Get Irs 4549 Form

When individuals and businesses undergo an income tax examination by the Internal Revenue Service (IRS), the outcome of these audits can lead to changes in the amount of tax owed. Form 4549, "Income Tax Examination Changes," plays a crucial role in this process. This form serves as a communication tool between the IRS and the taxpayer, summarizing the adjustments made to the taxpayer's income, deductions, and credits that were previously reported. These adjustments can result in an increase or decrease in the taxpayer's tax liability. The form details various components such as adjustments to income, itemized or standard deductions, taxable income, tax method and filing status, additional taxes, the corrected tax liability, and any penalties or interests due to inaccuracies. Another critical aspect of Form 4549 is its role in the process of consenting to the assessment and collection of taxes without proceeding to appeal within the IRS or contest the findings in the United States Tax Court. Moreover, it informs taxpayers about the potential impact on their state tax liabilities, urging them to amend state returns if necessary. Lastly, it serves as a significant document for the IRS's internal processes, requiring acceptance by several high-ranking officials. Understanding Form 4549 is essential for taxpayers faced with examination changes, ensuring they are fully informed about their rights, the adjustments made, and the subsequent effects on their tax liabilities.

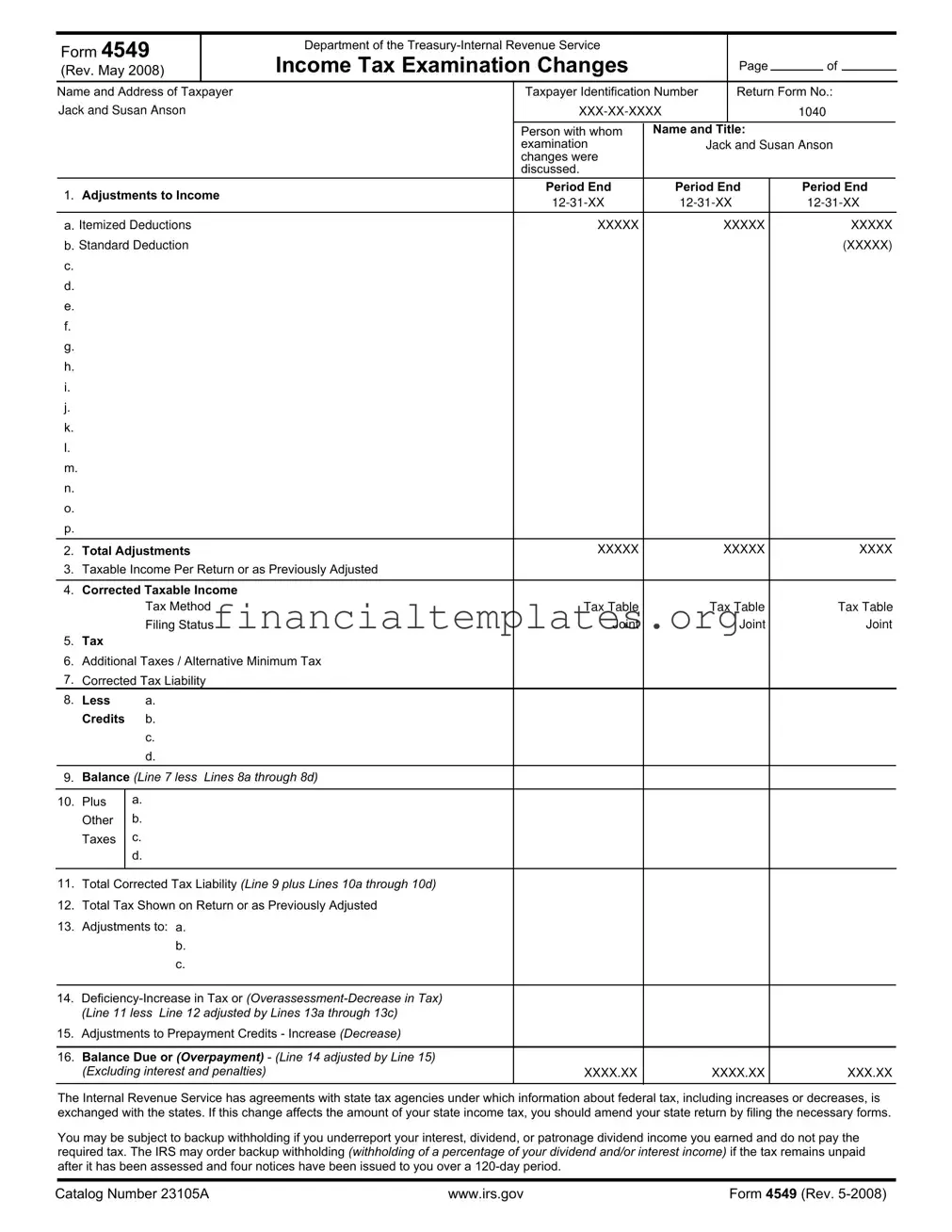

Irs 4549 Example

Form 4549 |

|

Department of the |

|

|

|

|

|

|

|

|

||

|

Income Tax Examination Changes |

|

|

|

Page |

|

of |

|

|

|||

(Rev. May 2008) |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||

Name and Address of Taxpayer |

|

Taxpayer Identification Number |

|

Return Form No.: |

||||||||

Jack and Susan Anson |

|

|

|

|

1040 |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Person with whom |

Name and Title: |

|

|

|

|

|||

|

