Get IRS 433-D Form

When individuals find themselves navigating the complexities of resolving tax debt with the Internal Revenue Service (IRS), the 433-D form often becomes a crucial step in the process. This form serves as an agreement between the taxpayer and the IRS, setting up a structured payment plan that allows the taxpayer to clear their outstanding debt over time. The significance of this form lies not just in its role as a facilitator of payment arrangements but also in its ability to provide taxpayers with a manageable path towards financial stability, avoiding the potential consequences of unresolved tax debt like liens or levies on their property. By submitting a 433-D form, taxpayers are effectively communicating their commitment to resolving their tax issues, while also securing a structured plan that considers their current financial situation. This document, therefore intricate and impactful, requires thorough understanding and careful consideration by those who are preparing to engage with it, ensuring that the agreed-upon payment plan is both feasible and sustainable over the long term.

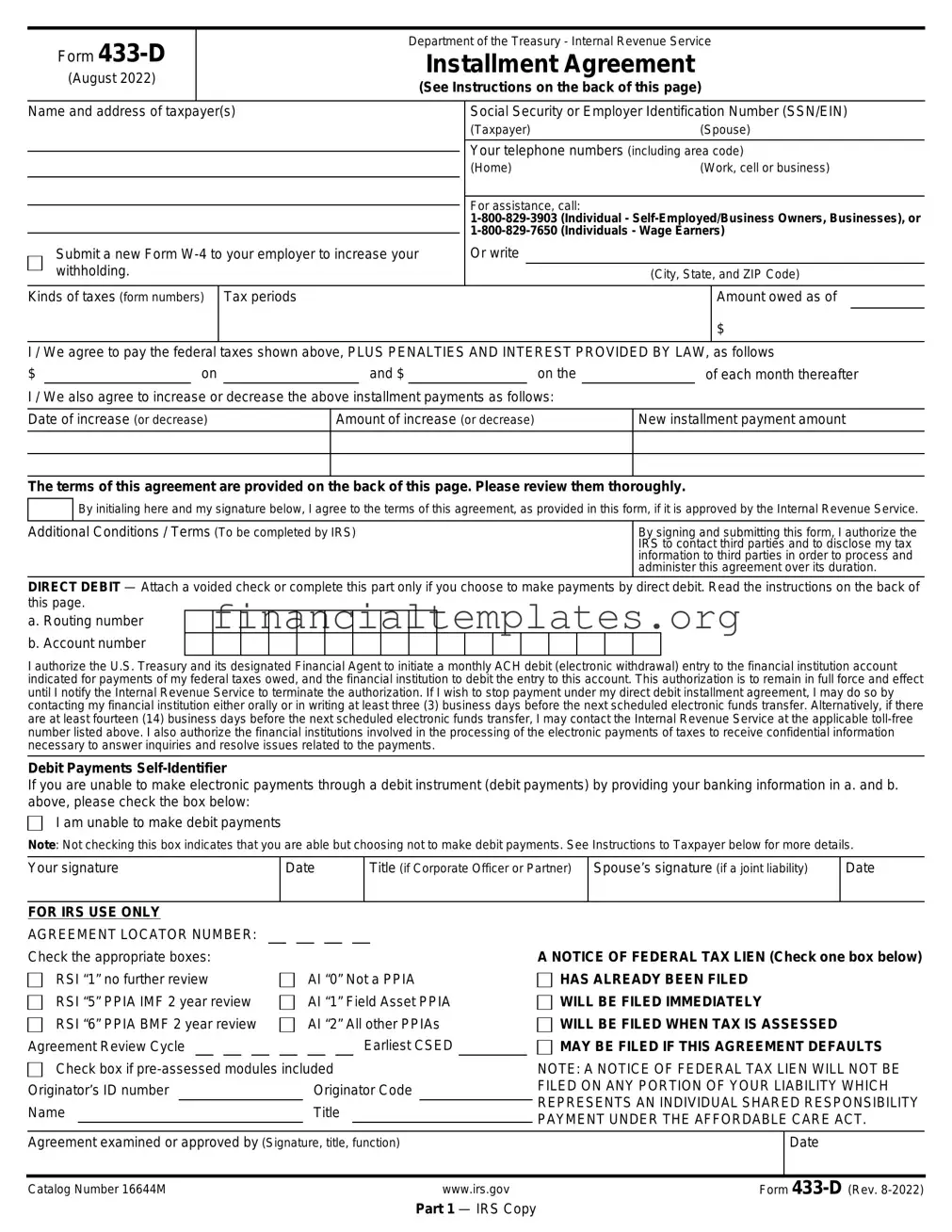

IRS 433-D Example

Form |

Department of the Treasury - Internal Revenue Service |

|

Installment Agreement |

||

(August 2022) |

||

(See Instructions on the back of this page) |

||

|

||

|

|

Name and address of taxpayer(s) |

|

Social Security or Employer Identification Number (SSN/EIN) |

||||||||||||||

|

|

|

|

|

|

|

|

|

(Taxpayer) |

|

|

(Spouse) |

||||

|

|

|

|

|

|

|

|

|

Your telephone numbers (including area code) |

|||||||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

(Home) |

|

|

(Work, cell or business) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For assistance, call: |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|||||||||

|

Submit a new Form |

|

Or write |

|

|

|

|

|

||||||||

|

withholding. |

|

|

|

|

|

|

|

|

|

|

(City, State, and ZIP Code) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kinds of taxes (form numbers) |

|

Tax periods |

|

|

|

|

|

|

|

Amount owed as of |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

I / We agree to pay the federal taxes shown above, PLUS PENALTIES AND INTEREST PROVIDED BY LAW, as follows |

||||||||||||||||

$ |

|

on |

|

|

|

and $ |

|

|

|

|

on the |

|

|

of each month thereafter |

||

I / We also agree to increase or decrease the above installment payments as follows: |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|||||||||||

Date of increase (or decrease) |

|

|

Amount of increase (or decrease) |

|

New installment payment amount |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The terms of this agreement are provided on the back of this page. Please review them thoroughly.

By initialing here and my signature below, I agree to the terms of this agreement, as provided in this form, if it is approved by the Internal Revenue Service.

