Get Irs 14420 Form

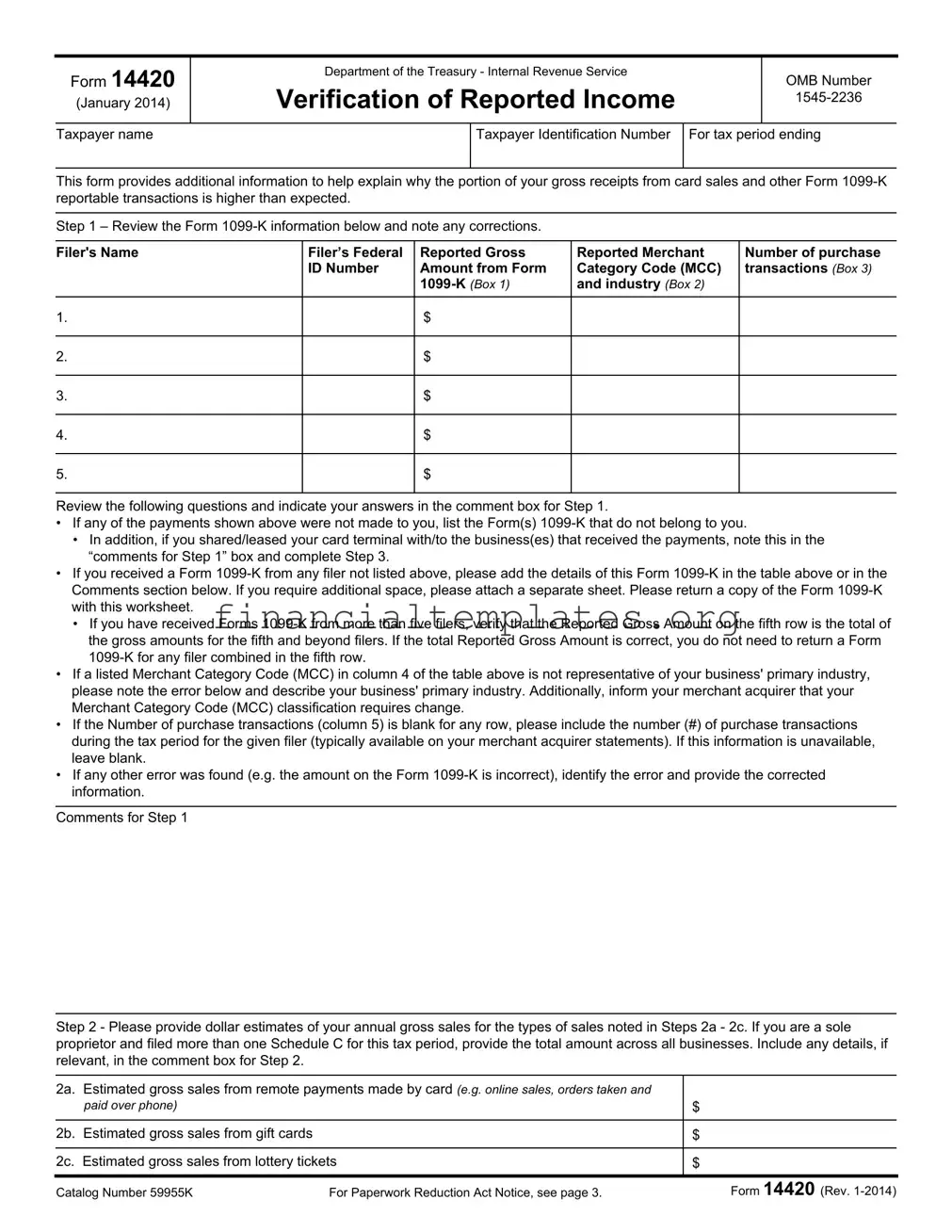

In an effort to streamline the correction and clarification process regarding reported income from payment card and third-party network transactions, the Internal Revenue Service introduced Form 14420, titled Verification of Reported Income, as a primary tool for taxpayers to provide supplementary information. This necessity often arises when the gross receipts derived from card sales and other Form 1099-K reportable transactions appear higher than what might be expected for a business, catching the attention of tax authorities seeking to ensure accurate tax reporting and compliance. Through a detailed breakdown, Form 14420 invites businesses to review and correct any discrepancies in their Form 1099-K reports, ranging from misreported gross amounts to incorrect merchant category codes (MCCs), and to clarify the nature of their gross sales across different platforms, including remote payments and online sales. Additionally, it opens up an avenue for taxpayers to denote shared or leased card terminals, which could account for higher reported amounts, and to adjust for non-income items that could have inadvertently inflated reported gross receipts. The structure of the form also enables taxpayers to provide insights into their online presence and elucidate reasons behind a lower-than-expected portion of cash and check transactions, culminating in a comprehensive opportunity to clarify and rectify reported figures directly with the IRS.

