| Name of Fact | Detail |

|---|---|

| Purpose of Form 4972 | Used by taxpayers to calculate the tax on a lump-sum distribution from a qualified retirement plan. |

| Eligibility for Using Form 4972 | Available to individuals who were born before January 2, 1936, or beneficiaries of those individuals. |

| Lump-Sum Distribution Requirement | A distribution must be from a qualified plan and must be the total balance payable to a participant. |

| Tax Calculation Options | Provides options for calculating tax - either using the 10-year tax option or the 5-year forward averaging method. |

| 10-year Tax Option | Allows taxpayers to calculate the tax as if the lump-sum was received evenly over 10 years. |

| Five-Year Forward Averaging Option | Available only to those who were eligible for the five-year forward averaging method under pre-1986 tax law. |

| Governing Laws | This form is governed by federal tax laws as it involves retirement distributions and their taxation. |

Guide to Writing IRS 4972

Navigating the complexities of tax forms is a critical skill individuals must possess to ensure they are in compliance with tax laws and making the most of potential tax benefits. The IRS Form 4972 is utilized under specific circumstances when taxpayers opt to calculate the tax on lump-sum distributions from qualified retirement plans. This form allows for a special tax calculation method that can result in significant savings. However, understanding how to properly fill out this form is paramount to ensuring accuracy and compliance with the Internal Revenue Service (IRS) requirements.

Steps to Fill Out IRS Form 4972

- Gather all relevant documents, such as the lump-sum distribution statement from your pension or retirement plan.

- Review the form instructions provided by the IRS to familiarize yourself with the form's requirements and the specific information it demands.

- Enter your name and social security number at the top of the form to identify your tax return.

- Check the appropriate box in Part I that describes the type of plan distributing the lump sum. This part helps determine eligibility for special tax treatment.

- In Part II, calculate your taxable amount of the lump-sum distribution if you have not previously done so. This may require additional forms or worksheets provided by the IRS.

- If aged 59½ or older or if you are a beneficiary of a deceased plan participant, proceed to Part III. Here, you will identify the total distribution and calculate the tax using the special 20% capital gains option or the 10-year tax option, determining which is more beneficial for your situation.

- Part IV requires information if your distribution includes employer securities. Specific calculations here ensure the correct valuation of these securities for tax purposes.

- Finally, tally up your total tax from Parts II, III, and IV and enter this on the last line of the form. This will represent the total tax due on your lump-sum distribution under the special methods allowed by the IRS Form 4972.

- Attach Form 4972 to your Form 1040 or Form 1040-SR. Ensure that you also report the distribution on these forms as required, even though you computed the tax separately on Form 4972.

Once completed, it is crucial to review the form for any errors or omissions, as mistakes can lead to processing delays or unwelcome scrutiny from the IRS. Individuals who find the form challenging or have questions about their specific situations should consider consulting with a tax professional. This step ensures not only compliance but also maximizes the tax benefits available for those who qualify for this special tax treatment. Accurate completion and submission of IRS Form 4972 are steps towards an effective tax strategy for retirees and beneficiaries alike, making it a valuable tool in one's tax planning arsenal.

Understanding IRS 4972

What is IRS form 4972 used for?

IRS Form 4972 is used for calculating the tax on lump-sum distributions from qualified retirement plans. Individuals can opt to use this form if they receive a lump-sum distribution and meet certain conditions, potentially leading to favorable tax treatment for amounts distributed from their retirement accounts.

Who is eligible to file IRS form 4972?

To be eligible to file IRS Form 4972, the taxpayer must have received a lump-sum distribution from a qualified retirement plan after reaching age 59½, due to retirement, disability, or death. The distribution must also be on account of the plan participant's death, or it must be received in a single tax year and cover the balance of the account.

What qualifies as a lump-sum distribution?

A lump-sum distribution qualifies if it represents the total balance payable to the participant from all of an employer's qualified plans of the same type (pension, profit-sharing, or stock bonus plans), and it's paid within one tax year due to the participant's retirement, reaching age 59½, death, or separation from service.

Can IRS Form 4972 be used for IRA distributions?

No, IRS Form 4972 cannot be used for distributions from Individual Retirement Accounts (IRAs), including traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. The form is specifically designed for lump-sum distributions from qualified retirement plans.

How does using IRS Form 4972 affect my taxes?

Using IRS Form 4972 may benefit taxpayers by taxing their lump-sum distribution at a potentially lower rate than their current income tax rate. It applies special tax calculations for lump-sum distributions, which could result in significant tax savings, especially for large distributions.

What are the tax options available with IRS Form 4972?

