Get IRS 4136 Form

Filing taxes can be a complex process, especially when it comes to understanding the specific forms necessary for various deductions and credits. Among these, the IRS 4136 form plays a crucial role for businesses and individuals eligible for a credit for federal tax paid on fuels. This form allows taxpayers to calculate and request a refund or credit for the taxes they've paid on gasoline, diesel, and other types of fuel used for business purposes, excluding uses on highways. Designed to encourage certain activities or compensate for specific expenditures in fuel, understanding the eligibility requirements and navigation through the complexities of the 4136 form is essential. Whether the fuel is used in farming, for commercial transportation on water, or in an off-highway business use, this form outlines the detailed information needed to claim the credit properly. The process may seem daunting, but with the right guidance, taxpayers can effectively recoup a portion of their expenses, potentially lowering their overall tax burden.

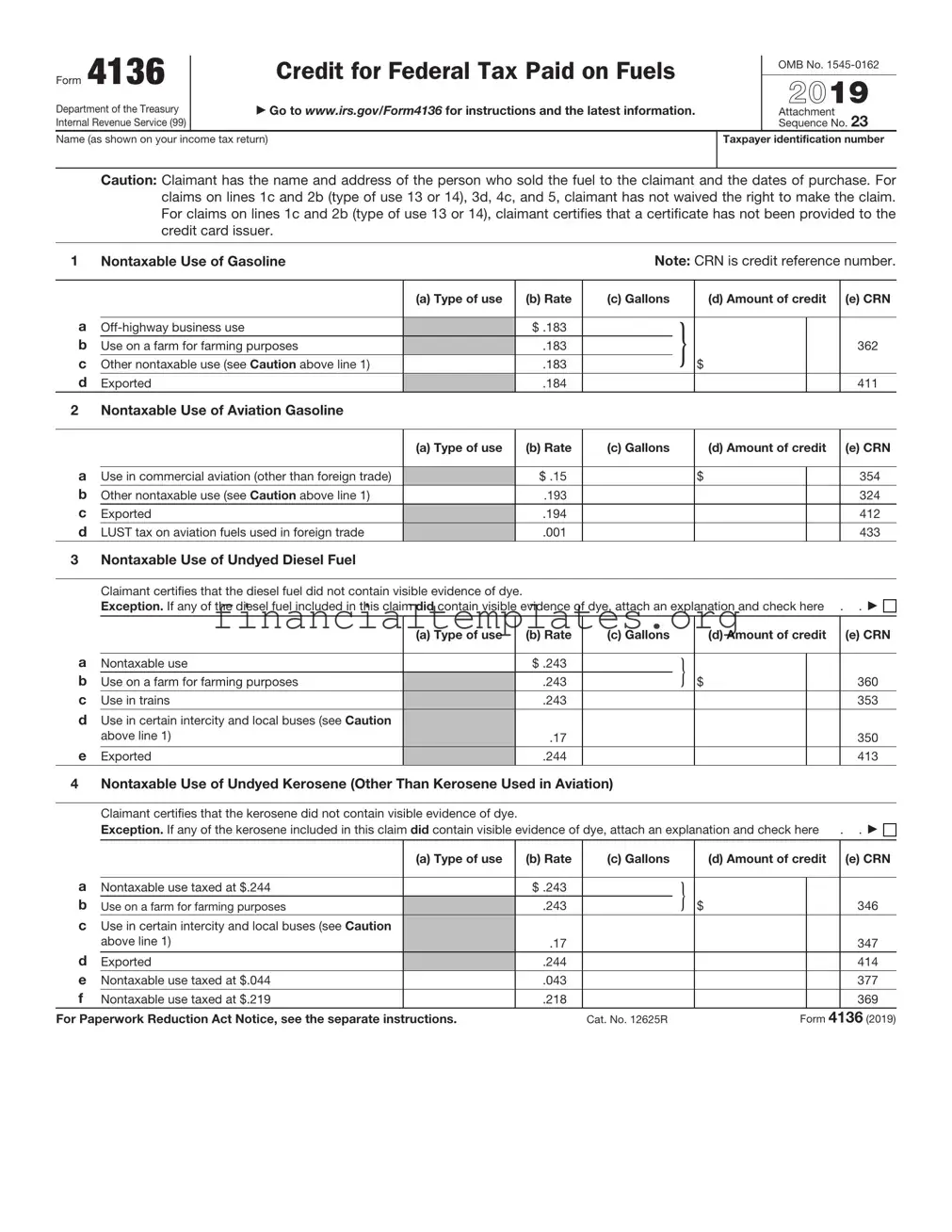

IRS 4136 Example

Form 4136 |

|

Credit for Federal Tax Paid on Fuels |

|

OMB No. |

|

|

|||

|

|

|

|

|

|

|

|

|

|

Department of the Treasury |

|

▶ Go to www.irs.gov/Form4136 for instructions and the latest information. |

2021 |

|

|

|

Attachment |

||

Internal Revenue Service (99) |

|

|

|

Sequence No. 23 |

Name (as shown on your income tax return) |

Taxpayer identification number |

|||

|

|

|

|

|

Caution: Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase. For claims on lines 1c and 2b (type of use 13 or 14), 3d, 4c, and 5, claimant has not waived the right to make the claim. For claims on lines 1c and 2b (type of use 13 or 14), claimant certifies that a certificate has not been provided to the credit card issuer.

1 Nontaxable Use of Gasoline |

|

Note: CRN is credit reference number. |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Type of use |

|

(b) Rate |

(c) Gallons |

|

(d) Amount of credit |

|

(e) CRN |

|

a |

|

|

|

|

|

|

|

|

|

|

|

