Get Irs 4421 Form

The IRS 4421 form, officially titled "Declaration Executor's Commissions and Attorney's Fees," is an important document that serves as a declaration by executors or administrators of an estate, specifying the commissions and attorney's fees related to the administration of an estate following an individual's death. This form meticulously details the total agreed-upon or to-be-paid commissions for estate administration and attorney fees, including names, addresses, social security numbers of the payees, the total amounts paid, and the dates of payment or planned payments. Furthermore, the form outlines the specific portion of these commissions or fees that will be claimed as an income tax deduction. It emphasizes the necessity for accurate reporting to the IRS, particularly if any adjustments are made to these amounts or if there are changes in the decision to claim deductions on the estate tax return. Failure to adhere to these guidelines can result in the imposition of penalties under perjury or even criminal prosecution in severe cases. By signing this form, executors, administrators, and attorneys affirm that all information provided is accurate and complete to the best of their knowledge, under penalty of perjury. The form also includes a Privacy Act Notice, which explains the legal basis for requesting this information, its intended use, and potential consequences of non-compliance, demonstrating the IRS's commitment to transparency and legal compliance while emphasizing the significance of these declarations in the broader context of tax law and estate administration.

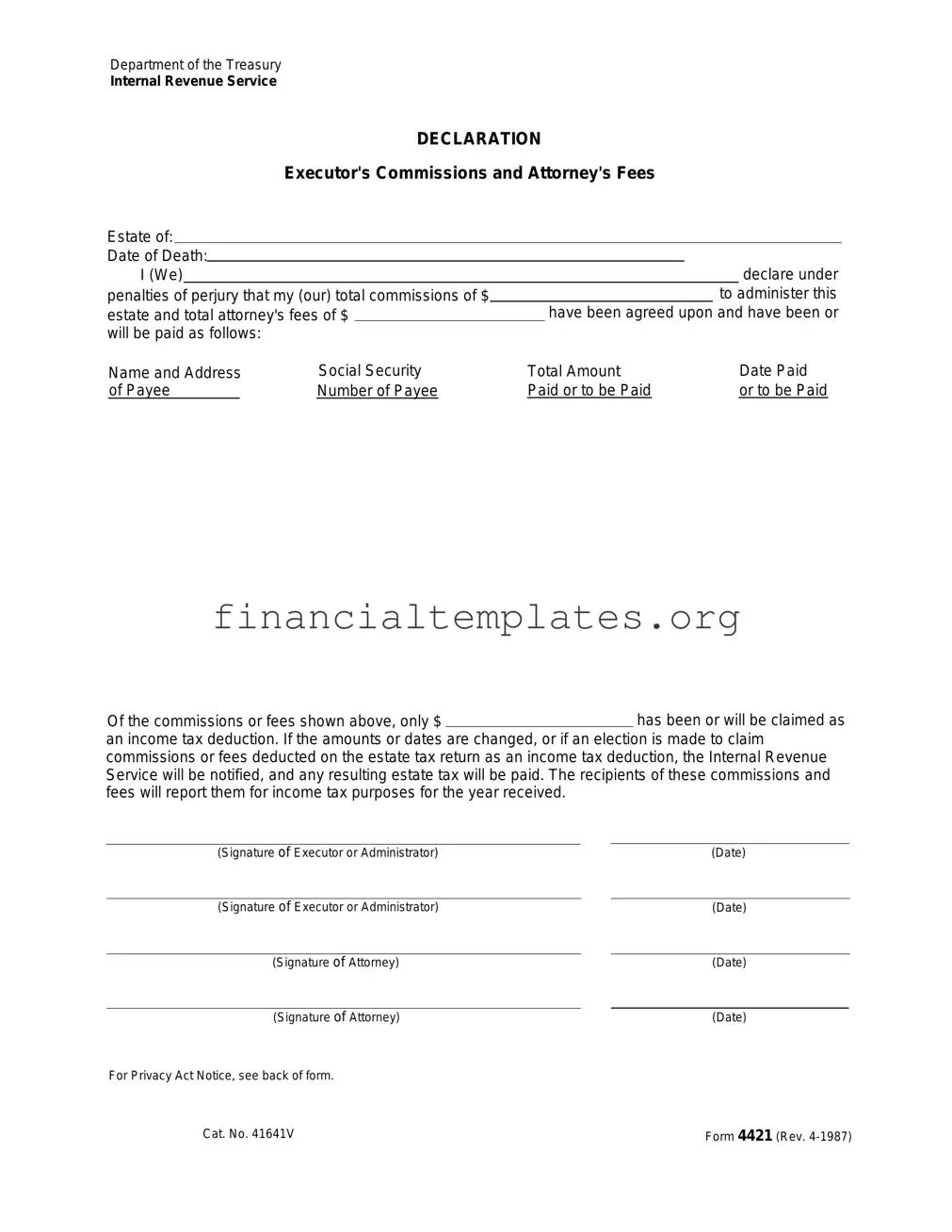

Irs 4421 Example

Department of the Treasury

Internal Revenue Service

DECLARATION

Executor's Commissions and Attorney's Fees

Estate of:

Date of Death: |

|

|

|

|

|

|

|

declare under |

|||

|

I (We) |

|

|

|

|

|

|

|

|||

penalties of perjury that my (our) total commissions of $ |

|

|

|

to administer this |

|||||||

estate and total attorney's fees of $ |

|

|

have been agreed upon and have been or |

||||||||

will be paid as follows: |

|

|

|

|

|

|

|

||||

Name and Address |

Social Security |

Total Amount |

|

|

Date Paid |

||||||

|

of Payee |

|

Number of Payee |

Paid or to be Paid |

|

|

or to be Paid |

||||

Of the commissions or fees shown above, only $has been or will be claimed as an income tax deduction. If the amounts or dates are changed, or if an election is made to claim commissions or fees deducted on the estate tax return as an income tax deduction, the Internal Revenue Service will be notified, and any resulting estate tax will be paid. The recipients of these commissions and fees will report them for income tax purposes for the year received.

