Get Irs 2848 Form

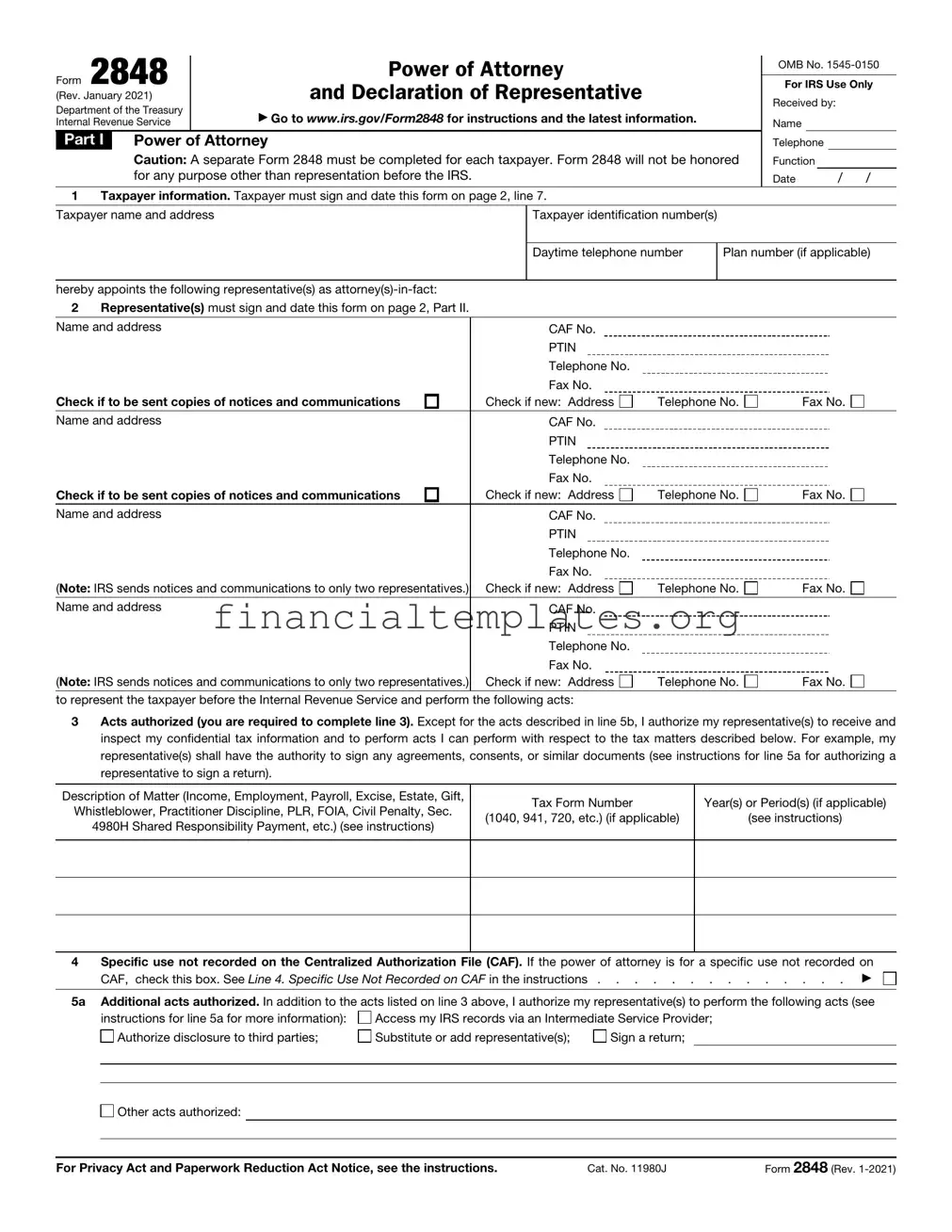

Navigating tax matters can be daunting, and sometimes, you may decide that it's best to have a professional handle dealings with the Internal Revenue Service (IRS) on your behalf. This is where Form 2848, Power of Attorney and Declaration of Representative, becomes a vital document. Essentially, this form is a tool that enables taxpayers to appoint an individual or individuals—qualified representatives such as attorneys, certified public accountants, enrolled agents, and others—to act on their behalf in matters related to the IRS. It requires detailed information, including the taxpayer's identification number and specifics about the representatives. A unique feature of this form is the specificity it demands; it requires indication of the tax matters for which the representation is authorized, including tax form numbers and years or periods involved. Representatives must adhere to strict guidelines and declare they are eligible to practice before the IRS, as stipulating by signing the form under penalties of perjury. Meanwhile, the form also allows for stipulations about what the representatives are not authorized to do, such as negotiating checks. Importantly, submitting a new Form 2848 revokes all previously filed authorizations for the same tax matters, unless otherwise indicated. Given its complex nature and significant implications, understanding and correctly completing Form 2848 is crucial for taxpayers seeking representation in their dealings with the IRS.

Irs 2848 Example

Form 2848 |

Power of Attorney |

OMB No. |

||||||

|

|

|

|

|

||||

For IRS Use Only |

||||||||

|

|

and Declaration of Representative |

||||||

(Rev. January 2021) |

Received by: |

|

||||||

Department of the Treasury |

|

|

||||||

▶ Go to www.irs.gov/Form2848 for instructions and the latest information. |

|

|

|

|

|

|||

Internal Revenue Service |

Name |

|

|

|||||

|

|

|||||||

Part I |

Power of Attorney |

Telephone |

|

|

||||

|

Caution: A separate Form 2848 must be completed for each taxpayer. Form 2848 will not be honored |

Function |

|

|

||||

|

for any purpose other than representation before the IRS. |

Date |

/ / |

|||||

