Get IRS 4797 Form

The intricacies of navigating the United States tax system can often be daunting for individuals and businesses alike, particularly when it comes to the disposal or sale of property. One critical piece of this complex puzzle is the IRS 4797 form, an essential document for reporting the sale or exchange of business or investment property. This form plays a pivotal role in determining how the profit or loss from such transactions is taxed, thereby influencing an entity's overall tax liability. It requires detailed information about the property sold, including the sale price, the original cost, and any depreciation claimed. This information helps in calculating the gain or loss from the sale, which can significantly impact one's tax return. Additionally, the form distinguishes between types of gains—ordinary or capital—each of which is subject to different tax rates, further underscoring its importance in the tax filing process. Understanding the nuances of the IRS 4797 form is crucial for individuals and enterprises alike to ensure compliance with tax laws and to optimize their tax outcomes.

IRS 4797 Example

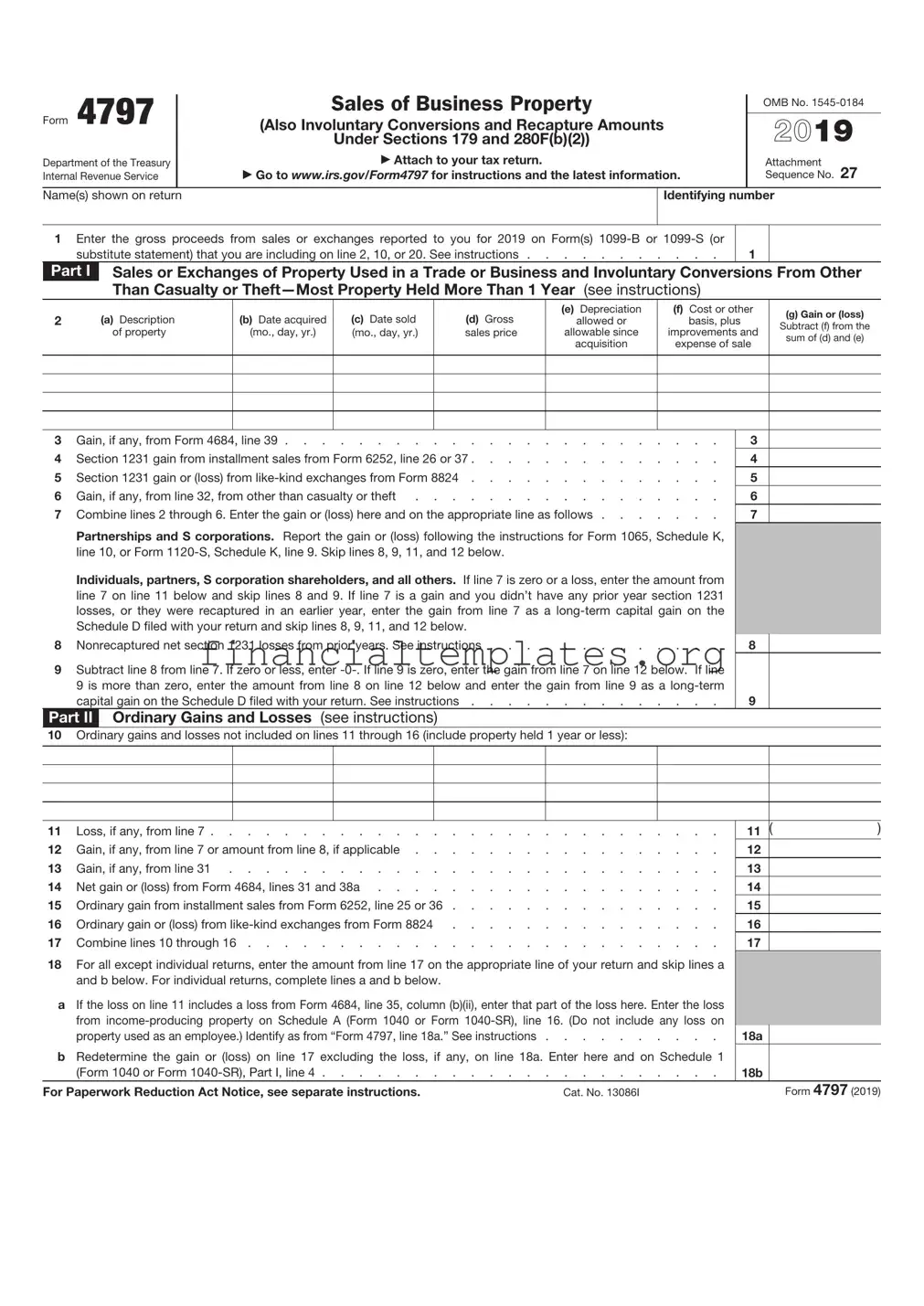

Form 4797 |

|

Sales of Business Property |

|

OMB No. |

||

|

|

|||||

|

|

|

|

|||

|

|

|

|

|

|

|

|

(Also Involuntary Conversions and Recapture Amounts |

|

2021 |

|||

|

|

Under Sections 179 and 280F(b)(2)) |

|

|||

Department of the Treasury |

|

▶ Attach to your tax return. |

|

Attachment |

27 |

|

Internal Revenue Service |

|

▶ Go to www.irs.gov/Form4797 for instructions and the latest information. |

|

Sequence No. |

||

|

|

|

|

|

|

|

Name(s) shown on return |

|

|

Identifying number |

|

||

|

|

|

|

|

||

1a Enter the gross proceeds from sales or exchanges reported to you for 2021 on Form(s) |

|

|

|

|||

substitute statement) that you are including on line 2, 10, or 20. See instructions |

1a |

|

||||

bEnter the total amount of gain that you are including on lines 2, 10, and 24 due to the partial dispositions of

MACRS assets |

1b |

cEnter the total amount of loss that you are including on lines 2 and 10 due to the partial dispositions of MACRS

assets |

. . . . |

1c |

|

|||||

Part I |

Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other |

|||||||

|

Than Casualty or |

|

|

|||||

2 |

(a) Description |

(b) Date acquired |

(c) Date sold |

(d) Gross |

