Get IRS 4952 Form

Navigating the complexities of tax forms can often feel overwhelming, yet understanding them is crucial for making informed decisions about your financial landscape. Among these, the IRS 4952 form plays a pivotal role for investors seeking to deduct investment interest expenses on their tax returns. This form allows taxpayers to calculate the allowable amount of investment interest expense that can be deducted for the tax year, which is essential for individuals who have borrowed money to purchase taxable investments. It serves as a detailed record, requiring the taxpayer to list the amount of investment income and expenses, thus helping to outline the specific deductions they are entitled to. By accurately completing this form, investors ensure compliance with the Internal Revenue Service (IRS) regulations, potentially reducing their taxable income and lowering their tax liability. The form encompasses several sections, each designed to guide the taxpayer through the process of determining the deductible amount, making it a crucial document for those looking to maximize their investment-related deductions.

IRS 4952 Example

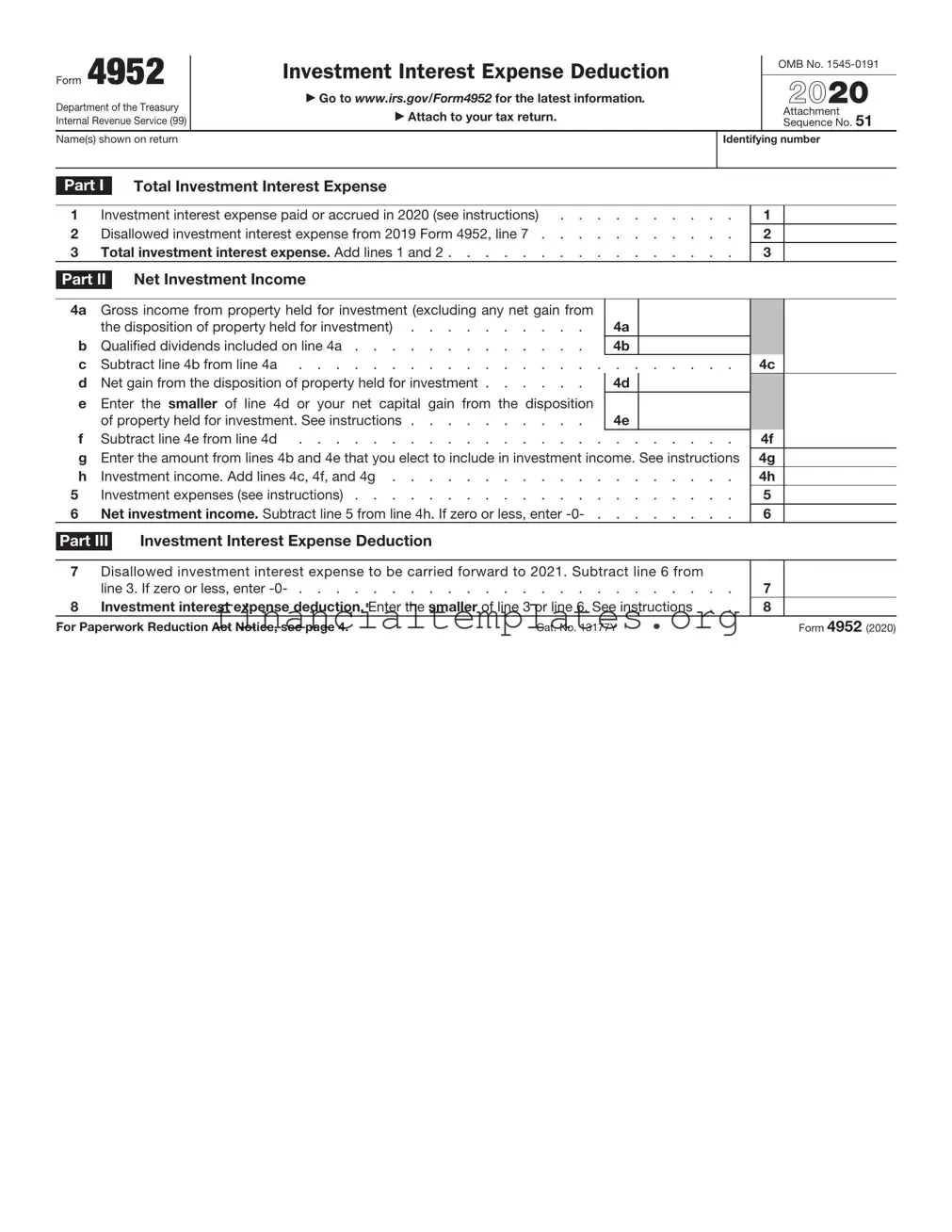

Form 4952 |

Investment Interest Expense Deduction |

|

|

|

OMB No. |

|||

|

|

|

|

|

||||

|

|

|

2021 |

|||||

Department of the Treasury |

▶ Go to www.irs.gov/Form4952 for the latest information. |

|

|

|

||||

|

|

|

▶ Attach to your tax return. |

|

|

|

Attachment |

|

Internal Revenue Service (99) |

|

|

|

Sequence No. 51 |

||||

Name(s) shown on return |

|

|

Identifying number |

|||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Part I |

Total Investment Interest Expense |

|

|

|

|

|

||

|

|

|

|

|

|

|

||

1 |

Investment interest expense paid or accrued in 2021 (see instructions) |

. |

. |

|

1 |

|

||

2 |

Disallowed investment interest expense from 2020 Form 4952, line 7 |

. |

. |

|

2 |

|

||

3 |

Total investment interest expense. Add lines 1 and 2 |

. |

. |

|

3 |

|

||

Part II Net Investment Income

4a |

Gross income from property held for investment (excluding any net gain from |

|

|

|

the disposition of property held for investment) |

