Get Irs 4419 Form

For many businesses and tax professionals, ensuring accurate and timely information submissions to the Internal Revenue Service (IRS) is a critical task that demands a thorough understanding of various forms and procedures. Among these, Form 4419 stands out as a crucial document for those looking to revise an existing Transmitter Control Code (TCC) for electronic filings. This form, specifically designed by the Department of the Treasury's IRS, plays a vital role in maintaining the integrity and accuracy of information returns submitted electronically through the Filing Information Returns Electronically (FIRE) system. Whether you're looking to update the legal name associated with your Employer Identification Number (EIN), change your mailing address, or modify the contact details of the person responsible for your application, Form 4419 is your go-to document, provided your TCC was obtained before September 26, 2021. With clear instructions on how to fill out and submit this form, including specific fields for the transmitter and/or issuer's information and a declaration under penalty of perjury, Form 4419 simplifies the process of keeping your electronic filing credentials up to date. It's also worth noting that, as of September 26, 2021, requests for a new TCC must be made through a new online process, reflecting the IRS's move towards more streamlined, digital interactions.

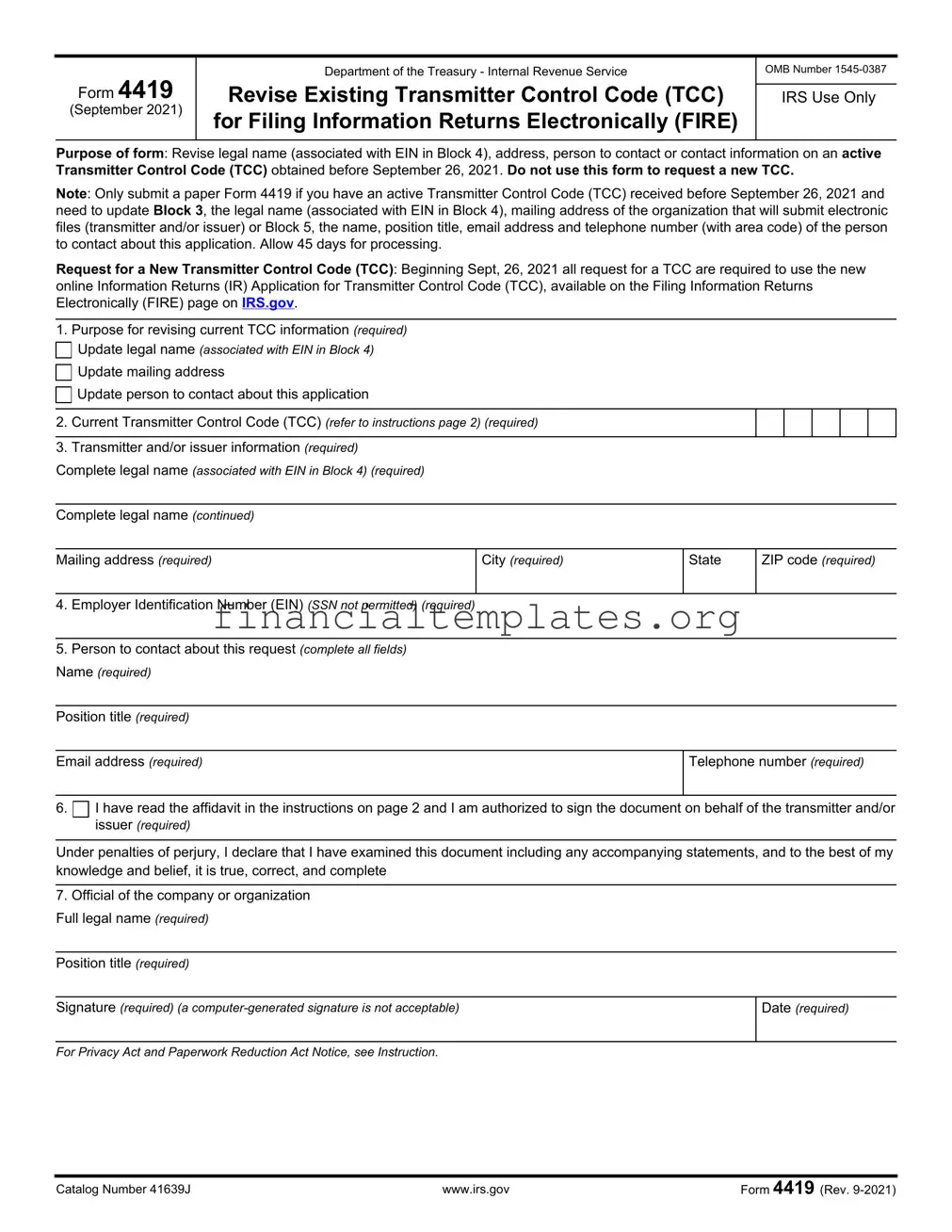

Irs 4419 Example

|

Department of the Treasury - Internal Revenue Service |

OMB Number |

Form 4419 |

Revise Existing Transmitter Control Code (TCC) |

|

IRS Use Only |

||

(September 2021) |

for Filing Information Returns Electronically (FIRE) |

|

|

|

|

|

|

|

Purpose of form: Revise legal name (associated with EIN in Block 4), address, person to contact or contact information on an active Transmitter Control Code (TCC) obtained before September 26, 2021. Do not use this form to request a new TCC.

Note: Only submit a paper Form 4419 if you have an active Transmitter Control Code (TCC) received before September 26, 2021 and need to update Block 3, the legal name (associated with EIN in Block 4), mailing address of the organization that will submit electronic files (transmitter and/or issuer) or Block 5, the name, position title, email address and telephone number (with area code) of the person to contact about this application. Allow 45 days for processing.

Request for a New Transmitter Control Code (TCC): Beginning Sept, 26, 2021 all request for a TCC are required to use the new online Information Returns (IR) Application for Transmitter Control Code (TCC), available on the Filing Information Returns Electronically (FIRE) page on IRS.gov.

