Get IRS 2441 Form

For many families and working parents, the cost associated with childcare or the care of a dependent can significantly impact household finances. Recognizing this, the U.S. tax system provides certain benefits aimed at alleviating these financial burdens. Central to accessing these benefits is the Internal Revenue Service (IRS) Form 2441, Child and Dependent Care Expenses. This form is an essential tool for taxpayers looking to claim a credit for the expenses incurred in the care of qualifying individuals. It serves to calculate the allowable amount of credit that can be applied towards their annual tax obligations, which, in turn, can lower the amount of tax owed or increase a taxpayer's refund. The form requires detailed information about the care provider, the amount paid for the services, and the qualifying person(s) who received the care. Accurate completion and understanding of IRS Form 2441 are critical for those hoping to maximize their potential tax benefits while adhering to legal tax filing requirements. Navigating the complexities of this form can be challenging, but it represents a vital step for many in managing the costs associated with caregiving.

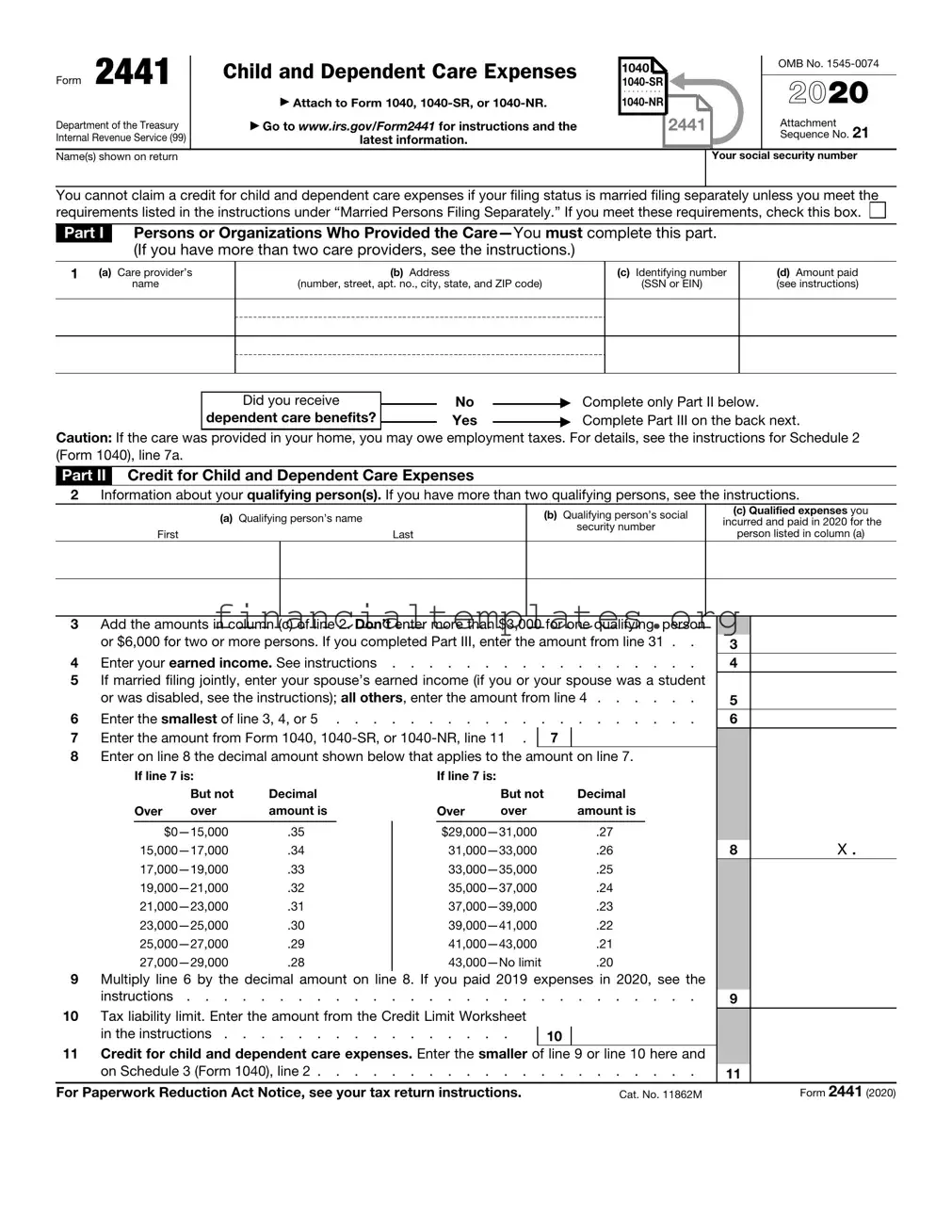

IRS 2441 Example

Form 2441 |

Child and Dependent Care Expenses |

1040 |

OMB No. |

2021 |

|||

|

▶ Attach to Form 1040, |

. . . . . . . . . |

|

|

|||

|

|

||

Department of the Treasury |

▶ Go to www.irs.gov/Form2441 for instructions and |

2441 |

Attachment |

Internal Revenue Service (99) |

the latest information. |

|

Sequence No. 21 |

Name(s) shown on return |

|

|

Your social security number |

AYou can’t claim a credit for child and dependent care expenses if your filing status is married filing separately unless you meet the

requirements listed in the instructions under “Married Persons Filing Separately.” If you meet these requirements, check this box .

BFor 2021, your credit for child and dependent care expenses is refundable if you, or your spouse if married filing jointly, had a

principal place of abode in the United States for more than half of 2021. If you meet these requirements, check this box . . .

Part I |

Persons or Organizations Who Provided the |

|

If you have more than three care providers, see the instructions and check this box |

1(a) Care provider’s

name

(b)Address

(number, street, apt. no., city, state, and ZIP code)

(c) Identifying number |

(d) Check here if the |

(e) Amount paid |

||

care provider is your |

||||

(SSN or EIN) |

household employee. |

(see instructions) |

||

