Get IRS 4684 Form

When an unexpected disaster strikes, it doesn't just leave physical damage in its wake but also financial turmoil. Navigating this upheaval can be daunting, especially when it comes to recouping losses through your tax return. This is where the IRS 4684 form becomes crucial. It serves as a vital tool for individuals and businesses to report casualties, thefts, and losses on personal and income-producing property. Understanding how to properly fill out and submit this form is essential for those seeking to claim deductions for property damage or loss due to events that are sudden, unexpected, or unusual. Whether it's damage from a natural disaster or loss from theft, the IRS 4684 form is designed to provide taxpayers a pathway to recover some of their losses by reducing their taxable income. Our guide aims to walk you through the critical aspects of this form, including eligibility requirements, the distinction between different types of losses, and step-by-step instructions for completing and filing the form with the IRS.

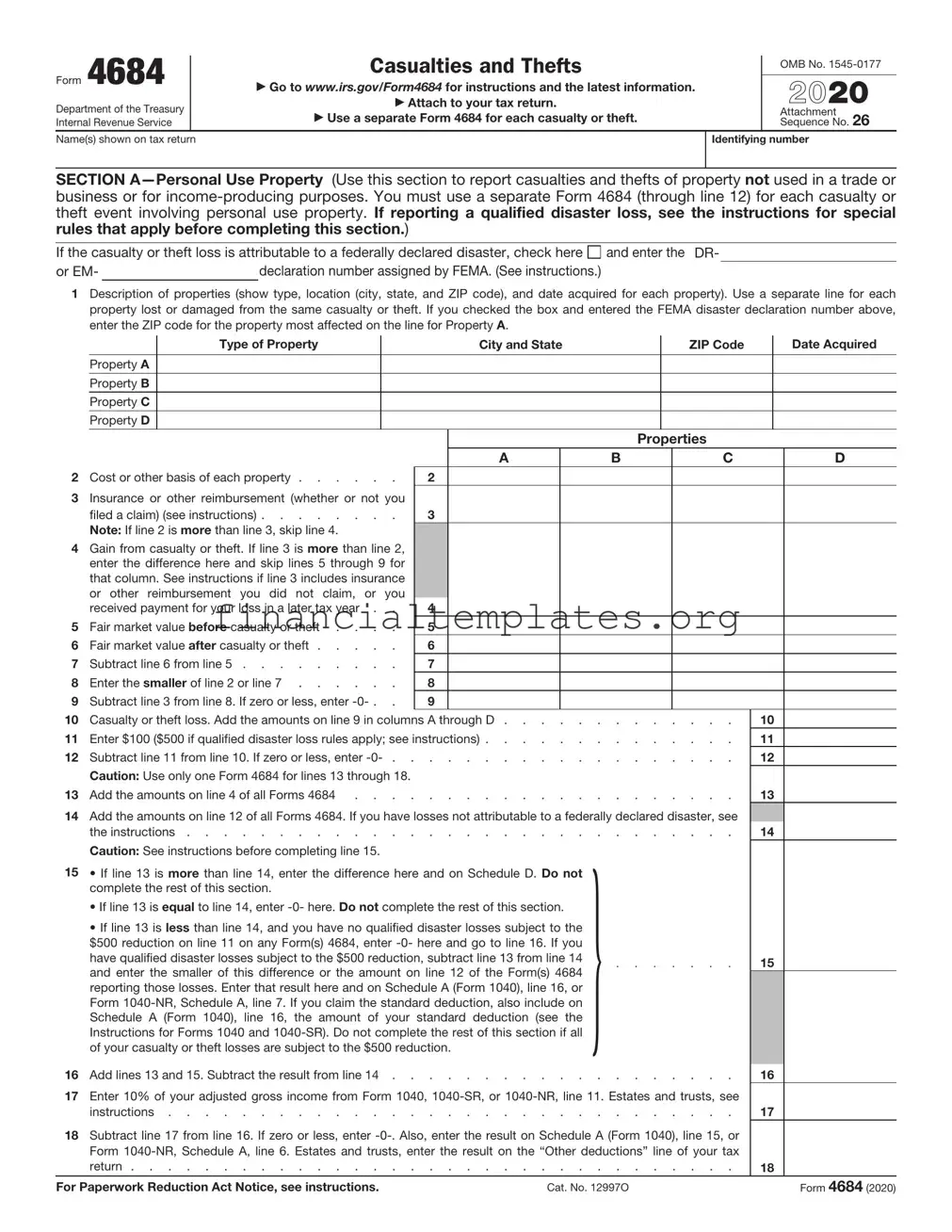

IRS 4684 Example

Form 4684 |

|

Casualties and Thefts |

|

OMB No. |

|

|

|||

|

|

|

||

|

|

|

|

|

|

▶ Go to www.irs.gov/Form4684 for instructions and the latest information. |

|

2021 |

|

Department of the Treasury |

|

▶ Attach to your tax return. |

|

|

|

▶ Use a separate Form 4684 for each casualty or theft. |

|

Attachment |

|

Internal Revenue Service |

|

|

Sequence No. 26 |

|

Name(s) shown on tax return |

|

Identifying number |

||

|

|

|

|

|

SECTION

If the casualty or theft loss is attributable to a federally declared disaster, check here and enter the DR- |

|

or EM- |

|

|

declaration number assigned by FEMA. (See instructions.) |

|

|

|

|

1Description of properties (show type, location (city, state, and ZIP code), and date acquired for each property). Use a separate line for each property lost or damaged from the same casualty or theft. If you checked the box and entered the FEMA disaster declaration number above, enter the ZIP code for the property most affected on the line for Property A.