|

$ .183 |

|

} |

|

|

|

|

||

b |

Use on a farm for farming purposes |

|

|

.183 |

|

|

|

|

362 |

|

c |

Other nontaxable use (see Caution above line 1) |

|

|

.183 |

|

$ |

|

|

|

|

d |

Exported |

|

|

.184 |

|

|

|

|

|

411 |

2 Nontaxable Use of Aviation Gasoline |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

|

|

(a) Type of use |

|

(b) Rate |

(c) Gallons |

|

(d) Amount of credit |

|

(e) CRN |

|

a |

|

|

|

|

|

|

|

|

|

|

Use in commercial aviation (other than foreign trade) |

|

|

$ .15 |

|

|

$ |

|

|

354 |

|

b |

Other nontaxable use (see Caution above line 1) |

|

|

.193 |

|

|

|

|

|

324 |

c |

Exported |

|

|

.194 |

|

|

|

|

|

412 |

d |

LUST tax on aviation fuels used in foreign trade |

|

|

.001 |

|

|

|

|

|

433 |

3 Nontaxable Use of Undyed Diesel Fuel |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

|

Claimant certifies that the diesel fuel did not contain visible evidence of dye. |

|

|

|

|

|

|

|

||

|

Exception. If any of the diesel fuel included in this claim did contain visible evidence of dye, attach an explanation and check here |

. |

. ▶ |

|||||||

|

|

|

|

|

|

|

|

|

||

|

|

(a) Type of use |

|

(b) Rate |

(c) Gallons |

|

(d) Amount of credit |

|

(e) CRN |

|

a |

|

|

|

|

|

|

|

|

|

|

Nontaxable use |

|

|

$ .243 |

|

} |

|

|

|

|

|

b |

Use on a farm for farming purposes |

|

|

.243 |

|

$ |

|

|

360 |

|

c |

Use in trains |

|

|

.243 |

|

|

|

|

|

353 |

d |

Use in certain intercity and local buses (see Caution |

|

|

|

|

|

|

|

|

|

|

above line 1) |

|

|

.17 |

|

|

|

|

|

350 |

e |

Exported |

|

|

.244 |

|

|

|

|

|

413 |

4 Nontaxable Use of Undyed Kerosene (Other Than Kerosene Used in Aviation) |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||

|

Claimant certifies that the kerosene did not contain visible evidence of dye. |

|

|

|

|

|

|

|

||

|

Exception. If any of the kerosene included in this claim did contain visible evidence of dye, attach an explanation and check here |

