Get IRS 4361 Form

When it comes to understanding the nuances of tax exemptions, especially for those who serve as ministers, members of religious orders, or Christian Science practitioners, the IRS 4361 form plays a pivotal role. This form is essentially the gateway for these individuals to request exemption from self-employment tax for their religious services. Navigating through the eligibility criteria, knowing the implications of opting out of social security taxes, and understanding the long-term effects of this decision are crucial aspects that need careful consideration. Not only does the form offer a means to secure financial relief, but it also requires a comprehensive understanding of what it means for future Social Security benefits. Those who are eligible and decide to file this form embark on a process that significantly alters their financial landscape in relation to their religious vocation. Therefore, getting acquainted with the IRS 4361 form is an important step for those who wish to explore this option, ensuring they make informed decisions about their tax obligations and benefits.

IRS 4361 Example

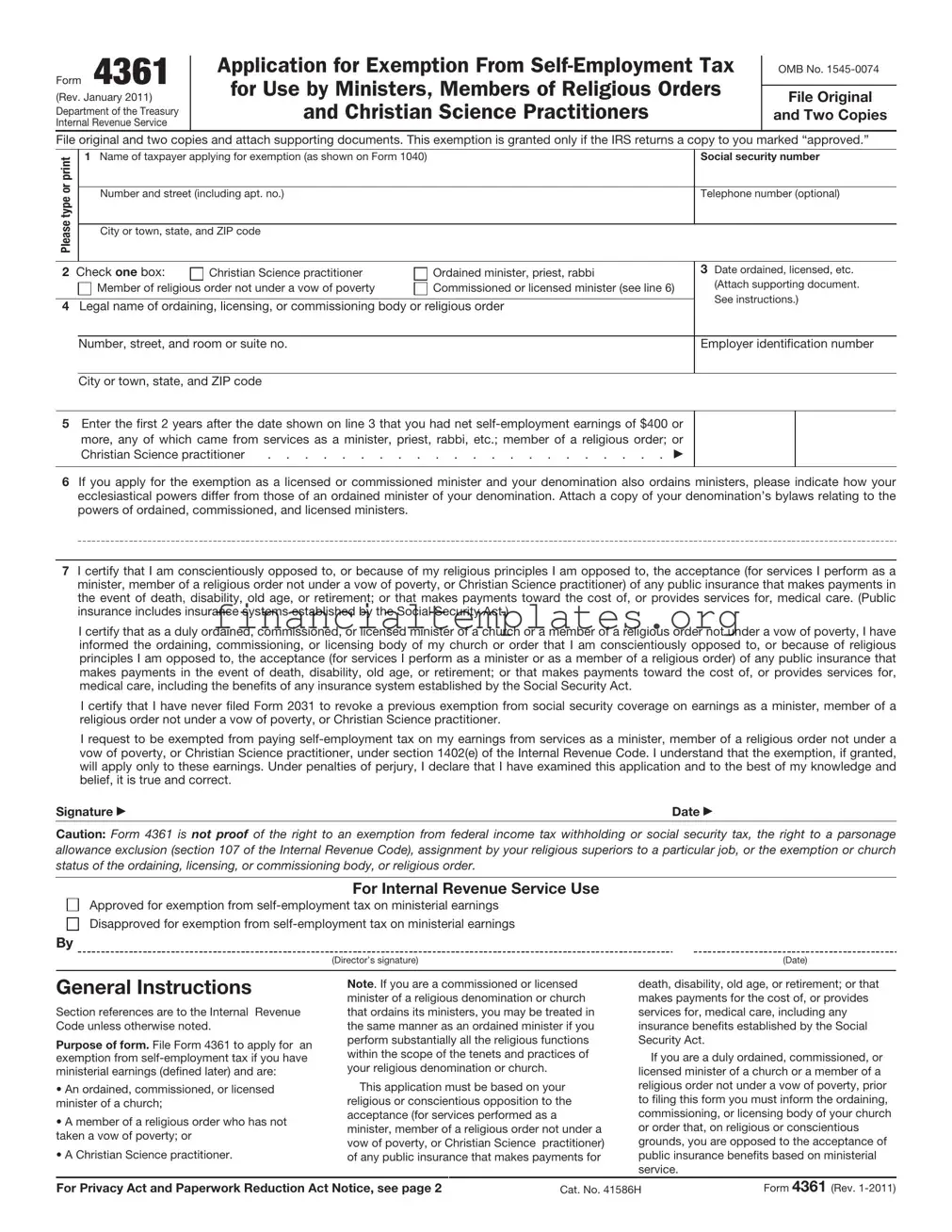

Form 4361

(Rev. January 2011)

Department of the Treasury

Internal Revenue Service

Application for Exemption From

OMB No.

File Original

and Two Copies

File original and two copies and attach supporting documents. This exemption is granted only if the IRS returns a copy to you marked “approved.”

or print |

1 Name of taxpayer applying for exemption (as shown on Form 1040) |

|

|

Number and street (including apt. no.) |

|

||

type |

|

||

|

|

|

|

Please |

City or town, state, and ZIP code |

|

|

|

|

||

|

|

|

|

2 Check one box: |

Christian Science practitioner |

Ordained minister, priest, rabbi |

|

|

Member of religious order not under a vow of poverty |

Commissioned or licensed minister (see line 6) |

|

4Legal name of ordaining, licensing, or commissioning body or religious order

Number, street, and room or suite no.

City or town, state, and ZIP code

5Enter the first 2 years after the date shown on line 3 that you had net

Christian Science practitioner |

. . . . . . . . . . . . . . . . . . . . . . |

Social security number

Telephone number (optional)

3Date ordained, licensed, etc. (Attach supporting document. See instructions.)

Employer identification number

