Get IRS 433-F Form

Navigating the turbulent waters of financial obligations to the Internal Revenue Service (IRS) can often feel like an uphill battle, fraught with uncertainty and complexity. At the heart of resolving substantial tax dues lies the critical yet often misunderstood IRS 433-F form, a key tool in the arsenal for those seeking to negotiate payment terms or achieve a compromise. This document is more than just a form; it is a gateway to potential relief for individuals overwhelmed by tax debt. It requires a comprehensive disclosure of an individual's financial situation, providing the IRS with a detailed snapshot of income, expenses, assets, and liabilities. The importance of accuracy and thoroughness cannot be overstated, as the information submitted will directly influence the IRS's decision regarding payment plans or settlements. Whether you are confronting this challenge head-on or are in the early stages of exploring your options, understanding the major aspects of the IRS 433-F form is the first step toward regaining financial stability and peace of mind.

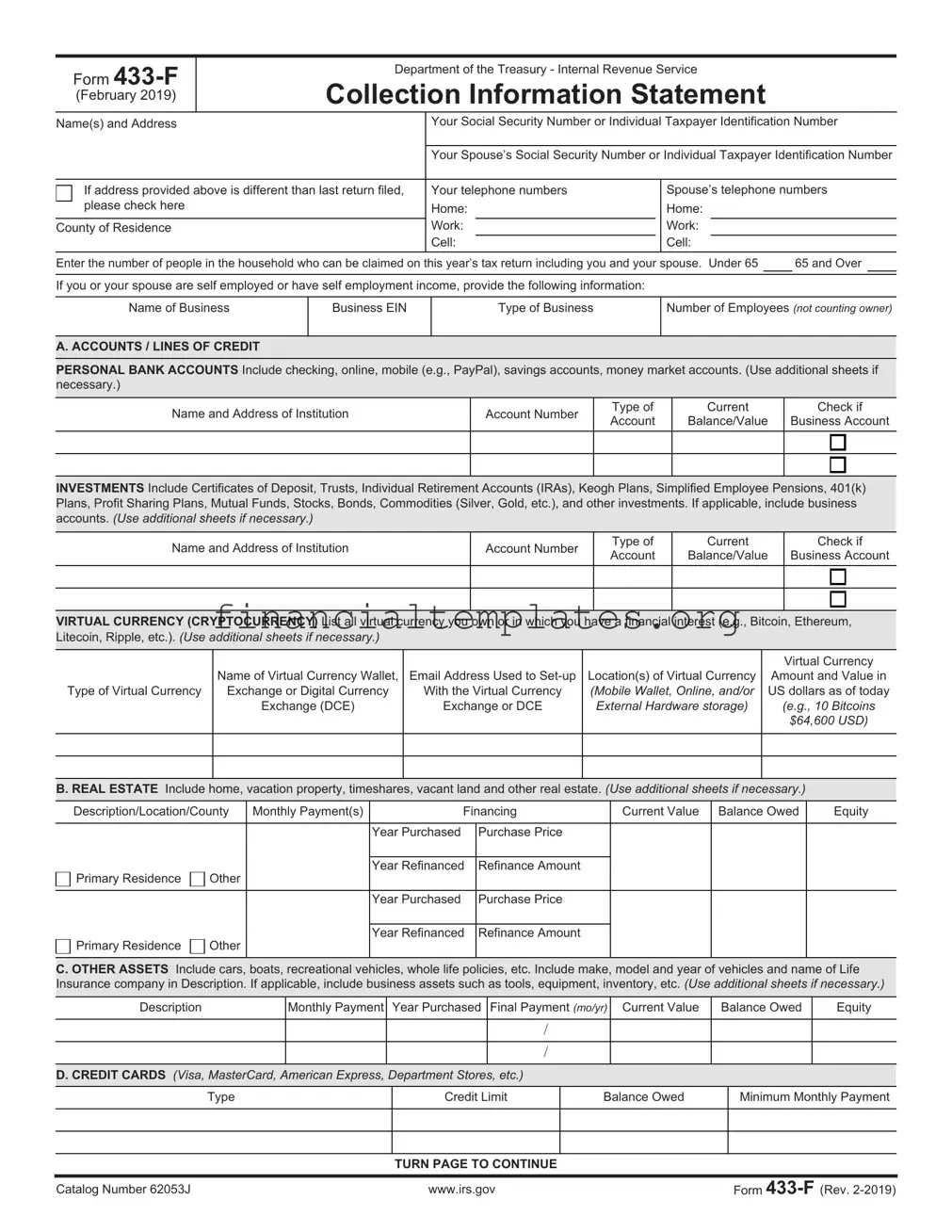

IRS 433-F Example

Form

(February 2019)

Department of the Treasury - Internal Revenue Service

Collection Information Statement

Name(s) and Address |

Your Social Security Number or Individual Taxpayer Identification Number |

|||||||

|

|

|

|

|

||||

|

Your Spouse’s Social Security Number or Individual Taxpayer Identification Number |

|||||||

|

|

|

|

|

|

|||

If address provided above is different than last return filed, |

Your telephone numbers |

|

Spouse’s telephone numbers |

|||||

please check here |

Home: |

|

Home: |

|

|

|

||

County of Residence |

Work: |

|

|

Work: |

|

|

|

|

|

Cell: |

|

|

Cell: |

|

|

|

|

Enter the number of people in the household who can be claimed on this year’s tax return including you and your spouse. Under 65 |

|

65 and Over |

||||||

|

|

|

|

|

|

|

|

|

If you or your spouse are self employed or have self employment income, provide the following information:

Name of Business

Business EIN

Type of Business

Number of Employees (not counting owner)

A. ACCOUNTS / LINES OF CREDIT

PERSONAL BANK ACCOUNTS Include checking, online, mobile (e.g., PayPal), savings accounts, money market accounts. (Use additional sheets if necessary.)

