Get IRS 4852 Form

When it comes to filing taxes, receiving accurate and timely documentation from employers and financial institutions is crucial. However, there are instances where taxpayers may not receive their W-2 or 1099-R forms due to various reasons such as the documents being lost, not issued, or containing incorrect information. In such situations, the IRS Form 4852 serves as a substitute for these forms, allowing individuals to accurately report their earnings and taxes withheld. This form is designed to ensure that taxpayers can meet their filing obligations even in the absence of the standard documents. It requires individuals to estimate their wage and tax details, based on their best available information, which can include their final pay stub or other relevant financial records. The process of using Form 4852 involves potentially more scrutiny from the IRS, hence it's critical to provide thorough and accurate estimates. The form acts as a testament to the importance the IRS places on enabling taxpayers to adhere to their filing requirements, ensuring that missing or incorrect documentation does not impede the tax filing process.

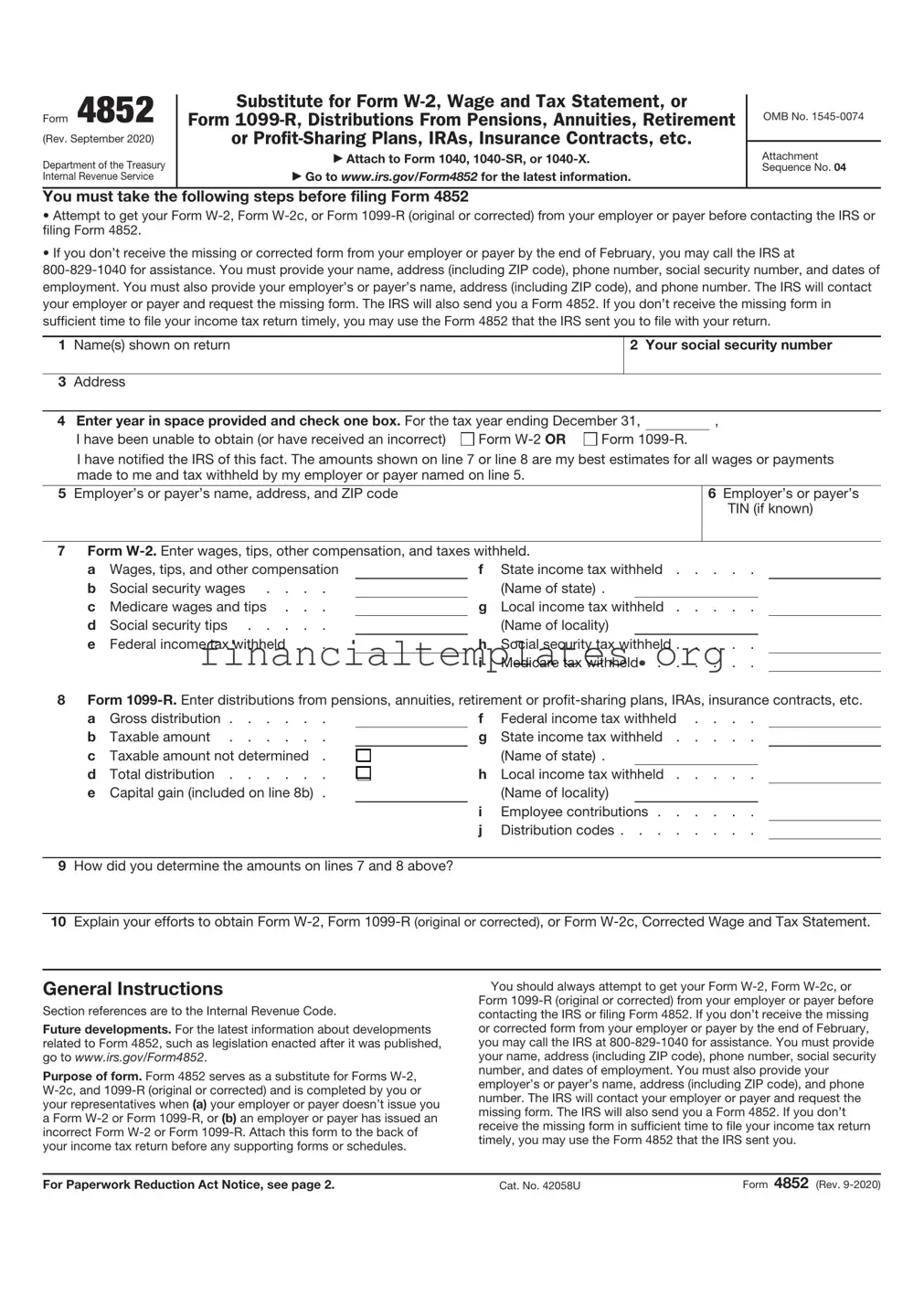

IRS 4852 Example

Form 4852

(Rev. September 2020)

Department of the Treasury Internal Revenue Service

Substitute for Form

Form

or

Attach to Form 1040,

Go to www.irs.gov/Form4852 for the latest information.

OMB No.

Attachment Sequence No. 04

You must take the following steps before filing Form 4852

•Attempt to get your Form

•If you don’t receive the missing or corrected form from your employer or payer by the end of February, you may call the IRS at

1Name(s) shown on return

3Address

2 Your social security number

4 Enter year in space provided and check one box. For the tax year ending December 31, |

|

, |

||

I have been unable to obtain (or have received an incorrect) |

Form |

Form |

|

|

I have notified the IRS of this fact. The amounts shown on line 7 or line 8 are my best estimates for all wages or payments made to me and tax withheld by my employer or payer named on line 5.

5Employer’s or payer’s name, address, and ZIP code

6Employer’s or payer’s TIN (if known)

7Form

a |

Wages, tips, and other compensation |

|

f |

State income tax withheld |

|

b |

Social security wages . . . . |

|

|

(Name of state) . |

|

c |

Medicare wages and tips . . . |

|

g |

Local income tax withheld |