Additional Conditions / Terms (To be completed by IRS)

By signing and submitting this form, I authorize the IRS to contact third parties and to disclose my tax information to third parties in order to process and administer this agreement over its duration.

DIRECT DEBIT — Attach a voided check or complete this part only if you choose to make payments by direct debit. Read the instructions on the back of this page.

a. Routing number b. Account number

I authorize the U.S. Treasury and its designated Financial Agent to initiate a monthly ACH debit (electronic withdrawal) entry to the financial institution account indicated for payments of my federal taxes owed, and the financial institution to debit the entry to this account. This authorization is to remain in full force and effect until I notify the Internal Revenue Service to terminate the authorization. If I wish to stop payment under my direct debit installment agreement, I may do so by contacting my financial institution either orally or in writing at least three (3) business days before the next scheduled electronic funds transfer. Alternatively, if there are at least fourteen (14) business days before the next scheduled electronic funds transfer, I may contact the Internal Revenue Service at the applicable

Debit Payments

If you are unable to make electronic payments through a debit instrument (debit payments) by providing your banking information in a. and b. above, please check the box below:

I am unable to make debit payments

Note: Not checking this box indicates that you are able but choosing not to make debit payments. See Instructions to Taxpayer below for more details.

Your signature

Date

Title (if Corporate Officer or Partner)

Spouse’s signature (if a joint liability)

Date

FOR IRS USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

AGREEMENT LOCATOR NUMBER: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Check the appropriate boxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A NOTICE OF FEDERAL TAX LIEN (Check one box below) |

||||||||

RSI “1” no further review |

|

|

|

|

|

|

|

AI “0” Not a PPIA |

|

HAS ALREADY BEEN FILED |

||||||||||||||||||

RSI “5” PPIA IMF 2 year review |

|

|

|

|

|

|

|

AI “1” Field Asset PPIA |

|

WILL BE FILED IMMEDIATELY |

||||||||||||||||||

RSI “6” PPIA BMF 2 year review |

|

|

|

|

|

|

|

AI “2” All other PPIAs |

|

WILL BE FILED WHEN TAX IS ASSESSED |

||||||||||||||||||

Agreement Review Cycle |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earliest CSED |

|

|

MAY BE FILED IF THIS AGREEMENT DEFAULTS |

|||||

Check box if |

|

NOTE: A NOTICE OF FEDERAL TAX LIEN WILL NOT BE |

||||||||||||||||||||||||||

Originator’s ID number |

|

|

|

|

|

|

|

Originator Code |

|

FILED ON ANY PORTION OF YOUR LIABILITY WHICH |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REPRESENTS AN INDIVIDUAL SHARED RESPONSIBILITY |

