Get IRS 4506 Form

For individuals and businesses alike, obtaining a copy of their tax return information is often a necessary step in a variety of financial situations. Whether it's for the purpose of applying for a mortgage, qualifying for student aid, or ensuring compliance in legal matters, the IRS 4506 form plays a pivotal role. This form serves as a request for a copy of one’s tax returns from the Internal Revenue Service. It can be used not only to fetch a copy of the tax return itself but also to obtain transcripts that summarize tax return information. These transcripts can be particularly useful for verifying income. While the process of requesting tax information might seem daunting, understanding the 4506 form can simplify matters greatly. It delineates the types of documents that can be requested, including individual tax returns, employment tax returns, and even information regarding forms W-2 and 1099 depending on the specific situation. However, it's not just about submitting a request; timing, fees, and specific instructions for different types of taxpayers also need to be taken into account to ensure the smooth processing of the request.

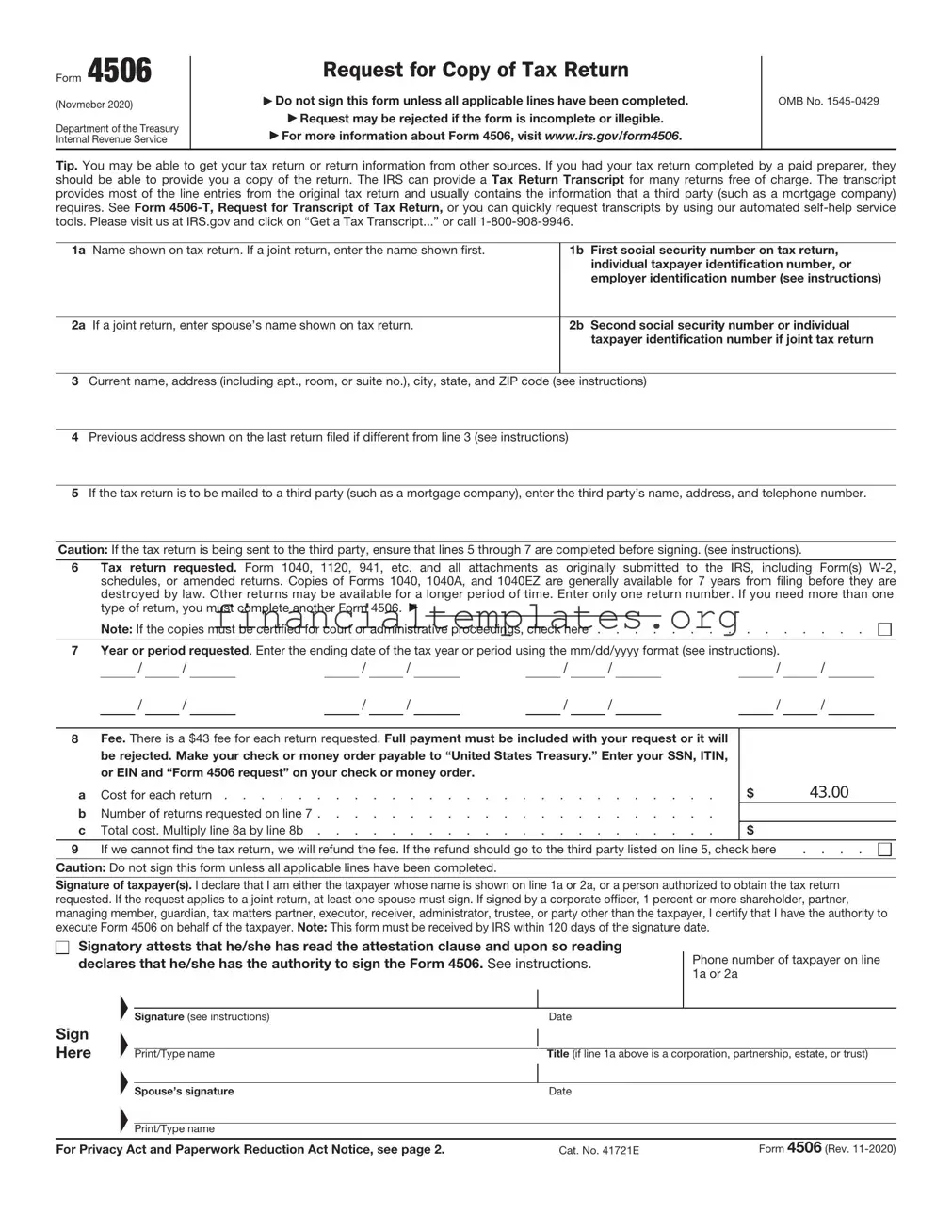

IRS 4506 Example

Form 4506

(Novmeber 2021)

Department of the Treasury Internal Revenue Service

Request for Copy of Tax Return

▶Do not sign this form unless all applicable lines have been completed.