Irs 14420 Example

Form 14420 |

Department of the Treasury - Internal Revenue Service |

OMB Number |

|||

Verification of Reported Income |

|||||

(January 2014) |

|||||

|

|||||

|

|

|

|

|

|

Taxpayer name |

|

Taxpayer Identification Number |

For tax period ending |

||

|

|

|

|

|

|

This form provides additional information to help explain why the portion of your gross receipts from card sales and other Form

Step 1 – Review the Form

Filer's Name |

Filer’s Federal |

Reported Gross |

Reported Merchant |

Number of purchase |

|

ID Number |

Amount from Form |

Category Code (MCC) |

transactions (Box 3) |

|

|

and industry (Box 2) |

|

|

|

|

|

|

|

1. |

|

$ |

|

|

|

|

|

|

|

2. |

|

$ |

|

|

|

|

|

|

|

3. |

|

$ |

|

|

|

|

|

|

|

4. |

|

$ |

|

|

|

|

|

|

|

5. |

|

$ |

|

|

|

|

|

|

|

Review the following questions and indicate your answers in the comment box for Step 1.

•If any of the payments shown above were not made to you, list the Form(s)

•In addition, if you shared/leased your card terminal with/to the business(es) that received the payments, note this in the “comments for Step 1” box and complete Step 3.

•If you received a Form

•If you have received Forms

•If a listed Merchant Category Code (MCC) in column 4 of the table above is not representative of your business' primary industry, please note the error below and describe your business' primary industry. Additionally, inform your merchant acquirer that your Merchant Category Code (MCC) classification requires change.

•If the Number of purchase transactions (column 5) is blank for any row, please include the number (#) of purchase transactions during the tax period for the given filer (typically available on your merchant acquirer statements). If this information is unavailable, leave blank.

•If any other error was found (e.g. the amount on the Form

Comments for Step 1

Step 2 - Please provide dollar estimates of your annual gross sales for the types of sales noted in Steps 2a - 2c. If you are a sole proprietor and filed more than one Schedule C for this tax period, provide the total amount across all businesses. Include any details, if relevant, in the comment box for Step 2.

2a. |

Estimated gross sales from remote payments made by card (e.g. online sales, orders taken and |