1Taxpayer information. Taxpayer must sign and date this form on page 2, line 7.

Taxpayer identification number(s)

Daytime telephone number

Plan number (if applicable)

Name and address |

CAF No. |

|

|

|

PTIN |

|

|

|

Telephone No. |

|

|

|

Fax No. |

|

|

Check if to be sent copies of notices and communications |

Check if new: Address |

Telephone No. |

Fax No. |

|

|

|

|

Name and address |

CAF No. |

|

|

|

PTIN |

|

|

|

Telephone No. |

|

|

|

Fax No. |

|

|

Check if to be sent copies of notices and communications |

Check if new: Address |

Telephone No. |

Fax No. |

|

|

|

|

Name and address |

CAF No. |

|

|

|

PTIN |

|

|

|

Telephone No. |

|

|

|

Fax No. |

|

|

(Note: IRS sends notices and communications to only two representatives.) |

Check if new: Address |

Telephone No. |

Fax No. |

Name and address |

CAF No. |

|

|

|

PTIN |

|

|

|

Telephone No. |

|

|

|

Fax No. |

|

|

(Note: IRS sends notices and communications to only two representatives.) |

Check if new: Address |

Telephone No. |

Fax No. |

to represent the taxpayer before the Internal Revenue Service and perform the following acts:

3Acts authorized (you are required to complete line 3). Except for the acts described in line 5b, I authorize my representative(s) to receive and inspect my confidential tax information and to perform acts I can perform with respect to the tax matters described below. For example, my representative(s) shall have the authority to sign any agreements, consents, or similar documents (see instructions for line 5a for authorizing a representative to sign a return).

Description of Matter (Income, Employment, Payroll, Excise, Estate, Gift, |

Tax Form Number |

Year(s) or Period(s) (if applicable) |

|

Whistleblower, Practitioner Discipline, PLR, FOIA, Civil Penalty, Sec. |

|||

(1040, 941, 720, etc.) (if applicable) |

(see instructions) |

||

4980H Shared Responsibility Payment, etc.) (see instructions) |

|||

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Specific use not recorded on the Centralized Authorization File (CAF). If the power of attorney is for a specific use not recorded on |

|||

|

CAF, check this box. See Line 4. Specific Use Not Recorded on CAF in the instructions . |

