Get Irs 2159 Form

Navigating through tax obligations can be a complex process, especially when it comes to resolving owed taxes. The IRS Form 2159, also known as the Payroll Deduction Agreement, offers a structured solution for individuals facing this challenge. Introduced by the Department of the Treasury and the Internal Revenue Service, this form facilitates an agreement between the taxpayer and their employer to deduct a specified amount from the taxpayer's wages or salary to apply towards their tax debt. This mechanism not only simplifies the repayment process but also ensures a disciplined and consistent reduction of the taxpayer's outstanding liabilities over time. As part of the agreement, taxpayers can select the frequency of deductions, which could be weekly, bi-weekly, monthly, or another specified interval. Additionally, the form allows for adjustments in the deduction amounts under certain conditions and outlines the roles and responsibilities of both the taxpayer and the employer. It’s worth noting that participating in such an agreement requires a user fee, though reduced rates or waivers might be available for eligible individuals. The form underscores the importance of staying compliant with all tax obligations during the agreement period while also detailing the implications of failing to adhere to the established terms, including the potential termination of the agreement and the methods the IRS may employ to recover owed taxes.

Irs 2159 Example

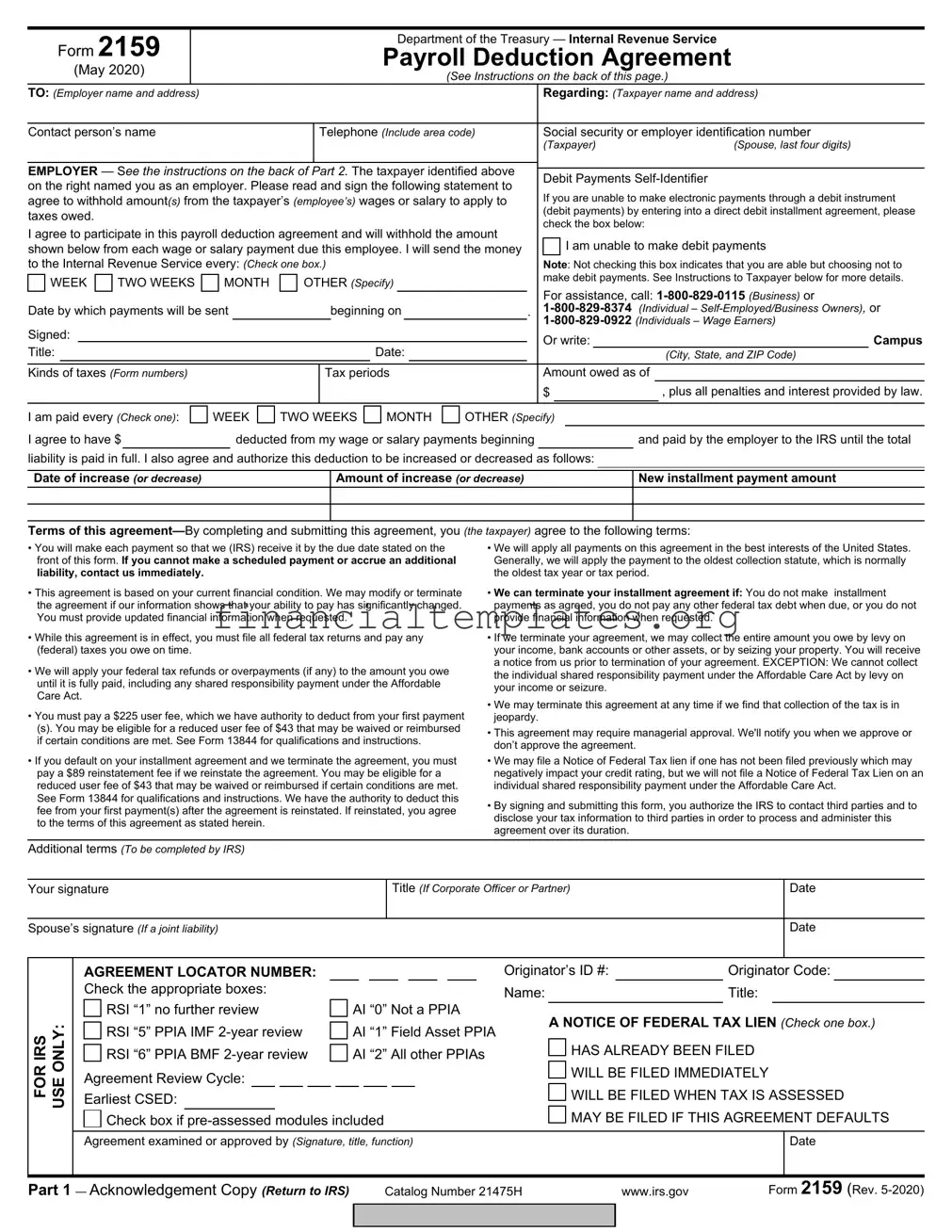

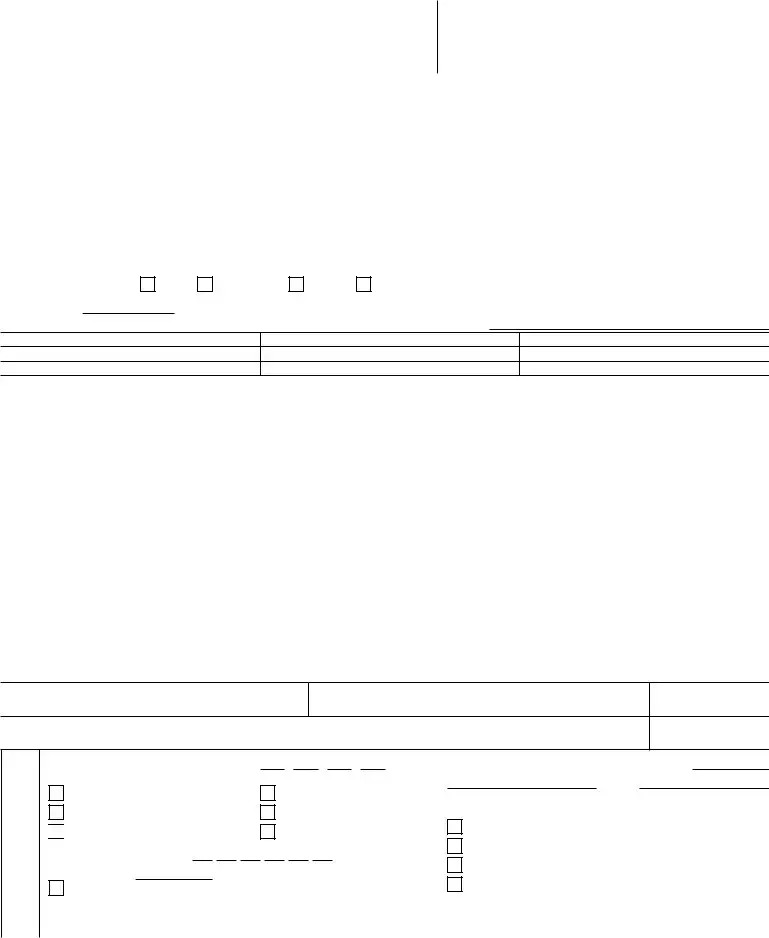

Form 2159 |

Department of the Treasury — Internal Revenue Service |

|

Payroll Deduction Agreement |

||

(May 2020) |

||

(See Instructions on the back of this page.) |

||

|

TO: (Employer name and address) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regarding: (Taxpayer name and address) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact person’s name |

|

|

|

|

|

|

Telephone (Include area code) |

|

|

Social security or employer identification number |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Taxpayer) |

|

(Spouse, last four digits) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER — See the instructions on the back of Part 2. The taxpayer identified above |

|

|

Debit Payments |

|||||||||||||||||||||||

on the right named you as an employer. Please read and sign the following statement to |

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||

agree to withhold amount(s) from the taxpayer’s (employee’s) wages or salary to apply to |

|

|

If you are unable to make electronic payments through a debit instrument |

|||||||||||||||||||||||

taxes owed. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(debit payments) by entering into a direct debit installment agreement, please |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

check the box below: |

|

|

|

|||||||

I agree to participate in this payroll deduction agreement and will withhold the amount |

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

I am unable to make debit payments |

||||||||||||||||||||||

shown below from each wage or salary payment due this employee. I will send the money |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||

to the Internal Revenue Service every: (Check one box.) |

|

|

Note: Not checking this box indicates that you are able but choosing not to |

|||||||||||||||||||||||

|

WEEK |

|

TWO WEEKS |

|

MONTH |

|

OTHER (Specify) |

