Get Irs 3311 Form

Understanding the IRS 3311 Form, also known as the American Goods Returned Declaration, is essential for businesses and individuals involved in the international trade of American-made products. This form is a critical document used by the U.S. Department of Homeland Security and the Bureau of Customs and Border Protection to ensure that American goods returned to the country can re-enter free of duty under specific conditions. It applies to products that were previously exported from the U.S. and are now being returned without having been enhanced in value or altered in condition. The form requires detailed information about the shipment, including the port of entry, the reason for return, and a declaration by the person making the return that the goods are indeed American-made, have not been improved, and are eligible for duty-free status. Besides, if the returned goods are valued over $10,000 and not clearly marked as American-made, additional documentation must be provided to substantiate the claim for duty-free entry. The form serves multiple purposes: it helps in reclaiming duty if applicable, ensures compliance with customs regulations, and provides necessary data for statistical purposes. Completing the IRS 3311 Form accurately is mandatory and plays a vital role in facilitating smooth customs processing for returned American goods.

Irs 3311 Example

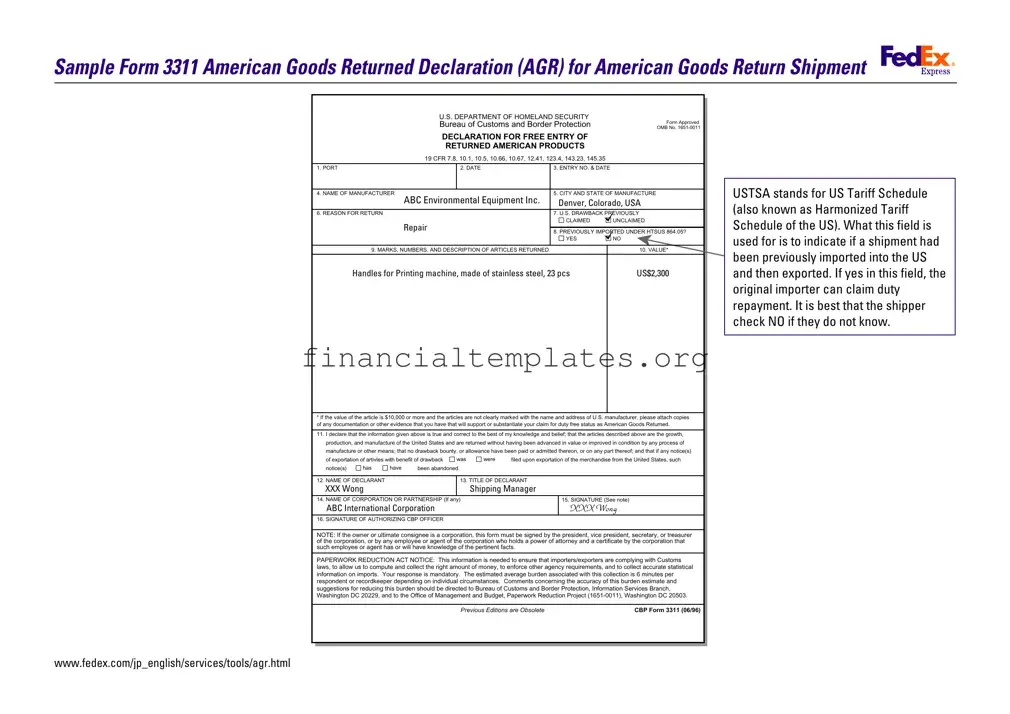

Sample Form 3311 American Goods Returned Declaration (AGR) for American Goods Return Shipment