|

|

|

examination |

|

|

Jack and Susan Anson |

|||||

|

|

|

|

changes were |

|

|

|

|

|

|

|

|

|

|

|

|

discussed. |

|

|

|

|

|

|

|

|

1. |

Adjustments to Income |

|

Period End |

|

Period End |

Period End |

||||||

|

|

|||||||||||

|

|

|

|

|

||||||||

a. Itemized Deductions |

|

XXXXX |

|

|

XXXXX |

|

|

XXXXX |

||||

b. Standard Deduction |

|

|

|

|

|

|

|

|

(XXXXX) |

|||

c. |

|

|

|

|

|

|

|

|

|

|

|

|

d. |

|

|

|

|

|

|

|

|

|

|

|

|

e. |

|

|

|

|

|

|

|

|

|

|

|

|

f. |

|

|

|

|

|

|

|

|

|

|

|

|

g. |

|

|

|

|

|

|

|

|

|

|

|

|

h. |

|

|

|

|

|

|

|

|

|

|

|

|

i. |

|

|

|

|

|

|

|

|

|

|

|

|

j. |

|

|

|

|

|

|

|

|

|

|

|

|

k. |

|

|

|

|

|

|

|

|

|

|

|

|

l. |

|

|

|

|

|

|

|

|

|

|

|

|

m. |

|

|

|

|

|

|

|

|

|

|

|

|

n. |

|

|

|

|

|

|

|

|

|

|

|

|

o. |

|

|

|

|

|

|

|

|

|

|

|

|

p. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2. |

Total Adjustments |

|

XXXXX |

|

|

XXXXX |

|

|

XXXX |

|||

3.Taxable Income Per Return or as Previously Adjusted

4.Corrected Taxable Income

Tax Method |

Tax Table |

Tax Table |

Tax Table |

Filing Status |

Joint |

Joint |

Joint |

5.Tax

6.Additional Taxes / Alternative Minimum Tax

7.Corrected Tax Liability

8.Less a. Credits b. c. d.

9.Balance (Line 7 less Lines 8a through 8d)

10.Plus a. Other b. Taxes c. d.

11.Total Corrected Tax Liability (Line 9 plus Lines 10a through 10d)

12.Total Tax Shown on Return or as Previously Adjusted

13.Adjustments to: a.

b.

c.

14.

15.Adjustments to Prepayment Credits - Increase (Decrease)

16.Balance Due or (Overpayment) - (Line 14 adjusted by Line 15)

(Excluding interest and penalties) |

XXXX.XX |

XXXX.XX |

XXX.XX |

The Internal Revenue Service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. If this change affects the amount of your state income tax, you should amend your state return by filing the necessary forms.

