Get IRS 433-A Form

Navigating the intricate landscape of tax obligations can be a daunting task for individuals, particularly when they find themselves unable to meet their due payments to the IRS. At the heart of the resolution process for those facing such financial hurdles is the IRS Form 433-A, a critical document used to collect detailed financial information from taxpayers. This comprehensive form serves a dual purpose: it assists the IRS in evaluating an individual's financial situation and helps in determining a feasible payment plan or settlement. By meticulously gathering data on a person's income, expenses, assets, and liabilities, the IRS Form 433-A effectively paves the way for negotiations between taxpayers and the federal tax authority. Submitting this form is a pivotal step for individuals striving to navigate through their tax dilemmas, offering a beacon of hope towards achieving financial stability and compliance. Understanding the nuances of this form, from its purpose to its parts, is essential for those embarking on the path to resolve their tax issues.

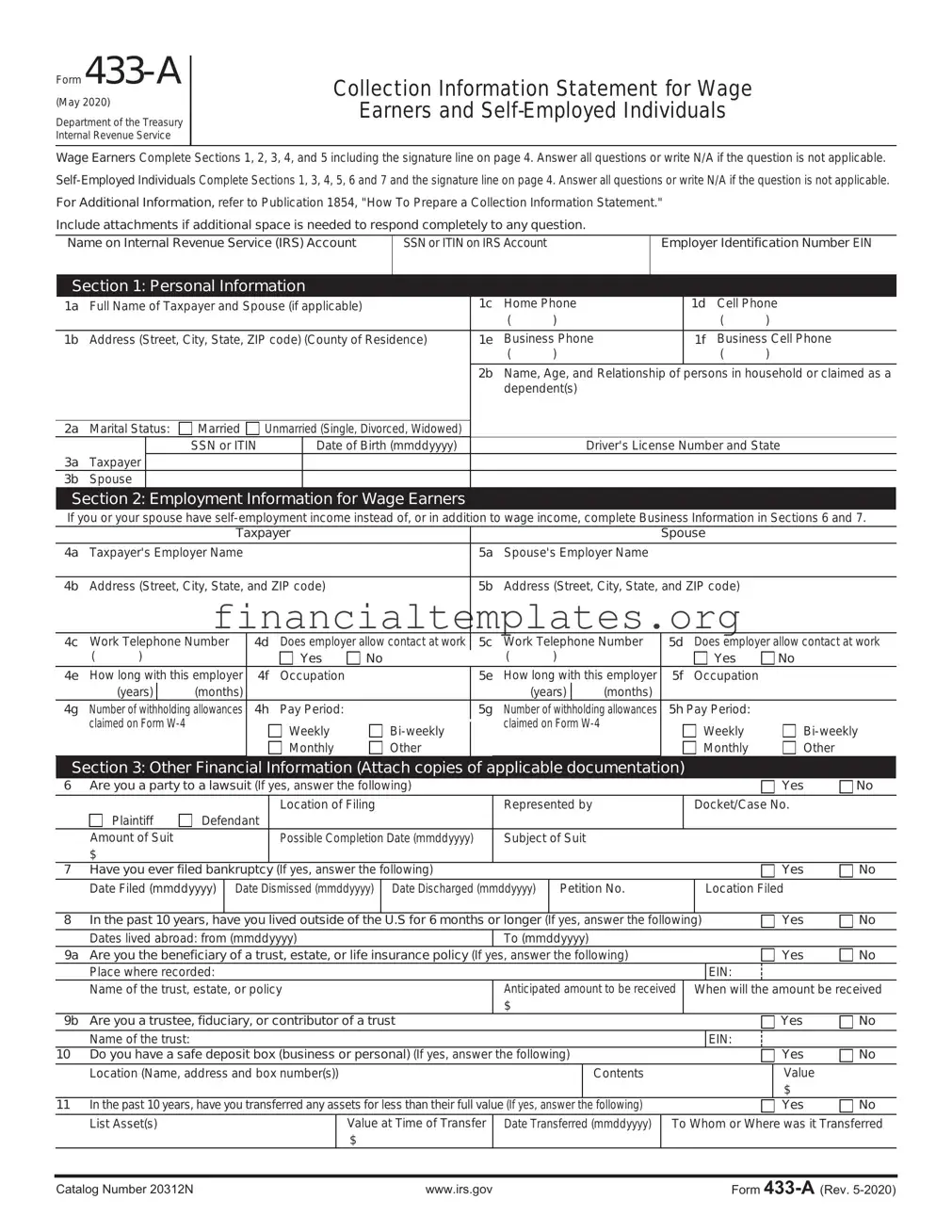

IRS 433-A Example

Form

(May 2020)

Department of the Treasury Internal Revenue Service

Collection Information Statement for Wage

Earners and

Wage Earners Complete Sections 1, 2, 3, 4, and 5 including the signature line on page 4. Answer all questions or write N/A if the question is not applicable.

For Additional Information, refer to Publication 1854, "How To Prepare a Collection Information Statement."

Include attachments if additional space is needed to respond completely to any question.

Name on Internal Revenue Service (IRS) Account |

SSN or ITIN on IRS Account |

Employer Identification Number EIN |

|

|

|

Section 1: Personal Information

1a |

Full Name of Taxpayer and Spouse (if applicable) |

1c |

Home Phone |

1d |

Cell Phone |

|||||||

|

|

|

|

|

|

|

( |

) |

|

( |

) |

|

1b |

Address (Street, City, State, ZIP code) (County of Residence) |

1e |

Business Phone |

1f |

Business Cell Phone |

|||||||

|

|

|

|

|

|

|

( |

) |

|

( |

) |

|

|

|

|

|

|

|

2b |

Name, Age, and Relationship of |

persons in household or claimed as a |

|

|||

|

|

|

|

|

|

|

dependent(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2a |

Marital Status: |

Married |

Unmarried (Single, Divorced, Widowed) |

|

|

|

|

|

|

|

||

3a |

Taxpayer |

|

SSN or ITIN |

|

Date of Birth (mmddyyyy) |

|

|

Driver's License Number and State |

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

3b |

Spouse |

|

|

|

|

|

|

|

|

|

|

|

Section 2: Employment Information for Wage Earners

If you or your spouse have

|

|

|

|

Taxpayer |

|

|

|

|

|

|

|

Spouse |

|

|

||

4a |

Taxpayer's Employer Name |

|

|

|

5a |

Spouse's Employer Name |

|

|

|

|||||||

|

|

|

|

|

|

|

||||||||||

4b |

Address (Street, City, State, and ZIP code) |

|

5b |

Address (Street, City, State, and ZIP code) |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