U.S. DEPARTMENT OF HOMELAND SECURITY

|

Bureau of Customs and Border Protection |

Form Approved |

|||

|

OMB No. |

||||

|

DECLARATION FOR FREE ENTRY OF |

|

|||

|

RETURNED AMERICAN PRODUCTS |

|

|||

|

19 CFR 7.8, 10.1, 10.5, 10.66, 10.67, 12.41, 123.4, 143.23, 145.35 |

|

|||

|

|

|

|

|

|

1. PORT |

|

2. DATE |

3. ENTRY NO. & DATE |

|

|

|

|

|

|

|

|

4. NAME OF MANUFACTURER |

ABC Environmental Equipment Inc. |

5. CITY AND STATE OF MANUFACTURE |

|||

|

Denver, Colorado, USA |

||||

|

|

|

|||

6. REASON FOR RETURN |

|

|

7. U.S. DRAWBACK PREVIOUSLY |

||

|

|

|

CLAIMED |

UNCLAIMED |

|

|

Repair |

|

|

|

|

|

8. PREVIOUSLY IMPORTED UNDER HTSUS 864.05? |

||||

|

|

|

|||

|

|

|

YES |

NO |

|

|

|

|

|

||

9. MARKS, NUMBERS, AND DESCRIPTION OF ARTICLES RETURNED |

|

|

10. VALUE* |

||

Handles for Printing machine, made of stainless steel,. 23 pcs |

|

US$2,300 |

|||

|

|

|

|

|

|

*If the value of the article is $10,000 or more and the articles are not clearly marked with the name and address of U.S. manufacturer, please attach copies of any documentation or other evidence that you have that will support or substantiate your claim for duty free status as American Goods Returned.

11.I declare that the information given above is true and correct to the best of my knowledge and belief; that the articles described above are the growth, production, and manufacture of the United States and are returned without having been advanced in value or improved in condition by any process of

manufacture or other means; that no drawback bounty, or allowance have been paid or admitted thereon, or on any part thereof; and that if any notice(s)

of exportation of artivles with benefit of drawback |

was |

were |

filed upon exportation of the merchandise from the United States, such |

|||

notice(s) |

has |

have |

been abandoned. |

|

|

|

|

|

|

|

|||

12. NAME OF DECLARANT |

|

|

13. TITLE OF DECLARANT |

|||

XXX Wong |

|

|

|

Shipping Manager |

||

|

|

|

|

|||

14. NAME OF CORPORATION OR PARTNERSHIP (If any) |

|

15. SIGNATURE (See note) |

||||

ABC International Corporation

16. SIGNATURE OF AUTHORIZING CBP OFFICER

NOTE: If the owner or ultimate consignee is a corporation, this form must be signed by the president, vice president, secretary, or treasurer of the corporation, or by any employee or agent of the corporation who holds a power of attorney and a certificate by the corporation that such employee or agent has or will have knowledge of the pertinent facts.

PAPERWORK REDUCTION ACT NOTICE: This information is needed to ensure that importers/exporters are complying with Customs laws, to allow us to compute and collect the right amount of money, to enforce other agency requirements, and to collect accurate statistical information on imports. Your response is mandatory. The estimated average burden associated with this collection is 6 minutes per respondent or recordkeeper depending on individual circumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to Bureau of Customs and Border Protection, Information Services Branch, Washington DC 20229, and to the Office of Management and Budget, Paperwork Reduction Project

PREVIOUS EDITIONS ARE OBSOLETE |

CBP FORM 3311 (06/96) |

www.fedex.com/jp_english/services/tools/agr.html

USTSA stands for US Tariff Schedule (also known as Harmonized Tariff Schedule of the US). What this field is used for is to indicate if a shipment had been previously imported into the US and then exported. If yes in this field, the original importer can claim duty repayment. It is best that the shipper check NO if they do not know.

Document Specifics

| Fact Name | Description |

|---|---|

| Title and Purpose | Form 3311 is the American Goods Returned Declaration (AGR) used for the free entry of returned American products to the U.S. |

| Regulating Authority | The form is regulated by the U.S. Department of Homeland Security, Bureau of Customs and Border Protection. |

| Relevant Regulations | This form is approved under the authority of several regulations including 19 CFR 7.8, 10.1, 10.5, 10.66, 10.67, 12.41, 123.4, 143.23, and 145.35. |

| Manufacturer Identification | The form requires details of the U.S. manufacturer, including the name (e.g., ABC Environmental Equipment Inc.) and city/state of manufacture (e.g., Denver, Colorado). |

| Reason for Return | One must specify the reason for returning goods to the U.S., such as repair, and indicate whether U.S. drawback has been previously claimed or unclaimed. |

| Value Declaration | The form requires declaration of the value of the returned articles, especially if the value is $10,000 or more, to support claims for duty-free status. |

| Declaration and Certification | The form must be signed by an authorized person, affirming that the information is correct and adhering to specific conditions regarding the goods' production and return status. |

Guide to Writing Irs 3311

Filling out the IRS Form 3311 is a necessary step for importing goods that were originally manufactured in the United States and are being returned. This process ensures that the goods can re-enter the U.S. without incurring additional duties, under the stipulation that they have not been enhanced in value or improved in condition by any means while abroad. The form is straightforward, but attention to detail is crucial to avoid any potential delays or issues with the customs clearance process. Here are the step-by-step instructions to accurately complete the Form 3311:

- Start by entering the Port of entry where the goods are being imported back into the U.S.

