Get IRS 4506-T-EZ Form

The IRS 4506-T-EZ form plays a critical role for individuals seeking to simplify their interactions with financial institutions, especially when applying for loans or mortgage modifications. This streamlined version of the more comprehensive IRS 4506-T form allows taxpayers to request a summary of their tax return information, known as a transcript, which can be vital for proving income when undergoing various financial processes. Key aspects of the form include its accessibility, designed to facilitate an easier application process by requiring less documentation than its full version. It specifically caters to requests for the Individual Tax Return Transcript, encompassing just the most recent tax year or up to the past three years, providing a concise yet comprehensive overview of a taxpayer’s income information. By offering a snapshot of financial standing without the need to provide a full tax return, the IRS 4506-T-EZ form assists in streamlining the validation process for loans or modifications, making it an essential tool for both individuals and financial entities in ensuring the accuracy and authenticity of reported income.

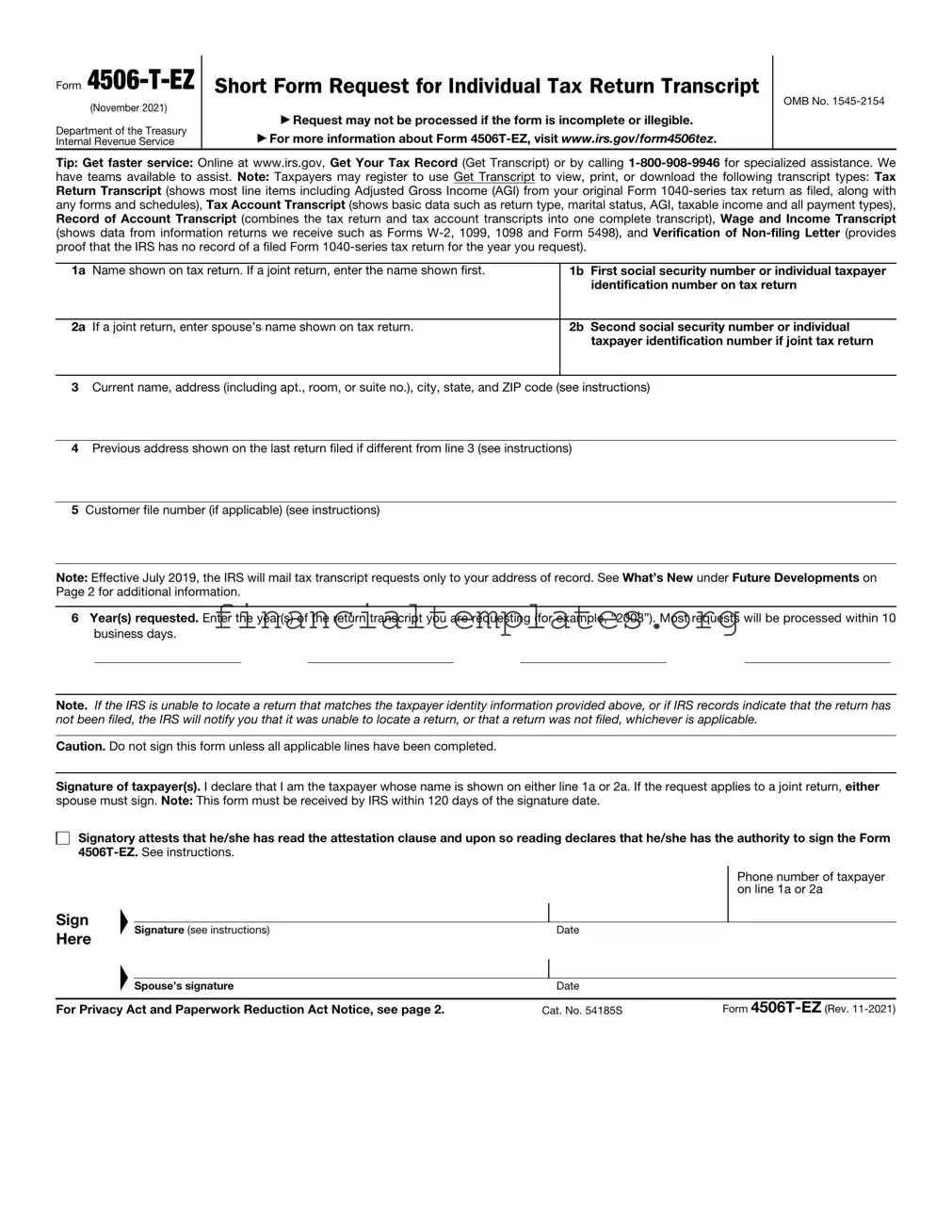

IRS 4506-T-EZ Example

Form

(November 2021)

Department of the Treasury Internal Revenue Service

Short Form Request for Individual Tax Return Transcript

▶Request may not be processed if the form is incomplete or illegible.