. . . . . . . . . . . . . ▶ |

||

5a |

Additional acts authorized. In addition to the acts listed on line 3 above, I authorize my representative(s) to perform the following acts (see |

|||

|

instructions for line 5a for more information): |

Access my IRS records via an Intermediate Service Provider; |

||

|

Authorize disclosure to third parties; |

Substitute or add representative(s); |

Sign a return; |

|

|

|

|

|

|

|

|

|

|

|

Other acts authorized:

For Privacy Act and Paperwork Reduction Act Notice, see the instructions. |

Cat. No. 11980J |

Form 2848 (Rev. |

Form 2848 (Rev. |

Page 2 |

|

|

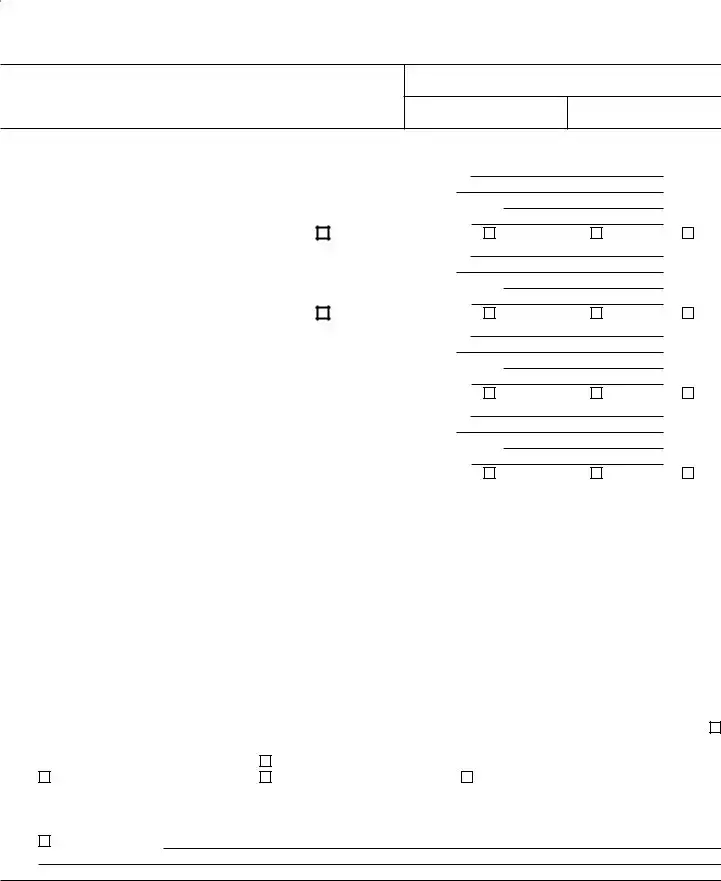

bSpecific acts not authorized. My representative(s) is (are) not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative(s) or any firm or other entity with whom the representative(s) is (are) associated) issued by the government in respect of a federal tax liability.

List any other specific deletions to the acts otherwise authorized in this power of attorney (see instructions for line 5b):

6Retention/revocation of prior power(s) of attorney. The filing of this power of attorney automatically revokes all earlier power(s) of attorney on file with the Internal Revenue Service for the same matters and years or periods covered by this form. If you do not want to

revoke a prior power of attorney, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

YOU MUST ATTACH A COPY OF ANY POWER OF ATTORNEY YOU WANT TO REMAIN IN EFFECT.

7Taxpayer declaration and signature. If a tax matter concerns a year in which a joint return was filed, each spouse must file a separate power of attorney even if they are appointing the same representative(s). If signed by a corporate officer, partner, guardian, tax matters partner, partnership representative (or designated individual, if applicable), executor, receiver, administrator, trustee, or individual other than the taxpayer, I certify I have the legal authority to execute this form on behalf of the taxpayer.

▶ IF NOT COMPLETED, SIGNED, AND DATED, THE IRS WILL RETURN THIS POWER OF ATTORNEY TO THE TAXPAYER.

