Get IRS 2210 Form

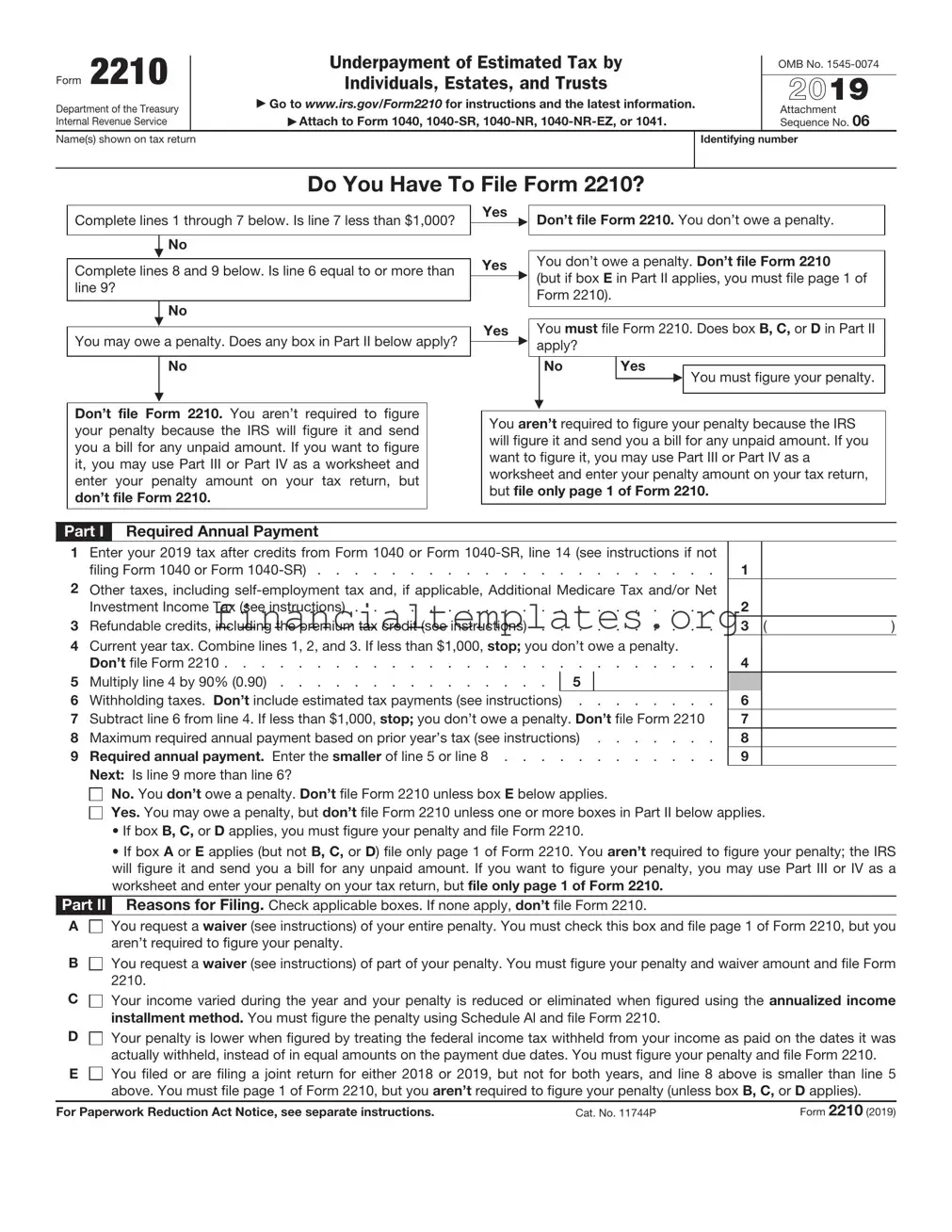

The United States tax system operates under the premise of pay-as-you-go, requiring taxpayers to make payments on their income as it is earned throughout the year. This framework ensures that the government has a steady inflow of revenue to fund its operations and services. For individuals whose earnings are not subject to withholding taxes—like self-employed professionals, investors, or those with significant income from other sources—navigating this system can be complex. The Internal Revenue Service (IRS) Form 2210 plays a crucial role in this context. It is designed for taxpayers who may need to calculate and justify underpayment or overpayment of their estimated tax throughout the year. Understanding and accurately completing this form is essential to avoid potential penalties for underpayment, ensuring taxpayers are compliant with federal tax obligations. It encapsulates various scenarios such as changes in income, unexpected financial gains, or deductions that can alter estimated tax calculations during the year, providing a structured way to report these fluctuations to the IRS. Accurately engaging with Form 2210 can save taxpayers time and financial resources, making it an integral part of annual tax filings for those who do not have taxes automatically withheld.