(e) Depreciation |

(f) Cost or other |

(g) Gain or (loss) |

|

allowed or |

basis, plus |

|

||||||

|

Subtract (f) from the |

|||||||

|

of property |

(mo., day, yr.) |

(mo., day, yr.) |

sales price |

allowable since |

improvements and |

||

|

sum of (d) and (e) |

|||||||

|

|

|

|

|

acquisition |

expense of sale |

||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Gain, if any, from Form 4684, line 39 |

3 |

4 |

Section 1231 gain from installment sales from Form 6252, line 26 or 37 |

4 |

5 |

Section 1231 gain or (loss) from |

5 |

6 |

Gain, if any, from line 32, from other than casualty or theft |

6 |

7 |

Combine lines 2 through 6. Enter the gain or (loss) here and on the appropriate line as follows |

7 |

|

Partnerships and S corporations. Report the gain or (loss) following the instructions for Form 1065, Schedule K, |

|

|

line 10, or Form |

|

|

Individuals, partners, S corporation shareholders, and all others. If line 7 is zero or a loss, enter the amount |

|

|

from line 7 on line 11 below and skip lines 8 and 9. If line 7 is a gain and you didn’t have any prior year section |

|

|

1231 losses, or they were recaptured in an earlier year, enter the gain from line 7 as a |

|

|

Schedule D filed with your return and skip lines 8, 9, 11, and 12 below. |

|

8 |

Nonrecaptured net section 1231 losses from prior years. See instructions |

8 |

9Subtract line 8 from line 7. If zero or less, enter

capital gain on the Schedule D filed with your return. See instructions |

9 |

Part II Ordinary Gains and Losses (see instructions)

10Ordinary gains and losses not included on lines 11 through 16 (include property held 1 year or less):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

Loss, if any, from line 7 |

11 |

( |

) |

|||||

12 |

Gain, if any, from line 7 or amount from line 8, if applicable |

12 |

|

|

|||||

13 |

Gain, if any, from line 31 |

13 |

|

|

|||||

14 |

Net gain or (loss) from Form 4684, lines 31 and 38a |

14 |

|

|

|||||

15 |

Ordinary gain from installment sales from Form 6252, line 25 or 36 |

15 |

|

|

|||||

16 |

Ordinary gain or (loss) from |

16 |

|

|

|||||

17 |

Combine lines 10 through 16 |

17 |

|

|

|||||

18For all except individual returns, enter the amount from line 17 on the appropriate line of your return and skip lines a and b below. For individual returns, complete lines a and b below.