|

|

make debit payments. See Instructions to Taxpayer below for more details. |

||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For assistance, call: |

||||||

Date by which payments will be sent |

|

|

|

beginning on |

. |

|

||||||||||||||||||||

Signed: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Or write: |

|

|

|

Campus |

||||||

Title: |

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(City, State, and ZIP Code) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kinds of taxes (Form numbers) |

|

|

|

|

|

|

Tax periods |

|

|

Amount owed as of |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

, plus all penalties and interest provided by law. |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I am paid every (Check one):

I agree to have $

WEEK |

TWO WEEKS |

MONTH |

OTHER (Specify) |

|

|

|

deducted from my wage or salary payments beginning |

|

|

and paid by the employer to the IRS until the total |

|||

liability is paid in full. I also agree and authorize this deduction to be increased or decreased as follows:

Date of increase (OR DECREASE)

Amount of increase (OR DECREASE)

New installment payment amount

Terms of this

• You will make each payment so that we (IRS) receive it by the due date stated on the |

• We will apply all payments on this agreement in the best interests of the United States. |

|

front of this form. If you cannot make a scheduled payment or accrue an additional |

Generally, we will apply the payment to the oldest collection statute, which is normally |

|

liability, contact us immediately. |

the oldest tax year or tax period. |

|

• This agreement is based on your current financial condition. We may modify or terminate |

• We can terminate your installment agreement if: You do not make installment |

|

the agreement if our information shows that your ability to pay has significantly changed. |

payments as agreed, you do not pay any other federal tax debt when due, or you do not |

|

You must provide updated financial information when requested. |

provide financial information when requested. |

|

• While this agreement is in effect, you must file all federal tax returns and pay any |

• If we terminate your agreement, we may collect the entire amount you owe by levy on |

|

(federal) taxes you owe on time. |

your income, bank accounts or other assets, or by seizing your property. You will receive |

|

• We will apply your federal tax refunds or overpayments (if any) to the amount you owe |

a notice from us prior to termination of your agreement. EXCEPTION: We cannot collect |

|

the individual shared responsibility payment under the Affordable Care Act by levy on |

||

until it is fully paid, including any shared responsibility payment under the Affordable |

||

your income or seizure. |

||

Care Act. |

||

• We may terminate this agreement at any time if we find that collection of the tax is in |

||

|

||

• You must pay a $225 user fee, which we have authority to deduct from your first payment |

jeopardy. |

|

(s). You may be eligible for a reduced user fee of $43 that may be waived or reimbursed |

• This agreement may require managerial approval. We'll notify you when we approve or |

|

if certain conditions are met. See Form 13844 for qualifications and instructions. |

||

don’t approve the agreement. |

||

|

||

• If you default on your installment agreement and we terminate the agreement, you must |

