Get IRS 211 Form

In the realm of tax administration, integrity and fairness play pivotal roles in maintaining public trust. Within this context, the IRS 211 form emerges as a critical tool designed to uphold these values. This form facilitates the reporting of suspected tax fraud or evasion, providing a channel for concerned individuals to notify authorities about potentially dishonest practices. It not only empowers citizens to take an active role in ensuring tax compliance but also aids in safeguarding the revenue system from abuse. The 211 form covers a wide array of situations, including but not limited to, underreported income, false deductions or credits, and other fraudulent activities that could undermine the tax foundation. Filing this form can be done anonymously, ensuring that individuals who report these activities are protected from retaliation. This protective measure encourages more people to come forward with information, playing a crucial part in the IRS's efforts to enforce tax laws fairly and diligently.

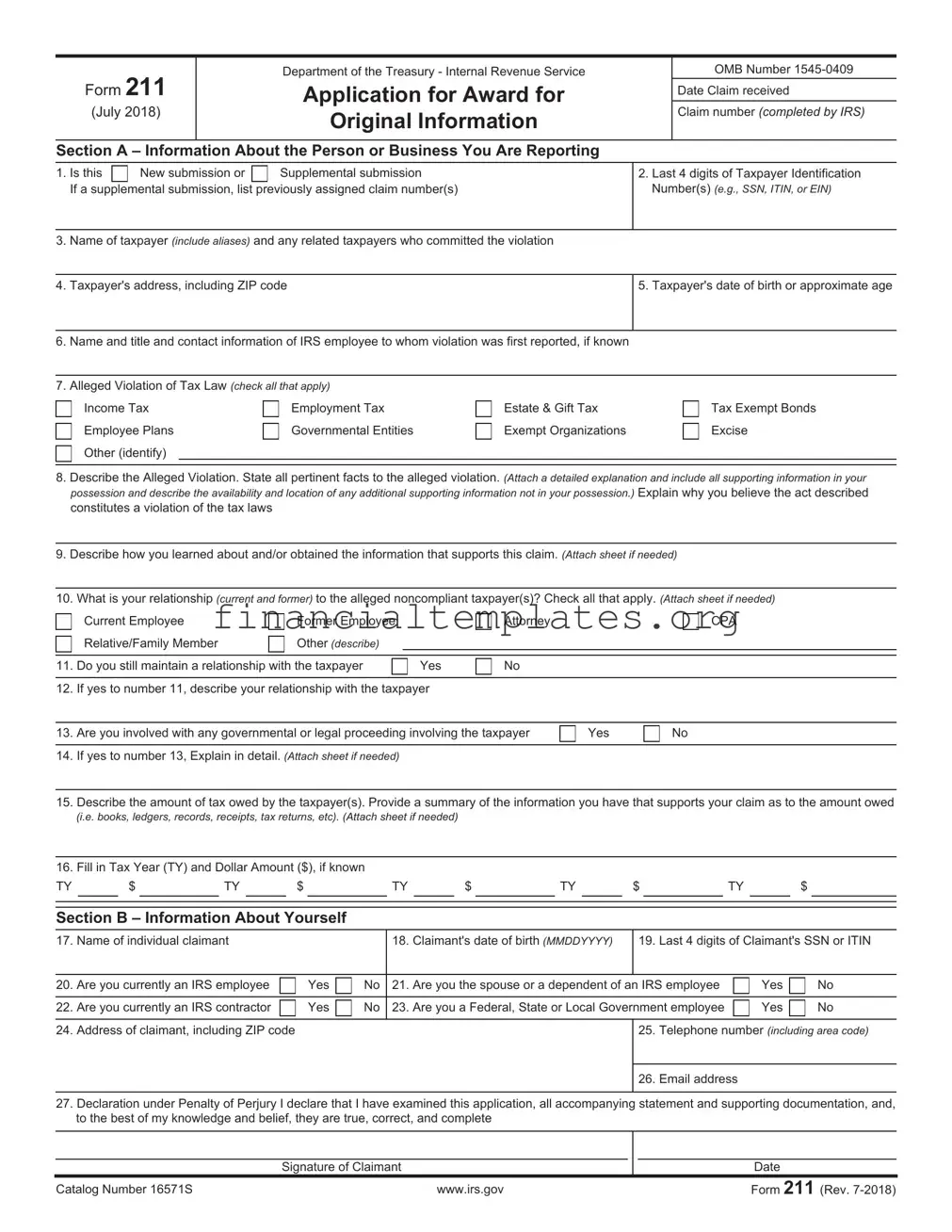

IRS 211 Example

|

Form 211 |

|

Department of the Treasury - Internal Revenue Service |

|

OMB Number |

|

|

|

Application for Award for |

|

Date Claim received |

||

|

|

|

|

|

|

|

|

(July 2018) |

|

Original Information |

|

Claim number (completed by IRS) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Section A – Information About the Person or Business You Are Reporting |

|

|

||||

1. |

Is this |

New submission or |

Supplemental submission |

2. Last 4 digits of Taxpayer Identification |

||

|

If a supplemental submission, list previously assigned claim number(s) |

Number(s) (e.g., SSN, ITIN, or EIN) |

||||

|

|

|

|

|

||

3. |

Name of taxpayer (include aliases) and any related taxpayers who committed the violation |

|

|

|||

4. Taxpayer's address, including ZIP code

5. Taxpayer's date of birth or approximate age

6.Name and title and contact information of IRS employee to whom violation was first reported, if known

7.Alleged Violation of Tax Law (check all that apply)

Income Tax |

Employment Tax |

Estate & Gift Tax |

Tax Exempt Bonds |

Employee Plans |

Governmental Entities |

Exempt Organizations |

Excise |

Other (identify) |

|

|

|

|

|

|

|

8.Describe the Alleged Violation. State all pertinent facts to the alleged violation. (Attach a detailed explanation and include all supporting information in your possession and describe the availability and location of any additional supporting information not in your possession.) Explain why you believe the act described constitutes a violation of the tax laws