IRS 2210 Example

Form 2210 |

Underpayment of Estimated Tax by |

|

OMB No. |

||

|

|

|

|||

|

|

|

|

|

|

|

|

Individuals, Estates, and Trusts |

|

|

|

|

|

|

2021 |

||

|

|

▶ Go to www.irs.gov/Form2210 for instructions and the latest information. |

|

||

Department of the Treasury |

|

|

Attachment |

||

|

|

|

|

||

Internal Revenue Service |

|

▶ Attach to Form 1040, |

|

Sequence No. 06 |

|

Name(s) shown on tax return |

|

|

Identifying number |

||

|

|

|

|

|

|

Do You Have To File Form 2210?

Complete lines 1 through 7 below. Is line 4 or line 7 less than $1,000?

No

▼

Complete lines 8 and 9 below. Is line 6 equal to or more than line 9?

No

▼

You may owe a penalty. Does any box in Part II below apply?

No

▼

Don’t file Form 2210. You aren’t required to figure your penalty because the IRS will figure it and send you a bill for any unpaid amount. If you want to figure it, you may use Part III as a worksheet and enter your penalty amount on your tax return, but don’t file Form 2210.

|

Yes |

Don’t file Form 2210. You don’t owe a penalty. |

|

|

|

▶ |

|

|

|

||

|

Yes |

|

|

|

|

||

|

|

||

|

You don’t owe a penalty. Don’t file Form 2210 unless |

||

|

|

▶ |

box E in Part II applies, then file page 1 of Form 2210. |

|

|

||

|

|

|

|

|

|

|

|

|

Yes |

You must file Form 2210. Does box B, C, or D in Part II |

|

▶apply?

No |

Yes |

|

||

You must figure your penalty. |

||||

|

|

▶ |

||

|

|

|||

|

|

|

|

|

▼

You aren’t required to figure your penalty because the IRS will figure it and send you a bill for any unpaid amount. If you want to figure it, you may use Part III as a worksheet and enter your penalty amount on your tax return, but file only page 1 of Form 2210.

Part I Required Annual Payment

1Enter your 2021 tax after credits from Form 1040,

instructions if not filing Form 1040.) |

1 |

2Other taxes, including

Investment Income Tax (see instructions) |

2 |

|

|

3 Other payments and refundable credits (see instructions) |

3 |

( |

) |

4Current year tax. Combine lines 1, 2, and 3. If less than $1,000, stop; you don’t owe a penalty.

|

Don’t file Form 2210 |

4 |

|

||

5 |

Multiply line 4 by 90% (0.90) |

5 |

|

|

|

6 |

Withholding taxes. Don’t include estimated tax payments. See instructions |

6 |

|

||

7 |

Subtract line 6 from line 4. If less than $1,000, stop; you don’t owe a penalty. Don’t file Form 2210 |

7 |

|

||

8 |

Maximum required annual payment based on prior year’s tax (see instructions) |

8 |

|

||

9 |

Required annual payment. Enter the smaller of line 5 or line 8 |

9 |

|

||

|

Next: Is line 9 more than line 6? |

|

|

|

|

No. You don’t owe a penalty. Don’t file Form 2210 unless box E below applies.

Yes. You may owe a penalty, but don’t file Form 2210 unless one or more boxes in Part II below applies.

•If box B, C, or D applies, you must figure your penalty and file Form 2210.

•If box A or E applies (but not B, C, or D), file only page 1 of Form 2210. You aren’t required to figure your penalty; the IRS will figure it and send you a bill for any unpaid amount. If you want to figure your penalty, you may use Part III as a worksheet and enter your penalty on your tax return, but file only page 1 of Form 2210.

Part II Reasons for Filing. Check applicable boxes. If none apply, don’t file Form 2210.

A

You request a waiver (see instructions) of your entire penalty. You must check this box and file page 1 of Form 2210, but you aren’t required to figure your penalty.

You request a waiver (see instructions) of your entire penalty. You must check this box and file page 1 of Form 2210, but you aren’t required to figure your penalty.

B

You request a waiver (see instructions) of part of your penalty. You must figure your penalty and waiver amount and file Form 2210.

C

D

E

Your income varied during the year and your penalty is reduced or eliminated when figured using the annualized income installment method. You must figure the penalty using Schedule Al and file Form 2210.

Your penalty is lower when figured by treating the federal income tax withheld from your income as paid on the dates it was actually withheld, instead of in equal amounts on the payment due dates. You must figure your penalty and file Form 2210.

You filed or are filing a joint return for either 2020 or 2021, but not for both years, and line 8 above is smaller than line 5 above. You must file page 1 of Form 2210, but you aren’t required to figure your penalty (unless box B, C, or D applies).