. |

. ▶ |

|||||||

|

|

|

|

|

|

|

|

|

||

|

|

(a) Type of use |

|

(b) Rate |

(c) Gallons |

|

(d) Amount of credit |

|

(e) CRN |

|

a |

|

|

|

|

|

|

|

|

|

|

Nontaxable use taxed at $.244 |

|

|

$ .243 |

|

} |

|

|

|

|

|

b |

Use on a farm for farming purposes |

|

|

.243 |

|

$ |

|

|

346 |

|

c |

Use in certain intercity and local buses (see Caution |

|

|

|

|

|

|

|

|

|

|

above line 1) |

|

|

.17 |

|

|

|

|

|

347 |

d |

Exported |

|

|

.244 |

|

|

|

|

|

414 |

e |

Nontaxable use taxed at $.044 |

|

|

.043 |

|

|

|

|

|

377 |

f |

Nontaxable use taxed at $.219 |

|

|

.218 |

|

|

|

|

|

369 |

For Paperwork Reduction Act Notice, see the separate instructions. |

|

Cat. No. 12625R |

|

Form 4136 (2021) |

||||||

Form 4136 (2021) |

|

|

|

|

Page 2 |

||

5 Kerosene Used in Aviation |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

(a) Type of use |

(b) Rate |

(c) Gallons |

(d) Amount of credit |

(e) CRN |

|

|

|

|

|

|

|

|

|

a Kerosene used in commercial aviation (other than |

|

|

|

|

|

|

|

|

foreign trade) taxed at $.244 |

|

$ .200 |

|

$ |

|

417 |

b Kerosene used in commercial aviation (other than |

|

|

|

|

|

|

|

|

foreign trade) taxed at $.219 |

|

.175 |

|

|

|

355 |

c Nontaxable use (other than use by state or local |

|

|

|

|

|

|

|

|

government) taxed at $.244 |

|

.243 |

|

|

|

346 |

d Nontaxable use (other than use by state or local |

|

|

|

|

|

|

|

|

government) taxed at $.219 |

|

.218 |

|

|

|

369 |

e |

LUST tax on aviation fuels used in foreign trade |

|

.001 |

|

|

|

433 |

6 Sales by Registered Ultimate Vendors of Undyed Diesel Fuel |

|

Registration No. ▶ |

|

||||

Claimant certifies that it sold the diesel fuel at a

|

Exception. If any of the diesel fuel included in this claim did contain visible evidence of dye, attach an explanation and check here |

. . ▶ |

||||

|

|

|

|

|

|

|

|

|

(b) Rate |

(c) Gallons |

(d) Amount of credit |

(e) CRN |

|

a |

|

|

|

|

|

|

Use by a state or local government |

$ .243 |

|

$ |

|

360 |

|

b |

Use in certain intercity and local buses |

.17 |

|

|

|

350 |

7 Sales by Registered Ultimate Vendors of Undyed Kerosene |

Registration No. ▶ |

|

(Other Than Kerosene For Use in Aviation) |

||

|

Claimant certifies that it sold the kerosene at a

|

Exception. If any of the kerosene included in this claim did contain visible evidence of dye, attach an explanation and check here |

. . ▶ |

|||||

|

|

|

|

|

|

|

|

|

|

(b) Rate |

(c) Gallons |

(d) Amount of credit |

(e) CRN |

||

a |

|

|

|

|

|

|

|

Use by a state or local government |

$ .243 |

|

} |

|

|

|

|

b |

Sales from a blocked pump |

.243 |

|

$ |

|

346 |

|

c |

Use in certain intercity and local buses |

.17 |

|

|

|

|

347 |

8 |

Sales by Registered Ultimate Vendors of Kerosene For Use in Aviation. |

Registration No. ▶ |

|

||||

Claimant sold the kerosene for use in aviation at a

(a) Type of use (b) Rate |

(c) Gallons |

(d) Amount of credit (e) CRN |

aUse in commercial aviation (other than foreign trade)

taxed at $.219 |

$ .175 |

$ |

355 |

bUse in commercial aviation (other than foreign trade)

|

taxed at $.244 |

.200 |

417 |

|

c |

Nonexempt use in noncommercial aviation |

|

.025 |

418 |

d |

Other nontaxable uses taxed at $.244 |

.243 |

346 |

|

e |

Other nontaxable uses taxed at $.219 |

.218 |

369 |

|

f |

LUST tax on aviation fuels used in foreign trade |

.001 |

433 |

|

Form 4136 (2021)

Form 4136 (2021) |

Page 3 |

9 Reserved for future use |

Registration No. ▶ |

aReserved for future use

bReserved for future use

(b) Rate |

(c) Gallons |

(d) Amount of credit |

(e) CRN |

|

|

of alcohol |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

10 Biodiesel or Renewable Diesel Mixture Credit |

Registration No. ▶ |

Biodiesel mixtures. Claimant produced a mixture by mixing biodiesel with diesel fuel. The biodiesel used to produce the mixture met ASTM D6751 and met EPA’s registration requirements for fuels and fuel additives. The mixture was sold by the claimant to any person for use as a fuel or was used as a fuel by the claimant. Claimant has attached the Certificate for Biodiesel and, if applicable, the Statement of Biodiesel Reseller. Renewable diesel mixtures. Claimant produced a mixture by mixing renewable diesel with liquid fuel (other than renewable diesel). The renewable diesel used to produce the renewable diesel mixture was derived from biomass, met EPA’s registration requirements for fuels and fuel additives, and met ASTM D975, D396, or other equivalent standard approved by the IRS. The mixture was sold by the claimant to any person for use as a fuel or was used as a fuel by the claimant. Claimant has attached the Certificate for Biodiesel and, if applicable, Statement of Biodiesel Reseller, both of which have been edited as discussed in the instructions for line 10. See the instructions for line 10 for information about renewable diesel used in aviation.

