Get IRS 3800 Form

Navigating the complexities of tax credits can be a daunting task for taxpayers, yet understanding the IRS 3800 form proves essential for those seeking to leverage various business and non-business credits. This form, also known as the General Business Credit, acts as a vessel through which multiple credits can be combined and applied against a taxpayer's liabilities, offering a way to reduce the amount of tax owed significantly. It encompasses an array of credits, from energy-efficient investments to employer credits for family and medical leave, making it a versatile tool in the arsenal of tax strategies. Despite its potential benefits, the form's intricate details and prerequisites require careful consideration and compliance, underscoring the importance of meticulous preparation. For taxpayers and professionals alike, mastering the intricacies of Form 3800 not only facilitates compliance with tax laws but also maximizes opportunities to benefit from available credits, ultimately contributing to financial efficiency and the realization of potential tax savings.

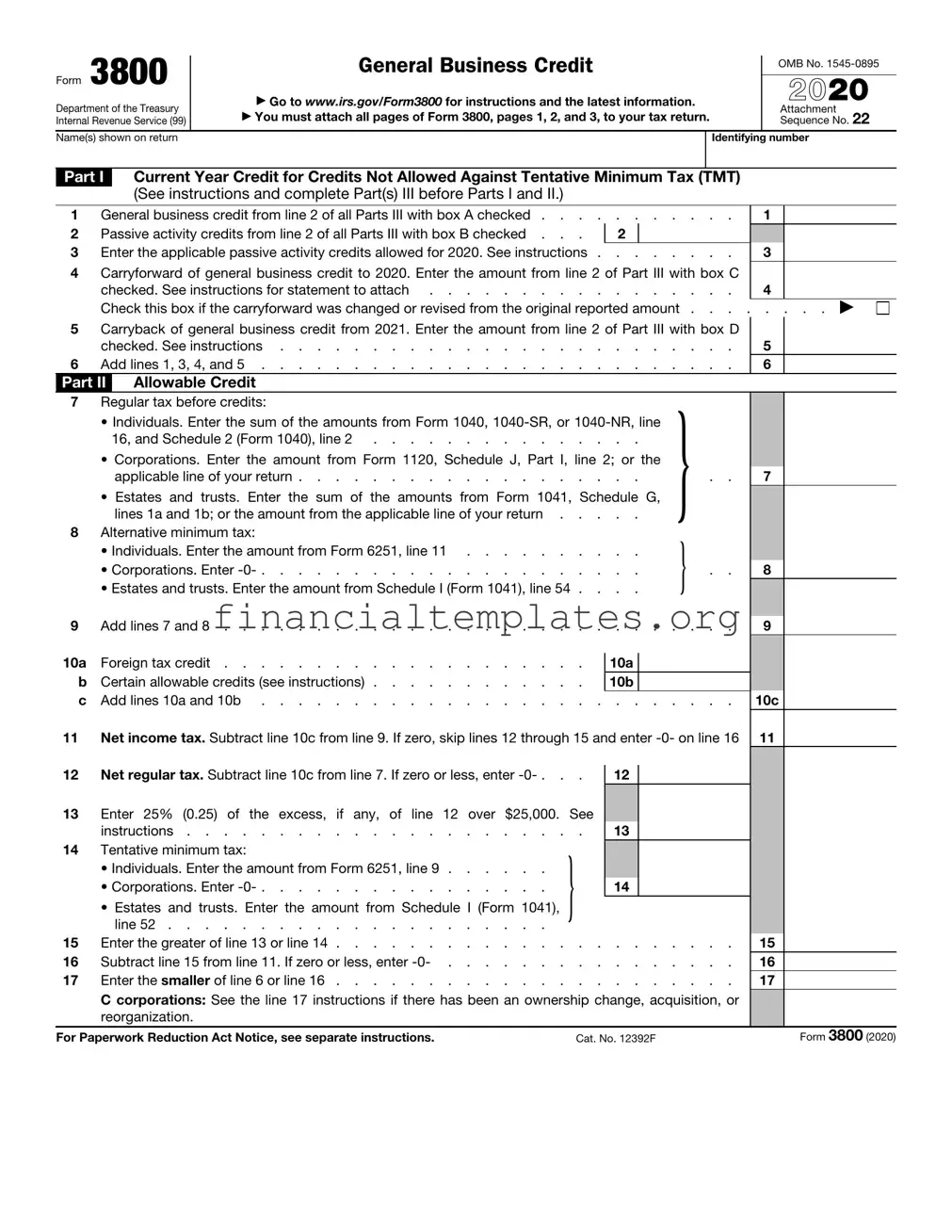

IRS 3800 Example

Form 3800 |

General Business Credit |

|

OMB No. |

|

|

||

|

|

|

|

|

|

|

|

Department of the Treasury |

▶ Go to www.irs.gov/Form3800 for instructions and the latest information. |

2021 |

|

▶ You must attach all pages of Form 3800, pages 1, 2, and 3, to your tax return. |

