Get IRS 433-A (OIC) Form

When individuals find themselves facing financial difficulties, particularly with the Internal Revenue Service (IRS), navigating the path towards resolution can often feel daunting. Among the various forms and procedures that the IRS employs to understand and possibly alleviate a taxpayer's burden, the IRS 433-A (OIC) form stands out as a critical tool for those looking to offer a compromise and settle their tax debts for less than the full amount owed. This form requires detailed information about the taxpayer’s financial situation, including income, expenses, assets, and liabilities, thus enabling the IRS to assess the taxpayer's ability to pay. It's designed for individual taxpayers, providing them with an opportunity to present their case for why settling their tax debt would serve in both parties' best interest. Successfully navigating this process can offer a lifeline to those overwhelmed by tax debt, allowing them to move towards financial recovery. However, it is essential to approach this form with thorough preparation and a clear understanding of its requirements and implications, as the information provided will be scrutinized closely by the IRS to ensure that any offer made reflects the taxpayer's true ability to pay.

IRS 433-A (OIC) Example

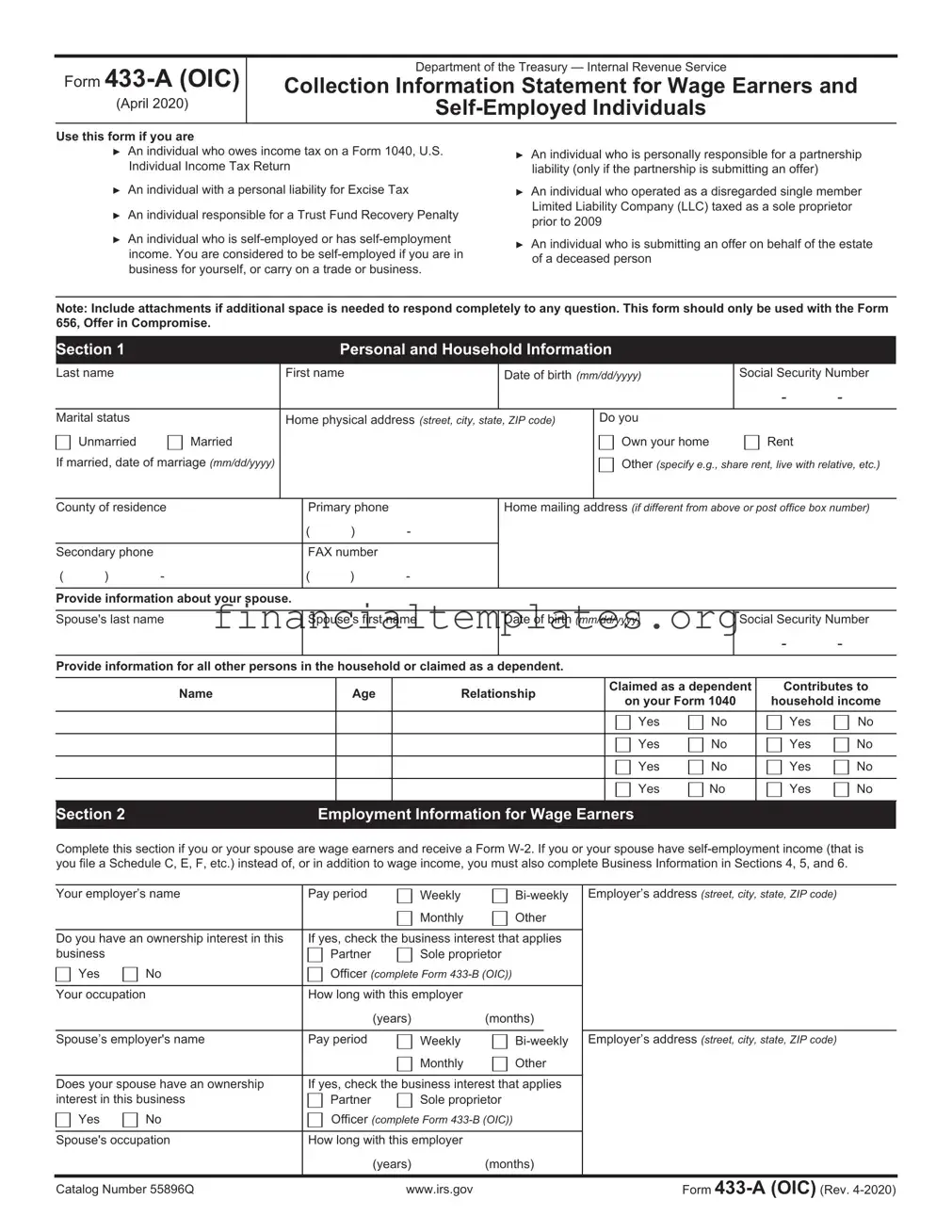

Form

(April 2021)

Department of the Treasury — Internal Revenue Service

Collection Information Statement for Wage Earners and

Use this form if you are

►An individual who owes income tax on a Form 1040, U.S. Individual Income Tax Return

►An individual with a personal liability for Excise Tax

►An individual responsible for a Trust Fund Recovery Penalty

►An individual who is

►An individual who is personally responsible for a partnership liability (only if the partnership is submitting an offer)

►An individual who is submitting an offer on behalf of the estate of a deceased person

Note: Include attachments if additional space is needed to respond completely to any question. This form should only be used with the Form 656, Offer in Compromise.

