Get Irs 4235 Form

Engaging with the IRS often requires a clear roadmap, particularly when it's about understanding the nuances of tax liens and how to manage them. The IRS Form 4235 serves as a critical guide for taxpayers seeking to navigate the complexities associated with federal tax liens. This form details the Collection Advisory Group numbers and addresses, proving essential for anyone needing to contact a local Collection Advisory office. Whether it's general lien questions, seeking a payoff balance, or addressing more specific concerns such as applying for a discharge of property from a federal tax lien, IRS Form 4235 outlines the exact office to contact. Importantly, it includes instructions and additional information for various lien-related certificates, such as releases, discharges, nonattachments, subordinations, and withdrawal notices. Moreover, for issues extending beyond generic inquiries, the form provides guidance on foreclosure of property, redemption issues, and non-judicial sales, ensuring taxpayers know where and how to seek the advice or actions they need to manage or remove federal tax liens. It doubles as a directory with comprehensive contact information, including phone numbers and addresses for Advisory Offices across different regions, making it easier for taxpayers to find relevant assistance within their locality or the centralized lien operation for broader concerns.

Irs 4235 Example

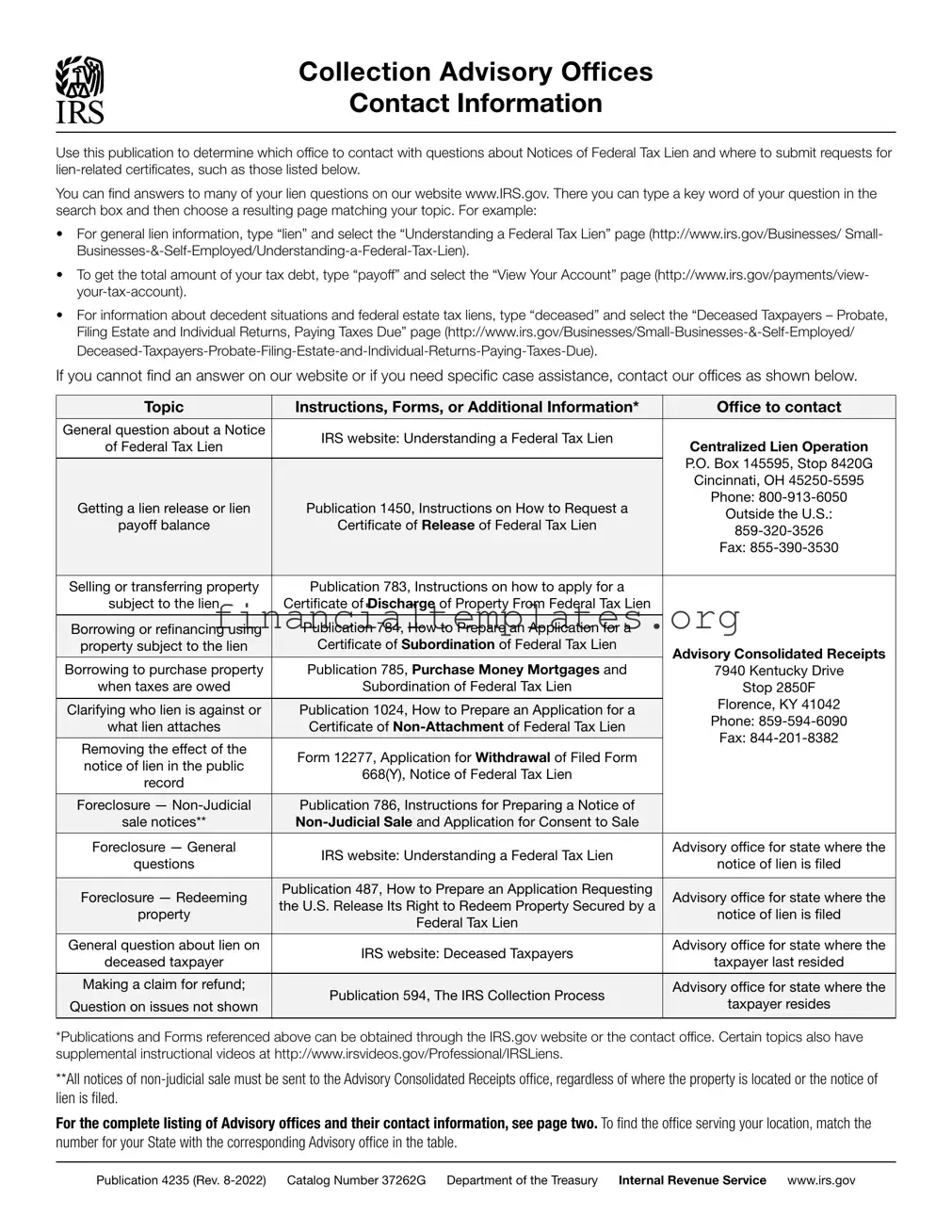

Collection Advisory Offices

Contact Information

Use this publication to determine which office to contact with questions about Notices of Federal Tax Lien and where to submit requests for

You can find answers to many of your lien questions on our website www.IRS.gov. There you can type a key word of your question in the search box and then choose a resulting page matching your topic. For example:

•For general lien information, type “lien” and select the “Understanding a Federal Tax Lien” page (http://www.irs.gov/Businesses/ Small-

•To get the total amount of your tax debt, type “payoff” and select the “View Your Account” page (http://www.irs.gov/payments/view-

•For information about decedent situations and federal estate tax liens, type “deceased” and select the “Deceased Taxpayers – Probate, Filing Estate and Individual Returns, Paying Taxes Due” page

If you cannot find an answer on our website or if you need specific case assistance, contact our offices as shown below.

Topic |

Instructions, Forms, or Additional Information* |

Office to contact |

|

|

|

|

|

General question about a Notice |

IRS website: Understanding a Federal Tax Lien |

|

|

of Federal Tax Lien |

Centralized Lien Operation |

||

|

|||

|

|

P.O. Box 145595, Stop 8420G |

