Get IRS 3520 Form

Navigating the complex landscape of international tax obligations can be a daunting task for individuals and entities with foreign assets or transactions. One significant aspect of this regulatory framework is the requirement to file IRS Form 3520, an annual reporting obligation for those who partake in certain foreign trusts, receive substantial gifts or bequests from foreign entities, or make large transfers to foreign trusts. This form serves as a critical tool for the Internal Revenue Service (IRS) to ensure transparency and compliance with United States tax laws, tackling the potential for tax evasion and undisclosed foreign financial activities. The penalties for failing to file or incorrect filings can be substantial, emphasizing the importance of understanding and complying with the specific requirements set forth by the IRS. With the intricate rules surrounding foreign trusts, receipt of gifts, and international financial transactions, IRS Form 3520 stands out as a pivotal element in the broader context of international tax compliance.

IRS 3520 Example

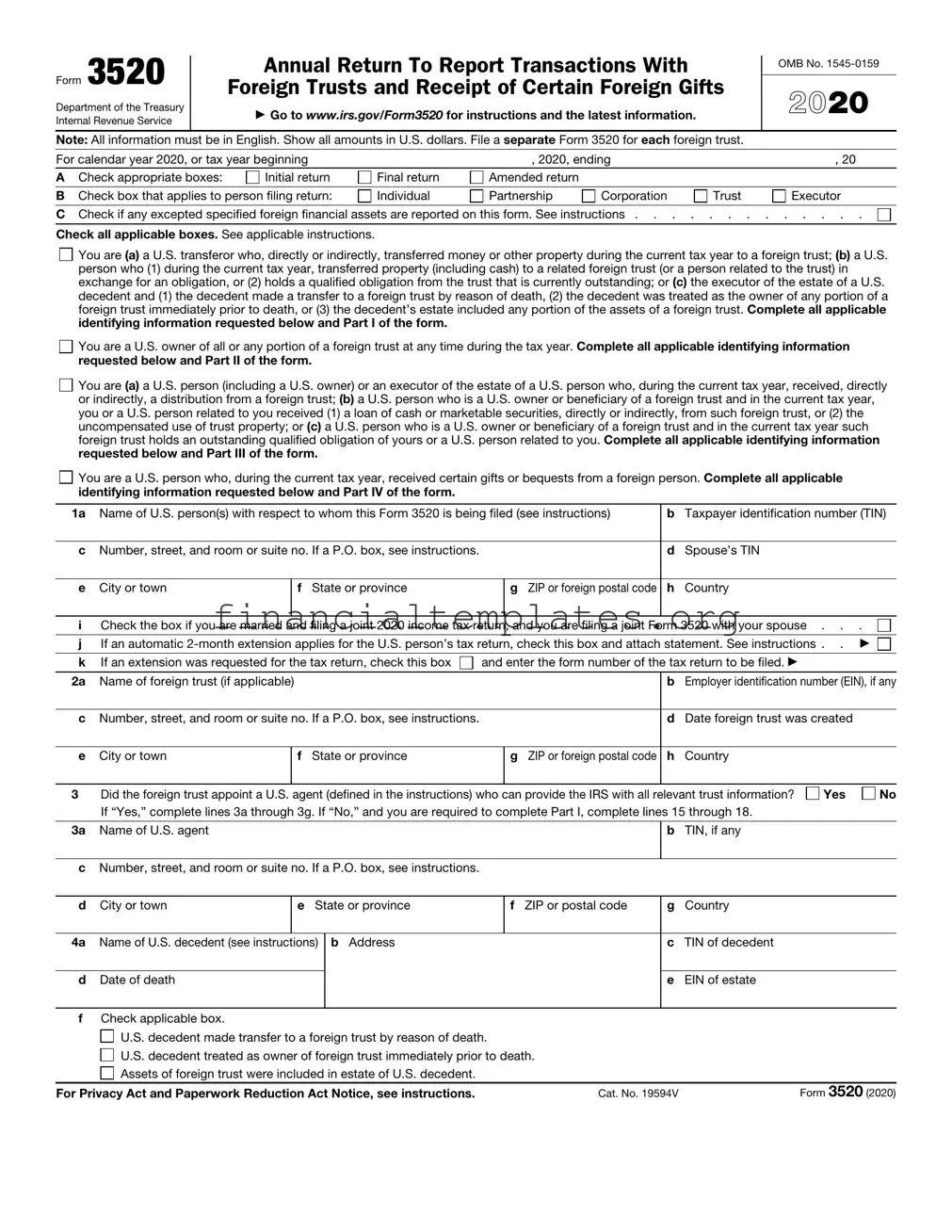

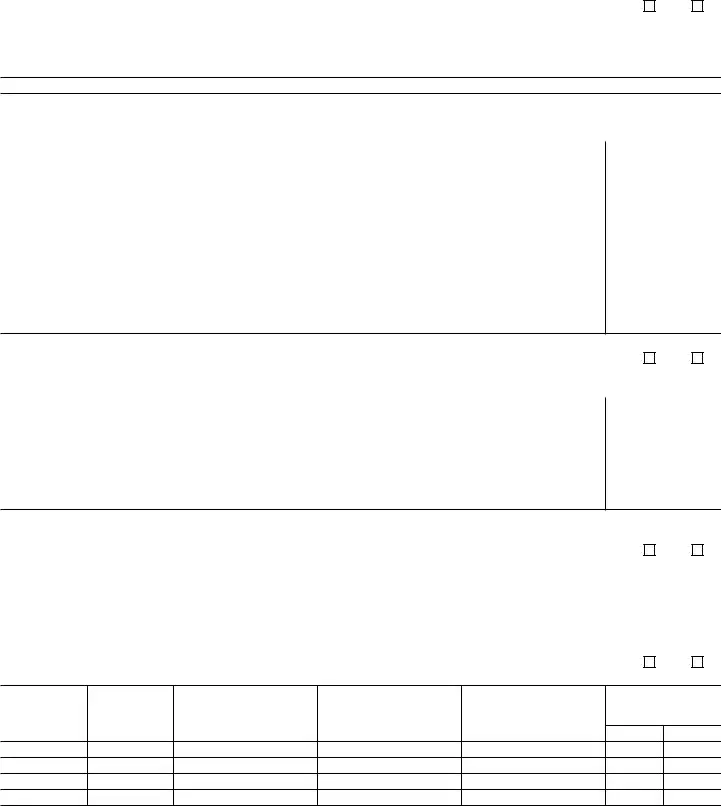

Form 3520

Department of the Treasury Internal Revenue Service

Annual Return To Report Transactions With

Foreign Trusts and Receipt of Certain Foreign Gifts

▶Go to www.irs.gov/Form3520 for instructions and the latest information.

OMB No.

2021

Note: All information must be in English. Show all amounts in U.S. dollars. File a separate Form 3520 for each foreign trust.

