Get Irs 4562 Form

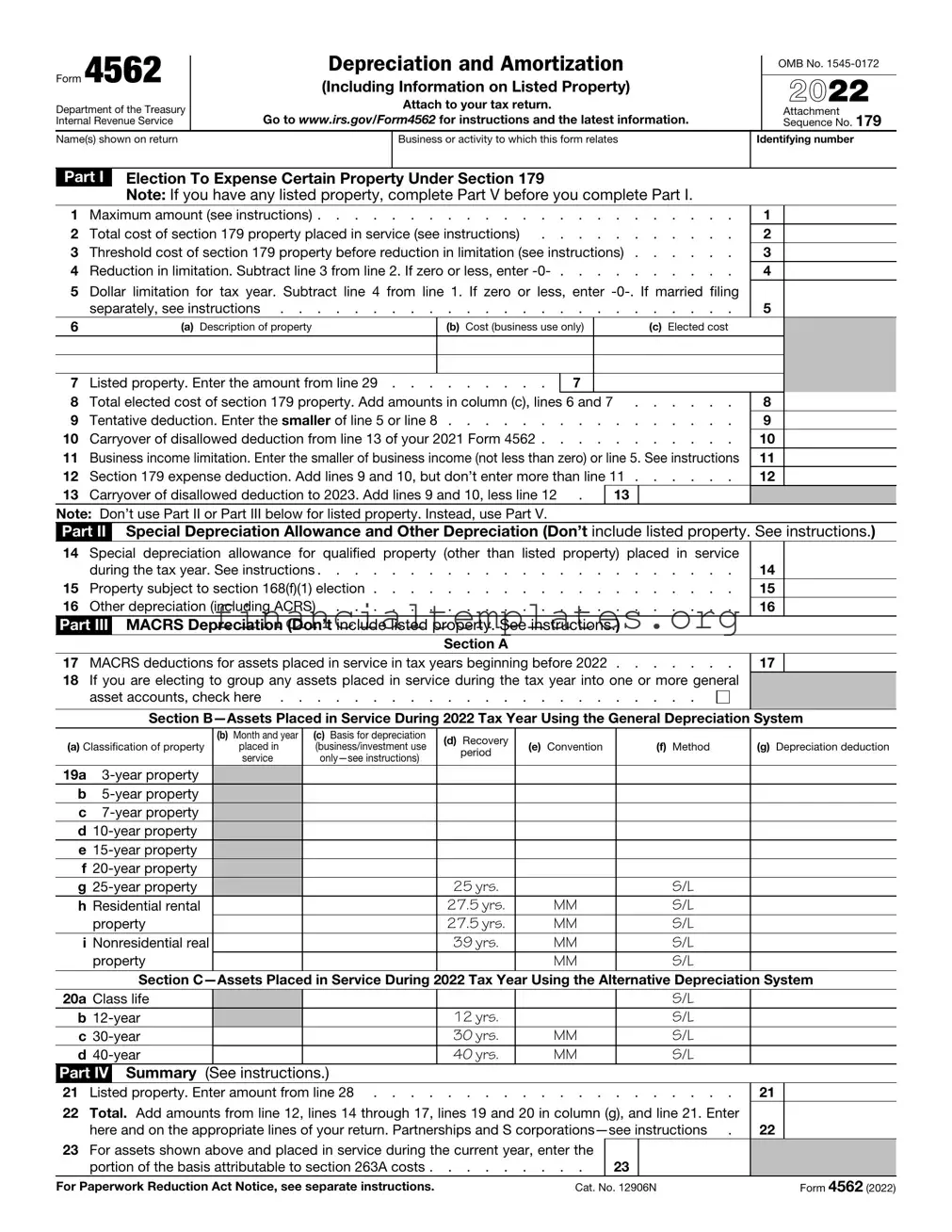

Understanding the complexities of the IRS Form 4562, Depreciation and Amortization, is crucial for taxpayers wishing to accurately report the depreciation of property and amortization expenses on their tax returns. Issued by the Department of the Treasury, this form serves as an attachment to a taxpayer's return, detailing specific information related to the depreciation of property, amortization of certain costs, and information on listed property for the tax year 2021. It outlines the election under Section 179 to expense certain property types and requires thorough documentation of each asset's acquisition and use within the business or income-generating activity to which it relates. Additionally, the form tackles special depreciation allowances and other depreciation methods, including the Modified Accelerated Cost Recovery System (MACRS) and the Alternative Depreciation System (ADS), providing a structured approach to report the wear and tear on assets over time. With specific sections dedicated to listed property — items more closely regulated due to their dual-use potential, such as vehicles and computers — Form 4562 demands careful attention to detail and proper adherence to IRS guidelines to leverage tax benefits associated with business and investment property effectively.