- Fill in the Date of entry next to the port information.

- Proceed to provide the Entry No. & Date, which refers to the reference number and date associated with the entry filing of these goods.

- Under Name of Manufacturer, input "ABC Environmental Equipment Inc." as the manufacturer of the returned goods.

- For the City and State of Manufacture, enter "Denver, Colorado, USA", indicating where the goods were originally produced.

- Identify the Reason for Return by selecting the appropriate reason from the provided options; in this case, mark "Repair".

- If a U.S. Drawback was previously claimed or unclaimed, tick the appropriate box. For the sample form, mark "Unclaimed".

- Answer whether the goods were Previously Imported under HTSUS by selecting "Yes" or "No". If unsure, it is advisable to check "No".

- In the section for Marks, Numbers, and Description of Articles Returned, provide a detailed account, such as "Handles for Printing machine, made of stainless steel, 23 pcs, US$2,300".

- For the Value* field, note that if the total value is $10,000 or more and the articles aren’t clearly marked with the name and address of the U.S. manufacturer, additional documentation should be attached.

- The declarant must then certify the statement by providing their name and title under sections for Name of Declarant and Title of Declarant, respectively, as "XXX Wong, Shipping Manager".

- Include the Name of Corporation or Partnership if applicable, in this case, "ABC International Corporation".

- Ensure that the form is signed by the appropriate individual as noted in the instructions. For corporations, this includes a president, vice president, secretary, treasurer, an authorized employee, or agent.

- Finally, the Signature of Authorizing CBP Officer section will be completed by the Customs and Border Protection officer upon processing your form.

In addition to accurately completing the form, it's essential to include all necessary documentation and ensure the form is submitted within the appropriate deadlines. Proper completion and timely submission of Form 3311 facilitate a smoother importation process for returning American goods. Always double-check entries for accuracy and compliance with U.S. customs regulations to avoid any unnecessary delays or complications.

Understanding Irs 3311

What is the IRS Form 3311?

IRS Form 3311, known as the American Goods Returned Declaration (AGR), is a document used for declaring the free entry of products manufactured in the United States that are being returned to the country. It is managed by the U.S. Department of Homeland Security's Bureau of Customs and Border Protection. This form ensures that American-made goods returned for any reason can re-enter the country without being subjected to customs duty, provided they have not been enhanced in value or improved in condition while outside the country.

When is Form 3311 required?

Form 3311 is required when American goods are returned to the United States after being exported. It serves to inform Customs and Border Protection (CBP) that the goods being imported are American-made and have previously been exported from the U.S. The form helps in claiming duty-free entry for these returned products.

How do I fill out Form 3311?

To correctly fill out Form 3311, you'll need to provide specific details such as the port of entry, date of entry, entry number, manufacturer's name, city, and state of manufacture, reason for return, and whether a U.S. drawback was previously claimed. Additionally, you must indicate if the returned goods were previously imported under the Harmonized Tariff Schedule of the U.S. (HTSUS), provide a description of the articles returned, their value, and certify the declaration with a signature.

What documentation is needed along with Form 3311?

If the value of the returned articles is $10,000 or more and not clearly marked with the name and address of the U.S. manufacturer, you must attach supporting documentation or evidence to substantiate the claim for duty-free status. This may include invoices, shipping documents, or any other relevant records that prove the goods were manufactured in the U.S. and are eligible for duty-free return.

Who should sign the Form 3311?

If the owner or ultimate consignee is a corporation, Form 3311 must be signed by an authorized officer of the corporation, such as the president, vice president, secretary, or treasurer. Alternatively, any employee or agent of the corporation who holds a power of attorney and can certify knowledge of the pertinent facts may also sign the form.

What is the importance of the "PREVIOUSLY IMPORTED UNDER HTSUS" section?

The "PREVIOUSLY IMPORTED UNDER HTSUS" section indicates whether the returned shipment was previously imported into the U.S. and then exported. This is crucial for determining if the original importer can claim a duty repayment for items that have been exported and are now being returned. It's recommended to check "NO" if unsure.