|

(see instructions) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Did you receive

dependent care benefits?

No |

|

▶ |

Complete only Part II below. |

|

|||

Yes |

▶ |

Complete Part III on page 2 next. |

|

Caution: If the care was provided in your home, you may owe employment taxes. For details, see the instructions for Schedule H (Form 1040). If you incurred care expenses in 2021 but didn’t pay them until 2022, or if you prepaid in 2021 for care to be provided in 2022, don’t include these expenses in column (c) of line 2 for 2021. See the instructions.

Part II Credit for Child and Dependent Care Expenses

2Information about your qualifying person(s). If you have more than three qualifying persons, see the instructions and check

this box |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

(a) |

Qualifying person’s name |

First |

Last |

(b)Qualifying person’s social security number

(c)Qualified expenses you incurred and paid in 2021 for the

person listed in column (a)

3Add the amounts in column (c) of line 2. Don’t enter more than $8,000 if you had one qualifying

person or $16,000 if you had two or more persons. If you completed Part III, enter the amount |

|

from line 31 |

3 |

4 Enter your earned income. See instructions |

4 |

5If married filing jointly, enter your spouse’s earned income (if you or your spouse was a student

|

or was disabled, see the instructions); all others, enter the amount from line 4 |

5 |

|

||

6 |

Enter the smallest of line 3, 4, or 5 |

6 |

|

||

7 |

Enter the amount from Form 1040, |

7 |

|

|

|

8 |

Enter on line 8 the decimal amount shown below that applies to the amount on line 7. |

|

|

||

|

• If line 7 is $125,000 or less, enter .50 on line 8. |

|

|

|

|

|

• If line 7 is over $125,000 and no more than $438,000, see the instructions for line 8 for the |

|

|

||

|

amount to enter. |

|

|

|

|

|

• If line 7 is over $438,000, don’t complete line 8. Enter zero on line 9a. You may be able to |

|

|

||

|

claim a credit on line 9b. |

|

|

8 |

X . |

9a |

Multiply line 6 by the decimal amount on line 8 |

9a |

|

||

bIf you paid 2020 expenses in 2021, complete Worksheet A in the instructions. Enter the amount

from line 13 of the worksheet here. Otherwise, go to line 10 |

9b |

10Add lines 9a and 9b and enter the result. If you checked the box on line B above, this is your refundable credit for child and dependent care expenses; enter the amount from this line on Schedule 3 (Form 1040), line 13g, and don’t complete line 11. If you didn’t check the box on line