|

Attachment |

|

Internal Revenue Service (99) |

|

Sequence No. 22 |

|

Name(s) shown on return |

|

Identifying |

number |

Part I Current Year Credit for Credits Not Allowed Against Tentative Minimum Tax (TMT)

(See instructions and complete Part(s) III before Parts I and II.)

1 |

General business credit from line 2 of all Parts III with box A checked . . . . |

. . . . . . . |

1 |

|

|

2 |

Passive activity credits from line 2 of all Parts III with box B checked . . . |

2 |

|

|

|

3 |

Enter the applicable passive activity credits allowed for 2021. See instructions . |

. . . . . . . |

3 |

|

|

4Carryforward of general business credit to 2021. Enter the amount from line 2 of Part III with box C

checked. See instructions for statement to attach |

|

4 |

Check this box if the carryforward was changed or revised from the original reported amount . . . |

. . . . . ▶ |

|

5Carryback of general business credit from 2022. Enter the amount from line 2 of Part III with box D

|

checked. See instructions |

. . . . |

. . . . |

5 |

|

||||

6 |

Add lines 1, 3, 4, and 5 |

. . . . |

. . . . |

6 |

|

||||

Part II |

Allowable Credit |

|

|

|

|

|

|

|

|

7 |

Regular tax before credits: |

|

|

|

} |

|

|

|

|

|

• Individuals. Enter the sum of the amounts from Form 1040, |

|

|

|

|||||

|

|

16, and Schedule 2 (Form 1040), line 2 |

|

|

|

||||

|

• Corporations. Enter the amount from Form 1120, Schedule J, Part I, line 2; or the |

|

|

|

|||||

|

|

applicable line of your return |

. . . |

|

. . |

7 |

|

||

|

• Estates and trusts. Enter the sum of the amounts from Form 1041, Schedule G, |

|

|

|

|||||

|

|

lines 1a and 1b, plus any Form 8978 amount included on line 1d; or the amount from |

|

|

|

||||

8 |

|

the applicable line of your return |

. . . |

|

|

|

|

||

Alternative minimum tax: |

|

|

|

} |

|

|

|

||

|

• Individuals. Enter the amount from Form 6251, line 11 |

|

|

|

|||||

|

• Corporations. Enter |

. . . |

|

. . |

8 |

|

|||

|

• Estates and trusts. Enter the amount from Schedule I (Form 1041), line 54 . |

. . . |

|

|

|

|

|||

|

|

|

|

|

|

|

|

||

9 |

Add lines 7 and 8 |

. . . . |

. . . . |

9 |

|

||||

|

|

|

|

|

|

|

|

||

10a |

Foreign tax credit |

|

10a |

|

|

|

|

|

|

b |

Certain allowable credits (see instructions) |

|

10b |

|

|

|

|

|

|

c |

Add lines 10a and 10b |

. . . . |

. . . . |

10c |

|||||

11 |

Net income tax. Subtract line 10c from line 9. If zero, skip lines 12 through 15 and enter |

11 |

|

||||||

12 |

Net regular tax. Subtract line 10c from line 7. If zero or less, enter |

12 |

|

|

|

|

|

||

13Enter 25% (0.25) of the excess, if any, of line 12 over $25,000. See

|

instructions |

. |

13 |

|

|

|

|

14 |

Tentative minimum tax: |

} |

|

|

|

|

|

|

• Individuals. Enter the amount from Form 6251, line 9 |

|

|

|

|

|

|

|

• Corporations. Enter |

14 |

|

|

|

|

|

|

• Estates and trusts. Enter the amount from Schedule I (Form 1041), |

|

|

|

|

|

|

|

line 52 |

|

|

|

|

|

|

15 |

Enter the greater of line 13 or line 14 |

. . . . . . . . . |

|

15 |

|

||

16 |

Subtract line 15 from line 11. If zero or less, enter |

. . . . . . . . . |

|

16 |

|

||

17 |

Enter the smaller of line 6 or line 16 |

. . . . . . . . . |

|

17 |

|

||

|

C corporations: See the line 17 instructions if there has been an ownership change, acquisition, or |