|

Name |

|

|

|

|

|

|

|

Title |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

PAYMENT UNDER THE AFFORDABLE CARE ACT. |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Agreement examined or approved by (Signature, title, function) |

|

|

Date |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Catalog Number 16644M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

www.irs.gov |

|

Form |

|||||||||

Part 1 — IRS Copy

Form |

Department of the Treasury - Internal Revenue Service |

|

Installment Agreement |

||

(August 2022) |

||

(See Instructions on the back of this page) |

||

|

||

|

|

Name and address of taxpayer(s) |

|

Social Security or Employer Identification Number (SSN/EIN) |

||||||||||||||

|

|

|

|

|

|

|

|

|

(Taxpayer) |

|

|

(Spouse) |

||||

|

|

|

|

|

|

|

|

|

Your telephone numbers (including area code) |

|||||||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

(Home) |

|

|

(Work, cell or business) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For assistance, call: |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|||||||||

|

Submit a new Form |

|

Or write |

|

|

|

|

|

||||||||

|

withholding. |

|

|

|

|

|

|

|

|

|

|

(City, State, and ZIP Code) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kinds of taxes (form numbers) |

|

Tax periods |

|

|

|

|

|

|

|

Amount owed as of |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

I / We agree to pay the federal taxes shown above, PLUS PENALTIES AND INTEREST PROVIDED BY LAW, as follows |

||||||||||||||||

$ |

|

on |

|

|

|

and $ |

|

|

|

|

on the |

|

|

of each month thereafter |

||

I / We also agree to increase or decrease the above installment payments as follows: |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|||||||||||

Date of increase (or decrease) |

|

|

Amount of increase (or decrease) |

|

New installment payment amount |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The terms of this agreement are provided on the back of this page. Please review them thoroughly.

By initialing here and my signature below, I agree to the terms of this agreement, as provided in this form, if it is approved by the Internal Revenue Service.

Additional Conditions / Terms (To be completed by IRS)

By signing and submitting this form, I authorize the IRS to contact third parties and to disclose my tax information to third parties in order to process and administer this agreement over its duration.

DIRECT DEBIT — Attach a voided check or complete this part only if you choose to make payments by direct debit. Read the instructions on the back of this page.

a. Routing number b. Account number

I authorize the U.S. Treasury and its designated Financial Agent to initiate a monthly ACH debit (electronic withdrawal) entry to the financial institution account indicated for payments of my federal taxes owed, and the financial institution to debit the entry to this account. This authorization is to remain in full force and effect until I notify the Internal Revenue Service to terminate the authorization. If I wish to stop payment under my direct debit installment agreement, I may do so by contacting my financial institution either orally or in writing at least three (3) business days before the next scheduled electronic funds transfer. Alternatively, if there are at least fourteen (14) business days before the next scheduled electronic funds transfer, I may contact the Internal Revenue Service at the applicable

Debit Payments

If you are unable to make electronic payments through a debit instrument (debit payments) by providing your banking information in a. and b. above, please check the box below:

I am unable to make debit payments

Note: Not checking this box indicates that you are able but choosing not to make debit payments. See Instructions to Taxpayer below for more details.

Your signature

Date

Title (if Corporate Officer or Partner)

Spouse’s signature (if a joint liability)

Date

FOR IRS USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

AGREEMENT LOCATOR NUMBER: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Check the appropriate boxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A NOTICE OF FEDERAL TAX LIEN (Check one box below) |

||||||||

RSI “1” no further review |

|

|

|

|

|

|

|

AI “0” Not a PPIA |

|

HAS ALREADY BEEN FILED |

||||||||||||||||||

RSI “5” PPIA IMF 2 year review |

|

|

|

|

|

|

|

AI “1” Field Asset PPIA |

|

WILL BE FILED IMMEDIATELY |

||||||||||||||||||

RSI “6” PPIA BMF 2 year review |

|

|

|

|

|

|

|

AI “2” All other PPIAs |

|

WILL BE FILED WHEN TAX IS ASSESSED |

||||||||||||||||||

Agreement Review Cycle |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earliest CSED |

|

|

MAY BE FILED IF THIS AGREEMENT DEFAULTS |

|||||

Check box if |

|

NOTE: A NOTICE OF FEDERAL TAX LIEN WILL NOT BE |

||||||||||||||||||||||||||

Originator’s ID number |

|

|

|

|

|

|

|

Originator Code |

|

FILED ON ANY PORTION OF YOUR LIABILITY WHICH |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REPRESENTS AN INDIVIDUAL SHARED RESPONSIBILITY |

|

Name |

|

|

|

|

|

|

|

Title |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

PAYMENT UNDER THE AFFORDABLE CARE ACT. |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Agreement examined or approved by (Signature, title, function) |

|

|

Date |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Catalog Number 16644M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

www.irs.gov |

|

Form |

|||||||||

Part 2 — Taxpayer’s Copy

INSTRUCTIONS TO TAXPAYER

If not already completed by an IRS employee, please fill in the information in the spaces provided on the front of this form for:

•Your name (include spouse’s name if a joint return) and current address; Your social security number and/or employer identification number (whichever applies to your tax liability); Your home and work, cell or business telephone numbers;

•The amount you can pay now as a partial payment;

•The amount you can pay each month (or the amount determined by IRS personnel); and

•The date you prefer to make this payment (This must be the same day for each month, from the 1st to the 28th). We must receive your payment by this date. If you elect the direct debit option, this is the day you want your payment electronically withdrawn from your financial institution account.

Review the terms of this agreement. When you’ve completed this agreement form, please sign and date it. Then, return Part 1 to IRS at the address on the letter that came with it or the address shown in the “For assistance” box on the front of the form.

Terms of this agreement

By completing and submitting this agreement, you (the taxpayer) agree to the following terms:

•This agreement will remain in effect until your liabilities (including penalties and interest) are paid in full, the statutory period for collection has expired, or the agreement is terminated. You will receive a notice from us prior to termination of your agreement.

•You will make each payment so that we (IRS) receive it by the monthly due date stated on the front of this form. If you cannot make a scheduled payment, contact us immediately.

•This agreement is based on your current financial condition. We may modify or terminate the agreement if our information shows that your ability to pay has significantly changed. You must provide updated financial information when requested.

•While this agreement is in effect, you must file all federal tax returns and pay any (federal) taxes you owe on time.

•We will apply your federal tax refunds or overpayments (if any) to the entire amount you owe, including the shared responsibility payment under the Affordable Care Act, until it is fully paid or the statutory period for collection has expired.

•You must pay a $225 user fee, which we have authority to deduct from your first payment(s) ($107 for Direct Debit). For

•If you default on your installment agreement, you must pay a $89 reinstatement fee if we reinstate the agreement. We have the authority to deduct this fee from your first payment(s) after the agreement is reinstated. For

•We will apply all payments on this agreement in the best interests of the United States. Generally we will apply the payment to the oldest collection statute, which is normally the oldest tax year or period.

•We can terminate your installment agreement if:

•You do not make monthly installment payments as agreed. You do not pay any other federal tax debt when due. You do not provide financial information when requested.

•If we terminate your agreement, we may collect the entire amount you owe, EXCEPT the Individual Shared Responsibility Payment under the Affordable Care Act, by levy on your income, bank accounts or other assets, or by seizing your property.

•We may terminate this agreement at any time if we find that collection of the tax is in jeopardy.

•This agreement may require managerial approval. We’ll notify you when we approve or don’t approve the agreement.

•We may file a Notice of Federal Tax Lien if one has not been filed previously, but we will not file a Notice of Federal Tax Lien with respect to the individual shared responsibility payment under the Affordable Care Act.

•You authorize the IRS to contact third parties and to disclose your tax information to third parties in order to process and administer this agreement over its duration.

HOW TO PAY BY DIRECT DEBIT

Instead of sending us a check, you can pay by direct debit (electronic withdrawal) from your checking account at a financial institution (such as a bank, mutual fund, brokerage firm, or credit union). To do so, fill in Lines a and b. Contact your financial institution to make sure that a direct debit is allowed and to get the correct routing and account numbers.

Line a. The first two digits of the routing number must be 01 through 12 or 21 through 32. Don’t use a deposit slip to verify the number because it may contain internal routing numbers that are not part of the actual routing number.

Line b. The account number can be up to 17 characters. Include hyphens but omit spaces and special symbols. Enter the number from left to right and leave any unused boxes blank.

CHECKLIST FOR MAKING INSTALLMENT PAYMENTS:

1.Write your social security or employer identification number on each payment.

2.Make your check or money order payable to “United States Treasury.”

3.Make each payment in an amount at least equal to the amount specified in this agreement.

4.Don’t double one payment and skip the next without contacting us first.