||||||||

4c |

Work Telephone Number |

4d |

Does employer allow contact at work |

5c |

Work Telephone Number |

5d Does employer allow contact at work |

|

|||||||||

|

( |

) |

|

|

|

Yes |

No |

|

|

( |

) |

|

|

Yes |

No |

|

4e |

How long with this employer |

4f |

Occupation |

|

5e |

How long with this employer |

5f Occupation |

|

|

|||||||

|

|

(years) |

|

(months) |

|

|

|

|

|

|

(years) |

|

(months) |

|

|

|

4g |

Number of withholding allowances |

4h |

Pay Period: |

|

5g |

Number of withholding allowances |

5h Pay Period: |

|

|

|||||||

|

claimed on Form |

|

|

Weekly |

|

|

claimed on Form |

|

Weekly |

|||||||

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

Monthly |

Other |

|

|

|

|

|

|

Monthly |

Other |

|

Section 3: Other Financial Information (Attach copies of applicable documentation)

6 |

Are you a party to a lawsuit (If yes, answer the following) |

|

|

|

|

|

|

|

Yes |

No |

||||||

|

Plaintiff |

Defendant |

Location of Filing |

Represented by |

|

|

Docket/Case No. |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Amount of Suit |

|

|

Possible Completion Date (mmddyyyy) |

Subject of Suit |

|

|

|

|

|

|

|

||||

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Have you ever filed bankruptcy |

(If yes, answer the following) |

|

|

|

|

|

|

|

Yes |

No |

|||||

|

Date Filed (mmddyyyy) |

Date Dismissed (mmddyyyy) |

Date Discharged (mmddyyyy) |

Petition No. |

|

|

|

Location Filed |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

8 |

In the past 10 years, have you lived outside of the U.S for 6 months or longer (If yes, answer the following) |

|

Yes |

No |

||||||||||||

|

Dates lived abroad: from (mmddyyyy) |

To (mmddyyyy) |

|

|

|

|

|

|

|

|||||||

9a |

Are you the beneficiary of a trust, estate, or life insurance policy (If yes, answer the following) |

|

|

|

|

Yes |

No |

|||||||||

|

Place where recorded: |

|

|

|

|

|

|

|

|

|

|

EIN: |

|

|

||

|

Name of the trust, estate, or policy |

Anticipated amount to be received |

|

When will the amount be received |

||||||||||||

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

9b |

Are you a trustee, fiduciary, or contributor of a trust |

|

|

|

|

|

|

|

Yes |

No |

||||||

|

Name of the trust: |

|

|

|

|

|

|

|

|

|

|

|

EIN: |

|

|

|

10 |

Do you have a safe deposit box (business or personal) (If yes, answer the following) |

|

|

|

|

Yes |

No |

|||||||||

|

Location (Name, address and box number(s)) |

|

|

Contents |

|

|

|

|

Value |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

11 |

In the past 10 years, have you transferred any assets for less than their full value (If yes, answer the following) |

|

|

|

|

Yes |

No |

|||||||||

|

List Asset(s) |

|

|

|

Value at Time of Transfer |

Date Transferred (mmddyyyy) |

To Whom or Where was it Transferred |

|||||||||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Catalog Number 20312N |

|

|

|

|

www.irs.gov |

|

|

|

|

|

|

Form |

|

|||

Form |

Page 2 |

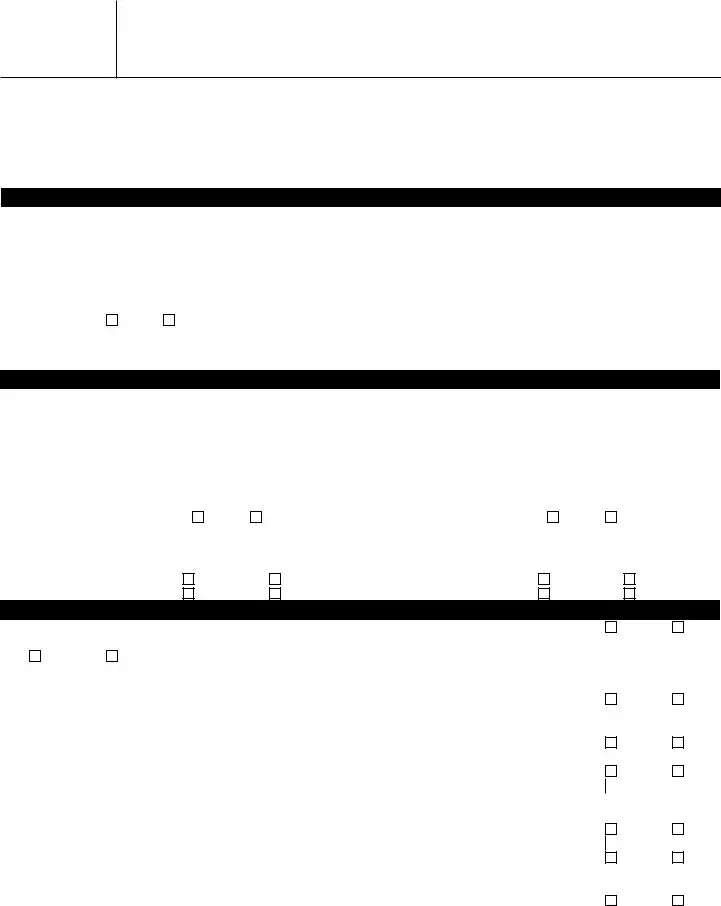

Section 4: Personal Asset Information for all Individuals (Foreign and Domestic)

12 CASH ON HAND Include cash that is not in a bank |

Total Cash on Hand |

$

PERSONAL BANK ACCOUNTS Include all checking, online and mobile (e.g., PayPal etc.) accounts, money market accounts, savings accounts, and stored value cards (e.g., payroll cards, government benefit cards, etc.).

|

Type of Account |

Full Name & Address (Street, City, State, ZIP code) of Bank, |

Account Number |

Account Balance |

||

|

As of |

|

|

|||

|

Savings & Loan, Credit Union, or Financial Institution |

|

|

|||

|

mmddyyyy |

|||||

|

|

|

|

|

||

13a |

|

|

|

$ |

|

|

13b |

|

|

|

$ |

|

|

13c |

Total Cash (Add lines 13a, 13b, and amounts from any attachments) |

|

$ |

|

|

|

INVESTMENTS Include stocks, bonds, mutual funds, stock options, certificates of deposit, and retirement assets such as IRAs, Keogh, 401(k) plans and commodities (e.g., gold, silver, copper, etc.). Include all corporations, partnerships, limited liability companies, or other business entities in which you are an officer, director, owner, member, or otherwise have a financial interest. Include attachment(s) if additional space is needed to respond.