6If you apply for the exemption as a licensed or commissioned minister and your denomination also ordains ministers, please indicate how your ecclesiastical powers differ from those of an ordained minister of your denomination. Attach a copy of your denomination’s bylaws relating to the powers of ordained, commissioned, and licensed ministers.

7I certify that I am conscientiously opposed to, or because of my religious principles I am opposed to, the acceptance (for services I perform as a minister, member of a religious order not under a vow of poverty, or Christian Science practitioner) of any public insurance that makes payments in the event of death, disability, old age, or retirement; or that makes payments toward the cost of, or provides services for, medical care. (Public insurance includes insurance systems established by the Social Security Act.)

I certify that as a duly ordained, commissioned, or licensed minister of a church or a member of a religious order not under a vow of poverty, I have informed the ordaining, commissioning, or licensing body of my church or order that I am conscientiously opposed to, or because of religious principles I am opposed to, the acceptance (for services I perform as a minister or as a member of a religious order) of any public insurance that makes payments in the event of death, disability, old age, or retirement; or that makes payments toward the cost of, or provides services for, medical care, including the benefits of any insurance system established by the Social Security Act.

I certify that I have never filed Form 2031 to revoke a previous exemption from social security coverage on earnings as a minister, member of a religious order not under a vow of poverty, or Christian Science practitioner.

I request to be exempted from paying

Signature |

Date |

Caution: Form 4361 is not proof of the right to an exemption from federal income tax withholding or social security tax, the right to a parsonage allowance exclusion (section 107 of the Internal Revenue Code), assignment by your religious superiors to a particular job, or the exemption or church status of the ordaining, licensing, or commissioning body, or religious order.

For Internal Revenue Service Use

Approved for exemption from

Disapproved for exemption from

By

(Director’s signature) |

(Date) |

|

|

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Purpose of form. File Form 4361 to apply for an exemption from

•An ordained, commissioned, or licensed minister of a church;

•A member of a religious order who has not taken a vow of poverty; or

•A Christian Science practitioner.