(Signature of Executor or Administrator) |

|

(Date) |

|

|

|

|

|

(Signature of Executor or Administrator) |

|

(Date) |

|

|

|

|

|

(Signature of Attorney) |

|

(Date) |

|

|

|

|

|

(Signature of Attorney) |

|

(Date) |

|

For Privacy Act Notice, see back of form.

Cat. No. 41641V |

Form 4421 (Rev. |

Privacy Act Notice

Under the Privacy Act of 1974, we must tell you:

Our legal right to ask for the information and whether the law says you must give it.

Our legal right to ask for the information and whether the law says you must give it.

What major purposes we have in asking for it, and how it will be used.

What major purposes we have in asking for it, and how it will be used.

What could happen if we do not receive it.

What could happen if we do not receive it.

The law covers: Tax returns and any papers

filed with them. Any questions we need to ask

filed with them. Any questions we need to ask

you so we can:

you so we can:

Complete, correct, or process your return. Figure your tax.

Collect tax, interest, or penalties.

Our legal right to ask for information is Internal Revenue Code sections 6001, 601 1, and 6012(a), and their regulations. They say that you must file a return or statement with us for any tax you are liable for. Code section 6109 and its regulations say that you must show your social security number on what you file. This is so we know who you are, and can process your return and papers.

You must fill in all parts of the tax form that apply to you. But you do not have to check boxes for the Presidential Election Campaign Fund.

We ask for tax return information to carry out the In- ternal Revenue

We may give the information to the Department of Justice and to other Federal agencies, as provided by law. We may also give it to cities, States, the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. And we may give it to foreign governments because of tax treaties they have with the United States.

If you do not file a return, do not provide the infor- mation we ask for, or provide fraudulent information, the law provides that you may be charged penalties and, in certain cases, you may be subject to criminal prosecution. We may also have to disallow the exemp- tions, exclusions, credits, deductions, or adjustments shown on the tax return. This could make the tax higher or delay any refund. Interest may also be charged.

Please keep this notice with your records. It may help you if we ask you for other information.

If you have questions about the rules for filing and giving information, please call or visit any Internal Revenue Service office.

This is the only notice we must give you to explain the Privacy Act. However, we may give you other notices if we have to examine your return or collect any tax, interest, or penalties.