1. Purpose for revising current TCC information (required) Update legal name (associated with EIN in Block 4) Update mailing address

Update person to contact about this application

2. Current Transmitter Control Code (TCC) (refer to instructions page 2) (required)

3. Transmitter and/or issuer information (required) Complete legal name (associated with EIN in Block 4) (required)

Complete legal name (continued)

Mailing address (required)

City (required)

State

ZIP code (required)

4.Employer Identification Number (EIN) (SSN not permitted) (required)

5.Person to contact about this request (complete all fields)

Name (required)

Position title (required)

Email address (required)

Telephone number (required)

6.

I have read the affidavit in the instructions on page 2 and I am authorized to sign the document on behalf of the transmitter and/or issuer (required)

I have read the affidavit in the instructions on page 2 and I am authorized to sign the document on behalf of the transmitter and/or issuer (required)

Under penalties of perjury, I declare that I have examined this document including any accompanying statements, and to the best of my knowledge and belief, it is true, correct, and complete

7.Official of the company or organization Full legal name (required)

Position title (required)

Signature (required) (a

Date (required)

For Privacy Act and Paperwork Reduction Act Notice, see Instruction.

Catalog Number 41639J |

www.irs.gov |

Form 4419 (Rev. |

General Instructions

Purpose of Form: Submit a paper Form 4419 to revise an active Transmitter Control Code (TCC) received before September 26, 2021. If you do not have a TCC to transmit through the FIRE System, complete the Information Returns (IR) Application for Transmitter Control Code (TCC) at

A revised Form 4419 can only be submitted if you are updating information for a previously approved Form 4419 for the following:

•Block 3 - Legal name or Business mailing address

•Block 5 - Person to contact or contact information

Specific Instructions

When completing this form, please print or type clearly.

If you do not provide all the information, we may not be able to process your application

Block 1 - Indicate the purpose for revising the current TCC information.

Block 2 - Enter your current TCC.

Block 3 - Enter the legal name associated with the EIN in Block 4 and the complete address of the organization that will submit electronic files (transmitter and/or issuer).

Block 4 - Enter the employer identification number (EIN), Qualified Intermediary Number

Block 5 - Enter the name, position title, email address and telephone number (with area code) of the person to contact about this application. This should be a person who is knowledgeable about the electronic filing of your information returns.