|

|

paid over phone) |

$ |

|

|

|

2b. |

Estimated gross sales from gift cards |

$ |

|

|

|

2c. |

Estimated gross sales from lottery tickets |

$ |

|

|

|

Catalog Number 59955K |

For Paperwork Reduction Act Notice, see page 3. |

Form 14420 (Rev. |

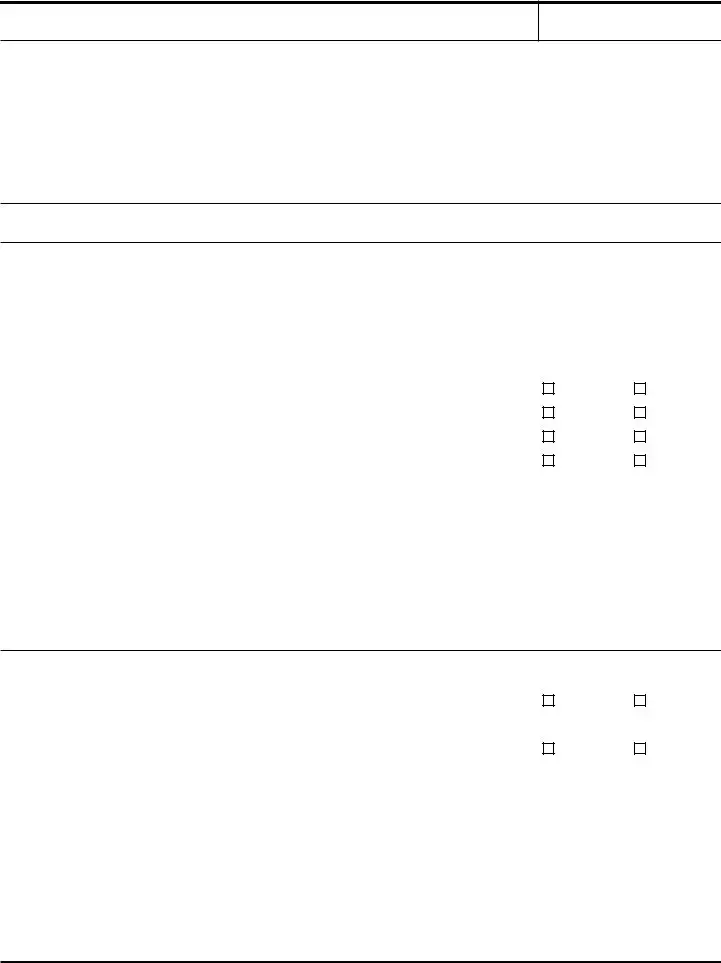

Page 2 of 4

Taxpayer name

Comments for Step 2

Taxpayer Identification Number

Step 3 - If you shared your card terminal(s) with other persons or businesses at any time during the tax year, complete the section below.

•In the table below, list the names, taxpayer identification numbers, and dollar amounts of payment card receipts attributable to any persons or businesses you shared or leased your terminal and indicate whether or not you filed a Form 1099 for these businesses. If you shared/leased your card terminal(s) with more than four other persons or businesses, provide the details on the fifth and subsequent persons/businesses in the comment box for Step 3 or on a separate sheet.

•Provide a brief explanation of how these businesses are related to your own in the comment box for Step 3 or on a separate sheet.

Name of Person or Business |

Taxpayer |

Payment Card Receipts |

Did you file a Form 1099 |

|

|

Identification |

|

showing these receipts for |

|

|

Number (SSN or EIN) |

|

this person or business |

|

|

|

|

|

|

|

|

$ |

Yes |

No |

|

|

|

|

|

|

|

$ |

Yes |

No |

|

|

|

|

|

|

|

$ |

Yes |

No |

|

|

|

|

|

|

|

$ |

Yes |

No |

|

|

|

|

|

Comments for Step 3 |

|

|

|

|

Step 4 – Indicate whether you included the following

4a. |

Sales tax included in the Gross Receipts line |

Yes |

No |

|

|

|

|

4b. |

Total sales taxes paid during tax period |

$ |

|

|

|

|

|

4c. |

Merchant acquirer fees included in the Gross Receipts line |

Yes |

No |

|

|

|

|

4d. |

Total merchant acquirer fees paid during tax period |

$ |

|

|

|

|

|

Comments for Step 4

Catalog Number 59955K |

Form 14420 (Rev. |

|

|

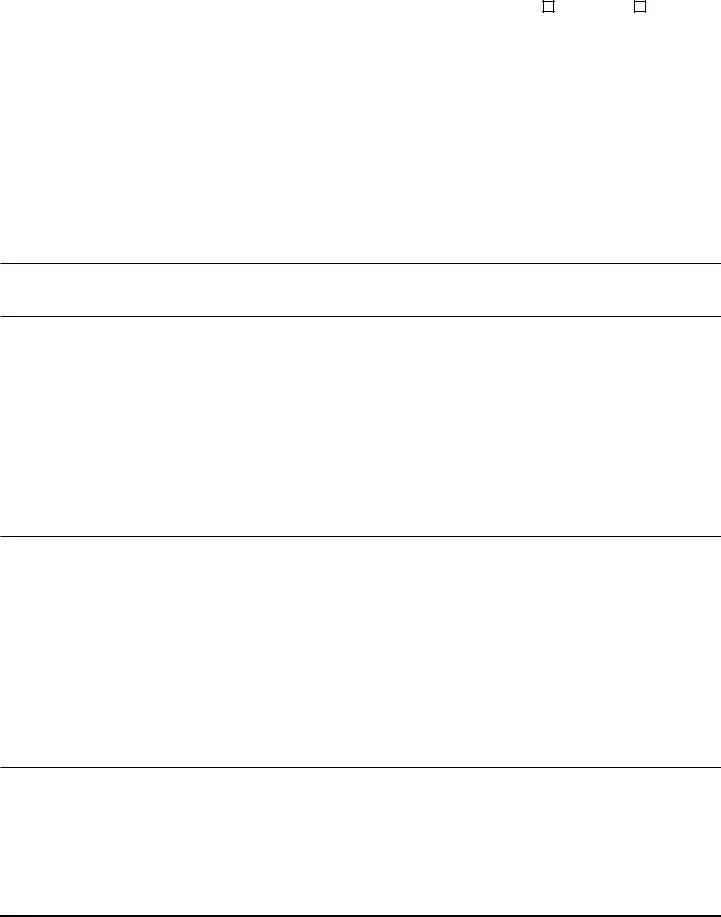

Page 3 of 4 |

|

|

|

Taxpayer name |

Taxpayer Identification Number |

|

|

|

|

Step 5 - Does your business have a website? If so, please provide the business web address below |

Yes |

No |

and a brief description of your online business in the comment box for Step 5. |

|

|

|

|

|

Web address |

|

|

|

|

|

Comments for Step 5 |

|

|

Step 6 - In the comment box (or attach a separate sheet) please provide any other information to explain why cash and checks seem to account for a lower portion of your reported gross receipts than expected for your type of business, given the amount of card payments you received.

