Get Irs 3210 Form

The IRS 3210 form, issued by the Department of the Treasury Internal Revenue Service, serves as a critical document used for the secure transmittal of sensitive information and documents between officials or departments. Its primary role involves the careful documentation and acknowledgment of the transfer of tax reports, documents, or other items that require tracking and verification to ensure they have reached their intended destination safely and securely. The form is meticulously structured to include sections for both the sender and receiver's information, detailed content identification, including but not limited to, types of reports, periods covered, and specific identification data such as block numbers, DLN (Document Locator Number), EIN (Employer Identification Number), or the last four digits of the Social Security Number (SSN). Additionally, it is designed to accommodate both numbered and unnumbered documents, thereby, enhancing its utility across a wide array of document types. The form also emphasizes the importance of accountability and verification in document transfer processes through its requirement for the signatures of the releasing official and the individual who received and verified the documents. This ensures a dual layer of confirmation that the documents have been both sent and received as intended. Tailored instructions on the form guide the user on how to precisely fill in the required information, ensuring both clarity and security in the transmittal process. Its systematic approach to documenting the handoff of information underscores the IRS's commitment to maintaining stringent controls over the dissemination of sensitive tax-related information.

Irs 3210 Example

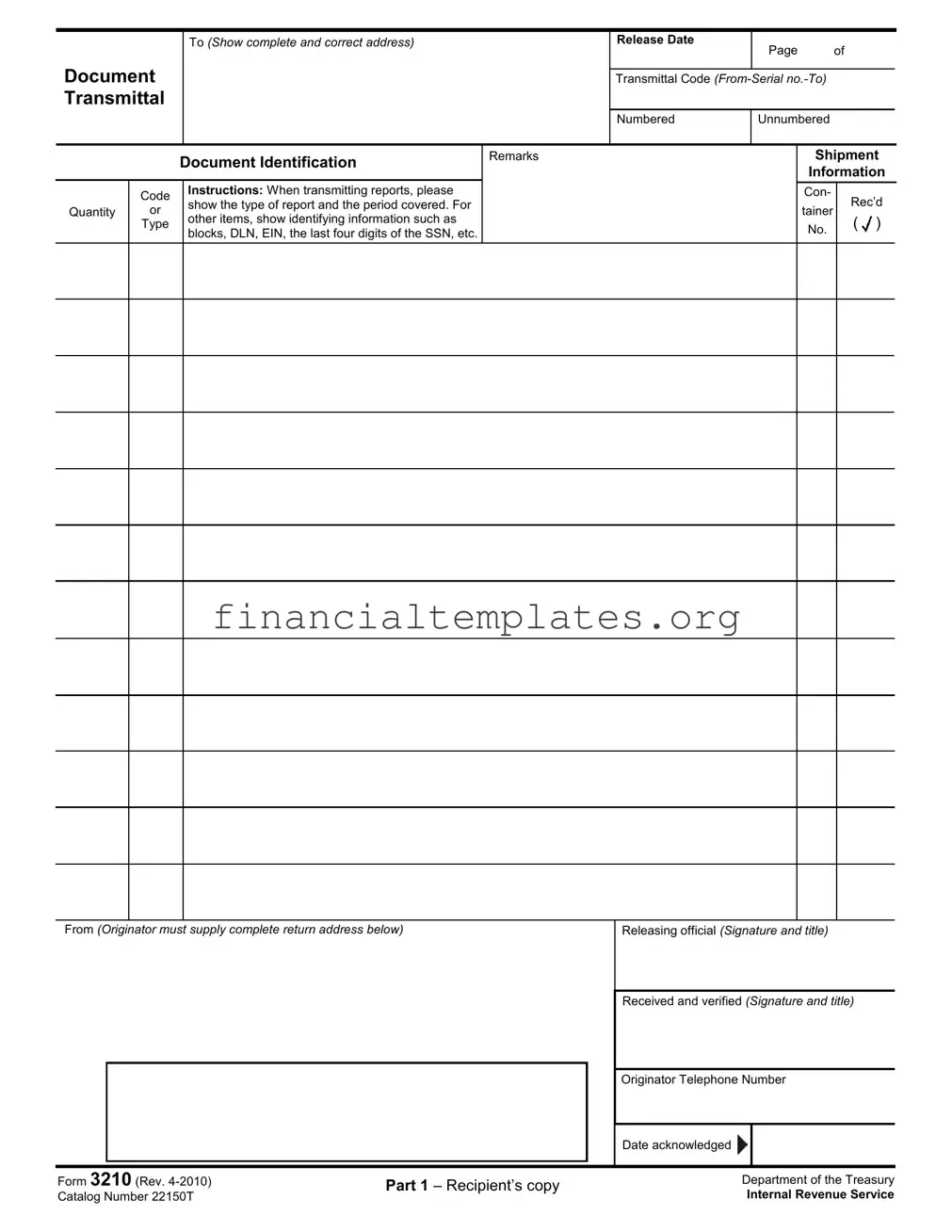

Document Transmittal

To (Show complete and correct address)

Release Date

Page of

Transmittal Code

|

Numbered |

Unnumbered |

|

|

|

|

|

Document Identification

Remarks

Shipment

Information

|

Code Instructions: When transmitting reports, please |

|

Quantity |

or |

show the type of report and the period covered. For |

|

||

Con-

tainer

Rec’d

Type |

other items, show identifying information such as |

|

blocks, DLN, EIN, the last four digits of the SSN, etc. |

||

|

No. |

( ) |

|

From (Originator must supply complete return address below) |

Releasing official (Signature and title) |

|||||

|

|

|

|

|

|

|

|

|

|

|

Received and verified (Signature and title) |

||

|

|

|

|

|

|

|

|

|

|

|

Originator Telephone Number |

||

|

|

|

|

|

|

|

|

|

|

|

Date acknowledged |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 3210 (Rev. |

Part 1 – Recipient’s copy |

Department of the Treasury |

||||

Catalog Number 22150T |

Internal Revenue Service |

|||||

|

|

|||||

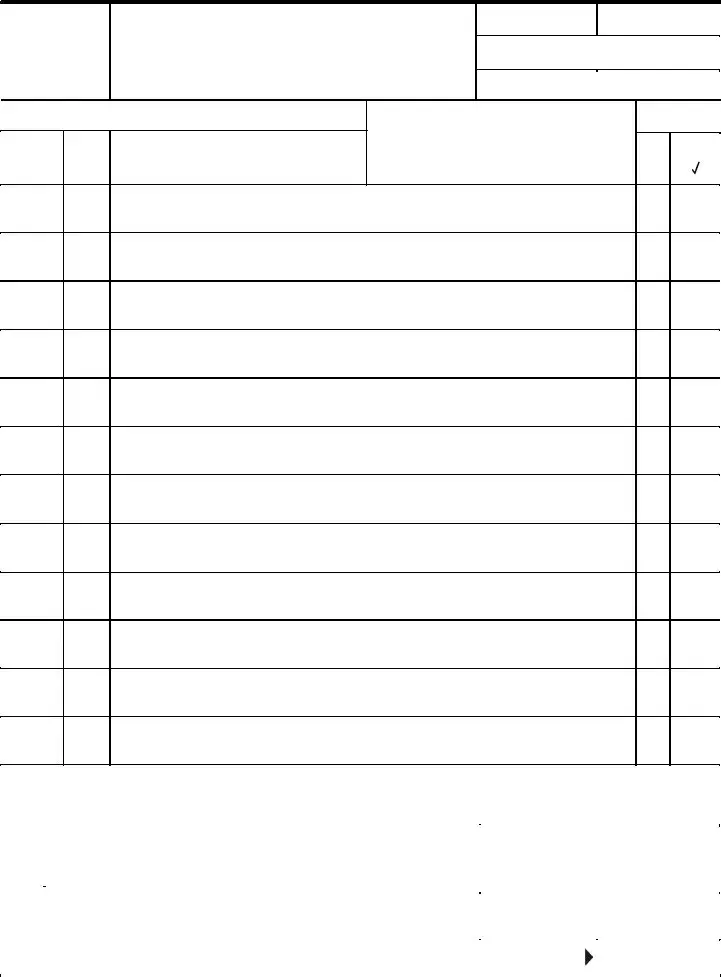

Document Transmittal

To (Show complete and correct address)