Type of Property |

City and State |

ZIP Code |

Date Acquired |

Property A

Property B

Property C

Property D

Properties

A |

B |

C |

D |

2 Cost or other basis of each property |

2 |

3Insurance or other reimbursement (whether or not you

filed a claim) (see instructions) |

3 |

Note: If line 2 is more than line 3, skip line 4. |

|

4Gain from casualty or theft. If line 3 is more than line 2, enter the difference here and skip lines 5 through 9 for that column. See instructions if line 3 includes insurance

|

or other reimbursement you did not claim, or you |

|

|

|

|

|

|

|

received payment for your loss in a later tax year . . |

|

4 |

|

|

|

|

5 |

Fair market value before casualty or theft . . . . |

|

5 |

|

|

|

|

6 |

Fair market value after casualty or theft |

|

6 |

|

|

|

|

7 |

Subtract line 6 from line 5 |

|

7 |

|

|

|

|

8 |

Enter the smaller of line 2 or line 7 |

|

8 |

|

|

|

|

9 |

Subtract line 3 from line 8. If zero or less, enter |

|

9 |

|

|

|

|

10 |

Casualty or theft loss. Add the amounts on line 9 in columns A through D |

10 |

|

||||

11 |

Enter $100 ($500 if qualified disaster loss rules apply; see instructions) |

11 |

|

||||

12 |

Subtract line 11 from line 10. If zero or less, enter |

. . . . . . . . . . . . . . . . . |

12 |

|

|||

|

Caution: Use only one Form 4684 for lines 13 through 18. |

|

|

|

|

|

|

13 |

Add the amounts on line 4 of all Forms 4684 . . . . |

. . . . . . . . . . . . . . . . . |

13 |

|

|||

14 |

Add the amounts on line 12 of all Forms 4684. If you have losses not attributable to a federally declared disaster, see |

|

|

||||

|

the instructions |

. . . . . . . . . . . . . . . . . |

14 |

|

|||

|

Caution: See instructions before completing line 15. |

|

} |

|

|

|

|

|

|

|

|

|

|||

15 |

• If line 13 is more than line 14, enter the difference here and on Schedule D. Do not |

|

|

|

|||

|

complete the rest of this section. |

|

|

|

|

||

|

• If line 13 is equal to line 14, enter |

|

|

|

|||

|

• If line 13 is less than line 14, and you have no qualified disaster losses subject to the |

|

|

|

|||

|

$500 reduction on line 11 on any Form(s) 4684, enter |

|

|

|

|||

|

have qualified disaster losses subject to the $500 reduction, subtract line 13 from line 14 |

. . . . . . . |

15 |

|

|||

|

and enter the smaller of this difference or the amount on line 12 of the Form(s) 4684 |

|

|||||

|

|

|

|

||||

|

reporting those losses. Enter that result here and on Schedule A (Form 1040), line 16; or |

|

|

|

|||

|

Schedule A (Form |

|

|

|

|||

|

Schedule A (Form 1040), line 16, the amount of your standard deduction (see the |

|

|

|

|||

|

Instructions for Form 1040). Do not complete the rest of this section if all of your |