|

d |

Social security tips |

|

|

(Name of locality) |

|

e |

Federal income tax withheld . . |

|

h |

Social security tax withheld |

|

|

|

|

i |

Medicare tax withheld |

|

8Form

a |

Gross distribution |

|

f |

Federal income tax withheld . . . . |

|

b |

Taxable amount |

|

g |

State income tax withheld |

|

c |

Taxable amount not determined . |

|

|

(Name of state) . |

|

d |

Total distribution |

|

h |

Local income tax withheld |

|

e |

Capital gain (included on line 8b) . |

|

|

(Name of locality) |

|

|

|

|

i |

Employee contributions |

|

|

|

|

j |

Distribution codes |

|

9How did you determine the amounts on lines 7 and 8 above?

10Explain your efforts to obtain Form

General Instructions

Section references are to the Internal Revenue Code.

Future developments. For the latest information about developments related to Form 4852, such as legislation enacted after it was published, go to www.irs.gov/Form4852.

Purpose of form. Form 4852 serves as a substitute for Forms

You should always attempt to get your Form

For Paperwork Reduction Act Notice, see page 2. |

Cat. No. 42058U |

Form 4852 (Rev. |

Form 4852 (Rev. |

Page 2 |

If you received an incorrect Form

Note: Retain a copy of Form 4852 for your records. To help protect your social security benefits, keep a copy of Form 4852 until you begin receiving social security benefits, just in case there is a question about your work record and/or earnings in a particular year. After September 30 following the date shown on line 4, you may use your Social Security online account to verify wages reported by your employers. Please visit www.SSA.gov/myaccount. Or, you may contact your local SSA office to verify wages reported by your employer.

Will I need to amend my return? If you receive a Form

Penalties. The IRS will challenge the claims of individuals who attempt to avoid or evade their federal tax liability by using Form 4852 in a manner other than as prescribed. Potential penalties for the improper use of Form 4852 include:

•

•Civil fraud penalties equal to 75% of the amount of taxes that should have been paid, and

•A $5,000 civil penalty for filing a frivolous return or submitting a specified frivolous submission as described by section 6702.

Specific Instructions

Lines 1 through 3. Enter your name, social security number, and current address including street, city, state, and ZIP code.