• We may file a Notice of Federal Tax lien if one has not been filed previously which may |

|

pay a $89 reinstatement fee if we reinstate the agreement. You may be eligible for a |

negatively impact your credit rating, but we will not file a Notice of Federal Tax Lien on an |

|

reduced user fee of $43 that may be waived or reimbursed if certain conditions are met. |

individual shared responsibility payment under the Affordable Care Act. |

|

See Form 13844 for qualifications and instructions. We have the authority to deduct this |

• By signing and submitting this form, you authorize the IRS to contact third parties and to |

|

fee from your first payment(s) after the agreement is reinstated. If reinstated, you agree |

||

disclose your tax information to third parties in order to process and administer this |

||

to the terms of this agreement as stated herein. |

||

agreement over its duration. |

||

|

||

|

|

|

Additional terms (To be completed by IRS) |

|

Your signature

Title (If Corporate Officer or Partner)

Date

Spouse’s signature (If a joint liability)

Date

FOR IRS USE ONLY:

AGREEMENT LOCATOR NUMBER: Check the appropriate boxes:

RSI “1” no further review

RSI “5” PPIA IMF

RSI “6” PPIA BMF

RSI “6” PPIA BMF

Earliest CSED:

AI “0” Not a PPIA

AI “1” Field Asset PPIA AI “2” All other PPIAs

Originator’s ID #: |

|

Originator Code: |

Name:Title:

A NOTICE OF FEDERAL TAX LIEN (Check one box.)

HAS ALREADY BEEN FILED

WILL BE FILED IMMEDIATELY

WILL BE FILED WHEN TAX IS ASSESSED

Check box if

MAY BE FILED IF THIS AGREEMENT DEFAULTS

|

Agreement examined or approved by (Signature, title, function) |

Date |

|

|

|

Part 1 — Acknowledgement Copy (RETURN TO IRS) |

Catalog Number 21475H |

www.irs.gov |

Form 2159 (Rev. |

|

|

|

|

|

|

|

|

Form 2159 |

Department of the Treasury — Internal Revenue Service |

|

Payroll Deduction Agreement |

||

(May 2020) |

||

(See Instructions on the back of this page.) |

||

|

TO: (Employer name and address) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regarding: (Taxpayer name and address) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact person’s name |

|

|

|

|

|

|

Telephone (Include area code) |

|

|

Social security or employer identification number |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Taxpayer) |

|

(Spouse, last four digits) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER — See the instructions on the back of Part 2. The taxpayer identified above |

|

|

Debit Payments |

|||||||||||||||||||||||

on the right named you as an employer. Please read and sign the following statement to |

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||

agree to withhold amount(s) from the taxpayer’s (employee’s) wages or salary to apply to |

|

|

If you are unable to make electronic payments through a debit instrument |

|||||||||||||||||||||||

taxes owed. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(debit payments) by entering into a direct debit installment agreement, please |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

check the box below: |

|

|

|

|||||||

I agree to participate in this payroll deduction agreement and will withhold the amount |

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

I am unable to make debit payments |

||||||||||||||||||||||

shown below from each wage or salary payment due this employee. I will send the money |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||

to the Internal Revenue Service every: (Check one box.) |

|

|

Note: Not checking this box indicates that you are able but choosing not to |

|||||||||||||||||||||||

|

WEEK |

|

TWO WEEKS |

|

MONTH |

|

OTHER (Specify) |

|

|

make debit payments. See Instructions to Taxpayer below for more details. |

||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For assistance, call: |

||||||

Date by which payments will be sent |

|

|

|

beginning on |

. |

|

||||||||||||||||||||

Signed: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Or write: |

|

|

|

Campus |

||||||

Title: |

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(City, State, and ZIP Code) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kinds of taxes (Form numbers) |

|

|

|

|

|

|

Tax periods |

|

|

Amount owed as of |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

, plus all penalties and interest provided by law. |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I am paid every (Check one):

I agree to have $

WEEK |

TWO WEEKS |

MONTH |

OTHER (Specify) |

|

|

|

deducted from my wage or salary payments beginning |

|

|

and paid by the employer to the IRS until the total |

|||

liability is paid in full. I also agree and authorize this deduction to be increased or decreased as follows:

Date of increase (OR DECREASE)

Amount of increase (OR DECREASE)

New installment payment amount

Terms of this

• You will make each payment so that we (IRS) receive it by the due date stated on the |

• We will apply all payments on this agreement in the best interests of the United States. |

|

front of this form. If you cannot make a scheduled payment or accrue an additional |

Generally, we will apply the payment to the oldest collection statute, which is normally |

|

liability, contact us immediately. |

the oldest tax year or tax period. |

|

• This agreement is based on your current financial condition. We may modify or terminate |

• We can terminate your installment agreement if: You do not make installment |

|

the agreement if our information shows that your ability to pay has significantly changed. |

payments as agreed, you do not pay any other federal tax debt when due, or you do not |

|

You must provide updated financial information when requested. |

provide financial information when requested. |

|

• While this agreement is in effect, you must file all federal tax returns and pay any |

• If we terminate your agreement, we may collect the entire amount you owe by levy on |

|

(federal) taxes you owe on time. |

your income, bank accounts or other assets, or by seizing your property. You will receive |

|

• We will apply your federal tax refunds or overpayments (if any) to the amount you owe |

a notice from us prior to termination of your agreement. EXCEPTION: We cannot collect |

|

the individual shared responsibility payment under the Affordable Care Act by levy on |

||

until it is fully paid, including any shared responsibility payment under the Affordable |

||

your income or seizure. |

||

Care Act. |

||

• We may terminate this agreement at any time if we find that collection of the tax is in |

||

|

||

• You must pay a $225 user fee, which we have authority to deduct from your first payment |

jeopardy. |

|

(s). You may be eligible for a reduced user fee of $43 that may be waived or reimbursed |

