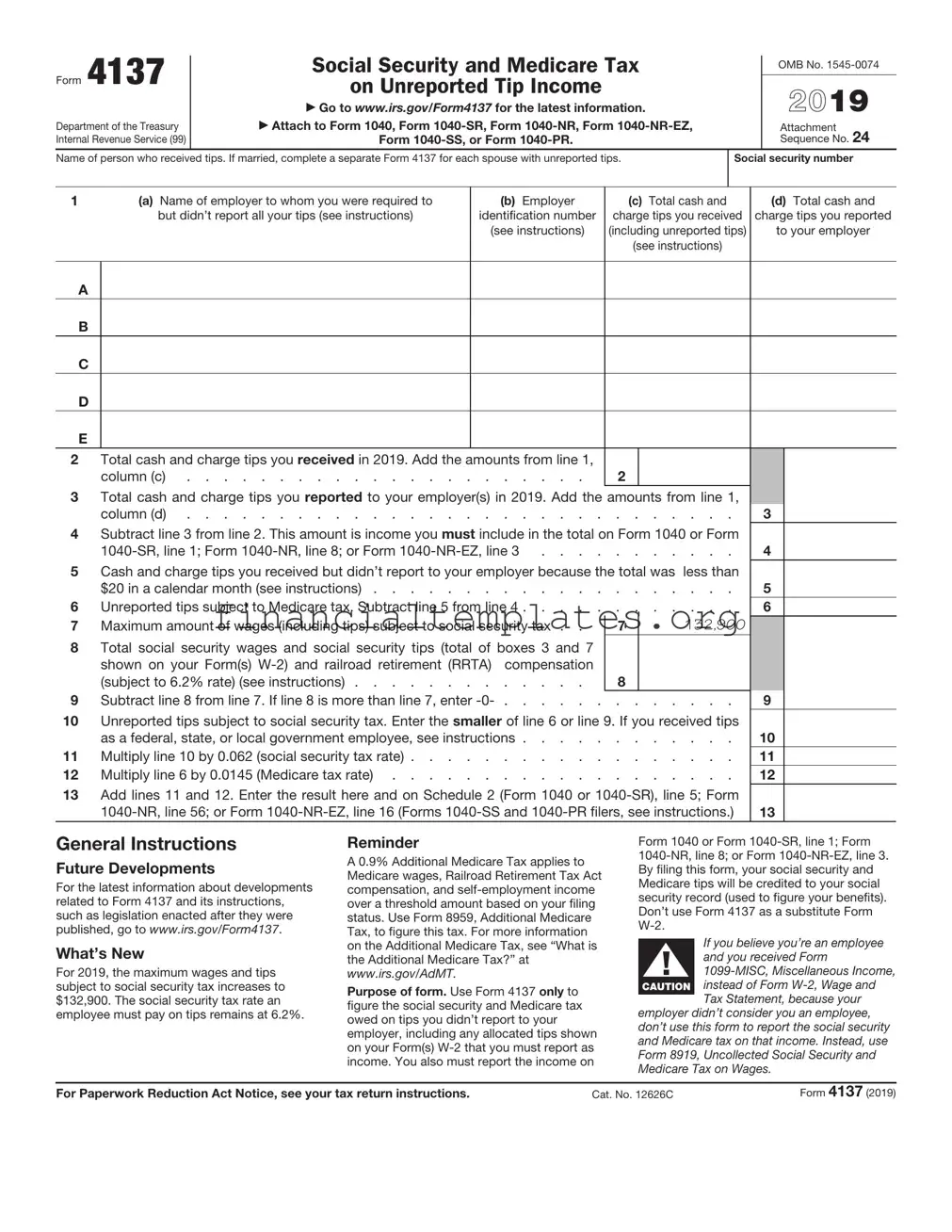

Get IRS 4137 Form

For individuals navigating the complexities of reporting income that hasn't been subject to payroll taxes, the IRS 4137 form stands as a pivotal tool. This essential document serves the purpose of accounting for tips and other similar earnings, which, though not directly withheld by an employer, still require acknowledgment to the Internal Revenue Service for tax purposes. The significance of accurately completing this form cannot be overstated, as it ensures compliance with federal tax obligations, potentially averting penalties related to underreported income. It meticulously guides the taxpayer through the process of declaring tips from various sources, be they direct, allocated, or shared, ensuring that all relevant income is captured. By facilitating a transparent avenue for this income reporting, the form plays a crucial role in maintaining the integrity of both the tax system and the individual’s financial records. As such, understanding the overarching principles and the detailed instructions of IRS 4137 is paramount for anyone earning tip income, making it a fundamental aspect of personal finance management for a broad segment of the workforce.

IRS 4137 Example

Form 4137 |

Social Security and Medicare Tax |

|

|

|

OMB No. |

|||

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

on Unreported Tip Income |

|

|

|

|

|

|

|

|

|

|

|

|

2021 |

||

|

|

▶ Go to www.irs.gov/Form4137 for the latest information. |

|

|

|

|||

Department of the Treasury |

|

|

|

Attachment |

||||

|

|

|

|

|

|

|||

Internal Revenue Service (99) |

▶ Attach to your tax return. |

|

|

|

|

Sequence No. 24 |

||

Name of person who received tips. If married, complete a separate Form 4137 for each spouse with unreported tips. |

|

Social security number |

||||||

|

|

|

|

|

|

|

|

|

1 |

(a) Name of employer to whom you were required to |

(b) Employer |

(c) |

Total cash and |

|

(d) Total cash and |

||

|

but didn’t report all your tips (see instructions) |

identification number |

charge tips you received |

charge tips you reported |

||||

|

|

|

(see instructions) |

(including unreported tips) |

|

to your employer |

||

|

|