|

|

(b) Rate |

(c) Gallons |

(d) Amount of credit |

(e) CRN |

|

|

|

|

of biodiesel or |

|

|

|

|

|

|

renewable diesel |

|

|

|

|

|

|

|

|

|

|

a |

Biodiesel (other than |

$1.00 |

|

$ |

|

388 |

b |

1.00 |

|

|

|

390 |

|

c |

Renewable diesel mixtures |

1.00 |

|

|

|

307 |

11Nontaxable Use of Alternative Fuel

Caution: There is a reduced credit rate for use in certain intercity and local buses (type of use 5). See instructions.

|

|

(a) Type of use |

(b) Rate |

(c) Gallons, |

|

(d) Amount |

(e) CRN |

|

|

|

|

|

or gasoline |

|

of credit |

|

|

|

|

|

|

or diesel gallon |

|

|

|

|

|

|

|

|

equivalents |

|

|

|

|

a |

|

|

|

|

|

|

|

|

Liquefied petroleum gas (LPG) (see instructions) |

|

$ .183 |

|

$ |

|

|

419 |

|

b |

“P Series” fuels |

|

.183 |

|

|

|

|

420 |

c |

Compressed natural gas (CNG) (see instructions) |

|

.183 |

|

|

|

|

421 |

d |

Liquefied hydrogen |

|

.183 |

|

|

|

|

422 |

e |

|

|

|

|

|

|

|

|

|

(including peat) |

|

.243 |

|

|

|

|

423 |

f |

Liquid fuel derived from biomass |

|

.243 |

|

|

|

|

424 |

g |

Liquefied natural gas (LNG) (see instructions) |

|

.243 |

|

|

|

|

425 |

h |

Liquefied gas derived from biomass |

|

.183 |

|

|

|

|

435 |

12 |

Alternative Fuel Credit |

|

Registration No. ▶ |

|

||||

|

|

|

|

|

|

|

||

|

|

|

(b) Rate |

(c) Gallons, or |

|

(d) Amount of credit |

(e) CRN |

|

|

|

|

|

gasoline or diesel |

|

|

|

|

|

|

|

|

gallon equivalents |

|

|

|

|

a |

|

|

|

|

|

|

|

|

Liquefied petroleum gas (LPG) (see instructions) |

$ .50 |

|

$ |

|

|

426 |

||

b |

“P Series” fuels |

.50 |

|

|

|

|

427 |

|

c |

Compressed natural gas (CNG) (see instructions) |

.50 |

|

|

|

|

428 |

|

d |

Liquefied hydrogen |

.50 |

|

|

|

|

429 |

|

e |

.50 |

|

|

|

|

430 |

||

f |

Liquid fuel derived from biomass |

.50 |

|

|

|

|

431 |

|

g |

Liquefied natural gas (LNG) (see instructions) |

.50 |

|

|

|

|

432 |

|

h |

Liquefied gas derived from biomass |

.50 |

|

|

|

|

436 |

|

i |

Compressed gas derived from biomass |

.50 |

|

|

|

|

437 |

|

|

|

|

|

|

|

|

Form 4136 (2021) |

|

Form 4136 (2021) |

|

|

|

|

Page 4 |

||

13 |

|

Registered Credit Card Issuers |

|

Registration No. ▶ |

|

||

|

|

|

|

|

|

|

|

|

|

|

(b) Rate |

(c) Gallons |

(d) Amount of credit |

(e) CRN |

|

|

|

|

|

|

|

|

|

|

a |

Diesel fuel sold for the exclusive use of a state or local government |

$ .243 |

|

$ |

|

360 |

|

b |

Kerosene sold for the exclusive use of a state or local government |

.243 |

|

|

|

346 |

|

c Kerosene for use in aviation sold for the exclusive use of a state or local |

|

|

|

|

|

|

|

|

government taxed at $.219 |

.218 |

|

|

|

369 |

14Nontaxable Use of a

Caution: There is a reduced credit rate for use in certain intercity and local buses (type of use 5). See instructions.

