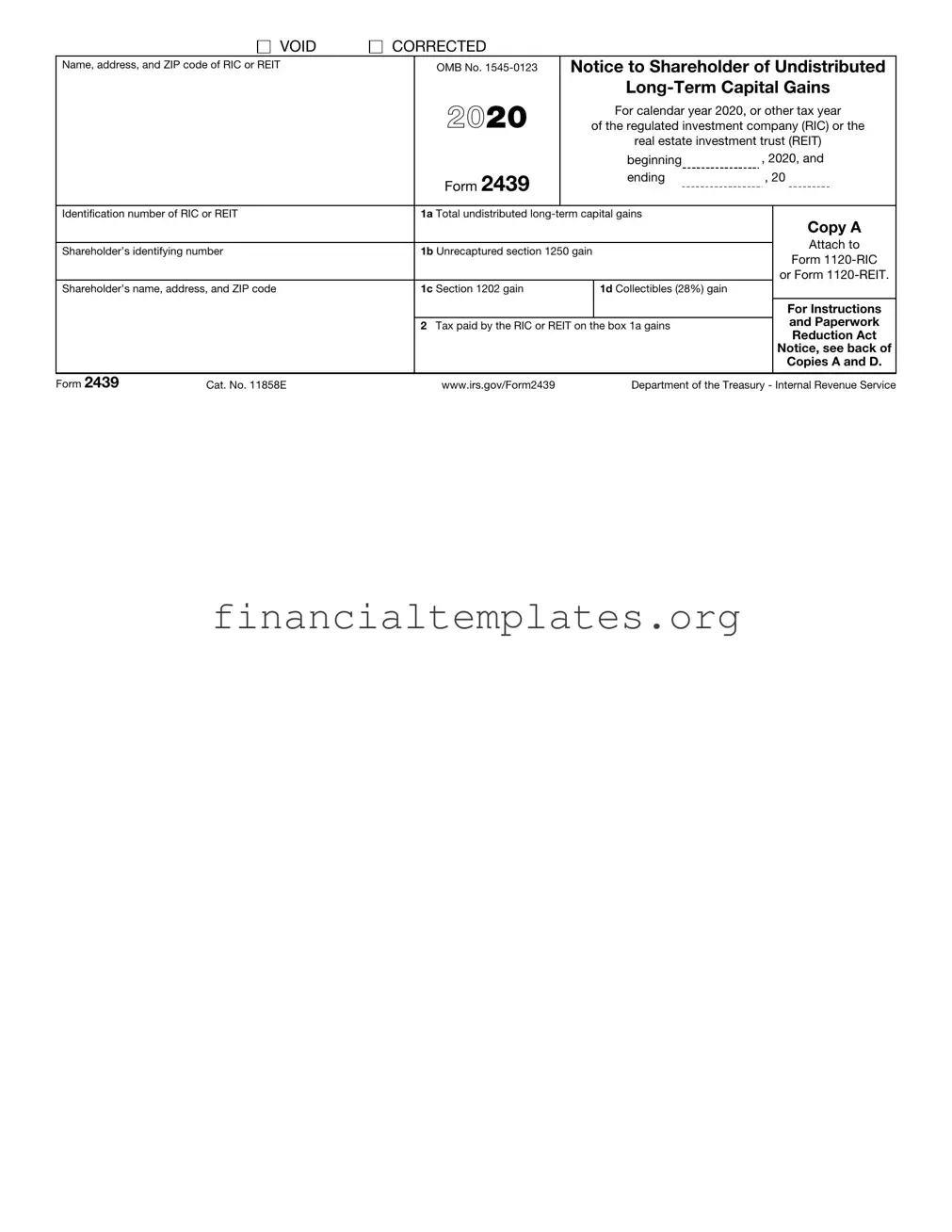

Get IRS 2439 Form

For investors who earn income from their investments in certain mutual funds or real estate investment trusts (REITs), understanding the significance of the IRS Form 2439 is essential. This document plays a pivotal role in tax reporting for shareholders who receive capital gains distributions that have been retained by the fund or trust, rather than distributed. Essentially, it serves as a notification to shareholders of the amount of undistributed capital gains, and provides essential information needed to adjust the cost basis of their investment. Furthermore, Form 2439 informs shareholders of the tax credit they may claim for the taxes paid by the fund or REIT on these gains. Knowing how to properly use this form can lead to more accurate tax reporting, potentially saving investors from overpaying on their taxes. Within this context, the form acts as a critical link between the tax obligations of the fund or trust and the individual tax responsibilities of the investor, emphasizing the interconnected nature of investment income taxation.