4a |

|

b |

Qualified dividends included on line 4a |

4b |

|

c |

Subtract line 4b from line 4a |

||

d |

Net gain from the disposition of property held for investment |

4d |

|

eEnter the smaller of line 4d or your net capital gain from the disposition

of property held for investment. See instructions |

4e |

f Subtract line 4e from line 4d . . . . . . . . . . . . . . . . . . . . . . . .

gEnter the amount from lines 4b and 4e that you elect to include in investment income. See instructions

h |

Investment income. Add lines 4c, 4f, and 4g |

5 |

Investment expenses (see instructions) |

6 |

Net investment income. Subtract line 5 from line 4h. If zero or less, enter |

4c

4f

4g

4h

5

6

Part III Investment Interest Expense Deduction

7Disallowed investment interest expense to be carried forward to 2022. Subtract line 6 from line

|

3. If zero or less, enter |

7 |

|

8 |

Investment interest expense deduction. Enter the smaller of line 3 or line 6. See instructions . . |

8 |

|

For Paperwork Reduction Act Notice, see page 4. |

Cat. No. 13177Y |

Form 4952 (2021) |

|

THIS PAGE INTENTIONALLY LEFT BLANK

Form 4952 (2021) |

Page 3 |

Section references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about developments related to Form 4952 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form4952.

General Instructions

Purpose of Form

Use Form 4952 to figure the amount of investment interest expense you can deduct for 2021 and the amount you can carry forward to future years. Your investment interest expense deduction is limited to your net investment income.

For more information, see Pub. 550, Investment Income and Expenses.

Who Must File

If you are an individual, estate, or a trust, you must file Form 4952 to claim a deduction for your investment interest expense.

Exception. You don’t have to file Form 4952 if all of the following apply.

•Your investment income from interest and ordinary dividends minus any qualified dividends is more than your investment interest expense.

•You don’t have any other deductible investment expenses.

•You don’t have any carryover of disallowed investment interest expense from 2020.