|

|

|

||

|

|

Cincinnati, OH |

|

Getting a lien release or lien |

Publication 1450, Instructions on How to Request a |

Phone: |

|

Outside the U.S.: |

|||

payoff balance |

Certificate of Release of Federal Tax Lien |

||

|

|

||

|

|

Fax: |

|

|

|

|

|

Selling or transferring property |

Publication 783, Instructions on how to apply for a |

|

|

subject to the lien |

Certificate of Discharge of Property From Federal Tax Lien |

|

|

|

|

|

|

Borrowing or refinancing using |

Publication 784, How to Prepare an Application for a |

|

|

property subject to the lien |

Certificate of Subordination of Federal Tax Lien |

Advisory Consolidated Receipts |

|

|

|

||

Borrowing to purchase property |

Publication 785, Purchase Money Mortgages and |

||

7940 Kentucky Drive |

|||

when taxes are owed |

Subordination of Federal Tax Lien |

Stop 2850F |

|

|

|

Florence, KY 41042 |

|

Clarifying who lien is against or |

Publication 1024, How to Prepare an Application for a |

||

Phone: |

|||

what lien attaches |

Certificate of |

||

Fax: |

|||

|

|

||

Removing the effect of the |

Form 12277, Application for Withdrawal of Filed Form |

||

|

|||

notice of lien in the public |

|

||

668(Y), Notice of Federal Tax Lien |

|

||

record |

|

||

|

|

||

|

|

|

|

Foreclosure — |

Publication 786, Instructions for Preparing a Notice of |

|

|

sale notices** |

|

||

|

|

|

|

Foreclosure — General |

IRS website: Understanding a Federal Tax Lien |

Advisory office for state where the |

|

questions |

notice of lien is filed |

||

|

|||

|

|

|

|

Foreclosure — Redeeming |

Publication 487, How to Prepare an Application Requesting |

Advisory office for state where the |

|

the U.S. Release Its Right to Redeem Property Secured by a |

|||

property |

notice of lien is filed |

||

Federal Tax Lien |

|||

|

|

||

|

|

|

|

General question about lien on |

IRS website: Deceased Taxpayers |

Advisory office for state where the |

|

deceased taxpayer |

taxpayer last resided |

||

|

|||

|

|

|

|

Making a claim for refund; |

Publication 594, The IRS Collection Process |

Advisory office for state where the |

|

Question on issues not shown |

taxpayer resides |

||

|

|||

|

|

|

*Publications and Forms referenced above can be obtained through the IRS.gov website or the contact office. Certain topics also have supplemental instructional videos at http://www.irsvideos.gov/Professional/IRSLiens.

**All notices of

For the complete listing of Advisory offices and their contact information, see page two. To find the office serving your location, match the number for your State with the corresponding Advisory office in the table.