Signature |

Date |

Title (if applicable) |

Print name |

|

Print name of taxpayer from line 1 if other than individual |

Part II Declaration of Representative

Under penalties of perjury, by my signature below I declare that:

•I am not currently suspended or disbarred from practice, or ineligible for practice, before the Internal Revenue Service;

•I am subject to regulations in Circular 230 (31 CFR, Subtitle A, Part 10), as amended, governing practice before the Internal Revenue Service;

•I am authorized to represent the taxpayer identified in Part I for the matter(s) specified there; and

•I am one of the following:

a

bCertified Public

cEnrolled

d

e

fFamily

gEnrolled

hUnenrolled Return

kQualifying Student or Law

rEnrolled Retirement Plan

▶IF THIS DECLARATION OF REPRESENTATIVE IS NOT COMPLETED, SIGNED, AND DATED, THE IRS WILL RETURN THE POWER OF ATTORNEY. REPRESENTATIVES MUST SIGN IN THE ORDER LISTED IN PART I, LINE 2.

Note: For designations

Designation—

Insert above

letter

Licensing jurisdiction

(State) or other

licensing authority

(if applicable)

Bar, license, certification, registration, or enrollment number (if applicable)

Signature

Date

Form 2848 (Rev.

Document Specifics

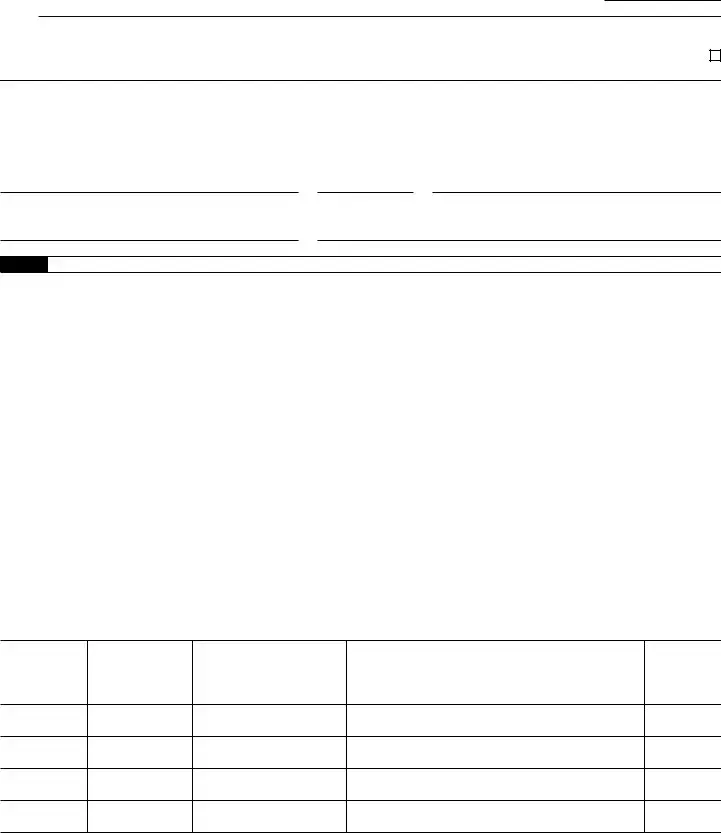

| Fact Name | Description |

|---|---|

| Form Purpose | Form 2848 is used to appoint an individual as an attorney-in-fact to represent the taxpayer before the IRS. |

| Representation Authorization | The form authorizes the representative to receive and inspect confidential tax information and perform acts on behalf of the taxpayer. |

| Specific Acts Not Authorized | The appointed representative(s) is not authorized to endorse or negotiate any government check issued for a federal tax liability, among other specific restrictions. |

| Automatic Revocation | Filing Form 2848 automatically revokes all earlier power(s) of attorney filed with the IRS for the same matters and years or periods, unless otherwise stated. |

Guide to Writing Irs 2848

Filling out the IRS Form 2848 can seem daunting, but it is a fundamental step for granting someone the authority to represent you before the IRS. This form allows your chosen representative, such as an attorney, certified public accountant, or enrolled agent, to receive and inspect your confidential tax information and perform specific acts on your behalf. Whether you're unable to handle your tax matters due to various commitments or need expert help navigating through them, completing Form 2848 correctly ensures that your representative can act in your best interests. Here's a step-by-step guide to complete the form effectively:

- Enter the taxpayer’s information: Start by writing the taxpayer's name and address in the designated space. Make sure to include the taxpayer identification number (TIN), daytime telephone number, and if applicable, the plan number.

