Get IRS 2106 Form

Filing taxes can be a complicated process, especially when it involves declaring all eligible work-related expenses. For employees who incur these costs, the IRS 2106 form plays a crucial role in the tax preparation process. This specific form allows individuals to itemize and deduct employment-related expenses that are not reimbursed by their employer. Such expenses might include travel, uniforms, and even home office costs under certain conditions. However, it’s important to note that not everyone is eligible to use this form, as the IRS has set specific guidelines on who can claim these deductions. Moreover, the Tax Cuts and Jobs Act of 2017 introduced significant changes to the deductions available, further narrowing the scope of eligible taxpayers. Understanding the intricacies of the IRS 2106 form is essential for ensuring that all deductions are claimed correctly, thereby potentially reducing one's taxable income and the amount of taxes owed.

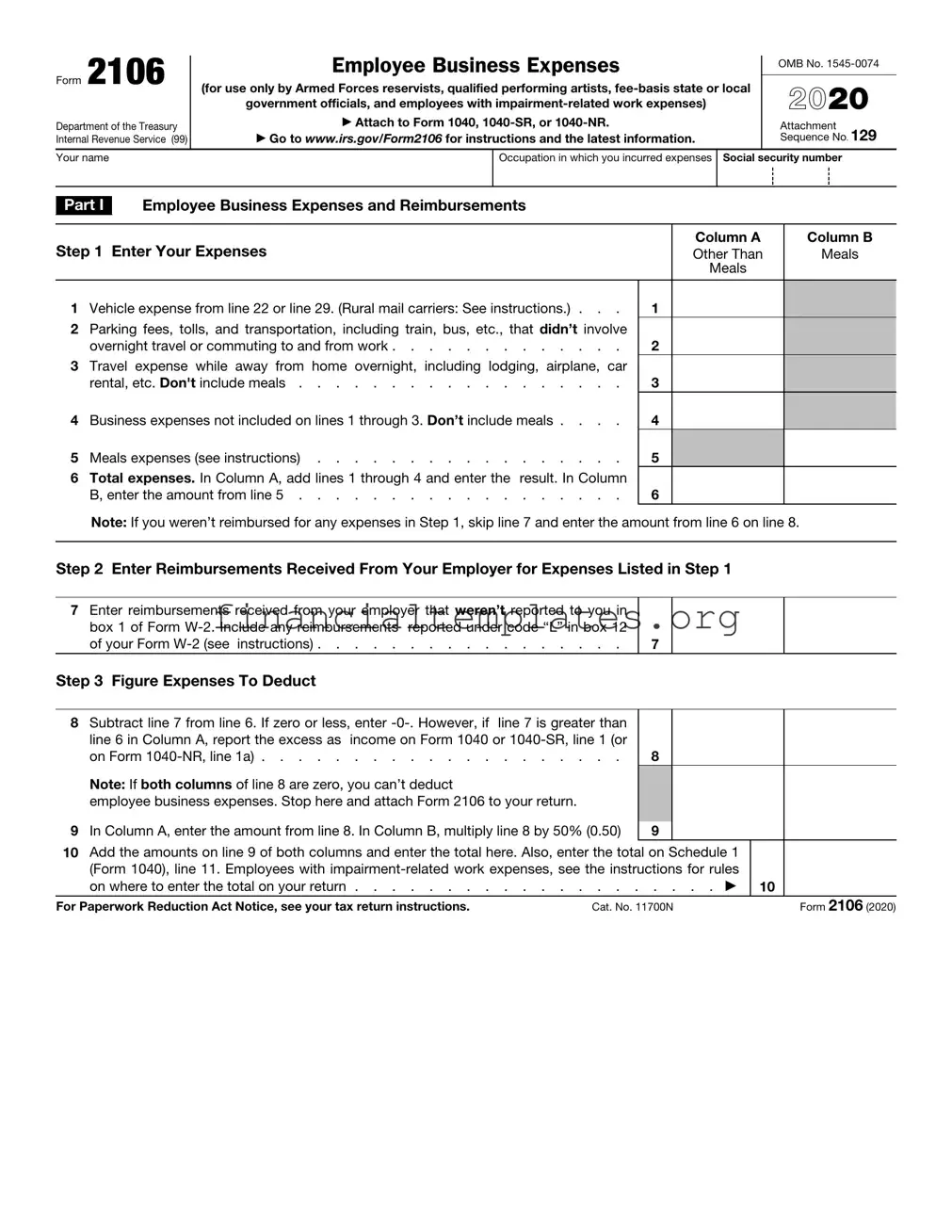

IRS 2106 Example

Form 2106 |

|

Employee Business Expenses |

|

|

|

OMB No. |

||||

|

|

|

|

|||||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

||||

|

(for use only by Armed Forces reservists, qualified performing artists, |

|

2021 |

|||||||

|

|

|

|

government officials, and employees with |

|

|||||

Department of the Treasury |

|

▶ Attach to Form 1040, |

|

|

|

Attachment |

||||

Internal Revenue Service (99) |

|

▶ Go to www.irs.gov/Form2106 for instructions and the latest information. |

|

Sequence No. 129 |

||||||

Your name |

|

|

|

|

Occupation in which you incurred expenses |

Social security number |

||||

|

|

|

|

|

|

|

|

|

||

|

|

Employee Business Expenses and Reimbursements |

|

|

|

|

|

|||