|

|

(see instructions) |

|

|

||

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

E

2Total cash and charge tips you received in 2021. Add the amounts from line 1,

column (c) |

2 |

3Total cash and charge tips you reported to your employer(s) in 2021. Add the amounts from line 1,

column (d) |

3 |

4Subtract line 3 from line 2. This amount is income you must include in the total on Form 1040 or

4 |

5Cash and charge tips you received but didn’t report to your employer because the total was less than

|

$20 in a calendar month (see instructions) |

. . |

. . . . . |

5 |

|

6 |

Unreported tips subject to Medicare tax. Subtract line 5 from line 4 |

. . |

. . . . . |

6 |

|

7 |

Maximum amount of wages (including tips) subject to social security tax . . |

7 |

142,800 |

|

|

8 |

Total social security wages and social security tips (total of boxes 3 and 7 |

|

|

|

|

|

shown on your Form(s) |

|

|

|

|

|

(subject to 6.2% rate) (see instructions) |

8 |

|

|

|

9 |

Subtract line 8 from line 7. If line 8 is more than line 7, enter |

. . |

. . . . . |

9 |

|

10Unreported tips subject to social security tax. Enter the smaller of line 6 or line 9. If you received tips

|

as a federal, state, or local government employee, see instructions |

10 |

|

11 |

Multiply line 10 by 0.062 |

(social security tax rate) |

11 |

12 |

Multiply line 6 by 0.0145 |

(Medicare tax rate) |

12 |

13Add lines 11 and 12. Enter here and include as tax on Schedule 2 (Form 1040), line 5; Form

Part I, line 6; or Form |

13 |

General Instructions

Future Developments

For the latest information about developments related to Form 4137 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form4137.

What’s New

For 2021, the maximum wages and tips subject to social security tax increases to $142,800. The social security tax rate an employee must pay on tips remains at 6.2%.

Reminder

A 0.9% Additional Medicare Tax applies to Medicare wages, Railroad Retirement Tax Act (RRTA) compensation, and self- employment income over a threshold amount based on your filing status. Use Form 8959, Additional Medicare Tax, to figure this tax. See the Instructions for Form 8959 for more information on the Additional Medicare Tax.