9.Describe how you learned about and/or obtained the information that supports this claim. (Attach sheet if needed)

10.What is your relationship (current and former) to the alleged noncompliant taxpayer(s)? Check all that apply. (Attach sheet if needed)

|

Current Employee |

Former Employee |

|

Attorney |

|

CPA |

|

Relative/Family Member |

Other (describe) |

|

|

|

|

|

|

|

|

|

|

|

11. |

Do you still maintain a relationship with the taxpayer |

Yes |

No |

|

|

|

|

|

|

|

|

||

12. |

If yes to number 11, describe your relationship with the taxpayer |

|

|

|

||

|

|

|

|

|||

13. |

Are you involved with any governmental or legal proceeding involving the taxpayer |

Yes |

No |

|||

14.If yes to number 13, Explain in detail. (Attach sheet if needed)

15.Describe the amount of tax owed by the taxpayer(s). Provide a summary of the information you have that supports your claim as to the amount owed

(i.e. books, ledgers, records, receipts, tax returns, etc). (Attach sheet if needed)

16.Fill in Tax Year (TY) and Dollar Amount ($), if known

TY $TY $TY $TY $TY $

Section B – Information About Yourself

17. |

Name of individual claimant |

|

|

18. |

Claimant's date of birth (MMDDYYYY) |

19. |

Last 4 digits of Claimant's SSN or ITIN |

||

|

|

|

|

|

|

|

|

|

|

20. |

Are you currently an IRS employee |

Yes |

No |

21. |

Are you the spouse or a dependent of an IRS employee |

Yes |

No |

||

|

|

|

|

|

|

|

|

||

22. |

Are you currently an IRS contractor |

Yes |

No |

23. |

Are you a Federal, State or Local Government employee |

Yes |

No |

||

|

|

|

|

|

|

|

|

||

24. |

Address of claimant, including ZIP code |

|

|

|

|

25. |

Telephone number (including area code) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. |

Email address |

|

|

|

|

|

|

|

|

|

|

|

|

27.Declaration under Penalty of Perjury I declare that I have examined this application, all accompanying statement and supporting documentation, and, to the best of my knowledge and belief, they are true, correct, and complete

Signature of Claimant

Date

Catalog Number 16571S |

www.irs.gov |

Form 211 (Rev. |

Page 2

Instructions for Form 211, Application for Award for Original Information

General Information: The Whistleblower Office has responsibility for the administration of the whistleblower award program under section 7623 of the Internal Revenue Code. Section 7623 authorizes the payment of awards from the proceeds of amounts the Government collects as a result of the information provided by the whistleblower. A claimant must file a formal claim for award by completing and sending Form 211, Application for Award for Original Information, to be considered for the Whistleblower Program.