You may be subject to backup withholding if you underreport your interest, dividend, or patronage dividend income you earned and do not pay the required tax. The IRS may order backup withholding (withholding of a percentage of your dividend and/or interest income) if the tax remains unpaid after it has been assessed and four notices have been issued to you over a

Catalog Number 23105A |

www.irs.gov |

Form 4549 (Rev. |

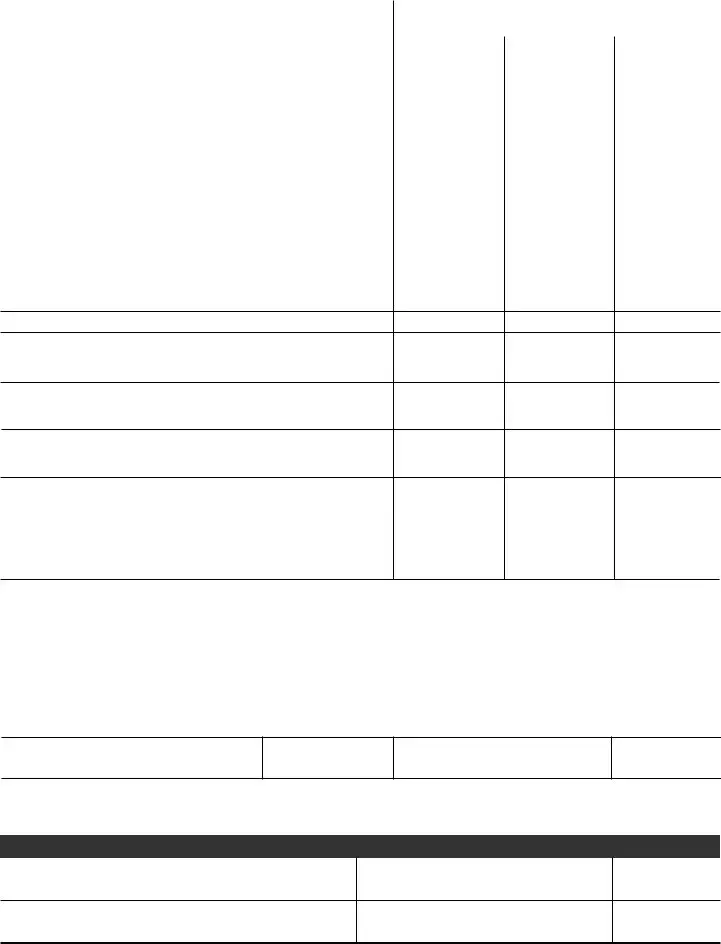

Form 4549 |

|

|

Department of the |

|

|

|

|

|

|

|

|

|

Income Tax Examination Changes |

|

|

Page |

|

of |

|

|

|

||

(Rev. May 2008) |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||

Name of Taxpayer |

|

Taxpayer Identification Number |

|

Return Form No.: |

|

||||||

Jack and Susan Anson |

|

|

|

|

1040 |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period End |

Period End |

Period End |

|

|||||

17. Penalties/ Code Sections |

|

|

|||||||||

a. Accuracy Related Penalty - IRC 6662 |

XXX.XX |

|

XXX.XX |

|

|

XX.XX |

|

||||

b. |

|

|

|

|

|

|

|

|

|

|

|

c. |

|

|

|

|

|

|

|

|

|

|

|

d. |

|

|

|

|

|

|

|

|

|

|

|

e. |

|

|

|

|

|

|

|

|

|

|

|

f. |

|

|

|

|

|

|

|

|

|

|

|

g. |

|

|

|

|

|

|

|

|

|

|

|

h. |

|

|

|

|

|

|

|

|

|

|

|

i. |

|

|

|

|

|

|

|

|

|

|

|

j. |

|

|

|

|

|

|

|

|

|

|

|

k. |

|

|

|

|

|

|

|

|

|

|

|

l. |

|

|

|

|

|

|

|

|

|

|

|

m. |

|

|

|

|

|

|

|

|

|

|

|

n. |

|

|

|

|

|

|

|

|

|

|

|

18.Total Penalties

Underpayment attributable to negligence: (19811987) A tax addition of 50 percent of the interest due on the underpayment will accrue until it is paid or assessed.