• This agreement may require managerial approval. We'll notify you when we approve or |

|

if certain conditions are met. See Form 13844 for qualifications and instructions. |

||

don’t approve the agreement. |

||

|

||

• If you default on your installment agreement and we terminate the agreement, you must |

• We may file a Notice of Federal Tax lien if one has not been filed previously which may |

|

pay a $89 reinstatement fee if we reinstate the agreement. You may be eligible for a |

negatively impact your credit rating, but we will not file a Notice of Federal Tax Lien on an |

|

reduced user fee of $43 that may be waived or reimbursed if certain conditions are met. |

individual shared responsibility payment under the Affordable Care Act. |

|

See Form 13844 for qualifications and instructions. We have the authority to deduct this |

• By signing and submitting this form, you authorize the IRS to contact third parties and to |

|

fee from your first payment(s) after the agreement is reinstated. If reinstated, you agree |

||

disclose your tax information to third parties in order to process and administer this |

||

to the terms of this agreement as stated herein. |

||

agreement over its duration. |

||

|

||

|

|

|

Additional terms (To be completed by IRS) |

|

Your signature

Title (If Corporate Officer or Partner)

Date

Spouse’s signature (If a joint liability)

Date

FOR IRS USE ONLY:

AGREEMENT LOCATOR NUMBER: Check the appropriate boxes:

RSI “1” no further review

RSI “5” PPIA IMF

RSI “6” PPIA BMF

RSI “6” PPIA BMF

Earliest CSED:

AI “0” Not a PPIA

AI “1” Field Asset PPIA AI “2” All other PPIAs

Originator’s ID #: |

|

Originator Code: |

Name:Title:

A NOTICE OF FEDERAL TAX LIEN (Check one box.)

HAS ALREADY BEEN FILED

WILL BE FILED IMMEDIATELY

WILL BE FILED WHEN TAX IS ASSESSED

Check box if

MAY BE FILED IF THIS AGREEMENT DEFAULTS

|

Agreement examined or approved by (Signature, title, function) |

Date |

|

|

|

Part 2 — Employer’s Copy |

Catalog Number 21475H |

www.irs.gov |

Form 2159 (Rev. |

INSTRUCTIONS TO EMPLOYER

This payroll deduction agreement is subject to your approval. If you agree to participate, please complete the spaces provided under the employer section on the front of this form.

WHAT YOU SHOULD DO

•Enter the name and telephone number of a contact person. (This will allow us to contact you if your employee’s liability is satisfied ahead of time.)

•Indicate when you will forward payments to IRS.

•Sign and date the form.

•After you and your employee have completed and signed all parts of the form, please return the parts of the form which were requested on the letter the employee received with the form. Use the IRS address on the letter the employee received with the form or the address shown on the front of the form.

HOW TO MAKE PAYMENTS

Please deduct the amount your employee agreed to have deducted from each wage or salary payment due the employee.

Make your check payable to the “United States Treasury.” To insure proper credit, please write your employee’s name and social security number on each payment.

Send the money to the IRS mailing address printed on the letter that came with the agreement. Your employee should give you a copy of this letter. If there is no letter, use the IRS address shown on the front of the form.

Note: The amount of the liability shown on the form may not include all penalties and interest provided by law. Please continue to make payments unless IRS notifies you to stop.

If you need assistance, please call the telephone number on the letter that came with the agreement or write to the address shown on the letter. If there’s no letter, please call the appropriate telephone number below or write IRS at the address shown on the front of the form.

For assistance, call:

THANK YOU FOR YOUR COOPERATION

Catalog Number 21475H |

www.irs.gov |

Form 2159 (Rev. |

Form 2159 |

Department of the Treasury — Internal Revenue Service |

|

Payroll Deduction Agreement |

||

(May 2020) |

||

(See Instructions on the back of this page.) |

||

|

TO: (Employer name and address) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regarding: (Taxpayer name and address) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact person’s name |

|

|

|

|

|

|

Telephone (Include area code) |

|

|

Social security or employer identification number |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Taxpayer) |

|

(Spouse, last four digits) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER — See the instructions on the back of Part 2. The taxpayer identified above |

|

|

Debit Payments |

|||||||||||||||||||||||

on the right named you as an employer. Please read and sign the following statement to |

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||

agree to withhold amount(s) from the taxpayer’s (employee’s) wages or salary to apply to |

|

|

If you are unable to make electronic payments through a debit instrument |

|||||||||||||||||||||||

taxes owed. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(debit payments) by entering into a direct debit installment agreement, please |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

check the box below: |

|

|

|

|||||||

I agree to participate in this payroll deduction agreement and will withhold the amount |

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

I am unable to make debit payments |

||||||||||||||||||||||

shown below from each wage or salary payment due this employee. I will send the money |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||

to the Internal Revenue Service every: (Check one box.) |

|

|

Note: Not checking this box indicates that you are able but choosing not to |

|||||||||||||||||||||||

|

WEEK |

|

TWO WEEKS |

|

MONTH |

|

OTHER (Specify) |

|

|

make debit payments. See Instructions to Taxpayer below for more details. |

||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For assistance, call: |

||||||

Date by which payments will be sent |

|

|

|

beginning on |

. |

|

||||||||||||||||||||

Signed: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Or write: |

|

|

|

Campus |

||||||

Title: |

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(City, State, and ZIP Code) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kinds of taxes (Form numbers) |

|

|

|

|

|

|

Tax periods |

|

|

Amount owed as of |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

, plus all penalties and interest provided by law. |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I am paid every (Check one):

I agree to have $

WEEK |

TWO WEEKS |

MONTH |

OTHER (Specify) |

|

|

|

deducted from my wage or salary payments beginning |

|

|

and paid by the employer to the IRS until the total |

|||

liability is paid in full. I also agree and authorize this deduction to be increased or decreased as follows:

Date of increase (OR DECREASE)

Amount of increase (OR DECREASE)

New installment payment amount

Terms of this

• You will make each payment so that we (IRS) receive it by the due date stated on the |

• We will apply all payments on this agreement in the best interests of the United States. |

|

front of this form. If you cannot make a scheduled payment or accrue an additional |

Generally, we will apply the payment to the oldest collection statute, which is normally |

|

liability, contact us immediately. |

the oldest tax year or tax period. |

|

• This agreement is based on your current financial condition. We may modify or terminate |

• We can terminate your installment agreement if: You do not make installment |

|

the agreement if our information shows that your ability to pay has significantly changed. |

payments as agreed, you do not pay any other federal tax debt when due, or you do not |

|

You must provide updated financial information when requested. |

provide financial information when requested. |

|

• While this agreement is in effect, you must file all federal tax returns and pay any |

• If we terminate your agreement, we may collect the entire amount you owe by levy on |

|

(federal) taxes you owe on time. |

your income, bank accounts or other assets, or by seizing your property. You will receive |

|

• We will apply your federal tax refunds or overpayments (if any) to the amount you owe |

a notice from us prior to termination of your agreement. EXCEPTION: We cannot collect |

|

the individual shared responsibility payment under the Affordable Care Act by levy on |

||

until it is fully paid, including any shared responsibility payment under the Affordable |

||

your income or seizure. |

||

Care Act. |

||

• We may terminate this agreement at any time if we find that collection of the tax is in |

||

|

||

• You must pay a $225 user fee, which we have authority to deduct from your first payment |

jeopardy. |

|

(s). You may be eligible for a reduced user fee of $43 that may be waived or reimbursed |

• This agreement may require managerial approval. We'll notify you when we approve or |

|

if certain conditions are met. See Form 13844 for qualifications and instructions. |

||

don’t approve the agreement. |

||

|

||

• If you default on your installment agreement and we terminate the agreement, you must |

• We may file a Notice of Federal Tax lien if one has not been filed previously which may |

|

pay a $89 reinstatement fee if we reinstate the agreement. You may be eligible for a |

negatively impact your credit rating, but we will not file a Notice of Federal Tax Lien on an |

|

reduced user fee of $43 that may be waived or reimbursed if certain conditions are met. |

individual shared responsibility payment under the Affordable Care Act. |

|

See Form 13844 for qualifications and instructions. We have the authority to deduct this |

• By signing and submitting this form, you authorize the IRS to contact third parties and to |

|

fee from your first payment(s) after the agreement is reinstated. If reinstated, you agree |

||

disclose your tax information to third parties in order to process and administer this |

||

to the terms of this agreement as stated herein. |

||

agreement over its duration. |

||

|

||

|

|

|

Additional terms (To be completed by IRS) |

|

Your signature

Title (If Corporate Officer or Partner)

Date

Spouse’s signature (If a joint liability)

Date

FOR IRS USE ONLY:

AGREEMENT LOCATOR NUMBER: Check the appropriate boxes:

RSI “1” no further review

RSI “5” PPIA IMF

RSI “6” PPIA BMF

RSI “6” PPIA BMF

Earliest CSED:

AI “0” Not a PPIA

AI “1” Field Asset PPIA AI “2” All other PPIAs

Originator’s ID #: |

|

Originator Code: |

Name:Title:

A NOTICE OF FEDERAL TAX LIEN (Check one box.)

HAS ALREADY BEEN FILED

WILL BE FILED IMMEDIATELY

WILL BE FILED WHEN TAX IS ASSESSED

Check box if

MAY BE FILED IF THIS AGREEMENT DEFAULTS

|

Agreement examined or approved by (Signature, title, function) |

Date |

|

|

|

Part 3 — Taxpayer’s Copy |

Catalog Number 21475H |

www.irs.gov |

Form 2159 (Rev. |

INSTRUCTIONS TO TAXPAYER

If not already completed by an IRS employee, please fill in the information in the spaces provided on the front of this form for the following items:

•Your employer’s name and address

•Your name(s) (plus spouse’s name if the amount owed is for a joint return) and current address.

•Your social security number or employer identification number. (Use the number that appears on the notice(s) you received.) Also, enter the last four digits of your spouse’s social security number if this is a joint liability.

•If you are a

•The kind of taxes you owe (form numbers) and the tax periods

•The amount you owe as of the date you spoke to IRS

•When you are paid

•The amount you agreed to have deducted from your pay when you spoke to IRS

•The date the deduction is to begin

•The amount of any increase or decrease in the deduction amount, if you agreed to this with IRS; otherwise, leave BLANK

After you complete, sign (along with your spouse if this is a joint liability), and date this agreement form, give it to your participating employer. If you received the form by mail, please give the employer a copy of the letter that came with it.

Your employer should mark the payment frequency on the form and sign it. Then, your employer should return the parts of the form which were requested on your letter or return Part 1 of the form to the address shown in the “For assistance” box on the front of the form.

If you need assistance, please call the appropriate telephone number below or write IRS at the address shown on the form. However, if you received this agreement by mail, please call the telephone number on the letter that came with it or write IRS at the address shown on the letter.