Purpose of form. Use Form 4137 only to figure the social security and Medicare tax owed on tips you didn’t report to your employer, including any allocated tips shown on your Form(s)

If you believe you’re an employee and you received ▲! Form

Who must file. You must file Form 4137 if you received cash and charge tips of $20 or more in a calendar month and didn’t report all of those tips to your employer. You must also file Form 4137 if your Form(s)

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 12626C |

Form 4137 (2021) |

Form 4137 (2021) |

Page 2 |

Allocated tips. You must report all your tips from 2021, including both cash tips and noncash tips, as income on Form 1040 or

Tips you must report to your employer. If you receive $20 or more in cash tips, you must report 100% of those tips to your employer through a written report. Cash tips include tips paid by cash, check, debit card, and credit card. The written report should include tips your employer paid to you for charge customers, tips you received directly from customers, and tips you received from other employees under any

Employees subject to the Railroad Retirement Tax Act. Don’t use Form 4137 to report tips received for work covered by the Railroad Retirement Tax Act. To get railroad retirement credit, you must report these tips to your employer.

Payment of tax. Tips you reported to your employer are subject to social security and Medicare tax (or railroad retirement tax), Additional Medicare Tax, and income tax withholding. Your employer collects these taxes from wages (excluding tips) or other funds of yours available to cover them. If your wages weren’t enough to cover these taxes, you may have given your employer the additional amounts needed. Your Form

Penalty for not reporting tips. If you didn’t report tips to your employer as required, you may be charged a penalty equal to 50% of the social security, Medicare, and Additional Medicare Taxes due on those tips. You can avoid this penalty if you can show (in a statement attached to your return) that your failure to report tips to your employer was due to reasonable cause and not due to willful neglect.

Additional information. See Pub. 531, Reporting Tip Income. See Rev. Rul.

Specific Instructions

Line 1. Complete a separate row for each employer. If you had more than five employers in 2021, attach a statement that contains all of the information (and in a similar format) as required on Form 4137, line 1, or complete and attach line 1 of additional Form(s) 4137. Complete lines 2 through 13 on only one Form 4137. The line 2 and line 3 amounts on that Form

4137 should be the combined totals of all your Forms 4137 and attached statements. Include your name, social security number, and calendar year (2021) on the top of any attachment.

Column (a). Enter your employer’s name exactly as shown on your Form

Column (b). For each employer’s name you entered in column (a), enter the employer identification number (EIN) or the words “Applied For” exactly as shown on your Form

Columns (c) and (d). Include all cash and charge tips you received. All of the following tips must be included.

•Total tips you reported to your employer on time. Tips you reported, as required, by the 10th day of the month following the month you received them are considered income in the month you reported them. For example, tips you received in December 2020 that you reported to your employer after December 31, 2020, but by January 11, 2021, are considered income in 2021 and should be included on your 2021 Form

(d).

•Tips you received in December 2021 that you reported to your employer after December 31, 2021, but by January 10, 2022, are considered income in 2022. Don’t include these tips on line 1 for 2021. Instead, report these tips on line 1, column (d), on your 2022 Form 4137.

•Tips you didn’t report to your employer on time. Report these tips in column (d). For example, tips you received in December 2021 that you reported to your employer after January 10, 2022, are considered income in 2021 because you didn’t report them to your employer on time.

•Tips you didn’t report at all (include any allocated tips (see Allocated tips, earlier) shown in box 8 on your Form(s)

•Tips you received that you weren’t required to report to your employer because they totaled less than $20 during the month. Report these tips in column (c).

Line 5. Enter only the tips you weren’t required to report to your employer because the total received was less than $20 in a calendar month. These tips aren’t subject to social security and Medicare tax.

Line 6. Enter this amount on Form 8959, line 2, if you’re required to file that form.

Line 8. For railroad retirement (RRTA) compensation, don’t include an amount greater than $142,800, which is the amount subject to the 6.2% rate for 2021.

Line 10. If line 6 includes tips you received for work you did as a federal, state, or local government employee and your pay was subject only to the 1.45% Medicare tax, subtract the amount of those tips from the line 6 amount only for the purpose of comparing lines 6 and 9. Don’t reduce the actual entry on line 6. Enter “1.45% tips” and the amount you subtracted on the dotted line next to line 10.