Comments for Step 6

Step 7 - Provide the taxpayer’s contact information. If the contact person is not the taxpayer or an officer of the business and a valid Form 2848, Power of Attorney and Declaration of Representative, has not previously been submitted, please include a signed Form 2848 with your response.

Name and title of taxpayer |

Telephone number |

Contact hours |

|

|

|

|

Telephone number |

Contact hours |

|

|

|

Name and title of authorized representative (if applicable) |

Telephone number |

Contact hours |

|

|

|

|

Telephone number |

Contact hours |

|

|

|

Paperwork Reduction Act Notice |

|

|

We ask for the information on this form to carry out the Internal Revenue laws of the United States. Providing this information is voluntary. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is: Recordkeeping No additional time beyond that required to prepare the tax return; Learning about the law or the form

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW,

Catalog Number 59955K |

Form 14420 (Rev. |

Page 4 of 4

Instructions for Form 14420, Verification of Reported Income

Form 14420 asks you to provide information that may explain why the portion of your gross receipts from card sales and other Form

Please complete Form 14420 in its entirety and return it within the timeframe noted in the accompanying letter.

Step 1:

Important: Note that for filers of Forms 1120,

In this step, review the information from each Form

If any of the payments shown were not made to you, list the Form(s)

If you received a Form

If a listed Merchant Category Code (MCC) in column 4 of the table above is not representative of your business' primary industry, please note the error below and describe your business' primary industry. Additionally, inform your merchant acquirer that your Merchant Category Code (MCC) classification requires change.

If the Number of purchase transactions (column 5) is blank for any row, please include the number (#) of purchase transactions during the tax period for the given filer (typically available on your merchant acquirer statements). If this information is unavailable, leave blank.

If any other error was found (e.g. the amount on the Form

Step 2:

In this step, provide dollar estimates of your annual gross sales from each of the types of sales noted in Steps 2a – 2c. For Step 2a, please note that you should only include sales from remote payments made by card (e.g. online sales, orders taken and paid over phone).

If you are a sole proprietor and filed more than one Schedule C for this tax period, provide the sum of these dollar amounts across all of your businesses.

Provide comments as necessary in the “Comments for Step 2” box.

Step 3:

Only complete this step if you shared/leased your card terminal(s) with/to other persons or businesses at some time during the tax period. In the table provided, list the names, taxpayer identification numbers, and dollar amounts of payment card receipts attributable to these persons or businesses. Also indicate whether or not you filed a Form 1099 (i.e., a Form

Note: If you shared/leased your card terminal(s) with more than four other persons or businesses, provide details on the fifth and subsequent persons/ businesses in the “Comments for Step 3” box or on a separate sheet.

Step 4:

In Steps 4a and 4c, indicate whether you included sales tax and merchant acquirer fees, respectively, in the Gross Receipts line reported on your tax return. If you included them in your Gross Receipts, please provide the total sales tax and merchant acquirer fees paid in the tax period in Steps 4b and 4d, respectively. If you are unsure of the merchant acquirer fees paid in the tax period, please estimate the total fees and include in the comment box an explanation.

Include an explanation, if necessary, in the “Comments for Step 4” box.

Step 5:

In this step, indicate whether your business has a website, and if so, provide the web address in the row just below the prompt and a brief description of your online business in the “Comments for Step 5” box. Please describe the nature of your online business and describe the goods and services that you sell online.

Step 6:

In this step, provide any other information to explain why the gross receipts reported on your tax return are lower than expected based on your card payments and other Form

Step 7:

In this step, provide the taxpayer’s/officer’s contact information, including name, title, telephone number(s), and contact hours. If the contact person is not the taxpayer or an officer of the business and a valid Form 2848, Power of Attorney and Declaration of Representative, has not previously been submitted, please include a signed Form 2848 with your response.

