Get IRS 3949-A Form

Many Americans find themselves at a crossroads when they witness or suspect tax fraud. It's a situation that demands action, yet the path to reporting such activities isn't always clear. Enter the IRS 3949-A form, a crucial tool designed for the public to report suspected tax law violations. This form encompasses a range of violations, from unreported income to fraudulent activities by an individual or a company. Its design is straightforward, aiming to make the reporting process as seamless as possible. The form not only serves as a bridge between the observer and the IRS but also underscores the importance of public involvement in maintaining the integrity of the nation’s tax system. By filling out the IRS 3949-A, individuals can provide detailed information about the suspected fraud, including the identity of the person or entity involved, the nature of the alleged violation, and any relevant financial details. This information is then used by the IRS to initiate investigations, reinforcing the collective effort to uphold fairness and legality in tax matters.

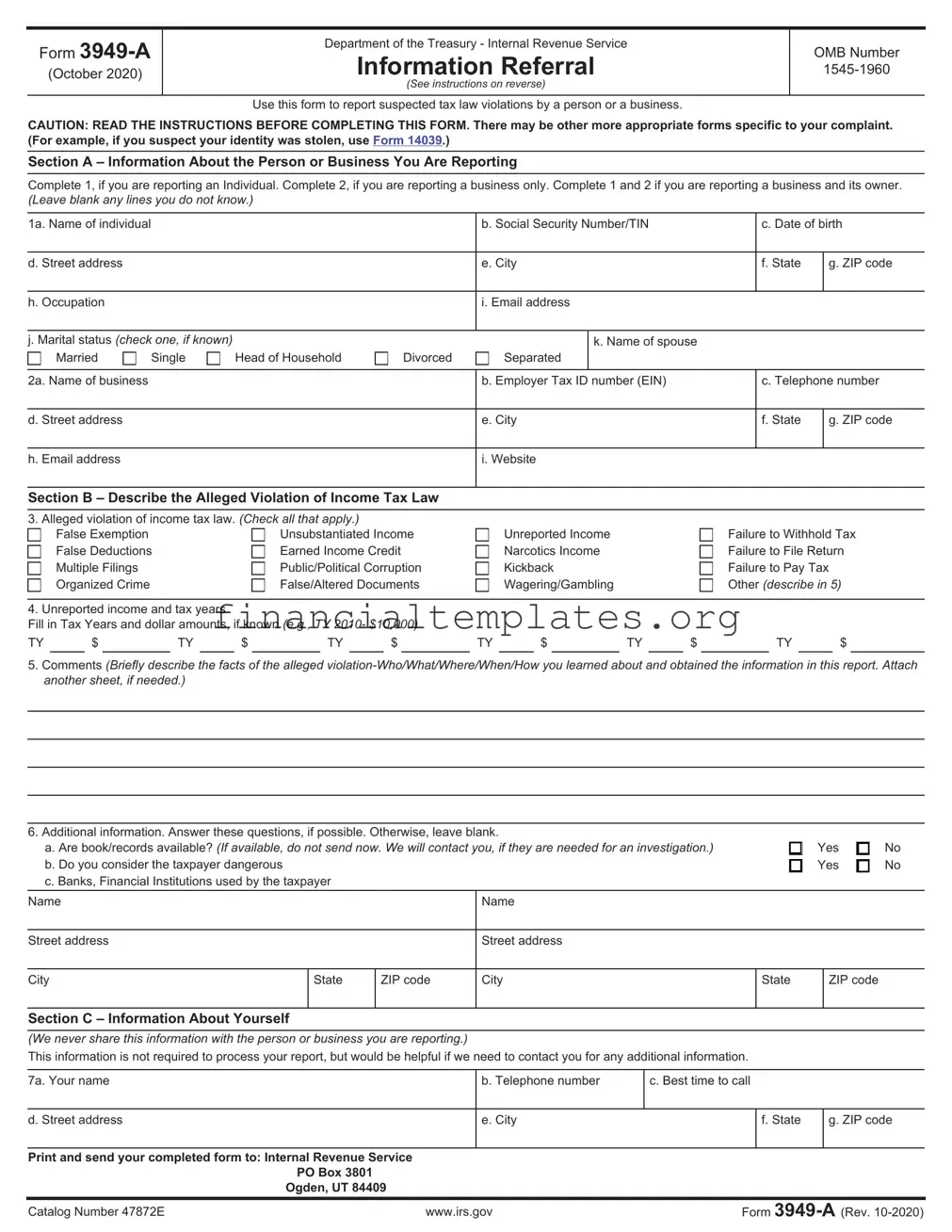

IRS 3949-A Example

Form |

Department of the Treasury - Internal Revenue Service |

OMB Number |

|

Information Referral |

|||

(October 2020) |

|||

|

(See instructions on reverse) |

|

|

|

Use this form to report suspected tax law violations by a person or a business. |