Allocation of Interest Expense

If you paid or accrued interest on a loan and used the loan proceeds for more than one purpose, you may have to allocate the interest. This is necessary because different rules apply to investment interest, personal interest, trade or business interest, home mortgage interest, and passive activity interest. See Pub. 535, Business Expenses.

Specific Instructions

Part

Line 1

Enter the investment interest expense paid or accrued during the tax year, regardless of when you incurred the indebtedness. Investment interest expense is interest paid or accrued on a loan or part of a loan that is allocable to property held for investment (as defined later).

Include investment interest expense reported to you on Schedule

Investment interest expense doesn’t include any of the following.

•Personal interest under section 163(h), including qualified residence interest.

•Interest expense that is properly allocable to a passive activity. Generally, a passive activity is any trade or business activity in which you don’t materially participate and any rental activity. See the Instructions for Form 8582, Passive Activity Loss Limitations, for details.

•Any interest expense that is capitalized, such as construction interest subject to section 263A.

•Interest expense related to

section 265.

•Interest expense, disallowed under section 264, on indebtedness with respect to life insurance, endowment, or annuity contracts issued after June 8, 1997, even if the proceeds were used to purchase any property held for investment.

Property held for investment. Property held for investment includes property that produces income, not derived in the ordinary course of a trade or business, from interest, dividends, annuities, or royalties. It also includes property that produces gain or loss, not derived in the ordinary course of a trade or business, from the disposition of property that produces these types of income or is held for investment. However, it doesn’t include an interest in a passive activity.

Exception. A working interest in an oil or gas property that you held directly or through an entity that didn’t limit your liability is property held for investment, but only if you didn’t materially participate in the activity.

Part

Line 4a

Gross income from property held for investment includes income, unless derived in the ordinary course of a trade or business, from interest, ordinary dividends (except Alaska Permanent Fund dividends), annuities, and royalties. Include investment income reported to you on Schedule

Also include on line 4a (or 4d, if applicable) net passive income from a passive activity of a publicly traded partnership (as defined in section 469(k)(2)). See Regulations sections

Net income from certain passive activities, such as rental of substantially nondepreciable property, may have to be recharacterized and included on line 4a. For details, see Pub. 925, Passive Activity and

If you are filing Form 8814, Parents’ Election To Report Child’s Interest and Dividends, part or all of your child’s income may be included on line 4a. See the instructions for Form 8814 and Pub. 550 for details.

|

Don’t include on line 4a any net gain from the disposition of |

▲ |

|

! |

property held for investment. Instead, enter it on line 4d. |

CAUTION |

|

Line 4b

Enter the portion of ordinary dividends included on line 4a that are qualified dividends. For the definition of qualified dividends, see the instructions for Form 1040, line 3a (or Form 1041, line 2b).

Line 4d

Net gain from the disposition of property held for investment is the excess, if any, of your total gains over your total losses from the disposition of property held for investment. When figuring this amount, include capital gain distributions from mutual funds and capital loss carryovers.

Line 4e

Net capital gain from the disposition of property held for investment is the excess, if any, of your net

Capital gain distributions from mutual funds are treated as

Note: If line 4e is more than zero and you enter an amount on line 4g, see the Note in the line 4g instructions, later.

Line 4g

In general, qualified dividends and net capital gain from the disposition of property held for investment are excluded from investment income. But you can elect to include part or all of these amounts in investment income.

The qualified dividends and net capital gain that you elect to ▲! include in investment income on line 4g aren’t eligible to be

taxed at the qualified dividends or capital gains tax rates. CAUTION You should consider the tax effect of using the qualified

dividends and capital gains tax rates before making this election. Once made, the election can be revoked only with IRS consent.

To make the election, enter on line 4g the amount you elect to include in investment income (don’t enter more than the sum of lines 4b and 4e). Also enter this amount on whichever of the following applies.

•The Schedule D Tax Worksheet, line 3.

•Schedule D (Form 1041), line 25.