|

|

|

|||

|

casualty or theft losses are subject to the $500 reduction. |

|

|

|

|

||

16 |

Add lines 13 and 15. Subtract the result from line 14 . . |

. . . . . . . . . . . . . . . . . |

16 |

|

|||

17Enter 10% of your adjusted gross income from Form 1040,

instructions |

17 |

18Subtract line 17 from line 16. If zero or less, enter

Schedule A (Form |

18 |

|

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 12997O |

Form 4684 (2021) |

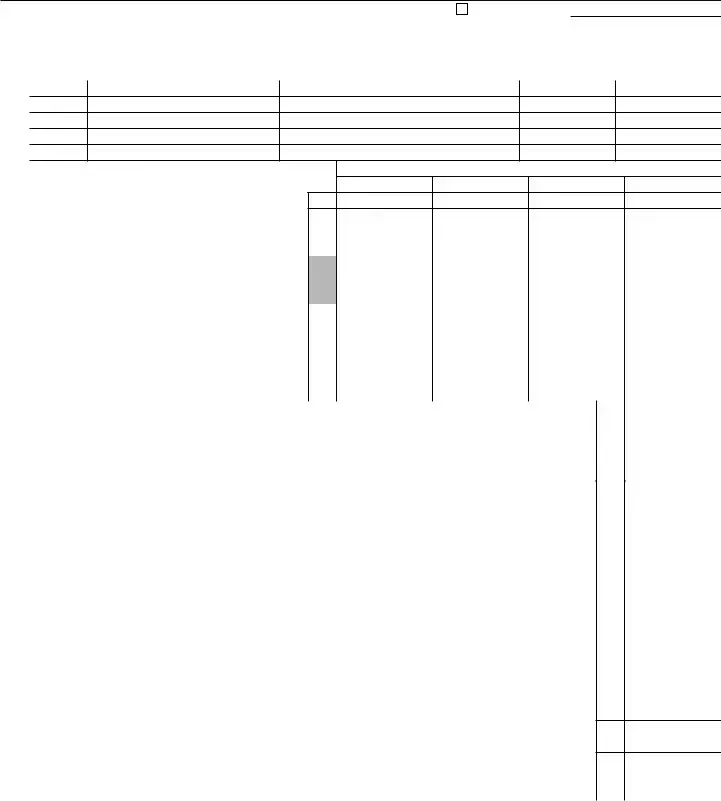

Form 4684 (2021) |

Attachment Sequence No. 26 |

Page 2 |

Name(s) shown on tax return. Do not enter name and identifying number if shown on other side. |

Identifying number |

|

SECTION

Part I Casualty or Theft Gain or Loss (Use a separate Part l for each casualty or theft.)

19Description of properties (show type, location, and date acquired for each property). Use a separate line for each property lost or damaged from the same casualty or theft. See instructions if claiming a loss due to a

Property A Property B Property C Property D

Properties

A |

B |

C |

D |

20 Cost or adjusted basis of each property |

20 |

21Insurance or other reimbursement (whether or not you

filed a claim). See the instructions for line 3 . . . . |

|

21 |

|

Note: If line 20 is more than line 21, skip line 22. |

|

|

|

|

|

|

|

22Gain from casualty or theft. If line 21 is more than line 20, enter the difference here and on line 29 or line 34, column (c), except as provided in the instructions for line 33. Also, skip lines 23

|

through 27 for that column. See the instructions for line 4 if line |

|

|

|

|

|

|

|

|

|

|

|

||

|

21 includes insurance or other reimbursement you did not |

|

|

|

|

|

|

|

|

|

|

|

||

|

claim, or you received payment for your loss in a later tax year |

|

22 |

|

|

|

|

|

|

|

|

|

|

|

23 |

Fair market value before casualty or theft . . . . |

|

23 |

|

|

|

|

|

|

|

|

|

|

|

24 |

Fair market value after casualty or theft |

|

24 |

|

|

|

|

|

|

|

|

|

|

|

25 |

Subtract line 24 from line 23 |

|

25 |

|

|

|

|

|

|

|

|

|

|

|

26 |

Enter the smaller of line 20 or line 25 |

|

26 |

|

|

|

|

|

|

|

|

|

|

|

|

Note: If the property was totally destroyed by casualty or |

|

|

|

|

|

|

|

|

|

|

|

||

|

lost from theft, enter on line 26 the amount from line 20. |

|

|

|

|

|

|

|

|

|

|

|

||

27 |

Subtract line 21 from line 26. If zero or less, enter |

|

27 |

|

|

|

|

|

|

|

|

|

|

|

28 |

Casualty or theft loss. Add the amounts on line 27. Enter the total here and on line 29 or line 34. See instructions . |

. |

|

28 |

|

|

||||||||

Part II |

Summary of Gains and Losses (from separate Parts l) |

|

|

(b) Losses from casualties or thefts |

|

|

(c) Gains from |

|||||||

|

|

|

|

|

|

|

|

(i) Trade, business, |

(ii) |

Income- |

|

|

casualties or thefts |

|

|

|

(a) Identify casualty or theft |

|

|

|

|

rental, or royalty |

|

|

includible in income |

||||

|

|

|

|

|

|

producing property |

|

|||||||

|

|

|

|

|

|

|

|

property |

|

|

|

|

|

|

|

|

Casualty or Theft of Property Held One Year or Less |

|

|

|

|

|

|

||||||

29 |

|

|

|

|

|

|

( |

) |

( |

|

|

|

) |

|

|

|

|

|

|

|

|

( |

) |

( |

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

30 |

Totals. Add the amounts on line 29 |

. . . . . |

30 |

( |

) |

( |

|

|

|

) |

|

|||

31Combine line 30, columns (b)(i) and (c). Enter the net gain or (loss) here and on Form 4797, line 14. If Form 4797 is

not otherwise required, see instructions . . . . . . . . . . . . . . . . . . . . . . .

32Enter the amount from line 30, column (b)(ii), here. Individuals, enter the amount from

Casualty or Theft of Property Held More Than One Year

31

32

33 |

|

Casualty or theft gains from Form 4797, line 32 |

33 |

|

||||

34 |

|

|

|

( |

) |

( |

) |

|

|

|

|

|

( |

) |

( |

) |

|

|

|

|

|

|

|

|

|

|

35 |

|

Total losses. Add amounts on line 34, columns (b)(i) and (b)(ii) |

35 |

( |

) |

( |

) |

|

36 |

|

Total gains. Add lines 33 and 34, column (c) |

36 |

|

||||

37 |

|

Add amounts on line 35, columns (b)(i) and (b)(ii) |

37 |

|

||||

38 |

|

If the loss on line 37 is more than the gain on line 36: |

|

|

|

|

|

|

|

a Combine line 35, column (b)(i), and line 36, and enter the net gain or (loss) here. Partnerships and S corporations, see |

