Get IRS 3911 Form

When a taxpayer expects a refund but hasn't received it, the steps to uncover the mystery may lead them to the IRS 3911 form. This critical document serves as a taxpayer's statement regarding a refund, allowing individuals to formally notify the IRS of the missing payment. It's more than just a notification; it opens up a line of inquiry with the IRS, enabling them to track down the whereabouts of the anticipated funds. Filling out the form entails providing detailed information about the specific tax return and refund in question, including tax year, the amount expected, and personal identification details. The IRS then uses the information to investigate the status of the refund, making the 3911 form an essential tool for resolving issues of non-received refunds. Regardless of whether the issue is due to a postal error, incorrect banking information, or another hiccup in the process, this form is the first step towards resolution, designed to safeguard taxpayers’ rights and ensure they receive the refunds they are due.

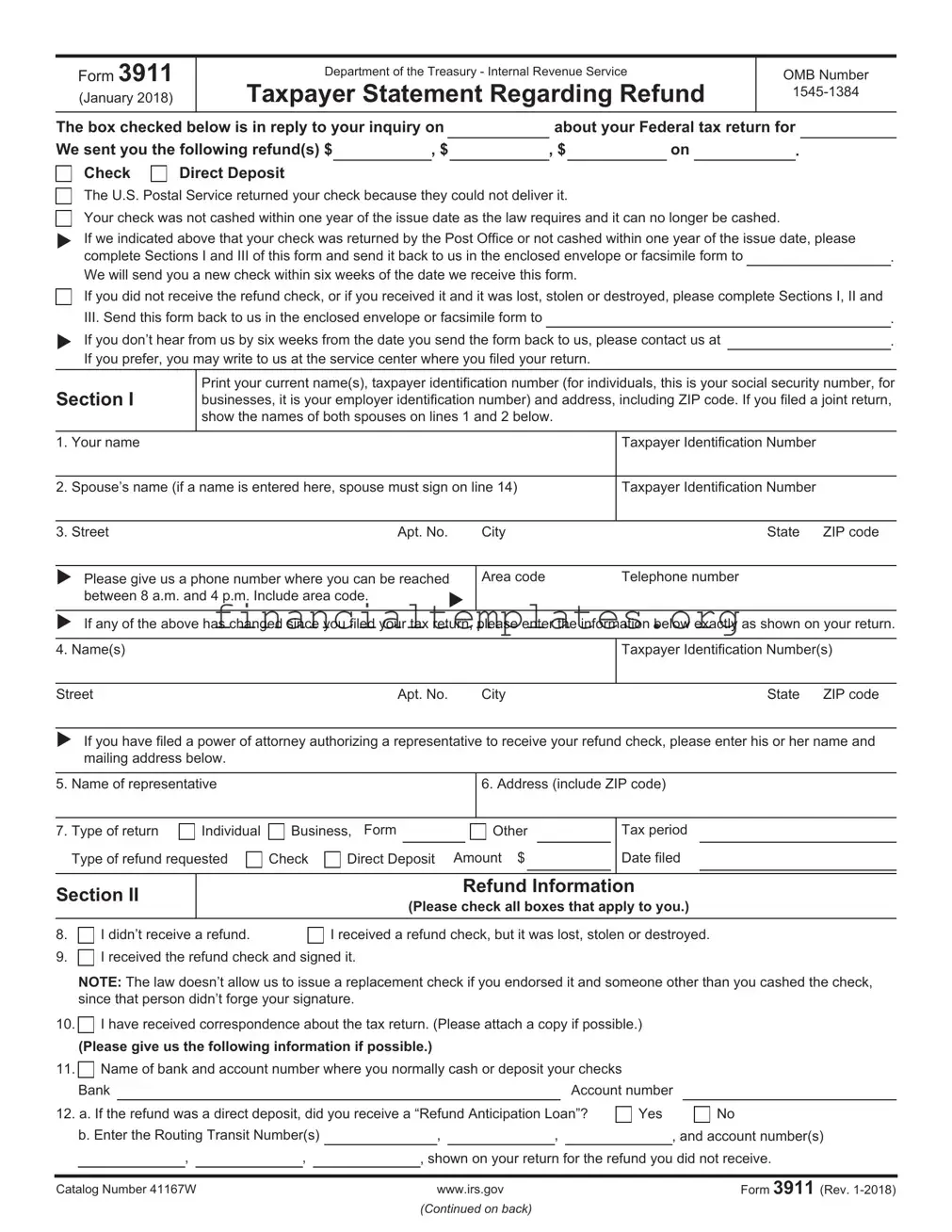

IRS 3911 Example

Form 3911

(January 2018)