Note. If you are a commissioned or licensed minister of a religious denomination or church that ordains its ministers, you may be treated in the same manner as an ordained minister if you perform substantially all the religious functions within the scope of the tenets and practices of your religious denomination or church.

This application must be based on your religious or conscientious opposition to the acceptance (for services performed as a minister, member of a religious order not under a vow of poverty, or Christian Science practitioner) of any public insurance that makes payments for

death, disability, old age, or retirement; or that makes payments for the cost of, or provides services for, medical care, including any insurance benefits established by the Social Security Act.

If you are a duly ordained, commissioned, or licensed minister of a church or a member of a religious order not under a vow of poverty, prior to filing this form you must inform the ordaining, commissioning, or licensing body of your church or order that, on religious or conscientious grounds, you are opposed to the acceptance of public insurance benefits based on ministerial service.

For Privacy Act and Paperwork Reduction Act Notice, see page 2 |

Cat. No. 41586H |

Form 4361 (Rev. |

Form 4361 (Rev. |

Page 2 |

Ministerial service, in general, is the service you perform in the exercise of your ministry, in the exercise of the duties required by your religious order, or in the exercise of your profession as a Christian Science pracitioner. Ministerial earnings are the

Do not file Form 4361 if:

•You ever filed Form 2031, Revocation of Exemption From

•You belong to a religious order and took a vow of poverty. You are automatically exempt from

Additional information. See Pub. 517, Social Security and Other Information for Members of the Clergy and Religious Workers.

When to file. File Form 4361 by the due date, including extensions, of your tax return for the second tax year in which you had at least $400 of net earnings from

Effective date of exemption. An exemption from

Where to file. Mail the original and two copies of this form to: Department of the Treasury, Internal Revenue Service Center, Philadelphia, PA

Approval of application. Before your application can be approved, the IRS must verify that you are aware of the grounds for exemption and that you want the exemption on that basis. When your completed Form 4361 is received, the IRS will mail you a statement that describes the grounds for receiving an exemption under section 1402(e). You must certify that you have read the statement and seek exemption on the grounds listed on the statement. The certification must be made by signing a copy of the statement under penalties of perjury and mailing it to the IRS not later than 90 days after the date the statement was mailed to you. If it is not mailed by that time, your exemption will not be effective until the date the signed copy is received by the IRS.

If your application is approved, a copy of Form 4361 will be returned to you marked “approved.” Keep this copy of Form 4361 for your permanent records. Once the exemption is approved, you cannot revoke it.

Exempt earnings. Only earnings from ministerial services (ministerial earnings) are exempt from

Conducting religious worship services or ministering sacerdotal functions are ministerial services whether or not performed for a religious organization.

Ministerial services also include controlling, conducting, and maintaining religious organizations (including religious boards,

societies, and other agencies integral to these organizations) under the authority of a church or church denomination.

If your church assigns or designates you to perform services for an organization that is neither a religious organization nor an integral agency of a religious organization, you are performing ministerial services even though they may not involve conducting religious worship or ministering sacerdotal functions. Your services are ordinarily not considered assigned or designated by your church if any of the following is true.

•The organization for which you perform the services did not arrange with your church for your services.

•You perform the same services for the organization as other employees not designated as you were.

•You perform the same services before and after the designation.

Nonexempt earnings. Exemption from self- employment tax does not apply to earnings from services that are not ministerial.

Earnings from the following entities are not exempt even if religious services are conducted or sacerdotal functions are ministered: the United States; a state, territory, or possession of the United States; the District of Columbia; a foreign government; or a subdivision of any of these bodies. For example, chaplains in the U.S. Armed Forces are considered commissioned officers, not ministers. Similarly, chaplains in state prisons or universities are considered civil servants.