▶Request may be rejected if the form is incomplete or illegible.

▶For more information about Form 4506, visit www.irs.gov/form4506.

OMB No.

Tip: Get faster service: Online at www.irs.gov, Get Your Tax Record (Get Transcript) or by calling

have teams available to assist. Note: Taxpayers may register to use Get Transcript to view, print, or download the following transcript types: Tax Return Transcript (shows most line items including Adjusted Gross Income (AGI) from your original Form

1a |

Name shown on tax return. If a joint return, enter the name shown first. |

1b |

First social security number on tax return, |

|

|

|

individual taxpayer identification number, or |

|

|

|

employer identification number (see instructions) |

|

|

|

|

2a |

If a joint return, enter spouse’s name shown on tax return. |

2b |

Second social security number or individual |

|

|

|

taxpayer identification number if joint tax return |

3Current name, address (including apt., room, or suite no.), city, state, and ZIP code (see instructions)

4Previous address shown on the last return filed if different from line 3 (see instructions)

5If the tax return is to be mailed to a third party (such as a mortgage company), enter the third party’s name, address, and telephone number.

Caution: If the tax return is being sent to the third party, ensure that lines 5 through 7 are completed before signing. (see instructions).

6Tax return requested. Form 1040, 1120, 941, etc. and all attachments as originally submitted to the IRS, including Form(s)

Note: If the copies must be certified for court or administrative proceedings, check here . . . . . . . . . . . . . . .

7Year or period requested. Enter the ending date of the tax year or period using the mm/dd/yyyy format (see instructions).

/ |

|

/ |

|

|

|

/ |

|

/ |

|

|

|

/ |

|

/ |

|

|

|

/ |

|

/ |

/ |

|

/ |

|

|

|

/ |

|

/ |

|

|

|

/ |

|

/ |

|

|

|

/ |

|

/ |

8Fee. There is a $43 fee for each return requested. Full payment must be included with your request or it will be rejected. Make your check or money order payable to “United States Treasury.” Enter your SSN, ITIN, or EIN and “Form 4506 request” on your check or money order.

a |

Cost for each return |

b |

Number of returns requested on line 7 |

c |

Total cost. Multiply line 8a by line 8b |

$

$

9 If we cannot find the tax return, we will refund the fee. If the refund should go to the third party listed on line 5, check here . . . . .

Caution: Do not sign this form unless all applicable lines have been completed.

Signature of taxpayer(s). I declare that I am either the taxpayer whose name is shown on line 1a or 2a, or a person authorized to obtain the tax return requested. If the request applies to a joint return, at least one spouse must sign. If signed by a corporate officer, 1 percent or more shareholder, partner, managing member, guardian, tax matters partner, executor, receiver, administrator, trustee, or party other than the taxpayer, I certify that I have the authority to execute Form 4506 on behalf of the taxpayer. Note: This form must be received by IRS within 120 days of the signature date.

Signatory attests that he/she has read the attestation clause and upon so reading |

Phone number of taxpayer on line |

||||

declares that he/she has the authority to sign the Form 4506. See instructions. |

|||||

|

|

|

|

|

1a or 2a |

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

Signature (see instructions) |

|

Date |

|

|

Sign |

▲ |

|

|

|

|

|

|

|

|

||

Here |

|

|

|

||

Print/Type name |

|

Title (if line 1a above is a corporation, partnership, estate, or trust) |

|||

|

|

|

|

|

|

|

▲ |

|

|

|

|

|

Spouse’s signature |

|

Date |

|

|

|

▲ |

|

|

|

|

|

Print/Type name |

|

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see page 2. |

Cat. No. 41721E |

Form 4506 (Rev. |

Form 4506 (Rev. |

Page 2 |

Section references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about Form 4506 and its instructions, go to www.irs.gov/form4506.

General Instructions

Caution: Do not sign this form unless all applicable lines, including lines 5 through 7, have been completed.