Type of Investment |

Full Name & Address |

Current Value |

Loan Balance (if applicable) |

Equity |

|||

As of |

|||||||

or Financial Interest |

(Street, City, State, ZIP code) of Company |

Value minus Loan |

|||||

|

|

|

|

mmddyyyy |

|

|

|

14a |

|

|

|

|

|

|

|

|

Phone |

$ |

$ |

|

|

$ |

|

14b |

|

|

|

|

|

|

|

Phone

$

$

$

VIRTUAL CURRENCY (CRYPTOCURRENCY) List all virtual currency you own or in which you have a financial interest. (e.g., Bitcoin, Ethereum, Litecoin, Ripple, etc.) If applicable, attach a statement with each virtual currency’s public key.

|

|

|

|

Name of Virtual Currency Wallet, |

Email Address Used to |

Location(s) of Virtual Currency |

Virtual Currency |

|||||||||||

Type of Virtual Currency |

|

Amount and Value in |

||||||||||||||||

|

Exchange or Digital Currency |

With the Virtual Currency |

(Mobile Wallet, Online, and/or |

US dollars as of |

||||||||||||||

|

|

|

|

|

Exchange (DCE) |

Exchange or DCE |

|

External Hardware storage) |

today (e.g., 10 Bitcoins |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$64,600.00 USD) |

||

14c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14e |

Total Equity (Add lines 14a through 14d and amounts from any attachments) |

|

|

|

|

|

|

$ |

|

|

||||||||

AVAILABLE CREDIT Include all lines of credit and bank issued credit cards. |

|

|

|

|

|

|

|

|

|

|||||||||

|

Full Name & Address (Street, City, State, ZIP code) of Credit Institution |

|

Credit Limit |

|

Amount Owed |

Available Credit |

||||||||||||

|

|

|

As of |

As of |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mmddyyyy |

|

|

mmddyyyy |

|

15a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acct. No |

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

15b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acct. No |

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

15c |

Total Available Credit (Add lines 15a, 15b and amounts from any attachments) |

|

|

|

|

|

|

$ |

|

|

||||||||

16a |

LIFE INSURANCE Do you own or have any interest in any life insurance policies with cash value (Term Life insurance does |

not have a cash value) |

||||||||||||||||

|

Yes |

No |

|

If yes, complete blocks 16b through 16f for each policy. |

|

|

|

|

|

|

|

|

||||||

16b |

Name and Address of Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Company(ies): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16c |

Policy Number(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16d |

Owner of Policy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16e |

Current Cash Value |

|

|

|

|

$ |

|

$ |

|

|

|

|

|

$ |

|

|

|

|

16f |

Outstanding Loan Balance |

|

$ |

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|||

16g |

Total Available Cash (Subtract amounts on line 16f from line 16e and include amounts from any attachments) |

$ |

|

|

||||||||||||||

Catalog Number 20312N |

www.irs.gov |

Form |

Form |

|

|

|

|

|

|

|

|

|

Page 3 |

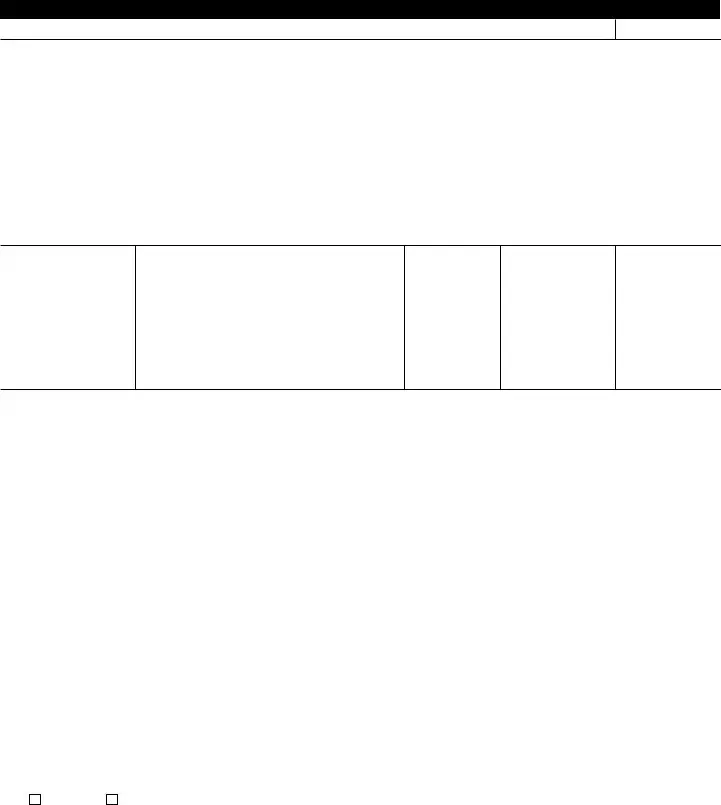

||

REAL PROPERTY Include all real property owned or being purchased |

|

|

|

|

|

|||||||

|

|

|

|

Purchase Date |

|

Current Fair |

Current Loan |

Amount of |

Date of Final |

Equity |

||

|

|

|

|

(mmddyyyy) |

|

Market Value |

Balance |

Monthly Payment |

Payment |

FMV Minus Loan |

||

|

|

|

|

|

(FMV) |

(mmddyyyy) |

||||||

17a |

Property Description |

|

$ |

|

|

$ |

$ |

|

|

$ |

||

|

|

|

|

|

|

|

|

|

||||

|

Location (Street, City, State, ZIP code) and County |

|

Lender/Contract Holder Name, Address (Street, City, State, ZIP code), and Phone |

|||||||||

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

17b |

Property Description |

|

$ |

|

|

$ |

$ |

|

|

$ |

||

|

|

|

|

|

|

|

|

|

||||

|

Location (Street, City, State, ZIP code) and County |

|

Lender/Contract Holder Name, Address (Street, City, State, ZIP code), and Phone |