Block 6 - Affidavit. This application must be completed and submitted by: (a) the owner, if the applicant is a sole proprietorship, (b) the president, vice president, or other principal officer, if the applicant is a corporation, (c) a responsible and duly authorized member or officer having knowledge of its affairs, if the applicant is a partnership, government entity, or other unincorporated organization, or (d) the fiduciary, if the applicant is a trust or an estate.

Check the box to confirm you have read the affidavit and are authorized to sign on behalf of the transmitter and/or issuer.

Block 7 - The form must be signed and dated by an official of the company or organization requesting authorization to file electronically (a

How to submit Form 4419:

Mail or Fax Form 4419 to: Internal Revenue Service

230 Murall Drive, Mail Stop 4360 Kearneysville, WV 25430

Fax: (877)

(304)

Contact the IRS for information return and electronic filing assistance Monday through Friday 8:30 a.m. - 5:30 p.m. ET. Listen to all options before making your selection.

•(866)

•(304)

•(304)

Request a New Transmitter Control Code (TCC): If you are a corporation, partnership, employer, estate and/or trust, required to file 250 or more information returns, Forms

Beginning Sept, 26, 2021 all request for a new TCC are required to use the new Information Returns (IR) Application for Transmitter Control Code (TCC), available on the Filing Information Returns Electronically (FIRE) page on IRS.gov. This new application replaces both the Form 4419 and

For further information concerning the electronic filing of information returns, visit IRS.gov. The following publications are available:

•Publication 1220, Specifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and

•Publication 1187, Specifications for Electronic Filing of Form

•Publication 1239, Specifications for Electronic Filing of Form 8027, Employer's Annual Information Return of Tip Income and Allocated Tips

•Publication 4810, Specifications for Electronic Filing of Form

Forms

Privacy Act and Paperwork Reduction Act Notice

The authority for requesting this information is Internal Revenue Code sections 7801, 6011(f) and 6109. The primary purpose for requesting the information is to identify you and to verify your fitness to transmit returns using the Filing Information Returns Electronically (FIRE) System. Your response is mandatory if you are required to file returns electronically. If you do not provide all or part of the information, we may not be able to process your application; providing false or fraudulent information may subject you to penalties. We may give this information to the Department of Justice for use in civil and/ or criminal litigation, to the public to help identify approved electronic filing practitioners, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, and to federal law enforcement and intelligence agencies to combat terrorism.

We ask for the information on these forms to carry out the Internal Revenue Laws of the United States. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form must be retained as long as their contents may become material in the administration of any Internal Revenue law. Tax returns and return information are confidential, as required by Code section 6103.

The time needed to provide this information would vary depending on individual circumstances. The estimated average time is:

Preparing Form 4419 . . . . . . . . . . . . . . . . . 20 minutes.

If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. Write to the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA

Catalog Number 41639J |

www.irs.gov |

Form 4419 (Rev. |

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | Form 4419 is used to revise existing Transmitter Control Code (TCC) information for filings prior to September 26, 2021. |

| 2 | Updates through Form 4419 can include changes to the legal name, address, and contact information associated with a TCC. |

| 3 | Requests for a new TCC after September 26, 2021, must use the online Information Returns (IR) Application for TCC available on the IRS FIRE system page. |

| 4 | The form requires identification of the applicant through an Employer Identification Number (EIN), excluding social security numbers. |

| 5 | Affirmation of an affidavit is required, confirming the authority of the signer to make these revisions on behalf of the entity. |

| 6 | Form 4419 necessitates the signature of an official within the company or organization, explicitly excluding computer-generated signatures. |

| 7 | The form and its instructions provide a detailed process for submission either by mail or fax, including address and fax numbers. |

| 8 | The Privacy Act and Paperwork Reduction Act Notice outlines the legal basis, required retention period, and potential disclosure of submitted information. |

Guide to Writing Irs 4419

Once the necessity arises to amend information associated with an active Transmitter Control Code (TCC), which was procured prior to September 26, 2021, the IRS Form 4419 must be employed for the purpose of revising critical details such as the legal name tied to an Employer Identification Number (EIN) in a specified block, mailing addresses, or contact personnel. Such amendments are pivotal for ensuring that all electronic filings conducted through the Filing Information Returns Electronically (FIRE) system remain accurately associated with the correct entity. Proper completion and submission of Form 4419 facilitate the continuation of compliant and efficient electronic filing processes. This adjustment does not apply to acquiring a new TCC, which as of September 26, 2021, necessitates utilizing the online Information Returns (IR) Application for TCC. Given the procedural nature of this form and its role in maintaining the integrity of records within the IRS electronic filing system, attention to detail during completion is paramount.