There are two main tax treatment options available with IRS Form 4972: the 10-year tax option and the 5-year averaging option for pre-1987 contributions. These options apply a specific tax treatment to the distribution, potentially lowering the overall tax burden compared to regular income taxation.

How do I file IRS Form 4972 with my tax return?

When filing your tax return, include IRS Form 4972 if you are utilizing the special tax treatments for your lump-sum distribution. Complete Form 4972 according to the instructions and attach it to your Form 1040, U.S. Individual Income Tax Return. Ensure all applicable lines are filled to properly report and calculate the tax due on your distribution.

Can I file IRS Form 4972 electronically?

Yes, IRS Form 4972 can be filed electronically as part of your tax return. Most tax preparation software supports the inclusion of Form 4972, facilitating electronic filing. Ensure the software you choose can handle this form if you plan to file electronically.

Where can I get help with completing IRS Form 4972?

Help with completing IRS Form 4972 can be obtained from several sources, including tax preparation professionals, IRS guidance available on the IRS website, and tax preparation software. It's important to ensure accuracy when completing this form due to its complex nature and potential impact on your tax obligations.

Common mistakes

When completing the IRS Form 4972, typically used for calculating taxes on lump-sum distributions from qualified retirement plans, individuals often encounter certain pitfalls. Awareness and avoidance of these mistakes can ensure the processing goes smoothly and accurately. Below are six common errors made during this process:

Not verifying eligibility requirements: Individuals occasionally fail to confirm their eligibility for using IRS Form 4972. The conditions include having received a lump-sum distribution and being born before January 2, 1936, among others. Ignoring these prerequisites can lead to disqualification and unnecessary delays.

Failing to accurately calculate the taxable amount: It is imperative to accurately determine the portion of the lump-sum distribution that is subject to tax. Errors in calculation can arise from misunderstandings about the pre-1974 and post-1973 contributions and their tax implications.

Omitting relevant supporting documents: Taxpayers frequently forget to attach necessary supporting documentation, such as forms and statements from the plan administrator. These documents are vital for verifying the distribution and its eligibility for special tax treatment.

Incorrectly applying the five-year averaging: The concept of five-year averaging, which is an option under Form 4972, is often misunderstood or incorrectly applied. This mistake can result in an inaccurate tax liability calculation.

Overlooking potential penalties: There are certain situations where additional taxes or penalties might apply, for instance, if the distribution is not rolled over properly. Failure to consider these possibilities can lead to unexpected financial consequences.

Misunderstanding the ten-year averaging option: Taxpayers who qualify for the ten-year averaging method often misinterpret its application rules. This misunderstanding can lead not only to errors in tax calculation but also to potential overpayment of taxes.

To avoid such issues, individuals are encouraged to review the form instructions thoroughly, consult with a tax professional if needed, and ensure all calculations and documentation are accurate and complete before submission. Doing so can help minimize errors and optimize tax outcomes.

Documents used along the form

When dealing with taxes, especially concerning unique or significant tax situations such as lump-sum distributions, a thorough approach is crucial. The IRS Form 4972 plays a pivotal role in this context, used for calculating the tax on lump-sum distributions from qualified retirement plans. Alongside this form, several other documents are often necessary to ensure compliance and accuracy in tax filings. Below is a list of these documents, providing a brief description of each to guide individuals through their tax preparation process.

- Form 1040 or 1040-SR: The U.S. Individual Income Tax Return, which is the foundational document for most taxpayers. It's where you'll report your income, deductions, and credits for the year.

- Schedule D (Form 1040): This form is crucial for reporting capital gains and losses from the sale or exchange of capital assets. It plays a significant role in calculating the tax implications of different forms of income.

- Form 1099-R: Issued by the custodians of retirement plans and IRAs, this document reports distributions from pensions, annuities, retirement or profit-sharing plans, and IRAs. It's essential for correctly filling out Form 4972.

- Form 8606: This form is used to report nondeductible contributions to IRAs, including Roth IRA conversions and the taxable amount of IRA distributions when there's a mix of pre-tax and after-tax dollars.

- Form 5329: Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts. This form is used if taxpayers need to report additional taxes due to early distributions or failures to meet the required minimum distributions.

- Form 5498: IRA Contribution Information. This form is sent by the financial institution managing the IRA and provides information about IRA contributions, rollovers, and the year-end account balance, which is necessary for accurate tax reporting and planning.

- Form W-2: Wage and Tax Statement, which reports income from employment. This form is essential for individuals who are both employed and receiving distributions that may impact their tax bracket and liability.

- Form 4852: Substitute for Form W-2 or Form 1099-R. Used if the taxpayer does not receive these forms or they are incorrect. This form allows taxpayers to estimate their wage and distribution information while noting that the official forms were not received.