Department of the Treasury - Internal Revenue Service

Taxpayer Statement Regarding Refund

OMB Number

The box checked below is in reply to your inquiry on |

|

|

about your Federal tax return for |

|||||||

We sent you the following refund(s) $ |

, $ |

, $ |

|

on |

. |

|||||

Check |

Direct Deposit |

|

|

|

|

|

|

|

|

|

The U.S. Postal Service returned your check because they could not deliver it.

Your check was not cashed within one year of the issue date as the law requires and it can no longer be cashed.

XIf we indicated above that your check was returned by the Post Office or not cashed within one year of the issue date, please complete Sections I and III of this form and send it back to us in the enclosed envelope or facsimile form to

We will send you a new check within six weeks of the date we receive this form.

If you did not receive the refund check, or if you received it and it was lost, stolen or destroyed, please complete Sections I, II and III. Send this form back to us in the enclosed envelope or facsimile form to

XIf you don’t hear from us by six weeks from the date you send the form back to us, please contact us at If you prefer, you may write to us at the service center where you filed your return.

.

.

.

Section I

Print your current name(s), taxpayer identification number (for individuals, this is your social security number, for businesses, it is your employer identification number) and address, including ZIP code. If you filed a joint return, show the names of both spouses on lines 1 and 2 below.

1. Your name

Taxpayer Identification Number

2. Spouse’s name (if a name is entered here, spouse must sign on line 14)

Taxpayer Identification Number

3. Street |

Apt. No. |

City |

State |

ZIP code |

XPlease give us a phone number where you can be reached

between 8 a.m. and 4 p.m. Include area code. |

X |

Area code |

Telephone number |

XIf any of the above has changed since you filed your tax return, please enter the information below exactly as shown on your return.

4. Name(s)

Taxpayer Identification Number(s)

Street |

Apt. No. |

City |

State |

ZIP code |

XIf you have filed a power of attorney authorizing a representative to receive your refund check, please enter his or her name and mailing address below.

5. Name of representative

7. Type of return |

Individual |

Business, Form |

|

|

Other |

|

Type of refund requested |

Check |

Direct Deposit |

Amount $ |

|||

Tax period

Date filed

Section II

Refund Information

(Please check all boxes that apply to you.)

8. |

I didn’t receive a refund. |

I received a refund check, but it was lost, stolen or destroyed. |

9. I received the refund check and signed it.

I received the refund check and signed it.

NOTE: The law doesn’t allow us to issue a replacement check if you endorsed it and someone other than you cashed the check, since that person didn’t forge your signature.

10. I have received correspondence about the tax return. (Please attach a copy if possible.)

I have received correspondence about the tax return. (Please attach a copy if possible.)

(Please give us the following information if possible.)

11.

Name of bank and account number where you normally cash or deposit your checks

Name of bank and account number where you normally cash or deposit your checks

|

Bank |

|

|

|

|

|

|

|

|

|

|

|

Account number |

|

|||||

12. a. If the refund was a direct deposit, did you receive a “Refund Anticipation Loan”? |

Yes |

|

No |

||||||||||||||||

|

b. Enter the Routing Transit Number(s) |

, |

|

, |

|

|

|

, and account number(s) |

|||||||||||

|

, |

|

, |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

, shown on your return for the refund you did not receive. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Catalog Number 41167W |

|

|

|

|

www.irs.gov |

|

|

|

|

|

|

Form 3911 (Rev. |

|

||||||

(Continued on back)