B above, go to line 11 |

10 |

11Nonrefundable credit for child and dependent care expenses. If you didn’t check the box on line B above, your credit is nonrefundable and limited by the amount of your tax; see the instructions to figure the portion of line 10 that you can claim and enter that amount here and on

Schedule 3 (Form 1040), line 2 |

11 |

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 11862M |

Form 2441 (2021) |

Form 2441 (2021) |

Page 2 |

Part III Dependent Care Benefits

12Enter the total amount of dependent care benefits you received in 2021. Amounts you received as an employee should be shown in box 10 of your Form(s)

amounts you received under a dependent care assistance program from your sole proprietorship or partnership . . . . . . . . . . . . . . . . . . . . . . . . . . .

13Enter the amount, if any, you carried over from 2020 and used in 2021. See instructions . . .

14If you forfeited or carried over to 2022 any of the amounts reported on line 12 or 13, enter the

|

amount. See instructions |

||||

15 |

Combine lines 12 through 14. See instructions |

||||

16 |

Enter the total amount of qualified expenses incurred in 2021 for |

|

|

||

|

the care of the qualifying person(s) |

16 |

|

||

17 |

Enter the smaller of line 15 or 16 |

17 |

|

||

18 |

Enter your earned income. See instructions |

18 |

|

||

19 |

Enter the amount shown below that applies to you. |

|

|

|

|

|

• If married filing jointly, enter your spouse’s |

} |

|

|

|

|

earned income (if you or your spouse was a |

|

|

|

|

|

student or was disabled, see the instructions |

|

|

|

|

|

. . . . . . |

19 |

|

||

|

for line 5). |

|

|||

|

• If married filing separately, see instructions. |

|

|

|

|

|

• All others, enter the amount from line 18. |

|

|

|

|

20 |

Enter the smallest of line 17, 18, or 19 |

20 |

|

||

21 |

Enter $10,500 ($5,250 if married filing separately and you were |

|

|

||

|

required to enter your spouse’s earned income on line 19). If you |

|

|

||

|

entered an amount on line 13, add it to the $10,500 or $5,250 |

|

|

||

|

amount you enter on line 21. However, don’t enter more than the |

|

|

||

|

maximum amount allowed under your dependent care plan. See |

|

|

||

|

instructions |

21 |

|

||

22Is any amount on line 12 or 13 from your sole proprietorship or partnership?

|

No. Enter |

||

|

Yes. Enter the amount here |

||

23 |

Subtract line 22 from line 15 |

23 |

|

24 |

Deductible benefits. Enter the smallest of line 20, 21, or 22. Also, include this amount on the |

||

|

appropriate line(s) of your return. See instructions |

||

25Excluded benefits. If you checked “No” on line 22, enter the smaller of line 20 or 21. Otherwise,

subtract line 24 from the smaller of line 20 or line 21. If zero or less, enter

26Taxable benefits. Subtract line 25 from line 23. If zero or less, enter

12

13

14 |

( |

) |

15 |

|

|

22

24

25

26

To claim the child and dependent care credit,

complete lines 27 through 31 below.

27 |

Enter $8,000 ($16,000 if two or more qualifying persons) |

27 |

|

28 |

Add lines 24 and 25 |

28 |

|

29 |

Subtract line 28 from line 27. If zero or less, stop. You can’t take the credit. Exception. If you |

|

|

|

paid 2020 expenses in 2021, see the instructions for line 9b |

29 |

|

30 |

Complete line 2 on page 1 of this form. Don’t include in column (c) any benefits shown on line |

|

|

|

28 above. Then, add the amounts in column (c) and enter the total here |

30 |

|

31 |

Enter the smaller of line 29 or 30. Also, enter this amount on line 3 on page 1 of this form and |

|

|

|

complete lines 4 through 11 |

31 |

|

|

|

|

Form 2441 (2021) |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of IRS Form 2441 | This form is used to apply for a credit for child and dependent care expenses. |

