Get IRS 2553 Form

For many entrepreneurs and small business owners, making the decision to structure their business as an S corporation can be a crucial step toward streamlining their tax responsibilities and maximizing their potential benefits. This is where the IRS Form 2553 comes into play, serving as a pivotal document in this transformation. The form is essentially the vehicle through which a business elects to be treated as an S corporation for tax purposes, aligning with the Internal Revenue Code's Subchapter S. Completing this form accurately is paramount, as it notifies the IRS of the company's election and sets the stage for the tax advantages that come with S corporation status. These advantages include pass-through taxation, which allows profits and losses to be reported on the individual tax returns of shareholders, thereby avoiding the double taxation often encountered by C corporations. However, navigating the requirements, deadlines, and nuanced instructions of the IRS Form 2553 can be complex, necessitating a clear understanding of the form's components, the eligibility criteria for S corporation status, and the potential impacts on a business's tax obligations and benefits.

IRS 2553 Example

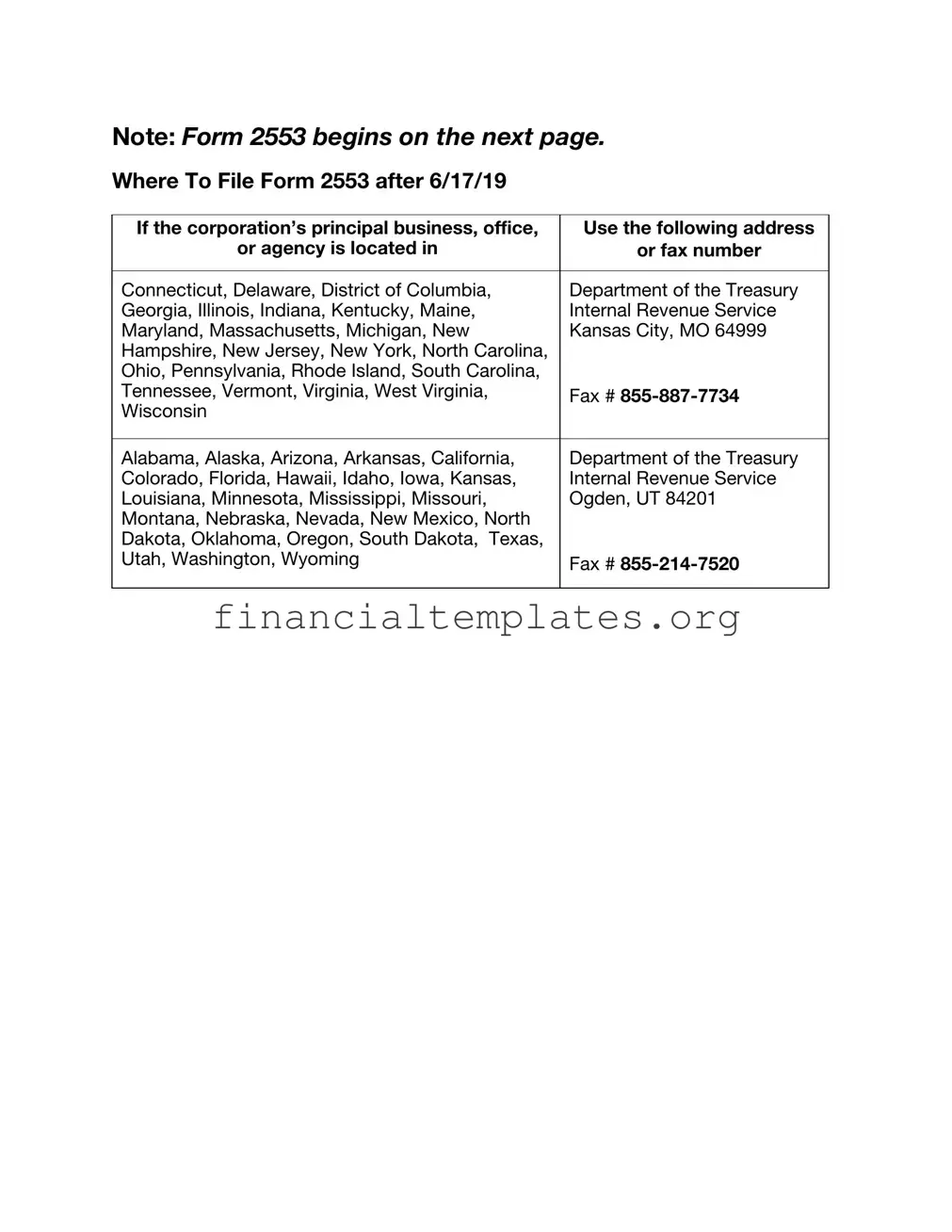

Note: Form 2553 begins on the next page.