•The Qualified Dividends Tax Worksheet, line 3, in the Instructions for Form 1041.

If you file Form 1040 or

Instructions for Schedule D (Form 1040) to figure the amount to enter on Form 1040 or

1041 and enter amounts on lines 4e and 4g, use the Schedule D Tax Worksheet in the Instructions for Schedule D (Form 1041) to figure the amount to enter on Form 1041, Schedule G, line 1a.

Form 4952 (2021) |

Page 4 |

Don’t reduce the amount of qualified dividends on Form 1040 or

Note: The amount on line 4g is generally treated as being attributable first to net capital gain from property held for investment (line 4e), and then to qualified dividends (line 4b). This treatment results in the least tax being figured for Form 1040 or

Generally, you must make this election on a timely filed return, including extensions. However, if you timely filed your return without making the election, you can make the election on an amended return filed within 6 months of the due date of your return (excluding extensions). Write “Filed pursuant to section

Line 5

Investment expenses are your allowed deductions, other than interest expense, directly connected with the production of investment income. For example, depreciation or depletion allowed on assets that produce investment income is an investment expense.

Include investment expenses incurred directly by you or reported to you on Schedule

Investment expenses don’t include any deductions used in determining your income or loss from a passive activity.

Don’t include any miscellaneous itemized deductions, which ▲! aren’t allowed deductions in tax years beginning after

December 31, 2017, and before January 1, 2026.

CAUTION

Part

Line 8

Individuals. Generally, enter the amount from line 8 (excluding any amount included on Form 6198, line

to royalties, enter that part on Schedule E (Form 1040). Also, if any part of the interest is attributable to a trade or business that isn’t a passive activity, enter that part on the schedule where you report other expenses for that trade or business.

Estates and trusts. Enter the amount from line 8 (excluding any amount included on Form 6198, line

Form 6198. If any of your deductible investment interest expense is attributable to an activity for which you aren’t at risk, you must also use Form 6198,

Alternative minimum tax (AMT). Deductible interest expense may be an adjustment for the AMT. For details, see Form 6251, Alternative Minimum

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You aren’t required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for individual taxpayers filing this form is approved under OMB control number

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. See the instructions for the tax return with which this form is filed.

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Purpose | The IRS Form 4952 is used to calculate the amount of investment interest expense that can be deducted. |

| Who Needs to File | Individuals, estates, and trusts who have investment interest expenses need to file Form 4952. |

| Attachment Requirement | This form must be attached to the filer's tax return if they are claiming a deduction for investment interest expenses. |

| Deduction Limitations | The deduction is limited to the net investment income received in the taxable year. |

| Investment Interest Expense | Interest paid on loans used to purchase property held for investment qualifies as investment interest expense. |

| Calculation of Deductible Amount | Form 4952 calculates the deductible amount of investment interest expense after considering various adjustments. |

| Carryover Provision | If the deductible amount is not fully utilized in the current year, it may be carried over to future years. |

| Form Availability | The form is available on the Internal Revenue Service (IRS) website and can be downloaded for free. |

| Governing Law | Federal tax laws govern the use and requirements of IRS Form 4952. State-specific laws do not apply to this federal form. |

Guide to Writing IRS 4952

Once you've gathered all your investment records and you're ready to tackle your tax return, Form 4952 becomes essential if you're planning to deduct investment interest expenses. The process of filling out this form can be straightforward if you follow the steps carefully. This form helps you determine the amount of investment interest you can deduct, and it plays a crucial role in managing your taxable income. Here are the detailed steps you need to follow to accurately complete Form 4952.

- First, you'll need to enter your name and social security number at the top of the form. This step ensures that the form is matched correctly with your tax return.

- Next, calculate your total investment income. This includes interest, dividends, and certain other income types. Enter this amount in Line 1.

- On Line 2, you'll list any qualified dividends or net capital gain that you're electing to include as investment income. It's crucial to make this election carefully, as it can impact your tax liability.

