Get IRS 433-B Form

When businesses find themselves navigating the complexities of federal tax obligations, the IRS 433-B form emerges as a critical tool in the process. This form is used by businesses that are working out a payment plan or an offer in compromise with the IRS to settle tax debts. It provides the IRS with detailed information about the business’s financial situation, including assets, liabilities, income, and expenses. The purpose of this form is not just to inform the IRS about a business's current financial state but to also lay the groundwork for negotiations that could lead to more manageable tax payment terms. Understanding and accurately completing this form is paramount for businesses aiming to alleviate their tax burdens while maintaining compliance with federal tax laws. The IRS 433-B form, thus, serves as a beacon for businesses in distress, guiding them through the often turbulent waters of tax resolution.

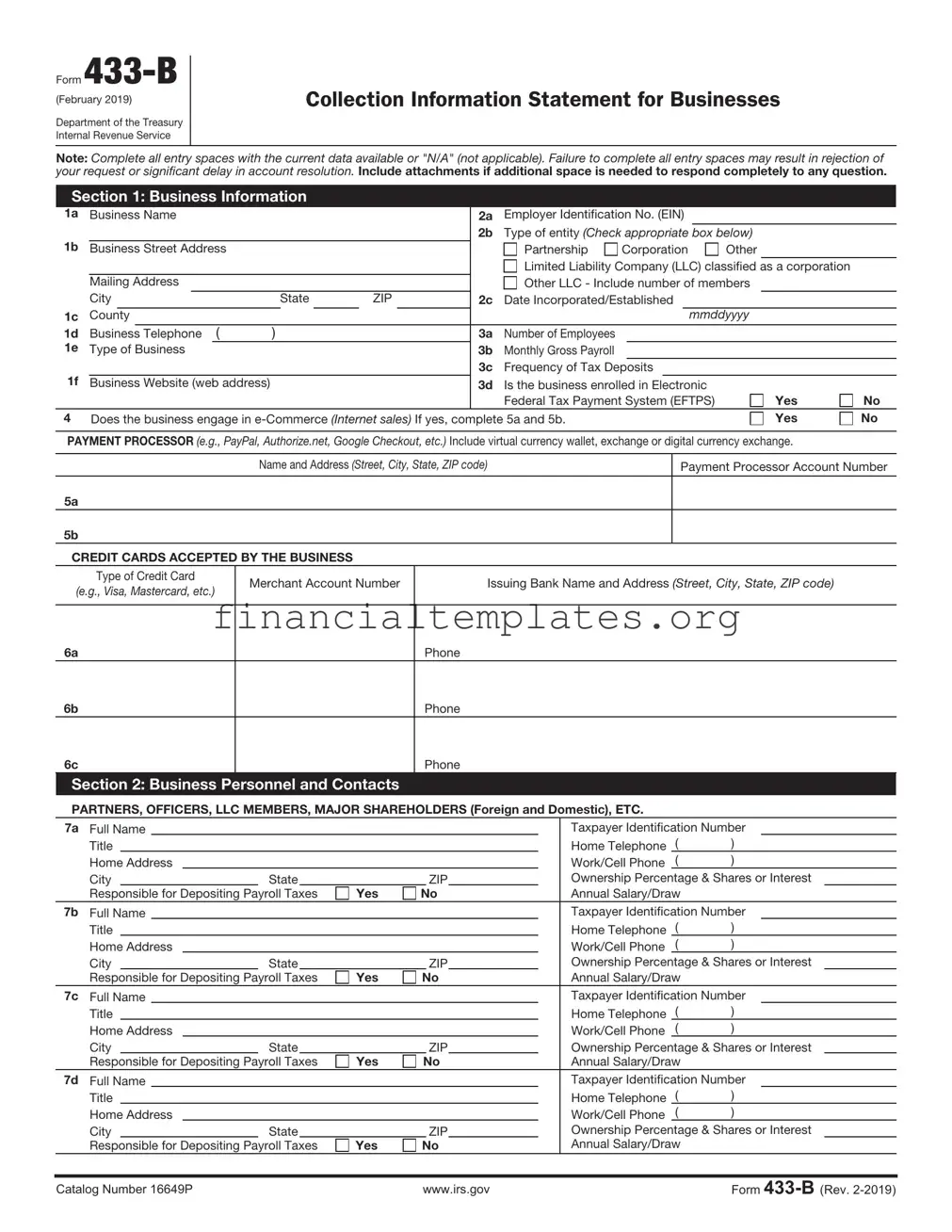

IRS 433-B Example

Form

(February 2019)

Department of the Treasury Internal Revenue Service

Collection Information Statement for Businesses

Note: Complete all entry spaces with the current data available or "N/A" (not applicable). Failure to complete all entry spaces may result in rejection of your request or significant delay in account resolution. Include attachments if additional space is needed to respond completely to any question.

Section 1: Business Information

1a |

Business Name |

|

|

|

|

|

2a |

Employer Identification No. (EIN) |

|

|

|

|

||||||||

1b |

|

|

|

|

|

|

|

|

|

|

2b |

Type of entity (Check appropriate box below) |

|

|||||||

Business Street Address |

|

|

|

|

|

|

Partnership |

Corporation |

Other |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Limited Liability Company (LLC) classified as a corporation |

|

|||||||

|

Mailing Address |

|

|

|

|

|

|

Other LLC - Include number of members |

|

|||||||||||

|

City |

|

|

State |

|

ZIP |

2c |

Date Incorporated/Established |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1c |

County |

|

|

|

|

|

|

|

|

|

|

mmddyyyy |

|

|||||||

1d |

Business |

Telephone ( |

) |

|

|

|

|

3a |

Number of Employees |

|

|

|

|

|

|

|

|

|||

1e |

Type of Business |

|

|

|

|

|

|

3b |

Monthly Gross Payroll |

|

|

|

|

|

|

|

|

|||

1f |

|

|

|

|

|

|

|

|

|

|

3c |

Frequency of Tax Deposits |

|

|

|

|

||||

Business Website (web address) |

|

|

|

|

|

3d |

Is the business enrolled in Electronic |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Federal Tax Payment System (EFTPS) |

|

Yes |

No |

|||||

4 |

Does the business engage in |

|

|

|

|

|

|

Yes |

No |

|||||||||||

PAYMENT PROCESSOR (e.g., PayPal, Authorize.net, Google Checkout, etc.) Include virtual currency wallet, exchange or digital currency exchange.