▶For more information about Form

OMB No.

Tip: Get faster service: Online at www.irs.gov, Get Your Tax Record (Get Transcript) or by calling

have teams available to assist. Note: Taxpayers may register to use Get Transcript to view, print, or download the following transcript types: Tax Return Transcript (shows most line items including Adjusted Gross Income (AGI) from your original Form

1a |

Name shown on tax return. If a joint return, enter the name shown first. |

1b |

First social security number or individual taxpayer |

|

|

|

identification number on tax return |

|

|

|

|

2a |

If a joint return, enter spouse’s name shown on tax return. |

2b |

Second social security number or individual |

|

|

|

taxpayer identification number if joint tax return |

|

|

|

|

3Current name, address (including apt., room, or suite no.), city, state, and ZIP code (see instructions)

4Previous address shown on the last return filed if different from line 3 (see instructions)

5Customer file number (if applicable) (see instructions)

Note: Effective July 2019, the IRS will mail tax transcript requests only to your address of record. See What’s New under Future Developments on Page 2 for additional information.

6Year(s) requested. Enter the year(s) of the return transcript you are requesting (for example, “2008”). Most requests will be processed within 10 business days.

Note. If the IRS is unable to locate a return that matches the taxpayer identity information provided above, or if IRS records indicate that the return has not been filed, the IRS will notify you that it was unable to locate a return, or that a return was not filed, whichever is applicable.

Caution. Do not sign this form unless all applicable lines have been completed.

Signature of taxpayer(s). I declare that I am the taxpayer whose name is shown on either line 1a or 2a. If the request applies to a joint return, either spouse must sign. Note: This form must be received by IRS within 120 days of the signature date.

Signatory attests that he/she has read the attestation clause and upon so reading declares that he/she has the authority to sign the Form

Sign Here

▲ ▲

Signature (see instructions)

Spouse’s signature

Phone number of taxpayer on line 1a or 2a

Date

Date

For Privacy Act and Paperwork Reduction Act Notice, see page 2. |

Cat. No. 54185S |

Form |

Form |

Page 2 |

Section references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about developments related to Form

The filing location for the Form

What’s New. As part of its ongoing efforts to protect taxpayer data, the Internal Revenue Service announced that in July 2019, it will stop all

If a

General Instructions

Caution. Do not sign this form unless all applicable lines have been completed.

Purpose of form. Individuals can use Form

Use Form

Customer File Number. The transcripts provided by the IRS have been modified to protect taxpayers’ privacy. Transcripts only display partial personal information, such as the last four digits of the taxpayer's Social Security Number. Full financial and tax information, such as wages and taxable income, are shown on the transcript.

An optional Customer File Number field is available to use when requesting a transcript. This number will print on the transcript. See Line 5 instructions for specific requirements. The customer file number is an optional field and not required.

Automated transcript request. You can quickly request transcripts by using our automated

Where to file. Mail or fax Form

If you are requesting more than one transcript or other product and the chart below shows two different addresses, send your request to the address based on the address of your most recent return.