| Eligible Filers | Taxpayers who have incurred expenses for the care of children under 13 or disabled dependents/spouses to enable work or job search qualify. |

| Maximum Expense Amounts | Up to $3,000 for one qualifying person or $6,000 for two or more qualifying persons. |

| Credit Percentage | The credit ranges from 20% to 35% of allowable expenses, based on the filer's adjusted gross income. |

| Form Submission | The form must be attached to the taxpayer's Form 1040, 1040-SR, or 1040-NR. |

| Governing Law | Internal Revenue Code sections benefiting child and dependent care are the primary governing laws for this form. |

Guide to Writing IRS 2441

Filling out the IRS 2441 form is a necessary step for taxpayers looking to claim a credit for child and dependent care expenses. This process can be straightforward if you understand what each section asks for and you have all your information ready. Keep in mind, this form is used to calculate the amount of credit you're eligible for based on your expenses. Getting this right can lead to significant tax savings. Let's break down the steps needed to accurately complete the form.

- Gather all necessary documents, including receipts for child and dependent care expenses, the taxpayer identification number (TIN), and the Social Security numbers (SSNs) for all dependents.

- Begin with the top section of the form, where you will provide your name and SSN. Make sure the information matches what's on your tax return.

- In line 1, enter the total amount of child and dependent care expenses. This should be the amount you spent on services that allowed you to work or look for work.

- If you received any dependent care benefits from your employer, such as payments through a flexible spending account (FSA), enter this amount on line 12. Subtract this from your total expenses to calculate your allowable expenses.

- For lines 2 through 4, provide information about the individual(s) who provided care. This includes their name, address, and taxpayer identification number (TIN) or Social Security number (SSN).

- Lines 5 through 9 focus on your dependents. Input the names of the persons the care was provided for, their relationship to you, and the amount of expenses incurred for each person.

- Calculate your credit in lines 10 and 11 according to the instructions, based on your income and the allowable expenses you've reported. This section determines the amount of credit you're eligible for.

- Complete the rest of the form following the instructions provided for each line, ensuring that all applicable fields are filled out based on your personal and financial situation.

- Review the form carefully to ensure that all information is accurate and that you've included all necessary documentation. Mistakes can delay processing or affect the amount of your credit.

- Attach Form 2441 to your tax return and file it according to the IRS instructions for your specific tax situation.

After you've completed and submitted Form 2441 with your tax return, the next steps depend on the IRS's processing times which can vary. Generally, you can expect the IRS to review your tax return and the accompanying Form 2441 to ensure everything is in order. If there are any questions or additional documentation required, the IRS will contact you directly. Once everything has been verified, your tax return will be processed, and any applicable credit from Form 2441 will be applied to your tax liability, potentially resulting in a refund. Keep a copy of Form 2441 for your records and track the status of your return through the IRS website or by contacting them directly for updates.

Understanding IRS 2441

Understanding the IRS Form 2441 can be essential for taxpayers who incur expenses for child and dependent care. This form helps them to claim a credit for these expenses on their tax return. Here are answers to some frequently asked questions about Form 2441 to guide you through the process.

What is IRS Form 2441?

IRS Form 2441 is a tax form used by taxpayers to calculate and claim a credit for child and dependent care expenses. This credit is designed to help offset the costs of care for qualifying children or dependents, allowing parents and guardians to work or actively search for employment. The amount of the credit is based on the taxpayer's income and the total amount spent on care.

Who can use IRS Form 2441?

Anyone who has incurred expenses for the care of a qualifying child or dependent so they could work or look for work may use Form 2441. However, to be eligible, you must have earned income from wages, salaries, tips, other taxable employee compensation or net earnings from self-employment. If you are married, both you and your spouse must have earned income, unless one spouse is either a full-time student or physically or mentally incapable of self-care.

What are the qualifying expenses for Form 2441?

Qualifying expenses for Form 2441 include amounts paid for household services and care of the qualifying person while you work or look for work. Such expenses may include payments to day care centers, babysitters, or summer camps. However, expenses do not qualify if they are paid to a spouse, the parent of your qualifying child who is not your spouse, your child who is under age 19 at the end of the year, or someone else you can claim as a dependent on your return.