For calendar year 2021, or tax year beginning |

|

, 2021, ending |

|

, 20 |

|||

A |

Check appropriate boxes: |

Initial return |

Final return |

Amended return |

|

|

|

|

|

|

|

|

|

|

|

B |

Check box that applies to person filing return: |

Individual |

Partnership |

Corporation |

Trust |

Executor |

|

|

|

||||||

C |

Check if any excepted specified foreign financial assets are reported on this form. See instructions |

||||||

Check all applicable boxes. See applicable instructions.

You are (a) a U.S. transferor who, directly or indirectly, transferred money or other property during the current tax year to a foreign trust; (b) a U.S. person who (1) during the current tax year, transferred property (including cash) to a related foreign trust (or a person related to the trust) in exchange for an obligation, or (2) holds a qualified obligation from the trust that is currently outstanding; or (c) the executor of the estate of a U.S. decedent and (1) the decedent made a transfer to a foreign trust by reason of death, (2) the decedent was treated as the owner of any portion of a foreign trust immediately prior to death, or (3) the decedent’s estate included any portion of the assets of a foreign trust. Complete all applicable identifying information requested below and Part I of the form.

You are (a) a U.S. transferor who, directly or indirectly, transferred money or other property during the current tax year to a foreign trust; (b) a U.S. person who (1) during the current tax year, transferred property (including cash) to a related foreign trust (or a person related to the trust) in exchange for an obligation, or (2) holds a qualified obligation from the trust that is currently outstanding; or (c) the executor of the estate of a U.S. decedent and (1) the decedent made a transfer to a foreign trust by reason of death, (2) the decedent was treated as the owner of any portion of a foreign trust immediately prior to death, or (3) the decedent’s estate included any portion of the assets of a foreign trust. Complete all applicable identifying information requested below and Part I of the form.

You are a U.S. owner of all or any portion of a foreign trust at any time during the tax year. Complete all applicable identifying information requested below and Part II of the form.

You are a U.S. owner of all or any portion of a foreign trust at any time during the tax year. Complete all applicable identifying information requested below and Part II of the form.

You are (a) a U.S. person (including a U.S. owner) or an executor of the estate of a U.S. person who, during the current tax year, received, directly or indirectly, a distribution from a foreign trust; (b) a U.S. person who is a U.S. owner or beneficiary of a foreign trust and in the current tax year, you or a U.S. person related to you received (1) a loan of cash or marketable securities, directly or indirectly, from such foreign trust, or (2) the uncompensated use of trust property; or (c) a U.S. person who is a U.S. owner or beneficiary of a foreign trust and in the current tax year such foreign trust holds an outstanding qualified obligation of yours or a U.S. person related to you. Complete all applicable identifying information requested below and Part III of the form.

You are (a) a U.S. person (including a U.S. owner) or an executor of the estate of a U.S. person who, during the current tax year, received, directly or indirectly, a distribution from a foreign trust; (b) a U.S. person who is a U.S. owner or beneficiary of a foreign trust and in the current tax year, you or a U.S. person related to you received (1) a loan of cash or marketable securities, directly or indirectly, from such foreign trust, or (2) the uncompensated use of trust property; or (c) a U.S. person who is a U.S. owner or beneficiary of a foreign trust and in the current tax year such foreign trust holds an outstanding qualified obligation of yours or a U.S. person related to you. Complete all applicable identifying information requested below and Part III of the form.

You are a U.S. person who, during the current tax year, received certain gifts or bequests from a foreign person. Complete all applicable identifying information requested below and Part IV of the form.

You are a U.S. person who, during the current tax year, received certain gifts or bequests from a foreign person. Complete all applicable identifying information requested below and Part IV of the form.

1a |

Name of U.S. person(s) with respect to whom this Form 3520 is being filed (see instructions) |

b |

Taxpayer identification number (TIN) |

||||

|

|

|

|

|

|

|

|

c |

Number, street, and room or suite no. If a P.O. box, see instructions. |

|

|

d |

Spouse’s TIN |

||

|

|

|

|

|

|

|

|

e |

City or town |

|

f State or province |

|

g ZIP or foreign postal code |

h |

Country |

|

|

|

|

|

|||

i |

Check the box if you are married and filing a current year joint income tax return, and you are filing a joint Form 3520 with your spouse . |

||||||

|

|

||||||

j |

If an automatic |

||||||

|

|

|

|||||

k |

If an extension was requested for the tax return, check this box |

and enter the form number of the tax return to be filed ▶ |

|||||

|

|

|

|

|

|

||

2a |

Name of foreign trust (if applicable) |

|

|

|

b Employer identification number (EIN), if any |

||

cNumber, street, and room or suite no. If a P.O. box, see instructions.

dDate foreign trust was created

eCity or town

fState or province

gZIP or foreign postal code

hCountry

3 |

Did the foreign trust appoint a U.S. agent (defined in the instructions) who can provide the IRS with all relevant trust information? |

Yes |

No |

|||||

|

If “Yes,” complete lines 3a through 3g. If “No,” and you are required to complete Part I, complete lines 15 through 18. |

|

|

|||||

|

|

|

|

|

|

|

|

|

3a |

Name of U.S. agent |

|

|

|

b |

TIN, if any |

|

|

|

|

|

|

|

|

|

|

|

c Number, street, and room or suite no. If a P.O. box, see instructions. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

d |

City or town |

e State or province |

f ZIP or postal code |

g |

Country |

|

|

|

|

|

|

|

|

|

|

|

|

4a |

Name of U.S. decedent (see instructions) |

b Address |

|

c |

TIN of decedent |

|

|

|

|

|

|

|

|

|

|

|

|

d |

Date of death |

|

|

|

e |

EIN of estate |

|

|

|

|

|

|

|

|

|

|

|

fCheck applicable box.

U.S. decedent made transfer to a foreign trust by reason of death. |

|

|

U.S. decedent treated as owner of foreign trust immediately prior to death. |

|

|

Assets of foreign trust were included in estate of U.S. decedent. |

|

|

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 19594V |

Form 3520 (2021) |

Form 3520 (2021) |

Page 2 |

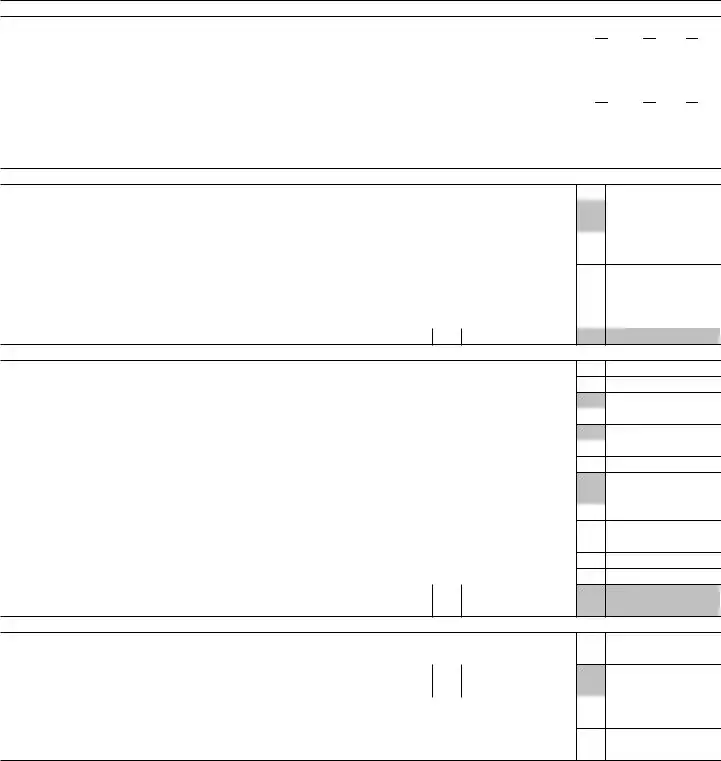

Part I Transfers by U.S. Persons to a Foreign Trust During the Current Tax Year (see instructions)