Name and Address of Institution

Account Number

Type of Account

Current

Balance/Value

Check if

Business Account

INVESTMENTS Include Certificates of Deposit, Trusts, Individual Retirement Accounts (IRAs), Keogh Plans, Simplified Employee Pensions, 401(k) Plans, Profit Sharing Plans, Mutual Funds, Stocks, Bonds, Commodities (Silver, Gold, etc.), and other investments. If applicable, include business accounts. (Use additional sheets if necessary.)

Name and Address of Institution

Account Number

Type of Account

Current

Balance/Value

Check if

Business Account

VIRTUAL CURRENCY (CRYPTOCURRENCY) List all virtual currency you own or in which you have a financial interest (e.g., Bitcoin, Ethereum, Litecoin, Ripple, etc.). (Use additional sheets if necessary.)

Type of Virtual Currency

Name of Virtual Currency Wallet,

Exchange or Digital Currency

Exchange (DCE)

Email Address Used to

With the Virtual Currency

Exchange or DCE

Location(s) of Virtual Currency (Mobile Wallet, Online, and/or External Hardware storage)

Virtual Currency

Amount and Value in US dollars as of today (e.g., 10 Bitcoins $64,600 USD)

B. REAL ESTATE Include home, vacation property, timeshares, vacant land and other real estate. (Use additional sheets if necessary.)

Description/Location/County |

Monthly Payment(s) |

Financing |

Current Value |

Balance Owed |

Equity |

||

|

|

|

|

|

|

|

|

|

|

|

Year Purchased |

Purchase Price |

|

|

|

|

|

|

|

|

|

|

|

Primary Residence |

Other |

|

Year Refinanced |

Refinance Amount |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Year Purchased |

Purchase Price |

|

|

|

|

|

|

|

|

|

|

|

Primary Residence |

Other |

|

Year Refinanced |

Refinance Amount |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

C. OTHER ASSETS Include cars, boats, recreational vehicles, whole life policies, etc. Include make, model and year of vehicles and name of Life Insurance company in Description. If applicable, include business assets such as tools, equipment, inventory, etc. (Use additional sheets if necessary.)

Description |

Monthly Payment Year Purchased Final Payment (mo/yr) Current Value |

Balance Owed |

Equity |

/

/

D. CREDIT CARDS (Visa, MasterCard, American Express, Department Stores, etc.)

Type

Credit Limit

Balance Owed

Minimum Monthly Payment

TURN PAGE TO CONTINUE

Catalog Number 62053J |

www.irs.gov |

Form |

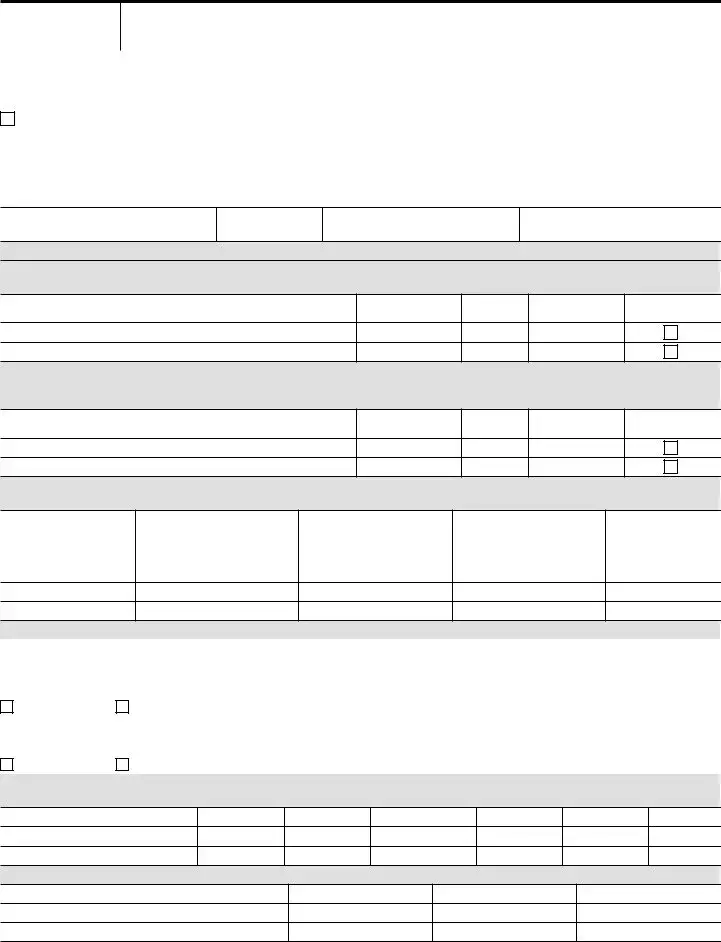

Page 2 of 4

E. BUSINESS INFORMATION Complete E1 for Accounts Receivable owed to you or your business. (Use additional sheets if necessary.) Complete E2 if you or your business accepts credit card payments. Include virtual currency wallet, exchange or digital currency exchange.