Part I |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||

Step 1 Enter Your Expenses |

Column A |

|

Column B |

|||||||

Other Than |

|

Meals |

||||||||

|

|

|

|

|

|

Meals |

|

|

||

|

|

|

|

|

|

|||||

1 Vehicle expense from line 22 or line 29. (Rural mail carriers: See instructions.) . . . |

1 |

|

|

|

|

|||||

2Parking fees, tolls, and transportation, including train, bus, etc., that didn’t involve

overnight travel or commuting to and from work |

2 |

3Travel expense while away from home overnight, including lodging, airplane, car

|

rental, etc. Don't include meals |

3 |

|

|

4 |

Business expenses not included on lines 1 through 3. Don’t include meals . . . . |

4 |

|

|

5 |

Meals expenses (see instructions) |

5 |

|

|

6Total expenses. In Column A, add lines 1 through 4 and enter the result. In Column

B, enter the amount from line 5 |

6 |

Note: If you weren’t reimbursed for any expenses in Step 1, skip line 7 and enter the amount from line 6 on line 8.

Step 2 Enter Reimbursements Received From Your Employer for Expenses Listed in Step 1

7Enter reimbursements received from your employer that weren’t reported to you in box 1 of Form

7

Step 3 Figure Expenses To Deduct

8Subtract line 7 from line 6. If zero or less, enter

line 6 in Column A, report the excess as |

income on Form 1040 or |

|

on Form |

. . . . . . . . . . . . . . . |

8 |

Note: If both columns of line 8 are zero, you can’t deduct

employee business expenses. Stop here and attach Form 2106 to your return.

9In Column A, enter the amount from line 8. In Column B, see the instructions for the

amount to enter |

9 |

10Add the amounts on line 9 of both columns and enter the total here. Also, enter the total on Schedule 1 (Form 1040), line 12. Employees with

