Get Irs 4598 Instructions Form

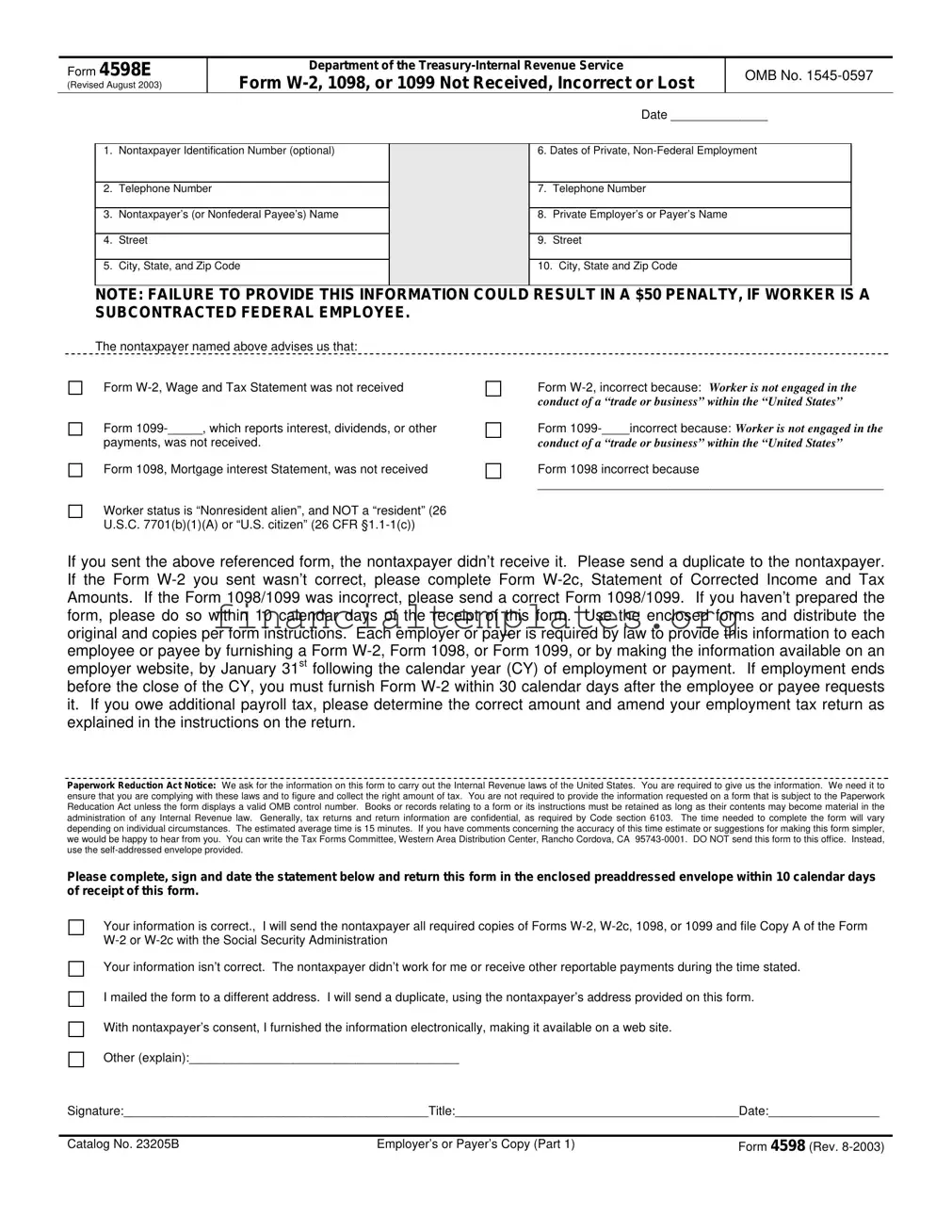

The intricacies of navigating tax documentation and compliance are exemplified in the complexities of Form 4598E, revised in August 2003 by the Department of the Treasury-Internal Revenue Service. This form plays a pivotal role in addressing issues concerning the non-receipt, inaccuracies, or loss of critical tax documents such as Form W-2, Form 1098, or Form 1099. Its utility spans a range of scenarios, from private, non-federal employment to cases involving nonresident aliens, underscoring the diverse tax situations it seeks to rectify. Employers or payers are mandated to furnish these forms by specific deadlines, with the potential imposition of penalties for non-compliance, highlighting the form’s significance in ensuring accurate tax reporting and withholding. Furthermore, the form serves as a medium for taxpayers to request duplicates of these essential documents, rectify incorrect information, and fulfill their tax obligations even in the absence of these forms by providing estimations. The procedural aspects embedded within the Form 4598E instructions reveal a structured approach towards addressing and mitigating issues related to tax document discrepancies, embodying both the challenges and resolutions inherent in the realm of tax administration and compliance.

Irs 4598 Instructions Example

Form 4598E

(Revised August 2003)

Department of the

Form

OMB No.

|

|

|

|

Date ______________ |

|

|

|

|

|

1. |

Nontaxpayer Identification Number (optional) |

|

6. Dates of Private, |

|

|

|

|

|

|

2. |

Telephone Number |

|

7. |

Telephone Number |

|

|

|

|

|

3. |

Nontaxpayer’s (or Nonfederal Payee’s) Name |

|

8. |

Private Employer’s or Payer’s Name |

|

|

|

|

|

4. |

Street |

|

9. |

Street |

|

|

|

|

|

5. |

City, State, and Zip Code |

|

10. |

City, State and Zip Code |

|

|

|

|

|

NOTE: FAILURE TO PROVIDE THIS INFORMATION COULD RESULT IN A $50 PENALTY, IF WORKER IS A SUBCONTRACTED FEDERAL EMPLOYEE.

The nontaxpayer named above advises us that:

Form

Form

payments, was not received.

Form 1098, Mortgage interest Statement, was not received

Form

Form

conduct of a “trade or business” within the “United States”

Form 1098 incorrect because

__________________________________________________

Worker status is “Nonresident alien”, and NOT a “resident” (26