E1. Accounts Receivable owed to you or your business

Name |

Address |

Amount Owed |

|

|

|

|

|

|

|

|

|

List total amount owed from additional sheets

Total amount of accounts receivable available to pay to IRS now

E2. Name of individual or business on account

Credit Card

(Visa, Master Card, etc.)

Issuing Bank Name and Address

Merchant Account Number

F. EMPLOYMENT INFORMATION If you have more than one employer, include the information on another sheet of paper. (If attaching a copy of current pay stub, you do not need to complete this section.)

Your current Employer (name and address)

How often are you paid (check one) |

|

|

|

|

|

||||

Weekly |

Biweekly |

Monthly |

|||||||

Gross per pay period |

|

|

|

|

|

|

|

|

|

Taxes per pay period (Fed) |

|

(State) |

(Local) |

||||||

How long at current employer |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

Spouse’s current Employer (name and address)

How often are you paid (check one)

Weekly |

Biweekly |

|

Monthly |

||||||

Gross per pay period |

|

|

|

|

|

|

|

|

|

Taxes per pay period (Fed) |

|

|

(State) |

(Local) |

|||||

How long at current employer |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

G.

Alimony Income

Child Support Income

Net Self Employment Income

Net Rental Income

Unemployment Income

Pension Income

Interest/Dividends Income

Social Security Income

Other:

H. MONTHLY NECESSARY LIVING EXPENSES List monthly amounts. (For expenses paid other than monthly, see instructions.)

1. Food / Personal Care See instructions. If you do not spend more than |

4. Medical |

Actual Monthly |

IRS Allowed |

||

the standard allowable amount for your family size, fill in the Total amount |

Health Insurance |

Expenses |

|

||

only. |

|

|

|

|

|

Actual Monthly |

IRS Allowed |

|

|

||

|

Out of Pocket Health Care |

|

|

||

|

Expenses |

|

|

||

Food |

|

|

Expenses |

|

|

|

|

|

|

||

|

|

Total |

|

|

|

Housekeeping Supplies |

|

|

|

|

|

Clothing and Clothing Services |

|

|

5. Other |

Actual Monthly |

IRS Allowed |

Personal Care Products & Services |

|

|

|

Expenses |

|

|

|

|

|

||

Miscellaneous |

|

|

Child / Dependent Care |

|

|

Total |

|

|

Estimated Tax Payments |

|

|

2. Transportation |

Actual Monthly |

IRS Allowed |

Term Life Insurance |

|

|

|

Expenses |

Retirement (Employer Required) |

|

|

|

|

|

|

|

||

Gas / Insurance / Licenses / |

|

|

Retirement (Voluntary) |

|

|

Parking / Maintenance etc. |

|

|

Union Dues |

|

|

Public Transportation |

|

|

Delinquent State & Local Taxes |

|

|

Total |

|

|

(minimum payment) |

|

|

3. Housing & Utilities |

Actual Monthly |

IRS Allowed |

Student Loans (minimum |

|

|

|

Expenses |

payment) |

|

|

|

|

|

|

|

||

Rent |

|

|

Court Ordered Child Support |

|

|

Electric, Oil/Gas, Water/Trash |

|

|

Court Ordered Alimony |

|

|

Telephone/Cell/Cable/Internet |

|

|

Other Court Ordered Payments |

|

|

Real Estate Taxes and Insurance |

|

|

Other (specify) |

|

|

(if not included in B above) |

|

|

Other (specify) |

|

|

Maintenance and Repairs |

|

|

Other (specify) |

|

|

Total |

|

|

Total |

|

|

Under penalty of perjury, I declare to the best of my knowledge and belief this statement of assets, liabilities and other information is true, correct and complete.