Release Date

Page of

Transmittal Code

|

Numbered |

Unnumbered |

|

|

|

|

|

Document Identification

Remarks

Shipment

Information

|

Code Instructions: When transmitting reports, please |

|

Quantity |

or |

show the type of report and the period covered. For |

|

||

Con-

tainer

Rec’d

Type |

other items, show identifying information such as |

|

blocks, DLN, EIN, the last four digits of the SSN, etc. |

||

|

No. |

( ) |

|

From (Originator must supply complete return address below)

Releasing official (Signature and title)

Received and verified (Signature and title)

Originator Telephone Number

Date acknowledged

Form 3210 (REV. |

Part 3 – Acknowledgement copy |

Catalog Number 22150T |

|

Department of the Treasury

Internal Revenue Service

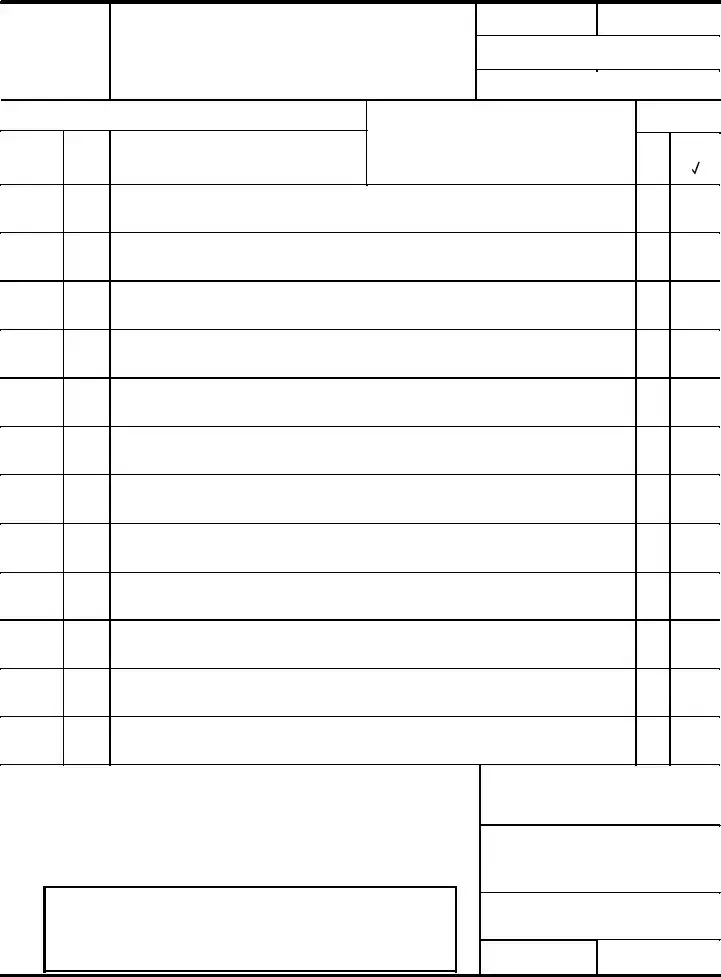

Document Transmittal

To (Show complete and correct address)

Release Date

Page of

Transmittal Code

|

Numbered |

Unnumbered |

|

|

|

|

|

Document Identification

Remarks

Shipment

Information

|

Code Instructions: When transmitting reports, please |

|

Quantity |

or |

show the type of report and the period covered. For |

|

||

Con-

tainer

Rec’d

Type |

other items, show identifying information such as |

|

blocks, DLN, EIN, the last four digits of the SSN, etc. |

||

|

No. |

( ) |

|

|

|

|

|

From (Originator must supply complete return address below) |

Releasing official (Signature and title) |

||

|

|

|

|

Received and verified (Signature and title)

|

|

|

|

Originator Telephone Number |

||

|

|

|

|

|

|

|

|

|

|

|

Date acknowledged |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 3210 (Rev. |