Irs 4562 Example

Form 4562 |

Depreciation and Amortization |

|

OMB No. |

|

(Including Information on Listed Property) |

|

2022 |

||

|

|

|||

Department of the Treasury |

|

Attach to your tax return. |

|

Attachment |

|

|

|

||

Internal Revenue Service |

Go to WWW.IRS.GOV/FORM4562 for instructions and the latest information. |

|

Sequence No. 179 |

|

Name(s) shown on return |

|

Business or activity to which this form relates |

Identifying number |

|

|

|

|

|

|

Part I Election To Expense Certain Property Under Section 179

Note: If you have any listed property, complete Part V before you complete Part I.

1 |

Maximum amount (see instructions) |

2 |

Total cost of section 179 property placed in service (see instructions) |

3 |

Threshold cost of section 179 property before reduction in limitation (see instructions) |

4 |

Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter |

5Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter

separately, see instructions |

. . . . . . . . . . . . . . . . . . . . . . . . . |

1

2

3

4

5

6 |

(a) Description of property |

|

(b) |

Cost (business use only) |

|

|

(c) Elected cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Listed property. Enter the amount from line 29 . |

. . . |

. . . . . |

7 |

|

|

|

|

|

|

8 |

Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 |

8 |

|

|||||||

9 |

Tentative deduction. Enter the smaller of line 5 or line 8 |

9 |

|

|||||||

10 |

Carryover of disallowed deduction from line 13 of your 2021 Form 4562 |

10 |

|

|||||||

11 |

Business income limitation. Enter the smaller of business income (not less than zero) or line 5. See instructions |

11 |

|

|||||||

12 |

Section 179 expense deduction. Add lines 9 and 10, but don’t enter more than line 11 |

12 |

|

|||||||

13 |

Carryover of disallowed deduction to 2023. Add lines 9 and 10, less line 12 . |

|

13 |

|

|

|

||||

Note: Don’t use Part II or Part III below for listed property. Instead, use Part V.

Part II Special Depreciation Allowance and Other Depreciation (Don’t include listed property. See instructions.)

14 |

Special depreciation allowance for qualified property (other than listed property) |

placed |

in |

service |

|

|

|

|

during the tax year. See instructions |

. . |

. . |

. . |

14 |

|

|

15 |

Property subject to section 168(f)(1) election |

. . |

. . |

. . |

15 |

|

|

16 |

Other depreciation (including ACRS) |

. . |

. . |

. . |

16 |

|

|

Part III |

MACRS Depreciation (Don’t include listed property. See instructions.) |

|

|

|

|

|

|

|

|

Section A |

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

MACRS deductions for assets placed in service in tax years beginning before 2022 . |

. . |

. . |

. . |

17 |

|

|

18If you are electing to group any assets placed in service during the tax year into one or more general

asset accounts, check here . . . . . . . . . . . . . . . . . . . . . . .

Section

(b) |

Month and year |

(c) Basis for depreciation |

(d) |

Recovery |

|

|

|

|

(a) Classification of property |

placed in |

(business/investment use |

(e) Convention |

(f) Method |

(g) Depreciation deduction |

|||

|

period |

|||||||

|

service |

|

|

|

|

|||

|

|

|

|

|

|

19a

b

c

d

e |

|

|

|

|

|

|

|

|

||

f |

|

|

|

|

|

|

|

|

||

g |

|

|

|

25 YRS. |

|

|

S/L |

|

||

h Residential rental |

|

|

27.5 YRS. |

MM |

|

S/L |

|

|||

|

property |

|

27.5 YRS. |

MM |

|

S/L |

|

|||

|

|

|

|

|

|

|

|

|

|

|

i |

Nonresidential real |

|

|

39 YRS. |

MM |

|

S/L |

|

||

|

property |

|

|

MM |

|

S/L |

|

|||

|

|

|

|

|

|

|

|

|

||

|

|

Section |

||||||||

|

|

|

|

|

|

|

|

|

|

|

20a |

Class life |

|

|

|

|

|

|

S/L |

|

|

b |

|

|

|

12 YRS. |

|

|

S/L |

|

||

c |

|

|

|

30 YRS. |

MM |

|

S/L |

|

||

d |

|

|

|

40 YRS. |

MM |

|

S/L |

|

||

Part IV |

Summary (See instructions.) |

|

|

|

|

|

|

|||

21 Listed property. Enter amount from line 28 |

. . . . . . . . . . . . |

. . . . . . . . |

21 |

|||||||

22Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21. Enter

here and on the appropriate lines of your return. Partnerships and S |

22 |

23For assets shown above and placed in service during the current year, enter the