Name and Address (Street, City, State, ZIP code) |

Payment Processor Account Number |

5a

5b

CREDIT CARDS ACCEPTED BY THE BUSINESS

Type of Credit Card

(e.g., Visa, Mastercard, etc.)

Merchant Account Number

Issuing Bank Name and Address (Street, City, State, ZIP code)

6a

Phone

6b

Phone

6c

Phone

Section 2: Business Personnel and Contacts

PARTNERS, OFFICERS, LLC MEMBERS, MAJOR SHAREHOLDERS (Foreign and Domestic), ETC.

7a |

Full Name |

|

|

|

|

|

|

|

|

Taxpayer Identification Number |

|

|||||

|

Title |

|

|

|

|

|

|

|

|

Home Telephone |

( |

) |

|

|

||

|

Home Address |

|

|

|

|

|

|

|

|

Work/Cell Phone |

( |

) |

|

|

||

|

City |

|

State |

|

|

|

ZIP |

|

|

Ownership Percentage & Shares or Interest |

|

|||||

|

Responsible for Depositing Payroll Taxes |

Yes |

No |

|

Annual Salary/Draw |

|

|

|

||||||||

7b |

Full Name |

|

|

|

|

|

|

|

|

Taxpayer Identification Number |

|

|||||

|

Title |

|

|

|

|

|

|

|

|

Home Telephone |

( |

) |

|

|

||

|

Home Address |

|

|

|

|

|

|

|

|

Work/Cell Phone |

( |

) |

|

|

||

|

City |

|

State |

|

|

|

ZIP |

|

|

Ownership Percentage & Shares or Interest |

|

|||||

|

Responsible for Depositing Payroll Taxes |

Yes |

No |

|

Annual Salary/Draw |

|

|

|

||||||||

7c |

Full Name |

|

|

|

|

|

|

|

|

Taxpayer Identification Number |

|

|||||

|

Title |

|

|

|

|

|

|

|

|

Home Telephone |

( |

) |

|

|

||

|

Home Address |

|

|

|

|

|

|

|

|

Work/Cell Phone |

( |

) |

|

|

||

|

City |

|

State |

|

|

|

ZIP |

|

|

Ownership Percentage & Shares or Interest |

|

|||||

|

Responsible for Depositing Payroll Taxes |

Yes |

No |

|

Annual Salary/Draw |

|

|

|

||||||||

7d |

Full Name |

|

|

|

|

|

|

|

|

Taxpayer Identification Number |

|

|||||

|

Title |

|

|

|

|

|

|

|

|

Home Telephone |

( |

) |

|

|

||

|

Home Address |

|

|

|

|

|

|

|

|

Work/Cell Phone |

( |

) |

|

|

||

|

City |

|

State |

|

|

|

ZIP |

|

|

Ownership Percentage & Shares or Interest |

|

|||||

|

Responsible for Depositing Payroll Taxes |

Yes |

No |

|

Annual Salary/Draw |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Catalog Number 16649P |

|

|

|

www.irs.gov |

|

|

|

Form |

||||||||

Form |

Page 2 |

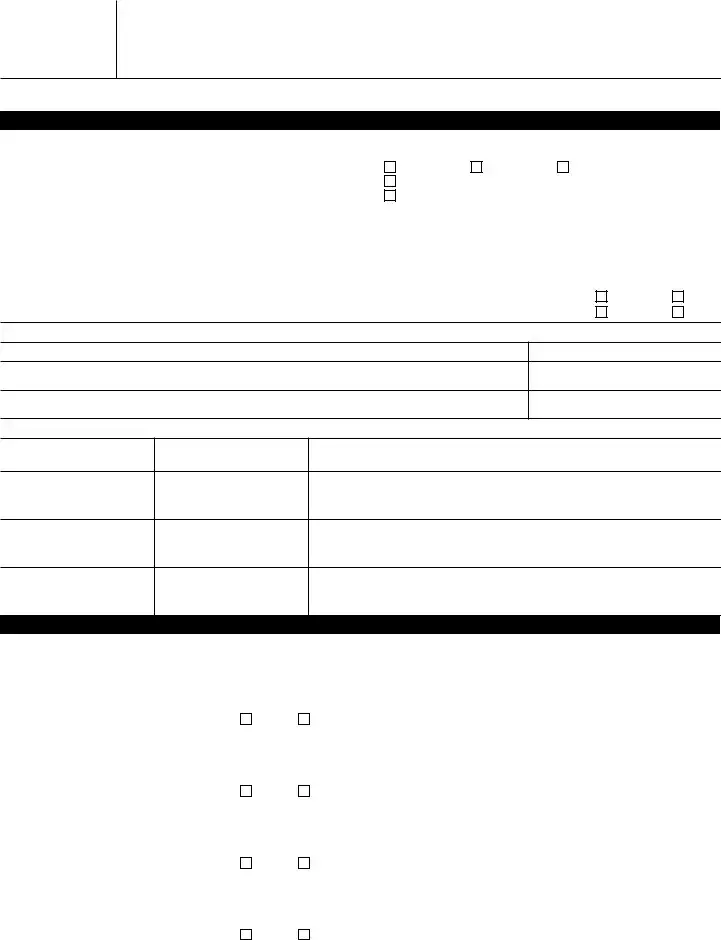

Section 3: Other Financial Information (Attach copies of all applicable documents)

8 |

Does the business use a Payroll Service Provider or Reporting Agent (If yes, answer the following) |