aIf the loss on line 11 includes a loss from Form 4684, line 35, column (b)(ii), enter that part of the loss here. Enter the loss from

employee.) Identify as from “Form 4797, line 18a.” See instructions |

18a |

bRedetermine the gain or (loss) on line 17 excluding the loss, if any, on line 18a. Enter here and on Schedule 1

(Form 1040), Part I, line 4 |

18b |

|

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 13086I |

Form 4797 (2021) |

Form 4797 (2021) |

|

|

|

Page 2 |

|||

Part III |

Gain From Disposition of Property Under Sections 1245, 1250, 1252, 1254, and 1255 |

|

|||||

|

|

(see instructions) |

|

|

|

|

|

19 |

(a) |

Description of section 1245, 1250, 1252, 1254, or 1255 property: |

|

(b) Date acquired |

(c) Date sold |

||

|

(mo., day, yr.) |

(mo., day, yr.) |

|||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

These columns relate to the properties on lines 19A through 19D. |

Property A |

Property B |

Property C |

Property D |

||

|

▶ |

|

|

|

|||

20 |

Gross sales price (Note: See line 1a before completing.) . |

|

20 |

|

|

|

|

21 |

Cost or other basis plus expense of sale |

|

21 |

|

|

|

|

22 |

Depreciation (or depletion) allowed or allowable . . . |

|

22 |

|

|

|

|

23 |

Adjusted basis. Subtract line 22 from line 21. . . . |

|

23 |

|

|

|

|

24 |

Total gain. Subtract line 23 from line 20 |

24 |

|

|

|

||

25 |

If section 1245 property: |

|

|

|

|

||

a |

Depreciation allowed or allowable from line 22 . . . |

|

25a |

|

|

|

|

b |

Enter the smaller of line 24 or 25a |

25b |

|

|

|

||

26If section 1250 property: If straight line depreciation was used, enter

a Additional depreciation after 1975. See instructions . |

26a |

bApplicable percentage multiplied by the smaller of line

24 or line 26a. See instructions |

26b |

cSubtract line 26a from line 24. If residential rental property

|

or line 24 isn’t more than line 26a, skip lines 26d and 26e |

26c |

d |

Additional depreciation after 1969 and before 1976. . |

26d |

e |

Enter the smaller of line 26c or 26d |

26e |

f |

Section 291 amount (corporations only) |

26f |

g |

Add lines 26b, 26e, and 26f |

26g |

27If section 1252 property: Skip this section if you didn’t dispose of farmland or if this form is being completed for a partnership.

a |

Soil, water, and land clearing expenses |

27a |

b |

Line 27a multiplied by applicable percentage. See instructions |

27b |

c |

Enter the smaller of line 24 or 27b |

27c |

28 |

If section 1254 property: |

|

aIntangible drilling and development costs, expenditures for development of mines and other natural deposits,

|

mining exploration costs, and depletion. See instructions |

28a |

b |

Enter the smaller of line 24 or 28a |

28b |

29 |

If section 1255 property: |

|

a |

Applicable percentage of payments excluded from |

|

|

income under section 126. See instructions . . . . |

29a |

b |

Enter the smaller of line 24 or 29a. See instructions . |

29b |

Summary of Part III Gains. Complete property columns A through D through line 29b before going to line 30.

30 |

Total gains for all properties. Add property columns A through D, line 24 |

30 |

31 |

Add property columns A through D, lines 25b, 26g, 27c, 28b, and 29b. Enter here and on line 13 |

31 |

32Subtract line 31 from line 30. Enter the portion from casualty or theft on Form 4684, line 33. Enter the portion from

|

other than casualty or theft on Form 4797, line 6 |

. . . . . . |

|

32 |

||

Part IV |

Recapture Amounts Under Sections 179 and 280F(b)(2) When Business Use Drops to |

50% or Less |

||||

|

|

(see instructions) |

|

|

|

|

|

|

|

|

(a) Section |

(b) Section |

|

|

|

|

179 |

|

280F(b)(2) |

|

33 |

|

|

|

|

|

|

Section 179 expense deduction or depreciation allowable in prior years |

|

33 |

|

|

||

34 |

Recomputed depreciation. See instructions |

|

34 |

|

|

|

35 |

Recapture amount. Subtract line 34 from line 33. See the instructions for where to report . . |