5.Enclose a copy of the reminder notice, if you received one, with each payment using the envelope provided. Make a payment even if you do not receive a reminder notice. Write the type of tax, the tax period and "Installment Agreement" on your payment. For example, "1040, 12/31/2021, Installment Agreement”. You should choose the oldest unpaid tax period on your agreement. Mail the payment to the IRS address indicated on the front of this form.

6.If you didn’t receive an envelope, call the number at the top of Part 1.

7.To make payments electronically, go to www.IRS.gov/Payments for payment options.

This agreement will not affect your liability (if any) for backup withholding under Public Law

QUESTIONS? — If you have any questions, about the direct debit process or completing this form, call the applicable telephone number on your notice or the telephone number at the top of this form for assistance.

Catalog Number 16644M |

www.irs.gov |

Form |

Part 2 — Taxpayer’s Copy

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 433-D, Installment Agreement, is used to establish a payment plan for paying off federal tax debt over time. |

| Applicability | It is applicable to individuals and businesses that owe federal taxes and cannot pay the full amount by the due date. |

| Requirements for Submission | To submit Form 433-D, taxpayers must owe $50,000 or less in combined tax, penalties, and interest, and have filed all required tax returns. |

| Processing Time | The processing time can vary, but taxpayers are generally notified within 30 days if their payment plan has been approved. |

Guide to Writing IRS 433-D

The IRS 433-D, also known as the Installment Agreement, serves as an important document for individuals seeking to establish a payment plan for their tax dues. This arrangement allows taxpayers to make smaller, more manageable payments over time, helping them to avoid further penalties and interest. A carefully completed form ensures clear communication of the terms agreed upon by both the taxpayer and the Internal Revenue Service (IRS). To fill out this form correctly, follow the steps below closely to ensure all necessary information is accurately provided.

- Start by providing your personal information: In the top section of the form, you will need to enter your full name, address, and taxpayer identification number (SSN or EIN). If the agreement includes another taxpayer, their information should be entered as well.

- Identify your tax form and period: Clearly state the type of tax (for example, income tax), and the specific period or year the tax debt is for. This helps the IRS apply your payments correctly.

- Enter the name and address of your employer: This step is critical for the IRS to have on record, especially if direct debit from your wages is part of your agreement.

- Fill out the proposed monthly payment amount: Specify the amount you are proposing to pay each month. It's essential to be realistic about your budget to ensure you can consistently make these payments.

- Specify the payment due date: Choose a specific date of each month when you will make your payment. Ensure this date is achievable based on your monthly income and expenditures.

- Choose your payment method: Decide how you will make your payments to the IRS. Options typically include direct debit from your bank account, payroll deduction, or manual payment via check or money order.

- Provide bank information for direct debit (if applicable): If you opt for direct debit as your payment method, you must include your bank's routing number and your account number.

- Sign and date the form: Both you and a co-taxpayer (if applicable) must sign and date the form. By signing, you agree to the terms of the payment plan, including keeping future tax obligations current.

- Submit the form to the IRS: Depending on your location, the IRS directs you to send your completed 433-D form to the appropriate office. Check the IRS website or the instructions provided with the form to find out where to send your installment agreement request.

Once submitted, the IRS will review your installment agreement request. If they need more information, they may contact you. Upon approval, you will receive a confirmation letter outlining your payment plan's terms and conditions. It's important to adhere strictly to these terms to avoid defaulting on your agreement. Regular, timely payments will contribute to settling your tax debt without accruing additional penalties or interest.

Understanding IRS 433-D

-

What is the IRS Form 433-D?

The IRS Form 433-D, Installment Agreement, is a document that allows individuals or businesses to set up a payment plan with the IRS for their tax debts. This arrangement enables taxpayers to pay their debts over time when they are unable to pay the full amount immediately. The form outlines the terms of the agreement, including the monthly payment amount, due date, and duration of the payment plan.

-

Who is eligible to use Form 433-D?

Individuals and businesses that owe taxes to the IRS and are unable to pay the full amount by the due date may be eligible to use Form 433-D. Eligibility is generally determined by the amount owed and the taxpayer's financial situation. The IRS will assess the taxpayer's ability to pay, considering their income and necessary living expenses.

-

How do I submit Form 433-D to the IRS?

Form 433-D can be submitted to the IRS by mail or, in some cases, through a phone call with an IRS representative, who will fill out the form on your behalf based on the information you provide. The specific address to mail the form can vary depending on your location and the type of tax debt you owe, so it is crucial to check the IRS website or contact the IRS directly for the correct mailing address.

-

Can I negotiate the payment amount on Form 433-D?