|

CAUTION: READ THE INSTRUCTIONS BEFORE COMPLETING THIS FORM. There may be other more appropriate forms specific to your complaint. (For example, if you suspect your identity was stolen, use Form 14039.)

Section A – Information About the Person or Business You Are Reporting

Complete 1, if you are reporting an Individual. Complete 2, if you are reporting a business only. Complete 1 and 2 if you are reporting a business and its owner. (Leave blank any lines you do not know.)

1a. Name of individual |

|

|

|

b. Social Security Number/TIN |

c. Date of birth |

||

|

|

|

|

|

|

|

|

d. Street address |

|

|

|

e. City |

f. State |

g. ZIP code |

|

|

|

|

|

|

|

|

|

h. Occupation |

|

|

|

i. Email address |

|

|

|

|

|

|

|

|

|

|

|

j. Marital status (check one, if known) |

|

|

|

k. Name of spouse |

|

|

|

Married |

Single |

Head of Household |

Divorced |

Separated |

|

|

|

|

|

|

|

|

|

|

|

2a. Name of business |

|

|

|

b. Employer Tax ID number (EIN) |

c. Telephone number |

||

|

|

|

|

|

|

|

|

d. Street address |

|

|

|

e. City |

f. State |

g. ZIP code |

|

|

|

|

|

|

|

|

|

h. Email address |

|

|

|

i. Website |

|

|

|

|

|

|

|

|

|

|

|

Section B – Describe the Alleged Violation of Income Tax Law

3. |

Alleged violation of income tax law. (Check all that apply.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

False Exemption |

|

|

|

Unsubstantiated Income |

|

Unreported Income |

|

|

|

Failure to Withhold Tax |

||||||||||||

|

|

False Deductions |

|

|

|

Earned Income Credit |

|

Narcotics Income |

|

|

|

Failure to File Return |

||||||||||||

|

|

Multiple Filings |

|

|

|

Public/Political Corruption |

|

Kickback |

|

|

|

Failure to Pay Tax |

|

|

||||||||||

|

|

Organized Crime |

|

|

|

False/Altered Documents |

|

Wagering/Gambling |

|

|

|

Other (describe in 5) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

4. |

Unreported income and tax years |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Fill in Tax Years and dollar amounts, if known (e.g., TY 2010- $10,000) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

TY |

|

$ |

|

TY |

|

$ |

|

TY |

|

$ |

|

TY |

|

$ |

|

TY |

|

$ |

|

TY |

|

$ |

|

|

5.Comments (Briefly describe the facts of the alleged

6. Additional information. Answer these questions, if possible. Otherwise, leave blank. |

Yes |

No |

|

a. Are book/records available? (If available, do not send now. We will contact you, if they are needed for an investigation.) |

|||

b. Do you consider the taxpayer dangerous |

|

Yes |

No |

c. Banks, Financial Institutions used by the taxpayer |

|

|

|

Name |

Name |

|

|

Street address

Street address

City

State

ZIP code

City

State

ZIP code

Section C – Information About Yourself

(We never share this information with the person or business you are reporting.)

This information is not required to process your report, but would be helpful if we need to contact you for any additional information.

7a. Your name |

b. Telephone number |

c. Best time to call |

|

|

|

d. Street address

e. City

f. State

g. ZIP code

Print and send your completed form to: Internal Revenue Service

PO Box 3801

Ogden, UT 84409

Catalog Number 47872E |

www.irs.gov |

Form |

Page 2

Instructions for Form

General Instructions

Purpose of the Form

Use Form

CAUTION: DO NOT USE Form

oIf you suspect your identity was stolen. Use Form 14039. Follow “Instructions for Submitting this Form” on Page 2 of Form 14039.

oTo report suspected misconduct by your tax return preparer. Use Form 14157. Submit to the address on the Form 14157.

oIf your paid preparer filed a return or made changes to your return without your authorization. Instead, use Form 14157 AND Form

oIf you received a notice from the IRS about someone claiming your exemption or dependent. Follow the instructions on the notice. Do not complete Form

oTo report an abusive tax avoidance scheme, promotion, or a promoter of such a scheme. Use Form 14242. Mail or FAX to the address or FAX number on the Form 14242.

oTo report misconduct or wrongdoing by a tax exempt organization or its officers, directors, or authorized persons. Use Form 13909. Submit by mail, FAX, or email, according to the instructions on the Form 13909.