5a Name of trust creator

bAddress

cTIN, if any

6a Country code of country where trust was created

bCountry code of country whose law governs the trust

cDate trust was created

7a Will any person (other than the foreign trust) be treated as the owner of the transferred assets after the transfer? . . . . |

Yes |

No |

b(i)

Name of foreign

trust owner

(ii)

Address

(iii)

Country of residence

(iv)

TIN, if any

(v)

Relevant Code

section

8 |

Was the transfer a completed gift or bequest? If “Yes,” see instructions |

|

Yes |

|

No |

9a |

Now or at any time in the future, can any part of the income or corpus of the trust benefit any U.S. beneficiary? . . . . |

|

Yes |

|

No |

b |

If “No,” could the trust be revised or amended to benefit a U.S. beneficiary? |

|

Yes |

|

No |

10 |

Reserved for future use |

|

Yes |

|

No |

|

|

Schedule

11a During the current tax year, did you transfer property (including cash) to a related foreign trust in exchange for an obligation of the trust or an obligation of a person related to the trust? See instructions . . . . . . . . . . . . . .

If “Yes,” complete the rest of Schedule A, as applicable. If “No,” go to Schedule B.

bWere any of the obligations you received (with respect to a transfer described in line 11a above) qualified obligations? . .

If “Yes,” complete the rest of Schedule A and attach a copy of each loan document entered into with respect to each qualified obligation reported on line 11b. If these documents have been attached to a Form 3520 filed within the previous 3 years, attach only relevant updates.

If “No,” go to Schedule B.

Yes

Yes  No

No

Yes

Yes  No

No

(i)

Date of transfer giving rise to obligation

(ii)

Maximum term

(iii)

Yield to maturity

(iv)

FMV of obligation

12With respect to each qualified obligation you reported on line 11b, do you agree to extend the period of assessment of any income or transfer tax attributable to the transfer, and any consequential income tax changes for each year that the

obligation is outstanding, to a date 3 years after the maturity date of the obligation? |

Yes |

No |

Note: You have the right to refuse to extend the period of limitations or limit this extension to a mutually |

|

|

issue(s) or mutually |

|

|

each qualified obligation you reported on line 11b, then such obligation is not a qualified obligation and you cannot check |

|

|

“Yes” to the question on line 11b. |

|

|

Schedule

13During the current tax year, did you make any transfers (directly or indirectly) to the trust and receive less than FMV, or no

consideration at all, for the property transferred? |

. . . . . . . . . . . . . |

. . . . . . . . . |

Yes |

No |

||||||

If “Yes,” complete columns (a) through (i) below and the rest of Schedule B, as applicable. When completing columns (a) |

|

|

||||||||

through (i) with respect to each nonqualified obligation, enter |

|

|

|

|

||||||

If “No,” go to Schedule C. |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

(a) |

(b) |

(c) |

(d) |

|

(e) |

(f) |

(g) |

(h) |

(i) |

|

Date of |

Description |

FMV of property |

U.S. adjusted |

Gain recognized |

Excess, if any, |

Description |

FMV of property |

Excess of |

|

|

transfer |

of property |

transferred |

basis of |

|

at time of |

of column (c) |

of property |

received |

column (c) over |

|

|

transferred |

|

property |

|

transfer, |

over the sum of |

received, |

|

column (h) |

|

|

|

|

transferred |

|

if any |

columns (d) and (e) |

if any |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals ▶ |

|

|

|

|

|

$ |

|

|

$ |

|

14If you have a sale or loan document in connection with a transfer reported on line 13, complete 14a through 14c and attach the relevant document(s). If these documents have been attached to a Form 3520 filed within the previous 3 years, attach only relevant updates.

|

|

|

|

Attached |

Year |

|

Are you attaching a copy of any of the following? |

Yes |

No |

Previously |

Attached |

a |

Sale document |

|

|

|

|

b |

Loan document |

|

|

|

|

c |

Subsequent variances to original sale or loan documents |

|

|

|

|

Form 3520 (2021)

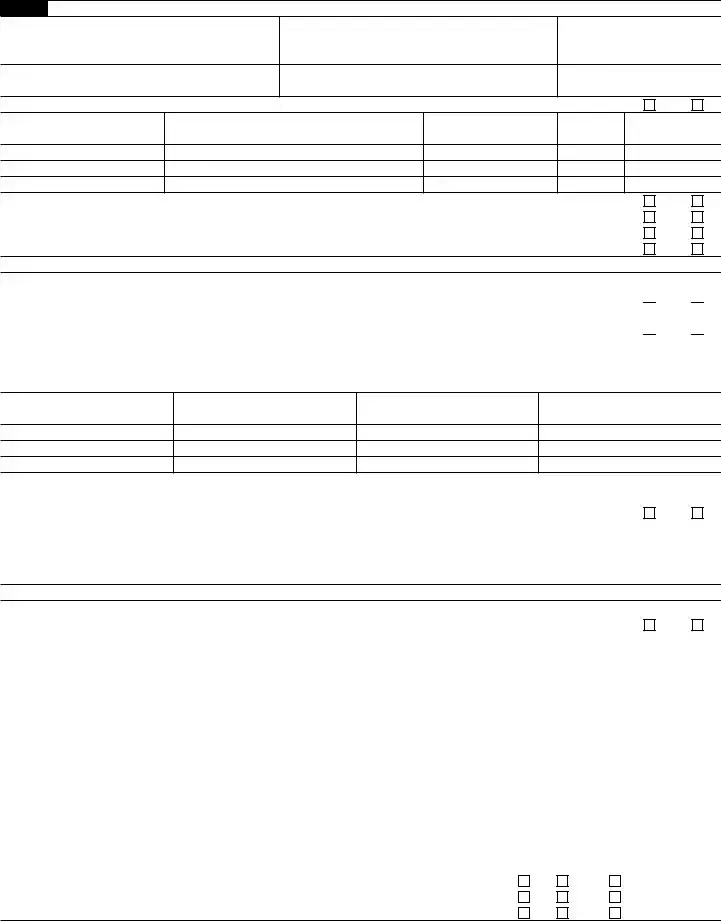

Form 3520 (2021) |

Page 3 |

Part I Schedule

Note: Complete lines 15 through 18 only if you answered “No” to line 3, acknowledging that the foreign trust did not appoint a U.S. agent to provide the IRS with all relevant trust information.