Part 4 – To be retained by originator |

Department of the Treasury |

||||

Catalog Number 22150T |

Internal Revenue Service |

|||||

|

|

|||||

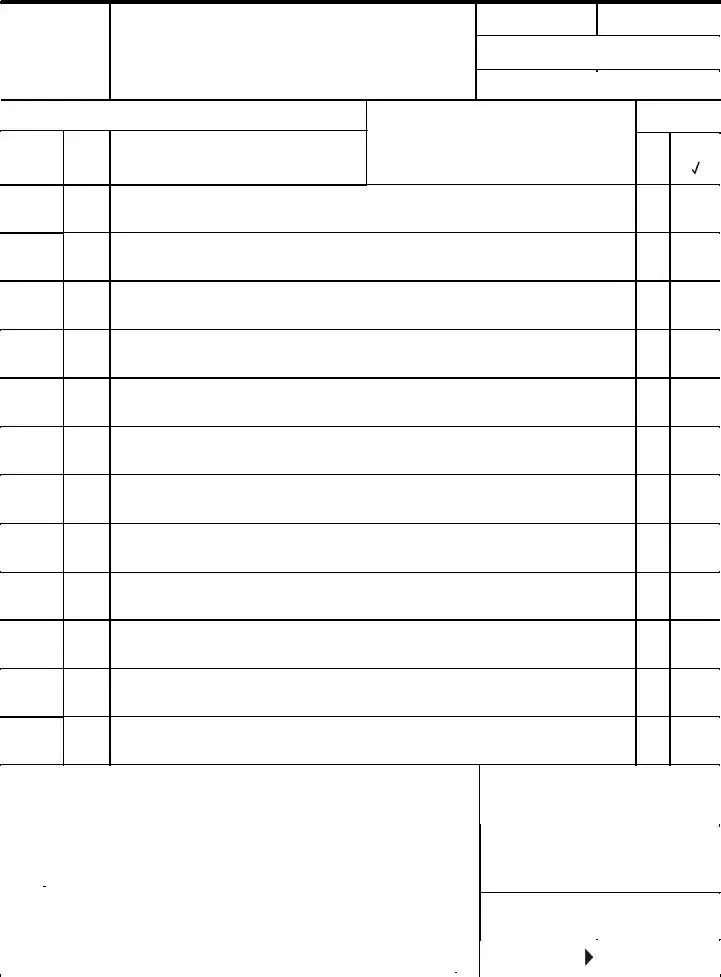

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 3210 is primarily used for document transmittal within the Department of the Treasury, specifically for the Internal Revenue Service (IRS). |

| Content Overview | This form includes sections for the complete and correct address of the recipient, transmittal codes (including from, serial number, to), document identification, remarks, and shipment information. It also has spaces allocated for both the releasing and receiving officials' signatures and titles, the originator's telephone number, and the date acknowledged. |

| Partition Sections | The Form 3210 is divided into four parts: Part 1 for the recipient's copy, Part 3 for the acknowledgment copy, and Part 4 is to be retained by the originator. Each part contains similar fields for consistency and tracking. |

| Document Identification | For effective documentation and tracking, the form requests identification details such as blocks, DLN (Document Locator Number), EIN (Employer Identification Number), and the last four digits of the Social Security Number (SSN). |

| Governing Law | As a federal document, the IRS Form 3210 is governed by federal laws and regulations that apply to the Department of the Treasury and the Internal Revenue Service. |

Guide to Writing Irs 3210

Filling out the IRS Form 3210 is a straightforward process that ensures secure document transmission. This form is utilized when sending reports or other significant items within the IRS or between IRS and another entity, safeguarding sensitive information through proper documentation and acknowledgment. For a seamless experience, follow the step-by-step instructions detailed below, keeping in mind that accuracy and completeness are paramount in this procedure.