U.S.C. 7701(b)(1)(A) or “U.S. citizen” (26 CFR

If you sent the above referenced form, the nontaxpayer didn’t receive it. Please send a duplicate to the nontaxpayer. If the Form

Paperwork Reduction Act Notice: We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to figure and collect the right amount of tax. You are not required to provide the information requested on a form that is subject to the Paperwork Reducation Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103. The time needed to complete the form will vary depending on individual circumstances. The estimated average time is 15 minutes. If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA

Please complete, sign and date the statement below and return this form in the enclosed preaddressed envelope within 10 calendar days of receipt of this form.

Your information is correct., |

I will send the nontaxpayer all required copies of Forms |

|

|

||

Your information isn’t correct. The nontaxpayer didn’t work for me or receive other reportable payments during the time stated. |

||

I mailed the form to a different address. I will send a duplicate, using the nontaxpayer’s address provided on this form. |

||

With nontaxpayer’s consent, I furnished the information electronically, making it available on a web site. |

|

|

Other (explain):_______________________________________ |

|

|

Signature:____________________________________________Title:_________________________________________Date:________________ |

||

|

|

|

Catalog No. 23205B |

Employer’s or Payer’s Copy (Part 1) |

Form 4598 (Rev. |

Form 4598E

(Revised August 2003)

Department of the

Form

OMB No.

|

|

|

|

Date ______________ |

|

|

|

|

|

1. |

Nontaxpayer Identification Number (optional) |

|

6. Dates of Private |

|

|

|

|

|

|

2. |

Telephone Number |

|

7. |

Telephone Number |

|

|

|

|

|

3. |

Nontaxpayer’s (or Payee’s) Name |

|

8. |

Private Employer’s or Payer’s Name |

|

|

|

|

|

4. |

Street |

|

9. |

Street |

|

|

|

|

|

5. |

City, State, and Zip Code |

|

10. |

City, State and Zip Code |

|

|

|

|

|

NOTE: FAILURE TO PROVIDE THIS INFORMATION COULD RESULT IN A $50 PENALTY, IF WORKER IS A SUBCONTRACTED FEDERAL EMPLOYEE.

The nontaxpayer named above advises us that:

Form

Form

payments, was not received.