Section 1 |

|

|

|

|

Personal and Household Information |

|

|

|

|

|

||||||

Last name |

|

First name |

|

|

Date of birth (mm/dd/yyyy) |

|

|

Social Security Number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

Marital status |

|

Home physical address (street, city, state, ZIP code) |

Do you |

|

|

|

|

|

||||||||

|

Unmarried |

Married |

|

|

|

|

|

|

|

|

Own your home |

|

|

|

Rent |

|

If married, date of marriage (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

Other (specify e.g., share rent, live with relative, etc.) |

|||||||

|

|

|

|

|

|

|

|

|

|

|||||||

County of residence |

|

Primary phone |

|

|

Home mailing address (if different from above or post office box number) |

|||||||||||

|

|

|

|

( |

) |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Secondary phone |

|

|

FAX number |

|

|

|

|

|

|

|

|

|

|

|||

( |

) |

- |

|

( |

) |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Provide information about your spouse. |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Spouse's last name |

|

Spouse's first name |

|

Date of birth (mm/dd/yyyy) |

|

|

Social Security Number |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

Provide information for all other persons in the household or claimed as a dependent. |

|

|

|

|

|

|

|

|||||||||

|

|

Name |

|

|

|

Age |

|

Relationship |

|

Claimed as a dependent |

Contributes to |

|||||

|

|

|

|

|

|

|

on your Form 1040 |

|

household income |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Section 2 |

|

|

|

Employment Information for Wage Earners |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete this section if you or your spouse are wage earners and receive a Form

Your employer’s name |

Pay period |

Weekly |

Employer’s address (street, city, state, ZIP code) |

|||

|

|

|

Monthly |

Other |

|

|

|

|

|

|

|||

Do you have an ownership interest in this |

If yes, check the business interest that applies |

|

||||

business |

|

Partner |

Sole proprietor |

|

||

Yes |

No |

Officer (complete Form |

|

|||

|

|

|

|

|

||

Your occupation |

How long with this employer |

|

|

|

||

|

|

|

(years) |

(months) |

|

|

|

|

|

|

|

|

|

Spouse’s employer's name |

Pay period |

Weekly |

Employer’s address (street, city, state, ZIP code) |

|||

|

|

|

Monthly |

Other |

|

|

|

|

|

||||

Does your spouse have an ownership |

If yes, check the business interest that applies |

|

||||

interest in this business |

Partner |

Sole proprietor |

|

|||

Yes |

No |

Officer (complete Form |

|

|||

|

|

|

|

|

||

Spouse's occupation |

How long with this employer |

|

|

|

||

|

|

|

(years) |

(months) |

|

|

|

|

|

|

|

|

|

Catalog Number 55896Q |

|

www.irs.gov |

|

|

Form |

|

Page 2

Section 3 |

Personal Asset Information |

|

|

Use the most current statement for each type of account, such as checking, savings, money market and online accounts, stored value cards (such as a payroll card from an employer), investment, retirement accounts (IRAs, Keogh, 401(k) plans, stocks, bonds, mutual funds, certificates of deposit) and virtual currency (such as Bitcoin, Ripple, Ethereum, etc.), life insurance policies that have a cash value, and safe deposit boxes. Asset value is subject to adjustment by IRS based on individual circumstances. Enter the total amount available for each of the following (if additional space is needed include attachments).

Round to the nearest dollar. Do not enter a negative number. If any line item is a negative number, enter "0".

Cash and Investments (domestic and foreign)

|

Cash |

Checking |

Savings |

Money Market Account/CD |

Online Account |

Stored Value Card |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank name |

|

|

|

|

|

|

|

|

|

|

|

Account number |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1a) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Checking |

|

Savings |

Money Market Account/CD |

Online Account |

Stored Value Card |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank name |

|

|

|

|

|

|

|

|

|

|

|

Account number |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1b) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total of bank accounts from attachment |

(1c) |

$ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Add lines (1a) through (1c) minus ($1,000) = |

(1) |

$ |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment account |

|

|

Stocks |

|

|

Bonds |

|

Other |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name of Financial Institution |

|

|

|

|

|

Account number |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current market value |

|

|

|

|

|

|

|

|

|

|

|

Minus loan balance |

|

|

|

|

|||||||

$ |

|

|

|

|

|

|

X .8 = $ |

|

|

|

|

|

|

– $ |

|

|

|

= |

(2a) |

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Investment account |

|

|

Stocks |

|

|

Bonds |

|

Other |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Name of Financial Institution |

|

|

|

|

|

Account number |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Current market value |

|

|

|

|

|

|

|

|

|

|

|

Minus loan balance |

|

|

|

|

|||||||

$ |

|

|

|

|

|

|

X .8 = $ |

|

|

|

|

|

|

– $ |

|

|

|

= |

(2b) |

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Virtual currency |

|

|

Name of virtual currency |

|

Email address used to |

Location(s) of virtual |

|

|

|

|||||||||||||

|

|

|

|

|

wallet, exchange or digital |

currency |

|

|

|

||||||||||||||

Type of virtual currency |

|

|

|

|

|||||||||||||||||||

|

currency exchange (DCE) |

currency exchange or DCE |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Current market value in U.S. dollars as of today |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

$ |

|

|

|

|

|

|

X .8 = $ |

|

|

|

|

|

|

|

|

|

|

|

= |

(2c) |

$ |

||

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

Total investment accounts from attachment. [current market value minus loan balance(s)] |

(2d) |

$ |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add lines (2a) through (2d) =

(2) $

Retirement account |

401K |

IRA |

Other |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Financial Institution |

|

|

|

Account number |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Current market value |

|

|

|

|

|

Minus loan balance |

|

|

|

|||

$ |

|

|

X .8 = $ |

|

|

|

– $ |

|

= |

(3a) |

$ |

|

|

|

|

|

|||||||||

|

Total of retirement accounts from attachment. [current market value X .8 minus loan balance(s)] |

(3b) |

$ |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Add lines (3a) through (3b) =

(3) $

Note: Your reduction from current market value may be greater than 20% due to potential tax consequences/withdrawal penalties.