- Schedule R (Form 1040): Credit for the Elderly or the Disabled. This form may be relevant for taxpayers who are of age or disabled and receiving a pension or annuity distribution. It can provide a tax credit, lowering overall tax liability.

Navigating through the process of filing taxes, especially when it involves specific situations like lump-sum distributions, can be complex. Each of these documents plays an essential role in accurately reporting income, calculating taxes due, and identifying potential credits. Taxpayers should ensure they have all relevant forms and understand their purpose. Seeking professional advice or assistance is often beneficial to navigate the intricacies of tax law and maximize financial outcomes.

Similar forms

The IRS Form 4972 is utilized for calculating taxes on lump-sum distributions from qualified retirement plans. A similar document is the IRS Form 1040, which is the standard federal income tax form used by individuals to report their annual income to the Internal Revenue Service. Both forms are crucial for taxpayers to comply with U.S. tax laws and must be filed accurately and timely. However, while Form 4972 focuses on specific lump-sum distributions, Form 1040 encompasses all sources of income, deductions, and applicable credits.

Another document similar to IRS Form 4972 is Form 1099-R, which reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts. Both forms are connected because the information from Form 1099-R often needs to be reported on Form 4972 if the taxpayer is taking a lump-sum distribution. Form 1099-R provides the distribution amounts that may be eligible for special tax treatment under Form 4972.

Form 8606, concerning nondeductible IRAs, shares similarities with IRS Form 4972, as both deal with retirement funds. While Form 4972 focuses on the taxation of lump-sum distributions, Form 8606 is used by taxpayers to track and report nondeductible contributions to their IRAs, ensuring that these amounts are not taxed again when they are distributed. Both forms help taxpayers navigate the complex rules surrounding retirement distributions and their tax implications.

The IRS Form W-2, Wage and Tax Statement, though primarily a document employers provide to employees and the IRS to report annual wages and taxes withheld, shares a common purpose with Form 4972, which is tax reporting. Similar to Form 4972's role in reporting specific tax information related to lump-sum distributions, Form W-2 provides critical information that affects the taxpayer's overall tax liabilities and potential refunds.

Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, parallels Form 4972 as it deals with issues related to retirement distributions. Form 5329 is used to report additional taxes due to early distributions, excess contributions, and other anomalies in retirement accounts. Both forms address the taxation of retirement benefits, albeit from different angles, highlighting the IRS's comprehensive approach to retirement fund taxation.

IRS Form 8915-E, Qualified 2020 Disaster Retirement Plan Distributions and Repayments, is similar to Form 4972 as it pertains to specific tax treatments of retirement fund distributions. Form 8915-E is geared towards disaster-related distributions, offering special tax relief options. While Form 4972 deals with lump-sum distributions, both forms modify the taxpayer's obligations based on unique distribution circumstances.

Form 6251, Alternative Minimum Tax—Individuals, is related to Form 4972 by its role in ensuring taxpayers pay a minimum level of taxes on certain types of income. Users of Form 4972 may need to consider the alternative minimum tax (AMT) implications of taking a lump-sum distribution, as the income reported could affect their AMT calculations. Both forms are instrumental in calculating taxes owed under different parameters set by the tax code.

The Schedule D (Form 1040), Capital Gains and Losses, shares a thematic link with Form 4972, focusing on the taxation of specific types of income. While Schedule D is concerned with profits and losses from the sale of assets, Form 4972 deals with the tax treatment of lump-sum retirement distributions. Both documents play a key role in determining the taxpayer's comprehensive tax obligations.

IRS Form 8880, Credit for Qualified Retirement Savings Contributions, is akin to Form 4972 as both involve retirement savings and their impact on taxes. Form 8880 allows taxpayers to claim a credit for qualifying retirement contributions, mitigating their tax liability. Although Form 4972 serves a different function by calculating tax on lump-sum distributions, both forms encourage attention to retirement planning and its implications on taxes.

Last, IRS Form 5500, Annual Return/Report of Employee Benefit Plan, resembles Form 4972 in its focus on retirement plans. While Form 5500 is a requirement for plan administrators to report about the plan's financial conditions, operations, and investments, Form 4972 is used by individual taxpayers receiving lump-sum distributions. The two forms together ensure transparency and compliance from both the provision and reception ends of retirement planning.

Dos and Don'ts

Filing IRS Form 4972, related to tax on lump-sum distributions, requires careful attention to detail to ensure accuracy and compliance with tax regulations. Below are essential guidelines to follow when completing this form:

- Do review the eligibility criteria for using Form 4972, ensuring that your lump-sum distribution qualifies for the tax benefits.