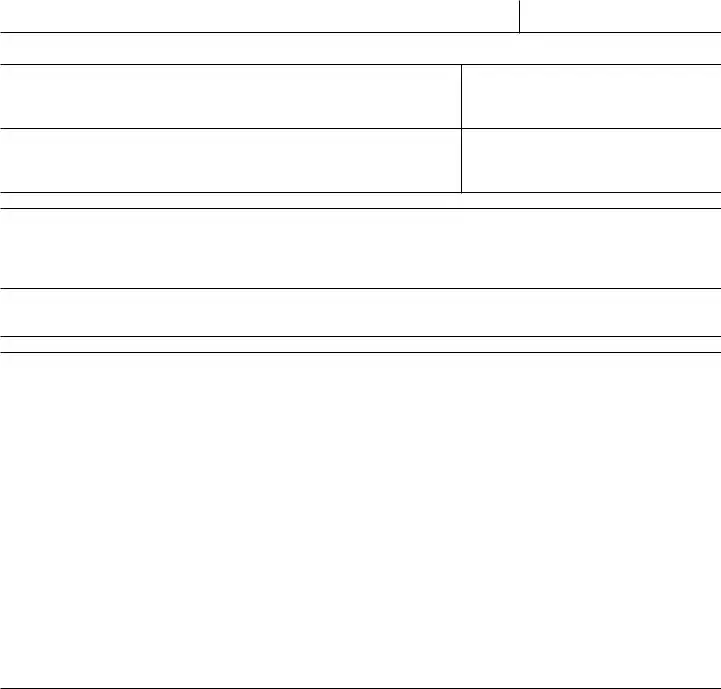

Where To File Form 2553 after 6/17/19

If the corporation’s principal business, office, |

Use the following address |

or agency is located in |

or fax number |

|

|

Connecticut, Delaware, District of Columbia, |

Department of the Treasury |

Georgia, Illinois, Indiana, Kentucky, Maine, |

Internal Revenue Service |

Maryland, Massachusetts, Michigan, New |

Kansas City, MO 64999 |

Hampshire, New Jersey, New York, North Carolina, |

|

Ohio, Pennsylvania, Rhode Island, South Carolina, |

|

Tennessee, Vermont, Virginia, West Virginia, |

Fax # |

Wisconsin |

|

|

|

Alabama, Alaska, Arizona, Arkansas, California, |

Department of the Treasury |

Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, |

Internal Revenue Service |

Louisiana, Minnesota, Mississippi, Missouri, |

Ogden, UT 84201 |

Montana, Nebraska, Nevada, New Mexico, North |

|

Dakota, Oklahoma, Oregon, South Dakota, Texas, |

|

Utah, Washington, Wyoming |

Fax # |

|

|

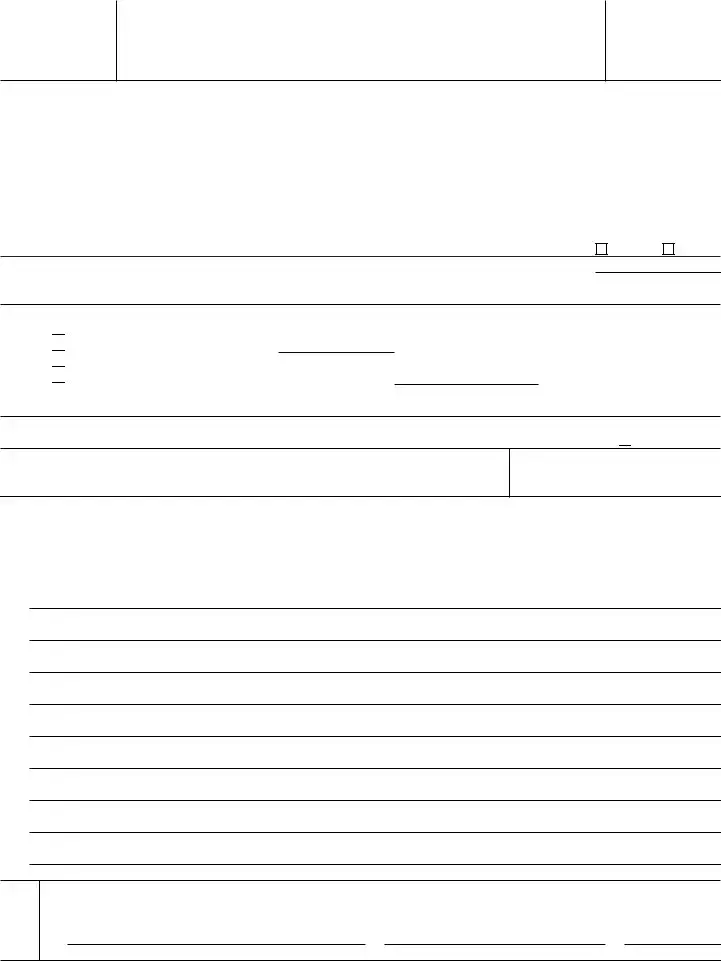

Form 2553

(Rev. December 2017)

Department of the Treasury Internal Revenue Service

Election by a Small Business Corporation

(Under section 1362 of the Internal Revenue Code)

(Including a late election filed pursuant to Rev. Proc.