Yes |

No |

||||||

|

|

|

|

|

|

|

|

||

|

Name and Address (Street, City, State, ZIP code) |

|

|

|

Effective dates (mmddyyyy) |

||||

|

|

|

|

|

|

|

|

|

|

9 |

Is the business a party to a lawsuit (If yes, answer the following) |

|

|

Yes |

No |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location of Filing |

|

Represented by |

|

Docket/Case No. |

|

|

Plaintiff |

Defendant |

|

|

|

|

|

|

|

|

Amount of Suit |

|

|

Possible Completion Date (mmddyyyy) |

Subject of Suit |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

10 Has the business ever filed bankruptcy (If yes, answer the following) |

|

|

Yes |

No |

|||||

|

|

|

|

|

|

|

|||

|

Date Filed (mmddyyyy) |

Date Dismissed (mmddyyyy) |

Date Discharged (mmddyyyy) |

Petition No. |

District of Filing |

|

|||

|

|

|

|

|

|

|

|

|

|

11 Do any related parties (e.g., officers, partners, employees) have outstanding amounts owed to the business (If yes, answer the following)

Yes

No

Name and Address (Street, City, State, ZIP code) |

Date of Loan |

Current Balance As of |

|

Payment Date |

Payment Amount |

|

|

|

|

mmddyyyy |

|

|

|

|

|

$ |

|

|

$ |

|

12 Have any assets been transferred, in the last 10 years, from this business for less than full value (If yes, answer the following) |

Yes |

No |

||||

List Asset |

Value at Time of Transfer |

|

$ |

Date Transferred (mmddyyyy)

To Whom or Where Transferred

13 Does this business have other business affiliations (e.g., subsidiary or parent companies) (If yes, answer the following)

Yes

No

Related Business Name and Address (Street, City, State, ZIP code)

Related Business EIN:

14 Any increase/decrease in income anticipated (If yes, answer the following) |

|

Yes |

No |

|

|

|

|

Explain (Use attachment if needed) |

How much will it increase/decrease |

When will it increase/decrease |

|

|

$ |

|

|

15 Is the business a Federal Government Contractor (Include Federal Government contracts in #18, Accounts/Notes Receivable)

Yes

No

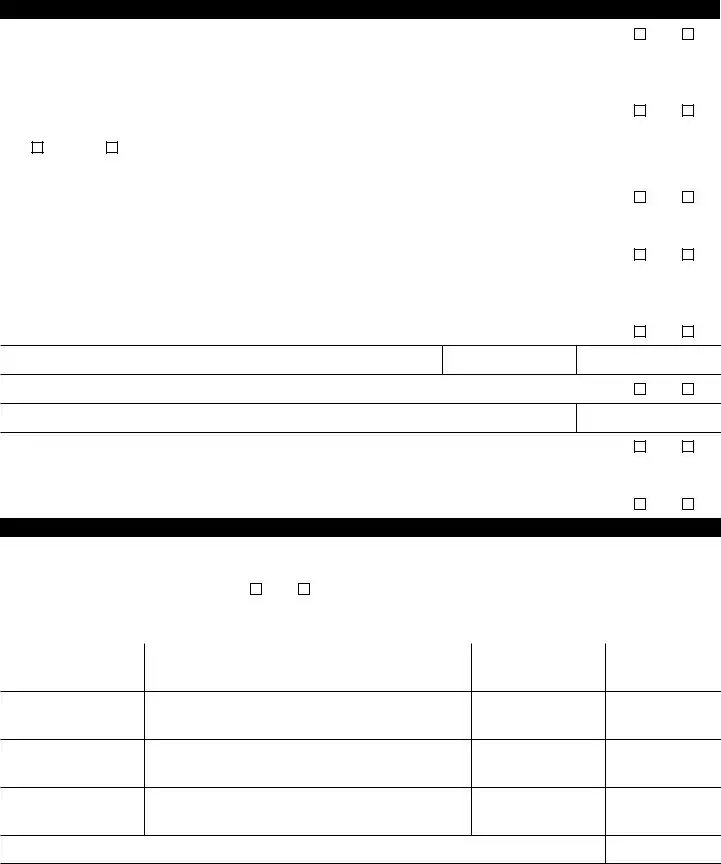

Section 4: Business Asset and Liability Information (Foreign and Domestic)

16a |

CASH ON HAND Include cash that is not in the bank |

|

|

Total Cash on Hand |

$ |

|

|

||

|

|

|

|

|

Contents |

|

|

|

|

16b |

Is there a safe on the business premises |

Yes |

No |

|

|

|

|

|

|

|

BUSINESS BANK ACOUNTS Include online and mobile accounts (e.g., PayPal), money market accounts, savings accounts, checking accounts |

||||||||

|

and stored value cards (e.g., payroll cards, government benefit cards, etc.) |

|

|

|

|

||||

|

List safe deposit boxes including location, box number and value of contents. Attach list of contents. |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Type of |

Full Name and Address (Street, City, State, ZIP code) of |

|

Account Balance |

|||||

|

Account Number |

As of |

|

|

|||||

|

Account |

Bank, Savings & Loan, Credit Union or Financial Institution |

|||||||

|

|

|

mmddyyyy |

||||||

|

|

|

|

|

|

|

|

||

17a

$

17b

$

17c

$

17d Total Cash in Banks (Add lines 17a through 17c and amounts from any attachments)