IRS 2439 Example

VOID

CORRECTED

Name, address, and ZIP code of RIC or REIT |

OMB No. |

Notice to Shareholder of Undistributed |

|||||

|

|

|

|

||||

|

|

|

|

For calendar year 20 |

, or other tax year |

||

|

|

Form 2439 |

|

of the regulated investment company (RIC) or the |

|||

|

|

|

real estate investment trust (REIT) |

||||

|

|

(Rev. November 2021) |

|

beginning |

, 20 |

, and |

|

|

|

|

|

||||

|

|

|

|

ending |

, 20 |

|

|

|

|

|

|

|

|

|

|

Identification number of RIC or REIT |

|

1a Total undistributed |

|

|

Copy A |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach to |

Shareholder’s identifying number |

|

1b Unrecaptured section 1250 gain |

|

|

|||

|

|

|

Form |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or Form |

Shareholder’s name, address, and ZIP code |

1c Section 1202 gain |

|

1d Collectibles (28%) gain |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Instructions |

|

|

2 Tax paid by the RIC or REIT on the box 1a gains |

|

|

and Paperwork |

||

|

|

|

|

|

|

|

Reduction Act |

|

|

|

|

|

|

|

Notice, see back of |

|

|

|

|

|

|

|

Copies A and D. |

|

|

|

|

|

|

||

Form 2439 (Rev. |

Cat. No. 11858E |

www.irs.gov/Form2439 |

|

Department of the Treasury - Internal Revenue Service |

|||

Instructions for the Regulated Investment Company (RIC) and the Real Estate Investment Trust (REIT)

Section references are to the Internal Revenue Code.

Reporting Information

1.Complete Copies A, B, C, and D for each shareholder for whom the regulated investment company (RIC) or real estate investment trust (REIT) paid tax on undistributed capital gains under section 852(b)(3)(D) or 857(b)(3)(C).

2.Attach Copy A of all Forms 2439 to Form

3.Furnish Copies B and C of Form 2439 to the shareholder by the 60th day after the end of the RIC’s or the REIT’s tax year.

4.Retain Copy D for the RIC’s or REIT’s records.

▲ |

For a shareholder that is an individual retirement |

|

! |

||

arrangement (IRA), send Copies B and C to the trustee or |

||

custodian of the IRA. Do not send copies to the owner of |

||

CAUTION |

the IRA. |

RIC’s or REIT’s name, address, and identification number. Enter the name, address (including ZIP code) and employer identification number (EIN) of the RIC or REIT as shown on Form 2438, Undistributed Capital Gains Tax Return.

Shareholder’s identifying number, name, and address. Enter the shareholder’s social security number (SSN), name, and address (including ZIP code). If the shareholder is not an individual, enter the EIN. If a shareholder is an IRA, enter the identification number of the IRA trust. Do not enter the SSN of the person for whom the IRA is maintained.

The RIC or REIT can truncate a shareholder’s identifying number on the Form 2439 the RIC or REIT sends to the shareholder. Truncation is not allowed on the Form 2439 the RIC or REIT files with the IRS. Also, the RIC or REIT cannot truncate its own identification number on any form.

To truncate, where allowed, replace the first 5 digits of the

Box 1a. Enter the amount of undistributed capital gains from line 11, Form 2438 (Rev. December 2020) or the applicable line of the current revision of the form, allocable to the shareholder.

(Continued on the back of Copy D)

VOID

CORRECTED

Name, address, and ZIP code of RIC or REIT |

|

OMB No. |

Notice to Shareholder of Undistributed |

||||

|

|

|

|

||||

|

|

|

|

For calendar year 20 |

, or other tax year |

||

|

|

Form 2439 |

|

of the regulated investment company (RIC) or the |

|||

|

|

|

real estate investment trust (REIT) |

||||

|

|

(Rev. November 2021) |

|

beginning |

, 20 |

, and |

|

|

|

|

|

||||

|

|

|

|

ending |

, 20 |

|

|

|

|

|

|

|

|

|

|

Identification number of RIC or REIT |

|

1a Total undistributed |

|

|

Copy B |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach to the |

Shareholder’s identifying number |

|

1b Unrecaptured section 1250 gain |

|

|

|||

|

|

|

shareholder’s |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

income tax return |

Shareholder’s name, address, and ZIP code |

|

1c Section 1202 gain |

|

1d Collectibles (28%) gain |

|

|

for the tax year |

|

|

|

|

|

|

|

that includes the |

|

|

|

|

|

|

|

last day of the |

|

|

2 Tax paid by the RIC or REIT on the box 1a gains |

|

|

|||

|

|

|

|

RIC’s or REIT’s |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

tax year. |

|

|

|

|

|

|

||

Form 2439 (Rev. |

www.irs.gov/Form2439 |

|

Department of the Treasury - Internal Revenue Service |

||||

Instructions for the Shareholder

Section references are to the Internal Revenue Code.