- Enter the full and correct address of the recipient in the "To" field to ensure the document reaches the intended party without delays.

- Fill in the release date, indicating when the document is sent. This ensures a clear timeline of the transmittal process.

- In the "Page of Transmittal Code" segment, if applicable, include the appropriate code that identifies the sequence or nature of the documents transmitted.

- Specify whether the documents are numbered or unnumbered by marking the appropriate box. This helps in maintaining an organized record.

- Under "Document Identification," provide identifying details such as report types, periods covered, or other relevant identification like DLN, EIN, or the last four digits of an SSN. These specifics aid in accurate document handling and identification.

- In the "Remarks" section, add any additional notes or instructions that would assist the receiver in processing the documents.

- For "Shipment Information Code," if there is a specific code for the shipment, include it to categorize the type of transmittal accurately.

- Indicate the quantity or container number, if applicable, to record the volume or specific container being used for the shipment.

- Complete the "From" section with the originator's complete return address, ensuring any returns or correspondence can be accurately directed back.

- Have the releasing official sign and title in the designated "Releasing official" fields to authenticate the transmittal.

- Once received, the receiving party should sign and title in the "Received and verified" fields to confirm receipt and verification of the contents.

- Include the originator's telephone number for any necessary follow-up or clarification.

- Finally, ensure the date acknowledged is filled in to complete the documentation of the transmittal process.

After completing these steps, the form facilitates a well-documented transmission of sensitive information, enhancing accountability and traceability within the communication process. This form, acting as a bridge, ensures that both the sender and the recipient maintain a mutual understanding and acknowledgment of the documents shared, safeguarding the integrity and confidentiality of the information transmitted.

Understanding Irs 3210

What is the purpose of IRS Form 3210?

IRS Form 3210, also known as Document Transmittal, serves as a communication tool within the Internal Revenue Service and between the IRS and other entities. This form is primarily used to track the sending and receiving of documents safely and securely. It is instrumental in ensuring that reports or other sensitive documents are officially accounted for, from the point of origin to the recipient. It details the type of document being sent, its identification, the sender, and the recipient, along with signatures for verification upon receipt.

How should one properly fill out the IRS Form 3210?

To fill out IRS Form 3210 correctly, it's crucial to provide comprehensive and accurate information in all the sections it requires. This includes:

- The complete and correct address of the recipient.

- The transmittal code, which may include a from-serial number to a serial number identifying the transmission sequence.

- Categorization of the document as numbered or unnumbered, including specific document identification like DLN, EIN, or the last four digits of the SSN.

- Any relevant remarks regarding the shipment.

- Detailed shipment information including the quantity or container type, if applicable.

- The originator’s complete return address, along with the releasing official's signature and title, and the receiving official's signature and title upon verification of the document’s receipt.

- Contact information of the originator along with the date the form was acknowledged by the recipient.

Attention to detail is crucial to ensure that all parts of the form are accurately completed, minimizing the risk of miscommunication or loss of important documents.

Are there different parts to the IRS Form 3210?

Yes, IRS Form 3210 is structured into several parts, each designated for a specific use within the document transmittal and reception process. These parts include:

- Recipient’s copy: To be sent to the recipient for their records.

- Acknowledgement copy: Sent along with the main document for the recipient to sign and return to the sender as proof of receipt.

- Originator's copy: To be retained by the sender as a record of the document sent.

Each part plays a significant role in creating an audit trail for the document transmission process, ensuring both sender and receiver have records of the transaction for future reference or in case of discrepancy.

When is it necessary to use IRS Form 3210?

IRS Form 3210 is necessary when transmitting official documents, especially reports or sensitive information, within the IRS or between the IRS and other agencies, organizations, or individuals. Its use is crucial for documentation that requires verification of receipt due to its confidential or significant nature. The form ensures that there is an official record of the document’s transmission and receipt, providing an extra layer of security and accountability for sensitive information.