|

|

||||

|

reorganization. |

|

|

|

|

|

|

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 12392F |

|

Form 3800 (2021) |

||||

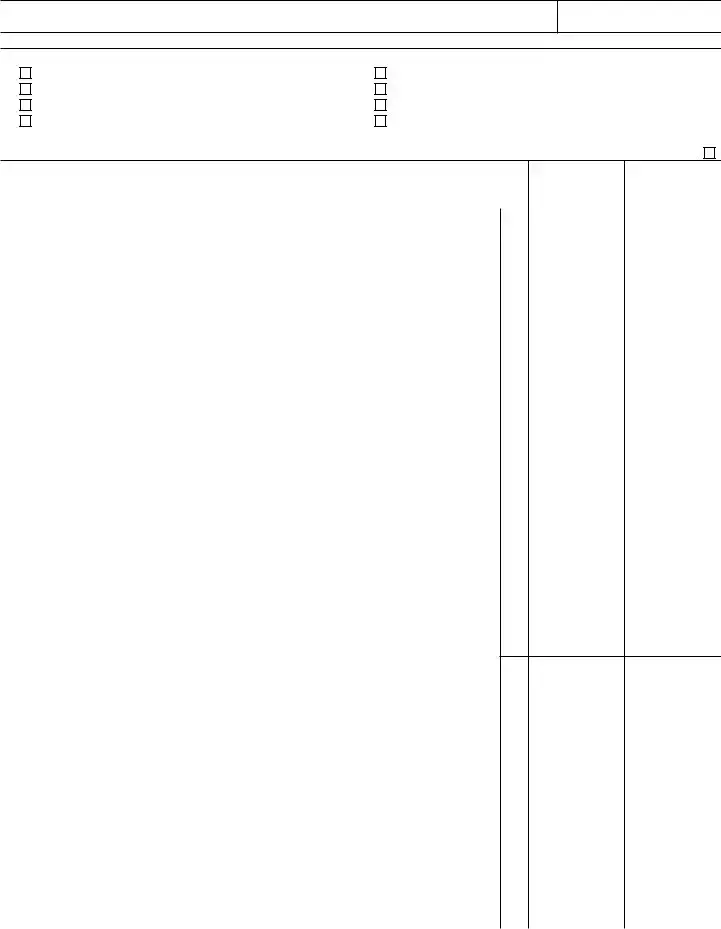

Form 3800 (2021) |

Page 2 |

Part II Allowable Credit (continued)

Note: If you are not required to report any amounts on line 22 or 24 below, skip lines 18 through 25 and enter

18 |

Multiply line 14 by 75% (0.75). See instructions |

. . . . . . . . |

18 |

|

||

19 |

Enter the greater of line 13 or line 18 |

. . . . . . . . |

19 |

|

||

20 |

Subtract line 19 from line 11. If zero or less, enter |

. . . . . . . . |

20 |

|

||

21 |

Subtract line 17 from line 20. If zero or less, enter |

. . . . . . . . |

21 |

|

||

22 |

Combine the amounts from line 3 of all Parts III with box A, C, or D checked . |

. . . . . . . . |

22 |

|

||

23 |

Passive activity credit from line 3 of all Parts III with box B checked . . . |

|

23 |

|

|

|

|

|

|

|

|||

24 |

Enter the applicable passive activity credit allowed for 2021. See instructions |

. . . . . . . . |

24 |

|

||

25 |

Add lines 22 and 24 |

. . . . . . . . |

25 |

|

||

26Empowerment zone and renewal community employment credit allowed. Enter the smaller of line 21

|

or line 25 |

. . . . . . . |

26 |

|

||

27 |

Subtract line 13 from line 11. If zero or less, enter |

. . . . . . . |

27 |

|

||

28 |

Add lines 17 and 26 |

. . . . . . . |

28 |

|

||

29 |

Subtract line 28 from line 27. If zero or less, enter |

. . . . . . . |

29 |

|

||

30 |

Enter the general business credit from line 5 of all Parts III with box A checked . |