Reporting Information

Shareholder’s identifying number. For your protection, Form 2439 may show only the last four digits of your identifying number (social security number (SSN), etc.). However, the RIC or REIT has reported your complete identifying number to the IRS.

Box 1a. This amount is your total undistributed

Report the total amount as a

Corporate shareholders report this amount in Part II of Form 8949. See Form 8949, Schedule D (Form 1120), and the related instructions for details.

If there is an amount in box 1b, 1c, or 1d, special instructions apply for entering those amounts on the appropriate Schedule D.

See Undistributed Capital Gains in the Schedule D (Form 1040) and Schedule D (Form 1041) instructions.

Box 1b. This amount is the unrecaptured section 1250 gain. Individual filers report this amount on line 11 of the Unrecaptured Section 1250 Gain Worksheet in the Schedule D (Form 1040) instructions for 2021 or the applicable line of the worksheet in the instructions for the current year. Estates and trusts use this amount to complete the Unrecaptured Section 1250 Gain Worksheet in the Schedule D (Form 1041) instructions.

Box 1c. This amount applies to the portion of the amount in box 1a attributable to a section 1202 gain (sale of qualified small business stock). Individual filers, see Exclusion of Gain on Qualified Small Business (QSB) Stock in the Schedule D (Form 1040) instructions. Estates and trusts, see Exclusion of Gain on Qualified Small Business (QSB) Stock (Section 1202) in the Schedule D (Form 1041) instructions.

Box 1d. This amount is the collectibles gain (28% rate gain) portion of the amount in box 1a. Individual filers enter this amount on line 4 of the 28% Rate Gain Worksheet in the Schedule D (Form 1040) instructions for 2021 or the applicable line of the worksheet in the instructions for the current year. Estates and trusts use this amount to complete the 28% Rate Gain Worksheet in the Schedule D (Form 1041) instructions.

Box 2. This amount is the tax paid by the RIC or REIT on the undistributed

(Continued on the back of Copy C)

VOID

CORRECTED

Name, address, and ZIP code of RIC or REIT |

OMB No. |

Notice to Shareholder of Undistributed |

||||

|

|

|

||||

|

|

|

For calendar year 20 |

, or other tax year |

||

|

Form 2439 |

|

of the regulated investment company (RIC) or the |

|||

|

|

real estate investment trust (REIT) |

||||

|

(Rev. November 2021) |

|

beginning |

, 20 |

, and |

|

|

|

|

||||

|

|

|

ending |

, 20 |

|

|

|

|

|

|

|

|

|

Identification number of RIC or REIT |

1a Total undistributed |

|

|

|

||

|

|

|

|

|

|

|

Shareholder’s identifying number |

1b Unrecaptured section 1250 gain |

|

|

|

||

|

|

|

|

|

|

Copy C |

Shareholder’s name, address, and ZIP code |

1c Section 1202 gain |

|

1d Collectibles (28%) gain |

|

|

For shareholder’s |

|

|

|

|

|

|

records. |

|

|

|

|

|

|

|

2Tax paid by the RIC or REIT on the box 1a gains

Form 2439 (Rev. |

www.irs.gov/Form2439 |

Department of the Treasury - Internal Revenue Service |

Instructions for the Shareholder (Continued)

Individuals, nonresident aliens, and estates and trusts. See line 13a of Schedule 3 (Form 1040) of the 2021 form or the applicable line on the current year form, or Schedule G, line 16a of Form 1041 of the 2021 form or the applicable line on the current year form, and the related instructions.

Corporations (other than S corporations). See Schedule J, line 20a of Form 1120 of the 2021 form or the applicable line on the current year form, or line 5f of Form

S corporations and partnerships. See the Specific Instructions for Schedules K and

Exempt organizations and certain trustees. See the Instructions for Form

1.Organizations exempt from tax under section 501(a) filing Form

2.Trustees for individual retirement arrangements (IRAs) described in section 408 (including accounts described in section 408(h)) filing a single composite Form

Nominees. If you are not the actual owner of the shares for which this form is issued, you must do the following.