15 |

(a) |

(b) |

|

(c) |

|

(d) |

|

|

Name of beneficiary |

Address of beneficiary |

|

U.S. beneficiary? |

TIN, if any |

||

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

(a) |

(b) |

|

|

|

|

(c) |

|

Name of trustee |

Address of trustee |

|

|

|

|

TIN, if any |

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

17 |

(a) |

(b) |

(c) |

|

(d) |

||

|

Name of other person |

Address of other person with trust powers |

Description of powers |

|

TIN, if any |

||

|

with trust powers |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18If you checked “No” on line 3, you are required to attach a copy of all trust documents as indicated below. If these documents have been attached to a Form

|

|

|

|

Attached |

Year |

|

Are you attaching a copy of any of the following? |

Yes |

No |

Previously |

Attached |

a |

Summary of all written and oral agreements and understandings relating to the trust . . . . |

|

|

|

|

b |

Trust instrument |

|

|

|

|

c |

Memoranda or letters of wishes |

|

|

|

|

d |

Subsequent variances to original trust documents |

|

|

|

|

e |

Trust financial statements |

|

|

|

|

f |

Organizational chart and other trust documents |

|

|

|

|

Schedule

19Did you, at any time during your tax year, hold an outstanding obligation of a related foreign trust (or a person related to the

trust) that you reported as a qualified obligation in the current tax year? |

Yes |

No |

If “Yes,” complete columns (a) through (f) below for each obligation. |

|

|

(a)

Date of original

obligation

(b)

Tax year qualified

obligation first reported

(c)

Amount of principal

payments made during

your tax year

(d)

Amount of interest

payments made during

your tax year

(e)

Balance of the outstanding

obligation at the end

of the tax year

(f)

Does the obligation

still meet the criteria for a qualified obligation?

Yes |

No |

Form 3520 (2021)

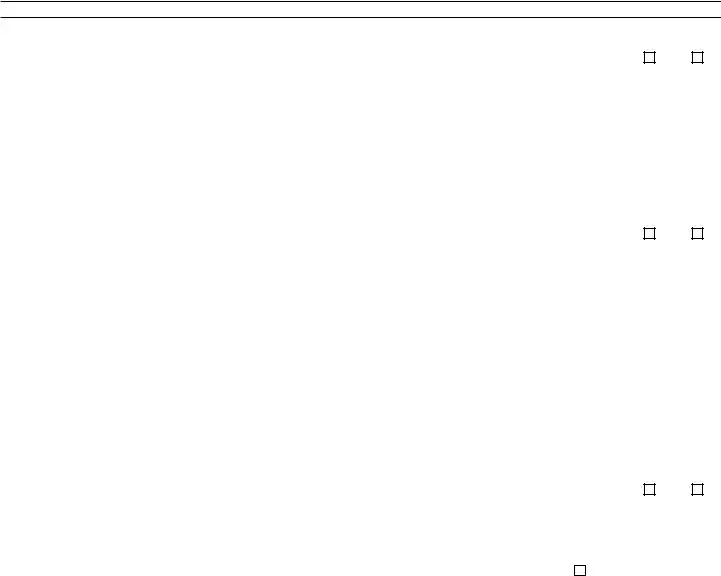

Form 3520 (2021) |

|

|

|

|

|

|

Page 4 |

|||

Part II |

U.S. Owner of a Foreign Trust (see instructions) |

|

|

|

|

|

||||

20 |

|

(a) |

|

|

(b) |

(c) |

(d) |

|

(e) |

|

|

|

Name of foreign |

|

Address |

Country of tax residence |

TIN, if any |

|

Relevant Code |

||

|

|

trust owner |

|

|

section |

|

||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

21a |

Country code of country where foreign trust was created |

|

b Country code of country whose law governs the trust |

c Date foreign trust was created |

||||||

|

|

|

|

|

|

|||||

22 |

Did the foreign trust file Form |

. . . . . |

Yes |

No |

||||||

|

If “Yes,” attach the Foreign Grantor Trust Owner Statement you received from the foreign trust. |

|

|

|

|

|||||

|

If “No,” to the best of your ability, complete and attach a substitute Form |

|

|

|

|

|||||

|

See instructions for information on penalties for failing to complete and attach a substitute Form |

|

|

|

|

|||||

23Enter the gross value of the portion of the foreign trust that you are treated as owning at the end of your tax year . ▶ $

Part III Distributions to a U.S. Person From a Foreign Trust During the Current Tax Year (see instructions)

Note: If you received an amount from a portion of a foreign trust of which you are treated as the owner, only complete lines 24 and 27.

24Enter cash amounts or FMV of property received, directly or indirectly, during your current tax year, from the foreign trust (exclude loans and uncompensated use of trust property included on line 25).

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

Date of distribution |

Description of property received |

FMV of property received |

Description of property |

FMV of property |

Excess of column (c) |

|

|

(determined on date |

transferred, if any |

transferred |

over column (e) |

|

|

of distribution) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶ $ |

25During your current tax year, did you (or a person related to you) receive a loan or uncompensated use of trust property from a

related foreign trust (including an extension of credit upon the purchase of property from the trust)? |

Yes |

No |

If “Yes,” complete columns (a) through (g) below for each such loan or use of trust property. |

|

|

Note: See instructions for additional information, including how to complete columns (a) through (g) for use of trust property.

(a) |

(b) |

(c) |

(d) |

|

(e) |

(f) |

(g) |

|

Is the obligation a |

Amount treated as |

|||||||

FMV of loan proceeds |

Date of original |

Maximum term of |

Interest rate |

qualified obligation? |

FMV of qualified |

distribution from the trust |

||

or property |

transaction |

repayment of |

of obligation |

|

|

|

obligation |

(subtract column (f) |

|

|

obligation |

|

Yes |

|

No |

|

from column (a)) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶ $ |

26With respect to each obligation you reported as a qualified obligation on line 25, do you agree to extend the period of assessment of any income or transfer tax attributable to the transaction, and any consequential income tax changes for each

year that the obligation is outstanding, to a date 3 years after the maturity date of the obligation? . . . |

. |

. |

. |

. . . |

Yes |

No |

|

Note: You have the right to refuse to extend the period of limitations or limit this extension to a mutually |

|

|

|||||

or mutually |

|

|

|||||

that you reported as a qualified obligation on line 25, then such obligation is not a qualified obligation and you cannot check |

|

|

|||||

“Yes” in column (e) of line 25. |

|

|

|

|

|

|

|

27 Total distributions received during your current tax year. Add line 24, column (f), and line 25, column (g) . |

. |

. |

. |

▶ $ |

|

|

|

|

|

|

|

|

|

|

|

28Did the trust, at any time during the current tax year, hold an outstanding obligation of yours (or a person related to you) that

you reported as a qualified obligation? |

Yes |

No |

If “Yes,” complete columns (a) through (f) below for each obligation. |

|

|

(a) |

(b) |

(c) |

(d) |

Date of original |

Tax year qualified |

Amount of principal payments |

Amount of interest payments |

loan transaction |

obligation first |

made during your tax year |

made during your tax year |

|

reported |

|

|

(e)

Balance of the outstanding

obligation at the end

of the tax year

(f)

Does the loan still

meet the criteria of a qualified obligation?