- Appoint your representative(s): In the section titled "Representative(s) must sign and date this form on page 2, Part II," list the name(s), telephone number(s), and address(es) of the individual(s) you are appointing. If you're appointing more than one representative, ensure to provide their contact information and check if you want them to receive copies of notices and communications. Each representative needs to have a CAF No., PTIN, and, if applicable, list new addresses or fax numbers.

- Specify the acts authorized: On line 3, describe the tax matters for which you are granting authority, including the specific type of tax, the forms associated, and the years or periods involved. This comprehensive description ensures that the IRS understands the scope of the authorization.

- If applicable, check the box for specific use not recorded on CAF: If your power of attorney is meant for a specific use that will not be recorded on the IRS's Centralized Authorization File (CAF), indicate this by checking the box on line 4 and provide the relevant details.

- Indicate additional acts authorized (if any): In line 5a, if you wish to grant your representative(s) additional authority, such as accessing your IRS records via an intermediary or authorizing disclosure to third parties, specify these acts clearly. If there are acts that you do not authorize, list these exclusions in line 5b.

- Retention/revocation of prior power(s) of attorney: By filing this form, you automatically revoke all earlier power(s) of attorney on file with the IRS for the same matters and years. If you wish to retain a previous power of attorney, check the box in line 6 and attach a copy of the power(s) of attorney you want to remain in effect.

- Taxpayer declaration and signature: The taxpayer must sign and date the form to validate it. If the form is for a joint matter, such as a joint tax return, each spouse must complete a separate Form 2848. In cases where the taxpayer is not an individual, the form must be signed by an authorized individual, who must then print their name and title.

- Representative(s) declaration and signature: The appointed representative(s) must complete Part II of the form by declaring their eligibility and signing the form. Each representative must also indicate their designation (e.g., attorney, certified public account, etc.), including the relevant jurisdiction and their license or certification number.

Once completed, review the form thoroughly to ensure all the information provided is accurate and complete. Submitting Form 2848 with missing or incorrect details can delay the processing of your request for representation. Filling out this form with care allows you to delegate your tax matters confidently, knowing that your chosen representative has the authority and information needed to act on your behalf.

Understanding Irs 2848

What is IRS Form 2848?

IRS Form 2848, also known as the Power of Attorney and Declaration of Representative, is a document that allows taxpayers to appoint an individual to represent them before the IRS. This representative can perform acts such as receiving confidential tax information, signing agreements, and even signing a return on behalf of the taxpayer for specified tax matters and periods.

Who can be appointed as a representative on Form 2848?

The taxpayer can appoint individuals such as attorneys, certified public accountants, enrolled agents, family members, or other eligible persons listed under the form's Declaration of Representative. These representatives must be eligible to practice before the IRS and not be suspended, disbarred, or otherwise ineligible. They must also adhere to the regulations governing practice before the IRS as outlined in Circular 230.

How do I complete IRS Form 2848?

To properly complete Form 2848, the taxpayer must fill out their name, address, and taxpayer identification number. Specific tax matters and years or periods must be indicated, alongside appointing a representative by providing their name and contact information. The taxpayer and the representative(s) must then sign and date the form. If appointing more than one representative, it is crucial to specify which representative(s) the IRS should send notices and communications to.

Can I specify which acts my representative is authorized to perform?

Yes, on line 3 of Form 2848, taxpayers can specify the acts their representative is authorized to perform concerning the tax matters described. However, there are limitations. For instance, representatives cannot endorse or negotiate checks from the government meant for the taxpayer. If the taxpayer wishes to authorize additional acts or restrict certain ones, lines 5a and 5b provide space to outline these permissions and restrictions.

What if I have multiple issues or need representation for different tax years?

Each tax matter or year requires specific authorization on the form. If a taxpayer needs representation for different types of taxes, forms, or periods, they must clearly mention each on the form. For entirely separate issues not recorded on the IRS's Centralized Authorization File (CAF), checking the box for "Specific use not recorded on CAF" on line 4 is necessary.