Indicating exemption on Form 1040. If the IRS returns your application marked “approved” and your only

Specific Instructions

Line 3. Enter the date you were ordained, commissioned, or licensed as a minister of a church; became a member of a religious order; or began practice as a Christian Science practitioner. Do not file Form 4361 before this date. Attach a copy of the certificate (or, if you did not receive one, a letter from the governing body of your church) that establishes your status as an ordained, commissioned, or licensed minister; a member of a religious order; or a Christian Science practitioner.

Line 4. If you are a minister or belong to a religious order, enter the legal name, address, and employer identification number of the denomination that ordained, commissioned, or licensed you, or the order to which you belong. Get the employer identification number from your church or order.

You must be able to show that the body that

ordained, commissioned, or licensed you, or your religious order, is exempt from federal income tax under section 501(a) as a religious organization described in section 501(c)(3). You must also be able to show that the body is a church (or convention or association of churches) described in section 170(b)(1)(A)(i). To assist the IRS in processing your application, you can attach a copy of the exemption letter issued to the organization by the IRS. If that is not

available, you can attach a letter signed by an individual authorized to act for the organization stating that the organization meets both of the above requirements.

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. We need this information to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax. Applying for an exemption from

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

Generally, tax returns and return information are confidential, as stated in section 6103. However, section 6103 allows or requires the Internal Revenue Service to disclose or give the information shown on your tax return to others as described in the Code. We may disclose this information to the Social Security Administration for administration of the exemption, to the Department of Justice to enforce civil and criminal tax laws, and to cities, states, the District of Columbia, and U.S. commonwealths or possessions to administer their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, and to federal law enforcement and intelligence agencies to combat terrorism.

Please keep this notice with your records. It may help you if we ask you for other information. If you have any questions about the rules for filing and giving information, please call or visit any Internal Revenue Service office.

The average time and expenses required to complete and file this form will vary depending on individual circumstances. For the estimated averages, see the instructions for your income tax return.

If you have suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Avenue, NW,

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 4361 | Allows certain ministers, members of religious orders, and Christian Science practitioners to be exempt from self-employment tax for their religious work. |

| Eligibility Criteria | Must be ordained, commissioned, or licensed by a religious body constituting a church or church denomination, and must have a sincere objection to public insurance due to religious considerations. |

| Application Process | The form must be filed with the IRS, specifically stating the reason for the exemption based on religious grounds. |

| Deadline for Filing | Must be filed by the due date of the tax return for the second tax year in which the applicant has net earnings from self-employment of at least $400 mainly from religious activities. |

| Impact of Approval | Exempts approved individuals from paying self-employment tax on their ministerial income. However, it also disqualifies them from receiving social security benefits for those services. |

| Revocation of Exemption | Once granted, the exemption can be revoked only under specific circumstances, as outlined by the IRS. |

| Governing Law | Form 4361 is governed by federal law, as it pertains to federal income tax regulations and the Internal Revenue Code (IRC). |

| State-Specific Forms | There are no state-specific versions of Form 4361; it is a federal form used across all states. |

Guide to Writing IRS 4361

Filling out the IRS Form 4361 involves a series of steps that must be followed carefully to ensure accuracy and compliance. Designed for a specific group of individuals, this form plays a crucial role in the submission process. It's important to gather all necessary information before beginning, as this will streamline the completion process. The following guidelines will assist in filling out the form accurately. Remember, the details you provide should be up-to-date and true to the best of your knowledge. Let's walk through the process step-by-step.

- Start by reading the entire form carefully to understand what information is required. This preliminary step ensures that you have all necessary details at hand before you begin filling it out.

- Enter your full name as it appears on your social security card. This is crucial for identity verification purposes.

- Provide your social security number, ensuring no digits are transposed or incorrect. This number is key to matching your form with your tax records.

- List your home address, including street name, city, state, and ZIP code. Accuracy here ensures that any correspondence from the IRS reaches you without delay.

- Specify your ordination or licensing information. This includes the date of the ordination, the religious body that ordained or licensed you, and your title.