- Don't rush through the process. Take your time to understand each section to avoid common mistakes that could lead to an audit or penalties.

- Do gather all necessary documents beforehand, including distribution statements and previous year's tax returns, to facilitate accurate reporting.

- Don't estimate figures. Use exact numbers from your distribution and financial documents to prevent discrepancies.

- Do consult the IRS instructions for Form 4972 carefully to ensure you're applying the correct tax rates and calculations.

- Don't forget to sign and date the form. An unsigned form is considered incomplete and can delay processing.

- Do consider seeking advice from a tax professional if you encounter confusion or complex situations. Some aspects of tax law can be intricate, and professional guidance ensures compliance and optimizes tax benefits.

- Don't file Form 4972 electronically. As of the latest guidance, this form needs to be attached to your paper-filed tax return.

- Do keep copies of Form 4972 and all relevant documentation for at least three years after you file. This documentation is crucial if the IRS requests more information or you need to amend a past return.

- Don't ignore IRS notices. If you receive correspondence concerning your Form 4972 filing, respond promptly to avoid further complications or penalties.

Misconceptions

Discussing the IRS 4972 form, used for calculating tax on lump-sum distributions from qualified retirement plans, brings up several common misconceptions. Understanding these can help individuals navigate their retirement planning more effectively. Here are five myths clarified:

Myth 1: The IRS 4972 form is required for all retirement distributions. This is not true. Form 4972 is specifically for taxpayers who have received a lump-sum distribution and choose to calculate the tax on this amount separately from their other income to potentially reduce their tax liability. Not all retirement distributions qualify for this treatment.

Myth 2: The form is too complicated for the average person to complete. While the IRS 4972 form involves specific calculations, it comes with instructions designed to guide individuals through the process. Many find that with careful reading and perhaps some assistance from a tax professional, completing the form is achievable.

Myth 3: Using Form 4972 always results in lower taxes. However, the benefit of using Form 4972 depends on various factors, including total income and the amount of the lump-sum distribution. In some cases, separating the lump-sum distribution for tax calculation might not provide a significant tax advantage.

Myth 4: Form 4972 can only be filed with a paper return. This misconception could delay filing. Many taxpayers can, and do, electronically file Form 4972 along with their other tax forms. The IRS encourages electronic filing because it's faster and reduces the risk of errors.

Myth 5: Once you opt to use Form 4972, you must use it for all future distributions. This statement is inaccurate. The decision to use Form 4972 is made on a year-by-year basis, depending on the individual’s circumstances at the time of each distribution. Taxpayers have the flexibility to decide each year whether the form's specific tax treatment benefits them.

Understanding these misconceptions can help individuals make informed decisions regarding their retirement distributions and tax obligations. Always consulting with a tax professional can provide personalized advice and clarity.

Key takeaways

When it comes to managing lump-sum distributions and understanding how they are taxed, the IRS 4972 form plays a critical role. This form is used to calculate the tax on a lump-sum distribution from qualified retirement plans. Here are six key takeaways about filling out and using the IRS 4972 form:

- Familiarity with eligibility criteria is crucial: Not every retirement plan distribution qualifies for the special tax calculations allowed by form 4972. To use this form, the distribution must be a lump-sum distribution received after the plan participant reaches the age of 59 ½, due to the participant's death, after the participant has become disabled, or upon retirement or separation from service.

- Understanding of lump-sum distribution: A lump-sum distribution is defined as the entire balance paid within one tax year to a plan participant or their beneficiary from all of the employer’s qualified plans of the same type.

- Precision in calculations is necessary: The form provides options for computing tax under the Ten-Year Tax Option or the Capital Gain Treatment. These calculations directly affect the amount of tax owed and require accurate input of historical and current data.

- Consequences of improper form completion: Any errors in filling out form 4972 can lead to an incorrect tax liability calculation, potentially resulting in underpayment penalties or the need to file an amended return.

- Consultation with a tax professional is advisable: Due to the complex nature of tax laws and the critical financial implications, consultation with a tax advisor or professional is highly recommended when completing IRS 4972 to ensure compliance and optimization of tax benefits.

- Record keeping is important: Always keep a copy of form 4972 and any related documentation for at least three years after the due date of your return or the date it was filed, whichever is later, to support the calculations made in case of an IRS inquiry.

Popular PDF Documents

California Poa - Assists in the strategic planning of taxes, with authorized experts making informed decisions on your behalf.

Irs Installment Plan - A binding certificate that accurately reflects the current financial obligations status of a strata lot owner towards the strata corporation.

Tax Lien Removal - Understanding who to contact within the IRS for lien-related matters becomes straightforward with the directory provided in this publication.