Have information and want to claim a reward? Use Form 211, Application For Award For Original Information. Mail it to the address in the Instructions for the form.

Specific Instructions

Section A – Provide Information About the Person/Business You Are Reporting, if known.

Provide as much information as you know about the person or business you are reporting.

1.Complete if you are reporting an individual. Include their name, street address, city, state, ZIP code, social security number or taxpayer identification number, occupation, date of birth, marital status, name of spouse (if married), and email address. Include as much information as you know.

2.Complete if you are reporting a business. Include the business name, business street address, city, state, ZIP code, employer identification number (EIN), telephone number(s), email address, and website, if known.

Note: Complete both parts if you are reporting a business and its owner.

Section B – Use to Describe the Alleged Tax Law Violation(s)

3.Check all Tax Violations That Apply to Your Report.

False Exemption- Claimed persons as dependents they are not entitled to claim.

False Deductions- Claimed false or exaggerated deductions to reduce their taxable income. Multiple Filings- Filed more than one tax return to receive fraudulent refunds.

Organized Crime- Member of a group of persons who engaged in illegal enterprises such as drugs, gambling, loansharking, extortion, or laundering illegal money through a legitimate business.

Unsubstantiated Income- Reported false income from an unverifiable source in order to get a false refund.

Earned Income Credit- Claimed Earned Income Credit which they were not entitled to receive. They may have reported income they did not earn or claimed children they were not entitled to claim.

Public/Political Corruption- Public official or politician violated laws against using their position illegally for personal gain.

False/Altered Documents- Changed documents, such as a

Unreported Income- Received cash or other untraceable payments, such as goods or services, and did not report the income.

Narcotics Income- Received income from illegal drugs or narcotics.

Catalog Number 47872E |

www.irs.gov |

Form |

Page 3

Kickback- Received illegal payments or kickbacks in exchange for referring the business of a government agency or other business towards a company or for influencing business decisions that result in part of the payment for the business received or service performed being returned to the person who made the referral.

Wagering/Gambling- Did not report income received from wagering or gambling.

Failure to Withhold Tax- Individual or business did not withhold legally owed taxes from income paid to their employee(s), such as Social Security or Medicare taxes. Example: A business treated employees as independent contractors and issued Forms 1099, with no tax withheld, instead of a

Failure to File Return- Individual or business has not filed returns legally due. Failure to Pay Tax- Individual or business has not paid taxes legally due. Other- Describe in 5.

4.If your report involves unreported income, indicate the year(s) and the dollar amount(s).

5.Briefly describe the facts of the alleged tax law violation(s) as you know them. Attach another sheet, if you need more room.

6.Additional Information, if known. Attach another sheet, if you need more room.

Section C – Provide Information about Yourself

7.Note: Information about yourself is NOT required to process your report, but may be helpful if we need additional information.

Print and send your completed form to the Internal Revenue Service at:

Internal Revenue Service

PO Box 3801

Ogden, UT 84409

Paperwork Reduction Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States. This report is voluntary and the information requested helps us determine if there has been a violation of Income Tax Law. We need it to insure that taxpayers are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administrations of any Internal Revenue laws. Generally, tax returns and tax return information are confidential, as required by Code section 6103.

The time required to complete this form will vary depending on individual circumstances. The estimated average time is 15 minutes.

Privacy Act Notice

We are requesting this information under authority of 26 U.S.C. 7801. The primary purpose of this form is to report potential violations of the Internal Revenue laws. The information may be disclosed to the Department of Justice to enforce the tax laws. Providing the information is voluntary. Not providing all or part of the information will not affect you.