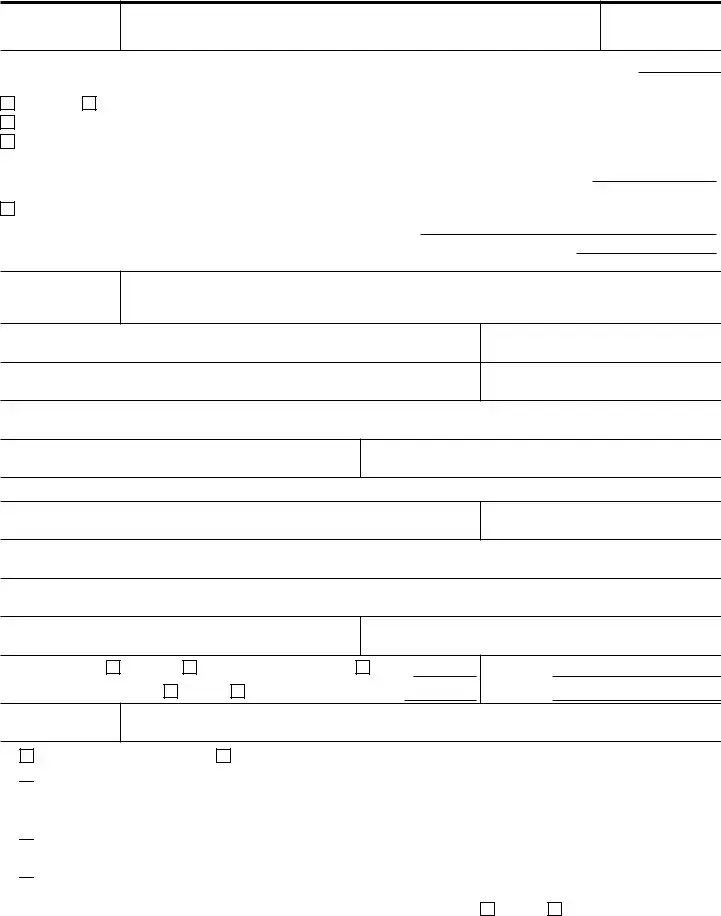

Page 2

Section III

Certification

XPlease sign below, exactly as you signed the return. If this refund was from a joint return, we need the signatures of both spouses before we can trace it.

Under penalties of perjury, I declare that I have examined this form, and to the best of my knowledge and belief, the information is true, correct, and complete. I request that you send a replacement refund, and if I receive two refunds I will return one.

13. Signature (For business returns, signature of person authorized to sign the check)

Date

14. Spouse’s signature, if required (For businesses, enter the title of the person who signed above.)

Date

Section IV |

Description of Check |

|

(For Internal Revenue Service use only) |

||

|

||

|

|

Schedule number |

Refund Date |

Amount |

Other (DLN, Check/Symbol, etc.) |

|

|

|

|

Schedule number |

Refund Date |

Amount |

Other (DLN, Check/Symbol, etc.) |

|

|

|

|

Schedule number |

Refund Date |

Amount |

Other (DLN, Check/Symbol, etc.) |

Privacy Act and Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States.

You aren’t required to give us the information since the refund you claimed has already been issued. However, without the information we won’t be able to trace your refund, and may be unable to replace it. You may give us the information we need in a letter.

We need the information to ensure that you are complying with these laws and to allow us to determine the correctness of your refund or the right amount of payment. Your Social Security Number and the other information are being requested in order that the Department of the Treasury can process your refund. The authority of requesting your social security number is 26 United States Code, section 6109. If you cannot or will not furnish the information, the tracing of your refund may be delayed.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or record relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Internal Revenue Code section 6103. The time needed to compete and file this form will vary depending on individual circumstances. The estimated average time is less than 5 minutes.

If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Attention: Tax Products Coordinating Committee, Western Area Distribution Center, Rancho Cordova, CA

Do not send this form to this office. Instead, please use the envelope provided or mail the form to the Internal Revenue Service center where you would normally file a paper tax return.

Catalog Number 41167W |

www.irs.gov |

Form 3911 (Rev. |

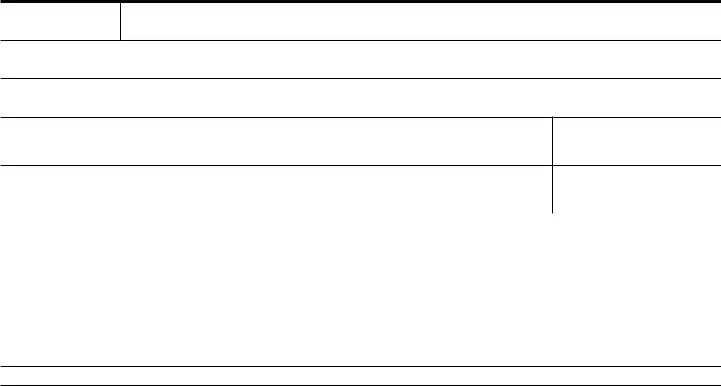

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of the IRS 3911 Form | Used by taxpayers to initiate a trace for a refund check that is lost, stolen, or never received. |