Form 1098, Mortgage interest Statement, was not received

Form

Form

conduct of a “trade or business” within the “United States”

Form 1098 incorrect because

__________________________________________________

Worker status is “Nonresident alien”, and NOT a “resident” (26

U.S.C. 7701(b)(1)(A) or “U.S. citizen” (26 CFR

If you don’t receive the Form

If you have already filed a return on which you estimated your wages, payments, interest, dividends, and withholdings, we will process it based upon the information it contains.

If you later receive the Form

Paperwork Reduction Act Notice: We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to figure and collect the right amount of tax. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103. The time needed to complete the form will vary depending on individual circumstances. The estimated average time is 15 minutes. If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA

Catalog No. 23205B |

NONTaxpayer’s Copy (Part 2) |

Form 4598 (Rev. |

Document Specifics

| Fact Number | Detail |

|---|---|

| 1 | Form 4598E is issued by the Department of the Treasury-Internal Revenue Service. |

| 2 | It addresses issues related to not receiving, losing, or receiving incorrect Forms W-2, 1098, or 1099. |

| 3 | The form was revised in August 2003. |

| 4 | It contains OMB No. 1545-0597. |

| 5 | Failure to provide information could result in a $50 penalty if the worker is a subcontracted federal employee. |

| 6 | It allows for the reporting of incorrect information due to the worker not being engaged in a trade or business within the United States or having a “Nonresident alien” worker status. |

| 7 | Employers or payers are required by law to furnish the correct tax documents by January 31st following the calendar year of employment or payment. |

| 8 | If the correct documents are not received by the tax return filing date, the taxpayer should file their return with Form 4852, estimating wages and withholdings. |

| 9 | Books or records related to the form or its instructions must be retained as long as they may become material in the administration of any Internal Revenue law. |

| 10 | The estimated average time to complete the form is 15 minutes. |

Guide to Writing Irs 4598 Instructions

Completing the IRS Form 4598E requires attention to detail to ensure accurate reporting of unpaid or incorrect wages, dividends, interests, or any other type of income. This form is critical for individuals who have not received their essential tax documents or have received incorrect ones. It involves providing personal details, employment information, and specifics about the missing or incorrect forms. It's essential to accurately fill out this form to avoid potential penalties and ensure proper tax filings.

- Fill in the date at the top of the form.

- Enter the Nontaxpayer Identification Number if available. This step is optional.

- Provide the telephone number where you can be reached for any follow-up.

- Write the Nontaxpayer’s (or Nonfederal Payee’s) Name clearly.

- Fill in the street address, including the Street Name, City, State, and Zip Code.

- Specify the Dates of Private, Non-Federal Employment.

- Enter the Telephone Number of the employer or payer.

- Write the Private Employer’s or Payer’s Name involved in the reporting.

- Provide the employer’s or payer’s address, including Street Name, City, State, and Zip Code.

- Indicate the type of form not received, lost or incorrect by marking the appropriate box and provide specifics if the form is incorrect. If a Form W-2, 1098, or 1099 was not received or was incorrect, specify the reasons such as worker status as “Nonresident alien” not a “resident” or “U.S. citizen.”

- Request a duplicate form or correction by specifying the needed action from the employer or payer.

- Sign the form, including the title and the date, to authenticate the report.

Once filled out, it's crucial to return this form within 10 calendar days of receipt using the enclosed preaddressed envelope. This prompt action facilitates the correction or issuance of the required tax documents, ensuring compliance with tax laws and accurate reporting for tax purposes.

Understanding Irs 4598 Instructions

What is Form 4598E and why might I need it?

Form 4598E is a document provided by the IRS for individuals who have either not received their Form W-2, 1098, or 1099, or have received incorrect versions of these forms. It serves a crucial role in ensuring taxpayers can accurately report their income and expenses on their tax returns, even when the original documents are missing or contain errors.

What should I do if I haven't received my Form W-2, 1098, or 1099?

If you find yourself without your Form W-2, 1098, or 1099 by the time you need to file your taxes, the IRS advises using Form 4598E to notify the agency. While awaiting the correct forms, you should estimate your wages, withholding, interest, dividends, or other payments and report these estimates on your tax return. Be sure to attach Form 4598E and any other relevant documents to support your estimations.