$

Catalog Number 16649P |

www.irs.gov |

Form |

Form |

Page 3 |

ACCOUNTS/NOTES RECEIVABLE Include

Name & Address (Street, City, State, ZIP code) |

Status (e.g., age, |

Date Due |

Invoice Number or Government |

Amount Due |

|

factored, other) |

(mmddyyy) |

Grant or Contract Number |

|||

|

|

||||

|

|

|

|

|

|

18a |

|

|

|

|

|

Contact Name |

|

|

|

|

|

Phone |

|

|

|

$ |

|

18b |

|

|

|

|

|

Contact Name |

|

|

|

|

|

Phone |

|

|

|

$ |

|

18c |

|

|

|

|

|

Contact Name |

|

|

|

|

|

Phone |

|

|

|

$ |

|

18d |

|

|

|

|

|

Contact Name |

|

|

|

|

|

Phone |

|

|

|

$ |

|

18e |

|

|

|

|

|

Contact Name |

|

|

|

|

|

Phone |

|

|

|

$ |

18f Outstanding Balance (Add lines 18a through 18e and amounts from any attachments)

$

INVESTMENTS List all investment assets below. Include stocks, bonds, mutual funds, stock options, certificates of deposit, commodities (e.g., gold, silver, copper, etc.) and virtual currency (e.g., Bitcoin, Ripple and Litecoin).

|

Name of Company & Address |

|

Used as collateral |

Current Value |

Loan Balance |

Equity |

||||||

|

(Street, City, State, ZIP code) |

|

on loan |

|

Value Minus Loan |

|||||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

19a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

$ |

$ |

|

|

$ |

|

|

|

19b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

$ |

$ |

|

|

$ |

|

|

|

19c |

Total Investments (Add lines 19a, 19b, and amounts from any attachments) |

|

|

|

$ |

|

|

|||||

|

AVAILABLE CREDIT Include all lines of credit and credit cards. |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Amount Owed |

Available Credit |

||||

|

Full Name & Address (Street, City, State, ZIP code) |

|

|

|

Credit Limit |

As of |

|

|

As of |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

mmddyyyy |

|

mmddyyyy |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

20a |

|

|

|

|

|

|

|

|

|

|

|

|

|

Account No. |

|

|

|

$ |

$ |

|

|

$ |

|

|

|

20b |

|

|

|

|

|

|

|

|

|

|

|

|

|

Account No. |

|

|

|

$ |

$ |

|

|

$ |

|

|

|

20c |

Total Credit Available (Add lines 20a, 20b, and amounts from any attachments) |

|

|

|

$ |

|

|

|||||

Catalog Number 16649P |

www.irs.gov |

Form |

Form |

|

|

|

|

|

|

|

|

|

|

Page 4 |

|||

REAL PROPERTY Include all real property and land contracts the business owns/leases/rents. |

|

|

|

|

||||||||||

|

|

|

|

|

Purchase/ |

|

Current Fair |

|

Current Loan |

Amount of |

Date of Final |

Equity |

||

|

|

|

|

|

Lease Date |

|

Market Value |

|

Monthly |

Payment |

||||

|

|

|

|

|

|

|

Balance |

FMV Minus Loan |

||||||

|

|

|

|

|

(mmddyyyy) |

|

(FMV) |

|

Payment |

(mmddyyyy) |

||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21a |

Property Description |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

$ |

|

|

$ |

|

$ |

|

|

$ |

|

|

Location (Street, City, State, ZIP code) and County |

|

Lender/Lessor/Landlord Name, Address, (Street, City, State, ZIP code) and Phone |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21b |

Property Description |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

$ |

|

|

|

Location (Street, City, State, ZIP code) and County |

|

Lender/Lessor/Landlord Name, Address, (Street, City, State, ZIP code) and Phone |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21c |

Property Description |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

$ |

|

|

|

Location (Street, City, State, ZIP code) and County |

|

Lender/Lessor/Landlord Name, Address, (Street, City, State, ZIP code) and Phone |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21d |

Property Description |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

$ |

|

|

|

Location (Street, City, State, ZIP code) and County |

|

Lender/Lessor/Landlord Name, Address, (Street, City, State, ZIP code) and Phone |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

21e Total Equity (Add lines 21a through 21d and amounts from any attachments) |

|

|

|

$ |

|

|||||||||

VEHICLES, LEASED AND PURCHASED Include boats, RVs, motorcycles, |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

Purchase/ |

|

Current Fair |

|

Current Loan |

Amount of |

Date of Final |

Equity |

||

|

|

|

|

|

Lease Date |

|

Market Value |

|

Monthly |

Payment |

||||

|

|

|

|

|

|

|

Balance |

FMV Minus Loan |

||||||

|

|

|

|

|

(mmddyyyy) |

|

(FMV) |

|

Payment |

(mmddyyyy) |

||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22a |

Year |

|

Make/Model |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

$ |

|

|

|

Mileage |

|

License/Tag Number |

Lender/Lessor Name, Address, (Street, City, State, ZIP code) and Phone |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle Identification Number (VIN) |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

22b |

Year |

|

Make/Model |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

$ |

|

|

|

Mileage |

|

License/Tag Number |

Lender/Lessor Name, Address, (Street, City, State, ZIP code) and Phone |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle Identification Number (VIN) |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

22c |

Year |

|

Make/Model |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

$ |

|

|

|

Mileage |

|

License/Tag Number |

Lender/Lessor Name, Address, (Street, City, State, ZIP code) and Phone |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle Identification Number (VIN) |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

22d |

Year |

|

Make/Model |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

$ |

|

|

|

Mileage |

|

License/Tag Number |

Lender/Lessor Name, Address, (Street, City, State, ZIP code) and Phone |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle Identification Number (VIN) |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

22e Total Equity (Add lines 22a through 22d and amounts from any attachments)

$

Catalog Number 16649P |

www.irs.gov |

Form |

Form |

Page 5 |

BUSINESS EQUIPMENT AND INTANGIBLE ASSETS Include all machinery, equipment, merchandise inventory, and other assets in 23a through 23d. List intangible assets in 23e through 23g (licenses, patents, logos, domain names, trademarks, copyrights, software, mining claims, goodwill and trade secrets.)