| Filing Requirement | The form must be filed when a taxpayer does not receive their refund within a reasonable time frame. |

| Components of the Form | Includes information such as the taxpayer's name, address, social security number, refund amount, and the tax year for the missing refund. |

| Processing Time | Investigation initiated by submitting Form 3911 can take up to six weeks for the IRS to complete. |

| Governing Law | Federal tax law governs the use and processing of IRS Form 3911, without specific state variations. |

Guide to Writing IRS 3911

When dealing with taxes, everyone hopes for a smooth process. However, sometimes things don't go as planned, and you might find yourself waiting longer than expected for your tax refund or notice that it hasn't arrived at all. That's where the IRS 3911 form comes into play. This form helps taxpayers communicate with the IRS about missing, lost, or stolen tax refunds or checks. Filling it out correctly is crucial to resolving your issue. Here are the steps to guide you through completing the form accurately.

- Start by entering your full name, alongside your spouse's name if you filed jointly, at the top of the form.

- Next, fill in your current mailing address, including the city, state, and ZIP code.

- Provide your daytime phone number in the space given so the IRS can reach you if they have any questions.

- In the section that asks for your Social Security Number (SSN), include your SSN or your Individual Taxpayer Identification Number (ITIN). If you filed jointly, include your spouse’s SSN or ITIN as well.

- Detail the tax form number for the return you are inquiring about (for example, Form 1040, 1040-SR, etc.) in the designated area.

- Specify the tax period related to your inquiry. This is typically the year for which you filed or are filing your return.

- Indicate the precise amount of the refund, as shown on your tax return, in dollars and cents.

- In the section marked “Type of Return,” check the appropriate box to indicate whether your return was filed electronically or on paper.

- If your original check was received but then lost, stolen, or destroyed, check the appropriate box and provide the date you received the check.

- For direct deposit issues, if the refund was sent to the wrong account, fill in the corresponding section with the bank routing and account numbers initially provided on your tax return.

- Sign and date the bottom of the form. If you filed jointly, make sure both spouses sign.

After you've filled out the form, review it carefully to ensure all the information is correct and complete. The next steps include finding out where to send or fax your filled 3911 form, which you can do by visiting the IRS website or contacting the IRS directly. It’s important to keep a copy for your records. Once the IRS receives your form, they will begin the process of investigating your inquiry. They might contact you for additional information or to inform you of the resolution. Patience is key, as resolving these issues can take some time.

Understanding IRS 3911

-

What is the IRS Form 3911?

IRS Form 3911, also known as the "Taxpayer Statement Regarding Refund," is a document used by individuals to request information about a refund that has not been received. It serves as a means to initiate a trace of the refund by the IRS if it has been lost, stolen, or not received by the taxpayer for various other reasons. When a taxpayer is expecting a refund that hasn’t arrived within the expected timeframe, filling out and submitting this form allows the IRS to investigate the issue.

-

When should you use IRS Form 3911?

Form 3911 should be used after the taxpayer has checked the status of their refund through the "Where's My Refund?" tool on the IRS website or by contacting the IRS and learning that the refund has been issued but not received. It's important to wait for a reasonable period after the expected date of the refund before submitting this form to allow for any delays in mailing or processing. If after this period the refund has still not arrived, the taxpayer should then proceed with filling out Form 3911.

-

How do you complete IRS Form 3911?

To complete IRS Form 3911, taxpayers must provide specific information related to the refund that is being traced. This includes the taxpayer’s full name, Social Security Number, current address, the tax year of the refund in question, the amount of the refund, and whether the refund was expected in the form of a check or direct deposit. Additionally, taxpayers must describe the situation and any actions already taken to locate the refund. It’s essential to provide accurate and complete information to assist the IRS in tracing the refund efficiently.

-

What happens after you submit Form 3911 to the IRS?

Upon submission of Form 3911, the IRS will conduct a trace of the missing refund. This process involves verifying whether the refund check was cashed or if there was an issue with direct deposit. If the check was not cashed, the IRS might issue a replacement check. If it was cashed, further investigation will be required to determine the next steps. Taxpayers will receive communication from the IRS regarding the outcome of the trace or if additional information is needed.