Send completed form along with any supporting information to: Internal Revenue Service Whistleblower Office - ICE 1973 N. Rulon White Blvd. M/S 4110

Ogden, UT 84404

Instructions for Completion of Form 211:

Question 1 If you have not previously submitted a Form 211 regarding the same or similar

If you are providing additional information regarding the same or similar

Questions 2 – 5 Information about the Taxpayer – Provide the taxpayer’s name, address, taxpayer identification number – last 4 digits (if known), and the taxpayer’s date of birth or approximate age.

Question 6 If you reported the violation to an IRS employee; please provide the employee’s name, title and the date the violation was reported. If known, provide contact information.

Questions 7 - 8 Indicate the type of tax that has not been paid or the tax liability that has not been reported and describe the alleged violation. Explain why you believe the act described constitutes a violation of the tax laws. Attach all supporting documentation (for example, books and records) to substantiate the claim. If documents or supporting evidence are not in your possession, describe these documents and their location.

Questions 9 - 14 These questions ask how and when you learned of the alleged violation and what relationship, if any, you have to the taxpayer.

Questions 15 – 16 These questions are asking for an estimate of the tax owed and the years/periods that the tax applies.

Questions 17 – 26 Information about the claimant – Provide the claimant’s name, address, date of birth, SSN or ITIN (last 4 digits), email address, and telephone number.

Question 27 Information provided in connection with a claim under this provision of law must be made under an original signed Declaration under Penalty of Perjury. For joint or multiple claimants. Form 211 must be signed by each claimant.

Privacy Act and Paperwork Reduction Act Notice

We ask for the information on this form to carry out the internal revenue laws of the United States. Our authority to ask for this information is 26 USC 6109 and 7623. We collect this information for use in determining the correct amount of any award payable to you under 26 USC 7623. We may disclose this information as authorized by 26 USC 6103, including to the subject taxpayer(s) as needed in a tax compliance investigation and to the Department of Justice for civil and criminal litigation. You are not required to apply for an award. However, if you apply for an award you must provide as much of the requested information as possible. Failure to provide information may delay or prevent processing your request for an award; providing false information may subject you to penalties.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. Generally, tax returns and return information are confidential, as required by 26 U.S.C. 6103.

The time needed to complete this form will vary depending on individual circumstances. The estimated average time is 45 minutes. If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can email us at *taxforms@irs.gov (please type "Forms Comment" on the subject line) or write to the Internal Revenue Service, Tax Forms Coordinating Committee, SE: W: CAR: MP: T: T: SP, 1111 Constitution Ave. NW,

Send the completed Form 211 to the above Ogden address of the Whistleblower Office. Do NOT send the Form 211 to the Tax Forms Coordinating Committee.

Catalog Number 16571S |

www.irs.gov |

Form 211 (Rev. |

Document Specifics

| Fact Number | Detail |

|---|---|

| 1 | The IRS Form 211 is used for reporting suspected tax law violations by an individual or business. |

| 2 | Submitter can remain anonymous but providing contact information may assist the IRS in case further information is needed. |

| 3 | Award claims under the Whistleblower Informant Award program are made through this form. |

| 4 | The form requires detailed information about the alleged tax non-compliance including the violator's identifying information and the nature of the violation. |

| 5 | Whistleblowers may receive between 15-30% of the collected proceeds if the IRS uses information provided on Form 211. |

| 6 | The IRS reviews submissions to determine eligibility for an award based on several criteria, including the significance of the information provided. |

| 7 | Submissions through Form 211 are protected under confidentiality provisions, allowing information to be shared without compromising the whistleblower's identity. |

| 8 | There is no statute of limitations for submitting a Form 211; however, earlier submissions can result in more effective tax enforcement actions. |

| 9 | While the form is federal and not state-specific, its usage and the implications of the reported information are governed by federal tax laws and regulations. |

Guide to Writing IRS 211

Filling out IRS Form 211 is a step in the process that should be taken with attention to detail and accuracy. Once the form is completed and submitted, it is reviewed for eligibility under the criteria established by the IRS. If the submission meets these criteria, it moves forward in the process. The specific outcome will depend on the nature of the information provided, as the form is used for reporting certain types of information to the IRS. To ensure a smooth experience, follow these step-by-step instructions carefully.