Your signature

Spouse’s signature

Date

Catalog Number 62053J |

www.irs.gov |

Form |

Page 3 of 4

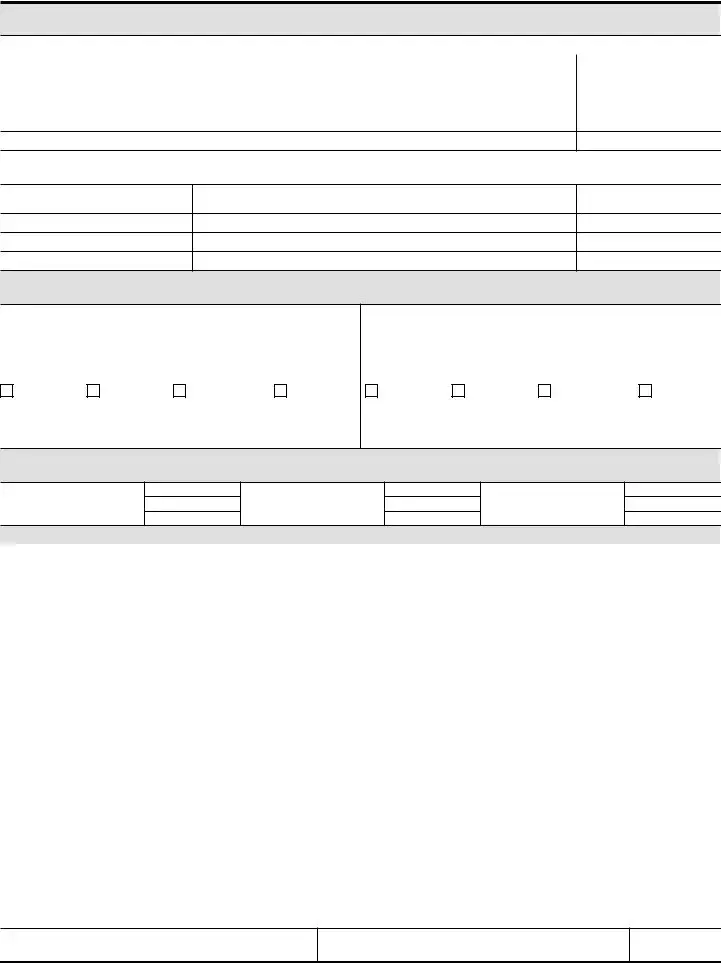

Instructions for Form

What is the purpose of Form 433F?

Form

Note: You may be able to establish an Online Payment Agreement on the IRS web site. To apply online, go to https://www.irs.gov, click on “I need to pay my taxes,” and select “Installment Agreement” under the heading “What if I can't pay now?”

If you are requesting an Installment Agreement, you should submit Form 9465, Installment Agreement Request, along with Form

Please retain a copy of your completed form and supporting documentation. After we review your completed form, we may contact you for additional information. For example, we may ask you to send supporting documentation of your current income or substantiation of your stated expenditures.

If any section on this form is too small for the information you need to supply, please use a separate sheet.

Section A – Accounts / Lines of Credit

List all accounts, even if they currently have no balance. However, do not enter bank loans in this section. Include business accounts, if applicable. If you are entering information for a stock or bond, etc. and a question does not apply, enter N/A.

Section B – Real Estate

List all real estate you own or are purchasing including your home. Include insurance and taxes if they are included in your monthly payment. The county/description is needed if different than the address and county you listed above. To determine equity, subtract the amount owed for each piece of real estate from its current market value.

Section C – Other Assets

List all cars, boats and recreational vehicles with their make, model and year. If a vehicle is leased, write “lease” in the “year purchased” column. List whole life insurance policies with the name of the insurance company. List other assets with a description such as “paintings”, “coin collection”, or “antiques”. If applicable, include business assets, such as tools, equipment, inventory, and intangible assets such as domain names, patents, copyrights, etc. To determine equity, subtract the amount owed from its current market value. If you are entering information for an asset and a question does not apply, enter N/A.

Section D – Credit Cards

List all credit cards and lines of credit, even if there is no balance owed.

Section E – Business Information

Complete this section if you or your spouse are

E1: List all Accounts Receivable owed to you or your business. Include federal, state and local grants and contracts.

E2: Complete if you or your business accepts credit card payments (e.g., Visa, MasterCard, etc.) and/or virtual currency wallet, exchange or digital currency exchange.

Section F – Employment Information

Complete this section if you or your spouse are wage earners.

If attaching a copy of current pay stub, you do not need to complete this section.

Section G –

List all

Net

spouse earns after you pay ordinary and necessary monthly business expenses. This figure should relate to the yearly net profit from Schedule C on your Form 1040 or your current year profit and loss statement. Please attach a copy of Schedule C or your current year profit and loss statement. If net income is a loss, enter “0”.

Net Rental Income is the amount you earn after you pay ordinary and necessary monthly rental expenses. This figure should relate to the amount reported on Schedule E of your Form 1040.

Do not include depreciation expenses. Depreciation is a

If net rental income is a loss, enter “0”.

Other Income includes distributions from partnerships and subchapter S corporations reported on Schedule

Section H – Monthly Necessary Living Expenses

Enter monthly amounts for expenses. For any expenses not paid monthly, convert as follows:

If a bill is paid … |

Calculate the monthly |

|

amount by … |

||

|

||

Quarterly |

Dividing by 3 |

|

|

|

|

Weekly |

Multiplying by 4.3 |

|

|

|

|

Biweekly (every two |

Multiplying by 2.17 |

|

weeks) |

||

|

||

Semimonthly (twice |

Multiplying by 2 |

|

each month) |

||

|

Catalog Number 62053J |

www.irs.gov |

Form |

Page 4 of 4

For expenses claimed in boxes 1 and 4, you should provide the IRS allowable standards, or the actual amount you pay if the amount exceeds the IRS allowable standards. IRS allowable standards can be found by accessing https://www.irs.gov/

Substantiation may be required for any expenses over the standard once the financial analysis is completed.

The amount claimed for Miscellaneous cannot exceed the standard amount for the number of people in your family. The miscellaneous allowance is for expenses incurred that are not included in any other allowable living expense items. Examples are credit card payments, bank fees and charges, reading material and school supplies.