Designated Recipient Notification. Internal Revenue Code, Section 6103(c), limits disclosure and use of return information received pursuant to the taxpayer’s consent and holds the recipient subject to penalties for any unauthorized access, other use, or redisclosure without the taxpayer’s express permission or request.

Taxpayer Notification. Internal Revenue Code, Section 6103(c), limits disclosure and use of return information provided pursuant to your consent and holds the recipient subject to penalties, brought by private right of action, for any unauthorized access, other use, or redisclosure without your express permission or request.

Purpose of form. Use Form 4506 to request a copy of your tax return. You can also designate (on line 5) a third party to receive the tax return.

How long will it take? It may take up to 75 calendar days for us to process your request.

Where to file. Attach payment and mail Form 4506 to the address below for the state you lived in, or the state your business was in, when that return was filed. There are two address charts: one for individual returns (Form 1040 series) and one for all other returns.

If you are requesting a return for more than one year or period and the chart below shows two different addresses, send your request based on the address of your most recent return.

Chart for individual returns (Form 1040 series)

If you filed an

individual return Mail to: and lived in:

Florida, Louisiana, |

|

|

Mississippi, Texas, a |

|

|

foreign country, American |

Internal Revenue Service |

|

Samoa, Puerto Rico, |

||

RAIVS Team |

||

Guam, the |

||

Stop 6716 AUSC |

||

Commonwealth of the |

||

Austin, TX 73301 |

||

Northern Mariana Islands, |

||

|

||

the U.S. Virgin Islands, or |

|

|

A.P.O. or F.P.O. address |

|

|

|

|

|

Alabama, Arkansas, |

|

|

Delaware, Georgia, |

|

|

Illinois, Indiana, Iowa, |

|

|

Kentucky, Maine, |

Internal Revenue Service |

|

Massachusetts, |

||

Minnesota, Missouri, |

RAIVS Team |

|

New Hampshire, New |

Stop 6705 |

|

Jersey, New York, North |

Kansas City, MO 64999 |

|

Carolina, Oklahoma, |

|

|

South Carolina, |

|

|

Tennessee, Vermont, |

|

|

Virginia, Wisconsin |

|

|

|

|

|

Alaska, Arizona, |

|

|

California, Colorado, |

|

|

Connecticut, District of |

|

|

Columbia, Hawaii, Idaho, |

Internal Revenue Service |

|

Kansas, Maryland, |

||

Michigan, Montana, |

RAIVS Team |

|

Nebraska, Nevada, New |

P.O. Box 9941 |

|

Mexico, North Dakota, |

Mail Stop 6734 |

|

Ohio, Oregon, |

Ogden, UT 84409 |

|

Pennsylvania, Rhode |

|

|

Island, South Dakota, |

|

|

Utah, Washington, West |

|

|

Virginia, Wyoming |

|

|

|

|

Chart for all other returns

For returns not in

Form 1040 series, Mail to: if the address on

the return was in:

Connecticut, Delaware, |

|

District of Columbia, |

|

Georgia, Illinois, Indiana, |

|

Kentucky, Maine, |

|

Maryland, |

|

Massachusetts, |

Internal Revenue Service |

Michigan, New |

RAIVS Team |

Hampshire, New Jersey, |

Stop 6705 |

New York, North |

Kansas City, MO |

Carolina, Ohio, |

64999 |

Pennsylvania, Rhode |

|

Island, South Carolina, |

|

Tennessee, Vermont, |

|

Virginia, West Virginia, |

|

Wisconsin |

|

|

|

Alabama, Alaska, |

|

Arizona, Arkansas, |

|

California, Colorado, |

|

Florida, Hawaii, Idaho, |

|

Iowa, Kansas, Louisiana, |

|

Minnesota, Mississippi, |

|

Missouri, Montana, |

|

Nebraska, Nevada, New |

|

Mexico, North Dakota, |

Internal Revenue Service |

Oklahoma, Oregon, |

RAIVS Team |

South Dakota, Texas, |

P.O. Box 9941 |

Utah, Washington, |

Mail Stop 6734 |

Wyoming, a foreign |

Ogden, UT 84409 |

country, American |

|

Samoa, Puerto Rico, |

|

Guam, the |

|

Commonwealth of the |

|

Northern Mariana |

|

Islands, the U.S. Virgin |

|

Islands, or A.P.O. or |

|

F.P.O. address |

|

Specific Instructions

Line 1b. Enter the social security number (SSN) or individual taxpayer identification number (ITIN) for the individual listed on line 1a, or enter the employer identification number (EIN) for the business listed on line 1a. For example, if you are requesting Form

1040 that includes Schedule C (Form 1040), enter your SSN.