What happens if the information provided on Form 3311 is inaccurate?

Providing accurate information on Form 3311 is mandatory. Inaccuracies can lead to delays in the customs process, potential penalties, or denial of the duty-free status for the returned goods. It's vital to verify all details and provide supporting documentation to ensure compliance with Customs laws and regulations.

Where can I find Form 3311?

Form 3311 can be obtained from the U.S. Customs and Border Protection website or through customs brokers and shipping companies that manage international shipments. Additionally, digital versions may be available for submission through certain authorized online platforms or service providers.

Common mistakes

Not verifying the accuracy of the manufacturer's name and location: Many people make the mistake of inaccurately listing the name or the location of the manufacturer. It's crucial to provide the exact name of the manufacturer as it appears on official documents and to specify the correct city and state where the items were manufactured. This information is fundamental in establishing that the goods being returned were indeed manufactured in the United States.

Incorrectly stating the reason for return: A common error is to provide vague or incorrect reasons for the return of the goods. The IRS 3311 form requires a specific reason for the return, such as repair in the sample provided. Detailing the precise reason helps Customs and Border Protection (CBP) to process the declaration efficiently and accurately determine duty exemptions.

Omitting or incorrectly stating the Previous Importation Status: Those filling out the form sometimes fail to indicate whether the shipment had been previously imported under the Harmonized Tariff Schedule of the United States (HTSUS) code. It is important to check the correct box to inform if the goods were previously imported to ensure proper handling regarding duty repayment or exemptions.

Failing to include requisite supplemental documentation for high-value articles: For articles valued at $10,000 or more not clearly marked with the U.S. manufacturer's name and address, additional documentation is required to support the claim for duty-free status as American Goods Returned. Failure to attach this documentation can result in delays or denial of the duty-free entry.

Misunderstanding the signature requirements: The form must be signed by an authorized individual with the proper title or by an agent who holds a power of attorney from the corporation, along with a certificate from the corporation. This is often overlooked or misunderstood, leading to the submission of forms without the proper authorization, thereby invalidating the declaration.

Avoiding these mistakes is crucial for ensuring that the AGR declaration is processed smoothly and efficiently. Paying close attention to the details and following the instructions carefully can save time and prevent complications with the Customs and Border Protection processing of returned American products.

Documents used along the form

When dealing with the intricacies of U.S. customs and border protection, several forms and documents accompany the IRS Form 3311, each playing a vital role in the smooth processing of returned American goods. This document trail helps in substantiating claims, facilitating inspections, and complying with legal requirements for duty-free status of returned merchandise. Understanding these documents is crucial for businesses and individuals navigating the complexities of import-export regulations.

- CBP Form 3461: This is the entry/release document used primarily for cargo clearance at the port of entry. It provides essential information to the Customs and Border Protection to determine the admissibility of the merchandise.

- CBP Form 7501: Also known as the Entry Summary, this form is used to declare the value of goods being imported, calculate duties or taxes owed, and provide detailed information about the shipment.

- Commercial Invoice: A critical document that provides a comprehensive breakdown of the items being returned, including their value. This document is necessary for assessing duties and taxes.

- Packing List: Accompanies the commercial invoice, detailing the contents of the shipment. It helps customs officials verify the cargo and its compliance with import regulations.

- Bill of Lading or Air Waybill: This contract between the shipper and the carrier details the goods being transported, their destination, and the terms of shipping. It serves as a receipt and a document of title.

- Proof of Export: Documentation showing that goods were previously exported from the U.S., crucial for re-importing goods under the American Goods Returned program without incurring additional duties.

- Manufacturer’s Affidavit: A sworn statement from the original manufacturer verifying that the goods were made in the U.S. This document is essential for claiming the duty-free status of American-made products being returned.

- Certificate of Origin: Demonstrates the national origin of the merchandise. While similar to the Manufacturer's Affidavit, this document may be required for specific trade agreements or preference programs.

- Power of Attorney (POA): Authorizes a customs broker to act on behalf of an importer or exporter in dealings with Customs authorities. The POA is essential for ensuring that representatives can handle customs transactions legally and efficiently.