|

|

|||||

|

|

the Note below. All others, enter this amount on Form 4797, line 14. If Form 4797 is not otherwise required, see |

|

|

||||

|

|

38a |

||||||

|

|

instructions |

||||||

|

b Enter the amount from line 35, column (b)(ii), here. Individuals, enter the amount from |

|

|

|||||

|

|

Schedule A (Form 1040), line 16; or Schedule A (Form |

|

|

||||

|

|

an employee.) Estates and trusts, enter on the “Other deductions” line of your tax return. Partnerships and S |

|

|

||||

|

|

38b |

||||||

|

|

corporations, see the Note below |

||||||

39If the loss on line 37 is less than or equal to the gain on line 36, combine lines 36 and 37 and enter here. Partnerships,

see the Note below. All others, enter this amount on Form 4797, line 3 |

39 |

Note: Partnerships, enter the amount from line 38a, 38b, or 39 on Form 1065, Schedule K, line 11. |

|

S corporations, enter the amount from line 38a or 38b on Form |

|

Form 4684 (2021)

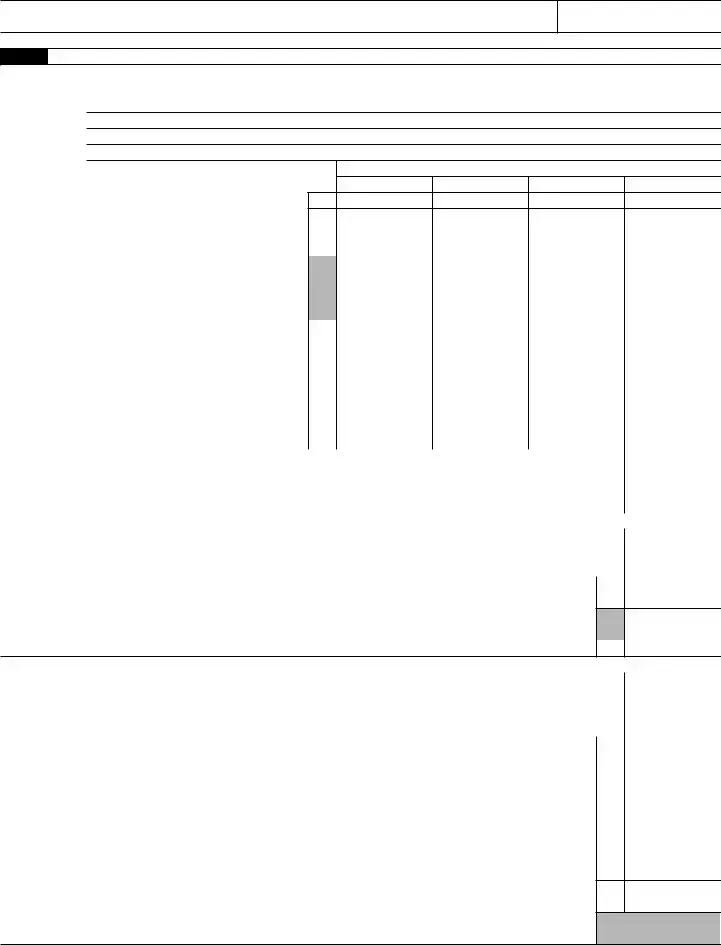

Form 4684 (2021) |

Attachment Sequence No. 26 |

Page 3 |

Name(s) shown on tax return |

|

Identifying number |

SECTION

Part I |

Computation of Deduction |

|

|

|

||

40 |

Initial investment |

40 |

|

|

||

41 |

Subsequent investments (see instructions) |

41 |

|

|

||

42 |

Income reported on your tax returns for tax years prior to the discovery year |

|

|

|

||

|

(see instructions) |

. . . . . . . . . . . . . . . . . . . . . . |

42 |

|

|

|

43 |

Add lines 40, 41, and 42 |

43 |

|

|

||

44 |

Withdrawals for all years (see instructions) |

44 |

|

|

||

45 |

Subtract line 44 from line 43. This is your total qualified investment |

45 |

|

|

||

46 |

Enter 0.95 (95%) if you have no potential |

|

|

|

||

|

potential |

46 |

. |

|

||

47 |

Multiply line 46 by line 45 |

47 |

|

|

||

48 |

Actual recovery |

48 |

|

|

||

49 |

Potential insurance/Securities Investor Protection Corporation (SIPC) recovery . . . . |

49 |

|

|

||

50 |

Add lines 48 and 49. This is your total recovery |

50 |

|

|

||

51 |

Subtract line 50 from line 47. This is your deductible theft loss. Include this amount on line |

|

|

|

||

|

28 of Section B, Part I. Do not complete lines |

|

|

|

||

|

Part II |

51 |

|

|

||

Part II |

Required Statements and Declarations (See instructions.) |

|

|

|

||

•I am claiming a theft loss deduction pursuant to Revenue Procedure

Name of individual or entity

Taxpayer identification number (if known) Address

•I have written documentation to support the amounts reported in Part I of this Section C.