Line 3. Enter your current address. If you use a P.O. box, please include it on this line 3.

Line 4. Enter the address shown on the last return filed if different from the address entered on line 3.

Note. If the addresses on lines 3 and 4 are different and you have not changed your address with the IRS, file Form 8822, Change of Address, or Form

Line 7. Enter the end date of the tax year or period requested in mm/dd/yyyy format. This may be a calendar year, fiscal year or quarter. Enter each quarter requested for quarterly returns. Example: Enter 12/31/2018 for a calendar year 2018 Form 1040 return, or 03/31/2017 for a first quarter Form 941 return.

Signature and date. Form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. The IRS must receive Form 4506 within 120 days of the date signed by the taxpayer or it will be rejected. Ensure that all applicable lines, including lines 5 through 7, are completed before signing.

|

|

▲ |

You must check the box in the |

! |

signature area to acknowledge you |

have the authority to sign and request |

|

CAUTION |

the information. The form will not be |

processed and returned to you if the box is unchecked.

Individuals. Copies of jointly filed tax returns may be furnished to either spouse. Only one signature is required. Sign Form 4506 exactly as your name appeared on the original return. If you changed your name, also sign your current name.

Corporations. Generally, Form 4506 can be signed by: (1) an officer having legal authority to bind the corporation, (2) any person designated by the board of directors or other governing body, or (3) any officer or employee on written request by any principal officer and attested to by the secretary or other officer. A bona fide shareholder of record owning 1 percent or more of the outstanding stock of the corporation may submit a Form 4506 but must provide documentation to support the requester's right to receive the information.

Partnerships. Generally, Form 4506 can be signed by any person who was a member of the partnership during any part of the tax period requested on line 7.

All others. See section 6103(e) if the taxpayer has died, is insolvent, is a dissolved corporation, or if a trustee, guardian, executor, receiver, or administrator is acting for the taxpayer.

Note: If you are Heir at law, Next of kin, or Beneficiary you must be able to establish a material interest in the estate or trust.

Documentation. For entities other than individuals, you must attach the authorization document. For example, this could be the letter from the principal officer authorizing an employee of the corporation or the letters testamentary authorizing an individual to act for an estate.

Signature by a representative. A representative can sign Form 4506 for a taxpayer only if this authority has been specifically delegated to the representative on Form 2848, line 5a. Form 2848 showing the delegation must be attached to Form 4506.

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to establish your right to gain access to the requested return(s) under the Internal Revenue Code. We need this information to properly identify the return(s) and respond to your request. If you request a copy of a tax return, sections 6103 and 6109 require you to provide this information, including your SSN or EIN, to process your request. If you do not provide this information, we may not be able to process your request. Providing false or fraudulent information may subject you to penalties.

Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation, and cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file Form 4506 will vary depending on individual circumstances. The estimated average time is: Learning about the law or the form, 10 min.; Preparing the form, 16 min.; and Copying, assembling, and sending the form to the IRS, 20 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making Form 4506 simpler, we would be happy to hear from you. You can write to:

Internal Revenue Service

Tax Forms and Publications Division

1111 Constitution Ave. NW,

Do not send the form to this address. Instead, see Where to file on this page.

Document Specifics

| Fact | Description |

|---|---|

| Form Name | IRS Form 4506 |

| Purpose | Used to request a copy of your tax return or other tax records from the IRS. |

| User | Individuals and businesses needing proof of income for loans or mortgage applications. |

| Fee | A fee is charged by the IRS for each return request. |

| Available Years | Requests can be made for tax returns up to six years back. |

| Processing Time | Typically, it takes the IRS about 60 days to process requests. |

| Electronic Filing | As of the knowledge cutoff date, electronic filing of this form is not available; it must be mailed or faxed to the IRS. |

| Governing Law(s) | Federal tax law governs the use and processing of IRS Form 4506. |

Guide to Writing IRS 4506

Filling out the IRS Form 4506 is an essential process for individuals who need to obtain a copy of their tax return for purposes such as loan applications, verifying income for renting a property, or preparing for future tax situations. This form requests a copy of your tax return directly from the IRS. The information provided should be accurate and reflective of what was submitted in the past to ensure a smooth retrieval process. By following a structured step-by-step guide, individuals can navigate filling out the form confidently and accurately.