Publication 4235 (Rev.

Advisory Offices

For requests not going to Advisory Consolidated Receipts (see page 1), contact the Advisory office associated with the State.

State |

Address |

|

State |

Address |

|

State |

Address |

|

|

|

|

|

|

|

|

Alabama |

11 |

|

Iowa |

14 |

|

Ohio |

20 |

|

|

|

|

|

|

|

|

Alaska |

29 |

|

Kansas |

15 |

|

Oklahoma |

21 |

|

|

|

|

|

|

|

|

Arizona |

1 |

|

Kentucky |

20 |

|

Oregon |

29 |

|

|

|

|

|

|

|

|

Arkansas |

25 |

|

Louisiana |

11 |

|

Pennsylvania (Southeast) |

22 |

|

|

|

|

|

|

Includes Philadelphia, Delaware, |

|

California (North, Central) |

4 |

|

Maine |

24 |

|

|

|

|

|

Montgomery, Bucks Counties |

|

||||

|

|

|

|

|

|

|

|

Includes Monterey, San Benito, |

|

|

|

|

|

|

|

|

|

Maryland |

22 |

|

Pennsylvania (All other areas) |

23 |

|

Merced, Madera Counties |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

California (Central, South) |

3 |

|

Massachusetts |

24 |

|

Rhode Island |

24 |

Includes Los Angeles, San Luis |

|

|

|

|

|

|

|

|

|

Michigan |

13 |

|

South Carolina |

19 |

|

Obispo, Fresno Counties |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

California (South) |

2 |

|

Minnesota |

14 |

|

South Dakota |

14 |

Includes Orange, San Bernardino, |

|

|

|

|

|

|

|

|

|

Mississippi |

11 |

|

Tennessee |

25 |

|

Inyo Counties |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Colorado |

5 |

|

Missouri |

15 |

|

Texas (North) |

26 |

|

|

|

|

|

|

Includes Dallas, Ft. Worth, |

|

Connecticut |

24 |

|

Montana |

29 |

|

|

|

|

|

Abilene, Lubbock, Odessa, Tyler |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware |

22 |

|

Nebraska |

14 |

|

Texas (South) |

27 |

|

|

|

|

|

|

Includes Houston, Austin, |

|

District of Columbia |

12 |

|

Nevada |

1 |

|

|

|

|

|

Beaumont, El Paso, Waco |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida (North) |

6 |

|

New Hampshire |

24 |

|

Utah |

5 |

Includes Tallahassee, Jacksonville, |

|

|

|

|

|

|

|

|

|

New Jersey |

16 |

|

Vermont |

24 |

|

Orlando, Tampa, St. Petersburg |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida (South) |

7 |

|

New Mexico |

1 |

|

Virginia |

28 |

Includes Miami, Ft. Lauderdale, |

|

|

|

|

|

|

|

|

|

New York (NYC area) |

17 |

|

Washington |

29 |

|

Sarasota, Port St. Lucie |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

Includes Suffolk, Nassau, Rockland, |

|

|

|

|

Georgia |

8 |

|

|

|

West Virginia |

20 |

|

|

Westchester counties |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hawaii |