Catalog Number 47872E |

www.irs.gov |

Form |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 3949-A is used to report suspected tax fraud or tax law violations to the Internal Revenue Service (IRS). |

| Who Can File | Any individual can file Form 3949-A if they suspect or know of an individual or business that is not complying with tax laws. |

| Type of Information to Report | The form is designed to collect information about various types of tax law violations, including unreported income, false exemptions or deductions, organized crime, failure to withhold taxes, and other fraudulent activities. |

| Governing Law | Federal tax laws and regulations govern the submission and processing of Form 3949-A. There are no state-specific laws for this form, as it pertains to federal tax evasion and fraud. |

Guide to Writing IRS 3949-A

After identifying a potential instance of tax fraud or evasion, an individual might feel compelled to take action. The IRS Form 3949-A offers a structured way to report suspected tax law violations confidentially. This form can be filled out and submitted by anyone who wishes to report activities such as fraudulent tax returns, unreported income, or other discrepancies directly related to tax laws. Below is a step-by-step guide designed to simplify the process of filling out this form.

- Begin by gathering all relevant information about the person or business you are reporting. This includes full names, addresses, business names, and any known Social Security numbers or Employer Identification Numbers.

- Access the IRS Form 3949-A online through the IRS website or request a paper copy by calling the IRS.

- Provide details about the alleged tax law violation. Clearly explain the activity, being as specific as possible regarding dates, amounts, and the type of violation you believe has occurred (e.g., unreported income, false exemptions, etc.).

- Indicate the years during which the alleged violation took place.

- If available, attach any documentation that supports your allegations. Though it's possible to submit the form without documentation, providing evidence can significantly aid the IRS in its investigation.

- Fill in your contact information in the designated section of the form. This step is optional; however, providing your details can be helpful if the IRS needs to contact you for further information or clarification. Remember, your identity remains confidential.

- Review the form for accuracy and completeness. Making sure all the information provided is correct and well-detailed can expedite the process.

- Mail the completed Form 3949-A to the IRS address provided on the form or on the IRS website dedicated to reporting tax fraud. Ensure the form is securely enclosed in an envelope to maintain confidentiality.

Once submitted, the form will be reviewed by the IRS. While the process of investigation may take some time, rest assured that each report is taken seriously and contributes to maintaining the integrity of the tax system. It's important to note that due to tax privacy laws, the IRS may not be able to disclose the outcome of its investigation or whether an investigation has been initiated. However, individuals who report suspected tax fraud can be confident that they have taken a meaningful step towards upholding the law and protecting public resources.

Understanding IRS 3949-A

What is the IRS 3949-A form used for?

Who can file a 3949-A form?

What information is required to complete the form?

How can the IRS 3949-A form be submitted?

Is it necessary to provide evidence along with the form submission?

What happens after the form is submitted?

Can the person reporting tax fraud receive a reward?

The IRS 3949-A form is utilized by individuals to report suspected tax fraud or questionable activity to the Internal Revenue Service. This could involve someone not reporting their full income, engaging in fraudulent activity regarding tax returns, or businesses not withholding proper taxes. By filling out and submitting this form, you can anonymously alert the IRS to investigate potential violations of tax laws.

Any individual who has information about suspected tax fraud or violations can file a 3949-A form. This includes employees reporting their employers, neighbors, customers, or anyone else who suspects that tax laws are being violated. It's important to note that you do not need to provide your personal information to file this report, allowing for anonymous submissions.

To complete the IRS 3949-A form, you'll need to provide detailed information about the person or business you're reporting, including their name, address, and, if known, their Social Security number or Employer Identification Number (EIN). Additionally, you should describe the alleged tax law violation in as much detail as possible, including the tax years involved, how you became aware of the issue, and any related financial amounts if known. Providing specific details can help the IRS in their investigation.

The IRS 3949-A form can be submitted in two main ways: either by mailing a physical copy to the Internal Revenue Service at the address provided on the form or by fax. Before sending, ensure that all sections of the form are completed to the best of your ability. It's also recommended to keep a copy of the form for your records.

While it's not mandatory to provide evidence with your submission of the IRS 3949-A form, including any relevant documentation you have can be incredibly helpful to the IRS in their investigation. This could be copies of receipts, ledgers, emails, or any other materials that support your claims. Remember, the goal is to provide as much clear and specific information as possible to assist in a thorough investigation.