How is the credit calculated using Form 2441?

The credit is calculated based on your total qualifying expenses, your income, and the applicable percentage that correlates with your adjusted gross income. The maximum amount of expenses you can claim is $3,000 for one qualifying person and $6,000 for two or more qualifying persons. The percentage ranges from 20% to 35% of your qualifying expenses, decreasing as your adjusted gross income increases. The form contains a table to help you determine your percentage.

Can I claim the credit for child and dependent care expenses if I’m not required to file a tax return?

No, you cannot claim the credit for child and dependent care expenses using Form 2441 if you're not required to file a tax return. You must file a tax return to claim the credit, even if you otherwise would not need to file.

Where do I file IRS Form 2441?

Form 2441 should be completed and attached to your Form 1040 or Form 1040-SR, U.S. Tax Return for Seniors. You must file it with your tax return to the Internal Revenue Service (IRS) by the tax filing deadline, which is typically April 15th, unless an extension has been granted. Electronic filing options are also available and might be preferable for faster processing.

For specific questions about your situation or if you need assistance, consider consulting with a tax professional or visiting the IRS website. They can provide additional information and ensure that you take full advantage of the available tax credits for child and dependent care expenses.

Common mistakes

Filling out IRS Form 2441, which is used for the Child and Dependent Care Expenses Credit, can be complex. People often make several mistakes when completing this form, which can lead to delays or the denial of deserved credits. Here are six common errors:

Not meeting the eligibility requirements: Before filing Form 2441, individuals need to ensure they meet the eligibility requirements. This includes having earned income and the care being necessary for work. Failing to meet these prerequisites can result in the incorrect filing of this form.

Incorrect Social Security numbers: Entering an incorrect Social Security number (SSN) for any person listed on the form—whether it's for the filer, spouse, or dependent—can lead to processing delays or the IRS rejecting the credit claim.

Not reporting all care providers: All individuals or organizations that provided care must be reported, including their names, addresses, and taxpayer identification numbers (TINs). Omitting any care provider can result in a denial of the credit for those expenses.

Failing to differentiate between qualifying persons: Costs must be associated with the care of qualifying persons, such as dependent children under 13 or disabled dependents/spouses. Mixing up or incorrectly allocating expenses between them can adversely affect the credit amount.

Miscalculating expenses: The amount of expenses that can be claimed is subject to various limits and regulations. Overestimating or underestimating these expenses can lead to either a reduced credit or penalties for claiming excessive credit.

Incorrectly filling out the credit amount: The credit is a percentage of allowed child and dependent care expenses. This percentage varies based on income. Filling out this section incorrectly can either leave money on the table or trigger an audit if the credit is overstated.

Making sure these mistakes are avoided can help ensure that the process of claiming the Child and Dependent Care Credit is as smooth and beneficial as possible.

Documents used along the form

When preparing your tax return, particularly focusing on child and dependent care expenses, the IRS Form 2441 is crucial. However, it's often not the only form or document you might need to ensure your taxes are filled out correctly and beneficially. Here's a look at six other forms and documents commonly used in conjunction with IRS Form 2441. Each plays a vital role in the tax preparation process, helping taxpayers navigate their financial responsibilities with ease.

- Form W-10: This form is used to provide the necessary information about the child or dependent care provider. It’s important because it verifies the provider's identification number and address, which are required on Form 2441.

- Form 1040: The U.S. Individual Income Tax Return is where you’ll summarize your overall tax liability. It’s the form that houses the information inputted on Form 2441 and integrates the deductions or credits calculated there into your broader tax picture.

- Schedule C: For those who are self-employed, Schedule C is a necessary document that outlines the profits and losses of your business. Since self-employment income affects eligibility for certain credits, including those related to child and dependent care, it’s directly relevant.

- Schedule 3: This schedule is part of Form 1040. It's used to claim a variety of credits, including the nonrefundable part of the credit for child and dependent care expenses calculated on Form 2441.