Yes |

No |

Form 3520 (2021)

Form 3520 (2021) |

Page 5 |

Part III Distributions to a U.S. Person From a Foreign Trust During the Current Tax Year (continued)

29Did you receive a Foreign Grantor Trust Beneficiary Statement from the foreign trust with respect to a distribution? If “Yes,” attach the statement and do not complete the remainder of Part III with respect to that distribution.

If “No,” complete Schedule A with respect to that distribution. Also, complete Schedule C if you enter an amount greater than zero on line 37.

30Did you receive a Foreign Nongrantor Trust Beneficiary Statement from the foreign trust with respect to a distribution?

If “Yes,” attach the statement and complete either Schedule A or Schedule B below. See instructions. Also, complete Schedule C if you enter an amount greater than zero on line 37 or line 41a.

If “No,” complete Schedule A with respect to that distribution. Also, complete Schedule C if you enter an amount greater than zero on line 37.

Yes

Yes

Yes

Yes

No

No  N/A

N/A

No

No  N/A

N/A

Schedule

31 |

Enter amount from line 27 |

. . . . . . . . . |

|

31 |

|

32 |

Number of years the trust has been a foreign trust (see instructions) . . . ▶ |

32 |

|

|

|

33Enter total distributions received from the foreign trust during the 3 preceding tax years (or during the number

|

of years the trust has been a foreign trust, if fewer than 3 years) |

33 |

34 |

Multiply line 33 by 1.25 |

34 |

35Average distribution. Divide line 34 by 3.0 (or the number of years the trust has been a foreign trust, if fewer

|

than 3 years) and enter the result |

35 |

|

36 |

Amount treated as ordinary income earned in the current year. Enter the smaller of line 31 or line 35 . . . |

36 |

|

37 |

Amount treated as accumulation distribution. Subtract line 36 from line 31. If zero, do not complete the rest of Part III |

37 |

|

38 |

Applicable number of years of trust. Divide line 32 by 2.0 and enter the result here ▶ |

38 |

|

Schedule

39 |

Enter amount from line 27 |

|||

40a |

Amount treated as ordinary income in the current tax year |

|||

b |

Qualified dividends |

. . . . . . . . . . . ▶ |

40b |

|

41a |

Amount treated as accumulation distribution. If zero, do not complete Schedule C below |

|||

b |

Amount of line 41a that is tax exempt . |

. . . . . . . . . . . ▶ |

41b |

|

42a |

Amount treated as net |

|||

b |

Amount treated as net |

|||

c |

28% rate gain |

. . . . . . . . . . . ▶ |

42c |

|

d |

Unrecaptured section 1250 gain . . |

. . . . . . . . . . . ▶ |

42d |

|

43 |

Amount treated as distribution from trust corpus |

|||

44Enter any other distributed amount received from the foreign trust not included on lines 40a, 41a, 42a, 42b,

|

and 43. (Attach explanation.) |

45 |

Amount of foreign trust’s aggregate undistributed net income |

46 |

Amount of foreign trust’s weighted undistributed net income |

47Applicable number of years of trust. Divide line 46 by line 45 and enter the result

here . . . . . . . . . . . . . . . . . . . . . . ▶ |

47 |

Schedule

39

40a

41a

42a

42b

43

44

45

46

48 |

Enter accumulation distribution from line 37 or line 41a, as applicable |

48 |

49 |

Enter tax on total accumulation distribution from line 28 of Form 4970. (Attach Form |

49 |

50Enter applicable number of years of foreign trust from line 38 or line 47, as

|

applicable (round to nearest half year) . . . . . . . . . . . . ▶ |

50 |

|

|

51 |

Combined interest rate imposed on the total accumulation distribution (see instructions) |

|

51 |

|

52 |

Interest charge. Multiply the amount on line 49 by the combined interest rate on line 51 |

52 |

||

53Tax attributable to accumulation distributions. Add lines 49 and 52. Enter here and as “additional tax” on your

income tax return |

53 |

Form 3520 (2021)

Form 3520 (2021) |

Page 6 |

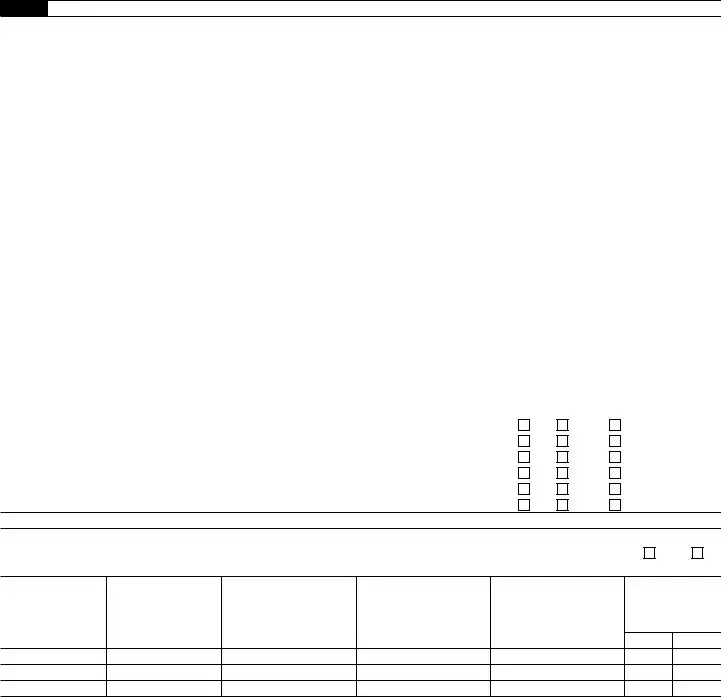

Part IV U.S. Recipients of Gifts or Bequests Received During the Current Tax Year From Foreign Persons (see instructions)

54During your current tax year, did you receive more than $100,000 that you treated as gifts or bequests from a nonresident

alien (including a distribution received from a domestic trust treated as owned by a foreign person) or a foreign estate? See |

Yes |

No |

|||||||||||||

instructions for special rules regarding related donors |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. . . |

|||||

If “Yes,” complete columns (a) through (c) with respect to each such gift or bequest in excess of $5,000. If more space is |

|

|

|||||||||||||

needed, attach a statement. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

(b) |

|

|

|

|

|

|

|

|

|

|

|

(c) |

|

Date of gift or bequest |

|

Description of property received |

|

|

|

|

|

|

|

|

|

|

FMV of property received |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

. |

. |

. |

. |

. |

. |

. |

. |

. |

▶ |

$ |

|

|

||

55During your current tax year, did you receive amounts from a foreign corporation or a foreign partnership that you treated as

|

|

gifts in excess of the amount provided in the instructions? See instructions regarding related donors |