•I am a qualified investor, as defined in section 4.03 of Revenue Procedure

•If I have determined the amount of my theft loss deduction using 0.95 on line 46 above, I declare that I have not pursued and do not intend to pursue any potential

•I agree to comply with the conditions and agreements set forth in Revenue Procedure

•If I have already filed a return or amended return that does not satisfy the conditions in section 6.02 of Revenue Procedure

Form 4684 (2021)

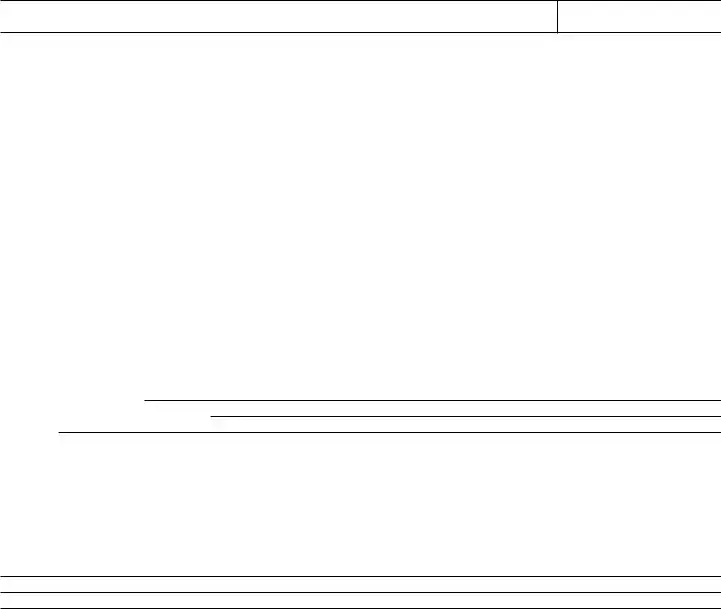

Form 4684 (2021) |

Attachment Sequence No. 26 |

Page 4 |

Name(s) shown on tax return |

|

Identifying number |

SECTION

Part I Election Statement

By providing all of the information below, the taxpayer elects, under section 165(i) of the Internal Revenue Code, to deduct a loss attributable to a federally declared disaster and that occurred in a federally declared disaster area in the tax year immediately preceding the tax year the loss was sustained.

Attach this Section D to your return or amended return for the tax year immediately preceding the tax year the loss was sustained to claim the disaster loss deduction.

52Provide the name or a description of the federally declared disaster.

53Provide the date or dates (mm/dd/yyyy) of the loss or losses attributable to the federally declared disaster.

54Specify the address, including the city or town, county or parish, state, and ZIP code where the damaged or destroyed property was located at the time of the disaster.

Part II Revocation of Prior Election

By providing all of the information below, the taxpayer revokes the prior election under section 165(i) of the Internal Revenue Code to deduct a loss attributable to a federally declared disaster and that occurred in a federally declared disaster area in the tax year immediately preceding the tax year the loss was sustained.

Attach this Section D to your amended return for the tax year immediately preceding the tax year the loss was sustained to remove the previous disaster loss deduction.

55Provide the name or a description of the federally declared disaster and the address of the property that was damaged or destroyed and for which the election was claimed.

56Specify the date (mm/dd/yyyy) you filed the prior election, which you are now revoking. (See instructions and note that new rules went into effect on October 13, 2016.)

57Enclose your payment or otherwise provide evidence for, or explanation of, your arrangements for the repayment of the amount of any credit or refund which you received and which resulted from the prior election (which you are now revoking).

Form 4684 (2021)

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 4684 is used to report casualties and thefts of personal property. |

| Who Must File | Individuals, businesses, and estates that have suffered a loss due to casualty or theft. |

| Relevant Tax Years | Form 4684 is applicable for the tax year in which the casualty or theft occurred. |

| Deduction Limits | There are specific limitations and thresholds that must be met in order to claim a deduction for casualty and theft losses. |

| Documentation Required | Claimants must provide proof of the property's value before and after the casualty or theft, and evidence of the event itself. |

| State-Specific Variations | Some states may require additional forms or documentation to substantiate claims on the state tax return. |

| Interaction with Insurance | Insurance reimbursements must be deducted from the loss claimed on Form 4684. |

| Filing Deadline | The form needs to be filed with the individual or entity's federal income tax return by the annual IRS deadline. |

| Governing Laws | Federal tax laws govern the requirements and qualifications for reporting casualty and theft losses via Form 4684. |

Guide to Writing IRS 4684

Filing a tax document can feel overwhelming, especially when facing unexpected circumstances that impact your financial situation. The IRS Form 4684 is designed for such instances, helping taxpayers to report losses due to theft, disasters, or other casualties. Completing this form accurately is crucial for ensuring you receive any due relief or deductions. Here are the steps needed to fill out the form effectively, presented in a manner that's straightforward and easy to understand.

- Start by gathering any documents related to the loss or theft. These might include police reports, insurance claims, appraisals, or repair estimates.

- Enter your name and Social Security number (or taxpayer identification number) at the top of the form.

- Detail each item or property affected in Section A for personal-use property, or Section B for income-producing property. For each item, you'll need to provide:

- Type of event (theft, disaster, etc.) and date it occurred.

- Description of the property.

- Whether it was insured.

- The cost or adjusted basis of the property.