Line 4. Enter the year for which Form

Line 5. Enter your employer’s or payer’s name, address, and ZIP code.

Line 6. Enter your employer’s or payer’s taxpayer identification number (TIN), if known. If you had the same employer or payer in the prior year, use the employer identification number (EIN) shown on the prior year’s Form

Line

Line

Line 9. Explain how you determined the amounts on line 7 or 8. For example, tell us if you estimated the amounts, used your pay stubs, or used a statement reporting your distribution.

Line 10. Explain any attempts made to get the missing or corrected Form

Paperwork Reduction Act Notice. We ask for the information on Form 4852 to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The average time and expenses required to complete and file this form vary depending on individual circumstances. For the estimated averages, see the instructions for your income tax return.

If you have suggestions for making Form 4852 simpler, we would be happy to hear from you. See the instructions for your income tax return.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 4852 | This form serves as a substitute for Forms W-2, W-2c, and 1099-R, providing taxpayers an alternative way to report wages and withholding if they have not received these forms or received incorrect forms from their employers or payers. |

| When to Use Form 4852 | It is used when an individual has not received their W-2 or 1099-R form by the tax filing deadline or if the information on the received forms is incorrect and the payer has not issued a corrected form. |

| IRS Guidelines | The Internal Revenue Service (IRS) advises taxpayers to attempt to obtain the missing or corrected forms from their employer or payer before resorting to Form 4852. If those attempts are unsuccessful, Form 4852 may be filed with the taxpayer's return. |

| Submission Process | Form 4852 should be attached to the taxpayer's income tax return and submitted either by mail or electronically, depending on the taxpayer's filing method. |

| Required Information | Taxpayers must provide an estimate of their wages and taxes withheld, based on their pay stubs or other employment records. |

| Impact on Tax Filing | Using Form 4852 may delay the processing of the taxpayer's return and any refund due. The IRS may also need to verify the information, which could require additional time. |

| Correction of Form 4852 | If a taxpayer receives the missing or corrected W-2 or 1099-R after filing Form 4852, they may need to amend their tax return if the new information changes their tax liability. |

| Governing Law | Form 4852 is governed by federal tax law, as it is a standardized form used across the United States for federal income tax reporting purposes. |

| State-Specific Versions | There are no state-specific versions of Form 4852. However, taxpayers should be aware of their state's requirements for reporting income and withholding information, as they may need to contact their state tax agency for guidance on how to proceed without a W-2 or 1099-R. |

Guide to Writing IRS 4852

When filling out the IRS 4852 form, it's crucial to remember that this form serves as a substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., when the employer or payer has not provided one, or when the provided form is incorrect. Completing this form accurately is essential for ensuring the correct reporting of your income and taxes to the Internal Revenue Service (IRS). Follow these steps carefully to fill out the form correctly.

- Begin by gathering all necessary information about your wages and withholding for the tax year in question. This could include pay stubs, bank statements, or other records if your employer has not provided a W-2 or 1099-R form.

- On the form, enter your name, social security number, and address in the designated sections.

- Specify the tax year that the form corresponds to in the space provided.

- Enter your employer’s or payer's name, address, and identification number if available. If not, provide as much information as possible to help the IRS identify the entity.

- Fill in the amount of wages, salaries, tips, or other compensation you received during the year in question. Use your records to estimate these figures as accurately as possible.

- Report the amount of federal income tax withheld. Again, refer to your pay records or last pay statement to estimate if necessary.

- If applicable, fill in the sections concerning social security wages, Medicare wages, and any social security or Medicare tax withheld. This is important for ensuring the correct calculation of your social security and Medicare benefits.

- Explain in the designated area why the form is being filed instead of the W-2 or 1099-R and why these were not attached. This includes detailing the efforts made to obtain the required document from your employer or payer.

- Sign and date the form to certify that the information provided is accurate to the best of your knowledge.

After completing the IRS 4852 form, attach it to your tax return and file it according to the instructions for your specific tax situation. Submitting this form allows you to accurately report your income and taxes withheld even in the absence or error of the standard forms. The IRS may contact you or your employer to verify the information provided, so ensure everything is accurate and that you have documentation to support your claims. By following these steps, you can navigate this process smoothly and fulfill your tax obligations appropriately.