portion of the basis attributable to section 263A costs |

23 |

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 12906N |

Form 4562 (2022) |

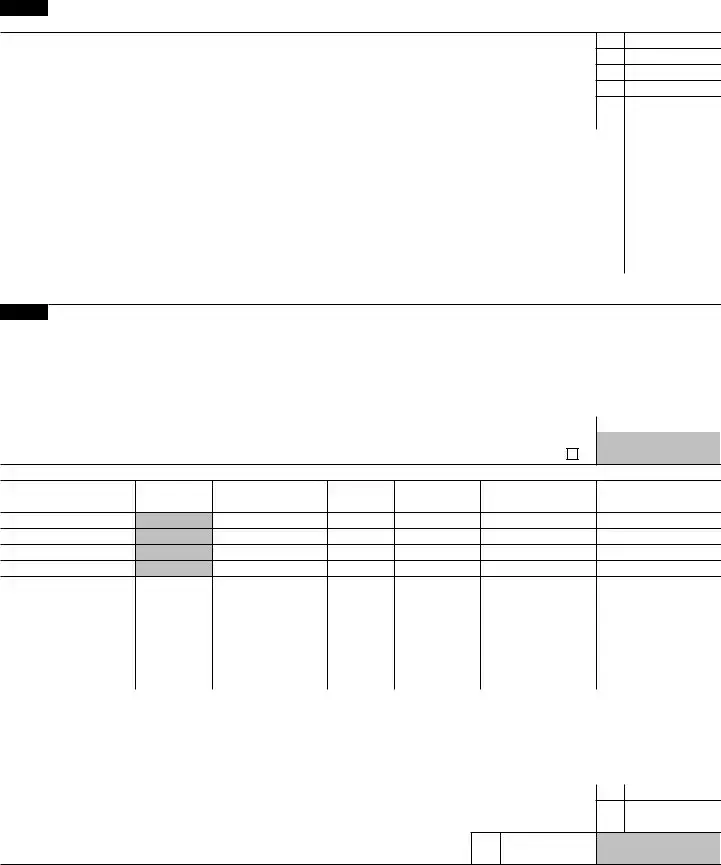

Form 4562 (2022) |

Page 2 |

|

|

|

|

Part V |

Listed Property (Include automobiles, certain other vehicles, certain aircraft, and property used for |

|

|

entertainment, recreation, or amusement.) |

|

Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a, 24b, columns (a) through (c) of Section A, all of Section B, and Section C if applicable.

Section

24a Do you have evidence to support the business/investment use claimed?

Yes

No

24b If “Yes,” is the evidence written?

Yes

No

(a) |

(b) |

(c) |

|

(e) |

(f) |

(g) |

(h) |

(i) |

|

Business/ |

(d) |

Basis for depreciation |

|||||||

Type of property (list |

Date placed |

Recovery |

Method/ |

Depreciation |

Elected section 179 |

||||

investment use |

Cost or other basis |

(business/investment |

|||||||

vehicles first) |

in service |

period |

Convention |

deduction |

cost |

||||

|

|

percentage |

|

use only) |

|

|

|

|

25Special depreciation allowance for qualified listed property placed in service during

|

the tax year and used more than 50% in a qualified business use. See instructions . |

25 |

|

|

|

|||||||

26 |

Property used more than 50% in a qualified business use: |

|

|

|

|

|

|

|||||

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

27 |

Property used 50% or less in a qualified business use: |

|

|

|

|

|

|

|||||

|

|

|

% |

|

|

|

|

S/L – |

|

|

|

|

|

|

|

% |

|

|

|

|

S/L – |

|

|

|

|

|

|

|

% |

|

|

|

|

S/L – |

|

|

|

|

28 |

Add amounts in column (h), lines 25 through 27. Enter here and on line 21, page 1 . |

28 |

|

|

|

|||||||

29 |

Add amounts in column (i), line 26. Enter here and on line 7, page 1 . . . |

. . . . |

. . . . . |

29 |

|

|||||||

Section

Complete this section for vehicles used by a sole proprietor, partner, or other “more than 5% owner,” or related person. If you provided vehicles to your employees, first answer the questions in Section C to see if you meet an exception to completing this section for those vehicles.