Document Specifics

| Fact | Description |

|---|---|

| Form Name | IRS Form 4137 |

| Purpose | Used to report tips that you received but were not reported to your employer, and to calculate Social Security and Medicare taxes on those tips. |

| Who must file | Employees who received cash tips totaling $20 or more in a month and did not report all of those tips to their employers. |

| Governing Law | Federal tax law as enforced by the Internal Revenue Service (IRS). |

Guide to Writing IRS 4137

Once someone has gathered all necessary financial documents, information about unreported tips, and other relevant income statements, the next step is to fill out IRS Form 4137. This process involves accurately reporting tip income that wasn't subject to payroll tax withholdings. It's essential to follow the instructions carefully to ensure compliance with tax regulations. To efficiently complete this task, a series of steps need to be followed. These steps are designed to help navigate through the form without missing critical information required by the IRS.

- First, obtain a current version of IRS Form 4137 from the Internal Revenue Service website to ensure all information is up to date.

- Enter your social security number at the top of Form 4137 in the space provided.

- Fill in your full legal name as it appears on your social security card in the designated area.

- In the section labeled "Employer’s name," write down the name of the employer or employers for whom you received tip income not reported to you in box 1 of your Form W-2.

- Proceed to calculate the total amount of unreported tips you received. Enter this total on the line specified for such amount. Ensure you include all tips received directly from customers, charged tips (for example, credit and debit card charges) distributed to you by your employer, and your share of any tips received under a tip-splitting or tip-pooling arrangement.

- Follow the instructions on Form 4137 to compute social security and Medicare taxes owed on the unreported tips. Enter the calculated amounts in the spaces provided for both social security and Medicare taxes.

- After calculations, add the figures to determine the total tax on your unreported tips. This total should be entered in the line indicating your total tax due on these earnings.

- Refer to the section of Form 4137 that provides instructions on where to report the total tax figured. This typically involves transferring the total to your Form 1040 or the form specified in the instructions, ensuring it is included in your overall tax calculations for the year.

- Review your entries on the entire form to verify that all information is accurate and complete. This includes double-checking your social security number, name, the total amount of unreported tips, and the calculated taxes.

- Finally, sign and date Form 4137 at the designated area. If you're filing jointly, make sure that both parties sign the form. Attach Form 4137 to your Form 1040 or other tax return forms as instructed and submit it to the IRS following their submission guidelines.

Once IRS Form 4137 is filled out correctly and attached to the appropriate tax return forms, the next steps involve reviewing all the documents for accuracy, making a copy for personal records, and submitting the paperwork to the IRS by the filing deadline. Timely and accurate submission is crucial to avoid penalties or delays. If any corrections are needed after submission, the IRS will provide instructions on how to amend the tax return and resubmit the corrected information.

Understanding IRS 4137

-

What is IRS Form 4137 and who needs to file it?

IRS Form 4137, "Social Security and Medicare Tax on Unreported Tip Income," is designated for taxpayers to report tips that they received directly from customers, allocated tips provided by their employer, and any other tip income that was not reported to their employer. This includes cash tips, credit and debit card tips, and tips received from tip-sharing arrangements. Individuals who receive such income are required to file Form 4137 with their federal income tax return to calculate and report Social Security and Medicare taxes owed on that income.

-

How does one report tip income using Form 4137?

To accurately report tip income using Form 4137, individuals should carefully fill out the form by entering the total amount of unreported tip income received during the tax year. This amount is then used to compute the Social Security and Medicare taxes owed. Form 4137 provides line-by-line instructions for calculating these amounts. After completing the calculations, the calculated taxes are added to the total tax owed on the individual’s income tax return. It's essential to keep detailed records of all tips received throughout the year to ensure accurate reporting.

-

What are the consequences of not reporting tip income?