- Start by entering your name and your spouse's name (if applicable) as shown on your tax return. Include your Social Security Number (SSN) next to your name and your spouse’s SSN next to their name if filed jointly.

- For the address, enter the current address you wish the IRS to send the tax return copy to. If you have moved since filing the return you are requesting, provide the address listed on the return.

- Enter the form number that you are requesting, such as 1040, 1040-SR, etc., in line 6.

- Specify the year(s) of the tax return(s) you need in the format YYYY in line 9. You can request multiple years, but you must use a separate line for each year.

- Make sure to read the certification section carefully, as you need to acknowledge the IRS can disclose your tax information to a third party if you choose to designate one. This is an optional step and only necessary if you want the return sent to someone other than yourself.

- If you are appointing a third party to receive the return, enter their name, address, and phone number on line 5.

- Be sure to sign and date the form. If you are filing jointly and requesting a joint return, both spouses must sign and date the form.

- Check the appropriate box in line 6c to indicate the type of transcript you are requesting. For example, choose "Return Transcript" for a standard copy of your tax return.

- Review the form for accuracy, ensuring that all required fields are completed and that your request covers all the years needed.

- Lastly, submit the form to the IRS using the correct mailing or fax number, which can be found in the instructions for Form 4506. Payment must accompany your request if a fee is required for the years you are requesting.

After completing these steps, the requested tax return information should arrive by mail or be available for you, or your designated third party, assuming all the information provided matches the IRS's records. Remember, processing times may vary based on the method of submission and IRS workload, so plan accordingly if you need the documents by a specific date.

Understanding IRS 4506

-

What is the IRS 4506 form used for?

The IRS 4506 form, officially titled "Request for Copy of Tax Return," is a document that individuals or authorized representatives can use to request a copy of previously filed tax returns from the Internal Revenue Service (IRS). This form is particularly useful for obtaining official copies of tax returns needed for loan applications, legal proceedings, or for personal records.

-

Can anyone request a tax return using the IRS 4506 form?

Not exactly. To request a tax return using the IRS 4506 form, you must be the taxpayer or a person legally authorized to obtain this information. Authorized representatives include a power of attorney, a guardian, an executor of an estate, or any person charged with the property of the taxpayer under local law.

-

What information do I need to provide on the IRS 4506 form?

To complete the IRS 4506 form, you'll need to provide specific details including the taxpayer's name, Social Security Number (or ITIN/ EIN), current address, and the address listed on the last filed tax return if different. Additionally, you must specify which tax form number you're requesting and the years you're requesting copies for.

-

Is there a fee to request copies of tax returns?

Yes, there is a fee for each tax year you request a copy for. The fee amount can vary, so it's a good idea to check the most recent instructions on the IRS website or call their toll-free number to get the current fee structure. Remember, these fees are subject to change, so confirming the cost before submitting your request is essential.

-

How long does it take to receive the tax return after submitting Form 4506?

After submitting Form 4506, it typically takes the IRS about 75 days to process the request and mail out the tax return copy. However, processing times can vary depending on the IRS's workload, so it's possible it may take longer. Planning ahead and allowing plenty of time for processing is advisable.

-

Is there a faster way to obtain my tax information than using Form 4506?

If you need tax information but don't require an official copy of your tax return, you might consider using Form 4506-T or Form 4506T-EZ. These forms allow you to request a transcript of your tax return, which is available free of charge and typically processed faster than the Form 4506 requests. Transcripts can suffice for many lending and legal requirements.

-

Can I submit Form 4506 electronically?

Currently, Form 4506 must be submitted by mail or fax. While the IRS has made strides in digital processes, the submission of certain forms, including the 4506, remains traditional. However, always check the latest IRS updates as digital services are continuously evolving.

-

What if I make a mistake on my Form 4506?

If you realize a mistake on your Form 4506 after submission, it's important to correct it as soon as possible. Generally, you would need to complete a new form with the correct information and resubmit it to the IRS. Be sure to explain the correction in a cover letter, noting that it's a revised submission to help avoid confusion or delays in processing.

Common mistakes

-

Not checking the correct box for the type of form they need. The IRS 4506 form is used to request past tax returns, tax account information, W-2 information, and more. Each request type has its own box to check, and selecting the wrong one can delay processing.