. . . . . . . |

30 |

|

||

31 |

Reserved |

. . . . . . . |

31 |

|

||

|

||||||

32 |

Passive activity credits from line 5 of all Parts III with box B checked . . . |

|

32 |

|

|

|

|

|

|

|

|||

33 |

Enter the applicable passive activity credits allowed for 2021. See instructions . |

. . . . . . . |

33 |

|

||

34Carryforward of business credit to 2021. Enter the amount from line 5 of Part III with box C checked

and line 6 of Part III with box G checked. See instructions for statement to attach |

|

34 |

Check this box if the carryforward was changed or revised from the original reported amount . . . |

. . . . . ▶ |

|

35Carryback of business credit from 2022. Enter the amount from line 5 of Part III with box D checked.

|

See instructions |

. . |

35 |

|

|

36 |

Add lines 30, 33, 34, and 35 |

. . |

36 |

|

|

37 |

Enter the smaller of line 29 or line 36 |

. . |

37 |

|

|

38 |

Credit allowed for the current year. Add lines 28 and 37. |

|

|

|

|

|

Report the amount from line 38 (if smaller than the sum of Part I, line 6, and Part II, lines 25 and 36, |

|

|

||

|

see instructions) as indicated below or on the applicable line of your return. |

} |

|

|

|

|

• Individuals. Schedule 3 (Form 1040), line 6 |

|

|

|

|

|

• Corporations. Form 1120, Schedule J, Part I, line 5c |

. . |

|

|

|

|

• Estates and trusts. Form 1041, Schedule G, line 2b |

|

38 |

|

|

Form 3800 (2021)

Form 3800 (2021) |

Page 3 |

Name(s) shown on return

Part III General Business Credits or Eligible Small Business Credits (see instructions)

Identifying number

Complete a separate Part III for each box checked below. See instructions.

A |

General Business Credit From a |

E |

|

Reserved |

|

||||

B |

General Business Credit From a Passive Activity |

F |

|

Reserved |

|

||||

C |

General Business Credit Carryforwards |

G |

|

Eligible Small Business Credit Carryforwards |

D |

General Business Credit Carrybacks |

H |

|

Reserved |

|

IIf you are filing more than one Part III with box A or B checked, complete and attach first an additional Part III combining amounts from

all Parts III with box A or B checked. Check here if this is the consolidated Part III . . . . . . . . . . . . . . . . ▶

|

(a) Description of credit |

|

(b) Enter EIN if |

(c) Enter the |

Note: On any line where the credit is from more than one source, a separate Part III is needed for each |

|

claiming the credit |

appropriate |

|

|

from a |

amount. |

||

|

||||

|

entity. |

|

||

1a |

Investment (Form 3468, Part II only) (attach Form 3468) |

1a |

|

|

b |

Reserved |

1b |

|

|

c |

Increasing research activities (Form 6765) |

1c |

|

|

d |

1d |

|

||

e |

Disabled access (Form 8826)* |

1e |

|

|

f |

Renewable electricity, refined coal, and Indian coal production (Form 8835) . . |

1f |

|

|

g |

Indian employment (Form 8845) |

1g |

|

|

h |

Orphan drug (Form 8820) |

1h |

|

|

i |

New markets (Form 8874) |

1i |

|

|

j |

Small employer pension plan startup costs and |

1j |

|

|

k |

1k |

|

||

l |

Biodiesel and renewable diesel fuels (attach Form 8864) |

1l |

|

|

m |

Low sulfur diesel fuel production (Form 8896) |

1m |

|

|

n |

Distilled spirits (Form 8906) |

1n |

|

|

o |

Nonconventional source fuel (carryforward only) |

1o |

|

|

p |

Energy efficient home (Form 8908) |

1p |

|

|

q |

Energy efficient appliance (carryforward only) |

1q |

|

|

r |

Alternative motor vehicle (Form 8910) |

1r |

|

|

s |

Alternative fuel vehicle refueling property (Form 8911) |

1s |

|

|

t |

Enhanced oil recovery credit |

1t |

|

|

u |

Mine rescue team training (Form 8923) |

1u |

|

|

v |

Agricultural chemicals security (carryforward only) |

1v |

|

|

w |

Employer differential wage payments (Form 8932) |

1w |

|

|

x |

Carbon oxide sequestration (Form 8933) |

1x |

|

|

y |

Qualified |

1y |

|

|

z |

Qualified |

1z |

|

|

aa |

Employee retention (Form |

1aa |

|

|

bb |

General credits from an electing large partnership (carryforward only) . . . . |

1bb |

|

|

zzOther. Oil and gas production from marginal wells (Form 8904) and certain other

|

credits (see instructions) |

1zz |

||

2 |

Add lines 1a through 1zz and enter here and on the applicable line of Part I . . |