. . . . |

. . . |

Yes |

No |

||||||||||||

|

|

If “Yes,” complete columns (a) through (g) with respect to each such gift. If more space is needed, attach a statement. |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

(b) |

|

|

|

|

(c) |

|

|

|

|

(d) |

|

|||

|

Date of gift |

|

Name of foreign donor |

|

|

|

|

Address of foreign donor |

|

|

|

|

TIN, if any |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(e) |

|

|

|

|

|

|

(f) |

|

|

|

|

(g) |

|

||

Check the box that applies to the foreign donor |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Description of property received |

|

|

|

FMV of property received |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Corporation |

|

Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

56 |

|

Do you have any reason to believe that the foreign donor, in making any gift or bequest described in lines 54 and 55, was |

|

|

||||||||||||||

|

|

acting as a nominee or intermediary for any other person? If “Yes,” see instructions |

. . . . |

. . . |

Yes |

No |

||||||||||||

|

|

Under penalties of perjury, I declare that I have examined this return, including any accompanying reports, schedules, or statements, and to the best of my |

|

|||||||||||||||

Sign |

|

knowledge and belief, it is true, correct, and complete. |

|

|

|

|

|

|

|

|

|

|

||||||

Here |

▲ |

|

|

|

|

|

|

|

▲ |

|

|

|

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Signature |

|

|

|

|

|

Title |

|

|

Date |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Paid |

|

|

Print/Type preparer’s name |

Preparer’s signature |

|

|

|

Date |

|

Check |

if |

PTIN |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Firm’s name |

▶ |

|

|

|

|

|

|

|

Firm’s EIN ▶ |

|

|

|

||||||

Use Only |

|

|

|

|

|

|

|

|

|

|

||||||||

Firm’s address ▶ |

|

|

|

|

|

|

|

Phone no. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 3520 (2021) |

|

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 3520 is used to report transactions with foreign trusts and the receipt of certain large gifts or bequests from certain foreign persons. |

| Filing Requirement | It is required for any U.S. person (which includes individuals, trusts, estates, and corporations) that receives more than $100,000 from a non-resident alien individual or a foreign estate in the form of gifts or bequests, or more than $16,388 (for 2023) from foreign corporations or partnerships. |

| Due Date | The form must be filed by the 15th day of the 4th month following the end of the U.S. person's tax year. For most individuals, this is April 15th of the following year, with an extension available. |

| Penalties | Failure to file, or incomplete or incorrect filing, may result in substantial penalties, including a penalty of 35% of the gross value of any property transferred to a foreign trust or received from a foreign trust, and 5% of the amount of a foreign gift for each month the failure continues, up to 25%. |

| Governing Law | This form is governed by the Internal Revenue Code (IRC), particularly sections related to the transactions with foreign trusts and the receipt of gifts or bequests from foreign persons. |

| Associated Forms | IRS Form 3520-A: Annual Information Return of Foreign Trust With a U.S. Owner is often required in conjunction with Form 3520. Filing Form 3520 without the required Form 3520-A (if applicable) can result in penalties. |

Guide to Writing IRS 3520

After completing the IRS 3520 form, it signals to the IRS that a taxpayer has engaged in transactions with foreign trusts or received large gifts from certain foreign entities. This step is crucial for ensuring compliance with U.S. tax obligations, helping individuals avoid penalties by accurately reporting these transactions or gifts. In preparing this form, it is important to gather all relevant financial information and documents related to the foreign transactions or gifts prior to starting. The following steps guide you through the process of filling out the form effectively.

- Identify the taxpayer's relationship to the foreign trust or nature of the foreign gift to determine which parts of the form must be completed.

- Enter the taxpayer's personal information, including name, address, and Tax Identification Number (TIN), on the top of the form.

- For each foreign trust the taxpayer has transactions with, provide the trust's name, address, and TIN, if applicable, in Part I.

- Detail all transactions between the taxpayer and the foreign trust, including transfers of property to the trust and distributions received from the trust in Part II. Include dates and amounts for each transaction.

- If the taxpayer received a large gift or bequest from a foreign person, report the details in Part III. This includes the donor's name, address, and the value of the gift or bequest.

- For any other foreign gifts received from unknown sources, provide estimates of their value in the appropriate section of Part III.

- Review the information provided for accuracy and completeness. The taxpayer must certify the accuracy of the information by signing and dating the form at the end.

- Consult the form's instructions to determine whether any supporting documents must be attached to the form. If so, include these documents when filing.

- Depending on the filing deadline, either mail the completed form to the IRS or file electronically, according to the instructions provided by the IRS for Form 3520.

After submitting Form 3520, keep a copy of the form and any supporting documents for your records. The IRS will process the information, and if further information or clarification is needed, they will contact you. This process ensures that taxpayers are compliant with reporting requirements for transactions with foreign trusts or receiving significant gifts from abroad. Timely and accurate completion of Form 3520 helps avoid potential penalties and ensures compliance with U.S. tax laws.

Understanding IRS 3520

What is the IRS 3520 form?

The IRS 3520 form, officially titled "Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts," is a document required by the United States Internal Revenue Service (IRS). It is used to report specific transactions involving foreign trusts, including the creation of a foreign trust by a U.S. person, transfers of property to a foreign trust, and the receipt of distributions from foreign trusts. Additionally, it reports the receipt of certain large gifts or bequests from foreign persons.

Who needs to file IRS 3520?

Individuals, estates, and domestic entities must file the IRS 3520 form if they receive certain large gifts or bequests from foreign entities or individuals, are treated as the owner of any part of a foreign trust under the grantor trust rules, or have transactions with or receive distributions from a foreign trust. Specific thresholds for reporting gifts include more than $100,000 from a nonresident alien individual or foreign estate, or more than $16,649 (for 2022, this figure is adjusted annually for inflation) from foreign corporations or foreign partnerships.

What are the consequences of failing to file Form 3520?

Failing to file the IRS 3520 form or filing it incorrectly can lead to severe penalties. The initial penalty is equal to the greater of $10,000 or 35% of the gross reportable amount for failures related to foreign trusts, and 5% of the gift or bequest for failures related to reporting the receipt of certain large gifts or bequests. Additional penalties and interest may accrue if the failure continues after IRS notification.

When is the deadline to file Form 3520?

The filing deadline for Form 3520 aligns with the filer's annual tax return due date, including extensions. For most individuals, this means the form must be filed by April 15 of the year following the transaction with a foreign trust or the receipt of a large gift or bequest from a foreign person. If an extension is granted for filing the individual's income tax return, the same extension applies to Form 3520.

How do I file Form 3520?