Underpayment attributable to fraud: (19811987)

A tax addition of 50 percent of the interest due on the underpayment will accrue until it is paid or assessed.

Underpayment attributable to Tax Motivated Transactions (TMT). The interest will accrue and be assessed at 120% of the under payment rate in accordance with IRC §6621(c)

19.Summary of Taxes, Penalties and Interest:

a. |

Balance due or (Overpayment) Taxes - (Line 16, Page 1) |

XXXX.XX |

XXXX.XX |

XXX.XX |

|

b. |

Penalties (Line 18) - computed to |

|

XXX.XX |

XXX.XX |

XX.XX |

c. |

Interest (IRC § 6601) - computed to |

|

XXX.XX |

XXX.XX |

XX.XX |

d. |

TMT Interest - computed to |

(on TMT underpayment) |

|

|

|

e. |

Amount due or (refund) (sum of Lines a, b, c and d) |

XXXX.XX |

XXXX.XX |

XXXX.XX |

|

Other Information:

Examiner's Signature:

Employee ID:

XXXXXXX

Office:

SBSE- Exam

Date:

Consent to Assessment and Collection- I do not wish to exercise my appeal rights with the Internal Revenue Service or to contest in the United States Tax Court the findings in this report. Therefore, I give my consent to the immediate assessment and collection of any increase in tax and penalties, and accept any decrease in tax and penalties shown above, plus additional interest as provided by law. It is understood that this report is subject to acceptance by the Area Director, Area Manager, Specialty Tax Program Chief, or Director of Field Operations.

PLEASE NOTE: If a joint return was filed. BOTH taxpayers must sign

Signature of Taxpayer |

Date: |

Signature of Taxpayer |

|

|

|

Date:

By:

Title:

Date:

Catalog Number 23105A |

www.irs.gov |

Form 4549 (Rev. |

Document Specifics

| Name | Fact |

|---|---|

| Form Number and Title | Form 4549: Income Tax Examination Changes |

| Revision Date | May 2008 |

| Issuing Department | Department of the Treasury - Internal Revenue Service |

| Main Purpose | To report adjustments to a taxpayer's income tax following an examination |

| Taxpayer Identification | Includes the name, address, and taxpayer identification number of the individuals being assessed |

| Adjustments | Documents adjustments to income, deductions, and taxable income |

| Tax Calculation | Details on the corrected tax liability, including taxes owed or overpaid, additional taxes, and total penalties |

| Penalties and Interest | Includes specific penalties such as the accuracy-related penalty and interest due on underpayments |

| State Tax Implications | Advises taxpayers to amend state returns if federal adjustments affect state income tax |

| Consent Clause | Provides an option for taxpayers to consent to the assessment and collection of changes without appeal |

Guide to Writing Irs 4549

Filling out IRS Form 4549 can seem complicated, but taking it step by step can simplify the process. This form is used to document adjustments to your income tax returns following an examination. Once completed, it plays a crucial role in resolving discrepancies identified during the tax audit. Understand that completion of this form is just part of an ongoing process where additional steps, including potential adjustment of state taxes and addressing any interest or penalties, may be required.

- Start by filling out the top section with the Name and Address of Taxpayer, which would be "Jack and Susan Anson" according to the given information.

- Enter the Taxpayer Identification Number next to the taxpayer's names without dashes, as "XXX-XX-XXXX".

- Specify the Return Form No.: as "1040" for the type of tax return that was examined.

- Under Name and Title:, confirm the examination was discussed with both "Jack and Susan Anson".

- For each Period End column, ensure the date is correctly entered as "12-31-XX" across all necessary fields.

- In the section labeled Adjustments to Income, fill in the amounts for itemized deductions, standard deduction, and any other applicable adjustments as listed, making sure to follow the format provided in the document (use XXXXX for numbers).

- Tabulate the Total Adjustments for each period as directed in the form, ensuring accuracy in the arithmetic.