2 |

|

|

3 |

Enter the amount from Form 8844 here and on the applicable line of Part II . . |

3 |

|

|

4a |

Investment (Form 3468, Part III) (attach Form 3468) |

4a |

||

b |

Work opportunity (Form 5884) |

4b |

||

c |

Biofuel producer (Form 6478) |

4c |

||

d |

4d |

|||

e |

Renewable electricity, refined coal, and Indian coal production (Form 8835) . . |

4e |

||

f |

Employer social security and Medicare taxes paid on certain employee tips (Form 8846) |

4f |

||

g |

Qualified railroad track maintenance (Form 8900) |

4g |

||

h |

Small employer health insurance premiums (Form 8941) |

4h |

||

i |

Increasing research activities (Form 6765) |

4i |

||

j |

Employer credit for paid family and medical leave (Form 8994) |

4j |

||

z |

Other |

4z |

||

5 |

Add lines 4a through 4z and enter here and on the applicable line of Part II . . |

5 |

|

|

6 |

Add lines 2, 3, and 5 and enter here and on the applicable line of Part II . . . |

6 |

|

|

* See instructions for limitation on this credit. |

|

|

Form 3800 (2021) |

|

Document Specifics

| Fact Name | Description |

|---|---|

| Form Designation | IRS Form 3800 is known as the General Business Credit form. |

| Purpose | It is utilized to calculate and claim various business credits available to a taxpayer. |

| Applicability | This form is relevant for businesses that qualify for one or more of the nonrefundable business credits. |

| Components | Form 3800 includes parts for carrying back and carrying forward unused credit amounts, as well as for specifying credits from different parts of the tax return. |

| Taxation Year | It applies to the taxation year for which the business is filing a return. |

| Governing Laws | Federal tax law, particularly the Internal Revenue Code (IRC), governs the requirements and provisions related to Form 3800. |

Guide to Writing IRS 3800

Filling out IRS Form 3800 can be an important step for individuals or businesses looking to claim various federal tax credits. These credits could be related to anything from research and development to energy efficiency improvements. Understanding how to accurately complete this form is crucial in ensuring you receive all the tax benefits you're eligible for. The process does not need to be daunting. By following these steps, you can navigate the completion of Form 3800 with confidence.

- Gather all necessary documents that outline the tax credits you're claiming. This might include receipts, financial statements, or certification forms.

- Download the latest version of IRS Form 3800 from the official IRS website to ensure you have the most current form.

- Start by reading the instructions provided with the form carefully. It's vital to understand each section to apply your specific credits correctly.

- Fill in your personal information at the top of the form, including your name and taxpayer identification number (Social Security Number for individuals or Employer Identification Number for businesses).

- Carefully work through Parts I through III, entering information regarding the general business credits. This includes specifying each type of credit you're applying for and its amount.

- If applicable, complete Part IV, which is used to compute carryback and carryforward amounts. This section is only necessary if you're applying credits from previous or future tax years to the current year.

- Review your entries for accuracy. Make sure that the total credits claimed match the documentation you have gathered.

- Attach Form 3800 to your tax return. Remember, Form 3800 is a summary of credits, so any specific form for individual credits (e.g., Form 3468 for investment credits) must also be completed and attached.

- Keep a copy of Form 3800 and all related documents for your records. It's important to have this information available in case of any future questions from the IRS.

- Submit your tax return with Form 3800 attached by the applicable deadline. This could be April 15 for personal returns or March 15 or April 15 for most businesses, depending on the organization type.

After completing these steps, you've successfully navigated the process of claiming your federal tax credits through IRS Form 3800. By keeping detailed records and ensuring the accuracy of your submissions, you help facilitate a smoother review by the IRS and increase your likelihood of receiving the tax benefits you're entitled to. Remember, when it comes to tax forms and credits, staying organized and meticulous is key.