-

Providing incorrect taxpayer information. This can include misspelled names, wrong Social Security numbers, or incorrect tax years. Such errors can lead to the IRS being unable to locate the requested information.

-

Failing to sign and date the form. An unsigned form is invalid and will be returned, causing delays in obtaining the needed information.

-

Omitting necessary line items. Every line that requires an answer must be filled out. Skipping lines can make the form incomplete.

-

Requesting information not covered by the form. The IRS 4506 form has specific uses, and asking for information beyond its scope can lead to confusion and delays.

-

Making corrections improperly. If a mistake is made, some people try to correct it by scribbling over the error or using correction fluid. Instead, one should start with a new form to avoid processing delays caused by illegibility.

-

Misunderstanding the form's purpose. Some individuals confuse the IRS 4506 form with other IRS forms, such as the 4506-T or 4506-T-EZ, which serve different purposes.

-

Using outdated forms. The IRS updates its forms periodically. Submitting an outdated version can lead to it being rejected.

-

Not including the fee for paper requests. While accessing some tax information is free, there are fees for paper copies. Failing to include the correct payment can lead to delays.

Understanding and avoiding these common mistakes can help ensure that the process of requesting tax documents via the IRS 4506 form goes smoothly and efficiently.

Documents used along the form

When individuals or businesses submit a request for tax information from the Internal Revenue Service (IRS), they often use Form 4506. This form requests a copy of a tax return, which can be necessary for a range of matters, such as obtaining a mortgage, verifying income for a loan, or resolving tax issues. However, this form rarely stands alone in the process. Several other documents might be required or utilized alongside Form 4506 to complete various financial, legal, or tax-related tasks. Let’s examine some of these crucial documents and their purposes.

- Form 4506-T: Often used in conjunction with Form 4506, Form 4506-T requests transcripts of tax returns instead of the full returns, which can suffice for loans or federal aid.

- Form 1040: The U.S. individual income tax return is essential for individuals reporting their annual income, deductions, and credits to the IRS.

- Form W-2: This wage and tax statement is required for individuals to report wages earned and taxes withheld by employers, often accompanying tax return submissions.

- Form 1099: Various versions of Form 1099 report income from self-employment, interest, dividends, government payments, and more, crucial for accurate tax return preparation.

- Form 8863: For individuals claiming education credits, Form 8863 is necessary, detailing expenses and scholarships to calculate allowable education credits.

- Form 4884-T: Used for requesting transcripts related to a business tax return, including corporate or partnership returns.

- Form SS-4: Businesses use Form SS-4 to apply for an Employer Identification Number (EIN), often needed for tax reporting and identification.

- Schedule SE: Self-employed individuals use Schedule SE to calculate the tax due on net earnings from self-employment, accompanying their Form 1040.

- Loan application forms: When applying for mortgages or loans, these forms require financial information that can necessitate tax return or income data from forms like the IRS 4506.

- Proof of identity documents: Copies of a driver's license, social security card, or passport may be required to verify identity when requesting tax documents or filing returns.

Understanding each of these documents and their roles in the broader landscape of finance and taxation can significantly streamline many processes, from loan applications to tax disputes. While Form 4506 is a critical piece of the puzzle, the associated forms and documents help paint a complete picture of an individual's or business's financial health and compliance with tax laws. Always ensure you have the correct documents prepared and filed to support your specific needs and requirements.

Similar forms

The IRS 4506 form, a crucial document for requesting a copy of one's tax return, shares similarities with a variety of other forms across different spectrums of finance and legal documentation. Each of these documents is integral within its context, serving a fundamental purpose in verifying, processing, or reporting information vital to individuals or entities.

Similar to the 4506 form, the IRS 4506-T form enables individuals and entities to request tax return transcripts, tax account information, W-2 information, and 1099 information, directly from the IRS. The difference lies primarily in the specifics of the information retrieved - the 4506-T does not provide an actual copy of the tax return, but rather a summary or transcript of it. This form is often used for income verification purposes by mortgage lenders and for student loans.

Another analogous document is the IRS Form 8821, Tax Information Authorization. This form authorizes individuals or third parties to access or receive a taxpayer’s information for a specified period. Unlike the 4506 form, which is a request for a physical copy of a tax return, Form 8821 allows for broader access to a taxpayer’s records without requesting copies of the actual returns.