- Employer W-2 Forms: W-2 forms report your annual wages and the amount of taxes withheld from your paycheck. Information from your W-2 is necessary for filling out Form 2441, especially if you're claiming dependent care benefits offered by your employer.

- Receipts and Records for Child and Dependent Care Expenses: While not an IRS form, keeping detailed receipts and records of your child and dependent care expenses is essential. These documents support the claims made on your Form 2441 and may be required for verification purposes.

Together with IRS Form 2441, these forms and documents facilitate a thorough and accurate tax preparation process. They ensure that all relevant financial aspects, particularly those relating to child and dependent care, are correctly accounted for. This not only helps in maximizing potential benefits but also in maintaining compliance with tax laws. Always consider consulting with a tax professional to ensure these documents are properly filled out and submitted, optimizing your tax outcome.

Similar forms

The IRS 2441 form, used for claiming child and dependent care expenses, bears resemblance to several other IRS forms, each serving specific purposes but sharing common elements in reporting and deductions. One such form is the Schedule C (Form 1040), utilized by sole proprietors to report the income, gains, losses, deductions, credits, and to figure out the net profit or loss from a business. Similar to Form 2441, Schedule C involves calculating allowable deductions which can affect the taxpayer's overall tax liability, focusing on business-related expenses instead of child and dependent care expenses.

Another related document is the Form 8863, employed for claiming education credits. Like the IRS 2441 form, Form 8863 requires taxpayers to report expenses, in this case, educational expenses, and calculate the credit amount to reduce their tax owed. Both forms aim to provide financial relief by recognizing the importance of supporting significant life activities, albeit in different areas. The process of calculating credits based on expenses directly impacts the taxpayer's taxable income and potentially, their tax refund.

Form 1040, the U.S. Individual Income Tax Return, also shares similarities with the IRS 2441 form. Being the primary form for individuals to file their annual income tax returns, Form 1040 encompasses comprehensive information about the taxpayer's income, deductions, and credits, including those reported on Form 2441. In essence, Form 2441 supplements the information provided in Form 1040 by detailing specific deductible expenses that contribute to the taxpayer's overall credits and taxable income calculation.

Finally, the Schedule A (Form 1040) for itemized deductions parallels the IRS 2441 form in its purpose of reducing taxable income through specific allowable expenses. While Schedule A focuses on a broader range of deductions such as medical and dental expenses, taxes paid, interest paid, gifts to charity, and casualties and theft losses, it operates on a similar principle to Form 2441. Both forms enable taxpayers to lower their tax bill by detailing out-of-pocket expenses incurred throughout the year, ultimately affecting the final tax calculation.

Dos and Don'ts

Filing your IRS 2441 form, also known as the Child and Dependent Care Expenses form, is crucial for claiming the credit for child and dependent care expenses. To ensure you fill out this form correctly, here are some important dos and don’ts:

Do:- Ensure you're eligible for the credit before you start filling out the form. Your expenses must be for the care of a qualifying person, and your purpose for these expenses must be to allow you to work or actively look for work.

- Provide accurate information about the care provider, including their name, address, and Taxpayer Identification Number (TIN) or Social Security Number (SSN).

- Report all relevant expenses. Only certain types of expenses qualify for the credit, such as payments to daycares or individuals providing care inside or outside the home but not payments to relatives younger than 19 at the end of the year or dependents of any age.

- Check your filing status. Generally, to claim the credit, your filing status must be Single, Married Filing Jointly, Head of Household, or Qualifying Widow(er) with a dependent child.

- Keep receipts and records of all child and dependent care expenses. These documents are essential if the IRS requests proof of your expenses.

- Forget to sign your form. An unsigned form is like an incomplete application—it won’t be processed.

- Miss the deadline for filing. Submitting your IRS 2441 form after the deadline may result in you losing out on potential credits.

- Mix personal information. Make sure all personal information, like SSNs and addresses, is accurate and specific to the person or entity it pertains to.

- Estimate expenses. Base your numbers on actual receipts and bank statements to ensure accuracy and avoid issues with the IRS.

- Dismiss the necessity of consulting with a tax advisor if you're unsure of your situation. Tax laws are complex, and professional advice can be invaluable.