What happens after the IRS Form 3210 is filled out and sent?

After IRS Form 3210 is properly filled out and dispatched, the recipient is expected to sign the acknowledgement copy upon receiving the documents, then return this acknowledgment copy to the sender. This act confirms that the documents have been received and verified, thus closing the loop on the transmittal process. The sender and the recipient both should maintain their copies of the form for record-keeping, ensuring they have evidence of the transaction and its details.

Is there a digital version of IRS Form 3210 available for use?

As of the last update, the IRS has not provided a specific digital version of IRS Form 3210 that can be completed and submitted online. Typically, this form is filled out manually and sent via mail or hand-delivered with the accompanying documents. Users looking for digital solutions should check the official IRS website or contact the IRS directly to inquire about any updates regarding an electronic filing option for Form 3210 or for guidance on securely transmitting documents without the form.

Common mistakes

Filling out the IRS 3210 form accurately is critical for ensuring secure document transmittal. However, individuals often make mistakes that can lead to delays or misdirected documents. Recognizing and avoiding these common errors is essential for a smooth process.

- Incorrectly filling out the "To" section: Not providing a complete or correct address impairs the delivery process.

- Omitting the transmittal code or filling it out incorrectly: This code is vital for tracking and categorizing documents.

- Inaccurate document identification: Failing to properly identify documents, such as not using the last four digits of the SSN or not stating EIN clearly, can cause confusion and delays.

- Missing shipment information: Neglecting to fill out shipment details completely can lead to issues with document transit.

- Insufficient details in the remarks section: This section provides crucial information that can assist in document processing; vague or missing remarks can lead to inefficiencies.

- Incorrect quantity or container type listed: Misstating these details can cause issues with document receipt and verification.

- Incomplete return address: Not providing a full return address can jeopardize the return process if needed.

- Signature and title oversight by the releasing official and receiver: Signatures verify the document's release and receipt, while titles clarify roles; overlooking these can compromise the document's integrity.

- Failure to record the acknowledgment date: This is essential for tracking the document's processing timeline and is often overlooked.

Avoiding these mistakes not only ensures compliance but also streamlines the document transmittal process, reducing the likelihood of delays or miscommunication.

Documents used along the form

When handling documents related to the Internal Revenue Service (IRS), the Form 3210 plays a pivotal role in ensuring the secure transmission of such materials. This form is often accompanied by various other forms and documents, each serving its unique purpose in the realm of tax administration and compliance. Understanding these additional documents can provide a clearer picture of their collective importance in maintaining accurate and lawful tax processes.

- Form 1040: The U.S. Individual Income Tax Return is the foundational document for personal tax filing, detailing income, deductions, and applicable credits.

- Form 8821: Tax Information Authorization enables a designate to access and view a taxpayer's information but does not allow them to represent the taxpayer to the IRS.

- Form 2848: Power of Attorney and Declaration of Representative grants a qualified individual the authority to represent the taxpayer before the IRS, making decisions on their behalf.

- Form 4506-T: Request for Transcript of Tax Return is used to request a transcript of previously filed tax returns, vital for loans or government assistance applications.

- Form 433-F: Collection Information Statement required from individuals to set up payment plans or settle tax debts, providing detailed financial information.

- Form W-2: Wage and Tax Statement, issued by employers to report an employee's annual wages and taxes withheld, crucial for completing Form 1040.

- Form 1099-MISC: Miscellaneous Income, used to report payments made to non-employees, such as independent contractors, rent, or other income payments.

- Form 941: Employer's Quarterly Federal Tax Return filed by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks.

- Form 940: Employer's Annual Federal Unemployment (FUTA) Tax Return, required from employers to report and pay unemployment taxes to the IRS.

- Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return, necessary for reporting the transfer of property upon death.

Together with Form 3210, these documents enable individuals and businesses to fulfill their tax responsibilities efficiently and in accordance with federal law. Understanding their function and significance can demystify the tax filing process and reinforce the importance of precise and timely submissions to the IRS.