35 |

|

|

||

Form 4797 (2021)

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 4797 is used to report the sale or exchange of business property, including real estate used in a trade or business, as well as Section 1231 gains and losses. |

| Form Users | This form is primarily utilized by individuals, partnerships, corporations, and estates or trusts involved in the sale or exchange of business property. |

| Required Sections | Form 4797 requires details about the type of property sold, date of acquisition and sale, sales price, and the cost or adjusted basis of the property, among other financial details. |

| Link to IRS Instructions | The IRS provides detailed instructions for completing Form 4797 on its official website, guiding taxpayers on how to accurately report their transactions. |

| Associated Schedules | Sales of depreciable property must be detailed in Part III of Form 4797, while Part I is used for reporting the sales of property held more than one year. |

| Governing Law | Form 4797 filing requirements are governed by the Internal Revenue Code (IRC) and its regulations, which dictate the taxation of gains and losses from the sale of property used in a trade or business. |

Guide to Writing IRS 4797

When engaging in transactions involving the sale or exchange of property used in a trade or business, taxpayers are required to report these transactions to the Internal Revenue Service (IRS) using Form 4797. This form is crucial for accurately calculating the gain or loss from such transactions, which ultimately affects the taxpayer's income tax. The aim here is to guide you through the meticulous process of filling out IRS Form 4797, step by step, ensuring clarity and compliance with the tax regulations. This guide is designed to simplify the process, making it more approachable for individuals who may not have extensive experience with tax forms.

- Begin by gathering all necessary documents related to the sale or exchange of the business property. This includes sale price, original purchase price, improvements made, and any depreciation claimed on the property.

- Access the latest version of IRS Form 4797 from the IRS website. Ensure you have the correct tax year's form.

- Enter your name and taxpayer identification number (usually your Social Security number) at the top of the form.

- In Part I, if applicable, report sales of property held for one year or less. List each property in a separate line, including:

- Description of the property

- Date acquired and sold

- Sales price

- Cost or other basis plus improvements

- Depreciation allowed or allowable

- Gain or (loss)

- Part II should be used for sales of property held more than one year. Follow a similar process as in Part I, providing detailed information for each property sold.

- In Part III, calculate the gain or loss from involuntary conversions and certain other dispositions not reported elsewhere on the form.

- Use Part IV to reconcile amounts reported elsewhere on your tax return and schedules. This includes calculating the net gain or loss for the year from all sales and exchanges of business property.

- After completing the form, review all information to ensure accuracy. Incorrect or incomplete forms can lead to processing delays or potential audits.

- Attach Form 4797 to your tax return. If you have more than one Form 4797, summarize the totals from all forms and report this on your tax return as instructed.

- Lastly, submit your tax return by the filing deadline (typically April 15) to avoid any penalties or interest charges for late filing.

By carefully following these steps, you can confidently complete IRS Form 4797, ensuring that your tax return accurately reflects your transactions involving business properties. Remember, it's important to keep thorough records of all business transactions, as these will be invaluable not only for tax purposes but also for managing your business's financial health. Should you encounter complexities or uncertainties in filling out the form, seeking advice from a tax professional can provide both guidance and peace of mind.

Understanding IRS 4797

What is IRS Form 4797 used for?

IRS Form 4797 is used by taxpayers to report the sale or exchange of business property, the involuntary conversion of business property, and the recapture of amounts under Section 179 or certain other sections. This form allows taxpayers to calculate their gain or loss from these transactions and report it on their tax returns. It's pertinent for properties that were used in a trade or business, as well as the sale of depreciable property and real estate used in business, excluding inventory.

Who needs to file IRS Form 4797?

Individuals, partnerships, corporations, trusts, and estates should file Form 4797 if they have engaged in the sale, exchange, or involuntary conversion of business or investment property not held primarily for sale to customers in the ordinary course of trade or business. This includes sales or exchanges of machinery, land, buildings, and equipment used in a trade or business. Moreover, taxpayers who have to recapture depreciation previously taken under Section 179 or applicable sections also need to file this form.

What are the key sections of IRS Form 4797?

- Part I: Sales or Exchanges of Business Property - This section is for reporting sales, exchanges, or involuntary conversions of property used in a trade or business and held for more than one year.