|

|

(a) Type of use |

(b) Rate |

(c) Gallons |

|

(d) Amount of credit |

(e) CRN |

|

a |

|

|

|

|

|

|

|

|

Nontaxable use |

|

$ .197 |

|

$ |

|

|

309 |

|

b |

Exported |

|

.198 |

|

|

|

|

306 |

15 |

|

Registration No. ▶ |

|

|

|

|||

Blender credit

(b) Rate |

(c) Gallons |

|

(d) Amount of credit |

(e) CRN |

|

$ .046 |

|

$ |

|

310 |

|

|

|

|

|||

16 |

Exported Dyed Fuels and Exported Gasoline Blendstocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) Rate |

(c) Gallons |

(d) Amount of credit |

(e) CRN |

||

|

|

|

|

|

|

|

|

a Exported dyed diesel fuel and exported gasoline blendstocks taxed |

|

|

|

|

|

|

|

|

at $.001 |

$ .001 |

|

|

$ |

|

415 |

b |

Exported dyed kerosene |

.001 |

|

|

|

|

416 |

17 |

Total income tax credit claimed. Add lines 1 through 16, column (d). Enter here and on |

|

|

|

|

||

|

Schedule 3 (Form 1040), line 12; Form 1120, Schedule J, line 20b; Form |

|

|

|

|

||

|

Form 1041, Schedule G, line 16b; or the proper line of other returns . |

. . . . |

. . ▶ |

17 |

$ |

|

|

|

|

|

|

|

Form 4136 (2021) |

||

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The IRS Form 4136 is used to claim a credit for certain federal taxes paid on fuels. |

| 2 | This form is applicable for businesses, individuals, and tax-exempt organizations that use fuel for a qualifying purpose not related to highway use. |

| 3 | The form can be attached to the filer's income tax return, allowing them to receive a credit for the excise taxes previously paid on fuels. |

| 4 | Fuels eligible for credit or refund include gasoline, aviation gasoline, undyed diesel fuel, undyed kerosene, among others specified by the IRS. |

| 5 | Form 4136 requires detailed information about the type and amount of fuel used, the purpose for which the fuel was used, and calculations for the credit. |

| 6 | While the IRS Form 4136 is federal, states may have their own forms and rules for fuel tax credits or refunds that should be consulted separately. |

Guide to Writing IRS 4136

Filling out the IRS 4136 form, an individual or a business can claim certain fuel tax credits. The form might seem daunting at first glance, but with a step-by-step guide, the process becomes straightforward. Once the form is correctly completed and submitted, the applicant might be eligible for a refund on taxes paid on specific types of fuel. Here is a simple process to follow:

- Begin with your personal information. Enter your name and taxpayer identification number (TIN) at the top of the form. If you're filing as a business, use the business name and Employer Identification Number (EIN) instead.

- For each type of fuel used, locate the correct line on the form. IRS 4136 covers a variety of fuels and uses, so ensure you're recording information in the appropriate section.

- Enter the total gallons of each fuel type you've used in the designated columns. It's crucial to report the usage accurately to ensure your claim is processed correctly.

- Calculate the credit rate for each type of fuel. This will involve some math based on the rates provided in the form's instructions. Multiply the total gallons by the rate to find the amount of your credit.

- Add up the credit amounts from all sections to get your total credit. This figure goes on the line labeled "Total Credit."

- If applicable, adjust your total credit based on any taxable fuel mixture or nontaxable use reported. The instructions provided with Form 4136 include specific guidelines on how to make these adjustments.

- Review your form carefully. Ensure that every section is completed and that your math adds up. Errors can delay processing or result in a denial of your claim.

- Sign and date the form. An unsigned form will not be processed.

- Attach Form 4136 to your income tax return. This form is not standalone and must be submitted as part of your annual tax filing.

After submitting IRS Form 4136 along with your tax return, the next step is to wait for processing. The IRS will review your claim and determine your eligibility for the fuel tax credits. If approved, your credit will either reduce the amount of tax you owe or increase your refund. Keep a copy of the form and any supporting documents for your records in case of future queries from the IRS.

Understanding IRS 4136

-

What is the IRS Form 4136?