3 |

|

New York (All other areas) |

18 |

|

Wisconsin |

30 |

|

|

|

|

|

|

|

|

Idaho |

5 |

|

North Carolina |

19 |

|

Wyoming |

29 |

|

|

|

|

|

|

|

|

Illinois |

9 |

|

North Dakota |

14 |

|

International |

7 |

|

|

|

|

|

|

Includes Puerto Rico, |

|

Indiana |

30 |

|

|

|

|

|

|

|

|

|

|

U.S. Possessions & Territories |

|

||

|

|

|

|

|

|

|

# |

Address |

|

Phone/Fax |

|

|

|

|

1 |

4041 N. Central Ave., Suite 112, |

Ph |

|

|

MS 5021PHX, Phoenix, AZ 85012 |

Fx |

|

|

|

|

|

2 |

24000 Avila Rd., MS 5905 |

Ph |

|

|

Laguna Niguel, CA 92677 |

Fx |

|

|

|

|

|

3 |

300 N. Los Angeles St., |

Ph |

|

|

Los Angeles, CA 90012 |

Fx |

|

|

|

|

|

4 |

1301 Clay St., Suite 1410S |

Ph |

|

|

Oakland, CA 94612 |

Fx |

|

|

|

|

|

5 |

1999 Broadway, MS 5021DEN |

Ph |

|

|

Denver, CO |

Fx |

|

|

|

|

|

6 |

400 West Bay St. Stop 5710 |

Ph |

|

|

Jacksonville, FL 32202 |

Fx |

|

|

|

|

|

7 |

7850 SW 6th Court, MS 5780 |

Ph |

|

|

Plantation, FL 33324 |

Fx |

|

|

|

|

|

8 |

401 W. Peachtree St., NW, Stop |

Ph |

|

|

Atlanta, GA 30308 |

Fx |

|

|

|

|

|

9 |

Stop 5012 CHI, 230 S Dearborn, Rm 2630 |

Ph |

|

|

Chicago, IL 60604 |

Fx |

|

|

|

|

|

10 |

Left blank intentionally |

|

|

|

|

|

|

|

|

|

|

11 |

1555 Poydras St, Suite |

Ph |

|

|

New Orleans, LA |

Fx |

|

|

|

|

|

12 |

31 Hopkins Plaza, MS 1150 |

Ph |

|

|

Baltimore, MD 21201 |

Fx |

|

|

|

|

|

13 |

985 Michigan Ave., Stop 47 |

Ph |

|

|

Detroit, MI 48226 |

Fx |

|

|

|

|

|

14 |

M/S 5900, 30 E. 7th St, |

Ph |

|

|

St. Paul, MN |

Fx |

|

|

|

|

|

15 |

Stop 5333STL, Rm 9203, 1222 Spruce St |

Ph |

|

|

St. Louis, MO 63103 |

Fx |

|

|

|

|

|

# |

Address |

|

Phone/Fax |

|

|

|

|

16 |

4 Paragon Way, Suite 2 |

Ph |

|

|

Freehold, NJ 07728 |

Fx |

|

|

|

|

|

17 |

290 Broadway, MS |

Ph |

|

|

New York, NY 10007 |

Fx |

|

|

|

|

|

18 |

11A Clinton Ave., Suite 521 |

Ph |

|

|

Albany, NY 12207 |

Fx |

|

|

|

|

|

19 |

10715 David Taylor Dr., MB 25 |

Ph |

|

|

Charlotte, NC 28262 |

Fx |

|

|

|

|

|

20 |

550 Main St., Room 9010B |

Ph |

|

|

Cincinnati, OH 45202 |

Fx |

|

|

|

|

|

21 |

55 N. Robinson, MS 5021 OKC |

Ph |

|

|

Oklahoma City, OK 73102 |

Fx |

|

|

|

|

|

22 |

600 Arch St., Suite |

Ph |

|

|

Philadelphia, PA 19106 |

Fx |

|

|

|

|

|

23 |

1000 Liberty Ave., Room |

Ph |

|

|

Pittsburgh, PA 15222 |

Fx |

|

|

|

|

|

24 |

380 Westminster St., 4th floor |

Ph |

|

|

Providence, RI 02903 |

Fx |

|

|

|

|

|

25 |

801 Broadway, MDP 53 |

Ph |

|

|

Nashville, TN 37203 |

Fx |

|

|

|

|

|

26 |

1100 Commerce St., Mail Code 5028 DAL |

Ph |

|

|

Dallas, TX 75242 |

Fx |

|

|

|

|

|

27 |

1919 Smith St., 5021 HOU |

Ph |

|

|

Houston, TX 77002 |

Fx |

|

|

|

|

|

28 |

400 N. 8th St., Room 898, Box 75 |

Ph |

|

|

Richmond, VA 23219 |

Fx |

|

|

|

|

|

29 |

915 2nd Ave, MS W245 |

Ph |

|

|

Seattle, WA 98174 |

Fx |

|

|

|

|

|

30 |

Stop 5303MIL, 211 W. Wisconsin Ave |

Ph |

|

|

Milwaukee, WI 53203 |

Fx |

|

|

|

|

|

Document Specifics

| Fact | Detail |

|---|---|

| 1. Form Title | Collection Advisory Group Numbers and Addresses |

| 2. Purpose | To contact a local Collection Advisory office for questions regarding Notices of Federal Tax Lien and submissions for lien-related certificates. |

| 3. Centralized Lien Operation Address | P.O. Box 145595, Stop 8420G Cincinnati, OH 45250-5595 |