on where to enter the total on your return |

. . . . . . . . . . . . ▶ |

10 |

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 11700N |

Form 2106 (2021) |

Form 2106 (2021) |

|

|

|

|

|

|

Page 2 |

||

|

|

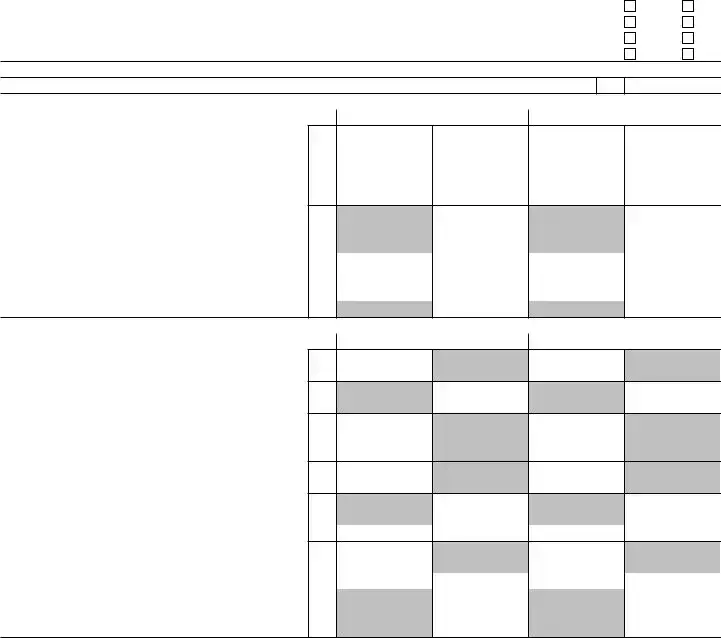

Vehicle Expenses |

|

|

|

|

|

|

|

Part II |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

Section |

|

(a) |

Vehicle 1 |

|

(b) Vehicle 2 |

||||

claiming vehicle expenses.) |

|

|

|||||||

|

|

|

|

|

|

||||

11 |

Enter the date the vehicle was placed in service |

11 |

/ |

/ |

|

/ |

/ |

||

12 |

Total miles the vehicle was driven during 2021 |

12 |

|

miles |

|

|

miles |

||

13 |

Business miles included on line 12 |

13 |

|

miles |

|

|

miles |

||

14 |

Percent of business use. Divide line 13 by line 12 |

14 |

|

% |

|

|

% |

||

15 |

Average daily roundtrip commuting distance |

15 |

|

miles |

|

|

miles |

||

16 |

Commuting miles included on line 12 |

16 |

|

miles |

|

|

miles |

||

17 |

Other miles. Add lines 13 and 16 and subtract the total from line 12 . . |

17 |

|

miles |

|

|

miles |

||

18 |

Was your vehicle available for personal use during |

Yes |

No |

||||||

19 |

Do you (or your spouse) have another vehicle available for personal use? |

Yes |

No |

||||||

20 |

Do you have evidence to support your deduction? |

Yes |

No |

||||||

21 |

If “Yes,” is the evidence written? |

Yes |

No |

||||||

Section

22Multiply line 13 by 56¢ (0.56). Enter the result here and on line 1 . . . . . . . . . . . . .

Section

22

(a) Vehicle 1 |

(b) Vehicle 2 |

23 |

Gasoline, oil, repairs, vehicle insurance, etc. . |

23 |

|

|

|

|

24a |

Vehicle rentals |

24a |

|

|

|

|

b |

Inclusion amount (see instructions) . . . . |

24b |

|

|

|

|

c |

Subtract line 24b from line 24a |

24c |

|

|

|

|

25Value of

|

Form |

25 |

|

|

|

|

26 |

Add lines 23, 24c, and 25 |

26 |

|

|

|

|

27 |

Multiply line 26 by the percentage on line 14 . |

27 |

|

|

|

|

28 |

Depreciation (see instructions) |

28 |

|

|

|

|

29 |

Add lines 27 and 28. Enter total here and on line 1 |

29 |

|

|

|

|

Section

(a) Vehicle 1 |

(b) Vehicle 2 |

30 |

Enter cost or other basis (see instructions) . . |

30 |

31Enter section 179 deduction and special allowance

(see instructions) |

31 |

32Multiply line 30 by line 14 (see instructions if you claimed the section 179 deduction or special

allowance) |

. . . . . . . . . . . . |

32 |

33Enter depreciation method and percentage (see

instructions) |

33 |

34Multiply line 32 by the percentage on line 33 (see

instructions) |

34 |

|

|

|

|

35 Add lines 31 and 34 |

35 |

|

|

|

|

36Enter the applicable limit explained in the line 36

|

instructions |

36 |

|

|

|

|

37 |

Multiply line 36 by the percentage on line 14 . |

37 |

|

|

|

|

38 |

Enter the smaller of line 35 or line 37. If you |

|

|

|

|

|

|

skipped lines 36 and 37, enter the amount from |

|

|

|

|

|

|

line 35. Also enter this amount on line 28 above |

38 |

|

|

|

|

Form 2106 (2021)