The IRS Form 1040, U.S. Individual Income Tax Return, directly relates to the 4506 form as it is often the document requested. The 1040 form is the standard federal income tax form individuals use to report their annual income to the IRS, calculate their tax liability, and claim tax deductions or credits. Individuals may request a copy of their Form 1040 via a completed 4506 form.

Similar in its financial transparency function, the FAFSA (Free Application for Federal Student Aid) leverages information that could be obtained through the 4506 form. Although not a tax document, FAFSA is critical for students in the United States seeking federal financial aid for higher education. It uses tax return information to assess eligibility and determine the amount of federal aid for which an individual qualifies.

The Mortgage Application Form is closely related to the IRS 4506 form as well. Mortgage lenders commonly require applicants to fill out a 4506 form or 4506-T form to verify the income reported on their mortgage application against the income reported to the IRS. This process helps prevent fraud and ensures that borrowers have the financial capacity to repay their mortgage.

Form W-2, Wage and Tax Statement, also shares a connection with the 4506 form. It is a federal required form employers must fill out for each of their employees, stating the employee's annual wages and the amount of taxes withheld from their paycheck. While the 4506 form is used to request a copy of one's tax return, the W-2 form could be one of the documents needed for completing one's tax return or requested separately through the use of a 4506-T form.

The Bankruptcy Forms, particularly those involving proof of income or financial statements, are related to the IRS 4506 form in function. When declaring bankruptcy, individuals must often supply copies of their tax returns as evidence of their financial status. The 4506 form facilitates obtaining these documents directly from the IRS, ensuring the accuracy and validity of the financial information presented in bankruptcy proceedings.

The HUD-1 Settlement Statement, used in real estate transactions, parallels the 4506 form in terms of financial documentation. The HUD-1 outlines the final transaction details between the buyer and seller. While the 4506 form doesn't directly relate to real estate transactions, borrowers might need to request past tax returns using this form as part of the mortgage approval process, especially if they are self-employed or require proof of income.

Last but not least, the Employment Verification Form (or proof of employment letter) is conceptually similar to the IRS 4506 form because both are used to verify financial or employment information. Employers use the employment verification form to confirm an employee’s job status, earnings, and other employment details. In contrast, the 4506 form serves to verify income information filed with the IRS but linking the two can paint a comprehensive picture of an individual's financial stability and integrity.

Dos and Don'ts

Filling out IRS Form 4506, which is a request for a copy of your tax return, can be a crucial step for many financial processes, including applying for a mortgage or loan. To ensure that your request is processed smoothly and efficiently, it is important to follow these guidelines:

Do's:- Double-check your form number: Make sure you are filling out Form 4506 and not another variation like Form 4506-T or 4506-T-EZ, which are used for tax transcript requests.

- Provide accurate information: Ensure all personal information, including your name, Social Security Number (SSN), and address, matches the information on your tax return.

- Specify the exact type of form you need: There are multiple tax forms like the 1040, 1120, among others. Be clear about which year's return you are requesting.

- Sign and date the form: An unsigned form is incomplete and will not be processed.

- Include the required fee: If a fee is applicable for your request, make sure to attach a check or money order for the correct amount.

- Use the correct IRS address or fax number: Depending on your location and the type of form you are requesting, you'll need to send it to the right IRS office.

- Keep a copy for your records: It’s always a good idea to have a copy of what you’ve sent for your personal files.

- Be patient: Processing times can vary, especially during peak periods. Expect to wait several weeks for your request to be processed.

- Know the expiration: Be aware that Form 4506 requests can only be made for returns from the past six years.

- Check your eligibility: Some requests might not be necessary or applicable to your situation. Ensure that you actually need the full copy of your tax return for your specific purpose.

- Don't guess information: If you’re unsure about what to put in a field, it's better to look it up than to guess, as incorrect information can delay processing.

- Don't leave fields blank: Complete all required fields to prevent delays. If a field doesn’t apply, note it as “N/A” instead of leaving it blank.

- Don't use incorrect payment methods: Make sure any payment for fees meets the IRS’s accepted methods. Sending cash, for instance, is discouraged.

- Don't forget to check your state’s requirements: Some states have specific requirements or additional forms for accessing state tax return information.

- Don't ignore IRS communications: If the IRS contacts you with questions or requests for more information, respond promptly to avoid delays in processing your form.