Cash value of Life Insurance Policies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Insurance Company |

Policy number |

|

|

|

||

|

|

|

|

|

|

|

Current cash value |

Minus loan balance |

|

|

|

||

$ |

|

– $ |

|

= |

(4a) |

$ |

|

|

|

|

|

||

Total cash value of life insurance policies from attachment |

Minus loan balance(s) |

|

|

|

||

$ |

|

– $ |

|

= |

(4b) |

$ |

|

|

|

|

|

|

|

|

|

|

Add lines (4a) through (4b) = |

(4) |

$ |

|

|

|

|

|

|||

Catalog Number 55896Q |

www.irs.gov |

|

Form |

|||

Page 3

Section 3 (Continued) |

Personal Asset Information |

|

|

Real property (enter information about any house, condo,

Is your real property currently for sale or do you anticipate selling your real property to fund the offer amount

|

Yes |

(listing price) |

|

No |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property description (indicate if personal residence, rental property, vacant, etc.) |

Purchase date (mm/dd/yyyy) |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

Amount of mortgage payment |

Date of final payment |

How title is held (joint tenancy, etc.) |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Location (street, city, state, ZIP code, county, and country) |

|

Lender/Contract holder name, address (street, city, |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

state, ZIP code) and phone |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||||

Current market value |

|

Minus loan balance (mortgages, etc.) |

|

|

||||||||||

$ |

|

|

X .8 = $ |

|

|

|

– |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

(total value of real estate) = |

(5a) |

$ |

||||||

|

|

|

|

|

||||||||||

Property description (indicate if personal residence, rental property, vacant, etc.) |

Purchase date (mm/dd/yyyy) |

|

|

|||||||||||

|

|

|

|

|

|

|||||||||

Amount of mortgage payment |

Date of final payment |

How title is held (joint tenancy, etc.) |

|

|

||||||||||

|

|

|

|

|

|

|

|

|||||||

Location (street, city, state, ZIP code, county, and country) |

|

Lender/Contract holder name, address (street, city, |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

state, ZIP code) and phone |

|

|

||

|

|

|

|

|

|

|

||||||||

Current market value |

|

Minus loan balance (mortgages, etc.) |

|

|

||||||||||

$ |

|

|

X .8 = $ |

|

|

|

– |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

(total value of real estate) = |

(5b) |

$ |

||||||

|

|

|

|

|

|

|||||||||

|

|

Total value of property(s) from attachment [current market value X .8 minus any loan balance(s)] |

(5c) |

$ |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add lines (5a) through (5c) =

(5) $

Vehicles (enter information about any cars, boats, motorcycles, etc. that you own or lease)

Vehicle make & model |

Year |

|

|

Date purchased |

|

Mileage |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease |

|

Name of creditor |

|

|

|

Date of final payment |

|

Monthly lease/loan amount |

|

|

|||

|

Loan |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current market value |

|

Minus loan balance |

|

|

|

|

||||||||

$ |

|

|

|

X .8 = $ |

|

|

– $ |

Total value of vehicle (if the vehicle |

(6a) |

$ |

||||

|

|

|

|

|

is leased, enter 0 as the total value) = |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtract $3,450 from line (6a) |

(6b) |

$ |

|

|

|

|

|

|

|

|

|

(If line (6a) minus $3,450 is a negative number, enter "0") |

|||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||||

Vehicle make & model |

Year |

|

|

Date purchased |

|

Mileage |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Lease |

|

Name of creditor |

|

|

|

Date of final payment |

|

Monthly lease/loan amount |

|

|

|||

|

Loan |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

||||||

Current market value |

|

Minus loan balance |

|

|

|

|

||||||||

$ |

|

|

|

X .8 = $ |

|

|

|

– $ |

|

Total value of vehicle (if the vehicle |

(6c) |

$ |

||

|

|

|

|

|

is leased, enter 0 as the total value) = |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

If you are filing a joint offer, subtract $3,450 from line (6c) |

|

|

|||

|

|

|

|

|

|

|

|

|

(If line (6c) minus $3,450 is a negative number, enter "0") |

(6d) |

$ |

|||

|

|

|

|

|

|

|

If you are not filing a joint offer, enter the amount from line (6c) |

|

|

|||||

|

|

|

|

|

||||||||||

|

|

Total value of vehicles listed from attachment [current market value X .8 minus any loan balance(s)] |

(6e) |

$ |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total lines (6b), (6d), and (6e) =

(6) $

Catalog Number 55896Q |

www.irs.gov |

Form |

Page 4

Section 3 (Continued) |

Personal Asset Information |

Other valuable items (artwork, collections, jewelry, items of value in safe deposit boxes, interest in a company or business that is not publicly traded, etc.)

Description of asset(s)

Current market value |

|

|

|

|

|

|

|

Minus loan balance |

|

|

|

|

|

|||||||||||||||

$ |

|

|

|

|

|

X .8 = $ |

|

|

|

|

– $ |

|

|

|

= |

|

|

(7a) |

$ |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Value of remaining furniture and personal effects (not listed above) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Description of asset |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Current market value |

|

|

|

|

|

|

|

Minus loan balance |

|

|

|

|

|

|||||||||||||||

$ |

|

|

|

|

|

X .8 = $ |

|

|

|

|

– $ |

|

|

|

= |

|

|

(7b) |

$ |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total value of valuable items listed from attachment [current market value X .8 |

|

minus any loan balance(s)] |

(7c) |

$ |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

Add lines (7a) through (7c) minus IRS deduction of $9,790 = |

|

(7) |

$ |

|

|||||||||||||||||

|

|

Do not include amount on the lines with a letter beside the number. Round to the nearest whole dollar. |

|

|

Box A |

|||||||||||||||||||||||

|

|

|

|

Do not enter a negative number. If any line item is a negative, enter "0" on that line. |

|

|

Available Individual Equity in Assets |

|||||||||||||||||||||

|

|

|

|

|

|

$ |

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

Add lines (1) through (7) and enter the amount in Box A = |

|

|

|

|

|

||||||||||||||

NOTE: If you or your spouse are |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Section 4 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