-

Is there a deadline for submitting IRS Form 3911?

There is no specific deadline for submitting IRS Form 3911. However, taxpayers should act promptly once they realize their refund has not been received and after verifying the status through the IRS "Where's My Refund?" tool or contact. The sooner the IRS is notified of the issue, the quicker they can begin the process of tracing and potentially recovering the missing refund.

-

Where can you find IRS Form 3911?

IRS Form 3911 can be found on the Internal Revenue Service’s official website. Taxpayers can download the form, print it, and complete it by hand. Alternatively, they may also contact the IRS directly to request a physical copy of the form if they are unable to access it online. It’s important to ensure that the form is filled out completely and accurately before submission to avoid any delays in the tracing process.

Common mistakes

Filling out the IRS 3911 form, which is requested by the Internal Revenue Service (IRS) to trace a taxpayer's refund check, requires careful attention to avoid errors that can delay the process. Here are four common mistakes individuals often make:

-

Not checking the form for completeness: Often, individuals overlook the importance of reviewing the entire form before submission. Every field needs to be filled out accurately. Skipping even a seemingly minor detail can result in the form being returned, thus delaying the tracing process.

-

Incorrect information: It might seem obvious, but incorrect information is a frequent issue on the IRS 3911 form. This might be something as simple as a mistyped Social Security Number or an outdated address. These errors can lead to the IRS being unable to match the form with the taxpayer, causing further delays.

-

Failure to sign the form: The IRS requires a signature to process the 3911 form. Forgetting to sign the document is a common oversight that results in the form's rejection. This step is crucial for the form to be considered valid and for the process to continue smoothly.

-

Using outdated forms: The IRS occasionally updates its forms to reflect current policies or procedures. Filing a 3911 form that is not the most current version can lead to processing delays. It’s important to ensure that the form used is the latest version provided by the IRS.

Avoiding these mistakes can help ensure that the process of tracing a refund is as smooth and quick as possible. Paying attention to details and following the instructions carefully are key to successfully submitting the IRS 3911 form.

Documents used along the form

When dealing with the Internal Revenue Service (IRS), individuals often find themselves navigating through a sea of forms and documents. One such form is the IRS Form 3911, used to initiate a tracer for a lost, stolen, or misplaced refund check. However, this form is just a piece of the puzzle in the taxpayer's interaction with the IRS. Several other documents frequently accompany or are related to the IRS Form 3911, each with its unique importance in ensuring financial matters are handled accurately and efficiently.

- Form 1040: The U.S. Individual Income Tax Return is a foundational document many taxpayers must fill out. It reports yearly earnings, tax deductions, and credits to the IRS.

- Form 2848: Power of Attorney and Declaration of Representative allows taxpayers to authorize an individual, such as an accountant or attorney, to represent them before the IRS.

- Form 4506-T: Request for Transcript of Tax Return helps taxpayers obtain a copy of their tax returns or transcript, which is often needed for loan applications or similar purposes.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return gives taxpayers extra time to file their Form 1040, without extending the time to pay any taxes owed.

- Form 8822: Change of Address notifies the IRS of a change in address to ensure all correspondences reach the taxpayer.

- Form 8857: Request for Innocent Spouse Relief is used by taxpayers seeking relief from joint tax liability due to actions of their spouse or former spouse.

- Form W-2: Wage and Tax Statement, issued by employers, reports an employee's annual wages and the amount of taxes withheld from their paycheck.

- Form W-4: Employee's Withholding Certificate helps employers withhold the correct federal income tax from employees' paychecks.

- Form W-7: Application for IRS Individual Taxpayer Identification Number is required for individuals who are not eligible for a Social Security Number but need an identification number for tax purposes.

- Form 1099: There are various versions of this form, reporting income from self-employment earnings, interest, dividends, government payments, and more.

In managing taxes and related financial matters, understanding and correctly utilizing these documents can significantly streamline the process. They serve to report income, adjust withholding, authorize representation, request information, and update personal details with the IRS. Proper handling of these forms ensures compliant and efficient interaction with tax regulations, minimizing issues and optimizing potential benefits. Remember, while this list covers common forms and documents, taxpayers' individual situations may require additional forms.