How do I revoke a previous Power of Attorney or maintain an existing one?

Filing a new Form 2848 automatically revokes all previously filed powers of attorney for the same tax matters and periods covered by the new form unless explicitly stated otherwise. If a taxpayer wishes to keep an existing power of attorney active, they must check the appropriate box in Section 6 and attach a copy of the power of attorney they want to remain in effect.

What happens if Form 2848 is not signed or correctly completed?

If Form 2848 is incomplete, not signed by the taxpayer and the representative, or missing required information, the IRS will return the form to the taxpayer. It's essential to ensure that all parts of the form are filled out correctly and that every necessary signature is in place to avoid delays in processing and representation issues.

Common mistakes

When filling out IRS Form 2848, Power of Attorney and Declaration of Representative, individuals can encounter several pitfalls. Avoiding common mistakes ensures the proper handling of one’s tax matters by an appointed representative. Here are six mistakes people frequently make:

Failing to complete separate forms for each taxpayer: For situations involving joint filers, such as married couples, each individual must submit a separate Form 2848. Overlooking this requirement can lead to incomplete representation.

Not specifying the tax matters and years covered: It’s critical to clearly define the scope of authority granted to your representative, including the types of taxes, form numbers, and the tax periods or years involved. Vague descriptions may limit your representative’s ability to fully assist you.

Omitting the representative’s information and signatures: Both the taxpayer and the appointed representative(s) must sign and date the form. Incomplete or missing information in Part II, where representatives declare their eligibility and credentials, will result in the IRS rejecting the form.

Ignoring the need to specify acts authorized: If you wish to grant your representative the authority to perform certain acts such as receiving refunds or signing returns on your behalf, these must be explicitly authorized in line 5a. Neglecting to specify these authorizations can restrict your representative’s ability to act.

Forgetting to revoke prior powers of attorney: By default, the filing of a new Form 2848 revokes all previously filed powers of attorney for the same tax matters and years or periods. If your intention is to retain any previous authorizations, you must indicate this on the form and attach copies of any powers of attorney you wish to remain in effect.

Providing incorrect taxpayer information: Ensuring the accuracy of the taxpayer’s identification numbers and contact information is fundamental. Any discrepancies can invalidate the form or delay processing.

Avoiding these mistakes helps ensure that the IRS can process your Form 2848 without delay, enabling your appointed representative to begin managing your tax matters efficiently.

Documents used along the form

When managing tax matters, particularly for complex situations or when representation before the IRS is necessary, there is a suite of forms and documents that often accompany or complement Form 2848, Power of Attorney and Declaration of Representative. These documents serve various roles, from reporting specific types of income to requesting tax account information. Understanding these forms is crucial for anyone undergoing the process of tax preparation, disputes, or general tax management.

- Form 8821, Tax Information Authorization: This form allows appointees to receive and inspect confidential tax information but does not permit them to represent the taxpayer before the IRS.

- Form 1040, U.S. Individual Income Tax Return: The core form used by individuals to file their annual income tax returns, which might be discussed or amended by the representative.

- Form 941, Employer's Quarterly Federal Tax Return: Used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks and is relevant for business representation.

- Form 4506-T, Request for Transcript of Tax Return: Allows the taxpayer or their representative to request previous tax returns, which can be necessary for clarification or amendment of past filings.

- Form 2848D, Declaration of Representative: Accompanies Form 2848, providing certification of the representative's qualifications as outlined by the IRS requirements.

- Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return: Used to report estate taxes; representatives may need to access or amend these forms for estates they are managing.

- Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return: Similar to Form 706 but for gifts. Ensuring proper filing and representation may require a power of attorney if disputes or audits arise.

- Form 990, Return of Organization Exempt from Income Tax: Nonprofit organizations use this form to report their income, expenditures, and other financial information. A representative might need to access these for compliance or audit purposes.