- Specify the motivation behind the TCC revision by marking the appropriate purpose in Block 1. Choices include updating the legal name (associated with the EIN in Block 4), address, or point of contact information.

- In Block 2, enter the current Transmitter Control Code (TCC) assigned to your organization.

- Within Block 3, input the legal name of the transmitter and/or issuer as it is officially associated with the Employer Identification Number given in Block 4 and complete the mailing address, including city, state, and ZIP code.

- Enter the Employer Identification Number (EIN) in Block 4. Remember, a Social Security Number (SSN) is not permissible.

- Designate the primary contact regarding this request in Block 5 by providing the full name, position title, email address, and telephone number of the individual.

- Block 6 necessitates acknowledgment of the affidavit indicated on the form's instructions, asserting the authority of the signer to act on behalf of the transmitter and/or issuer under penalty of perjury.

- The declaration's legitimacy must be validated through the signature of a person in a position of authority within the company or organization, as required in Block 7. This block requires the full legal name, title, manual signature (not computer-generated), and the date.

Post-completion, the form is to be submitted either through mail or fax to the provided addresses specific to the Internal Revenue Service (IRS) depending on the geographical location of the submitter. It is recommended to allow a processing period of approximately 45 days. This span ensures meticulous updating of the electronic filing system records which is crucial for the streamlined submission of information returns through the FIRE system. Adhering closely to these steps ensures the effective revision of TCC-related information, thereby supporting compliance and accuracy in electronic filings.

Understanding Irs 4419

What is the purpose of IRS Form 4419?

The primary purpose of IRS Form 4419 is to request a revision on an active Transmitter Control Code (TCC) that was obtained before September 26, 2021. This includes updates to the legal name associated with an Employer Identification Number (EIN) in Block 4, a change in the mailing address of the organization that will submit electronic files (either as a transmitter and/or issuer), or modifications to contact information such as the name, position title, email address, and telephone number of the person to contact regarding the application. It's important to note that this form is exclusively for revisions; new TCC requests post-September 26, 2021, must be processed through the Information Returns Application for TCC available on the IRS website.

How do I submit Form 4419?

To submit Form 4419, the completed document can be mailed or faxed to the Internal Revenue Service at the addresses provided in the form instructions. For mailing within the United States, send to Internal Revenue Service, 230 Murall Drive, Mail Stop 4360, Kearneysville, WV 25430. If you are faxing the form, the numbers are (877) 477-0572 for submissions within the U.S. and (304) 579-4105 for International submissions (note that this is not a toll-free number). Before sending off the form, ensure that all the required fields are filled out to avoid processing delays.

What are the key sections in Form 4419 that require attention?

Certain sections in Form 4419 necessitate careful consideration and accurate completion:

- Block 1: Clearly indicate the revision reason for the current TCC information—whether it’s for an update in the legal name, mailing address, or contact person details.

- Block 2: Provide your current active Transmitter Control Code (TCC).

- Block 3 and 4: Input the complete legal name (associated with the Employer Identification Number, EIN) and the complete mailing address of the entity submitting the files.

- Block 5: Fill in the details of the contact person, including name, position title, email address, and telephone number.

- Block 6 and 7: Acknowledge reading the affidavit, confirm authorization to sign, and make sure an official of the company or organization signs and dates the form.

What happens if I do not complete all the sections of Form 4419?

If Form 4419 is submitted with incomplete sections, the IRS may be unable to process your application. This could lead to delays in updating your Transmitter Control Code (TCC) information, which might impact your ability to submit electronic files timely. Ensuring that all necessary fields are accurately completed and that you provide a comprehensive update on either your legal name, mailing address, or contact person information is crucial. In cases where false or fraudulent information is identified, it may also subject the submitter to penalties. To ensure a smooth processing experience, thoroughness and accuracy are key.