IRS Form 4136, also known as the Credit for Federal Tax Paid on Fuels, is used by taxpayers to claim a credit for certain federal excise taxes paid on fuels. These credits are available for fuels used for specific purposes that align with the tax policies, such as in farming equipment, for off-highway business use, in commercial fishing vessels, and for home heating purposes, among other qualifying uses. The intention behind the form is to avoid or reclaim unnecessary taxation on fuel that's used in a manner that benefits from tax incentives.

-

Who needs to file IRS Form 4136?

IRS Form 4136 must be filed by taxpayers who are seeking to claim a credit for the federal excise taxes that were paid on fuels used for qualifying non-taxable purposes. This includes businesses, farmers, and individuals who have used fuel within the scope of the tax credit's intended uses. It's important to note that to claim this credit, you must have directly purchased the fuel and used it in a qualifying manner as defined by the IRS guidelines.

-

How do you file IRS Form 4136?

IRS Form 4136 should be filed as an attachment to your federal income tax return. It requires you to provide detailed information about the type and amount of fuel for which you're claiming a credit, as well as calculations to determine the credit amount. Accuracy in reporting and adherence to the IRS instructions are crucial to ensure that your claim is processed correctly. It's recommended to keep all receipts and records of fuel purchases and usage to support your claim.

-

What supporting documents are needed to file Form 4136?

When filing Form 4136, you must keep detailed records of all fuel purchases and uses that qualify for the credit. These records should include receipts, invoices, and logs detailing how and when the fuel was used. Although these documents are not submitted with the tax return, they must be retained for a period, typically three years from the date of filing the return, to support your claim in case of an IRS audit. Detailed record-keeping ensures you can substantiate every aspect of your claim if required.

Common mistakes

Filling out tax forms can seem like navigating through a maze without a map, especially when dealing with specific credits like the one involving the IRS Form 4136, which is used to claim a credit for federal tax paid on fuels. It's easy to go off track. Here are five common mistakes that people often make when completing this form:

Not verifying eligibility. Before even picking up a pen, it's crucial to ensure you're actually eligible to claim the credit. Many overlook the specific requirements laid out for fuel usage and end up filing for credits they're not entitled to.

Failing to detail fuel usage accurately. This form demands precise information about how much fuel was used, and for what purpose. Guesswork or estimations can lead to inaccuracies, potentially resulting in a denied claim or a request for additional information.

Incorrectly calculating the credit. Math errors are common on tax forms, and the IRS 4136 is no exception. Using the wrong rates or misinterpreting the tax codes can lead to either claiming too much or too little. This mistake can either leave money on the table or invite unintended scrutiny from the IRS.

Omitting required documentation. Some situations require additional documentation to support the credit claim. Forgetting to attach this documentation, or assuming it's not necessary, can lead to delays or denial of the credit.

Mixing up fuel types. With various fuels qualifying for different credit rates, mixing them up is a common pitfall. Each type of fuel used must be accurately reported under the correct category to ensure the claim is processed correctly.

Avoiding these mistakes requires a keen eye for detail and familiarity with IRS instructions. When in doubt, consulting a tax professional can help clarify any confusion and increase the likelihood of a successful claim.

Documents used along the form

When dealing with the IRS 4136 form, which is used to claim a credit for certain federal excise taxes paid on fuels, individuals and businesses often need to complement it with several other forms and documents. These forms help streamline the tax filing process, ensuring compliance with federal regulations and accurate reporting. Their necessity varies based on the taxpayer’s unique circumstances, including the nature of their business and the specific fuels for which they are claiming a credit.

- IRS Form 8849: This form is relevant for claiming refunds on taxes paid on fuel. It often accompanies IRS 4136 when a taxpayer not only claims credits but is also eligible for refunds for taxes paid on nontaxable uses of fuel.

- IRS Form 720: Required for quarterly federal excise tax returns, this form is used to report excise taxes collected by the business, including those on fuels. It is pertinent for entities that both incur and claim credits for fuel taxes.

- IRS Form 1040: The individual income tax return form is where the credits from IRS 4136 can be applied, reducing the total tax liability for qualifying individuals. This link makes Form 1040 essential in the context of fuel tax credits.

- IRS Form 941: Employers who claim credits for fuel used in business operations might also need to adjust their employment tax filings using Form 941, the Employer's Quarterly Federal Tax Return.

- Schedule C (Form 1040): For sole proprietors and single-member LLCs, Schedule C is used to report income or loss from a business. Information from IRS 4136 can impact the net profit or loss reported on this form.

- Schedule F (Form 1040): This form is used by individuals to report income and expenses from farming. Since fuel is a significant expense for many farmers, the IRS 4136 form’s credits can significantly impact the financials reported on Schedule F.