Securing the correct filling and use of these forms can be a pivotal step in ensuring proper representation and management of tax affairs. Each plays a unique role in the broader context of tax preparation and planning, underlining the necessity of both thoroughness and precision in their application. Proper engagement with these forms not only facilitates smoother interactions with the IRS but also promotes better outcomes for the taxpayer, whether addressing regular filings or resolving more complex disputes.

Similar forms

The IRS Form 2848, Power of Attorney and Declaration of Representative, shares similarities with several other legal documents, notably in its objective to designate another individual or entity to act on one's behalf. One such comparable document is the Healthcare Proxy form, which also allows individuals to appoint a representative to make medical decisions on their behalf should they become incapable of doing so. Both forms require explicit consent and delineate the scope of authority granted to the appointed representative, ensuring that the appointer's wishes are respected in specific scenarios.

Similarly, a Durable Financial Power of Attorney bears resemblance to Form 2848 in that it empowers a chosen agent to manage the financial affairs of the principal. This authority can include handling transactions, managing real estate, and other financial decisions, paralleling the IRS form's purpose of managing tax-related matters. Both documents necessitate clear identification of the parties involved and the extent of power granted to ensure that the representatives act within their assigned boundaries.

The General Power of Attorney document, comparable to Form 2848, grants broad authorization to an agent to perform a wide range of actions on the principal's behalf, unlike the IRS form's tax-specific focus. However, both documents serve the fundamental purpose of delegating authority from one individual to another, requiring signatures and often other formalities such as notarization to validate the agreement.

The Limited Power of Attorney is designed to grant specific powers to an agent for limited purposes, akin to how Form 2848 specifies the tax matters a representative can address. This similarity highlights the importance of expressly outlining the agent's powers in both documents to prevent unauthorized actions outside of those intended by the principal.

An Advanced Directive is a document that prescribes an individual's wishes regarding medical treatment and care, which, like Form 2848, may appoint a representative to make decisions on the individual's behalf. Both documents ensure that a trusted individual can act in the best interest of the person who appointed them, following specified instructions related to health care or tax representation, respectively.

The Business Power of Attorney allows business owners to designate an agent to handle a variety of business-related tasks. This parallels the IRS Form 2848 when business owners authorize representatives to manage tax matters on their company’s behalf. Both documents are crucial for delegating authority to ensure business continuity, especially in situations where the principal cannot act personally.

A Real Estate Power of Attorney grants an agent the authority to manage real estate transactions for the principal, bearing similarity to Form 2848’s purpose of handling tax affairs. While the real estate version focuses on property matters, including buying, selling, or managing real estate assets, both forms illustrate the need for trust and clarity in the agent’s powers to act on behalf of the principal.

The Executor of Estate form, which designates an individual to manage the affairs of a deceased person's estate, also shares parallels with Form 2848. This document is essential in estate planning, akin to how the power of attorney is critical for tax representation. Both documents involve appointing someone to act in the best interest of the person or estate they represent, underscoring the theme of delegated authority.

Dos and Don'ts

When completing the IRS Form 2848, Power of Attorney and Declaration of a Representative, there are several important dos and don'ts to keep in mind to ensure the process is handled accurately and effectively. Following these guidelines can help in avoiding common mistakes and ensuring that your representation is established as intended.

- Do ensure that every taxpayer fills out a separate Form 2848 if the representation involves more than one person. This includes situations where a joint return was filed.

- Do accurately provide all the required taxpayer identification numbers to avoid any processing delays.

- Do specify the exact tax matters and years or periods for which you are granting authority to the representative. Being clear and precise here is crucial.

- Do ensure the representative(s) you are appointing is eligible to represent you in front of the IRS and that they sign and date Part II of the form.

- Don't authorize any representative to endorse or negotiate any government-issued checks on your behalf, as this is specifically prohibited on the form.

- Don't forget to check the box on line 6 if you do not wish to revoke all earlier power(s) of attorney filed with the IRS for the same matters and years or periods covered by this form. Remember to attach copies of any power(s) of attorney you wish to remain in effect.

- Don't leave the signature and date fields on line 7 empty. The form will be returned to you if these fields are not completed, making the power of attorney invalid.

- Don't omit checking whether the representative's declaration in Part II is completed, signed, and dated, as failure to do so will result in the IRS returning the form.