| 4. Phone Numbers | 1-800-913-6050 (U.S.), 859-669-4811 (Outside the U.S.) |

| 5. Fax Number | 859-390-3528 |

| 6. Website for More Information | www.IRS.gov |

| 7. Search Website for "lien" | For detailed information on federal tax liens. |

| 8. Supplemental Instructional Videos | Available at http://www.irsvideos.gov/Individual/IRSLiens |

| 9. Publication Number | Publication 4235 (Rev. 3-2013) |

| 10. Catalog Number | 37262G |

Guide to Writing Irs 4235

Before diving into the specifics of filling out the IRS 4235 form, it’s important to understand what comes next. After successfully completing and submitting this form, you're creating a bridge between yourself and the appropriate Advisory Office capable of addressing your lien-related inquiries or requests. Whether you're seeking information on general lien questions, needing a payoff balance for a federal tax lien, or applying for any certificates related to federal tax liens, such as release, discharge, nonattachment, subordination, or withdrawal, this form gets you to the right place. Now, let’s walk through the steps to efficiently fill it out.

- Start by reading the form thoroughly to identify which category your request or question falls into. Is it a general query or specific to lien certificates like release, discharge, nonattachment, subordination, or withdrawal?

- Determine the advisory office location relevant to your situation based on the nature of your inquiry or application. The form lists offices by geographic region, focusing on where the notice of lien is filed, where the taxpayer resides, or in specific instances, where the property subject to foreclosure is located.

- Once you've identified the correct advisory office, take note of the corresponding area and location address provided in the form. This will be crucial for sending your complete application or making a query.

- For general lien questions or requesting payoff balances, direct your attention to the Centralized Lien Operation details provided. Note the appropriate phone numbers, fax numbers, and the mailing address for your submissions or inquiries.

- If your request pertains to lien certificates such as release, discharge, nonattachment, subordination, or requesting the withdrawal of a Notice of Federal Tax Lien, refer to the specific publications listed for detailed instructions. These publications will guide you on the additional forms and information required for your specific application.

- After gathering all necessary information and, if applicable, completing additional forms as guided by the referenced publications, prepare your correspondence for the advisory office. Ensure your communication includes all required details to expedite processing; this may include your contact information, tax identification numbers, descriptions of your inquiry or request, and any pertinent documentation.

- Before sending, double-check the recipient’s address and contact information for accuracy. Confirm you are directing your request or query to the correct office location based on your geographic or case-specific circumstances.

- Finally, send your completed package—whether it’s a simple query, a detailed application for a lien certificate, or other related requests—to the identified advisory office via the specified mailing address. If the situation allows for it, or if you seek a quicker response, consider using the provided phone numbers or fax information.

By following these detailed steps, you ensure that your interaction with the IRS concerning federal tax liens is as smooth and effective as possible. Remember, clarity and correctness in your documentation can significantly influence the efficiency of responses and the eventual outcomes of your requests.

Understanding Irs 4235

What is IRS Form 4235 used for?

IRS Form 4235, titled "Collection Advisory Group Numbers and Addresses," is designed for individuals who need to get in touch with a local Collection Advisory office regarding federal tax liens. This form helps determine which office to contact for questions about Notices of Federal Tax Lien and for submitting requests or applications related to lien certificates, like releases, discharges, and subordinations of liens.

How can I find the Collection Advisory office closest to me?

To locate the Collection Advisory office nearest to you, consult IRS Form 4235. This form lists Advisory Group Areas by geographic location, including the corresponding address and contact numbers. The form categorizes offices across the United States, ensuring you can find the office responsible for your particular state or territory.

Where do I submit a request for a Federal Tax Lien Release?

Requests for a Certificate of Release of Federal Tax Lien should be submitted to the Centralized Lien Operation. IRS Form 4235 provides specific instructions on how to request this release under the topic "Release of Federal Tax Lien" and directs you to use Publication 1450 for further guidance.

Can IRS Form 4235 help me with a payoff balance request?

Yes, IRS Form 4235 guides individuals on how to request a payoff balance for a federal tax lien. It directs such requests to the Centralized Lien Operation, detailing the necessary instructions, forms, or additional information required to make the request.

How do I apply for a Certificate of Discharge of Property from Federal Tax Lien?

To apply for a Certificate of Discharge of Property From Federal Tax Lien, you should refer to the publication 783 for instructions, as indicated on IRS Form 4235. Your application should be sent to the Advisory office where the notice of lien is filed, which can be determined based on your geographic location as listed on the form.