Document Specifics

| Fact Number | Fact Description |

|---|---|

| 1 | The IRS Form 4421 is used to declare executor's commissions and attorney's fees related to the administration of an estate. |

| 2 | This form requires the disclosure of the total commissions and attorney's fees agreed upon for administering the estate. |

| 3 | Recipients of the commissions and fees must report them for income tax purposes in the year they are received. |

| 4 | Form 4421 must be signed under penalties of perjury, affirming its accuracy. |

| 5 | The form contains provisions for updating the IRS if the amounts or dates of commissions and fees paid change, or if a decision is made to claim these amounts as income tax deductions. |

| 6 | Specifically, the form asks for the name, address, social security number, total amount, and date paid or to be paid to each payee. |

| 7 | The Privacy Act Notice on the form explains the legal right of the IRS to request this information and the consequences of not providing it or providing fraudulent information. |

| 8 | Under the Privacy Act of 1974, the form outlines how the collected information may be shared with other federal agencies, state and local governments, and foreign governments under tax treaties. |

| 9 | The legal foundation for requesting the information on this form includes Internal Revenue Code sections 6001, 6011, and 6012(a), and their regulations. |

| 10 | Failure to properly file Form 4421 can result in penalties, potential criminal prosecution, and adjustments that may affect the taxes owed by the estate or the refund due. |

Guide to Writing Irs 4421

After completing IRS Form 4421, you're taking an important step in managing the financial aspects related to the estate in question. This form is used to declare executor's commissions and attorney's fees associated with the estate, a significant step in ensuring transparency and compliance with tax obligations. Here's how to fill it out:

- Start with the Estate of: field. Enter the full legal name of the deceased whose estate is being managed.

- In the Date of Death: field, provide the date on which the individual passed away, ensuring accuracy.

- Under the declaration statement, carefully enter the total commission amount for the executor in the designated space. This amount reflects the compensation agreed for administering the estate.

- Similarly, input the total attorney’s fees in the provided space. This sum represents the agreed payment for legal services rendered in relation to the estate.

- For each commission and fee amount, detail the payments as follows:

- Under Name and Address of Payee, list the individual or entity receiving payment.

- Enter the Social Security Number of Payee to ensure proper tax reporting and identification.

- In the Total Amount Paid or to be Paid section, specify the amount allocated to each payee.

- Fill in the Date Paid or to be Paid with the relevant dates reflecting when each payment was or will be made.

- Specify the amount from the commissions or fees that will be claimed as an income tax deduction in the provided space.

- Certify the document by signing in the Signature of Executor or Administrator space and dating each signature accordingly. Attorney(s) must also sign and date the form in the allocated areas.

- Review the entire form for accuracy and completeness, ensuring all necessary information has been accurately entered and that the declaration reflects your honest intention and understanding.

After the form is completed and signed, it should be retained for your records, and as necessary, copies may be forwarded to relevant parties or used in proceedings related to the estate. Filing Form 4421 is a crucial step in the estate administration process, reflecting the financial transactions and commitments undertaken in the process, and ensuring that these are documented in compliance with Internal Revenue Service requirements.

Understanding Irs 4421

- What is Form 4421 and who needs to use it?

Form 4421, issued by the Department of the Treasury's Internal Revenue Service, serves as a declaration for executor's commissions and attorney's fees related to an estate. Executors or administrators of an estate should use this form to declare the total commissions and attorney's fees agreed upon for the administration of the estate. This form is critical for accurately reporting and potentially deducting these expenses on estate tax returns.

- What are the key components that must be filled out on Form 4421?

The form requires detailed information including the estate's name, the date of death, the total commissions for estate administration, attorney's fees, and the breakdown of payments made or to be made. This includes the names and addresses of payees, their social security numbers, total amounts paid or to be paid, and the dates of these payments. A notable section of the form specifies the amount, if any, that will be claimed as an income tax deduction from the reported commissions or fees.

- How do executor's commissions and attorney's fees affect estate taxes and income taxes?

Commissions and attorney's fees paid by an estate may impact both estate and income taxes. For estate taxes, these expenses can potentially reduce the taxable estate's value, thus possibly lowering the estate tax liability. For income taxes, the recipients of these payments must report them as income for the year received. The form also mentions that if any amount is deducted on the estate tax return but is later claimed as an income tax deduction, the IRS must be notified, which may result in adjusted estate taxes.

- Can changes be made after Form 4421 is submitted?