1.Complete Copies A, B, C, and D of Form 2439 for each owner. The total undistributed

2.Enter your name as “Nominee” and your address in the block for the RIC’s or REIT’s name and address, and the RIC’s or REIT’s name and address in the same block.

3.Write “Nominee” in the upper right corner of the Copy B you received from the RIC or REIT and attach it to the Copy A you completed.

4.File the Copy B you received (with an attached Copy A) with the Internal Revenue Service Center where you file your income tax return.

5.Give the actual owner Copies B and C of the forms you complete.

6.Copy D is to be maintained by the RIC or REIT.

A nominee has 90 days after the close of the RIC’s or REIT’s tax year to complete items 1 through 5 above. However, a nominee acting as a custodian of a unit investment trust described in section 851(f)(1) has 70 days. A nominee who is a resident of a foreign country has 150 days.

VOID

CORRECTED

Name, address, and ZIP code of RIC or REIT |

|

OMB No. |

Notice to Shareholder of Undistributed |

||||

|

|

|

|

||||

|

|

|

|

For calendar year 20 |

, or other tax year |

||

|

|

Form 2439 |

|

of the regulated investment company (RIC) or the |

|||

|

|

|

real estate investment trust (REIT) |

||||

|

|

(Rev. November 2021) |

|

beginning |

, 20 |

, and |

|

|

|

|

|

||||

|

|

|

|

ending |

, 20 |

|

|

|

|

|

|

|

|

|

|

Identification number of RIC or REIT |

|

1a Total undistributed |

|

|

|

||

|

|

|

|

|

|

|

Copy D |

Shareholder’s identifying number |

|

1b Unrecaptured section 1250 gain |

|

|

|||

|

|

|

For records of the |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

regulated |

Shareholder’s name, address, and ZIP code |

|

1c Section 1202 gain |

|

1d Collectibles (28%) gain |

|

|

investment |

|

|

|

|

|

|

|

company or the |

|

|

|

|

|

|

|

real estate |

|

|

2 Tax paid by the RIC or REIT on the box 1a gains |

|

|

|||

|

|

|

|

investment trust. |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Form 2439 (Rev. |

www.irs.gov/Form2439 |

|

Department of the Treasury - Internal Revenue Service |

||||

Instructions for the RIC and the REIT

(Continued)

Box 1b. Enter the shareholder’s allocable portion of the amount from box 1a that has been designated as unrecaptured section 1250 gain from the disposition of depreciable real property.

Box 1c. The section 1202 gain is the portion of box 1a that is attributable to the sale or exchange by the RIC of qualified small business stock issued after August 10, 1993, and held for more than 5 years. Enter the shareholder’s allocable portion of the amount from box 1a attributable to a section 1202 gain. In addition, attach a statement that reports separately for each designated section 1202 gain the following information: the amount of the section 1202 gain, the name of the corporation that issued the stock, the dates on which the RIC acquired and sold the stock, and the shareholder’s portion of the RIC’s adjusted basis and sales price of the stock.

Box 1d. Enter the shareholder’s allocable portion of the amount from box 1a attributable to collectibles gain (28% rate gain). Do not include any section 1202 gain in box 1d.

Box 2. Enter the tax paid on the amount in box 1a.

Future developments. For the latest information about developments related to Form 2439 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form2439.

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for business taxpayers filing this form is approved under OMB control number

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can send us comments from www. irs.gov/FormComments. Or you can write to the Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form | The IRS Form 2439 is used to report undistributed long-term capital gains to shareholders of a regulated investment company (RIC) or a real estate investment trust (REIT). |

| Shareholder Benefit | Shareholders can increase their basis in the RIC or REIT by the amount of undistributed capital gains reported, effectively deferring tax until the sale of the investment. |

| Tax Payment | The RIC or REIT pays tax on the undistributed capital gains at the corporate rate, allowing shareholders to recognize these gains without immediate taxation. |

| Notification Requirement | RICs and REITs must send Form 2439 to their shareholders and file a copy with the IRS, ensuring both parties are aware of the capital gains distribution. |

| Due Date | Form 2439 must be filed by the end of the first month following the close of the RIC or REIT's tax year, ensuring timely reporting of distributions. |

| Governing Laws | This form is governed by U.S. federal tax laws, specifically relating to the taxation of corporations and partnerships as outlined in the Internal Revenue Code (IRC). |

Guide to Writing IRS 2439

Filling out IRS Form 2439 can seem like a daunting task at first. However, with the right guidance, you can complete the form accurately and on time. This form is all about reporting undistributed long-term capital gains to the IRS. Shareholders involved will also use this information when filing their personal tax returns. Let’s walk through the steps needed to fill out the form correctly. Ensuring each line is completed with the proper information will help both you and the IRS process the form efficiently.