Similar forms

The IRS 3911 form is used to trace a refund that hasn't been received, but there are several other forms and documents in the realm of tax and financial matters that share similarities in purpose or function. For instance, the IRS Form 8822, Change of Address, is akin to the IRS 3911 in that they both deal with the rectification or updating of personal information to ensure proper handling and receipt of vital documents and funds. While Form 3911 is targeted at locating missing funds, Form 8822 ensures the IRS has current information to prevent misdirection of funds or correspondence in the first place.

Form 4506-T, Request for Transcript of Tax Return, also shares similarities with IRS 3911. Both are used to obtain important tax-related information, but they serve different ends. The 4506-T is specifically used to request a transcript of a tax return from the IRS, which can be necessary for mortgage applications or financial aid. The IRS 3911, on the other hand, is used when the return or refund itself goes astray. Despite these differences, each form plays a crucial role in managing and rectifying tax records.

The W-9, Request for Taxpayer Identification Number and Certification, somewhat parallels the IRS 3911 form in its role in ensuring the proper allocation and reporting of funds. However, the W-9 is primarily used by employers or entities that pay individuals for services rendered to ensure they have the correct taxpayer identification number (TIN) for reporting purposes. While the IRS 3911 seeks to find where money sent by the IRS went, the W-9 helps prevent issues with misreported earnings from the start.

Similar in spirit to the IRS 3911 form is the Form 1040-X, Amended U.S. Individual Income Tax Return. This form is used when an individual needs to correct a previously filed Form 1040, 1040-A, or 1040-EZ. Like the 3911, the 1040-X addresses discrepancies and ensures accuracy in taxpayer records, albeit from the perspective of amending errors or omissions in previously filed information rather than tracing missing refunds.

Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, shares the IRS 3911 form's intent to prevent or rectify delays, although in a different context. Form 4868 is used to formally request additional time to file one's taxes, essentially preventing the kind of issues that might later require a 3911 form to solve, such as delays in refunds due to late filing.

Lastly, Form 9465, Installment Agreement Request, bears a resemblance to the IRS 3911 form in that both deal with the resolution of payment-related issues. However, Form 9465 is used when a taxpayer cannot pay their due taxes in full and seeks to make installment payments. While the 3911 is concerned with the whereabouts of refunds sent out by the IRS, the 9465 addresses the incoming direction of taxpayer funds to the IRS, specifically how they can be structured over time to resolve tax liabilities.

In sum, while each of these forms and documents serves a unique purpose within the complex machinery of tax administration and personal finance, they all share the IRS 3911 form's fundamental objective of ensuring accuracy, timeliness, and fairness in financial and tax-related matters.

Dos and Don'ts

When you're dealing with the IRS 3911 form, which is essentially used to trace a refund that you haven't received, it's crucial to handle the process with care to ensure that your inquiry proceeds smoothly. Below are lists of do's and don'ts that will guide you through the completion and submission of this form.

Things You Should Do:

- Ensure all the information provided on the form is accurate and matches the details you submitted on your tax return. This includes your name, address, Social Security Number (SSN), and the refund amount you're expecting.

- Clearly explain the issue you're facing. Whether it's a missing refund or a refund that was received but for the incorrect amount, providing a concise and clear description helps the IRS address your concerns more effectively.

- Include any relevant dates, such as when you filed your tax return and when you expected to receive your refund. This helps the IRS to better trace the status of your refund.

- Sign and date the form. An unsigned form may lead to unnecessary delays or might even be disregarded by the IRS.

- Keep a copy of the form and any other documents you send to the IRS for your records. Having a record of your correspondence can be helpful if there are further questions or delays.

Things You Shouldn't Do:

- Don't leave any sections blank. If a section doesn’t apply to you, indicate this with "N/A" (not applicable) instead of leaving it empty. This helps to ensure that the form is processed without delays.

- Don't send the form without first checking if the standard processing time for your refund has passed. Often, refunds can take several weeks to process, especially during peak times.

- Don't forget to include any necessary documentation that supports your case. While the 3911 form does not typically require additional documents, your specific situation might require further evidence.

- Don't use aggressive or disrespectful language in your communications. Staying polite and professional can help your case be handled more smoothly and efficiently.

- Don't submit multiple forms for the same issue, as this can slow down the process. If you haven't heard back from the IRS within a reasonable time, consider calling their helpline for an update instead.