Catalog Number 59955K |

Form 14420 (Rev. |

Document Specifics

| Fact Name | Detail |

|---|---|

| Purpose | The Form 14420 is used for Verification of Reported Income to clarify why gross receipts from card sales and other Form 1099-K reportable transactions may appear higher than expected. |

| OMB Number and Revision Date | The form bears the OMB Number 1545-2236 and was last revised in January 2014. |

| Target Audience | Intended for taxpayers who need to provide additional information regarding the income reported from card payments and other transactions reported on Form 1099-K. |

| Components of the Form | Includes sections for reviewing 1099-K information, estimating annual gross sales from various types of sales, sharing card terminal information, and detailing non-income items included in gross receipts. |

| Regulatory Requirements | Submitting this form is voluntary and aids in compliance with U.S. Internal Revenue laws, under the authority of the Paperwork Reduction Act. Detailed record-keeping related to the form's contents is essential for tax administration purposes. |

Guide to Writing Irs 14420

Form 14420 is designed to assist in providing the IRS with additional information regarding the gross receipts from card sales and other Form 1099-K reportable transactions that appear higher than expected. Completing this form thoroughly and accurately is essential for clarifying these discrepancies. Follow the steps below to ensure you fill out the form correctly and comprehensively.

- Review the Form 1099-K information presented on the form. Correct any inaccuracies in the filer's name, filer’s federal identification number, reported gross amount, merchant category code (MCC), and the number of purchase transactions. In the "Comments for Step 1" box, address any payments not made to you, share details if you leased your card terminal, add any missing Form 1099-Ks, correct any MCC errors, include missing transaction numbers, or identify and rectify any other discovered errors.

- Provide dollar estimates for your annual gross sales in the categories specified:

- Remote payments made by card (e.g., online sales, phone orders).

- Gross sales from gift cards.

- Gross sales from lottery tickets.

- If you shared or leased your card terminal(s) with/to other businesses or persons during the tax year, list their names, taxpayer identification numbers, and the dollar amounts of payment card receipts attributed to them. Also indicate whether you filed a Form 1099 for these businesses or persons. Provide a brief explanation of how these entities are related to your business in the "Comments for Step 3" box or on a separate sheet if more space is needed.

- Indicate whether the gross receipts line on your tax return included non-income items such as sales tax and merchant acquirer fees. If yes, provide the total amounts of sales taxes and merchant acquirer fees paid during the tax period. Offer additional details or clarifications in the "Comments for Step 4" box.

- State whether your business has a website. If applicable, provide the web address and a brief description of your online business in the "Comments for Step 5" box.

- In the "Comments for Step 6", provide any additional information that explains why cash and checks seem to account for a lower portion of your reported gross receipts, given the amount of card payments you received. Attach a separate sheet if more space is required.

- Fill in the contact information for the taxpayer or the officer of the business, including name, title, telephone number, and contact hours. If the contact person is not the taxpayer or an officer of the business, and a Form 2848, Power of Attorney and Declaration of Representative, has not been previously submitted, include a signed Form 2848 with your response.

By following these detailed steps, you will provide the IRS with the necessary information to understand and verify the income reported from card sales and other transactions as indicated on Form 1099-K. Completing Form 14420 with care and accuracy will help in clarifying any discrepancies and ensuring compliance with tax laws.

Understanding Irs 14420

FAQ Section: IRS Form 14420 - Verification of Reported Income

What is IRS Form 14420?

IRS Form 14420, titled Verification of Reported Income, is a document designed by the Department of the Treasury - Internal Revenue Service. It's used to provide additional information or clarification about discrepancies or higher-than-expected amounts in the gross receipts from card sales and other Form 1099-K reportable transactions.

Who needs to complete IRS Form 14420?

Any taxpayer who has been contacted by the IRS regarding discrepancies or questions about the income reported from payment card and third-party network transactions may need to complete and return Form 14420. This includes individual filers, corporations, S corporations, and partnerships that have received Form 1099-K.

What information do I need to provide on Form 14420?

- Corrections to any reported Form 1099-K information.

- Details on shared or leased card terminal transactions.

- Estimated annual gross sales from various types of sales (e.g., remote payments, gift cards, lottery tickets).

- Whether sales tax or merchant acquirer fees are included in gross receipts.

- Information about your business website.

- Explanations for lower portions of reported cash and checks in your gross receipts.

- Contact information of the taxpayer or the authorized representative.

How do I submit IRS Form 14420?

After completing Form 14420, you should return it to the IRS within the timeframe noted in the accompanying letter. The form can be sent via mail to the address provided by the IRS. If a valid Form 2848, Power of Attorney and Declaration of Representative, has not been submitted and the contact person is not the taxpayer or a business officer, a signed Form 2848 should be included.

What happens if I identify errors in the Form 1099-K information?

If errors are identified in the information listed on Form 14420 from Form 1099-K, such as incorrect gross amounts, incorrect merchant category codes, or transactions that were not made to you, you should note these errors in the appropriate section of Form 14420 and provide the correct information. Additionally, if you received a Form 1099-K from a filer not listed, you should add these details in the provided sections or comments box.