- Start by gathering all necessary information regarding the undistributed capital gains. This includes the total gains that were not distributed to shareholders during the tax year.

- Enter the name of the regulated investment company (RIC) or real estate investment trust (REIT) on the appropriate line.

- Fill in the employer identification number (EIN) for the RIC or REIT in the designated space.

- Next, input the total undistributed capital gains in the box for line 1. This amount should match the total gains calculated before starting the form.

- Determine the tax due on these undistributed capital gains. Refer to the instructions provided by the IRS to calculate this amount correctly, and enter it on line 2.

- On line 3, write down the overpayment amount, if applicable. This could be a credit from the previous year or any amount already paid towards the tax due on these gains.

- Line 4 is where you input the amount of tax due after subtracting any overpayment from line 3 from the tax calculated on line 2.

- Indicate the total amount of undistributed capital gains designated for each shareholder on line 5. This should be proportional to the shares they hold.

- Fill in the date and the tax year for which form 2439 is being filed.

- Lastly, ensure that a duly authorized person signs the form, verifying that all the information provided is accurate and complete.

After completing IRS Form 2439, keep a copy for your records and distribute copies to all affected shareholders. They will need this information to properly report their share of the undistributed capital gains on their own tax returns. Remember, accuracy is key when dealing with tax forms to avoid any potential issues with the IRS down the line.

Understanding IRS 2439

-

What is an IRS 2439 form and who needs to file it?

The IRS 2439 form is utilized to report undistributed long-term capital gains by regulated investment companies (RICs) or real estate investment trusts (REITs) to their shareholders and the IRS. This form serves a dual purpose: it notifies shareholders of the capital gain distributions they are entitled to and allows them to claim a credit for the taxes the RIC or REIT paid on those distributions. Shareholders of RICs or REITs are typically the ones who need to file this form, specifically if they have reinvested their capital gains distributions back into the fund or trust.

-

How does a shareholder benefit from Form 2439?

When shareholders receive a Form 2439, they benefit in a couple of key ways. First, they are credited with their share of the tax the RIC or REIT has already paid on the undistributed capital gains. This effectively increases their cost basis in the investment, which may reduce taxable gains or increase a loss for tax purposes when they sell their shares. Second, shareholders can claim a refundable credit on their individual tax return for the amount of tax reported as paid on their behalf by the RIC or REIT. This ensures that shareholders are not doubly taxed on these distributions.

-

Are there any deadlines associated with filing Form 2439?

Yes, deadlines play a crucial role in the filing of Form 2439. RICs and REITs must furnish Form 2439 to their shareholders by the due date of their income tax return, including extensions. This is typically on or before April 15 for most companies. Shareholders, on their part, should include the information from Form 2439 in their personal income tax returns. This inclusion ensures that they claim the tax credit and adjust their stock basis accordingly, in line with the tax year in which the undistributed capital gains were reported.

-

What are the implications if a shareholder does not use Form 2439 correctly?

If shareholders fail to correctly incorporate the information from Form 2439 into their tax returns, they may miss out on claiming a credit for taxes already paid on their behalf, leading to potential overpayment of taxes. Additionally, not adjusting their cost basis to reflect the distributed but undistributed capital gains could result in a higher tax liability when they sell their shares. It's critical for shareholders to ensure that they fully comprehend how to apply the details of Form 2439 to their tax filings to maximize their benefits and comply with IRS regulations.

Common mistakes

Filling out tax forms can be a daunting task, and the IRS 2439 form is no exception. It's essential to pay close attention to detail when completing this form to ensure accuracy and compliance with tax laws. Here are seven common mistakes people make when filling out the IRS 2439 form:

-

Not checking the form version. Tax forms are updated regularly. Using an outdated version of the IRS 2439 can lead to errors in filing.

-

Failing to report all required information. Every section of the form is important. Omitting information can result in processing delays or an incorrect tax calculation.

-

Incorrectly calculating the undistributed capital gains. This is a common error that can affect the tax owed or the refund expected.

-

Misunderstanding the taxpayer's role. Whether you're a nominee or the actual recipient, understanding your role in relation to the form is crucial for accurate completion.