▶You can fax this form to the IRS. See separate instructions.

▶Go to www.irs.gov/Form2553 for instructions and the latest information.

OMB No.

Note: This election to be an S corporation can be accepted only if all the tests are met under Who May Elect in the instructions, all shareholders have signed the consent statement, an officer has signed below, and the exact name and address of the corporation (entity) and other required form information have been provided.

Part I |

|

Election Information |

|

|

|

|

|

|

|

Name (see instructions) |

A Employer identification number |

||

Type |

|

|

|

|

|

|

|

Number, street, and room or suite no. If a P.O. box, see instructions. |

B Date incorporated |

|

|||

or |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

City or town, state or province, country, and ZIP or foreign postal code |

C State of incorporation |

|

|||

|

|

|

|

|||

|

|

|

|

|

|

|

D |

Check |

the applicable box(es) if the corporation (entity), after applying for the EIN shown in A above, changed its |

name or |

address |

||

EElection is to be effective for tax year beginning (month, day, year) (see instructions) . . . . . . ▶

Caution: A corporation (entity) making the election for its first tax year in existence will usually enter the beginning date of a short tax year that begins on a date other than January 1.

FSelected tax year:

(1) Calendar year

Calendar year

(2) Fiscal year ending (month and day) ▶

Fiscal year ending (month and day) ▶

(3)

(4)

If box (2) or (4) is checked, complete Part II.

GIf more than 100 shareholders are listed for item J (see page 2), check this box if treating members of a family as one shareholder results in no more than 100 shareholders (see test 2 under Who May Elect in the instructions) ▶

HName and title of officer or legal representative whom the IRS may call for more information

Telephone number of officer or legal representative

IIf this S corporation election is being filed late, I declare I had reasonable cause for not filing Form 2553 timely. If this late election is being made by an entity eligible to elect to be treated as a corporation, I declare I also had reasonable cause for not filing an entity classification election timely and the representations listed in Part IV are true. See below for my explanation of the reasons the election or elections were not made on time and a description of my diligent actions to correct the mistake upon its discovery. See instructions.

|

Under penalties of perjury, I declare that I have examined this election, including accompanying documents, and, to the best of my |

||

Sign knowledge and belief, the election contains all the relevant facts relating to the election, and such facts are true, correct, and complete. |

|||

Here |

▲Signature of officer |

|

|

|

Title |

Date |

|

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 18629R |

Form 2553 (Rev. |

|

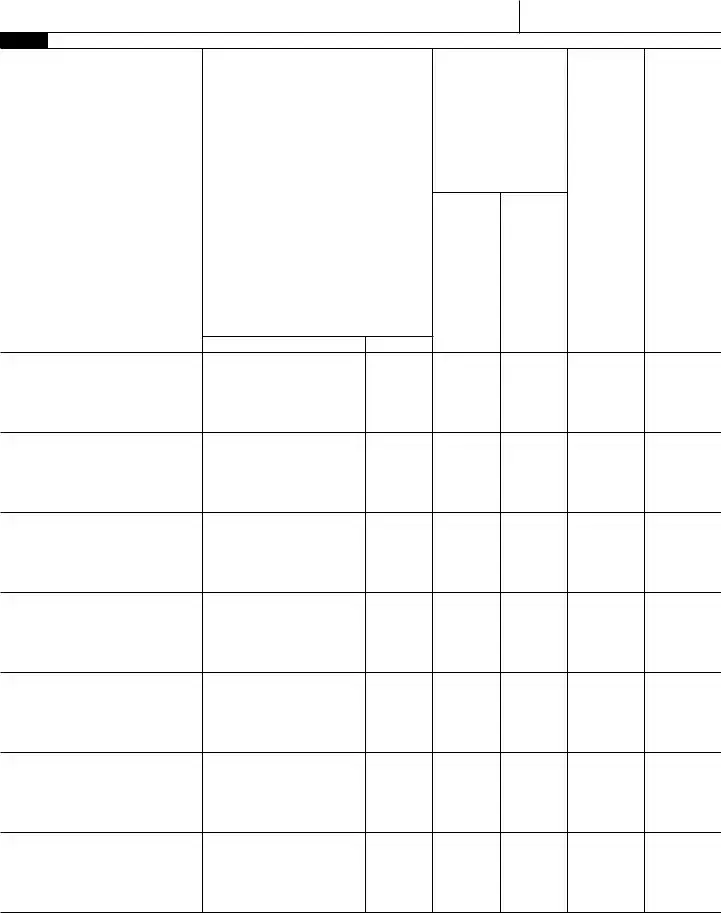

Form 2553 (Rev. |

Page 2 |

Name |

Employer identification number |

Part I Election Information (continued) Note: If you need more rows, use additional copies of page 2.