- Gather all necessary information and documentation related to the information you wish to report. This includes identifying details, financial records, and any relevant dates and figures.

- Access IRS Form 211 from the official Internal Revenue Service website. Ensure you have the latest version of the form.

- Read the instructions provided with Form 211 thoroughly before you begin filling it out. This will help clarify what specific information is required and where it should be entered on the form.

- Enter your personal information in the designated areas at the top of the form. This includes your name, address, and taxpayer identification number (TIN), such as your Social Security Number (SSN).

- Provide detailed information about the entity or individual you are reporting, including their name, address, and any known TIN.

- Describe the specific actions or issues you are reporting. Be as detailed as possible, providing dates, amounts, and any other relevant information that supports your report.

- Include any documentation that supports your report. Attach these documents to the form if submitting by mail, or follow the instructions for electronic submission if you are filing online.

- Review all the information you have provided on Form 211, ensuring it is complete and accurate. Correct any errors you may find.

- Sign and date the form. Your signature attests to the truthfulness and accuracy of the information you have provided.

- Submit the form and any accompanying documentation to the IRS, following the submission instructions provided with Form 211. Remember to keep a copy of the form and any documents you submit for your personal records.

After submitting Form 211, it is important to be patient. The review process can take time, and the IRS will contact you if additional information is needed or if a decision has been made regarding your submission. Ensure that all contact information you provided is accurate to avoid any delays in communication.

Understanding IRS 211

-

What is the IRS 211 form used for?

The IRS 211 form is commonly known as the "Award for Original Information" form. It's essentially a way for individuals to report tax fraud or evasion they know about in return for a potential reward. If the information provided leads to the collection of taxes, penalties, interest, or other amounts from the noncompliant taxpayer, the informant might receive a monetary award based on a percentage of the amount collected.

-

Who can file an IRS 211 form?

Almost anyone with specific and credible information about tax evasion or fraud can submit a Form 211. This includes employees, ex-spouses, competitors, and even complete strangers to the taxpayer in question. However, IRS employees, government officials, or those obtaining information while providing services to the IRS are usually ineligible to receive an award. It's important for informants to provide detailed information and any evidence they have to support their claims.

-

How do you file a Form 211?

To file a Form 211, you need to complete it with specific information about the taxpayer you are reporting and the tax evasion or fraud you're alleging. This includes descriptions of the violations, how you became aware of them, and any evidence you might have. The completed form can then be sent to the IRS via mail. The IRS encourages individuals to provide as much detail and documentation as possible to support their claim.

-

Is my identity protected when I submit a Form 211?

Yes, the IRS takes the confidentiality of informants seriously. The identity of individuals submitting a Form 211 is protected by law. However, in some cases, if the case goes to court, the informant might be asked to testify, which could potentially reveal their identity. Informants can also choose to submit their information anonymously, but this might affect the ability to receive an award, as the IRS would not have a contact for potential payments.

-

How long does it take to receive an award after submitting a Form 211?

The process can be lengthy, often taking several years. This is because the IRS must thoroughly examine the information, decide on the appropriate action, and successfully collect the owed taxes and penalties. The amount and disbursement of any award come after the collection is completed, and the entire process has been finalized.

-

Can I appeal if my claim for an award is denied or if I disagree with the award amount?

Yes, individuals who submit a Form 211 and are dissatisfied with the IRS's decision regarding their claim for an award have the right to appeal. The appeal must be submitted within 30 days of the IRS's decision notification. The appeal process provides a chance to contest the denial or the amount of the award, but it requires a thorough understanding of the relevant tax laws and IRS procedures.