If you do not have access to the IRS web site, itemize your actual expenses and we will ask you for additional proof, if required. Documentation may include pay statements, bank and investment statements, loan statements and bills for recurring expenses, etc.

Housing and Utilities – Includes expenses for your primary residence. You should only list amounts for utilities, taxes and insurance that are not included in your mortgage or rent payments.

Rent – Do not enter mortgage payment here. Mortgage payment is listed in Section B.

Transportation – Include the total of maintenance, repairs, insurance, fuel, registrations, licenses, inspections, parking, and tolls for one month.

Public Transportation – Include the total you spend for public transportation if you do not own a vehicle or if you have public transportation costs in addition to vehicle expenses.

Medical – You are allowed expenses for health insurance and

Health insurance – Enter the monthly amount you pay for yourself or your family.

covered by health insurance, and include:

•Medical services

•Prescription drugs

•Dental expenses

•Medical supplies, including eyeglasses and contact lenses. Medical procedures of a purely cosmetic nature, such as plastic surgery or elective dental work are generally not allowed.

Child / Dependent Care – Enter the monthly amount you pay for the care of dependents that can be claimed on your Form 1040.

Estimated Tax Payments – Calculate the monthly

amount you pay for estimated taxes by dividing the quarterly amount due on your Form 1040ES by 3.

Life Insurance – Enter the amount you pay for term life insurance only. Whole life insurance has cash value and should be listed in Section C.

Delinquent State & Local Taxes – Enter the minimum

amount you are required to pay monthly. Be prepared to provide a copy of the statement showing the amount you owe and if applicable, any agreement you have for monthly payments.

Student Loans – Minimum payments on student loans for the taxpayer’s

Court Ordered Payments – For any court ordered

payments, be prepared to submit a copy of the court order portion showing the amount you are ordered to pay, the signatures, and proof you are making the payments. Acceptable forms of proof are copies of cancelled checks or copies of bank or pay statements.

Other Expenses not listed above – We may allow

other expenses in certain circumstances. For example, if the expenses are necessary for the health and welfare of the taxpayer or family, or for the production of income. Specify the expense and list the minimum monthly payment you are billed.

Catalog Number 62053J |

www.irs.gov |

Form |

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The IRS 433-F form is a Collection Information Statement used by the Internal Revenue Service. |

| 2 | It is used to collect financial information from individuals to establish payment plans or settle accounts. |

| 3 | Taxpayers are required to reveal income, expenses, and information about assets. |

| 4 | The form assists the IRS in determining the taxpayer's ability to pay outstanding tax debts. |

| 5 | Filling out Form 433-F accurately is crucial for taxpayers to arrange a feasible payment agreement. |

| 6 | The IRS may require additional documentation to verify the information provided on the form. |

| 7 | Based on the information in Form 433-F, the IRS can offer payment plans, such as an Installment Agreement. |

| 8 | The form is available for download from the IRS website. |

| 9 | Taxpayers can submit Form 433-F by mail or during an in-person interview with an IRS representative. |

| 10 | Failure to accurately complete Form 433-F or provide the necessary information can lead to enforcement actions by the IRS. |

Guide to Writing IRS 433-F

Completing the IRS 433-F form is a critical step for individuals who are working with the Internal Revenue Service to outline their financial situation. This process is necessary for setting up a payment plan or negotiating with the IRS on outstanding tax liabilities. The form requests detailed information about your finances, including income, expenses, and assets, to determine your ability to pay. It's important to approach this task with accuracy and honesty to facilitate a smooth negotiation process. The following steps guide you through filling out the form to ensure all necessary information is accurately captured.

- Begin by gathering all required financial documentation, such as pay stubs, bank statements, bills, and any records of assets. This will help you accurately fill out the form.

- Enter your personal information at the top of the form, including your full name, social security number, address, and contact information.

- Detail your employment information. If you're employed, provide the name and address of your employer, along with your occupation. If you're self-employed, provide details about your business.

- List all sources of income, including wages, salaries, dividends, pensions, and any other income, in the designated section. Be sure to include the frequency and amount of each source of income.

- Document your bank account information, including account types, balances, and the names of the banks where the accounts are held.

- Describe any assets you own, such as real estate, vehicles, life insurance with a cash value, and anything else of significant value. Include details like the asset type, location, value, and any associated debts.

- Under the expenses section, list all monthly living expenses, including rent or mortgage, food, utilities, transportation costs, and medical bills. Ensure these figures are accurate and reflect your current situation.

- Include the details of any non-wage household income, such as contributions from other household members or rental income.

- Review the form thoroughly to ensure all information is accurate and complete. Inaccurate or incomplete forms can delay the process and affect negotiations with the IRS.

- Sign and date the form. Your signature acknowledges the accuracy of the information and your agreement to provide additional documentation if required.

- Submit the completed form to the IRS office indicated in your notice or the instructions that came with the form. Keep a copy of the form and all accompanying documents for your records.

After submitting the form, the IRS will review your financial situation based on the information provided. They may request additional documentation or clarification. This review will determine your eligibility for certain payment plans or compromises and guide the next steps in resolving your tax liabilities.