J

Name and address of each

shareholder or former shareholder required to consent to the election.

(see instructions)

K

Shareholder’s Consent Statement

Under penalties of perjury, I declare that I consent to the election of the

Signature |

Date |

L

Stock owned or

percentage of ownership

(see instructions)

Number of |

|

shares or |

|

percentage |

Date(s) |

of ownership |

acquired |

M |

|

Social security |

|

number or |

N |

employer |

Shareholder’s |

identification |

tax year ends |

number (see |

(month and |

instructions) |

day) |

Form 2553 (Rev.

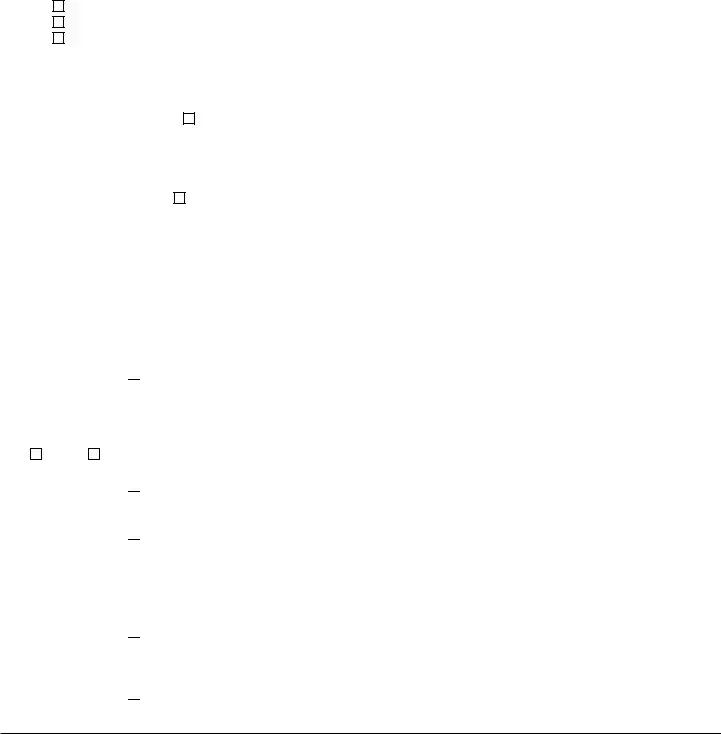

Form 2553 (Rev. |

Page 3 |

|

Name |

|

Employer identification number |

|

|

|

Part II |

Selection of Fiscal Tax Year (see instructions) |

|

Note: All corporations using this part must complete item O and item P, Q, or R. |

|

|

O Check the applicable box to indicate whether the corporation is: |

|

|

1. |

A new corporation adopting the tax year entered in item F, Part I. |

|

2. |

An existing corporation retaining the tax year entered in item F, Part I. |

|

3. |

An existing corporation changing to the tax year entered in item F, Part I. |

|

PComplete item P if the corporation is using the automatic approval provisions of Rev. Proc.

1. Natural Business Year ▶ |

I represent that the corporation is adopting, retaining, or changing to a tax year that qualifies |

as its natural business year (as defined in section 5.07 of Rev. Proc.

2. Ownership Tax Year ▶ |

I represent that shareholders (as described in section 5.08 of Rev. Proc. |

than half of the shares of the stock (as of the first day of the tax year to which the request relates) of the corporation have the same tax year or are concurrently changing to the tax year that the corporation adopts, retains, or changes to per item F, Part I, and that such tax year satisfies the requirement of section 4.01(3) of Rev. Proc.

Note: If you do not use item P and the corporation wants a fiscal tax year, complete either item Q or R below. Item Q is used to request a fiscal tax year based on a business purpose and to make a

QBusiness

1. Check here ▶  if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc.

if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc.

Yes |

No |

2.Check here ▶

to show that the corporation intends to make a

to show that the corporation intends to make a

3.Check here ▶

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a

RSection 444

1.Check here ▶

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete Form 8716, Election To Have a Tax Year Other Than a Required Tax Year, and either attach it to Form 2553 or file it separately.

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete Form 8716, Election To Have a Tax Year Other Than a Required Tax Year, and either attach it to Form 2553 or file it separately.

2.Check here ▶

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

Form 2553 (Rev.

Form 2553 (Rev. |

Page 4 |

Name |

Employer identification number |

Part III Qualified Subchapter S Trust (QSST) Election Under Section 1361(d)(2)* Note: If you are making more than

one QSST election, use additional copies of page 4.

Income beneficiary’s name and address

Social security number

Trust’s name and address

Employer identification number

Date on which stock of the corporation was transferred to the trust (month, day, year) . . . . . . . . ▶

In order for the trust named above to be a QSST and thus a qualifying shareholder of the S corporation for which this Form 2553 is filed, I hereby make the election under section 1361(d)(2). Under penalties of perjury, I certify that the trust meets the definitional requirements of section 1361(d)(3) and that all other information provided in Part III is true, correct, and complete.