- IRS Form 2290: This is the Heavy Highway Vehicle Use Tax Return, necessary for those who own and operate heavy highway vehicles. The form is crucial because it often precedes the claim for fuel credits, especially for businesses that use large amounts of diesel or gasoline.

The coordination of these forms with the IRS 4136 form ensures a comprehensive approach to handling fuel-related taxes and credits. Filing taxes can be complex, but understanding and properly utilizing these documents can significantly ease the process, aiding taxpayers in maximizing their potential benefits while adhering to federal guidelines.

Similar forms

The IRS Form 4136 is closely related to the IRS Form 1040, which is used by individuals to file their annual income tax returns. Both forms deal with financial data and tax calculations, but while Form 4136 focuses on claiming a credit for certain types of fuel taxes, Form 1040 covers a broader range of income, deductions, and credits. They share the trait of adjusting a taxpayer’s overall tax liability.

Similar to the IRS Form 4136, the IRS Form 8849 (Schedule 1) is used to claim a refund rather than a credit, for certain excise taxes, including those on fuel. The distinction lies in how the tax benefits are received: Form 4136 decreases the amount of tax owed on an income tax return, whereas Form 8849 is for requesting refunds for overpaid excise taxes, which can include fuel taxes under specific conditions.

IRS Form 8911 is designed for taxpayers who install alternative fuel vehicle refueling property and wish to claim a credit for it. Like Form 4136, it deals with incentives related to fuel and energy use, but Form 8911 specifically focuses on the installation of refueling property, emphasizing incentives for encouraging alternative energy uses.

The IRS Form 4868 shares a basic similarity with Form 4136 in the context of dealing with tax filings. Form 4868 is used to request an extension of time to file an income tax return. Both forms interact with the process of filing annual taxes but serve different functions: Form 4136 for credits related to fuel taxes and Form 4868 for extending the filing deadline.

IRS Form 720 is a quarterly federal excise tax return that businesses use to report and pay excise taxes on specific goods and services, including fuel charges. It parallels Form 4136 by dealing with taxes on fuel; however, Form 720 is more about reporting and paying excise taxes directly to the IRS on a quarterly basis, rather than claiming a credit.

Form 2290 is another document related to vehicle use and taxes. Specifically, it's used for the Heavy Highway Vehicle Use Tax Return. It's for owners of heavy highway vehicles weighing 55,000 pounds or more. Although it's primarily for vehicle use tax, similar to Form 4136, it touches on the taxes associated with vehicle operation, albeit from a different angle.

The IRS Form 8885 is used for claiming the Health Coverage Tax Credit, which helps eligible individuals cover health insurance costs. Like Form 4136, it provides a tax credit, but it's focused on health insurance premiums instead of fuel taxes. Both forms help taxpayers reduce their tax liabilities by claiming credits, yet they target different types of expenses.

The IRS Form 5695, which is used for residential energy credits, is akin to Form 4136. Form 5695 allows individuals to claim credits for home improvements that increase energy efficiency or utilize renewable energy sources. Both forms promote energy savings, but Form 5695 focuses on home energy improvements rather than fuel-related expenses.

IRS Form 3800, the General Business Credit form, is a comprehensive document for various business-related tax credits, including those related to energy and fuel in certain contexts. While Form 4136 is specifically for fuel tax credits, Form 3800 covers a wide range of credits that businesses can claim, encapsulating numerous incentives beyond just fuel.

Last but not least, the IRS Form 6478 is for alcohol and cellulosic biofuel production credit. This form, similar to Form 4136, provides tax incentives related to fuel, but it specifically focuses on the production of alcohol fuels and cellulosic biofuel. Both forms encourage the production and use of alternative fuels through tax incentives.

Dos and Don'ts

When preparing to fill out the IRS Form 4136, which is used to claim a credit for federal taxes paid on fuels, it is important to approach the process with precision. To navigate this process effectively, there are several recommendations and pitfalls to keep in mind.

Do:

- Ensure eligibility before you start. Confirm that your usage of the fuel qualifies for the credit under the IRS guidelines.

- Accurately report the type and amount of fuel for which you are claiming a credit. Mistakes can lead to processing delays or audit issues.

- Keep detailed records of fuel purchases and use. Documentation is crucial and must support the amounts claimed on Form 4136.

- Understand the applicable tax credit rates for the types of fuel you used. Rates can change, and different fuels have different rates.