- Part II: Ordinary Gains and Losses - This part is used for reporting transactions that resulted in gains and losses treated as ordinary rather than capital.

- Part III: Gains from Dispositions of Property Held More Than 1 Year - Here, taxpayers report gains (not losses) from the sale of property held more than one year that isn’t reported elsewhere.

- Part IV: Recapture Amounts Under Sections 179 and 280F(b)(2) When Business Use Drops to 50% or Less - This part is for reporting certain recapture amounts when business property usage drops to 50% or less.

How does filing IRS Form 4797 affect tax obligations?

Filing IRS Form 4797 can affect a taxpayer's obligations in several ways. If a gain is reported on the form, it can lead to an increase in taxable income, which may result in a higher tax liability. Conversely, reporting a loss could reduce taxable income, potentially leading to a lower tax bill. It's important to note that the treatment of gains or losses (as ordinary or capital) will also impact the tax rate applied. Additionally, recapture of depreciation could result in ordinary income rather than capital gain, which is often taxed at a higher rate.

Where can taxpayers find help for completing IRS Form 4797?

Taxpayers looking for assistance with IRS Form 4797 can find resources through several avenues. The IRS offers instructions for Form 4797 that detail how to compute and report gains and losses. Taxpayers can also seek help from tax professionals, such as certified public accountants (CPAs) or tax attorneys, who have experience with business transactions and tax law. Additionally, various tax preparation software is designed to help taxpayers complete Form 4797 correctly, ensuring all necessary information is accurately reported to the IRS.

Common mistakes

When it comes to dealing with taxes, specifically the Internal Revenue Service (IRS) Form 4797, which is used for reporting the sale or exchange of business property, even minor mistakes can lead to significant headaches. Properly completing this form is crucial because it affects how much you may owe in taxes or what you may receive back. Here are four common mistakes people often make during this process:

Not correctly classifying property - Often, individuals mistakenly classify property, not understanding the distinctions between types of properties such as depreciable business property, real estate used in a business, and other investment properties. This misclassification can lead to incorrect tax calculations and potential audits.

Failing to report all sales or exchanges - Some may overlook or choose not to report smaller transactions, thinking they might be inconsequential. However, all sales or exchanges of business property must be included on Form 4797 to ensure full compliance with IRS rules and avoid penalties.

Incorrectly calculating gain or loss - Calculating gains or losses can be tricky, especially when dealing with depreciation recapture or figuring out the basis of sold property. Incorrect calculations can either lead to paying more tax than necessary or underreporting income, which could result in penalties.

Not utilizing professional help when needed - Given the complexity of tax laws and the potential for costly mistakes, many individuals would benefit from professional guidance when completing Form 4797. Failing to seek help when it's needed can result in errors that could have been avoided.

Avoiding these mistakes not only aids in maintaining compliance with tax laws but also ensures you are not overpaying on taxes or facing unnecessary scrutiny from the IRS. When in doubt, consulting with a tax professional can provide clarity and peace of mind.

Documents used along the form

Completing and filing IRS Form 4797 is a critical step for many taxpayers, particularly those involved in the sale or exchange of business or income-producing property. However, to accurately and thoroughly comply with the tax reporting requirements, individuals often need to gather and complete additional forms and documents. These supplementary materials provide essential details and help in calculating gains or losses, ensuring comprehensive tax compliance.

- Schedule D (Form 1040) - Utilized to summarize capital gains and losses from investments or the sale of property. It works hand-in-hand with Form 4797 for certain transactions.

- Form 1040 - The U.S. Individual Income Tax Return is central for individuals, including details of income, deductions, and credits.

- Form 4562 - Used for reporting depreciation and amortization. Critical for taxpayers who need to report the depreciation of property sold, detailed on Form 4797.

- Form 6252 - Necessary for reporting income from an installment sale. This form helps calculate the installment sale income included in the current year’s income, affecting Form 4797 calculations.

- Form 8824 - For reporting like-kind exchanges. Essential when the sale or exchange reported on Form 4797 involves property obtained through a like-kind exchange.

- Schedule C (Form 1040) - Pertains to profit or loss from a business. It's relevant when the sale of property reported on Form 4797 is part of a business’s assets.

- Schedule E (Form 1040) - Used for reporting income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

- Form 8949 - Required for reporting sales and other dispositions of capital assets not reported directly on Schedule D or Form 4797. It helps in detailing individual transactions.