After the IRS 3949-A form is submitted, the IRS reviews the information provided to determine if there is enough detail to warrant an investigation. Due to the confidentiality of tax investigations, you will not receive updates or feedback about the outcome of the case or any investigations that are undertaken. The process can take some time, so patience is necessary.

While the IRS 3949-A form does not directly involve a reward system, the IRS does have a Whistleblower Informant Award program. If the information you submit leads to the collection of taxes, penalties, and interest from the reported individual or business, you may be eligible for a reward. However, to potentially receive a reward, you would need to submit a different form, Form 211, Application for Award for Original Information, detailing the same or additional information about the tax violation.

Common mistakes

When it comes to reporting suspected tax law violations to the IRS, the Form 3949-A serves as a crucial tool. Completing this form correctly is important to ensure that your report is processed efficiently and accurately. However, there are several common mistakes that people often make when filling out this form. Being aware of these can improve the quality of the information provided to the IRS and potentially expedite the investigation process.

Not providing detailed information about the suspected violation. The IRS requires specific details to investigate a case properly. Just stating that someone is evading taxes without providing clear examples or evidence can lead to delays or the report being disregarded.

Failing to include the taxpayer's identification. This includes the name, address, and, if known, the Social Security number or Employer Identification Number of the person being reported. Without this critical information, it may be nearly impossible for the IRS to proceed with an investigation.

Omitting your own contact information. While it's not mandatory to identify yourself when reporting a possible violation, leaving out your contact information means the IRS can't reach out to you for additional information or clarification, which might be necessary for a thorough investigation.

Using unclear or vague language. Being specific and clear in describing the suspected tax violation is essential. Ambiguous statements can lead to misunderstandings and potentially cause the IRS to miss critical information.

Misunderstanding the type of information being requested. Each section of the form is designed to gather specific types of information. Misinterpreting what is asked for and placing information in the wrong section can confuse the issue, making it harder for IRS agents to follow the report.

Reporting issues that don't pertain to tax law violations. The IRS Form 3949-A is specifically for reporting tax violations. Using it to report other concerns, such as customer service issues or disputes with employers that don't directly involve tax law, is not appropriate and will not result in an investigation.

Forgetting to sign and date the form, if you choose to identify yourself. Doing so can add credibility to your report; however, even if opting to remain anonymous, ensuring that all other fields are completed as thoroughly as possible is important.

Not making a copy of the completed form for personal records. Keeping a copy can be critical if you need to reference what information was provided, especially if you are contacted by the IRS for further information.

In addition, here are some general tips to avoid these mistakes:

Take your time to read each section carefully to ensure you understand what information is required.

Provide as much detail as possible, including dates, amounts, and any supporting evidence you might have.

Check the IRS guidelines available online for any updates or changes regarding Form 3949-A.

By avoiding these common errors, you can help the IRS more effectively process your report and investigate potential tax law violations.

Documents used along the form

When reporting suspected tax fraud or evasion to the IRS, the IRS 3949-A form plays a crucial role. This form allows individuals to report activities or individuals that might be trying to avoid paying taxes. However, to ensure the IRS has all necessary information to proceed, additional documents or forms are often submitted alongside the IRS 3949-A form. Each of these documents serves a specific purpose, adding more context or evidence to the report being made. Here is a list of other forms and documents frequently included with the IRS 3949-A form.

- Form 1040: U.S. Individual Income Tax Return – This is the standard federal income tax form people use to report their annual earnings. Including a copy can help the IRS compare reported income with suspected untaxed income.

- Form 1099: Miscellaneous Income – Independent contractors, freelancers, and others who are self-employed receive this form. Submitting it can help identify discrepancies in reported income or undisclosed earnings.

- Form 4564: Information Document Request – This form is used by the IRS to request additional information from taxpayers. When submitting IRS 3949-A, including this document filled out with information you believe the IRS should request can be beneficial.

- Bank statements or Records – Financial statements showing unusual deposits or transactions can support claims of unreported income. These documents can be critical in illustrating the discrepancy between reported income and lifestyle.

- Real Estate Records – Titles, deeds, and mortgage documents can demonstrate ownership of properties that might not align with reported income, indicating potential tax evasion.

- Employment Documents – Pay stubs, W-2 forms, and employment contracts can provide evidence of compensation that may not have been fully reported to the IRS.

- Correspondence – Emails, letters, or memos discussing financial transactions or tax planning strategies that imply an intent to evade taxes can be pivotal evidence when attached with Form 3949-A.