Understanding IRS 4852

-

What is an IRS Form 4852?

IRS Form 4852 serves as a substitute for Forms W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., when the employer or payer has not provided one, or the provided form is incorrect. This form allows you to estimate wage and withholding information to report on your federal tax return.

-

When should you use Form 4852?

You should use Form 4852 if you have not received your Form W-2 or Form 1099-R by the tax filing deadline or if the information provided on the forms is incorrect and your employer or payer has not issued a corrected form. It's important first to attempt to obtain the correct form from your employer or payer before resorting to Form 4852.

-

How do you fill out Form 4852?

- Start by entering your name, social security number, and the year for which you're filing the form.

- Indicate whether the form is being used as a substitute for Form W-2 or Form 1099-R.

- Provide estimates of your wages, tips, and other compensation, along with federal income tax withheld. For a substitute for Form 1099-R, estimate the total distribution and the taxable amount.

- Explain how you determined these amounts and any efforts made to obtain the correct forms from your employer or payer.

Attach Form 4852 to your federal tax return, placing it in front of your Form 1040 or other tax return form.

-

What are the potential consequences of using Form 4852?

Using Form 4852 may delay your refund, as the IRS might need to verify the information you provided. In some cases, this can lead to an audit if the IRS requires further proof to substantiate the income and withholding amounts reported. Always ensure that the estimates provided on Form 4852 are as accurate as possible to minimize potential issues.

Common mistakes

Filling out the IRS Form 4852, which serves as a substitute for Form W-2 or Form 1099-R, requires attention to detail and a thorough understanding of the information being requested. Unfortunately, mistakes can occur, leading to potential processing delays and issues with tax returns. Here are four common mistakes to avoid:

Incorrect Information: Taxpayers sometimes enter incorrect information, such as the Social Security number, employer identification number (EIN), or amounts related to wages and taxes. This can stem from simple human error or misreading documentation. It's critical to double-check all entries against your records.

Failure to Contact the Employer: The IRS requires that individuals make attempts to obtain their original W-2 or 1099-R forms from their employer before using Form 4852. Skipping this step and going straight to the substitute form without making a proper effort to contact the employer can result in complications or delays with your tax processing.

Estimating Figures Without Documentation: While it might be tempting to estimate income and withholding if exact figures aren't readily available, this approach can lead to inaccurate tax calculations. The IRS advises taxpayers to base these numbers on their final pay stub or other solid documentation, rather than making rough guesses.

Not Attaching Explanation: Forgetting to attach a detailed explanation of why Form 4852 is being filed and how the information was obtained can raise red flags. This explanation helps the IRS understand the context and verify the accuracy of the data provided. Lack of this can slow down the processing of your tax return.

By avoiding these errors and proceeding with caution, taxpayers can better ensure that their use of Form 4852 is correct and that their tax return will be processed smoothly.

Documents used along the form

When dealing with taxes, especially if there's a need to correct or substitute W-2 or 1099 forms, the IRS 4852 form is a critical document. Essentially, it serves as a stand-in for these forms when they're incorrect, not received, or lost. However, to complete your tax return accurately and to support the information reported on Form 4852, other forms and documents may become equally important. Here's a look at some of these additional documents that often accompany Form 4852, providing a more comprehensive approach to managing your tax obligations.

- IRS Form 1040: This is the standard federal income tax form used to report an individual's gross income. It's the main form used by individuals to file their annual income tax returns. Form 1040 works alongside Form 4852 to correct income and tax withholding amounts previously reported incorrectly.

- W-2 Form: The very document your Form 4852 seeks to replace or correct, the W-2, outlines your annual wages and the amount of taxes withheld from your paycheck. It's crucial for verifying the information you provide on Form 4852 if discrepancies arise.

- 1099 Form: Similar to the W-2 but for independent contractors and freelancers, the 1099 form reports income from sources other than salaried employment. It's another document that can serve as a reference point when filling out Form 4852, especially if the substitute is for a 1099 form.