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 2106, "Employee Business Expenses," is utilized by employees to deduct ordinary and necessary expenses related to their jobs which are not reimbursed by their employer. |

| Eligibility Criteria | Only certain individuals, such as Armed Forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses, are eligible to use Form 2106 due to changes from the Tax Cuts and Jobs Act of 2017. |

| Deduction Limitations | Expenses reported on Form 2106 must exceed 2% of the taxpayer's adjusted gross income to qualify for a deduction. This rule is applicable for tax years prior to 2018. From 2018 onwards, miscellaneous itemized deductions are suspended. |

| Relevance to Tax Returns | The deductions calculated on Form 2106 are used on Schedule A (Form 1040) to determine the total itemized deductions, impacting the taxpayer's overall tax liability. |

| State-specific Forms | Some states may require additional forms to claim similar deductions on state income taxes. These requirements can vary widely and are governed by the individual state's tax code and regulations. |

Guide to Writing IRS 2106

Filling out the IRS Form 2106 is a straightforward process if you follow a set of simple steps. This form is designed for individuals to deduct work-related expenses that have not been reimbursed by their employer. It's essential for those looking to accurately report these expenses and potentially lower their taxable income. The process starts by gathering all necessary documentation of your expenses before you begin the form. This preparation ensures accuracy and compliance with IRS requirements. After collecting your documents, follow these steps:

- Start by entering your personal information, including your name and Social Security Number, at the top of the form.

- On line 1, enter your occupation for which you incurred the expenses.

- In section A, if you are required to fill it out, list your vehicle expenses. This involves reporting the cost of operation, including gas, maintenance, and depreciation.

- In section B, detail all other job-related expenses. This includes supplies, union dues, education expenses, or travel.

- Calculate the total expenses and enter this amount in the designated area on the form.

- If applicable, list any reimbursements you received from your employer that were not included in your W-2 form, in the space provided.

- Subtract any employer reimbursements from your total expenses and enter the result. This is the amount that will be deducted from your taxable income.

- Follow the instructions on the form to determine where to report this amount on your IRS Form 1040.

- Review the form to ensure all information is accurate and complete.

- Sign and date the form. If you're filing jointly, ensure your spouse also signs if applicable.

- Attach Form 2106 to your tax return and submit it to the IRS by the filing deadline.

Once the form is filled out and submitted, the IRS will review your deductions as part of your tax return process. Accurate completion and timely submission of Form 2106 can lead to favorable adjustments to your taxable income, potentially lowering your overall tax liability. It's essential to keep copies of all submitted forms and relevant documentation in case the IRS requires further information or audit your tax return.

Understanding IRS 2106

-

What is the IRS 2106 form used for?

The IRS 2106 form, also known as the Employee Business Expenses form, is used by employees to deduct ordinary and necessary expenses related to their job that were not reimbursed by their employer. These expenses might include travel, transportation, meals, entertainment, and supplies. It's important to distinguish that these expenses must be both ordinary (common in your field of employment) and necessary (helpful and appropriate for your business).

-

Who is eligible to use the IRS 2106 form?

Eligibility to use the IRS 2106 form primarily applies to certain categories of employees. These include armed forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses. It's worth noting that due to tax law changes, many employees can no longer deduct unreimbursed work expenses. However, those falling into the categories mentioned are exceptions.

-

What types of expenses can be reported on Form 2106?

On Form 2106, employees can report various types of expenses. These typically include costs related to travel, meals, entertainment, transportation (including car expenses), and supplies necessary for their work. However, it's essential to remember that entertainment expenses are no longer deductible for most employees, with certain exceptions, such as for qualified performing artists.

-

How does the Tax Cuts and Jobs Act affect deductions reported on Form 2106?

The Tax Cuts and Jobs Act brought significant changes to the deductibility of employee business expenses. For tax years 2018 through 2025, most employees can no longer deduct unreimbursed work expenses. This change impacts the reporting on Form 2106, as only those with specific employment categories, such as armed forces reservists, qualified performing artists, and fee-basis state or local government officials, can still claim deductions for unreimbursed employee business expenses on their tax returns.

-

Can I claim vehicle expenses on Form 2106?

Yes, vehicle expenses related to work, not reimbursed by an employer, can be claimed on Form 2106. Employees have the option to calculate these expenses using the standard mileage rate or actual car expenses, which include gas, oil, repairs, insurance, and depreciation. The chosen method should be used consistently and requires thorough documentation and record-keeping.

-

What documentation is needed to support the deductions claimed on Form 2106?