Common mistakes

Not Providing Sufficient Detail: One of the biggest mistakes individuals make when completing the IRS 211 form is not providing enough detailed information. It's essential to include as much information as possible about the suspected tax evasion or fraud, including names, dates, amounts, and any evidence that can support the claim. A lack of detail can make it difficult for the IRS to investigate the allegation, potentially leading to the form being disregarded.

Failure to Sign the Form: Surprisingly, many people forget to sign the form before submission. An unsigned form may not be processed, as the signature certifies that the information provided is, to the best of the individual's knowledge, true, correct, and fully disclosed. Without a signature, the credibility of the information can be called into question.

Incorrect Mailing of the Form: The IRS 211 form needs to be sent to a specific address designated by the IRS for processing. Often, individuals mail their form to the wrong address, such as their local IRS office or the general IRS mailing address. This mistake can delay the review process or even result in the loss of the form. It's crucial to double-check the correct mailing address for the IRS Whistleblower Office to ensure that the form is appropriately directed.

Not Keeping a Copy: Many individuals forget to keep a copy of the IRS 211 form for their records. Maintaining a copy is vital for future reference, especially if there are follow-up questions or if the individual needs to prove that they submitted the form. Without a copy, it's challenging to track the status of a submission or provide additional information if requested by the IRS.

To avoid these common pitfalls, individuals should take the time to thoroughly review the form, ensure all provided information is detailed and accurate, double-check the form for a signature, confirm they are mailing it to the correct address, and keep a copy for their records. This careful attention to detail can make all the difference in the pursuit of justice and potentially earning a reward.Documents used along the form

The Internal Revenue Service (IRS) Form 211, also known as the Application for Award for Original Information, is a catalyst for individuals to report violations of tax laws. Notably, this form can be the cornerstone of myriad documents tailored to substantiate or elaborate the claims made. These documents vary in nature but share a common goal: to ensure comprehensive information is available for the IRS to evaluate the claim. Understanding these adjunct forms and documents is crucial for a holistic approach to tax law enforcement and compliance.

- Form 1040: Often, individuals reporting tax violations may reference the U.S. Individual Income Tax Return, Form 1040. This form, detailing the income, deductions, and credits of the whistleblower, can establish financial relationships or discrepancies relevant to the case at hand.

- Form 4506: The Request for Copy of Tax Return, Form 4506, proves invaluable when the claim involves needing actual copies of previously filed tax returns by the party under scrutiny. This document helps in comparing reported income versus actual income or substantiating fraudulent filings.

- Form 8821: Tax Information Authorization, Form 8821, allows the IRS to disclose tax information to third parties. In the context of a Form 211 filing, it might be used by the whistleblower to authorize an attorney or accountant to receive confidential tax information relevant to the claim.

- Schedule K-1 (Form 1065): For claims involving partnerships or pass-through entities, Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc., provides insights into the distribution of income or losses that may illuminate the alleged tax violations.

- Form 1099: Various versions of Form 1099, used to report miscellaneous incomes such as dividends, interest, or independent contractor income, may be attached to support allegations of undeclared income or tax evasion practices.

- Bank Statements: These are critical for corroborating the financial transactions pertinent to the whistleblower's claims. They serve as concrete evidence of the flow of money that contradicts or confirms the tax filings in question.

- Email Correspondences and Contracts: Often, whistleblowers may have access to email communications or contractual agreements that highlight the intent or execution of tax malpractices. These documents can be pivotal in substantiating the whistleblower’s allegations.

- Form 3949-A: Information Referral, this form is used by individuals who wish to report suspected tax law violations but do not seek a whistleblower award. While Form 211 is for those applying for a monetary award, Form 3949-A might be used in conjunction with it when whistleblowers want to provide additional tips without the reward incentive.

Conclusively, the assembly of these documents alongside the IRS Form 211 represents a meticulous approach to unveiling and addressing tax violations. It exemplifies the broader strategy encompassing vigilant observation, detailed documentation, and the rigorous pursuit of justice. Understanding the symbiotic relationship between these forms and how they collectively fortify a whistleblower's claim is indispensable for both practitioners and individuals navigating through the complex terrains of tax law.

Similar forms

The IRS 211 form, used for reporting suspected tax fraud or evasion, bears similarities to a variety of other documents across different fields. These documents share common purposes such as reporting misconduct, requesting investigations, or providing confidential information to authorities.