30Total business/investment miles driven during

the year (don’t include commuting miles) .

31Total commuting miles driven during the year

32Total other personal (noncommuting)

miles driven |

. . . . . . . . . |

33Total miles driven during the year. Add

lines 30 through 32 . . . . . . .

34Was the vehicle available for personal use during

35Was the vehicle used primarily by a more than 5% owner or related person? . .

36Is another vehicle available for personal use?

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

Vehicle 1 |

Vehicle 2 |

Vehicle 3 |

Vehicle 4 |

Vehicle 5 |

Vehicle 6 |

Yes No Yes No Yes No Yes No Yes No Yes No

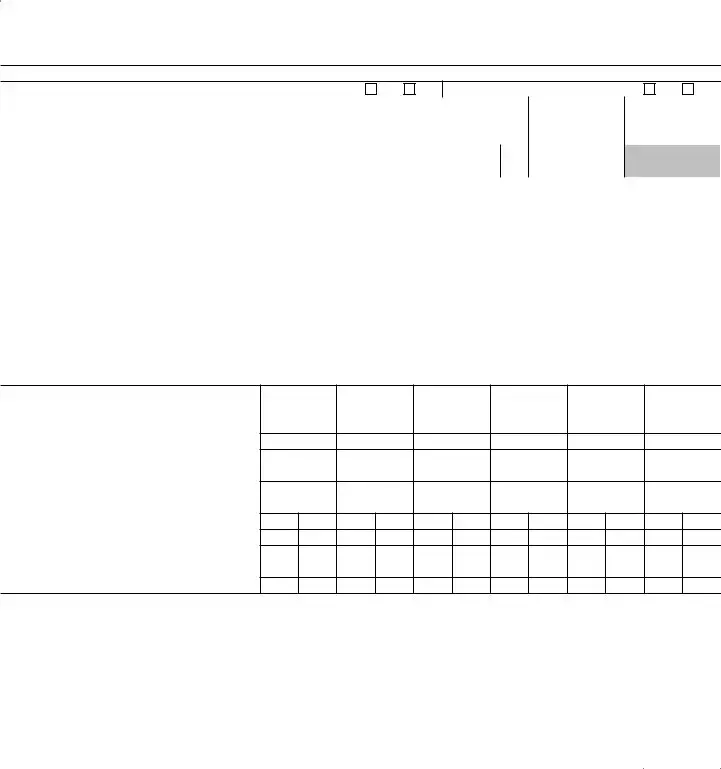

Section

Answer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who aren’t more than 5% owners or related persons. See instructions.

37 |

Do you maintain a written policy statement that prohibits all personal use of vehicles, including commuting, by |

Yes |

No |

|

your employees? |

|

|

38 |

Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by your |

|

|

|

|

||

|

employees? See the instructions for vehicles used by corporate officers, directors, or 1% or more owners . . |

|

|

39 |

Do you treat all use of vehicles by employees as personal use? |

|

|

|

|

||

40 |

Do you provide more than five vehicles to your employees, obtain information from your employees about the |

|

|

|

use of the vehicles, and retain the information received? |

|

|

41 |

Do you meet the requirements concerning qualified automobile demonstration use? See instructions . . . . |

|

|

|

|

||

|

Note: If your answer to 37, 38, 39, 40, or 41 is “Yes,” don’t complete Section B for the covered vehicles. |

|

|

Part VI Amortization

|

|

(b) |

|

|

|

|

|

(e) |

|

|

|

(a) |

(c) |

(d) |

|

Amortization |

(f) |

||||

|

Date amortization |

|

||||||||

|

Description of costs |

Amortizable amount |

Code section |

|

|

period or |

Amortization for this year |

|||

|

begins |

|

|

|||||||

|

|

|

|

|

|

percentage |

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

42 |

Amortization of costs that begins during your 2022 tax year (see instructions): |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43 |