In conclusion, while the IRS 3949-A form is vital for reporting possible tax evasion or fraud, supporting it with additional documents strengthens the case. Proper documentation not only enhances the credibility of the report but also assists IRS investigators in understanding the complete picture. Therefore, gathering as much relevant information and including these accompanying forms and documents can be instrumental in ensuring a thorough investigation.

Similar forms

The IRS 3949-A form, used to report suspected tax fraud or evasion, shares similarities with several other IRS forms and legal documents, each designed for specific reporting or disclosure purposes. One such document is the Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business. This form is used to report large cash transactions, aiming to prevent money laundering. Both forms serve as tools for compliance and enforcement, requiring individuals or businesses to report significant and potentially suspicious financial activities.

Another related document is the Form 14039, Identity Theft Affidavit, which individuals submit to report identity theft that has affected their tax records. Much like the 3949-A, the 14039 is a response mechanism for individuals to alert the IRS about fraudulent activities, in this case, relating to their identity rather than general tax fraud. Both forms are vital for the protection of the taxpayer's rights and assets.

The Whistleblower Informant Award Application Form 211 functions similarly to Form 3949-A by encouraging individuals to report tax evasion. Informants who submit Form 211 may become eligible for monetary awards if their information leads to a successful recovery of unpaid taxes. While Form 3949-A is for reporting suspected fraud without direct personal benefit, Form 211 incentivizes tip-offs with potential financial rewards.

The Suspicious Activity Report (SAR) is a document financial institutions must file with the Financial Crimes Enforcement Network (FinCEN) to report suspected cases of money laundering or fraud. Although SARs are not filed with the IRS, they parallel the 3949-A form's purpose in combating financial crimes and fraud. Both documents are essential components of the framework to detect and prevent illegal financial activities.

Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, is required from taxpayers who have a certain level of control or interest in a foreign corporation. This form, similar to the 3949-A, addresses the potential for tax evasion, particularly in the context of international business operations, ensuring transparency and compliance with U.S. tax laws.

Form 8938, Statement of Specified Foreign Financial Assets, necessitates the reporting of foreign bank accounts and financial assets, aiming to reduce offshore tax evasion. Like the 3949-A form, Form 8938 is a tool for the IRS to gather data necessary to enforce tax laws and identify potential instances of avoidance or fraud.

The Report of Foreign Bank and Financial Accounts (FBAR), filed separately from the tax return to the FinCEN, shares similarities with the IRS 3949-A by focusing on transparency and compliance in the context of foreign accounts. Both forms are critical for monitoring and mitigating the risks of tax evasion associated with offshore financial activities.

The Form 8886, Reportable Transaction Disclosure Statement, is used to disclose information about certain transactions that could be used for tax avoidance or evasion. Similarly, to the 3949-A form, it serves as a preventive measure, requiring transparency about transactions that might otherwise be used to undermine the integrity of the tax system.

Lastly, the Confidential Informant Declaration, Form 211, which, although mentioned earlier for its rewards system, also emphasizes the confidentiality and protection of the informants, similar to the protections offered to those filing a 3949-A. This ensures that individuals reporting tax fraud or evasion can do so without fear of retaliation, encouraging more people to come forward with information.

All these documents, while serving distinct purposes, collectively illustrate the vast mechanisms through which the IRS seeks to ensure tax compliance, tackle fraud, and maintain the integrity of the tax system. Each form, including the 3949-A, plays a unique role in this comprehensive effort.

Dos and Don'ts

The IRS Form 3949-A is utilized to report alleged tax law violations by an individual, a business, or both. When completing this form, here are important dos and don'ts to consider:

Do:

Provide as much detailed information as possible about the person or business you are reporting. This includes full names, addresses, and Social Security numbers or Employer Identification Numbers if available.

Specify the type of tax fraud you believe is being committed, such as unreported income or improper deductions and credits.

Include the tax years involved. It's crucial to identify the specific years you believe the fraudulent activity occurred.

Attach any documents that support your claim. Evidence strengthens your report and may include financial statements, ledgers, receipts, and other relevant documentation.

Remember to sign and date the form if you are submitting it in a physical format. Anonymity is an option; however, providing your contact information can be helpful if clarification or further information is needed.