What if I need to correct a lien that was filed in error (Nonattachment of Federal Tax Lien)?

If a lien was filed in error, IRS Form 4235 directs individuals to use Publication 1024 to prepare an application for a Certificate of Nonattachment of Federal Tax Lien. You would submit your application to the Advisory office corresponding to the location where the notice of lien is filed.

How do I request the subordination of a Federal Tax Lien?

To request a Certificate of Subordination of Federal Tax Lien, follow the directions in Publication 784 as noted on IRS Form 4235. Your request must go to the Advisory office where the original notice of the lien is filed, with the relevant office determined based on the taxpayer's location.

What should I do to withdraw a Notice of Federal Tax Lien?

To initiate the withdrawal of a Filed Form 668(Y), Notice of Federal Tax Lien, use Form 12277, "Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien." Depending on whether the lien has been released, your application is directed to the Advisory office where the taxpayer resides, as stated on IRS Form 4235.

Where can I find more information about dealing with federal tax liens?

For more detailed information regarding federal tax liens, including how to understand and resolve them, visit the IRS website at www.IRS.gov. Searching for "lien" or directly navigating to the Small Businesses & Self-Employed section on "Understanding a Federal Tax Lien" offers extensive resources, publications, and instructional videos.

How can I get copies of the publications referenced in IRS Form 4235?

Copies of the publications referenced in IRS Form 4235, including instructions for lien releases, discharges, subordinations, and nonattachment, can be obtained through the IRS.gov website. Alternatively, you may request them through the contact offices listed in the form, ensuring you have access to all necessary documents for managing federal tax liens.

Common mistakes

When filling out the IRS 4235 form, people often make mistakes that can lead to delays or inaccuracies in processing their requests. Here are some of the common errors:

Not using the most recent version of the form - The IRS periodically updates its forms, and using an outdated one can result in processing delays.

Skipping sections - Some tend to leave sections blank because they're unsure of the answers. Every question is important for the IRS to process the form correctly.

Incorrectly identifying the correct Advisory office - Submission to the wrong office can delay the processing of lien-related certificates or requests.

Misunderstanding the type of lien-related request needed - Selecting the wrong application for a lien-related certificate, like confusing a discharge of property with a subordination of federal tax lien, could lead to incorrect processing.

Inaccurate taxpayer information - Entering wrong details such as the taxpayer's identification number or address can lead to processing errors.

Forgetting to sign the form - An unsigned form is incomplete and cannot be processed until it is correctly signed.

Not consulting the IRS website for guidance - The IRS website offers links and additional information that can clarify instructions and forms usage, preventing mistakes.

Ignoring supplemental instructional videos - These resources on the IRS website provide visual guidance that can help avoid errors during the filing process.

Omitting attachments or required documentation - Failing to include necessary documents can result in the rejection or delay of the form's processing.

Not specifying the type of lien-related certificate needed - Without a clear indication of the specific certificate being requested, the form cannot be correctly processed.

Addressing these mistakes before submission can help ensure that your dealings with the IRS regarding federal tax liens go smoothly and efficiently.

Documents used along the form

When dealing with IRS Form 4235, "Collection Advisory Group Numbers and Addresses," individuals often find themselves navigating a complex web of additional forms and documentation related to federal tax liens. Understanding these documents can provide clarity and direction during what may feel like an overwhelming process.

- Publication 1450: Offers instructions on how to request a Certificate of Release of Federal Tax Lien. This document is essential when you're seeking to remove a lien after fulfilling your tax obligations.

- Publication 783: Provides guidance on applying for a Certificate of Discharge of Property from Federal Tax Lien, which is vital for selling or transferring property encumbered by a tax lien.

- Publication 1024: Outlines the steps to apply for a Certificate of Nonattachment of Federal Tax Lien, proving that a federal tax lien does not apply to your property.

- Publication 784: Explains how to prepare an application for a Certificate of Subordination of Federal Tax Lien, allowing other creditors to take priority over the federal tax lien.

- Form 12277: An Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien, used to request the withdrawal of a public notice of a federal tax lien, beneficial after resolving the tax debt.

- Publication 487: Describes how to prepare an application requesting the United States to release its right to redeem property secured by a federal tax lien in foreclosure and redemption situations.