Understanding IRS 433-F

If you're navigating the intricacies of resolving tax liabilities with the IRS, you may encounter Form 433-F, "Collection Information Statement." This document plays a crucial role in helping the IRS understand your financial situation to work out a payment plan or other resolution. Below are answers to frequently asked questions about the IRS 433-F form that can provide clarity and guidance.

-

What is Form 433-F?

Form 433-F, also known as the "Collection Information Statement," is used by the Internal Revenue Service (IRS) to collect financial information from individuals who owe taxes. This form helps the IRS assess an individual's ability to pay their tax debt. It includes sections on income, living expenses, assets, and liabilities, allowing taxpayers to outline their financial status comprehensively.

-

When should I complete Form 433-F?

You should complete Form 433-F if you're unable to pay your tax debt in full and are looking to set up a payment plan, or if the IRS has requested your financial information to determine your eligibility for certain tax relief options. This form is a key element in negotiating with the IRS to manage tax liabilities effectively.

-

How do I submit Form 433-F?

Form 433-F can be submitted to the IRS by mail or in some cases, over the phone, if you're working with an IRS representative who can fill out the form for you during your conversation. It's essential to ensure that all the information provided is accurate and complete, as the IRS will use it to make important decisions regarding your tax situation.

-

What information do I need to provide on Form 433-F?

- Personal information: Name, address, social security number, and employment details.

- Financial information: Detailed accounts of your monthly income and living expenses, such as rent or mortgage, food, utilities, and transportation.

- Asset information: Information on all your assets, including bank accounts, real estate, vehicles, and any other property of value.

- Liability information: A list of all debts and other liabilities, including other unpaid taxes, loans, and credit card debt.

This comprehensive collection of information helps the IRS understand your financial situation in detail.

-

Can completing Form 433-F influence the IRS’s decision on my tax resolution plan?

Yes, the information provided on Form 433-F significantly impacts the IRS's decision regarding your tax resolution plan. By thoroughly and accurately filling out this form, you give the IRS a clear picture of your financial capabilities, which helps them determine the most appropriate resolution for your tax liability, such as an installment agreement or an Offer in Compromise.

-

Are there consequences for not completing Form 433-F accurately?

Submitting inaccurate or incomplete information on Form 433-F can lead to serious consequences. The IRS may determine that you are capable of paying more than you claim, potentially leading to the denial of your proposed payment plan or other tax relief measures. In some cases, it may also trigger further investigation into your financial situation, or you may be subject to penalties for providing false information.

-

Where can I find help with completing Form 433-F?

If you need assistance with filling out Form 433-F or understanding your tax situation, there are several resources available. The IRS itself offers guidance through its website and hotline. Additionally, tax professionals, such as accountants and tax attorneys, can provide valuable advice and assistance in preparing your form accurately. Some community organizations also offer free or low-cost tax help to individuals struggling with their tax situations.

Common mistakes

Filling out the IRS Form 433-F, also known as the Collection Information Statement, involves providing detailed financial information to the Internal Revenue Service (IRS). This form is intricate and requires a careful, thorough approach. Mistakes can lead to delays, miscommunication, or unfavorable outcomes when resolving tax debt. Below are six common mistakes individuals make when completing this form:

Not thoroughly reviewing all sections before starting: It's crucial to read through the entire form first. This initial step helps individuals understand what information is required, ensuring they gather all necessary documents beforehand. Skipping this step might lead to incomplete sections or incorrect information.

Underreporting income: All sources of income must be accurately reported. This includes wages, business income, rental income, and any other income sources. Failing to report all income can be considered fraudulent and have serious consequences.

Overlooking allowable expenses: The IRS allows taxpayers to claim various living expenses, such as housing, food, transportation, and healthcare. Not claiming these allowable expenses or underestimating them can inflate your disposable income figure, potentially leading to an unrealistic repayment plan.

Forgetting to list all debts and liabilities: Complete transparency about debts and liabilities is necessary for an accurate assessment of one's financial situation. Overlooking or omitting any liabilities can misrepresent your financial capability, affecting the IRS's determination of your ability to pay.

Not signing or dating the form: An unsigned or undated form is considered incomplete by the IRS. This oversight can result in the rejection of the form or delays in processing. Always double-check that every required signature and date line is completed before submission.

Ignoring supplemental documents: The IRS often requires additional documentation to support the information provided on the form. Failure to attach required documents such as pay stubs, bank statements, or proof of expenses can halt the review process until all necessary documentation is received.

Avoiding these mistakes requires careful preparation, thorough review, and an understanding of the information requested by the IRS. When in doubt, individuals should consider seeking assistance from a tax professional who can offer guidance and help navigate the complexities of Form 433-F.

Documents used along the form

When dealing with the Internal Revenue Service (IRS), particularly regarding matters of debt resolution, the IRS Form 433-F, "Collection Information Statement," often comes into play. This form is crucial for individuals and businesses looking to set up payment plans or negotiate settlements. However, it is rarely the only document required. Several other forms and documents typically accompany Form 433-F in various situations, helping to provide a comprehensive view of one's financial situation to the IRS.

- Form 1040: The U.S. Individual Income Tax Return is essential for providing the IRS with details of an individual's annual income, tax deductions, and credits. This form is the starting point for understanding an individual's tax obligations and refund eligibility.