- Detail the Taxable Income Per Return or as Previously Adjusted, followed by the Corrected Taxable Income, using the Tax Table and confirming the Filing Status as "Joint".

- Calculate and enter the figures for Tax, Additional Taxes / Alternative Minimum Tax, and the Corrected Tax Liability.

- Subtract any credits from the corrected tax liability to find the balance, as stated in line 9.

- Add any other taxes or charges under section 10 to find the Total Corrected Tax Liability.

- Compare and record any adjustments from the amount shown on the return or previously adjusted, leading to a final calculation of deficiency or overassessment.

- Adjust prepayment credits as necessary.

- Sign and date the form. If filing jointly, ensure both taxpayers sign and date the form to validate it.

After completing IRS Form 4549, your next steps will involve waiting for any communication from the IRS regarding the acceptance of the adjustments or any further actions required. Remember, accuracy in filling out this form can significantly smooth the process moving forward. Keep a copy of the filled form for your records and monitor any correspondence from the IRS closely. If adjustments to state income tax are necessary based on the changes made, consider contacting a tax professional to help with the amendments to avoid any potential errors.

Understanding Irs 4549

What is IRS Form 4549?

IRS Form 4549, also known as the Income Tax Examination Changes form, is a document used by the Internal Revenue Service (IRS) to inform taxpayers about adjustments to their income tax returns following an examination or audit. It details the changes proposed by the IRS to the taxpayer's income, deductions, and taxable income, along with the corresponding adjustments to tax liability, credits, and payments. This form serves as a record of the IRS's findings and the taxpayer's agreement or disagreement with those findings.

Who receives IRS Form 4549?

IRS Form 4549 is issued to individuals or entities that have undergone a tax audit and where the IRS proposes adjustments to their tax returns. The form is addressed to the taxpayer(s) whose return was audited, detailing the specifics of the examination findings.

What should I do if I receive IRS Form 4549?

Upon receiving IRS Form 4549, carefully review the proposed changes to ensure accuracy. If you agree with the adjustments, you may sign the form, consenting to the assessment and collection of any additional taxes and penalties. If you disagree, you have the right to appeal the findings or contest them in the United States Tax Court. Consider consulting a tax professional for guidance on how to proceed.

Can I appeal the findings on IRS Form 4549?

Yes, recipients of IRS Form 4549 have the option to appeal the findings. If you disagree with the proposed adjustments, you may file an appeal with the IRS. This process involves providing documentation and evidence to support your position. It is advisable to seek assistance from a tax professional or attorney to navigate the appeals process effectively.

What happens if I agree with the adjustments proposed on IRS Form 4549?

If you agree with the proposed adjustments on IRS Form 4549, you should sign and return the form to the IRS, indicating your consent to the immediate assessment and collection of any increase in tax, penalties, and applicable interest. It is important to act promptly to avoid additional interest and penalties.

What are the consequences of not responding to IRS Form 4549?

Failure to respond to IRS Form 4549 can result in the IRS proceeding with the proposed adjustments. This includes the assessment and collection of any additional taxes, penalties, and interest deemed owed. Ignoring the form can lead to enforced collection actions. Therefore, it is crucial to address the findings, whether through agreement, appeal, or seeking professional advice.

Does IRS Form 4549 affect state income tax?

Yes, changes made to your federal tax return as a result of IRS Form 4549 can affect your state income tax. The IRS shares information with state tax agencies, which may necessitate amending your state return to reflect these changes. It is recommended to consult the tax agency in your state or a tax professional for guidance on amending your state tax return.

Are there penalties associated with IRS Form 4549?

IRS Form 4549 includes details of any penalties resulting from the audit, such as accuracy-related penalties or underpayment penalties due to negligence or fraud. These penalties are in addition to any taxes and interest owed. Understanding the nature of these penalties and the reasons they were assessed is important for resolving any tax liabilities.

How can I avoid issues that lead to receiving IRS Form 4549 in the future?

To minimize the likelihood of receiving IRS Form 4549, ensure accuracy and completeness when filing tax returns. Keep detailed records, report all income, and only claim deductions and credits for which you are eligible. Consider seeking guidance from a tax professional, especially if you have complex tax situations or are uncertain about specific tax laws.