Similar forms

The IRS 3210 form, a document used for transmitting reports and other items, bears similarities to several other forms and documents within the context of both government operations and private sector business practices. Each of these documents serves as a tool for communication, record-keeping, or ensuring accountability through the proper documentation of transactions and transmissions.

One similar document is the Form 8821, Tax Information Authorization. Much like the IRS 3210 form, it is used to document the action of granting authority to a third party to access or receive tax information on someone's behalf. Both forms ensure there is a paper trail for the authorization of information sharing, although the IRS 3210 focuses on the transmittal of documents, while Form 8821 specifically authorizes access to tax information.

The Bill of Lading, used in shipping, parallels the IRS 3210 form in its role as a document outlining the details of goods being transported. It includes information about the shipment, much like how the IRS 3210 includes details about documents being transmitted. Both serve as an official record verifying the dispatch and receipt of materials or information, safeguarding against disputes regarding the handling of the items or documents in question.

Form 4506-T, Request for Transcript of Tax Return, shares the concept of requesting documents or information with the IRS 3210. While the IRS 3210 is used for the actual transmittal of these items, Form 4506-T is specifically focused on requesting tax return information. Both ensure accountability and traceability in the handling of sensitive documents.

Memo of Transmittal is a general business document that, much like the IRS 3210 form, serves the purpose of accompanying important documents or reports to provide context or instructions to the recipient. This kind of memo ensures that the accompanying documents are correctly understood and processed by highlighting key points or instructions.

The Packing List, similar to the shipment information section of the IRS 3210, provides detailed information about the contents of a shipment. This helps in verifying that all items listed were indeed packed and shipped, paralleling the IRS 3210’s function of ensuring all documents transmitted are accounted for upon receipt.

Chain of Custody Form is used in legal and medical fields to document the handling of evidence or samples. It is reminiscent of the IRS 3210 in its purpose to meticulously record each transfer of the item or document to safeguard its integrity and prevent tampering or loss, ensuring that every party involved is held accountable.

The Form W-9, Request for Taxpayer Identification Number and Certification, like the IRS 3210, involves documentation and verification, but focuses on the identification and certification of tax information for individuals or entities. Both forms participate in the larger ecosystem of document and information verification within tax and financial operations.

Finally, the Interoffice Memo, often used within organizations, serves a similar purpose to the IRS 3210 by facilitating the transfer of information or documents between departments or individuals. Though less formal, it ensures communication and document transfers are documented, contributing to operational transparency and accountability.

Each of these documents, while serving unique specific purposes, shares the common goal of enhancing transparency, accountability, and efficiency in processes through proper documentation and verification methods, mirroring the values upheld by the IRS 3210 form.

Dos and Don'ts

Filling out IRS Form 3210, also known as the Document Transmittal, requires attention to detail and understanding of the procedure. Here are key dos and don'ts to keep in mind:

- Do ensure you provide the complete and correct address for both the sender and recipient to avoid any delays in processing.

- Do accurately fill out the Transmittal Code section, including the From, Serial No., and To information, to ensure proper tracking of the document.

- Do clearly identify the documents being transmitted. For reports, indicate the type and the period it covers. For other documents, include details such as block numbers, DLN, EIN, or the last four digits of the SSN.

- Do provide the quantity or container number for the shipment, which helps in verifying the received documents against the transmittal record.

- Do ensure that both the releasing official and the individual verifying receipt sign the form. Their signatures, alongside their titles, verify the accuracy and approval of the document transfer.

- Don't leave the originator’s telephone number and date acknowledged sections blank. These are crucial for follow-up and confirmation purposes.

- Don't disregard the requirement to retain a copy of the form (Part 4) for your records. This serves as evidence of the transmittal and can be helpful in case of discrepancies.

Remember, the accuracy and completeness of IRS Form 3210 are vital for the seamless transfer of documents within and outside the Internal Revenue Service. Taking the time to follow these guidelines will help ensure your documents are processed efficiently and correctly.