Is it mandatory to complete all sections of Form 14420?

While it is important to provide as much accurate and relevant information as possible, some sections of Form 14420 may not apply to every taxpayer. For example, if you did not share or lease your card terminal with other businesses, you do not need to complete Step 3. However, incomplete information may lead to further inquiries from the IRS, so ensure that all applicable sections are filled out accurately.

Where can I find help for filling out IRS Form 14420?

For guidance on completing Form 14420, taxpayers can consult the IRS’s official website or contact the IRS directly. Professional tax advisors or attorneys specializing in tax law can also provide assistance, ensuring that the information provided is accurate and complies with IRS requirements.

Common mistakes

Not verifying the accuracy of the Form 1099-K information presented in Step 1 is a common mistake. Taxpayers often overlook the importance of checking if the payments listed were indeed made to them, the correctiveness of the merchant category code, and the reported gross amount from card sales. This review is critical because it lays the groundwork for the rest of the form.

Failing to accurately complete the gross sales estimates in Step 2 can lead to discrepancies. It's essential to provide dollar estimates of annual gross sales from remote payments, gift cards, and lottery tickets as accurately as possible. An oversight or miscalculation in this step can throw off the IRS's understanding of your business's revenue sources.

Omitting details about shared or leased card terminals in Step 3 is another mistake. If you've shared or leased your card terminals with other businesses, omitting this information or failing to provide the names, taxpayer identification numbers, and payment amounts can lead to misunderstandings about your reported income.

Incorrectly reporting sales tax and merchant acquirer fees in Step 4 often trips taxpayers up. It is crucial to indicate correctly whether these figures were included in the Gross Receipts line of your tax return. Misreporting these amounts can affect the accuracy of your tax obligations.

When filling out the IRS 14420 form, attention to detail is paramount. Each of these steps requires careful consideration to ensure that the information provided is accurate and complete. Mistakes in any of these areas can lead to potential issues with the IRS, making it all the more critical to approach this form with diligence.

Documents used along the form

When managing IRS Form 14420, it’s crucial to have a comprehensive understanding of the other forms and documents that might be necessary to support or provide additional information requested by the IRS. Here's a detailed list:

- Form 1099-K: This form reports payment card and third-party network transactions to the taxpayer. It's directly related to Form 14420 as it provides details about the gross amounts of transactions processed by payment cards or third-party networks.

- Form 2848, Power of Attorney and Declaration of Representative: This authorizes an individual, such as an accountant or attorney, to represent the taxpayer before the IRS, allowing them to receive confidential information and act on the taxpayer's behalf.

- Schedule C (Form 1040): Profit or Loss from Business. Sole proprietors use this form to report profits or losses from their business operations, which may be necessary for clarifying income on Form 14420.

- Form 1120: U.S. Corporation Income Tax Return. Corporations fill this out to report their income, gains, losses, deductions, and credits, as well as to calculate their income tax liability.

- Form 1120-S: U.S. Income Tax Return for an S Corporation. This form is for S corporations to report their income, gains, losses, deductions, credits, etc., which may be relevant when completing Form 14420 for such entities.

- Form 1065: U.S. Return of Partnership Income. Partnerships use this form to report their financial results. This might be necessary to supplement information on Form 14420 if the business operates under a partnership structure.

- Form 1099-MISC: Miscellaneous Income. This form is used to report rents, royalties, prizes and awards, and other fixed determinable income. It might be referenced in Form 14420 for shared or leased card terminals.

- Merchant Acquirer Statements: Although not an IRS form, these monthly statements from the merchant processing payments might be needed to verify the number of transactions or fees deducted, which could explain discrepancies in reported income.

- Business Bank Statements: Bank statements may provide additional proof of income and can help verify the accuracy of reported transactions on Form 14420, especially when reconciling amounts from Form 1099-K.

This coordinated use of forms and documents plays a pivotal role in ensuring that businesses accurately report their income to the IRS and substantiate the information provided on Form 14420. It's important for taxpayers to keep thorough records and understand the interplay between these various forms to maintain compliance and accurately reflect their financial situation.

Similar forms

The Form 1099-K "Payment Card and Third Party Network Transactions" is quite similar to the IRS Form 14420. This form reports payment transactions processed by payment settlement entities. Much like the IRS Form 14420, the 1099-K includes information about the gross amount of all reportable payment transactions. The IRS Form 14420 leverages this data to verify inconsistencies or differences in reported income, focusing on the amounts reported through card sales and other transactions that would typically be detailed on a Form 1099-K.