Amortization of costs that began before your 2022 tax year |

. |

. |

. |

|

43 |

|

|||

44 |

Total. Add amounts in column (f). See the instructions for where to report |

. |

. |

. |

|

44 |

|

|||

Form 4562 (2022)

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| Fact 1 | The IRS Form 4562 is used for reporting Depreciation and Amortization. |

| Fact 2 | This form includes sections for Election To Expense Certain Property Under Section 179 and for Listed Property. |

| Fact 3 | It must be attached to the taxpayer's return and is applicable for a variety of assets including vehicles, equipment, and property. |

| Fact 4 | Part IV of Form 4562 provides a summary of depreciation and amortization, summarizing previously detailed amounts. |

| Fact 5 | For vehicles and certain other assets, the form requires detailed usage information, especially if used for both business and personal purposes. |

Guide to Writing Irs 4562

Filling out IRS Form 4562, which deals with depreciation and amortization, requires a systematic approach to accurately report the expenses on business or investment property. This form is essential for individuals and businesses aiming to capitalize on the tax deductions for the depreciation of property and amortization of qualifying costs. Keeping meticulous records and understanding the specifics of your property will make this process smoother. Follow these steps carefully to ensure that you fill out the form correctly.

- Begin with Part I: Election To Expense Certain Property Under Section 179. Ensure to complete Part V first if you have any listed property.

- Enter the maximum amount allowable for section 179 expense for the tax year in line 1, referring to the form's instructions for the current limit.

- Sum up the total cost of section 179 property placed in service during the tax year and record this in line 2.

- Calculate the threshold cost of section 179 property before any reduction in limitation (see instructions for thresholds), and enter this in line 3.

- Subtract line 3 from line 2 to find the reduction in limitation. Input this figure in line 4.

- Determine the dollar limitation for the tax year by subtracting line 4 from line 1. Record this in line 5.

- For each section 179 property, list the description, cost (business use only), and elected cost in the corresponding columns on lines 6(a) through 6(c).

- Input the total elected cost of section 179 property by summing the amounts in column (c), including any listed property, and enter this total in line 8.

- Calculate the tentative deduction, which is the smaller of line 5 or line 8, and enter this in line 9.

- Add any carryover of disallowed deduction from the previous year's Form 4562, and input this in line 10.

- Determine the business income limitation (see instructions) and enter this in line 11.

- Add lines 9 and 10, ensuring not to exceed the amount on line 11, and record this as your section 179 expense deduction in line 12.

- Proceed to Part II for Special Depreciation Allowance and Other Depreciation, not including listed property. Fill in the special depreciation allowance for qualified property in line 14.

- In Part III, compute the MACRS depreciation for assets placed in service during the tax year. For each type of property, enter the required information in lines 19a through 20d as applicable.

- Complete Part IV, Summary, to summarize the depreciation and amortization amounts. Make sure to include the totals from prior parts as instructed on the form.

- Fill in Part V for Listed Property, if applicable, providing detailed information for each listed item in Section A and completing Sections B and C as required based on vehicle use and employee access.

- For amortization expenses, fill out Part VI. List each cost, the corresponding code section, and the amortization amount or percentage for the current tax year.

- Review the entire form for accuracy, ensuring that all relevant parts are completed based on your specific circumstances.

Upon completion of IRS Form 4562, attach it to your tax return, keeping a copy for your records. This form plays a crucial role in maximizing your tax deductions related to property depreciation and amortization, providing a structured way to claim these expenses. Careful adherence to the instructions and accurate reporting are essential for compliance and optimization of your tax benefits.

Understanding Irs 4562

What is IRS Form 4562 used for?

IRS Form 4562 is utilized to calculate and report the depreciation and amortization of property for a given tax year. It covers a wide range of assets including business property, vehicles, and other tangible assets. This form is essential for taxpayers who need to attach it to their tax return if they are claiming deductions for depreciation and amortization, including deductions under Section 179 for electing to expense certain types of property.

Who needs to file Form 4562?

Any taxpayer who is claiming deductions for depreciation on assets, amortization of costs, or electing the Section 179 expense deduction needs to complete and file Form 4562. This includes businesses of all sizes, self-employed individuals, and anyone else who has placed depreciable property into service during the tax year.

When do you need to complete Part V of Form 4562?

Part V of Form 4562 should be completed if you have any listed property. Listed property includes vehicles, certain types of equipment used for entertainment, recreation, or amusement, and other specific categories of assets. It's critical to complete this part before Part I if you're claiming deductions for listed property.