Misconceptions

The IRS Form 3210 is a key tool for the secure transmission of documents within the IRS and between the agency and external entities. However, there are several misconceptions about how it is used and its requirements. Here, we will clarify some of these misunderstandings:

Form 3210 is only for internal IRS use: This is incorrect. While IRS Form 3210 is commonly used for internal document transfers within the IRS, it is also utilized for sending documents to and receiving documents from entities outside of the IRS. Its design facilitates a record of document transmittal, ensuring both the sender and receiver have a clear record of the items transmitted.

The form is complicated to fill out: In reality, Form 3210 is straightforward, requiring basic information about the documents being transmitted, such as the document identification, type, and recipient details. Its layout is designed for efficiency in documenting the transfer of information and ensuring the security and tracking of sensitive documents.

Using Form 3210 is optional: This misconception might stem from varied practices across different departments and under specific circumstances. However, in many cases, using Form 3210 is a mandatory procedural step for the secure transmission of documents, especially those containing sensitive or confidential information. This ensures a formal record of the transmittal, which can be crucial for audit trails and document tracking.

Form 3210 only applies to paper documents: While it's true that Form 3210 is widely used for the transmittal of physical documents, it can also be utilized in the context of electronic document transfers. The form acts as a cover sheet or transmittal record for various types of documents, regardless of their physical or digital nature, ensuring accountability and traceability.

There is no need to acknowledge receipt with Form 3210: On the contrary, acknowledging receipt of the documents is a critical part of the process when using Form 3210. The form is designed as a three-part document, with a copy for the sender, the recipient, and an acknowledgment copy that the recipient must return to the sender. This acknowledgment is essential for verifying that the documents have been received and for maintaining a complete record of the transmission.

Understanding the correct use and requirements of IRS Form 3210 is crucial for ensuring that document transmissions are conducted securely and efficiently, with clear accountability for both parties involved.

Key takeaways

Understanding the IRS Form 3210 is essential for the secure and accurate transmission of documents to the Internal Revenue Service (IRS). Here are seven key takeaways about filling out and using the IRS 3210 form:

- Correct Address and Contact Information: It's crucial to provide the complete and correct address of the recipient to ensure the document reaches the right destination. Additionally, the originator's return address must be supplied to facilitate any necessary correspondence.

- Document Identification: When using the form for transmitting reports, the type of report and the period covered should be clearly indicated. For other items, include identifying information such as the Document Locator Number (DLN), Employer Identification Number (EIN), or the last four digits of the Social Security Number (SSN).

- Signatures Are Mandatory: The form requires signatures from both the releasing official (the one sending the documents) and the receiving official (the one acknowledging receipt). These signatures serve as a formal acknowledgement of the document's transmission and reception.

- Keep Record of Transmission: The IRS Form 3210 is designed with multiple parts, including a recipient's copy and an acknowledgment copy. It is important for both the sender and the recipient to retain these copies for their records, ensuring a documented trail of the transmission.

- Shipment Information: Accurate shipment information, including quantity and container type, if applicable, should be provided. This detail aids in verifying the content upon receipt, ensuring accuracy in documentation and processing.

- Transmittal Code and Serial Numbers: Utilize the transmittal code and a range of serial numbers (from-to) if necessary. This helps in tracking and organizing transmitted documents, especially when multiple items are being sent.

- Immediate Acknowledgment: The form requires the date of acknowledgment to be noted, which encourages prompt processing. This date should be recorded as soon as the documents are received and verified, signifying the completion of the transmission process.

The IRS Form 3210 plays a vital role in the secure and organized transmission of important documents. By adhering to these guidelines and meticulously completing the form, individuals and institutions can contribute to a more efficient and error-free documentation process within the IRS framework.

Popular PDF Documents

Alabama Tax Forms - It includes a section for calculating Alabama income tax withheld from pay, helping residents reconcile amounts already paid.

Tax 5498 - This form is an essential tool for verifying that all IRA transactions are properly documented and recognized by the IRS.