For assistance, call:

Note: This agreement will not affect your liability (if any) for backup withholding under Public Law

Catalog Number 21475H |

www.irs.gov |

Form 2159 (Rev. |

Document Specifics

| Fact Name | Detail |

|---|---|

| Purpose of Form 2159 | Form 2159, Payroll Deduction Agreement, is used by the IRS to allow taxpayers to make payments towards their owed taxes through deductions from their wages or salary by their employers. |

| User Fees | Taxpayers must pay a $225 user fee for setting up the agreement, which may be reduced to $43 under certain conditions outlined in Form 13844. |

| Termination Conditions | The IRS may terminate the installment agreement if taxpayers fail to make payments as agreed, do not pay any other federal tax debt when due, or do not provide financial information when requested. |

| Notice of Federal Tax Lien | The IRS may file a Notice of Federal Tax Lien to secure the interest of the government, although it will not do so for the individual shared responsibility payment under the Affordable Care Act. |

Guide to Writing Irs 2159

Successfully completing the IRS Form 2159, the Payroll Deduction Agreement, is a significant step towards managing and paying off a tax debt directly through an individual's salary. This method allows for regular payments to be deducted from one's wages, thus ensuring a consistent approach to reducing tax liability over time. Once the form is filled out and submitted, and the agreement is in place, it's important to adhere strictly to the payment schedule. Any changes in financial status or if an inability to make the scheduled payments arises should be communicated to the IRS immediately. Following the right steps to complete this form can provide a structured path to resolving tax obligations.

- Begin by entering the employer name and address in the designated space at the top of the form.

- Fill in the taxpayer name and address, ensuring accuracy to avoid any processing delays.

- Provide a contact person’s name and telephone number with the area code for any necessary communication between the employer and the IRS.

- Enter the Social Security Number (SSN) for the taxpayer and the last four digits of the SSN for the spouse if it’s a joint liability.

- If unable to make electronic payments through a debit instrument by entering a direct debit installment agreement, check the appropriate box indicating this.

- Choose the frequency at which the employer will send the money to the IRS by checking the appropriate box. The options include weekly, every two weeks, monthly, or other (which must be specified).

- Fill in the date by which payments will start, the title of the signatory from the employer side, and the date signed.

- Under Taxpayer Agreement, specify the kinds of taxes, form numbers, and tax periods related to the owed amount, ensuring the total liability is noted as of the current status including all penalties and interest.

- Indicate how often the taxpayer is paid by selecting one of the given options: week, every two weeks, monthly, or other (specify if chosen).

- Enter the amount to be deducted from each wage or salary payment. Additionally, if there are any changes in the deduction amount, specify the date of increase or decrease, the amount of change, and the new installment payment amount.

- Review the Terms of this agreement section carefully. It outlines the responsibilities and obligations of the taxpayer throughout the duration of the agreement.

- Add the taxpayer's signature and the date at the bottom of the agreement. If it is a joint liability, ensure the spouse also signs and dates the form.

After filling out Form 2159 accurately, it's crucial to keep a copy for personal records. The form should then be submitted to the IRS through the designated channels. Employers must agree to the payroll deduction setup, which requires cooperation and communication between employee and employer. This arrangement is designed to facilitate the steady repayment of tax debt directly from one's salary, aligning with the financial capabilities and ensuring compliance with tax obligations.

Understanding Irs 2159

- What is IRS Form 2159? Form 2159, issued by the Department of the Treasury - Internal Revenue Service, is known as the Payroll Deduction Agreement. It enables taxpayers to make arrangements for their employers to deduct a specified amount from their wages or salary to be applied directly towards their tax debt. This form is particularly useful for those seeking an organized method to manage and reduce their outstanding tax liabilities over time.

- How does the Payroll Deduction Agreement work? The process begins when a taxpayer and their employer agree to participate in the payroll deduction program. The taxpayer indicates the amount to be deducted from each payroll period, which the employer then remits to the IRS on a designated schedule — weekly, bi-weekly, monthly, or another specified interval. This agreement helps ensure that payments are made consistently towards the taxpayer's debt, ideally minimizing the risk of accruing additional penalties and interest due to missed or late payments.

- Who can use IRS Form 2159? Any taxpayer with outstanding tax liabilities who is employed and receives wages or a salary from an employer willing to participate can use this form. It's a voluntary agreement between the taxpayer and their employer, subject to the employer’s approval. Both parties must sign the form to indicate their consent to the terms of the agreement.

- What are the obligations of the employer in the Payroll Deduction Agreement? Upon agreeing to participate, the employer is responsible for withholding the agreed-upon amount from the employee's wages or salary. The employer must then forward these payments to the Internal Revenue Service in accordance with the schedule outlined in the agreement. The employer should continue making payments until instructed by the IRS or the taxpayer’s liability is fully satisfied. Employers are also required to provide a contact person and phone number for IRS inquiries and to sign and date the form indicating their participation.

- What happens if the taxpayer’s financial situation changes? The agreement is established based on the taxpayer's current ability to pay. If there’s a significant change in the taxpayer’s financial situation, the agreement can be modified or terminated by the IRS. Taxpayers are required to update their financial information as requested to reflect accurately their payment capability. In the event that a taxpayer can no longer make the agreed-upon installment payments, they should contact the IRS immediately to discuss modifications to the agreement.

- Are there any fees associated with the Payroll Deduction Agreement? Yes, initiating a Payroll Deduction Agreement incurs a user fee. The standard fee is $225, but taxpayers may be eligible for a reduced fee of $43, which could further be waived or reimbursed under certain conditions outlined in Form 13844. Additionally, if the agreement is terminated due to default and later reinstated, a reinstatement fee of $89 may apply, although a reduced fee of $43 can also apply for reinstatement under qualifying circumstances.

Common mistakes

When filling out the IRS Form 2159, Payroll Deduction Agreement, it's important to avoid common mistakes to ensure the process goes smoothly. Here are ten mistakes to watch out for:

- Not providing complete employer information, including name and address, which can delay processing.

- Failing to include accurate taxpayer identification such as social security numbers or employer identification numbers, leading to misapplied payments.

- Overlooking to select the correct payment frequency (e.g., weekly, bi-weekly, monthly), which can result in incorrect withholding amounts.

- Omitting the date by which payments will start, causing uncertainty and potential for missed payments.

- Incorrectly calculating the amount to be deducted from each wage or salary payment, which can either overburden the taxpayer or extend the repayment period unnecessarily.