If you or your spouse are |

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Is your business a sole proprietorship |

|

|

|

|

Address of business (if other than personal residence) |

|||||||||||||||||||||||

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Business telephone number |

|

|

|

|

Employer Identification Number |

|

Business website address |

|

|

|

|

Trade name or DBA |

||||||||||||||||

( |

|

) |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Description of business |

|

|

|

|

Total number of employees |

|

Frequency of tax deposits |

Average gross monthly |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

payroll $ |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Do you or your spouse have any other |

business interests? Include any |

|

Business address (street, city, state, ZIP code) |

|

|

|||||||||||||||||||||||

interest in an LLC, LLP, corporation, partnership, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Yes |

(percentage of ownership: |

|

) Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Business name |

|

|

|

|

|

|

|

|

|

|

|

Business telephone number |

|

|

Employer Identification Number |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Type of business (select one) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Partnership |

LLC |

|

|

|

Corporation |

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Section 5 |

|

|

|

|

|

|

Business Asset Information (for |

|

|

|

|

|

||||||||||||||||

List business assets such as bank accounts, virtual currency (cryptocurrency), tools, books, machinery, equipment, business vehicles and real property that is owned/leased/rented. If additional space is needed, attach a list of items. Do not include personal assets listed in Section 3.

Round to the nearest whole dollar. Do not enter a negative number. If any line item is a negative number, enter "0".

|

Cash |

Checking |

Savings |

Money Market Account/CD |

Online Account |

Stored Value Card |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank name |

|

|

|

|

|

|

|

Account number |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

(8a) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash |

Checking |

Savings |

Money Market Account/CD |

Online Account |

Stored Value Card |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank name |

|

|

|

|

|

|

|

Account number |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

(8b) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Virtual currency |

Name of virtual currency |

|

Email address used to |

Location(s) of virtual |

|

|

|

|||||

|

|

|

wallet, exchange or digital |

currency |

|

|

|

||||||

Type of virtual currency |

|

|

|

||||||||||

currency exchange (DCE) |

currency exchange or DCE |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Current market value in U.S. dollars as of today |

|

|

|

|

|

|

|

|

|||||

$ |

|

|

|

X .8 = $ |

|

|

|

|

|

= |

(8c) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total bank accounts from attachment |

(8d) |

$ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add lines (8a) through (8d) = |

(8) |

$ |

||

Catalog Number 55896Q |

|

|

|

|

www.irs.gov |

|

|

Form |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 5 |

Section 5 (Continued) |

|

Business Asset Information (for |

|

|

|

||||||||

Description of asset |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current market value |

|

|

|

Minus loan balance |

|

Total value (if leased or used |

|

|

|

||||

$ |

|

X .8 = $ |

|

|

|

– $ |

|

|

|

in the production of income, |

= |

(9a) |

$ |

|

|

|

|

|

|

enter 0 as the total value) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of asset: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Current market value |

|

|

|

Minus Loan Balance |

|

Total value (if leased or used |

|

|

|

||||

$ |

|

X .8 = $ |

|

|

|

– $ |

|

|

|

in the production of income, |

= |

(9b) |

$ |

|

|

|

|

|

|

enter 0 as the total value) |

|||||||

|

|

|

|

||||||||||

|

Total value of assets listed from attachment [current market value X .8 minus any loan balance(s)] |

(9c) |

$ |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Add lines (9a) through (9c) = |

(9) |

$ |

||

|

|

|

|

|

IRS allowed deduction for professional books and tools of trade – |

(10) |

$ |

||||||

|

|

|

|

|

|||||||||

|

|

Enter the value of line (9) minus line (10). If less than zero enter zero. = |

(11) |

$ |

|||||||||

Notes Receivable |

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you have notes receivable |

|

Yes |

No |

|

|

|

|

|

|

||||

If yes, attach current listing that includes name(s) and amount of note(s) receivable |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts Receivable |

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you have accounts receivable, including |

Yes |

|

No |

|

|

|

|||||||

companies, and any bartering or online auction accounts |

|

|

|

|

|||||||||

If yes, provide a list of your current accounts receivable |

|

|

|

|

|

|

|||||||

|

|

Do not include amounts from the lines with a letter beside the number [for example: (9c)]. |

Box B |

||||||||||

|

|

|

|

|

|

|

|

|

Round to the nearest whole dollar. |

Available Business Equity in |

|||

|

|

Do not enter a negative number. If any line item is a negative, enter "0" on that line. |

Assets |

||||||||||

|

|

|

|

||||||||||

|

|

|

|

|

Add lines (8) and (11) and enter the amount in Box B = |

$ |

|

||||||

Section 6 |

|

Business Income and Expense Information (for |

|

|

|||||||||

If you provide a current profit and loss (P&L) statement for the information below, enter the total gross monthly income on line 17 and your monthly expenses on line 29 below. Do not complete lines (12) - (16) and (18) - (28). You may use the amounts claimed for income and expenses on your most recent Schedule C; however, if the amount has changed significantly within the past year, a current P&L should be submitted to substantiate the claim.

Period provided beginning |

through |

|

|

|

|

|

|||

Round to the nearest whole dollar. Do not enter a negative number. If any line item is a negative number, enter "0". |

||||

|

|

|

|

|

Business income (you may average |

|

|

|

|

|

|

|

|

|

Gross receipts |

|

|

(12) |

$ |

|

|

|

|

|

Gross rental income |

|

|

(13) |

$ |

|

|

|

|

|

Interest income |

|

|

(14) |

$ |

|

|

|

|

|

Dividends |

|

|

(15) |

$ |

|

|

|

|

|

Other income |

|

|

(16) |

$ |

|

|

|

|

|

|

Add lines (12) through (16) = |

(17) |

$ |

|

Business expenses (you may average |

|

|

|

|

|

|

|

|

|

Materials purchased (e.g., items directly related to the production of a product or service) |

|

(18) |

$ |

|

|

|

|

|

|

Inventory purchased (e.g., goods bought for resale) |

|

|

(19) |

$ |

|

|

|

|

|

Gross wages and salaries |

|

|

(20) |

$ |

|

|

|

|

|

Rent |

|

|

(21) |

$ |

|

|

|

|

|

Supplies (items used to conduct business and used up within one year, e.g., books, office supplies, professional equipment, etc.) |