Failing to report tip income not only violates federal tax law but can also lead to several consequences. Individuals may face underpayment penalties, interest on the unpaid taxes, and in some cases, additional fines. Unreported income may trigger an audit by the IRS, during which individuals would need to provide evidence of income and deductions. Accurately reporting all income, including tips, helps ensure individuals remain compliant with tax laws, avoiding unnecessary penalties and interest.

-

Can employers be held responsible for unreported tip income by their employees?

Employers have specific obligations regarding their employees' tip income, including accurate reporting of tips to the IRS and proper withholding of federal income, Social Security, and Medicare taxes based on the total income reported. However, employees are ultimately responsible for reporting any tips not reported by their employer to the IRS. Employers can face their own set of penalties for failing to accurately report tips or for not properly withholding and paying the respective taxes. Nonetheless, employees remain responsible for ensuring all their income, including tips, is accurately reported on their tax returns.

Common mistakes

When completing the IRS 4137 form, which is used for reporting unreported tips to the Internal Revenue Service, individuals often encounter several pitfalls. Recognizing and avoiding these mistakes can prevent complications with one's tax filings. Here are six common errors:

-

Not Reporting All Tips: Many mistakenly believe that only tips received directly in cash require reporting. However, all tips, including those from credit cards, shared tips with other employees, and non-cash tips, must be reported.

-

Miscalculating Total Tips: Individuals often err in the arithmetic involved in reporting their total tips. This includes failing to accurately add up daily tips to reach an annual total or mistakenly including non-tip income in their calculations.

-

Omitting Tips Reported to Employers: There is a common misconception that tips reported to an employer do not need to be included on the IRS 4137 form. In reality, these tips must be documented to accurately assess Social Security and Medicare taxes.

-

Filing the Form When Not Necessary: Sometimes, individuals file IRS 4137 with their tax return when it's not required. This form should only be filed by employees who received more than $20 in tips in any month that were not reported to their employer.

-

Incorrectly Calculating Additional Taxes Owed: The form calculates additional taxes owed on unreported tips. Errors can occur if one does not follow the instructions carefully, potentially leading to underpayment or overpayment of taxes.

-

Not Including the Form with Tax Return: A final, critical mistake is not attaching the completed IRS 4137 form to one's tax return. This oversight can lead to questions from the IRS, potential audits, and delays in processing one's taxes.

It's always advisable to double-check one's work when filling out tax forms, or even better, consult with a professional. This ensures that all information is accurate and complete, helping to avoid issues with the IRS down the line.

Documents used along the form

Filing taxes in the United States can often seem like navigating through a labyrinth, with the IRS Form 4137 being one of the pathways. Specifically designed for reporting social security and Medicare tax on unreported tip income, this form is crucial for employees who receive tips as a major part of their income. However, it's just one piece of the puzzle. Many other forms and documents typically accompany or are necessary in conjunction with Form 4137 to ensure that taxpayers meet their obligations comprehensively. Understanding these additional forms can provide a clearer picture of the tax filing process, making it less daunting and more manageable.

- Form 1040: The U.S. Individual Income Tax Return is the starting point for most personal tax filings. It serves as the primary form for individuals to report their income, calculate their tax due, or determine their refund.

- Form W-2: This form is issued by employers to report an employee’s annual wages and the amount of taxes withheld from their paycheck. It is vital for completing the Form 1040 accurately.

- Schedule C (Form 1040): For individuals who are self-employed or sole proprietors, this form details the income and losses of their business, which is essential for accurately reporting taxable income.

- Form 1099-MISC: Used to report miscellaneous income, including freelance or independent contractor income, as well as any tips not reported by employers.

- Form 4868: An Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. If more time is needed to gather documents or resolve discrepancies, this form is used to request a six-month extension.

- Schedule SE (Form 1040): Addresses Self-Employment Tax. For those who have to fill out Schedule C, Schedule SE is used to calculate the self-employment tax owed on income from self-employment.

- Form 885-T: This form is used for Adjustments for Qualified Tuition and Related Expenses, beneficial for students or parents paying for college to claim education credits.