Common mistakes

Not specifying the purpose for revising the current TCC information: Many filers overlook Block 1, where it's essential to clearly state the reason for the update, be it a change in the legal name, mailing address, or contact person's information.

Failing to provide the current Transmitter Control Code (TCC): Block 2 requires the current TCC, which is crucial for identifying the existing record that needs to be updated. Omitting this information can delay processing or lead to rejection of the form.

Incomplete transmitter or issuer information: In Block 3, every detail, from the legal name associated with the EIN to the complete mailing address, must be filled out thoroughly to ensure the IRS can accurately update the records.

Using a Social Security Number instead of an EIN: Block 4 specifically requires an Employer Identification Number (EIN) and does not allow for a Social Security Number (SSN), a common error that can invalidate the submission.

Providing incomplete contact information: Block 5 demands complete details for the contact person, including name, position title, email address, and telephone number. Missing any part of this can hinder communication regarding the application.

Omitting the affidavit acknowledgment: In Block 6, filers must check the box to confirm they've read the affidavit and are authorized to sign on behalf of the issuer. Skipping this step questions the authority of the submission.

Submitting with a computer-generated signature: The form expressly requires a handwritten signature in Block 7. A digital or typed signature is not accepted and will result in the form being rejected.

Common Mistakes:

- Ignoring the detailed instructions provided for each block, leading to incomplete or incorrect submissions.

- Attempting to request a new TCC with this form—Form 4419 is strictly for updating information related to an existing TCC.

- Not allowing adequate processing time and failing to plan accordingly, which can delay electronic filing of information returns.

Documents used along the form

When organizations plan to file their information returns electronically with the IRS, using Form 4419 to revise an existing Transmitter Control Code (TCC) is often just one step in the process. To efficiently manage their tax responsibilities, businesses might need to incorporate a variety of other forms and documents. The following list highlights some commonly used forms alongside Form 4419, each serving a unique purpose in the broader context of tax management and compliance.

- Form W-9: Request for Taxpayer Identification Number and Certification - This form is used to request the taxpayer identification number (TIN) of a U.S. person, including a resident alien, and to request certain certifications and claims for exemption.

- Form 1099 series: Information Returns - These forms report various types of income other than wages, salaries, and tips. The exact form used depends on the nature of the income.

- Form W-2: Wage and Tax Statement - Employers use this form to report wages, tips, and other compensation paid to employees, as well as the employee's tax withholdings.

- Form 945: Annual Return of Withheld Federal Income Tax - This form is used to report withheld federal income tax from nonpayroll payments, including backup withholding and withholding on pensions, annuities, and IRAs.

- Form 1042-S: Foreign Person's U.S. Source Income Subject to Withholding - This form reports amounts paid to foreign persons, including individuals, corporations, partnerships, or estates that are subject to income tax withholding.

- Form 8809: Application for Extension of Time to File Information Returns - Organizations use this form to request an extension of time to file the Form 1099 series, 1098 series, and other information returns.

- Form 8966: FATCA Report - Used under the Foreign Account Tax Compliance Act (FATCA), this form reports certain information about foreign financial accounts and offshore assets to prevent tax evasion.

- Form 1096: Annual Summary and Transmittal of U.S. Information Returns - This form serves as a summary for paper filings of various forms in the 1099 series, among others, and is sent to the IRS along with the information returns.

- Form 2848: Power of Attorney and Declaration of Representative - This document grants an individual or organization the authority to represent the taxpayer before the IRS, allowing them to handle tax matters on the taxpayer's behalf.

- Form 4506-T: Request for Transcript of Tax Return - Individuals and businesses use this form to request a transcript of their tax return, which may be needed for loans, legal, or regulatory reasons.

In conclusion, understanding and utilizing the appropriate forms and documents in conjunction with Form 4419 is critical for businesses to comply with IRS requirements and maintain accurate tax records. Each form plays a vital role in the tax filing process, offering structure and clarity for different financial and regulatory obligations. Proper preparation and submission of these forms ensure that businesses fulfill their tax responsibilities efficiently and accurately.