Misconceptions

Filing taxes can be complicated, especially when it comes to understanding different forms and their requirements. The IRS Form 2441, which is used for Child and Dependent Care Expenses, is no stranger to misconceptions. Here, we aim to clarify some of the common misunderstandings associated with this form.

Only for child care expenses: A common misconception is that Form 2441 is exclusively for expenses related to child care. In reality, this form can also be used to claim care expenses for dependents of any age who are physically or mentally incapable of self-care, as long as other IRS requirements are met.

Income limits automatically disqualify you: Many people mistakenly believe that high income immediately disqualifies them from claiming expenses on Form 2441. While there are phase-out limits which can reduce the credit amount, there isn't an absolute income cut-off that disallows you from filing the form altogether.

Any type of care qualifies: Not all care expenses are eligible under Form 2441. The care must be necessary to allow you (and your spouse, if filing jointly) to work or look for work. Furthermore, overnight camps or schooling costs for children in kindergarten or above do not qualify.

It directly reduces your taxes: It's easy to confuse tax credits with deductions. Form 2441 provides a tax credit, not a deduction. This means it reduces your tax liability dollar for dollar, rather than reducing your taxable income.

Only one parent can claim in case of joint custody: In situations of divorce or separation, the misconception exists that only one parent (the custodial) is eligible to use Form 2441 for claiming the credit. In reality, the rule is more nuanced, focusing on who the child spent more nights with and who paid the majority of the care expenses.

No benefit for late filers: Some believe that if they file their taxes late, they forfeit the opportunity to claim the Child and Dependent Care Credit. However, you can still claim the credit when you file your return late, though penalties and interest might apply for late filing and payment of taxes owed.

Filing this form is too complicated: While dealing with IRS forms can seem daunting, Form 2441 is not particularly complicated. With clear instructions and plenty of resources available online, including tax software that guides you through the process, many filers can successfully claim their rightful credit without professional help.

Understanding these misconceptions about IRS Form 2441 can demystify the process of claiming your child and dependent care expenses, potentially saving you money and reducing your tax liability. Always consult the latest IRS guidelines or a tax professional if you have specific questions about your situation.

Key takeaways

The IRS 2441 form is crucial for taxpayers who want to claim the Child and Dependent Care Expenses Credit. This credit helps families by decreasing the amount of tax they owe, making it easier to afford care for their children or dependents. Here are four key takeaways to consider when filling out and using the IRS 2441 form:

- Eligibility requirements: To use form 2441, you must be paying someone to care for a dependent under 13, a spouse, or another dependent who cannot take care of themselves. Both you and your spouse must have earned income, unless one is disabled or a full-time student.

- Information needed: Gather all necessary information before filling out the form. This includes the caregiver's name, address, taxpayer identification number (TIN) or Social Security number, and the total amount paid to the caregiver. Additionally, you'll need detailed information regarding the dependent's care, including specific amounts and the purpose of the expense.

- Calculating the credit: The credit is worth between 20% and 35% of your allowable expenses, depending on your adjusted gross income. The maximum amount of expenses you can claim is $3,000 for one qualifying person and $6,000 for two or more qualifying persons.

- Special circumstances: There are various special circumstances that can affect how you fill out Form 2441. For instance, if you're divorced or separated, you may still be able to claim the credit under certain conditions. Also, if your employer provides dependent care benefits, this can impact the amount of credit you're eligible for. It's vital to understand these nuances to maximize your benefit.

Accurately completing the IRS 2441 form ensures that you take full advantage of the Child and Dependent Care Expenses Credit, thereby helping to offset the costs of dependent care. This support is essential for working families, making it easier for them to manage care expenses while maintaining employment.

Popular PDF Documents

Irs Efile 941 - Enables a smooth transition to electronic filing for exempt organizations, ensuring compliance and efficiency in tax submissions.

IRS 5405 - Submitting IRS Form 5405 is a step required for taxpayers who are adjusting their first-time homebuyer credit for any reason.

IRS 4868 - Taxpayers should consider state tax implications when filing Form 4868, as not all states automatically recognize the federal extension.