- IRS Form 2848: This form grants a certified individual, like a tax attorney or CPA, the authority to represent you before the IRS. It may be necessary to involve a professional when navigating complicated tax situations involving Form 4852.

- Last Year’s Tax Return: While not a form in its own right, last year's tax return can provide an invaluable reference point for comparison and verification purposes when attempting to estimate incomes and withholdings accurately for Form 4852.

Filing your taxes can often feel like weaving through a complex labyrinth of forms and regulations. While Form 4852 plays a critical role in ensuring your tax information is accurate, the supplementary documents listed above are essential tools in your arsenal for a complete and correct tax filing. By understanding the role each document plays, you can navigate the tax season with greater certainty and ease, ensuring you remain in good standing with the IRS.

Similar forms

The IRS Form 4852 is a document individuals use as a substitute for Forms W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., when the original documents haven't been received or contain incorrect information. This form allows taxpayers to estimate their wages or distributions and the amount of taxes withheld, so they can accurately complete their tax returns.

Similar to the IRS Form 4852 is the IRS Form 1040, U.S. Individual Income Tax Return. Both are integral to the tax filing process, with the former providing a way to report estimated wage and withholding information in the absence of standard documents, and the latter serving as the primary method for individuals to file their annual income taxes. The Form 1040 relies on accurate income information, which can be provided by Form 4852 when necessary.

The IRS Form 1099-MISC, Miscellaneous Income, parallels Form 4852 in that it also reports income to taxpayers, specifically income that doesn't fit the categories of traditional wages or salary. While Form 4852 serves as a substitute to provide estimates when standard documents are not available, Form 1099-MISC supplies detailed information about various types of income, ranging from rental income to prize winnings, directly to the taxpayer and the IRS.

W-2 Forms share a close relationship with Form 4852, as the latter is directly used as a substitute when the former cannot be obtained or contains errors. The W-2 is essential for reporting an employee's annual wages and the amount of taxes withheld by their employer. When this information is missing or incorrect, taxpayers turn to Form 4852 to fill in the gaps and ensure their tax returns are complete.

Form 8888, Direct Deposit of Refund, although different in its primary function, shares a similar end goal with Form 4852: to expedite and ensure the accuracy of the tax return process. Form 8888 allows taxpayers to allocate their refunds directly into multiple accounts, while Form 4852 ensures that taxpayers can accurately report their income and withholding, even in the absence of standard documentation.

The IRS Form 4506-T, Request for Transcript of Tax Return, is somewhat analogous to Form 4852 in its supplementary role in the tax filing process. Form 4506-T is used to request past tax return information, which can be crucial for verifying income and tax payments in situations where original documentation has been lost or is unavailable—much in the way Form 4852 stands in for missing W-2 or 1099-R documents.

Lastly, the IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), compares to Form 4852 by offering a method to claim specific tax benefits without standard documentation. While Form 8863 helps taxpayers claim education-related expenses for credits, Form 4852 assists in estimating income and taxes withheld when the usual documents are not received or are incorrect, thus maintaining the integrity of the taxpayer's return.

Dos and Don'ts

When filling out the IRS Form 4852, which serves as a substitute for Form W-2 or Form 1099-R, certain practices should be followed to ensure accuracy and compliance with IRS requirements. Attention to detail can prevent processing delays or issues with your tax return. Below are things you should and shouldn't do when completing this form.

Do:- Double-check the accuracy of your Social Security Number (SSN) and Employer Identification Number (EIN) to prevent mismatches or processing delays.

- Estimate your wages and taxes as accurately as possible, using your final pay stub or other relevant documentation if you do not have your original W-2 or 1099-R form.

- Contact your employer first to request a copy of your missing W-2 or 1099-R before deciding to use Form 4852 as a substitute.

- Attach Form 4852 to your tax return and file it by the tax filing deadline to avoid penalties for late filing.

- Explain the efforts made to obtain your original W-2 or 1099-R forms and why those efforts were unsuccessful, in the space provided on the form.

- Keep copies of all documents used in preparing Form 4852 and your tax return for your records.

- Don't guess your income and withholding figures; use your last paystub or contact your employer/payroll department for accurate information.