|||||||||

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

17c Total Equity (Add lines 17a, 17b and amounts from any attachments) |

|

|

|

$ |

|

|||||||

PERSONAL VEHICLES LEASED AND PURCHASED Include boats, RVs, motorcycles, |

||||||||||||

Description (Year, Mileage, Make/Model, |

Purchase/ |

|

Current Fair |

Current Loan |

Amount of |

Date of Final |

Equity |

|||||

Lease Date |

|

Market Value |

Payment |

|||||||||

Tag Number, Vehicle Identification Number) |

(mmddyyyy) |

|

(FMV) |

Balance |

Monthly Payment |

(mmddyyyy) |

FMV Minus Loan |

|||||

18a Year |

|

Make/Model |

|

$ |

|

|

$ |

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||||

|

Mileage |

|

License/Tag Number |

Lender/Lessor |

Name, Address |

(Street, City, State, |

ZIP code), and Phone |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle Identification Number |

|

|

|

|

|

Phone |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

18b Year |

|

Make/Model |

|

$ |

|

|

$ |

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||||

|

Mileage |

|

License/Tag Number |

Lender/Lessor |

Name, Address |

(Street, City, State, |

ZIP code), and Phone |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle Identification Number |

|

|

|

|

|

Phone |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

18c Total Equity (Add lines 18a, 18b and amounts from any attachments)

$

PERSONAL ASSETS Include all furniture, personal effects, artwork, jewelry, collections (coins, guns, etc.), antiques or other assets. Include intangible assets such as licenses, domain names, patents, copyrights, mining claims, etc.

|

Purchase/ |

|

Current Fair |

Current Loan |

Amount of |

Date of Final |

Equity |

|||

|

Lease Date |

|

Market Value |

Payment |

||||||

|

(mmddyyyy) |

|

(FMV) |

Balance |

Monthly Payment |

(mmddyyyy) |

FMV Minus Loan |

|||

19a Property Description |

|

|

$ |

|

|

$ |

$ |

|

|

$ |

|

|

|

|

|

|

|

||||

Location (Street, City, State, ZIP code) and County |

|

Lender/Lessor Name, Address (Street, City, State, ZIP code), and Phone |

||||||||

|

|

|

|

|

|

|

Phone |

|

|

|

19b Property Description |

|

|

$ |

|

|

$ |

$ |

|

|

$ |

|

|

|

|

|

|

|

||||

Location (Street, City, State, ZIP code) and County |

|

Lender/Lessor Name, Address (Street, City, State, ZIP code), and Phone |

||||||||

|

|

|

|

|

|

|

Phone |

|

|

|

19c Total Equity (Add lines 19a, 19b and amounts from any attachments) |

|

|

|

$ |

|

|||||

Catalog Number 20312N |

www.irs.gov |

Form |

Form |

Page 4 |

|

If you are |

Section 5: Monthly Income and Expenses

Monthly Income/Expense Statement (For additional information, refer to Publication 1854.)

|

Total Income |

|

|

|

Total Living Expenses |

|

IRS USE ONLY |

|

Source |

|

Gross Monthly |

|

Expense Items 6 |

Actual Monthly |

Allowable Expenses |

20 |

Wages (Taxpayer) 1 |

$ |

|

35 |

Food, Clothing and Misc. 7 |

$ |

|

21 |

Wages (Spouse) 1 |

$ |

|

36 |

Housing and Utilities 8 |

$ |

|

22 |

Interest - Dividends |

$ |

|

37 |

Vehicle Ownership Costs 9 |

$ |

|

23 |

Net Business Income 2 |

$ |

|

38 |

Vehicle Operating Costs 10 |

$ |

|

24 |

Net Rental Income 3 |

$ |

|

39 |

Public Transportation 11 |

$ |

|

25 |

Distributions |

$ |

|

40 |

Health Insurance |

$ |

|

26 |

Pension (Taxpayer) |

$ |

|

41 |

Out of Pocket Health Care Costs 12 |

$ |

|

27 |

Pension (Spouse) |

$ |

|

42 |

Court Ordered Payments |

$ |

|

28 |

Social Security (Taxpayer) |

$ |

|

43 |

Child/Dependent Care |

$ |

|

29 |

Social Security (Spouse) |

$ |

|

44 |

Life Insurance |

$ |

|

30 |

Child Support |

$ |

|

45 |

Current year taxes (Income/FICA) 13 |

$ |

|

31 |

Alimony |

$ |

|

46 |

Secured Debts (Attach list) |

$ |

|

|

Other Income (Specify below) 5 |

|

|

47 |

Delinquent State or Local Taxes |

$ |

|

32 |

|

$ |

|

48 |

Other Expenses (Attach list) |

$ |

|

33 |

|

$ |

|

49 |

Total Living Expenses (add lines |

$ |

|

34 |

Total Income (add lines |

$ |

|

50 |

Net difference (Line 34 minus 49) |

$ |

|

1Wages, salaries, pensions, and social security: Enter gross monthly wages and/or salaries. Do not deduct tax withholding or allotments taken out of pay, such as insurance payments, credit union deductions, car payments, etc. To calculate the gross monthly wages and/or salaries:

If paid weekly - multiply weekly gross wages by 4.3. Example: $425.89 x 4.3 = $1,831.33

If paid biweekly (every 2 weeks) - multiply biweekly gross wages by 2.17. Example: $972.45 x 2.17 = $2,110.22

If paid semimonthly (twice each month) - multiply semimonthly gross wages by 2. Example: $856.23 x 2 = $1,712.46

2Net Income from Business: Enter monthly net business income. This is the amount earned after ordinary and necessary monthly business expenses are paid. This figure is the amount from page 6, line 89. If the net business income is a loss, enter “0”. Do not enter a negative number. If this amount is more or less than previous years, attach an explanation.

3Net Rental Income: Enter monthly net rental income. This is the amount earned after ordinary and necessary monthly rental expenses are paid. Do not include deductions for depreciation or depletion. If the net rental income is a loss, enter “0.” Do not enter a negative number.

4Distributions: Enter the total distributions from partnerships and subchapter S corporations reported on Schedule

5Other Income: Include agricultural subsidies, unemployment compensation, gambling income, oil credits, rent subsidies, sharing economy income from providing

6Expenses not generally allowed: We generally do not allow tuition for private schools, public or private college expenses, charitable contributions, voluntary retirement contributions or payments on unsecured debts. However, we may allow the expenses if proven that they are necessary for the health and welfare of the individual or family or the production of income. See Publication 1854 for exceptions.