- Line 3 requires you to add the amounts from Line 1 and Line 2, then enter the total.

- For Line 4, detail any investment expenses that are not interest expenses. Subtract these from the total on Line 3 and enter the result on Line 4.

- Line 5 is where you enter the total investment interest paid or accrued during the tax year. This information should be gathered from your financial records.

- If Line 4 is smaller than Line 5, enter the amount from Line 4 on Line 6. If not, enter the amount from Line 5 on Line 6. This determines your allowable investment interest expense deduction.

- Finally, any disallowed investment interest expenses, calculated as the difference between Line 5 and Line 6, should be entered on Line 7. This amount can be carried forward to next year's tax filing.

After completing Form 4952, you'll include the amount from Line 6 on the Schedule A of your tax return, if itemizing deductions. This process integrates the investment interest expense deduction into your overall tax calculations. If at any point you feel unsure about a particular section of the form, seeking advice from a tax professional can help ensure accuracy and compliance with IRS rules.

Understanding IRS 4952

-

What is IRS Form 4952, and why is it used?

IRS Form 4952 is used to calculate the amount of investment interest expense one can deduct on their federal income tax return. Investors who borrow money to purchase investment property might pay interest on the borrowed funds. This form helps determine how much of that interest is deductible, thereby potentially lowering the tax liability. The primary purpose is to limit the investment interest expense deduction to the net investment income earned in a given tax year.

-

Who needs to file Form 4952?

Individuals, estates, and trusts that have paid interest on debts related to investments and have received income from those investments usually need to file Form 4952. This is particularly relevant if you are seeking to deduct investment interest expenses on your tax return. If the total investment income is less than the investment interest expense, filing this form becomes essential to calculate the deductible amount accurately.

-

What information do you need to fill out Form 4952?

To complete Form 4952, several pieces of information are required:

- The amount of investment income.

- The amount of investment expenses (excluding interest expenses).

- The total amount of investment interest expense paid or accrued during the tax year.

- Details about the investments that generated income or were purchased with borrowed funds.

-

How does Form 4952 affect the deduction for investment interest expenses?

The primary goal of Form 4952 is to cap the deduction for investment interest expenses to the net amount of investment income received during the year. This means that if your investment interest expenses exceed your investment income, you can only deduct expenses up to the amount of your income on your tax return. However, the form also allows for the carryover of disallowed interest expenses to the next tax year, providing a potential future tax benefit.

-

Can investment interest expenses be carried over to future years?

Yes, if your investment interest expense in a given year exceeds your investment income, the unused portion of the interest expense can be carried forward to future years. This allows individuals to potentially deduct the carried-over interest in a subsequent year when their investment income may be higher, offering a strategic tax planning tool.

-

Are there any investments that do not qualify for the interest expense deduction?

Certain investments do not qualify for the interest expense deduction on Form 4952. Investments that produce tax-exempt income, such as stocks or bonds that pay exempt-interest dividends, are not eligible. Additionally, loans used for personal purposes unrelated to investments, or for the purchase of life insurance or annuities, are typically not eligible for the deduction.

-

Where and how do you file Form 4952?

Form 4952 should be attached to your tax return (Form 1040 or its equivalent for estates and trusts) and filed to the IRS. It is important to ensure that the form is accurately completed and includes all necessary documentation about your investment interest expenses and income. You may file this form electronically with your tax return or mail it if you are submitting a paper return. Consultation with a tax professional is recommended to ensure accuracy and compliance with IRS rules.

Common mistakes

When filling out the IRS Form 4952, which is used for determining the amount of investment interest expense you can deduct, many individuals make errors that can affect their tax situation. Awareness of these mistakes can help in avoiding them:

-

Not properly separating investment expenses from personal expenses: Individuals often fail to distinguish investment-related expenses from their personal expenses. This can lead to inaccurately claiming deductions, as only investment-related expenses are deductible on Form 4952.