Understanding IRS 3800

-

What is the IRS Form 3800?

IRS Form 3800, known as the "General Business Credit," is a form used to claim a variety of business credits. These credits can include incentives for specific industries, investments in certain types of property, or hiring individuals from groups with employment barriers. Form 3800 consolidates these credits into one form, making it easier for businesses to apply them against their tax liability.

-

Who needs to file Form 3800?

Businesses that are eligible for one or more of the specific credits detailed in the form's instructions need to file Form 3800. This can apply to a wide range of businesses, from small startups to large corporations, across various industries. If your business has engaged in activities that qualify for any of these tax incentives during the tax year, you should consider filing Form 3800.

-

What types of credits can be claimed with Form 3800?

Several credits can be claimed using Form 3800. These include, but are not limited to, the Research and Development Credit, the Work Opportunity Credit, and the Energy Efficient Home Credit. Each credit has its own set of qualifications and rules, which are detailed in the instructions for Form 3800 and the individual forms for each specific credit.

-

How does filing Form 3800 affect my tax return?

Filing Form 3800 can significantly impact your tax return by reducing your overall tax liability. The credits claimed on Form 3800 are used to offset your income tax owed on a dollar-for-dollar basis. However, it’s important to accurately calculate and substantiate your claim since errors can lead to reviews or audits by the IRS.

-

Can I carry forward or back any unused General Business Credits?

Yes, if you cannot use the entire amount of credit in the current tax year, the IRS allows businesses to carry back unused credit amounts one year and carry forward the remaining balance for up to 20 years. This ensures that businesses can fully benefit from their credits over time, even if they do not have a tax liability in the year the credits were originally claimed.

-

Where can I find Form 3800 and its instructions?

Form 3800 and its detailed instructions can be found on the IRS website. The form and instructions are usually updated annually to reflect any changes to the tax laws or eligible credits. It’s a good idea to review the latest version of the form and all related materials to ensure compliance and to take advantage of all applicable credits for your business.

Common mistakes

When it comes to tax forms, attention to detail is key. The IRS 3800 form, known as the General Business Credit form, is no exception. Here are some common mistakes people make while completing this form:

- Not checking the eligibility criteria for credits before applying. Many people miss this crucial step, leading to unnecessary time spent on ineligible claims.

- Failing to attach Form 3800 to their tax return. This oversight can delay processing times significantly.

- Incorrectly calculating the carryback and carryforward amounts. This mistake often results from a misunderstanding of the rules or a simple math error.

- Missing important information, such as names or identification numbers, can lead to processing delays and potentially, denial of the credit.

- Using outdated forms or not following the latest instructions. Tax laws and forms can change annually, making it essential to use the most current version.

- Mixing up the credits. With numerous credits listed, it's easy to apply information to the wrong section, which can affect the accuracy of your claim.

- Omitting necessary supplemental forms or documentation that support the credit claim. Many credits require specific forms that detail the calculation of the credit.

- Not seeking professional advice when needed. The complexity of the IRS 3800 form can be overwhelming, and professional guidance can help navigate the intricacies.

Being aware of these mistakes can save time, effort, and potentially money. A careful review of the IRS 3800 form instructions and, if necessary, consultation with a tax professional can help ensure a smoother process.

Documents used along the form

When it comes to tax credits for businesses and individuals, the IRS Form 3800, General Business Credit, plays a pivotal role. This form serves as a comprehensive tool allowing taxpayers to calculate and claim various business credits. The intricacies of tax filings often necessitate the use of additional forms and documents alongside Form 3800 to ensure a thorough and accurate tax return. Below are four key forms often used in tandem with Form 3800, each significant in its capacity to support specific types of credits or provide necessary details for the tax filing process.

- Form 3468: Investment Credit - This form is essential for taxpayers seeking to claim the investment credit, which includes the rehabilitation, energy, qualifying advanced coal project, qualifying gasification project, and qualifying advanced energy project credits. Form 3468 calculates the total investment credits that can be claimed and is instrumental for businesses making significant investments in these areas.

- Form 8864: Biodiesel and Renewable Diesel Fuels Credit - For businesses involved in the production or use of biodiesel and renewable diesel, Form 8864 is key. It allows taxpayers to calculate and claim credits for these specific types of fuels, supporting environmentally friendly energy sources.