One similar document is the SEC Form TCR (Tip, Complaint or Referral). This form allows individuals to report violations of the securities laws to the U.S. Securities and Exchange Commission (SEC). Like the IRS 211, the SEC Form TCR is a tool for individuals to report suspicious activities confidentially, aiming to protect market integrity and prevent financial fraud.

Another document similar to the IRS 211 form is the FINCEN Suspicious Activity Report (SAR). Financial institutions use the SAR to report suspicious activities that may indicate money laundering, fraud, or other illegal transactions. Both forms are integral to their respective agencies' efforts to combat illicit activities, relying on reports from those within or interacting with the system.

The OSHA Whistleblower Complaint Form is used by employees to report workplace safety violations or retaliation for voicing concerns about unsafe practices. Though this form concerns workplace safety, it shares the IRS 211 form's intent of providing a channel for reporting misconduct, emphasizing the protection of the reporter's identity.

The HUD Housing Discrimination Complaint Form similarly allows individuals to report unfair treatment or discrimination in housing and lending. It parallels the IRS 211 in its aim to rectify illegal behaviors, providing a mechanism for individuals to report violations of federal housing laws confidentially.

The HHS OIG Hotline Complaint Form enables individuals to report fraud, waste, or abuse within Health and Human Services programs. This form, akin to the IRS 211 form, plays a critical role in safeguarding the integrity of federal programs and ensuring the rightful use of government funds.

The EPA Violations Reporting Form is another analogous document, used to report environmental violations. Both the EPA form and the IRS 211 form serve as vital tools for the enforcement of federal laws, depending on concerned citizens to report activities that may harm public health or the environment.

The FTC Complaint Assistant is used to report fraudulent, scam, and unfair business practices to the Federal Trade Commission. Similar to the IRS 211 form, it helps in identifying and investigating operations that contravene established federal regulations, aimed at protecting consumers and maintaining market fairness.

Finally, the IC3 Internet Crime Complaint Center Form, managed by the FBI, is for reporting cyber crimes. Like the IRS 211, this form allows for the confidential submission of information regarding illegal online activities, catering to the digital realm's unique challenges in law enforcement and security.

While these documents span various fields and types of reports, they collectively underscore the importance of citizen participation in enforcing laws and regulations. Each form, including the IRS 211, ultimately contributes to maintaining lawful conduct and protecting individual rights and societal welfare.

Dos and Don'ts

When tackling the IRS Form 211, a document designed for reporting information about people who may not be complying with tax laws, accuracy and attention to detail are critical. Here is a comprehensive guide on what to do and what to avoid to ensure the process is smooth and effective.

Do's when filling out the IRS Form 211:

Thoroughly read the instructions provided by the IRS to understand each section of the form correctly.

Gather all necessary information, including specific details about the taxpayer you are reporting, such as names, addresses, and the nature of the tax violation, before beginning the form.

Be as precise and detailed as possible in your descriptions to provide the IRS with enough information to investigate the alleged violation.

Use additional sheets if the space provided in the form is insufficient, making sure to indicate clearly the section of the form that your additional information relates to.

Confirm the type of reward you are seeking, if applicable, by checking the appropriate box and understanding the criteria under which rewards are granted.

Sign and date the form to certify the accuracy of the information provided and your understanding of the submission's implications.

Keep a copy of the form and all supporting documents for your records, in case the IRS needs to contact you for further information.

Don'ts when filling out the IRS Form 211:

Do not guess or speculate when providing information. If you are unsure about a detail, it's better to leave it blank than to risk submitting incorrect information.

Avoid leaving fields blank without explanation. If a section does not apply to your report, indicate this appropriately by writing "N/A" or "Not Applicable".

Do not overlook the requirement for supporting documentation. If you have evidence to support your claim, mention this in your submission and be prepared to provide it if asked.

Resist the urge to exaggerate or fabricate details in an attempt to make your report seem more credible. Honesty is crucial in these submissions.

Do not submit the form anonymously if you are seeking a reward, as the IRS needs your information to process any potential award payments.

Avoid using the form for personal grievances or disputes that do not relate to tax law violations. The IRS is focused on enforcing tax laws, not mediating personal disputes.