-

Incorrectly calculating adjusted gross income (AGI): The calculation of the investment interest expense deduction is impacted by your AGI. Errors in AGI calculation can result in either underestimating or overestimating the deduction.

-

Failing to include all sources of investment income: It's crucial to account for all sources of investment income, such as dividends and interest, when filling out Form 4952. Omitting income can lead to claiming a higher deduction than allowed.

-

Not carrying forward unused investment interest: If you have more investment interest expense than income in a given year, you may carry over the unused portion to future years. Many individuals miss this opportunity by not properly carrying forward the unused interest.

-

Miscalculating investment interest expense: This is a common mistake due to the complexity of the calculations required. Using incorrect figures or misunderstanding the calculation process can significantly affect the deductible amount.

In addition, here are some general tips for avoiding these mistakes:

- Maintain clear records of investment income and expenses separately from personal finances.

- Ensure accuracy in calculating your AGI, as this affects your investment interest expense deduction.

- Include all investment income sources to accurately compute the deductible amount.

- Understand the rules for carrying forward unused investment interest to future tax years.

- Seek professional help if you are unsure about how to calculate your investment interest expense deduction.

Documents used along the form

When preparing to file taxes, especially when dealing with investment interest expense deductions, the IRS Form 4952 plays a crucial role. However, to provide a full picture and ensure accuracy in one’s tax filings, several other forms and documents may often be used in conjunction with IRS Form 4952. These help taxpayers, tax preparers, and advisors to systematically account for various aspects of income, deductions, and tax credits, ensuring compliance and optimizing one's tax return.

- Schedule A (Form 1040): This itemized deductions form is used to report various types of deductions beyond the standard deduction, including medical expenses, state and local taxes, and charitable contributions.

- Schedule B (Form 1040): Focused on interest and ordinary dividends, this document is essential for taxpayers who receive income from these sources above certain thresholds.

- Schedule D (Form 1040): It records capital gains and losses from the sale of financial assets, providing a detailed account that influences investment income and expenses.

- Form 1040: The main tax return form for individual taxpayers, its sections must be accurately completed to reflect income, deductions, and applicable credits.

- Form 8582: This form helps in reporting passive activity loss limitations, a critical part for investors in rental properties or partnerships who might have restrictions on claiming losses.

- Form 1099-INT: Issued by banks and other financial institutions, it summarizes the amount of interest earned from various sources, and is pivotal in filling out the 4952 form for investment interest expense deductions.

- Form 1099-DIV: Used to report dividends and distributions received during the tax year, it’s necessary for accurately completing schedules that pertain to investment income.

- Form 2848: Power of Attorney and Declaration of Representative, allows taxpayers to authorize an individual to represent them before the IRS, making it easier to manage tax filings that involve multiple forms and schedules.

In conclusion, while the IRS Form 4952 is a critical document for documenting investment interest expense deductions, it does not stand alone. A variety of other forms and documents are often required to ensure a comprehensive and compliant tax filing. By being aware of and understanding these additional requirements, taxpayers can better navigate the complexities of tax season, accurately report their financial activities, and potentially maximize their deductions and credits.

Similar forms

The IRS Form 4952, "Investment Interest Expense Deduction," is not an island unto itself in the sea of IRS paperwork. It shares traits with several other forms, one of which is IRS Form 1040, "U.S. Individual Income Tax Return." Similar to Form 4952, which is used to calculate the deductible amount of investment interest expense, Form 1040 requires taxpayers to report their income, deductions, and credits to determine the amount of tax they owe or the refund they are due. Both forms are integral in the personal tax filing process, though Form 4952 specifically deals with the nuances of investment income and expenses.

Another document close in kind to Form 4952 is IRS Form Schedule A (Form 1040), "Itemized Deductions." Like Form 4952, Schedule A is used for itemizing deductions that taxpayers wish to claim, which could include mortgage interest, charitable contributions, and large medical expenses, among others. The essence of both forms is to reduce the amount of taxable income by recognizing certain eligible expenses, albeit in different categories of personal finance.