Yes, changes to the amounts or dates listed on Form 4421 can be made after its submission. However, it's crucial to notify the IRS if any such changes occur, especially if an election is made to claim commissions or fees deducted on the estate tax return as an income tax deduction. Such adjustments may necessitate recalculating estate taxes and ensuring compliance with tax laws.

- What might happen if the required information is not provided on Form 4421?

Failing to provide the necessary information on Form 4421, or providing fraudulent information, may lead to penalties. In severe cases, criminal prosecution may result. Not supplying required details could also result in disallowed exemptions, exclusions, credits, deductions, or adjustments, which might increase the tax liability or delay any refunds. Interest charges on owed taxes are another possible repercussion for incomplete or incorrect information submission.

- Where can one find more information or assistance with Form 4421?

For further details or assistance with Form 4421, individuals can visit any Internal Revenue Service office or call the IRS. The official IRS website also provides resources and contact information that can help with questions about filing this form and understanding its implications for estate and income taxes.

Common mistakes

Filling out IRS Form 4421, the declaration for Executor's Commissions and Attorney's Fees, requires attention to detail and an understanding of the specific requirements. Common mistakes can lead to processing delays or potentially incorrect tax liability. Below are eight common errors to avoid:

- Not verifying the estate's information, such as the name of the estate and the date of death, can lead to the form being processed for the wrong estate.

- Failing to accurately declare total commissions and attorney's fees. This can affect the estate's tax responsibilities and result in penalties.

- Incorrectly listing the name and address of the payee can lead to payments being sent to the wrong recipient or not properly recorded.

- Omitting or inaccurately reporting the Social Security Number (SSN) of the payee can cause delays and potential identity verification issues.

- Not specifying the total amount paid or to be paid clearly. This lack of clarity can create confusion regarding the estate’s financial obligations.

- Forgetting to indicate the date paid or to be paid for each commission or fee leads to a lack of record for the timeline of payments.

- Overlooking the section which specifies the amount to be claimed as an income tax deduction. Accurately completing this part is crucial for correct tax filing.

- Skipping the signatures and dates at the bottom of the form, which officially validate the declaration, rendering the document incomplete without them.

Beyond filling out the form correctly, it's essential to understand the implications of the data provided:

- Changes in the amounts or dates must be communicated to the Internal Revenue Service (IRS) to ensure accurate tax reporting and payment.

- The Privacy Act Notice on the form outlines important information regarding the use and privacy of the provided data, emphasizing the necessity for accuracy and honesty in reporting.

- Recipients of commissions and fees have an obligation to report these for income tax purposes in the year received, underscoring the importance of precise and timely information on Form 4421.

Adhering to these guidelines helps to ensure the seamless processing of Form 4421. Avoiding these common mistakes can prevent unnecessary penalties and interest, safeguarding the estate's and beneficiaries' interests.

Documents used along the form

When dealing with the administration of an estate, several additional forms and documents often accompany the IRS Form 4421, which is utilized for declaring executor's commissions and attorney's fees related to estate management. These documents play crucial roles in ensuring compliance with tax laws and facilitating the smooth execution of estate responsibilities. Understanding each document's purpose can greatly assist executors and administrators in navigating the complexities of estate management.

- IRS Form 706: This form is the United States Estate (and Generation-Skipping Transfer) Tax Return, which executors use to report the estate's value and calculate any estate tax due.

- IRS Form 1041: Known as the U.S. Income Tax Return for Estates and Trusts, this document is required for reporting income, deductions, and credits of the estate or trust.

- IRS Form W-9: Request for Taxpayer Identification Number and Certification, used by the estate to request the identification numbers of beneficiaries or other entities paid by the estate, to ensure proper reporting to the IRS.

- IRS Form 8971: This form, along with its Schedule A, provides information regarding the final value of certain assets distributed from a decedent’s estate, essential for beneficiaries for tax reporting purposes.

- IRS Form 709: United States Gift (and Generation-Skipping Transfer) Tax Return, required if the decedent made any gifts that are subject to the gift tax.

- Last Will and Testament: Not a tax form, but a critical legal document that outlines how the decedent wished their estate to be distributed among heirs and beneficiaries.