Common mistakes

Completing the IRS Form 4549, also known as the Income Tax Examination Changes form, can be a daunting task. This document is crucial as it highlights adjustments to your income tax following an examination. However, individuals often make mistakes during this process, leading to further complications. Below are five common errors to be mindful of:

-

Incorrect Personal Information: It may seem basic, but entering inaccurate personal details such as name, address, or Taxpayer Identification Number can derail the process. This is the foundation of your form, and errors here can lead to misplaced documents or misapplied adjustments.

-

Misinterpreting Adjustments: The form outlines various income and deduction adjustments. Misunderstanding these adjustments or incorrectly calculating their impact on taxable income and tax liability is a common pitfall. It's crucial to thoroughly review the explanations provided by the examiner and consult a professional if needed.

-

Overlooking Penalties and Interest: Sections related to penalties, such as for accuracy-related issues or underpayment, require close attention. Failing to accurately account for or understand the calculation of these penalties can lead to underestimating the total amount due.

-

Ignoring State Tax Implications: Federal adjustments often have a ripple effect on state tax filings. Not amending state returns in light of the changes reported can result in discrepancies, potential penalties, or missed refund opportunities at the state level.

-

Neglecting Consent to Assessment and Collection Section: This section may seem like a formality, but it's crucial for wrapping up the examination process. Failure to properly consent (or decline to consent) to the assessment and collection can delay resolution or affect appeal rights.

Beyond these errors, it's valuable to approach the IRS Form 4549 with diligence and to seek clarification or assistance when in doubt. This ensures a smoother resolution to any examination findings and helps avoid unnecessary stress or financial impact.

Documents used along the form

Understanding the landscape of tax documentation is crucial, especially when it comes to dealing with the Internal Revenue Service (IRS). The IRS Form 4549, known as the Income Tax Examination Changes form, is a pivotal document used when there are adjustments to be made to an individual's income tax return after an examination. However, this form doesn't stand alone in the process of tax examination and adjustments. There are several other forms and documents that are often used alongside Form 4549 to streamline tax corrections and understanding these can significantly ease the process for taxpayers.

- Form 886-A: This form is an Explanation of Items. It provides a detailed explanation of the adjustments or changes proposed by the IRS. It's where the IRS examiner lists out their reasoning behind each adjustment to your income, deductions, or credits. It acts as a supporting document to the changes outlined in Form 4549, giving taxpayers a clearer view of why certain changes are being suggested.

- Form 872: Known as the Consent to Extend the Time to Assess Tax, this form plays a crucial role when more time is needed beyond the usual statute of limitations for assessing tax. By signing this agreement, the taxpayer and the IRS agree to extend the period to assess tax, which may be necessary to resolve any disputes or adjustments needed on the taxpayer's return.

- Form 433-A: This form, the Collection Information Statement for Wage Earners and Self-Employed Individuals, is often used if there’s a balance due after adjustments. It's a detailed form where taxpayers provide information about their finances, including income, living expenses, assets, and liabilities. This information is crucial for the IRS to determine how the taxpayer can settle the outstanding balance, offering a pathway to payment plans or other arrangements.

- Form 2859: The Request for Quick or Prompt Assessment is a document crucial for closing out certain cases rapidly. It is particularly used in instances where there's an impending expiration of the statute of limitations for assessment. This form helps expedite the assessment process, ensuring that the IRS can make any additional assessments before the statutory deadline passes.

When faced with tax examinations and adjustments, understanding the purpose and use of these forms can demystify the process. Everyone’s tax situation is unique, and while not all forms may be relevant to every taxpayer undergoing an examination, knowing that these tools exist provides a foundation for navigating potential complexities with more confidence. It’s always advisable to consult with a tax professional when dealing with IRS examinations and adjustments to ensure that one's rights are protected and that the process is as smooth as possible.