To support the deductions claimed on Form 2106, thorough documentation is crucial. Receipts, logs, and records should detail the nature, amount, and business purpose of each expense. For vehicle expenses, a mileage log showing dates, miles traveled, and the purpose of each trip is essential. Keeping detailed and organized records will help validate the expenses if ever questioned by the IRS.

-

How does Form 2106 affect my tax return?

Filing Form 2106 can impact your tax return by potentially lowering your taxable income. The total of the allowable expenses calculated on Form 2106 is transferred to Schedule 1 (Form 1040), which then adjusts your gross income on Form 1040. It’s important to note that you must itemize deductions on Schedule A to benefit, which means your total itemized deductions should exceed the standard deduction amount for your filing status to make itemizing advantageous.

-

Where do I file Form 2106 with my tax return?

Form 2106 should be filed along with your annual tax return. The deductions calculated on Form 2106 are reported on Schedule 1 (Form 1040), and the total is then used to adjust your income on your Form 1040. Ensure all calculations are completed accurately and that any documentation supporting your deductions is kept on hand, in case it is requested by the IRS for verification.

Common mistakes

When it comes to tax preparation, accurately filling out IRS Form 2106, which is used by employees to deduct ordinary and necessary expenses incurred while performing their jobs, is key. However, people often make several common mistakes that can potentially lead to miscalculations or scrutiny from the IRS. Here are six mistakes to avoid:

Not distinguishing between reimbursable and non-reimbursable expenses. It's crucial to differentiate expenses your employer has reimbursed you for from those that have not been reimbursed. Only unreimbursed expenses that are ordinary and necessary for your job can be deducted.

Overlooking the necessity of records. For every expense you deduct, you must keep detailed records. This includes receipts, bills, and logs, especially for mileage. Failure to maintain these records can result in a denied deduction if audited.

Confusing personal expenses with business expenses. It's important to strictly separate personal expenditures from those that are truly business-related. Including personal expenses, even unintentionally, might not only reduce your deduction but could also trigger an audit.

Not understanding the standard mileage rate. If you're deducting vehicle expenses, the IRS allows you to use a standard mileage rate. However, taxpayers often incorrectly calculate these expenses by either using the wrong rate or failing to account for all deductible miles driven for work purposes.

Incorrectly categorizing meals and entertainment. The IRS has specific guidelines on what constitutes a deductible meal or entertainment expense. Taxpayers frequently misinterpret these rules, either inflating these deductions or missing out on legitimate ones. Remember, only 50% of these expenses are generally deductible.

Failing to meet the deadline for filing Form 2106. Just like the main tax return, Form 2106 has a filing deadline. Missing this deadline can lead to penalties and interest on any amount of tax that might have been reduced by these deductions.

Avoiding these mistakes not only ensures compliance with the IRS but can also maximize your eligible work-related deductions. Keeping thorough records and understanding the specifics of each deductible expense can significantly simplify the process of filling out Form 2106.

Documents used along the form

When preparing tax returns, particularly for individuals who are employed and incur job-related expenses, the IRS 2106 form, Employee Business Expenses, is often not the sole document required. This form is used by taxpayers to deduct ordinary and necessary expenses incurred while performing their job duties. However, to accurately fill out and support the deductions claimed on Form 2106, a range of other documents and forms may also be necessary. These additional documents help in substantiating the expenses claimed and ensuring that the taxpayer complies with the IRS regulations.

- IRS Form 1040 - The main tax return form for individual taxpayers. It is where the summary of income, deductions, and credits is reported, and the information from Form 2106 is transferred to this form.

- IRS Schedule C (Form 1040) - Utilized by self-employed individuals or sole proprietors to report income or loss from a business. Taxpayers need this form if they are deducting expenses related to self-employment on Form 2106.

- IRS Schedule A (Form 1040) - Itemized Deductions form. It's where taxpayers list various deductions they're claiming, such as medical expenses, charitable donations, and certain work-related expenses not covered by Form 2106.

- Receipts and Invoices - Physical or electronic receipts and invoices for all expenses being claimed. These are crucial for substantiating the deductions on Form 2106 and may be required in case of an audit.