What actions should I take if the information on my Form W-2, 1098, or 1099 is incorrect?

In cases where the information provided on your Form W-2, 1098, or 1099 is not accurate, you should first attempt to contact the issuer (employer or payer) to rectify the errors. Meanwhile, use the details you believe to be correct when filing your return. If you later receive corrected forms and there are discrepancies with your filed return, you may need to submit an amended return using Form 1040X.

How can Form 4598E help if I'm a subcontracted federal employee?

For subcontracted federal employees, failure to provide the information requested on Form 4598E may result in a $50 penalty. This form acts as a means to communicate with the IRS about missing or incorrect tax documents, thus ensuring compliance and possibly avoiding penalties associated with misreported income.

What are the deadlines for employers or payers to respond to a Form 4598E?

Employers or payers are required to correct or furnish the missing forms within 10 calendar days of receiving Form 4598E. Compliance with this quick turnaround is crucial for the taxpayer to meet their own tax filing deadlines and ensure accurate reporting.

What should I do if I do not receive the corrected forms in time for tax filing?

If the corrected or missing forms do not arrive in time to file your taxes, go ahead and file your return with the best estimates of your income and withholdings. Attach Form 4598E to indicate to the IRS that you've taken action to procure the correct information. This will help in the processing of your return and mitigate issues arising from incorrect or incomplete information.

Who is responsible for ensuring that the forms are corrected and sent?

The responsibility for correcting and sending the required tax documents rests with the employer or payer. However, as a taxpayer, it is in your best interest to follow up with the issuer to ensure that the necessary corrections are made and that the IRS receives accurate information to process your tax return efficiently.

Common mistakes

When filling out the IRS 4598E Form, common mistakes can lead to unnecessary delays and complications. It's crucial to fill in the form accurately to ensure timely processing. Here are some common errors to avoid:

-

Not filling in the "Nontaxpayer Identification Number" section, which, although optional, can speed up the resolution process. Including an identification number can help the IRS more efficiently locate records and address the issue.

-

Omitting contact information such as telephone number and address, both of which are critical for facilitating communication between the IRS and the individual. If this information is not provided, it may delay the process significantly.

-

Failure to properly describe the issue with the Form W-2, 1098, or 1099 in the designated section. Merely stating that a form is incorrect without providing a specific reason can hinder the IRS's ability to rectify the problem.

-

Misunderstanding the submission deadlines and requirements, such as not sending a duplicate form if the original was not received, or failing to use Form W-2c for corrections. Adhering to the submission guidelines is crucial for accurate tax filing.

To ensure clarity and avoid these mistakes, individuals should:

Carefully read all instructions provided with the IRS 4598E Form.

Double-check all filled-in information for accuracy before submission.

Include all necessary details and documentation to support the form's purpose.

Contact a tax professional if there are any uncertainties during the completion of the form.

By avoiding these common mistakes, individuals can help streamline the process of correcting issues with their tax forms, ensuring that their tax information is accurate and up to date.

Documents used along the form

When dealing with IRS Form 4598E, which pertains to not receiving, losing, or identifying incorrect forms such as the W-2, 1098, or 1099, individuals may find themselves interacting with a range of other documents. Understanding these documents can make navigating tax issues much smoother.

- Form W-2: This "Wage and Tax Statement" is issued by employers to report annual wages and the amount of taxes withheld from an employee's paycheck.

- Form 1099: Used to report various types of income other than wages, salaries, and tips. This includes but is not limited to dividends, interest, and freelance income. Depending on the specific type of income, there are several 1099 forms like 1099-MISC, 1099-DIV, and 1099-INT.

- Form 1098: Known as the "Mortgage Interest Statement," it details the amount of interest and mortgage-related expenses paid on a mortgage during the tax year, which may be deductable.

- Form W-2c: The "Corrected Wage and Tax Statement" is used to correct errors on a previously issued W-2 form. This might be necessary if there’s an incorrect wage, tax amount, or employee information.

- Form 4852: This serves as a substitute for Form W-2, Form W-2c, or Form 1099-R when the payer does not provide the original form or when the provided form is incorrect, and a corrected form is not available in time for filing.