- Detail your employment history with any religious organizations. Include names of organizations, roles, and employment dates. This information is critical to establish the basis for your form submission.

- Read the attestations carefully and make sure you meet the qualifications before signing and dating the form. Your signature attests to the accuracy and truthfulness of the information provided.

After completing these steps, review the form to ensure all information is correct and complete. Missing or inaccurate information can lead to delays or issues with your form's processing. Once satisfied with the completeness and accuracy of the form, submit it to the appropriate IRS office as directed. Remember, filing this form is a significant step that impacts your tax situation, so take care to follow each step meticulously. Keep a copy of the form for your records, noting the submission date. This will be helpful for future reference or in case any follow-up is required.

Understanding IRS 4361

What is the IRS Form 4361?

The IRS Form 4361 is a document that ministers use to apply for an exemption from self-employment tax. This form is specifically for those who oppose receiving public insurance benefits due to religious reasons. By filing this form, eligible ministers can exclude their earnings from pastoral services from self-employment taxes. However, it’s important to note that this exemption applies only to their ministerial income, not to any other income they might have.

Who is eligible to file Form 4361?

Eligibility for filing Form 4361 is limited to ministers, members of religious orders who have not taken a vow of poverty, and Christian Science practitioners. The key requirement is that these individuals must have a conscientious objection to accepting public insurance benefits, which includes Social Security and Medicare benefits, based on their religious beliefs. To be successful in the exemption, the individual must convincingly demonstrate their objection on the basis of religious principles.

How does one apply for the exemption using Form 4361?

To apply for the exemption, an eligible individual must accurately complete and file Form 4361. This involves providing detailed information about one's ministry and the religious beliefs that lead to the conscientious objection to public insurance. The form requires a statement that explains the individual’s specific reasons for requesting the exemption. It's crucial to file this form before the deadline for the tax year in which the exemption is sought. Once filed, the IRS will review the application and notify the applicant of their decision.

What are the consequences of being granted this exemption?

Being granted an exemption through Form 4361 means that a minister will not pay self-employment taxes on their ministerial earnings. It's important to understand, however, that this also means they will not receive Social Security or Medicare benefits for those earnings. This decision is irrevocable and affects future entitlements to these programs. Before applying, individuals should carefully consider their future financial security and retirement plans.

Can the exemption be revoked or ended once granted?

Once the IRS grants the exemption via Form 4361, it is permanent and irrevocable. This means that an individual cannot decide to start paying self-employment taxes again in the hopes of receiving Social Security or Medicare benefits for their ministerial services at a later date. The decision to apply for and receive this exemption should be made with careful consideration of long-term financial and retirement needs.

Where can one find additional help or resources?

For those looking for help with Form 4361, several resources are available. The IRS website provides detailed instructions and the form itself. Additionally, tax professionals familiar with clergy taxes can offer guidance and support throughout the application process. Religious organizations and denominations may also have resources to help their ministers understand and decide whether to apply for this exemption. Seeking advice from multiple sources can be beneficial in making an informed decision.

Common mistakes

Filling out IRS Form 4361, Application for Exemption From Self-Employment Tax for Use by Ministers, Members of Religious Orders, and Christian Science Practitioners, carries its challenges. Here are common mistakes to avoid to ensure proper filing:

Not verifying eligibility before filing. Only individuals who are ministers, members of religious orders not under a vow of poverty, or Christian Science practitioners can file Form 4361.

Missing the deadline. Applicants must file Form 4361 by the due date of their tax return for the second year in which they have net earnings from self-employment of at least $400.

Omitting required personal information. Every section asking for personal details, including Social Security Number and address, must be filled out completely.

Failure to provide ordination or commissioning details. The form requires specific information about ordination, commissioning, or licensing, including dates and denominational details.

Skipping the statement of religious opposition. The form requires a statement that the applicant is conscientiously opposed to public insurance due to religious considerations.