Yes, taxpayers can negotiate the payment amount when setting up an installment agreement using Form 433-D. The IRS will consider your financial situation, including your income, expenses, and asset equity, to determine a reasonable monthly payment amount. However, it is essential to propose a payment amount that you can consistently meet to avoid defaulting on the agreement.

-

What happens if I miss a payment under an installment agreement established by Form 433-D?

If you miss a payment under an installment agreement, the IRS may default your agreement, leading to potential collection actions such as levies, liens, or the seizure of assets. It is critical to contact the IRS as soon as possible if you foresee missing a payment to discuss your options, which may include adjusting your payment amount or temporarily delaying payments.

-

Is there a fee to set up an installment agreement using Form 433-D?

Yes, there is a fee to set up an installment agreement with the IRS using Form 433-D. The fee amount varies depending on the method used to set up the agreement and whether you qualify for a low-income fee reduction. The IRS provides updated fee amounts and criteria for fee reductions on its website.

-

Can I make changes to an existing installment agreement established with Form 433-D?

Yes, changes can be made to an existing installment agreement established with Form 433-D. If your financial situation changes and you need to adjust your payment amount or the payment due date, you should contact the IRS as soon as possible to request a modification of your agreement. The IRS will consider your updated financial situation and may require additional documentation.

-

How long does it take the IRS to process Form 433-D?

The processing time for Form 433-D can vary depending on the IRS's current workload and the complexity of your financial situation. Generally, it may take several weeks for the IRS to review your application and notify you of their decision. During peak times, such as tax season, processing times may be longer.

-

Are there alternatives to Form 433-D for resolving tax debts?

Yes, there are alternatives to using Form 433-D for resolving tax debts. These alternatives include negotiating an offer in compromise, which allows you to settle your tax debt for less than the full amount owed, or requesting a temporary delay of the collection process due to financial hardship. The best option depends on your specific financial situation, and it may be beneficial to consult a tax professional for advice.

Common mistakes

-

Not verifying personal information: It’s essential to double-check all personal information, including social security numbers and addresses. Incorrect information can lead to processing delays or miscommunication.

-

Omitting financial details: Failing to provide complete financial details or underestimating income and assets can result in an unrealistic payment plan that might be difficult to adhere to.

-

Overlooking the calculation of monthly expenses: Accurately reporting monthly expenses is crucial. Over or underestimating these can impact the feasibility of the proposed payment plan.

-

Ignoring tax liabilities: All outstanding tax liabilities must be included. Forgetting to list some can invalidate the agreement or require a new agreement to be drafted.

-

Selecting an inappropriate payment amount: Proposing a payment amount that is too high or too low without considering actual financial capacity can lead to future financial strain or rejection of the plan.

-

Forgetting to sign and date the form: An unsigned or undated form is not valid. Ensure that all required signatures are on the document before submission.

-

Misunderstanding the terms: Not fully understanding the terms and conditions of the installment agreement can lead to breaches of the agreement. It’s important to fully understand all obligations.

-

Sending the form to the wrong address: The IRS has specific addresses for submission based on the taxpayer’s location. Sending the form to the incorrect address can delay the process.

Avoiding these mistakes not only helps in the smooth processing of the IRS 433-D form but also in establishing a feasible payment plan that aligns with one’s financial situation. It’s advisable to review the form thoroughly or seek professional guidance to ensure all information is accurate and complete.

Documents used along the form

Submitting the IRS Form 433-D, which is an agreement for installment payments, often requires individuals and businesses to provide additional documentation. These documents are necessary for the Internal Revenue Service (IRS) to assess the taxpayer's financial situation accurately and determine a feasible payment plan. The following forms and documents commonly accompany Form 433-D to ensure a thorough evaluation and a smooth processing of the payment agreement request.

- Form 1040: The U.S. Individual Income Tax Return is crucial for individuals. It provides the IRS with detailed information about an individual's annual income, tax deductions, and tax credits. This form helps determine the taxpayer's financial status and ability to make installment payments.

- Form 941: Employers use this Employer's Quarterly Federal Tax Return to report federal income tax withheld from their employees, along with the employer and employee's share of Social Security and Medicare taxes. For businesses arranging a payment plan, this form aids in understanding the business's payroll tax obligations.

- Form 433-F: The Collection Information Statement is used by individuals and businesses to provide detailed information about their financial situation. This includes income, bank accounts, assets, living expenses, and debts. The comprehensive data collected by Form 433-F assists the IRS in determining an appropriate monthly installment amount.