- Form 8962: The Premium Tax Credit form is necessary for individuals or families participating in a health insurance plan through the Health Insurance Marketplace. It reconciles the credit received with the amount you qualify for based on your final income.

Each of these forms has its unique role in the tax filing process, and when used in tandem, they ensure that all aspects of an individual's financial landscape are accurately represented to the IRS. Whether reporting tip income on Form 4137, detailing business expenses on Schedule C, or calculating self-employment tax on Schedule SE, the meticulous preparation and understanding of these documents safeguard taxpayers against potential errors and compliance issues. Taxpayers are encouraged to seek guidance when necessary to navigate this complex process efficiently.

Similar forms

The IRS 1099-MISC form shares similarities with the IRS 4137 form in that both deal with reporting income not subject to traditional withholding. Where the 4137 form is for reporting Social Security and Medicare taxes on unreported tips or allocated tips, the 1099-MISC is used by businesses to report payments made to non-employees, such as independent contractors. Both forms ensure that income is properly reported to the IRS for taxation purposes.

Another document, the IRS W-2 form, also parallels the 4137 form, but it serves a slightly different purpose. The W-2 is used by employers to report the wages paid to employees and the taxes withheld from them. Like the 4137, it deals with the reporting of income and taxation to the IRS, but the W-2 covers a broader category of income, including salaries, wages, and tips directly reported by the employer, unlike the tip income self-reported by employees on the 4137 form.

The IRS 1040 form, or the U.S. Individual Income Tax Return, is connected to the 4137 in that it is the primary form used by individuals to file their annual income tax returns, which may include reporting extra income addressed in the 4137 form. The form 1040 covers the comprehensive income of an individual, including wages, salaries, and tips, the latter of which are directly computed on the 4137 form before being included on the 1040 form.

Similarly, the Schedule SE (Form 1040) is associated with the IRS 4137, as it pertains to calculating the self-employment taxes owed, covering Social Security and Medicare. Individuals who fill out the IRS 4137 for unreported tip income may need to also complete Schedule SE if their tips, along with any other self-employment income, exceed certain thresholds, indicating a convergence in the purpose of reporting and paying due taxes on earned income.

The IRS Schedule C (Form 1040) bears relevance to the 4137 form in its function for reporting income or loss from a business operated as a sole proprietorship. While Schedule C focuses on business income, and the 4137 form is concerned with tips not reported to an employer, both forms contribute to the individual’s total income, affecting the overall tax responsibility.

The IRS 8846 form, or the Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips, is directly related to the IRS 4137 since it allows employers to claim a credit for the Social Security and Medicare taxes paid on their employees' reported tips. This form operates in the ecosystem of tip reporting, handling the employer's side of obligations and incentives, in contrast to the 4137 form, which deals with the employee's reporting responsibilities.

The IRS W-4 form, while primarily a withholding allowance certificate that employees fill out to determine the amount of taxes to be withheld from their paycheck, shares a procedural connection with the IRS 4137. The W-4's purpose is to ensure correct tax withholding based on the employee's income, adjustments, deductions, and credits, which could include anticipated tip income, linking it to the overall goal of accurate income reporting and tax calculation within the IRS framework.

Last but not least, the IRS 4852 form, acting as a substitute for the W-2 or 1099-R, provides a mechanism for taxpayers to report wage and income information if the original documents are not furnished by the employer or payer, or if the information is incorrect. Like the 4137 form, which is used when tips are not properly reported, the 4852 form addresses discrepancies in income reporting, ensuring that individuals have a path to correct or report income information to accurately fulfill their tax obligations.

Dos and Don'ts

Filling out the IRS 4137 form, which is used for reporting social security and Medicare tax on unreported tip income, requires careful attention to detail and an accurate reporting of your earnings. There are several key do's and don'ts that you should keep in mind to ensure that the process goes smoothly and correctly.

Do:

- Report all tips to your employer, except for those that total less than $20 per month.

- Use accurate figures to fill out the form. Estimating or rounding numbers can lead to discrepancies and potential audits.

- Include both cash tips and non-cash tips, such as tickets, products, or services.