If you filed an |

Mail or fax to the |

individual return |

“Internal Revenue |

and lived in: |

Service” at: |

|

|

Florida, Louisiana, |

RAIVS Team |

Mississippi, Texas, a |

Stop 6716 AUSC |

foreign country, |

Austin, TX 73301 |

American Samoa, |

|

Puerto Rico, Guam, |

|

the Commonwealth |

|

of the Northern |

|

Mariana Islands, the |

|

U.S. Virgin Islands, or |

|

A.P.O. or F.P.O. |

|

address |

|

|

|

Alabama, Arkansas, |

RAIVS Team |

Delaware, Georgia, |

Stop 6705 |

Illinois, Indiana, Iowa, |

Kansas City, MO |

Kentucky, Maine, |

64999 |

Massachusetts, |

|

|

|

Minnesota, Missouri, |

|

New Hampshire, New |

|

Jersey, New York, |

|

North Carolina, |

|

Oklahoma, South |

|

Carolina, Tennessee, |

|

Vermont, Virginia, |

|

Wisconsin |

|

|

|

Alaska, Arizona, |

RAIVS Team |

California, Colorado, |

P.O. Box 9941 |

Connecticut, District |

Mail Stop 6734 |

of Columbia, Hawaii, |

Ogden, UT 84409 |

Idaho, Kansas, |

|

|

|

Maryland, Michigan, |

|

Montana, Nebraska, |

|

Nevada, New Mexico, |

|

North Dakota, Ohio, |

|

Oregon, |

|

Pennsylvania, Rhode |

|

Island, South Dakota, |

|

Utah, Washington, |

|

West Virginia, |

|

Wyoming |

|

|

|

Specific Instructions

Line 1b. Enter your employer identification number (EIN) if your request relates to a business return. Otherwise, enter the first social security number (SSN) or your individual taxpayer identification number (ITIN) shown on the return. For example, if you are requesting Form 1040 that includes Schedule C (Form 1040), enter your SSN.

Line 3. Enter your current address. If you use a P.O. box, include it on this line.

Line 4. Enter the address shown on the last return filed if different from the address entered on line 3.

Note. If the address on lines 3 and 4 are different and you have not changed your address with the IRS, file Form 8822, Change of Address.

Line 5. Enter up to 10 numeric characters to create a unique customer file number that will appear on the transcript. The customer file number should not contain an SSN. Completion of this line is not required.

Note. If you use an SSN, name or combination of both, we will not input the information and the customer file number will reflect a generic entry of “9999999999” on the transcript.

Signature and date. Form

You must check the box in the signature area to acknowledge you have the authority to sign and request the information. The form will not be processed and returned to you if the box is unchecked

Transcripts of jointly filed tax returns may be furnished to either spouse. Only one signature is required. Sign Form

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to establish your right to gain access to the requested tax information under the Internal Revenue Code. We need this information to properly identify the tax information and respond to your request. If you request a transcript, sections 6103 and 6109 require you to provide this information, including your SSN. If you do not provide this information, we may not be able to process your request. Providing false or fraudulent information may subject you to penalties.

Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation, and cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file Form

Copying, assembling, and sending the form to the IRS, 20 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making Form

Internal Revenue Service

Tax Forms and Publications Division 1111 Constitution Ave. NW,

Do not send the form to this address. Instead, see Where to file on this page.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS 4506-T-EZ form is designed to simplify the process of requesting a tax transcript. It specifically allows individuals to obtain a transcript of their Form 1040 series tax return. |

| Eligibility | This form is for use by individuals only and cannot be used by businesses. |

| Transcript Types Available | With the 4506-T-EZ, individuals can request the Tax Return Transcript, which summarizes most line items from the Form 1040 series filed with the IRS. |

| Application Process | Applicants must fill out the form with their personal details, the tax years they are requesting, and their signature, then submit it to the IRS. |

| Useful For | The form is particularly useful for persons applying for mortgages or college financial aid, as these entities commonly request a tax return transcript for income verification purposes. |

| Governing Law | While the IRS 4506-T-EZ form is a federal form, the information provided and requested through it must comply with federal tax law. No state-specific laws directly govern this form, but state tax authorities may have their own requirements for state-level income verification. |

Guide to Writing IRS 4506-T-EZ

Filling out the IRS 4506-T-EZ form is a critical step for individuals who need to obtain a transcript of their past tax returns. This straightforward process demands attention to detail to ensure accuracy and timely processing of your request. Once the form is filled out and submitted, the IRS will process it and provide the transcript requested, which can be vital for loan applications, housing matters, or personal record keeping. Here is a step-by-step guide to help you complete the form correctly.

- Start by entering your full name and Social Security Number (SSN) as they appear on your most recent tax return. If filing jointly, also include your spouse's name and SSN.

- Provide your current address. If it has changed since your last tax return, also include your previous address to avoid any processing delays.

- Enter your telephone number to facilitate communication regarding your request.

- Specify the tax form number you are requesting a transcript for (e.g., 1040, 1040-A, etc.)

- Indicate the tax years you need transcripts for, remembering to use the format "MM/DD/YYYY."

- Review the form for accuracy, ensuring all requested information is complete and correct.

- Sign and date the form. If you’re filing jointly, your spouse must also sign.

- Double-check the IRS mailing address or fax number for submitting your form, as it can vary depending on your location.