|

(22) |

$ |

|

|

|

|

|

|

Utilities/telephones |

|

|

(23) |

$ |

|

|

|

|

|

Vehicle costs (gas, oil, repairs, maintenance) |

|

|

(24) |

$ |

|

|

|

|

|

Business insurance |

|

|

(25) |

$ |

|

|

|

|

|

Current business taxes (e.g., real estate, excise, franchise, occupational, personal property, sales and employer's portion of |

|

(26) |

$ |

|

employment taxes) |

|

|

||

Secured debts (not credit cards) |

|

|

(27) |

$ |

|

|

|

|

|

Other business expenses (include a list) |

|

|

(28) |

$ |

|

|

|

|

|

|

Add lines (18) through (28) = |

(29) |

$ |

|

|

Round to the nearest whole dollar. |

Box C |

||

Do not enter a negative number. If any line item is a negative, enter "0" on that line. |

Net Business Income |

|||

|

||||

Subtract line (29) from line (17) and enter the amount in Box C = |

$ |

|

||

Catalog Number 55896Q |

www.irs.gov |

Form |

||

Page 6

Section 7 |

Monthly Household Income and Expense Information |

Enter your household's gross monthly income. Gross monthly income includes wages, social security, pension, unemployment, and other income. Examples of other income include but are not limited to: agricultural subsidies, gambling income, oil credits, rent subsidies, Uber & Lyft driver income, and Airbnb rentals etc. The information below is for yourself, your spouse, and anyone else who contributes to your household's income. The entire household includes spouse,

Monthly Household Income

Note: Entire household income should also include income that is considered not taxable and may not be included on your tax return.

Round to the nearest whole dollar.

Primary taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross wages |

Social Security |

|

Pension(s) |

Other income (e.g. unemployment) |

|

|

|||||||

$ |

|

+ $ |

|

+ $ |

|

|

+ $ |

|

Total primary |

(30) |

$ |

||

|

|

|

|

|

taxpayer income = |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross wages |

Social Security |

|

Pension(s) |

Other Income (e.g. unemployment) |

|

|

|||||||

$ |

|

+ $ |

|

+ $ |

|

|

+ $ |

|

Total spouse |

(31) |

$ |

||

|

|

|

|

|

income = |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Additional sources of income used to support the household, e.g., |

|

|

|||||||||||

contribute to the household income, etc. List source(s) |

|

|

|

|

(32) |

$ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest, dividends, and royalties |

|

|

|

|

|

|

|

|

(33) |

$ |

|||

|

|

|

|

|

|

|

|

||||||

Distributions (e.g., income from partnerships, |

|

|

|

|

(34) |

$ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net rental income |

|

|

|

|

|

|

|

|

|

|

(35) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Net business income from Box C |

|

|

|

|

|

|

|

|

(36) |

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

|||

Child support received |

|

|

|

|

|

|

|

|

(37) |

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alimony received |

|

|

|

|

|

|

|

|

|

|

(38) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Round to the nearest whole dollar. |

Box D |

|||

|

|

|

|

|

|

|

|

|

Total Household Income |

||||

|

|

|

Do not enter a negative number. If any line item is a negative, enter "0" on that line. |

||||||||||

|

|

|

$ |

|

|||||||||

|

|

|

|

Add lines (30) through (38) and enter the amount in Box D = |

|

||||||||

Monthly Household Expenses

Enter your average monthly expenses.

Note: For expenses claimed in boxes (39) and (45) only, you should list the full amount of the allowable standard even if the actual amount you pay is less. For the other boxes input your actual expenses. You may find the allowable standards at

|

|

|

|

|

|

|

Round to the nearest whole dollar. |

|

Food, clothing, and miscellaneous (e.g., housekeeping supplies, personal care products , minimum payment on credit card). |

|

(39) |

$ |

|||||

A reasonable estimate of these expenses may be used |

|

|||||||

Housing and utilities (e.g., rent or mortgage payment and average monthly cost of property taxes, home insurance, |

|

|

|

|||||

maintenance, dues, fees and utilities including electricity, gas, other fuels, trash collection, water, cable television and internet, |

|

|

|

|||||

telephone, and cell phone) |

|

|

monthly rent payment |

|

(40) |

$ |

||

|

|

|

|

|

|

|

|

|

Vehicle loan and/or lease payment(s) |

|

|

|

|

|

(41) |

$ |

|

|

|

|

|

|

|

|||

Vehicle operating costs (e.g., average monthly cost of maintenance, repairs, insurance, fuel, registrations, licenses, |

|

(42) |

$ |

|||||

inspections, parking, tolls, etc.). A reasonable estimate of these expenses may be used |

|

|||||||

Public transportation costs (e.g., average monthly cost of fares for mass transit such as bus, train, ferry, taxi, etc.). A |

|

|

|

|||||

reasonable estimate of these expenses may be used |

|

(43) |

$ |

|||||

Health insurance premiums |

|

|

|

|

|

(44) |

$ |

|

|

|

|

|

|

|

|||

|

(45) |

$ |

||||||

eyeglasses, hearing aids, etc.) |

|

|

|

|

|

|||

|

(46) |

$ |

||||||

|

|

|

|

|

|

|||

Child/dependent care payments (e.g., daycare, etc.) |

|

(47) |

$ |

|||||

|

|

|

|

|

|

|

|

|

Life insurance premiums |

|

|

|

|

|

(48) |

$ |

|

|

|

|

|

|

|

|||

Current monthly taxes (e.g., monthly cost of federal, state, and local tax, personal property tax, etc.) |

|

(49) |

$ |

|||||

|

|

|

|

|

|

|||

Secured debts/Other (e.g., any loan where you pledged an asset as collateral not previously listed, government guaranteed |

|

|

|

|||||

student loan, employer required retirement or dues) |

List debt(s)/expense(s) |

|

(50) |

$ |

||||

|

|

|

|

|

|

|

|

|

Enter the amount of your monthly delinquent state and/or local tax payment(s) . Total tax owed |