- Keep a daily record of your tips. Accurate records can provide valuable evidence in case of discrepancies.

- Use the information from your daily records to fill out your Form 4137 accurately.

Don't:

- Forget to include tips you received from sharing with other employees, known as "split" or "tip pooling."

- Attempt to hide or underreport your tip income. This can lead to penalties, interest, and in some cases, legal actions.

- Mistake the form as a substitute for reporting your tips to your employer. Form 4137 is specifically for unreported tips.

- Overlook the necessity to report all your income on your tax return, not just what is reported on your W-2.

- Rush through filling out the form without double-checking the accuracy of the information you've provided.

By following these guidelines, you can ensure that your IRS 4137 form is filled out correctly and completely, reflecting your tip income accurately. This careful approach can help avoid unnecessary complications with the IRS and ensure that you're paying the correct amount of social security and Medicare taxes.

Misconceptions

When it comes to tax forms, the IRS 4137 form is one that often gets misunderstood. Designed for reporting income from tips that weren’t reported to an employer, it has its fair share of myths surrounding it. Here are four common misconceptions explained:

- "The IRS 4137 form is only for workers in the service industry." While it's true that many service industry workers use this form to report their tip income, it’s not exclusive to them. Any employee who receives tips directly from customers and doesn’t fully report those to their employer should use this form, regardless of their industry.

- "If I receive less than $20 a month in tips, I don't need to report it." This is a common misunderstanding. The $20 rule applies to what you're required to report to your employer each month. However, all tip income must be reported on your tax return, using Form 4137, even if you didn't report it to your employer because it was less than the monthly threshold.

- "Using Form 4137 means I’ll end up paying more taxes." Reporting your tip income does ensure your earnings are accurately reflected and taxes are correctly calculated, which might mean paying more in taxes. However, it also means you're correctly paying into Social Security and Medicare, which can boost your benefits down the line. Plus, accurately reporting your income avoids potential penalties for underreporting.

- "Filling out Form 4137 is complicated." The thought of dealing with any IRS form can be daunting. Nevertheless, Form 4137 is relatively straightforward. It requires you to list the amount of tips you received that weren’t reported to your employer. The IRS uses this information to adjust your income tax, Social Security, and Medicare contributions. If you've kept good records of your tips, filling out this form can be simple.

Key takeaways

Filling out and using IRS Form 4137, "Social Security and Medicare Tax on Unreported Tip Income," is essential for accurately reporting your tips to the Internal Revenue Service (IRS). This form helps you calculate and report any tips you received that were not reported to your employer. Understanding the key aspects of this form ensures compliance with tax laws and avoids potential pitfalls.

- Know when to use Form 4137: You should use Form 4137 if you received tips directly from customers or through tip-sharing arrangements with fellow employees that were not reported to your employer. This includes cash tips, tips added to credit or debit card charges, and the value of any non-cash tips like tickets or other items of value.

- Accurately report all tips: It is crucial to keep track of and report all tips received. The IRS requires that all tips, except for those that are insignificant, be reported. If you didn’t report tips to your employer, Form 4137 is the method to calculate and report the social security and Medicare taxes owed on those unreported tips.

- Calculate social security and Medicare taxes: Form 4137 provides a straightforward way to calculate the social security and Medicare taxes on tips not reported to your employer. You must enter the total amount of unreported tips, and the form will guide you through calculating the taxes owed on those tips, ensuring you pay your fair share to Medicare and Social Security.

- Include Form 4137 with your tax return: After filling out Form 4137, attach it to your Form 1040 or other tax return form. This ensures that your unreported tip income is accounted for in your total tax calculation. Filing Form 4137 with your tax return documents your adherence to tax laws and contributes to the accuracy of your Social Security records, which can affect future benefits.

Correctly using Form 4137 is important for anyone in the service industry receiving tips. By following these key takeaways, taxpayers can ensure they're complying with U.S. tax laws and avoiding potential penalties. Remember, accurately reporting all income, including tips, helps maintain the integrity of your tax return and ensures your Social Security record is accurate, potentially affecting future benefits.