Signature of income beneficiary or signature and title of legal representative or other qualified person making the election |

|

Date |

*Use Part III to make the QSST election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation makes its election to be an S corporation. The QSST election must be made and filed separately if stock of the corporation is transferred to the trust after the date on which the corporation makes the S election.

Part IV Late Corporate Classification Election Representations (see instructions)

If a late entity classification election was intended to be effective on the same date that the S corporation election was intended to be effective, relief for a late S corporation election must also include the following representations.

1The requesting entity is an eligible entity as defined in Regulations section

2The requesting entity intended to be classified as a corporation as of the effective date of the S corporation status;

3The requesting entity fails to qualify as a corporation solely because Form 8832, Entity Classification Election, was not timely filed under Regulations section

4The requesting entity fails to qualify as an S corporation on the effective date of the S corporation status solely because the S corporation election was not timely filed pursuant to section 1362(b); and

5a The requesting entity timely filed all required federal tax returns and information returns consistent with its requested classification as an S corporation for all of the years the entity intended to be an S corporation and no inconsistent tax or information returns have been filed by or with respect to the entity during any of the tax years, or

bThe requesting entity has not filed a federal tax or information return for the first year in which the election was intended to be effective because the due date has not passed for that year’s federal tax or information return.

Form 2553 (Rev.

Document Specifics

| Fact Name | Detail |

|---|---|

| Purpose of Form 2553 | Used by qualifying small businesses to elect S corporation tax status. |

| Filing Deadline | No later than two months and 15 days after the beginning of the tax year the election is to take effect, or at any time during the tax year preceding the tax year it is to take effect. |

| Eligibility Requirements | Must be a domestic corporation or entity, have only allowable shareholders (including individuals, certain trusts, and estates), have no more than 100 shareholders, have only one class of stock, and not be an ineligible corporation (e.g., certain financial institutions, insurance companies, and domestic international sales corporations). |

| Where to File | Filed with the Internal Revenue Service Center designated for the legal address of the corporation. |

| State-Specific Forms | Some states require a separate state election; check with state tax authorities to determine specific requirements. |

Guide to Writing IRS 2553

After deciding to elect S corporation status for your business, the next step involves filling out and submitting IRS Form 2553. This form, essential for the election process, requires careful attention to detail to ensure accuracy and compliance with IRS guidelines. Once submitted, the IRS will review your election for S corporation status, and, if approved, your business will be taxed accordingly. It's important to remember that specific deadlines apply for the election to be effective in the current tax year, making timely completion and submission crucial.

To accurately complete IRS Form 2553, follow these steps:

- Enter the name of the corporation in the designated field.

- Provide the corporation’s taxpayer identification number.

- List the address of the corporation, including the city, state, and ZIP code.

- Fill in the date the corporation first had assets, began doing business, or acquired shares, whichever occurred first.

- Specify the tax year for which the S corporation election is intended.

- If applicable, explain the reason for the late filing in the provided space.

- Complete the section regarding the selection of fiscal tax year if the corporation elects a fiscal year basis instead of a calendar year basis.

- Have all shareholders sign and date the form, indicating their consent to the election.

- Enter the names, addresses, and social security numbers of all shareholders, and indicate their shares’ percentage ownership.

- Designate a contact person for the IRS to reach out to if there are any questions, providing their name and phone number.

After completing these steps, review the form to ensure all information is accurate and complete. The next step involves submitting the form to the IRS. The method of submission (mail or fax) and the specific address or fax number depend on the location of the corporation's legal address. It’s critical to adhere to submission guidelines and deadlines to avoid delays or rejection of your S corporation election request. Once the IRS receives and processes your form, they will notify you of your election's acceptance or if further information is required.

Understanding IRS 2553

-

What is the IRS 2553 form?

The IRS 2553 form, also known as the Election by a Small Business Corporation, is a tax document used by small businesses to be treated as an S corporation for tax purposes. This election allows the company's income, deductions, and tax credits to be passed directly to shareholders, avoiding the double taxation typically applied to corporations.

-

Who needs to file Form 2553?

Any corporation or entity that wishes to be treated as an S corporation must file Form 2553. The election must be made by an eligible entity with 100 or fewer shareholders, all of whom are individuals, estates, exempt organizations, or certain trusts.

-

When must Form 2553 be filed?

Form 2553 must be filed no more than two months and 15 days after the beginning of the tax year the election is to take effect, or at any time during the year preceding the tax year it is to take effect. For example, if you want the election to be effective for the 2023 tax year, you would need to file by March 15, 2023, if your business operates on a calendar year.

-

How can a business file Form 2553?

A business can file Form 2553 by mailing it to the appropriate Internal Revenue Service Center. It's also possible to file via fax for certain businesses. It's important to ensure all shareholders have signed the form before filing.

-

What information is required on Form 2553?