- Form 8910: Alternative Motor Vehicle Credit - Owners of vehicles that qualify as alternative fuel vehicles, such as electric or hydrogen-powered vehicles, use Form 8910 to determine the credit they can claim. It supports the move towards more sustainable transportation options.

- Form 5884: Work Opportunity Credit - This form is crucial for employers who hire individuals from certain groups that have historically faced significant barriers to employment. Form 5884 calculates the work opportunity credit available for hiring such individuals, encouraging diversity and inclusivity in the workforce.

Together, these forms complement Form 3800 in capturing the full scope of credits available, helping taxpayers maximize their benefits while adhering to tax laws and regulations. Accurate and complete documentation is integral to the tax filing process, ensuring individuals and businesses alike can claim credits they are rightfully entitled to. Navigating these forms can be complex, but they are key components in the broader context of tax planning and compliance.

Similar forms

The IRS 3800 form, known as the General Business Credit form, is designed to consolidate various tax credits available to businesses into one, streamlined document. In essence, it works to simplify the process for taxpayers to claim multiple credits. Similar in function and purpose, the IRS Form 3468 (Investment Credit) captures a blend of credits related to investment in certain property and projects. Like Form 3800, it aggregates various incentives aimed at encouraging specific types of investments, thus serving to promote economic activities within certain sectors.

Another document bearing similarity to IRS Form 3800 is the IRS Form 5884 (Work Opportunity Credit). This form allows businesses to claim credits for hiring individuals from certain groups that have significant barriers to employment. Both forms serve to incentivize behavior that contributes to broader social or economic goals, emphasizing the government's role in promoting employment opportunities among underserved populations through tax benefits.

Similarly, the IRS Form 8844 (Empowerment Zone Employment Credit) encourages businesses to hire employees who live and work in designated empowerment zones. This is in line with the objectives of Form 3800, as both aim at stimulating economic activity in specific areas or sectors, rewarding businesses with tax credits for contributing to these efforts. Each form plays a part in a larger framework designed to use fiscal policies to guide economic development.

The IRS Form 8845 (Indian Employment Credit) offers tax incentives for businesses that employ American Indians and Alaska Natives. This parallels the theme of Form 3800 by supporting employment in targeted communities, thus both forms share a common goal of using tax policy as a tool for social and economic empowerment.

Furthermore, IRS Form 8834 (Qualified Plug-in Electric and Electric Vehicle Credit) promotes environmental sustainability by providing credits to businesses and individuals who purchase certain types of vehicles. This form, akin to Form 3800, is part of the tax code's efforts to encourage environmentally friendly business practices and consumer behavior, demonstrating how tax incentives can be used to support broader policy objectives related to energy and environmental conservation.

IRS Form 8826 (Disabled Access Credit) allows small businesses to claim a credit for expenditures made to make their businesses more accessible to persons with disabilities. Just like the Form 3800, it uses the tax code to encourage businesses to undertake activities with positive social impacts, in this case, enhancing accessibility and inclusivity for individuals with disabilities.

Last but not least, the IRS Form 8874 (New Markets Credit) is aimed at incentivizing investments in low-income communities, aligning closely with the goals of the Form 3800 in encouraging economic growth and development in underserved areas. Both documents reflect a broader trend in tax policy aimed at leveraging fiscal tools to stimulate specific kinds of investments that carry potential public benefits or address societal challenges.

Each of these documents, in reflecting the philosophy behind the IRS 3800 form, showcases the multifaceted approach of the tax system in influencing business practices. By extending various credits, the system rewards behaviors and investments that align with overarching policy goals, whether they pertain to economic development, sustainability, or social inclusion.

Dos and Don'ts

Filling out the IRS Form 3800, which pertains to General Business Credit, requires careful attention to detail to ensure accuracy and compliance with tax laws. Here are some guidelines to help taxpayers navigate this process effectively:

Do:- Read the instructions thoroughly before attempting to fill out the form. The IRS provides specific guidelines to help taxpayers understand the requirements and how to accurately report their information.

- Ensure that you are eligible for the credits you plan to claim on Form 3800. Each tax credit has its own set of qualifications that must be met.

- Gather all necessary documentation related to the credits you are claiming. This may include receipts, financial statements, and certificates, among other documents that provide evidence of eligibility and the basis of the credit.

- Use accurate and up-to-date information to complete the form. Erroneous entries can lead to delays or denials of the claimed credits.