Similar forms

One document similar to IRS Form 4549 is Form 1040, the U.S. Individual Income Tax Return. Both forms are fundamental in the tax filing process, with Form 1040 being the starting point for individual taxpayers to report their annual income, deductions, and credits to the Internal Revenue Service (IRS). Form 4549, on the other hand, comes into play after an audit or review of the taxpayer's initial submission on Form 1040 when adjustments to the reported figures might be necessary. While Form 1040 represents the taxpayer's claims about their tax responsibilities, Form 4549 reflects the IRS's conclusions about what those responsibilities actually are after a closer examination. This examination can lead to changes in taxable income, tax liabilities, or credits.

Another document related to Form 4549 is Form 886-A, Explanation of Items. This form is often used in conjunction with Form 4549 during an audit. It provides detailed explanations and justifications for any adjustments made by the auditor to the taxpayer's reported items. While Form 4549 summarizes the financial outcome of those adjustments – such as changes to income, deductions, and subsequent tax liabilities – Form 886-A gives the reasoning behind each change. This reasoning is crucial, as it offers the taxpayer insights into the auditor's decisions, which can be instrumental for those considering whether to accept the IRS's findings or to dispute them.

Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals, also shares similarities with Form 4549. Although the primary purpose of Form 433-A is to gather financial information from taxpayers who are setting up a payment plan or compromise with the IRS, both forms are integral to the assessment and resolution of tax liabilities. While Form 4549 identifies adjustments to tax liabilities resulting from an audit, Form 433-A is used to determine the taxpayer’s ability to pay the adjusted amount. Thus, both forms can play pivotal roles in resolving tax issues, albeit at different stages of the process.

Form 656, Offer in Compromise, is another document closely related to Form 4549. After receiving a revised tax liability via Form 4549, some taxpayers may find themselves unable to pay the full amount owed. Form 656 allows taxpayers to negotiate with the IRS to settle their tax debts for less than the amount owed. The connection between these forms lies in the financial realities they address. Form 4549 may increase a taxpayer's debt, and Form 656 provides a potential pathway to financial relief by enabling an agreement that considers the taxpayer's ability to pay.

Last but not least, Form 843, Claim for Refund and Request for Abatement, has relevancy to Form 4549. This form is used to request a refund of taxes paid or to ask for an abatement of certain taxes, penalties, fees, or interest. It becomes particularly relevant if, after receiving the adjustments outlined in Form 4549, a taxpayer believes an error has been made that resulted in overpayment or incorrect assessment of penalties and interest. Where Form 4549 might increase a taxpayer's liability, Form 843 offers a recourse for correcting possible over-assessments or for reclaiming excess amounts paid as a result of those adjustments. Both forms, therefore, play critical roles in ensuring taxpayer rights and the accuracy of assessed tax liabilities.

Dos and Don'ts

When filling out the IRS 4549 Form, there are key actions you should take to ensure the process is complete and accurate. Equally, there are mistakes to avoid that could lead to further complications with your tax situation. Here are essential dos and don'ts:

Do's:

- Review the entire form carefully before beginning to fill it out. Understanding each section can help you provide accurate information and avoid errors.

- Verify your personal information, including your name, address, and Taxpayer Identification Number, to ensure it matches the information the IRS has on file.

- Include all necessary adjustments to your income, deductions, and credits. This step is crucial for accurately determining your taxable income and tax liability.

- Seek professional advice if you're unsure about any adjustments or changes proposed in the form. A tax professional can provide guidance and help you avoid potential issues.

Don'ts:

- Overlook the examination changes. The adjustments to income, deductions, and credits must be thoroughly reviewed to understand their impact on your taxable income.

- Forget to review penalties and interest sections. These can significantly affect your total tax liability, so it's important to understand why they were assessed.

- Ignore the requirement for both signatures on a joint return. Both parties must sign the form to validate it if filing jointly.

- Delay addressing any balance due or overpayment. Promptly attend to any amount owed to avoid additional interest and penalties, or file for a refund if applicable.