Incomplete supporting documentation. All relevant documents, such as ordination certificates or letters from the religious order, must accompany the form.

Incorrect filing status. It's crucial to accurately report your tax status, as this can affect eligibility and the exemption process itself.

Not retaining a copy. Applicants often forget to keep a copy of the completed form and any attached documents for their records.

Avoiding these errors can lead to a smoother application process and help ensure that the exemption request is processed without unnecessary delays.

Documents used along the form

When filing IRS Form 4361, individuals are often navigating the process of exemption from self-employment tax for ministers, members of religious orders, and Christian Science practitioners. This form is just one of several documents that may need to be completed or gathered during this process. Understanding the additional forms and documents typically required can make the filing process smoother and ensure compliance with IRS regulations.

- IRS Form 1040 - The standard Individual Income Tax Return form, which everyone must file annually. It’s where you report your total income for the year and calculate tax liability or refund.

- IRS Schedule SE (Form 1040) - Required for self-employed individuals to calculate the amount of self-employment tax owed. Although those filing Form 4361 seek exemption, this form might be needed for other income or prior to exemption approval.

- IRS Form W-2 - A wage and tax statement provided by employers. Ministers or religious workers employed by a church may receive a W-2 for their non-religious employment income.

- IRS Form 1099-MISC or Form 1099-NEC - Used to report income for independent contractors or freelance work. Religious workers might need this for services performed outside of their exempt duties.

- IRS Form 8853 - Accompanies Form 4361 for archer MSAs and long-term care insurance contracts, including information on deductions and contributions.

- IRS Form 8941 - Helps small employers, including religious institutions, calculate the credit for employee health insurance premiums.

- Church Salary Report - Not an IRS form, but often necessary. This internal church document details the compensation package (including housing allowance) of the minister or religious worker.

- Social Security Administration Request for Social Security Earnings Information - Not directly related to tax filing, but may be needed to provide evidence of earnings (or lack thereof) from non-ministerial duties in support of Form 4361.

- Ordination Certificate - While not filed with the IRS, having your ordination or consecration documents in order is essential when claiming exemption as a minister or member of a religious order.

Filing forms with the IRS can be complicated, and it's essential to understand both the primary and supplementary documents required. Each document plays a critical role in ensuring that individuals meet eligibility requirements, claim appropriate exemptions, and comply with federal tax obligations. Accurate and thorough completion of these forms prevents processing delays and potential audits. Always consult with a tax professional or advisor to ensure compliance and maximization of benefits.

Similar forms

The IRS 1040 form shares similarities with the IRS 4361 form in that both are pivotal documents for tax reporting purposes in the United States. The 1040 form is the standard federal income tax form used by individuals to report their annual income to the Internal Revenue Service (IRS). Like the 4361, it plays a crucial role in determining tax liability and potential refunds, impacting an individual’s financial obligations to the federal government.

Form W-2 is akin to the IRS 4361 form because it is also integral to the tax reporting process. Employers issue Form W-2 to employees to report annual wages and the amount of taxes withheld from their paycheck. For individuals who are employed, this form is essential for filling out their tax returns accurately, similar to how the 4361 form is used by certain clergy members to opt out of social security taxes.

The IRS 1099 form is a collection of documents that are somewhat similar to the 4361 form because they deal with reporting various types of non-employment income. Independent contractors, freelancers, and others who earn income outside of traditional employment use this form to report their earnings. Like the 4361 form, the 1099 encompasses specific financial information crucial for accurately reporting an individual's income and determining their tax liability.

Similar to the 4361 form, the Schedule C attachment to the IRS Form 1040 is used by sole proprietors to report income or loss from a business they operate or a profession they practice. This form is essential for individuals who own their business to accurately declare their business earnings and expenses, playing a significant role in the calculation of taxable income and tax due, paralleling the function of Form 4361 for qualifying clergy members.