7Food, Clothing and Miscellaneous: Total of food, clothing, housekeeping supplies, and personal care products for one month. The miscellaneous allowance is for expenses incurred that are not included in any other allowable living expense items. Examples are credit card payments, bank fees and charges, reading material, and school supplies.

8Housing and Utilities: For principal residence: Total of rent or mortgage payment. Add the average monthly expenses for the following: property taxes, homeowner’s or renter’s insurance, maintenance, dues, fees, and utilities. Utilities include gas, electricity, water, fuel, oil, other fuels, trash collection, telephone, cell phone, cable television and internet services.

9Vehicle Ownership Costs: Total of monthly lease or purchase/loan payments.

10Vehicle Operating Costs: Total of maintenance, repairs, insurance, fuel, registrations, licenses, inspections, parking, and tolls for one month.

11Public Transportation: Total of monthly fares for mass transit (e.g., bus, train, ferry, taxi, etc.)

12Out of Pocket Health Care Costs: Monthly total of medical services, prescription drugs and medical supplies (e.g., eyeglasses, hearing aids, etc.)

13Current Year Taxes: Include state and Federal taxes withheld from salary or wages, or paid as estimated taxes.

Certification: Under penalties of perjury, I declare that to the best of my knowledge and belief this statement of assets, liabilities, and other information is true, correct, and complete.

Taxpayer's Signature

Spouse's signature

Date

After we review the completed Form

IRS USE ONLY (Notes)

Catalog Number 20312N |

www.irs.gov |

Form |

Form |

|

Page 5 |

Sections 6 and 7 must be completed only if you are |

||

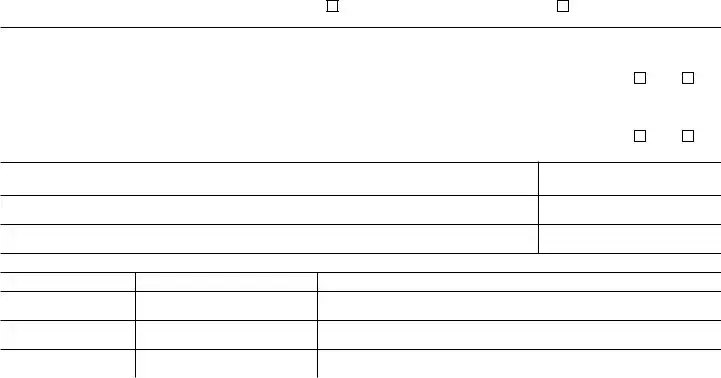

Section 6: Business Information |

|

|

51 Is the business a sole proprietorship (filing Schedule C) |

Yes, Continue with Sections 6 and 7. |

No, Complete Form |

All other business entities, including limited liability companies, partnerships or corporations, must complete Form

52Business Name & Address (if different than 1b)

53 |

Employer Identification Number |

54 Type of Business |

|

|

55 |

Is the business a |

Yes |

No |

|

|

|

|

|

|

Federal Contractor |

||

56 |

Business Website (web address) |

57 |

Total Number of Employees |

58 |

Average Gross Monthly Payroll |

|

||

|

|

|

|

|

|

|

||

59 |

Frequency of Tax Deposits |

60 |

Does the business engage in |

Yes |

No |

|||

|

|

|

|

(Internet sales) If yes, complete lines 61a and 61b |

||||

PAYMENT PROCESSOR (e.g., PayPal, Authorize.net, Google Checkout, etc.) Include virtual currency wallet, exchange or digital currency exchange.

Name & Address (Street, City, State, ZIP code). Name & Address (Street, City, State, ZIP code) |

Payment Processor Account Number |

61a

61b

CREDIT CARDS ACCEPTED BY THE BUSINESS

Credit Card

Merchant Account Number

Issuing Bank Name & Address (Street, City, State, ZIP code)

62a

62b

62c

63 BUSINESS CASH ON HAND Include cash that is not in a bank. |

Total Cash on Hand |

$ |

BUSINESS BANK ACCOUNTS Include checking accounts, online and mobile (e.g., PayPal) accounts, money market accounts, savings accounts, and stored value cards (e.g., payroll cards, government benefit cards, etc.). Report Personal Accounts in Section 4.

|

Type of Account |

Full name & Address (Street, City, State, ZIP code) |

Account Number |

Account Balance |

||

|

As of |

|

|

|||

|

of Bank,Savings & Loan, Credit Union or Financial Institution. |

|

|

|||

|

mmddyyyy |

|||||

|

|

|

|

|

||

64a |

|

|

|

$ |

|

|

64b |

|

|

|

$ |

|

|

64c |

Total Cash in Banks (Add lines 64a, 64b and amounts from any attachments) |

|

$ |

|

|

|

ACCOUNTS/NOTES RECEIVABLE Include

Accounts/Notes Receivable & Address (Street, City, State, ZIP code) |

Status (e.g., age, |

Date Due |

Invoice Number or Government |

Amount Due |

factored, other) |

(mmddyyyy) |

Grant or Contract Number |

||

65a |

|

|

|

$ |

65b |

|

|

|

$ |

65c |

|

|

|

$ |

65d |

|

|

|

$ |

65e |

|

|

|

$ |

65f Total Outstanding Balance (Add lines 65a through 65e and amounts from any attachments) |

|

$ |

||

Catalog Number 20312N |

www.irs.gov |

Form |

Form |

Page 6 |

BUSINESS ASSETS Include all tools, books, machinery, equipment, inventory or other assets used in trade or business. Include a list and show the value of all intangible assets such as licenses, patents, domain names, copyrights, trademarks, mining claims, etc.

|

|

Purchase/ |

|

Current Fair |

Current Loan |

Amount of |

Date of Final |

Equity |

|

|

|

Lease Date |

|

Market Value |

Payment |

||||

|

|

(mmddyyyy) |

|

(FMV) |

Balance |

Monthly Payment |

(mmddyyyy) |

FMV Minus Loan |

|

66a |

Property Description |

|

$ |

|

|

$ |

$ |

|

$ |

|

|

|

|

|

|

||||

|

Location (Street, City, State, ZIP code) and Country |

|

|

Lender/Lessor/Landlord |

Name, Address (Street, |

City, State, ZIP code), and Phone |

|||

|

|

|

|

|

|

|

Phone |

|

|

66b |

Property Description |

|

$ |

|

|

$ |

$ |

|

$ |

|

|

|

|

|

|

||||

Location (Street, City, State, ZIP code) and Country

Lender/Lessor/Landlord Name, Address (Street, City, State, ZIP code), and Phone

Phone

66c Total Equity (Add lines 66a, 66b and amounts from any attachments)

$

Section 7 should be completed only if you are

Section 7: Sole Proprietorship Information (lines 67 through 87 should reconcile with business Profit and Loss Statement)

Accounting Method Used:

Cash

Accrual

Use the prior 3, 6, 9 or 12 month period to determine your typical business income and expenses.