- Mail or fax your completed form to the IRS following the provided instructions.

After submitting the form, patience is key. It may take the IRS up to 10 days to process your request and mail your transcript. During peak times, such as tax season, processing times may be longer. Keep a copy of your completed form and note the date you submitted it for your records. If you encounter any issues or delays, you may contact the IRS directly for assistance.

Understanding IRS 4506-T-EZ

Welcome to the FAQ section regarding the IRS 4506-T-EZ form. Here, you will find answers to some of the most commonly asked questions about this particular form, helping individuals understand its purpose and how it is used.

What is the IRS 4506-T-EZ form?

The IRS 4506-T-EZ is a simplified version of the IRS 4506-T form, designed for individuals to request a tax return transcript. This form is specifically used for requesting a transcript of the Form 1040 series, which includes the 1040, 1040A, and 1040EZ. The main purpose of the 4506-T-EZ is to provide taxpayers with a means to easily obtain a copy of their tax return information necessary for specific financial transactions, like applying for a mortgage or student loans.

Who should use the IRS 4506-T-EZ form?

Individuals who need to provide proof of their income to lenders or other financial institutions for non-business related loans are the primary users of the 4506-T-EZ form. It is particularly useful for those applying for personal loans, mortgages, or for college financial aid, where a transcript of the tax return rather than a full copy is sufficient. It's important to note that businesses, partnerships, and individuals who need transcripts of forms other than the 1040 series must use the full IRS 4506-T form instead.

How do you file an IRS 4506-T-EZ form?

Filing the 4506-T-EZ form is relatively straightforward. Individuals must complete the form with their personal information, including their Social Security Number (SSN), address, and the tax years they wish to obtain transcripts for. Once completed, the form can be mailed or faxed to the IRS based on the provided instructions. It's crucial for individuals to ensure that all the information is accurate and complete to avoid delays. The IRS does not charge a fee for this service, and typically, it takes about 10 business days to receive the transcript.

What years are available with the IRS 4506-T-EZ?

The IRS generally maintains tax return transcripts for the current tax year and the past three years. Therefore, individuals can request their tax return transcripts for these periods using the 4506-T-EZ form. It's important to highlight that if an individual needs information beyond these years, they might need to request a full copy of their tax return using a different form. Additionally, the availability of transcripts may be subject to change, so it's always a good idea to check the most current IRS guidelines before submitting a request.

Common mistakes

Filling out the IRS 4506-T-EZ form, which is a simplified version of the 4506-T form and is primarily used to request a transcript of your tax return, requires attention to detail. Mistakes made during this process can lead to delays or incorrect information on your tax transcript. Here are some common errors to avoid:

- Not using the correct form version. The IRS periodically updates its forms. Ensure you are using the most recent version available on the IRS website to avoid processing delays.

- Failing to check the appropriate box for the type of transcript needed. This form allows the requester to specify the type of transcript they need. Selecting the incorrect type can result in receiving the wrong information.

- Incorrectly entering the Social Security Number (SSN) or Employer Identification Number (EIN). This is crucial for identity verification. Entering this information incorrectly can result in a failure to match IRS records.

- Omitting the address listed on the last tax return, or not updating it if you have moved since your last filing. The IRS uses this address to verify your identity and send correspondence.

- Not signing and dating the form. An unsigned form is invalid. Ensure that the person requesting the transcript signs and dates the form.

- Requesting information not available for the form. The 4506-T-EZ is intended for specific transcript requests. Requesting information that is beyond its scope, such as account transcripts or records of account, requires a different form.

- Failure to specify the correct tax years. Being clear about the tax years you are requesting is essential. The IRS cannot process your request without this information.

- Not using the exact name as it appears on the tax return. Similar to ensuring your SSN or EIN is correct, the name on the request must match the IRS records exactly, including any middle names or initials.

Avoiding these common mistakes will streamline the process of obtaining your tax transcript. It is always best to review your form for accuracy before submitting to the IRS to ensure your request is processed without unnecessary delays.

Documents used along the form

When individuals or businesses need to request tax return transcripts, the IRS Form 4506-T-EZ is a commonly used document. However, the process often requires additional forms and documents to support or complete various financial, legal, or tax-related procedures. Here is a list of other documents and forms that are frequently used alongside the IRS 4506-T-EZ form, each with a specific purpose to aid the requester in their endeavors.