The SSA-1099 form, issued by the Social Security Administration, reports the amount of social security benefits one receives. This form bears resemblance to the IRS 4361 form in that both relate directly to social security matters. However, while the 4361 form is used by qualified individuals opting out of social security taxes, the SSA-1099 form helps recipients of social security benefits determine if any portion of their benefits are taxable.

The IRS 1023 form, similar to the 4361 form, is used by organizations seeking exemption status, specifically 501(c)(3) nonprofit exemption. Though the 1023 pertains to organizations and the 4361 to individuals, both forms facilitate a tax-exempt status under specific qualifications, highlighting their function in the complex landscape of tax liability and exemption.

Form 8863 is used for calculating and claiming education credits on a tax return, similar to how the IRS 4361 form is used by clergy to opt out of social security taxes. Both forms enable individuals to adjust their taxable income based on specific personal circumstances, thus influencing their overall tax liability and financial planning.

The W-4 form is utilized by employees to instruct employers on the amount of tax to withhold from their paycheck. This form is related to the 4361 in its role in managing tax obligations. While the 4361 allows qualifying clergy to manage their social security tax commitments, the W-4 influences the handling of income tax, showcasing each document's role in personal tax strategy.

The IRS 4868 form, providing taxpayers with an extension of time to file their tax return, shares its goal with the 4361 of managing tax responsibilities. Though serving different purposes—one grants additional time for filing taxes, and the other allows certain clergy to opt out of social security taxes—both are instrumental in tax planning and fulfillment.

Lastly, the IRS 4506-T form, which is used to request tax transcripts, parallels the 4361 form in the facilitation of tax-related processes. While the 4506-T allows individuals and third parties to review historical tax information, the 4361 provides qualified ministers the opportunity to make significant tax-related decisions about their social security contributions. Both serve crucial roles in broader tax management and compliance efforts.

Dos and Don'ts

Filling out the IRS Form 4361 can be a crucial step for certain individuals who wish to apply for exemption from self-employment tax for religious reasons. Here are some important do's and don'ts to consider:

Do's:Ensure you meet the eligibility criteria before applying. This form is specific to members of recognized religious groups opposed to insurance benefits.

Complete the form accurately, providing detailed information about your religious group and your opposition to public insurance.

Provide your ordination or commissioning date, as well as details of the religious body ordaining, commissioning, or licensing you.

Sign and date the form to certify that the statements you've made are true.

Keep a copy of the completed form and any correspondence for your records.

Do not leave any required fields blank. Incomplete forms may be rejected or returned, which can delay processing.

Avoid guessing or approximating important dates and details. Accuracy is crucial for your application's success.

Do not forget to explain your specific reasons for opposing public insurance. This explanation is critical to the evaluation of your application.

Refrain from submitting the form without first reviewing it thoroughly. Mistakes or omissions can significantly impact your application.

Misconceptions

The IRS Form 4361 is a subject surrounded by a number of misconceptions. This form is specific to ministers, members of religious orders, and Christian Science practitioners, allowing them to opt out of paying self-employment tax on their religious earnings. Let's address some of the common misunderstandings:

Anyone can file Form 4361. In truth, only ministers, members of religious orders who have not taken a vow of poverty, and Christian Science practitioners are eligible to use this form for exemption from self-employment taxes on their ministerial income.

Form 4361 exempts you from all taxes. This is incorrect. It only exempts you from self-employment taxes on your religious income. Ministers still need to pay income taxes and may also have to pay self-employment taxes on other earnings.

Filing Form 4361 is a one-time process. While it's true that you only need to file Form 4361 once, the decision is irrevocable. This means you can't opt back into self-employment tax coverage for your ministry income after the IRS approves your exemption.

Form 4361 affects your congregation's obligations. In reality, Form 4361 only impacts the individual minister's tax obligations. It does not change the tax responsibilities or the reporting requirements of the religious organizations they serve.