- Don't submit duplicate requests: Sending in multiple copies of Form 4506 can cause confusion and delays. If you're concerned about the status of your request, contact the IRS directly.

- Don't use outdated forms: Always download the latest version of Form 4506 from the IRS website to ensure you’re using the most current form.

- Don't underestimate the importance of accuracy: Simple mistakes can lead to rejections or delays, so take your time and fill out the form carefully.

- Don't forget postage: If you’re mailing the form, make sure your envelope has the correct postage, especially since tax documents can be bulky.

- Don't panic: If you find the process confusing, the IRS website offers guides and contact information to help you through the process.

Misconceptions

The IRS 4506 form often comes surrounded by misconceptions, which can lead to confusion and anxiety. Understanding the truths behind these common misunderstandings can help make the process of requesting tax return information much smoother. Let's clarify some of these misconceptions.

It’s only for people being audited. This is a common misunderstanding. In reality, the IRS 4506 form is used by individuals and businesses to request past tax return information for a variety of reasons, not just audits. Lenders often use it to verify income for loan applications, and individuals might use it to apply for mortgages or student financial aid.

You can only request records for the current tax year. The belief that the 4506 form limits requests to the current tax year’s records is incorrect. In fact, you can request tax information going back up to six years, allowing for a comprehensive view of your financial history when needed.

There’s a fee for every request. Many people think that every request through the 4506 form comes with a fee. While there are cases where a fee is required, not all requests incur charges. For instance, requests related to disaster declarations by the Federal Emergency Management Agency are often fee-exempt.

The process takes months. Another common myth is that obtaining records through the 4506 form is a lengthy process that can take months. While it's true that you should allow time for processing, records are typically sent within 60 days. Planning ahead can help mitigate any delays.

Online submission is available to everyone. Many assume that the 4506 form can be submitted online by individuals. However, this convenience is currently only available to authorized third parties. Individuals and businesses requesting their own records must submit their requests through mail or fax.

Clearing up these misconceptions about the IRS 4506 form can make navigating your financial documentation significantly easier. Whether you're applying for a loan, handling estate matters, or verifying income, understanding the purpose and process of the 4506 form can save you time and trouble.

Key takeaways

The IRS 4506 form, officially titled "Request for Transcript of Tax Return," plays a crucial role for individuals and businesses in need of proving their tax return information to lenders, or for legal or financial purposes. Understanding its use and nuances ensures that these entities can accurately and efficiently meet their needs. Below are key takeaways about completing and utilizing the IRS 4506 form.

- The primary purpose of the IRS 4506 form is to allow taxpayers to request a copy of previously filed tax returns and tax information. This can be crucial for loan application processes, legal matters, or personal record-keeping.

- There are different versions of the form, such as the 4506-T and 4506T-EZ, which are designed for specific requests. For instance, the 4506-T is often used to request tax return information free of charge, while the 4506T-EZ is tailored towards requests for the transcript of an individual's tax return when applying for a mortgage.

- When filling out the form, it is essential to provide accurate information to avoid processing delays. This includes the taxpayer's name, Social Security Number (SSN) or Employer Identification Number (EIN), and the address as it appeared on the original tax return.

- Specifying the type of tax return and the year(s) requested is crucial. The IRS 4506 form allows the requestor to specify up to four years of tax return information, but additional forms may be needed if more years are required.

- There is a fee associated with the request for a full copy of a tax return. However, if the request is for a tax return transcript, which summarizes the return information, it is typically provided free of charge.

- Processing times for requests can vary, usually depending on the type of request and current IRS workload. Taxpayers should anticipate a general waiting period, which can extend from a few days to several weeks.

- Digital signatures on the IRS 4506 form are now accepted, streamlining the process for individuals and businesses. This facilitates faster submission and processing of the request.

- It is advisable to review the request for accuracy and completeness before submission. This includes ensuring that the correct form version is used and that all required sections are filled out. Mistakes can lead to processing delays or the rejection of the request.

Employing the IRS 4506 form accurately can significantly impact the requester's ability to secure loans, resolve legal issues, or meet financial compliance requirements. As such, attention to detail and understanding the form’s requirements are paramount.

Popular PDF Documents

Assignment Of Payment - The Assignment of Payment form includes safeguards to prevent financial misuse, protecting the interests of the federal government and the parties involved.

Form 1065 for Llc - Filing this form is a testament to a partnership's commitment to adhering to U.S. tax laws and regulations.