Don't:

Submit vague or speculative accusations. Your report should be based on factual information, not guesses or assumptions.

Forget to specify the tax years. Reporting on alleged fraud without mentioning the relevant tax years can lead to delays in investigation.

Use the form for non-tax related issues. Form 3949-A is designed specifically for reporting tax law violations. Other concerns should be directed to the appropriate agency or department.

Assume immediate action. The IRS receives a large volume of reports and each is reviewed in the order it is received. Investigations can take time, and the IRS may not provide updates due to tax privacy laws.

Misconceptions

Many individuals often find the IRS 3949-A form confusing, leading to several misconceptions. Below, we address four common myths and clarify the truth behind each.

Only professionals can file Form 3949-A. Some believe that a special skill set or professional background is necessary to report suspected fraud on Form 3949-A. In truth, anyone who suspects tax fraud or evasion can complete and file this form. The IRS encourages individuals to report any suspicious activities, providing a standard way for citizens to help ensure fairness and compliance in tax matters.

You need concrete evidence to file. While having detailed information can certainly help the IRS in its investigations, it's a myth that you must provide concrete evidence of fraud when filing Form 3949-A. Individuals are encouraged to report any suspected fraudulent activity, even if they only have limited details or information. The IRS will take it from there, conducting a thorough investigation into the matter.

Filing Form 3949-A will automatically trigger an audit of the reported party. Many people hesitate to file due to the belief that an audit will immediately follow. However, not all reports result in audits. The IRS evaluates each submission carefully and decides on the appropriate course of action. An audit is just one of many tools the IRS might use during its investigation.

Filing Form 3949-A guarantees anonymity for the reporter. While the IRS does its best to protect the identity of individuals reporting suspected tax fraud, absolute anonymity cannot be guaranteed. In some cases, further investigation might require revealing the source of information. However, the IRS is committed to maintaining confidentiality to the fullest extent possible.

Understanding these key facts about IRS Form 3949-A demystifies the process and empowers individuals to participate in maintaining the integrity of the tax system with confidence.

Key takeaways

The IRS 3949-A form is a document used by the Internal Revenue Service (IRS) to report suspected tax law violations by an individual or a business. Understanding how to properly fill out and use this form is essential for those who are looking to report tax evasion or fraud in a responsible and effective manner. Below are ten key takeaways regarding the IRS 3949-A form:

- Identification of the taxpayer is required: The form requires detailed information about the person or entity you are reporting, including name, address, and Social Security Number (SSN) or Employer Identification Number (EIN), if known.

- Describe the alleged tax law violation clearly: You must provide a clear and concise description of the actions or behaviors that you believe are in violation of tax laws.

- Specific details increase effectiveness: Providing specific details such as dates, amounts, and types of evidence you have will make your report more credible and easier for the IRS to investigate.

- Anonymous reporting is possible but limits follow-up: You can submit the form anonymously, but doing so may limit the IRS’s ability to contact you for further information, potentially reducing the effectiveness of the investigation.

- Documentation supports your report: While not required, attaching copies of documents that support your claims (never original documents) can significantly strengthen your report.

- Multiple ways to submit the form: The IRS 3949-A form can be submitted via mail or fax, but not electronically, to protect the sensitivity of the information provided.

- No reward for reporting through IRS 3949-A: Unlike the IRS Whistleblower Program, submitting a report through the 3949-A form does not make you eligible for a reward.

- Protect your personal information: If you choose not to report anonymously, be cautious and protect your personal information to avoid any potential retaliation.

- Response times may vary: The IRS receives a high volume of reports, so response times and investigation commencement can vary widely.

- Alternative forms for identity theft or fraudulent returns: If your report concerns identity theft or fraudulent tax returns, other specific forms like the IRS Form 14039 (Identity Theft Affidavit) may be more appropriate.

Correctly using the IRS 3949-A form plays a critical role in the enforcement of tax laws and the integrity of the tax system. Following these guidelines ensures that reports are both effective and properly handled, contributing to the overall efficiency of tax law enforcement efforts.

Popular PDF Documents

How to Print 2022 Tax Forms - It is a convenient way for individuals to ensure they do not miss any payments and incur further penalties.

IRS Notice 703 - Notice 703 comes with instructions for how to report pension and annuity income on your federal tax return.

Work Completion Template - A statement certifying the completion and payment of all repair work on your property due to specific damage.