- Form 1065 - For partnerships to report income, deductions, gains, losses, etc. It’s relevant when the asset sold or exchanged is held by a partnership.

Each of these documents plays a vital role in ensuring that taxpayers accurately report and account for their income, expenses, and capital transactions to the IRS. For anyone dealing with the complexities of business or income-producing property sales, it is crucial to understand how these forms interact and support the information reported on Form 4797. Seeking guidance from a tax professional can help navigate these requirements, ensuring compliance and potentially optimizing tax outcomes.

Similar forms

The IRS 4797 form, devoted to reporting gains and losses from the sale or exchange of business property, bears similarity to several other tax documents, each with its distinct purpose yet interconnected in how they handle asset transactions and taxation. One closely related document is the Schedule D (Form 1040), focused primarily on capital gains and losses from the sale of investments or assets held for personal use. While Schedule D captures a broader spectrum of capital assets, the IRS 4797 zeroes in on business assets, delineating a clear boundary yet sharing the common ground of reporting gains and losses.

Another document akin to the IRS 4797 is Form 4562, Depreciation and Amortization. This form is essential for businesses to claim depreciation on property, delineating the wear and tear or gradual loss in value of business assets over time. Whereas the IRS 4797 deals with the actual sale or disposition of assets, Form 4562 addresses the decrease in value of such assets while still in use by the business. Both forms are integral in managing business assets' lifecycle, from acquisition through depreciation to eventual sale or disposal.

Form 8949, Sales and Other Dispositions of Capital Assets, also shares similarities with IRS 4797, as it is utilized for reporting sales and exchanges of capital assets not held for business purposes. Although it caters primarily to personal asset transactions, it operates in a parallel manner to IRS 4797 by requiring detailed information about each transaction to ensure accurate tax computation. Both forms play pivotal roles in ensuring individuals and businesses alike report their transactions comprehensively, supporting the overarching structure of capital gains taxation.

The Schedule E (Form 1040), Supplemental Income and Loss, is yet another document with connections to the IRS 4797, though it focuses on reporting income and losses from rental property, royalties, partnerships, S corporations, estates, and trusts. Despite its broader scope, Schedule E intersects with the IRS 4797 in situations where rental properties or assets held for income production are sold, necessitating a detailed account of such transactions for tax purposes. This shared focus on asset disposition underscores the nuanced relationships between different types of income and their tax implications.

Lastly, Form 8824, Like-Kind Exchanges, parallels the IRS 4797 by dealing with a specific type of asset disposition—trading business or investment assets without immediate tax implications. Both forms necessitate a thorough understanding of the assets involved, their value, and any recognized gains or losses, albeit Form 8824 is nuanced towards deferring tax through like-kind exchanges. Together, they underscore the complex nature of tax law as it applies to asset transactions, offering pathways for recognizing or deferring gains and losses within the tax system.

Dos and Don'ts

Filling out IRS Form 4797, which pertains to the sale of business property, can be complex and requires careful attention. To ensure accuracy and compliance with IRS regulations, there are specific actions you should take, as well as pitfalls to avoid. Here's a guide to assist you:

Do's:

- Review the IRS instructions for Form 4797 carefully. Before you begin filling out the form, make sure to read the detailed instructions provided by the IRS. This will help you understand which transactions need to be reported and how to correctly report them.

- Correctly categorize your property. It is crucial to identify the correct type of property being sold (e.g., real estate, depreciable property) and to report it in the appropriate section of the form. This ensures accurate calculation of gains or losses.

- Keep detailed records of the property's original cost and any improvements. Accurate records are necessary to calculate the basis of the property sold. This includes the original purchase price, plus any costs for improvements and less any depreciation claimed.

- Consult with a tax professional if you have questions. Given the complexity of tax laws and potential changes, seeking advice from a qualified tax advisor can help you avoid mistakes and maximize your tax benefits.

Don'ts:

- Overlook reporting any sale of business property. Regardless of whether the sale resulted in a gain or loss, you must report all transactions involving business property. Failing to do so can result in penalties and interest.

- Miscalculate your gain or loss. Accurate calculation is essential. This involves subtracting the property's basis from the sale price. Errors here can lead to incorrect tax liabilities being reported.