IRS Form 8863, "Education Credits (American Opportunity and Lifetime Learning Credits)," is akin to Form 4952 in the sense that it provides a way to reduce tax liability by claiming allowable credits. While Form 4952 deals with investment interest, Form 8863 addresses the credits available for education expenses paid. Both forms support the principle of offering tax benefits for certain types of expenditures, though they target entirely different areas of an individual's financial life.

Similarly, IRS Form 8283, "Noncash Charitable Contributions," parallels Form 4952 in terms of itemizing and justifying deductions, but in this case, for donations of property rather than financial expenses. Users of Form 8283 must detail the value of property donated to charity to reduce their taxable income, just as users of Form 4952 calculate deductible investment interest. Each form helps taxpayers receive recognition for specific investments, whether in the form of contributions to charitable organizations or financial investments.

IRS Form 3468, "Investment Credit," also mirrors the essence of Form 4952, albeit focusing on credits rather than deductions. Form 3468 is designed for taxpayers to claim various investment credits for qualifying projects, such as rehabilitation, energy, or reforestation projects. Though the nature of benefits differs (credits vs. deductions), both forms aim to lessen the tax burden by acknowledging investments that align with certain policy goals, underpinning the value of investing in specific areas or activities.

Lastly, IRS Form 8582, "Passive Activity Loss Limitations," shares a conceptual connection with Form 4952 by addressing limitations on the deductions taxpayers can take. While Form 4952 calculates the allowable deduction for investment interest expenses, Form 8582 deals with losses from passive activities, potentially limiting what can be deducted based on the taxpayer's involvement and income levels. Both forms navigate the intricacies of what can and cannot be deducted, ensuring taxpayers only claim what is permitted under current tax laws.

Dos and Don'ts

Filling out IRS Form 4952, used for calculating investment interest expense deductions, can seem daunting at first. However, approaching it with a clear understanding of what to do and what to avoid can simplify the process. Below, you'll find key dos and don'ts that can help you accurately complete the form and stay compliant with IRS rules.

Do:

- Ensure you're eligible to deduct investment interest expenses. This deduction is only available if you have investment income to offset it.

- Accurately report all your investment income and expenses. Misreporting can lead to penalties or an audit.

- Use the correct form to accompany the 4952 if required, such as Schedule A (Form 1040) for itemized deductions.

- Double-check your calculations. Errors in calculation can lead to inaccuracies that may flag your return for review.

- Keep records of all the investments and expenses you're claiming. Documentation is key in case the IRS needs to verify your deduction.

- Seek professional advice if you're unsure about how to complete the form or if you have a complex investment situation.

Don't:

- Attempt to deduct non-investment interest expenses, such as personal loan interest or credit card interest not related to investments.

- Forget to include all sources of investment income, including taxable and tax-exempt interest, dividends, and any other qualifying income.

- Mix personal expenses with investment expenses. Only investment-related expenses are deductible on Form 4952.

- Leave sections of the form blank. If a section doesn't apply, fill in "0" or "N/A" to indicate it has been considered.

- Ignore the instructions. The IRS provides detailed instructions for Form 4952 that can answer many common questions and guide you through the process.

- Delay filing due to confusion over the form. If you're unsure, it's better to seek help than to file late or incorrectly.

Misconceptions

The IRS Form 4952, used for determining the amount of investment interest expense one can deduct, is often misunderstood. Below, let’s clarify some common misconceptions:

- Only for Wealthy Investors: Many assume Form 4952 is exclusively for wealthy individuals. However, it's applicable to any taxpayer who has incurred investment interest expenses, regardless of their wealth status.

- Complicated and Time-Consuming: Though it involves detailed calculations, with a systematic approach or professional assistance, taxpayers can correctly fill it out without it being overly time-consuming.