- Travel Logs and Mileage Records - For those claiming vehicle expenses, detailed records including dates, mileage, and purposes of trips are necessary. This documentation supports deductions for business use of a vehicle.

- Entertainment and Meal Receipts - Specific records showing the cost, location, attendees, and business purpose of any meals or entertainment expenses claimed.

- Form 1099-MISC - Reports income from self-employment or as an independent contractor. If such income is related to the expenses being deducted on Form 2106, this form may be needed to verify the income earned.

- Bank Statements and Credit Card Statements - These can provide additional support for expenses claimed, showing that payment was indeed made.

In ensuring accurate and IRS-compliant tax returns, each of these documents plays a vital role alongside the IRS 2106 form. Detailed record-keeping and organizing these documents can significantly smooth the process of filing taxes and substantiating work-related expense deductions. It is beneficial for taxpayers to keep these documents readily available not just for the current tax filing season but also for potential future inquiries or audits.

Similar forms

The IRS 2106 form, used by employees to deduct work-related expenses not reimbursed by their employer, shares similarities with several other tax documents, each serving distinct purposes within the realm of tax filing and financial documentation. For instance, the Schedule C (Form 1040) is akin to the IRS 2106 in that it's also concerned with reporting expenses. However, Schedule C targets the self-employed, detailing profits and losses from their business, contrasting with 2106's focus on employees.

Similarly, the Schedule A (Form 1040) document parallels the IRS 2106, as it's utilized for itemizing deductions, which can include certain work-related expenses for those who qualify. While Schedule A encompasses a broader range of deductions beyond employment, such as mortgage interest and charitable donations, it still serves a complementary role to the 2106 form for employees seeking to maximize their deductible expenses.

The IRS form 1040-ES is designed for calculating and paying estimated quarterly taxes, mainly aimed at freelancers and independent contractors. Though distinct in its primary function from the 2106, which targets employees, both forms deal with the tax implications of work-related income and expenses, offering a platform for individuals to address their tax responsibilities based on their employment status.

The W-2 form is markedly related to the 2106, as it outlines an employee's annual wages and tax withholding by their employer. While the W-2 form reports earnings and pre-tax withholdings, the 2106 form allows for the detailing of work-related expenses not covered by such withholdings, complementing each other in the process of reporting an individual’s full tax obligations and savings.

Form 8829, Expenses for Business Use of Your Home, is used by home-based businesses to calculate the deduction for business use of a home. It parallels the IRS 2106 form in its purpose to itemize specific expenses for tax deduction purposes, though it specifically caters to home office and related expenses for those self-employed.

The IRS form 8863, for Education Credits (American Opportunity and Lifetime Learning Credits), serves a similar purpose to the 2106 by allowing individuals to claim deductions, in this case, for qualified education expenses. Both forms aid taxpayers in reducing their taxable income through various deductions, though they target different types of expenses.

Form W-9, Request for Taxpayer Identification Number and Certification, is primarily used in contexts where freelance or contract work is performed, serving a different purpose but still related to the realm of employment. It allows companies to collect the necessary information to report income paid to freelancers, who may then use forms like the 2106 to document their work-related expenses.

The IRS form 1099-MISC and its newer counterpart, form 1099-NEC, are used to report payments made to freelancers and independent contractors. These forms are related to the 2106 in the broad context of reporting income and associated work expenses, albeit targeting a different audience, emphasizing the IRS's categorization of workers and their respective tax reporting obligations.

Dos and Don'ts

When you're preparing to fill out the IRS 2106 form, it's important to approach it correctly to ensure accuracy and compliance. Here are five dos and don'ts to guide you through the process.

Do:

- Ensure you are actually eligible to use Form 2106. Only employees who have deductible business expenses not reimbursed by their employer should use this form.

- Gather all necessary documentation before starting. This includes receipts, mileage logs, and any records of expenses you plan to claim.

- Double-check your calculations. Errors in your math can lead to processing delays or an audit.

- Clearly list your expenses in the appropriate sections. The form is designed to categorize different types of expenses, so make sure you place each expense in its correct category.

- Consult with a tax advisor if you're unsure about any claims or how to fill out the form. Professional advice can prevent mistakes and ensure you're taking advantage of all your entitled deductions.