Income and Expenses during the period (mmddyyyy) |

|

|

to (mmddyyyy) |

|

||

Provide a breakdown below of your average monthly income and expenses, based on the period |

of time used above. |

|

||||

|

Total Monthly Business Income |

|

Total Monthly Business Expenses (Use attachments as needed) |

|||

|

Source |

Gross Monthly |

|

Expense Items |

Actual Monthly |

|

67 |

Gross Receipts |

$ |

77 |

Materials Purchased 1 |

$ |

|

68 |

Gross Rental Income |

$ |

78 |

Inventory Purchased 2 |

$ |

|

69 |

Interest |

$ |

79 |

Gross Wages & Salaries |

$ |

|

70 |

Dividends |

$ |

80 |

Rent |

$ |

|

71 |

Cash Receipts not included in lines |

$ |

81 |

Supplies 3 |

$ |

|

|

Other Income (Specify below) |

|

82 |

Utilities/Telephone 4 |

$ |

|

72 |

|

$ |

83 |

Vehicle Gasoline/Oil |

$ |

|

73 |

|

$ |

84 |

Repairs & Maintenance |

$ |

|

74 |

|

$ |

85 |

Insurance |

$ |

|

75 |

|

$ |

86 |

Current Taxes 5 |

$ |

|

76 |

Total Income (Add lines 67 through 75) |

$ |

87 |

Other Expenses, including installment payments |

$ |

|

|

(Specify) |

|||||

|

|

|

88 |

Total Expenses (Add lines 77 through 87) |

$ |

|

|

|

|

89 |

Net Business Income (Line 76 minus 88) 6 |

$ |

|

Enter the monthly net income amount from line 89 on line 23, section 5. If line 89 is a loss, enter "0" on line 23, section 5.

1Materials Purchased: Materials are items directly related to the production of a product or service.

2Inventory Purchased: Goods bought for resale.

3Supplies: Supplies are items used in the business that are consumed or used up within one year. This could be the cost of books, office supplies, professional equipment, etc.

4Utilities/Telephone: Utilities include gas, electricity, water, oil, other fuels, trash collection, telephone, cell phone and business internet.

5Current Taxes: Real estate, excise, franchise, occupational, personal property, sales and employer’s portion of employment taxes.

6Net Business Income: Net profit from Form 1040, Schedule C may be used if duplicated deductions are eliminated (e.g., expenses for business use of home already included in housing and utility expenses on page 4). Deductions for depreciation and depletion on Schedule C are not cash expenses and must be added back to the net income figure. In addition, interest cannot be deducted if it is already included in any other installment payments allowed.

IRS USE ONLY (Notes)

Privacy Act: The information requested on this Form is covered under Privacy Acts and Paperwork Reduction Notices which have already been provided to the taxpayer.

Catalog Number 20312N |

www.irs.gov |

Form |

Document Specifics

| Fact Name | Detail |

|---|---|

| Purpose of Form 433-A | The IRS 433-A form is used to collect financial information from individuals to determine their ability to pay outstanding tax liabilities. |

| Usage | This form is specifically used by individuals who are self-employed or have income outside of traditional wages. |

| Components | The form includes sections on personal information, employment details, income and expenses, assets, and personal financial statements. |

| Outcome | Based on the information provided, the IRS assesses the individual's payment options, which may include installment agreements or offers in compromise. |

| Accessibility | The IRS provides Form 433-A on its official website for download and printing. |

| Update Frequency | The IRS updates this form periodically to reflect current financial assessment practices and tax laws. |

| Requirement for Accuracy | There is a legal obligation to provide accurate and complete information. Failing to do so can result in penalties or legal actions. |

| Assistance | Individuals can seek help from tax professionals or use IRS resources like the official website and helplines to understand how to correctly fill out the form. |

| Related Forms | Form 433-A is often used in conjunction with other IRS forms, such as Form 9465 (Installment Agreement Request) or Form 656 (Offer in Compromise). |

| State-Specific Versions | While the IRS 433-A is a federal form, some states may have similar forms based on their own tax laws and requirements for state tax obligations. |

Guide to Writing IRS 433-A

The IRS Form 433-A is a detailed document used to collect financial information from individuals who need to set up a payment plan or settle tax debts with the Internal Revenue Service. Before diving into the intricacies of completing this form, it's crucial to gather all relevant financial documentation, including income sources, living expenses, asset values, and liabilities. This preparatory step ensures a smoother and more accurate filling process. Following a systematic approach can help alleviate potential challenges associated with this form.

- Gather all required documentation: Before starting, ensure you have recent pay stubs, bank statements, bills, loan statements, and information on assets and investments at hand.

- Fill in basic information: Section 1 solicits general information such as name, social security number, address, and information about your spouse if filing jointly.

- Report employment details: In Section 2, provide your current employment information. If self-employed, detail your business's name and nature.

- Detail self-employment information: For those self-employed, Section 3 is dedicated to detailing business information, including revenue and expenses.

- Declare all financial accounts and assets: Section 4 requires the disclosure of all checking, savings, investments, and other assets.

- List credit and debit card information: Section 5 asks for information on all credit cards accessible to the individual.

- Detail real estate holdings: Section 6 is where you provide information on any real estate owned, including property value and mortgage details.

- Report other assets: Section 7 covers other types of assets, such as vehicles, life insurance, and retirement accounts.

- Outline personal living expenses: In Section 8, itemize your monthly living expenses, including rent or mortgage, food, and utilities.

- Detail business information: For those owning a business, Section 9 requires a thorough breakdown of business expenses and sources of income.

- Review and sign: After completing all sections, review the form for accuracy. The final step is to sign and date the form, attesting to the truthfulness of the information provided.

Accurate completion of the IRS Form 433-A is fundamental to negotiating a manageable repayment plan or an offer in compromise with the IRS. By meticulously following the steps outlined, individuals can navigate this process with greater ease and precision. It's advisable to consult with a tax professional if there are any uncertainties or complex issues related to your financial situation.