What is the Section 179 deduction, and how is it related to Form 4562?

The Section 179 deduction allows taxpayers to expense the cost of qualifying property purchased or financed during the tax year, rather than capitalizing and depreciating the asset over time. On Form 4562, Part I is dedicated to the Election To Expense Certain Property Under Section 179, where taxpayers calculate the deduction limit and the total cost of property they're electing to expense.

How does one calculate depreciation using Form 4562?

Depreciation is calculated on Form 4562 through Parts II, III, and IV, depending on the type of property and the applicable depreciation system. For most business and investment-use property, the Modified Accelerated Cost Recovery System (MACRS) sections in Part III will apply. Taxpayers will list their property, its cost basis, and the recovery period to calculate the depreciation deduction.

Can Form 4562 be used for vehicles?

Yes, Form 4562 is used to report depreciation and the Section 179 deduction for vehicles used in a business, which are considered listed property. Specific limitations and deduction caps apply, and detailed vehicle information and usage must be provided in Part V, Section A and B, as applicable.

What evidence is required to support business or investment use claimed on Form 4562?

For listed property, including vehicles, taxpayers must have evidence to support the business or investment percentage of use claimed. This evidence can be in the form of logs or records detailing the use of the property. Question 24b on the form asks if this evidence is written, emphasizing the IRS’s preference for documented proof.

What happens if the business income limitation affects my Section 179 deduction?

The business income limitation can restrict the amount of the Section 179 deduction a taxpayer can claim in a single year. It requires that the total Section 179 expense deduction cannot exceed the taxpayer's business income. Any excess is carried forward to subsequent years. This calculation is made in Part I, specifically lines 10 through 12, of Form 4562.

Common mistakes

When filling out IRS Form 4562, which is used for reporting depreciation and amortization, people often make several common mistakes. Recognizing and avoiding these errors can help ensure the form is completed accurately and can assist in maximizing potential tax benefits.

-

Not Completing Part V for Listed Property First: A crucial step often overlooked is the requirement to complete Part V before Part I if you have any listed property. Listed property includes certain vehicles, computers, and other equipment used for both business and personal purposes. Missing this step can lead to inaccuracies in calculating depreciation deductions.

-

Incorrect Calculation of Business Use Percentage: For vehicles and other listed properties, accurately determining the percentage of business use is critical. An error in this calculation can lead to incorrect depreciation amounts. This percentage impacts the allowable deduction and must reflect the actual business use compared to the total use of the property.

-

Failure to Properly Elect the Section 179 Deduction: Taxpayers often miss taking advantage of the Section 179 deduction by improperly electing this option on the form. This mistake can occur from not correctly filling out lines 6 through 13 of Part I. The Section 179 deduction allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year, subject to certain limitations.

-

Miscalculating Depreciation for Assets: Another common error is the incorrect calculation of depreciation for assets, particularly in Parts II, III, and V for MACRS depreciation, special depreciation allowance, and listed property depreciation. This includes using the wrong recovery period, convention, or method. Such mistakes can significantly impact the depreciation deductions claimed for the tax year.

-

Always refer to the latest IRS guidelines and instructions for Form 4562 to ensure all data is accurately reported and calculated based on current tax laws.

-

Consider consulting with a tax professional if you have complex depreciation scenarios or need guidance on maximizing your deductions while complying with tax regulations.

Documents used along the form

Form 4562, utilized for reporting Depreciation and Amortization, including information on listed property, is a critical tool for businesses and individual taxpayers to claim their depreciation and amortization deductions on their tax returns. Alongside Form 4562, several other forms and documents are frequently submitted to provide additional details and support for the deductions claimed. These forms ensure compliance with tax laws and maximize legitimate tax benefits.

- Form 1040: The U.S. Individual Income Tax Return is the starting point for personal tax filing, to which Form 4562 is attached if the taxpayer has deductions for depreciation or amortization to report. This form helps to summarize an individual's income, tax deductions, and tax credits.

- Form 1120: For corporations, Form 1120 or the U.S. Corporation Income Tax Return serves a similar purpose as Form 1040 but for corporate entities. It is used to report the income, gains, losses, deductions, credits, and to calculate the income tax liability of corporations.

- Schedule C (Form 1040): Profit or Loss from Business (Sole Proprietorship) is crucial for individuals who operate a business as a sole proprietor. This schedule requests information on the business's income and expenses, including deductions for depreciation calculated using Form 4562.