- Publication 786: Provides instructions for preparing a Notice of Non-Judicial Sale and an Application for Consent to Sale, necessary for selling property encumbered by a federal tax lien without judicial proceedings.

Each of these documents plays a crucial role in managing or resolving federal tax liens, complementing the information found in IRS Form 4235. Whether you're requesting a lien release, seeking priority for other creditors, or proving a lien doesn't apply to your property, understanding and utilizing these forms effectively can significantly impact your dealings with federal tax liens.

Similar forms

IRS Form 433-A, often referred to as the Collection Information Statement for Wage Earners and Self-Employed Individuals, bears similarity to IRS 4235 in its function related to tax liens, though it serves a different purpose. While IRS 4235 provides information for contacting Collection Advisory Groups for lien-related matters, Form 433-A is used by individuals to provide detailed financial information to the IRS. This is typically for setting up a payment plan or proving financial hardship, which can ultimately affect the handling of federal tax liens, making the two forms closely related in the context of resolving taxpayer liabilities.

Form 656, commonly known as the Offer in Compromise form, is another document related to IRS 4235, as they both deal with resolving tax liabilities, but from different angles. Form 656 allows taxpayers to negotiate with the IRS to settle their tax debts for less than the full amount owed. Successfully navigating an Offer in Compromise can lead to adjustments or changes in the status or existence of a federal tax lien, aligning it with the objectives outlined in the IRS 4235 for seeking lien relief or resolutions.

Form 12277, Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien, is directly linked to the content outlined in IRS 4235. This form is the procedural step taken by a taxpayer requesting the withdrawal of a Notice of Federal Tax Lien after it has been released. The IRS 4235 publication specifically lists this form and its purpose, illustrating a direct operational connection between these documents in the process of managing and potentially removing a federal tax lien from the public record.

Form 8821, Tax Information Authorization, while not directly related to tax liens, is similar to IRS 4235 in that it involves the designation of third-party representatives in dealings with the IRS. Form 8821 authorizes individuals or entities to access a taxpayer's information, which could be crucial in resolving matters related to federal tax liens, as laid out in IRS 4235. This form can facilitate communication and procedures between taxpayers, their representatives, and the IRS Advisory Groups mentioned in IRS 4235.

Form 2848, Power of Attorney and Declaration of Representative, shares a functional resemblance to IRS 4235 by enabling taxpayer representation in dealing with the IRS, specifically regarding tax liens. By granting a power of attorney through Form 2848, a taxpayer can authorize an individual, such as an attorney, CPA, or enrolled agent, to represent them in tax matters, making it a critical document for those seeking to address issues related to Notices of Federal Tax Lien and other lien-related certificates through the Advisory Offices specified in IRS 4235.

Publication 1450, Instructions on How to Request a Certificate of Release of Federal Tax Lien, is intimately connected to the content of IRS 4235. This publication provides taxpayers with the necessary steps to request the official release of a federal tax lien from the public record, aligning with the information and objectives found in IRS 4235 about resolving tax liens. It serves as a detailed guide for engaging with the appropriate IRS Advisory Office, as determined by the taxpayer's location or the location of the lien filing.

Publication 783, Instructions on How to Apply for a Certificate of Discharge of Property from Federal Tax Lien, also aligns closely with the objectives of IRS 4235. As with other documents listed, it provides specific procedural guidance for one aspect of managing federal tax liens — in this case, the discharge of property. This publication outlines the steps a taxpayer needs to take to remove a specific property from under the blanket of an IRS lien, which is crucial for selling or transferring property free of the lien. Both documents pivot on the broader theme of navigating federal tax liens and resolving related issues through the stipulated IRS channels.

Dos and Don'ts

When filling out the IRS 4235 form, it's important to pay attention to the details to ensure your submission is accurate and complete. Here are some do's and don'ts to guide you through the process:

Do:- Review the publication carefully to determine the correct office to contact based on your specific lien-related issue and geographic location.

- Use the most recent version of the publication to ensure you have up-to-date contact information and instructions.

- Contact the Centralized Lien Operation for general lien questions or requests for payoff balances, as specified.

- Refer to the listed instructions and forms, such as Publication 1450 for a Certificate of Release of Federal Tax Lien, to gather all necessary information before submission.

- Ensure your requests or applications are directed to the correct Advisory office, especially in cases involving property discharges or certificate of nonattachment.

- Assume all lien-related inquiries can be handled by the same office; the IRS specifies different contact points for different issues.