- IRS Form 1040: This is the standard U.S. individual income tax return form. It is used to report an individual's financial income and taxes to the IRS and is often required when applying for loans or financial aid.

- IRS Form W-2: The Wage and Tax Statement is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. It is crucial for verifying income when submitting tax returns.

- IRS Form 1099: This form series reports various types of non-employment income. It is essential for individuals who are self-employed or have received income from interest, dividends, rents, or other sources.

- IRS Form 4868: The Application for Automatic Extension of Time to File U.S. Individual Income Tax Return allows individuals to request a six-month extension for filing their tax return.

- IRS Form 8821: The Tax Information Authorization form permits a third party to access and review a person's tax information, often used by tax professionals or financial advisors.

- IRS Form 2848: The Power of Attorney and Declaration of Representative form grants a designated individual the authority to represent another person before the IRS, handling matters such as audits, appeals, and tax collections.

- IRS Form 8850: The Pre-Screening Notice and Certification Request for the Work Opportunity Credit is a document employers file to request certification for hiring individuals from certain target groups that face significant barriers to employment.

- IRS Form 4506: Similar to Form 4506-T-EZ, this form is used to request a copy of a tax return rather than just the transcript. It is helpful for individuals needing the actual tax filings for more detailed financial scrutiny.

- SSA-1099: A form issued by the Social Security Administration, it reports any social security benefits received. This information is often needed for tax filing and proving income for various financial purposes.

- Bank statements: These are commonly requested to corroborate the financial information provided on tax documents, especially when applying for loans or mortgages, to verify assets and income.

Collectively, these documents serve to provide a comprehensive view of an individual's or business's financial and tax status. When completing financial transactions, applying for loans, or undergoing legal processes, being prepared with the correct forms and documents can facilitate smoother interactions with financial institutions, legal entities, and the Internal Revenue Service.

Similar forms

The IRS 4506-T form is quite similar to the 4506-T-EZ form in that both are used to request tax return information from the IRS. However, the 4506-T form is more comprehensive and can be used to request a wider range of documents, including tax account transcripts, wage and income transcripts, and verification of non-filing. This makes the 4506-T form suitable for more complex situations where a detailed tax history is required.

Another related document is the IRS Form 8821, Tax Information Authorization, which authorizes someone else, like a tax preparer or an accountant, to view and receive confidential tax information. Unlike the 4506-T-EZ, which is used to request personal tax return information, Form 8821 does not explicitly request the information but provides a third party with the authority to do so on behalf of the individual or business.

The W-2 form is also somewhat related to the 4506-T-EZ. The W-2 form is given to employees by their employers at the end of each year. It reports annual wages and the amount of taxes withheld from paychecks. While the 4506-T-EZ is used to request tax return transcripts, individuals often use their W-2 forms to file their tax returns. They serve different purposes but are part of the broader tax filing and reporting process.

The IRS Form 1099 is another document with similarities to the 4506-T-EZ form. Form 1099 reports various types of income other than wages, salaries, and tips (unlike form W-2). It's relevant in the discussion because individuals who request their tax return transcript via the 4506-T-EZ may also need their 1099 forms to ensure that all income sources are reported when filing their tax returns.

Form 1040, U.S. Individual Income Tax Return, is directly related to the information requested by the 4506-T-EZ. Form 1040 is the main form individuals use to file their federal income tax returns with the IRS. The 4506-T-EZ form allows individuals to request a transcript of their tax return, essentially a summation of what was reported on Form 1040, making these two forms complementary in the tax filing process.

Lastly, the Verification of Non-filing Letter is another document from the IRS, which, as the name suggests, verifies that the IRS has no record of a filed tax return for a particular year. This letter can be requested using the 4506-T form, not the 4506-T-EZ. However, it's related because it involves the authentication of someone's tax-filing status, much like how the 4506-T-EZ is used to authenticate and provide records of someone's tax return information.

Dos and Don'ts

Filling out the IRS 4506-T-EZ form is critical for requesting a transcript of your tax return. It's essential to approach this process with attention to detail to ensure the accurate processing of your request. Here are some dos and don'ts to keep in mind.

Do:

- Ensure all personal information is accurate, including your full name, Social Security Number (SSN), and address. This aligns your request with your tax records.

- Specify the exact form number of the tax return you're requesting to avoid any confusion or delays.

- Include the years you are requesting transcripts for, making sure to format the dates correctly.

- Sign and date the form, as an unsigned form will not be processed.