Finally, do not expect immediate results. Investigations can take time, and patience is required during this process.

Misconceptions

When dealing with the IRS Form 211, numerous misconceptions can complicate the understanding and process of reporting or dealing with tax-related information. Here's a detailed look at some common misunderstandings that need to be clarified:

The form is only for reporting tax evasion. While Form 211 is commonly associated with reporting tax fraud or evasion, its use spans beyond just these issues. It is also used for reporting other kinds of tax noncompliance, including but not limited to, incorrect tax filings or failure to pay the correct amount of taxes.

There’s a guarantee of a monetary reward. Another prevalent misunderstanding is that submitting a Form 211 guarantees a reward. In truth, the IRS awards are discretionary, based on the value of the information provided, and not all submissions result in payment.

Filing this form is a lengthy and complicated process. While it's crucial to provide detailed and accurate information, the process of filling out Form 211 is straightforward. The IRS designed it to be accessible, with clear instructions for each part.

Your identity will be made public. The IRS takes privacy and confidentiality seriously. When you submit a Form 211, your identity is protected by law, except in rare circumstances where disclosure is required, such as court proceedings.

Only individuals can file Form 211. This is a common misconception. In reality, both individuals and entities can submit a Form 211 if they have information on tax noncompliance.

The IRS acts on all submissions. While the IRS reviews all submitted forms, not every report results in an investigation. The decision to investigate depends on several factors, including the credibility of the information and its potential impact on tax compliance.

Submitting Form 211 will make you liable. Many people fear that if they report someone and the information turns out to be incorrect, they could face penalties. However, as long as the information was provided in good faith, the person submitting the form is not liable for mistakes or inaccuracies.

There’s a specific “tax season” for filing Form 211. Unlike tax returns that have a specific filing season, Form 211 can be submitted to the IRS at any time during the year. There’s no need to wait for a particular period to report tax noncompliance.

Understanding the truths behind these misconceptions can empower individuals with the right knowledge and confidence to report tax noncompliance, contributing to a fairer tax system for everyone.

Key takeaways

The IRS Form 211, also known as the "Application for Reward for Original Information," is a key document for anyone looking to report tax fraud or evasion and possibly receive a reward for their information. The process and implications of filling out this form are significant and should be understood thoroughly. Below are seven crucial takeaways about filling out and using the IRS 211 Form.

- Accuracy is Critical: When completing the IRS 211 form, every piece of information provided must be accurate and truthful. Any attempt to submit false information can result in legal repercussions.

- Details Matter: The effectiveness of your submission greatly depends on the quality and depth of the information provided. Detailed descriptions, including dates, amounts, and involved parties, can significantly impact the IRS's ability to investigate the case.

- Documentation Supports Your Claim: Including relevant documentation with your Form 211 can enhance the credibility of your report. Copies of receipts, ledgers, emails, or contracts can serve as substantial evidence for the IRS's investigation.

- Anonymity Options: While you can choose to remain anonymous during the submission process, doing so may affect your ability to receive a reward. Providing contact information enables the IRS to reach out if additional information is needed or to deliver any reward you may earn.

- Understanding the Reward Process: The decision to issue a reward and its amount is at the discretion of the IRS, based on the significance of the information provided and the outcome of the investigation. Not all submissions result in a reward.

- Rewards are Taxable: It's important to note that any reward received from the IRS for information provided is subject to federal income tax.

- Patience is Necessary: The process from submitting the IRS 211 form to the conclusion of the investigation and potential reward issuance can be lengthy, often taking several years. It requires patience as the IRS thoroughly examines the reported information.

Filling out the IRS 211 form can be a significant step towards combating tax fraud and evasion. By ensuring your submission is detailed, accurate, and supported by documentation, you can assist the IRS effectively while potentially earning a reward for your efforts.

Popular PDF Documents

IRS 1120-S - On Form 1120-S, S corporations declare any dividends distributed to shareholders, affecting their individual tax returns.

IRS 1120-S - Streamlines the tax reporting process for S corporations, offering a clear format to declare income and tax liabilities.

Sale of Donated Property Within 3 Years - This document helps the IRS track the sale of donated property to ensure charities are not misusing assets.