|

Purchase/ |

|

Current Fair |

|

Current Loan |

|

Amount of |

Date of Final |

Equity |

|

Lease Date |

Market Value |

|

|

Monthly |

Payment |

|||

|

|

Balance |

|

FMV Minus Loan |

|||||

|

(mmddyyyy) |

|

(FMV) |

|

|

Payment |

(mmddyyyy) |

||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

23a Asset Description |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

$ |

Location of asset (Street, City, State, ZIP |

code) and County |

Lender/Lessor Name, Address, (Street, City, State, ZIP code) and Phone |

|||||||

|

|

|

|

|

|

Phone |

||

23b Asset Description |

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

$ |

|

|

$ |

Location of asset (Street, City, State, ZIP |

code) and County |

Lender/Lessor Name, Address, (Street, City, State, ZIP code) and Phone |

||||||

|

|

|

|

|

|

Phone |

||

23c Asset Description |

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

$ |

|

|

$ |

Location of asset (Street, City, State, ZIP |

code) and County |

Lender/Lessor Name, Address, (Street, City, State, ZIP code) and Phone |

||||||

|

|

|

|

|

|

Phone |

||

23d Asset Description |

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

$ |

|

|

$ |

Location of asset (Street, City, State, ZIP |

code) and County |

Lender/Lessor Name, Address, (Street, City, State, ZIP code) and Phone |

||||||

|

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

23e |

Intangible Asset Description |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

23f |

Intangible Asset Description |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

23g |

Intangible Asset Description |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

23h |

Total Equity (Add lines 23a through 23g and amounts from any attachments) |

|

|

$ |

|

|

|||||

|

|

BUSINESS LIABILITIES Include notes and judgements not listed previously on this form. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Liabilities |

Secured/ |

Date Pledged |

|

|

Date of Final |

|

Payment |

|||

|

|

|

Balance Owed |

Payment |

|

|||||||

|

|

Unsecured |

(mmddyyyy) |

|

|

Amount |

||||||

|

|

|

|

|

|

|

(mmddyyyy) |

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

|

24a |

Description: |

Secured |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unsecured |

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Name |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Street |

Address |

|

|

|

|

|

|

|

|

|

|

|

City/State/ZIP code |

|

|

|

Phone |

|

|

|

|

||

|

24b |

Description: |

Secured |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unsecured |

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Name |

|

|

|

|

|

|

|

|

||

|

|

Street |

Address |

|

|

|

|

|

|

|

|

|

|

|

City/State/ZIP code |

|

|

|

Phone |

|

|

|

|

||

24c Total Payments (Add lines 24a and 24b and amounts from any attachments)

$

Catalog Number 16649P |

www.irs.gov |

Form |

Form |

|

|

Page 6 |

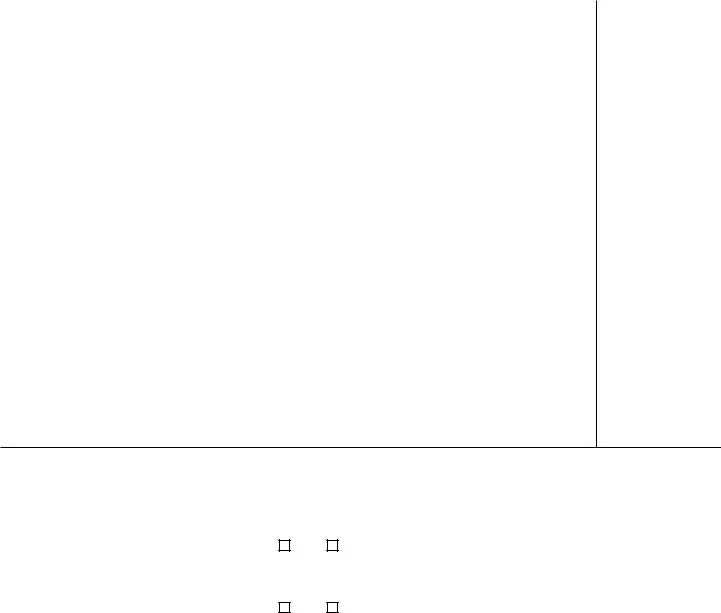

Section 5: Monthly Income/Expenses Statement for Business |

|

||

Accounting Method Used: |

Cash |

Accrual |

|

Use the prior 3, 6, 9 or 12 month period to determine your typical business income and expenses. |

|||

|

|

||

Income and Expenses during the period (mmddyyyy) |

to (mmddyyyy) |

||

Provide a breakdown below of your average monthly income and expenses, based on the period of time used above.

|

Total Monthly Business Income |

|

|

Total Monthly Business Expenses |

||

|

|

|

|

|

|

|

|

Income Source |

|

Gross Monthly |

|

Expense items |

Actual Monthly |

25 |

Gross Receipts from Sales/Services |

$ |

|

36 |

Materials Purchased 1 |

$ |

26 |

Gross Rental Income |

$ |

|

37 |

Inventory Purchased 2 |

$ |

27 |

Interest Income |

$ |

|

38 |

Gross Wages & Salaries |

$ |

28 |

Dividends |

$ |

|

39 |

Rent |

$ |

29 |

Cash Receipts (Not included in lines |

$ |

|

40 |

Supplies 3 |

$ |

|

Other Income (Specify below) |

|

|

41 |

Utilities/Telephone 4 |

$ |

30 |

|

$ |

|

42 |

Vehicle Gasoline/Oil |

$ |

31 |

|

$ |

|

43 |

Repairs & Maintenance |

$ |

32 |

|

$ |

|

44 |

Insurance |

$ |

33 |

|

$ |

|

45 |

Current Taxes 5 |

$ |

34 |

|

$ |

|

46 |

Other Expenses (Specify) |

$ |

35 |

Total Income (Add lines 25 through 34) |

$ |

|

47 |

IRS Use |

$ |

|

|

|

|

48 |

Total Expenses (Add lines 36 through 47) |

$ |

|

|

|

|

49 |

Net Income (Line 35 minus Line 48) |

$ |

1Materials Purchased: Materials are items directly related to the production of a product or service.