- Not Relevant for Small Investments: Even taxpayers with modest investments can benefit from this form if they have incurred investment interest expenses. It’s about the interest expense, not the size of the investment.

- Limited to Certain Types of Investments: Some believe Form 4952 is only for stocks or bonds. In reality, it covers a broader range of investment vehicles, as long as the interest expense is related to producing taxable income.

- Can Be Filed Separately: Form 4952 must be filed with your tax return and cannot be submitted independently at a later date. It’s an integral part of your annual tax filing if relevant.

- No Impact on State Taxes: The misconception here is that this form only affects federal taxes. However, depending on your state’s tax laws, the information from Form 4952 can also influence your state tax obligations.

- Only Benefits in the Current Tax Year: While it primarily impacts the current tax year, unused investment interest expenses can be carried forward. This means the benefits can extend into future tax years as well.

- Personal Loans Interest is Deductible: A common misunderstanding is that interest from personal loans used for investments is deductible with this form. Only interest on loans taken out specifically for investment purposes qualifies.

- Mandatory for All Investors: Not everyone who invests needs to file Form 4952. It’s only required if you’re taking a deduction for investment interest expenses against your investment income.

Understanding the facts about IRS Form 4952 is crucial for accurately reporting investment interest expenses and maximizing potential deductions. Taxpayers should review their individual situations or consult with a professional to ensure they comply with IRS requirements and take advantage of allowable deductions. Misconceptions can lead to overlooked opportunities or, conversely, unintended misreporting.

Key takeaways

The IRS 4952 form, officially titled "Investment Interest Expense Deduction," serves a specific role in the preparation of federal income tax returns. Its primary purpose is to allow investors to calculate the amount of investment interest expense they can deduct for the tax year. Understanding the nuances of this form can enhance tax-saving strategies for investors who finance their investments with borrowed money. Here are six key takeaways about filling out and using the IRS 4952 form.

- Determine eligibility first. Before diving into the IRS 4952 form, investors should ensure they're actually eligible to deduct investment interest expenses. This deduction is specifically available for the interest paid on money borrowed to purchase property held for investment. The first step is identifying if your investment interest expenses qualify.

- Gather all necessary information. Completing the form requires detailed financial records. These include the amount of interest paid, investment income, and the investment expenses related to generating investment income. Accuracy in gathering this data ensures the correct calculation of deductible interest.

- Understand the investment income limitation. The amount of investment interest expense you're allowed to deduct is limited to your net investment income. This stipulation prevents investors from claiming a deduction amount exceeding the income generated from their investments. Form 4952 provides a methodology for calculating this limitation.

- Know the carryover rule. If your investment interest expense exceeds your investment income, the IRS doesn't let this excess go to waste. Instead, you can carry over the unused portion to the next tax year. This carryover mechanism ensures that investors can potentially deduct the interest in future years when they have sufficient investment income.

- Electing to include qualified dividends and long-term capital gains. Taxpayers have the option to treat qualified dividends and long-term capital gains as investment income on the IRS 4952 form, which could increase the deductible amount of investment interest expense. However, this election comes with a trade-off, as these types of income are usually taxed at a lower rate than ordinary income. Carefully consider the implications of making this election on your overall tax strategy.

- Consult with a tax professional. The nuances of the IRS 4952 form and the tax code, in general, can be complex. Errors in filling out the form or misunderstanding the rules can lead to missed opportunities for deductions or potential disputes with the IRS. Seeking assistance from a tax professional can provide peace of mind and ensure that you're maximizing your deductible investment interest expense.

Popular PDF Documents

Tax Forms 2023 - Solicits taxpayer and spouse personal identification, including Social Security numbers for verification.

1120s K1 - S corporations rely on this form to report tax deductions related to health insurance, retirement plans, and other employee benefits.

Cancellation of Debt Insolvency - Insolvency analysis through detailed listings of immediate pre-cancellation liabilities and the fair market value of assets.