- Overlook the variety of lien certificates and their specific submission locations, such as discharge, nonattachment, subordination, and withdrawal of liens.

- Forget to check the IRS website for additional information, including instructional videos that may assist with your submission.

- Send requests or forms to outdated addresses or phone numbers; always verify with the latest publication or IRS website.

- Ignore the importance of reviewing the listing and contact information for each Advisory Office to ensure accurate communication and processing.

Misconceptions

There are several misconceptions about the IRS Form 4235, which is of great importance when dealing with federal tax liens and the procedures for their release, discharge, or subordination. Understanding these misconceptions can help taxpayers navigate their responsibilities and rights more effectively.

Form 4235 is for filing a tax return: This is a misconception. IRS Form 4235 is not for filing tax returns. Instead, it provides the contact information for Collection Advisory Groups across the United States, which handle issues related to federal tax liens.

You can request lien release directly through Form 4235: Incorrect. While Form 4235 lists Advisory Group Numbers and Addresses for lien-related inquiries, it does not serve as a request form for lien release, discharge, or subordination. These actions require specific forms and procedures as outlined in the form’s instructions.

Form 4235 is only for individuals: Another misunderstanding. Both individuals and businesses that deal with federal tax liens can use the information provided in Form 4235 to get in touch with the appropriate IRS advisory office for assistance.

It provides a way to appeal a lien: This is not accurate. While Form 4235 helps taxpayers find the right office to contact for lien issues, it does not offer a direct appeal process. The form or its guidance do not serve as a mechanism for challenging or appealing a federal tax lien.

Using Form 4235 speeds up the lien removal process: Simply using Form 4235 will not expedite the removal of a federal tax lien. The form provides contact information, but resolution speed depends on numerous factors including case complexity and IRS workload.

Form 4235 is needed for all tax issues: This is not the case. Form 4235 is specifically designed to guide those dealing with federal tax liens to the appropriate advisory office. Other tax matters, such as filing returns or disputes, are handled through different IRS processes and forms.

Contact details are the same for all regions: This is a misconception. The IRS has different Collection Advisory Groups based on geographic locations, each with unique contact numbers and addresses. Form 4235 lists these to ensure taxpayers reach the correct office relevant to their location.

Correcting these misconceptions about IRS Form 4235 is crucial for effectively addressing federal tax lien issues. By understanding what the form is and is not designed for, taxpayers can more efficiently navigate their obligations and available resources.

Key takeaways

When dealing with federal tax liens, understanding how to properly utilize IRS Form 4235 is crucial for taxpayers and professionals alike. Here are key takeaways that should be considered:

- The purpose of Form 4235 is to provide contact information for local Collection Advisory offices, which are critical resources for addressing lien-related queries and issues.

- If you have general questions about a federal tax lien, or need to request a payoff balance, the Centralized Lien Operation should be your first point of contact.

- To apply for a Certificate of Release of Federal Tax Lien, one should refer to Publication 1450 for detailed instructions on the process.

- When seeking a discharge of property from a federal tax lien, Publication 783 outlines the necessary application steps, and contact should be made with the Advisory office where the lien notice was filed.

- A Certificate of Nonattachment of Federal Tax Lien can be requested through the steps provided in Publication 1024, with submissions directed to the appropriate Advisory office.

- For taxpayers looking to subordinate a federal tax lien, Publication 784 provides guidance on the application for a Certificate of Subordination, which must be submitted to the relevant Advisory office.

- Form 12277 is used to apply for a withdrawal of a filed notice of a federal tax lien, both before and after the lien's release, and should be sent to the Advisory office in the taxpayer's residing area.

- In instances involving foreclosure of property or redemption issues, specific publications (487 and 786) offer instructions for requesting the United States to release its right to redeem property secured by a federal tax lien and for notifying the IRS of a non-judicial sale, respectively. These requests must be made to the Advisory office where the notice of lien is filed.

Understanding the correct procedure for managing and resolving federal tax liens is essential for protecting one's financial interests and rights. The IRS provides various publications and forms, specifically designed to guide taxpayers through each step of the process, ensuring that those faced with lien issues have access to the necessary resources and support.

Popular PDF Documents

Lgl-001 - This legal form contributes to a more organized and effective approach to tax management, minimizing the risk of errors and penalties.

IRS 1120-S - Used by S corporations to comply with federal tax obligations, summarizing yearly financial information.