- Don't file Form 4852 before attempting to contact your employer or the IRS for assistance in obtaining a missing W-2 or 1099-R form.

- Don't leave any required fields blank. If a field does not apply, enter "N/A" or "0," as appropriate.

- Don't forget to sign and date your tax return and Form 4852; an unsigned form may delay processing.

- Don't disregard IRS instructions for attaching additional documentation, if necessary, to support your estimates on Form 4852.

- Don't ignore IRS notices or communications requesting additional information about your Form 4852 or tax return.

Misconceptions

The IRS 4852 form often comes wrapped in misconceptions. Understanding the truth behind these common myths can help individuals navigate their tax situations more effectively. Here's a breakdown of six widespread misunderstandings:

- Form 4852 can replace any tax document. This is not accurate. The IRS Form 4852 is specifically a substitute for Forms W-2, 1098, 1099-R, and W-2G, not for other tax documents. It's used when the issuer has not provided the original form or the information on the issued form is incorrect.

- You can file Form 4852 anytime before your tax return. Actually, this form should only be used if you have not received the correct form by the tax filing deadline or after you have made substantial efforts to obtain the correct form from the issuer.

- Filing Form 4852 will delay your refund for months. While it's possible that the use of Form 4852 can lead to additional review time, it doesn't necessarily mean your refund will be delayed for months. The IRS handles each case individually, and processing times can vary.

- The IRS provides the information needed to complete Form 4852. The responsibility to accurately estimate wages and taxes lies with the taxpayer, not the IRS. You need to use your final pay stub or other accurate financial records to complete the form.

- Using Form 4852 automatically triggers an audit. This is a common fear but not necessarily true. Filing Form 4852 does require the IRS to pay closer attention to your return, but it does not automatically lead to an audit. Ensuring the information you provide is as accurate as possible is crucial.

- There’s no deadline for submitting Form 4852. You must submit Form 4852 with your tax return by the tax filing deadline (usually April 15) or by the extended filing date if you have requested an extension. Filing late can lead to penalties and interest on any taxes you owe.

Key takeaways

Filing taxes accurately is crucial to ensure compliance with U.S. tax laws. When taxpayers encounter issues receiving their W-2 or 1099-R forms, the IRS Form 4852 serves as a substitute. Understanding its use and requirements is vital. Here are key takeaways for filling out and using the IRS Form 4852:

- Contact the employer or payer first if you do not receive your W-2 or 1099-R forms. The IRS Form 4852 is a last resort after all efforts to obtain the original documents have failed.

- Accuracy is paramount when recreating your wage and tax information on Form 4852. Utilize your final pay stub or other concrete documentation to ensure the information provided matches your records.

- The IRS may require proof of attempts to obtain your missing forms and any documents used to fill out Form 4852, such as contact with your employer or payer.

- Be prepared for potential processing delays. Filing a substitute form like the 4852 can slow down the processing of your tax return and any refund due.

- If you receive the missing W-2 or 1099-R form after filing with a 4852 and the information differs, you must amend your tax return using Form 1040-X.

- Understand that the IRS will verify the information on Form 4852 with your employer or payer. Discrepancies can lead to further inquiries or audits.

- Filing Form 4852 requires a detailed explanation of how earnings, taxes, and withholdings were determined, including the method for calculating these figures.

- Using Form 4852 does not exempt taxpayers from tax deadlines. Ensure you file your return by the deadline, even if you must use this substitute form.

- Electronic filing of your tax return is still available when using Form 4852. However, some tax preparation software may require manual input for this form.

- Stay informed about your rights and responsibilities. The IRS provides resources and assistance for taxpayers who are unsure about using Form 4852 or who have specific questions about their tax situation.

Approaching the task of filing your tax return with missing documentation can be daunting. However, Form 4852 provides a legitimate pathway to fulfilling your tax obligations. Always seek clarity and assistance when needed to navigate this process smoothly.

Popular PDF Documents

IRS 4868 - Using Form 4868 responsibly involves accurately estimating taxes owed and paying any amount due to avoid interest charges.

Budget Loan - Instructions on the application process, emphasizing the importance of providing complete and accurate information, are provided.