2 Inventory Purchased: Goods bought for resale.

3Supplies: Supplies are items used to conduct business and are consumed or used up within one year. This could be the cost of books, office supplies, professional equipment, etc.

4Utilities/Telephone: Utilities include gas, electricity, water, oil, other fuels, trash collection, telephone, cell phone and business internet.

5Current Taxes: Real estate, state, and local income tax, excise, franchise, occupational, personal property, sales and the employer's portion of employment taxes.

Certification: Under penalties of perjury, I declare that to the best of my knowledge and belief this statement of assets, liabilities, and other information is true, correct, and complete.

Signature

Title

Date

Print Name of Officer, Partner or LLC Member

After we review the completed Form

IRS USE ONLY (Notes)

Privacy Act: The information requested on this Form is covered under Privacy Acts and Paperwork Reduction Notices which have already been provided to the taxpayer.

Catalog Number 16649P |

www.irs.gov |

Form |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | The IRS 433-B form is used by businesses to provide financial information to the Internal Revenue Service. |

| Purpose | It is designed to help the IRS assess the business’s ability to pay back taxes and determine suitable payment options. |

| Applicants | The form is specifically for businesses, including corporations, partnerships, and limited liability companies (LLCs) that are considered 'disregarded entities'. |

| Information Required | Businesses must report their assets, liabilities, income, and expenses. |

| Submission Timing | Generally, the form must be submitted when requested by the IRS during a collection process or when applying for a payment plan. |

| Governing Laws | The collection of information and processes related to the IRS 433-B form are governed by federal tax laws and regulations. |

| State-Specific Versions | There are no state-specific versions of the IRS 433-B form, as it is a federal form. However, state taxes may have equivalent forms or requirements. |

| Impact on Businesses | Accurate completion of the form can help businesses negotiate feasible tax payment plans and avoid enforcement actions like levies or liens. |

| Accessibility | The form and its instructions are available on the IRS website for download and printing by businesses and tax professionals. |

Guide to Writing IRS 433-B

After completing the IRS 433-B form, it is essential to review the information provided to ensure its accuracy and completeness. The following steps detail how to properly fill out the form, focusing on providing clear and concise information. This form is crucial for businesses as it outlines their financial status and capabilities. Once the form is filled, submitted, and processed, the individual or business will receive guidance on the next stages of their financial assessment process from the IRS.

- Begin by gathering all necessary financial documents and information about the business, including recent tax returns, bank statements, profit and loss statements, and lists of assets and liabilities.

- Enter the basic information about the business at the top of the form, including the legal name, doing business as (DBA) name if applicable, Employer Identification Number (EIN), and address.

- Provide the names, Social Security Numbers, and titles of all officers, partners, or managing members of the business in the section designated for personal information.

- Outline the nature of the business and the type of products or services offered in the specified section. Include the number of employees and information on the payroll schedule.

- Detail the business's financial information by listing all bank accounts, including checking, savings, and investment accounts. Be sure to include the name of the bank, account numbers, and current balances.

- Document all assets owned by the business, such as real estate, vehicles, machinery, and inventory. Provide descriptions, locations, values, and any associated debts.

- Report the income and expenses on a monthly basis in the section provided. This should include all sources of income and categories of expenses, reflecting a typical month.

- List all accounts payable and other liabilities, including loans, credit lines, and vendor obligations. Specify the creditor's name, balance owed, and monthly payment.

- Sign and date the form at the bottom, ensuring that all provided information is truthful and accurate. If necessary, have another authorized individual from the business review the form before submission.

- Submit the completed form to the IRS following the instructions provided. This may include mailing or electronically filing the form, depending on the requirements at the time of submission.

Once the IRS 433-B form has been successfully submitted, the IRS will review the information to assess the business's financial situation. The business may be contacted for further information or to discuss the next steps regarding their financial obligations to the IRS. It's important for the business to stay responsive and cooperative during this process to resolve any financial issues efficiently.

Understanding IRS 433-B

-

What is the IRS Form 433-B?

The IRS Form 433-B is used by businesses to provide financial information to the Internal Revenue Service. It’s required when a business needs to request a payment plan or an offer in compromise to settle back taxes. This form allows the IRS to assess the financial situation of a business in order to work out a manageable repayment plan or a reduction in the amount owed.

-

Who needs to file IRS Form 433-B?

Any business that is looking to arrange a payment plan or an offer in compromise with the IRS for outstanding taxes should complete Form 433-B. This includes corporations, partnerships, and limited liability companies (LLCs) that are facing financial difficulties in settling their tax liabilities.

-

How do you obtain IRS Form 433-B?

IRS Form 433-B can be downloaded directly from the IRS website. It’s available in a PDF format that can be filled out electronically or printed and filled out by hand. Assistance in completing the form can be found on the IRS website, or by contacting a tax professional or the IRS directly.

-

What information is required on Form 433-B?

Form 433-B requires detailed information about the business’s financial situation. This includes but is not limited to current assets and liabilities, income and expenses, and information regarding business operations. The form is comprehensive and requires detailed documentation to support the amounts reported. Accurate and complete financial statements are crucial for the IRS to make an informed decision.

-

How do you submit IRS Form 433-B?

After completing Form 433-B, it can be submitted to the IRS via mail. The appropriate mailing address will depend on the state where the business is located and can be found on the IRS website. It's important to retain a copy of the form and all accompanying documentation for your records.

-

What happens after submitting Form 433-B to the IRS?

Once the IRS receives Form 433-B, they will review the provided financial information to determine the business's ability to pay the outstanding tax debt. The IRS may request additional information or documentation. Negotiations between the business and the IRS will follow to reach an agreement on a payment plan or an offer in compromise, based on the business’s financial situation.

-

Can filing IRS Form 433-B prevent IRS collection actions?

Filing Form 433-B itself does not automatically prevent IRS collection actions. However, once a repayment plan has been agreed upon and approved, or an offer in compromise has been accepted, the IRS generally halts further collection efforts as long as the business adheres to the terms of the agreement. It is critical to maintain open and honest communication with the IRS throughout this process.