- Schedule E (Form 1040): Supplemental Income and Loss is used by taxpayers to report income and losses from rental real estate, royalties, partnerships, S corporations, estates, and trusts. The form accommodates reporting depreciation and amortization deductions related to these income sources.

- Form 4797: Sales of Business Property is another form that may accompany Form 4562. This form is used to report the sale or exchange of property used in a trade or business, including sections for recapturing depreciation previously claimed on items such as equipment, vehicles, or buildings.

The labyrinth of tax forms can be daunting, but each serves a purpose, guiding taxpayers through the intricate process of accurately reporting income, expenses, and deductions. Forms such as Form 4562 and those listed above play pivotal roles in ensuring that entities take full advantage of tax laws whilst adhering to their obligations. Properly filling these forms not only aids in compliance but also in optimizing tax outcomes, making it imperative to understand their use and interconnections.

Similar forms

The IRS Form 1040, Schedule C, is quite similar to Form 4562 in that both are used by businesses and self-employed individuals. Schedule C is specifically for reporting income and expenses from a business or profession. Just like Form 4562 allows for the deduction of depreciation and amortization, Schedule C lets a business owner deduct various business expenses, which could include depreciation of assets. The main connection between these two forms lies in how the assets depreciated on Form 4562 might directly impact the expenses listed on Schedule C, thereby affecting the net income reported by a business.

Form 4797, Sales of Business Property, shares similarities with Form 4562, especially in the handling of asset depreciation. Both forms deal with assets used in a business or income-producing activity. While Form 4562 is used to calculate depreciation and amortization deductions for a given tax year, Form 4797 is used when one of those assets is sold or disposed of. It considers the depreciation taken on the asset, which was initially reported on Form 4562, to determine the gain or loss on the sale. The interplay between these forms highlights the lifecycle of a business asset from acquisition and use to disposition.

The IRS Form 8829, Expenses for Business Use of Your Home, is another document that relates closely to Form 4562. Form 8829 is used to deduct expenses related to the business use of a home, including a portion of depreciation for the home itself. Similar to how Form 4562 calculates depreciation for various business assets, Form 8829 calculates depreciation on the home being used for business purposes. This form highlights the depreciation aspect of a very specific business asset—the taxpayer's home—and in turn, affects the total business expenses reported.

Lastly, the IRS Form 1120, which is the U.S. Corporation Income Tax Return, parallels Form 4562 because it requires corporate entities to report their income, gains, losses, deductions, and credits. Within Form 1120, corporations can deduct depreciation on assets, a calculation derived from using Form 4562. This connection underscores the importance of Form 4562 in accurately determining the depreciation deductions that can significantly impact a corporation's taxable income and, consequently, its tax liability. Although each serves different purposes, the need to calculate and report depreciation makes Form 4562 critical for completing Form 1120 accurately.

Dos and Don'ts

When it comes to completing IRS Form 4562 for depreciation and amortization, it's important to move carefully to ensure accuracy and compliance. Here are some things you should and shouldn't do:

What You Should Do- Read the Instructions: Before filling out the form, thoroughly review the IRS instructions specific to Form 4562. This will give you an overview of the requirements and help prevent common mistakes.

- Gather Necessary Information: Make sure you have all the necessary information about the property you're depreciating, including cost, date of service, and business use percentage.

- Correctly Determine the Property Section: Properties are classified differently and must be reported in the correct section (Part III, Part IV, Part V) of the form depending on their type and the depreciation system used.

- Calculate Accurately: Ensure all your calculations are correct, especially when figuring the depreciation deduction, business income limitation, and any carryover of disallowed deduction.

- Double-Check Listed Property Requirements: If you're claiming depreciation for listed property (Part V), verify that it meets the more-than-50% business use requirement and that you have the necessary documentation to support its business use.

- Sign and Date the Form: Don't forget to sign and date your form if filing by paper. This might seem simple, but it's a crucial final step that certifies the information is accurate to the best of your knowledge.

- Avoid Guessing: Don't estimate or guess information. Use actual figures and records to fill out your form. Incorrect information can lead to errors in your tax return and potentially an audit.

- Skip Parts of the Form: Even if it seems repetitive, complete every part of the form that applies to your situation. Skipping sections can result in incomplete reporting and raise red flags with the IRS.