Form 2553 requires detailed information including the corporation's name, address, employer identification number (EIN), the tax year the election is to take effect, information about the corporation’s shareholders, and their consent to the S corporation election.

-

Can a corporation change its tax status back to a C corporation after filing Form 2553?

Yes, a corporation can change its tax status back to a C corporation by revoking the S corporation election. This process involves filing a statement of revocation with the IRS. However, certain restrictions and tax implications may apply, so it's advisable to consult with a tax professional.

-

Are there any deadlines or penalties for late filing of Form 2553?

Yes, there is a deadline for filing Form 2553, which is no more than two months and 15 days after the beginning of the tax year the election is to take effect. The IRS may grant relief for late filings if certain conditions are met. Failure to file on time without IRS-granted relief may result in the corporation being treated as a C corporation, along with potential penalties and interest for late taxes.

-

How can a business know if its Form 2553 has been approved?

After submitting Form 2553, the business will receive a letter of acknowledgment from the IRS. Once processed, the IRS will send a confirmation letter indicating whether the S corporation election has been approved or if additional information is needed.

-

Where can more information about Form 2553 be found?

More information about Form 2553, including instructions for filling it out and where to file it, can be found on the IRS website or by contacting a tax professional. The IRS website offers extensive resources and guides to assist with the preparation and filing of Form 2553.

Common mistakes

Filling out the IRS 2553 form, essential for companies electing to be treated as an S corporation, often involves common errors. These mistakes can delay processing and affect the company's tax status. Understanding these pitfalls is paramount for accurate completion.

Not verifying eligibility before filing: Before submitting Form 2553, it's crucial to ensure the company meets all the S corporation eligibility requirements, including the number and type of shareholders and stock.

Mismatched information with the IRS records: Names and identification numbers of the business must align exactly with what the IRS has on file. Discrepancies can lead to processing delays.

Incorrect or missing election date: The specific date the S corporation election is to take effect must be clearly stated. A common error is misunderstanding the election deadlines and either providing a date that has passed or is too far in the future.

Failing to obtain all required shareholder consents: Every shareholder must consent to the election by signing the form. Missing signatures can invalidate the election.

Incomplete sections or missing information: Skipping sections or not providing required details, such as the business’s address or the type of tax year election, can lead to unnecessary back-and-forth with the IRS.

Incorrectly classifying the business entity: The form must reflect the correct entity type that is electing S corporation status. Misclassification can cause the IRS to reject the form.

Failure to file by the deadline: The form must be filed by March 15th of the current tax year for the election to take effect that year. Late filings can result in the election applying to the next tax year.

Avoiding these mistakes requires careful attention to detail and an understanding of both the form’s requirements and the business’s tax situation. When completed accurately, Form 2553 can help companies reap the tax benefits of an S corporation election without delay.

Documents used along the form

When business entities decide to elect S corporation status by filing the IRS Form 2553, they embark on a path that requires meticulous attention to detail and compliance with tax filing requirements. This election can provide tax advantages, such as passing corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. However, to navigate this process successfully, various other forms and documents often accompany the IRS Form 2553. These documents ensure that the business aligns with IRS requirements and maintains its S corporation status without any hitches.

- IRS Form SS-4: This form is used to apply for an Employer Identification Number (EIN), which is necessary for tax administration for any business, including those electing S corp status. An EIN is essentially the business's social security number.

- IRS Form 1120S: S corporations must file this form annually to report their income, gains, losses, deductions, credits, etc. It's the tax return for an S corporation.

- IRS Schedule K-1 (Form 1120S): This schedule accompanies Form 1120S and is used to report each shareholder's share of the corporation's income, deductions, and credits. It's a way to keep each shareholder informed about their tax liability from the S corp.

- Operating Agreement: While not a federal tax document, most S corporations also have an operating agreement. This internal document outlines the governance of the business operations, roles, and responsibilities of the members or shareholders.

- Articles of Incorporation: This is a document filed with the state government to legally establish the business. It includes fundamental details about the corporation, such as its name, purpose, and structure.

- IRS Form 8832: This form is used by eligible entities to choose how they are classified for federal tax purposes: as a corporation, a partnership, or an entity disregarded as separate from its owner.

- IRS Form 941: Employers use this form to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks and the employer's portion of social security or Medicare tax.

- IRS Form 940: This form is used to report the annual Federal Unemployment Tax Act (FUTA) tax. The FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs.

- Shareholder Agreement: Similar to an operating agreement, this document outlines the rights and obligations of the shareholders, including how the company is managed and how shares can be bought and sold.

- IRS Form 2553: It seems redundant to list, yet it's crucial to acknowledge that keeping a copy of the filed IRS Form 2553 itself is important for records. This form officially elects the S corporation status and is pivotal for tax purposes.