In the landscape of international trade, accurate paperwork is not just bureaucratic red tape; it's the backbone of efficient, legally compliant transactions. For businesses re-importing goods to the U.S., the intersection of these documents with the IRS Form 3311 encapsulates a critical process—ensuring that American products return home smoothly and affordably. Navigating through this paperwork meticulously can safeguard against delays, penalties, and unnecessary costs, streamlining the process of reintroducing goods to the American market.

Similar forms

The CBP Form 7501, "Entry Summary," is similar to the IRS 3311 form in that both play a crucial role in the customs clearance process for imported goods. While IRS 3311 focuses on the re-entry of American goods that were previously exported, CBP Form 7501 provides detailed information about the products being imported, including their classification, value, and the duties owed. Both forms are essential in ensuring compliance with U.S. customs regulations and facilitating accurate duty calculations.

Another comparable document is the CBP Form 3461, "Entry/Immediate Delivery," which, like the IRS 3311, is used in the importation process. The Form 3461 is typically filed for immediate release of goods upon their arrival in the United States. It's similar to IRS 3311 in that it also requires information about the imported items, but it's specifically designed for faster processing to allow urgent shipments to be delivered without delay.

The CBP Form 4455, "Certificate of Registration," shares similarities with IRS 3311 regarding American goods taken abroad that are intended for return to the United States. The 4455 form is used to register items with Customs before they leave the country, ensuring duty-free re-entry, just as IRS 3311 declares returned American products for duty-free entry. Both facilitate the movement of goods across the border by proving their eligibility for exemption from duties.

The NAFTA Certificate of Origin, another critical trade document, parallels the IRS 3311 form for products traded between NAFTA countries. Both documents are used to certify the origin of goods to qualify for preferential tariff treatment. The NAFTA Certificate specifies that the goods are eligible for duty-free or reduced tariff entry under the NAFTA agreement, similar to how IRS 3311 certifies American goods returned for duty-free entry.

The "Shipper’s Export Declaration" (SED), now known as the Electronic Export Information (EEI) filed through the Automated Export System (AES), is akin to IRS 3311 in the exportation context. While IRS 3311 deals with the re-importation of American manufactured goods, the EEI/SED records details about goods leaving the United States, including their value and destination. Both forms are crucial for compliance with U.S. export regulations and customs requirements.

The "Application and Special Permit for Immediate Delivery" (CBP Form 3461-Alternate) works in concert with forms like IRS 3311 to expedite the clearance process for certain imports. This form allows for immediate delivery of cargo prior to the completion of customs formalities, similar to how IRS 3311 expedites the re-entry of American goods by declaring their duty-free status upfront.

CBP Form 3299, "Declaration for Free Entry of Unaccompanied Articles," is similar to IRS 3311 in its objective to declare items for duty-free entry. However, Form 3299 is used for personal and household effects entering the U.S. when the owner is not physically accompanying them. Like IRS 3311, it ensures compliance with customs regulations and helps in the smooth entry of goods without the imposition of duties.

Lastly, the "Informal Entry" process bears resemblance to the streamlined customs procedure facilitated by IRS 3311 for returned American goods. Informal entries, typically for shipments valued under a certain threshold, require less documentation and processing compared to formal entries. IRS 3311 simplifies the re-importation of American goods in a similar fashion by streamlining the duty-free return process for eligible items.

Dos and Don'ts

When filling out the IRS 3311 form, it's essential to proceed with care to ensure accuracy and compliance. Below are dos and don'ts that should be followed:

- Do verify the manufacturer's name and address is correct, as stated in Section 4.

- Do accurately state the reason for return in Section 6, ensuring it matches your records and situation.

- Do check whether U.S. drawback was previously claimed or unclaimed by accurately responding in Section 7.

- Do ensure all information regarding the articles returned, including marks, numbers, and descriptions in Section 9, is detailed and precise.

- Don't overlook the importance of accurately indicating if the previously imported goods under HTSUS as noted in Section 8. If unsure, avoid guessing and seek clarification.

- Don't estimate the value of the returned articles in Section 10; ensure the value stated is accurate and verifiable.

- Don't neglect the requirement for additional documentation for items valued at $10,000 or more not clearly marked with the name and address of the U.S. manufacturer.

- Don't sign the declaration in Section 15 without thoroughly reviewing all entered information for correctness and ensuring you're authorized to sign on behalf of the corporation or partnership.

Following these guidelines can help in avoiding common mistakes and ensure the smooth processing of your Form 3311.