Similar forms

The IRS Form W-9, "Request for Taxpayer Identification Number and Certification", shares a functional similarity with the IRS 4419 Form in regard to the provision of taxpayer identification information. Both forms require the submission of accurate taxpayer identification numbers (TINs) for the purpose of tax reporting and compliance. However, Form W-9 is specifically used to provide a TIN to entities that will pay you income, whereas Form 4419 is utilized for updating information associated with an existing Transmitter Control Code (TCC) for electronic filing.

Form SS-4, "Application for Employer Identification Number (EIN)", also parallels the IRS 4419 Form in certain aspects. Both forms require an EIN for identification purposes. While Form SS-4 is used to apply for an EIN for a new entity, Form 4419 necessitates an EIN to update contact or business information for entities that already have a TCC for filing information returns electronically.

Form 8822, "Change of Address", is similar to IRS 4419 in its purpose of updating contact information with the IRS. While Form 8822 is used by individuals and businesses to notify the IRS of a change in address, Form 4419 specifically serves businesses that need to update their legal name, mailing address, or contact person associated with their TCC for electronic filing purposes.

The "Application for Transmitter Control Code (TCC)," available through the IRS’s FIRE (Filing Information Returns Electronically) system, is akin to Form 4419 as it relates to electronic filing of information returns. However, the online TCC application is intended for requesting a new Transmitter Control Code, whereas Form 4419 is utilized for revising information associated with an existing TCC.

Form 2848, "Power of Attorney and Declaration of Representative", shares a tangential relationship with IRS Form 4419 in the aspect of designation of authority. While Form 2848 is used to authorize an individual to represent another party before the IRS, Form 4419 appoints a contact person for correspondence related to electronic filings under a specific TCC.

Form 8453, "U.S. Individual Income Tax Transmittal for an IRS e-file Return", has a functional similarity with the IRS 4419 in terms of electronic filing facilitation. Form 8453 is used to send certain paper documents to the IRS that are needed to process electronically filed returns, while Form 4419 involves updating details for entities that file information returns electronically.

Form 8879, "IRS e-file Signature Authorization", exhibits a similar purpose to Form 4419 in facilitating electronic filing processes, albeit in different contexts. Form 8879 allows taxpayers to authorize electronic filing of their tax returns using a personal identification number, while Form 4419 is concerned with updating the details of entities registered for electronic filing of information returns.

Form 1096, "Annual Summary and Transmittal of U.S. Information Returns", has a functional overlap with IRS 4419, as both are involved in the process of information returns. However, Form 1096 is a paper form that accompanies certain types of information returns submitted on paper, whereas Form 4419 deals with the electronic submission and update process for entities with a TCC.

Form 8809, "Application for Extension of Time To File Information Returns", while distinct in its immediate purpose of requesting filing extensions, intersects with Form 4419 in the broader context of information return filing. Both forms serve entities managing the submission of various informational documents to the IRS, with Form 8809 specifically addressing the need for more time to file these documents electronically.

Dos and Don'ts

Filling out IRS Form 4419, intended for revising an existing Transmitter Control Code (TCC) for electronic filing, requires attention to detail and an understanding of what to do—and what not to do. Whether updating a legal name, address, or contact person’s information associated with an active TCC, the following tips can help avoid common pitfalls.

Do:

- Review instructions carefully: Before filling out the form, ensure understanding of each section by carefully reviewing the instructions to avoid any mistakes or omissions that could delay processing.

- Provide complete and accurate information: Fill in all required fields with the correct information, especially the legal name associated with the EIN, current TCC, and complete and up-to-date contact details.

- Check the affidavit box: Acknowledge the affidavit by checking the box to confirm that the information provided is accurate and that you are authorized to make these changes on behalf of the transmitter or issuer.

- Sign and date the form: Ensure that an authorized official of the company or organization signs and dates the form. Remember, a computer-generated signature is not acceptable.

Don't:

- Use the form for new TCC requests: Remember, Form 4419 is only for revising details associated with an existing TCC. For new TCC requests, use the Information Returns (IR) Application for TCC available on the IRS website.

- Leave sections incomplete: Failing to provide all the required information might result in processing delays. Carefully review the form to ensure nothing has been missed.