- The Fair Market Value (FMV) before and after the event.

- Any insurance or other reimbursements received.

- Calculate the decrease in Fair Market Value (FMV) for each item. This is done by subtracting the FMV after the event from the FMV before the event.

- Determine the loss amount. Subtract any insurance or reimbursement amounts from the smaller of the cost/adjusted basis or the decrease in FMV. Enter this amount in the column provided.

- If any business or income-producing property was affected, provide the information required in Section C, including income details and whether the activity qualifies for a net operating loss deduction.

- Follow the form's instructions to total your losses and calculate the deductible amount, considering any applicable limits and thresholds. This involves comparing the total loss to your income and applying limits based on the type of property and your insurance recoveries.

- Finally, review your entries carefully. Accuracy is key to avoid delays or questions from the IRS.

- Sign and date the form where indicated once you are confident in the accuracy of your information.

- Attach Form 4684 to your federal income tax return and submit it by the deadline for your tax filing.

Understanding and completing IRS Form 4684 can make a significant difference in managing the aftermath of unexpected events. While the process requires attention to detail, breaking it down step-by-step simplifies the task, helping you claim what's rightfully yours with confidence. If at any point the process seems daunting, don’t hesitate to seek assistance from a tax professional who can guide you through the specifics based on your unique situation.

Understanding IRS 4684

-

What is IRS Form 4684 used for?

IRS Form 4684 is used by taxpayers to report casualties and thefts of personal property. It allows individuals to claim deductions for property lost due to unexpected events like natural disasters, accidents, or unlawful acts like theft. The form helps in calculating the allowable loss deduction, which can reduce taxable income.

-

Who needs to file Form 4684?

Individuals, businesses, and any entity that has suffered a loss of property due to casualty or theft may need to file Form 4684. This includes losses not covered or reimbursed by insurance. It's crucial for the taxpayer to have owned the damaged or stolen property and to itemize deductions on their tax return.

-

When should Form 4684 be filed?

Form 4684 should be filed in the same tax year in which the casualty or theft occurred. If you receive insurance or other reimbursements in a later year, you may need to include that information in your tax return for that later year, which could involve amending a previously filed Form 4684.

-

How do you determine the loss amount on Form 4684?

The loss amount is determined by considering the property's adjusted basis, its decrease in fair market value due to the casualty or theft, and any insurance or other reimbursements received. The form provides detailed instructions on how to calculate these amounts, ensuring taxpayers claim the correct deduction amount.

-

Are there any special considerations for disaster-related losses?

Yes, for federally declared disaster areas, special rules may apply that can affect the timing of the loss deduction or provide additional relief. These special considerations often aim to aid recovery by offering tax relief to affected taxpayers. Information on specific disaster declarations and applicable tax benefits can be found on the IRS website.

-

Can losses from every type of casualty or theft be deducted?

Not all losses qualify for a deduction. Generally, deductible losses must be sudden, unexpected, or unusual in nature. Losses due to normal wear and tear, deterioration, or predictable events are not deductible. Each situation is unique, and the IRS provides guidelines to help determine whether a loss is deductible.

-

How does one submit Form 4684 with their tax return?

After completing Form 4684, attach it to your federal income tax return, Form 1040, and file them together by the tax return’s due date. Make sure to keep all documentation related to the casualty or theft, including police reports, insurance claims, and evidence of property value, as these may be necessary for substantiating the claimed loss.

Common mistakes

Filling out IRS Form 4684, which is used to report casualties and thefts, can sometimes be tricky. People often make mistakes that could be avoided with a little guidance. Knowing what these common errors are can help ensure the process goes more smoothly and correctly. Here are nine mistakes to watch out for:

Not fully understanding what constitutes a "casualty" or "theft" for tax purposes. It's important to know the IRS definitions to correctly apply them to your situation.

Failing to properly calculate the decrease in fair market value. This requires accurately assessing the property's value before and after the casualty or theft.

Omitting information about insurance or other reimbursements. Reimbursements must be subtracted from the loss calculation, and forgetting to do this can lead to errors in the amount of loss claimed.

Overlooking the $100 rule. For personal-use property, the IRS requires you to reduce each casualty or theft loss by $100 when calculating your deduction.

Ignoring the 10% AGI (Adjusted Gross Income) limitation. Casualty and theft losses on personal-use property must exceed 10% of your AGI after you subtract the $100 per event reduction.

Misinterpreting the deduction rules for business or income-producing property, which are subject to different criteria than personal-use property.

Forgetting to provide required documentation and evidence of the loss. This includes police reports for thefts, insurance claims, and estimates for repairs.

Inaccurate record-keeping, which leads to mistakes in claiming the deduction. It's crucial to keep detailed records of the property's value and any expenditures related to its recovery or repair.

Not consulting with a tax professional when dealing with complex situations. Sometimes the nuances of a casualty or theft loss are best handled by someone with expertise.

Avoiding these mistakes can improve the accuracy of your Form 4684 and help ensure that you receive the appropriate deduction for your casualty or theft loss. Always remember, when in doubt, seek professional advice to navigate through these complex tax situations.