Misconceptions

There are several misconceptions about the IRS Form 4549, Income Tax Examination Changes, which can lead to confusion among taxpayers. It's essential to clarify these misunderstandings to ensure accurate tax compliance and avoid unnecessary stress. Below are seven common misconceptions about Form 4549:

- It's only for taxpayers who have underpaid their taxes. While Form 4549 is often associated with adjustments resulting in additional tax owed, it is also used to document any changes to a taxpayer’s income tax return that could result in either an increase or decrease in tax liability or even result in a refund.

- Receiving Form 4549 means you are in trouble with the IRS. This is not always the case. The form is standard procedure for documenting any discrepancies found during an income tax examination. It details the adjustments made by the IRS and explains the reasons for those changes. It does not necessarily imply wrongdoing or intentional error on the part of the taxpayer.

- Form 4549 calculates penalties and interest. While the form does include information on any penalties and interest due to adjustments, it is primarily focused on the changes to the income, deductions, credits, and tax liability. The calculation of penalties and interest is a related but separate consideration.

- If you agree with the adjustments, no further action is needed. If you receive Form 4549 and agree with the adjustments, you still need to take action. The form requires your consent for assessment and collection of any increase in tax and any applicable penalties and interest. Taxpayers must sign and return the form for the adjustments to be officially accepted and processed by the IRS.

- Disagreeing with Form 4549 means going to court. If a taxpayer disagrees with the adjustments proposed on Form 4549, there are several avenues available before court action is considered. Taxpayers can request a conference with an IRS manager or seek mediation. The IRS also offers an appeals process to resolve disputes without going to court.

- Form 4549 is the final step in the examination process. Receipt of Form 4549 does not necessarily mark the end of the examination process. Taxpayers have the right to appeal the findings, request further clarification or explanation, and provide additional documentation. The process can involve several steps before reaching a final resolution.

- All information shared with the IRS will be automatically forwarded to state tax agencies. While the IRS does have agreements to exchange information with state tax agencies, this exchange is typically focused on specific cases of interest and under certain conditions. Taxpayers should separately inform their state tax authority of any changes to their federal tax situation, especially if those changes affect their state income tax.

Understanding the purpose and procedures associated with IRS Form 4549 can help taxpayers navigate the examination process more effectively, ultimately leading to a more accurate and fair tax assessment.

Key takeaways

Understanding the IRS Form 4549, or the Income Tax Examination Changes form, is crucial for taxpayers who are undergoing an audit or revision of their filed taxes. Here are key takeaways about filling out and using this form effectively:

- Personal Information is Critical: Ensure that your name, address, and taxpayer identification number (usually your Social Security Number) are correct. These details should match those on your tax return.

- Examination Details Need Attention: The form outlines changes proposed by the IRS agent after an examination of your tax return. It's essential to review these adjustments to your income, deductions, and tax liability carefully.

- Adjustments to Income: This section lists the modifications to your reported income or deductions. It's important to understand why each adjustment was made and how it affects your taxable income.

- Understanding Your Tax Liability: Pay close attention to the calculation of your corrected tax liability, which includes your original tax due plus or minus any adjustments, and any additional taxes or credits.

- Penalties and Interest: If applicable, penalties for accuracy-related errors or underpayments, and any interest due on unpaid taxes, are listed. Understanding the basis for these penalties is important for rectifying issues and preventing future ones.

- State Tax Implications: Changes to your federal tax return may affect your state income tax. Checking if you need to amend your state return is a critical follow-up action.

- Consent to Assessment and Collection: Signing this form indicates your agreement with the findings and waives your right to appeal within the IRS or contest the findings in U.S. Tax Court. Both parties in a joint return must sign if affected.

- Immediate Action May Be Required: If you agree with the changes, prompt action can help avoid additional interest and penalties. If you disagree, exploring appeal rights or seeking professional advice is advisable before consenting to the adjustments.

Handling Form 4549 with a thorough understanding and careful review can ensure that your tax obligations are accurate and that you are complying effectively with IRS requirements.

Popular PDF Documents

At What Age Do Seniors Stop Paying Property Taxes in Massachusetts? - Applications not timely filed will be denied, and the assessors cannot grant an abatement by law.

Cab Bill Format in Word - Documentation required for reimbursement or record-keeping of taxi travel expenses incurred at Washington Dulles International Airport.