- Not specifying types of taxes and periods owed, leading to misallocated payments.

- Leaving the signature and date fields blank, rendering the agreement incomplete and unenforceable.

- Choosing to participate in debit payments without understanding the implications, or failing to check the box when unable to make electronic debit payments.

- Ignoring to indicate if a federal tax lien has been filed, which is crucial for the IRS’s records and the taxpayer’s credit history.

- Failing to communicate with the employer about the agreement or neglecting to provide them with a copy, resulting in non-compliance or delayed implementation of the payroll deduction.

By avoiding these mistakes, taxpayers and employers can ensure that the Payroll Deduction Agreement is processed efficiently, leading to a smoother resolution of tax liabilities.

Documents used along the form

When dealing with the IRS, especially in situations requiring a Form 2159 for a Payroll Deduction Agreement, it's likely you'll need additional forms and documents to properly manage your financial situation. These documents can vary based on individual circumstances, but a common set of forms often accompany Form 2159 for a comprehensive approach to resolving tax issues.

- Form 1040: U.S. Individual Income Tax Return - This is the standard federal income tax form people use to report their income, claim tax deductions and credits, and calculate the amount of tax they owe or the refund they are due.

- Form W-2: Wage and Tax Statement - Employers issue this form to their employees to report annual wages and the amount of taxes withheld from their paychecks.

- Form 9465: Installment Agreement Request - Taxpayers use this form to request a monthly installment plan if they cannot pay the full amount they owe on their tax return.

- Form 433-F: Collection Information Statement - This form provides the IRS with information about your financial situation to help determine how you can settle your tax debt.

- Form 8821: Tax Information Authorization - This form authorizes a third party to receive and inspect your confidential tax information from the IRS.

- Form 2848: Power of Attorney and Declaration of Representative - Taxpayers use this to authorize an individual, such as an accountant or attorney, to represent them before the IRS.

- Form 13844: Application For Reduced User Fee For Installment Agreements - If you meet certain income thresholds, this form can help you qualify for a reduced fee on your installment agreement.

- Form 1099-MISC: Miscellaneous Income - Used to report incomes, such as fees, commissions, prizes, and awards for services provided as a non-employee.

- Form 433-A: Collection Information Statement for Wage Earners and Self-Employed Individuals - Similar to Form 433-F but tailored specifically for self-employed individuals and wage earners to provide their financial information to the IRS.

- Form 656: Offer in Compromise - This form allows taxpayers to settle their tax debt for less than the full amount owed if they meet certain conditions.

Together, these forms and documents provide a framework for individuals dealing with complex tax situations or seeking to negotiate terms with the IRS. Whether engaging in installment agreements, like the one outlined in Form 2159, or resolving other tax-related issues, it's important to understand and accurately complete the necessary paperwork to achieve a favorable outcome. Always consult with a tax professional or the IRS directly if you need further assistance or clarification.

Similar forms

The IRS Form 433-D, Installment Agreement, is quite similar to Form 2159, as it also allows taxpayers to make arrangements for paying off their tax debts over time. Both forms are designed to facilitate a structured payment plan between the taxpayer and the IRS, but Form 433-D is initiated by the taxpayer directly with the IRS, as opposed to being arranged through the taxpayer's employer like Form 2159.

Form 9465, Installment Agreement Request, is another document closely related to Form 2159. Form 9465 is a request by taxpayers to pay their tax liability in installments if they cannot pay the full amount immediately. While both forms aim to help manage tax debts through installment payments, Form 9465 is the initial step a taxpayer would take to request a payment plan before potentially engaging in a Payroll Deduction Agreement like Form 2159.

The IRS Form 13844, Application for Reduced User Fee for Installment Agreements, shares a connection with Form 2159 through its focus on making the repayment of tax debts more manageable. If eligible, taxpayers can use Form 13844 to apply for a reduced fee for setting up their installment agreement, which could then be executed through arrangements like those detailed in Form 2159, easing the financial burden associated with repayment.

Form 2848, Power of Attorney and Declaration of Representative, is relevant to individuals utilizing Form 2159 as it allows taxpayers to authorize another person to represent them in dealings with the IRS. This power of attorney could be crucial for taxpayers arranging a payroll deduction agreement via Form 2159, particularly if they prefer a representative to negotiate and oversee the agreement's details on their behalf.

The Offer in Compromise (OIC) program, though not a single form but established through Forms 656 and 433-A (OIC), shares a goal with Form 2159 of providing taxpayers an alternative method to settle their tax liabilities. However, instead of facilitating a payment plan, the OIC program allows taxpayers to negotiate a settlement for less than the full amount owed. Taxpayers might explore an OIC before or after considering payment options like those in Form 2159, depending on their financial situation.

Form 12277, Application for Withdrawal of Filed Notice of Federal Tax Lien, is indirectly connected to Form 2159, as it deals with the aftermath of tax liens that might be filed against a taxpayer failing to comply with their tax obligations. Successfully entering into and complying with a payroll deduction agreement through Form 2159 could prevent the need for filing a tax lien, making the potential use of Form 12277 less likely.

Dos and Don'ts

When completing the IRS Form 2159, Payroll Deduction Agreement, individuals and employers enter into an agreement with the Internal Revenue Service (IRS) to satisfy outstanding tax liabilities through payroll deductions. Here are some essential do's and don'ts to consider:

Do:- Review the entire form carefully, including instructions, to ensure a clear understanding of the terms and responsibilities.

- Verify all taxpayer information for accuracy, including social security numbers and employer identification numbers.

- Choose the appropriate frequency of payment deduction (weekly, bi-weekly, monthly, or other) that aligns with the taxpayer's payroll schedule.

- Clearly state the amount to be deducted each pay period to ensure it covers the tax liability within the stipulated timeframe.