- Form W-2: This wage and tax statement is issued by employers to detail an employee's annual earnings and the amount of taxes withheld from their paycheck. It verifies the income information provided on the 1040 form.

- Form 1099: Various 1099 forms report income from non-employment-related sources, such as independent contracting work, interest, dividends, and retirement distributions. This diversity of income sources demands scrutiny for a comprehensive financial analysis.

- Bank Statements: Recent bank statements are often required to corroborate the information provided in Form 433-F, showing current balances, average deposits, and expenditures.

- Pay Stubs: These are needed to provide proof of current income and verify any changes from the last tax return filed. They reflect an up-to-date income situation, which is essential for determining ability to pay.

- Proof of Expenses: Documents such as utility bills, mortgage or rent statements, insurance premiums, and other receipts are necessary to verify living expenses claimed on Form 433-F. These expenses play a significant role in determining an individual's or business's ability to pay back the IRS.

- Asset Documentation: Information on assets, including property deeds, vehicle registration, and statements of investment accounts, is required to assess an individual's or business's total worth. Asset valuation is critical in debt resolution negotiations.

In summary, the IRS Form 433-F acts as a gathering point for financial information, but it doesn't operate in isolation. These additional forms and documents paint a fuller picture of one's financial health, allowing the IRS to make informed decisions regarding payment plans or settlements. Understanding what each document represents and how it contributes to the overall assessment process is crucial for anyone navigating through the complexities of resolving tax debt.

Similar forms

The IRS 433-F form, a document used for collecting financial information from individuals to set up payment plans or settlements, bears resemblance to several other forms in terms of function and purpose. One such document is the IRS Form 433-A, which also gathers financial information but is specifically tailored for individuals who are self-employed or have earnings from a sole proprietorship. The critical difference lies in the depth of details regarding the taxpayer's business income and expenses, illustrating the form's specialized nature for understanding the financial situation of self-employed individuals.

Similarly, the IRS Form 433-B plays a parallel role to the 433-F but is designed for businesses. It collects information about the business's financial health, including assets, liabilities, income, and expenditures. The main aim is to evaluate the business's ability to pay back taxes. Whereas the 433-F focuses on individual financial circumstances, the 433-B delves into the finances of entities, providing the IRS with a comprehensive view of a business's fiscal capacity to settle tax liabilities.

Another document, the IRS Form 9465, although distinct in function, shares a common purpose with the 433-F. The Form 9465 is an installment agreement request form that taxpayers use to apply for a payment plan for their due taxes. While the 433-F collects detailed financial data to determine the feasibility of such a plan, the 9465 officially requests the payment plan, making them complementary in the process of addressing outstanding tax liabilities.

The Statement of Financial Condition for Individuals, not a specific IRS form but commonly used in financial evaluations, mirrors aspects of the 433-F. It's a broader financial snapshot, detailing an individual's assets, liabilities, income, and expenses. Used by various financial institutions and credit counselors, it assesses a person's overall financial health, similar to how the 433-F evaluates one's financial situation to understand their ability to pay taxes.

On the state level, many local tax authorities use forms akin to the IRS 433-F to evaluate taxpayers' ability to pay state taxes. Though these forms vary by state, their goal is uniform: assessing an individual's or business's financial condition to create a feasible tax payment solution. These state-specific forms underscore the widespread practice of collecting financial data as a baseline for tax resolution strategies.

Lastly, the Consumer Financial Statement, used by creditors and debt collectors, reflects elements of the 433-F's purpose. This document collects detailed financial information from individuals facing debt to evaluate their payment capabilities. While the context differs—debt repayment versus tax liability—the underlying goal of understanding a person's financial capacity to meet their obligations aligns these forms closely.

Dos and Don'ts

Filling out the IRS 433-F form, known as the Collection Information Statement, is a key step in resolving your tax situations such as setting up a payment plan or negotiating an offer in compromise. Here are some important dos and don'ts to keep in mind during this critical process:

Things You Should Do:

Ensure that all the information you provide is accurate and up-to-date. The IRS uses this information to assess your financial situation and make decisions on your tax case.

Include all your sources of income. This includes wages, business income, rental income, and any other earnings, to give a comprehensive overview of your financial capacity.

List all your allowable living expenses. These are necessary for the IRS to determine your ability to pay. Accurately reporting expenses such as housing, food, transportation, and health care is crucial.

Provide complete information about your assets, including bank accounts, real estate, vehicles, and retirement accounts. This helps in creating an accurate financial profile for the IRS's consideration.

Be honest and transparent. Falsifying information or hiding assets can lead to severe penalties, including criminal charges.

Review your form multiple times before submission. Ensuring that all the information is correct and that no errors are present will aid in the smooth processing of your case.

Things You Shouldn't Do:

Don't leave any fields blank. If a section does not apply to you, write “N/A” (Not Applicable) instead of leaving it empty. This shows the IRS you did not accidentally overlook anything.

Don't underestimate or overestimate your income and expenses. It's important to give a realistic view of your finances to avoid complications or delays in your case.

Don't forget to sign and date the form. An unsigned form can delay processing since the IRS considers it incomplete.

Don't ignore the documentation requirements. Supporting documents are often necessary to verify the information on your form. Be prepared to provide them upon request.