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 11744P |

Form 2210 (2021) |

Form 2210 (2021) |

|

|

|

|

Page 2 |

|

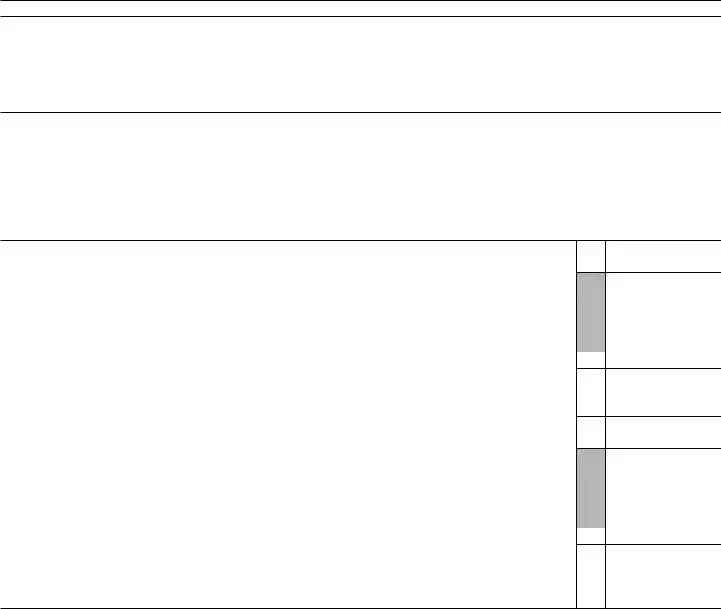

Part III |

Penalty Computation (See the instructions if you’re filing Form |

|

|

|||

Section |

|

|

Payment Due Dates |

|

||

|

(a) |

(b) |

(c) |

(d) |

||

|

|

|

4/15/21 |

6/15/21 |

9/15/21 |

1/15/22 |

10 Required installments. If box C in Part II applies, |

|

|

|

|

|

|

enter the amounts from Schedule AI, line 27. |

|

|

|

|

|

|

Otherwise, enter 25% (0.25) of line 9, Form 2210, in |

|

|

|

|

|

|

each column. For fiscal year filers, see instructions |

10 |

|

|

|

|

|

11 Estimated tax paid and tax withheld (see the |

|

|

|

|

|

|

instructions). For column (a) only, also enter the |

|

|

|

|

|

|

amount from line 11 on line 15, column (a). If line 11 |

|

|

|

|

|

|

is equal to or more than line 10 for all payment |

|

|

|

|

|

|

periods, stop here; you don’t owe a penalty. Don’t |

|

|

|

|

|

|

file Form 2210 unless you checked a box in Part II |

11 |

|

|

|

|

|

Complete lines 12 through 18 of one column before going to line 12 of the next column.

12Enter the amount, if any, from line 18 in the previous

column . . . . . . . . . . . . . . .

13 Add lines 11 and 12 . . . . . . . . . . .

14Add the amounts on lines 16 and 17 in the previous

column . . . . . . . . . . . . . . .

15Subtract line 14 from line 13. If zero or less, enter

16If line 15 is zero, subtract line 13 from line 14.

Otherwise, enter

17Underpayment. If line 10 is equal to or more than line 15, subtract line 15 from line 10. Then go to line 12 of

the next column. Otherwise, go to line 18 . . . ▶

18Overpayment. If line 15 is more than line 10, subtract line 10 from line 15. Then go to line 12 of the next column . . . . . . . . . . . .

12

13

14

15

16

17

18

Section

19Penalty. Enter the total penalty from line 14 of the Worksheet for Form 2210, Part III, Section

27. Don’t file Form 2210 unless you checked a box in Part II . . . . . . . . . . . . ▶ |

19 |

Form 2210 (2021)

Form 2210 (2021) |

Page 3 |

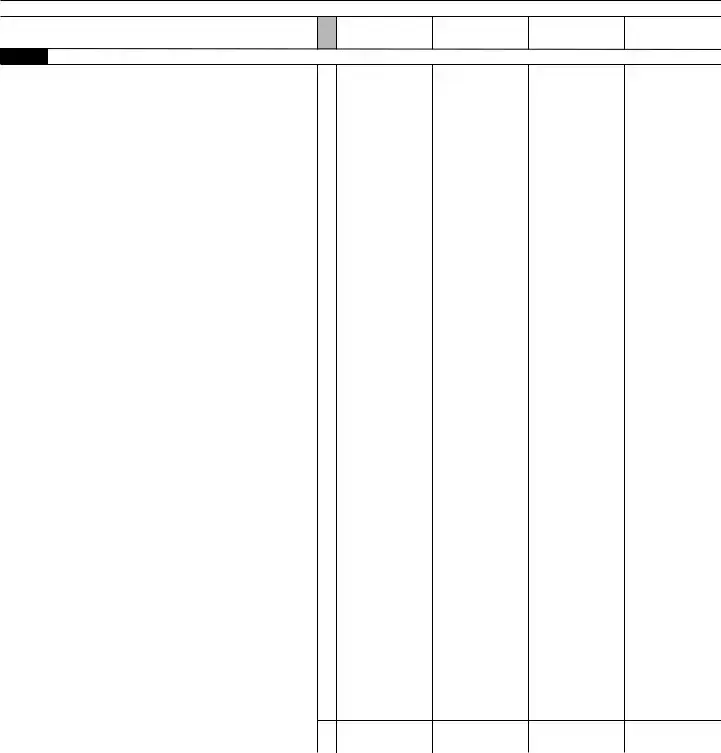

Schedule

Estates and trusts, don’t use the period ending dates shown to the right. Instead, use the following: 2/28/21, 4/30/21, 7/31/21, and 11/30/21.