- Certificate of Trust: A document that verifies the existence of a trust and provides essential information without revealing the trust's detailed contents, important in cases where assets are to be transferred under a trust's terms.

- Death Certificate: Needed to prove the death of the estate's owner, this official document is required by various institutions before transferring assets or closing accounts.

- Appraisal Reports: Professional appraisals are necessary to establish the fair market value of estate assets, especially important for real estate, business interests, and valuable personal property.

- Account Statements: Statements from banks, brokerages, and other financial institutions are necessary to establish the value of financial assets owned by the deceased at the time of death.

In sum, the process of settling an estate involves numerous steps and required documentation. Executors and administrators must be diligent in gathering and completing all relevant forms and documents in addition to IRS Form 4421 to ensure the estate's legal and financial matters are handled accurately and in compliance with federal and state laws. This comprehensive approach aids in the efficient and effective administration of an estate, benefiting all parties involved.

Similar forms

The IRS Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, shares similarities with the IRS Form 4421 as both are integral in the administration of estates. Form 706 is used to report the estate's value and calculate the estate tax due to the federal government, if any, following a person's death. This process is crucial for the proper administration and finalization of an estate, similar to how Form 4421 is used to declare executor's commissions and attorney's fees, which are necessary expenses in managing an estate. Both forms require detailed information about the estate and its administration, ensuring compliance with tax obligations and the efficient processing of the estate.

The IRS Form 1041, U.S. Income Tax Return for Estates and Trusts, is another document related to Form 4421 in that it deals with the financial aspects of an estate or trust following someone's death. Form 1041 is used to report the income, deductions, gains, losses, etc., of estates and trusts. The relation to Form 4421 is evident in the aspect of managing the estate's financial obligations, including paying taxes on income the estate generates. The completion of Form 4421, which includes declarations about commissions and attorney's fees, complements the financial overview provided by Form 1041, ensuring a comprehensive approach to estate management and taxation.

Similar in context to the IRS Form 4421 is the IRS Form 1099-MISC, Miscellaneous Income. This form is employed for reporting payments made during the course of a trade or business to others who are not employees, such as payments to independent contractors. In the realm of estate administration, Form 1099-MISC might be used to report payments for services rendered by attorneys, accountants, and others who the estate might employ, akin to the way Form 4421 reports agreed-upon commissions and fees to executors and attorneys. Both forms deal with the financial transactions associated with managing estates, underscoring the necessity of documenting and reporting these payments for tax purposes.

IRS Form 56, Notice Concerning Fiduciary Relationship, bears relevance to Form 4421 by establishing a person or entity as a fiduciary to the IRS, thus allowing them to act on behalf of another in financial or tax matters. When an executor or administrator is managing an estate, as reported on Form 4421, Form 56 may be filed to notify the IRS of this fiduciary relationship, enabling the fiduciary to make tax-related decisions, including those about executor's commissions and attorney's fees. This interconnection highlights the importance of transparently managing and reporting estate activities to tax authorities.

Lastly, the IRS Form 2848, Power of Attorney and Declaration of Representative, is also related to Form 4421, as it allows an individual to authorize another person, typically an attorney, to represent them before the IRS. This authorization can be crucial in the administration of estates, where executors or administrators—potentially declared through Form 4421—might need legal representation to manage tax matters associated with the estate. Form 2848 facilitates this representation, ensuring that those handling the estate can engage with the IRS effectively, similar to how commissions and attorney’s fees are managed and reported on Form 4421.

Dos and Don'ts

When preparing the IRS Form 4421, it's essential to approach it with care and diligence to ensure compliance and accuracy. Here are eight imperative dos and don'ts you should keep in mind:

- Do double-check the executor’s and attorney’s information, including names and addresses, to ensure they are correct and match other official documents.

- Do accurately report the total commissions and attorney’s fees as agreed upon, ensuring these amounts are precise to avoid any discrepancies.

- Do include the correct Social Security Numbers for all individuals involved, as this is critical for tax purposes and IRS records.

- Do ensure that the declaration is signed and dated by the executor, administrator, and attorney to validate the form.

- Don’t overlook the detailed instructions on the IRS website or accompanying the form itself, as these can guide you through the process and ensure compliance.

- Don’t forget to report any changes in the amounts or dates of commissions or fees paid, as failing to notify the IRS could lead to penalties.