Adhering to these guidelines will streamline the process of obtaining representation for IRS matters, ensuring your interests are properly and effectively represented.

Misconceptions

There are several misconceptions about IRS Form 2848, Power of Attorney and Declaration of Representative, that are important to clear up. Understanding this form accurately is crucial for taxpayers and their representatives.

- Only lawyers can be appointed on Form 2848. This is not true. In addition to attorneys, certified public accountants (CPAs), enrolled agents, family members, and other specified professionals can be authorized representatives.

- One form can cover all tax matters for multiple taxpayers. Each taxpayer must complete their own form for their specific tax matters. For joint filings, each spouse must submit a separate Form 2848 if they both seek representation.

- The form grants unlimited powers to the appointed representative. Actually, the taxpayer can specify the tax matters and years or periods for which the representative is authorized to act, limiting their scope of authority.

- Representatives can endorse or negotiate checks from the IRS. Representatives are specifically not authorized to endorse or negotiate any government checks issued for tax refunds as per the instructions on the form.

- Completing the form automatically revokes all previous forms. While this can be true, taxpayers have the option to not revoke previous powers of attorney by checking a specific box on the form and attaching a copy of any power of attorney they wish to remain in effect.

- The representative’s signature is not necessary. The representative must sign and date the form in Part II to validate their acceptance of the appointment, under penalties of perjury.

- Filing Form 2848 allows a representative to sign tax returns on behalf of the taxpayer. This is generally not the case, except under specific circumstances outlined in the instructions for line 5a.

- Any representative can access the taxpayer’s IRS records via an Intermediate Service Provider. This requires specific authorization, which can be granted in line 5a of the form.

- The form is effective immediately upon IRS receipt. The form's effectiveness can be contingent upon IRS processing times and the completeness of the information provided. Missing information can delay processing.

- The IRS needs a new Form 2848 for each tax year or issue. A single form can specify multiple tax forms and years if properly completed, so it isn't always necessary to submit a new form for each issue or tax year.

Addressing these misconceptions ensures that taxpayers can effectively grant the appropriate individuals the power to represent them before the IRS, facilitating smoother interactions and resolution of tax matters.

Key takeaways

Filling out and using IRS Form 2848, Power of Attorney and Declaration of Representative, allows taxpayers to appoint an individual to represent them before the IRS. This representation includes the ability to access confidential tax information and perform certain acts on behalf of the taxpayer. Here are six key takeaways about the Form 2848:

- Every taxpayer must file a separate Form 2848 even if they share the same representative. This ensures that individual taxpayer rights and information are properly handled and protected.

- Representatives must sign and date the form in Part II to validate their acceptance of the appointment, confirming their ability and willingness to act on the taxpayer's behalf.

- Form 2848 not only allows representatives to receive and inspect confidential tax information but also to perform specific acts described in the document, such as signing agreements, consents, or other similar documents directly related to tax matters.

- If the power of attorney is intended for a specific use not recorded on the IRS’s Centralized Authorization File (CAF), it must be clearly indicated on the form, which will guide how the IRS processes and recognizes the power of attorney.

- Appointing a representative does not remove the taxpayer's obligations under the law; rather, it allows the named individual to act in addition to the taxpayer, especially in matters requiring detailed dealings with the IRS.

- Filing Form 2848 automatically revokes all earlier powers of attorney filed with the IRS for the same tax matters and periods unless the taxpayer specifies otherwise by checking the appropriate box and attaching a copy of any power of attorney they wish to remain in effect.

It is crucial for both taxpayers and their representatives to understand these points to ensure that their rights and responsibilities are maintained throughout their dealings with the IRS. Proper completion and filing of Form 2848 can facilitate smoother interactions with the IRS, providing taxpayers with peace of mind knowing their tax matters are being professionally managed.

Popular PDF Documents

IRS 4972 - Form 4972 allows for special tax calculations under certain conditions, providing potentially lower tax rates on large distributions.

Apply for Reseller Permit - Businesses are reminded to write their account number on their payment check to ensure proper credit to their account.