|

|

(51) |

$ |

||||

|

|

|

|

|

|

|

||

|

|

|

|

Round to the nearest whole dollar. |

|

Box E |

||

|

Do not enter a negative number. If any line item is a negative, enter "0" on that line. |

|

Total Household Expenses |

|||||

|

Add lines (39) through (51) and enter the amount in Box E = |

|

$ |

|

||||

|

|

|

|

Round to the nearest whole dollar. |

|

Box F |

||

|

Do not enter a negative number. If any line item is a negative, enter "0" on that line. |

|

Remaining Monthly Income |

|||||

|

Subtract Box E from Box D and enter the amount in Box F = |

|

$ |

|

||||

Catalog Number 55896Q |

|

www.irs.gov |

|

Form |

||||

Page 7

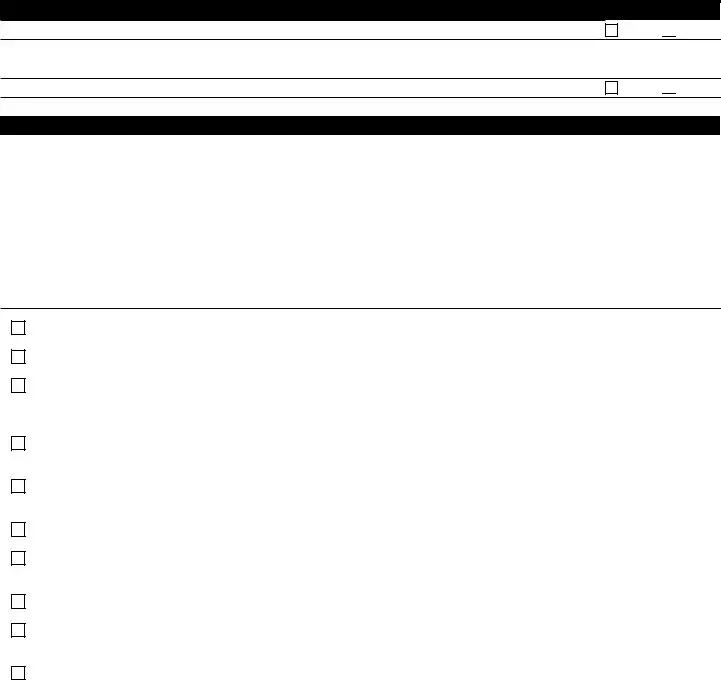

Section 8 |

Calculate Your Minimum Offer Amount |

The next steps calculate your minimum offer amount. The amount of time you take to pay your offer in full will affect your minimum offer amount. Paying over a shorter period of time will result in a smaller minimum offer amount.

Note: The multipliers below (12 and 24) and the calculated offer amount (which included the amount(s) allowed for vehicles and bank accounts) do not apply if the IRS determines you have the ability to pay your tax debt in full within the legal period to collect.

Round to the nearest whole dollar.

If you will pay your offer in 5 or fewer payments within 5 months or less, multiply "Remaining Monthly Income" (Box F) by 12 to get "Future Remaining Income" (Box G). Do not enter a number less than $0.

Enter the total from Box F

$

X 12 =

Box G Future Remaining Income

$

If you will pay your offer in 6 to 24 months, multiply "Remaining Monthly Income" (Box F) by 24 to get "Future Remaining Income" (Box H). Do not enter a number less than $0.

Enter the total from Box F

$

X 24 =

Box H Future Remaining Income

$

Determine your minimum offer amount by adding the total available assets from Box A and Box B (if applicable) to the amount in either Box G or Box H.

Enter the amount from Box A plus Box B (if applicable)

$

+

Enter the amount from either Box G or Box H

$

=

Offer Amount

Your offer must be more than zero ($0). Do not leave blank. Use whole dollars only.

$

If you cannot pay the Offer Amount shown above due to special circumstances, explain on the Form 656, Offer in Compromise, Section 3, Reason for Offer, Explanation of Circumstances. You must offer an amount more than $0.

Section 9 |

Other Information |

Additional information IRS needs to consider settlement of your tax debt. If you or your business are currently in a bankruptcy proceeding, you are not eligible to apply for an offer.

Are you a party to or involved in litigation (if yes, answer the following) |

|

|

|

|

|

|

|

Yes |

No |

||||

|

|

|

|

|

|

|

|

|

|

||||

Plaintiff |

Location of filing |

|

Represented by |

|

|

|

|

Docket/Case number |

|||||

Defendant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Amount of dispute |

Possible completion date (mmddyyyy) |

|

Subject of litigation |

|

|

|

|

|

|

|

|||

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Have you filed bankruptcy in the past 7 years (if yes, answer the following) |

|

|

|

|

|

Yes |

No |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date filed (mmddyyyy) |

|

Date dismissed (mmddyyyy) |

Date discharged (mmddyyyy) |

Petition no. |

|

Location filed |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In the past 10 years, have you lived outside of the U.S. for 6 months or longer (if yes, answer the following) |

|

|

|

Yes |

No |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||

Dates lived abroad: From (mmddyyyy) |

|

To (mmddyyyy) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||||

Are you or have you ever been party to any litigation involving the IRS/United States (including any tax litigation) |

|

|

|

Yes |

No |

||||||||

|

|

|

|

|

|

|

|

||||||

If yes and the litigation included tax debt, provide the types of tax and periods involved |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

||||||

Are you the beneficiary of a trust, estate, or life insurance policy (if yes, answer the following) |

|

|

|

|

|

Yes |

No |

||||||

|

|

|

|

|

|

|

|

|

|

|

|||

Place where recorded |

|

|

|

|

|

|

|

|

EIN |

|

|||

|

|

|

|

||||||||||

Name of the trust, estate, or policy |

|

Anticipated amount to be received |

When will the amount be received |

||||||||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Are you a trustee, fiduciary, or contributor of a trust |

|

|

|

|

|

|

|

Yes |

No |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of the trust |

|

|

|

|

|

|

|

|

EIN |

|

|||

|

|

|

|

|

|

|

|

||||||

Do you have a safe deposit box (business or personal) (if yes, answer the following) |

|

|

|

|

|

Yes |

No |

||||||

|

|

|

|

|

|

|

|

|

|

||||

Location (name, address and box number(s)) |

|

|

|

Contents |

|

|

|

Value |

|

||||

|

|

|

|

|

|

|

|

|

|

$ |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In the past 10 years, have you transferred any assets, including real property, for less than their full value (if yes, answer the following)