Part I Annualized Income Installments

(a)

(b)

(c)(d)

1Enter your adjusted gross income for each period. See instructions. (Estates and trusts, enter your taxable

income without your exemption for each period.) . .

2Annualization amounts. (Estates and trusts, see instructions.)

3 Annualized income. Multiply line 1 by line 2 . . .

4If you itemize, enter itemized deductions for the period shown in each column. All others, enter

5 |

Annualization amounts |

6 |

Multiply line 4 by line 5 |

7In each column, enter the sum of your standard deduction and line 12b from Form 1040 or

8 Enter the larger of line 6 or line 7 . . . . . . .

9 |

Deduction for qualified business income. Estates and |

|

|

trusts: Subtract this amount from the amount on line 3, skip |

|

|

line 10, and enter the result on line 11 |

|

10 |

Add lines 8 and 9 |

|

11 |

Subtract line 10 from line 3 |

. . . . . . . . |

12Form 1040,

13Subtract line 12 from line 11. If zero or less, enter

14Figure your tax on the amount on line 13. See instructions

15

16Enter other taxes for each payment period including, if applicable, Additional Medicare Tax and/or Net Investment Income Tax. See instructions

17 Total tax. Add lines 14, 15, and 16 . . . . . .

18For each period, enter the same type of credits as allowed

on Form 2210, Part I, lines 1 and 3. See instructions . .

19Subtract line 18 from line 17. If zero or less, enter

20 |

Applicable percentage |

21 |

Multiply line 19 by line 20 |

1 |

|

|

|

|

2 |

4 |

2.4 |

1.5 |

1 |

3 |

|

|

|

|

4 |

|

|

|

|

5 |

4 |

2.4 |

1.5 |

1 |

6 |

|

|

|

|

7 |

|

|

|

|

8 |

|

|

|

|

9 |

|

|

|

|

10 |

|

|

|

|

11 |

|

|

|

|

12 |

|

|

|

|

13 |

|

|

|

|

14 |

|

|

|

|

15 |

|

|

|

|

16 |

|

|

|

|

17 |

|

|

|

|

18 |

|

|

|

|

19 |

|

|

|

|

20 |

22.5% |

45% |

67.5% |

90% |

21 |

|

|

|

|

Complete lines

22 |

Enter the total of the amounts in all previous columns of line 27 |

22 |

|

|

23 |

Subtract line 22 from line 21. If zero or less, enter |

23 |

|

|

24 |

Enter 25% (0.25) of line 9 on page 1 of Form 2210 in each column |

24 |

|

|

25 |

Subtract line 27 of the previous column from line 26 of that column 25 |

|

|

|

26 |

Add lines 24 and 25 |

26 |

|

|

27Enter the smaller of line 23 or line 26 here and on Form 2210, Part III, line 10 . . . . . . . . ▶ 27

Part II Annualized

28Net earnings from

29 |

Prorated social security tax limit |

29 |

$35,700 |

$59,500 |

$95,200 |

$142,800 |

30 |

Enter actual wages for the period subject to social security tax |

|

|

|

|

|

|

or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax. |

|

|

|

|

|

|

Exception: If you filed Form 4137 or Form 8919, see instructions |

30 |

|

|

|

|

31Subtract line 30 from line 29. If zero or less, enter

32 |

Annualization amounts |

32 |

0.496 |

0.2976 |

0.186 |

0.124 |

33 |

Multiply line 32 by the smaller of line 28 or line 31 . |

33 |

|

|

|

|

34 |

Annualization amounts |

34 |

0.116 |

0.0696 |

0.0435 |

0.029 |

35 |

Multiply line 28 by line 34 |

35 |

|

|

|

|

36 |

Add lines 33 and 35. Enter here and on line 15 above ▶ |

36 |

|

|

|

|

Form 2210 (2021)

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form 2210 | Used to determine if an individual owes a penalty for underpayment of estimated tax. |

| Who Needs to File | Typically, filed by individuals, estates, and trusts that have not paid enough tax through withholding or estimated tax payments. |

| When to File | Filed with the annual income tax return, unless specific conditions allow or require the form to be filed separately or at a different time. |

| Components of the Penalty Calculation | Includes underpayment amounts, the period of underpayment, and applicable interest rates. |

| Waiver Conditions | Certain conditions, such as natural disasters, disability, or retirement (after age 62), may qualify an individual for a waiver of the penalty. |

| Governing Law | Under the Internal Revenue Code (IRC), specifically addressing estimated tax payments and penalties for underpayment. |