Understanding IRS 433-A

-

What is the purpose of the IRS 433-A form?

The IRS 433-A form, also known as the Collection Information Statement for Wage Earners and Self-Employed Individuals, is a document that the Internal Revenue Service uses to gather financial information. This form assists the IRS in understanding an individual's financial situation to make informed decisions regarding payment plans or settlement options for outstanding tax debts. It requires detailed information about the taxpayer's income, expenses, assets, and liabilities.

-

Who needs to fill out the IRS 433-A form?

This form is typically required from individuals who owe more in taxes than they can afford to pay all at once. If you're self-employed or a wage earner and you're seeking to negotiate a payment plan or an offer in compromise (a settlement with the IRS for less than the full amount owed), you'll likely need to complete and submit this form. The IRS specifically requests it after initial communication about your tax debt situation.

-

What information do I need to complete the 433-A form?

- Personal information, including your Social Security Number and contact details.

- Comprehensive details about your employment or business operation, if self-employed.

- A detailed summary of your monthly income and expenses, broken down by category.

- Information on all assets you own, including bank accounts, investments, life insurance, real estate, vehicles, and any valuable personal property.

- Liabilities and outstanding debts, such as mortgage, credit card debts, loans, and other financial obligations.

Accurate and thorough completion of this form is crucial, as it directly influences the IRS's decision on your case.

-

How do I submit the IRS 433-A form?

After completing the form, you should review it for accuracy and completeness. Then, you can submit it to the IRS via mail or in person during a scheduled meeting with an IRS representative. It's essential to retain a copy for your records. The specific address or IRS office to which you should send the form can vary, so it's advisable to check the IRS website or contact an IRS representative for guidance.

-

What happens after I submit the form?

Upon receiving your IRS 433-A form, the IRS will review the information to evaluate your financial situation. An IRS agent might contact you for additional documentation or clarification. Based on their assessment, they will propose a payment plan you can afford, consider an offer in compromise, or explore other tax relief options. Keep in mind, honesty and transparency in completing the form are paramount to arriving at a workable solution for settling your tax debt.

Common mistakes

-

Not accurately reporting all income sources. People sometimes neglect to include every income source, such as freelance jobs, interest, or dividends. This omission can lead to underestimating one's financial capability, potentially resulting in penalties or an inaccurate assessment of the ability to pay.

-

Omitting or misrepresenting the value of assets. Assets, including real estate, vehicles, life insurance, or retirement accounts, must be accurately valued and reported. Underreporting the value of these assets can be perceived as an attempt to conceal the actual ability to settle tax debts.

-

Incorrectly deducting expenses. There’s often confusion over what constitutes an allowable expense. Taxpayers sometimes incorrectly deduct non-allowable expenses or misunderstand the extent to which certain expenses can be deducted, leading to a misrepresentation of their disposable income.

-

Failure to provide supporting documentation. The IRS requires documentation for income, expenses, assets, and liabilities declared on the Form 433-A. Failing to attach sufficient proof can result in processing delays or the assumption of inaccuracies in the reported figures.

-

Not updating the information to reflect current status. Financial situations can change. Submitting Form 433-A with outdated information can mislead the IRS about one's current financial state, negatively affecting the taxpayer’s ability to negotiate payment terms or settlements.

To avoid these pitfalls, individuals should approach the completion of Form 433-A with attention to detail and a commitment to accuracy. Where confusion exists, consulting with a tax professional can prove invaluable. This ensures that the submission accurately reflects the taxpayer’s financial position, fostering a smoother negotiation process with the IRS.

Documents used along the form

When dealing with the IRS, particularly in matters related to individual financial information and arrangement for payment plans, the IRS 433-A form is commonly used. However, this form rarely stands alone in the submission process. Various other forms and documents play crucial roles in painting a full picture of an individual's financial situation. Below is a list of eight forms and documents often required alongside the IRS 433-A form, each serving its unique purpose.

- IRS Form 1040: The U.S. Individual Income Tax Return is essential for reporting an individual's yearly income. It provides the IRS with a snapshot of the taxpayer's financial status, crucial for determining their ability to pay.

- Proof of Income: This includes recent pay stubs, business income statements, or any other documents evidencing current income. They substantiate the income declared on the 433-A form.

- Bank Statements: Recent bank statements are requested to verify cash reserves and regular expenses. This helps in assessing the taxpayer's monthly cash flow and financial health.

- Expenses Documentation: Receipts, bills, or a detailed list of monthly expenses justify the living expenses claimed, ensuring they meet IRS Collection Financial Standards.

- Asset Information: Documents related to the ownership and value of assets, like real estate, vehicles, life insurance policies, or retirement accounts, must be accurately reported on the 433-A.

- IRS Form 9465: The Installment Agreement Request form is often filed with the 433-A for taxpayers seeking to make monthly payments on their tax debt.

- Proof of Non-filing: For individuals who did not file a tax return in previous years, a verification of non-filing letter from the IRS may be necessary.

- Letters of Explanation: If there are unusual circumstances or discrepancies in the information provided, a detailed letter of explanation may be required to clarify these matters to the IRS.

In summary, the IRS 433-A form is a critical component in negotiating with the IRS, but it does not stand alone. A comprehensive package including various forms and documents, as highlighted above, is necessary to provide a clear picture of an individual's financial status. Whether you're an individual or working with a professional, understanding the importance of each document can significantly streamline the process and increase the chances of a favorable outcome.

Similar forms

The IRS 433-A form, often used for detailing financial information to the IRS, bears similarity to the 433-F form. The 433-F is a streamlined version that the IRS sometimes requires from individuals to understand their financial situation for debt resolution purposes. Like the 433-A, it collects information about income, expenses, and liabilities, but it is typically used for those with simpler financial situations. This makes the process faster and slightly less detailed, aiming to ease the repayment or settlement negotiations.

Another document quite similar to the 433-A form is the Schedule C (Form 1040), primarily used by sole proprietors. Although the Schedule C is focused on reporting income and expenses from a business operated as a sole proprietorship, it requires the taxpayer to provide detailed financial information. This parallels the 433-A’s requirement for taxpayers to disclose their business income and expenses when they are self-employed, showcasing how both forms delve into the financial mechanics of operating a business.

The Financial Statement of Debtor form, often used in bankruptcy proceedings, also shares commonalities with the IRS 433-A form. This form is required to give a comprehensive overview of the debtor's financial condition, including assets, liabilities, income, and expenditures. Much like the 433-A, which the IRS uses to assess an individual's ability to pay back tax debt, the Financial Statement of Debtor aims to provide a snapshot of the debtor's financial health to determine repayment capabilities in the context of bankruptcy.