Understanding and preparing these documents, in conjunction with the IRS Form 2553, form a critical foundation for successfully managing an S corporation's tax and legal obligations. Each document plays a specific role in ensuring compliance, facilitating operations, and maintaining transparent financial and tax reporting. This comprehensive approach helps in safeguarding the benefits that come with S corporation status, emphasizing the importance of each form and document in the broader context of corporate governance and tax compliance.

Similar forms

The IRS 2553 form, commonly associated with the election by a small business corporation to be treated as an S corporation, has cousins in the realm of tax documents that serve similarly pivotal roles for different entities or circumstances. These forms, while unique in purpose, share a conceptual thread with the IRS 2553 in facilitating specific tax-related declarations or elections by taxpayers.

Similar to the IRS 2553, the IRS Form 8832, Entity Classification Election, provides a mechanism for an entity to elect how it wishes to be classified for federal tax purposes. This could be as a corporation, a partnership, or an entity disregarded as separate from its owner. The parallel lies in the elective nature of both forms, granting entities control over their tax treatment. Where the 2553 is exclusive to S corporations, Form 8832 offers a broader range of classification possibilities, accommodating a wider variety of business structures under its umbrella.

Another document, IRS Form 8822-B, Change of Address or Responsible Party — Business, shares a procedural similarity with the 2553 form, albeit for a different purpose. It is pivotal for businesses to keep the IRS informed of their current address and the identity of their responsible party, as this ensures vital communications regarding tax responsibilities are duly received. While not directly related to tax election, like the 2553, it's a critical administrative task that maintains the integrity of a business’s tax account, reflecting the importance of updating information with the IRS.

The IRS Form 1120S, U.S. Income Tax Return for an S Corporation, directly complements the 2553 form, acting as a subsequent step in the life of an S corporation. After a corporation files Form 2553 and is approved to elect S corporation status, it must annually file Form 1120S to report the income, gains, losses, deductions, credits, etc., of the corporation. The two forms are closely linked, with the 2553 serving as the gateway through which a business must pass to enter the realm of S corporation taxation, necessitating the yearly filing of Form 1120S thereafter.

Analogous in its niche purpose, the IRS Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, opens the door for non-profit organizations to be recognized as tax-exempt by the IRS. This form is critical for charitable, religious, educational, and scientific organizations seeking to operate without the burden of federal income tax. Similar to how the 2553 form defines a corporation's tax status, Form 1023 delineates the federal tax exemption status for nonprofits, underlining the transformative impact such elections have on an entity's financial and operational landscape.

Lastly, the IRS Form W-9, Request for Taxpayer Identification Number and Certification, though more frequently encountered and broader in its application, shares a foundational connection with the 2553 form. It is used to provide the correct taxpayer identification number (TIN) to entities that are required to file information returns with the IRS to report income, such as interest, dividends, and proceeds from real estate transactions. This form underpins the importance of proper identification and classification in the eyes of the IRS for tax reporting and compliance purposes, reflecting the overarching theme of entity identification and classification critical to both individual and business tax affairs.

Dos and Don'ts

When it comes to filling out the IRS 2553 form, which is crucial for businesses electing to be treated as an S corporation, it’s essential to approach this task with careful attention to detail. Below, find a guide to key dos and don'ts that can help ensure the process goes smoothly.

Do:

- Double-check the eligibility requirements for S corporation status before you begin.

- Make sure all information is accurate, especially the company's name and Employer Identification Number (EIN).

- Obtain consent from all shareholders. Their signatures are required for the election to be valid.

- Use the correct version of the form for the tax year for which you're making the election.

- Adhere to state filing requirements, as some states require a separate S corporation election.

- Consult with a tax professional or advisor if you have any questions or concerns about the form or the election process.

- File the form by the specified deadline—generally by March 15 for an existing entity to have the election effective for the current tax year.

- Keep a copy of the completed form and all relevant documentation for your records.

- Review the form for completeness and accuracy before submission.

- Be aware of the specific instructions regarding where to file the form, as the IRS has different addresses for different states.

Don't:

- Miss the filing deadline. Late submissions may delay or invalidate your election.

- Overlook the need for all shareholders to sign the form, a common mistake that leads to processing delays.

- Submit the form without double-checking all entered information for accuracy.

- Ignore the specific mailing requirements and addresses provided by the IRS for submitting Form 2553.

- Forget to consult the instructions for any updates to the filing process that may affect your submission.

- Assume the state requirements are the same as the federal; some states have different forms or additional requirements.

- Use outdated forms. The IRS updates its forms regularly, so always use the most current version.

- Fail to keep a copy of the signed form and any correspondence received from the IRS regarding your election.

- Dismiss the importance of timely communication with all shareholders about the election and its implications.

- Underestimate the importance of seeking professional assistance if you're unsure about any part of the process.

Misconceptions

The IRS Form 2553, Election by a Small Business Corporation, is a document that is misunderstood in several ways. This form is used by corporations that want to be treated as S corporations for tax purposes. An S corporation allows income to pass through to the shareholders, avoiding the double taxation normally associated with corporations. However, misconceptions about this form can lead to confusion and errors in filing. Let’s clarify four common misunderstandings.