Misconceptions

Many people hold misconceptions about the IRS 3911 form, which can lead to confusion or errors when dealing with tax issues. Here are nine common misunderstandings about this form:

The IRS 3911 form is only for reporting stolen tax refunds. This is incorrect. While the form is often used to inquire about a missing refund, it serves a broader purpose. It is an official way to address any question or issue related to a tax refund, not just theft or fraud.

Individuals must wait for the IRS to request the completion of a 3911 form. In reality, taxpayers should proactively complete and send in the form if they have concerns about their refund and haven’t received a request from the IRS to fill it out.

The form can be submitted electronically. As of the last update, the IRS 3911 form must be mailed or faxed to the IRS, contrary to the popular belief that it can be submitted online like many other tax forms.

Completing a 3911 form guarantees a quick resolution. While it is an important step in resolving issues with your refund, it does not guarantee an immediate response or solution from the IRS due to the volume of inquiries and internal processing times.

Filling out the form is complicated. The form is designed to be straightforward, asking for basic information regarding your tax return and the specific issue with your refund. Following the instructions carefully should make the process manageable.

It’s unnecessary to use the 3911 form if you have a tax preparer. Even if a professional prepared your taxes, the taxpayer is responsible for initiating inquiry for a missing refund using the 3911 form, although the preparer can certainly assist in the process.

Once submitted, the IRS provides regular updates on the form’s status. Unfortunately, the IRS does not typically provide ongoing updates after you submit a 3911 form. It's essential to wait a reasonable time before following up.

Taxpayers can use the IRS 3911 form to request changes to their tax return. This form is specifically for inquiries about the status of refunds, not for amending previously submitted tax returns. For changes, a different form, such as the 1040X, must be used.

There’s a filing deadline for the IRS 3911 form. This form does not have a specific filing deadline since it relates to issues that may arise unpredictably. However, addressing issues promptly is recommended.

Understanding the correct use and expectations around IRS Form 3911 can significantly reduce stress and confusion for taxpayers dealing with refund issues.

Key takeaways

When it comes to dealing with tax issues, navigating the paperwork can often feel overwhelming. One essential form that comes into play if you're dealing with missing or unresolved tax refunds or payments is the IRS 3911 form. Here are seven key takeaways to remember when you find yourself needing to fill out and use this form:

- Understanding the purpose: The IRS 3911 form is a taxpayer statement regarding a refund. This form is specifically used when a taxpayer hasn't received their expected refund or if there's any discrepancy with the refund amount.

- Timeliness is crucial: If your refund has gone missing or is incorrect, it's essential to act quickly. The IRS recommends waiting for a specific period after filing your taxes before filling out the 3911 form, but once that period has passed, don't delay in submitting this form.

- Accurate Information: Ensure all the information you provide on the form is accurate and complete. Double-check your personal information, tax year, and the details of your expected refund. Any errors could further delay the resolution of your issue.

- Detailing the issue: The form requires a clear explanation of your issue. Whether your check was lost, stolen, or destroyed, or perhaps the refund amount was incorrect, provide as much detail as possible to help the IRS resolve your problem efficiently.

- Follow-up: After submitting the form, keep track of your submission and stay proactive in following up with the IRS. It might take some time for the issue to be resolved, but checking in periodically can ensure that your case doesn't fall through the cracks.

- IRS response: Once the IRS receives your 3911 form, they will investigate the situation. Be prepared for possible follow-up questions or requests for additional information. The IRS will inform you about their findings and the steps they will take to correct the issue.

- Seeking assistance if needed: If filling out the IRS 3911 form or dealing with a tax refund issue feels daunting, don't hesitate to seek assistance. This can come from a tax professional who can provide guidance and help ensure that your form is filled out correctly and that your issue is adequately addressed.

Dealing with tax issues can undoubtedly be stressful, but knowing how to properly fill out and use the IRS 3911 form can lead to a faster resolution to your problems. Remember, the goal is to clear up any issues with your tax refund efficiently and accurately, and these key takeaways are here to guide you through the process.

Popular PDF Documents

New Idr Plan - Offers a recourse for borrowers and, if applicable, their spouses, who might not be adequately served by standard income verification methods.

Lic Loan Form Filled Sample - The application process for a loan under form 5196 includes submitting the policy, signed receipt for the loan amount, and a completed assignment declaration.