- Proof of Income: This can include recent pay stubs, business income statements, or other documentation that evidences current income levels. Proof of income helps the IRS assess the taxpayer's ability to pay and ensures that the proposed payment plan is viable given the taxpayer's financial situation.

Together, these documents play a vital role in the installment agreement process by offering a complete picture of the taxpayer's fiscal health. They assist the IRS in making informed decisions that align with the taxpayer's ability to fulfill their tax obligations efficiently. It is essential for individuals and businesses to prepare these documents accurately and submit them promptly to avoid delays in the approval of their payment plan requests.

Similar forms

The IRS Form 433-D, the Installment Agreement, shares similarities with IRS Form 9465, the Installment Agreement Request. Both forms are utilized by taxpayers to set up payment plans for paying off their owed taxes over time. The key difference lies in their complexity and the detailed information required. Form 433-D is generally used after direct interaction with the IRS and is more detailed, often requiring financial statements, whereas Form 9465 can be used by individuals to request an installment plan without prior in-depth negotiations with the IRS.

IRS Form 433-A, the Collection Information Statement for Wage Earners and Self-Employed Individuals, is another document closely related to Form 433-D. This form collects detailed financial information from individuals, which the IRS uses to determine the taxpayer's ability to pay outstanding taxes. While Form 433-D establishes the agreement for an installment plan, Form 433-A provides the financial background that often precedes the establishment of such a plan, making it a necessary step for those who cannot immediately pay in full.

Similarly, IRS Form 433-B, the Collection Information Statement for Businesses, operates alongside Form 433-D for business entities. It gathers exhaustive information about the business’s financial situation to evaluate its capability to settle tax debts. Form 433-D would then be used to finalize the payment agreement based on the financial analysis provided by Form 433-B. This form is essential for businesses seeking to enter into installment agreements with the IRS.

IRS Form 433-F, the Collection Information Statement, is a streamlined version of the 433 series, used to gather financial information from taxpayers quickly. It’s less detailed than Forms 433-A and 433-B but still plays a crucial role in setting up installment agreements, including those finalized with Form 433-D. Form 433-F is often used in simpler cases where a full collection information statement is not necessary.

The IRS Form 656, the Offer in Compromise, is another document related to Form 433-D, although it serves a different purpose. Form 656 allows taxpayers to settle their tax debt for less than the full amount owed if they can prove paying the full debt would cause financial hardship. While Form 433-D facilitates payment over time, Form 656 might be an option when installment payments are not viable, showcasing an alternative tax resolution strategy.

IRS Form 1127, Application for Extension of Time for Payment of Tax Due to Undue Hardship, is somewhat akin to Form 433-D as it provides taxpayers with a temporary relief from paying taxes. However, instead of setting up a payment plan, Form 1127 requests a deferral on tax payments, demonstrating hardship. Both forms aim to assist individuals struggling to meet their tax obligations, albeit through different means.

IRS Form 2159, Payroll Deduction Agreement, is closely related to Form 433-D in that it is another method to facilitate tax debt payments. Form 2159 allows for tax debt repayments through direct payroll deductions. This method can simplify the repayment process for the taxpayer by automating payments, similarly aiming to ease the burden of tax debt repayment.

Lastly, IRS Form 8821, Tax Information Authorization, while not directly involved in payment agreements, is related to Form 433-D in the broader context of managing one's tax affairs. This form allows a taxpayer to authorize any individual or organization to inspect and receive confidential tax information on their behalf. It can be particularly useful in situations where a taxpayer is working with a tax professional to set up an installment agreement or is otherwise managing complex tax issues.

Dos and Don'ts

Filling out the IRS 433-D form, which is the installment agreement request, can seem daunting at first. However, with a few simple dos and don'ts, anyone can navigate it smoothly. Taking the right steps ensures that your application is not only complete but also accurate, potentially speeding up the approval process. Here’s a helpful list to guide you through:

Do:- Review all instructions carefully before beginning. Understanding each section thoroughly can help prevent common mistakes.

- Ensure all personal information is correct, including your name, address, Social Security number (SSN), or employer identification number (EIN). Accuracy here is key to avoid any processing delays.

- Clearly state your proposed monthly payment amount and the date you will make your payment each month. This shows that you are committed to resolving your tax debt.

- Attach a copy of your tax bill if available. This can help in matching your request to the correct tax account.

- Sign and date the form. An unsigned form is like sending a letter without an envelope – it won’t reach its destination in the realm of processing.