Guide to Writing IRS 2210

Once individuals gather the necessary documents and are prepared to navigate the complexities of the IRS 2210 form, attention to detail becomes crucial. This form, pivotal for calculating potential penalties for underpayment of estimated taxes, demands precision. The process need not be daunting, however, and by following a step-by-step approach, filers can ensure accuracy and completeness. It is imperative to have all relevant tax information at hand before beginning. This guide simplifies the procedure, focusing on a clear, methodical completion of each required section.

- Start by entering your full name and Social Security number at the top of the form. Make sure these match the details on your Form 1040 or 1040-SR.

- Proceed to Part I if you have earnings that were not subject to withholding tax, like earnings from self-employment, interest, dividends, and rents. If all your earnings had taxes withheld, you might not need to complete this section.

- In Part II, calculate your required annual payment using the information from your current and previous year's tax returns. This ensures that you pay the correct amount of estimated tax throughout the year.

- For Part III, determine if you have made any payments toward your estimated tax. Record all estimated tax payments you've made during the year, including the date and amount of each payment.

- Utilize Part IV to calculate if you owe a penalty. Follow the instructions to determine the underpayment amount and corresponding penalty, if applicable. This section may require additional forms or schedules for precise calculations.

- In certain cases, Part V and VI might need to be completed, particularly if your income varied throughout the year. These parts allow for a more accurate penalty calculation based on when income was received.

- After filling out the form, review it thoroughly to ensure accuracy and completeness. Any mistakes or omissions can lead to further complications or increase the likelihood of incurring additional penalties.

- Finally, attach Form 2210 to your tax return if you determined a penalty is due and you cannot use the Short Method. Ensure that you also have the necessary documentation to support any figures entered on the form.

Having completed and reviewed the form, the next steps involve submission to the Internal Revenue Service, according to the instructions provided with your tax return. It’s vital to adhere to the deadlines to avoid any further penalties. For peace of mind and to ensure all aspects of the form and tax return are in order, filers might consider seeking assistance from a professional. Tax professionals can provide guidance, clarify any uncertainties, and offer advice on potential ways to reduce or avoid penalties in the future.

Understanding IRS 2210

What is Form 2210 and who needs to file it?

Form 2210, titled "Underpayment of Estimated Tax by Individuals, Estates, and Trusts," is used to determine if you've paid enough tax through withholding and estimated tax payments. If you haven't, it calculates any penalties for underpayment of estimated taxes. Typically, this form is necessary for those who haven't paid at least 90% of their current year tax obligation or 100% of the tax shown on the prior year’s return, though there are special rules for higher income individuals.

How does the Form 2210 calculate penalties?

Penalties on Form 2210 are computed using a few steps. First, it divides the year into four payment periods. Then, it calculates the underpayment for each period, taking into account the taxes you should have paid by specific dates throughout the year. The form uses these figures to determine if there were any underpayments and, if so, applies the IRS interest rate for underpayments to calculate the penalty.

Are there exceptions to avoid the penalty?

Yes, several exceptions can help you avoid the penalty. These exceptions include situations where your total tax due is less than $1,000, if you had no tax liability in the previous year, or if you've paid, through withholding or estimated tax payments, at least 90% of the tax for the current year or 100% of the tax shown on your previous year’s return. There are also special rules for farmers, fishermen, and certain households affected by casualty, disaster, or other unusual circumstances.

Is it mandatory to file Form 2210 if there's an underpayment?

Not always. The IRS can calculate the penalty for you if you prefer not to file Form 2210. However, if you believe an exception applies or you want to request a waiver for a specific reason, such as a casualty, disaster, or retirement/disability-related underpayment, you should complete and submit Form 2210 with your tax return to explain your situation.

Can I file Form 2210 electronically?

Yes, you can file Form 2210 electronically with your tax return. Most tax preparation software will guide you through the process of determining if you owe a penalty and calculating it for you, including the option to file this form electronically if needed.

What periods does Form 2210 cover?

Form 2210 divides the tax year into four payment periods to calculate underpayments and penalties accurately. These periods correspond to the quarters of a calendar year, ending on March 31, June 30, September 30, and December 31. The form assesses whether you made sufficient payments by the due date for each of these periods.

How can I avoid underpayment penalties in the future?

To avoid underpayment penalties, ensure you pay at least 90% of your current year's tax liability or 100% of the prior year's liability through withholdings and estimated tax payments. Consider using the IRS's Withholding Calculator or consulting with a tax professional to adjust your withholding on Form W-4 or to estimate your payments more accurately for the year.