Don't:

- Don't guess on amounts. Estimations can lead to inaccuracies and potential issues with the IRS. Always use exact numbers supported by documentation.

- Avoid waiting until the last minute to fill out Form 2106. Rushing can lead to mistakes or omissions that could impact your tax return.

- Don't mix personal and business expenses. Only business-related expenses that are not reimbursed by your employer are deductible.

- Don't forget to sign and date the form. An unsigned form is considered incomplete and will not be processed by the IRS.

- Avoid filing Form 2106 if you’re not required to. Tax laws change, and certain employees may no longer need to file this form, depending on the tax year and their circumstances.

Misconceptions

The IRS 2106 form, often misunderstood, plays a pivotal role in tax filing for employees who itemize deductions. Here, we clarify common misconceptions to ensure accurate and beneficial use:

Only for Travel Expenses: Many believe the IRS 2106 form is reserved solely for travel and entertainment expenses. However, it is designed to report a broader range of unreimbursed employee expenses, including work-related tools, supplies, and professional certifications.

Unnecessary for Remote Workers: The misconception that remote workers have no use for Form 2106 arises frequently. In reality, remote employees may deduct home office expenses if their employer does not reimburse these costs and they meet certain IRS criteria.

Available to All Employees: A common misunderstanding is that any employee can utilize Form 2106 for deductions. Following tax law changes, as of 2018, only certain categories of employees, such as reservists, qualified performing artists, and fee-basis government officials, are eligible to use this form.

Increases Audit Risk: A prevalent but unfounded concern is that filing a 2106 form increases the likelihood of an IRS audit. Filers should rest assured that while ensuring accuracy and legitimacy in their claims is crucial, merely using Form 2106 does not in itself raise audit risk.

Too Complex to Fill Out on One's Own: While the form can seem daunting at first glance, individuals often overestimate the difficulty of completing Form 2106. With detailed instructions provided by the IRS and various resources available, most employees can accurately complete the form without the need for professional assistance.

Key takeaways

The IRS Form 2106, Employee Business Expenses, is designed for employees to deduct ordinary and necessary expenses related to their job that are not reimbursed by their employer. Understanding the nuances of this form is essential for accurately reporting and maximizing deductions. Below are key takeaways about filling out and utilizing Form 2106 effectively:

- Eligibility: Only certain employees can use Form 2106. Specifically, armed forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses are eligible.

- Ordinary and Necessary Expenses: To qualify for a deduction, expenses must be both ordinary (common and accepted in your field of trade or business) and necessary (appropriate and helpful for your business).

- Vehicle Expenses: Form 2106 allows for the deduction of vehicle expenses using either the standard mileage rate or actual car expenses. Detailed records must be kept in either case to substantiate the deduction.

- Travel Expenses: Expenses for travel away from home overnight can be deductible. This includes transportation, meals (subject to a 50% limitation), lodging, and other related expenses.

- Entertainment Expenses: Under the Tax Cuts and Jobs Act of 2017, most entertainment expenses are no longer deductible, a significant change from previous years.

- Reimbursements: Employees must reduce their deductible expenses by any amounts reimbursed by their employer. Only unreimbursed business expenses are deductible.

- Record Keeping: Maintaining accurate and detailed records of all expenses is crucial. Receipts, logs, and other documentary evidence should support the amounts claimed on Form 2106.

- Tax Reform Changes: As of the Tax Cuts and Jobs Act, miscellaneous itemized deductions, including those on Form 2106, were suspended for most employees for tax years 2018 through 2025. Check the latest tax regulations to understand current applicability.

- Filing the Form: Form 2106 is filed with an individual's Form 1040, and the deductible expenses are included as part of the total itemized deductions on Schedule A, if itemizing deductions is beneficial and allowable under current tax laws.

Understanding these aspects of Form 2106 can ensure that employees accurately report their expenses and comply with IRS regulations, potentially reducing their taxable income by rightfully claiming all permissible deductions associated with their employment.

Popular PDF Documents

2848 Poa - The clarity and specificity of the D-2848 form help safeguard the taxpayer's rights while allowing designated professionals to provide effective assistance.

Federal Form 2441 - The form serves as a documentation tool for taxpayers to validate their eligibility for care-related tax benefits.