- Ignore Listed Property Rules: Don't skip the special rules for listed property, such as vehicles and computers. Failing to adhere to these rules can lead to disallowed deductions.

- Omit Carryover Amounts: If you have any carryover of disallowed deductions from the previous year, make sure to include them on your current year's Form 4562. Omitting these amounts can result in an inaccurate tax calculation.

- Use Outdated Forms: Always use the most current version of IRS forms. Tax laws and forms can change from year to year, and using an outdated form can cause processing delays or form rejections.

- Ignore the Evidence Requirement for Listed Property: Do not overlook the necessity of having written evidence to support the business/investment use claimed for listed property. Lack of proper documentation can lead to deduction denials.

Misconceptions

When it comes to understanding tax forms, few can seem as daunting as the IRS Form 4562, which deals with depreciation and amortization. Over the years, several misconceptions have arisen about how to accurately complete and use this form. Let's clarify some of the most common misunderstandings.

- Only large businesses need to file Form 4562. This assumption is incorrect. Regardless of the size, businesses that own assets subject to depreciation or amortization must file Form 4562 to claim their deductions. This can include small businesses, sole proprietors, and even individuals who have business assets being used for income-producing activities.

- Section 179 deductions are limitless. Although Section 179 of the Internal Revenue Code allows taxpayers to deduct the full purchase price of qualifying equipment or software, there are limits. These limits are adjusted annually for inflation and can be affected by the total value of equipment purchased in a year, limiting the benefit for higher expenditures.

- You can only depreciate new property. This misconception overlooks the tax provisions that allow for both new and used property to qualify for depreciation, provided the taxpayer has not used the property before acquiring it for business purposes. The key requirement is that the asset must be used in a business or income-producing activity and have a determinable useful life of more than one year.

- Claiming depreciation is optional. While taxpayers may choose not to claim depreciation in a given year, it's critical to understand the implications of this decision. Failing to claim depreciation reduces the basis of the asset, which can increase taxes owed upon its sale. Moreover, the IRS assumes depreciation has been claimed, and this assumption will reflect in calculations of capital gains or losses.

Demystifying Form 4562 helps taxpayers make informed decisions about their deductions related to depreciation and amortization. As with all tax forms and IRS procedures, staying informed about the rules and limitations is crucial in maximizing benefits while remaining compliant.

Key takeaways

When it comes to filing the IRS Form 4562, there are several key points you should keep in mind to ensure accurate completion and utilization. Here's a list of takeaways:

- Form 4562 is used for reporting depreciation and amortization. These deductions can significantly impact your taxable income by reducing the amount of income that's subjected to taxes.

- The form is divided into six parts, each designed to guide you through different depreciation and amortization calculations for various types of property, including listed property.

- Before filling out Part I, if you have any listed property, it's crucial to complete Part V first. This part addresses specific items like cars, computers, and equipment used for entertainment purposes.

- Part I focuses on the Section 179 deduction, which allows you to deduct the full purchase price of qualifying property immediately instead of depreciating the cost over several years.

- Be mindful of the maximum amount and limitations outlined in Part I when electing to expense certain property under Section 179. These figures can change annually and are subject to legislative adjustments.

- Part II deals with special depreciation allowances and other depreciation that doesn't fall under the Modified Accelerated Cost Recovery System (MACRS).

- In Part III, you calculate depreciation using MACRS for assets placed in service during the tax year. It's essential to accurately classify property to apply the correct depreciation method and convention.

- Pay attention to listed property rules in Part V, as there are strict requirements for documenting business versus personal use. Failure to comply can lead to disallowed deductions.

- For vehicles and other listed properties, whether the asset was available for personal use and the amount of business versus personal miles driven, must be accurately tracked and reported.

- Part VI addresses amortization of certain costs, allowing for the gradual deduction of specific expenses over a period that reflects their use or benefit to the business.

Completing IRS Form 4562 requires attention to detail and an understanding of depreciation and amortization rules. By carefully following the instructions and knowing what information is needed for each part, you can take full advantage of the tax benefits associated with depreciation and amortization deductions.

Popular PDF Documents

Ein Number Form - Entrepreneurs must not overlook the completion of the SS-4 as part of their business setup checklist to avoid future tax issues.

Form 11-c - The form's structure helps employers easily determine their tax liabilities and avoid potential legal issues.

Formula for Marked Price - Unveils the financial journey of a taxi business over a fiscal year, spotlighting the major income and expense categories.