Don't submit the form without understanding all its parts. If you're unsure about any section, seeking guidance from a tax professional can prevent errors.

Don't procrastinate on filling and submitting the form. Timeliness is key in resolving tax matters and avoiding further interest and penalties.

Misconceptions

The IRS 433-F form, often associated with the process of seeking tax debt resolution, is subject to various misconceptions. Here, we aim to clarify some of these misunderstandings to provide a clearer understanding of its purpose and how it operates within the realm of U.S. tax law.

Misconception #1: The form is only for businesses. In reality, the IRS 433-F form is used by individuals to provide the IRS with detailed information about their financial situation. This helps the IRS work with individuals to manage tax debts and determine appropriate payment plans or settlements.

Misconception #2: Filling out the form will immediately lead to wage garnishment. This is not accurate. While the form does request detailed financial information, its purpose is to help establish a feasible payment arrangement between the taxpayer and the IRS, not to automatically initiate wage garnishment.

Misconception #3: The 433-F form is a one-time submission. The IRS may require updates to your financial situation, meaning the form may need to be submitted more than once. Changes in income, assets, or expenses can necessitate a new submission to accurately reflect your current financial standing.

Misconception #4: Taxes owed can be negotiated down significantly with this form. While it is true that providing detailed financial information can help in creating a manageable payment plan, it does not guarantee that the overall tax liability will be reduced. The IRS considers various factors in determining eligible reductions.

Misconception #5: It's better to fill out the form without professional help. Seeking the assistance of a tax professional when dealing with the IRS and complex financial matters is generally a prudent step. Professionals can offer guidance and ensure that the form is completed accurately and effectively.

Misconception #6: The information provided on the form is only used to determine payment plans. The information can also be used by the IRS to assess eligibility for other tax relief options such as Offers in Compromise or Currently Non-Collectible status.

Misconception #7: Submitting the 433-F form is a voluntary action. In situations where the IRS requests the form, compliance is not optional. Failure to submit the requested form may result in enforcement actions from the IRS, such as liens or levies.

Misconception #8: Personal financial information is shared with third parties. The IRS is subject to federal privacy laws, and the information provided on the 433-F form is protected. It is used strictly for the purpose of determining appropriate tax resolutions and is not disclosed to third parties without consent or legal requirement.

Misconception #9: The 433-F form can solve all tax debt issues. While the form is a critical tool in the tax resolution process, resolving tax debt typically requires a comprehensive approach, including possible adjustments to withholdings, estimated tax payments, and adherence to any established payment plan.

Understanding these misconceptions can aid individuals in navigating the complexities of dealing with tax debt and the Internal Revenue Service more effectively. The 433-F form serves as a means for individuals to communicate their financial circumstances to the IRS, thereby playing a vital role in the resolution process.

Key takeaways

When it comes to managing your taxes, the IRS Form 433-F, known as the Collection Information Statement, plays a crucial role for individuals who need to set up payment plans or settle their tax debts. Understanding how to navigate this form can significantly impact one’s financial dealings with the Internal Revenue Service. Below are several key takeaways to help guide you through filling out and using the IRS 433-F form.

- Accuracy is Crucial: Ensure every piece of information you provide on the form is accurate and up-to-date. This includes your income, expenses, and asset information. Inaccuracies can lead to delays or issues in the processing of your form.

- Complete All Required Sections: The 433-F form is comprehensive and requires detailed financial information. Don’t leave any required fields blank. If a section doesn’t apply to you, it's better to note it as “N/A” (not applicable) rather than leaving it empty.

- Understand Your Living Expenses: The IRS allows for certain living expenses, but they often use standard amounts for these expenses based on national or local averages. Familiarize yourself with what's allowable to ensure you’re not under or overreporting your living expenses.

- Gather Supporting Documents: Before you start filling out the form, gather all necessary financial documents. This might include bank statements, pay stubs, bills, and any other documents that prove your income and expenses. Having these on hand will make the process smoother.

- Consider Future Changes: If you know your financial situation is about to change, take this into account when filling out the form. For instance, if you’re expecting a significant decrease in income, mention this on the form as it can affect your payment plan.

- Use Attachments if Necessary: If you find that the space provided on the form is not sufficient to list all your assets, expenses, or sources of income, you can attach additional sheets. Make sure these are clearly labeled and referenced in the corresponding section of the form.

- Review Before Submitting: Once you have completed the form, review it thoroughly. This step is crucial to catch any errors or omissions. Remember, the information on this form will be used to determine your payment options, so it's vital to ensure everything is correct and clear.

Completing the IRS 433-F form can be a straightforward process if approached with care and attention to detail. By keeping these key takeaways in mind, individuals can effectively present their financial situation to the IRS, helping to facilitate a fair and manageable resolution to their tax obligations.

Popular PDF Documents

Irs Tax Lien - Through Form 12277, taxpayers seek official acknowledgment from the IRS that their once problematic tax lien issue has been properly resolved.

What Is a 1098t - It details the financial transactions between a student and an educational institution, including scholarships and grants, that may affect a student's tax obligations.

Nj St-50 - New Jersey businesses can enter payment details directly on the form, ensuring accurate and timely tax payments.