- Review the entire form upon completion for accuracy. Ensuring all information is correct before submission can prevent delays.

Don't:

- Don't assume all fuel use is eligible for a credit. Personal use, for example, does not qualify.

- Don't guess or approximate fuel quantities or costs. Use actual figures from your records.

- Don't overlook the instructions provided by the IRS for Form 4136. They contain valuable information on eligibility, rates, and other details.

- Don't ignore the tax year for which you are filing. Claims must be made for the correct tax year.

- Don't delay in addressing any IRS inquiries regarding your Form 4136 submission. Timely responses are critical.

Misconceptions

The IRS 4136 form, also known as the Credit for Federal Tax Paid on Fuels, is surrounded by a web of misconceptions that can obscure its real benefits and requirements. Understanding these misconceptions is essential for accurately claiming fuel tax credits and navigating the form properly. Here are six common misunderstandings about the IRS 4136 form:

- Only for Large Businesses: It’s a common belief that the IRS 4136 form is solely for large corporations. However, small businesses and even individuals who meet specific criteria can also be eligible. This eligibility extends to those who use fuel for business purposes in a variety of ways, not restricted by size or revenue.

- Applicable Only to Highway Use: Many assume this form is only for fuel used in vehicles on public highways. In truth, the tax credit also applies to non-highway uses such as farming equipment, generators, and other off-highway business applications of fuel.

- Complex and Time-Consuming: While tax forms can indeed be complex, the perception that the IRS 4136 form is overly complicated is misleading. With proper documentation and understanding of applicable uses, taxpayers find the form manageable. Resources and guidance are available to help navigate the process.

- Automatically Audited: The fear of audit often deters individuals and businesses from claiming credits they are entitled to. There is no evidence to suggest that filing form 4136 significantly increases the chance of an audit. Claims made with accurate and truthful information should not fear an IRS audit any more than with other tax forms.

- Only for Gasoline Taxes: Another misconception is that the credit pertains only to gasoline taxes. The IRS 4136 form actually covers a wide range of fuels, including but not limited to gasoline, diesel, kerosene, and certain alternative fuels. It's important to review the form specifics to understand the breadth of applicable fuel types.

- Limited Benefit: Some taxpayers might think the effort to claim this credit isn't worth the potential benefit. However, for businesses with significant fuel expenses, the tax credit can provide a substantial financial return. This is particularly true for companies in transportation, agriculture, and construction industries.

Navigating tax credits and understanding the specifics of forms like IRS 4136 can make a significant difference in a company’s or individual’s financial health. Dispelling these misconceptions is the first step towards taking full advantage of available tax benefits.

Key takeaways

The IRS Form 4136 is used for claiming a credit for certain taxes paid on fuels. It's important to understand how to properly fill out and use this form to ensure you receive the credits you're eligible for.

Eligibility Requirements: Review the eligibility criteria carefully to determine if you can claim a credit for the fuel taxes you've paid. The form is specific about the types of fuel and uses that qualify.

Accurate Records: Keep detailed records of all fuel purchases, including the type of fuel, the amount purchased, and its specific use. These records are crucial for accurately completing Form 4136 and supporting your claim if audited.

Complete All Required Sections: Fill out every section of the form that applies to your situation. Omitting information can delay processing or result in a denial of the credit.

Calculate the Credit Correctly: Use the instructions provided with Form 4136 to calculate your credit accurately. Incorrect calculations can lead to processing delays or adjustments.

Type of Use: Clearly identify the purpose for which the fuel was used. The credit amount varies depending on the type of use, such as on a farm, for off-highway business use, or in a commercial fishery.

Filing Deadline: Submit Form 4136 with your annual tax return by the due date. Late submissions may result in lost credits or penalties.

Attachment Requirements: Attach Form 4136 to your tax return. Do not send it separately. This ensures that your credit claim is processed along with your tax return.

Professional Assistance: Consider seeking help from a tax professional if you're unsure about any part of the form or if your situation is complex. They can provide guidance and help avoid mistakes.

By understanding these key aspects of Form 4136, taxpayers can effectively claim fuel tax credits and potentially reduce their tax liability. Always refer to the latest version of the form and its instructions, available on the IRS website, to ensure compliance with current tax laws and requirements.

Popular PDF Documents

IRS 8960 - IRS 8960 is relevant for taxpayers with investment income and also engaged in a passive activity or trading financial instruments or commodities.

Form 1065 for Llc - For partnerships, this form is foundational in sorting out complex tax issues and complying with IRS regulations.