Documents used along the form

When dealing with a casualty or theft, the IRS Form 4684 is crucial for reporting these events and their impact on personal property for tax purposes. However, to successfully navigate the complexities of such situations, additional forms and documents are often required. These forms support the filed claim, provide detailed information, and ensure compliance with tax laws. Understanding each of these documents can streamline the process and avoid complications down the line.

- Form 1040 - This is the standard IRS form for individual income tax returns. It’s where you summarize your income, deductions, credits, and tax payments. Your casualty or theft loss deduction calculated on Form 4684 is reported on your Form 1040.

- Schedule A (Form 1040) - This schedule is used for itemizing deductions rather than taking the standard deduction. Theft and casualty losses reported on Form 4684 are itemized deductions and must be reported here.

- Form 1040-NR - Non-resident aliens who experienced a casualty or theft loss use this form. Like Form 1040, it serves for reporting income but suits those not considered U.S. residents for tax purposes.

- Form 8822 - This form is used to inform the IRS of a change in address. Promptly updating your address ensures that you receive any correspondence or refunds without delay, especially relating to the casualty or theft loss claim.

- Form 2848 - Power of Attorney and Declaration of Representative. If you are using a tax professional or another person to act on your behalf with the IRS, this form grants them the authorization to speak, write, and make decisions for you regarding your tax matters.

- Police reports - For theft losses, a police report substantiates the occurrence of the theft. It’s a critical piece of documentation that the IRS may request to verify the claim.

- Insurance statements - These statements provide details on the coverage of the lost or damaged property, any compensation received, or reasons for denial. They are vital for calculating the deductible loss.

- Appraisals - Professional appraisals are used to establish the fair market value of the property before and after a casualty. These documents support the amount claimed as a loss on Form 4684.

- Photographs or videos - Visual evidence of the damaged property helps to substantiate the extent of the damage or the value of stolen items. These can be crucial in supporting your reported loss.

Each of these documents plays a unique role in the context of a casualty or theft loss claim. Together, they create a comprehensive picture of the incident, its financial impact, and the taxpayer's eligibility for a deduction. Collecting and organizing these documents in advance can facilitate a smoother, more efficient process when preparing your tax return.

Similar forms

The IRS Schedule A (Form 1040) is similar to the IRS 4684 form in that both are used for itemizing deductions on an individual's federal income tax return. While Form 4684 focuses on losses from thefts or casualties, Schedule A encompasses a broader range of deductible expenses, such as medical and dental expenses, taxes paid, home mortgage interest, and gifts to charity. Both forms require detailed information about the deductions claimed and directly impact the tax filer's adjusted gross income.

Form 1040, U.S. Individual Income Tax Return, shares similarities with IRS 4684 form since it is the primary form used by individuals to file their annual income tax returns. The IRS 4684 form supplements Form 1040 when the filer needs to report casualty or theft losses. The information from Form 4684 is used to calculate deductions that affect the total taxable income reported on Form 1040, demonstrating their interconnectivity in the tax preparation process.

The IRS 8829, Expenses for Business Use of Your Home, is akin to Form 4684 in its provision for deductions stemming from specific events affecting the taxpayer’s financial standing. While Form 8829 is dedicated to those who use part of their home for business purposes, allowing for the deduction of expenses like utilities, mortgage interest, and repairs, Form 4684 addresses deductions due to casualty or theft loss, requiring the taxpayer to detail the loss and its effect on property value. Both forms adjust gross income based on calculated deductions.

Form 4797, Sales of Business Property, bears resemblance to IRS Form 4684 due to both involving the impact of losses on tax obligations. Form 4797 is used to report the sale or exchange of property used in a trade or business, including the calculation of gain or loss. Similar to how IRS 4684 allows for casualty and theft loss deductions, Form 4797 impacts the taxpayer's income and potential deductions through the reporting of business asset transactions.

Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), similar to IRS 4684, provides taxpayers a way to lower their tax liability through specific deductions—in this case, for education expenses. While Form 8863 focuses on credits for tuition and related expenses, offering a benefit in the form of direct reductions in owed tax, Form 4684 deals with deducting losses from unfortunate events. Both forms serve to decrease the overall tax burden under certain qualifying circumstances.

The IRS Schedule D (Form 1040), Capital Gains and Losses, also parallels the IRS 4684 form by focusing on the financial changes affecting the taxpayer's income due to market events or personal circumstances. Schedule D is used to report the sale or exchange of capital assets, including stocks, real estate, and more, similarly requiring taxpayers to calculate gains or losses. Both Schedule D and Form 4684 involve detailing specific financial events that significantly impact the taxpayer’s income and tax liability.

Finally, Form 8938, Statement of Specified Foreign Financial Assets, shares a connection with IRS 4684 through its requirement for taxpayers to report particular financial information affecting their tax calculations. While Form 8938 is used by taxpayers with significant foreign financial assets to report those assets to the IRS, Form 4684 involves reporting domestic or foreign casualty or theft losses. Both forms add another layer of complexity to the tax return process by involving additional disclosures that can impact tax liability.

Dos and Don'ts

Filling out the IRS 4684 form, which is used for reporting casualties, thefts, and losses on income-producing property, can be nuanced. Paying close attention to detail and understanding the importance of precision helps ensure the process is completed correctly. Here are ten dos and don'ts to assist you in navigating this important form:

Do:Collect and organize all necessary documentation related to the loss before beginning the form. This includes police reports, insurance documents, and repair estimates.