-

Overlooking the need for supporting documentation. Supporting documents must accompany the form to validate the information submitted.

-

Not utilizing the instructions provided by the IRS. The IRS provides detailed instructions for the IRS 2439 form, ignoring these can lead to mistakes in how the form is completed.

-

Forgetting to sign and date the form. An unsigned form is considered incomplete and can be rejected or lead to processing delays.

To avoid these mistakes:

Always use the latest version of the form.

Complete every section, providing all required information.

Accurately calculate all figures, double-checking your math.

Ensure you understand your role in relation to the form.

Gather and attach all necessary supporting documents.

Review the official IRS instructions carefully.

Check that the form is signed and dated before submission.

Being meticulous and thorough when completing the IRS 2439 form can save time, prevent delays, and avoid potential legal issues down the road.

Documents used along the form

Completing tax-related forms requires careful attention to detail and an understanding of which documents are needed to support the filing. The IRS 2439 form, known as the "Notice to Shareholder of Undistributed Long-Term Capital Gains," is often accompanied by other forms and documents. These documents are essential for shareholders and mutual funds to accurately report and pay taxes on undistributed long-term capital gains. Below is a list of other forms and documents frequently used alongside the IRS 2439 form, each serving a specific purpose in the tax filing process.

- Form 1040: The U.S. Individual Income Tax Return is the backbone of personal tax filing, used to report an individual's financial income and calculate their tax liability.

- Form 1099-DIV: Dividends and Distributions form is issued by banks and other financial institutions to report dividends and distributions, crucial for determining the tax owed on investments.

- Schedule D (Form 1040): Used to report capital gains and losses from transactions, this schedule is vital for accurately documenting investment performance over the financial year.

- Form 8960: Net Investment Income Tax form calculates the tax owed on certain types of investment income by individuals, estates, and trusts.

- Form 1041: The U.S. Income Tax Return for Estates and Trusts is required for reporting income, gains, losses, and other financial activities related to estates and trusts.

- Form 8949: Sales and Other Dispositions of Capital Assets form is necessary for detailing the sale or exchange of capital assets not reported directly on Schedule D.

- Form 8606: Nondeductible IRAs form is used to report contributions to and distributions from traditional IRAs and Roth IRAs, ensuring correct taxation.

- Form 5500: Annual Return/Report of Employee Benefit Plan provides information on the condition, investments, and operations of pension and other employee benefit plans.

- Form 1120-POL: U.S. Income Tax Return for Certain Political Organizations is required for political organizations to report their taxable income and expenses.

- Form W-2: Wage and Tax Statement, issued by employers to employees, documents wages earned and taxes withheld, a fundamental document for personal tax filings.

Understanding the role and requirements of each of these forms and documents can significantly streamline the tax filing process. Accurate and timely submission of these forms, in conjunction with IRS 2439, ensures compliance with IRS regulations and helps taxpayers avoid potential penalties. Whether you are preparing your taxes independently or with the assistance of a professional, being familiar with these documents will equip you with the knowledge needed for a stress-free filing experience.

Similar forms

The IRS 2439 form is akin to the IRS 1099-DIV form, primarily because both are used to report distributions. While the 2439 form is specific to reporting undistributed long-term capital gains by mutual funds or real estate investment trusts (REITs) paid to shareholders and taxes paid on those gains, the 1099-DIV covers dividends and distributions on all sorts of investments. Each serves the purpose of informing investors and the IRS about income that may affect the investor's tax liability.

Similar to the IRS 2441 form, the IRS 2439 connects with tax benefits, albeit with a different focus. The 2441 form is used for child and dependent care expenses, offering taxpayers a way to deduct care-related expenses from their taxable income. Despite their different applications — investment income versus care expenses — both forms feed into an individual's overall tax situation by providing mechanisms to reduce taxable income or report income that might not be captured through traditional wages.

The IRS 1099-INT form shares its purpose with the 2439 form as they both report income types that could impact an individual's annual taxes. While the 2439 form deals with undistributed capital gains from mutual funds or REITs, the 1099-INT form reports interest income from various sources like savings accounts and interest-bearing investments. Both are critical for accurately reporting income to avoid potential issues with the IRS.

The IRS Schedule D (Form 1040) is closely related to the IRS 2439 in the sense that it is essential for reporting capital gains and losses. Investors use Schedule D to summarize capital gains and losses from all sources, including those reported on form 2439. The information from 2439 helps to complete Schedule D, which in turn affects the taxpayer’s overall capital gains tax liability.