Form 3520 must be filed separately from your income tax return. It should be mailed to the Internal Revenue Service Center at the address specified in the form's instructions. Importantly, it cannot be filed electronically. The form requires detailed information about the foreign trust or the foreign gift, including the amount, the giver's identity, and any transactions between the taxpayer and the foreign trust.

Can the IRS waive penalties for not filing Form 3520 on time?

Yes, the IRS can waive penalties for failing to file Form 3520 on time if it can be shown that the failure was due to reasonable cause and not willful neglect. Taxpayers must provide a detailed explanation, supported by facts, to demonstrate reasonable cause. Documentation to support the explanation may also be required. The waiver is not automatic and is at the discretion of the IRS.

What are the differences between Form 3520 and Form 3520-A?

While both forms relate to foreign trusts, Form 3520-A, "Annual Information Return of Foreign Trust With a U.S. Owner," is specifically required to be filed by the foreign trust itself. Form 3520-A provides the IRS with information about the trust, its U.S. owner, and anyone treated as an owner of any part of the foreign trust's assets under the grantor trust rules. Form 3520, on the other hand, is filed by the U.S. person engaging in transactions with the foreign trust or receiving certain large gifts. Essentially, Form 3520-A is from the perspective of the foreign trust, while Form 3520 is from the perspective of the U.S. taxpayer.

Are there any exceptions to the filing requirements for Form 3520?

Yes, there are exceptions to the filing requirements. Not all receipts of gifts or bequests from foreign persons require reporting on Form 3520. For example, gifts received from foreign corporations or partnerships that are less than the reporting thresholds ($16,649 for corporations and partnerships for 2022) do not need to be reported. Additionally, transactions between a U.S. person and a foreign trust may not need to be reported if certain conditions are met, such as transfers under certain compensation agreements or qualified tuition programs. Careful review of the Form 3520 instructions is necessary to determine if an exception applies.

Common mistakes

-

Not Realizing When It’s Required: A significant mistake is simply not recognizing the need to file Form 3520. This form is necessary for transactions with foreign trusts and the receipt of large gifts or bequests from certain foreign persons. Persons may overlook their filing obligations if they underestimate the value of foreign gifts or are unaware that a transaction constitutes interaction with a foreign trust.

-

Inaccurate Reporting of Transactions: Filling out Form 3520 requires detailed information about transactions with foreign trusts or the receipt of foreign gifts. Errors can include incorrectly reporting the value of a gift, transaction dates, or the nature of the transaction. Accurate detailed records are critical to correct reporting.

-

Failing to Properly Attach Required Additional Information: Form 3520 can require additional documentation or attachments to provide full details of the reported transactions. Forgetting to attach these documents, or not providing detailed enough attachments, can result in an incomplete submission, potentially leading to audits or penalties.

-

Missing the Filing Deadline: Like many tax forms, Form 3520 has a strict deadline that corresponds with the taxpayer’s annual tax return due date, including extensions. Misunderstanding the due date can lead to late filings, resulting in penalties and interest charges.

-

Omitting Information on the Beneficial Owner: When reporting transactions with foreign trusts, a common mistake is not providing complete information on the beneficial owner (the person for whom the trust is managed). This omission can cause complications, as the IRS needs to see the full picture to assess taxes and compliance properly.

To avoid these errors, it's beneficial to understand the form's requirements thoroughly or seek professional advice. Accurate completion of Form 3520 is essential to comply with the reporting obligations imposed by U.S. tax law on international transactions and gifts.

Documents used along the form

When dealing with international transactions or receiving gifts from abroad, individuals often encounter the need to file an IRS Form 3520. This form serves as a declaration for transactions with foreign trusts and the receipt of certain large gifts from foreign persons. To ensure compliance and proper reporting, several other forms and documents can be required in conjunction with IRS Form 3520, each serving a specific purpose in the broader context of international financial activities and tax obligations.

- IRS Form 8938: This document is necessary for reporting specified foreign financial assets if the total value exceeds certain thresholds. It helps in providing detailed information on foreign assets, complementing the information submitted via the IRS Form 3520.

- IRS Form 709: Used for reporting gifts exceeding the annual exclusion amount, this form is essential when an individual gives gifts to a foreign trust or receives substantial gifts from foreign entities, necessitating further disclosure.

- IRS Form 1040: As the standard form for individual income tax returns in the U.S., it might require additional schedules or disclosures related to foreign income or gifts, which are reported elsewhere.

- IRS Form 3520-A: Specifically for foreign trusts with a U.S. owner, this form provides information about the trust's assets and income, essential for fulfilling reporting requirements linked to IRS Form 3520.

- IRS Form 5471: Required for U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations, this form collects details on the corporation's financial activities and ownership.

- IRS Form 8865: Similar to Form 5471 but for foreign partnerships, it requires disclosure from U.S. persons who are partners in foreign partnerships, detailing the partnership's activities and the partner's share of income.

- IRS Form 926: Filed by U.S. persons who transfer property to a foreign corporation, this form is necessary for disclosing the transfer and ensuring it's properly taxed under U.S. law.

- FBAR (FinCEN Form 114): Not an IRS form but a Treasury Department requirement, the Foreign Bank Account Report (FBAR) is needed if a U.S. person holds over $10,000 in foreign bank accounts at any time during the calendar year, aiming at preventing tax evasion.

The combination of these forms and documents with the IRS Form 3520 ensures a comprehensive disclosure of international financial activities, crucial for maintaining transparency and adherence to tax regulations. It's important for individuals and entities engaged in cross-border transactions or receiving significant foreign gifts to be aware of these requirements to avoid penalties and ensure compliance with U.S. tax laws.

Similar forms

The IRS Form 3520, often associated with transactions or trusts involving foreign entities, shares similarities with various other tax documents based on its function to report certain transactions. One comparable document is the FinCEN Form 114, also known as the FBAR (Foreign Bank and Financial Accounts Report). Like Form 3520, the FBAR is used to report foreign financial accounts exceeding a certain threshold, underscoring the IRS's focus on international financial transparency and compliance with U.S. tax laws.

Another document with comparable objectives is the IRS Form 8938, Statement of Specified Foreign Financial Assets. This form requires taxpayers to report their foreign financial assets if they exceed certain thresholds, offering a broader spectrum of reporting that includes not just bank accounts but also foreign stocks and securities. Similar to Form 3520, Form 8938 ensures U.S. persons comply with international tax reporting obligations, although focusing more on personal asset ownership.

The IRS Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, also parallels Form 3520 in its aim to monitor and report international financial activities. Required from U.S. citizens or residents who are officers, directors, or shareholders in certain foreign corporations, Form 5471 tracks control and financial involvement, thereby complementing Form 3520's focus on transactions with foreign trusts and receipt of foreign gifts.

Similarly, IRS Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships, requires U.S. persons who participate in foreign partnerships to report transactions and changes in partnership interest. This form aligns with the objective of Form 3520 by enhancing transparency in international financial dealings and ensuring adherence to U.S. tax regulations regarding foreign transactions.