- Form 1040X: The "Amended U.S. Individual Income Tax Return" is used to correct or make changes to a previously filed Form 1040, 1040-A, 1040-SR, or 1040-EZ.

- Form 8949: Used to report sales and exchanges of capital assets, Form 8949 is crucial for taxpayers who have to report capital gains or losses. Each transaction is detailed, impacting the Schedule D of the tax return.

- Schedule D (Form 1040): This is used to summarize capital gains and losses from transactions reported on Form 8949, real estate, and the sale or exchange of capital assets not reported on another form or schedule.

Together, these documents play crucial roles across various situations, from correcting wage and tax statement errors, reporting different types of income, to amending previously filed tax returns. Understanding each document’s purpose and knowing when to use them can lead to a more streamlined process in managing tax duties and resolving related issues.

Similar forms

The Form W-2, "Wage and Tax Statement," closely mirrors aspects of the IRS Form 4598E. Both documents pertain to reporting wages, tax withholdings, and employment-related financial information to the taxpayer. The primary similarity lies in their use for taxpayers to accurately report income and tax withholding to the Internal Revenue Service (IRS). While Form 4598E is utilized when a taxpayer did not receive, lost, or received an incorrect Form W-2, the W-2 itself is the standard form employers are required to send to employees and the IRS to report annual wages and taxes withheld from paychecks.

Similarly, Form 1099 series, which includes forms like 1099-INT for interest income and 1099-DIV for dividends, shares common ground with Form 4598E in reporting specific types of income. The connection between these forms and the 4598E is that the latter serves as a mechanism to address issues when a taxpayer does not receive or receives incorrect forms 1099. These forms are critical for taxpayers to report various forms of income, other than wages, to the IRS. Form 4598E helps ensure that taxpayers can comply with their tax obligations even in the absence or correction of their Form 1099.

Form 1098, "Mortgage Interest Statement," is another document similar to IRS Form 4598E because both are involved in the reporting of important financial information for tax purposes. Form 1098 is issued by lenders to report the amount of interest and related expenses paid on a mortgage during the tax year. Form 4598E's role comes into play when taxpayers do not receive, lose, or find discrepancies in their Form 1098, thereby offering a pathway to rectify or acknowledge these issues and ensure accurate tax reporting.

Form W-2c, "Corrected Wage and Tax Statements," is directly linked to the purpose of Form 4598E. When an individual identifies inaccuracies in their original Form W-2, or when the employer acknowledges a mistake, Form W-2c is issued as a correction. Form 4598E acts as a precursor in these situations by providing a structured method for taxpayers to notify employers of the need for corrections, paving the way for the issuance of Form W-2c. It ensures that any discrepancies affecting tax liabilities are promptly and properly addressed.

Dos and Don'ts

When completing the IRS 4598 Instructions form, it is important to follow specific guidelines to ensure the process is done correctly and efficiently. Below are some recommended dos and don'ts:

Do:- Ensure all the information provided is accurate and complete to avoid possible penalties.

- Use the pre-addressed envelope provided for returning the completed form to ensure it reaches the correct department.

- Complete, sign, and date the statement at the bottom of the form to affirm that the information is correct and to authorize the necessary actions.

- Fill out the form promptly and return it within 10 calendar days of receipt to ensure timely processing.

- If you have not received the necessary Form W-2, 1098, or 1099, attach Form 4852 to your tax return, estimating the wages and withholdings as accurately as possible.

- Leave sections incomplete unless they are not applicable to your situation.

- Forget to include a telephone number where you can be reached for any clarifications or additional information.

- Ignore the guidelines for amended returns if you receive the correct forms after filing an estimated return.

- Send the form to the address listed for the Tax Forms Committee in Rancho Cordova, CA; this address is for comments or suggestions, not for submitting the form.

- Disregard the Paperwork Reduction Act Notice, as it contains important legal information regarding your rights and the requirements for retaining records.

Misconceptions

There are several misconceptions surrounding the IRS Form 4598E, also known as "Form W-2, 1098, or 1099 Not Received, Incorrect or Lost." Understanding these misconceptions is crucial for individuals and entities to accurately navigate their tax responsibilities and avoid potential issues with the Internal Revenue Service (IRS). Here is a list of common misunderstandings and their clarifications:

- Misconception #1: Form 4598E is a replacement for Forms W-2, 1098, or 1099.