Similarly, the IRS 8960 form is related due to its role in calculating the Net Investment Income Tax, which might include income reported on form 2439. This form targets individuals, estates, and trusts with income above certain thresholds and involves a tax on investment income. Given that undistributed capital gains can form part of an individual's investment income, the 2439's reporting feeds into the calculation of potential liability on the 8960 form.

Another comparable document is the IRS 1041 form, used by estates and trusts to report income, deductions, gains, losses, and taxes due. Since trusts and estates can own shares in mutual funds or REITs, they may need to utilize information from the 2439 form for accurate 1041 completion. The interconnectedness of these forms underscores the complexity of tax reporting for entities with investment incomes.

The IRS 8824 form, albeit focusing on like-kind exchanges under Section 1031, shares a connection with the 2439 form through the principle of deferring taxes on certain kinds of income. While the 2439 form deals with capital gains that have been taxed at the fund level, the 8824 form pertains to the deferral of taxes on the exchange of real estate used for business or investment. Both offer strategies for managing tax liabilities related to investments.

The IRS W-9 form, although not a tax reporting form per se, is indirectly related to the 2439 form since it is often required by financial institutions to ensure accurate tax reporting on accounts. The W-9 form provides taxpayer identification numbers (TINs) to entities that pay dividends, interest, or other forms of income. In cases where 2439 income is reported, a W-9 may have been on file to assist in the accurate reporting and withholding as necessary.

Lastly, the IRS 706 form, used for reporting estate taxes, intersects with the IRS 2439 in scenarios where estates earn income from investments in mutual funds or REITs. Although the 706 form is primarily concerned with the valuation of an estate and its tax liabilities upon the death of an individual, capital gains and other investment income reported via form 2439 can affect the overall taxable estate value. Understanding the nuances of how these forms interact ensures comprehensive tax planning and reporting.

Dos and Don'ts

Filing tax forms correctly is crucial to ensuring compliance with IRS regulations. When dealing with Form 2439, "Notice to Shareholder of Undistributed Long-Term Capital Gains," there are specific practices to follow for accuracy and completeness. Below are key dos and don'ts to consider.

Do:

- Read the instructions provided by the IRS for Form 2439 carefully. Understanding each section ensures that you fill out the form correctly.

- Verify the taxpayer identification numbers (TINs) for both the mutual fund (or other regulated investment company) and the shareholder. Accurate identification is essential for the IRS to process the form efficiently.

- Report the correct amount of undistributed long-term capital gains. This figure should match the records of the fund distributing the gains.

- Keep a copy of the completed Form 2439 for your records. Retaining financial documents is important for future reference and can be helpful in case of audit.

Don't:

- Do not overlook the need to attach Form 2439 to your tax return. Filing this form separately from your tax return could lead to processing delays or errors.

- Avoid making estimations or rounding off figures. It's imperative to use exact amounts as reported by the fund to ensure accurate tax reporting.

- Do not ignore IRS deadlines. Submitting Form 2439 after the deadline can result in penalties or interest charges on any taxes due.

- Do not forget to report any foreign taxes paid on these gains, if applicable. This information is crucial for taxpayers who are eligible to claim a foreign tax credit.

Misconceptions

Taxpayers and investors often encounter confusion when dealing with the IRS Form 2439, "Notice to Shareholder of Undistributed Long-Term Capital Gains." This confusion stems from common misconceptions about the form's purpose, requirements, and implications. Clarification of these misunderstandings is crucial to ensure accurate tax reporting and compliance.

Misconception 1: Form 2439 is only for large investors. In reality, any shareholder who receives a distribution of undistributed long-term capital gains from a regulated investment company (RIC) or a real estate investment trust (REIT) may need to file Form 2439. This includes individual investors, not just institutional or large-scale investors.

Misconception 2: Only the entity (RIC or REIT) needs to worry about Form 2439. While it's true that these entities are responsible for issuing Form 2439, shareholders must still report the information on their own tax returns. Failure to do so could result in underreported income and potential penalties.

Misconception 3: Form 2439 reports regular income distributions. This form specifically deals with undistributed long-term capital gains, not ordinary dividend income. It's crucial to distinguish this form from others, like the 1099-DIV, which reports dividend income.

Misconception 4: Filing Form 2439 is optional. When a shareholder receives Form 2439, reporting the information on their tax return is mandatory. This form results in a tax credit for the shareholder, offsetting the tax paid by the entity on the shareholder's behalf.