IRS Form 8621, Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund, shares similarities with IRS Form 3520 as it involves reporting on foreign investments. Form 8621 is required from U.S. persons who have investments in passive foreign investment companies (PFICs), aimed at preventing tax deferral on indirect foreign investments, akin to the direct transactions reported on Form 3520.

The Schedule B (Form 1040), Interest and Ordinary Dividends, is another related document, particularly for individuals who must report interest from foreign bank accounts or dividends from foreign corporations. Although it covers a different aspect of financial reporting, its requirement for disclosing foreign accounts and sources of income complements the transparency sought with Form 3520.

The IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, while domestically focused, parallels Form 3520 in its oversight of gift transactions. Form 709 is concerned with tracking large transfers of wealth through gifts, similar to how Form 3520 is concerned with large gifts from foreign entities. Both forms play a crucial role in preventing tax evasion and ensuring proper tax collection on substantial transfers of wealth.

Lastly, the IRS Form 1040, U.S. Individual Income Tax Return, indirectly relates to Form 3520 through its catch-all nature, requiring taxpayers to report their worldwide income, including income generated from foreign trusts or received as gifts from foreign persons. This overarching requirement reinforces the comprehensive tax reporting regime facilitated by the specific disclosures required under Form 3520, ensuring U.S. persons pay the appropriate taxes on all international transactions.

Dos and Don'ts

When tackling the IRS 3520 form, it's key to move forward with caution and clarity. This form, integral for reporting transactions with foreign trusts and receipt of certain foreign gifts, demands precision. Below, find essential do's and don'ts you should keep in mind to ensure the process is smooth and error-free.

- Do gather all necessary documentation before starting. Having all your information on hand makes the process smoother and helps prevent errors.

- Do thoroughly read the instructions provided by the IRS for filling out the form. These instructions are designed to guide you through each part of the form accurately.

- Do double-check the numbers you enter, especially those related to financial information. Inaccuracies can lead to significant problems down the line.

- Do use the correct tax year's form. IRS forms can update annually, so ensure the version you're filling out matches the year you're reporting for.

- Do seek professional help if you're unsure about any aspect of the form. Tax professionals are well-versed in these matters and can provide valuable assistance.

- Don't rush through filling out the form. Taking your time can help you avoid mistakes and overlook crucial information.

- Don't disregard the importance of reporting all required transactions. Failing to properly report can result in penalties and interest charges.

- Don't submit the form without proofreading it. A final review can catch errors that were previously overlooked.

- Don't forget to sign and date the form. An unsigned form can lead to processing delays or be considered incomplete by the IRS.

Misconceptions

The IRS Form 3520, or the Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts, often comes with misconceptions that can lead to confusion and errors when individuals try to comply with U.S. tax law. Here are six common misunderstandings about this form:

- Misconception 1: Only large transactions need to be reported. In fact, the IRS requires the reporting of any foreign gift or bequest valued more than $100,000 from an individual or $16,388 (for 2020) from foreign corporations or partnerships. The thresholds are lower than many people assume.

- Misconception 2: The Form 3520 is filed with your annual tax return. This is incorrect; Form 3520 must be filed separately and directly to the IRS, not attached to your annual income tax return. It has a different filing deadline, which is April 15, with an extension option until October 15.

- Misconception 3: Only cash transactions need to be reported. This isn't true; the requirement covers all types of gifts, including property and other non-cash assets. The fair market value of these assets must be reported on the form.

- Misconception 4: Form 3520 is only for U.S. citizens. While U.S. citizens do need to file this form if they meet the criteria, it is also required for resident aliens of the United States. Essentially, anyone who is considered a U.S. person for tax purposes needs to comply if they engage in transactions with a foreign trust or receive applicable foreign gifts.

- Misconception 5: Penalties are rare or negligible for not filing. Unfortunately, this is far from the truth. The penalties for failing to file Form 3520 can be quite steep, including 35% of the gross reportable amount for foreign trusts and up to 25% for foreign gifts. Even unintentional mistakes can lead to significant financial penalties.

- Misconception 6: It's easy to amend mistakes made in previous years. Correcting past errors related to Form 3520 is not always straightforward. Although it is possible to amend previously filed forms, it's important to approach these cases carefully to avoid further scrutiny or penalties from the IRS. Professional advice is often recommended.

Understanding the requirements and common misconceptions about Form 3520 can help individuals avoid costly errors and ensure compliance with U.S. tax laws. When in doubt, consulting with a tax professional who is familiar with international tax issues can provide clarity and guidance.

Key takeaways

Filing taxes can be a complex process, especially when it involves foreign transactions. The IRS Form 3520, "Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts," plays a crucial role for individuals or entities partaking in these activities. Here are seven key takeaways about filling out and using the IRS 3520 form:

- The purpose of Form 3520 is to provide information about transactions with foreign trusts, receipt of large gifts or bequests from certain foreign persons, and certain foreign corporations ownership. Understanding its purpose ensures compliance with U.S. tax laws and avoids potential penalties.

- Filing requirements are triggered by specific types of interactions with foreign entities, including receiving gifts or bequests valued above the IRS threshold from a nonresident alien individual or foreign estate, ownership or transactions with foreign trusts, and receiving distributions from foreign trusts. It is crucial for taxpayers to recognize these activities in their financial dealings.

- Deadlines are tied to the individual’s tax return due date, including extensions. For most taxpayers, this means the form must be filed by April 15, or October 15 if an extension has been granted. Adhering to these deadlines is essential to avoid penalties.

- Penalties for failing to file Form 3520 on time, or filing an incomplete or incorrect form, can be severe. These can include a percentage of the foreign gift or trust amounts involved in the reporting, emphasizing the importance of accurate and timely filing.

- Professional assistance is often advisable. Given the complexity of the tax rules surrounding foreign transactions, seeking help from a tax professional who is experienced with international tax issues can provide valuable guidance and peace of mind.

- The form requires detailed information about the foreign entities and transactions involved, including the identity of the donor or foreign trust, the nature of the transaction, and the amount of the gift or distribution. Collecting this information in advance can simplify the filing process.

- Filing Form 3520 does not by itself result in a tax liability. It is a reporting requirement designed to provide the IRS with information necessary to enforce tax laws. However, the transactions reported may have tax implications that affect an individual's overall tax liability.

Understanding and complying with the IRS Form 3520 filing requirements is integral for those who have financial dealings with foreign trusts or receive certain types of foreign gifts. Proper adherence to these rules not only ensures compliance but also helps avoid potentially significant penalties. When in doubt, the assistance of a professional experienced in international tax matters can be invaluable.

Popular PDF Documents

Tax Form 1040 - It covers less common credits, ensuring you don’t miss out on any tax benefits available to you.

Rushmore Loss Mitigation - Applicants must submit a complete Borrower Assistance Application, including recent paystubs, bank statements, federal tax returns, and if applicable, HOA statements to verify homeowners association dues.

Arizona Income Tax Forms - The application must be signed by an authorized individual and returned as per the guidance provided in the ARS § 23-722.