Common mistakes

-

Not fully completing all required sections is a common mistake. People often overlook or intentionally skip parts of the form, not realizing that every section is important for providing the IRS with a complete understanding of the business's financial situation.

-

Underreporting income is another frequent error. Business owners might not include all sources of income, either by mistake or in an attempt to lower their tax liability. This can lead to discrepancies that the IRS may investigate further.

-

Overlooking deductions can also occur. Businesses may fail to list all allowable expenses, which could help reduce their overall tax obligation. This mistake can result in businesses paying more than they need to.

-

Incorrectly valuing assets is a mistake that can have significant implications. When businesses undervalue or overvalue their assets, it can affect their ability to negotiate with the IRS or lead to penalties.

-

Failing to attach necessary documentation is a critical error. The IRS requires certain documents to verify the information provided on the form. Without these documents, processing the form could be delayed, or the submission might be considered incomplete.

Documents used along the form

When businesses find themselves navigating the complexities of resolving tax issues or setting up payment plans with the Internal Revenue Service (IRS), the IRS Form 433-B often plays a fundamental role. This form is particularly designed for businesses to provide financial information critical for the IRS to assess their ability to pay back taxes. However, the Form 433-B does not stand alone. To fully comprehend a business's financial position and ensure a thorough evaluation, several other forms and documents are commonly required in addition to the 433-B. Understanding these additional requirements can be crucial for businesses aiming for a favorable resolution with the IRS.

- IRS Form 941, Employer's Quarterly Federal Tax Return: This form is used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks. It also reports the employer's portion of Social Security or Medicare tax, making it essential for evaluating current tax compliance.

- IRS Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return: This document is necessary for businesses to report their annual Federal Unemployment Tax Act (FUTA) tax. Understanding a business’s compliance with unemployment tax obligations is crucial for a comprehensive financial assessment.

- IRS Form 1120, U.S. Corporation Income Tax Return: For corporations, this form is vital as it reports the company's income, gains, losses, deductions, credits, and to figure out the income tax liability of the corporation. It gives a snapshot of the company's financial health over the past year.

- Profit and Loss Statement: Often required to provide a detailed picture of the business’s financial activities over a specific period. This statement highlights the company's revenues, costs, and expenses, showcasing its profitability or losses.

- Balance Sheet: This document offers a snapshot of a company's financial condition at a specific moment in time, detailing assets, liabilities, and equity. It's essential for understanding the company's overall financial stability.

- Bank Statements: Recent bank statements are often requested to verify the cash flow and the actual cash reserves of the business. They help corroborate the financial information provided in other documents.

Together, these documents paint a comprehensive picture of a business's financial health and compliance with tax obligations. For businesses working through tax-resolution processes or payment arrangements, accurately completing and submitting the IRS Form 433-B along with these additional documents is pivotal. It's not just about fulfilling a requirement; it's about offering the IRS a clear, transparent view into the business's financial world. This, in turn, can lead to more favorable terms or understandings, ultimately helping businesses navigate their tax responsibilities more effectively.

Similar forms

The IRS 433-B form, utilized by businesses to provide financial information to the Internal Revenue Service for the purpose of setting up payment plans or resolving tax liabilities, shares similarities with several other documents in terms of structure and purpose. These documents are essential tools in navigating and complying with financial and tax-related obligations both for individuals and businesses.

Similar to the IRS 433-B, the IRS 433-A form is used by individuals rather than businesses to report their financial information to the IRS. This form aids in establishing payment agreements or offers in compromise for personal tax debts. Both forms gather extensive details about the financial state of the entity or individual, including assets, liabilities, expenses, and income, to evaluate the ability to pay back taxes.

The IRS Form 9465, Installment Agreement Request, is another document resembling the 433-B in that it's used to arrange a payment plan for taxes owed to the IRS. While Form 9465 initiates the request for an installment agreement, the 433-B provides the detailed financial information needed to determine the terms of such an agreement for businesses.

Form 656, Offer in Compromise, shares a goal with the 433-B: helping taxpayers settle their tax debts for less than the full amount owed. Where the 433-B helps establish the taxpayer's ability to pay, Form 656 allows them to offer a specific amount to clear their debt, contingent on IRS approval.

The Schedule C (Form 1040), Profit or Loss from Business, is connected to the IRS 433-B in its focus on business finances, specifically reporting income and expenses from a sole proprietorship. While Schedule C summarizes yearly business performance for tax filing, the 433-B offers a more detailed snapshot of current financial status to negotiate tax payment plans.

The Collection Information Statement for Wage Earners and Self-Employed Individuals (Form 433-F) bears resemblance to the 433-B as it is another form designed to collect financial information. However, Form 433-F is tailored for individuals, including self-employed persons, to assist in the resolution of personal tax liabilities, juxtaposed to 433-B’s focus on businesses.

Form 1120, U.S. Corporation Income Tax Return, is in the same realm as the IRS 433-B as they both pertain to business financial affairs. Form 1120 is specifically for corporations to report their income, gains, losses, deductions, credits, and to calculate their federal income tax liability. While it serves a different function, both documents are critical for businesses in managing their tax responsibilities.

The Employment Tax Return forms, such as Form 941, Employer's Quarterly Federal Tax Return, also parallel the IRS 433-B. These forms are required for reporting income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks and are integral to business tax handling. Whilst focusing on payroll taxes specifically, they complement the broader financial picture rendered by the 433-B.

Form SS-4, Application for Employer Identification Number (EIN), while not a financial disclosure form, connects to the 433-B in the business tax process. The SS-4 is essential for new businesses to obtain an EIN, required for tax filings and financial statements, including those potentially leading to the use of form 433-B for addressing tax issues.

The Bankruptcy Forms, specifically those related to Chapter 11 reorganization, can also be associated with the IRS 433-B. These forms provide a comprehensive look at a business’s financial situation to manage debts, similar to how the 433-B outlines financial status for tax resolution purposes. Both processes aim to facilitate financial recovery, albeit through different legal mechanisms.