What should I do if I disagree with an IRS penalty assessment?

If you disagree with a penalty assessment from the IRS, you can respond by explaining your situation and providing documentation as needed. You may also consider completing Form 2210 to show your calculations. If more assistance is needed, contacting the IRS directly or consulting a tax professional or attorney specializing in tax law may be beneficial.

Where can I find more information about Form 2210?

More information about Form 2210 can be found on the Internal Revenue Service (IRS) website. The site offers detailed instructions for Form 2210, including how to fill it out, when to file it, and how to calculate any penalties. For complex situations or for help in dealing with IRS notices, it may be advisable to seek professional guidance.

Common mistakes

Filling out IRS forms can often feel overwhelming, particularly when it comes to the 2210 form, which deals with underpayment of estimated tax by individuals, estates, and trusts. Unfortunately, errors can occur in the process, leading to potential penalties or delays. Here's an overview of common mistakes to watch out for:

-

Incorrect Calculation of Estimated Tax Payments: One of the most prevalent errors involves miscalculating the amount that needs to be paid. Taxpayers often overlook the need to factor in all sources of income, deductions, and credits throughout the year. This miscalculation can result in underpayment or overpayment of taxes.

-

Failure to Adjust for Changes in Income: Not adjusting estimated tax payments to reflect changes in income or financial status throughout the year can lead to discrepancies. It's crucial to update estimated taxes if significant income fluctuations occur, whether those changes stem from a new job, loss of employment, or other financial gains or losses.

-

Not Using the Correct Tax Year's Form: The IRS updates forms annually to reflect current tax laws and provisions. Using an outdated version of Form 2210 can lead to errors in compliance, as the guidelines or calculations may have changed.

-

Overlooking Exceptions and Waivers: There are specific scenarios where taxpayers might qualify for an exception or waiver regarding underpayment penalties. Missing out on these opportunities due to a lack of understanding or awareness can unnecessarily cost money.

-

Incorrect Social Security Number (SSN) or Employer Identification Number (EIN): Entering an incorrect SSN or EIN can lead to processing delays. The IRS uses these identifiers to track taxpayers' files, so any discrepancy can cause significant issues in record-keeping and possibly result in penalties.

When completing IRS Form 2210, taking your time to carefully review each section and understanding the form's instructions can significantly reduce the likelihood of these common errors. Remember, taxpayers also have the option to consult with tax professionals or utilize IRS resources for guidance, ensuring that their estimated tax payments are accurately calculated and submitted on time.

Documents used along the form

When dealing with the Internal Revenue Service (IRS), particularly around the subject of penalties for underpayment of estimated taxes, IRS Form 2210 plays a pivotal role. However, navigating tax obligations doesn't stop at one form. Various other documents often accompany Form 2210 to ensure taxpayers meet their responsibilities comprehensively and accurately. The list below outlines such documents, shedding light on their importance and function in the broader context of tax preparation.

- Form 1040: The U.S. Individual Income Tax Return is the foundational document for personal tax reporting. It covers income, deductions, and credits, and calculates the amount of tax owed or refunded by the federal government.

- Form 1040-ES: This form is for estimating taxes for the current year. Taxpayers, especially those who are self-employed, use this to calculate and pay their quarterly estimated taxes.

- Form 1099-MISC: The Miscellaneous Income form is crucial for reporting earnings from sources other than wages, salaries, and tips. This might include freelance income, rental income, or prizes.

- Form 4868: This Application for Automatic Extension of Time To File U.S. Individual Income Tax Return allows taxpayers who need more time to file beyond the April 15 deadline.

- Form 1099-DIV: Dividends and Distributions form is essential for reporting income from stocks or mutual funds. It includes information on dividends received, capital gain distributions, and nontaxable distributions.

- Form 1099-INT: This form reports interest income. It's used by banks and other financial institutions to report interest a taxpayer has earned on savings accounts, CDs, and bonds.

- Form W-2: The Wage and Tax Statement must be filed by employers for every employee paid a salary, wage, or other compensation. This form reports an employee's annual wages and the amount of taxes withheld from their paycheck.

- Schedule A (Form 1040): This itemized deductions form is necessary for taxpayers who choose to itemize deductions rather than take the standard deduction.

- Schedule B (Form 1040): Schedule B is required for reporting interest and ordinary dividends exceeding certain thresholds.

- Schedule D (Form 1040): This form is used to report capital gains or losses from transactions involving capital assets. It's crucial for taxpayers who have sold stocks, bonds, or real estate during the tax year.

Navigating the complexities of the U.S. tax system can be daunting. By understanding and accurately completing not just Form 2210 but also the related documents, taxpayers can better manage their tax obligations and avoid potential penalties. To ensure compliance and possibly optimize tax liability, consulting with a tax professional may be beneficial.