Thoroughly read the instructions for Form 4684 to ensure you understand the type of information required.

Use precise figures when reporting the value of lost or damaged property. Estimate to the best of your ability if exact numbers are unavailable.

Make sure to report any reimbursements or expected reimbursements from insurance or other sources, as these affect the amount that can be claimed.

Accurately determine the fair market value (FMV) of the property both before and after the casualty or theft.

Consider consulting with a tax professional if you encounter any difficulties or have questions while filling out the form.

Report any improvements or enhancements made to the property, as these can impact the calculation of loss.

Take the time to double-check your calculations and the information entered on the form for accuracy.

Keep a copy of the completed form and all related documents for your records.

Remember to file the form by the tax return deadline, including any extensions that you have received.

Overlook the importance of completing every section of the form that applies to your situation.

Guess or make rough estimates without attempting to find accurate figures first.

Omit information about reimbursements or other compensation received, as this can result in inaccuracies and potential issues with the IRS.

Forget to report any and all losses, even those that may seem insignificant, as they may contribute to your overall deduction.

Assume that the fair market value is the same as the cost to replace the property; they can be different amounts.

Use the form without checking the most current IRS guidelines and updates, as tax laws and form requirements can change.

File the form without thoroughly reviewing your entries for potential mistakes.

Dismiss the possibility of seeking assistance from a tax professional; their expertise can be invaluable in complex situations.

Mistake the form for a quick process—take your time to ensure accuracy and completeness.

Ignore the necessity of keeping good records. Document everything related to your claim, including communications with insurance companies and any expenses incurred.

Misconceptions

Many taxpayers have misconceptions about the IRS 4684 form, which is used to report casualties, disasters, and thefts. Understanding the truth behind these misunderstandings can help ensure proper and beneficial use of the form. Here are six common misconceptions:

Only natural disasters qualify. There’s a widespread belief that the IRS 4684 form is exclusively for natural disasters like hurricanes or earthquakes. However, it also covers other unfortunate events, including vandalism, theft, and accidents, provided they meet certain criteria.

Any personal property loss can be claimed. Not all personal property losses due to a casualty, disaster, or theft can be claimed. To be deductible, the loss must be directly caused by the identified event and not reimbursed by insurance or other means.

The full amount of the loss can always be deducted. The actual amount that can be deducted is often less than the total loss. There are calculations involving the property's basis, insurance reimbursements, and a fixed deductible that must be applied to determine the deductible amount.

Filing Form 4684 will significantly delay your tax return. While it's true that adding Form 4684 to your tax return could introduce additional review steps by the IRS, it doesn't necessarily lead to significant delays. The key is ensuring that the form is completed accurately and accompanied by the necessary documentation.

Business and income-producing property are treated the same as personal use property. The IRS makes a distinction between properties based on their use. Losses on personal-use property are subject to more restrictive rules compared to business or income-producing property, which can have significant implications for your claim.

You must itemize deductions to benefit. While many tax benefits require itemizing deductions, in the case of federally declared disasters, taxpayers can choose to claim these losses even if they opt for the standard deduction. This exception allows for broader use of the form under specific circumstances.

Key takeaways

The IRS Form 4684, concerning Casualties and Thefts, plays a crucial role for taxpayers needing to report property loss due to unexpected events. Understanding this form thoroughly ensures accurate filing, which can help in possibly recuperating some losses through deductions. Here are four key takeaways to consider when filling out and using IRS Form 4684:

- Know the Type of Loss: IRS Form 4684 is designed for two types of losses - casualty and theft. A casualty loss comes from sudden events like natural disasters, accidents, or vandalism. Theft loss, however, relates to the stealing of your property, where it's evident that the intention was to remove it from you without permission. Distinguishing between these losses is the first step in filling out this form correctly.

- Document Everything: One of the most critical steps in utilizing Form 4684 effectively is to have thorough documentation. This includes police reports for thefts, insurance claims, and any other official records that substantiate the loss. The more evidence you can provide, the smoother the process will be. Remember, the burden of proof lies with the taxpayer, so detailed records are indispensable.

- Understand Deduction Limits: It's important to note that not all losses will result in a deduction, and certain thresholds must be met. The loss must exceed $100, and the total losses for the year must surpass 10% of your adjusted gross income (AGI). Knowing these limitations ahead of time can help manage expectations regarding potential tax relief.

- Timeliness Matters: For a casualty or theft loss, timing is key. Normally, you must report these losses on your tax return for the year the event happened. However, if the loss occurred in a federally declared disaster area, you might have the option to amend your previous year's return to claim the loss sooner. This can potentially provide quicker access to financial relief.

By keeping these insights in mind, taxpayers can navigate the complexities of IRS Form 4684 with greater confidence and precision, ultimately facilitating a smoother tax filing process in the wake of unfortunate property losses.

Popular PDF Documents

Reseller Permit Renewal - Legal business names, mailing addresses, and contact information are crucial details needed for the JT-1 application.

Irs Form 56 - It allows for the declaration of any limitations on the fiduciary's authority, specifying years or tax periods applicable.