Form 122A-1, a means test form for Chapter 7 bankruptcy, serves a purpose similar to the 433-A form in assessing financial status, but in a different context. The 122A-1 evaluates an individual's income and expenses to determine eligibility for filing Chapter 7 bankruptcy. This means test ensures that those who have the financial capacity to repay their debts do so, paralleling the 433-A form’s role in helping the IRS decide on appropriate tax repayment or settlement options based on one’s financial capacity.

The Application for Enrollment to Practice Before the Internal Revenue Service (Form 23) also parallels the IRS 433-A in that both forms involve detailed personal and financial information. Form 23 is used by individuals seeking approval to represent taxpayers before the IRS. While its primary focus isn't on the applicant's personal financial liabilities or income, it requires detailed information on the applicant’s background, education, and credentials, showing how both forms gather in-depth information but for different purposes.

Lastly, the Uniform Borrower Assistance Form, commonly used by mortgage lenders to assess a borrower’s request for loan modification or foreclosure prevention assistance, shares similarities with the IRS 433-A form. This document requires homeowners to provide detailed financial information, including income, expenses, and assets, to evaluate their ability to continue making mortgage payments under modified terms. Similar to the 433-A, it’s used to assess an individual's financial situation to find workable solutions for managing or alleviating debt.

Dos and Don'ts

Filling out IRS Form 433-A requires careful attention to detail and complete honesty to accurately represent your financial situation to the IRS. To assist in this process, here is a list of dos and don'ts to keep in mind:

Do:

- Provide complete and accurate information about your assets, income, liabilities, and expenses. Inaccuracy can lead to significant problems, including penalties.

- Gather all necessary documents, such as pay stubs, bank statements, and bills, before starting the form to ensure the information is accurate and complete.

- Review each section of the form carefully to ensure no sections applicable to your situation are overlooked.

- Consider seeking assistance from a tax professional if you are unsure about any part of the form or your financial information. Understanding the implications of the information you provide is crucial.

- Keep a copy of the completed form and all supportive documents for your records. It's important to have this information on hand should any questions or issues arise later.

Don't:

- Leave any sections blank. If a section does not apply to you, write "N/A" (not applicable) to indicate that you have read and considered every part of the form.

- Estimate or guess amounts. Use actual figures from your financial documents to ensure accuracy. Being vague can result in inaccuracies that may affect your agreement with the IRS.

- Ignore deadlines. Submitting the form in a timely manner is crucial. Late submissions can result in penalties or further action from the IRS.

- Conceal assets or income. The IRS has means of uncovering inaccuracies in your reporting, and being caught in a lie will only complicate your situation.

- Fear to ask for installment plans or not disclose financial hardship thinking it will not help. If you're unable to pay in full, explaining your situation can lead to an arrangement that is manageable based on your financial situation.

Misconceptions

Filling out government forms can often be intimidating, and many people hold misconceptions about these processes, especially when it comes to dealing with the IRS. The IRS Form 433-A, often used to collect financial information from individuals to establish payment plans or settle tax debts, is no exception. Let's debunk a few common misconceptions about this particular form.

- Only those who are self-employed need to fill it out. This belief is widespread but incorrect. In reality, the IRS Form 433-A is intended for a broader audience. It must be filled out by individuals who owe income taxes to the IRS and are seeking to make arrangements for payment. This includes not only self-employed individuals but also wage earners and others facing financial difficulties in paying their tax debt.

- Once submitted, the information cannot be updated. Circumstances change, and the IRS is aware of this. Should your financial situation change after you’ve submitted Form 433-A, it is possible to update the information. The key is to maintain open communication with the IRS and provide them with the most accurate, up-to-date information to reassess your payment plan or settlement offer.

- There’s no need to disclose all financial information. Some people believe they can pick and choose what financial information to disclose on Form 433-A. This is a risky misconception. The form requires a complete and truthful disclosure of one's financial situation. Omitting information or providing inaccurate data can lead to significant penalties, including potential legal action. Complete honesty is the best policy when dealing with the IRS.

- Filling out Form 433-A guarantees an Offer in Compromise will be accepted. Completing and submitting Form 433-A is often part of the process for applying for an Offer in Compromise, which allows taxpayers to settle their debt for less than the amount owed. However, submitting this form doesn’t guarantee acceptance of your offer. The IRS evaluates each case based on the provided financial information, alongside other factors, including your ability to pay, income, expenses, and asset equity.

Key takeaways

The IRS 433-A form, also known as the Collection Information Statement for Wage Earners and Self-Employed Individuals, plays a critical role in providing the IRS with detailed information about an individual's financial situation. This information is used to work out payment plans or settlements for outstanding taxes. Here are key takeaways you should be aware of when filling out and using this form:

- Accuracy is vital: Ensure that all the information provided on the form is accurate and complete. Inaccuracies can lead to delays in processing or even penalties. It's important to thoroughly check the figures and details you enter.

- Gather necessary documents first: Before starting the form, collect all necessary documents such as pay stubs, bank statements, and bills. This preparation makes filling out the form easier and more efficient.

- Include all sources of income: You must report all sources of income, not just wages from employment. This includes business income, rental income, and any other types of income you receive.

- Detail your living expenses carefully: The form requires a detailed account of your monthly living expenses. Be honest and precise in documenting these costs, as they are critical in determining your ability to pay.

- Asset disclosure is required: Besides income and expenses, the IRS 433-A form also requires a thorough disclosure of your assets, such as real estate, vehicles, and investments. This information helps the IRS understand your financial situation comprehensively.

- Professional advice can be beneficial: Given the complexity of the form and the potential implications of the information provided, seeking advice from a tax professional can be very beneficial. They can provide guidance and ensure that the form is filled out correctly.

- Timely submission is critical: Once completed, submit the form promptly to the appropriate IRS office. Delays in submission can affect your standing with the IRS and potentially lead to increased debt due to accumulated interest and penalties.

Popular PDF Documents

Contractor Payment Form - By focusing on detailed financial breakdowns and legal waivers, this form is an invaluable tool for subcontractors in securing timely payments for their work.

IRS 4952 - This form is specifically structured to help taxpayers navigate the complexities of investment interest deduction claims.

Moneygram Refund Form - By completing your sender details, you can ensure fast payment to thousands of companies or instant card loading.