Similar forms

The IRS 2210 form, utilized for calculating underpayment of estimated tax by individuals, estates, and trusts, shares similarities with several other tax-related documents. One notable document is the IRS 1040 form, the standard federal income tax form used by individuals. Both forms deal with personal financial information, with the 1040 form serving as the basis for calculating income tax liability. By contrast, the 2210 form addresses specific situations where the tax was not sufficiently withheld throughout the year. Nonetheless, both require meticulous attention to one's income and tax payments.

Similarly, the IRS 1040-ES form, which is used for estimating taxes for the forthcoming year, bears resemblance to the 2210 form. Individuals, including self-employed professionals, use the 1040-ES to calculate and pay estimated taxes quarterly. This proactive approach to tax payments is intricately linked to the 2210's retrospective adjustment of underpaid estimated taxes. Both documents are essential for managing tax obligations efficiently and avoiding potential penalties for underpayment.

The IRS Schedule SE form, necessary for computing self-employment tax, also parallels the 2210 form. Self-employed individuals use Schedule SE to determine the tax owed on their net earnings from self-employment, reflecting an assessment similar to that of the 2210 for underpayment penalties. Although Schedule SE focuses on Social Security and Medicare contributions, both forms are indispensable for individuals with complex income sources ensuring accurate tax contributions.

Another document, the IRS Form 4868, provides an extension for filing income tax returns, indirectly connecting to the 2210 form's concerns with taxation periods. While the 4868 addresses delays in filing, any tax owed is still due by the original deadline, which might necessitate adjustments through Form 2210 if estimated taxes were underpaid. These forms together help taxpayers manage deadlines and payment obligations to avoid undue penalties.

The IRS W-4 form, designed to inform employers about the tax withholding amount from an employee's paycheck, also correlates with Form 2210's purpose. While the W-4 aims to adjust withholdings to prevent underpayment or overpayment of tax, Form 2210 rectifies situations where these adjustments were insufficient. Both forms are vital in the pursuit of balancing tax obligations throughout the fiscal year.

Form W-9, requested by financial institutions and companies paying non-employment income, is another form with a link to Form 2210. It is used for taxpayer identification and certification to inform payers on how much tax to withhold. Where the withholding is insufficient, Form 2210 becomes relevant for addressing any discrepancies in estimated tax payments, emphasizing the importance of accurate withholding information.

The IRS Form 1099-MISC, reporting miscellaneous income, is an essential document for individuals receiving such income. Similar to Form 2210, the 1099-MISC is a critical aspect of managing taxes for non-employment income. When this income is underreported or taxes on it are underpaid, Form 2210 is used to calculate the underpayment penalty, making both forms crucial for accurate tax reporting and payment.

Form 8822, employed for reporting a change of address to the IRS, while administratively different, indirectly affects the 2210 form's relevance. A change of address could impact where and how tax documents are received, potentially affecting the timely payment of estimated taxes and necessitating the use of Form 2210 to adjust for any underpayments due to administrative issues.

The IRS Form 8962, used to reconcile or claim the Premium Tax Credit (PTC), connects with Form 2210 through tax adjustments. Individuals who underestimate their income may receive too much PTC and have to pay it back, similar to the underpayment of estimated tax addressed by Form 2210. Both forms are crucial for individuals navigating the complexities of tax credits and payments.

Lastly, the IRS Form 9465, the installment agreement request form, complements the use of Form 2210 in managing tax liabilities. If Form 2210 calculates a penalty for underpayment of estimated tax, Form 9465 may be used to arrange a payment plan for this and any other tax owed. This synergy underscores the broader system of tax management and remediation provided by the IRS.

Dos and Don'ts

Filing IRS Form 2210, associated with underpayment of estimated tax, requires attention to detail and an understanding of tax regulations. By following these guidelines, individuals can better navigate the form and avoid common pitfalls.

Do:

- Review the criteria for who must file Form 2210. Not all taxpayers are required to complete this form, as it specifically relates to those who have underpaid their estimated taxes throughout the tax year.

- Use the IRS instructions for Form 2210 to accurately calculate underpayment penalties if you decide not to use tax software. These instructions can guide you step by step through the calculations and exceptions.

- Consider whether any exceptions to the penalty apply to your situation. Certain circumstances, such as casualty, disaster, or retirement, might exempt you from penalties.

- Keep accurate records of all estimated tax payments made during the year. This information is crucial for completing Form 2210 accurately.

- Double-check your Social Security number and other personal information to ensure there are no errors. Mistakes in personal details can cause processing delays.

- Consult with a tax professional if you encounter complex situations or if you're unsure how to proceed. Tax laws can be complicated, and professional guidance can be invaluable.

Don't:

- Don’t underestimate your income. If you anticipate changes in your income during the year, adjust your estimated tax payments accordingly to avoid underpayment.

- Don’t forget to account for all sources of income, including freelance work, interest, dividends, and any other taxable income that might not be subject to withholding.