Dos and Don'ts

The IRS Form 433-B is designed for businesses to provide financial information to the IRS. This information helps in setting up payment plans or evaluating other tax-related solutions. Given its importance, it's essential to approach this document with care. Below are critical dos and don'ts when filling out the form.

Do:

- Verify all information for accuracy before submission. Ensure that every detail you enter on the form reflects your current financial situation accurately. Incorrect information can lead to delays or unfavorable terms in any agreements with the IRS.

- Provide comprehensive details of your assets, income, and expenses. The IRS requires a full picture of your business's financial health. Leaving out information can be seen as non-compliance.

- Use actual numbers rather than estimates. When filling out the form, precise figures give the IRS a clearer understanding of your financial situation.

- Consult with a tax professional or accountant. These professionals can offer invaluable advice, ensuring the form is filled out correctly and in your best interest.

- Attach additional documentation if needed. Sometimes, the form alone might not capture the entirety of your financial situation. Attaching further documentation can provide a clearer picture.

- Review the form multiple times before submitting. This helps catch any errors or missing information, reducing the likelihood of delays in processing.

Don't:

- Rush through the form. Take your time to understand each section and fill it out carefully. Mistakes can complicate your dealings with the IRS.

- Leave sections blank. If a section does not apply to your business, fill it with “N/A” instead of leaving it empty. This indicates you didn't overlook the section.

- Underestimate your expenses. Be honest about your business expenses. Underreporting can lead to unrealistic payment plans that you may not be able to adhere to.

- Overstate your assets or income. Similarly, overstating assets or income can result in less favorable terms from the IRS.

- Ignore IRS deadlines. Submitting the 433-B form late can result in penalties and reduce your chances of negotiating terms that are favorable to you.

- Forget to sign and date the form. An unsigned or undated form is considered incomplete and won’t be processed until corrected, delaying your entire process.

By following these guidelines, you can ensure a smoother interaction with the IRS and better outcomes for your business financial matters.

Misconceptions

Filing taxes and managing tax forms can often feel like navigating a labyrinth, especially for businesses dealing with IRS forms, such as the 433-B. This specific form is used by businesses to provide financial information to the IRS, usually when they’re negotiating a payment plan for outstanding taxes. However, there are many misconceptions about the 433-B form that can complicate the process further. Let’s clear up some of these misunderstandings.

- The form is only for large corporations. This is a common misconception. In reality, the IRS 433-B form is required from any business that is not a sole proprietorship. This includes small businesses, LLCs, partnerships, and corporations, not just the large players.

- Personal financial information is not required. Actually, if you are a sole proprietor or your business is closely held, the IRS may require personal financial information as well. This helps them assess the overall financial health of the business entity and its ability to pay back taxes.

- Completion of IRS 433-B automatically leads to a payment agreement. This is not the case. While completing and submitting Form 433-B is a step towards negotiating a payment plan, it doesn't guarantee that an agreement will be made. The IRS will review your financial information thoroughly before any decisions are made.

- Only the business owner needs to fill out the form. Depending on the structure of your business, other individuals such as partners or corporate officers may also need to provide their financial information on the form or through separate submissions. The IRS requires a comprehensive understanding of the business’s financial responsibilities and assets.

- The form must be submitted by April 15th. Unlike individual tax returns, there’s no specific annual deadline for the IRS 433-B form. It is required when the IRS requests it, typically during a case involving the collection of back taxes.

- Filing IRS 433-B is an admission of guilt. This is not accurate. Submitting this form is simply a process of providing financial information to the IRS. It does not imply any wrongdoing or guilt concerning tax liabilities.

- All business assets must be disclosed on the form. While you do need to be thorough and honest when disclosing assets, not everything owned by the business or its officers must be included. For example, personal assets that do not impact the business’s ability to pay taxes might not be relevant. However, navigating what to include can be tricky, so seeking professional advice is recommended.

- The process is entirely private and confidential. While the IRS is required to keep taxpayer information confidential, be aware that in certain circumstances, such as court orders, your financial information could become public.

- Once submitted, the information on the form cannot be changed. If your financial situation changes after submission, it is possible to update the information provided to the IRS. This could be necessary if you believe the updates will affect your ability to pay or negotiate payment plans.

Understanding these misconceptions can help businesses approach the IRS 433-B form with more confidence and clarity. It's always beneficial to consult with a tax professional when dealing with complicated tax forms and issues to ensure compliance and optimize outcomes.

Key takeaways

The IRS 433-B form is a document used by businesses to provide financial information to the Internal Revenue Service. Filling it out accurately and understanding its use are crucial for any business dealing with tax issues. Here are four key takeaways to keep in mind:

- Accuracy is critical: Ensure every piece of information is accurate. Inaccurate information can lead to potential audits or penalties. It’s important to double-check figures, such as income and expenses, and ensure they are up-to-date.

- Comprehensive disclosure: The form requires detailed financial information. This includes not just income and expenses, but also assets like real estate, vehicles, and equipment, as well as liabilities. Missing details can result in incomplete representations of financial standing, affecting agreements with the IRS.

- Supporting documentation: Be prepared to provide documentation for the information you report. This could include bank statements, tax returns, profit and loss statements, and other relevant financial records. Keeping these documents organized will help in efficiently filling out the form.

- Understand its purpose: The IRS uses Form 433-B to assess a business’s ability to pay outstanding taxes. It might be required when setting up a payment plan or compromise. Knowing this helps in framing the financial details in the context of your negotiation or compliance strategy.

Popular PDF Documents

Trs Qpp Loan Application - The application offers the option for Electronic Fund Transfer if the applicant is paid on the City of New York payroll and receives paychecks via direct deposit.

Irs Pub 6744 - Non-profits and community organizations often use the IRS 6744 form as part of their training materials for volunteer tax assistance programs.