Form 1120 "U.S. Corporation Income Tax Return" also shares similarities with the IRS Form 14420. This form is used by corporations to report their income, gains, losses, deductions, and credits to calculate their federal income tax liability. IRS Form 14420 may require verification of the information reported on Forms 1120 when discrepancies in payment card transactions are identified, ensuring accurate reporting of gross receipts.

Form 1040 "U.S. Individual Income Tax Return" is similarly related to IRS Form 14420. While Form 1040 is broadly utilized by individuals to report their annual income and calculate taxes owed or refunds due, Form 14420 may be used in conjunction with this form for sole proprietors who have reported income from card payments or third-party network transactions that appear higher than expected.

Form 2848 "Power of Attorney and Declaration of Representative" is relevant in relation to the IRS Form 14420 in that it allows an individual to authorize another person to represent them before the IRS. This form might be necessary if the individual responding to inquiries made via Form 14420 is not the taxpayer or an officer of the business in question, indicating a procedural similarity.

Form 1099-MISC "Miscellaneous Income" is a form used to report various types of income. Like Form 14420, which deals with verification of income reported from payment card and third-party network transactions, Form 1099-MISC is concerned with accurately reporting income, albeit from other sources such as rents, services, prizes, awards, or other income.

Schedule C "Profit or Loss from Business" is a form used by sole proprietors. It significantly correlates with IRS Form 14420 in scenarios where a sole proprietor needs to verify income received through payment cards. This form details the income and expenses of the business, which might be scrutinized if there are discrepancies in card transaction amounts reported.

Form 1065 "U.S. Return of Partnership Income" also has elements in common with Form 14420. This form is used by partnerships to report their income, gains, losses, deductions, etc. Similar verification processes may apply if a partnership's reported card transaction income is flagged as higher than expected, requiring additional verification through Form 14420.

Form 1120-S "U.S. Income Tax Return for an S Corporation" is another form with similarities to the IRS Form 14420, particularly for S corporations that report income from card transactions. This form's filing may entail additional scrutiny if gross receipts from such transactions are inconsistent with expectations, necessitating the use of Form 14420 for clarifications.

Form Schedule SE "Self-Employment Tax" relates to IRS Form 14420 when discrepancies in reported income from card transactions may impact the calculation of self-employment tax. Sole proprietors, for example, who report higher than expected income from such transactions may need to clarify these amounts, affecting their Schedule SE filings.

Finally, Form W-9 "Request for Taxpayer Identification Number and Certification" is somewhat related to IRS Form 14420. Form W-9 is often used in conjunction to verify the correct taxpayer identification number (TIN) associated with reported income, including income reported on 1099-K forms. This aligns with the need to ensure accurate reporting of information related to payment card transactions, as seen with IRS Form 14420.

Dos and Don'ts

When filling out the IRS Form 14420, it's important to pay close attention to details and follow instructions carefully to ensure that the information you provide is accurate and complete. Here are some dos and don'ts to help guide you through the process:

Do:- Review the provided Form 1099-K information thoroughly. Make sure all payments listed were actually made to you and correct any discrepancies in the report.

- Provide detailed explanations. When addressing questions in the form or explaining your gross receipts, be as detailed and specific as possible.

- Include all necessary documentation. Attach a copy of the Form 1099-K and any other additional sheets if you need more space to provide comprehensive answers.

- Check your business's Merchant Category Code (MCC). Ensure that the MCC listed reflects your primary industry. If not, note the discrepancy and inform your merchant acquirer.

- Estimate your annual gross sales accurately. Include remote payments made by card, sales from gift cards, and lottery ticket sales as requested.

- Disclose shared or leased card terminal information. If applicable, provide details about any shared or leased card terminals, including names, taxpayer identification numbers, and payment card receipts.

- Clarify inclusions in your Gross Receipts. Specify if sales tax or merchant acquirer fees were included in your Gross Receipts line on your tax return, providing dollar amounts as requested.

- Skip parts of the form. Even if a section seems not to apply, review it carefully to ensure you’re not missing any relevant details or explanations.

- Ignore errors on your Form 1099-K. If you spot errors, it’s crucial to correct them. Failing to do so could lead to issues with your tax return.

- Overlook the need for additional sheets. If space is insufficient, attach separate sheets with all the necessary information and refer to these attachments clearly in your form.

- Forget to include your website information. If your business has a website, provide the web address and describe your online business activities as requested.

- Omit sales tax and merchant acquirer fees. If these were included in your Gross Receipts, you must provide accurate amounts and explain their inclusion.

- Leave out contact information. Ensure that the taxpayer's or officer’s contact information is complete and includes times when they can be reached.