- Don’t ignore penalties indicated by the form. If you calculate that you owe a penalty, timely payment can prevent further interest from accruing.

- Don’t submit the form without verifying all calculations. Errors can lead to further complications, including the assessment of additional penalties and interest.

- Don’t wait until the last minute to address underpayment issues. Being proactive can help you manage potential penalties more effectively and avoid additional stress.

- Don’t hesitate to amend previous returns if you discover mistakes that affect your estimated tax calculations. Amended returns can be filed using Form 1040-X.

Misconceptions

The IRS Form 2210, titled "Underpayment of Estimated Tax by Individuals, Estates, and Trusts," often comes shrouded in confusion and misconceptions. This form can seem daunting, but understanding the myths surrounding it can make navigating your taxes much easier. Below are ten common misconceptions about the IRS Form 2210 and the realities behind them:

- Everyone needs to file Form 2210. In reality, not everyone must submit this form with their tax return. It’s specifically for taxpayers who haven’t paid enough tax throughout the year through withholding or estimated tax payments.

- If you owe a penalty, you must calculate it yourself. Though Form 2210 is used to calculate underpayment penalties, the IRS can also calculate the penalty for you if you prefer not to do it yourself.

- You can't avoid penalties if you underpaid your taxes. There are several exceptions that allow taxpayers to avoid penalties, including situations where the underpayment was due to casualty, disaster, or other unusual circumstances.

- There’s no benefit to filing Form 2210 if the IRS can do it for you. Filing the form can be beneficial if you believe you qualify for a waiver or reduction of the penalty based on specific conditions that the IRS may not automatically consider.

- Form 2210 is only for individuals. While it’s primarily designed for individuals, the form is also applicable to estates and trusts that have underpaid their estimated tax.

- Filing an extension gives you an extension to pay taxes without penalties. An extension to file your tax return does not extend the time to pay taxes. If you haven’t paid by the deadline, you may still incur underpayment penalties.

- You must underpay by a significant amount to owe a penalty. You might owe a penalty for underpaying as little as $1,000 in taxes, depending on your situation.

- Only high-income earners need to worry about this form. Taxpayers at various income levels could need to file Form 2210 if they haven’t paid enough tax throughout the year, regardless of their income bracket.

- The same rules apply to everyone. There are different rules for farmers, fishermen, and certain other groups, which might result in different underpayment penalty assessments.

- You must pay the penalty in a lump sum. If you owe a penalty, you can include it with your tax return payment, or if the IRS calculates it later, you'll receive a bill and can make arrangements to pay it over time if necessary.

Understanding these misconceptions can prevent unnecessary stress and potentially save money when dealing with the IRS and your taxes. Always consult with a tax professional if you're unsure about your specific situation regarding Form 2210 or any tax-related matters.

Key takeaways

Filling out and using the IRS Form 2210 involves understanding its purpose, the situations in which it is required, and the nuances of its completion and submission. These key takeaways aim to provide clarity and ensure that you navigate this process with confidence.

- The IRS Form 2210 is primarily used to calculate underpayment of estimated tax by individuals, estates, and trusts. This is crucial for any taxpayer who did not pay enough tax through withholding or estimated tax payments.

- If you discover that you've underpaid your estimated tax, using Form 2210 helps determine if you owe a penalty for underpayment and the amount of such a penalty. This step is essential to avoid surprises when filing your taxes.

- Note that in some cases, the IRS can calculate the penalty for you if you do not wish to fill out the form. However, if you believe your situation includes special circumstances or you want to ensure accuracy, filling out the form yourself is advisable.

- There are specific situations where you are required to file Form 2210. These include cases where you request a waiver of the penalty or when your underpayment was due to a special circumstance, such as casualty, disaster, or other unusual conditions.

- Form 2210 is divided into several sections, with Part IV being particularly important for calculating the penalty in a detailed manner. It is where you account for income earned unevenly throughout the year, which can potentially reduce your penalty.

- When you fill out the form, make sure to have information about your income, tax payments, and dates of payments on hand. This detailed financial information will be necessary to accurately calculate any penalty for underpayment.

- Lastly, remember to check the IRS guidelines or consult a tax professional when in doubt. Tax laws and forms, including Form 2210, are subject to change, and ensuring that you have the most current information is critical for compliance and to minimize any potential penalties.

Familiarizing yourself with these key takeaways can streamline the process of dealing with IRS Form 2210, leading to a more understandable and less stressful tax filing experience. Whether you're handling personal or estate taxes, being proactive and informed about your estimated tax payments and potential underpayments can save time and avoid unnecessary penalties.

Popular PDF Documents

Form 709 - It acts as a record-keeping tool for both the taxpayer and the IRS, facilitating transparency in the transfer of large gifts.

Saanich School First Aid Record - Designed to be faxed to the Manager, Human Resources/Health and Safety, ensuring a timely and efficient flow of information.