Misconceptions

Understanding the IRS Form 3311 and clearing up common misconceptions is important for businesses involved in the import and export of American goods. Here are seven misconceptions about the Form 3311 - American Goods Returned Declaration (AGR) and the facts to correct them.

- Misconception 1: The Form 3311 is only for large corporations. In truth, any entity, including small businesses and individuals who are returning American manufactured goods to the United States, can use Form 3311 to claim a duty-free entry, provided the goods meet the eligibility criteria.

- Misconception 2: Goods advanced in value or improved in condition abroad are eligible for duty-free return under this form. However, for goods to qualify for duty-free treatment under Form 3311, they must be returned without having been advanced in value or improved in condition by any process of manufacture or other means while outside the United States.

- Misconception 3: All returned goods automatically qualify for duty-free status when using Form 3311. The reality is that the eligibility for duty-free return is contingent upon meeting specific criteria laid out by the Bureau of Customs and Border Protection, including that the goods are indeed American-made and are being returned within a certain period without any enhancement in value or condition.

- Misconception 4: The process is the same regardless of the value of the goods being returned. Actually, when the value of the returned goods is $10,000 or more, additional documentation is necessary to support the claim for duty-free status, as the form itself advises providing evidence for the American Goods Returned.

- Misconception 5: The declaration signed by the declarant is merely procedural. The declaration section is a crucial part of the form, wherein the declarant affirms that all information provided is true to the best of their knowledge and that the goods meet all criteria for duty-free return. Providing false information can have serious legal implications.

- Misconception 6: Only the president or vice president of a corporation can sign the Form 3311. The form specifies that in addition to these officers, the secretary, treasurer, or any employee or agent holding a power of attorney and a certificate by the corporation verifying their knowledge of the facts can sign the form.

- Misconception 7: There's no need to check the "Previously Imported Under HTSUS" field if unsure. It is actually recommended to check "NO" in this field if there's any uncertainty about whether the shipment had been previously imported under the U.S. Tariff Schedule (HTSUS), as incorrectly claiming duty repayment can lead to complications with Customs.

Clarifying these misconceptions about Form 3311 ensures that businesses and individuals are better equipped to navigate the complexities of returning American goods for duty-free entry into the United States. Proper completion and understanding of this form can lead to smoother transactions and compliance with U.S. Customs and Border Protection regulations.

Key takeaways

Understanding how to properly fill out and utilize the IRS Form 3311 can significantly smoothen the process of declaring returned American goods. This document, crucial for securing duty-free status for specific items, demands meticulous attention to detail. Here are eight key takeaways to guide individuals and businesses through this process:

- Identify the Port of Entry: It's essential to accurately specify the port through which the goods will re-enter the United States. This sets the stage for the entire declaration process.

- Accurately Record the Date and Entry Number: These details link your declaration to specific shipments, ensuring timely and accurate processing by customs officials.

- Manufacturer Details are Critical: Include the name and location of the goods' manufacturer. This information is vital to verify that the items are indeed American-made.

- Clear Reason for Return: Clearly state why the items are being returned. Common reasons include repair, defect, or incorrect shipment. This impacts duty considerations.

- Understand Duty Drawback: Indicate whether U.S. drawback (refund of duties) was previously claimed on these goods. This affects eligibility for duty-free re-entry.

- Check Previous Importation Status: If goods were previously imported under specific tariff schedules, it might influence their duty-free eligibility upon return.

- Provide a Detailed Description and Value of Returned Articles: This includes marking, numbers, and a thorough description. For items valued over $10,000, additional documentation may be required to substantiate their duty-free claim.

- Declaration Must Be Signed by Authorized Personnel: Depending on the organizational structure, the form must be signed by an individual with the proper authority, such as a president, vice president, secretary, treasurer, or an authorized agent. This ensures the declaration's validity and compliance with legal requirements.

Each of these steps is critical in ensuring that the returned goods are processed efficiently and accurately, potentially saving time and financial resources for businesses. Paying close attention to the documentation and requirements can facilitate a smoother re-entry process for American goods, emphasizing the importance of precision and transparency in international shipping and customs declarations.

Popular PDF Documents

Sample Letter to Land Owner to Buy Land - A form to officially express interest in buying a property, with terms outlined pending a formal sales contract.

Irs Forgiveness Form - Elaborates on the specifics of applying as a business with trust fund tax liabilities and the requirements for responsible individuals.