- Forget to report recapture income. For certain types of property, such as depreciable real estate, you may need to "recapture" previously claimed depreciation as taxable income upon sale. Neglecting this can lead to underreporting of income.

- Ignore state tax implications. While IRS Form 4797 focuses on federal tax obligations, selling business property can also have state tax consequences. Ensure you understand and comply with any applicable state tax filing requirements.

Misconceptions

The Internal Revenue Service (IRS) Form 4797 is an essential document for reporting the sale of business property. However, there are several misconceptions surrounding it that can lead to confusion. Clarifying these misconceptions is vital for individuals and businesses to ensure they comply with tax regulations effectively.

Only tangible property sales must be reported: A common misconception is that Form 4797 is only for reporting the sale of tangible property, like vehicles or machinery. However, it also covers intangible assets such as patents or copyrights when these are held for business use. Including both tangible and intangible assets ensures comprehensive reporting.

It’s only for large businesses: Some people believe that only large businesses need to file Form 4797. In reality, any taxpayer, including sole proprietors, small business owners, and even individuals who sell or exchange property used in a trade or business, should file Form 4797 if applicable. Size does not exempt a business from this requirement.

Personal property sales are always included: Another misunderstanding is that all personal property sales must be reported on Form 4797. This form is specifically for property used in a trade or business. Sales of personal property not used in your business do not go on this form but may need to be reported elsewhere, depending on the situation.

Losses aren’t important: Some taxpayers might think that only gains from the sale of business property need to be reported. However, losses are just as important and must be reported on Form 4797. Reporting losses can have a significant impact on your tax liability, potentially lowering it.

Gains are taxed as ordinary income: It's a common misconception that all gains reported on Form 4797 are taxed as ordinary income. The reality is more complex. Depending on the type of property and how long it was held, some gains may be subject to capital gains tax rates, which can be lower than ordinary income tax rates. It’s crucial to understand the nature of your gains to apply the correct tax treatment.

Understanding these misconceptions can prevent costly errors when filing taxes. Proper reporting on Form 4797 is a critical component of tax compliance for individuals and businesses dealing with the sale or exchange of business property. Always consult with a tax professional to ensure accurate and complete tax filings.

Key takeaways

Understanding and completing the IRS Form 4797, "Sales of Business Property," can seem daunting at first. This form is crucial for reporting the sale or exchange of property used in a trade or business. Below are key takeaways to guide you through the process with clarity and confidence.

- Know When to Use It: IRS Form 4797 is specifically for reporting the sale or exchange of business property, including real estate, equipment, and vehicles used in your business. It's also used for involuntary conversions and the disposition of noncapital assets.

- Identify the Property Type: Before filling out Form 4797, determine the type of property you're reporting. Different sections of the form apply to different types of property, such as Section 1231 property, which can receive beneficial tax treatment.

- Record the Sale Date and Price: Accurately report the date the property was sold and the gross proceeds from the sale. This information is crucial for calculating gain or loss correctly.

- Calculate Your Basis: Your basis in the property is essentially what you've invested in it, adjusted for factors like depreciation and improvements. This figure is key to determining your gain or loss from the sale.

- Understand Depreciation Recapture: If you've claimed depreciation on the property, you might have to "recapture" that benefit upon sale, meaning it's taxed as ordinary income. Form 4797 helps you figure out how much of the sale price is subject to recapture.

- Separate Ordinary Income from Capital Gain: One of Form 4797's main functions is to separate income that should be taxed as ordinary income from income that qualifies for capital gains treatment, which often has a lower tax rate.

- Attach to Your Tax Return: After filling out Form 4797, attach it to your tax return. The results from Form 4797 can affect your overall tax liability, so integrating it with your Form 1040 is crucial.

- Keep Detailed Records: Always keep thorough records of the property's purchase price, improvements, depreciation, and sale. This documentation will be invaluable if you need to support your reported figures on Form 4797.

While IRS Form 4797 may seem complex, breaking it down step by step can simplify the process. Properly reported, the sale or exchange of business property can have significant tax implications that benefit your financial landscape.

Popular PDF Documents

Estate Tax Kentucky - Form 92A200 is necessary for estates transferring assets to taxable beneficiaries, ensuring compliance with Kentucky's inheritance tax laws.

W 3 Form - Businesses must retain a copy of the W-3 form for at least four years, ensuring that records are available in case of audits.