In reality, Form 4598E serves as a notification to the IRS that an individual did not receive one of these forms or received it with incorrect information. It does not replace the original tax documents.

- Misconception #2: All taxpayers must file Form 4598E if they do not receive their W-2 or 1099 forms by January 31.

While it is true that employers and payers are required to send these forms by January 31, taxpayers should first contact their employer or payer to request a duplicate before submitting Form 4598E to the IRS. This form is not mandatorily required for all taxpayers in such situations.

- Misconception #3: Submitting Form 4598E automatically resolves discrepancies on tax forms.

Submission of Form 4598E alerts the IRS to an issue, but individuals may still need to take additional steps, such as filing an amended return if they receive the correct information after submitting their tax return.

- Misconception #4: The form is only for reporting missing W-2s.

Form 4598E can be used to report not receiving Forms W-2, 1098, or 1099, or receiving any of these forms with incorrect information. It covers a broader range of issues than just missing W-2 forms.

- Misconception #5: Filing Form 4598E extends the deadline for filing your tax return.

Submitting Form 4598E does not grant an extension to the taxpayer's filing deadline. Taxpayers should file their tax return by the due date, even if estimating income and withholding using Form 4852, to avoid penalties.

- Misconception #6: Electronic submissions of Form 4598E are accepted.

As of the last available information, the IRS requires this form to be mailed using the provided preaddressed envelope. Electronic submission is not an option.

- Misconception #7: There is a fee to file Form 4598E.

There is no fee associated with filing Form 4598E with the IRS. This form is provided to assist taxpayers in notifying the IRS of missing or incorrect forms.

- Misconception #8: Nonresident aliens cannot use Form 4598E.

Nonresident aliens can use Form 4598E if they did not receive or received incorrect Forms W-2, 1098, or 1099, similar to U.S. citizens and resident aliens. The form addresses worker status including nonresident aliens.

- Misconception #9: Form 4598E can be used to report missing forms for any tax year.

Form 4598E is specific to the tax year in question and must be filed for each year separately. Using the form for multiple years or outdated tax periods is not appropriate.

Understanding the specifics of Form 4598E helps taxpayers correctly address the situation where tax documents are not received, lost, or contain inaccuracies, enabling a smoother process in fulfilling their tax responsibilities.

Key takeaways

Understanding the IRS Form 4598E is crucial for correctly dealing with issues related to not receiving, or receiving incorrect, Forms W-2, 1098, or 1099. Here are six key takeaways to guide you through the process:

- Act promptly if you do not receive your forms: If you haven't received a Form W-2, 1098, or 1099 by the time your tax return is due, use Form 4852 to submit your tax return with estimated wages and tax withholding.

- Correcting information is part of the process: Employers or payers are obliged to send corrected forms (W-2c or the corrected 1098/1099 forms) if there are inaccuracies reported.

- Penalties may apply for non-compliance: A $50 penalty is applicable if the required information is not provided, especially if the worker is a subcontracted federal employee.

- Compliance with deadlines is essential: Employers must furnish the appropriate forms by January 31st following the employment year or within 30 days after an employee's request if employment ends before the close of the calendar year.

- Estimating income and withholdings is permitted: If the required forms are not received in time, taxpayers are advised to estimate their income and withholdings when filing their tax return, attaching Form 4598E as evidence.

- Documentation and confidentiality matter: Retain all records related to IRS Form 4598E as they may become important in the administration of Internal Revenue laws. Also, note that generally, tax returns and return information are confidential, safeguarded by Code section 6103.

Remember, IRS Form 4598E plays a critical role in ensuring compliance with tax reporting requirements. Whether you are an employer, payer, or taxpayer, understanding and following the instructions associated with this form helps in the accurate and timely reporting of income and taxes.

Popular PDF Documents

IRS 8718 - It represents the financial commitment of the applying organization towards processing their request.

How to Get Power of Attorney in Tennessee - The Tax POA RV-F0103801 form is an effective way to manage your taxes through a third party without relinquishing total control.

Metlife Dog Insurance - A transparent overview of the claims submission process, underlining the importance of accuracy and completeness for timely processing.