Misconception 5: Taxes have already been paid, so reporting is unnecessary. Although the RIC or REIT pays taxes on undistributed gains, shareholders must still report these gains and the associated credit on their returns. This ensures the gains are taxed at the shareholder's rate, potentially resulting in a refund due to the tax payment by the entity.

Misconception 6: Form 2439 increases the taxpayer's total tax liability. While it does report additional income, Form 2439 also provides a credit for taxes already paid. This often results in a neutral effect or potential tax advantage, rather than an increased liability.

Misconception 7: There are no deadlines for reporting Form 2439. Shareholders should report the information in the tax year they receive the form. Delaying could complicate the tax return process and potentially lead to interests or penalties for underpayment.

Misconception 8: Only U.S. citizens need to file Form 2439. Non-resident aliens and foreign entities may also need to file if they receive distributions from a RIC or REIT. Tax treaty positions may affect the reporting and taxation, making it essential for international investors to understand their obligations.

Misconception 9: Software will automatically handle Form 2439. While many tax software programs assist with this, taxpayers are responsible for ensuring all data from Form 2439 is correctly entered. This might require manual input or a review of the software's handling of the form to ensure accuracy.

Understanding these misconceptions about Form 2439 can help taxpayers and investors navigate their tax obligations more effectively. Accurate reporting is essential for compliance and to take advantage of potential tax benefits associated with undistributed long-term capital gains from RICs and REITs.

Key takeaways

When it comes to working with the Internal Revenue Service (IRS) Form 2439, it is crucial to grasp its purpose, the process of filling it out correctly, and the implications it has for taxpayers. This form is titled "Notice to Shareholder of Undistributed Long-Term Capital Gains" and plays a pivotal role for shareholders in mutual funds or Real Estate Investment Trusts (REITs). Understanding the key aspects of IRS Form 2439 can make a significant difference in managing tax obligations efficiently. Here are ten critical takeaways that can help in navigating this form:

- Understanding Form 2439: IRS Form 2439 is a notice from mutual funds or REITs to their shareholders about the amount of undistributed long-term capital gains. These gains are allocated to the shareholders even though the gains have not been physically distributed.

- Importance for Shareholders: Receiving Form 2439 indicates that a shareholder is entitled to a share of the undistributed long-term capital gains. This has implications for the shareholder's tax return, as these gains must be reported even in the absence of a direct payment.

- Reporting Requirements: Shareholders must report the undistributed gains shown on Form 2439 in their tax returns. Specifically, these gains should be reported on Schedule D (Form 1040), which is used to report capital gains and losses.

- Tax Credit for Shareholders: Form 2439 also reports a tax credit for the income tax paid by the mutual fund or REIT on the undistributed long-term capital gains. This credit is available to the shareholder to offset their tax liability.

- Correct Filing Status: It’s pivotal for shareholders to ensure that they have the correct filing status when reporting information from Form 2439. This status influences tax rates and the treatment of capital gains.

- Timeliness is Key: Efficient handling of Form 2439 is critical. Shareholders should include the reported amounts and tax credit in their tax return for the year in which the form was received.

- Documentation Retention: Keeping a copy of Form 2439 is advisable as part of one's financial records. This document may be needed for future reference, such as when calculating the basis of stock holdings.

- Impact on Basis: The undistributed capital gains reported on Form 2439 increase the shareholder’s basis in the mutual fund or REIT. This adjusted basis will affect the calculation of gain or loss when the shares are sold.

- Electronic Filing Preferences: While the IRS has been expanding electronic filing options for various tax forms, filers should verify whether Form 2439 can be filed electronically or if a paper copy needs to be submitted.

- Seek Professional Advice: Due to the complexities surrounding tax reporting and the potential for significant financial impact, consulting with a tax professional or financial advisor experienced with Form 2439 and investment-related tax issues is highly recommended.

Navigating the intricacies of Form 2439 is integral for shareholders to accurately fulfill their tax obligations and make informed decisions regarding their investments. Armed with these key takeaways, shareholders can approach their tax planning and investment strategy with greater confidence and clarity.

Popular PDF Documents

How to Get Certificate of Tax Clearance - Direct engagement with tax authorities via the TC1 form is an essential step for businesses and individuals in regulated sectors.

3,800 - By using this form, businesses can consolidate their credit claims in a structured manner.

Are Irs Whistleblower Anonymous - Through this form, the IRS empowers individuals to contribute to the integrity of the tax system.