Yes

No

List asset(s) |

Value at time of transfer |

Date transferred (mmddyyyy) |

To whom or where was it transferred |

|

$ |

|

|

|

|

|

|

Catalog Number 55896Q |

www.irs.gov |

|

Form |

Section 9 (Continued)Other Information

Do you have any assets or own any real property outside the U.S.

If yes, provide description, location, and value

Do you have any funds being held in trust by a third party

If yes, how much $ |

Where |

Section 10 |

Signatures |

Page 8

Yes

No

No

Yes

No

No

Under penalties of perjury, I declare that I have examined this offer, including accompanying documents, and to the best of my knowledge it is true, correct, and complete.

►Signature of Taxpayer

►Signature of Spouse

Remember to include all applicable attachments listed below.

Copies of the most recent pay stub, earnings statement, etc., from each employer.

Copies of the most recent statement for each investment and retirement account.

Copies of the most recent statement, etc., from all other sources of income such as pensions, Social Security, rental income, interest and dividends (including any received from a related partnership, corporation, LLC, LLP, etc.), court order for child support, alimony, royalties, and rent subsidies.

Copies of individual complete bank statements for the three most recent months. If you operate a business, copies of the six most recent complete statements for each business bank account.

Copies of the most recent statement from lender(s) on loans such as mortgages, second mortgages, vehicles, etc., showing monthly payments, loan payoffs, and balances.

List of Accounts Receivable or Notes Receivable, if applicable.

Verification of delinquent State/Local Tax Liability showing total delinquent state/local taxes and amount of monthly payments, if applicable.

Copies of court orders for child support/alimony payments claimed in monthly expense section.

Copies of Trust documents if applicable per Section 9.

Documentation to support any special circumstances described in the “Explanation of Circumstances” on Form 656, if applicable.

Attach a Form 2848, Power of Attorney, if you would like your attorney, CPA, or enrolled agent to represent you and you do not have a current form on file with the IRS. Make sure the current tax year is included.

Completed and signed current Form 656.

Catalog Number 55896Q |

www.irs.gov |

Form |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 433-A (OIC) is used by individuals to apply for an Offer in Compromise, allowing them to settle their tax debt for less than the full amount owed. |

| Eligibility | To be eligible to submit Form 433-A (OIC), individuals must have filed all required tax returns and made any required estimated tax payments. |

| Contents | The form requires detailed financial information, including income, expenses, assets, and liabilities, to evaluate the applicant's ability to pay. |

| Supporting Documents | Applicants must also submit supporting documents, such as pay stubs, bank statements, and property valuations, to verify the information provided on the form. |

| Submission Process | Form 433-A (OIC) and all supporting documentation must be submitted to the IRS, along with Form 656, Offer in Compromise, and the application fee, if applicable. |

| Application Fee and Initial Payment | Most applicants are required to pay a non-refundable application fee and an initial payment towards their tax debt as part of the offer submission. |

| Governing Law | The Offer in Compromise program, including the submission of Form 433-A (OIC), is governed by federal tax laws and regulations. |

| State-Specific Offers | Some states have their own Offer in Compromise programs with separate forms and requirements. The governing laws vary by state. |

Guide to Writing IRS 433-A (OIC)

Navigating the IRS 433-A (OIC) form can initially seem daunting, but with a clear, step-by-step approach, it becomes manageable. This form plays a crucial role for individuals seeking to make an Offer in Compromise (OIC) to the IRS, potentially allowing them to settle their tax liabilities for less than the full amount owed. To ensure accuracy and improve the chances of your offer being accepted, it's crucial to understand and meticulously fill out this form. Below are the steps needed to complete the IRS 433-A (OIC) form properly.

- Start by gathering all necessary financial documents. This includes your most recent tax return, bank statements, pay stubs, and records of expenses. These documents will support the information you'll provide in the form.

- Read through the entire form before filling anything out. This will give you a comprehensive overview of what's required and help prevent errors.

- Fill out the Basic Information section. This part requires straightforward details like your name, Social Security number, address, and marital status.

- Proceed to the Employment Information For Wage Earners section if you are employed. Here, you'll need to provide details about your employment, including the name and address of your employer, your occupation, and how often you get paid.

- Self-employed individuals should fill out the Business Information section, detailing the type of business, address, information about any partners, and the gross monthly business income

- Document your Asset Information, including cash, investments, available credit, life insurance, real property, vehicles, and personal assets. Be as accurate as possible, providing current market values and any owed amounts.

- In the Monthly Income and Expense section, precisely list all forms of income and routine expenses. This part helps the IRS understand your financial situation in detail.

- For the Other Information section, respond to various questions regarding your financial history, business affiliations, transfer of assets, and more. Complete honesty is crucial here to avoid potential legal issues.

- Review your form carefully. Mistakes or omitted information can lead to delays or rejection of your OIC.

- Sign and date the form. By signing, you're certifying that all information provided is complete and accurate to the best of your knowledge.

After completing the IRS 433-A (OIC) form, the next steps involve compiling any required supporting documentation and submitting your package to the IRS. Be aware that the IRS thoroughly reviews each offer, which can take time. Meanwhile, stay on top of any current tax obligations to avoid new debts. Remember, successfully navigating this process requires patience, precision, and honest disclosure of all relevant financial details.

Understanding IRS 433-A (OIC)

-

What is the IRS 433-A (OIC) Form?