- Immediately contact the IRS if there are any changes in financial condition or if unable to make a scheduled payment, to avoid defaulting on the agreement.

- Ensure that all applicable sections of the form are completed before submission, including signatures and dates.

- Keep a copy of the completed form and all communications with the IRS for records.

- Regularly review payroll deductions to guarantee the correct amounts are being withheld and transmitted to the IRS.

- Contact the IRS at the provided numbers for any questions or clarifications needed regarding the form or payment process.

- Remember the obligation to file all federal tax returns and pay any due taxes on time while the agreement is in effect.

- Leave blank sections or provide incomplete information, as this could delay the processing of the agreement or result in its rejection.

- Forget to indicate the specific start date for the payroll deductions, which ensures proper scheduling of payments.

- Check the box stating inability to make debit payments without fully understanding the implications and ensuring it applies.

- Underestimate the owed amount; include all penalties and interest to avoid falling short of the total liability.

- Ignore requests from the IRS to provide updated financial information or to review the agreement, as changes in financial condition may affect the agreement.

- Falsify information on the form, as this could lead to legal consequences or the immediate termination of the agreement by the IRS.

- Disregard the importance of ensuring the employer returns the employer section of the form to the IRS, as failure to do so could void the agreement.

- Assume the agreement exempts any future federal tax obligations; all taxes must be filed and paid as due.

- Forget to monitor the progress towards the total liability; ensuring each payment is correctly applied is crucial.

- Ignore IRS communications, especially those concerning modifications or terminations of the agreement, to avoid significant financial repercussions.

Misconceptions

Understanding the IRS Form 2159, a Payroll Deduction Agreement, can be complex, and several misconceptions often arise regarding its use and implications. By clarifying these points, individuals and employers can approach this form with confidence and in compliance with tax laws.

Misconception 1: The payroll deduction agreement is only for businesses. While Form 2159 involves an employer's participation, it's designed for employees who owe taxes and opt to have their repayment deducted directly from their wages or salary. Both individuals and businesses may be involved, but the core purpose is to facilitate an individual's tax repayment.

Misconception 2: Signing Form 2159 allows the IRS to take as much money as they want from your paycheck. The form actually specifies the amount agreed upon by the taxpayer and the IRS to be deducted. This amount is fixed unless a formal change is accepted by both the taxpayer and the IRS, safeguarding taxpayers from arbitrary deductions.

Misconception 3: Once you agree to a payroll deduction agreement, you cannot change the terms. The truth is, if your financial situation changes, you can request a modification or termination of the agreement. Both the taxpayer and the IRS have to agree to any alterations in the payment terms or amounts.

Misconception 4: If you enter into a payroll deduction agreement, you don't have to file your annual tax returns. Regardless of an existing payroll deduction agreement, taxpayers are still required to file their federal tax returns on time and pay any additional taxes owed beyond what is covered by the agreement.

Misconception 5: Employers have no choice but to accept a payroll deduction agreement when presented with Form 2159. Participation in this agreement is subject to an employer's approval. Employers have the right to decline participation if they choose, although many comply as a courtesy to their employees.

Misconception 6: A payroll deduction agreement prevents the IRS from taking collection actions. While a payroll deduction agreement can prevent certain aggressive collection actions, if a taxpayer fails to comply with the terms of their agreement or other federal tax obligations, the IRS may still take actions such as filing a Notice of Federal Tax Lien.

Misconception 7: Tax refunds are unaffected by a payroll deduction agreement. In reality, while under a payroll deduction agreement, any federal tax refunds or overpayments you may be entitled to will be applied toward your outstanding debt until it is fully satisfied.

Misconception 8: The agreement only covers the amount of tax owed at the time of signing. The total amount paid through the agreement can include not just the original tax owed, but also any penalties and interest accrued up to the point of full payment.

For individuals facing tax debts, understanding these nuances of IRS Form 2159 is crucial for responsible financial planning and compliance with tax obligations. Always consider seeking professional advice when dealing with tax matters to ensure that agreements like a payroll deduction are fully understood and properly executed.

Key takeaways

Filling out and using IRS Form 2159, the Payroll Deduction Agreement, can be a strategic step for taxpayers looking to manage their tax liabilities directly through their wages. Understanding the key aspects of this form will ensure a smoother process for both the taxpayer and the employer. Here are five key takeaways:

- Payroll Deduction as an Option: If you're unable to make electronic payments through direct debit, IRS Form 2159 allows you to arrange for tax debt payments to be deducted directly from your wages. This method ensures consistent payments towards your tax liabilities without the need to remember to make payments manually.

- Employer Agreement Is Crucial: Your employer must agree to participate in this payroll deduction agreement by withholding the specified amount from your wages or salary and sending it to the IRS as scheduled. The form requires your employer's signature, underscoring the importance of their willingness to facilitate this process.

- Flexibility in Payment Scheduling: Form 2159 provides options for the frequency of payments to be withheld. You can choose between weekly, bi-weekly, monthly, or another specified schedule, offering flexibility to better align with your pay cycle and financial planning.

- Compliance with Terms: By submitting this form, you agree to several terms, including making payments on time, filing all federal tax returns timely, paying all due (federal) taxes while the agreement is in effect, and allowing the IRS to apply federal tax refunds or overpayments to your tax debt. Failure to comply with these terms can result in the termination of the agreement.

- User Fees: There is a user fee associated with setting up a payroll deduction agreement using Form 2159. However, you might be eligible for a reduced fee under certain conditions. This fee is an important consideration as you weigh the benefits of entering into this type of agreement.

It's important to carefully review the conditions set forth in IRS Form 2159 and to discuss them with your employer. Ensuring that both you and your employer fully understand and agree to the terms of the payroll deduction can help manage tax debts more effectively, alleviating potential financial stress.