- Ignore the importance of thoroughness. Skipping sections or providing incomplete information can lead to your agreement being delayed or denied.

- Guess on numbers or make up figures. Use actual numbers from your tax documents and financial statements to ensure accuracy and prevent issues down the line.

Filling out the IRS 433-D form doesn't have to be a burden. With these simple tips, you can complete the process with confidence and ease. Always remember that providing complete and accurate information is the cornerstone of a successful installment agreement application. If you're ever in doubt, seeking guidance from a tax professional can be a wise move.

Misconceptions

The IRS 433-D form, known as the Installment Agreement Request, often comes wrapped in misconceptions. Let's debunk some common ones to better understand what this form is all about and its implications for taxpayers.

All taxpayers qualify for an installment agreement using Form 433-D. This is not accurate. The IRS assesses each taxpayer’s financial situation individually. Factors such as owed amount, current financial state, and past tax compliance play a crucial role in determining eligibility.

Filling out Form 433-D guarantees immediate IRS approval. While this form is the first step towards an installment agreement, approval is not immediate. The IRS reviews the submitted form, which may involve a detailed analysis of the taxpayer's financial information before making a decision.

Once you fill out Form 433-D, you don't need to pay taxes until the agreement is approved. This is false. Taxpayers are expected to continue making payments towards their tax liabilities to avoid further penalties and interest, even if their installment agreement request is still under review.

There are no consequences for defaulting on payments under Form 433-D. On the contrary, defaulting can lead to serious consequences, including the termination of the agreement, accrual of additional interest and penalties, and potential collection actions.

The IRS can't modify or terminate an installment agreement once it's been established through Form 433-D. The IRS maintains the right to modify or terminate an installment agreement if the taxpayer’s financial situation changes, fails to make timely payments, or doesn't comply with tax laws in subsequent years.

Submitting Form 433-D stops all IRS collection activities. While submitting this form can halt certain collection actions temporarily, such as levies, it does not apply to all enforcement measures. Notably, a federal tax lien may still be filed to protect the government's interest.

There's no need to update financial information once an installment agreement is in place. Incorrect. The IRS may require periodic updates on financial status to ensure that the installment agreement still reflects the taxpayer’s ability to pay. Taxpayers should report significant changes in their financial situation to the IRS.

Understanding these misconceptions about the IRS 433-D form is crucial for taxpayers seeking to manage their tax obligations effectively. With accurate information, taxpayers can navigate the process of requesting an installment agreement with more confidence and clarity.

Key takeaways

The IRS 433-D form is an essential document for individuals needing to set up a payment plan with the IRS. Understanding this form and its use correctly can significantly impact your financial relationship with the tax authorities. Here are ten key takeaways to keep in mind:

Personal Information is Crucial: Fill out all personal information fields accurately, including your full name, address, Social Security number (SSN), and phone number, to ensure the IRS can contact you regarding your payment plan.

Specify Tax Details: Clearly indicate the type of tax and the specific periods for which you are requesting a payment plan. Omitting details can delay the process.

Understand the Payment Plan Options: Before filling out the form, understand the different payment plan options available and choose one that best suits your financial situation.

Payment Amount and Schedule: Propose a realistic monthly payment amount and schedule. Ensure it's an amount you can consistently manage throughout the duration of the plan.

Direct Debit is Preferred: Setting up a Direct Debit for payments is recommended. It reduces the risk of missed payments and may qualify you for certain benefits, like reduced fees.

Sign and Date: Your signature and the date are crucial for the form's validity. If filing jointly, both parties must sign the form.

Include a Financial Statement if Required: Depending on your owed amount, you may need to attach a detailed financial statement to prove your inability to make larger payments.

Understanding Fees and Interest: Be aware that setting up a payment plan may involve setup fees and accrued interest until the full amount is paid off.

Seek Professional Advice: If unsure about any parts of the form or your financial situation, consult with a tax professional to ensure you're making informed decisions.

Submitting the Form: Know where and how to submit the form—whether by mail or electronically—and ensure it’s sent to the correct IRS office to avoid processing delays.

Filling out and submitting IRS 433-D requires careful attention to detail and honesty about your financial situation. Taking these steps responsibly can lead to a manageable resolution to your tax obligations.

Popular PDF Documents

Reseller Permit Renewal - A specific section on the JT-1 form addresses withholding and unemployment tax for businesses with employees in Arizona.

Schedule 8812 - Ensures transparent and straightforward calculation for taxpayers regardless of their income level.