The IRS 433-A (OIC) form, also known as the Collection Information Statement for Wage Earners and Self-Employed Individuals, is a document used by individuals to apply for an Offer in Compromise (OIC) with the IRS. An OIC allows taxpayers to settle their tax debt for less than the full amount they owe. It’s part of a program designed for those who are unable to pay their full tax liabilities due to financial hardship, allowing a fresh start. This form provides the IRS with detailed information about the taxpayer’s income, expenses, assets, and liabilities.

-

Who needs to fill out the IRS 433-A (OIC) form?

This form is specifically designed for wage earners and self-employed individuals seeking an Offer in Compromise. If you're facing financial difficulty and believe you qualify for an OIC, completing this form is a crucial step. The IRS utilizes the information provided to assess your ability to pay your tax debt. It’s important for anyone considering this avenue to understand that not all tax debts are eligible for an OIC, so it’s recommended to review the eligibility criteria first or consult with a tax professional.

-

What information do you need to complete the form?

- Personal information: Full name, Social Security Number (SSN), and contact details.

- Employment details: Information about your employer or your business if self-employed.

- Financial details: Comprehensive data on your monthly income and expenses, asset information (such as cash, investments, and available credit), and details of your liabilities and debt.

Accurately filling out this information is critical in helping the IRS understand your financial situation and determine your eligibility for an OIC.

-

How do you submit the IRS 433-A (OIC) form?

After completing the form, you should review it carefully to ensure all information is accurate and no section has been left blank. The form, accompanied by all required documentation and the application fee (if applicable), should be submitted to the IRS address provided in the form instructions. Remember, the application process also involves submitting Form 656, Offer in Compromise, along with the 433-A (OIC). The process can be complex, and many individuals opt to seek professional advice to navigate it successfully.

-

What happens after you submit the form?

Once your Form 433-A (OIC) and all accompanying paperwork are received, the IRS will review your application. This review process includes verifying the information you’ve provided and assessing your overall financial situation to make a decision on your OIC request. The IRS may request additional information or documentation. If your offer is accepted, you will receive written notification detailing the terms of your agreement and instructions for fulfilling your end of the bargain. If your offer is rejected, you have the option to appeal the decision.

Common mistakes

Filling out the IRS 433-A (OIC) form, which is used for an Offer in Compromise to settle tax debts for less than the full amount owed, can be tricky. People often make mistakes during this process, which can lead to delays or even rejections of their offer. Paying attention to detail and avoiding these common errors can significantly increase the chances of having your offer accepted.

Not reporting all income sources: It's essential to list all sources of income accurately. Missing even a small part-time job can raise questions about the completeness and honesty of your application.

Overlooking or underestimating expenses: Many people either forget to include certain living expenses or underestimate the amount they spend monthly. This can make it appear as though you have more disposable income than you actually do, potentially reducing the likelihood of your offer being accepted.

Failing to include all debts and liabilities: Just like income and expenses, all debts and liabilities must be disclosed. Omitting this information can portray an inaccurate financial situation.

Not providing sufficient documentation: The IRS requires proof for nearly every claim made on the form. Failing to attach the necessary documents or providing incomplete records can lead to processing delays or offer denial.

Miscalculating the offer amount: This critical mistake can stem from not understanding the guidelines or simple mathematical errors. An incorrectly calculated offer might be automatically rejected.

Ignoring the details of asset valuation: When valuing your assets, it's important to be realistic and follow the guidelines provided. Overvaluing or undervaluing assets can cause issues with your application.

Incorrectly using the form: The IRS 433-A (OIC) form is designed for individuals. Using this form for business taxes or failing to fill out every required section can result in an incomplete submission.

Forgetting to sign and date the form: This might seem minor, but an unsigned or undated form is considered incomplete and will not be processed until corrected.

Misunderstanding eligibility requirements: Submitting an Offer in Compromise without fully understanding the eligibility criteria can lead to a wasted effort if the IRS deems you not eligible.

Avoiding these mistakes requires careful attention to detail and a thorough understanding of the IRS guidelines concerning the Offer in Compromise program. When in doubt, seeking assistance from a tax professional can provide clarity and improve the chances of a favorable outcome.

Documents used along the form

Filling out the IRS 433-A (OIC) form is a crucial step for individuals seeking to settle tax debts through an Offer in Compromise (OIC) with the Internal Revenue Service. However, to provide a comprehensive picture of their financial situation and convince the IRS that they are not in a position to pay the full debt, individuals often need to submit additional documents and forms alongside the 433-A (OIC). Here is a list of documents frequently associated with the process, each serving a unique but complementary role in assembling a compelling case for an OIC.

- Form 656: Broadly, this form is the actual Offer in Compromise application where the taxpayer proposes the amount they can pay. It complements the 433-A by attaching a monetary proposal to the financial details provided.

- Form 2848, Power of Attorney and Declaration of Representative: This document allows taxpayers to appoint an individual, often a lawyer or accountant, to represent them in dealings with the IRS, including the negotiation of an OIC.

- Form 4506-T, Request for Transcript of Tax Return: A request for a transcript of past tax returns can be necessary to provide the IRS with a taxpayer’s history and insight into their past earnings and filings.

- Bank Statements: Recent bank statements are typically required to offer a current view of an individual’s financial situation, verifying the information provided on the 433-A form.

- Proof of Income: This can include recent pay stubs, business income statements, or other documents evidencing current income to support the income figures listed on the 433-A.

- Property Appraisals: For individuals who own property, recent appraisals can give the IRS a clear picture of the value of significant assets, potentially affecting the offer terms.

- Vehicle Registration and Valuation: Like property appraisals, documentation concerning vehicles the taxpayer owns, including current valuation and registration, may be required for a complete financial assessment.

- Credit Report: Occasionally, a current credit report might be requested to assess liabilities and existing debt obligations, complementing the liabilities stated on the 433-A.

- Monthly Expense Documentation: This can range from utility bills to grocery receipts and is essential for verifying the living expenses claimed on the 433-A form.