Only for Small Businesses: A common misconception is that Form 2553 is only for 'small businesses.' While it's true that S corporations are often small to medium in size, the term 'small' can be misleading. The IRS does not define an S corporation by its number of employees or its revenue, but rather by its number of shareholders and type of shareholders. An S corporation is limited to 100 shareholders, and they must be individuals, certain trusts, and estates — not partnerships or non-residential aliens.

Immediate Effect: Another misunderstanding is believing that the S corporation election takes effect immediately upon filing Form 2553. In reality, the timing of the election can be quite specific. To be effective for the current tax year, the form generally must be filed by March 15th of that year for corporations on a calendar year. However, a corporation can file the form at any time during the preceding tax year or at any time during the tax year the election is to be effective, as long as it’s before the 16th day of the 3rd month of the tax year.

Automatic Approval: Some assume that once Form 2553 is filed, the election to be treated as an S corporation is automatically approved. This is not the case. The IRS must first review and approve the election. While approval is common, it is not guaranteed. The IRS will notify the corporation in writing whether the election is accepted or rejected. If specific qualifications are not met, or if the form is filled out incorrectly, the election may be denied.

All Benefits, No Drawbacks: Often, business owners might think that electing to be treated as an S corporation only comes with benefits and no potential disadvantages. While the tax structure of an S corporation — allowing income to pass through to shareholders and avoiding double taxation — can be advantageous, it also comes with its complexities and obligations. For example, S corporations are subject to more scrutiny by the IRS and must adhere to strict filing requirements and operational processes. Additionally, the allocation of income and loss among shareholders must strictly follow stock ownership, which might not be suitable for all businesses.

Understanding the intricacies and common misconceptions of IRS Form 2553 is crucial for corporations considering the S corporation election. This awareness ensures that businesses make informed decisions and comply with IRS requirements, avoiding potential pitfalls associated with misinterpretation or misinformation.

Key takeaways

The IRS 2553 form is crucial for certain businesses looking to adopt an S corporation tax status. Understanding how to complete and use this form effectively is essential for reaping the benefits that come with this designation. Below are nine key takeaways designed to navigate the complexities of this form and ensure that your business leverages its advantages appropriately.

- Eligibility Requirements: Before filling out Form 2553, ensure your business meets the eligibility criteria. This includes being a domestic corporation or entity, having allowable shareholders (which include individuals, certain trusts, and estates but exclude partnerships, corporations, or non-resident alien shareholders), having no more than 100 shareholders, having only one class of stock, and finally, all shareholders must agree to the election.

- Filing Deadline: Timing is everything. Generally, to elect S corporation status for the current tax year, Form 2553 needs to be filed no later than two months and 15 days after the beginning of the tax year the election is to take effect. For newly formed corporations, this is often the date of incorporation. However, there is relief for late filings if certain criteria are met.

- Signature Requirements: All shareholders must consent to the election by signing the form. This unified approval is a testament to the collective agreement on taxation and governance structure within the entity.

- Specific Election Information Required: When completing the form, you'll need to provide detailed information about your election. This includes selecting an effective date of the S corporation status and deciding whether your business will adopt a tax year based on the calendar year or a fiscal year.

- Where to File: The form's filing location varies depending on the state in which your corporation is located. The IRS provides a list of addresses and fax numbers for where to file, so it's important to refer to the most current instructions provided by the IRS to ensure it's sent to the correct office.

- Taxation Implications: Electing to be treated as an S corporation changes how your business is taxed. Rather than paying corporate income taxes, the corporation's income, deductions, and credit pass through to shareholders, who report these amounts on their personal tax returns. This can avoid double taxation on corporate income.

- Responsible Party Information: Form 2553 requires the name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) of the corporation’s responsible party. This person is who the IRS will contact if there are any issues or questions regarding the election.

- Consistency in Reporting: Once the S corporation status is elected, consistent reporting is necessary. All shareholders must report profit, loss, and other tax items in their proportionate shares, each year the company operates under S corporation status.

- Revocation or Termination: Finally, it’s important to understand that S corporation status can be revoked or terminated either voluntarily by submitting a statement of revocation or automatically if the corporation no longer meets the eligibility criteria. Understanding the conditions under which this can occur is crucial for maintaining status or preparing for a change in tax classification.

Effectively managing and understanding the implications of Form 2553 is crucial for businesses seeking the benefits of an S corporation. These key takeaways provide a foundation, but always consider consulting with a tax professional to ensure compliance and to navigate the specific circumstances of your business.

Popular PDF Documents

Pa Department of Revenue Forms - Maximize your tax efficiency by allowing a designated agent to undertake your tax responsibilities with the PA-1 Tax Power of Attorney form.

IRS 8936 - Includes detailed instructions for accurately determining the credit amount, considering factors like battery capacity and vehicle weight.