- Consult a tax professional if you have questions or uncertainties. The complexity of tax laws and regulations can sometimes be daunting, and professional guidance can be invaluable.

- Overlook smaller credits. Even minor credits can accumulate to substantial amounts and should not be disregarded.

- Assume eligibility without verifying. The rules for tax credits can change, and what may have been eligible in one tax year could be altered or eliminated in another.

- Avoid waiting until the last minute to complete Form 3800. Rushing can lead to mistakes or omissions that might affect the total credit available.

Misconceptions

The IRS 3800 form, known as the General Business Credit form, is essential for taxpayers seeking to reduce their tax liability through various business-related tax credits. However, there are several misconceptions about the form that can lead to confusion or errors when filing taxes. Understanding these misconceptions is crucial for accurately completing the form and maximizing potential tax benefits.

- Only large businesses can benefit from filing Form 3800: A common misconception is that the IRS 3800 form is exclusively beneficial for large corporations. In reality, businesses of all sizes, including small and medium-sized enterprises, can take advantage of the credits available through Form 3800. The form consolidates various tax credits from different parts of the tax code, making them accessible to a broader range of businesses.

- Form 3800 is only for specific industries: Another widespread belief is that only businesses within certain industries can file Form 3800. This is not accurate, as the form is designed to apply to a wide variety of business credits that are available to multiple industries. The eligibility for these credits is determined by the nature of the expenses incurred rather than the industry of the business.

- Form 3800 can only be filed with annual tax returns: Some taxpayers assume that Form 3800 can only be included with annual income tax returns. However, this form can also be relevant and necessary for other filings, such as amended returns or carryback claims. Understanding the flexibility in filing can help taxpayers efficiently utilize their eligible credits.

- Any unused credits are forfeited: It's a common misconception that if a business does not have a tax liability high enough to use all of its available credits in one year, those credits are lost. In fact, many of the credits that are reported on Form 3800 can be carried back or forward to other tax years, allowing businesses to apply these credits in a manner that best suits their financial situation.

Key takeaways

The IRS Form 3800, also known as the General Business Credit form, serves as a means for businesses to calculate and claim various business credits. Understanding the nuances of this form is crucial for maximizing potential tax benefits while maintaining compliance with tax laws. Below are key takeaways that businesses should consider when dealing with IRS Form 3800.

- Form 3800 is a comprehensive document that aggregates several business credits from different parts of the tax return, ensuring businesses can claim everything they are entitled to under one form.

- It is important for businesses to accurately identify and document all the credits they qualify for, as these can significantly reduce their overall tax liability.

- The form includes a wide range of credits, such as the Investment Credit, Work Opportunity Credit, and the Research Credit, each with its own eligibility criteria and calculation methods.

- Proper documentation and record-keeping are essential when claiming credits on Form 3800 to provide evidence of eligibility in case of an IRS audit.

- Businesses need to pay attention to the carryback and carryforward rules that apply to certain credits, allowing unused amounts to be applied to tax years prior or subsequent to the current one, thereby optimizing tax benefits over time.

- The Alternative Minimum Tax (AMT) might limit the amount of credits that can be used in a single year, impacting how businesses plan their tax strategies.

- Small businesses, in particular, should explore the eligibility for credits targeted at small businesses, as these can offer substantial tax savings and support for business growth.

- Annual updates and changes to tax laws mean that businesses should review eligibility and calculations for Form 3800 credits each year to ensure compliance and optimal tax benefit.

- Seeking guidance from tax professionals can help businesses navigate the complexities of Form 3800, ensuring that all potential credits are identified, calculated accurately, and claimed in accordance with current tax laws.

In summary, IRS Form 3800 represents a vital opportunity for businesses of all sizes to reduce their taxable income through various credits. It demands thoroughness in the application process, a deep understanding of available credits, and an awareness of legal requirements for documentation and compliance. By approaching Form 3800 with diligence and informed strategy, businesses can significantly benefit from the tax incentives provided by the IRS.

Popular PDF Documents

How to Report a Workplace Injury - A checkbox for whether wages will continue to be paid instead of workers' compensation benefits hints at the options available to employers and the impact on employees.

What Is Form 1095-a - Taxpayers use the information from 1095-A to assure they've met health coverage requirements for the tax year.

Sc Sos Annual Report - Supporting documents may include federal and state tax returns to verify income from the land’s use.