- Ignore the Comments sections. Use these areas to provide any additional information that can help clarify your gross receipts and business operations.

Misconceptions

When it comes to the IRS Form 14420, Verification of Reported Income, there are several misconceptions that can lead to confusion. Understanding these misconceptions can help taxpayers accurately complete the form and comply with IRS requirements.

- Misconception 1: Form 14420 is only for businesses that exclusively operate online. In reality, this form is for any taxpayer who has received Form 1099-Ks, not just those with online sales, but also for those with physical storefronts or any other type of business that processes payment card transactions.

- Misconception 2: If you receive Form 14420, it automatically means you're under audit. The issuance of Form 14420 is primarily for informational and verification purposes. It does not necessarily indicate an audit but is a request from the IRS to verify or provide additional information related to reported card payment transactions.

- Misconception 3: All Form 1099-K amounts must be reported as income. Form 1099-K reports gross transactions, which can include refunds, fees, and other non-income amounts. When filling out Form 14420, it's important to clarify and adjust these amounts to reflect actual income.

- Misconception 4: You only need to respond to Form 14420 if you disagree with the information. Whether or not you agree with the Form 1099-K information provided, you must respond to Form 14420 to confirm or correct the reported amounts and provide any requested additional information.

- Misconception 5: Taxpayers need to return a copy of Form 1099-K for each transaction listed. While the form requests that you review transactions and provide corrections or comments, it specifically mentions that if the total Reported Gross Amount for filers beyond the fifth is correct, additional Form 1099-K copies are not necessary.

- Misconception 6: Sharing or leasing your card terminal is irrelevant to IRS reporting. If you have shared or leased your card terminal(s) with others, it's important to disclose this on Form 14420. This can explain why your gross receipts may appear higher than expected.

- Misconception 7: Only the gross amounts from card sales should be included in your response. Form 14420 asks for estimates of annual gross sales in specific categories, including remote payments made by card, gift cards, and lottery tickets, providing a broader context of your overall business operations beyond just card sales.

Understanding these misconceptions can greatly simplify the process of completing IRS Form 14420. It's essential to carefully review the form, provide accurate and detailed information as requested, and correct any mistakes or clarify any discrepancies in the reported income. Doing so will help ensure compliance with IRS requirements and avoid potential issues.

Key takeaways

Understanding the IRS Form 14420 is crucial for taxpayers looking to clarify discrepancies or provide additional information regarding their reported income from card sales and other Form 1099-K transactions. Here are key takeaways to assist in accurately filling out and utilizing the form:

- The purpose of Form 14420 is to offer taxpayers a structured way to provide explanations or corrections to the income reported through payment card transactions and Form 1099-K.

- Step 1 of the form focuses on verifying the accuracy of reported income from Form 1099-K, including the filer's name, the reported gross amount, and the merchant category code. Taxpayers are encouraged to note any discrepancies or corrections directly on the form.

- Taxpayers must review and potentially correct or validate the number of purchase transactions and the gross receipts reported for accuracy in Step 2.

- For those who have shared or leased their card terminals with other businesses or individuals, Step 3 requires detailed information about such arrangements, including the names and taxpayer identification numbers of those who used the terminal.

- Step 4 asks whether certain non-income amounts, such as sales tax or merchant acquirer fees, were included in the gross receipts line on the tax return. It's critical to clarify these amounts to prevent inflating taxable income.

- If your business has an online presence, Step 5 requests the website address and a brief description of the online operations, helping the IRS understand how online sales may impact reported income.

- Step 6 provides space for taxpayers to explain why cash and checks might represent a smaller portion of reported gross receipts, an effort to give context to the proportions of various payment methods received.

- Step 7 is designated for the taxpayer’s contact information, ensuring the IRS can reach out if further clarification or documentation is necessary.

- Filling out Form 14420 thoroughly and accurately is voluntary but can be instrumental in resolving questions or audits from the IRS concerning the income reported from card and online transactions.

- The form requires a detailed review of the taxpayer's recordkeeping, highlighting the importance of maintaining accurate and comprehensive records of all transactions.

By adhering to these guidelines, taxpayers can more effectively communicate with the IRS about their reported income, ensuring that all information is accurately represented and understood. This can assist in avoiding potential discrepancies or audits, promoting a smoother tax filing process.

Popular PDF Documents

Social Security Taxed - Lets individuals adjust their tax withholdings on benefits like social security to meet their personal financial strategy.

Employer's Quarterly Federal Tax Return - Timely and accurate filing of Form 941 safeguards employers from legal issues and contributes to the overall health of the nation’s tax collection efforts.