- Don’t neglect the Privacy Act Notice section, as understanding your rights and obligations under the Privacy Act of 1974 is crucial for proper form submission.

- Don’t hesitate to seek professional advice if uncertain about any aspect of the form, especially regarding the tax implications of estate administration fees and commissions.

Adhering to these guidelines can streamline the process, ensuring that the IRS Form 4421 is filled out accurately and complies with legal requirements. Always remember, taking the time to fill out forms correctly can save time, money, and potential legal issues down the road.

Misconceptions

Understanding the IRS Form 4421 can sometimes be complex, and unfortunately, there are several misconceptions that persist regarding its purpose and implications. Clearing up these misunderstandings is essential for a proper handling of estate affairs. Below are five common misconceptions about the IRS Form 4421:

It is only for executors to declare their commissions and attorney’s fees: While Form 4421 does involve declaring executor’s commissions and attorney fees, it's crucial to understand that this form plays an important role in the broader process of estate administration. It highlights the agreed-upon fees for estate administration and legal support, ensuring that these payments are transparent and acknowledged by the Internal Revenue Service (IRS).

All commissions and fees listed can be deducted from the estate’s income tax: This is a misunderstanding. Only a specific portion of the commissions or fees disclosed on Form 4421 will be claimed as an income tax deduction for the estate. It is essential to correctly identify and report these amounts to avoid any discrepancies with the IRS.

Once filed, the information on Form 4421 cannot be changed: Circumstances can change, and so can the details regarding commissions and attorney fees. If there are any adjustments to the amounts or the recipients, it’s imperative to notify the IRS. Form 4421 includes a provision for notifying the IRS if amounts or beneficiaries change, or if there's a decision to claim previously declared fees on the estate tax return as an income tax deduction.

Filing Form 4421 is the final step In declaring fees and commissions: Merely filing Form 4421 does not conclude your responsibility for reporting commissions or attorney's fees associated with estate administration. The recipients of these payments must also report them for income tax purposes in the year they are received, ensuring compliance with tax obligations.

The privacy act notice is just a formality: The Privacy Act Notice provided on Form 4421 is far from a mere formality. It outlines the lawful basis for requesting information, its intended use, and the consequences of failing to provide the necessary details. Understanding this notice ensures that you’re aware of your privacy rights and the importance of accurate information provision.

In summary, navigating the intricacies of IRS Form 4421 with a clear understanding of what it entails is crucial for properly managing estate affairs. Misunderstandings can lead to unnecessary complications or even legal repercussions. Ensuring accurate and timely communication with the IRS, as dictated by Form 4421, is foundational in fulfilling your duties in estate administration.

Key takeaways

Understanding the IRS Form 4421 is crucial for executors and attorneys managing an estate. This form serves as a declaration for executor's commissions and attorney's fees connected to an estate, specifying amounts agreed upon and the payment details.

- Estate and Executor Information: The form requires details about the estate, including the date of death, and a declaration by the executor or administrator on commissions and attorney's fees involved in estate administration.

- Reporting and Deduction Details: It's essential to accurately state the total commissions and attorney's fees, highlighting the portion that will be claimed as an income tax deduction. Any changes to the amounts or the decision to claim deductions on the estate tax return must be reported to the IRS.

- Payment Information: Form 4421 requires detailed information about payments made or to be made, including the name and address of payees, their social security numbers, the total amount paid, and payment dates.

- Legal Responsibility and Penalties: By signing Form 4421, the executor, administrator, or attorney affirms under penalties of perjury the accuracy of the information provided. This underscores the legal obligation to report truthful and accurate information regarding commissions and fees.

- Privacy Act Notice: The form includes a Privacy Act Notice, explaining individuals' rights and the IRS's legal authority in collecting and using personal information. It outlines how the information is used within the framework of the law and potential repercussions for non-compliance.

Appropriately completing and understanding the implications of Form 4421 is vital for all parties involved in estate administration. It ensures that financial matters related to the estate are handled legally and transparently, avoiding potential legal and financial consequences.

Popular PDF Documents

IRS 4797 - Proper use of Form 4797 aids in substantiating tax positions related to property transactions for audit purposes.

License and Permits - A precursor for businesses in Oakland, ensuring operations and locations are in harmony with zoning norms.