There's no time limit to file Form 4361. Actually, there's a deadline. Generally, you must file Form 4361 by the due date of your tax return for the second year in which you have earnings from your ministry that you're reporting on Schedule C (or the equivalent), and for which you owe self-employment tax.

The process is complicated. While dealing with tax forms can seem daunting, the process for filing Form 4361 involves filling out and submitting the form according to the instructions provided by the IRS. Proper documentation and consulting with a tax professional can simplify the process.

Form 4361 guarantees approval of the exemption. Filing the form does not ensure that the IRS will grant the exemption. The IRS reviews each application thoroughly and only approves those who meet all the requirements.

You can opt out for personal reasons. The exemption is strictly for those who object, on the basis of religious principles, to public insurance. This exemption isn’t available for objections based on economic, political, or other non-religious reasons.

If denied, you can't apply again. If the IRS denies your exemption, it's based on the application not meeting the legal requirements. You can reapply if your situation changes, allowing you to meet the eligibility criteria.

Opting out affects your future Social Security benefits. This is true and often overlooked. Those who opt out of paying self-employment taxes on their ministerial income will not earn Social Security credits for that income, potentially affecting their future Social Security benefit amounts.

Understanding these misconceptions is crucial for anyone considering filing IRS Form 4361. It ensures that ministers make informed decisions based on accurate information. Consulting with a tax professional familiar with clergy tax laws can provide further clarity and assistance.

Key takeaways

Filing the IRS 4361 form can be an important step for certain individuals who wish to apply for exemption from self-employment tax for their earnings from ministerial services. Below are key takeaways to help understand and navigate this process effectively:

- Eligibility: Before filling out the form, ensure you meet the eligibility criteria, which typically include being an ordained, commissioned, or licensed minister of a church, a member of a religious order, or a Christian Science practitioner.

- Deadlines Matter: It's crucial to file Form 4361 by the due date for filing your tax return (including extensions) for the second tax year in which you have at least $400 in net earnings from self-employment, part of which comes from your ministerial services.

- Complete Information: When filling out the form, provide all requested information, such as your name, social security number, and the specific services performed as a minister. Incomplete forms may lead to processing delays or denial of the exemption.

- Specify the Reason for Exemption: Clearly indicate your reason for seeking exemption from self-employment tax. This typically involves a statement that you are conscientiously opposed to, or because of your religious principles you are opposed to, the acceptance of public insurance with respect to services performed as a minister, member of a religious order, or Christian Science practitioner.

- Keep a Copy: After completing and submitting Form 4361, make sure to keep a copy for your records. This will be important for future reference, especially if questions arise about your tax status.

- Approval Is Not Guaranteed: Submitting Form 4361 does not automatically grant an exemption. The IRS reviews each application carefully, and approval is based on the information provided in the form.

- Notification of Decision: The IRS will notify you in writing once a decision has been made regarding your exemption application. This letter is important and should be kept with your tax records.

- Impact on Social Security Benefits: Be aware that if you are granted an exemption, it might affect your eligibility for Social Security benefits based on your ministerial earnings. This is an important consideration for your long-term financial planning.

- Revocation is Rare: Once granted, it's very rare for the IRS to allow revocation of the exemption. Therefore, consider the long-term implications carefully before applying.

- Seek Professional Advice: Given the complexities surrounding Form 4361 and the implications of being granted an exemption, it might be wise to consult with a tax professional or legal advisor who is familiar with this area of the tax code.

Popular PDF Documents

Form 1065 for Llc - It's not just for tax filing; the 1065 form helps partnerships evaluate their financial health and plan for future growth.

What Is a 1099r - Understanding the 1099-R form helps retirees manage their tax brackets more efficiently by planning withdrawals and distributions strategically.

1099sa - Receiving and reporting through the 1099-SA is a yearly obligation for those with HSA, Archer MSA, or Medicare Advantage MSA distributions.