- Check for the latest version of the form on the IRS website to ensure you're using the most current form.

Don't:

- Leave any required fields blank. Incomplete forms can lead to processing delays or rejections.

- Forget to double-check the information for accuracy before submission. Errors can significantly delay the process.

- Submit the form without ensuring that all personal information matches what the IRS has on file. Discrepancies can cause issues.

- Misplace the form after filling it out. Keep a copy for your records in case you need to refer to it later.

- Assume the process is instant. Allow several weeks for processing, and plan accordingly.

Misconceptions

Many people have misunderstandings about the IRS 4506-T-EZ form, which can lead to confusion and frustration. Here are six common misconceptions explained to help clarify the purpose and uses of this form.

The form is only for those who are self-employed. This misconception is quite widespread. While the IRS 4506-T-EZ form is indeed used by those who are self-employed to obtain a transcript of their tax return, it's also utilized by individuals who are not self-employed. This form enables many types of users, including students applying for financial aid and borrowers applying for certain types of loans, to easily order a transcript of their tax return information.

It gives access to a full tax return. Another common misunderstanding is that this form provides a copy of the full tax return. In reality, the 4506-T-EZ is designed to obtain a transcript of your tax return, which summarizes the return information but does not replicate the return in its entirety. A transcript is sufficient for many purposes, such as verifying income with potential lenders.

Using the form is complicated and time-consuming. Filling out government forms can sometimes be daunting, leading to the belief that the 4506-T-EZ form is difficult to use. However, this particular form is designed to be straightforward and user-friendly. It requires only basic information about the taxpayer and the tax years for which transcripts are requested.

Filling out the form is expensive. There’s a myth that requesting tax return transcripts comes with a hefty fee. On the contrary, using the IRS 4506-T-EZ form to order tax return transcripts is free of charge. The IRS does not charge individuals for this service, making it accessible to everyone who needs it.

It takes a long time to receive the transcript. Some individuals hesitate to use the 4506-T-EZ form due to the belief that it will take weeks or even months to receive their tax return transcript. While it's true that delivery times can vary, the IRS generally processes requests quickly, and users often receive their transcripts within 10 business days.

Your information is at risk when you use the form. In today’s digital age, concern about personal information security is justified. However, the IRS takes the privacy and security of taxpayer information very seriously. Using the 4506-T-EZ form to request a tax transcript is a secure process, and the IRS implements strict measures to protect taxpayer data.

Understanding the true purpose and functionality of the IRS 4506-T-EZ form can alleviate much of the stress and confusion often associated with tax-related processes. Dispelling these common misconceptions ensures that individuals are better informed and can use this form effectively and with confidence.

Key takeaways

The IRS 4506-T-EZ form is essential for obtaining a simple transcript of your tax returns, often needed for specific financial transactions, such as applying for a mortgage. Understanding its use and the process for filling it out can simplify what might initially appear as a daunting task. Here are seven key takeaways that could guide you through this process.

- The 4506-T-EZ form is designed for individuals who need to request a tax return transcript for personal use. It provides a more straightforward option than the full 4506-T form, focusing specifically on the 1040 series tax returns.

- Before filling out the form, ensure you have the necessary information at hand, including your Social Security Number (SSN), the address currently on file with the IRS, and the form number of the tax return you're requesting.

- Filling the form accurately is crucial. Any discrepancies between the information you provide and what the IRS has on file can lead to delays or even denials of your request.

- There is no fee to request a tax return transcript using this form, which is a relief for many. It means you can access your tax information freely, as long as you comply with the requirements.

- The 4506-T-EZ form allows you to request a tax return transcript for the current year and the three years prior. It’s important to specify the year you need on the form to avoid processing delays.

- After filling out the form, double-check all the information for accuracy. Then, sign and date it. An unsigned form is like an unsent letter – it won’t get you the information you need.

- You can submit the form to the IRS by mail or fax. The address and fax number you should use depend on the state you reside in, so make sure to check the most current IRS instructions to send it to the correct location.

Finally, remember that the IRS 4506-T-EZ is a powerful tool for verifying income and past tax filings, used in various financial situations. By following these key points, you can navigate the process of requesting a tax transcript with confidence.

Popular PDF Documents

IRS 1099-C - A form for reporting canceled debt of $600 or more by a financial institution or creditor to the IRS.

Non Profit Donation Receipt Example - Guarantees donor control over personal information, with clear procedures for those wishing to unsubscribe from future communications.