- Use a Social Security Number (SSN) as identification: When providing the employer identification number (EIN), do not use an SSN. SSNs are not permitted for this purpose.

- Submit without reviewing: Double-check the form for any errors or omissions before submission. This reduces the risk of rejection and helps ensure timely processing of your application.

Following these guidelines can assist in accurately completing and submitting Form 4419 to revise an active TCC, ensuring compliance with IRS requirements for electronic filing.

Misconceptions

When it comes to the IRS Form 4419, there are several misconceptions that can create confusion. Understanding the truth behind these misconceptions can ensure accurate and efficient handling of requests related to Transmitter Control Codes (TCC).

Form 4419 is only for obtaining a new TCC: This is incorrect. The main purpose of Form 4419 is to revise existing information associated with an active TCC obtained before September 26, 2021. For acquiring a new TCC, a separate online application is required.

Paper filing is the only method to submit Form 4419: While Form 4419 is traditionally mailed or faxed for revisions, it's important to note that new TCC requests are now handled through an online application process.

Social Security Numbers (SSNs) can be used in place of an EIN: This statement is false. Form 4419 requires an Employer Identification Number (EIN), and specifically notes that SSNs are not permissible for this purpose.

Any official in the organization can sign Form 4419: Incorrect. Only authorized individuals such as the owner, a principal officer, a responsible member or officer knowledgeable about the affairs if it’s a partnership, government entity, or unincorporated organization, or the fiduciary if it is a trust or estate, are allowed to sign the form.

Electronic signatures are accepted on Form 4419: This is a common misunderstanding. The form explicitly requires a handwritten signature; electronic or computer-generated signatures are not acceptable.

Form 4419 can be used to update TCC information anytime: This is partly true but lacking context. Form 4419 should only be used to update information for TCCs obtained before September 26, 2021. Any new TCC requests or updates must be processed through the new online system.

Form 4419 is applicable for all types of information returns: While it's true that TCC is required for filing specific information returns electronically, it's crucial to clarify that Form W-2 is excluded. W-2 forms are sent to the Social Security Administration (SSA), not processed through the IRS FIRE system.

Processing time for Form 4419 updates is immediate: On the contrary, applicants should allow up to 45 days for the processing of updates to a TCC.

TCC is optional for electronic filers with fewer than 250 returns: Although electronic filing is mandated for entities with 250 or more returns, the IRS encourages all filers, regardless of volume, to file electronically. Thus, securing a TCC is beneficial even for smaller volumes of returns.

Dispelling these misconceptions ensures a smoother process for those updating or acquiring a Transmitter Control Code. By understanding the requirements and procedures outlined by the IRS, entities can avoid unnecessary delays and ensure compliance in their electronic filing endeavors.

Key takeaways

Here are key takeaways regarding filling out and using the IRS Form 4419:

- To revise an active Transmitter Control Code (TCC) you received before September 26, 2021, use the IRS Form 4419.

- Use this form if you need to update your legal name, address, or contact person's details already associated with an existing TCC.

- A new TCC request requires using the online Information Returns (IR) Application for Transmitter Control Code available on the IRS's FIRE (Filing Information Returns Electronically) web page, not Form 4419.

- Provide complete and accurate information for Block 3 (transmitter and/or issuer information) and Block 5 (contact person details) to ensure your application can be processed.

- An Employer Identification Number (EIN) is required in Block 4; social security numbers are not permitted.

- The individual completing the form must be authorized to act on behalf of the transmitter and/or issuer, verifying their authority in Block 6.

- A physical signature from an official of the company or organization is mandatory; digital or computer-generated signatures are not accepted.

- Expect a processing time of about 45 days for changes to take effect after submitting Form 4419.

To submit, mail or fax the completed Form 4419 to the Internal Revenue Service at the address or fax number provided in the instructions. Make sure to not send this form to the office listed for comments on the form's time estimate or suggestions for improvement.

Popular PDF Documents

California Stop Payment - Provides a structure for detailing the nature of the contribution to a project, the monetary value involved, and the rationale behind the payment claim.

Determination of Heirship Oklahoma - A binding affidavit that identifies all rightful heirs and their entitlements within the state of Oklahoma.